Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-1-

Airlines Benchmarking Analysis based on Financial

Performance-Emirates, Southwest Airlines, Singapore

Airlines and Lufthansa

Shuqi Cui

*

, Zongwei Li

College of Commerce and Circulation, Shaanxi Polytechnic Institute, Xianyang 712000, China

*

Corresponding author

Abstract: This report mainly focuses on financial performance of airlines before and after COVID-19

pandemic, giving analysis of essential indicators based on comparison between selected airlines and

industry average performance. The impact of COVID-19 pandemic since 2020 is mentioned in each

part. Firstly, it provides an overview of four selected airlines, Emirates, Southwest Airlines, Singapore

Airlines and Lufthansa. Then the geographic analysis of airlines is given. Following this, this report

compares the performance of the airlines on main financial indicators in recent years respectively,

including unit cost, yield, load factor, break-even load factor, employee productivity and aircraft

productivity. In the next section, some other indicators such as EBIT margin, Debt/equity ratio and

Current ratio are listed. Finally, limitations of the report are discussed in the conclusion part.

Keywords: benchmarking analysis, airlines, financial performance, COVID-19 pandemic

1. Introduction

Air transportation is an indispensable part in current transportation system and the market is

growing rapidly. It is estimated that compound annual growth rate of air traffic would stay at around 4%

in the following decades [1]. This means the entire market could be doubled in the next 15 to 20 years.

However, global aviation industry is relatively vulnerable to catastrophes such as financial crisis and

terrorist attacks [2][3]. The COVID-19 pandemic which resulted in global border closures and

suspensions of flights also slows down the market expansion since 2020 [4]. But in long-term

perspective, global air network would be more sophisticated and mature, bringing significant changes

to global economy and societies. In order to seize the opportunities in facing COVID-19 challenges and

to handle air traffic appropriately both for passengers and cargo in the future, airlines should be

well-prepared and focus on critical aspects to keep competitive in the market.

Four outstanding and reputable airlines, Emirates, Southwest Airlines, Singapore Airlines and

Lufthansa, are selected to be analysed on the basis of respective economic, financial and operational

performance in recent years. Emirates is the primary object in the analysis while other airlines are

mainly used in comparison. Regional differences in terms of geography and regulation environment are

considered in the analysis.

In this report, all figures in the tables are extracted from recent annual reports of the four airlines,

unless otherwise stated.

2. The profile of the four airlines

2.1 Emirates

Emirates, aiming to be the best air service provider in the Middle East, is one of the largest airlines

in this area. It was founded in 1985 and owned by Dubai government. According to the annual report of

the airline, the company locates its hub at Dubai International Airport, serving 156 airports in 84

countries. Emirates operates a fleet consists of Airbus and Boeing aircrafts and it is also the largest

operator of both Airbus A380 and Boeing 777 worldwide. The average fleet age of the airline is 6.1

years which is relatively young, ensuring updated aeronautic technology is used. Average aircraft

capacity of Emirates is relatively large due to the aircraft type. Wide-body aircrafts such as A380 are

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-2-

the first choice in the past procurement orders of the airline. In order to improve flexibility of the fleet,

Emirates plans to convert some A380 orders to smaller aircrafts. This change could better match a

more flexible strategy of the airline.

2.2 Southwest Airlines

Southwest Airlines is the largest low-cost airline worldwide, operating mainly in America. The

company was established in 1967 and its headquarters is located in Dallas. The company claims that it

has one of the strongest route networks in the U.S., which accounts for around 95% of ASMs of the

airline. Although majority of the business remains in the United States, the airline plans to enhance its

international connection and it has continuous growth since 2013. Southwest Airlines operates only

Boeing aircrafts including 737-700, 737-800 and 737 MAX 8. Fewer aircraft types in operation could

contribute to saving overall maintenance costs. The average age of aircrafts is around 11 years. It is

worth to mention that the company has a continuous profit record since 1972. But it was broken in

2020 due to the COVID-19 pandemic.

2.3 Singapore Airlines

Singapore Airlines was established in 1947 and its hub was set at Singapore Changi Airport.

SilkAir which focuses on regional flights and Scoot which mainly targets at low-cost carrier market are

both parts of Singapore Airlines. According to the annual report of the airline, the company serves 138

destinations totally, mainly in Asia and Europe. The average fleet age of the airline is 6 years implies

its commitment to modern aircrafts and several different types of aircrafts operated by Singapore

Airlines enable the company significant flexibility. In the future, Singapore Airlines aims to build new

hubs in India and Thailand, expanding connectivity to further regions.

2.4 Lufthansa

Lufthansa was founded in 1955 and it is the largest German airline. The primary hub of the airline

is at Frankfurt Airport while secondary hub is at Munich Airport. Network Airlines and Eurowings are

two main entities in the group to provide air service. According to the annual report of Lufthansa, the

former airlines mainly focus on improving service quality and cost-effectiveness while the latter one

which concentrates on domestic market would be the primary driver of growth. Digitalization strategy

implemented by Eurowings may help the company to reinforce its competitiveness. The average age of

the fleet is relatively higher in Lufthansa, nearly 12 years. Thus, the airline needs to invest more to

modernize aircrafts for the sake of service quality improvement and safety consideration.

