27

Journal of Hospitality & Tourism Cases

case study

By Kimberly Mathe, Lauren Finnell and Paige Peterman

Emirates Airline: The new norm of air travel?

On April 9, 2017, passenger David Dao was forcibly removed from

a United Airline’s ight, hitting his face, rendering him unconscious,

leaving him with a broken nose, missing teeth, and sinus injuries

(McLaughlin, 2017). Not two weeks after, an American Airline’s employ-

ee was accused of hitting a woman with a stroller as she entered a plane

sobbing, holding an infant. As a male passenger intervened, during this

incident, a ght nearly ensues with the American Airline’s employee

(Karimi, 2017). The year 2017 has been a year of viral customer service

incidents for airlines based in the US, leading way for United Arab Emir-

ates’ (UAE) based Emirates Airline to showcase their superior customer

service, as they enter new markets worldwide (Brodey, 2017).

In their 30 years of business, Emirates Airline has revolutionized

the way the world thinks of air travel. When ying with Emirates one

can expect: complimentary airport transfer chaueurs, large and spa-

cious eets, inight Wi-Fi and power outlets, onboard lounge and

bar, gourmet dining, pamper kits, optional private suites, refreshing

inight spa and showers, and television with over 2,000 channels. As

mentioned, Emirates Airline is entering new markets and seeking new

routes worldwide. For example, in March of 2016, Emirates Airline

launched the longest non-stop commercial ight in history. The ight

departed from Emirates Airline’s home base in Dubai, and traveled

continuously for sixteen hours to Auckland, New Zealand (Yu, 2016).

With deluxe amenities being oered by Emirates Airline, this

begs the question, is this strategy feasible, and even more important,

sustainable? Atwal and Williams (2009) suggest that luxury market-

ing in the travel and tourism industry is particularly dicult due to its

intangible nature. For industries like retail, luxury marketing is a more

reasonable feat. The Holiday Book at Neiman Marcus, a shopping cata-

log, has a tangible way of signaling exclusivity and directing attention

to a select consumer segment by listing such items as a $1.5 million

private jet available for purchase, or a $100,000 set of children’s books

(Wahba, 2016). But in travel and tourism, one only gets to experience

the luxury while in the airport or on board the ight. There is no take

home tangibility, only a memorable experience.

Emirates Airline claims it does not want to exclude all passen-

gers and only cater to the most- wealthy. To the average person these

aforementioned amenities oered seem exclusive to the wealthy, but

in reality, Emirates Airline also caters to multiple classes of travelers

including: business, government, religious, military, student, and more.

Recently, the company’s objective has been to build on their success-

ful business model while leading the industry in delivering better

eciencies and customer outcomes (Emirates Group, 2016). This case

examines the development of the company, investigates luxury brand-

ing through impression and brand management, and delves into some

of the strengths, weaknesses, opportunities, and threats Emirates Airline

holds. Through this, the case will meet the following learning objectives:

identifying Emirates Airline’s strategic position in the international air-

space, determine dierences in brand management practices between

a luxury and low-cost airline, assess the sustainability of a luxury airline,

and examine how current events, legislation, and other external forces

inuence Emirates Airline and the airline industry.

Background and History

Emirates Airline’s story began in 1959 when the Dubai govern-

ment established dnata to provide ground handling services at the

new Dubai International Airport (Figure 1). Today, dnata is one of the

largest suppliers of combined air services including ground handling,

cargo, travel, and ight catering services, and is the largest travel

management services company in the United Arab Emirates. It is also

a subsidiary of Emirates Airline (dnata, 2017). In 1960, the airport was

opened by Sheikh Rashid bin Saeed Al Maktoum who implemented

an open skies, open seas, open trade policy, in part to help eliminate

the country’s dependence on oil resources. More than ever, the “travel

and tourism industries are being actively developed as major revenue

generators” (Albers, Koch, Lohmann, & Pavlovich, 2009, p. 209). The

implementation of this policy was one of the rst contributions to

building the business-friendly Dubai that we know today.

