57593

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

(iv) The notice must include

representations by the commodity pool

operator that:

(A) The pool for which the Annual

Report is being prepared has

investments in one or more collective

investment vehicles (the

‘‘Investments’’);

(B) For all reports prepared under

paragraph (c) of this section and for

reports prepared under § 4.7(b)(3)(i) that

are audited by an independent public

accountant, the commodity pool

operator has been informed by the

independent public accountant engaged

to audit the commodity pool’s financial

statements that specified information

required to complete the pool’s annual

report is necessary in order for the

accountant to render an opinion on the

commodity pool’s financial statements.

The notice must include the name, main

business address, main telephone

number, and contact person of the

accountant; and

(C) The information specified by the

accountant cannot be obtained in

sufficient time for the Annual Report to

be prepared, audited, and distributed

before the Extended Date.

(D) For unaudited reports prepared

under § 4.7(b)(3)(i), the commodity pool

operator has been informed by the

operators of the Investments that

specified information required to

complete the pool’s annual report

cannot be obtained in sufficient time for

the Annual Report to be prepared and

distributed before the Extended Date.

(v) For each fiscal year following the

filing of the notice described in

paragraph (f)(2)(i) of this section, for a

particular pool, it shall be presumed

that the particular pool continues to

invest in another collective investment

vehicle and the commodity pool

operator may claim the extension of

time; Provided, however, that if the

particular pool is no longer investing in

another collective investment vehicle,

then the commodity pool operator must

file electronically with the National

Futures Association an Annual Report

within 90 days after the pool’s fiscal

year-end accompanied by a notice

indicating the change in the pool’s

status.

(vi) Any notice or statement filed

pursuant to this paragraph (f)(2) must be

signed by the commodity pool operator

in accordance with paragraph (h) of this

section.

* * * * *

Issued in Washington, DC, on November 2,

2009, by the Commission.

David Stawick,

Secretary of the Commission.

[FR Doc. E9–26789 Filed 11–6–09; 8:45 am]

BILLING CODE P

DEPARTMENT OF THE TREASURY

Office of Foreign Assets Control

31 CFR Part 501

Economic Sanctions Enforcement

Guidelines

AGENCY

: Office of Foreign Assets

Control, Treasury.

ACTION

: Final rule.

SUMMARY

: The Office of Foreign Assets

Control (OFAC) of the U.S. Department

of the Treasury is issuing this final rule,

‘‘Economic Sanctions Enforcement

Guidelines,’’ as enforcement guidance

for persons subject to the requirements

of U.S. sanctions statutes, Executive

orders, and regulations. This rule was

published as an interim final rule with

request for comments on September 8,

2008. This final rule sets forth the

Enforcement Guidelines that OFAC will

follow in determining an appropriate

enforcement response to apparent

violations of U.S. economic sanctions

programs that OFAC enforces. These

Enforcement Guidelines are published

as an Appendix to the Reporting,

Procedures and Penalties Regulations.

DATES

: This final rule is effective

November 9, 2009.

FOR FURTHER INFORMATION CONTACT

:

Elton Ellison, Assistant Director, Civil

Penalties, (202) 622–6140 (not a toll-free

call).

SUPPLEMENTARY INFORMATION

:

Electronic Availability

This document and additional

information concerning OFAC are

available from OFAC’s Web site

(http://www.treas.gov/ofac) or via

facsimile through a 24-hour fax-on-

demand service, tel.: (202) 622–0077.

Procedural Requirements

Because this final rule imposes no

obligations on any person, but only

explains OFAC’s enforcement policy

and procedures based on existing

substantive rules, prior notice and

public comment are not required

pursuant to 5 U.S.C. 553(b)(A). Because

no notice of proposed rulemaking is

required, the provisions of the

Regulatory Flexibility Act (5 U.S.C.

chapter 6) do not apply. This final rule

is not a significant regulatory action for

purposes of Executive Order 12866.

Although a prior notice of proposed

rulemaking was not required, OFAC

solicited comments on this final rule in

order to consider how it might make

improvements to these Guidelines.

OFAC received a total of 11 comments.

The collections of information related

to the Reporting, Procedures and

Penalties Regulations have been

previously approved by the Office of

Management and Budget (OMB) under

control number 1505–0164. A small

adjustment to that collection was

submitted to OMB in order to take into

account the voluntary self-disclosure

process set forth in the Guidelines. An

agency may not conduct or sponsor, and

a person is not required to respond to,

a collection of information unless it

displays a valid control number

assigned by OMB. This collection of

information is referenced in subpart I of

Part I, subpart G of part III and subpart

B of part V of these Guidelines, which

will constitute the new Appendix to

part 501. The referenced subparts

explain that the voluntary self-

disclosure of an apparent violation to

OFAC will be considered in

determining the appropriate agency

response to the apparent violation and,

in cases where a civil monetary penalty

is deemed appropriate, the penalty

amount. As set forth in subpart B of part

V of the Guidelines, an apparent

violation involving a voluntary self-

disclosure will result in a base penalty

amount at least 50 percent less than the

base penalty amount in similar cases

that do not involve a voluntary self-

disclosure. This provides an incentive

for persons who have or may have

violated economic sanctions laws to

voluntarily provide OFAC information

that it can use to better implement its

economic sanctions programs. The

submitters who will likely seek to avail

themselves of the benefits of voluntary

self-disclosure are businesses, other

entities, and individuals who find that

they have or may have violated a

sanctions prohibition and wish to

disclose their actual or potential

violation.

The estimated total annual reporting

and/or recordkeeping burden: 1,250

hours. The estimated annual burden per

respondent/record keeper: 10 hours.

Estimated number of respondents and/

or record keepers: 125. Estimated

annual frequency of responses: Once or

less, given that OFAC expects that

persons who voluntarily self disclose

their violations will take better care to

avoid future violations.

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00035 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57594

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

1

Public Law 110–96, 121 Stat. 1011 (October 16,

2007) (amending 50 U.S.C. 1705).

2

50 U.S.C. 1701–06.

Background

The primary mission of OFAC is to

administer and enforce economic

sanctions against targeted foreign

countries and regimes, terrorists and

terrorist organizations, weapons of mass

destruction proliferators, narcotic

traffickers, and others, in furtherance of

U.S. national security, foreign policy,

and economic objectives. OFAC acts

under Presidential national emergency

powers, as well as specific legislation, to

prohibit transactions and block (or

‘‘freeze’’) assets subject to U.S.

jurisdiction. Economic sanctions are

designed to deprive the target of the use

of its assets and to deny it access to the

U.S. financial system and the benefits of

trade, transactions, and services

involving U.S. markets, businesses, and

individuals. These same authorities

have also been used to protect certain

assets subject to U.S. jurisdiction and to

further important U.S. nonproliferation

goals.

OFAC administers and enforces

economic sanctions programs pursuant

to Presidential and statutory authorities.

OFAC is responsible for civil

investigation and enforcement of

economic sanctions violations

committed by Subject Persons, as

defined in the Guidelines. Where

appropriate, OFAC may coordinate its

investigative and enforcement activities

with federal, state, local and/or foreign

regulators and/or law enforcement

agencies. Active enforcement of these

programs is a crucial element in

preserving and advancing the national

security, foreign policy, and economic

objectives that underlie these initiatives.

Among other things, penalties, both

civil and criminal, are intended to serve

as a deterrent to conduct that

undermines the goals of sanctions

programs.

