ЕNVIRONMENTAL AND SOCIAL

RESPONSIBILITY REPORT 2022

TABLE OF CONTENTS

INTRODUCTION AND STATEMENTS .................................. 3

ESG ACCENTS AND METRICS OF OUR MAIN ESG

ACHIEVEMENTS IN 2022 .......................................................7

RESPONSIBLE PROVIDER ....................................................8

RESPONSIBLE EMPLOYER .................................................. 12

RESPONSIBLE SOCIAL ACTOR ...........................................14

AWARDS .................................................................................20

2

Striving to keep transparent and comprehensible

communication with our interested

stakeholders, we prepared this report for the

second year in row in addition to the statutory

required Non-financial statement to share our

Environmental, Social and Governance (ESG)

achievements and commitments made to

promote the green transition of the economy

and to continuously reduce our -unfavourable

environmental impact resulting from our

activities, products and services. We also use

the opportunity to communicate our progress

on ESG matters achieved meanwhile, at the time

of drawing up the Report.

DSK Bank continues to maintain its trusted

leader position among the bank users and

financial services in Bulgaria. The Bank strives

to establish and maintain high client service

standards, advanced and suitable products and

services, best corporate and ethical practices in

its relations with all interested parties following

the relevant legislation. One of the Bank’s key

objectives is to become a market leader in all

banking segments, and at the same time to

emphasize on a number of initiatives in the field

of sustainable development that reflect our

responsiveness to environmental changes and

the needs of society.

In fulfilling one of the main objectives of

ECO project, established in 2021 to set the

fundamentals of a systemic management of

climate and environmental risks within DSK

Bank’s Group, in July 2022 DSK Bank’s ESG

Strategy was adopted by the Management Board

and approved by the Supervisory Board of the

Bank. The Strategy was developed to enhance

INTRODUCTION

3

the efforts and actions we take to become

a leader in sustainable financing. Given the

urgency of climate and environmental issues,

the main emphasis in this first edition is put on

the “E” part of ESG, covering two main topics –

sustainable financing/business opportunities

and own carbon footprint. The key strategic

ESG targets set are supported by a dashboard

of quantitative and qualitative KPIs and KRIs

to ensure proper follow-up on the progress

achieved and to facilitate the Management

Board in overseeing the climate-related and

environmental risks.

DSK’s ESG Strategy is aligned with OTP ambition

to be the regional leader in financing a fair and

gradual transition to a low-carbon economy

and building a sustainable future through

responsible solutions. It became part of OTP

Group ESG Strategy and outlines the three main

pillars of OTP Group:

• Responsible Provider

• Responsible Employer

• Responsible Social Actor

The presentation of information in the current

report is organized around these three pillars.

ESG Strategy of DSK Bank supports the UN

Sustainable Development Goals adopted by

all UN member states. Our strategic plans are

aligned with those which we believe we can

contribute the most to:

4

When it comes to matters of climate change (the E

in ESG), the strategic problem is not that the planet

is warming up, but why the world is yet to take

more decisive action to address it. My answer to this

conundrum: we, who are simultaneously consumers and voters,

do not feel the urgency to act. As such, we do not demand action

from our politicians, rendering government regulation ineffective

and slow.

We at DSK Bank continuously ask ourselves; what can I do to

change this situation? And we must ask it on three levels: as a

citizen, as a business leader, and as a banker.

Our guiding policy, and the leverage that we as business leaders

have, is to encourage (inspire) and enlighten (inform) the millions

of individuals who use our products and services. Unfortunately,

however, our E(SG) strategies are lacking breakthrough solutions

on this front. I would like to argue that we should measure

our efforts against a single criteria: are we encouraging and

enlightening our consumers?

Is there something else we, as banking executives, can do that

will differentiate us from other business leaders?

The short answer is yes. Finance, along with technology and

international cooperation, are critical enablers for accelerated

climate action.

Climate resilient development requires tremendous investment.

If climate goals are to be achieved, both adaptation and mitigation

financing needs to increase manifold. Our role is to smooth the

flow of capital towards climate action.

This leads us back to our duties as citizens. The award-winning

climate reporter Akshat Rathi has answered this question

succinctly for us: #4 - eat less meat, #3 - fly less, #2 - vote for the

right politician, and #1 - talk about climate change.

