INSEAD Alumni in Private Equity

PRIVATE EQUITY ASSIGNMENT - RESEARCH PROJECT

GROUP 9:CHEN YU, KHAMITOV TIMUR, PARKOV VLADIMIR, TAN ANNIE,

VISWANADHA KAUSHIK SRIRAM

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

1

Executive Summary

Based on the survey results, as well as the interviews with INSEAD alumni, there are three findings related to

INSEADers’ career in PE that we would like to highlight, as follows:

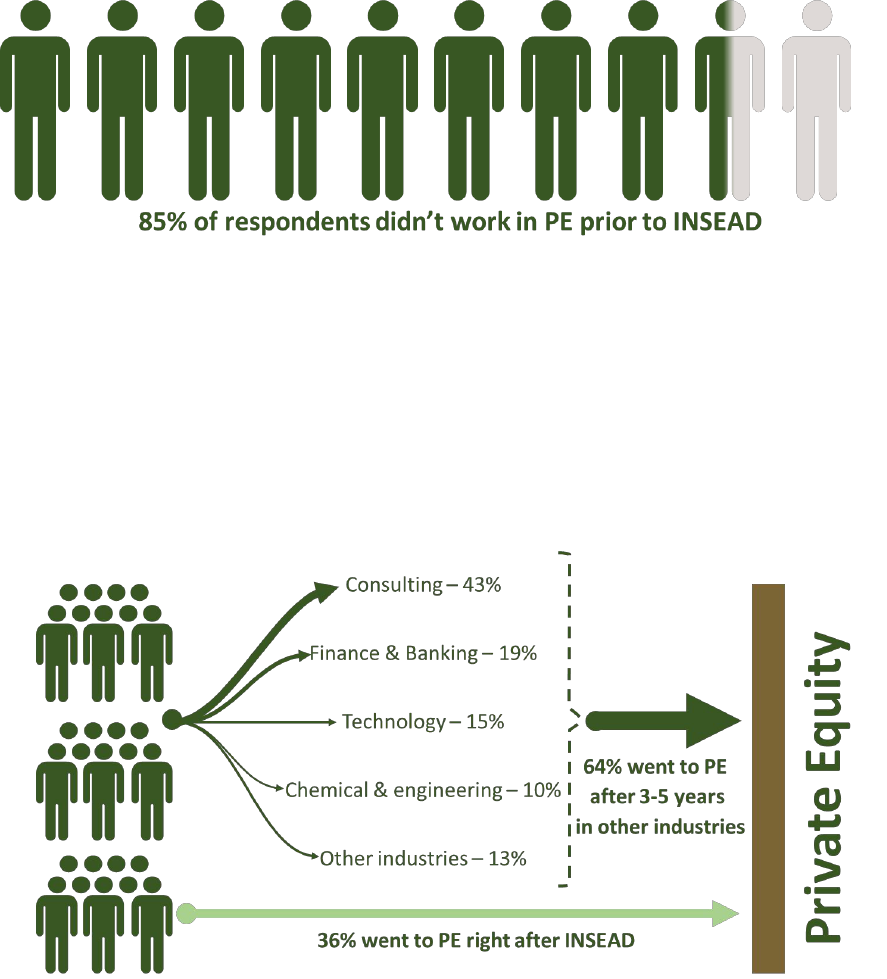

1. Consulting and finance & banking are the most common career options for switching to PE. Based

on our survey, 85% of the respondents did not work in PE before INSEAD. Among these, 64% went

into other industries before switching to PE, 36% went into PE immediately after INSEAD. In the

former case, 43% went into consulting, while 19% went into finance & banking; in the latter case,

38% had consulting experience prior to INSEAD; 31% had worked in finance & banking pre- INSEAD.