On January 29, 2003, OFAC

published, as a proposed rule, generally

applicable Economic Sanctions

Enforcement Guidelines, as well as a

proposed Appendix to the Cuban Assets

Control Regulations (CACR) providing a

schedule of proposed civil monetary

penalties for certain violations of the

CACR (Cuba Penalty Schedule). Though

this proposed rule was not finalized,

OFAC used the generally applicable

guidelines set forth therein as a general

framework for its enforcement actions

and the Cuban Penalty Schedule as a

framework for the imposition of civil

monetary penalties for the violations of

the CACR described therein. On January

12, 2006, OFAC published, as an

interim final rule, Economic Sanctions

Enforcement Procedures for Banking

Institutions, which withdrew the

January 29, 2003, proposed rule to the

extent that it applied to banking

institutions, as defined in the interim

final rule.

On October 16, 2007, the President

signed into law the International

Emergency Economic Powers

Enhancement Act (Enhancement Act),

1

substantially increasing the maximum

penalties for violations of the

International Emergency Economic

Powers Act (IEEPA),

2

a principal

statutory authority for most OFAC

sanctions programs. The increased

maximum penalty amounts set forth in

the Enhancement Act, as well as its

application to pending cases involving

apparent violations of IEEPA, prompted

the development of new Guidelines for

determining an appropriate enforcement

response to apparent violations of

sanctions programs enforced by OFAC,

and, in cases involving civil monetary

penalties, for determining the amount of

any civil monetary penalty.

On September 8, 2008, OFAC

published an interim final rule (73 FR

51933) setting forth Economic Sanctions

Enforcement Guidelines as enforcement

guidance for persons subject to the

requirements of U.S. sanctions statutes,

Executive orders, and regulations. The

Guidelines set forth in the interim final

rule superseded the enforcement

procedures for banking institutions set

forth in the interim final rule of January

12, 2006, which was withdrawn, as well

as the proposed guidelines set forth in

the proposed rule of January 29, 2003,

which was also withdrawn, with the

exception of the Cuba Penalty Schedule.

(Those withdrawn enforcement

procedures and guidelines continue to

apply to the categories of cases

identified in, and as provided in,

OFAC’s November 27, 2007 Civil

Penalties—Interim Policy and OFAC’s

October 28, 2008 Civil Penalties—

Revised Interim Policy, both of which

are available on OFAC’s Web site,

http://www.treas.gov/ofac. Those

Interim Policies provide that the

withdrawn enforcement procedures

generally apply to cases (a) in which a

Pre-Penalty Notice was mailed before

October 16, 2007, when the

Enhancement Act became law; (b)

where a tentative settlement amount

had been communicated and

memorialized; (c) where a party agreed

to a tolling or waiver of the statute of

limitations, which otherwise would

have expired before October 16, 2007;

and (d) in which a Pre-Penalty Notice

was mailed, or a settlement tentatively

reached, prior to the September 8, 2008,

publication of the interim final rule.) In

all cases in which a Pre-Penalty Notice

has been issued prior to the publication

of this final rule, the case will continue

to be processed in accordance with the

enforcement guidelines pursuant to

which such Pre-Penalty Notice was

issued. The interim final rule also

solicited comments on the Guidelines

set forth therein.

OFAC hereby publishes an amended

version of the Enforcement Guidelines

as a final rule. These Enforcement

Guidelines are published as an

Appendix to the Reporting, Procedures

and Penalties Regulations, 31 CFR part

501. Except as noted above, the

Guidelines set forth herein are

applicable to all persons subject to any

of the sanctions programs administered

by OFAC. The Guidelines set forth in

this final rule are not applicable to

penalty or enforcement actions by other

agencies based on the same underlying

course of conduct, the disposition of

goods seized by Customs and Border

Protection, or the release of blocked

property by OFAC.

The Guidelines set forth in this final

rule are applicable to all enforcement

matters currently pending before OFAC

or that will come before OFAC in the

future, whether such matters fall under

IEEPA or any of the other statutes

pursuant to which OFAC is authorized

to enforce sanctions (including, but not

limited to, the Trading With the Enemy

Act), with the exception of those

categories of cases set forth in OFAC’s

November 27, 2007 Civil Penalties—

Interim Policy and OFAC’s October 28,

2008 Civil Penalties—Revised Interim

Policy. The Guidelines reflect the

factors that OFAC will consider in

determining the appropriate

enforcement response to an apparent

violation of an OFAC sanctions

program, and those factors are

consistent across programs. The civil

penalty provisions of the Guidelines

take into account the maximum

penalties available under the various

statutes pursuant to which OFAC is

authorized to enforce its sanctions

programs.

Summary of Comments

OFAC received eleven sets of

comments on the interim final rule,

from the following organizations: The

American Bar Association, the

Association of Corporate Credit Unions,

the American Insurance Association, the

British Bankers’ Association, the

Clearing House Association, the Credit

Union National Association, the

Industry Coalition on Technology

Transfer, the Institute of International

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00036 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57595

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

3

Several of the comments were received after the

November 7, 2008, deadline for submission of

comments. Those comments are nevertheless

addressed herein.

Bankers, the National Foreign Trade

Council, the Securities Industry and

Financial Markets Association, and a

joint submission from the American

Bankers Association and the Bankers

Association for Finance and Trade.

3

Eight comments addressed the

definition of voluntary self-disclosure.

Although the final rule slightly amends

this definition, it does not do so in the

ways suggested by the comments. Six

comments questioned a perceived move

away from risk-based compliance, based

on OFAC’s withdrawal of the 2006

interim final rule setting forth Economic

Sanctions Enforcement Procedures for

Banking Institutions, and the risk

matrices that were issued as an annex to

that interim final rule. In response,

OFAC is reissuing a slightly edited and

consolidated risk matrix as an annex to

the Enforcement Guidelines and

clarifying that the adequacy of a Subject

Person’s risk-based compliance program

will be considered among the General

Factors considered by OFAC. Five

comments noted that OFAC should not

consider a Subject Person’s entering into

or refusing to enter into an agreement

tolling the statute of limitations in an

assessment of the Subject Person’s

cooperation with OFAC. In response,

OFAC is amending the Guidelines to

make clear that while entering into a

tolling agreement may be a basis for

mitigating the enforcement response or

lowering the penalty amount, a Subject

Person’s refusal to enter into such an

agreement will not be considered

against the Subject Person. Two

comments simply commended OFAC on

the Guidelines. Other comments

addressed other aspects of the

Guidelines.

Specific Responses to Comments

The comments received, OFAC’s

response to those comments, and

OFAC’s revisions to the Guidelines in

response to the comments are

summarized below.

1. Voluntary Self-disclosure

a. Third-Party Notifications. Many of

the comments that addressed the

definition of voluntary self-disclosure

expressed concern about the interim

final rule definition’s exclusion of

apparent violations where ‘‘a third party

is required to notify OFAC of the

apparent violation or a substantially

similar apparent violation because a

transaction was blocked or rejected by

that third party (regardless of whether or

when OFAC actually receives such

notice from the third party and

regardless of whether the Subject Person

was aware of the third party’s

disclosure).’’ The comments argued that

the definition should not exclude such

self-initiated notifications to OFAC, and

that OFAC should focus instead on the

good faith of the party making the

disclosure, regardless of whether

another party was obligated to report the

apparent violation. The comments

argued that broadening the definition of

voluntary self-disclosure will benefit

OFAC by encouraging such disclosures

and providing OFAC with additional

information regarding apparent

violations.

OFAC has considered these comments

but believes that the recommended

alternative approach would be difficult

to administer in a meaningful manner.