Tamas Hak- Kovacs

CEO and Chairman of the Management Board of DSK Bank

LETTER FROM THE CEO

5

ENVIRONMENTAL

Establishment of climate and environmental

targets

• DSK’s ESG Strategy sets clear and

ambitious targets on green financing and own

carbon footprint as well as KRIs to limit the

climate transition and physical risks

Business opportunities

• 130 project financing, mid- and large

corporate projects for renewable energy

production financed by DSK Bank in 2022; 4 local

projects for culture and urban development co-

financed by the Bank and its subsidiary Regional

Fund for Urban Development

Environmental initiatives

• Our participation in the Mastercard

Wildlife Impact Card program allows debit card

holders to become involved in the conservation

of critically endangered species. DSK Bank also

supports the Sofia Zoo’s conservation program

to protect endangered wildlife species

SOCIAL

Health and employee well-being

• We consider our employees as a key

to success. Therefore, we are committed to

strengthening our activity in employee well-

being and personal development

Employee engagement and inclusion

• Personal development ensured through

various specialized and advanced training

programs - Digital Academy, OTP Risk Academy

(incl. ESG module), Leadership Academy

Responsiveness to societal needs

• Numerous socially responsible initiatives

established/ supported by the Bank - “City as

its people” project for improving the urban

environment, donation campaigns to help

refugees from Ukraine, the affected people

from the flooded villages in Karlovo Region,

SOS Children’s Villages Bulgaria

GOVERNANCE

Sustainability governance in DSK

• Establishment of DSK ESG Strategy –

the first of its kind document that outlines our

ambitions and commitments in the field

• Social responsibility is one of the six

objectives set in the Group’s Risk Strategy for

2023-2025, and ESG factors in risk management

are part of the strategic focus programs for the

next three-year period

• Gradual integration of ESG factors in the

policies, processes, and systems to assess and

manage the relevant risks

• An organizational structure was

established, including the newly founded

Sustainability Development Section, that

ensures strong governance, regular monitoring,

and reporting to the MB for overseeing the ESG

Strategy implementation

ESG ACCENTS

6

METRICS OF OUR MAIN ESG ACHIEVEMENTS IN 2022

2020 2021

Electricity consumption (GJ), DSK Group 83092 -5,6% 78402

Total energy consumption per capita, GJ 21,38 -6,5% 19,98

Usage of paper, ink and toner cartridge, t 9260 -18,9% 7514

Share of financed low- or -zero-carbon assets in Leasing 1,55% +276% 5,84%

Volume of investment projects in RES powerplants financed (tsd EUR) 96 082 +157% 247494

Employees

Headquarter Branch network Subsidiaries

1978 2700 877

Access points

Branches ATMs

294 998

Total clients

2 658 100

Retail 2 569 000

Micro enterprise 80 000

Corporate 9 100

7

RESPONSIBLE

PROVIDER

Our ambition is to transform the Bank in a

way to successfully meet challenges of the

environment we face with, while continuously

improving financial results. To achieve that,

we built our Business Strategy on four main

pillars for future development: Protect, Grow,

Digitalize, Comply, and the ESG topic was put

(into the fourth pillar) as a strategic objective of

utmost importance.

The purpose of our existence is the Client. In

2022, we continued to intensify our activities in

improving the client services and to effectively

solve the various clients’ financial needs. The

New service model implemented in a hole

branch network ensures better customer

experience and management of customer

flow in the branches. Those who visited the

office only for a payment transaction can rely

on faster service with significant decrease of

waiting time. On the other hand, the customers

who are interested in a banking product/service

can rely on professional consultancy and

individual approach by a financial specialist.

To measure the customer experience, the Bank

uses an innovative metric, which allows the

customer to rate the service immediately after a

service has been provided or a visit to a branch.

This approach guarantees transparency and

provides an opportunity to take immediate

action to improve the customer experience

when using the Bank’s products and services.

The Bank uses Transactional NPS (Net Promoter

Score) – a leading global indicator for measuring

customer experience. In 2022, transactional

NPS increased compared to 2021, thus marking

the second year in a row with a higher level

of service quality at the Bank’s branches. This

result confirms the high level of service quality

and positive experience that our customers

receive.

As an acknowledged leader on the market of

innovative products and digital services in the

banking field, the Bank develops and improves

the functionality of its remote banking

platforms – DSK Direct and DSK Smart, to make

them as much as comfortable and easier for

use by the clients. Our customers can apply,

receive and use their consumer loancompletely

online without visiting bank offices, they can

receive a loan contract through the Evrotrust

application on their mobile phone, read and

sign it, and then return it to the Bank. Option

for documents signing using the QES is also

provided for the Premium clients, as thus they

save time, perform their operations faster and

more efficiently, and have 100% security of

their personal data. By using Evrotrust and the

Call Center, our clients who are temporary out

of the country can perform remote electronic

operations, requiring signing, such as access to

electronic and mobile banking, application for

signing method, registration of mobile phone

number for 3D password required for online

shopping, opening a bank account, issuing of

debit cards for individuals, etc.

In 2022, a strategic program for digitalization

has turned out to be a highly impactful endeavor

and undoubtedly has achieved its ambitious

8

purpose to even further improve DSK Bank

services and operations. As an acknowledged

leader on the market of innovative products

and digital services in the banking field, DSK

Bank Group develops various projects with

the approach of complete online servicing. To

improve the clients’ experience, and to provide

easy and fast access to our financial products

and services, DSK Bank Group constantly

upgrades the functionality of its remote banking

platforms. As a result of the difficult situation in

the country and the increased use of electronic

banking channels – DSK Direct and DSK Smart,

the team of the financial institution continues to

work on their improvement so to make them as

far as possible more comfortable and easier for

use by the clients.

Sustainable financing

We understand our role in supporting the

clients on the way to low-carbon economy. In

this respect we set clear targets into specific

business activities to provide financing that

supports the transition:

In October 2022, a group project for extension

of the group’s Green Loan Framework was

launched, aiming to include the subsidiary

banks in the GLF, and more importantly – to

implement the requirements of EU Taxonomy

and CBI taxonomy. Finishing the project will

give the instruments for assessing transactions

in terms of eligibility to the taxonomies. Once

assessed, the exposure could be distributed by

the group as part of the Sustainable portfolio

and linked to Green or Sustainable Bonds.

In 2022, following the EU Net-zero targets, and

on the other hand – increasing of electricity price

– the demand for renewable energy production

powerplants increased. We continue to provide

financing for clients, developing projects either

for trading or for own consumption.