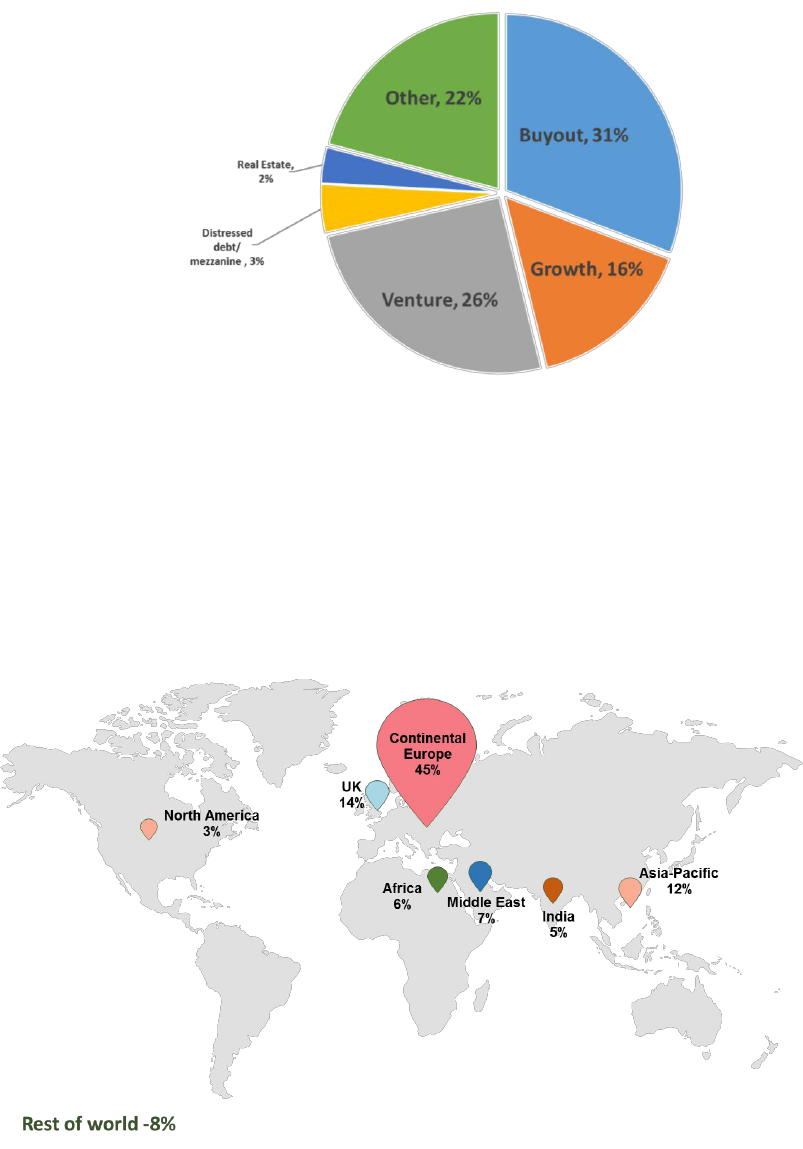

2. INSEAD alumni working in PE are spread across different types of funds and geographies. Among

the survey respondents, 31% worked in buyout funds, 26% in VCs, 16% in growth funds, while other

types make up 27%. Geographically, 59% primarily worked in Europe (14% in UK and 45% in

Continental Europe). APAC (including India) makes up 17%, followed by Middle East and Africa with

7% and 6% respectively.

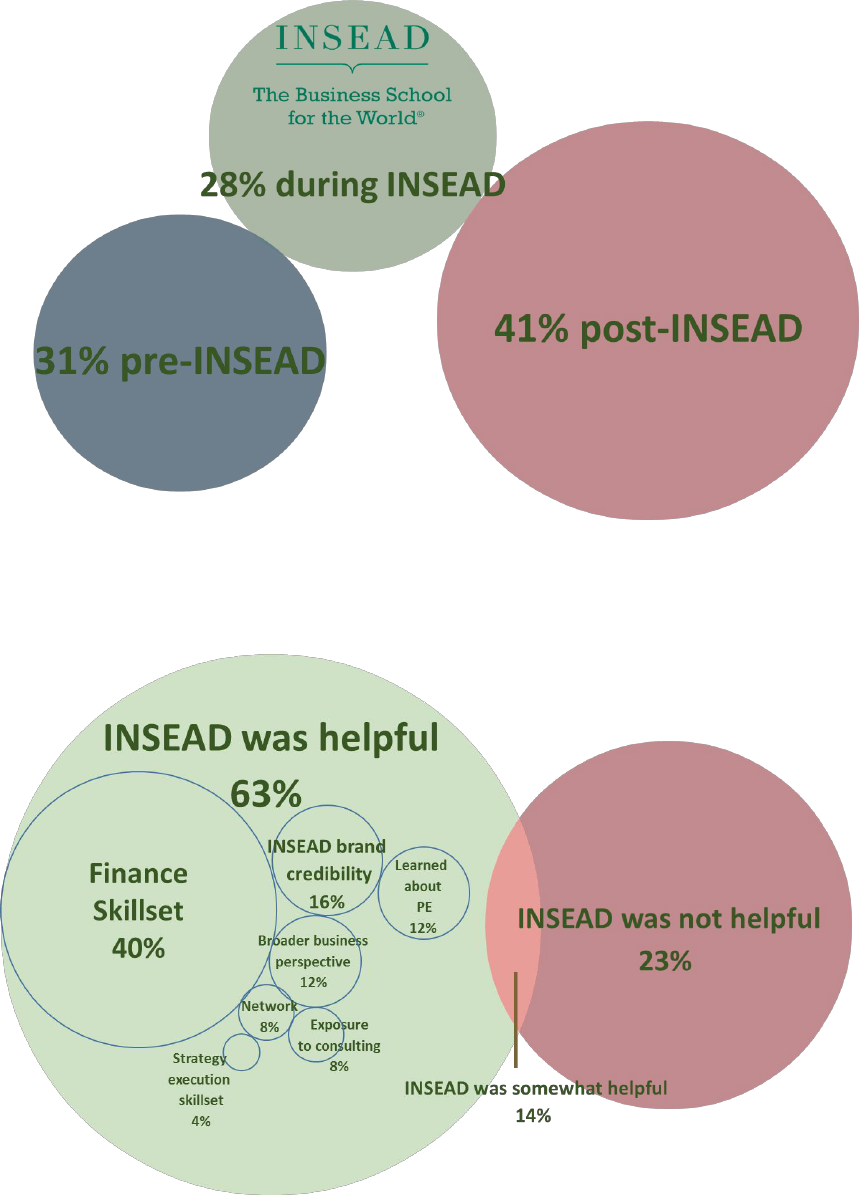

3. 63% of respondents consider the INSEAD experience useful for switching careers to PE. A majority

of respondents pointed out financial skillsets as being particularly useful for a PE career, followed by

INSEAD brand credibility, knowledge about the PE industry, and the broader business perspective

gained at INSEAD.

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

2

Table of Contents

1. Rationale for the project ........................................................................................................................... 3

2. The Approach ............................................................................................................................................ 3

3. The Findings .............................................................................................................................................. 4

3.1. Alumni background prior to switching to PE ............................................................................................ 4

3.2. Profiles and geography of PE firms ........................................................................................................... 6

3.3. Motivations and challenges of moving into PE ......................................................................................... 7

3.4. Role of INSEAD in a PE career ................................................................................................................... 8

3.5. Advice to INSEAD students planning to move into PE .............................................................................. 9

Exhibit 1. Questionnaire outline ......................................................................................................................... 12

Exhibit 2. Sample and population distribution by vintage .................................................................................. 14

Exhibit 3. The Alumni Profile – Roberto Biondi, Permira .................................................................................... 15

Exhibit 4. The Alumni Profile – Melissa Heng, General Atlantic ......................................................................... 21

