2015

2015

OTP Bank

Annual Report

OTP Bank

Annual Report

2

3

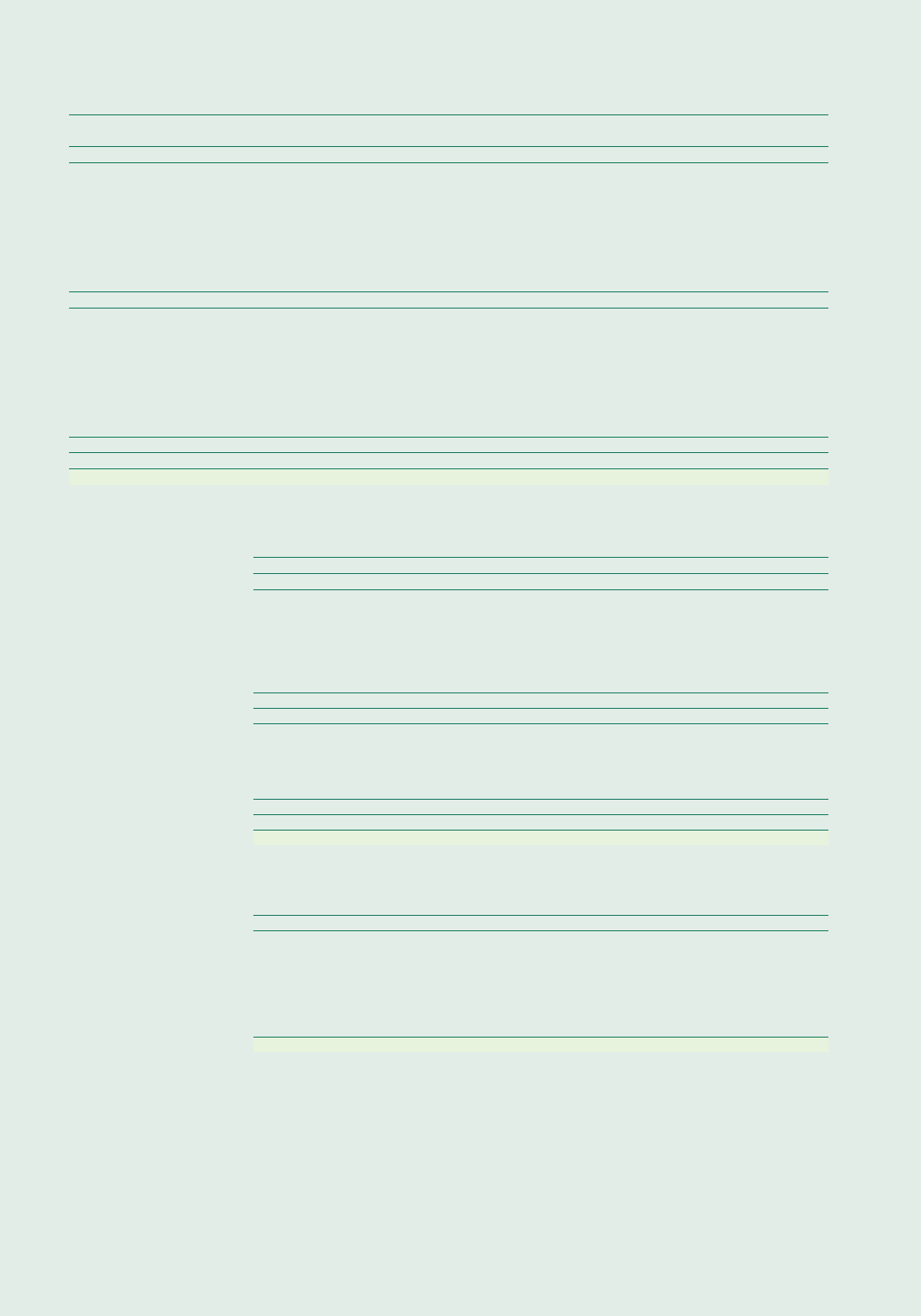

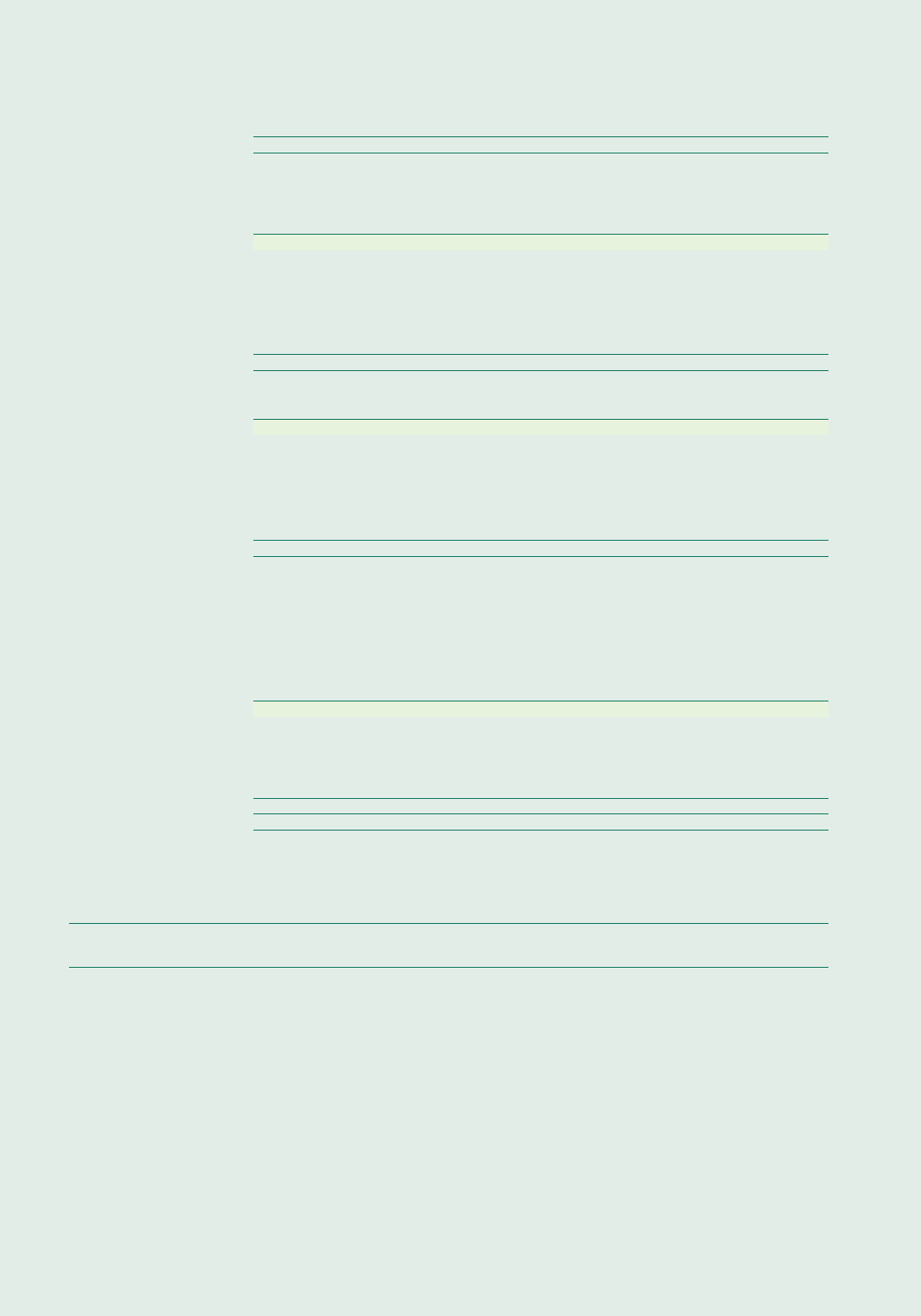

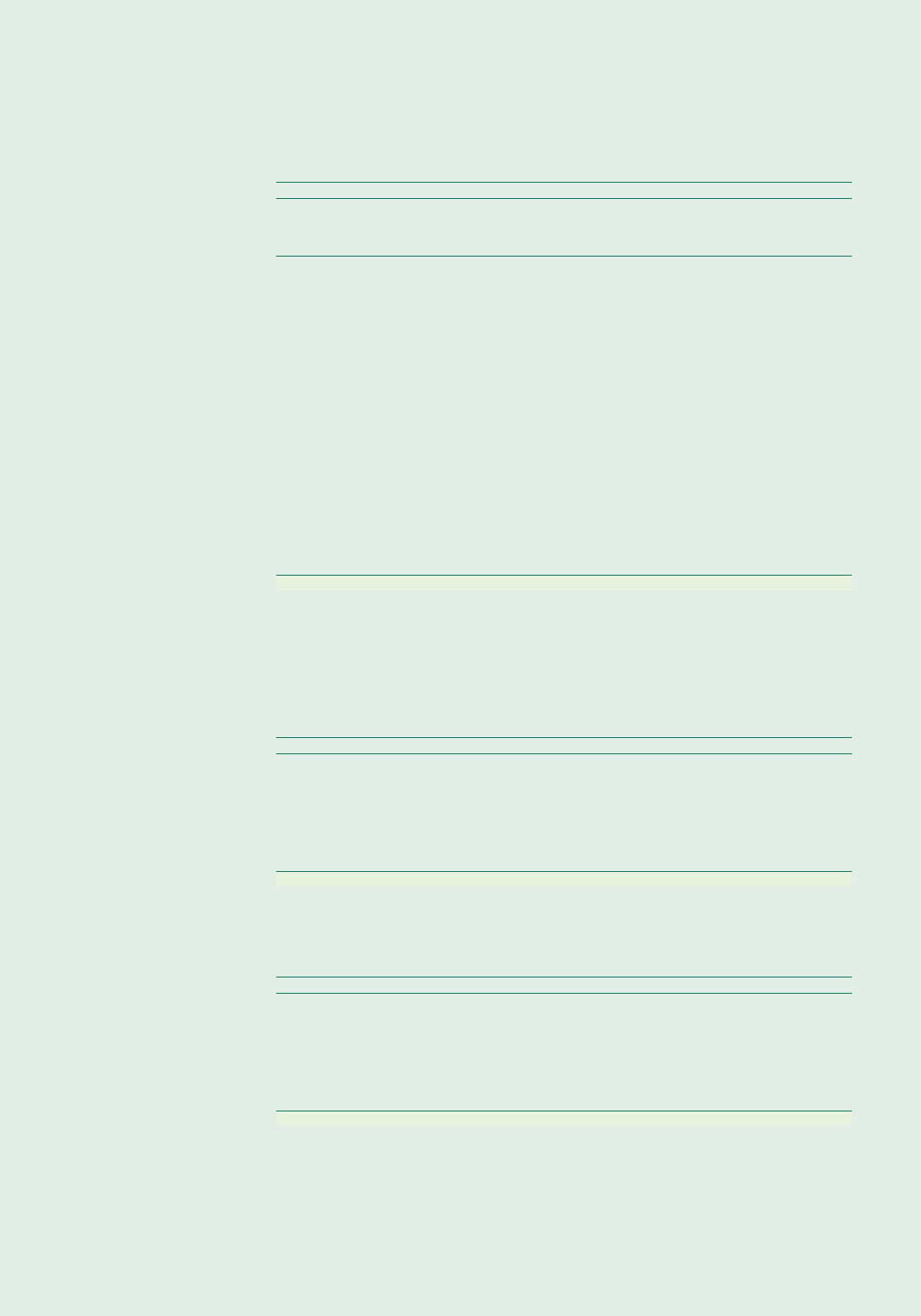

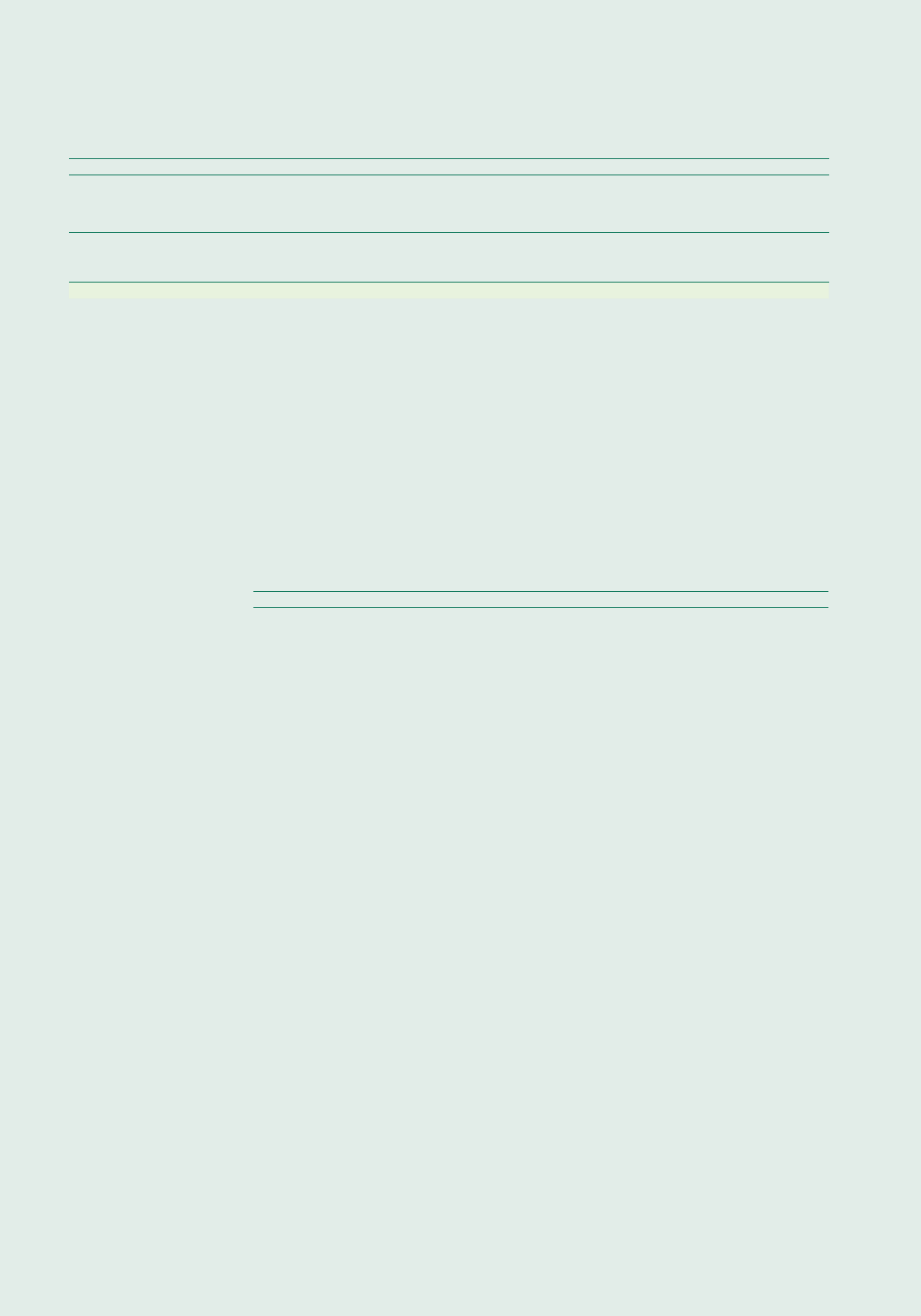

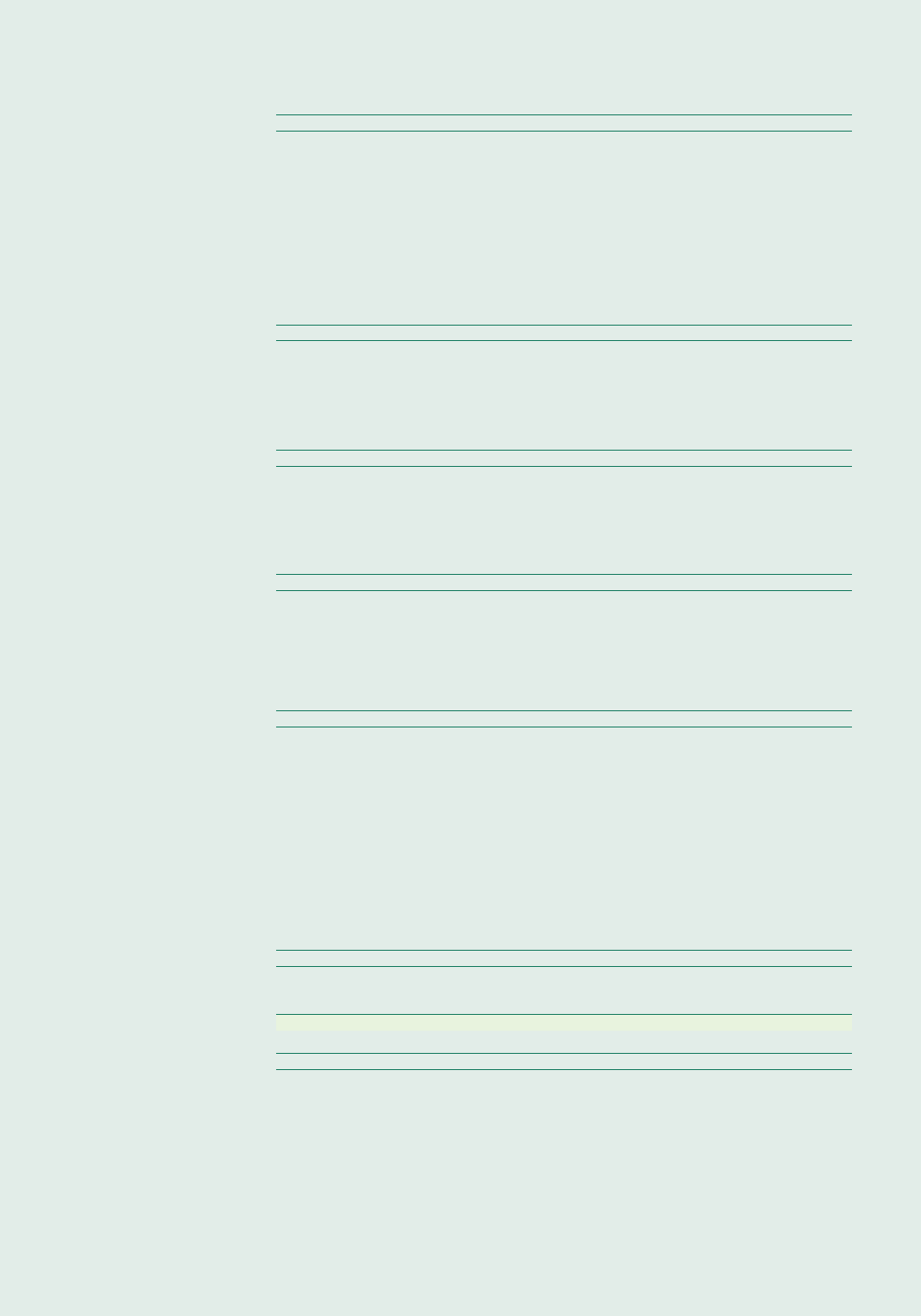

Contents

Message from the Chairman and Chief Executive O cer

Macroeconomic and fi nancial environment in 2015

Management’s Analysis

Management’s analysis of the 2015 results of the OTP Group

Financial Statements

Independent Auditors’ report (consolidated, in accordance with IFRS)

Statement of fi nancial position (consolidated, in accordance with IFRS)

Statement of recognized income (consolidated, in accordance with IFRS),

Statement of comprehensive income (consolidated, in accordance with IFRS)

Statement of cash fl ows (consolidated, in accordance with IFRS)

Statement of changes in shareholders’ equity (consolidated, in accordance with IFRS)

Notes to the consolidated IFRS fi nancial statements for the year ended 31 December 2015

Independent Auditors’ report (separate, in accordance with IFRS)

Statement of fi nancial position (separate, in accordance with IFRS)

Statement of recognized income (separate, in accordance with IFRS),

Statement of comprehensive income (separate, in accordance with IFRS)

Statement of cash fl ows (separate, in accordance with IFRS)

Statement of changes in shareholders’ equity (separate, in accordance with IFRS)

Notes to the separate IFRS fi nancial statements for the year ended 31 December 2015

Corporate Governance

Senior management of OTP Bank and executive members of the Board of Directors

Non-executive members of the Board of Directors of OTP Bank

Members of the Supervisory Board of OTP Bank

Information for Shareholders

Statement on Corporate Governance Practice

Anti-money laundering measures

OTP Bank’s social participation in 2015

4

12

17

18

73

74

76

77

78

79

80

160

162

163

164

165

166

237

238

240

242

244

247

252

253

4 OTP Bank Annual Report 2015

Message from the Chairman & CEO

And this past year was by no means a

straightforward one. Although the burdens

related to the settlement and conversion of

foreign currency consumer loans in Hungary

were reflected mainly in the profit figures for

2014, the tasks associated with this placed

massive administrative burdens on the entire

domestic banking sector, OTP included. We’d

never had to cope with so much extra work and

such a drain on our IT capacities as a result

of changes to the law! I’m proud to report that

our colleagues carried out their tasks in an

exemplary fashion.

Last year also represented a turning point in

that the problem of foreign currency lending,

which had been a bugbear for the banks and of

course customers for so many years, and had

put a strain on relations between the banking

sector and the government, was successfully

resolved. The price was enormous, and there

will certainly be players who have remained

unsatisfied, but overall in Hungary we have now

put this issue well and truly behind us.

Indeed, it appears that now that Hungarian

politics have tackled the problem of foreign

currency loans, other countries are following

suit: In Croatia, in September 2015, a law

provided for the settlement and conversion

by banks of CHF-based mortgage loans;

meanwhile in Serbia the central bank has

ordered the banks to give certain rebates,

and in Romania in November our subsidiary

bank launched its own initiative to help foreign

currency borrowers, while in Ukraine a major

restructuring process has got under way as the

result of cooperation between the supervisory

authority and the banks concerned. In the

course of 2015 the Bank Group set aside the

necessary provisions for its expected one-o

financial losses in the various countries where

it does business; the decreasing revenues

realisable on the lower volumes will be largely

compensated for in the years to come by the

fact that the switch from CHF or USD to the

domestic currency or EUR will substantially

reduce the risks of customers, thereby

improving the overall risk profile of the portfolio.

In another favourable development, there was

a significant improvement in the system of

regulatory and operating conditions for banks

in Hungary: In line with the Declaration of Intent

DEAR SHAREHOLDERS,

Based on our performance last year I am happy to report that

2015 marked the end of the seven lean years for the OTP Group,

and overall the Bank Group has emerged stronger from the

global financial crisis that broke out in 2008 and the subsequent

period of forced austerity. Here I’m referring to our – even by

international standards – exceptionally strong capital adequacy

and excellent liquidity. In addition to this, we not only retained

but succeeded in improving our positions in our key markets,

and also had energy to devote to innovation and development.

5Message from the Chairman & CEO

signed in February 2015 by the Government and

the EBRD, from 2016 there will be a substantial

drop of more than 40% in the burden of the

bank tax, which has remained unchanged since

its introduction in 2010, and this will be followed

by a further reduction from 2017. Accordingly,

in 2016 the annual bank tax liability of the

OTP Bank Group in Hungary will decrease,

from the previous figure of HUF 34.9 billion,

to HUF 16.1 billion. In addition to this, an

acceptable decision was also made with regard

to the sensible sharing and settlement of the

losses caused by the brokerage scandals

of 2015. We welcome the fact that this is in

tune with our general eorts to promote a

culture and attitude of awareness among

the consumers of financial products, and to

ensure that responsibility for the financial

consequences of decisions is not borne solely

by the banking sector.

And naturally, we should not forget the

most important factor from the perspective

of banking operations: since 2013, the

performance of the economy has been

improving steadily, and this is not only reflected

in the favourable development of the indicators,

as the structure of growth has also become

significantly healthier. Following the 1.5% GDP

growth of 2013, the economy expanded by a

robust 3.6%, and the 2.9% increase of 2015 also

represents a strong performance. While the rate

of growth in exports remains stable, household

consumption is strengthening in parallel with

the continuous growth in real wages, and

investments also grew at a rate of over 20%.

After years of floundering, the property market

has found its feet again, and turnover is rising

at a convincing rate, the number of new home

construction permit applications is on the rise,

and the occupancy of commercial properties

is improving rapidly. The Government’s latest

measures – such as the lowering of VAT

on new home construction from 27% to 5%

with eect from 2016, or the substantive

expansion of the Family Home Making

Subsidy (CSOK) and the major increase in

the available subsidies – could give a boost

to new home building in Hungary, and thus

to the construction industry, which employs

a considerable number of people; and they

could also lead to an improvement in the

demographic situation by rewarding families

that have more children with a higher amount

of assistance.

Another positive development is that the central

bank, in addition to its use of conventional

monetary policy tools, led the way in creating

the conditions for growth and lending,

continuously and eectively supporting the

healthy, sustainable growth of the economy.

In the first and second phases of the Funding

for Growth Scheme (FGS), launched in 2013,

more than HUF 1,700 billion in loans has been

disbursed to companies in the Hungarian SME

sector. While the scheme is set to be phased

out in 2016, the central bank has also launched

its Support for Growth Scheme (SGS), through

which the central bank aims to assist banks in

making the transition to market-based lending.

In addition to the FGS and SGS, the central

bank’s Self-Funding Scheme assisted a great

deal in making the financing of state debt as

independent as possible from foreign investors,

thereby helping to increase the room for

maneuver in economic policy.

All things considered, I can safely say that

in 2015 we put behind us not only a dicult

financial year, but a tough chapter in our

history. All of this provides a good foundation

on which the Hungarian economy can smoothly

weather the temporary slowing of GDP growth

in 2016, which is a prime consideration in terms

of banking operations too.

Overview of financial performance

in the year 2015

OTP’s share price closed at HUF 6,000 in 2015;

the 63.5% y/y rise was one of the highest

among listed blue chips, not just in Hungary, but

internationally too. I believe that, together with

the favourable macroeconomic developments

and regulatory changes that were supportive

of banking operations, the Bank Group’s

6 OTP Bank Annual Report 2015

fundamental performance also played a key

role in the development of the stock price and

the improvement in our market standing.

In 2015 the Bank Group posted a HUF 120.2

billion adjusted after-tax profit. This exceeded

the performance of the base period by 2%.

The pre-tax adjusted annual profit excluding

one-o items also grew by 3% in comparison to

the previous year. Operating profit dropped by

13%, but this was fully oset by the lower cost

of risk (–20%).

The change witnessed in 2014 in terms of the

relative contributions of individual subsidiaries

to the annual consolidated adjusted after-tax

profit was repeated last year: again it was

OTP Core (HUF 123.4 billion) and DSK Bank

(HUF 52.5 billion) that delivered the

greatest contribution to profit, while the

other Central and Eastern European subsidiary

banks – except Serbia – also achieved a profit,

overall improving the Group’s profit by

HUF 5.9 billion. In contrast, the Ukrainian

and Russian subsidiary banks made adjusted

losses of HUF 40.3 billion and HUF 15.1 billion

respectively; these figures combined

represent a smaller loss than that of 2014.

In 2015 our online bank Touch Bank, which in

legal terms operates as a part of the Russian

subsidiary but in practice functions as a

stand-alone key business line, realised a loss

of HUF 4.8 billion.

The HUF 755 billion in annual consolidated

revenue excluding one-o items represents a

9% decrease. Within this, net interest income

decreased by 13%: net interest income declined

in Hungary and dropped substantially in

Russia and Ukraine, but grew at the Bulgarian,

Romanian, Croatian and Slovak subsidiary

banks. The fall in the Russian and Ukrainian

net interest income is partly attributable to

the exchange rate eect, as both the ruble

and the hryvnia weakened considerably

during the past one year. Besides this, in both

these countries the decline in the performing

portfolios also had a substantial eect on

interest income. Net fee and commission

revenues decreased minimally. Consolidated

operating costs decreased by 5% y/y.

The consolidated annual revenue margin

(6.96%) narrowed by 78 basis points, while

the net interest margin (5.11%) fell short

of the base-period figure by 85 basis points.

The consolidated FX-adjusted gross loan

portfolio shrank by 8% y/y. Because of the

substantial credit write-downs that took place

in the reporting period, a more realistic picture

of the actual trends can be given by describing

the performing (DPD0–90) loan portfolio;

accordingly, the portfolios decreased by 5% at

annual level. In terms of the FX-adjusted change

in the performing portfolios, the greatest

decrease occurred in Russia and Ukraine (26%

each); at OTP Core, the fall was 8%. Within the

consolidated performing retail loan portfolio,

mortgage loans dropped by 6%, and consumer

loan volumes shrank by 8%, but by contrast

the portfolio of micro and small business loans

grew (+16% y/y). The portfolio of loans to large

corporations fell by 3% y/y.

In terms of the performance of the individual

subsidiaries, the Romanian and Serbian

banks saw the highest rate of growth in

the performing gross loan portfolio, while

consumer loans in Russia, which had grown

dynamically in previous years, dropped by 26%,

and in Ukraine by 28%. The mortgage loan

portfolio declined everywhere except at the

Romanian subsidiary. In the large corporate

segment, the performance of the Romanian

and Serbian subsidiaries stands out, with

each achieving growth of more than 30%.

The Hungarian micro and small business

DPD0–90 portfolio expanded by 14% year on

year, due in part to the Funding for Growth

Scheme.

After the dynamic growth of previous years,

FX-adjusted consolidated deposits grew again

in 2015 (+5% y/y). With this, the Group’s net

loan-to-deposit ratio (67%) declined by almost

9% last year, sinking to below 100% in all

countries with the exception of the Romanian

and Serbian subsidiary banks. On 31 December

7Message from the Chairman & CEO

2015 the Bank Group’s gross liquidity reserve

amounted to the equivalent of EUR 8.6 billion.

The DPD90+ portfolio growth trend

(FX-adjusted, stripped of the impacts of sales

and write-downs) presents a favourable picture

of the quality of the portfolio, showing that the

previous year’s record HUF 254 billion portfolio

growth decreased to HUF 133 billion in 2015.

The year-on-year improvement was observed

at virtually all the group members. The cost of

risk amounted to HUF 221 billion at annual level

(–20% y/y). The extent of provisions coverage for

loans more than 90 days past due was 93.4%

at group level at the end of 2015 (+9.1 pp y/y).

Behind this figure, the annual improvement in

coverage was substantial at OTP Core (+9.3 pp),

Ukraine (+21.3 pp), and at DSK Bank (+4.3 pp).

The OTP Group’s IFRS consolidated Common

Equity Tier 1 (CET1) ratio was 13.3% at the end

of 2015. The regulatory capital does not contain

either the positive annual net profit (which can

only be included in the audited profit figure), or

the deduction due to the accrual of dividends.

Individual performances of banks

in the group

OTP Core (the Group’s Hungarian core

operation) achieved a HUF 123.4 billion after-tax

profit excluding correction items in 2015

(–10% y/y). The lower annual adjusted profit

is attributable primarily to the 6% decrease

in net interest income and the 9% increase

in the cost of risk. The likewise 6% drop in

operating profit, excluding one-o revenue

items, was the combined result of the lower

revenues (–2% y/y) and the 2% increase

in operating expenses. The 30 basis-point

drop in the annual interest margin (3.62%)

was primarily due to the environment of low

domestic interest rates, and the increased

weight, within the loan portfolio, of the

lower-margin corporate volumes.

The change in portfolio quality shows a

favourable tendency: the DPD90+ portfolio,

adjusted for exchange rates and stripped of

sales and write-downs, grew by HUF 48 billion

in 2014, but fell by HUF 11 billion in 2015.

The provisions coverage for loans more than

90 days past due increased (85.8%), in addition

to which the DPD90+ ratio declined by 5.4 pp

(to 12.1%) due to write-downs and sales. The

total cost of risk increased by 9% y/y, and with

this the annual risk-cost ratio rose from 0.73%

to 0.84%.

The FX-adjusted gross loan portfolio shrunk by

13% at annual level, predominantly as a result

of the settlement and conversion to forint of retail

mortgage loans implemented during the year.