3. Operational and financial performance analysis

3.1 Geographic analysis

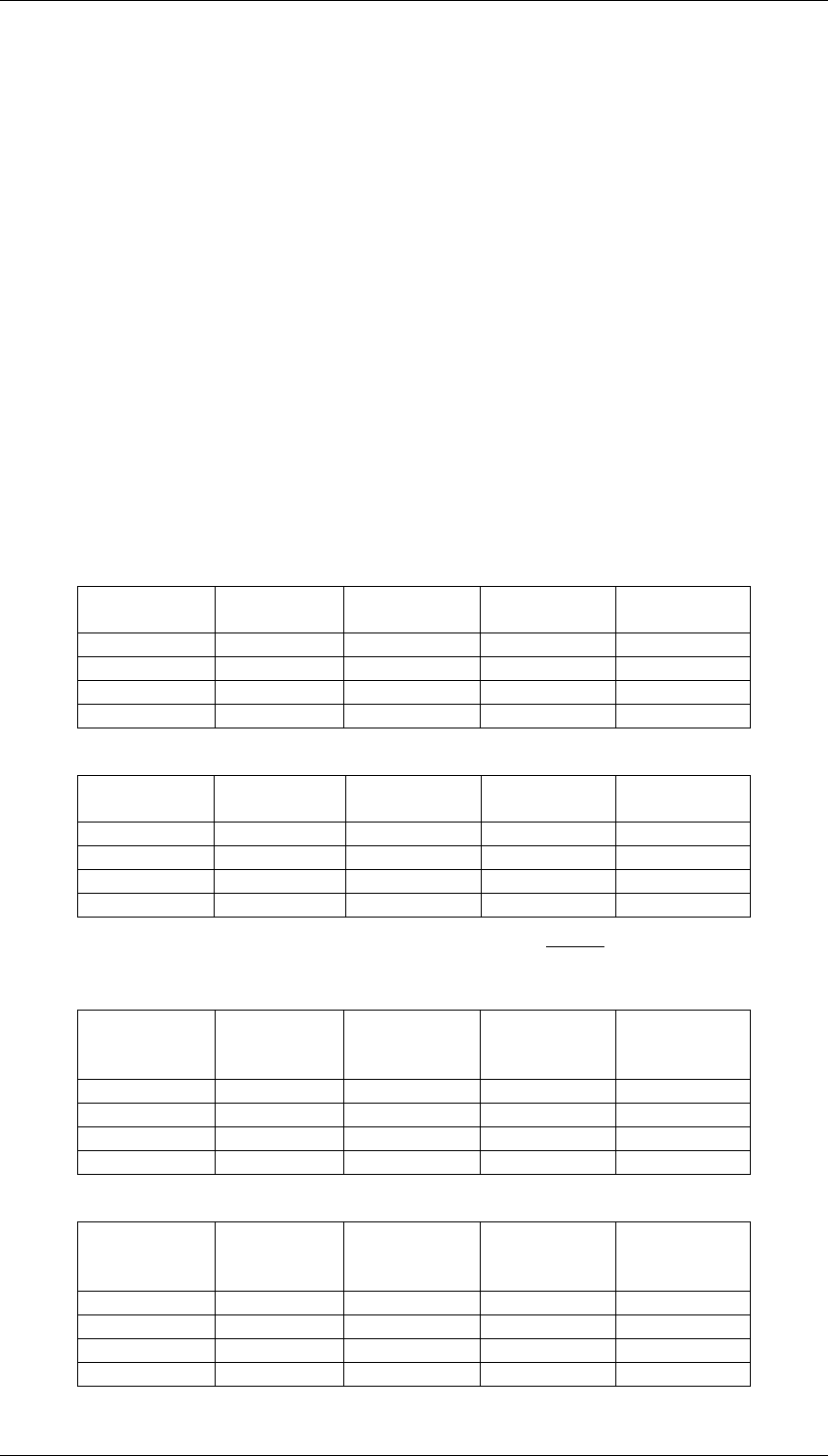

Figure 1: Geographic revenue of Emirates, Source: The Emirates Group Annual Report 2020-21

Because the impact of COVID-19 pandemic is worldwide, geographic characteristics are slightly

percentage

percentage

percentage

percentage

percentage

percentage

Geographic revenue of Emirates in %

Europe East Asia and Australasia

Americas Africa

Gulf and Middle East West Asia and Indian Ocean

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-3-

changed. As shown in the pie chart, Europe and East Asia still account for more than half of the

revenue of Emirates while Americas only contributes 15% to the total revenue. Thus, Lufthansa and

Singapore Airlines could be one of the main regional competitors to Emirates in Europe and East Asia

respectively. Southwest Airlines is low-cost airline and it has fewer competition with Emirates because

of less overlapped flight route and differentiated customers. However, the comparison between

Emirates and Southwest Airlines can still show the strengths and weaknesses of different operation

method in certain areas.

On the other hand, the hub of Emirates in Middle East could serve as a bridge between East Asia

and Europe. Economic connection between two regions would have stronger influence on Emirates

than other airlines. Similar to this regional effect, economic growth rate in Europe would influence

Lufthansa more significantly while Singapore Airlines might have more concern on internal economic

relationship in Association of Southeast Asian Nations. In addition, currency volatility could impair

financial performance of airlines while environmental costs in Europe might be higher compared to the

costs in Asia countries due to more strict and higher standard regulations. Labour costs is another

critical aspect and it could have great variation in different areas because of different average wage

standards.