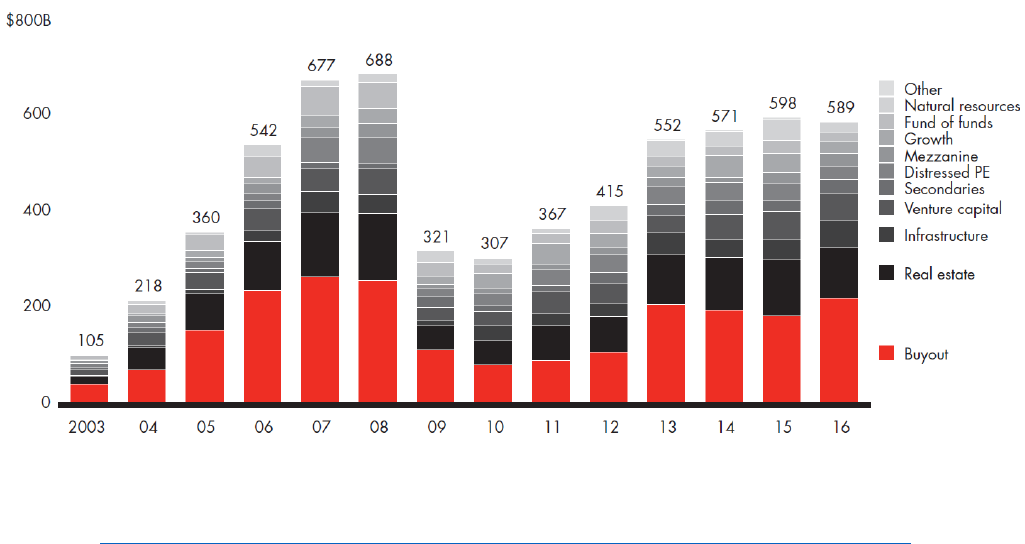

Exhibit 5. Global PE capital raised by fund type, USD billions ............................................................................ 24

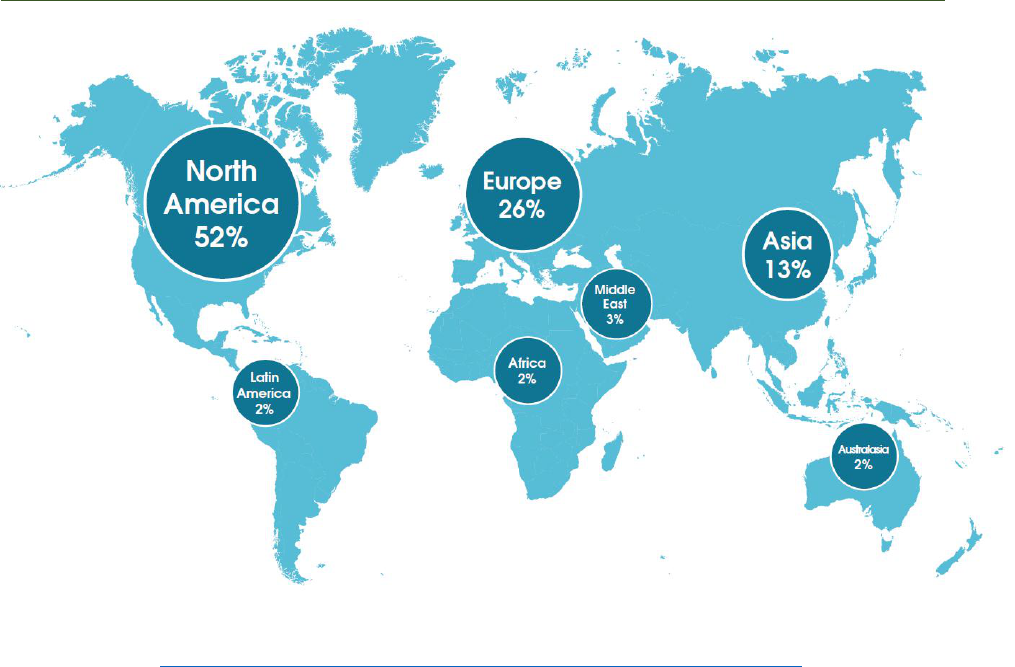

Exhibit 6. Breakdown of Institutional Investors in Private Equity by Location ................................................... 25

References .......................................................................................................................................................... 26

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

3

1. Rationale for the Project

It is common knowledge that breaking into the private equity (PE) industry is hard. The way in remains

a mystery to many potential employees. Yet given the sheer volume of assets under management - $2.5

trillion across around 4,700 firms – PE is clearly a lucrative place to work. The chances of getting into PE are

very small: an entry-level position typically attracts around 300 applications

1

(a 0.3% chance of success).

Compare that to the INSEAD acceptance rate of 20% (January intake) to 30% (September intake).

2

Of roughly 54,000

3

INSEAD alumni, more than 1,000

4

are working in PE – about 2%. Another estimate

puts the percentage of INSEAD alumni in PE at 14%.

5

Regardless of which is correct, clearly INSEAD alumni do

better at breaking in to PE than average. For this reason, our research aims at finding out how INSEAD alumni

make a career in private equity, and takes the view that any meaningful trends or takeaways will be useful

for current students or recent graduates looking for an opening into a PE career.

2. The Approach

There were two main parts to our research:

A. A survey of INSEAD alumni via email to extract raw data (see Exhibit 1) via an online questionnaire. We

used the alumni database as of March 22, 2017 as the total population, which contains 834 alumni

working in PE. Over the course of the project, over 600 INSEAD alumni were contacted, and 86

responses were received, which was our sample. Survey participants came from INSEAD ‘vintages’

encompassing over 30 years (from 1979J to 2015D), working in over 30 countries. (The vintage

distribution among the overall population is given in Exhibit 2). Hence we consider the responses to be

representative of the overall population.

B. Interviews with INSEAD alumni with significant PE expertise, holding senior positions in large and well-

known PE firms. The goal was to create alumni profiles that could potentially be placed on INSEAD’s

Global Private Equity Initiative (GPEI) website and used to promote IPEC conferences. Over the course

of the project, two interviews were held (another was scheduled but postponed). See Exhibits 3 and 4.