Discussions then began in 1984 between Sheikh Mohammed

bin Rashid Al Maktoum and Maurice Flanagan, director and general

manager of dnata, about launching an airline based in Dubai. Later

that year a business plan was devised, the name of the airline, Emir-

ates, was chosen, and the decision to build the airline on top of dnata

was made. The next year in 1986, due to infrastructure and expansion

costs, the young company would post losses for the only time in its

history. Nonetheless, the Airbus A310-304 was added to their lineup

the next year, designed to Emirates Airline specications, giving the

Kimberly Mathe is aliated with Oklahoma State University. Lauren

Finnell and Paige Peterman are both aliated with Tech Tech University.

28 Volume 7, Number 3

airline the opportunity to further implement their commitment to of-

fering a ying experience superior to their rivals (Emirates, 2017a).

Over the next several years the company continued to expand its

portfolio. By 1988, only 38 months in business, the company had route

networks to a total of 12 destinations. On its sixth anniversary, the air-

line was servicing 25,000 passengers per week among 23 destinations.

Dubai International Airport saw passenger arrivals hit the 11 million

mark in 1999. Emirates Airline’s rst ight to New York’s JFK Airport oc-

curred in 2004 and was marked as the rst non-stop passenger ight

from the Middle East to North America (Emirates, 2017b). Today, Emir-

ates Airline has been the most valuable airline brand in the world for

the past 5 years, with an estimated value of $7.7 billion. Emirates Air-

line’s also operates the world’s largest eet of Airbus A380s and Boeing

777s (Emirates Group, 2016). In 2016, customers recognized Emirates

Airline’s outstanding service by awarding the airline with the title of

“World’s Best Airline” at the World Airline Awards (Skytrax, 2017). Emir-

ates Airline strives to continually invest to improve their products and

services to ensure that they remain a major, if not the top, contender

in the international air travel industry.

Strategy and Positioning

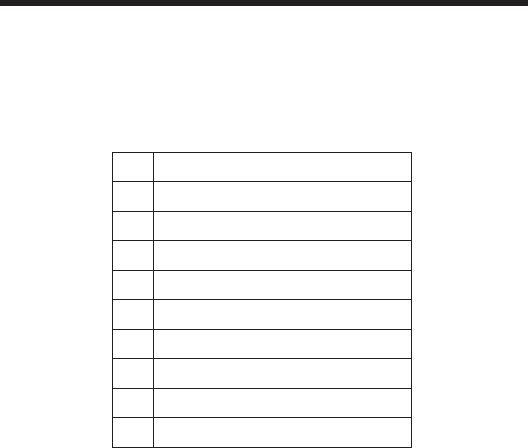

When managing a brand that oers luxury products and services,

companies are aware that it is the status of the product or service that

the consumer is purchasing, not the actual product itself. For the airline

industry, a low-cost airline and Emirates Airline will both get you to the

same destination; however, the status of ying Emirates and the ameni-

ties it oers are what makes the product a luxury (Figure 2). Simply put,

luxury can be dened as exclusivity or rarity. According to the theory

of impression management, research states that consumers are highly

aected by the internal drive to create a favorable social image from

the outcome of their purchase behavior (Hennigs, Siebels, & Wiedmann,

2007). Some view luxury as useless and superuous because it focuses

on the realm of desires rather than necessities (Mortelmans, 2005). On

the other hand, some people crave luxury products solely in spite of

them not being vital to life. The idea of having the “best of the best”

is what draws consumers to luxury products. So much so, that when

marketing your business as a luxury brand, the job is practically done for

you. It is human nature to desire the ner things in life.