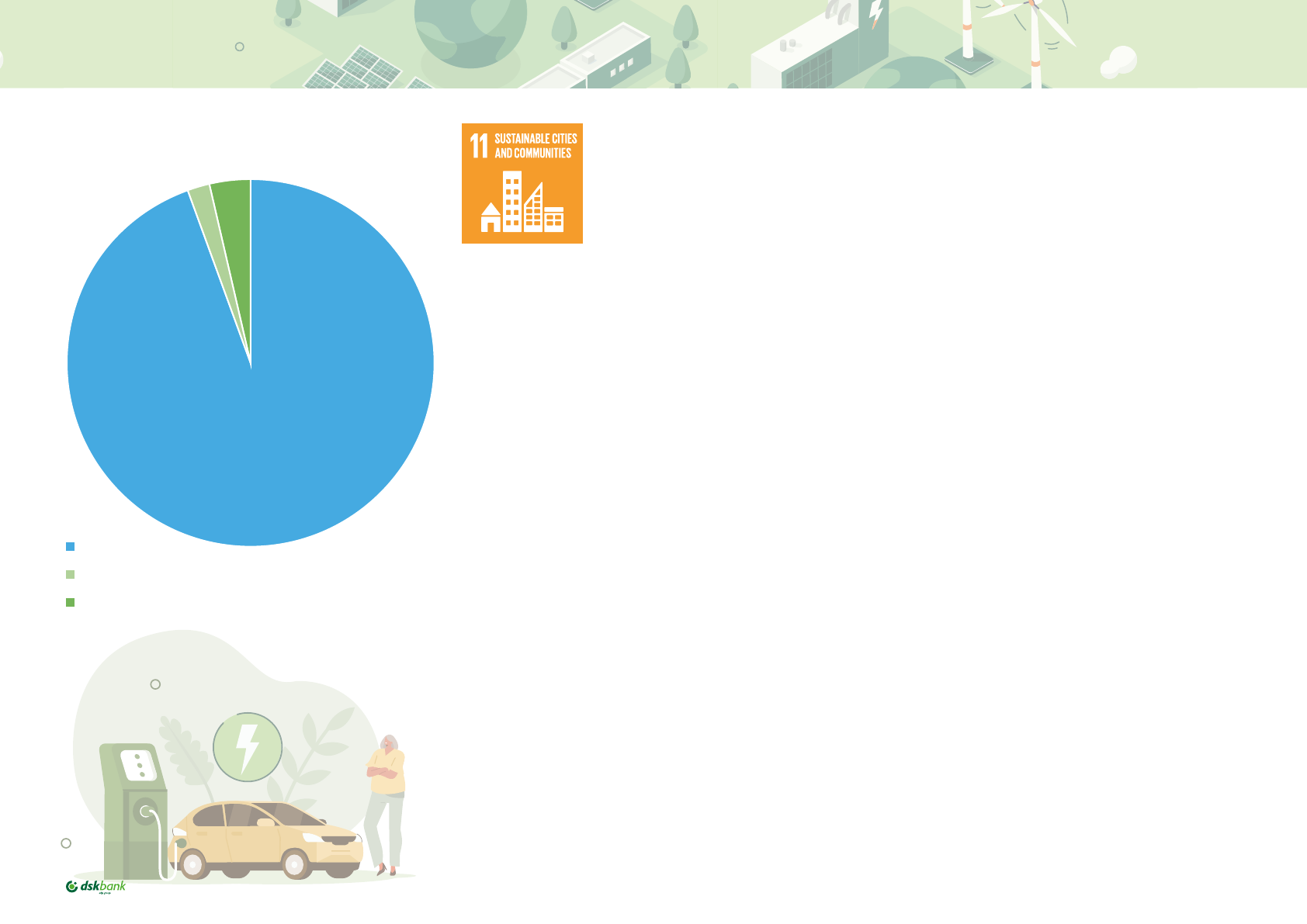

Leasing portfolio also shifts to low-carbon

emission vehicle financing. While in 2021 the

share of electric + hybrid vehicles in total

portfolio was 1,55%, in 2022 the share increased

to 5,84%. The target for the leasing entity set

into ESG Strategy is by the end of 2025 35%

of financed vehicles to be pure electric, and

the share of pure EV to be at least 6% of total

portfolio.

In November 2022, we launched a trading

initiative regarding the housing loans by

providing discount of application fee if a client

wants to purchase residential asset with energy

efficiency class “B” or higher. We consider this

incentive as a step ahead into changing the

mindset of clients, pointing out the importance of

impact of energy efficiency on the environment.