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

4

3. The Findings

3.1. Alumni background prior to switching to PE

The vast majority of respondents did not work in PE prior to INSEAD. People with prior experience in

PE began to apply to INSEAD from 2005, and had on average three years’ experience in the industry,

coinciding with the so-called ‘third’ private equity boom (after the LBO boom and bust in 1980s, and

resurrection of LBOs in 1990s when the dotcom bubble burst).

Profile of Switchers:

Among respondents who did not work in PE prior to INSEAD, we identified two types: direct

switchers, who went into PE right after INSEAD (36% of respondents); indirect switchers, who went

to work in other industries for on average 3 to 5 years before entering PE (64% of respondents).

i) Typical profile of direct switcher:

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

5

Direct switchers mostly worked in consulting (38%) and finance and banking (31%), which suggests

that a finance and consulting mix is a must to land job in PE, as was confirmed by our interviews with

alumni.

ii) Typical career path of an indirect switcher:

People with a consulting background (26%) mostly returned to consulting (often sponsored

students); those from a finance and banking background (26%) also returned to that industry;

almost 40% of people from other industries (48% of respondents) switched to consulting right after

INSEAD before going to PE.

People with prior PE experience tended to work in more senior positions (partners, directors) and

retained those positions after INSEAD.

80% of respondents without prior PE experience typically got more junior positions

(associate/associate directors and below).

Currently, 95% of respondents hold senior positions. Associate positions are held by 5% of

respondents. This correlates to their INSEAD vintage – more junior positions are held by alumni who

graduated after 2011.

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

6

3.2. Profiles and Geography of PE firms

INSEAD alumni work across various funds with different profiles:

Compared to the level of capital raised over the previous 14 years by fund profile (see Exhibit 5),

more PE professionals from INSEAD work in Venture and Growth funds, which is consistent with

INSEAD’s focus on entrepreneurship and consulting.

Geographic location is as varied as fund profiles and is correlated with the diversity of INSEAD

alumni:

This data is in stark contrast to breakdown of institutional investors in PE by location, who are

mostly based in North America (see Exhibit 6). This is largely explained by the fact that only a small

portion of respondents work for top GPs (most of which have their headquarters in North America),

and is directly related to INSEAD being based in Europe.

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

7

3.3. Motivations and challenges of moving into PE

The motives behind moving into PE include the following:

Among the key challenges that respondents faced in their career switch to PE are:

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

8

3.4. Roles of INSEAD in PE career

At which point of their career did respondents decide to move into PE:

Even though the majority decided to go to PE post-INSEAD, they found INSEAD experience useful for

switching to PE:

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

9

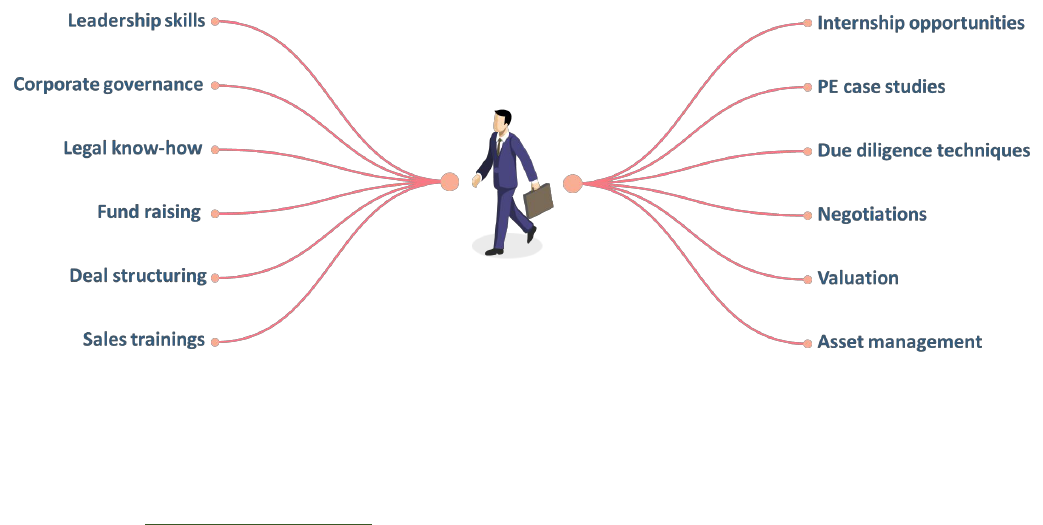

3.5. Advice to INSEAD students planning to move into PE

Respondents pinpointed which areas that they wished they had learned at INSEAD that would have

been useful for PE (knowledge and skill gaps):

The following advice was offered to current MBA students who aspire to move to into PE after

INSEAD:

i) Gain relevant experience

o “Get experience in strategy and the industry sector in which you'll be investing .“

o “If you are not successful approaching PE firms directly, consider joining development

finance institutions as plan B, which gets you into the industry and positions you for a further

move.”

o “Go to a small-mid cap fund to learn most and do some pro-bono projects.”

o “Consulting and investment banking are good skillsets to obtain prior to PE.“

o “Get relevant experience in M&A or transaction services before applying.“

o “An INSEAD MBA is unlikely to be the only reason a PE firm recruits you. Just as important is

relevant quality-specific experience in a given field or industry. If you have this experience

before obtaining your MBA, then great, go straight to the PE shops. If you do not, then you

will need a stepping stone to move forward. The three most attractive stepping stones are:

consulting firms (Bain, McKinsey, etc.), corporate finance shops (IBs and Big 4s), and

corporate industry leaders (Fortune 500 companies).“

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

10

o “Get enough business experience first - at least two to three different sectors and a

minimum of 6-7 years.”