Accordingly, OFAC has determined to

maintain the exclusion for apparent

violations that a third party is required

to and does report to OFAC as a result

of the third party having blocked or

rejected a transaction in accordance

with OFAC’s regulations. The purpose

of mitigating the enforcement response

in voluntary self-disclosure cases is to

encourage the notification to OFAC of

apparent violations of which OFAC

would not otherwise have learned. In

those cases where a third party is

required to, and does, report an

apparent violation to OFAC, OFAC is

aware of the violation and there is no

need to provide incentives for such

notification. In addition, OFAC’s

administrative subpoena authority, 31

CFR 501.602, generally provides the

basis for OFAC to require the

production of whatever additional

information it may require to assess its

enforcement response to the apparent

violation. In those cases, therefore, there

is no need to further incentivize

disclosure to OFAC. Moreover, OFAC

believes that the ‘‘good faith’’ standard

suggested in the comments would be

administratively unworkable, as OFAC

would be unable to ascertain the good

or bad faith of Subject Persons making

disclosures of apparent violations. A

bright line rule generally defining a

voluntary self-disclosure based on

whether OFAC would otherwise have

learned of the apparent violation is

more readily administrable.

Consistent with the premise that in

those cases where OFAC would

otherwise not have learned of the

apparent violation a notification to

OFAC should be deemed a voluntary

self-disclosure, and in response to the

suggestion made in one comment,

OFAC is amending this aspect of the

definition of ‘‘voluntary self-disclosure’’

by deleting the words ‘‘whether or’’

from that part of the definition in the

interim final rule that provided that

notification to OFAC of an apparent

violation would not be considered a

voluntary self-disclosure ‘‘regardless of

whether or when OFAC actually

receives such notice from the third party

* * *.’’ Thus, the final rule provides

that such notifications shall not be

considered voluntary self-disclosures

‘‘regardless of when OFAC receives

such notice from the third party * * *.’’

The change is intended to make clear

that in the event that a third party that

is required to report an apparent

violation to OFAC fails to do so, and the

Subject Person notifies OFAC of the

apparent violation in a manner

otherwise consistent with a voluntary

self-disclosure, the notification will be

considered a voluntary self-disclosure.

In those cases where the third party

does notify OFAC before a final

enforcement response to the apparent

violation, the Subject Person’s

notification will not be considered a

voluntary self-disclosure even if the

Subject Person’s notification precedes

the third party’s notification. This is

consistent with the notion that

voluntary self-disclosure does not apply

where OFAC would have learned of the

apparent violation in any event—in this

case, from the subsequent required

disclosure by the third party.

Interestingly, different industry

sectors all commented that this

provision of the definition would

unfairly target their industry. Thus, the

banking industry commented that

financial institutions are

disproportionately affected by this

exclusion, a trade group commented

that this exclusion ‘‘define[s] the entire

import-export sector out of’’ the

definition, and the securities industry

commented that as a result of this

exclusion most filings by securities

firms would not be considered

voluntary self-disclosures. The fact that

these different industries believe that

the definition unfairly targets them

weakens the force of the argument as to

each. In any event, the argument does

not address the underlying basis for the

rule: The purpose of treating certain

notifications as voluntary self-

disclosures is to bring to OFAC’s

attention apparent violations of which it

otherwise would not have learned.

OFAC stresses that the final rule

provides (as did the interim final rule),

that ‘‘[i]n cases involving substantial

cooperation with OFAC but no

voluntary self-disclosure as defined

herein, including cases in which an

apparent violation is reported to OFAC

by a third party but the Subject Person

provides substantial additional

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00037 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57596

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

information regarding the apparent

violation and/or other related violations,

the base penalty amount generally will

be reduced between 25 and 40 percent.’’

In addition, a Subject Person’s

cooperation with OFAC—including

whether the Subject Person provided

OFAC with all relevant information

regarding an apparent violation

(whether or not voluntarily self-

disclosed), and whether the Subject

Person researched and disclosed to

OFAC relevant information regarding

any other apparent violations caused by

the same course of conduct—is a

General Factor to be considered in

assessing OFAC’s enforcement response

to the apparent violation. These

provisions are intended to reward

voluntary disclosures of all relevant

information and address the concerns

raised by the comments. The provisions

make clear that a Subject Person’s

cooperation with OFAC can have a

substantial impact on the nature of

OFAC’s enforcement response to an

apparent violation, even in cases that do

not meet the definition of ‘‘voluntary

self-disclosure’’ set forth in the final

rule.

Several comments noted that failure

to treat self-initiated notifications to

OFAC in the circumstances discussed

above as voluntary self-disclosures

causes unwarranted reputational harm

to the institutions involved. OFAC does

not believe that this concern provides a

sufficient basis to alter the definition of

voluntary self-disclosure discussed

above. In response to this comment,

OFAC has amended the final rule to

expressly provide that, where

appropriate, substantial cooperation by

a Subject Person in OFAC’s

investigation will be publicly noted.

b. Material Completeness. Several

comments also suggested that the

definition’s exclusion of disclosures that

are materially incomplete is unfair

because a party may not have had time

to complete its investigation or access

supplementary material before OFAC

learns of an apparent violation from

another source. The definition of

voluntary self-disclosure set forth in the

interim final rule, and retained in this

final rule, excludes only those

notifications where ‘‘the disclosure

(when considered along with

supplemental information provided by

the Subject Person) is materially

incomplete’’ (emphasis added).

Similarly, the definition provides that

‘‘[i]n addition to notification, a

voluntary self-disclosure must include,

or be followed within a reasonable

period of time by, a report of sufficient

detail to afford a complete

understanding of an apparent violation’s

circumstances, and should also be

followed by responsiveness to any

follow-up inquiries by OFAC.’’

(emphasis added). The definition thus

expressly contemplates that a Subject

Person may notify OFAC of an apparent

violation before it has completed its

investigation or accessed all of the

supplementary material necessary for a

complete disclosure. So long as that

information is provided to OFAC within

a reasonable period of time after the

initial notification of the apparent

violation, and assuming the other

aspects of the definition are met, the

disclosure would still constitute a

voluntary self-disclosure. OFAC

therefore concludes that this aspect of

the definition already accommodates

these comments and does not need to be

changed.

c. Good Faith. OFAC likewise has

considered and rejected the suggestion

that the definition of voluntary self-

disclosure not exclude disclosures that

include false or misleading information

or that are made without management

authorization, when the disclosure is

made in good faith. As noted above, the

good faith standard is not readily

administrable. OFAC believes that

disclosures that contain false or

misleading information should not

receive the substantial benefit accorded

to voluntary self-disclosures. In such

cases, OFAC will consider the totality of

the circumstances in determining

whether the false or misleading

information warrants negation of a

finding of voluntary self-disclosure.

When the Subject Person is an entity,

disclosures made without the

authorization of the entity’s senior

management do not reflect disclosure by

the entity but rather by a third party. A

finding of voluntary self-disclosure by

the Subject Person is not warranted in

whistleblower cases. Nor does OFAC

believe that a whistleblower should be

required to first notify the entity’s senior

management, as one comment

suggested.

d. Regulatory Suggestion. One

comment suggested that OFAC delete

the word ‘‘suggestion’’ from that part of

the definition of voluntary self-

disclosure that excludes a disclosure

that ‘‘is not self-initiated (including

when the disclosure results from a

suggestion or order of a federal or state

agency or official),’’ on the ground that

the term ‘‘suggestion’’ produces a

subjective standard. While OFAC

recognizes the concern expressed in the

comment, in many instances federal or

state regulators do not formally order

institutions to report an apparent

violation to OFAC. The use of the

phrase ‘‘suggestion’’ in this context is

intended to capture those instances in

which a Subject Person’s regulator, or

another government agency or official,

directs, instructs, tells, or otherwise

suggests to the Subject Person that it

notify OFAC of the apparent violation.