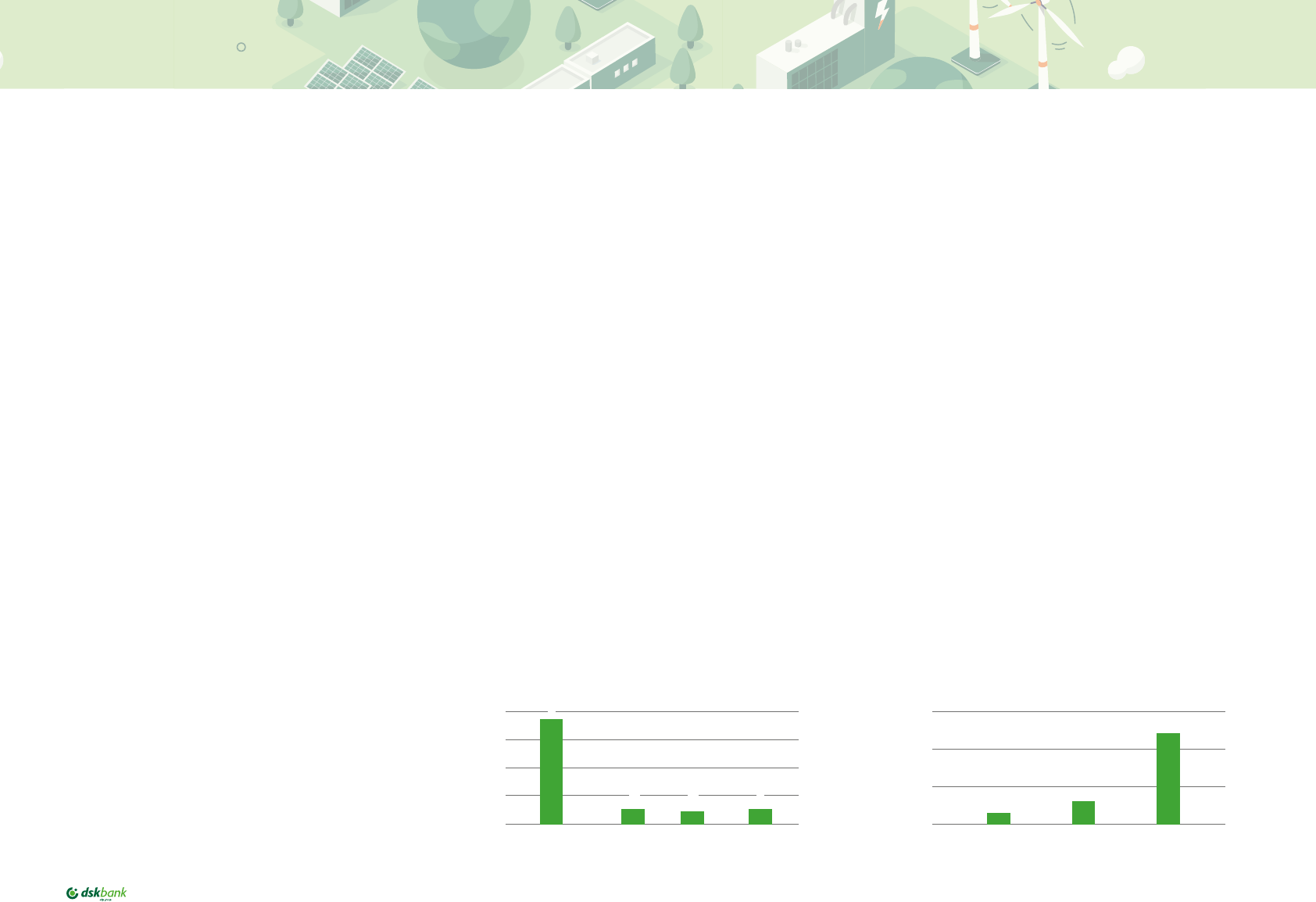

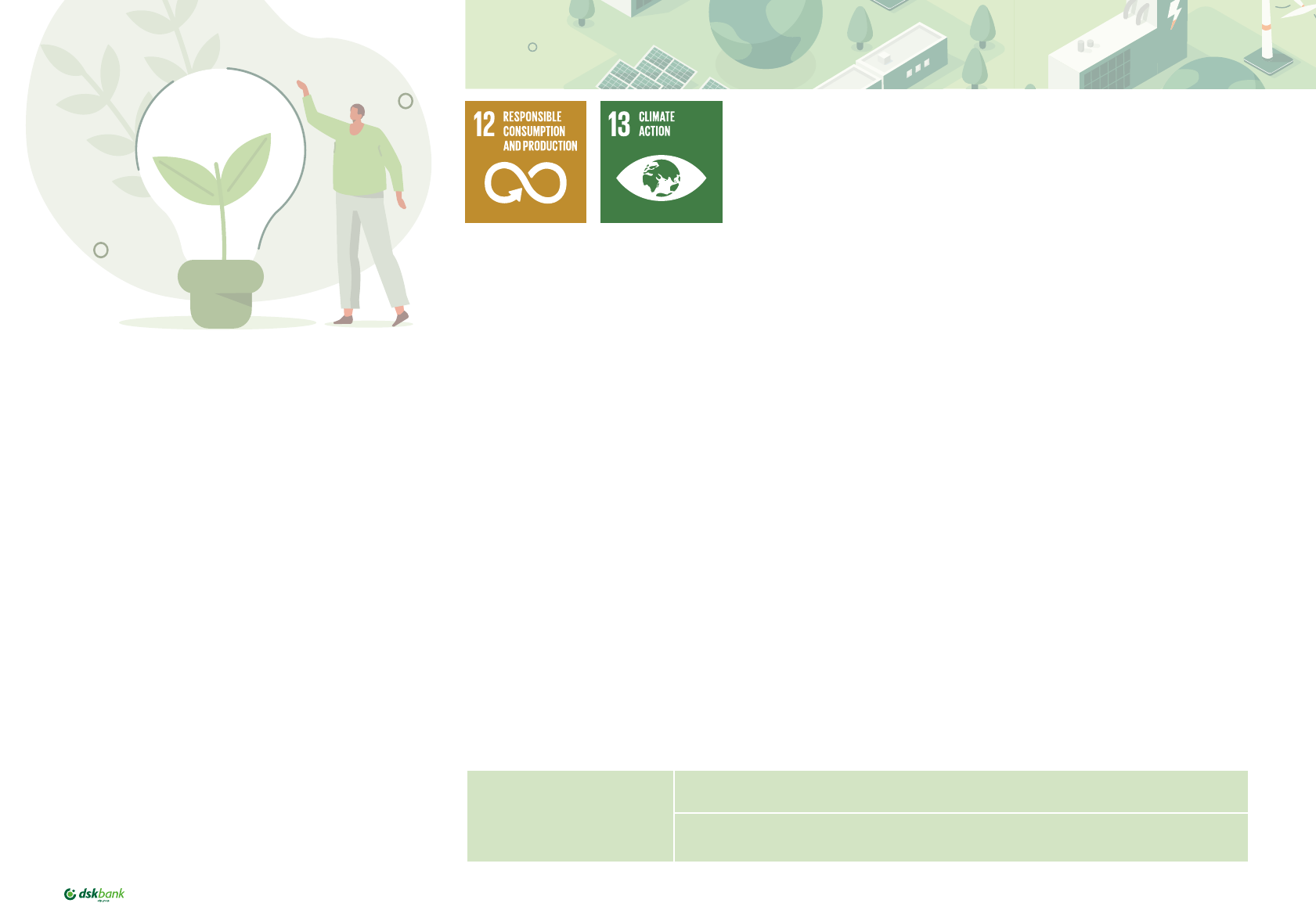

Renewable energy production* Real estates* Agriculture Retail mortgage*

DSK Bank’s targets by 2025, million EUR

0

100

200

300

400

344

56

48,3

41

2020 2021 2022

Financed renewables volume, thousand EUR

300 000

225 000

150 000

75 000

64781

96082

247494

9

Sustainable cities

In 2022, DSK Bank continued to contribute to

the development of local projects for culture

and urban development. Together with the

Regional Fund for Urban Development, DSK

Bank co-financed three sites from the cultural

infrastructure of Razgrad municipality - the

regional library “Prof. Boyan Penev”, the

Ethnographic Museum and the “Ilia Burnev”

School of Music at the community centre

“Development 1869”. The goal of the venture is

to transform them into modern and attractive

cultural and educational centres.