o “Do not focus exclusively on finance but also on all the human aspects linked to PE:

management team assessment, people management, understanding the drivers of CEOs and

founders of small-to-medium-size businesses.“

o “Get an internship with a VC and gain practical experience in founding a company prior to

moving to PE.“

o “Relevant private equity advisory experience is essential.”

o “Demonstrate relevance to geography, sector or transactional experience.”

o “Don't go straight to PE: start in banking, consulting or industry to gain experience.”

o “Consider roles other than investment professional: there is a growing trend of GPs

structuring themselves with operational improvement teams (creating value at the portfolio

company level) or investor relations teams.”

ii) Gain relevant knowledge

o “Take electives in negotiation, finance, operational improvement and family business.”

iii) Know how to market yourself and target the job

o “Jobs are rare so you must be patient and learn how to "tell your story" (why you should do

PE).”

o “Figure out what type of PE you want to do. Big LBO firms are a world apart from small

growth firms.”

o “Decide whether it is PE or Venture Capital you want to do, as PE requires solid finance

knowledge while VC requires significant people skills and a "feeling" for technologies and

science.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

11

o “Target the firms. Understand their hiring plans. Understand the philosophy of the fund and

why you fit. Understand the individuals and the strategy. Be stellar in your CV, especially on

academic achievements and specific hands-on experience.”

o “Be persistent and look for buyside roles in firms similar to PE (hedge funds, asset managers,

family offices) if coming from the advisory side.”

o “Contact the PE firms in your target geography directly.“

iv) Others

o “Best to enter PE early as it takes at least 7-10 years to build a track record.”

o “Build your network and industry expertise.“

o “Network - it’s all about timing. PE hires on an ad-hoc basis and securing a job in the industry

is more about being in the right place at the right time.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

12

Exhibit 1. Questionnaire outline

1. Basic Information

First and Last Name:

INSEAD Vintage:

Current Company:

Current Position:

Current profile of the fund (buyout, venture, real estate etc.):

Current Location:

2. Professional experience:

Did you work in PE before INSEAD?

If yes:

a) Years of PE experience before INSEAD?

b) What was your job role right before INSEAD?

c) In which country did you work right before INSEAD?

If no:

a) In which industry did you work right before INSEAD?

b) No. of years of working experience before INSEAD?

c) What was your job role right before INSEAD?

d) In which country did you work right before INSEAD?

Did you work in PE right after INSEAD?

If yes:

a) In which country did you work right after INSEAD?

b) What was your job role right after INSEAD?

If no:

a) In which country did you work right after INSEAD?

b) In which industry did you work right after INSEAD

c) What was your job role right after INSEAD?

d) How many years post-INSEAD before joining PE?

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

13

3. Motivation behind going into PE

When did you plan to enter PE? Pre-INSEAD, INSEAD, Post-INSEAD

If Pre-INSEAD:

a) Was INSEAD a part of the plan to PE?

If yes, what did you plan to gain from INSEAD?

If during INSEAD:

a) What at INSEAD prompted to move to PE?

If Post-INSEAD:

a) What prompted you to move to PE?

b) Was INSEAD helpful in switching to PE? How?

c) What are the challenges you faced in switching to PE from your industry?

4. Open-ended questions

a) What are the skills, knowledge or experience you wish you had had during INSEAD that would

be useful to switch to PE?

b) What is your advice for current INSEAD MBA students who aspire to move to PE after INSEAD?

c) Please provide the names of other INSEAD alumni who are currently working in PE that we

should reach out to (potential additions to GPEI alum database)

d) Would you be willing to be contacted for a further interview in the future?

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

14

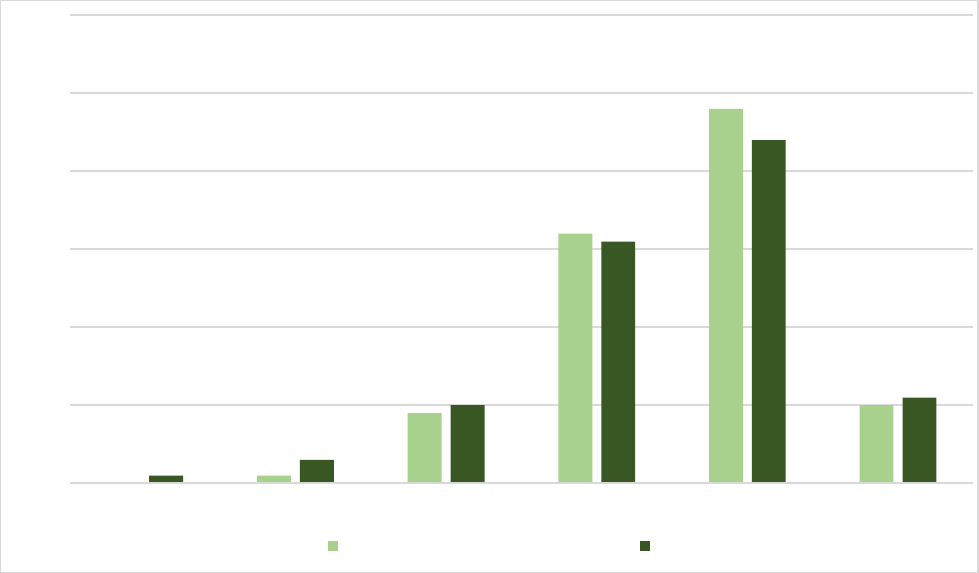

Exhibit 2. Sample and Population Distribution by Vintage

0%

1%

9%

32%

48%

10%

1%

3%

10%

31%

44%

11%

0%

10%

20%

30%

40%

50%

60%

1960s 1970s 1980s 1990s 2000s 2010s

Sample Population

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

15

Exhibit 3. Alumni Profile – Roberto Biondi, Permira

Roberto Biondi MBA’01J

Partner, Global Head of the Financing Group at Permira

Roberto Biondi is a Partner at Permira since 2010. Mr. Biondi also

focuses on the financial services sectors. Since 2013 he is the head

of Financing Group and has worked on a number of transactions.