In such cases, the notification to OFAC

by the Subject Person is not properly

considered self-initiated and OFAC

likely would have learned of the

apparent violation from the other

government agency or official in the

event that the Subject Person did not

itself notify OFAC.

e. Timing of Notification. OFAC has

also considered the comment that

offered an alternative definition of

voluntary self-disclosure that would

have treated as a voluntary self-

disclosure any notification to OFAC of

an apparent violation prior to the time

that OFAC issued a Pre-Penalty Notice,

and suggested other changes to the

definition. OFAC does not believe that

the suggested changes are warranted. A

Pre-Penalty Notice is typically issued

once OFAC has completed an

investigation into an apparent violation,

and such investigation often involves

the issuance of administrative

subpoenas to the Subject Person.

Affording voluntary self-disclosure

credit to disclosures made after the

issuance of such a subpoena would

reward Subject Persons who did not

disclose the apparent violation to OFAC

until after OFAC had learned of it from

other sources, and it would not accord

with the purpose of mitigating the

enforcement response in voluntary self-

disclosure cases, which is to encourage

the notification to OFAC of apparent

violations of which OFAC would not

otherwise have learned.

f. Suspicious Activity Report Filing.

One comment asked that OFAC clarify

that the filing of a Suspicious Activity

Report (SAR) by a Subject Person

pursuant to the Bank Secrecy Act has no

impact on whether a subsequent

notification to OFAC of an apparent

violation, presumably based on the

same transaction that is the subject of

the SAR, constitutes a voluntary self-

disclosure. The filing of a SAR does not

itself preclude a determination of

voluntary self-disclosure for a

subsequent self-disclosure to OFAC of

the same transaction, except to the

extent that OFAC has learned of the

apparent violation prior to the filing of

the self-disclosure.

g. What to Report. One comment

requested clarification regarding the

circumstances in which the mere

possibility that a violation exists should

cause an institution to make a voluntary

self-disclosure. The comment noted that

the alleged uncertainty surrounding this

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00038 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57597

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

issue creates a strong incentive for an

institution to err on the side of reporting

transactions that likely do not constitute

a violation. OFAC does not believe that

additional guidance is necessary or

warranted. The Guidelines define an

‘‘apparent violation’’ as an actual or

possible violation of U.S. economic

sanctions laws, and they define a

voluntary self-disclosure as a self-

initiated notification to OFAC of an

apparent violation (subject to the other

provisions of the definition). The

Subject Person determines whether to

report an apparent violation to OFAC.

Such a notification to OFAC need not

constitute an admission that the

conduct at issue actually constitutes a

violation in order to be considered a

voluntary self-disclosure. To the extent

that the Guidelines as written provide

an incentive for ‘‘over-reporting’’ to

OFAC of possible violations, OFAC does

not view that as a problem that needs to

be addressed. To the contrary, OFAC

would prefer that Subject Persons report

a transaction or conduct that is

ultimately determined to not be a

violation, rather than that they elect not

to report conduct that does constitute a

violation.

h. Other OFAC Modifications. Finally,

OFAC has made two additional changes

to the definition of voluntary self-

disclosure. The first change is to make

clear that a self-initiated notification to

OFAC that is made at the same time as

another government agency learns of the

apparent violation (through the Subject

Person’s disclosure to that other agency

or otherwise) does qualify as a voluntary

self-disclosure if the other aspects of the

definition are met. This change is

intended to cover voluntary self-

disclosures made simultaneously to

OFAC and another government agency.

OFAC has thus substituted the phrase

‘‘prior to or at the same time’’ for the

phrase ‘‘prior to’’ in the operative

sentence of the definition, which now

reads:

‘‘Voluntary self-disclosure means self-

initiated notification to OFAC of an apparent

violation by a Subject Person that has

committed, or otherwise participated in, an

apparent violation of a statute, Executive

order, or regulation administered or enforced

by OFAC, prior to or at the same time that

OFAC, or any other federal, state, or local

government agency or official, discovers the

apparent violation or another substantially

similar apparent violation.’’

OFAC has also added the following

sentence to the definition of voluntary

self-disclosure:

‘‘Notification of an apparent violation to

another government agency (but not to

OFAC) by a Subject Person, which is

considered a voluntary self-disclosure by that

agency, may be considered a voluntary self-

disclosure by OFAC, based on a case-by-case

assessment of the facts and circumstances.’’

This is intended to clarify that OFAC

may treat a voluntary self-disclosure to

another government agency as a

voluntary self-disclosure to OFAC when

the circumstances so warrant.

2. Risk-Based Compliance

Six comments questioned whether

OFAC intended to move away from the

risk-based compliance approach

reflected in the 2006 Economic

Sanctions Enforcement Procedures for

Banking Institutions, which, along with

their appended risk matrices, were

withdrawn by the interim final rule. In

no way has OFAC moved away from

considering an institution’s risk-based

compliance program in assessing the

appropriate enforcement response to an

apparent violation. The final rule

clarifies this by making explicit

reference to risk-based compliance in its

discussion of General Factor E, which

focuses on a Subject Person’s

compliance program, and by re-

promulgating with minor edits and in

consolidated form, as an annex to the

final rule, the risk matrices that had

originally been promulgated as an annex

to the 2006 Enforcement Procedures. By

these changes, OFAC intends to reflect

that it will continue to apply the same

risk-based principles it has been

applying in assessing the overall

adequacy of a Subject Person’s

compliance program.

Two comments argued that in the case

of banks, OFAC’s focus should be more

narrowly focused on the bank’s fault or

the nature of its compliance program.

OFAC has considered these comments,

but believes that all of the General

Factors are as applicable to banks as

they are to other Subject Persons. Those

Factors account for both fault and the

nature and existence of a compliance

program, but they also account for other

criteria that are relevant to a

determination of an appropriate

enforcement response to an apparent

violation. For example, the degree of

harm caused by an apparent violation is

as relevant and important a factor to

consider in cases involving banks as it

is in other cases. OFAC thus disagrees

with the comment that asserted that less

weight should be afforded to the harm

to sanctions programs objectives and a

greater emphasis placed on risk-based

compliance. The harm to sanctions

program objectives is as valid and

relevant a consideration as an

institution’s risk-based compliance

program, and the Final Guidelines

appropriately account for consideration

of both factors.

One comment expressed concern

about the absence of a process to

periodically evaluate an institution’s

violations in the context of its overall

OFAC compliance program and OFAC

compliance record. The Guidelines,

however, expressly provide for

consideration of both an institution’s

OFAC compliance program and its

overall compliance record over time in

a number of places. For example, the

Guidelines provide for consideration of

a Subject Person’s compliance program

in General Factor E, which, as noted

above, has been clarified to make

explicit reference to risk-based

compliance. The Guidelines also

provide that in considering the

individual characteristics of a Subject

Person (General Factor D), OFAC will

consider ‘‘[t]he total volume of

transactions undertaken by the Subject

Person on an annual basis, with

attention given to the apparent

violations as compared with the total

volume.’’ This provision of the

Guidelines is intended to allow for the

consideration of any apparent violation

in the context of a Subject Person’s

overall compliance record.