3.2 Unit cost and yield

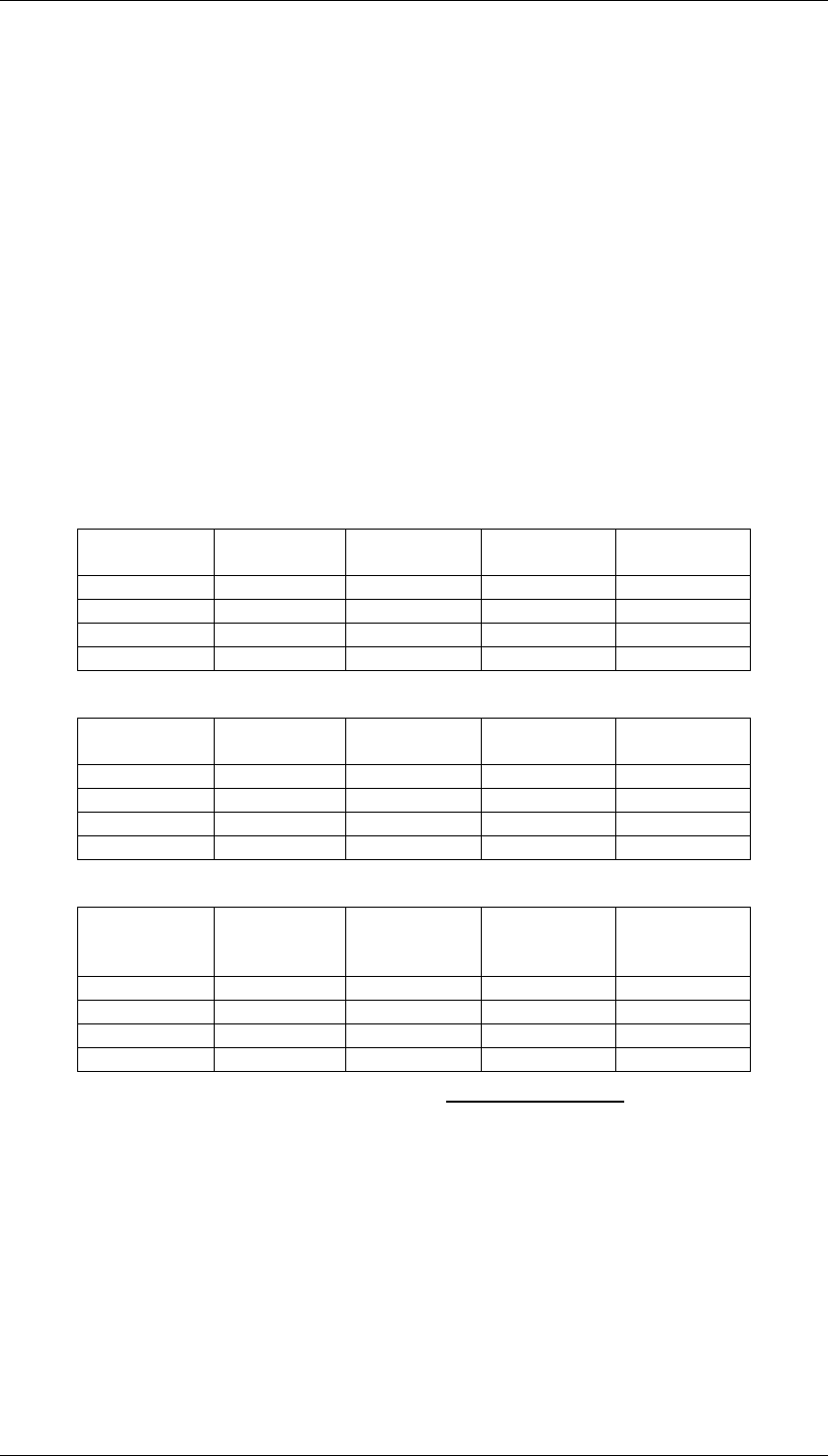

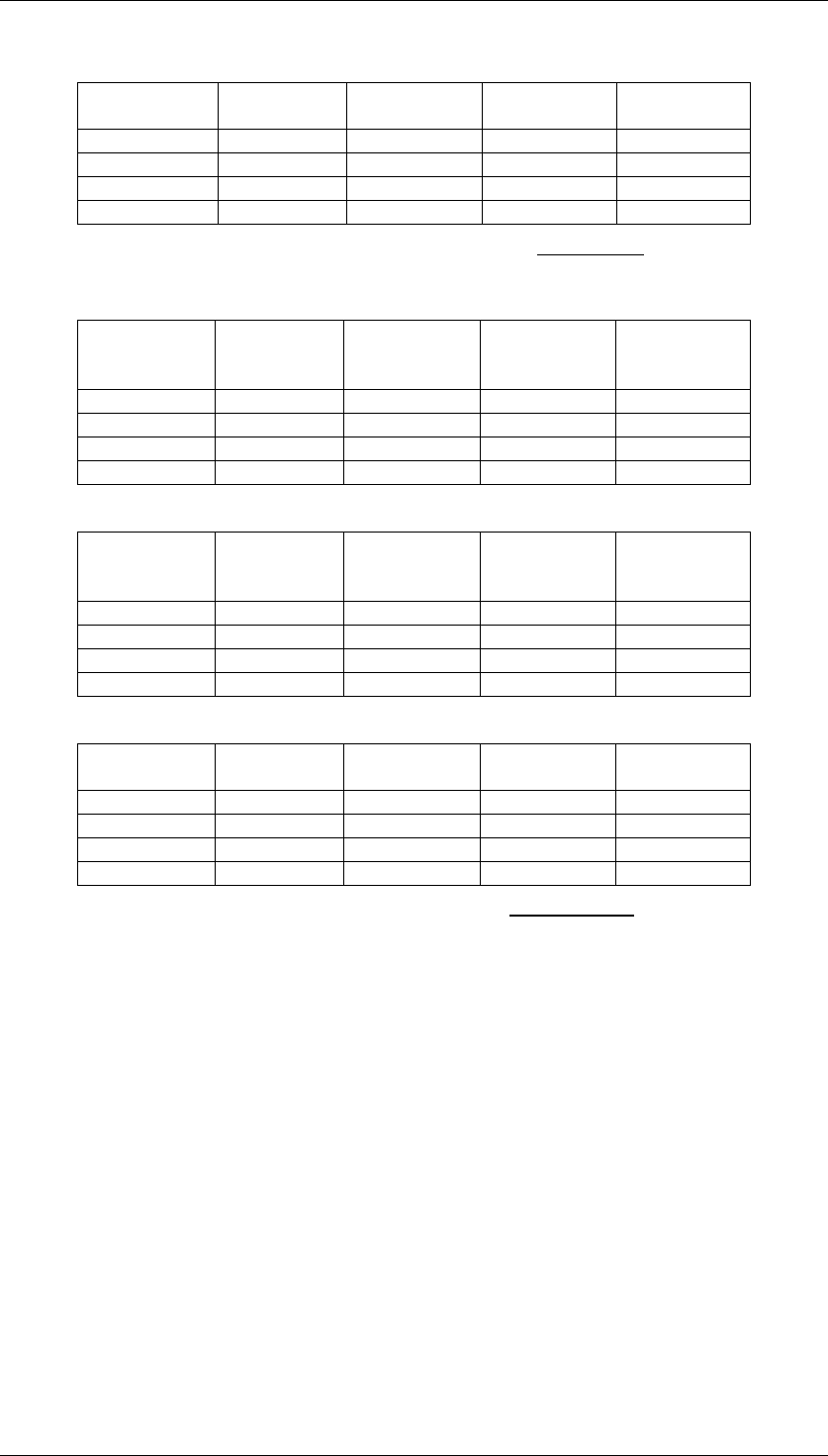

Table 1: Total costs of 4 airlines from 2017 to 2021

Total costs

/billion $

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

13.9

12.9

4.7

23.7

2020/2019

24.7

19.5

11.8

42.2

2019/2018

26.4

18.8

11.1

40.3

2018/2017

24.0

17.7

10.4

40.2

Table 2: Available seat kilometers of 4 airlines from 2017 to 2021

ASKs

/billion

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

64.1

166.5

21.7

109.8

2020/2019

367.2

253.1

171.2

358.8

2019/2018

390.8

257.2

169.6

349.5

2018/2017

377.1

247.5

159.4

322.9

Table 3: Unit cost of 4 airlines from 2017 to 2021

Unit cost

/ $ cents per

ASK

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

21.68

7.75

21.66

21.58

2020/2019

6.73

7.70

6.89

11.76

2019/2018

6.76

7.31

6.54

11.53

2018/2017

6.36

7.15

6.52

12.45

(1)

Unit cost is the average spend on one passenger per kilometre in operating process and related

activities to provide services to customers. Lower unit cost at same service level could help airlines to

gain competitive advantages in the markets.

Unit cost of Emirates had a slightly increase in 2018 due to sharp fuel price increase, similar trend

to Southwest Airlines and Singapore Airlines. Fuel forms 32% of Emirates operating costs, and

remains the biggest expense item. However, Lufthansa performed differently, making a reduction in

average unit cost. The airline claims that cost reduction and profit increase at Network Airlines

compensate the fuel price increase. But in horizontal comparison, unit cost of Emirates is at same level

as Singapore Airlines, much lower than Lufthansa. This is mainly because staff costs of Lufthansa are

much higher, representing over 20% of total costs. Employee cost of Emirates only accounts for around

13% of total costs. In 2020 and 2021, all airlines except Southwest Airlines confronted a sharp increase

of unit cost due to flight cancellation caused by government restriction on travel to prevent virus spread.

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-4-

Southwest Airlines kept unit cost at a much lower level in comparison to other airlines because of less

passenger transportation capacity reduction which results from fewer restrictions in domestic market of

America.