The retail gross loan portfolio decreased in the

case of both mortgage loans (–19% y/y) and

consumer loans (–17% y/y). Within the corporate

portfolios, the 58% annual drop in municipality

loans reflects the impact of the mid-year early

repayment of debt assumed by the state. In the

medium-sized and large corporate segment

the portfolios decreased by 3% y/y, mainly as

the consequence of early repayments by a few

large clients. At the same time, the portfolio of

loans provided to micro and small enterprises

grew by 11%, partly due to the National Bank of

Hungary’s Funding for Growth Scheme.

Although the 19% drop in the mortgage loan

portfolio is substantial, without the impact of

the settlement and forint conversion of foreign

currency loans the decrease would only have

been 7%; in other words, regular amortisation

and the increasing early repayments still

exceed new disbursements for the time

being. It is encouraging, however, that the

improvement in households’ financial positions

and the continuous rise in property prices are

generating strong demand: In 2015 the volume

of loan applications rose by 24% y/y, and that

of disbursements by 33%.

The FX-adjusted deposit volume, together with

retail bonds, increased by 2% over the year as

a whole. The net loan/deposit ratio dropped

further (47%, –6 pp y/y, FX-adjusted).

Of the Hungarian subsidiaries, Merkantil Bank

and Car realised a HUF 1.6 billion positive

adjusted after-tax profit, which is in contrast

8 OTP Bank Annual Report 2015

to the almost HUF 1.5 billion loss of the

previous year. The improvement is the

combined result of the 13% growth in operating

profit and 32% decrease in the cost of risk.

The several-year decline in the FX-adjusted

total gross loan portfolio came to a halt,

and the volume of newly placed vehicle loans

expanded by 36% y/y.

OTP Fund Management posted a HUF 4.8 billion

profit in 2015. The portfolio of management

funds decreased by 9% y/y against a backdrop

of declining yields, but stabilised in Q4.

The company maintained its leading position in

the domestic fund management market.

The performance of DSK Bank stands out

among the foreign subsidiaries, as the

Bulgarian subsidiary bank realised a

HUF 52.5 billion profit in 2015, which exceeded

the previous year’s figure by 34%. This

exceptional performance was due to strong

revenues from basic banking services, and

the 21% fall in the cost of risk. The annual net

interest margin is stable (5.24%), and the quality

of the portfolio is continuously improving.

The provisions coverage for the DPD90+

portfolio increased substantially (2015: 95.8%)

despite the lower cost of risk; the DPD90+ rate

(14.9%) decreased on a y/y basis. The bank’s

FX-adjusted loan portfolio grew by 1% y/y,

and thus the share of the corporate portfolio

expanded further (+5% y/y), and the bank’s

share of the corporate market also improved.

Owing to the bank’s excellent operation and

market reputation, the FX-adjusted deposit

volume rose by 16%. The bank’s profitability

and eciency is excellent: the annual ROE

was 21% and the cost/income ratio 36.1%.

In recognition of these outstanding results,

The Banker magazine awarded DSK Bank the

title of Bank of the Year of Bulgaria in 2015.

The Russian subsidiary bank remained

loss-making in 2015; the HUF 15.1 billion

negative result excluding Touch Bank exceeds

that of the base period by 4%. The loss

calculated in forint can be attributed primarily

to the 36% y/y drop in operating profit, which

was only partially oset by the 30% decrease

in the cost of risk. In its operations in 2015 the

bank focused on more eective cost control

and collection, an approach that yielded a

number of favourable results: From the second

half of 2015 the deterioration of the portfolio

slowed considerably, while the bank’s operating

expenses decreased by 38% at annual level due

to the headcount reduction and branch closures

carried out during the year. Business activity

remained cautious and targeted, as the bank

primarily focused on consumer goods loans; the

disbursement of personal loans was restrained,

and there was eectively no cross-selling of

credit cards at all. A positive development

was that, in line with the management’s aims,

the risk-cost ratio for consumer goods loans

dropped nearly 10% for the year as a whole,

and an improvement is also being seen in the

case of personal loans. The bank’s annual net

interest margin decreased on a y/y basis, but is

still the highest (15.6%) in the Group.

The loss made in 2015 by the digital bank,

Touch Bank, which in legal terms operates as

a part of the Russian subsidiary but in practice

functions as a stand-alone key business line,

came to HUF 4.8 billion. This was principally a

result of the bank’s operating expenses, which

in turn were due in part to intensive customer

acquisition and marketing activity. The bank’s

customers now number almost 20,000, with

deposits approaching the HUF 4.3 billion mark.

The Ukrainian subsidiary bank generated

a HUF 40.3 billion adjusted negative result,

which is 7% smaller than the loss incurred

one year previously. The cost of risk generated

on the Crimean and East Ukrainian exposures

represented HUF 2.4 billion (after tax); these

were stated as correction items at consolidated

level.

Due to the hryvnia’s substantial y/y weakening

against the forint, the changes in business

results can be better described in terms of the

local currency. On this basis the operating result

improved by 46% over the year as a whole,

and within this, the amount of interest income

9Message from the Chairman & CEO

remained eectively unchanged relative to the

previous year, whereas fee and commission

revenues improved by 19%, and other revenues

improved substantially, due partly to the base

eect. Revenues grew by 22% overall, while

operating expenses dropped by 3%.

The rate of growth in the FX-adjusted DPD90+

portfolio (excluding sales and write-downs)

decreased considerably at annual level

(2014: HUF 61 billion, 2015: HUF 11 billion); the

DPD90+ ratio increased by 2.4 pp y/y (48.6%).

The cost of risk increased by 35% y/y in hryvnia

terms. The provisions coverage of the DPD90+

portfolio rose by 21.3 pp y/y to reach 118.5%.

The FX-adjusted DPD0–90 loan portfolio shrank

by 26% year on year; a more pronounced

decrease occurred in respect of performing

retail loans (–36%), while the corporate loan

portfolio decreased at the more moderate rate

of 22%. Lending activity generally continued to

be restrained and conservative. The customers’

confidence in the bank is reflected in the fact

that the FX-adjusted deposit volume grew by 2%

year on year. The bank’s net loan/deposit ratio

dropped to 85%, which conceals a high degree

of adaptation (–63 pp y/y, FX-adjusted). Parallel

with this, in 2015 the volume of group financing

(including subordinated loan capital) decreased

by almost USD 250 million, amounting to the

equivalent of HUF 107 billion at the end of Q4.

The Romanian subsidiary bank’s adjusted

annual profit almost doubled year on year, to

nearly HUF 1.5 billion. The main balance sheet

and profit-and-loss items were influenced in

a considerable extent by the consolidation of

Banca Millennium S.A. in Q1 of 2015.

The 18% y/y increase in revenues was oset

by the jump in operating expenses (+59%

y/y), and as a result of this, the operating

profit also decreased by 38% in comparison

to the previous year. The annual cost of risk

halved. The FX-adjusted gross loan portfolio

expanded by 23% over the past one-year period

as a result of the acquisition. The volume of

personal loans was 9% higher and the portfolio

of mortgage loans 19% greater than one

year previously. The corporate loan portfolios

expanded at a higher rate than this, at 30%.

Deposits showed strong growth, with volumes

increasing by 51% y/y, and consequently the

net loan/deposit ratio dropped to 142% (–30 pp

y/y, FX-adjusted). The DPD90+ ratio declined to

16.7%, with stable coverage (79.1%).

The almost HUF 3 billion adjusted after-tax

profit attained by the Croatian subsidiary bank

in 2015 represents a substantial improvement

on the previous year’s figure (HUF 104 million).

Operating profit grew dynamically year on

year (+44), and all these factors more than

compensated for the increase in the cost of

risk (+32%) that occurred in the same period.

The bank’s net interest margin for the year

improved (3.12%). The FX-adjusted loan

portfolios showed minimal growth, while

deposits decreased by 2%, with the result

that the net loan-to-deposit ratio increased

slightly (84%). The loan portfolio shows an

improving trend; the ratio of DPD90+ loans

was 13.1%, and their coverage increased

(70.9%).

The Slovak subsidiary bank’s adjusted net

earnings of over HUF 900 million is a major

improvement on the HUF 32 million profit

achieved in 2014. This favourable change

is due to the combined impact of the 12%

improvement in operating profit and a 6% drop

in operating expenses. The bank’s interest

margin was unchanged from the previous

year (3.18%). In the favourable macroeconomic

environment the FX-adjusted loan portfolios

grew by 4% and deposits by 3% y/y.

The proportion of DPD90+ loans decreased by

0.6 pp to 9.7%, and their coverage increased

(61.2%).

The Serbian subsidiary bank was unable to

maintain its profitable operation, eventually

closing the year 2015 with a loss of close to

HUF 400 million. At annual level the operating

profit was weaker (–5%), while the cost of

risk increased by 28%. The FX-adjusted loan

portfolio grew by 9% y/y, with substantial

growth in volumes observed in both the retail

10 OTP Bank Annual Report 2015

and corporate divisions. The ratio of DPD90+

loans decreased further (39.3%), with stable

coverage (74.9%).

The Montenegrin subsidiary bank, as in 2013

and 2014, turned a profit again in 2015

(HUF 909 million), which was more than double

that of the previous year. The 17% y/y drop in

operating profit can primarily be attributed to

the decrease in revenues (–9%); this was only

partially oset by the bank’s eective cost

management. The improvement in after-tax

profit was due to the 35% y/y decrease in the

cost of risk. The FX-adjusted loan portfolio grew

by 5% y/y, and deposits by 4%. The portfolio

of loans more than 90 days in past due grew

(42.7%), but its coverage improved (83%).

Innovation, accolades

Although we continue to have a dominant

branch presence in many of our core markets,

OTP Bank was among the first to recognise the

opportunities inherent in innovations related

to digital channels, and this is one reason why

the Bank is the market leader in respect of all

digital channels in Hungary. It is a strategic

priority of the Bank to achieve full digital

transformation, which, beyond the development

of internal processes, also aims to provide an

outstanding customer experience. As part of

this, the Digital Transformation Programme

was launched, and has set itself the goal of

implementing more than 100 projects.

Meanwhile, the role of the branches is gradually

changing, with simple transactions – where the

role of the online channels is growing steadily –

increasingly giving over to the sale of complex

products and the provision of advice.

Last year we once again received numerous

professional accolades, but the one closest

to my heart was the award that the bank has

now received for many years running, for its

outstanding role in the promotion of financial

literacy. This is all a part of our eorts to

provide the younger generations with a diverse

and varied range of essential skills, within

the context of our active CSR commitments.

Through the OTP Fáy András Foundation’s

Training Centre, since November 2012 tens of

thousands of secondary school students have

received education in finance, economics and

money management, free of charge.

OTP Bank has for many years received the Best

Bank in Hungary award from financial journals

The Banker, Euromoney or Global Finance, but

OTP’s private banking service is also the proud

holder of the title of best domestic, and indeed

regional, service provider.

Expectations for 2016

Given the favourable macroeconomic

environment mentioned in the introduction,

and the constructive attitude displayed by the

regulators, I am essentially optimistic with

regard to 2016. Accordingly, I can confirm

that this year we are steadily approaching

the target that was set at the Annual General

Meeting of 2015, specifically: by 2017 the Bank

Group’s return on equity (ROE) will exceed 15%

(alongside a 12.5% CET1 ratio), and besides the

Hungarian and Slovak bank tax and the revenue

derived from the sale of our stake in Visa

Europe Ltd. (approx. HUF 10.5 billion), there are

no other one-o items that will influence our

consolidated after-tax profit in 2016. In eect,

this means that I expect to see a substantial

improvement in both our accounting profit and

in our after-tax profit adjusted for one-o items.

Furthermore, the previous years’ erosion of

the group-level performing loan portfolio will

come to an end in 2016, and hopefully we can

also expect to see slight growth. I have faith

particularly in lending to the corporate, and

specifically the micro and small enterprise, as

well as the agricultural sector, but decisions

by the Hungarian government may also have

a favourable eect on the growth of domestic

mortgage lending. The consolidated net interest

margin may decline slightly, because for one,

the weight of the higher-margin Russian and

Ukrainian operations will decrease, and for

another, we expect lower margins in both

11Message from the Chairman & CEO

Bulgaria and Hungary, especially if the central

bank carries out further interest rate cuts in the

course of the year. The favourable trends that

have got under way in terms of portfolio quality

will continue, and the cost of risk will decrease

significantly at the Russian and Ukrainian

subsidiary banks, and to a lesser extent in

Hungary and Bulgaria too. Operating expenses

will develop similarly to the 2015 trend; the

nominal extent of these will be substantively

influenced by the fact that a growing number of

group members will incur an obligation to pay

into the National Resolution Funds that must be

established under EU regulations, and by the

amounts payable into deposit protection and

investment protections funds, which are also

rising at annual level.

The greatest positive changes relative to the

past two years is that this year we do not expect

losses at either the Russian or the Ukrainian

operation.

Our stable capital strength makes it possible

for us to increase the dividend payout from year

to year: subject to approval from the General

Meeting, in respect of the 2015 financial year

we expect a dividend payout of HUF 46.2 billion,

which translates to approximately HUF 165

per share. Alongside organic growth, we are

constantly seeking acquisition opportunities:

there have been positive examples of this in

Croatia and Romania; in both countries the

integration related to the bank purchases has

been completed, and the market positions and

profit-generating capacity of our subsidiary

banks were strengthened. Furthermore, in

February 2016 we purchased the Hungarian

portfolio of AXA Bank, which predominantly

consists of mortgage loans. The integration

process could be completed at the end of 2016,

and as a result of the transaction our mortgage

loan portfolio could improve considerably,

by more than 20%, bringing a parallel

improvement in our market positions.

I am confident that 2016 and the years to

come will now be about normal banking

operation, lending growth rates and the

expansion of portfolios, with activities focusing

on improvements to the quality of customers

service, risk management and eectiveness.

While retaining the values that we have always

upheld, there is a need for constant renewal

and innovation. This is not only something that

is dictated by the competition; for ourselves,

too, we need to set objectives that are in line

with what is expected of a market-leading

financial institution, and which also oer a

realistically attainable vision for our employees

and customers. We have every reason to

believe that the OTP Group will fulfil society’s

expectation that, while ensuring stable,

predictable operation, it will provide individuals

and communities with an eective service

and a positive customer experience in the

management of their day-to-day finances.

I ask for your assistance and supportive

contribution in the achievement of these goals!

Dr. Sándor Csányi

Chairman & CEO

12 OTP Bank Annual Report 2015

Macroeconomic and financial

environment in

2015

MACROECONOMIC AND FINANCIAL

DEVELOPMENTS IN HUNGARY

In 2015 Hungary’s macroeconomy was mostly

shaped by the di erent monetary policies

expected from the Fed and the ECB, and by the

continued slump in commodity prices, which

started in 2014. In December 2015, the Fed

embarked on interest rate hikes (0.25–0.5%),

for the fi rst time in seven years, owing to the

accelerating growth and the favourable labour

market developments in the USA. Meanwhile

the ECB decided to extend its asset purchase

programme and cut the interest rate on

overnight deposits further (to –0.3%). For the

fi rst time since the crisis began, the eurozone

posted meaningful growth (1.5%), but with

signifi cant discrepancies among the European

Union’s regions. Preliminary GDP data for Q4

suggest that Central and South Eastern Europe

remained the strongest region.

The several-month-long negotiations with

Greece, which ultimately resulted in a

temporary solution to the country’s debt

crisis, failed to cast a cloud on the supportive

sentiment on global markets.

Commodity prices slumped deeper, owing to

the shrinking demand caused by the structural

changes in China’s economy. Despite the sliding

oil prices, the December meeting of OPEC

members decided to boost output. As a result,

prices hit lows last seen during the crisis in

2008.

The persistently low oil prices shifted infl ation

forecasts lower, providing room for the

monetary policy and helping the continued

easing of monetary conditions.

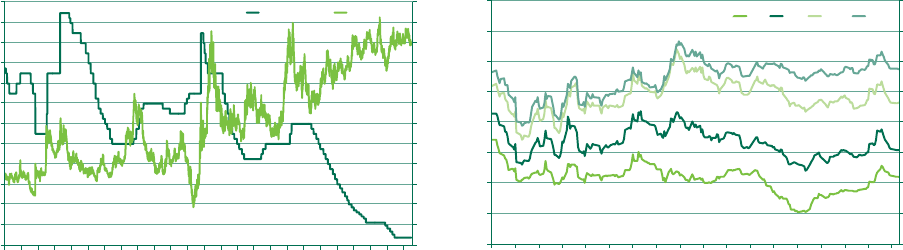

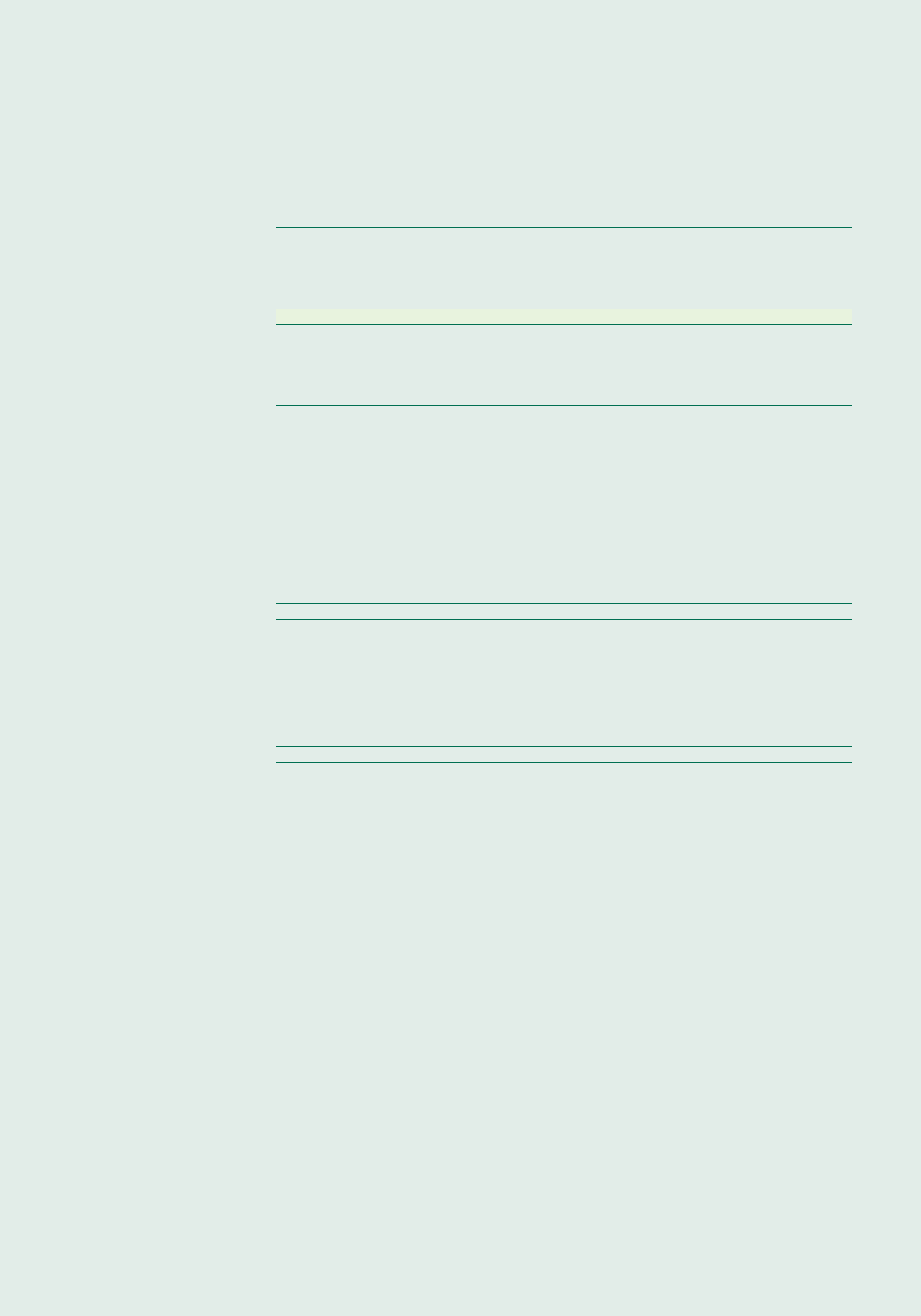

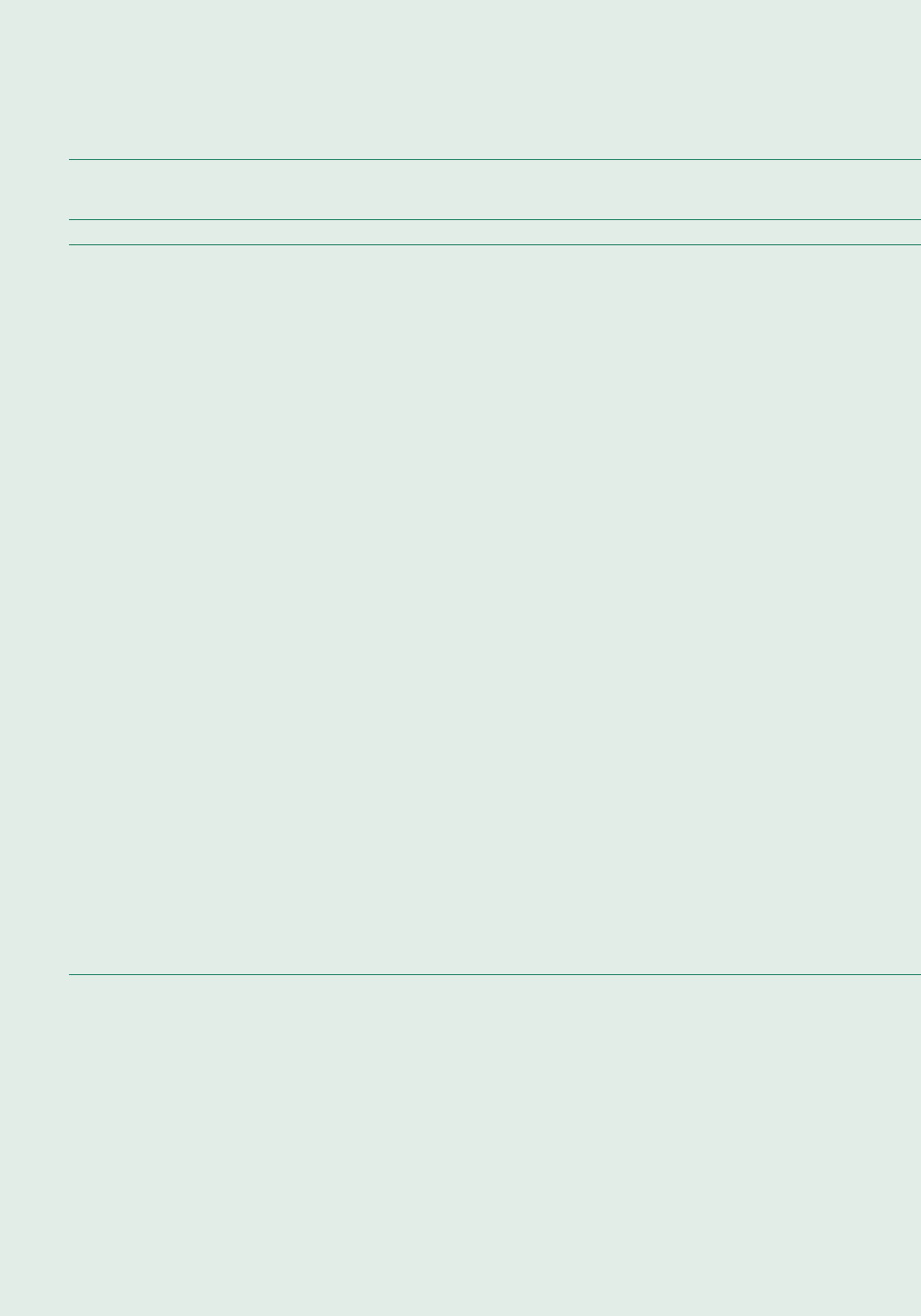

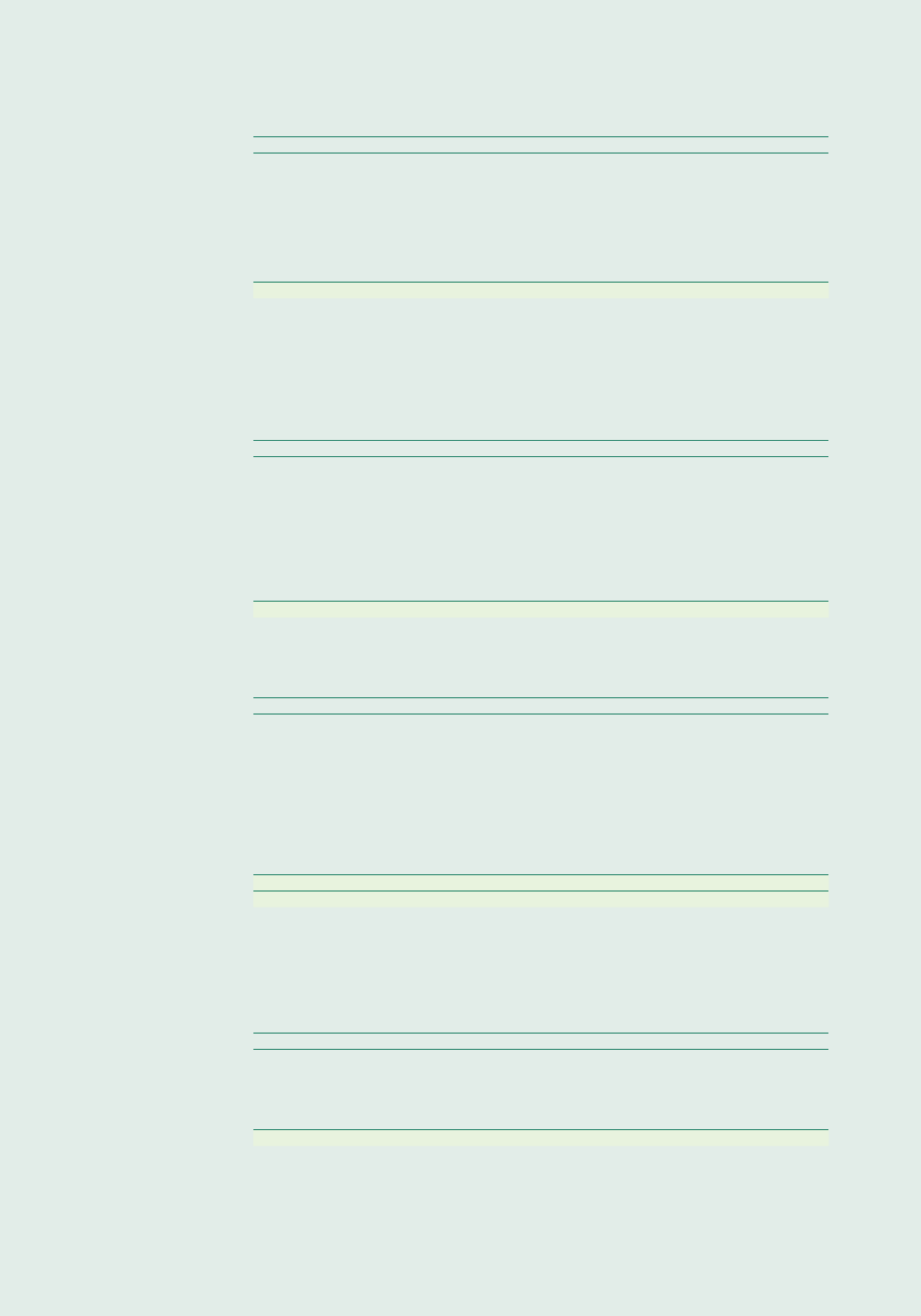

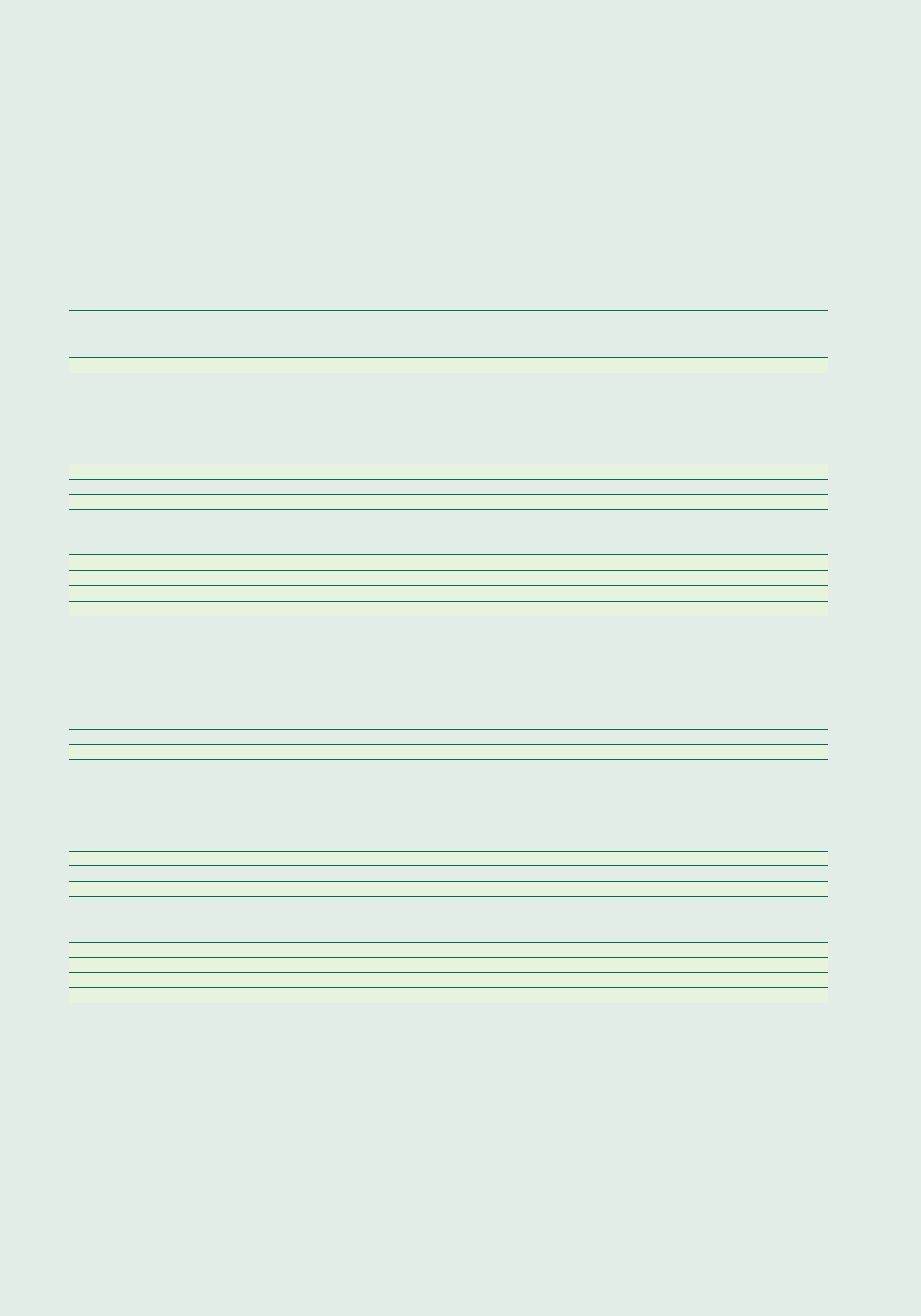

In line with our forecasts, Hungary’s economy

grew by 2.9% in 2015, after expanding by 3.6%

in 2014. After the election year, the volume of

investments fell, but net exports’ contribution

returned to positive territory from the slump

in the previous year. Nonetheless, the engine

of growth was clearly the further accelerating

consumption of households.