Another comment addressing risk-

based compliance asserted that the

Guidelines reflect ‘‘OFAC’s stated

intention to apply penalties on every

erroneous transaction.’’ The Guidelines

do not so state; to the contrary, they

expressly note that ‘‘OFAC will give

careful consideration to the

appropriateness of issuing a cautionary

letter or Finding of Violation in lieu of

the imposition of a civil monetary

penalty.’’ Another comment suggested

that OFAC should state that it will not

assess penalties based on minor or

isolated compliance deficiencies. OFAC

believes that the process set forth in the

Guidelines for determining its

enforcement response to an apparent

violation is appropriate and that it

would not be appropriate to make

broader, categorical statements of its

enforcement policy based on the minor

or isolated nature of an apparent

violation. The General Factors already

account for the consideration of the

minor or isolated nature of an apparent

violation in determining whether a civil

monetary penalty is warranted.

3. Cooperation and Tolling Agreements

Five comments argued that OFAC

should not consider whether a Subject

Person agreed to waive the statute of

limitations or enter into a tolling

agreement in assessing the Subject

Person’s cooperation with OFAC. The

comments argued that it was unfair and

contrary to public policy to consider

this as a factor. One comment suggested

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00039 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57598

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

4

The base penalty amount for a non-egregious

case involving a voluntary self-disclosure equals

one-half of the transaction value, capped at

$125,000 for an apparent violation of IEEPA and

$32,500 for an apparent violation of TWEA.

that the provision should either be

dropped or its consideration limited to

cases where late discovery by or

notification to OFAC threatens

resolution within the five year statute of

limitations period and that tolling

agreements should be limited to

extending the period for no more than

five years from discovery of the

apparent violation by OFAC.

OFAC has carefully considered these

comments. The interim final rule

addressed both waivers of the statute of

limitations and tolling agreements. It is

not OFAC’s general practice to seek

outright waivers of the statute of

limitations, and the final rule eliminates

any reference to statute of limitations

waivers.

OFAC agrees that a Subject Person’s

refusal to enter into a tolling agreement

should not be considered an aggravating

factor in assessing a Subject Person’s

cooperation or otherwise. At the same

time, a tolling agreement can be of

significant value to OFAC, especially in

cases where OFAC does not learn of an

apparent violation at or near the time it

occurs, in particularly complex cases, or

in cases in which a Subject Person has

requested and received additional time

to respond to a request for information

from OFAC. Accordingly, OFAC

believes it appropriate to consider a

Subject Person’s entering into a tolling

agreement in a positive light and as a

basis for mitigating the enforcement

response or lowering the penalty

amount. The final rule thus clarifies that

while a Subject Person’s willingness to

enter into a tolling agreement may be

considered a mitigating factor, a Subject

Person’s unwillingness to enter into

such an agreement will not be

considered against the Subject Person.

4. Penalty Calculation

Two comments addressed the

calculation of the base penalty amount

under the Guidelines.

a. Disparity in Base Penalty Amounts.

One comment suggested that the

applicable schedule amounts, which are

applicable to cases involving non-

egregious apparent violations that are

not voluntarily self-disclosed to OFAC,

be changed to lessen the disparity in the

base penalty amount between such

cases and non-egregious cases that are

voluntarily self-disclosed.

4

OFAC has

considered this suggestion but believes

that the applicable schedule amounts,

which provide for a gradated series of

penalties based on the underlying

transaction value, reflect an appropriate

starting point for the penalty calculation

in non-egregious cases not involving a

voluntary self-disclosure. As currently

structured, the base penalty calculation

ensures that the base penalty for a

voluntarily self-disclosed case will

always be one-half or less than one-half

of the base penalty for a similar case

that is not voluntarily self-disclosed.

This is intended to serve as an

additional incentive for voluntary self-

disclosure.

b. Other Penalty Issues. A second

comment made a number of suggestions

regarding the penalty calculation. OFAC

has considered each of these

suggestions, which are discussed below.

i. Egregious Cases. First, this

comment suggested that OFAC reduce

the base penalty amount for egregious

cases by 50 percent and clarify the

extent to which that amount may be

increased by aggravating factors.

Reducing the base penalty amount for

egregious cases would not adequately

reflect the seriousness with which

OFAC views such cases. As set forth in

the preamble to the interim final rule,

OFAC anticipates that the majority of

enforcement cases will fall in the non-

egregious category.

ii. Specified Reduction for

Remediation. Second, this comment

suggested that OFAC provide for

remedial measures as a mitigating factor

and state the extent to which such

actions generally will reduce the base

penalty amount (e.g., 10–25%). The

Guidelines expressly recognize a

Subject Person’s remedial response as

one of the General Factors OFAC will

consider in determining its enforcement

response to an apparent violation.

OFAC does not believe it appropriate to

identify a specific range of mitigation

for remedial measures, which can vary

widely in their nature and scope. The

Guidelines envision a holistic

examination of the facts and

circumstances surrounding an apparent

violation in determining a proposed

penalty amount. With the exception of

first offenses and substantial

cooperation, OFAC does not believe it

appropriate to provide a specified

mitigation percentage for the existence

of potentially mitigating factors.

iii. Specified Reduction for

Cooperation. Third, the comment

suggested that OFAC specify that

substantial cooperation in voluntary

self-disclosure cases would reduce the

base penalty amount by 25% to 40% (as

would occur in cases that do not involve

a voluntary self-disclosure). This

suggestion appears to misapprehend the

purpose of the provision of the

Guidelines that provides for such a

reduction in non-voluntarily self-

disclosed cases. The reduction in the

base penalty amount for cases involving

substantial cooperation but no voluntary

self-disclosure is intended to

approximate the significant mitigation

provided for voluntary self-disclosure

cases in the base penalty amount itself.

This reduction is intended to afford

parties whose conduct was reported to

OFAC by others (for example, through a

blocking or reject report) the

opportunity to obtain, by providing

substantial cooperation, much (but not

all) of the benefit they would have

obtained had they voluntarily self-

disclosed the apparent violation.

Subject Persons who have voluntarily

self-disclosed their apparent violations

to OFAC are already benefiting from a

significantly reduced base penalty

amount. Moreover, a voluntary self-

disclosure must include, or be followed

within a reasonable period of time by,

a report of sufficient detail to afford a

complete understanding of an apparent

violation’s circumstances, and should

also be followed by responsiveness to

any follow-up inquiries by OFAC.

OFAC recognizes that in some instances

an additional reduction in the base

penalty amount based on substantial

cooperation may be warranted in cases

involving voluntary self-disclosure, but

that additional reduction may be less

than 25 to 40 percent.

iv. Specified Additional Adjustments.

Fourth, the comment suggested that

OFAC specify that further adjustments

to the base penalty amount may be

made depending on the relevance of the

other General Factors, including in

particular the existence and nature of a

compliance program and permissibility

of the conduct under applicable foreign

law. The Guidelines already expressly

provide that the base penalty amount

may be adjusted to reflect applicable

General Factors, including the existence

and nature of a compliance program.

The suggestion that the penalty be

adjusted in light of the permissibility of

the conduct under applicable foreign

law is addressed below under the

heading ‘‘Compliance With Foreign

Law.’’

v. Emphasize Number vs. Value of

Transactions. Fifth, the comment

suggested that OFAC clarify that when

considering ‘‘apparent violations as

compared with the total volume’’ of

transactions undertaken by a Subject

Person, the focus will be on the number

rather than the value of transactions.

