Fiscal policy coordination in currency unions

at the effective lower bound

Thomas Hettig and Gernot J. M¨uller

∗

January 2017

Abstract

According to the pre-crises consensus there are separate domains for monetary and fiscal

stabilization in a currency union. While the common monetary policy takes care of union-

wide fluctuations, fiscal policies should be tailored to meet country-specific conditions.

This separation is no longer optimal, however, if monetary policy is constrained by an

effective lower bound on interest rates. Specifically, we show that in this case there are

benefits from coordinating fiscal policies across countries. By coordinating on a common

fiscal stance, policy makers are able to stabilize union-wide activity and inflation while

avoiding detrimental movements of a country’s terms of trade.

Keywords: Currency union, fiscal policy, effective lower bound, coordination,

EMU, terms-of-trade externality, optimal policy

JEL-Codes: E61, E62, F41

∗

Hettig: Bonn Graduate School of Economics and University of T¨ubingen; Email: thomas.hettig@uni-

tuebingen.de; M¨uller: University of T¨ubingen, CESifo and CEPR, London; Email: gernot.mueller@uni-

tuebingen.de. We thank Yao Chen, Cyntia Freitas Azevedo, Fabio Ghironi, Martin Hellwig, Keith Kuester,

Klaus Prettner, Joost R¨ottger, Alexander Scheer, Martin Wolf, and participants in various seminars and con-

ferences for helpful comments and discussions. Part of this research was conducted while Hettig visited the

Brazilian Central Bank in Bras´ılia and he would like to thank the research department for its hospitality. We

also gratefully acknowledge financial support by the German Science Foundation (DFG) under the Priority

Program 1578. The usual disclaimer applies.

1 Introduction

In the wake of the global financial crisis, fiscal policy staged a comeback as a stabilization tool.