Another co-financed project is construction

and installation activities for the renovation of

the “Katya Popova” concert hall in the city of

Pleven. The project will ensure the introduction

of energy efficiency measures, repair of the roof

and existing sanitary facilities, replacement of

electrical installations, linings, flooring, and

seats in the concert hall. New sound equipment

and stage control equipment are to be installed.

ESG Risks management

The integration of ESG risks in the risk

management processes of the Bank continued

in 2022.

Regarding credit risk management, based

on the established in 2021 internal ESG Risk

Management Framework in Loan Origination

and Monitoring of DSK Bank Group, we

introduced monthly monitoring of evolution of

our business loans portfolio by ESG categories.

The reported results as of end of 2022 show that

while on a client level the share of High ESG risk

transactions is still high, on a transaction level

it is only 9% of the portfolio. The client level risk

assessment is based on the NACE code of the

sector only, while the risk on a transaction level

is determined by considering the maturity and

purpose of the project as well as the positive

outcome of the due diligence performed

(possibility currently applied for a limited

number of deals - the riskiest sectors from

ESG perspective where a pre-defined exposure

threshold is exceeded).

Total portfolio

Electric assets

Hybrid vehicles

OTP Leasing: share of financed low- or

zero- carbon emission assets, thousand

EUR

10

The key supporting element is a risk indicator that was

introduced into ESG Strategy and later on implemented into

Risk Appetite Framework (RAF), affecting the corporate clients

– the share of newly contracted High ESG transactions to not

exceed 10% of total newly contracted transactions. This way,

the value and evolution of this RAF indicator is monitored

monthly, in addition to the Exclusion list (also included in the

RAF). Considering the requirement, both business and risk

underwriting units maintain proper structuring of the deals.

Regarding physical risk that affects collaterals, steps were

taken in the collateral assessment by engaging the valuators

to include climate-related and environmental risks into the

collateral evaluations. Landslide, groundwater, dust and

noise pollution are presented, and taken into account in the

assessment.

In 2022, OTP Group did its first climate change stress testing

based on the developed own framework, as part of the internal

capital adequacy assessment process. Calculations were made

under the stress testing methodology to measure the impact

of climate risk on the corporate portfolio of individual banks

within the Group of OTP Bank, incl. DSK Bank. The result of the

analysis shows that annual losses under the worst climate

scenario (so-called “Hot house”) would increase by up to 16

basis points compared to the scenario of planned transition to

a climate neutral economy by 2050.

Materiality assessment performed by the Bank for a second

year in a row shows that, apart from the credit risk, other

traditional risks could also be impacted by climate and

environmental changes. In the operational risk management

area, we strengthened the assessment of ESG risks in the

scenario analyses by analyzing a separate scenario related

to climate change, and we also started to indicate the risks

affected by ESG in both the risk control self-assessment and

the loss collection in order to accumulate the necessary data.

In 2022, one more KRI was established for monitoring the

number of incidents caused by damages to physical assets as

result of natural disasters.

We will continue to gradually embed the climate risk related

considerations in managing other types of banking risks

that could be impacted tangibly according to the materiality

assessment.

39%

39%

23%

26%

12%

9%

45%

46%

29%

31%

20%

18%

Business portfolio distribution

by ESG category

100%

75%

50%

25%

0%

Low Medium Medium-high High Unidentified

11

Strategic vision

Personal and leadership qualities are very

important for the Group to move forward. And

so is the diversity of professionals working

in the Bank. Thus, the focus set by DSK Bank

in 2022 was to further establish the Bank as a

top employer with a clearly defined Employee

Value Proposition (EVP) and a communication

campaign that follows “Everyone is looking

for employees, we are looking for people”. A

special focus was placed on the Bank offering

multiple career paths and opportunities,

transforming itself into collaborative mixed

teams that work flexibly towards a common

goal. The strategic vision of the campaign

includes overall initiatives and visualizations of

Bank employees.

“DSK New beginning” program was active in

2022 and focused on the most common Bank

position – clients relationship expert, providing

mobility and structured training program for

new colleagues, the internship program and

our overall campaign aimed at IT and digital

professionals.

In 2022, the main goal of DSK Bank was

digitization. In this regard, the focus of the

presentation of the Bank as an employer was

on its positioning in front of IT specialists. The

company invested resources in developing a

corporate profile on the DEV.BG platform, which

focuses on finding IT talents.

DSK Bank is also a regular participant in various

career forums, which are another connection

of the institution with young talents and

established professionals. Such an opportunity

is also the Bank’s internship program.