OFAC does not believe that such a

clarification is warranted. While in

many cases the overall number of

transactions, as compared to the number

of apparent violations, will be the

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00040 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57599

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

appropriate measure of a Subject

Person’s overall compliance program,

there may be cases where the relative

value of the transactions is the more

appropriate metric. OFAC will address

this issue on a case-by-case basis, as

appropriate.

vi. First Violations. Finally, the

comment suggested that OFAC clarify

that, for purposes of the reduction of the

penalty amount by up to 25% for cases

involving a Subject Person’s first

violation, OFAC will consider the entire

set of ‘‘substantially similar violations’’

at issue in a case as a single ‘‘first

violation,’’ and thus provide the penalty

reduction for all transactions at issue,

and not just for the first of the

substantially similar violations. OFAC

intends that in enforcement cases

addressing a set of ‘‘substantially similar

violations,’’ the penalty reduction for a

Subject Person’s first violation will

generally apply to the entire set of

‘‘substantially similar violations’’ and

not solely to the first of those violations.

OFAC has added the following sentence

to the final rule to clarify this: ‘‘A group

of substantially similar apparent

violations addressed in a single Pre-

Penalty Notice shall be considered as a

single violation for purposes of this

subsection.’’ In addition, OFAC has

clarified that an apparent violation

generally will be considered a ‘‘first

violation’’ if the Subject Person has not

received a penalty notice or Finding of

Violation from OFAC in the five years

preceding the date of the transaction

giving rise to the apparent violation, and

that in those cases where a prior penalty

notice or Finding of Violation within

the preceding five years involved

conduct of a substantially different

nature from the apparent violation at

issue, OFAC may still consider the

apparent violation at issue a ‘‘first

violation.’’

5. General Factors

A number of comments either

identified additional proposed General

Factors that OFAC should consider or

suggested the deletion of General

Factors as inappropriate for OFAC’s

consideration.

a. Compliance With Foreign Law. Two

comments suggested that, in cases

concerning conduct occurring outside

the United States, OFAC should

consider whether the conduct in

question is permissible under the

applicable law of another jurisdiction.

OFAC does not agree that the

permissibility of conduct under the

applicable laws of another jurisdiction

should be a factor in assessing an

apparent violation of U.S. laws. In cases

where the applicable laws of another

jurisdiction require conduct prohibited

by OFAC sanctions (or vice versa),

OFAC will consider the conflict under

General Factor K, which provides for

the consideration of relevant factors on

a case-by-case basis. OFAC notes that

Subject Persons can seek a license from

OFAC to engage in otherwise prohibited

transactions and that the absence of

such a license request will be

considered in assessing an apparent

violation where conflict of laws is raised

by the Subject Person.

b. Reliance on Advice from OFAC.

Three comments suggested that OFAC

should explicitly state that good faith

reliance on advice from the OFAC

hotline (two comments) or on a

reasoned analysis of OFAC regulations

with the assistance of private counsel

(one comment) should be considered in

assessing an appropriate enforcement

response. Subject Persons are

encouraged to seek written guidance

from OFAC on complex matters for the

sake of clarity. Good faith reliance on

substantiated advice received from the

OFAC hotline or from counsel is

subsumed within OFAC’s consideration

of whether a Subject Person willfully or

recklessly violated the law.

c. Relevance of Future Compliance/

Deterrence. One comment suggested

that OFAC should eliminate General

Factor J, which focuses on the impact

that administrative action may have on

promoting future compliance with U.S.

economic sanctions by the Subject

Person and similar Subject Persons,

arguing that OFAC’s enforcement

response should focus solely on the

Subject Person’s culpability. OFAC

rejects this argument, as the purpose of

enforcement action includes raising

awareness, increasing compliance, and

deterring future violations, and not

merely punishment of prior conduct.

d. Reason to Know. One comment

suggested that OFAC should eliminate

the ‘‘reason to know’’ provision of

General Factor B, which focuses on the

Subject Person’s awareness of the

conduct giving rise to the apparent

violation. OFAC rejects this suggestion

as it would invite Subject Persons to act

with willful blindness. OFAC believes

the ‘‘reason to know’’ formulation is

consistent with general legal principles

and appropriate for consideration.

e. Responsibility for Employees. One

comment suggested that OFAC should

make clear that actions of ‘‘rogue

employees,’’ including supervisors or

managers, will not be attributed to

organizations so long as a reasonable

compliance program was in place.

OFAC rejects this suggestion. The

actions of employees may be properly

attributable to their organizations,

depending on the facts and

circumstances of the particular case.

Among the factors OFAC will consider

in determining whether such actions are

attributable to an organization are the

position of the employee in question,

the nature of the conduct (including

how long it lasted), who else was or

should have been aware of the conduct,

and the existence and nature of a

compliance program intended to

identify and stop such conduct.

f. Sanctions History. One comment

suggested that cautionary letters,

warning letters, and evaluative letters

should not be considered when

assessing a Subject Person’s sanctions

violations history. OFAC believes that

such prior letters are appropriate to

consider in determining an appropriate

enforcement response. In addition, such

letters evidence the Subject Person’s

awareness of OFAC sanctions generally.

OFAC has amended the final rule to

refer to ‘‘sanctions history’’ instead of

‘‘sanctions violations history’’ to make

clear that consideration is not limited to

prior formal determinations of sanctions

violations.

OFAC has also amended the final rule

to note that, as a general matter,

consideration of a Subject Person’s

sanctions history will be limited to the

five years preceding the transaction

giving rise to the apparent violation. As

explained above, a five-year limitation

has also been incorporated into the

provision providing that in cases

involving a Subject Person’s first

violation, the base penalty amount

generally will be reduced up to 25

percent, so that ‘‘first violation’’ is

understood as the first violation in the

five years preceding the transaction

giving rise to the apparent violation. In

certain cases, however, such as those

involving enforcement responses to

substantially similar apparent

violations, it may be appropriate to

consider sanctions history outside the

five-year period.

g. Transition Period for Foreign

Acquisitions. One comment suggested

that the Guidelines should provide a

transition period for cases in which a

Subject Person acquires an entity

outside the United States not previously

subject to OFAC requirements. OFAC

does not believe that such a provision

is warranted. U.S. persons acquiring

entities outside the United States should

consider OFAC compliance as part of

their due diligence review of the

acquisition.

6. Provision of Information to OFAC

Four comments focused on possible

impediments to fully complying with an

OFAC request for information. Three of

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00041 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57600

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

5

The Trading With the Enemy Act and its

implementing regulations, 31 CFR part 501, subpart

D, provide for Administrative Law Judge hearings

on penalty determinations. Nothing in the

Guidelines affects the applicability of those

provisions.

these comments raised concerns about

foreign laws that may prohibit the

provision of requested information to

OFAC. OFAC does not believe that these

comments warrant a change to the text

of the interim final rule. As discussed

above with respect to conflict-of-laws

situations, OFAC will give due

consideration to applicable restrictions

of foreign law regarding the provision of

information to OFAC on a case-by-case

basis. OFAC expects that Subject

Persons will provide to OFAC a detailed

explanation of any allegedly applicable

foreign law and the steps undertaken by

the Subject Person to avail themselves

of all legal means to provide the

requested information.