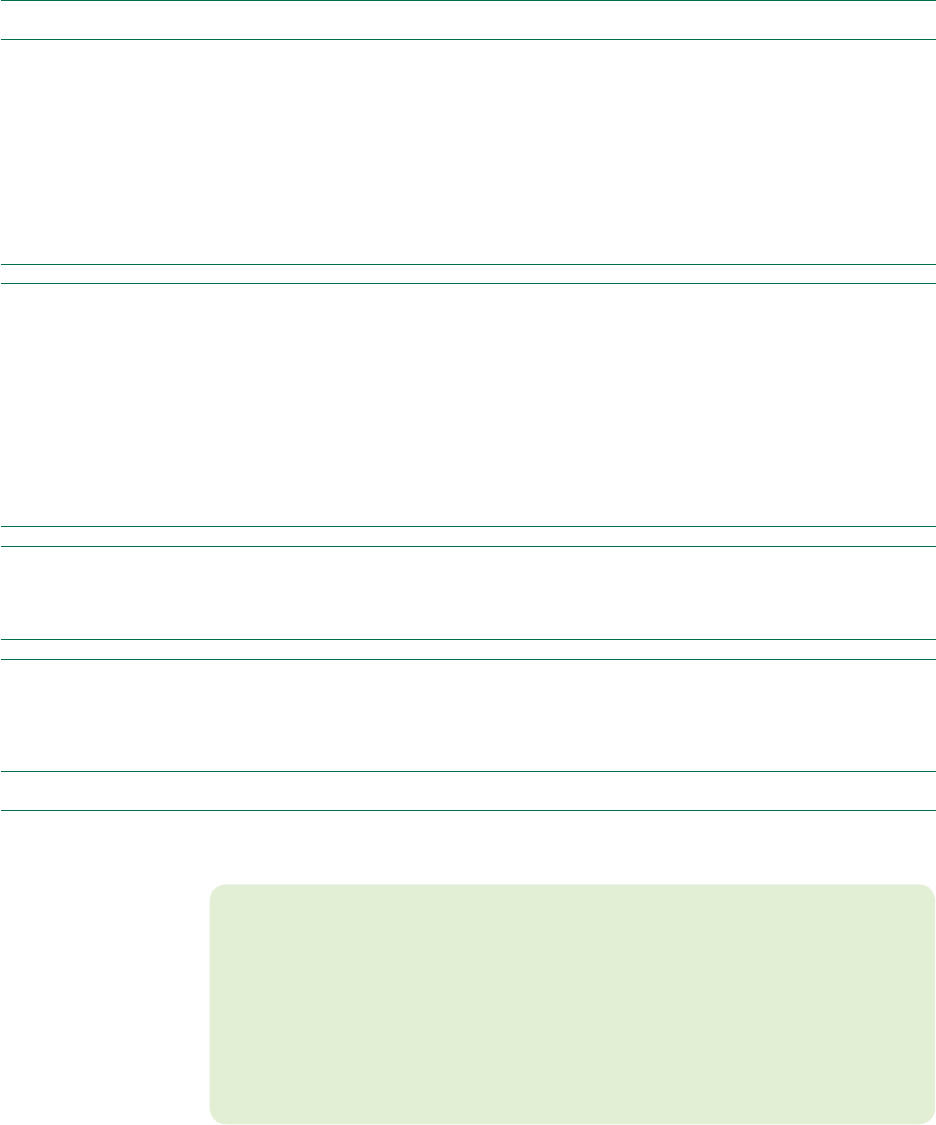

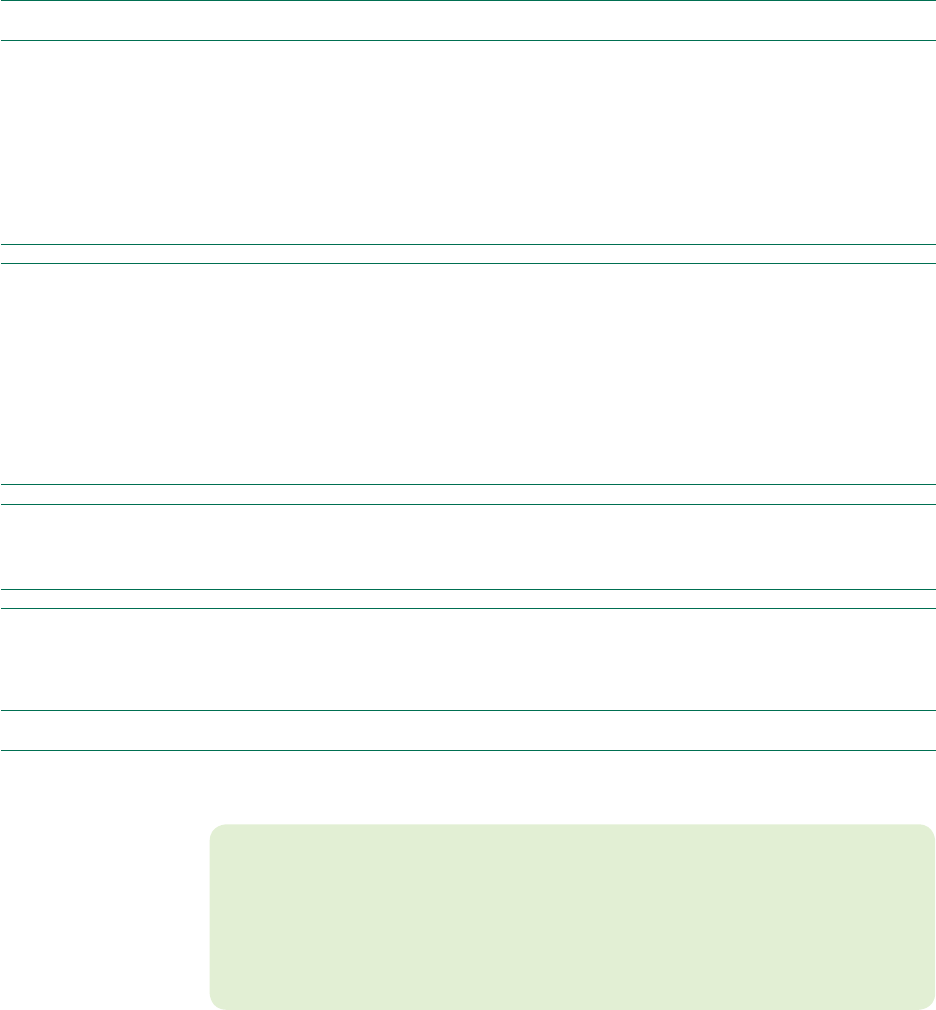

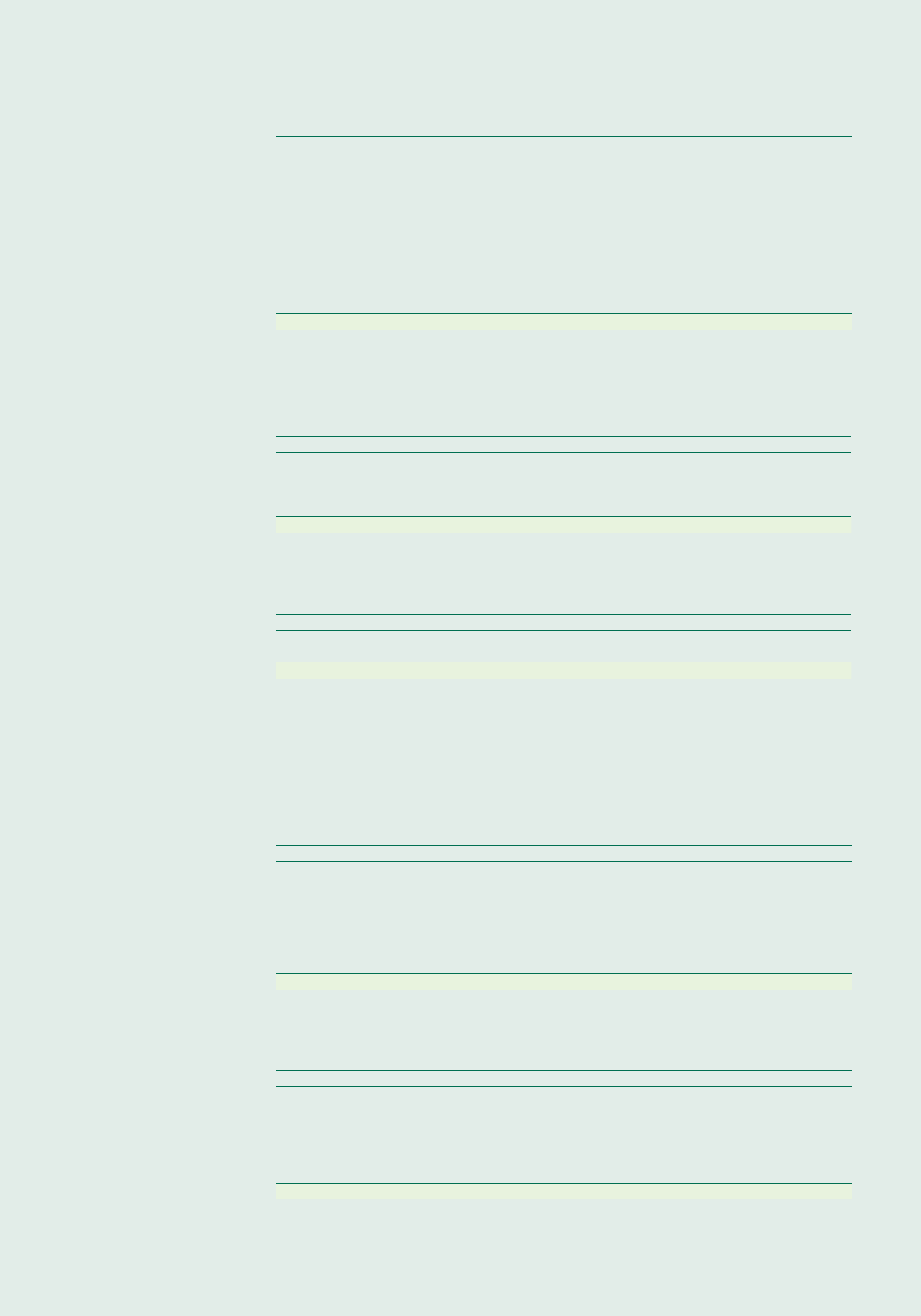

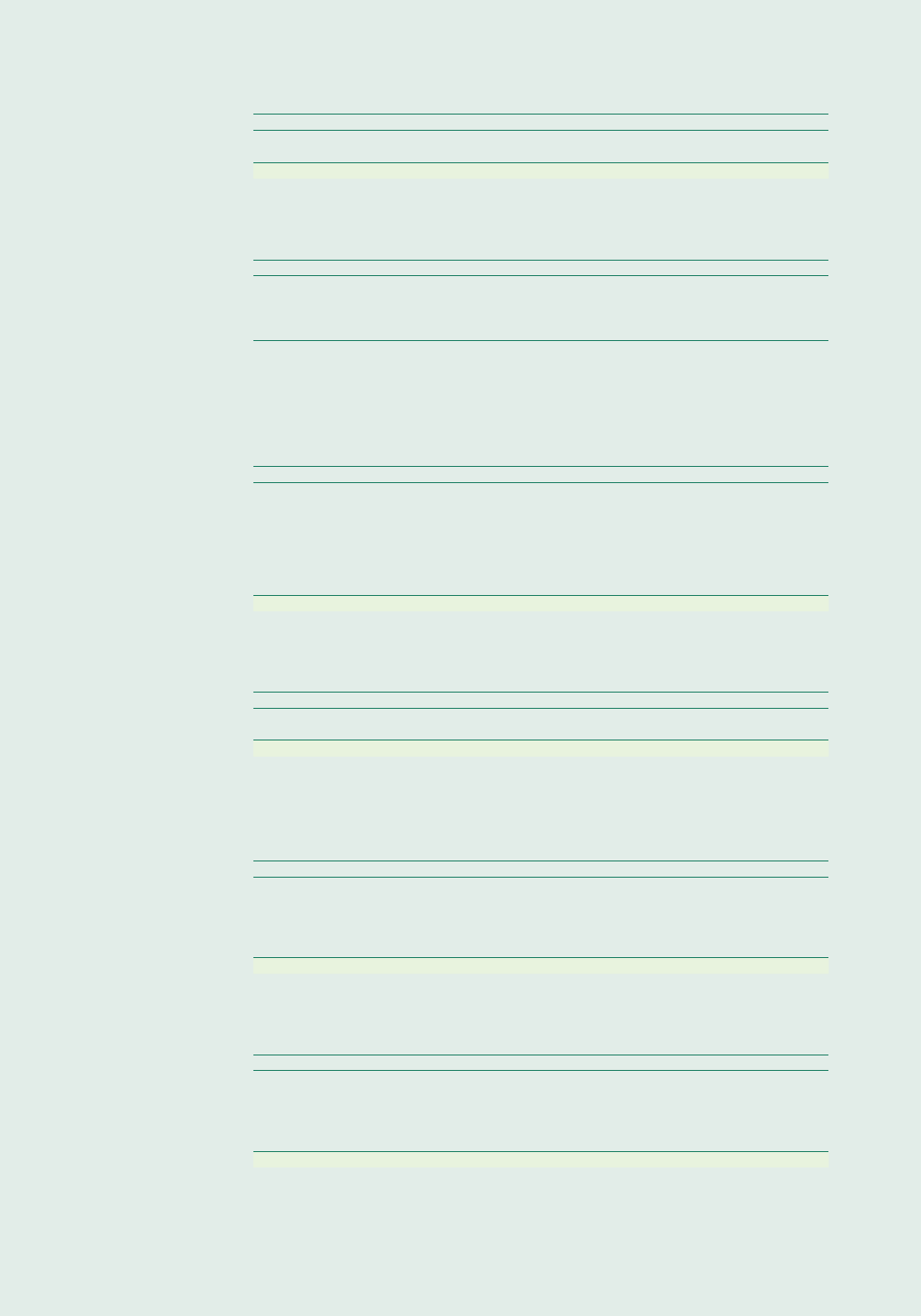

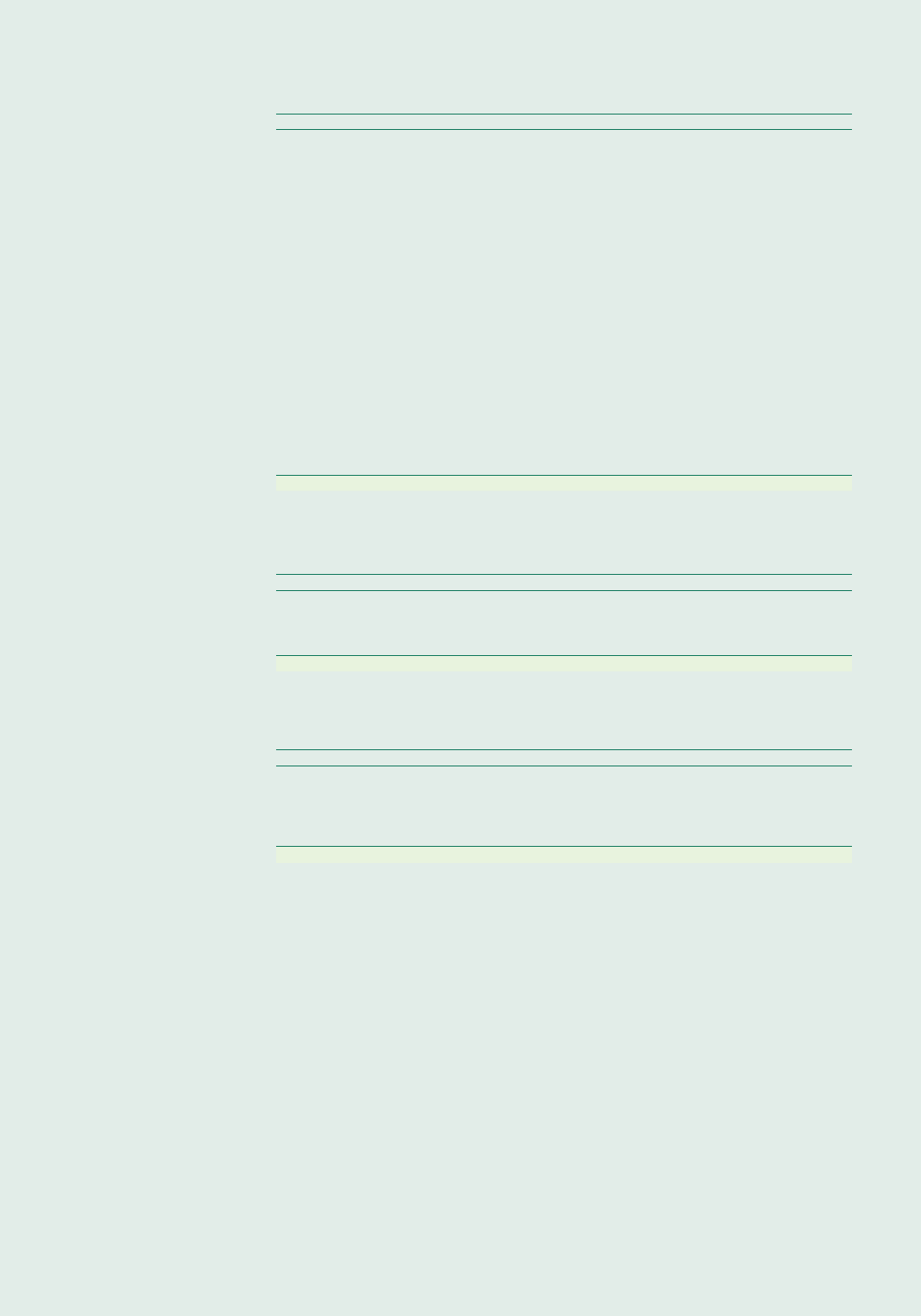

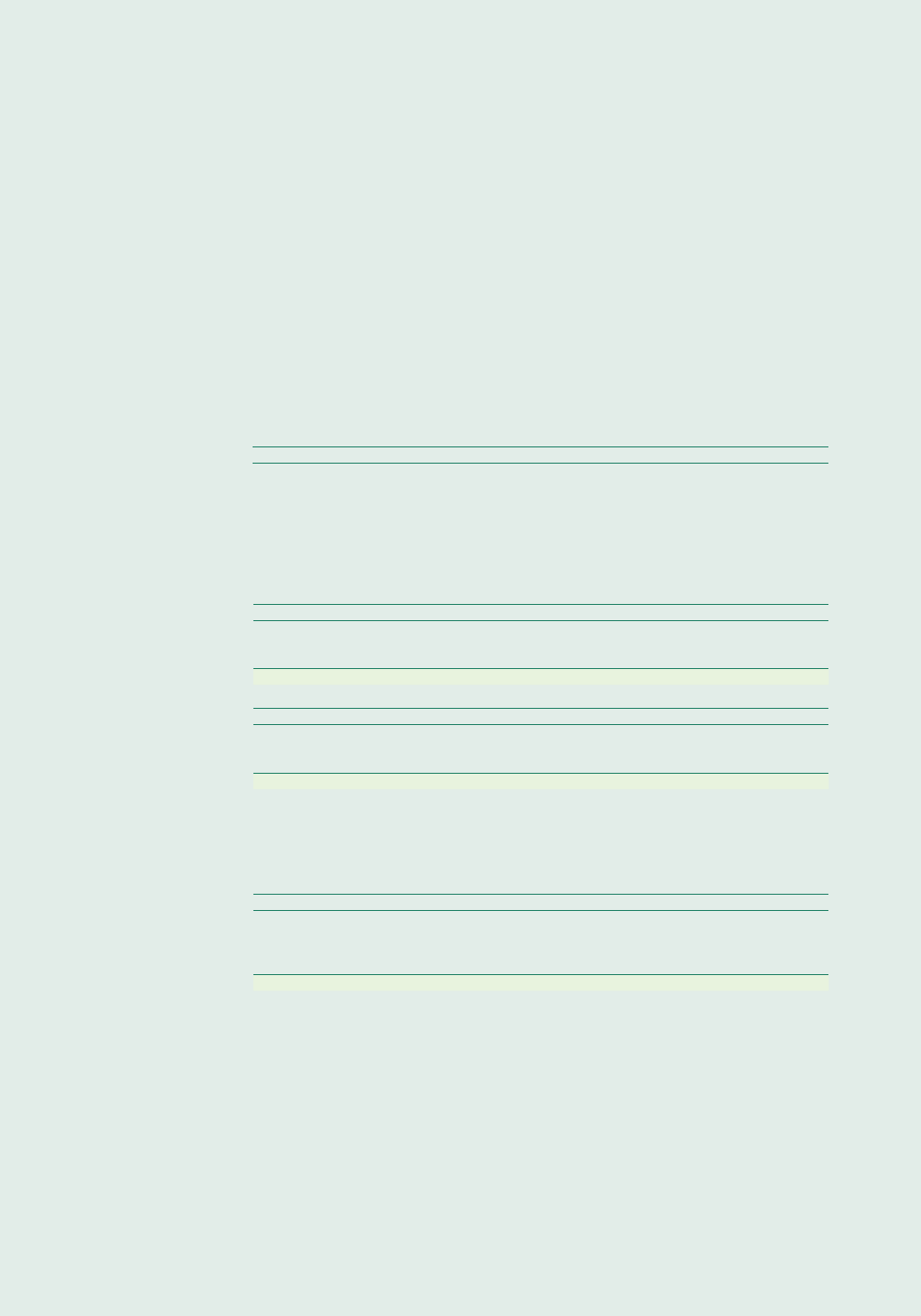

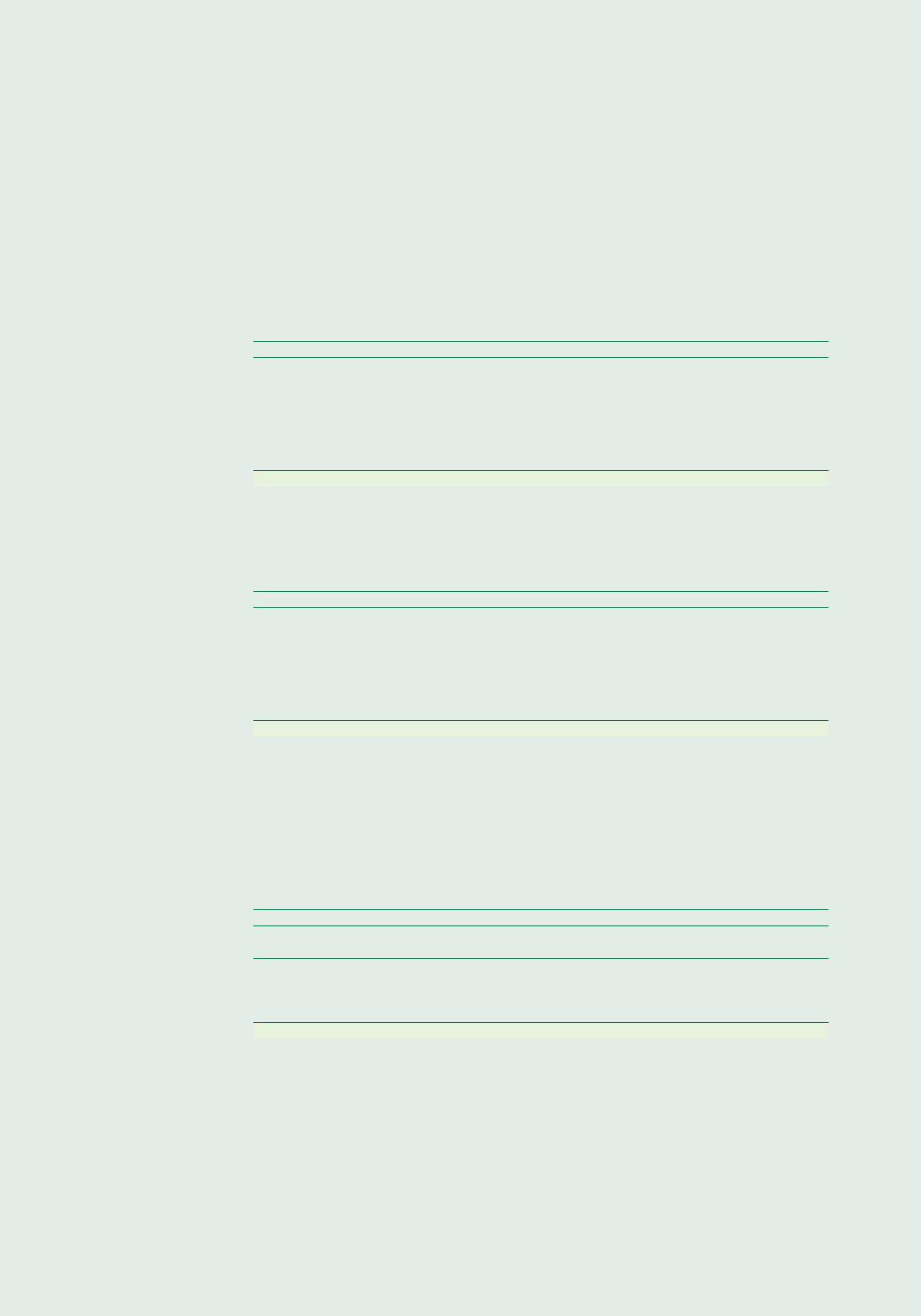

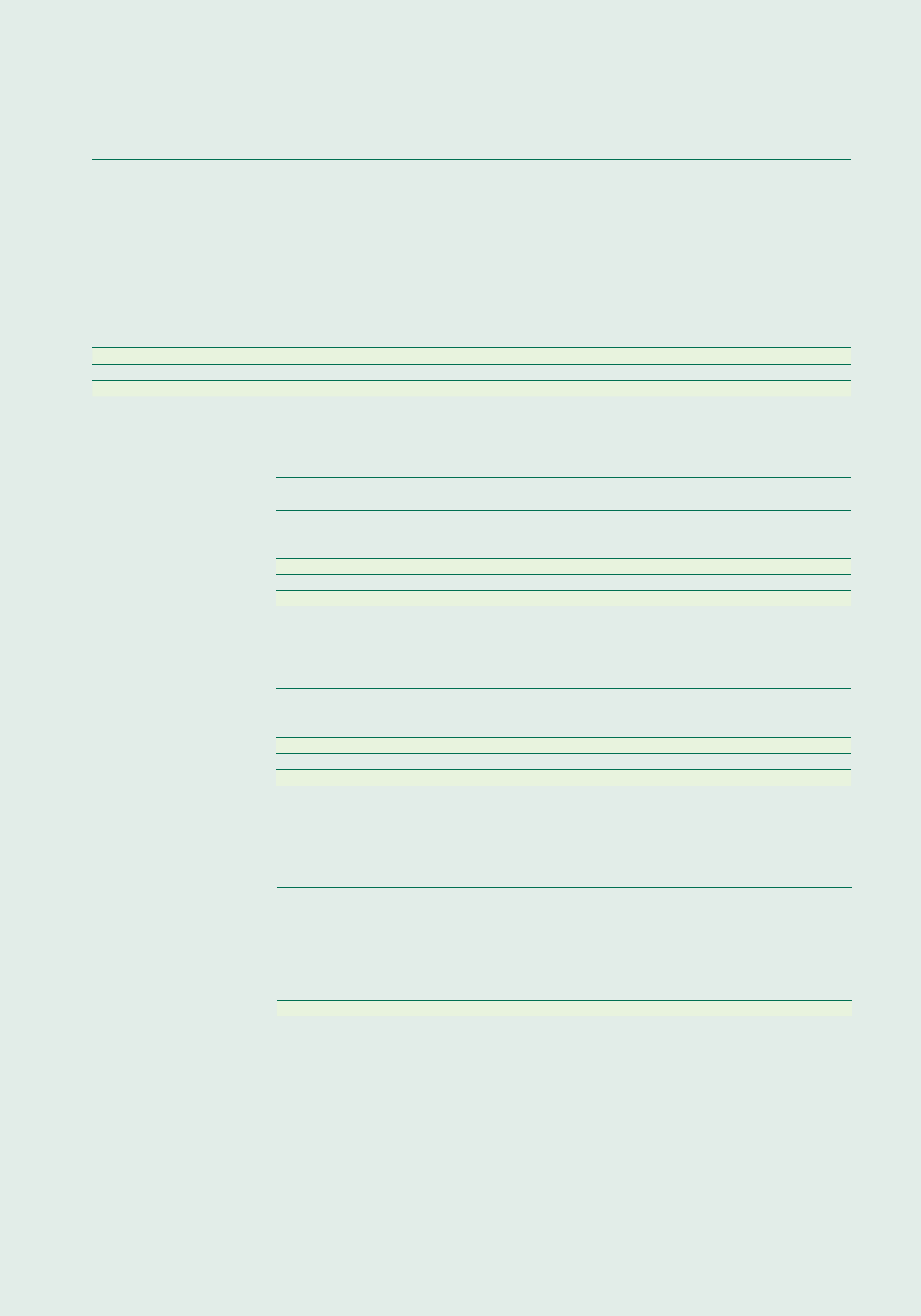

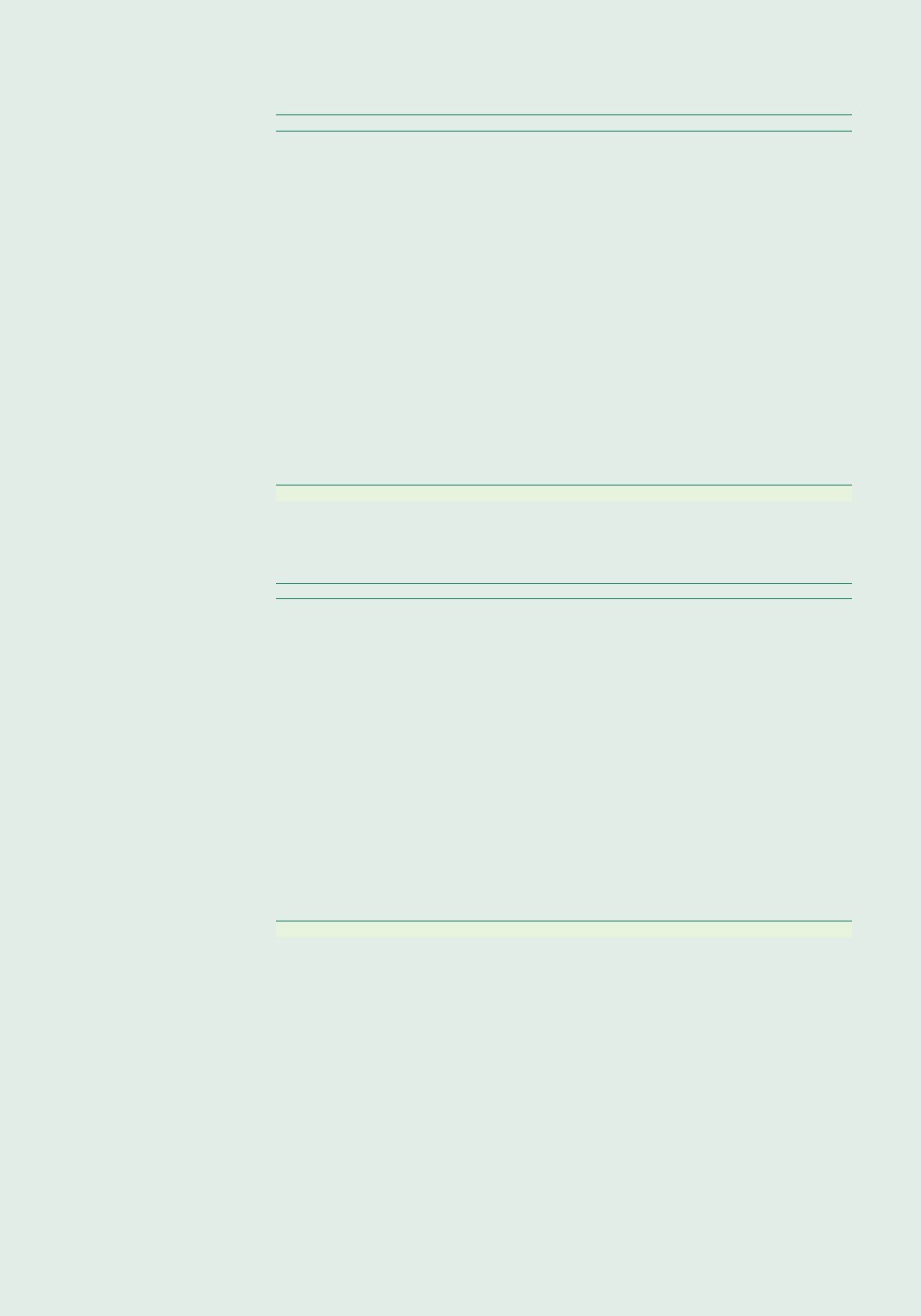

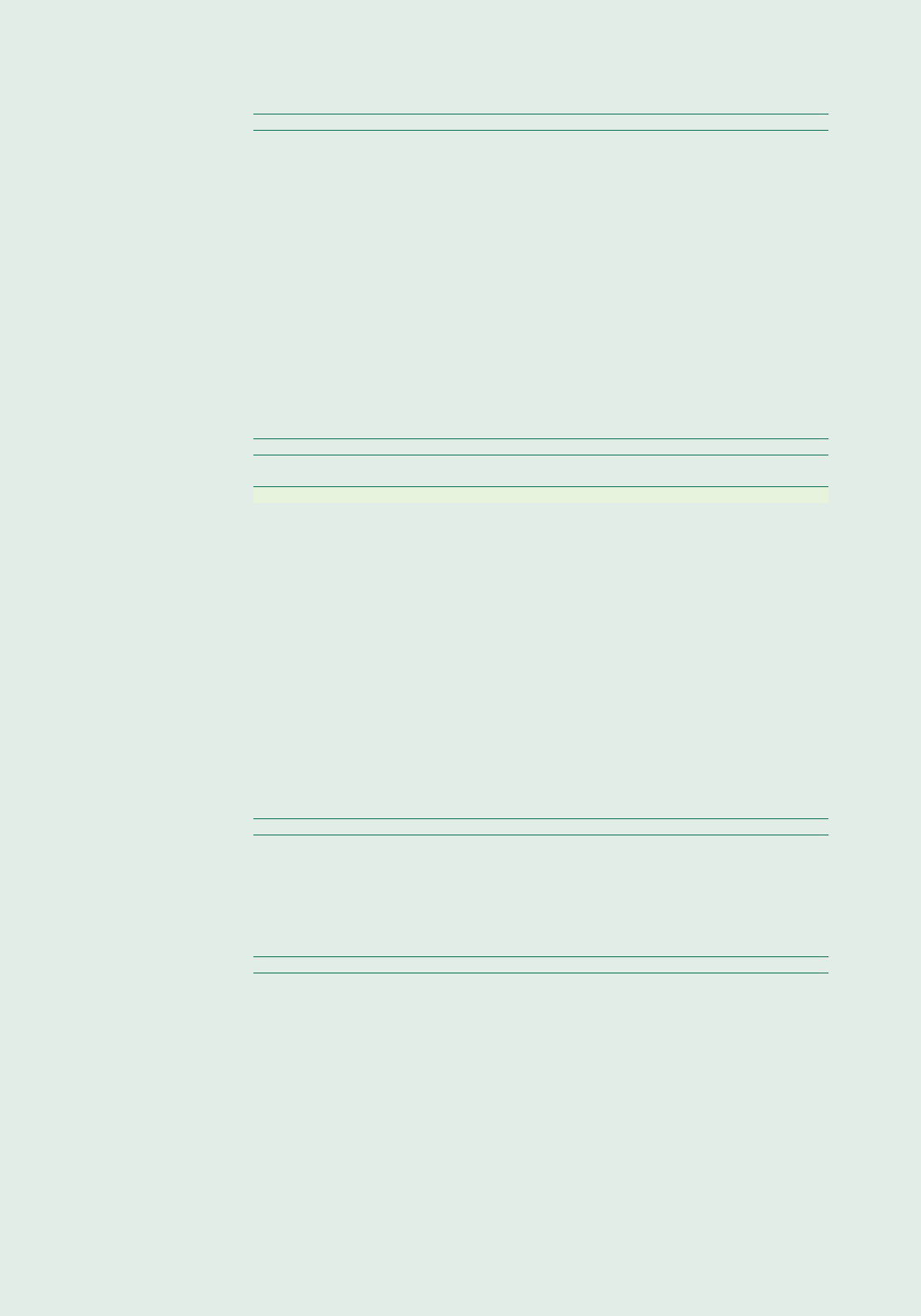

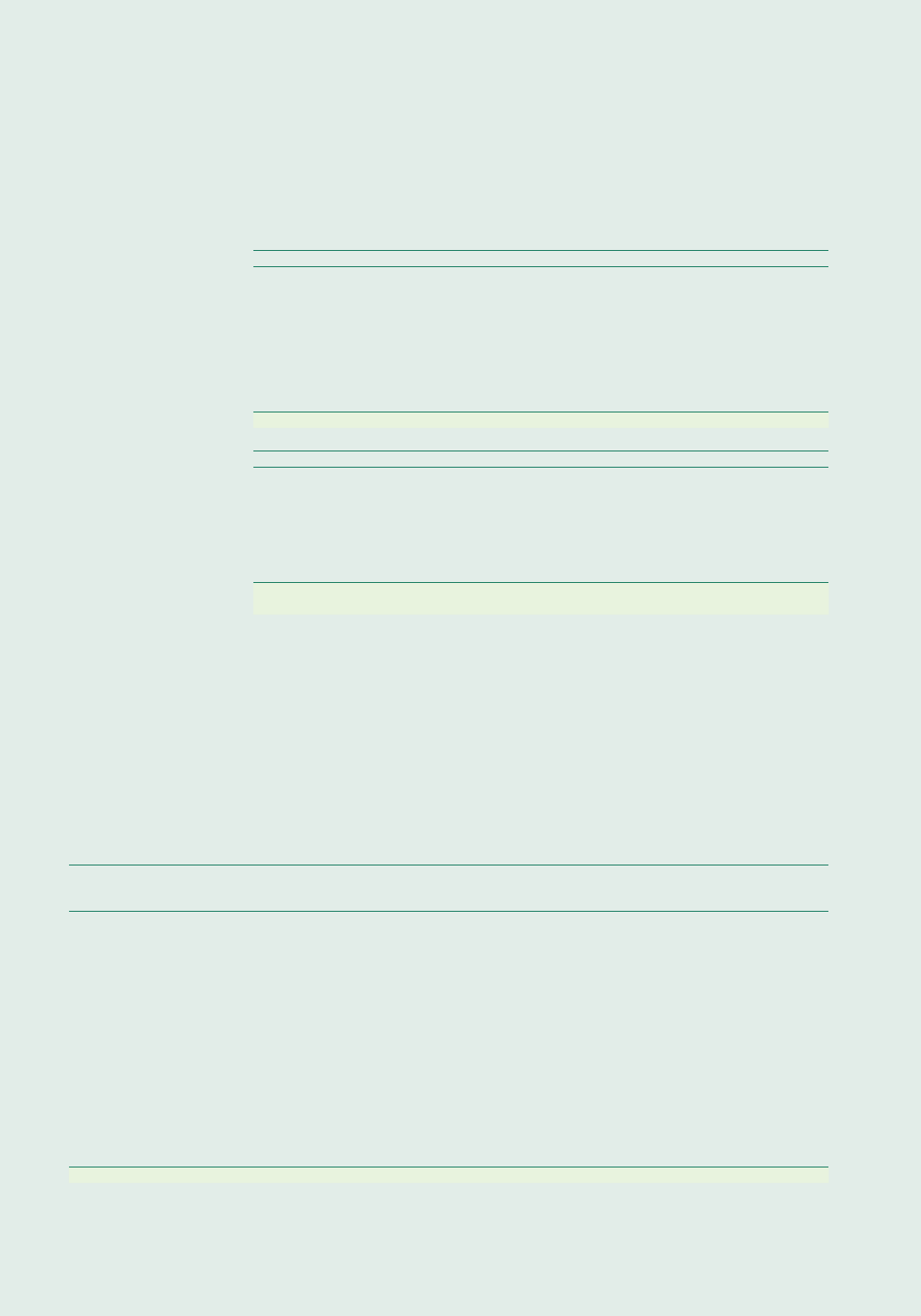

–16

–12

–8

–4

0

4

8

12

–16

–12

–8

–4

0

4

8

12

2006/Q1

2006/Q3

2007/Q1

2007/Q3

2008/Q1

2008/Q3

2009/Q1

2009/Q3

2010/Q1

2010/Q3

2011/Q1

2011/Q3

2012/Q1

2012/Q3

2013/Q1

2013/Q3

2014/Q1

2014/Q3

2015/Q1

2015/Q3

Consumption expenditure of households

Gross fixed investment

Government consumption

Inventories

Net export GDP

Decomposition of Hungary’s GDP growth

by expenditure side items (%)

Sources: HCSO, OTP Research

–8

–6

–4

–2

0

2

4

6

–8

–6

–4

–2

0

2

4

6

Agriculture Construction Market ServicesIndustry

Government Services

Taxes on production less subsidies GDP

Sources: HCSO, OTP Research

2006/Q1

2006/Q3

2007/Q1

2007/Q3

2008/Q1

2008/Q3

2009/Q1

2009/Q3

2010/Q1

2010/Q3

2011/Q1

2011/Q3

2012/Q1

2012/Q3

2013/Q1

2013/Q3

2014/Q1

2014/Q3

2015/Q1

2015/Q3

Decomposition of Hungary’s GDP growth

by production side items (%)

13Macroeconomic and fi nancial environment in 2015

The increase in the value added by market

services has largely contributed to the

economy’s expansion. Even though the

deceleration of Germany’s manufacturing may

pose risks to the demand for Hungary’s export

products, it seems that these fears did not get

in the way of production. Moreover, mostly

owing to the improved terms of trade,

Hungary’s trade surplus also hit an all-time

high, at EUR 8.1 billion (or 8% of GDP) in 2015.

A weaker-than-2014 year pushed agriculture’s

contribution to GDP into negative territory.

Non-farm private sector GDP was as

strong as elsewhere in the CEE region;

it may have grown by more than 4%.

Consumer prices dropped by 0.1% on

average in 2015, thanks to the fall in commodity

prices; demand-sensitive infl ation accelerated

until the end of summer, but somewhat slowed

towards the end of the year.

The further drop in infl ation justifi ed the

continuation of the easing cycle; the latest cut,

in July, brought the base rate to 1.35%.

The MNB’s Self-Financing Programme

introduced a two-pronged plan to boost lending

for SMEs, then the MNB decided to do away with

the two-week deposit bills, to boost commercial

banks’ appetite for government securities.

At the end of 2015, the MNB announced plans to

introduce unconventional monetary policy tools

because infl ation was likely to remain below its

target throughout the forecast horizon.

The further decrease in infl ation made a

case for the continuation of the easing cycle;

therefore the base rate was reduced in

July to 1.35%. As a part of the self-fi nancing

plan, the MNB introduced a Scheme which

aims to boost SME lending, later the MNB

decided to phase out the two-week deposit in

order to boost the demand of banks towards

government bonds.

Due to the fact that infl ation will remain below

the infl ation target over the forecast horizon,

at the end of the year the MNB announced they

plan to introduce new, mainly unconventional

monetary policy tools in the future.