Before joining Permira in 2001, he served as an Associate at

McKinsey & Company, Inc. for three years, where he worked in

the telecoms practice. He was Director of Sisal Group S.p.A. from

2007 and is a former Director of EEMS Italia SpA. Mr. Biondi holds

an MBA from INSEAD and a Degree in Chemical Engineering from

Politecnico di Milano.

Unlike most INSEAD alumni, Roberto initially didn’t plan to go to INSEAD but followed

the advice of colleagues at McKinsey.

“I was perfectly happy with my career at McKinsey but after some time more

and more colleagues kept telling me: ‘You should take a year off and go to

business school. It’s going to be good for your career and it’s going to be

good for your life.’

I didn’t want to go. Why would I want to waste one year and not keep doing

my job? Eventually I followed the advice from a partner at McKinsey and

decided to go to INSEAD as it was a short program.

I definitely wanted to go back to McKinsey. I didn’t do job interviews during

recruiting period at INSEAD. I was a walking McKinsey advertisement, in

contrast to many other consultants who wanted to change careers or become

entrepreneurs.

I am a chemical engineer by education and I started to learn new things in

McKinsey but I didn’t know how to read financial statements, didn’t know

much about accounting or banking, so I focused all my courses at INSEAD on

finance.”

In contrast to more traditional post-INSEAD career path when people typically work for

2-3 years at top consulting firms and then move to other industries, Roberto started

career in private equity right after INSEAD and already had 3 years of consulting

experience with McKinsey & Company working in Italy and Israel in the Telecoms

practice.

“Getting into private equity was thanks to mix of serendipity,

entrepreneurship and risk-taking. In February 2001, I got this weird

invitation resulting from a CV screening. The company was called Schroder

Ventures. Back then private equity was really private – there was nothing to

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

16

research: no data, no benchmarks, no returns. I knew nothing about the

company.

I went to the meeting and I liked the team, I liked the Head of Italy. For me it

was a good opportunity, a perfect mix of finance, consulting and opportunity

to live with your decisions.

I would say that my level of preparation for private equity back in 2001

would be not enough to jump the hurdle today.”

Permira was founded in 1985 by Nicholas Ferguson, initially operating a number of

businesses across multiple geographic regions under the umbrella of the Schroder

Ventures brand. In 1996, the company’s UK, France, Germany and Italy units merged

their operations to form Schroder Ventures Europe, and a year later launched the

company’s first Pan-European fund. Rebranded Permira in 2001, it has since expanded

its operations internationally, growing to become a leading name in the private equity

investment sector.

“When I joined Permira in September 2001, for the first time the benchmark

information and data on the invested funds was published in the Financial

Times. It was considered revolutionary because you started to get much

needed transparency.

I went to work the first day at Permira even without a contract. I let my offer

to McKinsey expire. They did it on purpose – they wanted to see whether I

would be willing to take the risk. Of course, we don’t do that anymore now!”

The skills and competencies needed to work in private equity have changed. As the

industry has become more developed, the focus is on candidates with more specialized

expertise and a less generalist approach.

“From day one I was working on a project that was related to my chemical

engineering background. Permira’s structure has always been very flat and I

started in junior position under the wing of the head of Italy. The office was

very small – there were only around 5 people. It was like working for a

clockmaker or a piano crafter: you go into the shop and you learn on the job,

learn how to perform financial due diligence, legal due diligence.

Now we have more formal training for the newcomers, but it is still learning

on the job. The industry is much more researched and our candidates plan

to go to private equity well ahead and are usually well versed in one or two

sectors for which we hire.

When we hire junior people without specific links to the sector, they work on

projects with generalist functions for the first year and then we let them

decide which sector they want to work with.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

17

While knowledge and expertise of the particular sector is helpful to get a job in private

equity, it is not enough to be successful in your career several years down the road,

when the entrepreneurship angle becomes more and more important.

“I was hired in part based on my experience at McKinsey and expected to be

fluent on the telecom markets side. After a few years, rather than staying

focused on a less attractive subsector, I contributed to business development

and was one of the partners that founded he Financial Services division at

Permira.

You need to find your way, your own platform, things that you like, whether

it’s origination or execution. You need to find how you can help the firm, how

you can create partnership economics on a global level.”

The industry has changed a lot. Candidate profiles and approaches to recruiting that

worked for private equity as a young, unresearched industry back in 2001 would not be

as effective now.

“The reality now is that my CV of 2001 would be probably OK for

approaching private equity but not a striking one. That’s because I was

100% consultant, even though I had a great track record at McKinsey and

international experience, but that was about it.

Unfortunately, the first impression comes from the CV and the bar is much

higher now, considering how visible and attractive private equity has

become. Your CV needs to be spectacular.

The thing that jumped out from my CV was that in my last 6 months at

McKinsey, while I was junior associate there, I opened an office in Israel and

did a lot of due diligence on the venture capital firms’ portfolios there. But

that is only part of what it would take now to become one of the Associates at

Permira.

What I look for is a specific experience in private equity transactions:

whether you are banker, consultant or an accountant. What have you done in

your previous career in direct relationship to PE? What are your specific

applications of skills? What can you bring to the table knowing how the

private equity industry functions now?

The second important thing is what I call being “multi-vertical”. Being a

banker or a consultant is not enough; in addition you need to be a specialist

in an area that fits very well with our strategy. Back then we were just a

network of local generalist offices, but times have changed and we now have

a focused sector strategy. Our investors are much more specific in what they

want and we are much more specific in what we deliver. Therefore, we need

very specific skills.

The bar has moved for everybody, not only for candidates, but also for us

because investors can get better deals from focused investors rather than

from generalists.

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

18

We are very pragmatic. We wouldn’t hire just consultants but consultants

with corporate experience, hands-on experience with complex projects,

international experience. My career prior to Permira didn’t involve just

consulting; I worked in the oil and gas division of General Electric for one

year under McKinsey. The next year I worked on a launch of a telecom

carrier in Italy. There were 30 people in that company when we started the

project and when we left it was number two player in the telecom space.