One comment raised concerns about

information protected by the attorney-

client privilege or the attorney work

product doctrine. OFAC generally does

not expect Subject Persons to provide

privileged or protected information in

response to a request for information or

otherwise. OFAC does, however, expect

Subject Persons who withhold

responsive information on the grounds

of the attorney-client or other privilege

or the work product doctrine to properly

invoke such privilege or protection and

to identify such withheld information

on a privilege log, in accordance with

any instructions accompanying requests

for information and ordinary legal

practice. OFAC has clarified the

provision of the Guidelines providing

for penalties for failure to respond to a

request for information by eliminating

the reference to ‘‘failure to furnish the

requested information’’ and instead

referring to a ‘‘failure to comply’’ with

a request for information. The revised

language is intended to make clear that

OFAC will not seek penalties in those

cases where responsive information is

withheld on the basis of an apparently

applicable and properly invoked

privilege.

7. Penalty/Finding of Violation Process

Several comments made suggestions

regarding OFAC’s penalty process. One

comment suggested that OFAC should

offer Subject Persons a meeting before

issuing a Pre-Penalty Notice, and

another comment suggested that OFAC

provide a process by which to appeal a

final enforcement decision. OFAC does

not believe that the adoption of either

suggestion is warranted. In most cases,

OFAC will have communicated with the

Subject Person (by means of issuing a

request for information or receiving a

disclosure) prior to issuance of the Pre-

Penalty Notice. Moreover, the Pre-

Penalty Notice does not constitute final

agency action and specifically affords a

Subject Person the opportunity to

respond to the allegations and proposed

penalty set forth therein with additional

information or argument.

OFAC also does not believe that an

administrative appeal process is

warranted. In cases involving civil

monetary penalties, the Pre-Penalty

Process just described affords a Subject

Person sufficient opportunity to present

its case to OFAC before a Penalty Notice

is issued. In cases involving a Finding

of Violation, the Guidelines provide that

a Finding of Violation will afford the

Subject Person an opportunity to

respond to OFAC’s determination that a

violation has occurred before the

finding is made final. No other actions

by OFAC constitute formal

determinations of violation, and no

administrative appeal process is

therefore necessary in such cases.

5

8. Other Comments

One comment suggested that OFAC

should be sensitive to the views of non-

U.S. regulators. The Guidelines explain

that OFAC may seek information from a

regulated institution’s foreign regulator,

and may take into account the views of

a foreign regulator with respect to a

Subject Person’s compliance program

where relevant. Nor do the Guidelines

preclude other consideration of foreign

regulators’ views. Accordingly, OFAC

believes that no additional changes are

necessary in this regard.

One comment suggested that the

definition of ‘‘transaction value’’ needs

clarification because it does not allocate

responsibility in multiparty

transactions, and this comment

suggested certain edits to the definition

with the goal of clarifying that

transaction value will be determined

based on a Subject Person’s role in the

transaction. OFAC has considered this

comment but determined that no change

is needed to the definition of transaction

value. The current definition provides

sufficient flexibility to allow for the

determination of an appropriate

transaction value in a wide variety of

circumstances, including multiparty

transactions where the differing roles of

the parties may result in differing

transaction values.

One comment suggested that there

should be two sets of guidelines, one for

financial institutions and one for

entities focused on trade in goods,

arguing that these types of entities

maintain different business models.

OFAC considered such an approach

when developing the Guidelines, but

determined that a single set of

Guidelines, providing general factors

and sufficient flexibility, was a better

approach. The Guidelines as crafted do

not dictate a particular outcome in any

particular case, but rather are intended

to identify those factors most relevant to

OFAC’s enforcement decision and to

guide the agency’s exercise of its

discretion. Because the General Factors

are equally applicable to all sectors, and

because the Guidelines provide

sufficient flexibility to allow for the

consideration of the factors most

relevant to a particular Subject Person,

OFAC does not believe that

particularized sets of Guidelines for

particular business models are

warranted or necessary.

OFAC Edits

In addition to the changes made in

response to public comments and the

additional changes to the definition of

voluntary self-disclosure described

above, OFAC has made several other

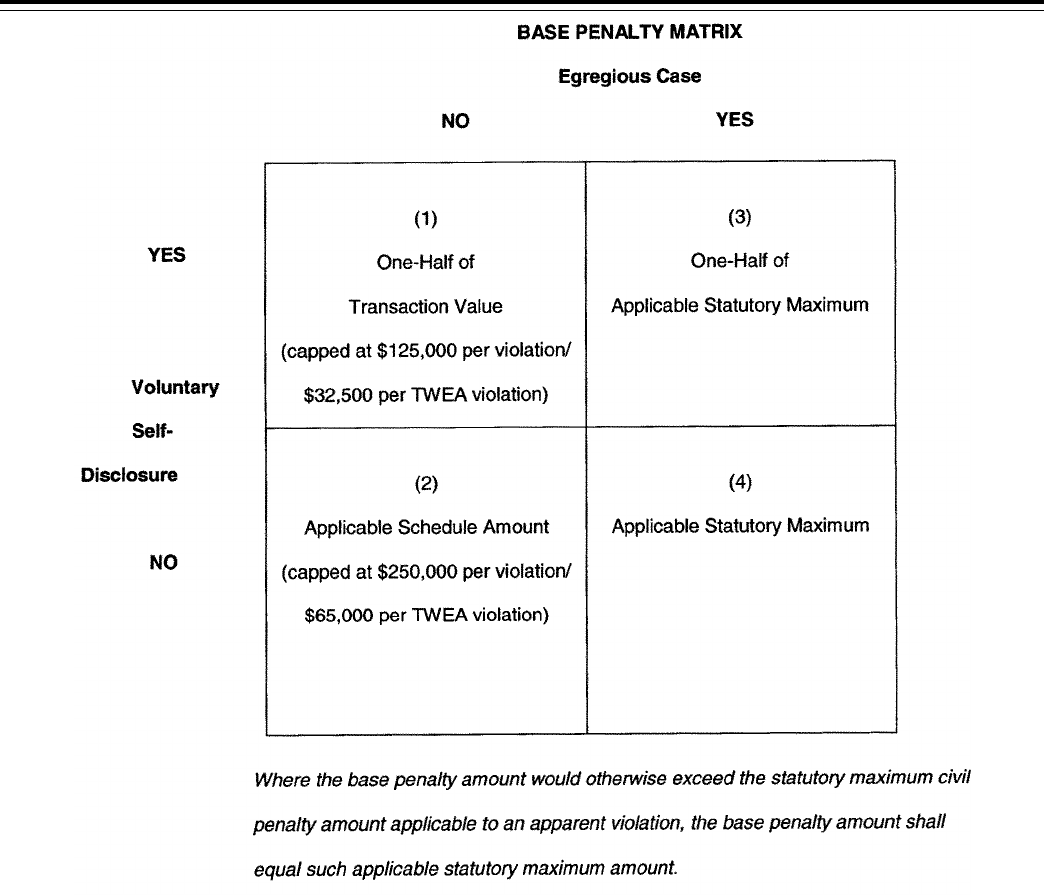

changes to the Guidelines. First, OFAC

has clarified the base penalty amounts

for transactions subject to the Trading

With the Enemy Act (TWEA), which

presently has a $65,000 statutory

maximum penalty. In non-egregious

cases involving apparent violations of

TWEA, where the apparent violation is

disclosed through a voluntary self-

disclosure by the Subject Person (i.e.,

Box ‘‘1’’ on the penalty matrix), the base

amount of the proposed civil penalty

shall be capped at a maximum of

$32,500 per violation. This correction is

necessary to ensure that in such cases

the base amount of the proposed civil

penalty is no more than one-half the

base penalty amount for a similar

transaction that is not voluntarily self-

disclosed.

OFAC is also clarifying that for non-

egregious transactions under TWEA that

are not voluntarily self-disclosed, the

base amount of the civil penalty shall be

capped at $65,000. The Guidelines

already provide for this by capping base

penalty amounts at the applicable

statutory maximum; this change is

intended simply to clarify this point.