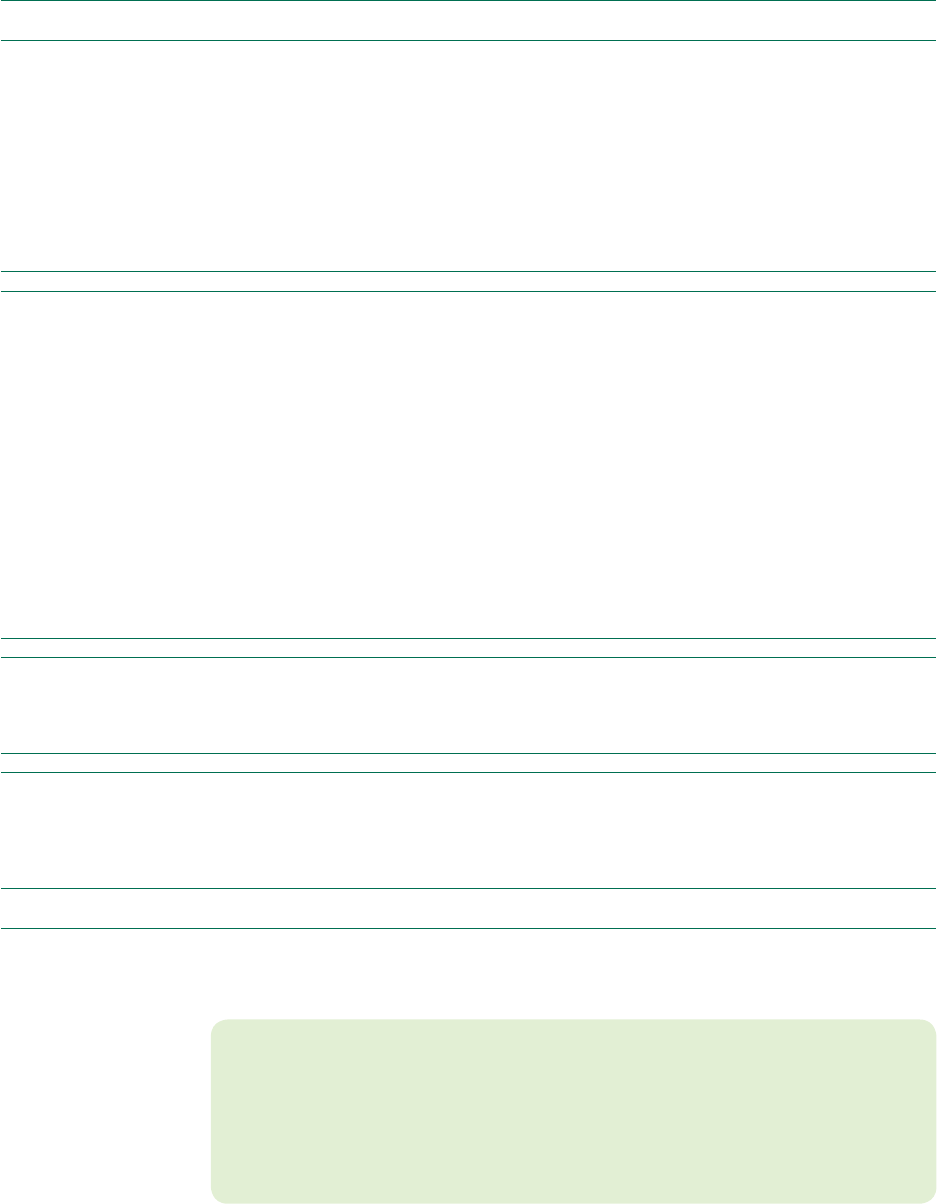

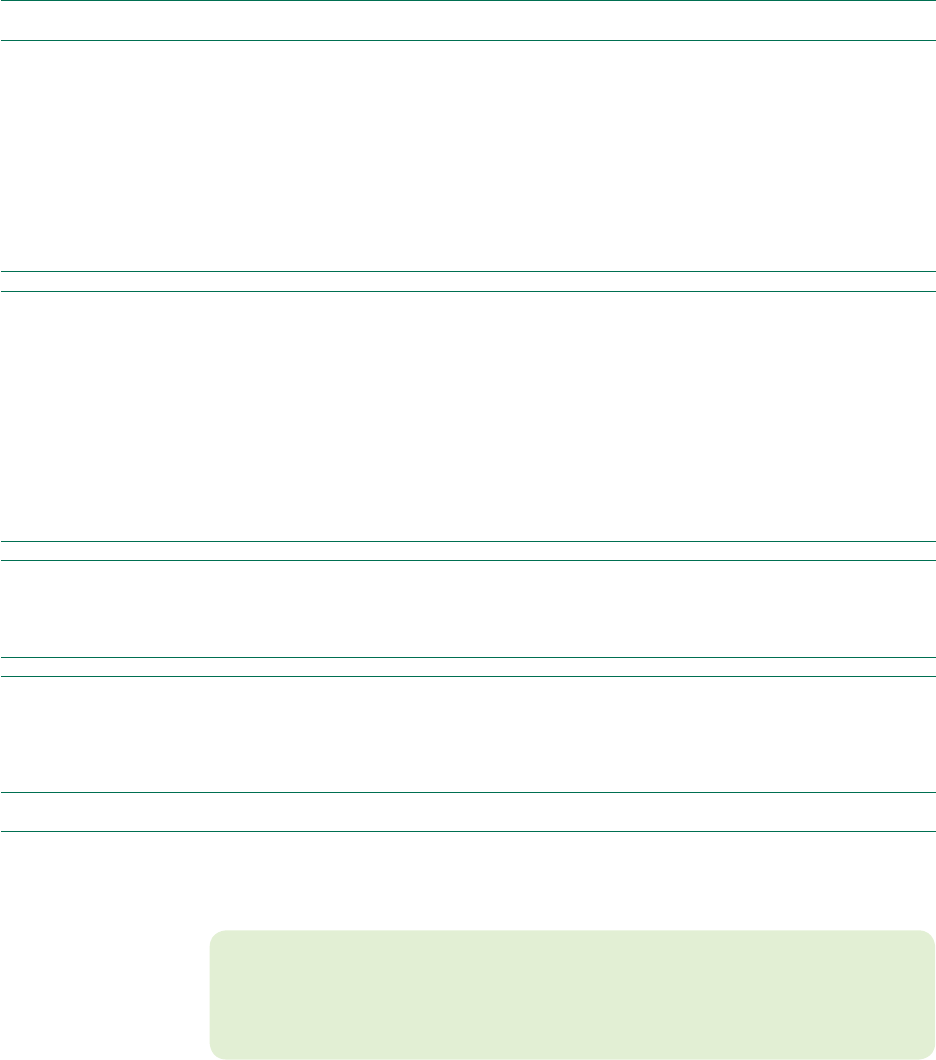

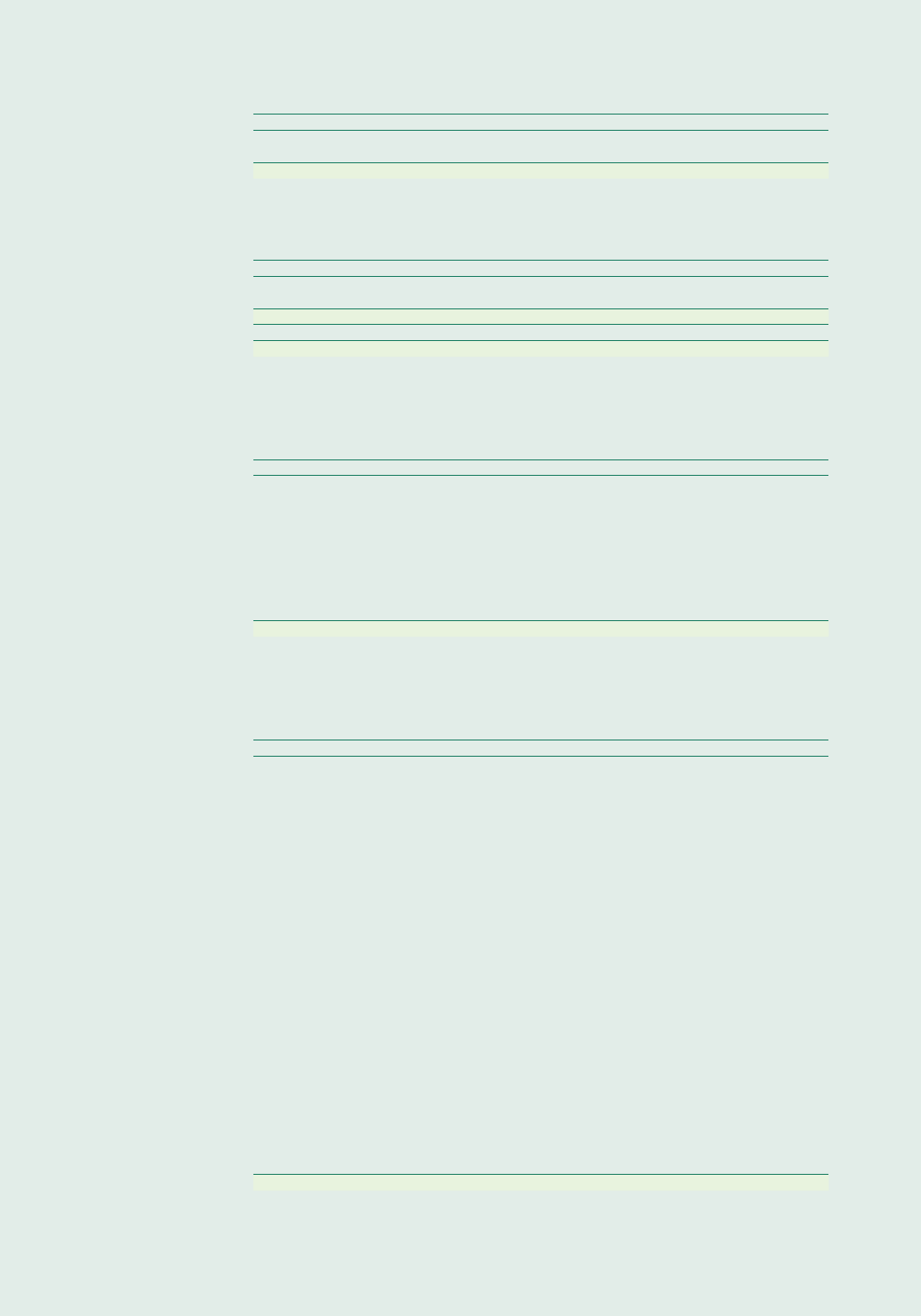

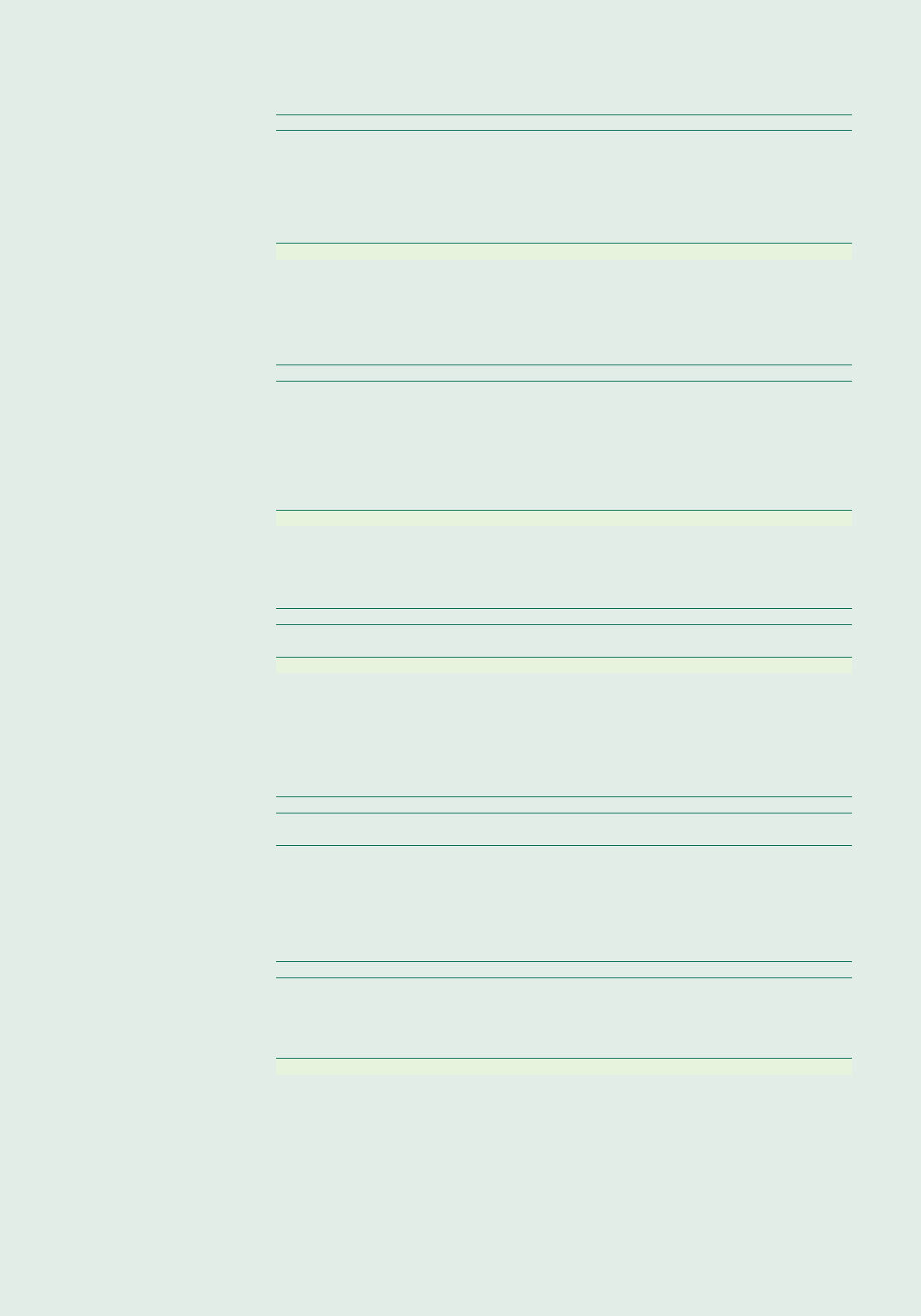

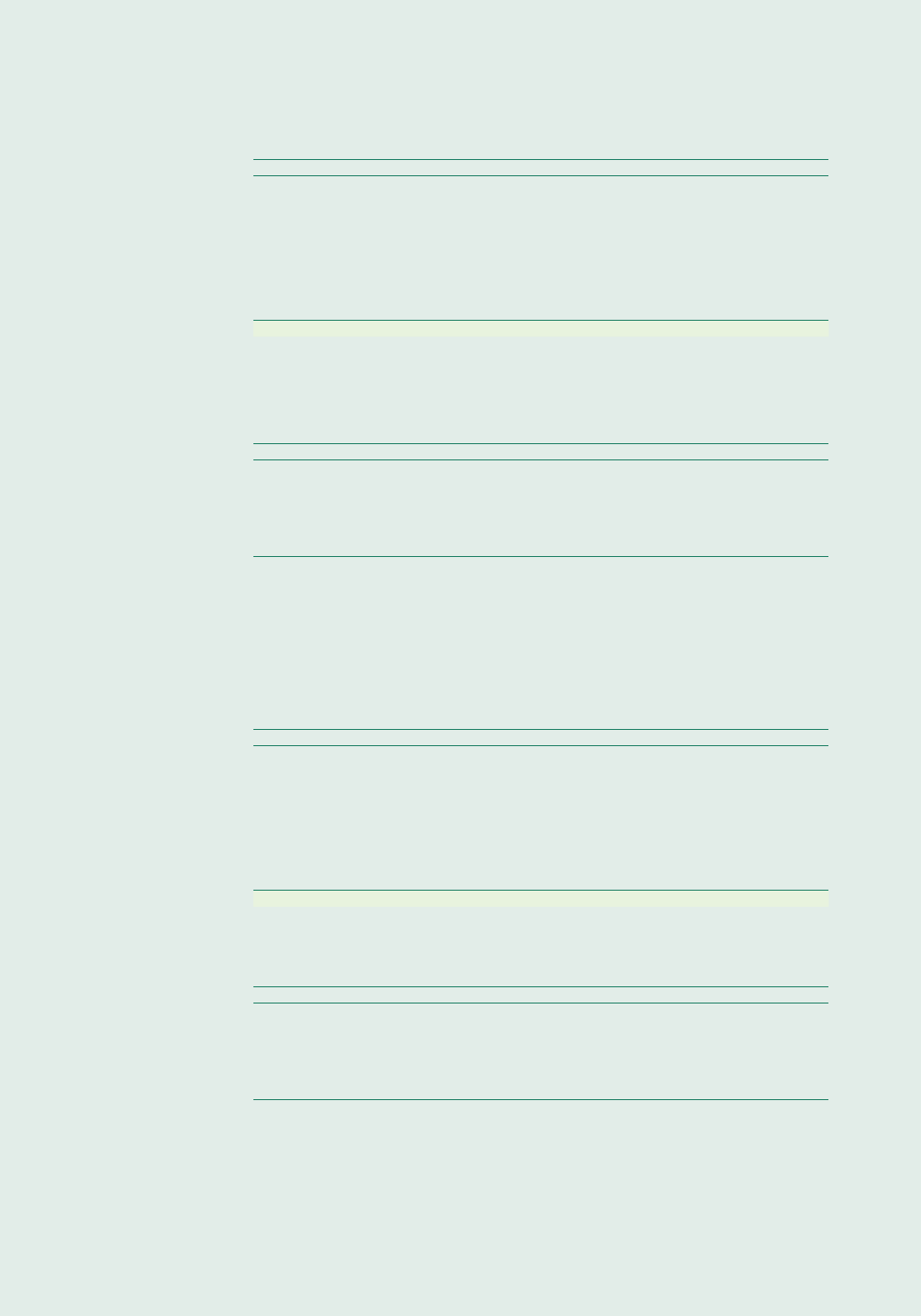

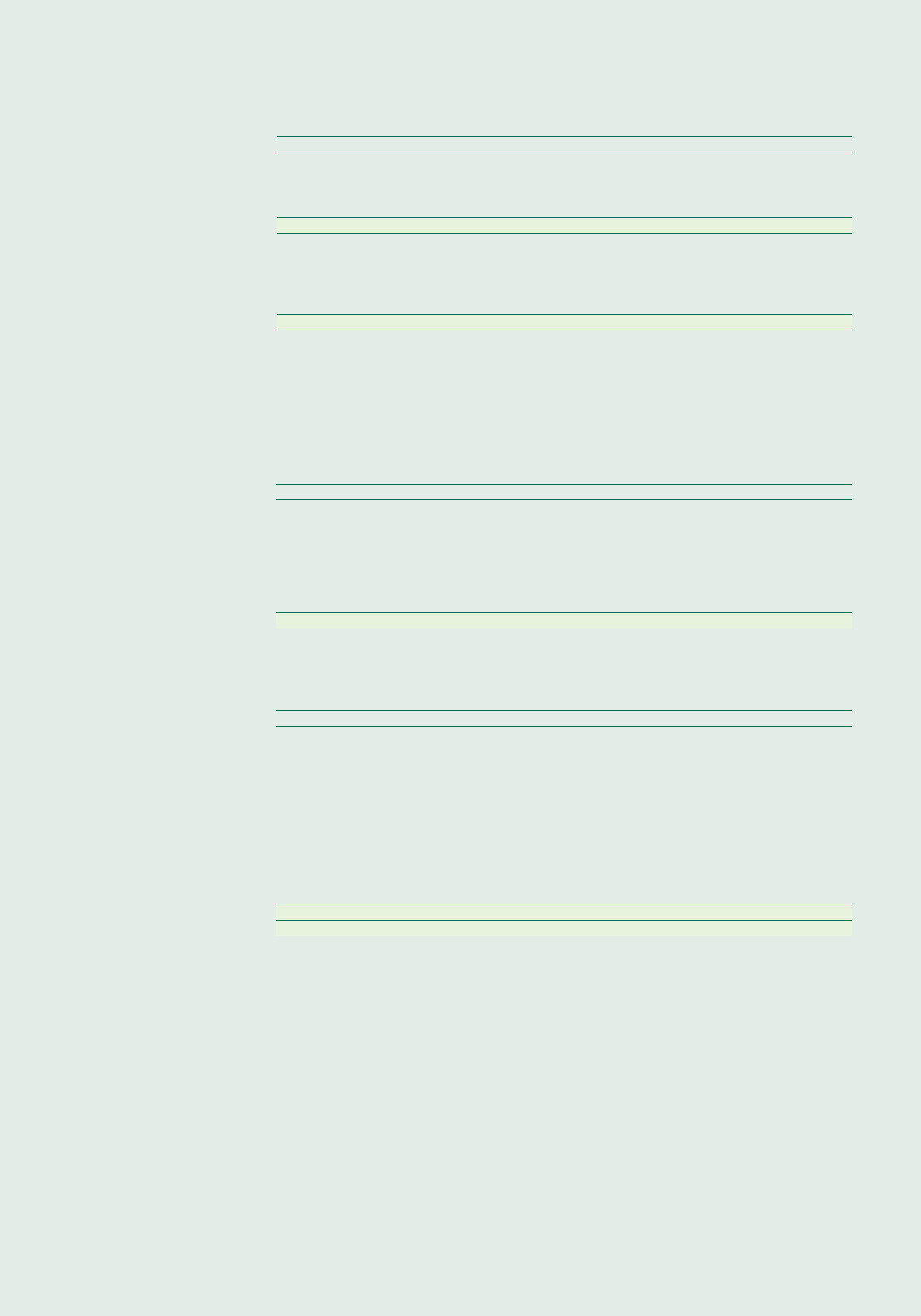

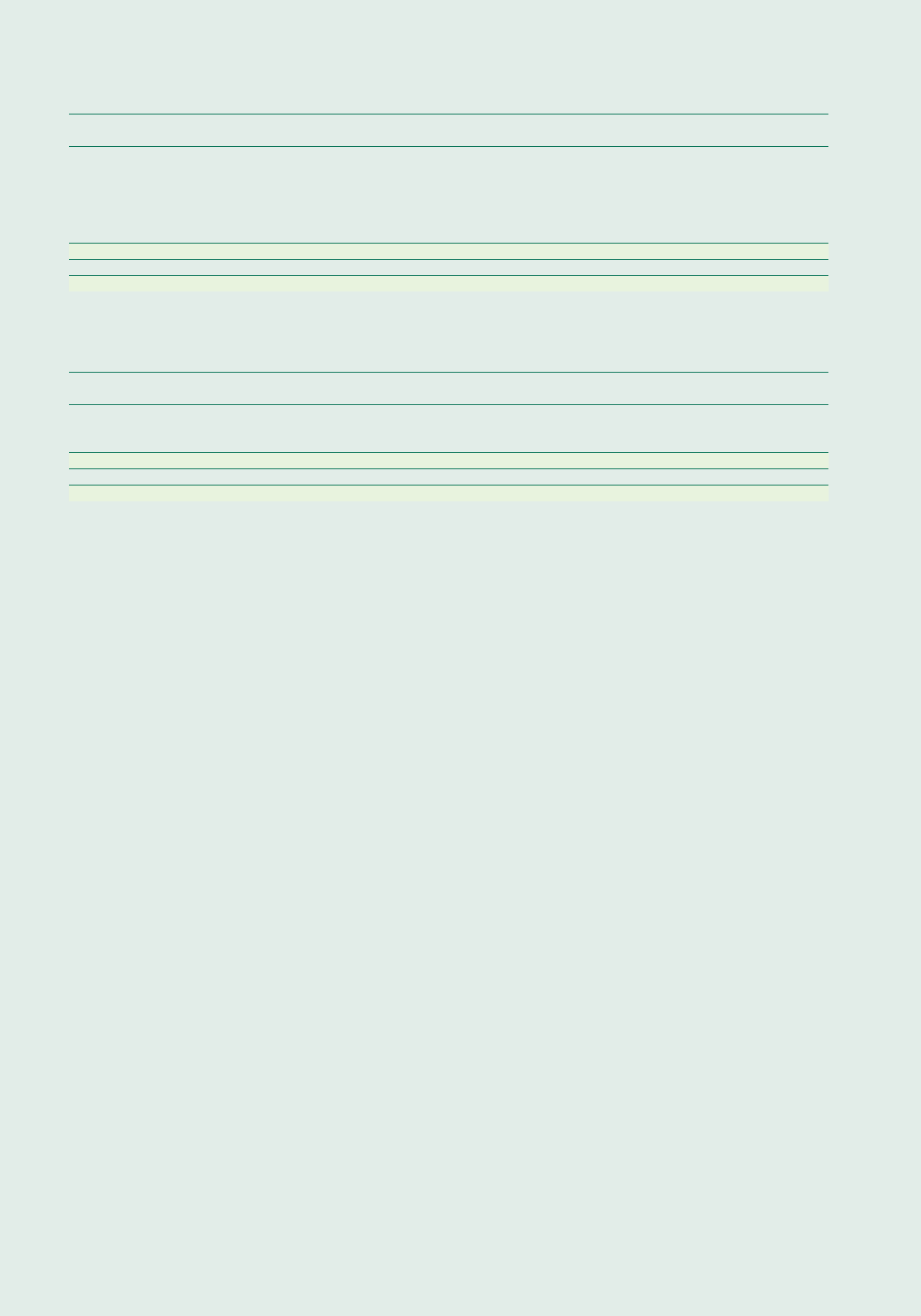

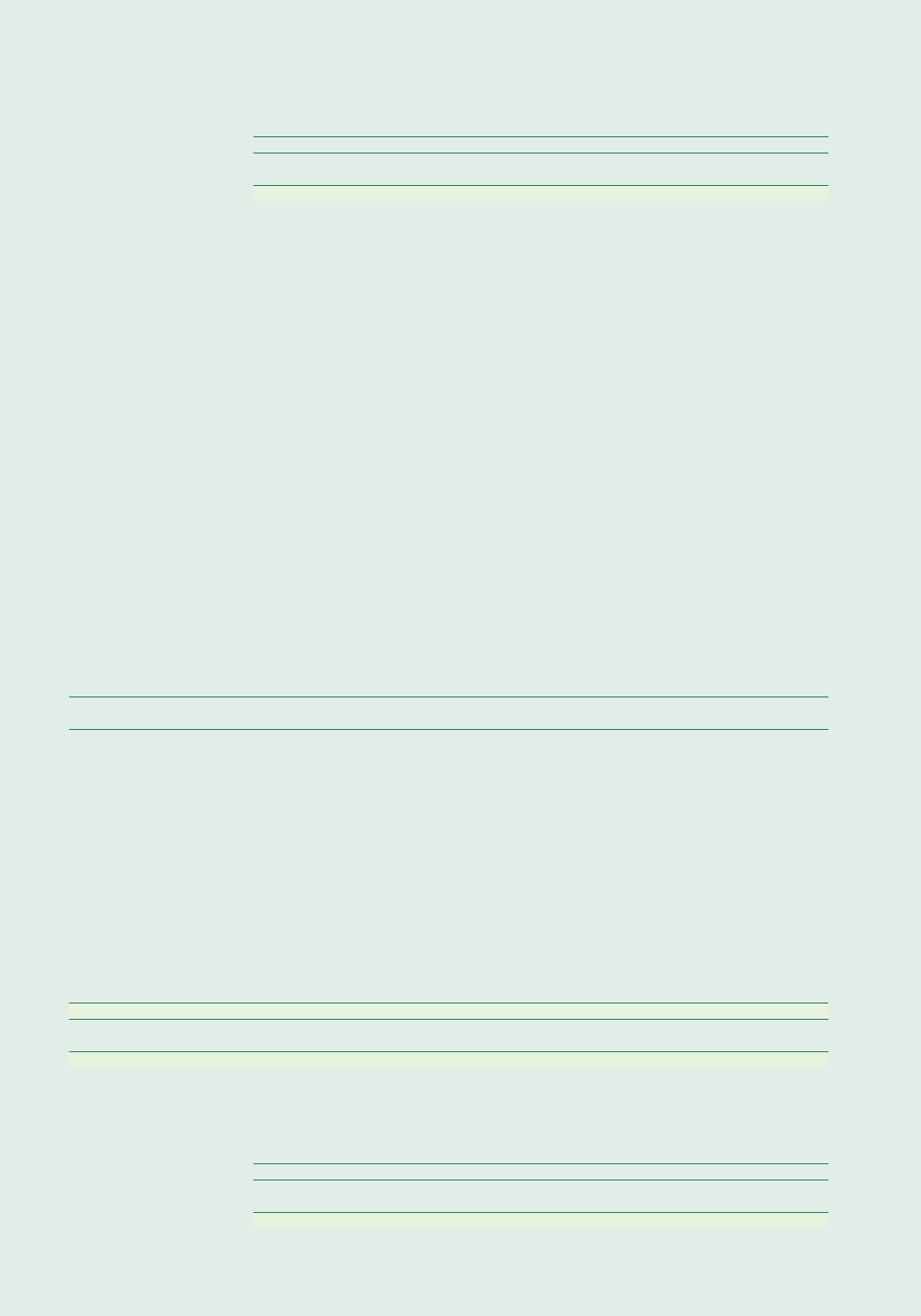

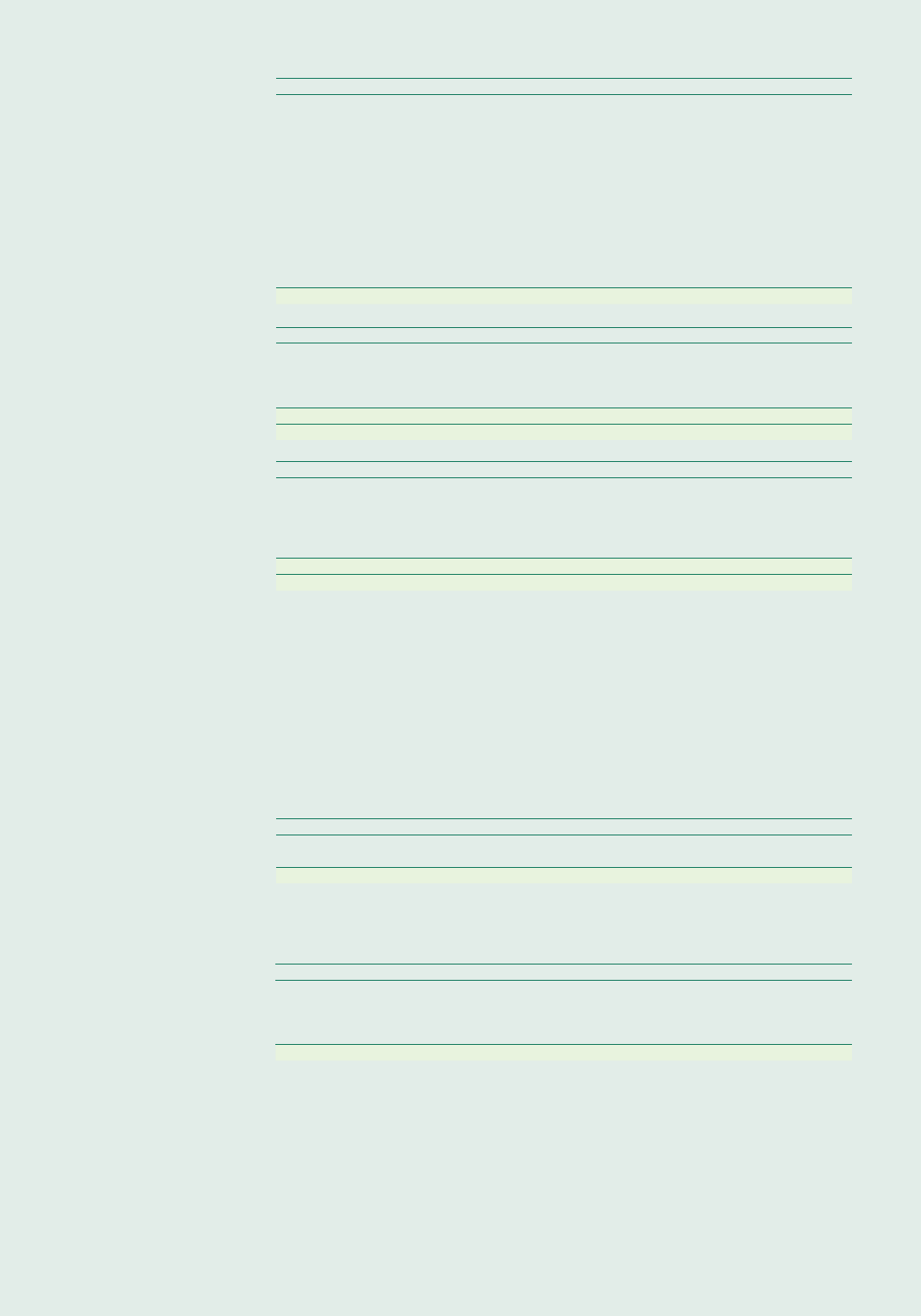

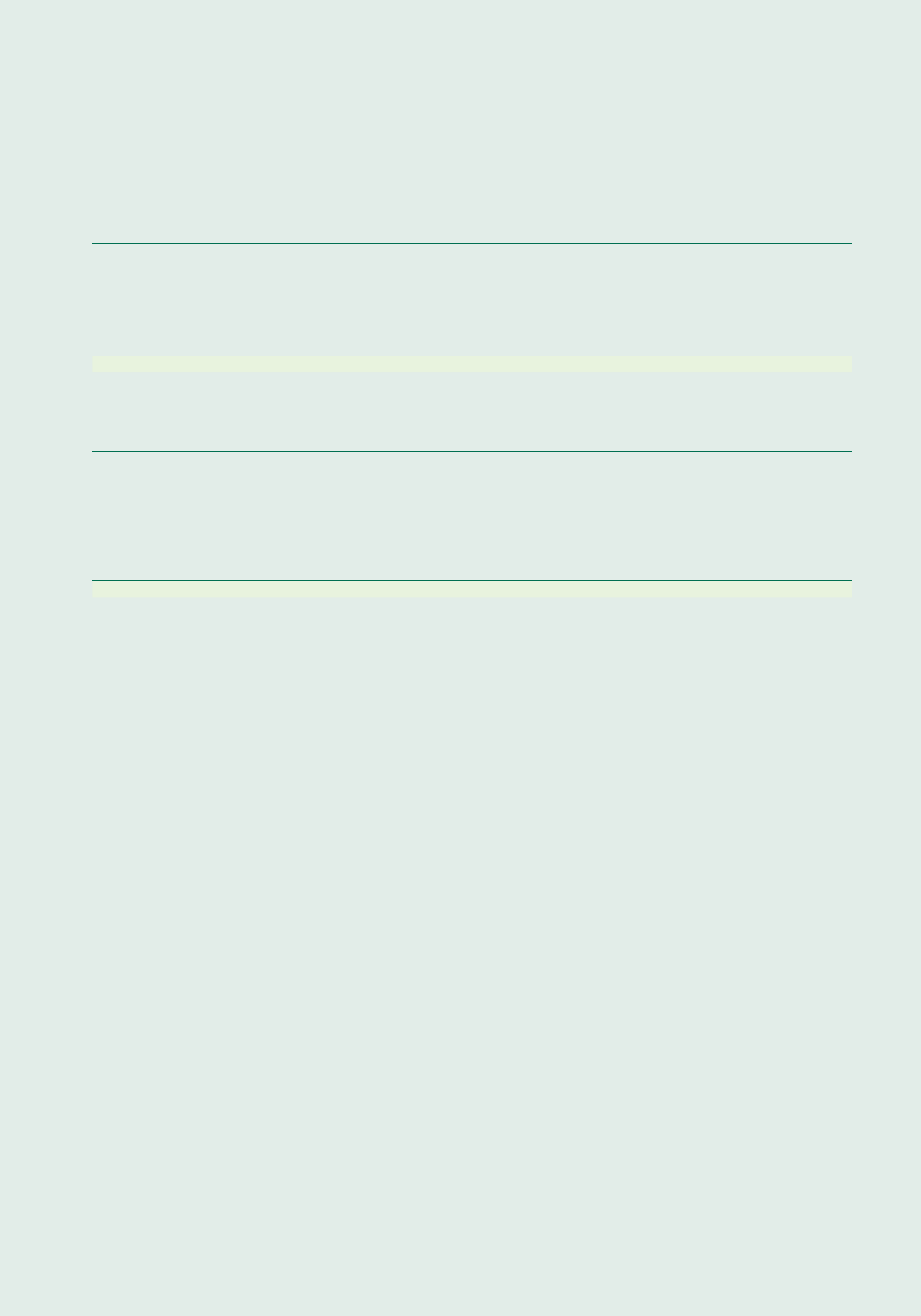

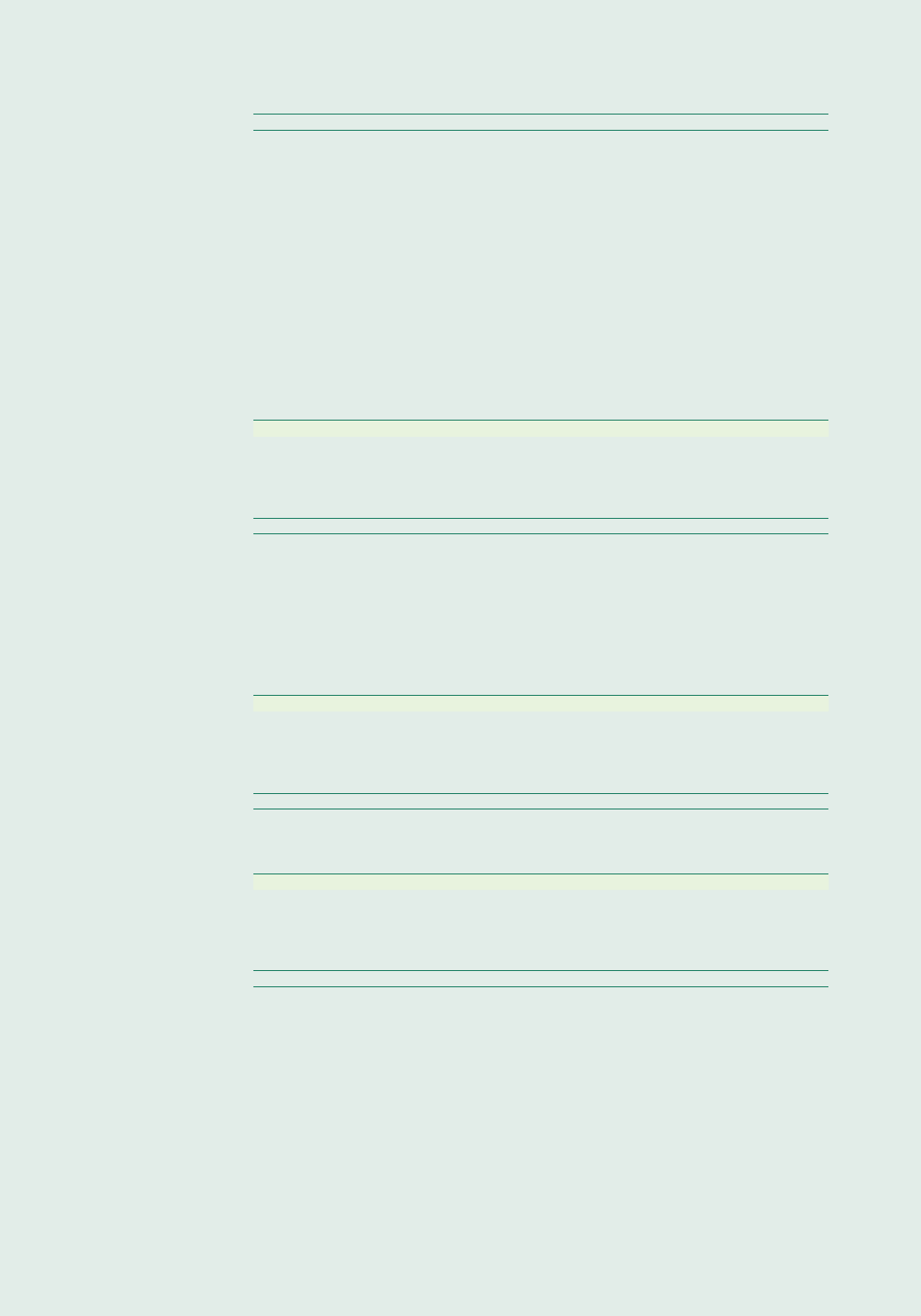

210

220

230

240

250

260

270

280

290

300

310

320

330

1

2

3

4

5

6

7

8

9

10

11

12

13

01.2002.

08.2002.

03.2003.

10.2003.

05.2004.

12.2004.

07.2005.

02.2006.

09.2006.

04.2007.

11.2007.

06.2008.

01.2009.

08.2009.

03.2010.

10.2010.

05.2011.

12.2011.

07.2012.

02.2013.

09.2013.

04.2014.

11.2014.

06.2015.

01.2016.

Base rate HUF/EUR

The HUF/EUR and the base rate

Sources: Reuters, MNB, OTP Research

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

01.2015.

01.2015.

02.2015.

03.2015.

03.2015.

04.2015.

05.2015.

05.2015.

06.2015.

07.2015.

07.2015.

08.2015.

09.2015.

10.2015.

10.2015.

11.2015.

12.2015.

12.2015.

3Y 5Y 10Y

15Y

Government bond yields (%)

Sources: ÁKK, OTP Research

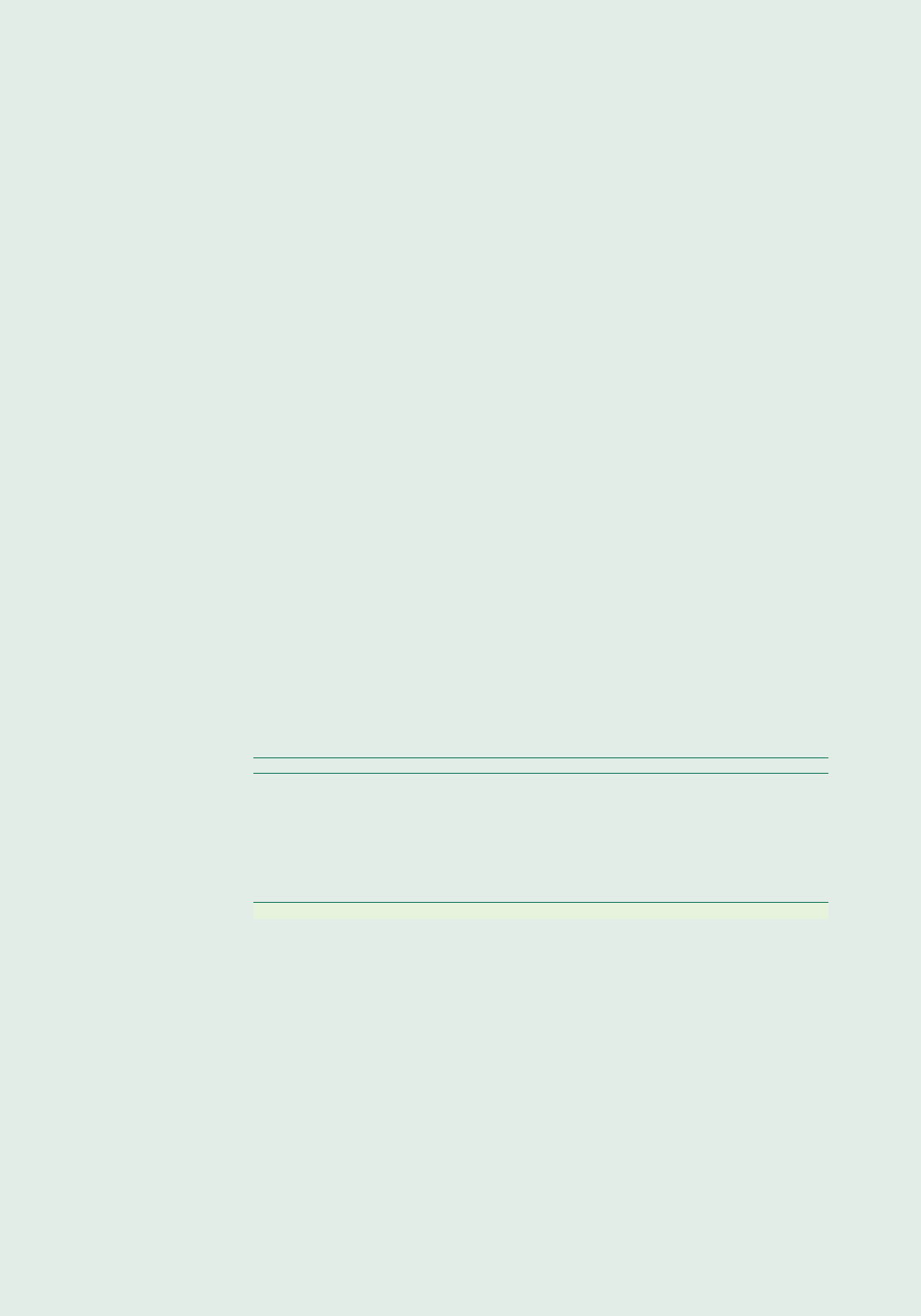

early 2015, the pair spent most of the second

half of the year around 310 levels, largely

owing to the measures taken by the central

bank.

Short-term yields dropped towards the end of

the year, while long-term yields barely moved.

The HUF/EUR oscillated in the 296.6–318.5

range. Following a forint appreciation in

14 OTP Bank Annual Report 2015

The countries where OTP Bank has foreign

subsidiary banks posted mixed economic

performance in 2015. In this respect, the eight

countries can be classified into three groups:

the clearly promising Central and Eastern

Europe, the improving Balkans region, and

commodity producers who are under pressure

but out of recession.

In the first group, the countries of Central

and Eastern Europe further enhanced their

favourable 2014 performance. The low budget

deficit and the shrinking government debt left

room for loosening fiscal policies, and these

countries used this opportunity more than once.

The good fiscal achievements owe a lot to the

low commodity prices and to the surge in EU

co-financing. External debts have decreased,

and external balance positions have improved.

Preliminary data rank Slovakia (+4%) and

Romania (+3.8%) among the most dynamically

expanding economies of the European Union.

The high savings ratio was accompanied by

consumption growth, which suggests to us

that this component’s contribution to GDP will

remain strong. Domestic demand is becoming

increasingly pronounced within economic

growth, which makes these economies resilient

to external tensions. Hungary, Romania and

Bulgaria saw their property markets recover,

which bodes well for a rise in lending in one or

two years.

Slovakia’s balanced economic performance

enabled it to better resist external shocks.