But is luxury what one seeks in an airline? In a typical customer

ight experience there are multiple transaction points one will encoun-

ter during their travels (Anderson, Pearo, & Widener, 2008). Prior research

has shown that the most important attributes for in-ight service is

courtesy of attendants, safety, comfort and cleanness of the seat, and

responsiveness of attendants (Tsaur, Chang, & Yen, 2002). Other research

suggests that services oered between the ight origin and destination,

Figure 1

Historic Photos of Dubai International Airport

(Left- 1965; Center-1971, Right-2000)

Figure 2

Actress Jennifer Aniston in Emirates TV

commercial showing luxuries like using a

tablet while lying in onboard sleeping suite

29

Journal of Hospitality & Tourism Cases

time involved in making the trip, the value of the service, and baggage

concerns are of vital importance to customer satisfaction (Gursoy, Chen

& Kim, 2005). More research suggests that interactions with ight per-

sonnel, the aircraft itself, amount of personal space, food on the ight,

and timeliness of the ight are all predictors of customer satisfaction;

and that these satisfaction levels vary greatly with certain customer

characteristics like age and gender (Anderson et al., 2008). The addition

of luxury into each of these aforementioned drivers of customer satisfac-

tion is what Emirates seeks to accomplish, and they have been rewarded

through numerous public awards as discussed next.

Service Awards and Industry Reviews

Emirates Airline continuously and successfully meets the expecta-

tions of most travelers according to many industry surveys and reports.

A comprehensive survey from 2010 was conducted among frequent

yers of seven major airlines operating longer haul ights out of the

UAE (Al-Aali, 2011). These airlines included Air France, British Airways,

Emirates, Etihad Airways, Qatar Airways, Swiss Air, and Virgin Atlantic

Airways. The purpose of the survey was to measure the level of service

quality provided in terms of customer experience from ight booking,

all the way through check-in, baggage drop, boarding, plane conditions,

in-ight services, to disembarkation and nal baggage claim. Results

of the survey indicated that Emirates Airline outperformed its rivals in

each of these areas (Al-Aali, 2011). Also, as stated previously, Emirates

Airline is a four- time winner of the number one airline in service since

2001, and has not fallen out of the top ve airlines since 2013 as evalu-

ated by the following categories: ground/airport, onboard: product,

and onboard: sta service (Skytrax, 2017; Table 1). From a subjective

perspective of luxury, in 2013 when Air-France-KLM CEO Alexandre de

Juniac ew Emirates, he took 15 pages of notes of his personal experi-

ence when ying to take back to his own airline for improvements

(CAPA, 2015). With its long run of awards and accolades, it is inevitable

that competitors will be curious as to what Emirates Airline is doing dif-

ferently, and look for ways that they can implement some of Emirates

Airline’s strategies into their own business.

Fleet

Emirates Airline utilizes multiple business strategies that have

proven successful to the company, one of which focuses on their

impressive eet of aircrafts. Specically, Emirates practices strong

environmental commitment by operating one of the world’s most

eco-ecient eets and also by their involvement with the Dubai Des-

ert Conservation Reserve. Due to their young age, Emirates Airline’s

average eet age is only 6.4 years old as compared to the IATA average

of 11.3 years (GoGreen, 2012). Because of this, fuel eciency and CO2

emissions are lower than the IATA average. But, Emirates has also re-

ceived some negative attention from competitors who claim Emirates

has an unfair advantage over them. Most of this criticism has come

from European ag carriers, as they have been the most vulnerable

in losing valuable intermediate stop’s in one’s home country (CAPA,

2015). Until 2003, Emirates initial expansion had gone largely unno-

ticed until the airline made the largest aircraft order in history for 71

wide body aircrafts. Today, they are the world’s biggest operator of

wide-bodied jets (Emirates Group, 2016).

Air France has also accused Emirates of ordering too many of Eu-

rope’s A380s, claiming that “it would seem dicult to meet all of their

growth targets” (Table 2; Open Sky, 2009). However, Emirates believes that

the A380 best represents the most ecient, environmentally friendly, and

productive large aircraft as they begin to grow their eet and implement

their replacement strategies. Yet, the large size of the aircraft does impact

their ability to reach certain markets that cannot handle them.

