School Readiness Tax Credit Act –

Staff Member Application

8-770-2021

Applicant Name and Address Eligible Program Name and Address

Applicant’s Name Eligible Program Name

Street or Other Mailing Address Street or Other Mailing Address

City State Zip Code City State Zip Code

Applicant’s Social Security Number (SSN) Dates of employment with the above eligible program. (If employed by more than one eligible program, attach additional documentation.)

From: To:

Below, please check the box that applies to your Nebraska Early Childhood Professional Records System classification

level as shown on the Attestation of Staff Member Classification Level form. You must attach the Attestation of

Staff Member Classification Level form to this application.

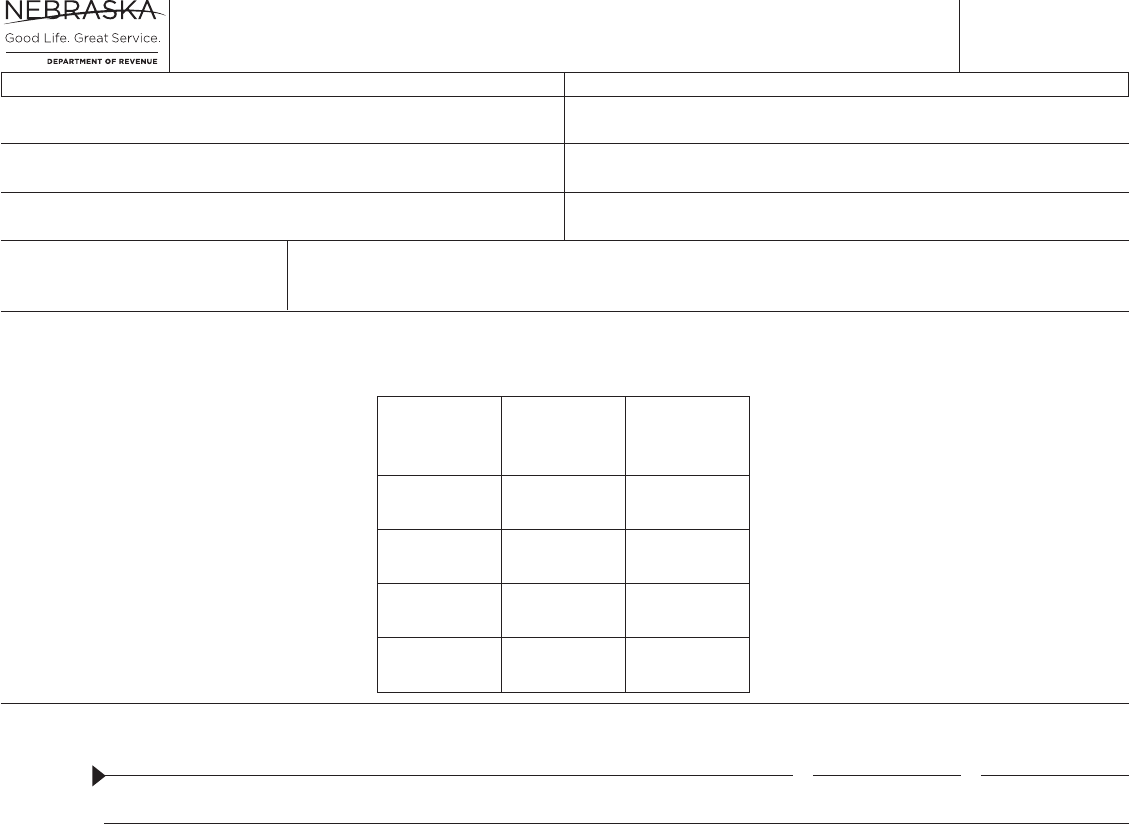

Level Tax Credit

Check the

Level that

Applies

One $540

Two $810

Three $1,350

Four $1,620

sign

here

Signature of Applicant Date Phone Number

Email Address

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

Instructions

Who May File. An eligible staff member may le this application. An eligible staff member is an individual that:

• Is employed by eligible program for at least six months of the tax year; or

• Is a self-employed individual for an eligible program for at least six months of the tax year; and

• Provided child care and early childhood education for the eligible program; and

• Is assigned a classication level in the Nebraska Early Childhood Professional Record System.

An eligible program is one that has been assigned a quality scale rating under the Step Up to Quality Child Care Act.

An eligible staff member does not include certied teaching and administrative staff employed by before-and after-

school or pre-kindergarten programs established by school boards or educational service units.

When to File. This application for credits must be led after you have been providing child care and early childhood

education for an eligible program for at least six months of the taxable year.

What to File. Attach and submit a signed School Readiness Tax Credit Act—Attestation of Staff Member

Classication Level along with this application.

Specific Instructions

Applicant Information. Enter your name, mailing address, and SSN.

Eligible Program Information. Enter the name and address of the eligible program.

Dates of Employment. Enter the dates you were employed by, or self-employed with the eligible program. If you

were employed by more than one eligible program, attach a list of additional employers. Be sure to include the name,

address, and dates of employment for each additional employer.

Mail this Application and your Attestation form to:

Nebraska Department of Revenue, PO Box 94609, Lincoln, NE 68509-4609.

2021

RESET

PRINT

Identify Classification. Place an “X” next to the most recent level you have been assigned on the Nebraska Early

Childhood Professional Record System.

Signature. This application must be signed by the eligible staff member. Include a daytime phone number in case

the Nebraska Department of Revenue (DOR) needs to contact you about the application. By entering an email

address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer accepts any risk to

condentiality associated with this method of communication. DOR will send all condential information by secure

email or the State of Nebraska’s le share system.

Additional Instructions

Application and Approval Steps.

1. Request the School Readiness Tax Credit Act — Attestation of Staff Member Classication Level form

from the Nebraska Department of Education. Please allow six weeks for your request to be processed by the

Nebraska Department of Education.

2. Attach your School Readiness Tax Credit Act — Attestation of Staff Member Classication Level form to

this application and le it with DOR by March 1 of the year following the taxable year for which you plan

to claim this credit.

DOR will process the applications in the order received until the program tax credit limitation of $5 million

has been reached. Please allow four weeks for DOR to process and respond to your application.

3. Claim your tax credit by attaching the tax credit certication from the DOR to your Individual Income Tax

Return, Form 1040N.