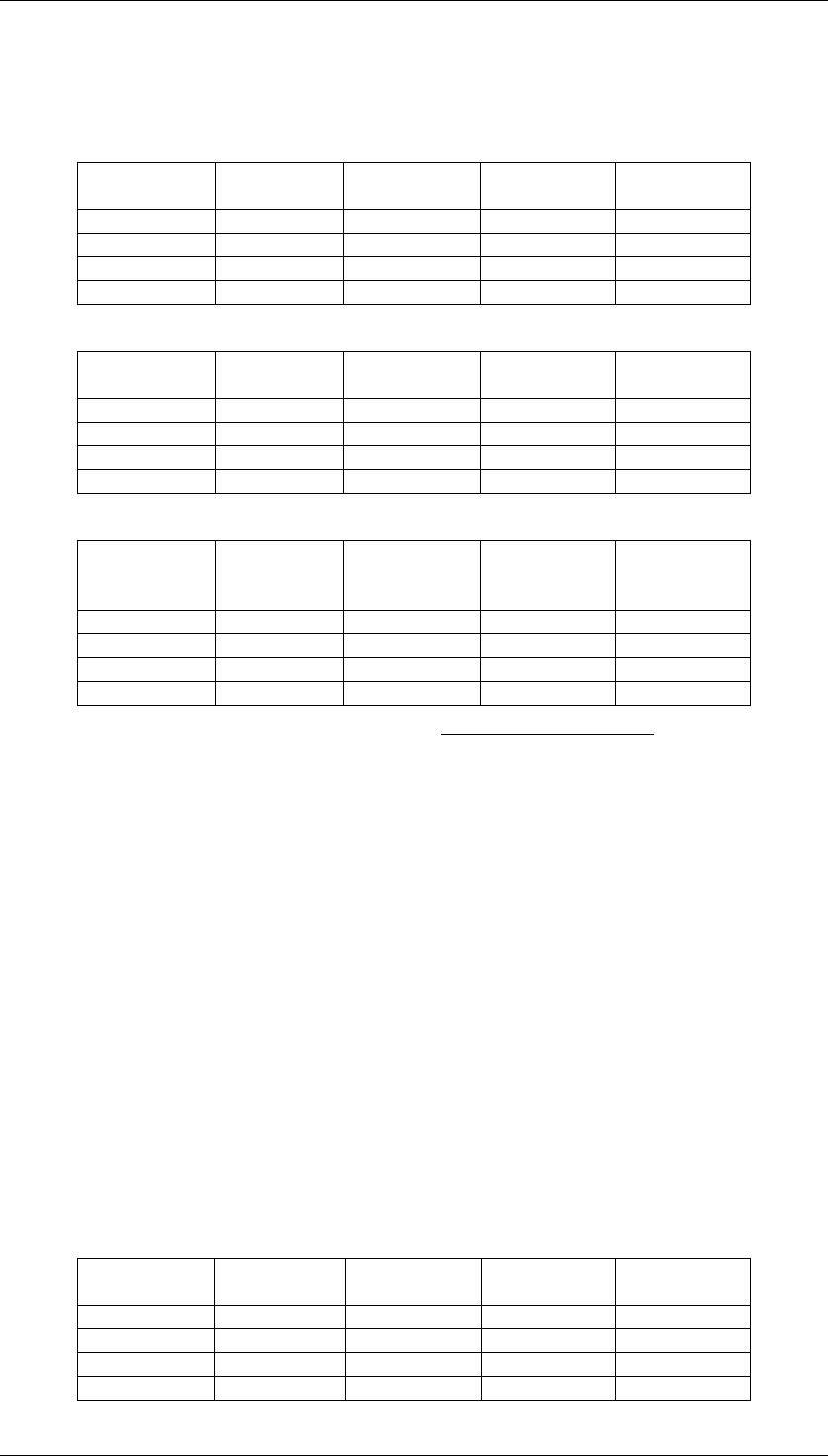

Table 4: Revenue of 4 airlines from 2017 to 2021

Revenue

/billion $

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

8.2

9.0

2.8

15.5

2020/2019

24.8

22.4

11.9

41.4

2019/2018

26.2

22.0

11.9

40.8

2018/2017

24.8

21.1

11.5

40.5

Table 5: Revenue passenger kilometres of 4 airlines from 2017 to 2021

RPKs

/billion

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

28.4

87.3

2.9

69.5

2020/2019

288.1

211.4

141.0

296.2

2019/2018

300.0

214.6

140.8

284.6

2018/2017

292.2

207.8

129.8

261.1

Table 6: Yield of 4 airlines from 2017 to 2021

Yield

/ $ cents per

RPK

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

28.87

10.31

96.55

22.30

2020/2019

8.61

10.60

8.44

13.98

2019/2018

8.73

10.25

8.45

14.34

2018/2017

8.49

10.15

8.86

15.51

(2)

Yield represents the average revenue earned per passenger-kilometre. It is the corresponding

indicator to the unit cost, reflecting the average ticket price of airlines directly. Higher yield means

higher revenue at same operating capacity.

Yield of four airlines is relatively stable before the pandemic. Normally, macroeconomy might be

the main cause of the yield changes, higher yield means higher profitability. But global travel

restrictions lead to a significant drop in passenger capacity of airlines which means a considerable drop