The company also received negative attention when Emirates

Airline was able to promote the growth of their company during the

world recession. A spokesperson for the airline at the time said, “there

was no temptation shown by the company to compromise standards

or adopt a ‘holding operation’ until the world economy recovered”

(Sa, 2011). When the airline industry was in a crisis, Emirates Airline

was still able to generate a prot of $964 million (Sa, 2011). This is

counterintuitive to what typically occurs during a recession; in which

large businesses will see sales and prots decline as costs are cut, and

hiring is frozen (Davis, n.d.). Major competitors have alleged that Emir-

ates Airline and others have beneted from fuel and infrastructure

subsidies (like dnata), lopsided nancing and taxation arrangements

and operating outside of the boundaries imposed on commercial

airlines. Seeing as Emirates Airline is owned by the Dubai govern-

ment and “operates in a tax free environment with no legacy costs”

(O’Connell, 2011), these allegations are not unwarranted.

Internal and External Stakeholders

Table 1

List of Top 10 Airlines

in 2016

(Skytrax, 2017)

1 Emirates Airline

2 Qatar Airways

3 Singapore Airlines

4 Cathay Pacic

5 ANA All Nippon Airways

6 Etihad Airways

7 Turkish Airlines

8 EVA Air

9 Qantas Airways

10 Lufthansa

30 Volume 7, Number 3

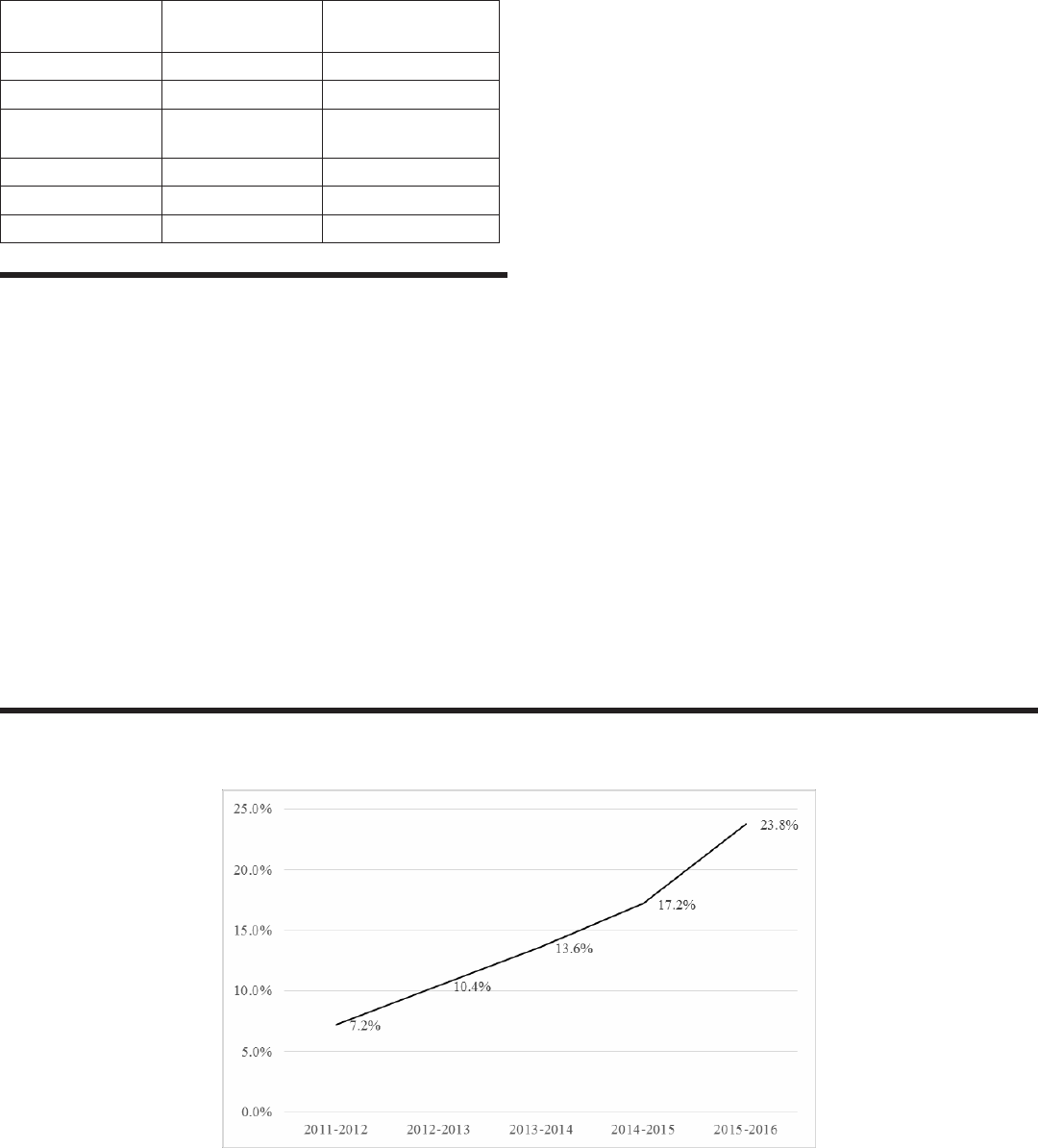

Emirates Airline has seen positive, growth for its return on share-

holder investment over the past ve years. With positive growth, the

company employs a strategy of rewarding its shareholders by oering

them special privileges and small discounts. Emirates recorded such a

protable 2016 that they were able to ensure a strong 23.8% return on

their shareholder’s investment (Emirates Group, 2016; Figure 3). This

is a major accomplishment for any business, but shows that Emirates

Airline continues to bring in a remarkable prot and growth of the

company while focusing on luxury consumer elements.

With such strong returns for its investors, it would be assumed

that Emirates Airline would likely be a leader in human resources best

practices within the airline industry. The company consists of 84,000

employees from over 160 nationalities (Emirates Group, 2016), but it

has been publicly implied that Emirates fails to treat all of their em-

ployees fairly which can cause poor public relations in today’s highly

communicative environment. Most recently, an Emirates ight atten-

dant reportedly was red after falling down the stairs in the company’s

signature red high heels (Ward, 2017). According to an opinion article

found on www.DontFlyEmirates.com titled, “Failure of recruitment

policy in Emirates Airline”, some employees of Emirates are “trapped”