Similarly, OFAC is clarifying that, in

egregious cases, the base penalty

calculation will be based on the

‘‘applicable’’ statutory maximum, in an

effort to signal that the base penalty in

such cases will differ for transactions

under IEEPA (where the statutory

maximum equals the greater of $250,000

or an amount that is twice the value of

the transaction), TWEA (where the

statutory maximum equals $65,000), or

other applicable statutes.

VerDate Nov<24>2008 15:01 Nov 06, 2009 Jkt 220001 PO 00000 Frm 00042 Fmt 4700 Sfmt 4700 E:\FR\FM\09NOR1.SGM 09NOR1

WReier-Aviles on DSKGBLS3C1PROD with RULES

57601

Federal Register / Vol. 74, No. 215 / Monday, November 9, 2009 / Rules and Regulations

OFAC has also amended the

Guidelines to provide for a penalty of

up to $50,000 for a failure to maintain

records in conformance with the

requirements of OFAC regulations. This

change is intended to ensure that

penalties for a failure to maintain

records are commensurate with

penalties for a failure to comply with a

requirement to furnish information.

The Guidelines are also amended to

make clear that for apparent violations

identified in the Cuba Penalty Schedule,

68 FR 4422, 4429 (Jan. 29, 2003), for

which a civil monetary penalty has been

deemed appropriate, the base penalty

amount shall equal the amount set forth

in the Schedule for such a violation,

except that the base penalty amount

shall be reduced by 50% in cases of

voluntary self-disclosure. This is

intended to clarify the interplay

between the penalty amounts set forth

in the Cuba Penalty Schedule and the

base penalty calculation process set

forth in the Guidelines.

OFAC has eliminated the reference to

the Cuba Travel Service Provider

Circular in Part IV of the Guidelines, as

that Circular has been amended to

include a reference to the Guidelines,

which now govern apparent violations

by licensed Travel Service Providers.

OFAC has also changed references to

‘‘conduct, activity, or transaction’’ to

‘‘conduct’’ throughout the Guidelines.

This change is not intended to have

substantive effect, but rather to provide

greater consistency in terminology

within the Guidelines. OFAC

understands the term ‘‘conduct’’ to

encompass ‘‘activities’’ and

‘‘transactions,’’ and notes the definition

of an ‘‘apparent violation’’ is based on

the term ‘‘conduct.’’

Finally, in General Factor H,

concerning the timing of the apparent

violation in relation to the imposition of

sanctions, OFAC has changed the word

‘‘soon’’ to ‘‘immediately’’ so that the

relevant provision reads: ‘‘the timing of

the apparent violation in relation to the

adoption of the applicable prohibitions,

particularly if the apparent violation

took place immediately after relevant

changes to the sanctions program

regulations or the addition of a new

name to OFAC’s List of Specially

Designated Nationals and Blocked

Persons (SDN List).’’ This change is

intended to more accurately reflect the

purpose of General Factor H and to

convey that mitigation as a result of

changes to sanctions program

regulations or additions to the SDN List

is unlikely to be applicable other than

in the time period immediately

following such changes or additions.

List of Subjects in 31 CFR Part 501

Administrative practice and

procedure, Banks, Banking, Insurance,

Money service business, Penalties,

Reporting and recordkeeping

requirements, Securities.

■ For the reasons set forth in the

preamble, 31 CFR part 501 is amended

as follows:

PART 501—REPORTING,

PROCEDURES AND PENALTIES

REGULATIONS

■ 1. The authority citation for part 501

continues to read as follows:

Authority: 8 U.S.C. 1189; 18 U.S.C. 2332d,

2339B; 19 U.S.C. 3901–3913; 21 U.S.C. 1901–

1908; 22 U.S.C. 287c; 22 U.S.C. 2370(a),

6009, 6032, 7205; 28 U.S.C. 2461 note; 31

U.S.C. 321(b); 50 U.S.C. 1701–1706; 50 U.S.C.

App. 1–44.

■ 2. Part 501 is amended by revising

Appendix A to Part 501 to read as

follows:

Appendix A to Part 501—Economic

Sanctions Enforcement Guidelines.

Note: This appendix provides a general

framework for the enforcement of all

economic sanctions programs administered

by the Office of Foreign Assets Control

(OFAC).

I. Definitions

A. Apparent violation means conduct that

constitutes an actual or possible violation of

U.S. economic sanctions laws, including the

International Emergency Economic Powers

Act (IEEPA), the Trading With the Enemy Act

(TWEA), the Foreign Narcotics Kingpin

Designation Act, and other statutes

administered or enforced by OFAC, as well

as Executive orders, regulations, orders,

directives, or licenses issued pursuant

thereto.

B. Applicable schedule amount means:

1. $1,000 with respect to a transaction

valued at less than $1,000;

2. $10,000 with respect to a transaction

valued at $1,000 or more but less than

$10,000;

3. $25,000 with respect to a transaction

valued at $10,000 or more but less than

$25,000;

4. $50,000 with respect to a transaction

valued at $25,000 or more but less than

$50,000;

5. $100,000 with respect to a transaction

valued at $50,000 or more but less than

$100,000;

6. $170,000 with respect to a transaction

valued at $100,000 or more but less than

$170,000;

7. $250,000 with respect to a transaction

valued at $170,000 or more, except that

where the applicable schedule amount as

defined above exceeds the statutory

maximum civil penalty amount applicable to

an apparent violation, the applicable

schedule amount shall equal such applicable

statutory maximum civil penalty amount.

C. OFAC means the Department of the

Treasury’s Office of Foreign Assets Control.

D. Penalty is the final civil penalty amount

imposed in a Penalty Notice.

E. Proposed penalty is the civil penalty

amount set forth in a Pre-Penalty Notice.

F. Regulator means any Federal, State,

local or foreign official or agency that has

authority to license or examine an entity for

compliance with federal, state, or foreign

law.

G. Subject Person means an individual or

entity subject to any of the sanctions

programs administered or enforced by OFAC.

H. Transaction value means the dollar

value of a subject transaction. In export and

import cases, the transaction value generally

will be the domestic value in the United

States of the goods, technology, or services

sought to be exported from or imported into

the United States, as demonstrated by

commercial invoices, bills of lading, signed

Customs declarations, or similar documents.

In cases involving seizures by U.S. Customs

and Border Protection (CBP), the transaction

value generally will be the domestic value as

determined by CBP. If the apparent violation

at issue is a prohibited dealing in blocked

property by a Subject Person, the transaction

value generally will be the dollar value of the

underlying transaction involved, such as the

value of the property dealt in or the amount

of the funds transfer that a financial

institution failed to block or reject. Where the

transaction value is not otherwise

ascertainable, OFAC may consider the market

value of the goods or services that were the

subject of the transaction, the economic

benefit conferred on the sanctioned party,

and/or the economic benefit derived by the

Subject Person from the transaction, in

determining transaction value. For purposes

of these Guidelines, ‘‘transaction value’’ will

not necessarily have the same meaning, nor

be applied in the same manner, as that term

is used for import valuation purposes at 19

CFR 152.103.

I. Voluntary self-disclosure means self-

initiated notification to OFAC of an apparent

violation by a Subject Person that has

committed, or otherwise participated in, an

apparent violation of a statute, Executive

order, or regulation administered or enforced

by OFAC, prior to or at the same time that

OFAC, or any other federal, state, or local

government agency or official, discovers the

apparent violation or another substantially