in RPKs as well. So, the yield increase in 2020 and 2021 cannot represent a positive financial

performance. Actually, it reflects a sharp increase of ticket price and lower passenger load factor which

is shown in the following part. In addition, political issues such as the U.K. leaving the EU also loom

further development and profitability of the industry in Europe. The threat of trade wars and

protectionist activity in some areas could have significant negative impact on aviation industry as well

[5]. Overall, yield level of four airlines is consistent with the unit cost level respectively.

3.3 Load factor and breakeven load factor

Load factor is a measure of capacity utilization and the indicator can be used for both passenger and

cargo transportation. Southwest Airlines, a low-cost carrier, only focuses on passenger transportation.

Thus, cargo load factor of the airline is not published and listed in the table. Other related data is shown

in the tables below.

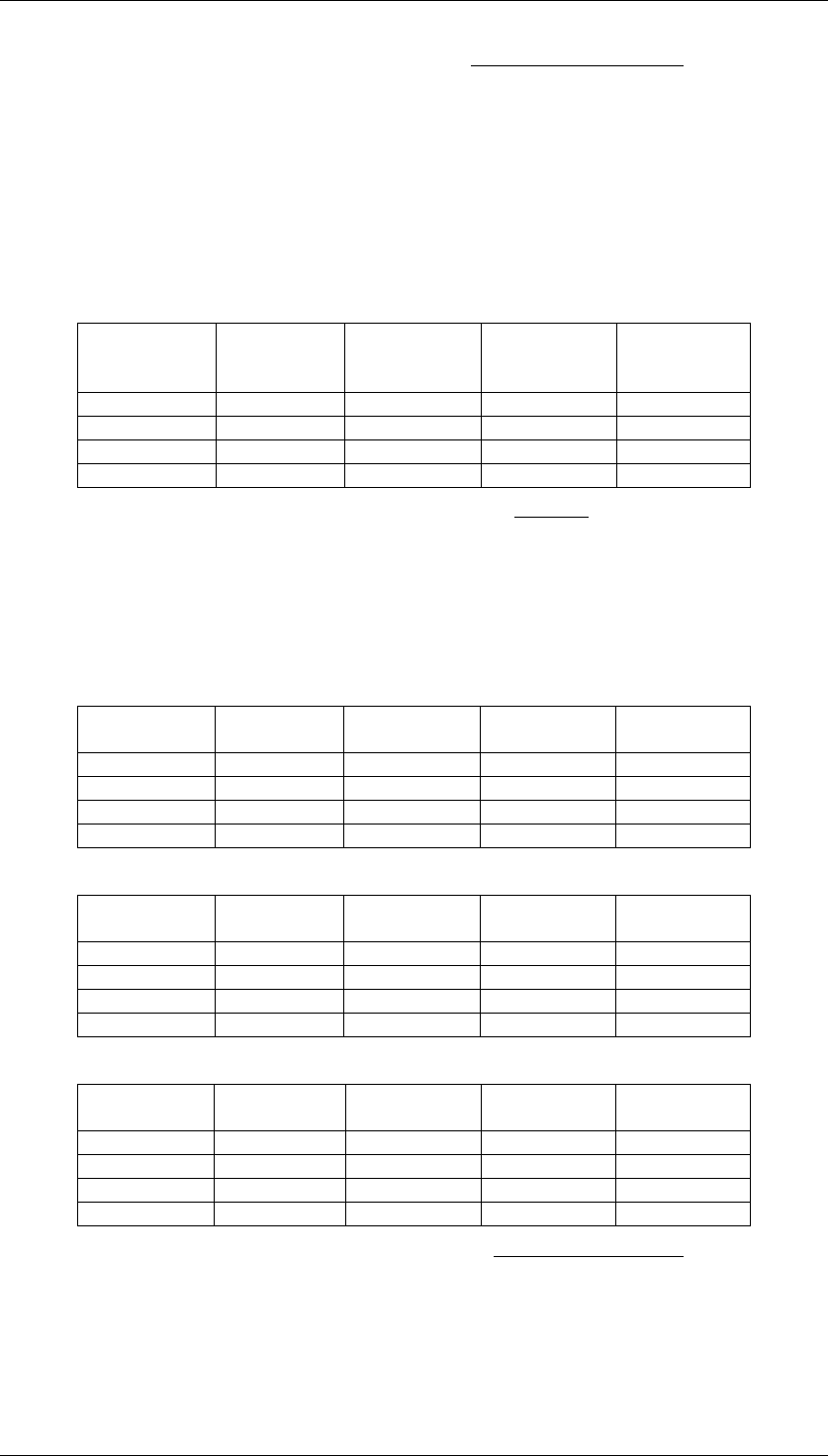

Table 7: Passenger load factor of 4 airlines from 2017 to 2021

Passenger

Load factor

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

44.3%

52.4%

13.4%

63.3%

2020/2019

78.5%

83.5%

82.4%

82.6%

2019/2018

76.8%

83.4%

83.0%

81.4%

2018/2017

77.5%

84.0%

81.4%

80.9%

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-5-

(3)