within the company. It claims employees have great expectations

when starting a career with the luxurious airline, but soon after many

employees seek out more employee friendly airlines like, Fly Dubai

and Qatar Airways. Supposedly these airlines oer higher salaries and

better employee benets than Emirates and when employees join

the Emirates Airline workforce they are forced to sign a non-compete

contract. Once employees sign this contract they are committed to

only employ with Emirates or are forced to quit the airline industry

altogether (Truth About Emirates Airlines Management, 2014). The

company counters this, claiming to provide a range of excellent ben-

ets to their employees and instills a strong diversity policy, as they

believe employees are their biggest asset (Emirates Group, 2017). Oth-

er airlines like Southwest Airlines utilize a perceptually more ethical

management practice by providing their employees competitive sala-

ries and job security (Condemi, Ferguson, Milliman, & Trickett, 1999).

Southwest claims that they are the cheapest airline, yet they continue

to rank at the top of the list in customer service among other airlines.

Employees at Southwest enjoy working for the company because they

have “a sense of family” at work and receive great benets.

Customer expectations

With their competitive positioning as the number one airline in

2016, it is expected Emirates would score exceptionally well in areas

Table 2

Airplane (A380) orders placed in 2009

compared to regional population of

headquarters (Open Sky, 2009)

Airline Firm A380

(passenger orders)

Regional Population

Emirates 58 260m (Middle East)

Qantas 20 36m (Oceania)

Singapore

Airlines

19 568m (SE Asia)

Lufthansa 15 499m (EU)

Air France 12 499m (EU)

British Airways 12 499m (EU)

m= millions

Figure 3

Emirates Return on Shareholder Investment (Emirates Group, 2016)

31

Journal of Hospitality & Tourism Cases

such as online booking, transfer services, cabin cleanliness, quality of

food, assistance during boarding, sta attitudes, and more (Skytrax,

2017). Subjectively, it is rare to nd any extremely low customer re-

views when evaluating Emirates. These rare bad reviews all seem to

have one thing common, cabin space (Skytrax, 2016b). Reviews on

AirlineEquity.com, which is directed through Skytrax, indicate that the

cramped seating of the business and economy class do not meet the

expectations of consumers. One economy traveler wrote in his review

that there was “not much more room than a cheap airline” on his Emir-

ates ight. Travelers perceive Emirates as a luxury airline and expect

much more from Emirates than less expensive airlines. The business

and economy seats of Emirates Airline are still priced at a luxury value.