Nonetheless, the biggest risk in the future is

the decline in external demand, mainly that

from Germany. The most important engines

of economic performance are exports and

domestic demand. Romania’s economy

is diversified, its public and private sector

indebtedness is low, and the considerable

MACROECONOMIC AND FINANCIAL

DEVELOPMENTS IN THE COUNTRIES

OF OTP BANK’S FOREIGN SUBSIDIARIES

15Macroeconomic and fi nancial environment in 2015

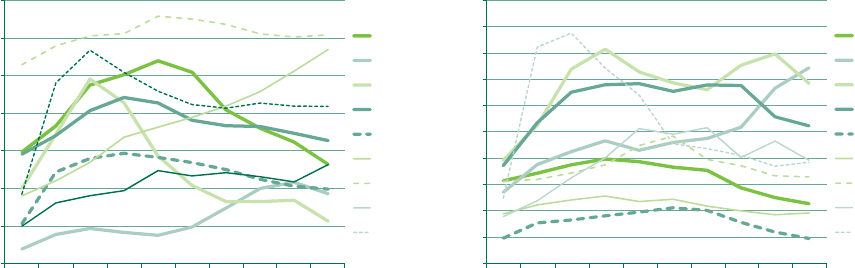

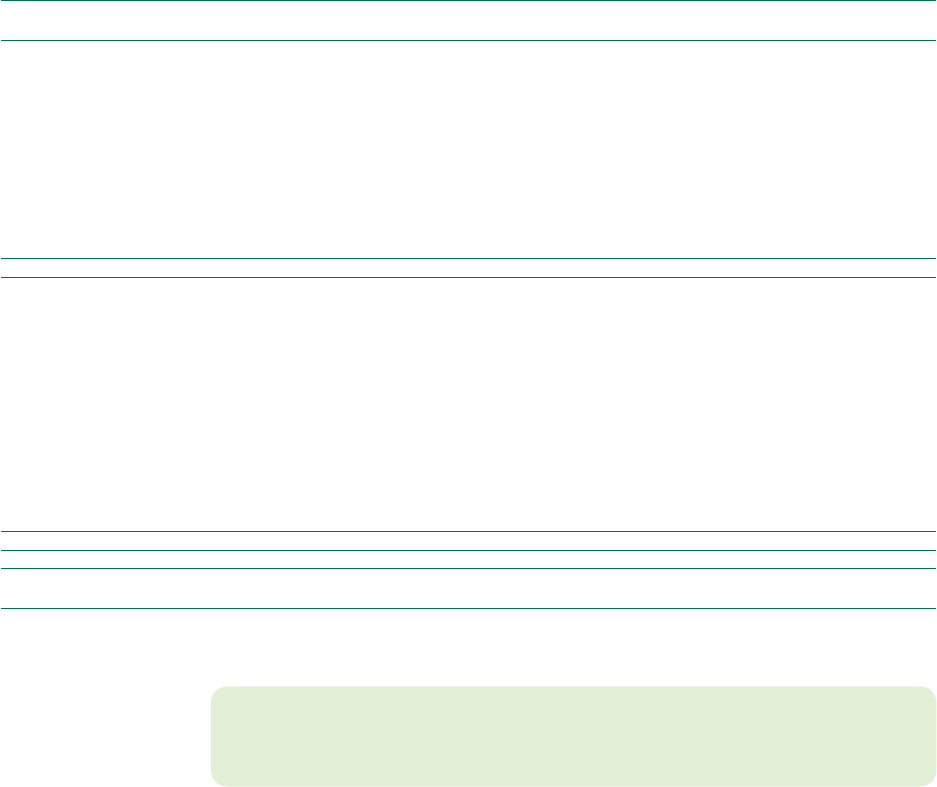

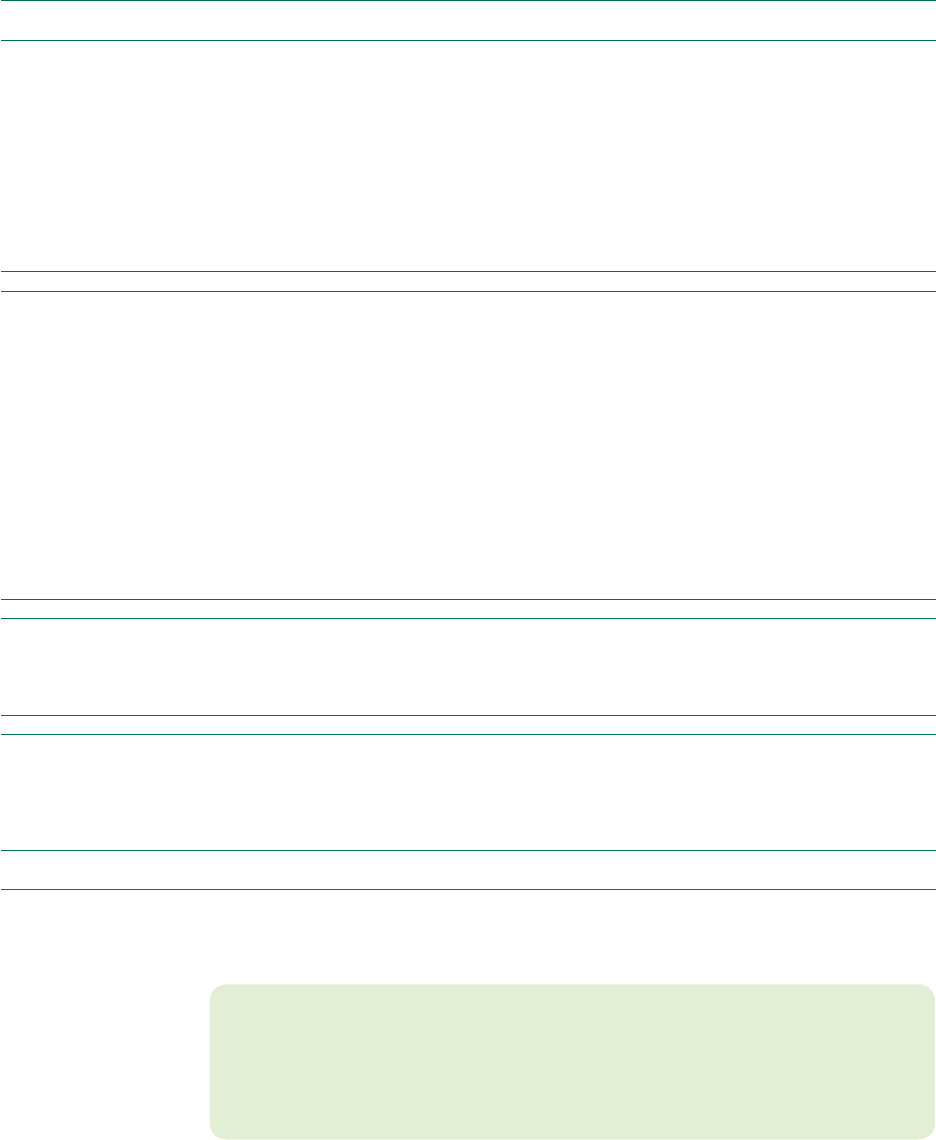

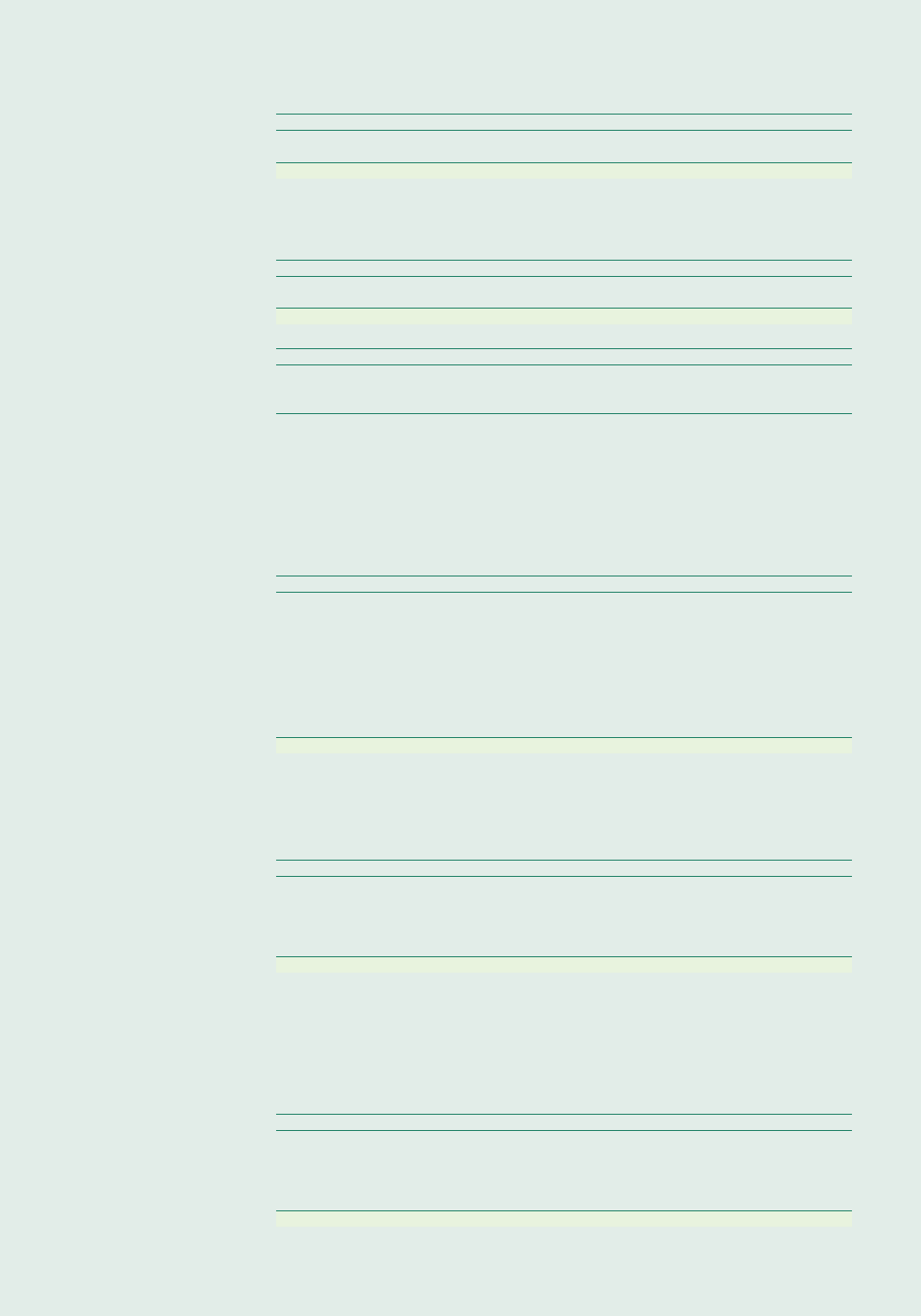

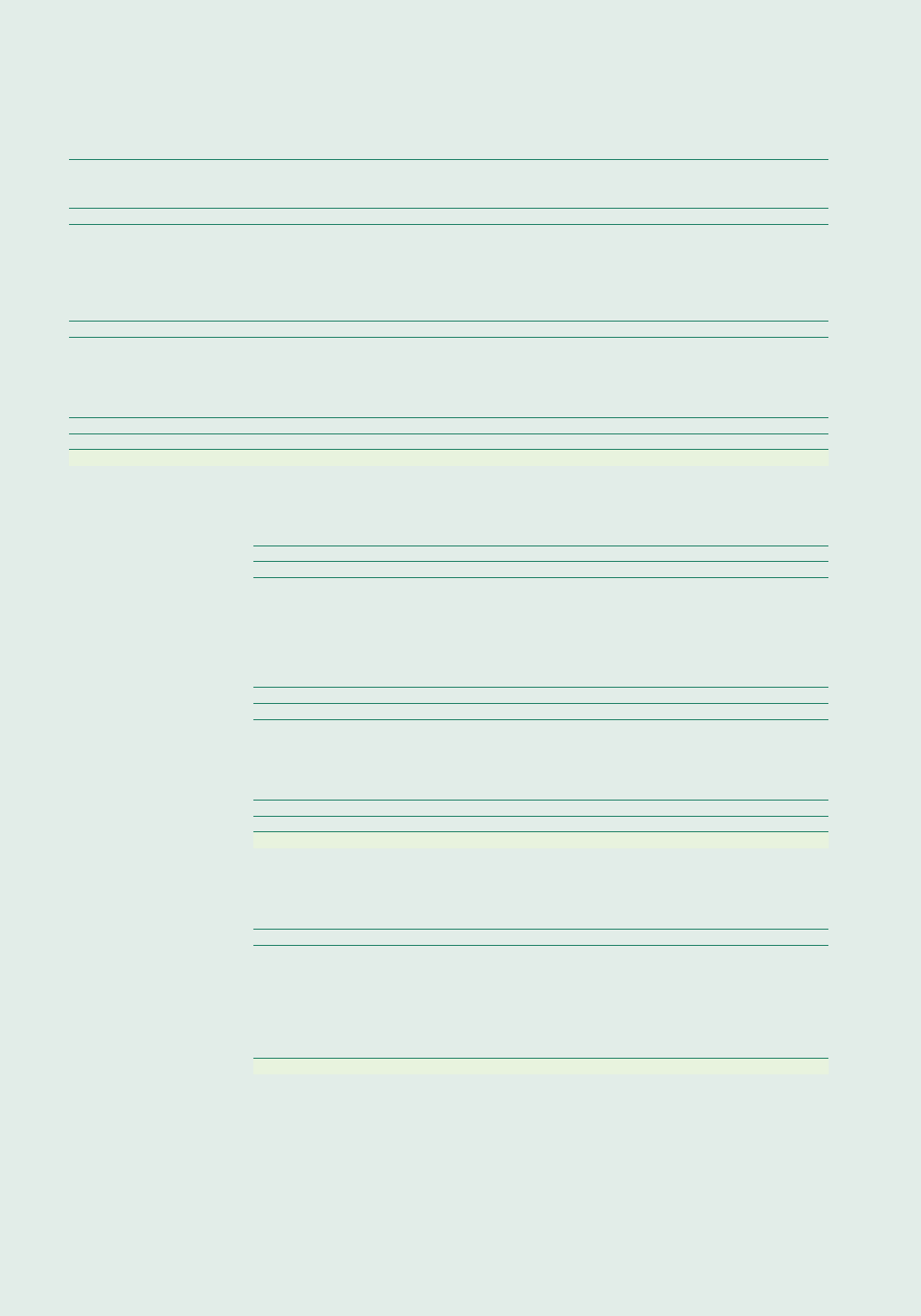

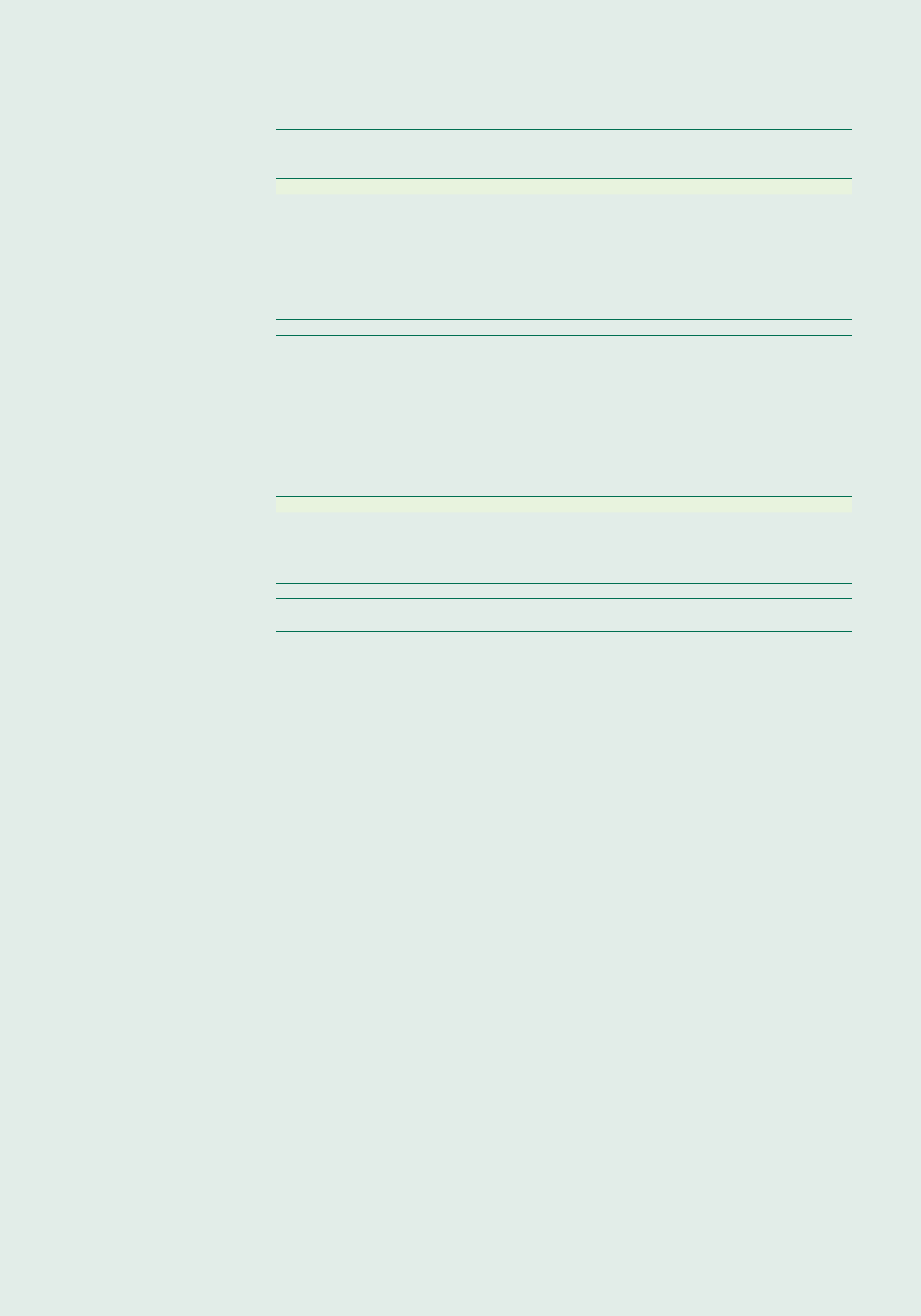

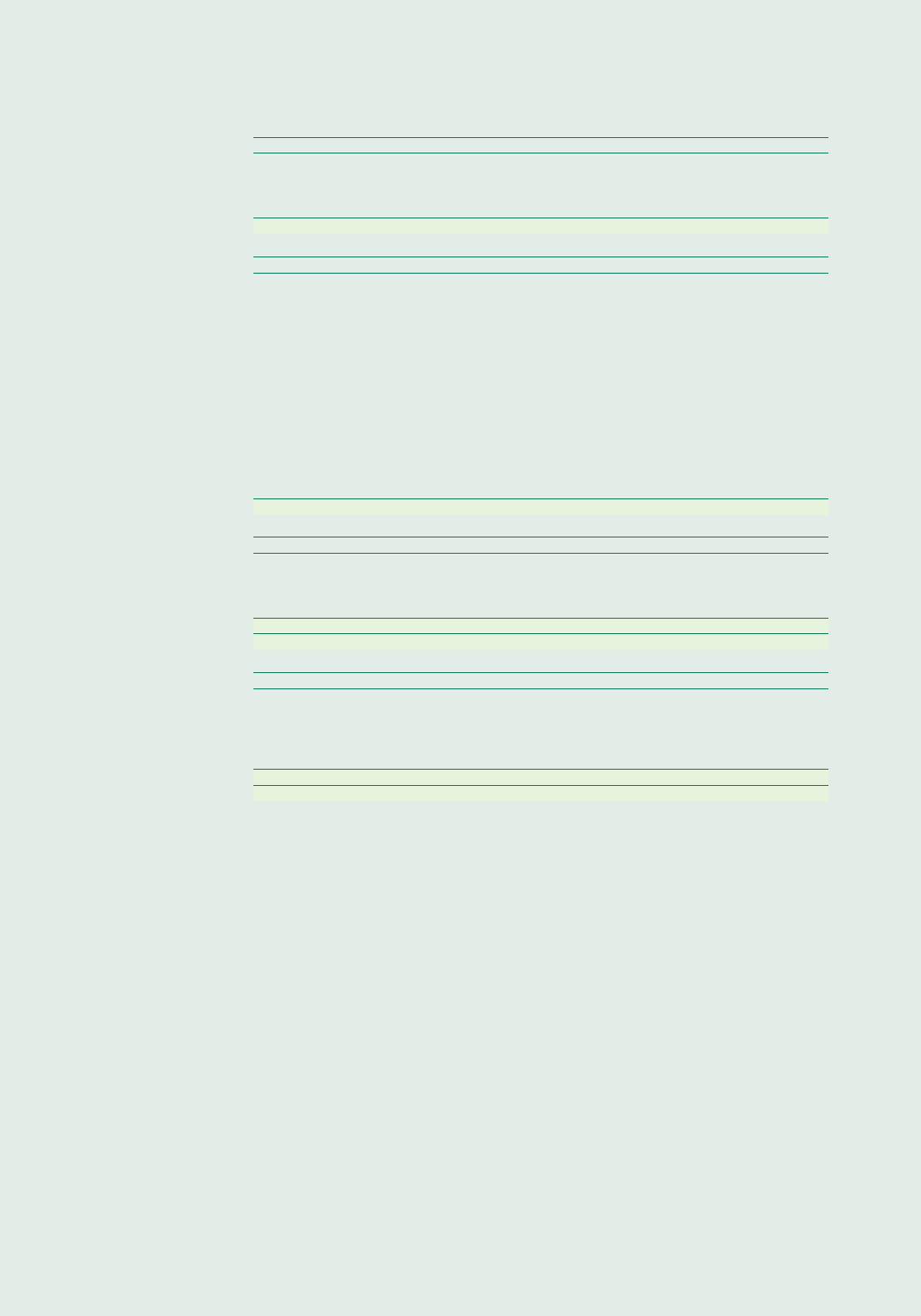

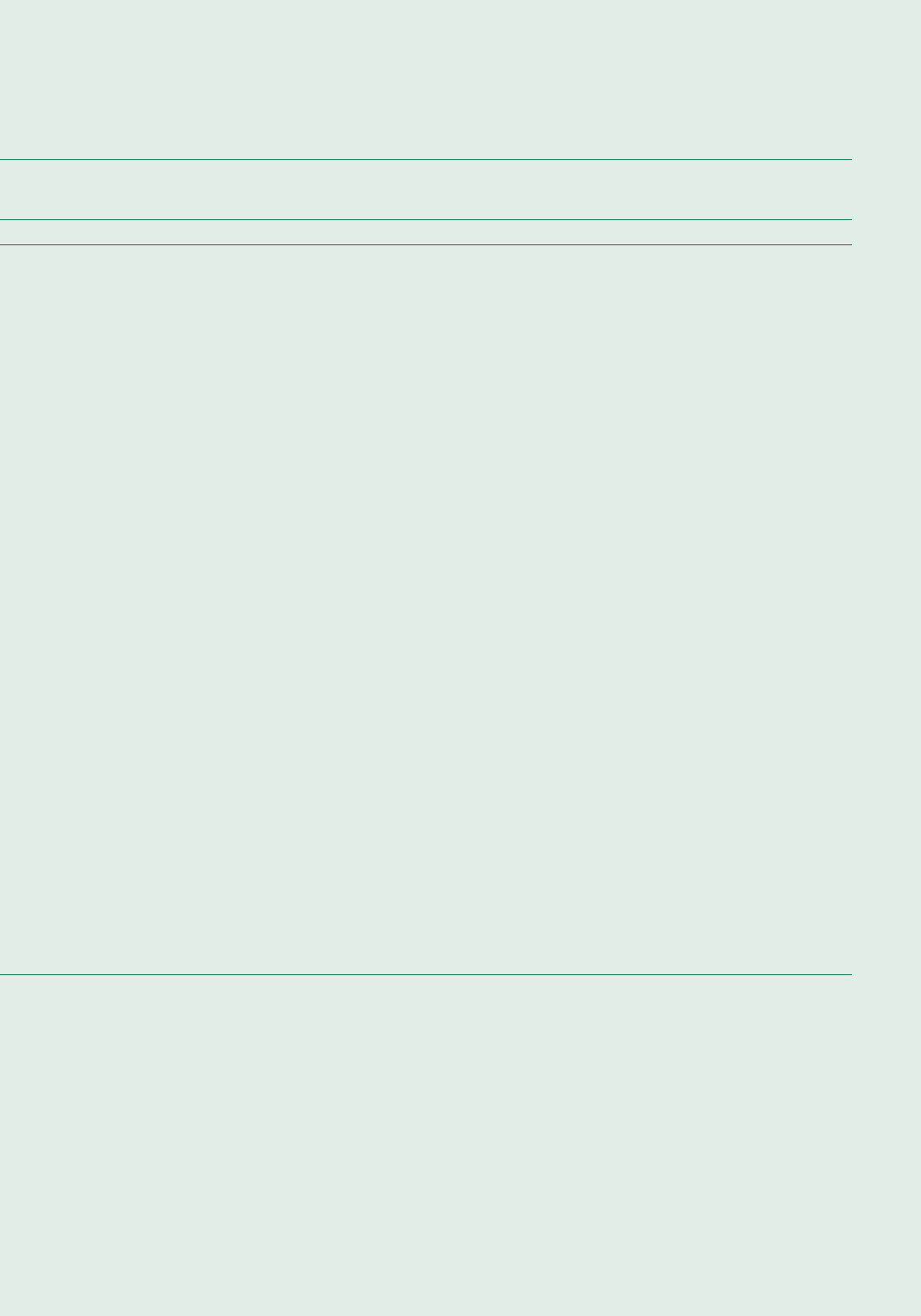

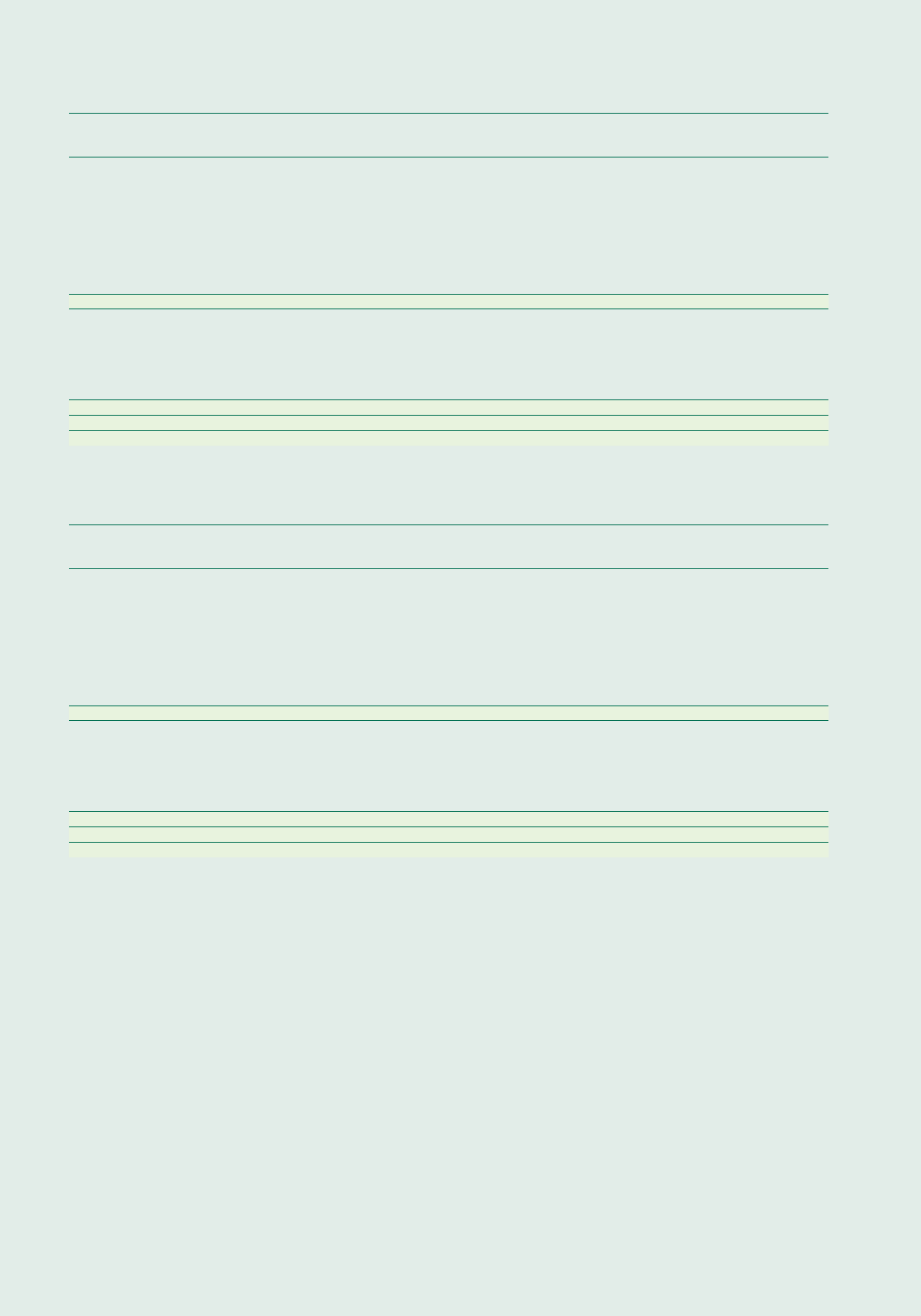

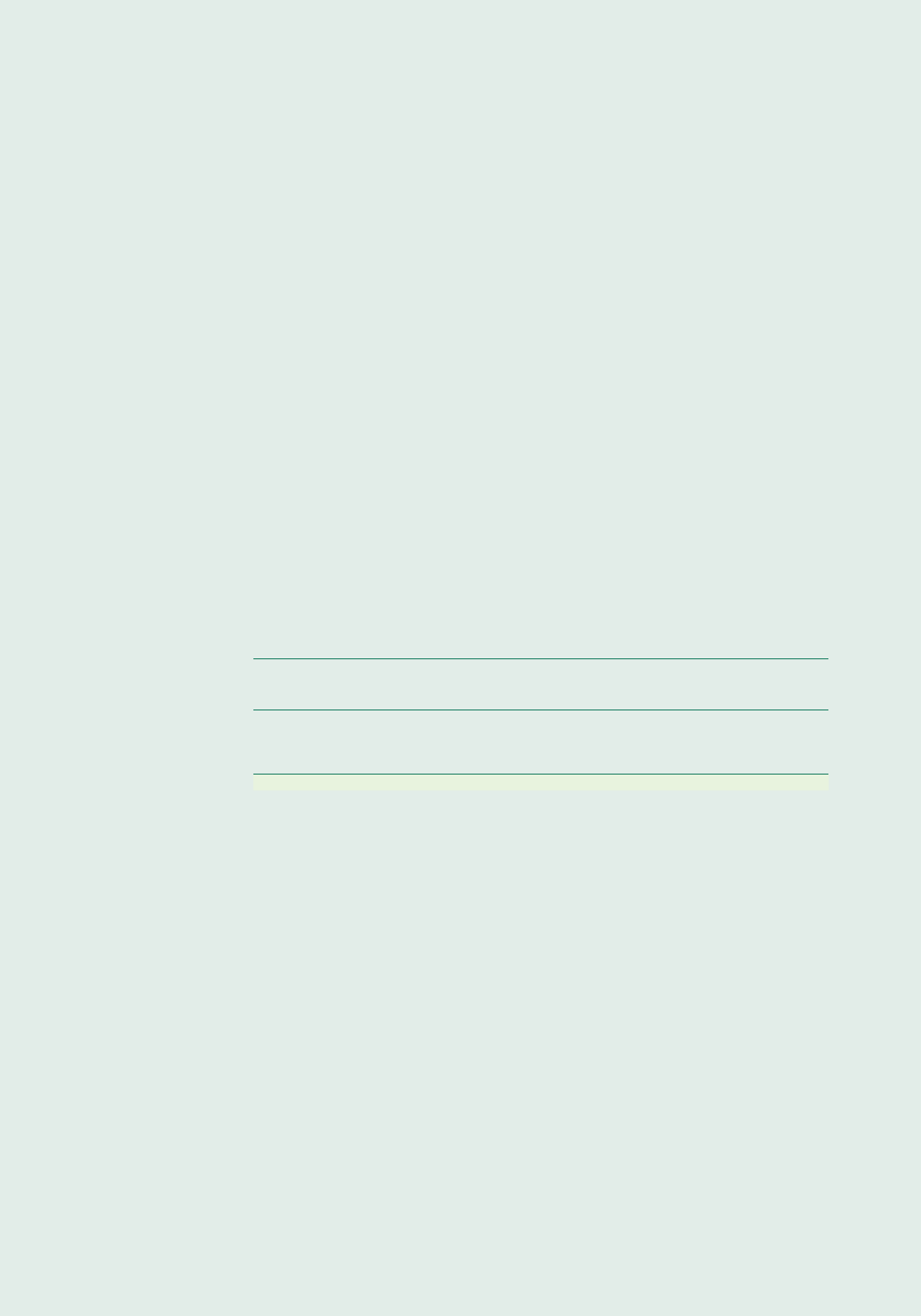

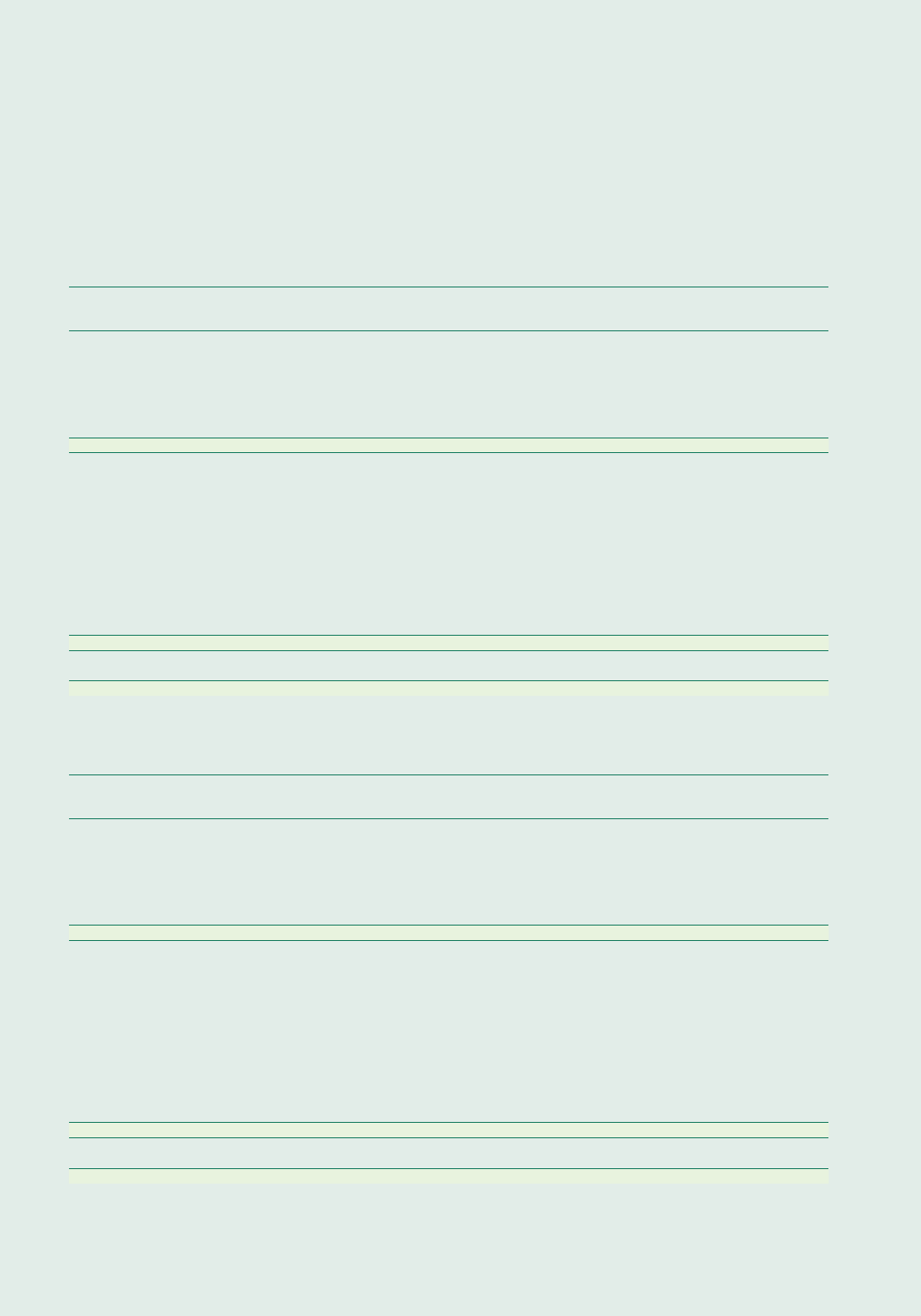

5

10

15

20

25

30

35

40

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Hungary

Russia

Ukraine

Bulgaria

Romania

Slovakia

Croatia

Serbia

Montenegro

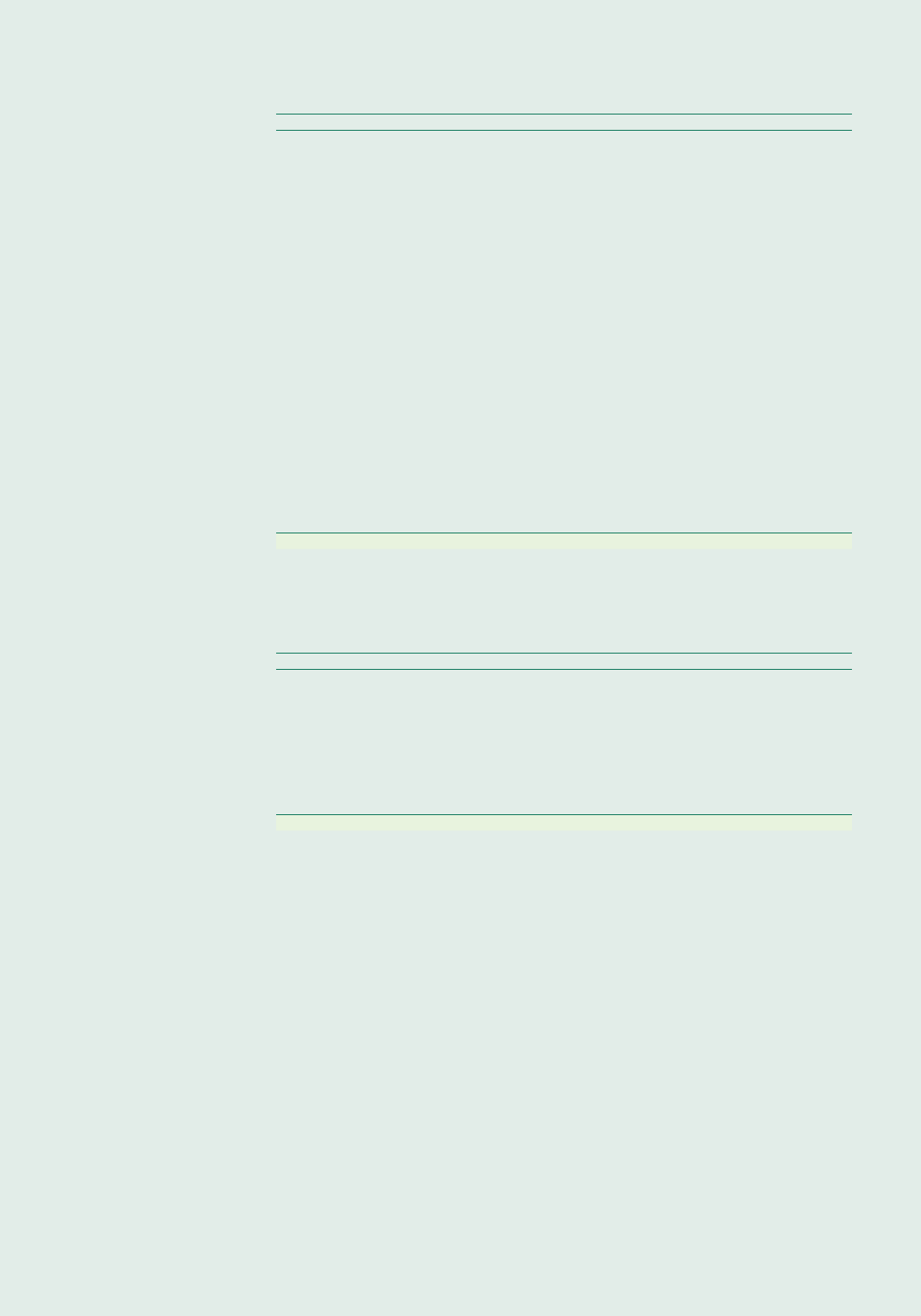

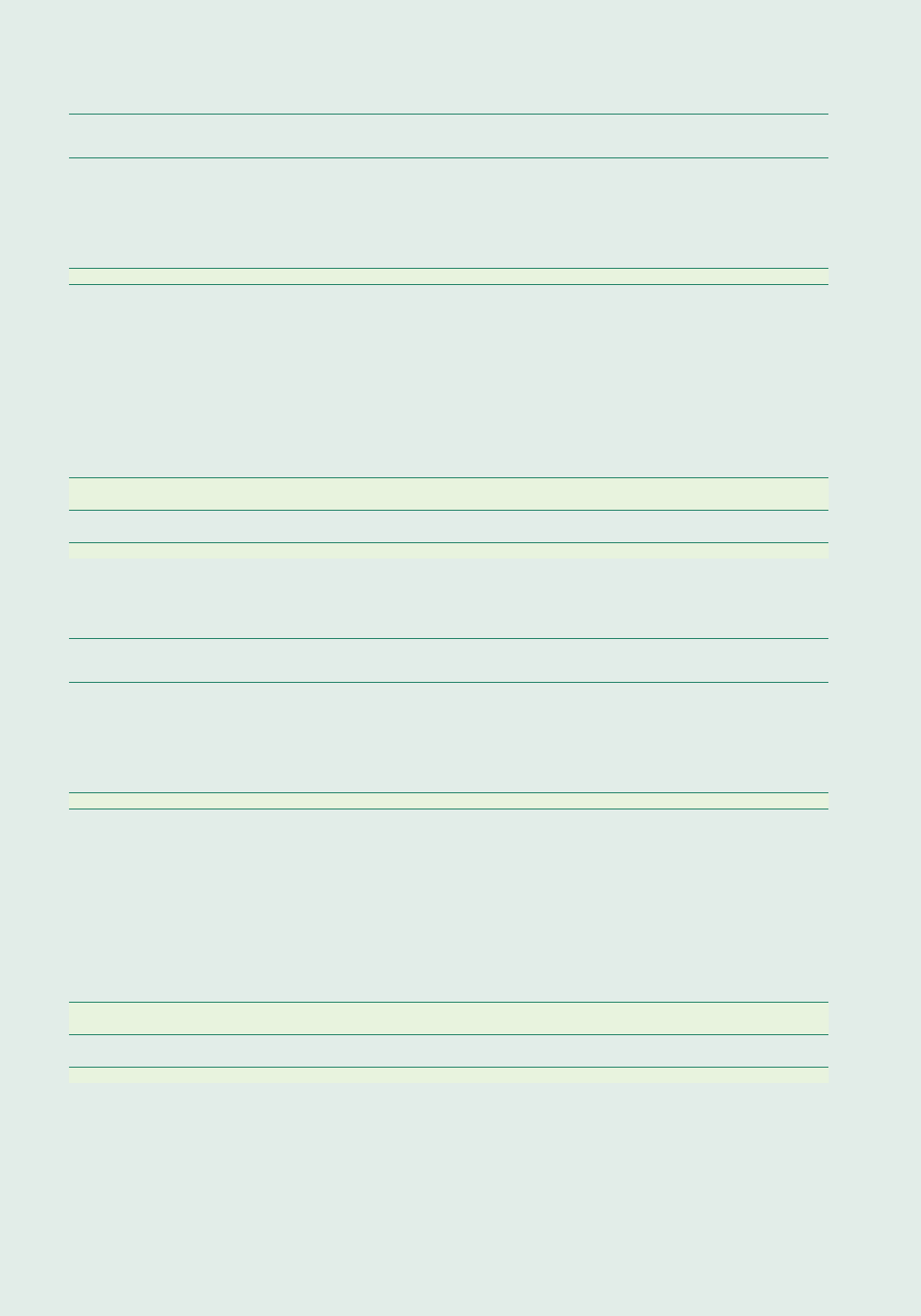

The banking system’s retail loan penetration

(year-end, % of GDP)

Sources: National banks, OTP Research, 2015 forecast

10

15

20

25

30

35

40

45

50

55

60

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

The banking system’s non-financial corporate

loan penetration (year-end, % of GDP)

Sources: National banks, OTP Research, 2015 forecast

Hungary

Russia

Ukraine

Bulgaria

Romania

Slovakia

Croatia

Serbia

Montenegro

fi scal room may give further impetus to

growth. Yet the double-digit wage growth

and the aggressive fi scal loosening may

pose downward risks to short-term growth

prospects. Bulgaria’s growth pace (at 2.8% YoY

in full-year 2015) has also become more robust

than in 2014. What may cloud its outlook is the

low diversifi cation of Bulgaria’s economy and

the lack of industries with high value added.

In the Balkans region, the most important

good news is that economic growth returned

to each country. Montenegro is expanding

at the fastest speed; its GDP grew by 4.2%

in Q3, greatly benefi ting from the increasing

number of infrastructural investments

by the government and from the robust

increase in tourism revenues; unfortunately,

the government fi nances the former from

debts. Serbia continues to face considerable

challenges, mostly owing to the weak economic