According to the computation result, passenger load factor of Emirates is relatively lower than other

airlines in pre-crisis period. The aviation industry passenger load factor is around 81%, which means

Emirates performed under average level [5]. This may result from the lack of flexibility of Emirates

fleet. The average aircraft capacity might be larger than the best volume to meet current market

demand. Compared to the previous year, the situation of all airlines in 2020 became worse, turning

down from 82.4% to 13.4% for Singapore Airlines. Although there was a huge decline on average,

Southwest Airlines still has a relatively higher load factor among four airlines, fitting the low-cost

strategy of the company.

Table 8: Passenger break-even load factor of 4 airlines from 2017 to 2021

Passenger

Break-even

Load Factor

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

75.1%

75.2%

22.4%

96.8%

2020/2019

78.1%

72.7%

81.7%

84.1%

2019/2018

77.4%

71.3%

77.4%

80.4%

2018/2017

75.0%

70.4%

73.6%

80.3%

(4)

Break-even load factor is the load factor required to cover operating costs. It can be influenced by

profitability of the airline. Break-even load factors of four airlines remain stable before the outbreak of

COVID-19. Southwest Airlines has the lowest break-even load factor, representing outstanding

profitability and cost control of the company. Abnormal break-even load factor of Singapore Airlines

results from its unusual load factor during the pandemic and higher ticket price.

Table 9: Revenue tonne kilometres of 4 airlines from 2017 to 2021

RTKs

/billion

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

12.5

/

4.1

7.4

2020/2019

39.5

/

6.4

10.7

2019/2018

42.3

/

7.0

10.9

2018/2017

41.3

/

7.3

10.8

Table 10: Available tonne kilometres of 4 airlines from 2017 to 2021

ATKs

/billion

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

24.8

/

4.8

10.6

2020/2019

58.6

/

10.8

17.4

2019/2018

63.3

/

11.2

16.4

2018/2017

61.4

/

11.1

15.8

Table 11: Cargo load factor of 4 airlines from 2017 to 2021

Cargo Load

factor

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

50.4%

/

85.8%

69.8%

2020/2019

67.4%

/

59.3%

61.5%

2019/2018

66.8%

/

62.5%

66.5%

2018/2017

67.2%

/

65.3%

68.4%

(5)

Cargo load factors in three airlines are similar, all at around 65% before 2020. This level is much

lower than Passenger load factor of the airlines. However, cargo load factor of the four airlines is better

than industry average performance which is under 50% [5]. It is reported that nearly a half of air freight

is moved by passenger aircrafts [6]. Although customer satisfaction for delivery has been more

time-sensitive, which has driven demand growth in air freight volume [7], the utilization of air cargo

capacity is far under economic standard. Although airlines such as Singapore airlines have changed its

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-6-

focus to air cargo to compensate loss in passenger transportation during COVID-19 pandemic, more

innovative methods and more efficient cooperation on cargo transportation should be implemented to

improve cargo load factor through the entire industry in the long-term.

3.4 Employee productivity and aircraft productivity

Employee productivity is a measure of output of labour. It can be represented by available capacity

or average revenue per employee. In this report, average revenue per employee is used in comparison.