Consumers who purchase these tickets expect the space and comfort

of a luxury aircraft. Nevertheless, the rst class cabin has more than

enough space to allow for leisure travel. By giving the rst class cabin

exceptional treatment, Emirates runs the risk of insulting the business

and economy travelers. Some consumers argue that if a traveler wants

rst class treatment, they should purchase a rst class ticket. Others

may desire that Emirates was more like Southwest Airline, which has

only one cabin level and treats all yers with the same level of respect.

For this reason, branding your business as a luxury company has

its drawbacks. A major risk companies impose on themselves when us-

ing the luxury strategy, is expectation. If consumers perceive a brand

to be luxurious, they will expect luxurious customer service, amenities,

and experiences along with the product. The higher the price tag, the

higher the expectations, however, Emirates has priced their product

not far from its competitors, especially for long-haul ights.

External forces

Changes in the political environment are certain to augment the

airline dynamics, in particular for Emirates Airline. For the US, certain

travel restrictions have been established by United States President

Donald Trump. Specically, Emirates declared it would cut ights to

ve US cities because of weakened demand from the travel restric-

tions (Cornwell, 2017). From the same restrictions, Turkish Airlines and

Emirates were placed under a ban that would not allow passengers to

have laptops in the cabin, unlike other major US based airlines for fear

of bombs (Cornwell & Butler, 2017). To help in gaining ground in the

US, Qatar Airways, one of Emirates largest competitors is set to begin

purchasing up to 10% of American Airline shares in order to expand

its investment in North America (Humphries, 2017). American Airline

and other US airlines are lobbying the federal government saying that

overseas brands need more regulation; as they say, the foreign airlines

are “encroaching on their turf” (O’Reilly, 2015).

Conclusion and Questions

Even with an embroiled turf battle with US based airlines, Emirates

Airline is employing US born actress Jennifer Aniston to help in selling

ights. It recently has activated a $20 million advertising campaign

to increase demand and showcase its luxury amenities, in particular

for traveling families. Emirates Airline’s precedence for luxury has

transformed air travel from a burden into a tranquil experience. The

innovative airline shows no signs of slowing down as it was recently

stated that Emirates Airline is considered the fastest growing airline in

the world (Shaban, 2015). Emirate Airline has grown so exponentially

that the company has announced plans to invest $32 billion in a second

Dubai airport to meet the rapid growth of the airline. The second airport

will be called Al Maktoum International at Dubai World Central (Jones,

2014). Emirates Airlines president, Tim Clark, has stated the airline will

soon be the largest airline on the planet in terms of international pas-

senger trac. The airline is expected to have more than 250 aircraft

serving 70 million passengers across six continents by 2020 (Sambidge,

2013). However, until recently, the travel restrictions put forth by the US

may change the growth rate at which these plans are set to happen.

With all of these strengths and weaknesses considered combined

with the forces outside of their control given the political environment

Emirates competes in, what should Emirates focus on next? Currently,

Emirates Airlines aims to connect travelers around the world with luxu-

rious non-stop ights. The airlines rapid growth and success is proof

that the company’s luxurious approach to air travel has been well re-

ceived, but external changes and certain weaknesses as discussed may

knock the company from its top spot as number one airlines. Emirates

Airlines changed the way passengers saw air travel, but what can it do

next to maintain its position as the world’s number one airline?

In-Class Discussion Questions

• How have the recent airline service failure incidents with Unit-

ed and American helped or hurt the airline industry as a whole?

How has Emirates faired? (Learning objectives 1,4)

• What amenities are most important to you in airline travel?

How much would you be willing to pay to ensure you receive

these amenities? (Learning objectives 2,3)

• What are some current events you have heard of recently that

could aect Emirates Airline’s business strategy? (Learning ob-

jectives 1, 2, 3 4)

Summary of the Case

With the recent incidents that have occurred in the airline indus-