performance, and the large fi scal and external

imbalances. Its banking system is stable, but

the ratio of non-performing loans needs to be

further reduced. In our view, Croatia exited the

six-year-long period of recession in 2015, owing

much to the dynamically increasing exports as

well as to the increased consumption caused by

the fall in commodity prices and administrative

changes. Regrettably, signifi cant fi scal and

external balance problems still persist in these

three countries, therefore their growth seem

less sustainable in the medium term than

elsewhere in Central and Eastern Europe. If the

external environment deteriorates, the market

pressure may mount particularly in Croatia.

The situation in Ukraine and Russia di ers

markedly from the above country groups.

In addition to the low commodity prices (steel,

oil), the geopolitical confl ict between these

countries further deepens the recession.

Ukraine’s economy contracted by 10% and that

of Russia shrank 3.7%; both fell more than we

had expected at the beginning of 2015. It is

noteworthy that Ukraine’s Q4 gross domestic

product (–1.2%) has beaten expectations

in year/year comparison. The USD/UAH

increased from 15.62 in early 2015 to 24 by

the end of the year. Infl ation was above 43%

in December. What poses risks for its future

outlook is the uncertainty surrounding the

IMF agreement and the political situation.

In Russia, oil prices’ slump to record lows

weighed heavily on the budget and the steadily

depreciating ruble pushed the USD/RUB above

70 by end-December, up from 54 in January

2015. The weak ruble accelerated infl ation,

thus reducing real wages and consumption as

well as lending. Oil prices, which we expect to

remain low, will justify further fi scal austerity

measures.

16

Management’s Analysis

OTP Bank Annual Report

2015

17

18 OTP Bank Annual Report 2015

Management analysis

of the

2015 results

of the

OTP Group

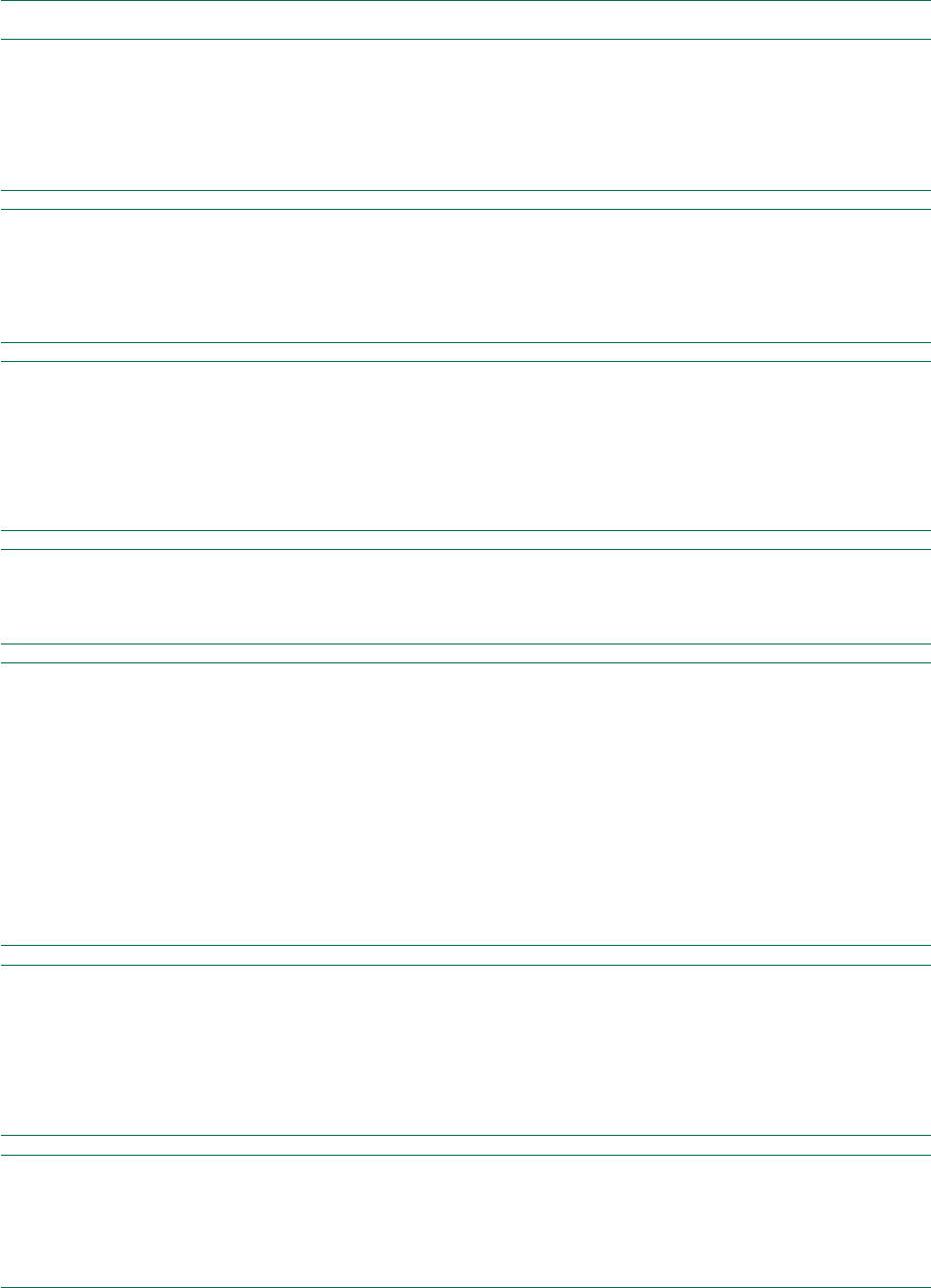

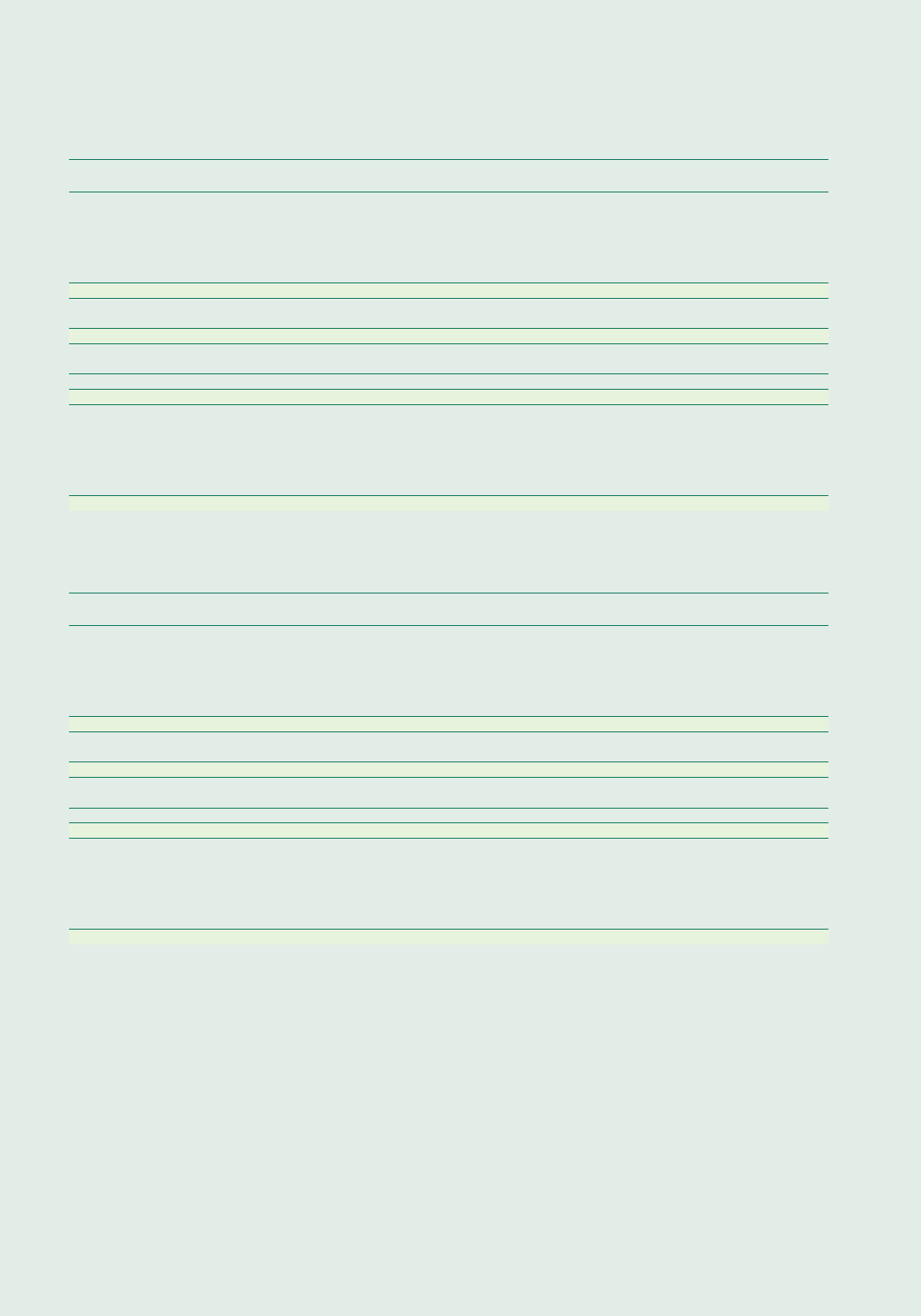

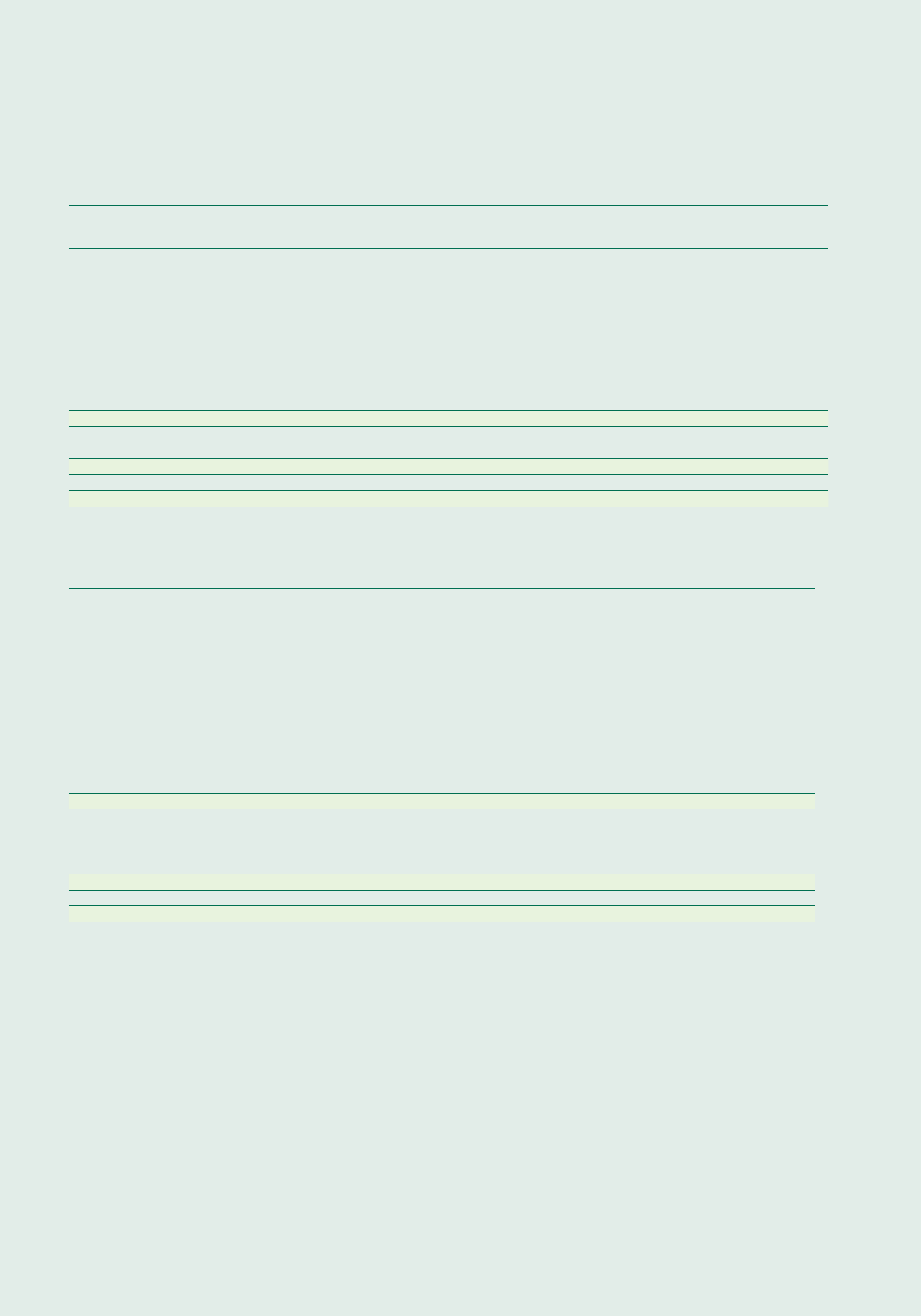

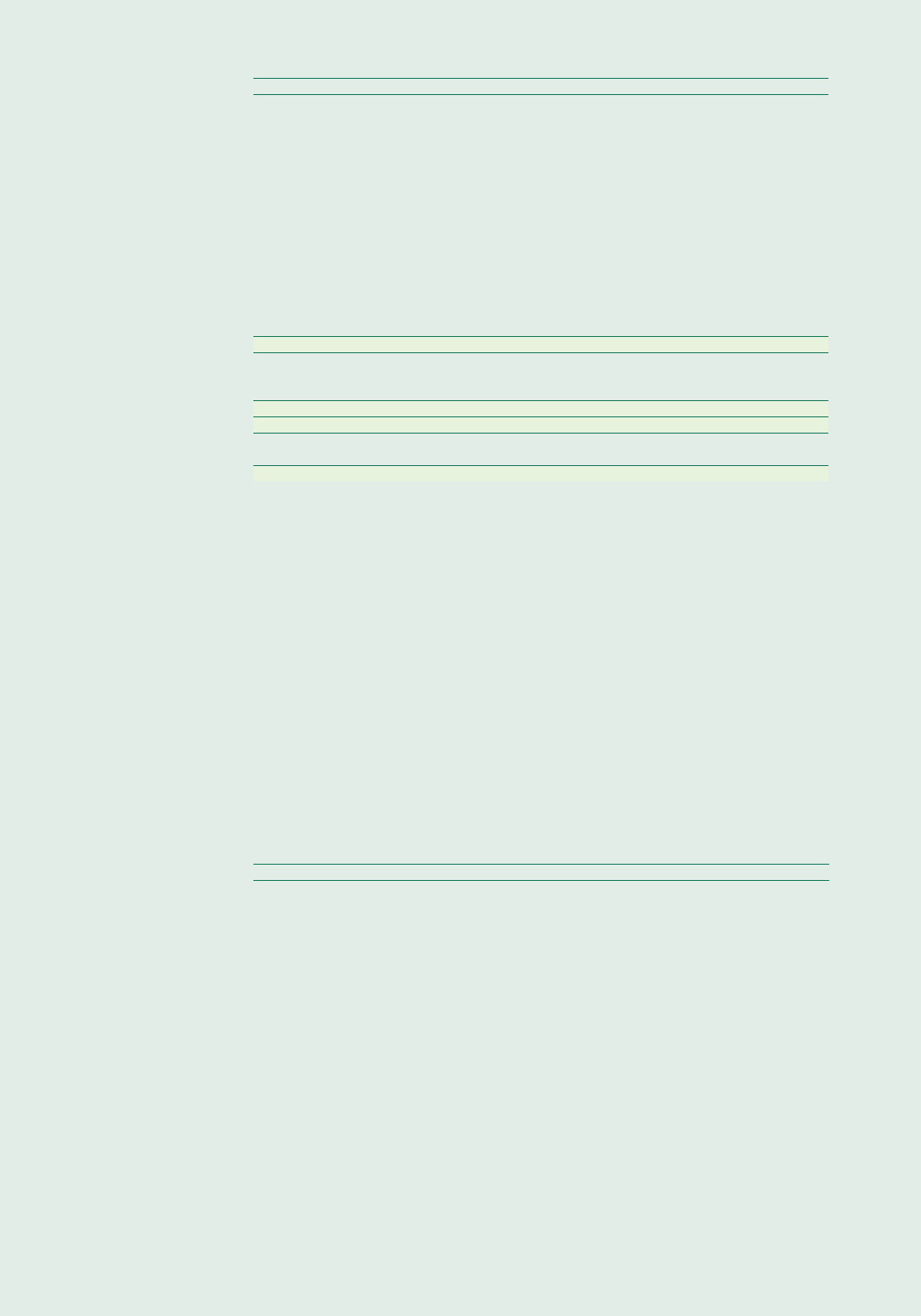

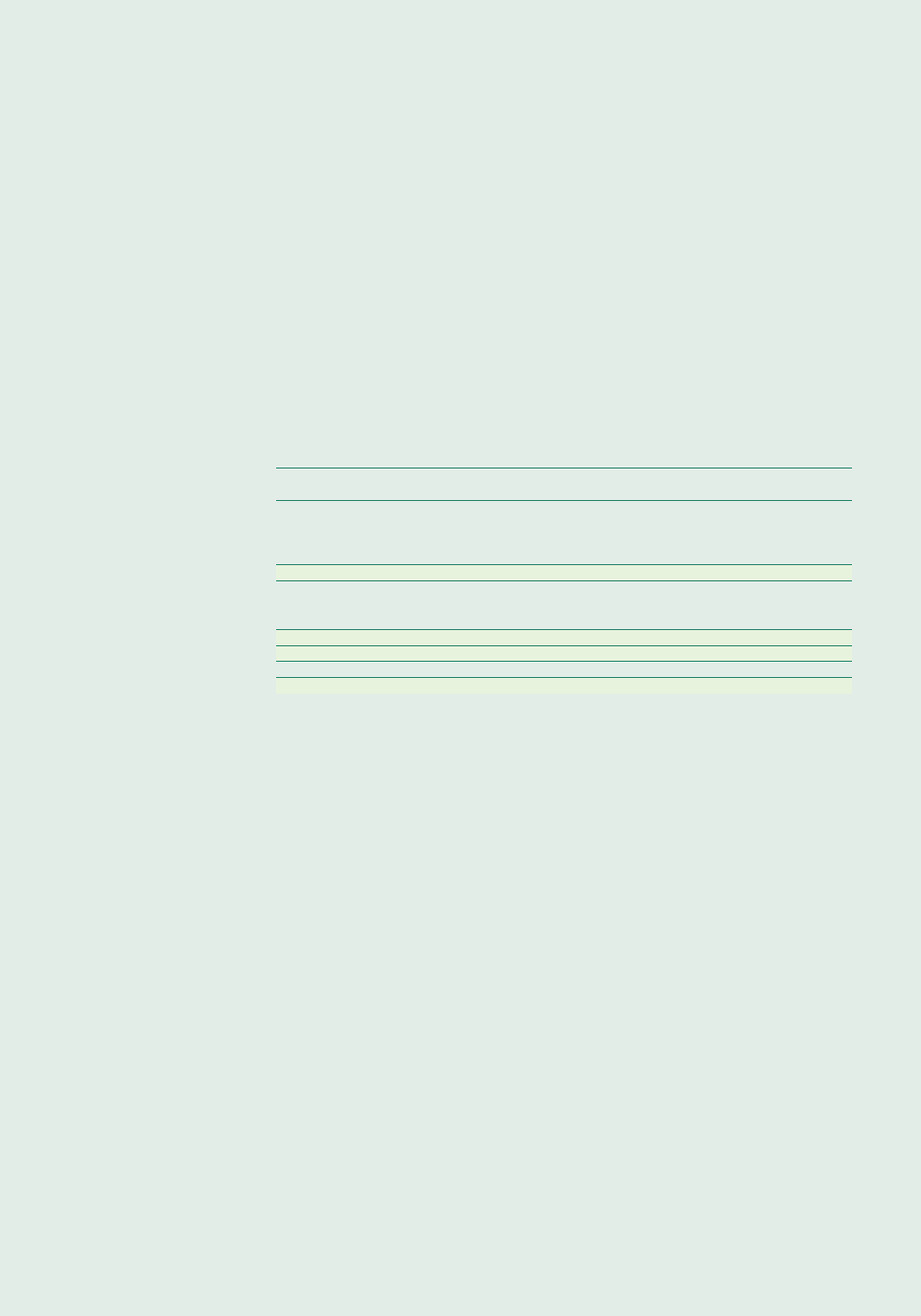

CONSOLIDATED FINANCIAL

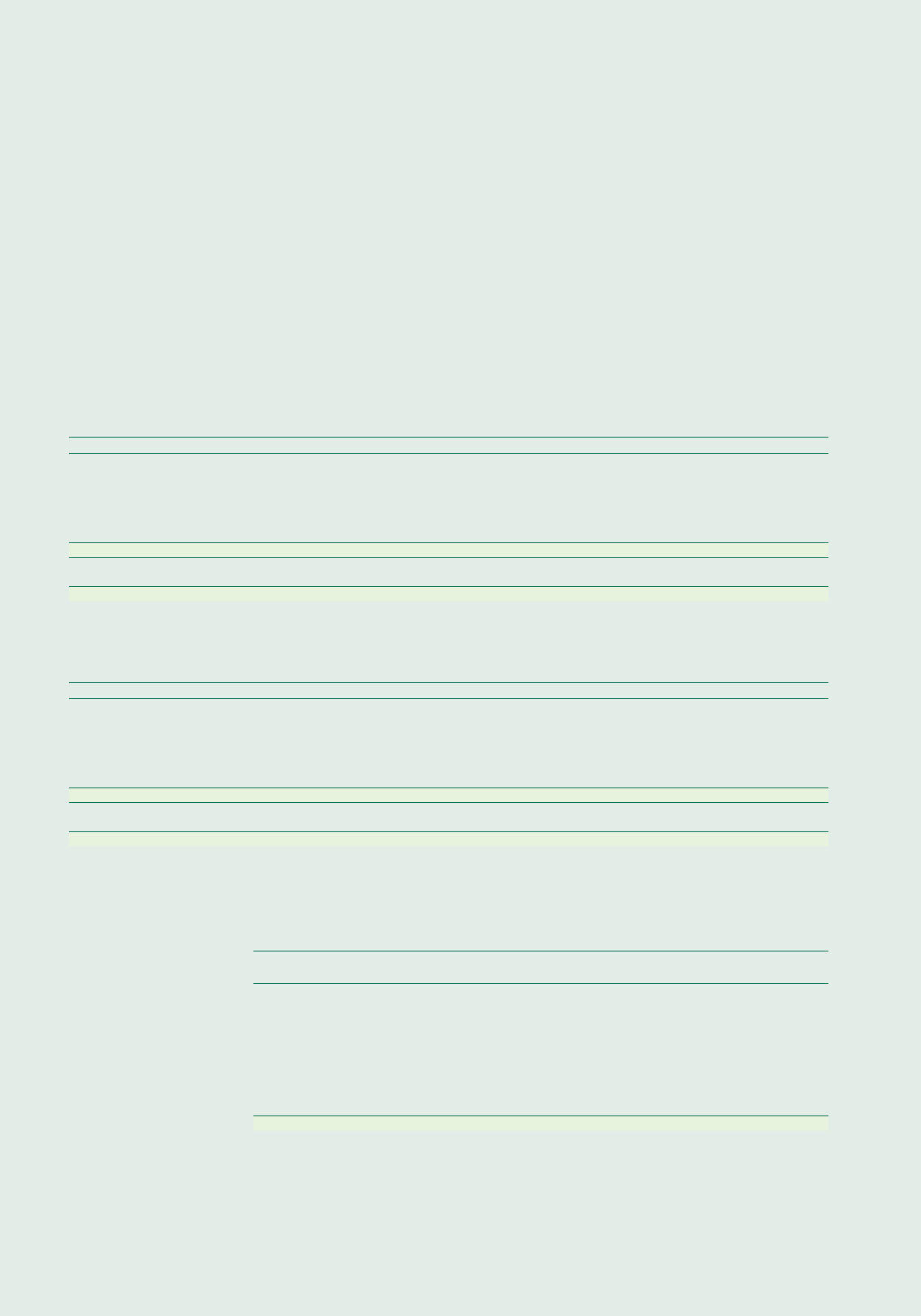

HIGHLIGHTS AND SHARE DATA*

* Structural adjustments made on consolidated IFRS profit and loss statement together with the calculation methodology of adjusted

indicators are detailed in the Supplementary data section of the Business Report.