The staff as of the end of 2022

2022, distribution by age

AGE Senior Management Middle level Subordinates Total

<30 789 789

30-50 4 138 3007 3149

> 50 3 40 1208 1251

Total 7 178 5004 5189

2022, distribution by gender

Gender Senior Management Middle level Subordinates Total

Women 2 73 3965 4040

Men 5 105 1039 1149

Total 7 178 5004 5189

2022, distribution by gender

Data Total Men Women

Distribution by

gender

100% 22,14% 77,86%

Turnover rate 16,46% 3,74% 12,72%

o.w. voluntary 12,14% 2,83% 9,3%

New employees in 2022

Gender/ Age <30 30-50 >50 Total

Women 263 221 27 511

Men 86 89 12 187

Total 310 39 698

RESPONSIBLE

EMPLOYER

12

Employee data

Employees under permanent vs. temporary

contracts: 94,87%/ 5,13%Full vs. part-time

employees: 96,3%/ 3,7%

Occupational health and employee well-being

We consider our employees as a key to success.

Therefore, we are committed in strengthening

our activities in employee well-being and

individual development.

Contract with the Occupational Health Service

is in place which provides full support of

the needed activities, and assessment of the

microclimate conditions in the workspace.

Periodic instruction on occupational health

and safety is performed on all employees on an

annual basis and is compulsory for newly hired

employees.

Prophylactic examinations are conducted

annually for all staff.

Two days of additional paid leave is granted to

all employees who have used all their accrued

paid leave for the current and previous years.

In 2022, we launched a pilot project for

refurbishment of one of the HQ buildings in

order to provide a new look for the office space

and to increase the employees’ comfort during

working hours.

The recently introduced initiative Balance Your

Life, part of our Wellbeing Program, ensures:

• Individual sharing space with internal

psychologists

• Various well-being awareness-raising

initiatives like wellness academy, guest

speakers, and webinars on wellbeing topics

• Social fund to support our employees in

need.

Employee engagement

The bank is strongly focused on

engaging employees and regularly follows

the engagement level with an annual OTP

engagement survey. The results are widely

spread and based on them a bank-level

action plan and an individual one are created

and followed so that we can increase the

engagement level of our staff.

In the field of developing skills and

competencies, the focus was put on digital

training for new and current employees. We

have developed the Digital Academy, which

is open for application to all employees and

offers professional training at a high level of

IT and Data knowledge. The Academy has 3

Paths – Reskill, DevOps, Ignite, and an additional

Data path (in which all employees working with

data in the whole bank are included).

Successful completion of the Academy gives

the participants further job perspectives and

opportunities within the Bank, including

promotion in position and salary.

Another important initiative of DSK Bank is

the Leadership Academy. In 2022 over 150

employees were trained in it including B-1, B-2,

B-3 managerial levels, and informal leaders.

Each Leadership Academy is 4 months long and

all graduates are certified by a professional

external trainer.

Finally, in 2022, the focus was developing our

E-learning programs for all bank employees.

All employees were trained in various topics

like GDPR, Operational Risk, AML, Bank and

information security, Ransomware, and social

engineering. E-learning courses were made

interactive, more interesting, and useful in

terms of content and practical knowledge.

13

RESPONSIBLE

SOCIAL ACTOR

Own consumption and GHG emissions

In our activity, we aim to create shared value

that is measurable and makes a recognizable

contribution to society and SDGs.

One of the directions we follow lies in the carbon

footprint of the Bank. In our ESG Strategy, we set

ambitious goals in terms of its own operations,

including the reduction of our own emissions:

Targets of DSK Bank group by the end of 2025

Achieve net carbon neutrality (Scope 1 and

Scope 2)

Achieve reduction of GHG emissions (Scope

1 and Scope 2) by 15%, compared to reported

emissions for 2021

In 2022, we managed to significantly reduce

the total energy consumption (roughly by 9%

compared to 2021) and to achieve improvement

in performance across all its elements. Reduction

in car fuel consumption (by nearly 4%) reflects

our efforts made to improve the ratio between

diesel and petrol cars in the car fleet, as well as

the investment in purchasing 13 new hybrid cars

in 2022. The replacement of gas boilers with air-

conditioning installations in some buildings led

to a reduction of natural gas consumption by

nearly 30%. In terms of electricity consumption,

the decrease is almost 6% which became

possible thanks to the implemented Heating,

Ventilation and Air-conditioning systems (HVAC)

and Building Management Systems in some of

our main HQ buildings, as well as to various

internal initiatives with a focus on the topic, e.g.,

conducting campaigns among employees and

organizing a competition between the branches

and HQ units dedicated to the responsible

consumption of electricity. The district heating

reduction (by nearly 34%) is related to one of

the largest HQ buildings in Sofia and comes

from cutting out two floors (approx. 2 000 m2)

out of district heating supply (replaced by air-

conditioning system) as well as reducing the

heating units while much of the staff in the

building was working 50 % at home office in the

beginning of 2022.

A slight increase (below 1%) is reported in the

total Scope 1 and Scope 2 carbon emissions

which, in the direct emissions, is due to the

equipment of air conditioning installations

(freon), and, in the indirect emissions – to the

use of updated (higher) emission factors upon

calculating CO2e emissions from purchased

electricity.

Targets of DSK Bank group

by the end of 2025

Achieve net carbon neutrality (Scope 1 and Scope 2)

Achieve reduction of GHG emissions (Scope 1 and Scope 2) by 15%, compared to

reported emissions for 2021

14

The energy consumption and own emissions

data are regularly monitored by the responsible

units within the Bank Group and are considered

in the investment planning.

Pursuing the targets, we are working on energy

efficiency program in several directions:

• Energy efficiency audit of own real

estate stock started with assessment of three

buildings and continues with another 9.

• Installation of roof photovoltaic

systems is in final stage and beginning from

Q1.2023 they will start to generate electricity

for partial satisfaction of respective buildings’

consumption.