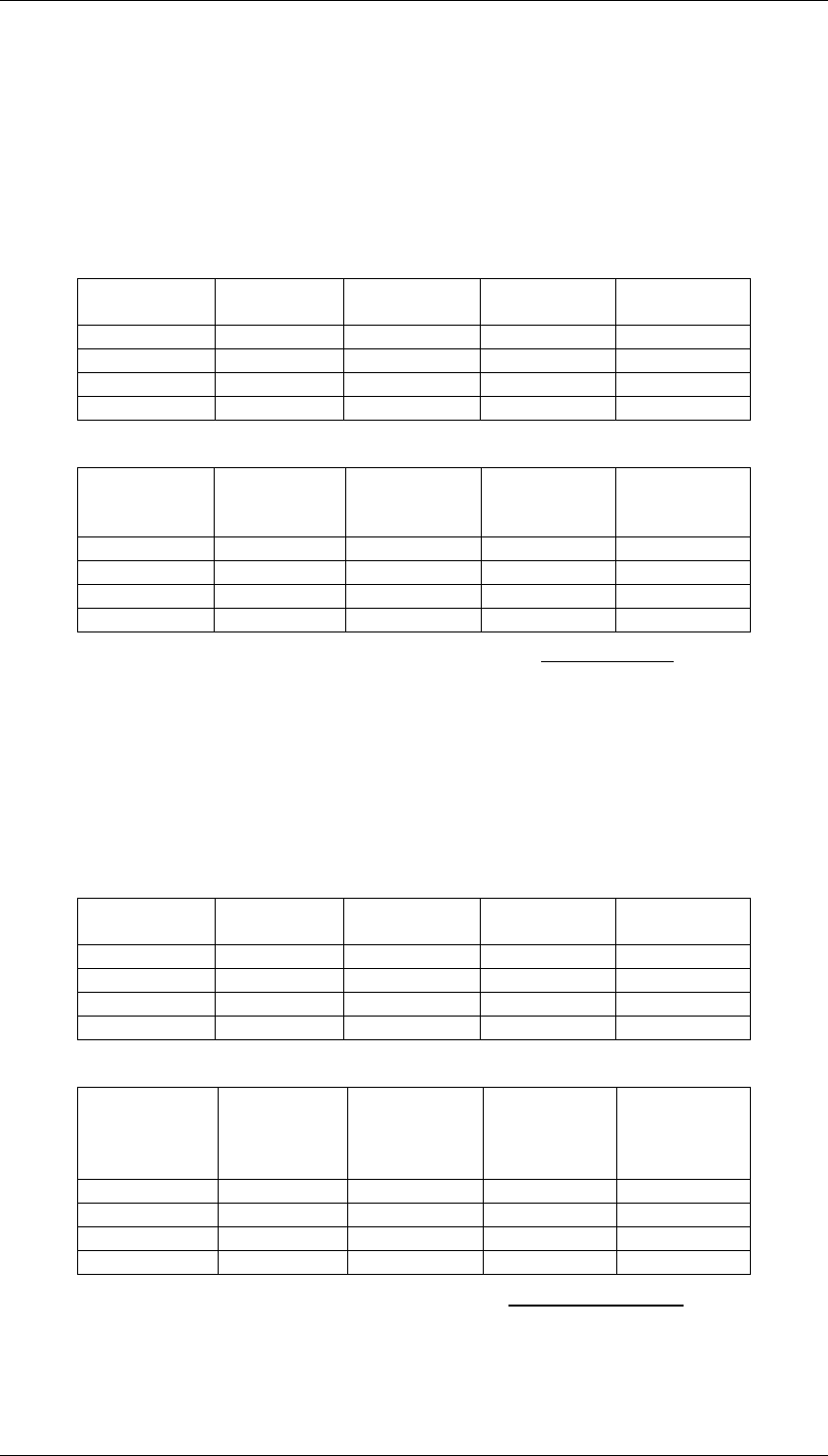

Table 12: Employee numbers of 4 airlines from 2017 to 2021

Employee

numbers

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

40801

56500

25547

125207

2020/2019

60033

60800

27619

137784

2019/2018

60282

58803

26534

134330

2018/2017

62356

56110

25901

128856

Table 13: Employee productivity of 4 airlines from 2017 to 2021

Revenue per

employee

/ $

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

200975

159292

109602

123795

2020/2019

413106

368421

430863

300470

2019/2018

434624

374131

448481

303730

2018/2017

397716

376047

443998

314304

(6)

Only Emirates reduced the employee numbers in 2018 among four airlines. The 3% reduction over

employee leads to a considerable increase in productivity at around 11% while Southwest Airlines and

Lufthansa perform negatively on this indicator. This is mainly because Emirates has applied more

smart methods and process in working environment, contributing to significant decline in workforce

requirement. In 2020, Emirates slimmed down at around 33% in order to save considerable labour costs.

This action also helps the company to keep higher employee productivity. In addition, reduced

recruitment and natural attrition are also reasons for the changes.

Table 14: Aircraft numbers of 4 airlines from 2017 to 2021

Aircraft

numbers

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

259

718

168

757

2020/2019

270

747

196

763

2019/2018

270

750

195

763

2018/2017

268

706

179

728

Table 15: Aircraft productivity of 4 airlines from 2017 to 2021

Aircraft

productivity

/ million

ASKs

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

247

232

129

145

2020/2019

1360

339

873

470

2019/2018

1447

343

870

458

2018/2017

1407

351

891

444

(7)

It can be seen in the table that aircraft productivity of Emirates is much higher than others before

the crisis. This is mainly because that aircraft capacity in the fleet of Emirates, which is formed by

Airbus A380 and Boeing 777, is considerably larger than single channel aircraft such as Boeing 737.

The latter aircraft type is more prevalent in other airlines. Singapore Airlines also operates some larger

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-7-

capacity aircrafts while low-cost carrier prefer flexibility provided by smaller aircrafts. Aircraft

capacity can be the primary reason for the productivity difference.

3.5 Employee productivity and aircraft productivity

EBIT margin, debt/equity ratio and current ratio of four airlines are calculated and listed below.

EBIT margin is the margin of earning before taking out interest and tax expense. It directly represents

the profitability of a company. Debt/equity ratio indicates how much debt a company is using to

finance its assets relative to the value of shareholders' equity. It is reported that general acceptable

Debt/equity ratio is around 1 while slightly over 2 is reasonable in aviation industry [8]. Current ratio is

for measuring company’s ability to pay for its short-term debt and other payables. Healthy current ratio

varies from industry to industry and it is usually lower in aviation industry because of the industry’s

heavy indebted nature [9].

Almost all four airlines earn less and less in the past 4 years. This situation may be partly caused by

continuous increase of jet fuel price and the market shrinking results from the travel restrictions since

2020. Emirates has the positive EBIT margin among four airlines during the pandemic and this is

relevant to successful cost control of the company. Southwest Airlines and Singapore Airlines have less

debt in comparison to Emirates and Lufthansa before 2020 while debt/equity ratio of Emirates is

acceptable nonetheless. However, only Singapore Airlines still kept it in healthy range after the crisis.

On the other hand, four airlines have acceptable current ratio in 2021, ensuring daily operation during

the crisis. Current ratio of Emirates and Lufthansa is still under 1 due to industry nature.