Main components of the Statement of recognised income 2014 2015 Change

HUF million HUF million %

Consolidated after tax profit (102,258) 63,171 (162)

Adjustments (total) (220,272) (57,074) (74)

Consolidated adjusted after tax profit without the eect of adjustments 118,014 120,245 2

Pre-tax profit 142,341 146,057 3

Operating profit 414,534 362,594 (13)

Total income 826,061 754,912 (9)

Net interest income 636,172 553,659 (13)

Net fees and commissions 169,579 167,250 (1)

Other net non-interest income 20,309 34,003 67

Operating expenses (411,527) (392,318) (5)

Total risk costs (274,749) (220,709) (20)

One o items 2,556 4,172 63

Corporate taxes (24,327) (25,812) 6

Main components of balance sheet closing balances 2014 2015 %

Total assets 10,971,052 10,718,848 (2)

Total customer loans (net, FX-adjusted) 5,828,583 5,409,967 (7)

Total customer loans (gross, FX-adjusted) 6,964,289 6,423,588 (8)

Allowances for possible loan losses (FX-adjusted) (1,135,705) (1,013,621) (11)

Total customer deposits (FX-adjusted) 7,624,295 7,984,579 5

Issued securities 267,084 239,376 (10)

Subordinated loans 281,968 234,784 (17)

Total shareholders’ equity 1,264,166 1,233,659 (2)

Indicators based on one-o adjusted earnings 2014 2015 ppts

ROE (from adjusted net earnings) 8.5% 9.6% 1.1

ROA (from adjusted net earnings) 1.1% 1.1% 0.0

Operating profit margin 3.88% 3.34% (0.54)

Total income margin 7.74% 6.96% (0.78)

Net interest margin 5.96% 5.11% (0.85)

Cost-to-asset ratio 3.85% 3.62% (0.23)

Cost/income ratio 49.8% 52.0% 2.20

Risk cost to average gross loans 3.68% 3.18% (0.50)

Total risk cost-to-asset ratio 2.57% 2.04% (0.53)

Eective tax rate 17.1% 17.7% 0.6

Net loan/(deposit+retail bond) ratio (FX-adjusted) 75% 67% (8)

Capital adequacy ratio (consolidated, IFRS) – Basel3 17.5% 16.2% (1.3)

Tier1 ratio – Basel3 14.1% 13.3% (0.8)

Common Equity Tier1 (‘CET1’) ratio – Basel3 14.1% 13.3% (0.8)

Share Data 2014 2015 %

EPS diluted (HUF) (from unadjusted net earnings) (382) 242 (163)

EPS diluted (HUF) (from adjusted net earnings) 441 458 4

Closing price (HUF) 3,811 6,000 57

Highest closing price (HUF) 4,875 6,065 24

Lowest closing price (HUF) 3,555 3,479 (2)

Market Capitalization (EUR billion) 3.4 5.4 59

Book Value Per Share (HUF) 4,515 4,406 (2)

Tangible Book Value Per Share (HUF) 3,948 3,840 (3)

Price/Book Value 0.8 1.4 75

Price/Tangible Book Value 1.0 1.6 60

P/E (trailing, from accounting net earnings) (10.4) 26.6 (356)

P/E (trailing, from adjusted net earnings) 9.0 14.0 56

Average daily turnover (EUR million) 14 15 7

Average daily turnover (million share) 1.1 0.9 (18)

19

2015 macroeconomic trends in Hungary

turned to be the most favourable since the

onset of the financial crisis in 2008. Despite

some moderation, according to preliminary

figures and as a result of the strong 4Q GDP

growth (+3.2% y-o-y), the economy grew

by 2.9% y-o-y. Balance indicators remained

consistently favourable: supported by stronger

than expected tax revenues the fiscal deficit

was kept below 2% of GDP and the public debt

was reduced to below 76% of GDP, too. Within

that both the share of external debts and

non-residents’ holding contracted massively.

Simultaneously, funding conditions improved

a lot and the vulnerability of the economy

moderated substantially.

As a result of a roughly 3 year continuous

monetary easing the base rate dropped to

1.35% by July 2015. Besides, the central

bank has been using other non-conventional

tools too, steadily and eectively supporting

the balanced and sustainable growth of the

economy. The central bank’s toolset is fairly

rich: apart from the new phases of Funding

for Growth Scheme it also includes the Self

Financing Programme which encourages

banks to increase their government securities

purchases and also the reform of the monetary

policy instruments.

From macroprudential perspective it was of

great importance that with the conversion

of FX-denominated mortgages, car loans

and consumer credits a major systemic risk

factor was eliminated, and the settlement was

completed with practically all aected clients

by end-2015. Simultaneously, the massive

operational burden induced by the settlement

and conversion vanished.

In December 2015 the Government decided

about a substantial reduction of the banking tax

starting from 2016. Also, a new legislation was

approved regarding the reasonable handling

and burden-sharing of the losses stemming

from the brokerage scandals in early 2015.

It was equally important that the Government

significantly eased the conditions of purchasing

new and used flats and widened the range of

eligible families within the framework of the

Housing Subsidy for Families (the so-called

CSOK). Also, from 1 January 2016 applicable

VAT level on newly built houses was scaled back

from 27% to 5%. Those changes might exert

positive impact on mortgage loan demand, too.

Based on those favourable regulatory changes

and macroeconomic developments there is a

strong chance that Hungary will be re-gaining

its investment-grade status in 2016 with the

major rating agencies.

MANAGEMENT’S ANALYSIS OF THE

FULL-YEAR 2015 RESULTS OF OTP GROUP

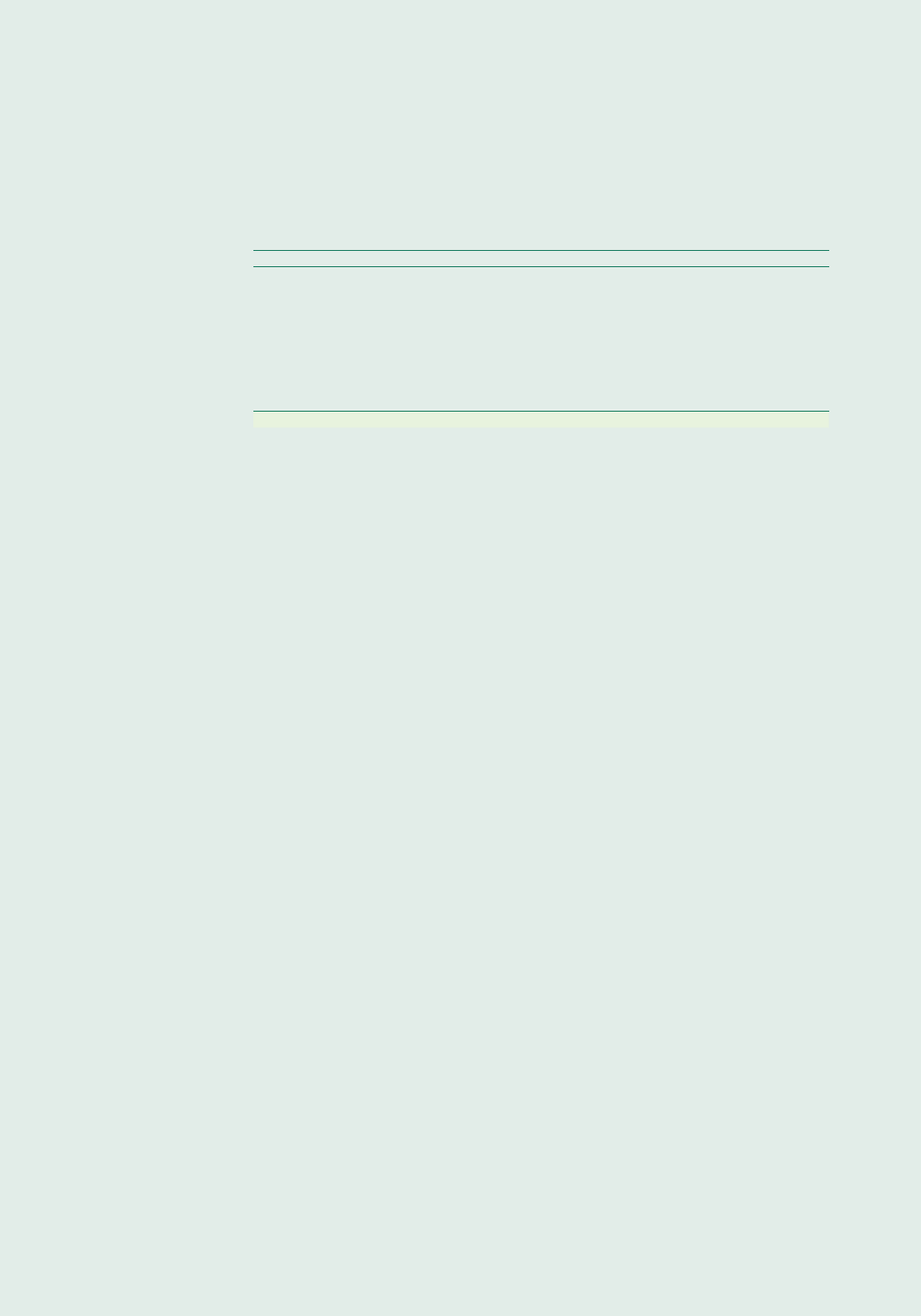

MOODY’S RATINGS

OTP Bank

Foreign currency long-term deposits Ba2

OTP Mortgage Bank

Covered mortgage bond Baa2

OTP Bank Russia

Foreign currency long-term deposits Ba3

STANDARD & POOR’S RATING

OTP Bank and OTP Mortgage Bank

Long-term credit rating BB

FITCH’S RATING

OTP Bank Russia

Long-term credit rating BB

Management’s analysis of the 2015 results of the OTP Group

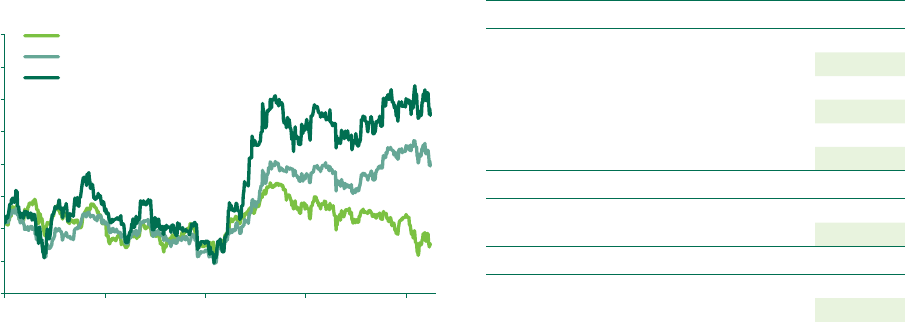

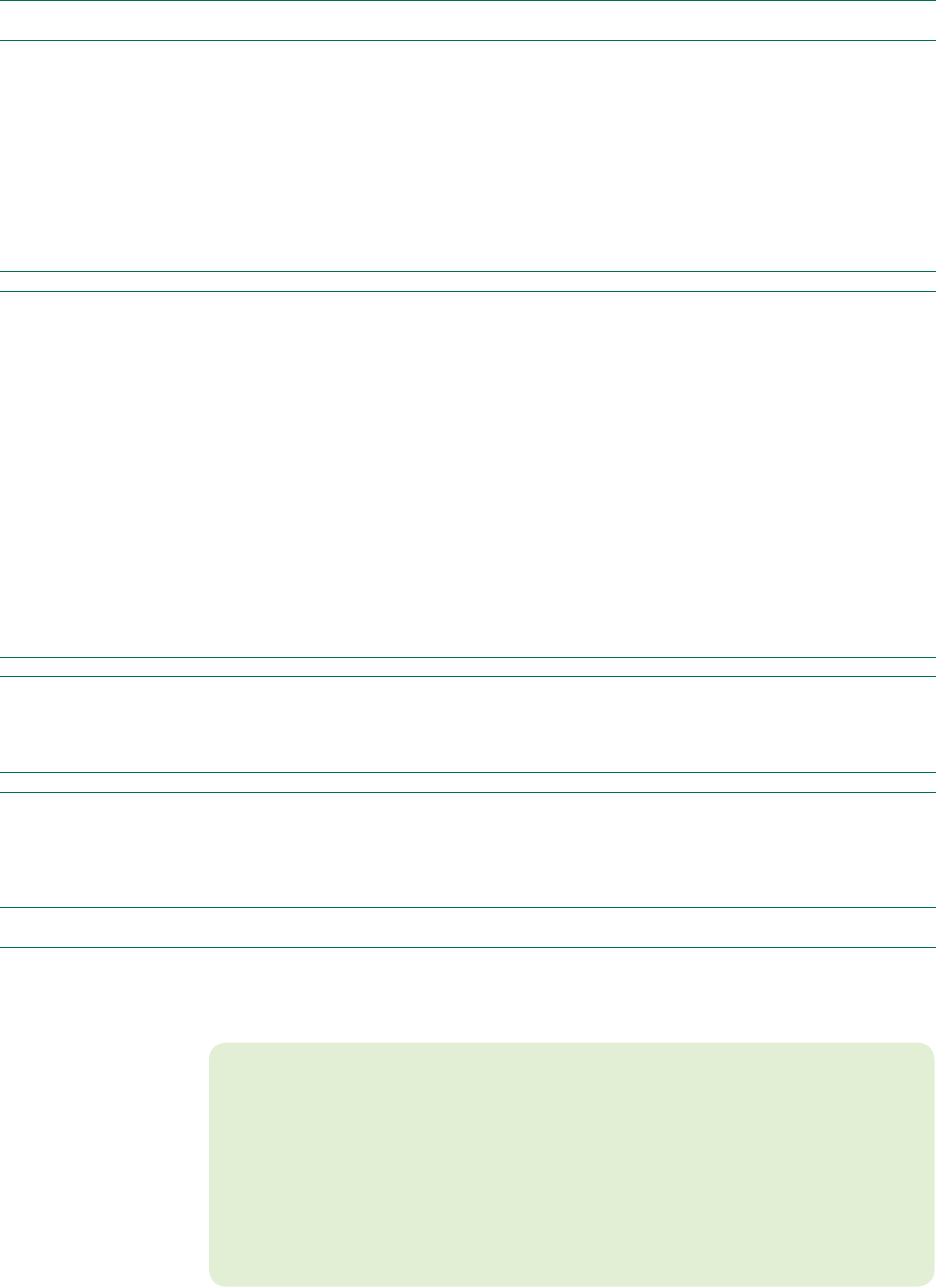

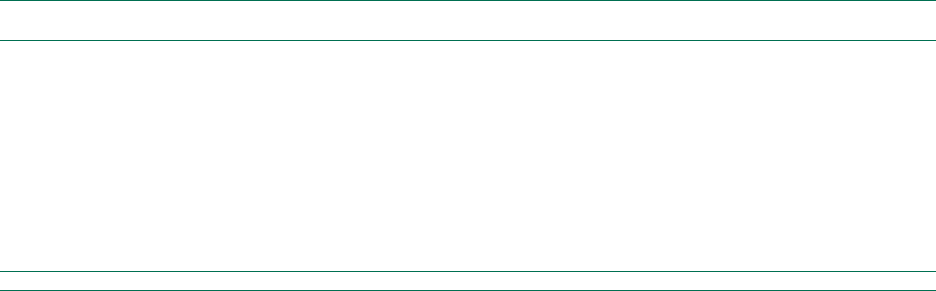

3.000

3.500

4.000

4.500

5.000

5.500

6.000

6.500

7.000

31/12/2013 31/12/201530/06/201531/12/201430/06/2014

CECE Banking Sector Index (relative to OTP)

BUX (relative to OTP)

OTP

Share price performance

20 OTP Bank Annual Report 2015

With regard to 2016 economic outlook

OTP Bank’s forecasts are fairly confident: the

bank expects 2.5% GDP growth, 1.7% fiscal

deficit, 0.7% inflation, further easing public

indebtedness and 2% real wage increase. Local

consumption has been gradually becoming the

key engine of growth. New loan disbursements

are expected to keep increasing dynamically,

however loan stocks might increase first of all

in the SME and corporate segments; as for the

households it is dicult to give any ballpark

estimation regarding the potential impact of the

recent Government measures.

According to the preliminary GDP data

published in February 2016 most of the CEE

countries with OTP presence enjoyed a fairly

positive backdrop: the Croatian economy

apparently left behind the recession and

the newly formed government submitted an

ambitious consolidation programme.

The overall Bulgarian, Romanian and

Slovakian macro indicators were equally good.

Furthermore, in certain countries – Croatia,

Serbia and Romania – either as a result of

mandatory conversions or under schemes

initiated by the subsidiary – the settlement and

conversion of CHF-based mortgages is either

underway or practically completed. With their

de-facto completion the banking community

might again focus on business activity.

For the last two years Ukraine and Russia

have been struggling with dierent challenges,

though a moderate consolidation is going on.

The Ukrainian GDP contracted by 10% in 2015

and for 2016 the central bank forecasts only

a moderate 1.1% growth. Ocial headline

inflation is expected to remain well above

10% in 2016 after exceeding 49% in 2015.

The promised structural reforms and the

anti-corruption fight is progressing slowly,

and the IMF raised concern in this respect

suggesting the temporary suspension of

the next round of financial aid what Ukraine

otherwise needs a lot.

As for Russia the most important risk factors

are the low oil price and the weak rouble, as

they fall short of the levels used for making the

2016 budget. Potential expenditure cuts might

take their toll through hampering domestic

demand; ability to pay might deteriorate both

in the corporate and household sectors. Due to

the high inflation induced by the weaker RUB

the central bank left the base rate in its January

rate-setting meeting at 11%, unchanged since

June 2015. In line with the inflation moderating

to single digit the base rate might be cut in 2H

2016. According to the ocial forecast of the

central bank the Russian economy will recover

from the recession only in 2017; for 2016 as a

whole the CBR expects 2% GDP contraction.

On 3 February 2016 OTP Bank announced

the purchase of AXA Bank Hungary’s

(predominantly) mortgage portfolio. According

to the plans, following the closing of the

transaction the integration process can be

completed at the end of 2016.

Legislative acts and decisions

aecting OTP Group’s operation

in Hungary

1. Settlement and conversion of FX-based

consumer contracts into HUF

According to legislations passed in 2014 the

settlement of the existing and matured

(or prepaid) FX mortgage and consumer loan

contracts at OTP Bank and OTP Mortgage Bank

was completed in March 2015. In 1Q 2015 the

conversion of FX mortgage loans into HUF has

been completed (except for OTP Flat Lease).

In 2Q 2015 the settlement with Merkantil and

OTP Flat Lease clients has been executed,

clients’ obligations arising from FX lease

contracts were converted into HUF. In 3Q 2015

the settlement of existing and matured HUF

consumer contracts at OTP Bank, OTP Mortgage

Bank, Merkantil and Flat Lease has been

completed.

According to the Act No. CXLV of 2015 approved

on 22 September 2015 the conversion of FX

car and consumer loans has been completed

by 1 December 2015 (the portfolio held by OTP

Factoring Ltd. has been converted as of January 1,

2016). The applied FX rates were the prevailing

ones on 19 August 2015 (ocial FX rates

published by the central bank: 287.2 HUF/CHF

and 309.2 HUF/EUR). Pursuant to the Act

21

customers enjoyed a benefit which equals to the

dierence between the FX rates applied for con-

verting the FX mortgage loans (256.5 HUF/CHF,

309.0 HUF/EUR) and the ocial FX rate quoted

by the central bank on 19 August 2015. This die-

rence was born jointly by the banks and the State.

2. Banking tax

On 15 December 2015 the Parliament amended

the Act No. CCXVII of 2015 on the banking tax

as a result of continuous conciliation between

the government and the Hungarian Banking

Association. The Act came into force partly

on 23 December 2015 and 1 January 2016.

Accordingly, for 2016 the banking tax rate is

going to be 0.15% for the tax base not exceeding

HUF 50 billion and 0.24% above that threshold.

The tax base will be the adjusted total assets

in 2009. The Act abolished certain concessions

stipulated by previously approved legislations,

such as the potential bank tax refund of maxi-

mum HUF 5 billion on sector-level for those

banks that suered losses in Ukraine, and also

the maximum HUF 10 billion sector-level bank

tax break related to corporate loan growth.

As a result, in 2016 the Hungarian members

of OTP Group will be paying HUF 16.1 billion in

banking tax (HUF 13.2 billion after tax) against

HUF 34.9 billion paid in 2015

(HUF 28.6 billion after tax).

According to the announcement of the Ministry

of National Economy on 10 December 2015

the Government plans to submit the relevant

banking tax legislation valid for 2017 in the first

half of 2016.

3. Deposit Protection Fund, Investor Protection

Fund and Resolution Fund

According to the new regulation eective

from 1 January 2016 the rate of the annual

contribution paid by member institutions into

the Deposit Protection Fund (OBA) was raised to

0.175% (2015: 0.14%).

Eective from 1 January 2016 the rate of the

normal contribution payable into the Investor

Protection Fund (Beva) was increased to 0.175%

versus 0.045% in 2015. Simultaneously, the

compensation threshold changed to EUR

100,000 from the previous EUR 20,000 level.

In 2014 OTP Core (the economic unit for

measuring the result of core business activity

of OTP Group in Hungary) paid in total

HUF 3.6 billion towards OBA, Beva and the

Resolution Fund, and HUF 6.6 billion in 2015.

The annual contribution in 2016 is expected to

go up to around HUF 10 billion. Those paid-in

amounts are booked amongst operational

expenses, not among adjustment items on

consolidated level.

4. Quaestor

On 17 November 2015 the Constitutional

Court made a decision on motions regarding

the Act on the indemnification of Quaestor

victims (Act No. XXXIX of 2015). Accordingly

the Constitutional Court ruled that certain

paragraphs of the Act were unconstitutional.

On 15 December the Parliament approved a

new law (Act No. CCXI of 2015 on compensation

measures aimed at strengthening the stability

of local capital markets) which took into account

the Constitutional Court’s ruling. The Act came

into force on 1 January 2016. Simultaneously

the previous “Quaestor” Act (Act No. XXXIX of

2015 on establishing a compensation fund)

being eective from April 2015 lost eect.

The new Act enlarged the range of clients

eligible for the compensation with the victims of

Hungarian Securities Ltd., however reduced the

maximum amount of compensation each clients

can receive. Accordingly, returns realized since

1 January 2008 must be deducted from the due

compensation. Furthermore, above HUF 3 million

11% co-payment by clients was introduced.

The compensation will be handled technically

by a newly established Fund which can take

a bridge loan from the central bank with

unconditional payment guarantee by the state

for servicing the payments. The bridge loan

will be serviced from the Beva-members’

contributions; however the sector-level

total annual contribution can’t exceed

HUF 7 billion. The contributions are deductible

on sub-consolidated level from dierent

tax obligations (banking tax, corporate tax,

contribution tax, financial transaction tax) in the

year of the payment. The first payments are due

in March 2017.

Management’s analysis of the 2015 results of the OTP Group

22 OTP Bank Annual Report 2015

The deadline for submitting compensation

claims is 15 February 2016 and payments will

start from May 2016. Since the total amount

of those claims is not yet known, OTP Bank’s

share is not calculable either.

5. Legislative changes related to the Hungarian

housing market

With a Government decree (455/2015) published

on 29 December 2015 and eective from

1 January 2016 the range and scale of the

Housing Subsidy for Families (CSOK) was further

enlarged. Modifications in February (government

decrees No. 16/2016 and 17/2016, both published

on 10 February 2016) made some fine-tunings.

Accordingly:

ş Customers can apply for a non-refundable

state subsidy, the so-called CSOK (originally

introduced on 1 July 2015) from 1 January

2016 with more favourable terms. Conditions

are determined by the above government

decrees. Under the current scheme the

amount of the state subsidy for building or

purchasing new flats is linked to the number

of (existing or undertaken) children: the

subsidy is HUF 0.6 million after 1 child,

HUF 2.6 million after 2 and 10 million

after 3 or more. For used-flat purchase or

enlargement the subsidy varies between

HUF 0.6 and 2.75 million, depending on the

number of children.

ş Those families granted CSOK with 3 or more

children are also eligible – under certain

criteria – for maximum HUF 10 million

subsidized loan. The interest rate of these

loans paid by the client is fixed at 3% for the

first 25 years. The formula for calculating

the total maximum interest rate chargeable

by banks is as follows: 3 month average of

the 5 year Government bond yield

¯ 1.3+3%.

Therefore, the interest subsidy by the state

equals to the dierence between the interest

rate paid by the client and the total interest

rate charged by the bank.

ş For those clients building a new house or flat

a tax refund capped at HUF 5 million became

available under certain conditions stipulated

by the legislation.

Furthermore, according to Act No. CCXII

of 2015 the VAT on newly built houses

was reduced from 27% to 5% from

1 January 2016 (under certain limitations

for the maximum ground-space of those

properties).

Changes related to FX mortgage

loans aecting foreign subsidiaries

1. Romania

In November 2015 OTP Bank approved a

conversion programme to be oered by the

Romanian subsidiary to its retail CHF mortgage

borrowers.

The CHF mortgage loan conversion programme

started on 9 December 2015. By the end of

January 2016 more than 10,000 eligible clients

were notified about the bank’s oer. Out of

those around 80% showed interest towards the

scheme, and 3% turned down the conversion

oer. According to recent experiences the

originally expected conversion ratio seems to be

achievable. The conversions de facto have been

started on 25 January 2016.

2. Croatia

Based on the amendments to the Act on

Credit institutions and Customer Lending

approved by the Croatian Parliament on

30 September 2015 the Croatian subsidiary

of OTP Bank announced a conversion

programme (from CHF into EUR) for its retail

CHF borrowers. Due to amendments to the

technical details the de facto conversion was

postponed to 1Q 2016.

3. Ukraine

In early July 2015 the Ukrainian Parliament

approved an Act on the conversion of retail

FX mortgages into UAH, however the President

did not sign the Act and it did not become

eective. At the end of January 2016 the

Parliament voted on the presidential veto,

as a result the Act was taken o the agenda.

In early September 2015 another draft

legislation was published aiming at providing

relief to FX denominated residential mortgage

23

holders. The draft was prepared by the central

bank with the involvement and agreement

of the local commercial banks. Since the

actual version of the draft is currently under

discussion, it has not been submitted to the

Parliament yet.

Consolidated earnings:

HUF 120.2 billion adjusted after-tax

profit, declining income margin and

net interest margin, moderating risk

costs, decelerating portfolio quality

deteriorating from 2H, improving

DPD90+ ratio and provision

coverage

The consolidated accounting profit for the

last 12 months was HUF 63.2 billion versus a

loss of HUF 102.3 billion in the base period.

The material y-o-y change was related mainly

to the adjustment items.

In 2015 the total volume of adjustments

amounted to HUF –57 billion after tax, which

is materially lower than HUF –220 billion

booked in the base period. In 2015 the following

adjustment items were presented:

ş The special banking tax in the amount of

HUF –29.4 billion (after tax);

ş In 2Q and 4Q 2015 impairment was booked

in relation to the Ukrainian investment under

Hungarian Accounting Standards. Though

under IFRS these impairments had no direct

eect either on the consolidated balance

sheet or on the P&L, there was a related

positive tax shield of altogether HUF 6.7 billion

that added to the Group’s IFRS accounting

profit;

ş The Hungarian Competition Authority

imposed a HUF 4 billion fine on the Banking

Association in its January 2016 ruling.

According to HCA’s reasoning the Banking

Association operated a banking database in a

way that could hamper market competition.

The Association has contested the ruling

at the court. For the potential payment

obligations by OTP Group’s aected group

members HUF 813 million other risk cost

was made (HUF 662 million after tax);

ş The one-o impact of regulatory changes

in relation to consumer contracts and the

impact of the related methodological changes

in Hungary was HUF +7.6 billion (after tax);

ş In 2015 the Bank made additional provisions

for its East Ukrainian and Crimean exposures,

resulting in an after-tax negative eect of

altogether HUF 2.4 billion;

ş The business model of OTP Life Annuity Ltd.

was aected by a modification of Act 2003

LX, accordingly from January 2015 only

insurance companies are eligible to conclude

reverse mortgage contracts. Consequently

provisions were made on the Company’s

portfolio which had a negative impact of

HUF 5.5 billion (after tax);

ş The positive impact of badwill related to the

acquisition of Banca Millennium reached

HUF 1.6 billion (after tax);

ş The expected one-o negative impact of the

Romanian CHF mortgage loan conversion

programme is around HUF 25.5 billion (after

tax), assuming that all eligible clients will

participate;

ş The expected one-o negative impact of

regulatory changes related to CHF consumer

contracts in Croatia is HUF 6.3 billion

after tax;

ş In Serbia the central bank made several

decisions on 24 February 2015 related to

FX loans. As a result of these decisions

and also due to subsequent fine-tuning of

the refund calculation methodology the

Serbian subsidiary saw an after-tax negative

result of HUF 211 million presented among

adjustment items on consolidated level;

ş The after tax impact of dividends and net

cash transfers amounted to HUF +144 million.

On 2 November 2015 Visa Inc. and Visa

Europe Limited reached an agreement on the

purchase of the shares of Visa Europe (owned

by European banks) by Visa Inc. According to

the deal the purchase price will be transferred

by cash and Visa Inc.”C-type” preferential

shares with limited marketability, after the

settlement of the transaction (after receiving

all the necessary approvals). In addition, the

framework terms of the transaction provide

for a deferred earn-out payment, which will

Management’s analysis of the 2015 results of the OTP Group

24 OTP Bank Annual Report 2015

be paid in cash after sixteen quarters from

the date of the transaction settlement (if the

relevant criteria of the earn-out component

are reached). According to the notification of

Visa sent in mid-December 2015, the expected

amount of cash is about EUR 34.2 million

(around HUF 10.8 billion, which was calculated

with the closing ocial exchange rate of NBH as

at 31 December 2015). Prior to the transaction

the book value of OTP’s share in Visa Europe

was close to zero, but at the end of 2015 it was

revaluated, which has been recognized on the

of Fair value adjustment of available for sale

securities line in the Consolidated Statement of

Comprehensive Income. The above said cash

component of the purchase price will be booked

in the Consolidated Statement of Recognized

Income at the settlement of the transaction,

and shown presumably in the second quarter

of 2016. For the time being the value of

the earn-out component cannot be reliably

measured.

OTP Group posted HUF 120.2 billion adjusted

profit in 2015 which underpins a y-o-y 2%

increase against the base period. The corporate

tax burden grew by HUF 1.5 billion y-o-y, as a

result, profit before tax advanced by 3% y-o-y.

The operating income dropped by 13%; the

negative impact was o-set by lower risk costs

(–20% y-o-y) and higher one-o revenue items.

As for individual performances, 2015 to

a great extent resembles 2014: it was again

OTP Core with HUF 123.4 billion and DSK Bank

with HUF 52.5 billion contributing the most to

consolidated adjusted earnings. Other Group

members in the CEE region except for Serbia

were profitable, too and in total posted

HUF 5.9 billion profit. Ukraine and Russia,

on the contrary, remained still in red (with

HUF 40.3 billion and HUF 15.1 billion adjusted

loss), still their combined negative result was

slightly lower than in 2014. Starting from 2015

the performance of the Russian online bank,

Touch Bank was presented separately, though

legally it is part of the Russian operation; in

2015 it posted HUF 4.8 billion negative result.

The annual total income represented

HUF 755 billion, by 9% less y-o-y. Within that

net interest income shrunk by 13%: OTP Core

suered a y-o-y 6% decline, more significant

was the drop in Russia and Ukraine (–38%

and –36% respectively); at the same time the

Bulgarian, Romanian, Croatian and Slovakian

subsidiaries managed to increase their net

interest income. The material set-back in

Russia and Ukraine was partly reasoned by the

FX-eect: in RUB the Russian NII erosion was

18%, whereas the Ukrainian NII remained flat in

UAH terms. Also, the erosion of performing loan

volumes in both countries took their toll, too.

The net fee and commission income decreased

marginally (–1% y-o-y). The annual other net

non-interest income surged by 66% y-o-y,

to a great extent attributable to the 4Q 2014

base eect. Furthermore, at OTP Core there

was a higher annual gain realized on the AFS

securities portfolio, and a significant FX gain

was booked in Ukraine in 1Q 2015.

The annual operating expenses melted down by

5% y-o-y.

The consolidated total income margin (6.98%)

eroded by 78 bps in 2015, whereas the net

interest margin (5.11%) shrunk by 85 bps.

The FX-adjusted consolidated loan portfolio

declined by 8% y-o-y. Since there have been

significant write os during 2014, the changes

in the performing DPD0–90 loan volumes

would draw a better picture on real trends.

Accordingly, the performing (DPD0–90) book

eroded by 5% y-o-y. Regarding the FX-adjusted

DPD0–90 volume changes, the most significant

erosion was booked at the Russian and

Ukrainian subsidiaries (26% in each case),

whereas OTP Core suered an 8% y-o-y

set-back. Within the performing retail book

mortgages declined by 6% and consumer

loans by 8% respectively. The SME book, on the

opposite, advanced steadily (+16% y-o-y). Large

corporate volumes dropped by 3% y-o-y.

As for individual performances, in 2015 the

Romanian and Serbian subsidiaries managed

to increase their FX-adjusted loan volumes

the fastest (+25% and 17% respectively); the

remarkable y-o-y increase for all product

segments in Romania was related mainly to