It is that experience that enabled me to position myself as a professional with

hand-on experience in strategy at Permira, even though I was a consultant.”

The challenges that need to be overcome to break out to private equity and to Permira,

in particular, are significant.

“We have a “seasonal” business in a sense and you need to be the right

person reaching out at the right time. We typically hire more people as we

ramp up our new fund. All the partners have their own hiring plans and

typically when our investment capacity goes up, our hiring capacity also

goes up.

We always run professionally-led hiring plans and rarely do hiring by

ourselves except for interns. Internship is something that we started doing

not a long time ago: we do a “road test” with that person for 3 months,

bringing him or her to an actual deal. If a candidate stands out and there is a

match with a hiring season, then we most likely give that person preference

over other candidates.

We also need a perfect match between skills and our strategy. If you are

fluent with the market and stand out in origination, most likely we already

know you. If you are an outstanding consultant, then most likely we already

have worked with you.

In addition, we want people that did their due diligence on us. First, we

want to understand how much people care about the job. Second, we want to

be sure that they know what are they getting to. Private equity is a long-term

career and you need to approach it on an extremely conscious basis. Why

would you want to work for Permira and not Blackstone, for example? Say,

you have experience in consumer goods and that’s one of the sectors

Permira invests in and you think you can do something for us in this sector.

The ability to fit personally is key here.”

To build a successful career in private equity one must overcome yet another set of

challenges.

“To be successful, the key element is to be a real entrepreneur. At Permira

nobody tells you exactly what to do. Some people get paralyzed by that fact.

For example, in banking you come to office in the morning and you know

what will you do exactly. At Permira, you are on your own: you interact with

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

19

your advisers, you do your own due diligence, you decide whether you want

to stay up all night at the office or whether you need to take a flight to have

face-to-face meeting with the target company executives. It is this level of

independence. You create your own agenda. That can be exhilarating or

not, depending on what kind of person you are. We all carry out tasks for the

team and results is what people focus on.

You get judged by whether you can roll up your sleeves and do the work,

whether you are careful to details, whether you can make a sale to the

management team, whether you are empathetic. You need to have all those

things and that is difficult. You could be a genius and never make partner if

you could not interact on a personal level and had zero empathy.

The more senior you get, the less specific tasks you have – you need to find

the deals and get deals to work.”

Accomplishments You are Proud of

“Permira now has five sectors for investments. We had three when I joined.

One of the two sectors that we decided to fund started with me asking a

question to a small group of peers: “What would happen if a private equity

firm owned a bank?” It took us four years to develop it since 2005. We

started analyzing opportunities, educating ourselves, educating our

investment committee. It was four of us, I wasn’t partner myself at the time,

and we convinced the whole partnership to invest in a new sector, to hire

more people. We started in 2009, in the middle of the crisis, and almost

immediately made the first the deal. People told us that we’d be dead before

long. In reality, the crisis started to shake up some lucrative assets. By the

end of 2016 we’d invested over 20% of our equity in the last 18 months

through that sector.

The second thing I am proud of is the fact that I started as a strategy

consultant at Permira and I am now the Global Head of Financing, which is a

move across pretty much perpendicular dimensions. I did so by learning and

doing things on the job. I am proud that now we have a global financing

team of 15 people working efficiently. We would beat the Permira of five-ten

years ago just by being able to organize our financing much quicker and on

more competitive terms. I came to Permira not knowing what financing was

and now have global responsibility for the fund. That is what I mean by

being entrepreneurial.”

Advice to INSEAD Students

“First, understand the industry. Become knowledgeable about the players,

about their differences, and then pick your targets. We can see immediately

when someone is spraying CVs like a machine-gun at different funds

because they are all the same to this person. You need to be very consistent

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

20

in applying to a limited number of firms and convince a company to pick

you. So pick your battles carefully.

Second, interact with people. Find a personal point of attachment. We are

reachable. Use the alumni network. People will talk with you: they owe

INSEAD and I owe INSEAD. INSEAD is why I am here at Permira.

Third, make your CV outstanding. If you are a consultant you need to plan

for 2-3 years. You want to have private equity-related experience on your

CV. Make a perfect match for private equity with your skills and experience.

Having both banking and consulting experience is a golden combination

that may get us interested in you.

All of the above are the ways to get you an interview, not to land a job.

During the interview, it is important to understand that it is not necessarily a

technical interview, there are no standard tests (you will have them later on).

I want to understand what you have done, but I also want to understand what

kind of person you are because this is at least a 10-year career path. If you

go out of the fund in year 2 along the race, it will be a tough sale.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

21

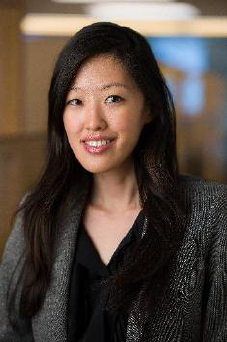

Exhibit 4. The Alumni Profile – Melissa Heng, General Atlantic

Melissa Heng MBA 11’J

Vice President, General Atlantic

As one of the founding members and the first local hire of General

Atlantic's South-East Asian office, Melissa joined GA right after

INSEAD, and has been working for GA for over 5 years. She is

responsible for the origination and execution of investment

opportunities in South-East Asia across sectors with a focus on

Internet & Technology and consumer-facing businesses.

Prior to INSEAD, Melissa worked as a corporate finance lawyer at

the law firm Drew & Napier in Singapore where she advised

clients across Asia. She then joined Macquarie as an investment

banker focusing on capital markets and M&A transactions in the

telecommunications, media, entertainment and technology space

in Singapore and the Middle East.

At INSEAD, Melissa was President of the Investment Management Club, which managed

the fund allocation of INSEAD.

She holds a Bachelor of Law (Hons) from King's College London.