Table 16: EBIT of 4 airlines from 2017 to 2021

EBIT

/ million $

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

1265

-3816

-1870

-8364

2020/2019

7039

2957

44

2112

2019/2018

6614

3206

779

3271

2018/2017

6799

3407

1130

3627

Table 17: EBIT margin of 4 airlines from 2017 to 2021

EBIT margin

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

15.4%

-42.4%

-66.8%

-54.0%

2020/2019

28.4%

13.2%

0.4%

5.1%

2019/2018

25.2%

14.6%

6.5%

8.0%

2018/2017

27.4%

16.1%

9.8%

9.0%

(8)

Table 18: Total liabilities of 4 airlines from 2017 to 2021

Total

liabilities

/ million

Emirates

/ AED

Southwest

Airlines

/ $

Singapore

Airlines

/ SGD

Lufthansa

/ €

2021/2020

131630

25712

21303

38102

2020/2019

148475

16063

23980

32421

2019/2018

89655

16390

16822

28640

2018/2017

90541

15469

12664

26668

Table 19: Total equity of 4 airlines from 2017 to 2021

Total equity

/ million

Emirates

/ AED

Southwest

Airlines

/ $

Singapore

Airlines

/ SGD

Lufthansa

/ €

2021/2020

20147

8876

16278

1382

2020/2019

23587

9832

9733

10238

2019/2018

37743

9853

13683

9573

2018/2017

37046

9641

13228

9110

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-8-

Table 20: Debt/equity ratio of 4 airlines from 2017 to 2021

Debt/equity

ratio

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

653.3%

289.7%

130.9%

2757.0%

2020/2019

629.5%

163.4%

246.4%

316.7%

2019/2018

237.5%

166.3%

122.9%

299.2%

2018/2017

244.4%

160.5%

95.7%

292.7%

(9)

Table 21: Current assets of 4 airlines from 2017 to 2021

Current assets

/ billion

Emirates

/ AED

Southwest

Airlines

/ $

Singapore

Airlines

/ SGD

Lufthansa

/ €

2021/2020

22891

15173

9672

10040

2020/2019

27705

5974

4843

11285

2019/2018

30915

5028

5500

10654

2018/2017

34170

4815

4967

11029

Table 22: Current liabilities of 4 airlines from 2017 to 2021

Current

liabilities

/ million

Emirates

/ AED

Southwest

Airlines

/ $

Singapore

Airlines

/ SGD

Lufthansa

/ €

2021/2020

35705

7506

5713

14659

2020/2019

48892

8952

11002

15986

2019/2018

37465

7905

7378

16215

2018/2017

41629

6863

6566

12638

Table 23: Current ratio of 4 airlines from 2017 to 2021

Current ratio

Emirates

Southwest

Airlines

Singapore

Airlines

Lufthansa

2021/2020

64.1%

202.1%

169.3%

68.5%

2020/2019

56.7%

66.7%

44.0%

70.6%

2019/2018

82.5%

63.6%

74.5%

65.7%

2018/2017

82.1%

70.2%

75.6%

87.3%

(10)

4. Conclusion

COVID-19 pandemic, regional trade conflicts and relatively lower global economy growth rate may

bring some difficulties to aviation industry in recent years. However, from the perspective of

macroeconomy, the industry would have strong growth in the long run. Governments also have strong

willingness to support airlines in order to develop economy and protect jobs [10]. Regional and

domestic markets may recover earlier than international markets [11].

Overall, Emirates is competitive in global aviation market and it is one of the largest airlines in

terms of ASKs. Unit cost and yield of the airline is relatively normal while employee productivity of

Emirates is outstanding due to applying smarter way of working to reduce demand for labour. However,

larger average capacity of aircrafts in the fleet of Emirates hampers the company to obtain flexibility

compared to competitors. This may also contribute to lower load factor of Emirates. The airline has

realised the situation and is trying to make some changes in future aircraft modernization. As for EBIT

margin, there is room for Emirates to gain more profit. Debt ratio of Emirates is at a risky level after

2020 and current ratio is rather healthy. Generally, all airlines have to counter COVID-19 challenge

and benefit from further globalization in the long-term perspective. Emirates should seize opportunities

to reinforce its current market position in Europe and East Asia, building connection to more regions

and to enhance its profitability.

Dnata, which provides ground service for Emirates, is excluded from the financial data of Emirates

Academic Journal of Business & Management

ISSN 2616-5902 Vol. 4, Issue 2: 1-9, DOI: 10.25236/AJBM.2022.040201

Published by Francis Academic Press, UK

-9-

while all subsidiaries of other airlines are considered in the analytical part of the report. This is because

financial data of Dnata are listed separately and the company owns no aircrafts. The structures of other

airlines are more complicated, thus airlines such as Lufthansa are considered as group. But it could

result in inconsistency and errors when doing financial comparison between airlines. This could be the

main limitation of this report.

References

[1] ICAO (2018).Long-Term Traffic Forecasts - Passenger and Cargo,

https://www.icao.int/sustainability/Pages/eap-fp-forecast-scheduled-passenger-traffic.aspx

[2] Sadi, M.A. & Henderson, J. C (2000).The Asian economic crisis and the aviation industry: impacts

and response strategies. Transport Review, vol.20, no.3, p.347-367.

[3] Chung, L. H (2015). Impact of pandemic control over airport economics: Reconciling public health

with airport business through a streamlined approach in pandemic control. Journal of Air Transport

Management, vol.44, p. 42-53.

[4] Dube, K., Nhamo, G. & Chikodzi, D (2021). COVID-19 pandemic and prospects for recovery of the

global aviation industry. Journal of Air Transport Management, vol.92, no.1, p.102022.

[5] IATA (2019), Annual Review 2019, viewed 2 June 2019,

https://www.iata.org/publications/pages/annual-review.aspx

[6] Morrell, P.S. & Klein, T (2018), Moving Boxes by Air: The Economics of International Air Cargo,

2nd edition, Routledge, London.

[7] So, K. C (2000). Price and Time Competition for Service Delivery. Manufacturing & Service

Operations Management, vol. 2, no. 4, p.392–409.

[8] Dizkirici, A.S., Topal, B. & Yaghi, H (2016), Analysing the Relationship between Profitability and

Traditional Ratios: Major Airline Companies Sample, Journal of Accounting. Finance and Auditing

Studies, vol.2, no.2, p.96-114

[9] Morrell, P. S (2012). Airline Finance, 3nd edition, Air Transport Economics and Planning, UK.

[10] Abate, M., Christidis, P. & Purwanto, A.J. (2020). Government support to airlines in the

aftermath of the COVID-19 pandemic. Journal of Air Transport Management, vol.89, p.101931.

[11] Warnock-smith, D., Graham, A., O’Connell, J.F. & Efthymiou, M (2021). Impact of COVID-19 on

air transport passenger markets: Examining evidence from the Chinese market. Journal of Air

Transport Management, vol.94, p.102085