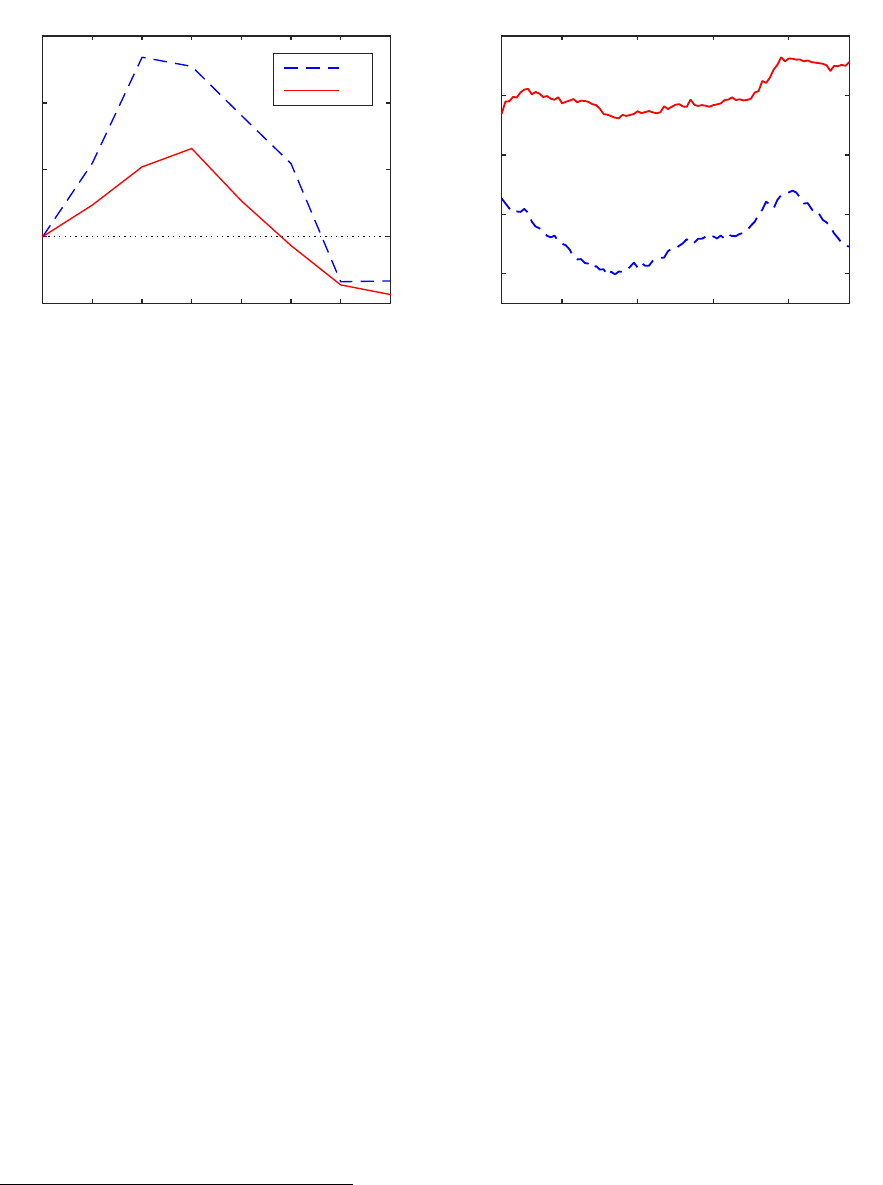

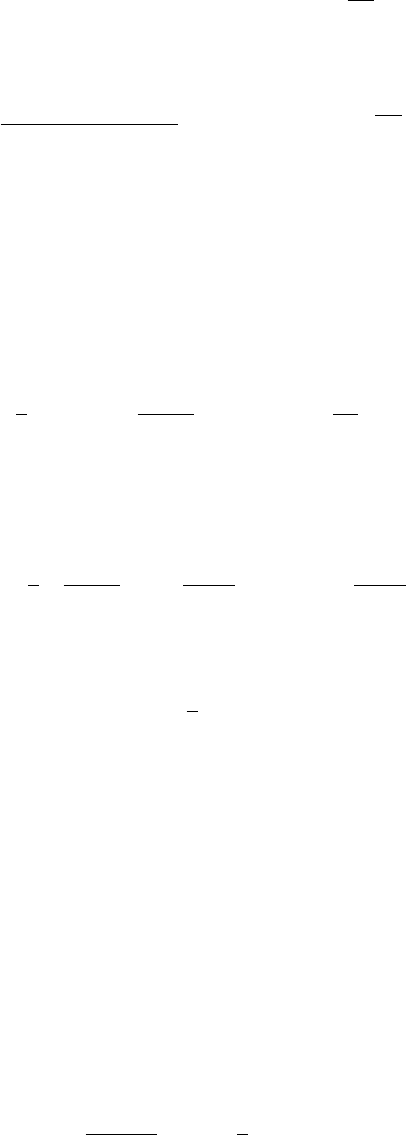

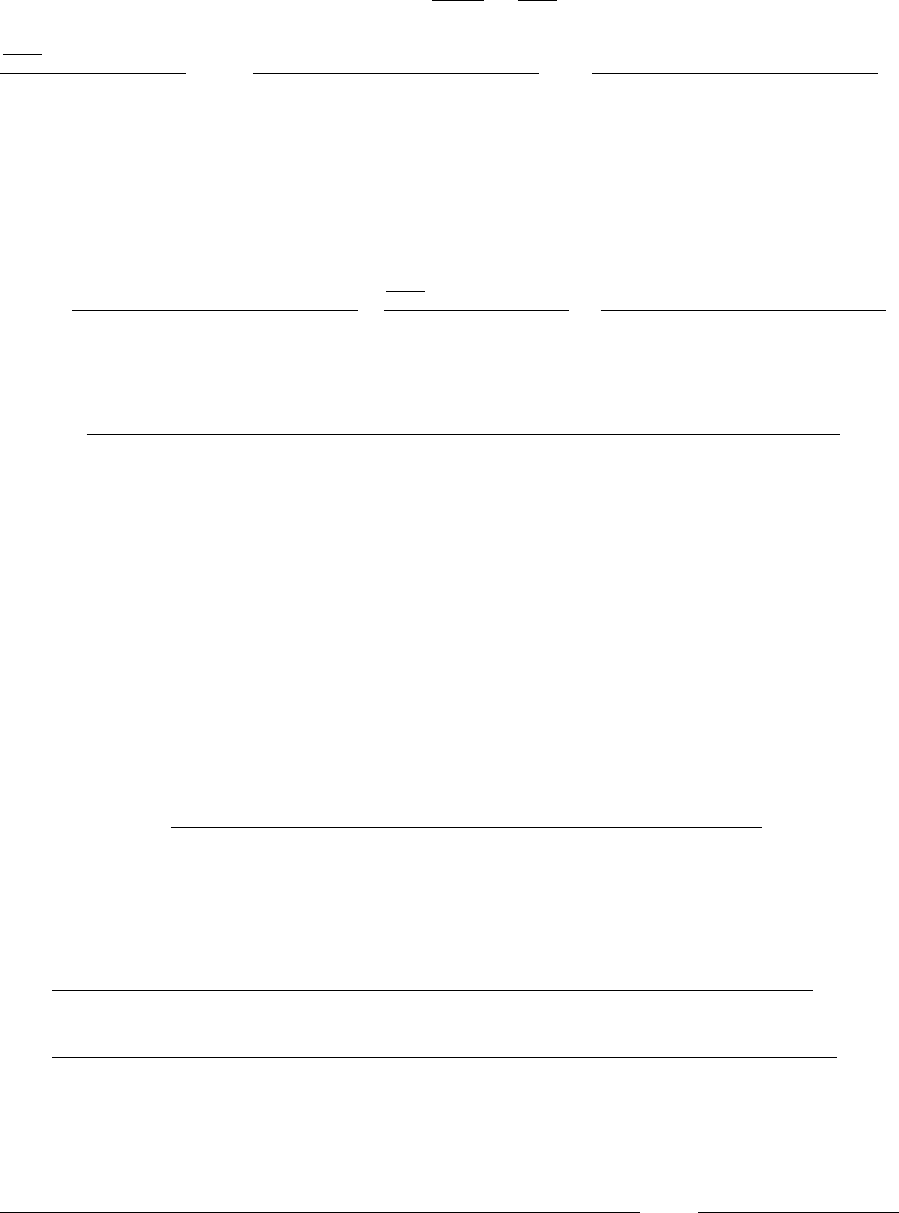

Figure 1 displays two rough measures of the discretionary fiscal stance, both for the US and

the euro area. The left panel shows the change of the cyclically adjusted government budget

deficit, measured in percentage-point changes relative to the pre-crisis year 2007. The right

panel shows the level of government consumption relative to trend output. Both measures

are indicative of an expansionary fiscal stance during the recession: deficits rose sharply after