Environmental care

We continue to collect separate waste in two

of our main locations. In 2022 53 t. paper and

30 kg. PET bottles were collected and sent for

Energy consumption within the organisation (GJ)

DSK Bank standalone,

without Expressbank

DSK Bank standalone, with

Expressbank

DSK Bank Group DSK Bank Group

2019 2020 2021** 2022

Natural gas 0 3890 5441 3815

Car fuel mineral 5579,17 4861,87 19508,78 18789,42

Total non-renewable fuel sources 5579,17 8751,87 24949,78 22604,42

Car fuel biogen * 0 0 1158,41 1137,10

Total renewable fuel sources 0 0 1158,41 1137,10

Electricity 62870,40 88480,80 83091,60 78402,60

District heating 3342 6830 10062 6665

Total indirect energy purchased 66212,40 95310,80 93153,60 85067,60

Total energy consumption 71791,57 104062,67 119261,80 108809,12

Total energy consumption per capita 18,59 23,19 21,38 19,98

* Car fuel biogen consumption collected separately since 2021

15

recycling. In 2022 over 600 kg of pet bottles

were donated to the initiative Kapachki za

budeshte. The aim of the campaign is to collect

caps, recycle them, and with the collected funds

to purchase incubators and ambulances for

hospitals in Bulgaria.

At the end of 2021, DSK Bank joined the global

Mastercard Wildlife Impact Card program

for the protection of the planet’s biodiversity.

The cards are produced by 85,5% recycled

and recyclable material. For each Mastercard

Wildlife Impact card issued, DSK Bank and

Mastercard donate $ 1 to the international

organization Conservation International to help

conserve and restore wildlife habitats. By 2030,

this project will cover priority areas equal to 40

million hectares of land and 4.5 million square

kilometers of water areas worldwide.

The result by the end of 2022 is 100,000

issued bank cards. In addition, for greater

engagement of current and future users, DSK

Bank and Mastercard are adding a local cause

Scope 1 and Scope 2 CO2e emissions (t)

DSK Bank standalone,

without Expressbank

DSK Bank standalone, with

Expressbank

DSK Bank Group DSK Bank Group

2019 2020 2021** 2022

Direct (Scope 1) 748,05 985,02 2091,38 2108,06

from motor vehicles mineral 415,84 360,83 1459,60 1399,10

from the use of natural gas 0 218,62 305,78 211,96

from air conditioning 332,21 405,57 326 497

Indirect (Scope 2)

Indirect location-based 7766,88 9455,47 9052,06 9117,25

from electricity 7631,59 9130,97 8574,82 8801,13

from district heating 135,28 324,49 477,24 316,12

Indirect market-based 7773,51 9470,46 9066,14 9117,25

from electricity 7638,23 9145,97 8588,90 8801,13

from district heating 135,28 324,49 477,24 316,12

Total (Scope 1 + 2) location-based 8514,93 10440,48 11143,45 11225,31

Total (Scope 1 + 2) market-based 8521,57 10455,48 11157,52 11225,31

Biogenic CO2e emissions 0 0 83 81

Per-capita location-based 2,21 2,33 2,00 2,06

Per capita market-based 2,21 2,33 2,00 2,06

**Some figures for 2021 have been recast as a consequence of restatement, the main one - district heating consumption and related GHG emissions. For historical data published in

the past, please refer to the 2021 Non-financial Declaration.

16

in partnership with the Sofia Zoo. The two

organizations support the Zoo’s conservation

program to protect endangered wildlife species.

Social projects

In 2022, DSK Bank continued its own socially

responsible project for the improvement of

the urban environment “City as its people”. The

initiative once again aimed to make the capital

a better place to live, as well as draw attention

to the problem of active lifestyles in the city. The

second edition of the campaign transformed a

municipal basketball court in Sofia. Once again,

we worked with an established Bulgarian graffiti

artist to transform the playground into a work

of street art. The site was chosen because the

financial institution wanted to draw attention

to the topic of abandoned sites and active

lifestyles in an urban environment.

DSK Bank continues its partnership with the

BCause Foundation, and the foundation’s

activities are aimed at developing the donation

culture, policies in the field of donations and

social investments, etc. In 2022, the Bank

implemented a campaign together with BCause

to help refugees from Ukraine, as a result of

the war that broke out. Funds collected were

distributed by the foundation’s team to the most

pressing needs in locations across the country.

DSK Bank also organizes an internal donation

campaign among employees to help colleagues

from OTP Ukraine.

In September 2022, again together with BCause,

the Bank’s employees made a donation to

provide timely support to the affected people

from the flooded villages in Karlovo Region.

In addition, the Bank’s regional team, in

partnership with the Ministry of Interior and the

Municipality of Karlovo, is assisting customers

from the region who have lost their identity

documents or debit cards during the disaster.

During the year DSK Bank continued its

successful partnership with SOS Children’s

Villages Bulgaria – a social development

organization, that aims to guarantee that every

child has a family and lives in an environment

of love, respect, and security. The partnership

dates back to 2011 when the Bank committed to

take care of two SOS families.

In 2022, we continued to share our time and

knowledge with the kids from SOS Children’s

Villages. For Easter, we held a workshop with

the children and employees of the Bank in one of

the organization’s centres in the village of Dren.

Towards the end of the summer, we organized a

photo contest for the children to challenge their

creativity and show us through their eyes the

beauty of this season.

In 2022, over BGN 675 thousand in the form

of donations were accumulated through the

different banking channels.

DSK Bank was for another year recognized the

largest corporate donor and partner of the

association.

402

448

Used paper, t

450

438

425

413

400

2021 2022

7112

8812

Used ink and toner cartrigde, kg

9000

6750

4500

2250

0

2021 2022

17

Financial education and innovations

In 2022, DSK Bank continued its educational

initiative “Calm on the Internet” with a

new campaign “We know, that you know,

but…” dedicated to raising consumer awareness

of safe banking and safe use of the Internet.

The campaign again was aimed not only at the

Bank’s customers but also at all those who use

online financial and other services. The purpose

of the initiative is to present in a simple and

understandable way the main highlights of safe

online banking and Internet browsing.