What brought her to GA?

- Right time, right place, and a lot of hard work.

“

GA reached out to me through INSEAD Private Equity CV book when they

were opening their office in Singapore. I didn’t have a traditional

background because I started off in law and then moved to investment

banking before going to B-school. Being actively involved in the Investment

Management Club helped develop and showcase my interest in investing.”

She recognized that students needed to put in more effort to get into investment after

INSEAD because private equity recruitment in South-East Asia tended to be ad-hoc and

unstructured (unlike in the US), with firms recruiting only when they have resource

needs. Being a Singaporean, Melissa was able to leverage her local networks in the

region to secure other offers before graduation, before finally accepting the offer from

GA.

“

It’s really about which funds are hiring at that point of time. So that’s a bit

of luck, a bit of hustle, and you need to constantly be talking to people in the

industry to find out if there are any events that signal potential recruiting

(e.g. new funds being raised etc.).”

Why PE after INSEAD?

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

22

- Knowing what you are not interested is as important as knowing what you are.

When evaluating career options, for Melissa it was very important to not spend time on

what she knew she didn’t want to do. It is easy to hop on the bandwagon when many of

your classmates are interviewing for consulting and investment banking jobs. Time

spent preparing for consulting case interviews can be better spent on industry

networking or developing you investment skillset.

“

You need to know what your strengths and weaknesses are and where

your interests lie. You generally need to be an all-rounder to succeed in PE.

You need to have people skills to interact with entrepreneurs, but you also

need strong analytical and technical skills for business analysis and financial

modelling.”

What she enjoys doing at GA?

-Learning new business models and meeting interesting entrepreneurs,

particularly in her focus sector.

In GA, everyone is encouraged to specialise in a sector. Melissa focuses primarily on

internet & technology for origination, an industry that she is passionate about.

“

I really enjoy looking at the new business models coming up (from the

sector) all the time. I’ve seen the evolution of tech from being a non-existent

sector in SEA to the booming sector that it is today, and it’s really exciting to

be part of that and to follow these entrepreneurs on that journey.”

On the other hand, the lean setup at GA in Singapore also allows Melissa to look at deals

across other sectors, which she enjoys because it allows her to develop perspectives on

different business models and on how technology can add value to companies operating

in those traditional industries.

What are the challenges?

-Right company, right deal, right size.

The main challenge Melissa faces is to find the right deal that fits GA’s check size, which

is on average between US$75-200 million but can range between US$25-500 million for a

minority stake. It is especially challenging in SEA, since there are only a handful of

companies that have a proven business model, are growing fast, and are able to absorb

such a large amount of capital – and they tend to be highly valued or don’t require

capital.

“

I feel it’s (to find a deal) a lot of like finding the right job. It’s about

building the right relationships through various channels, and positioning

ourselves so that when the entrepreneur does require capital, we are top of

mind.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

23

In addition, having a relationship of trust with entrepreneurs is also critical, and

investors need to spend the time to convince entrepreneurs of the non-monetary value

that the fund can bring to their business. This process can take anywhere from a few

months to up to a few years before the actual investment is made.

“Because we are minority shareholders, we are not in a position of control

and so there needs to be trust that the entrepreneur is going to do the right

thing as a partner and vice versa. The entrepreneur needs to trust that we

will bring real value to the business once we invest. And it takes time to build

up the trust.”

Advice to INSEAD students who aspire to work in PE

- Solid financial modelling + Passion for investing + Good interview

preparation

Firstly, one should definitely be proficient with financial modelling, which is required by

most of the global PE firms. Generally, students without any sort of financial background

will usually struggle with the technical case study.

“

Just like for consulting interview preparations, have one of your classmates

with an investment background help you through a typical investment case,

and just keep practicing until you get it right every time.”

Secondly, prepare thoroughly for any potential questions and know your transactions.

Melissa pointed out some red flags during interviews: e.g. some students, when probed

about past deals they have done, are not able to talk through the transactions from the

perspective of an investor. A great investor, from Melissa’s perspective, has strong

strategic and business acumen, in addition to solid technical skills.

Thirdly, be genuinely passionate about the industry. Not being well prepared for

interviews reflects poorly on one’s level of passion for the industry and general work

ethic.

“

You need to ask yourself ‘Is it something that I am really passionate about

and can see myself doing for a long time?’ That’s the difference between

having a career versus just another job.”

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

24

Exhibit 5. Global PE capital raised by fund type, USD billions

Source: Global Private Equity Report 2017 by Bain & Company, page 9, accessed April 16, 2017,

http://www.bain.com/publications/articles/global-private-equity-report-2017.aspx

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

25

Exhibit 6. Breakdown of Institutional Investors in Private Equity by Location

Source: 2016 Preqin Global Private Equity & Venture Capital Report, page 50, accessed April 16,

2017, https://www.preqin.com/user/my/Publications/Publications.aspx

PE – Research Assignment Paper – Group 9 – Chen, Khamitov, Parkov, Tan, Viswanadha

26

References

1

Paul Clarke, “How to get through private equity interviews”, August 6, 2016, http://news.efinancialcareers.com/uk-

en/177907/guide-surviving-thriving-private-equity-interview

2

INSEAD - Admission Trends Over 5 Years (2011-2015), gmatclub.forum, accessed on April 16, 2017,

https://gmatclub.com/forum/calling-all-insead-mba-applicants-january-2017-intake-class-of-209251.html

3

INSEAD alumni community page of INSEAD official website, accessed on April 16, 2017,

https://www.insead.edu/alumni

4

INSEAD Private Equity Club web-page, accessed on April 16, 2017, http://mba-clubs.insead.edu/private-equity/

5

Paul Clarke, “The top 35 MBAs for getting a job in hedge funds, private equity and asset management”, August 18,

2016, http://news.efinancialcareers.com/uk-en/186153/top-35-mbas-getting-job-hedge-funds-private-equity-asset-

management