Within the campaign, a special page was used

https://dskbank.bg/препоръки-за-сигурност

– together with social media activations in

different bank channels in combination with

paid digital ads in order to reach greater

audiences.

Ethics Code and Anti-Corruption Policy

DSK Bank as part of OTP Group is committed

to the fight against corruption and states zero

tolerance to any kind of bribery. The Bank has

adopted a Policy for corruption prevention,

where the principles of anti-corruption activity

are defined, as well as the main fields with risk

of corruption. In the course of and in connection

with the Bank’s activities, all staff members

and any other contractual partners of the Bank

are strictly prohibited from performing any act

of corruption and from participating or being

involved in corruption. The Bank consistently

and resolutely stands up against corruption. In

case of a violation of the Policy by any person,

the Bank shall take all steps necessary to avert

potential negative consequences and to avoid

similar events in the future. The Bank ensures

the full enforcement of all Bulgarian, European

Union, and international anti-corruption

regulations, and requires all of its staff members

and contractual partners to comply with such

regulations.

In addition, the Ethics Code of the institution

defines clear principles and requirements for

the employees and the partners of the Bank,

as well as its affiliated companies, in relation

to the adherence to ethical norms at work. The

main emphasis of the Ethics Code includes – the

right of employees to participate in political

or public life, ensuring a safe and healthy

occupational environment, promotion of

mutual respect, prohibition for discrimination

and abuse, integrity in business relations,

zero tolerance to corruption and attempts for

influence, limitations for offering and accepting

gifts above the specified value. In case of doubt

18

or possible violations of the norms of the Ethics

Code and the Policy, the employees are offered

an option to report it, including anonymously,

to the Regulatory Compliance Department,

which will undertake the measures necessary

as per the internal rules.

The Ethics Code of DSK Bank and the Policy for

Corruption Prevention are publicly accessible

on the Bank’s official website.

AML

DSK Bank is committed to combating financial

crime and ensuring that accounts held at

the Bank are not misused for the purpose of

money laundering or terrorism financing. As

an obliged entity under the Measures Against

Money Laundering Act, the Bank has AML

policies, procedures, and rules that comply

with applicable laws in Bulgaria and European

regulations. The established practice of the Bank

includes customer due diligence, enhanced due

diligence automated suspicious and prohibited

transaction monitoring and behavior and

reporting policies as well as surveillance

systems for monitoring such activity.

Customer Protection

The satisfaction and confidence of customers

have always been DSK Bank’s special priority

and accordingly, continuous compliance with

consumer protection principles has been

integrated into the Bank’s day-to-day operation.

DSK Bank has established a compliance culture

enabling the Bank to efficiently offer a broad

spectrum of products and services and satisfy

the financial needs of its clients. The Bank has

declared its commitment to ensure enforcement

of consumers’ interests in its Compliance Policy.

In all areas of its activities, it applies consumer

protection principles that are consistent in its

approach and take into account changes in

consumer habits and interests. In respect of

its products and services, the Bank specifically

strives to provide all necessary information to

its customers in order to enable them to take

recourse to the service that is most suitable for

them.

The purpose of the Consumer Protection

Compliance Program is to facilitate the

performance of the Bank’s obligations – as

set out in local and EU legislation relevant to

consumer protection, and internal regulations

– to define the procedural framework and

to provide professional assistance to the

relevant organizational units of the Bank.

The Compliance Program is also intended to

enable all employees and managers of the

Bank to understand the essence of consumer

protection principles, the objectives related to

ensuring compliance, and their importance,

and to make them aware of the risks and

potential consequences of non-compliance.

Actions carried out under the Compliance

Program include the continuous monitoring

for compliance of Internal rules with consumer

protection legislation; preliminary control to

facilitate compliance, submission of proposals

for correction, and as necessary, the provision of

information required for managerial decision-

making. When introducing new products and

technologies, their modification and updates,

the Bank pays special attention to regulatory

compliance in accordance with the Compliance

Program.

19

AWARDS

Last year DSK Bank has won several awards.

At the beginning of 2022, the CEO of DSK Bank,

Tamas Hak-Kovac, was awarded by the Employer

Branding Awards in category “Team Lead of the

year” award.

Shortly afterwards, the head of the Human

Resources team, Radoslava Krosneva, was

awarded the “HR Manager of the Year” award.

In February, DSK Bank was awarded by “24

Chasa” with the Business Honoris Causa award

for its long-term support to SOS Children’s

Villages.

In April, the corporate social responsibility

campaign “City as its people” was awarded in

the PR Digital category at the IAB Mixx Awards.

May brought us a Green Oscar for the Mastercard

Wildlife Impact Debit Card.

Again in May, the “City as its People” project won

another award in the “Digital Communications”

category, this time from the Bulgarian PR

Association - PR Prize competition.

Our subsidiary DSK-Rodina won the prize for

the most dynamically developing pension

insurance company.

In June, for the sixth time, we were awarded

the “Most Generous and Significant Corporate

Partner” award by SOS Children’s Villages

Bulgaria.

2022 brought many international honors to

DSK Bank. The British magazine “Euromoney”

recognized the bank as the “Best Bank in

Bulgaria” for 2022, and also in the categories

“Market Leader - Digital Solutions”, “Market

Leader in Corporate Social Responsibility” and

“Market Leader in Corporate banking’.

Another prestigious international edition -

Global Finance also recognized the bank as

the best service provider related to foreign

exchange operations in Bulgaria.

To close the awarding season for 2022 DSK

Bank, along with its advertising agency Noble

Graphics, won a bronze Effie from Effie Bulgaria

for positive change. It was for the campaign

“You get everywhere with a bank card” that aims

to inform Sofia’s citizens and visitors that they

can pay with a card for travelling in the public

transport.

20