2007, as did government spending. It appears, however, that fiscal stabilization has been used

more timidly in the euro area: not only did deficits increase less than in the US, government

spending was also raised relatively less, given its higher pre-crisis level.

One possible explanation is that euro-area fiscal policy is largely determined at the country

level, rather than at the union level and, hence, there may have been a failure to coordinate

fiscal stabilization across the member states of the euro area.

1

In line with this conjecture,

there have been calls for stronger policy coordination, urging European governments to en-

gineer a larger fiscal expansion during 2008–09 (see, for instance, Krugman, 2008). For the

same reason, the shift to austerity in the euro area after 2010 may have been excessive, as

argued by many observers (see, for instance, Cotarelli, 2012). Against this background, we

ask whether fiscal-stabilization policies should be coordinated across the member states of a

currency union with a view towards stabilizing area-wide activity and inflation.

According to the pre-crises consensus fiscal stabilization should be geared towards country-

specific conditions, because the common monetary policy can take care of union-wide fluctu-

ations (Beetsma and Jensen, 2005; Kirsanova et al., 2007; Gal´ı and Monacelli, 2008).

2

The

recent economic and financial crises have exposed a shortcoming of this paradigm: in a se-

vere economic downturn monetary policy may be constrained by an effective lower bound

(ELB) on nominal interest rates and thus be unable to stabilize fluctuations at the union

level. Moreover, it is precisely under these circumstances that fiscal policy is very effective in

stabilizing economic activity (Christiano et al., 2011; Woodford, 2011).

In our analysis we therefore explicitly account for the possibility that an ELB constrains

1

To be sure, there has been an attempt to coordinate European fiscal stabilization policies, namely through

the European Economic Recovery Plan, discussed and legislated in 2008–09. According to Cwik and Wieland

(2011) the measures foreseen by the plan amounted to 1.04 and 0.86 percent of 2009 and 2010 GDP, respectively.

Hence, they were considerably smaller than those due to US legislation under the American Recovery and

Reinvestment Act which amounted to roughly 5 percent of GDP.

2

Earlier contributions also allow for the possibility that the objectives of monetary and fiscal policy differ.

This does not necessarily strengthen the case for coordination (Dixit and Lambertini, 2003). In fact, fiscal

coordination may even be harmful (Beetsma and Bovenberg, 1998). Dixit and Lambertini (2001) offer some

qualifications as well as further references. Schmidt (2013) studies coordinated monetary and fiscal stabilization

in a closed economy when an effective bound on interest rates binds.

1

2007 2008 2009 2010 2011 2012 2013 2014

-2

0

2

4

6

Budget deficit

US

EA

1995 2000 2005 2010

0.14

0.16

0.18

0.2

0.22

Government consumption

Figure 1: Euro area (EA): solid lines, United Staates (US): dashed lines; left panel: cyclically

adjusted deficit, annual observations, change relative to 2007, measured in percentage points

of potential output; right panel: government consumption of general government in units of

trend output, quarterly observations; source: OECD Economic Outlook.

monetary policy. We do so within the framework of Gal´ı and Monacelli (2008). It specifies

a currency union which consists of a continuum of small open economies, each negligible in

terms of aggregate outcomes. Yet as countries specialize in the production of a specific set of

goods, domestic policies—if enacted unilaterally—will generally impact a country’s terms of

trade. In the absence of policy coordination, the optimal policy will therefore be conducted

with a view towards its effect on the terms of trade. Instead, by coordinating on a common

policy, countries can internalize this “terms-of-trade externality”.

3

Hence, optimal policies

will generally differ depending on whether there is coordination across countries or not.

In terms of country-specific policies, we focus on government spending. We assume that

the government purchases only domestically produced goods, financed by lump-sum taxes

levied on domestic households. We consider a representative household in each country which

supplies labor and trades a complete set of state-contingent assets across countries. Its con-

sumption basket includes goods produced in all countries of the union, but is biased towards

domestically produced goods. Goods, in turn, are produced in a monopolistic competitive

environment and firms are restricted in their ability to adjust prices. In “normal” (or pre-

crisis) times monetary policy is able to perfectly stabilize inflation and output at the union

level: there is no need for fiscal coordination across countries. We contrast this situation

with a “crisis scenario” where monetary policy is unable to lower interest rates sufficiently in

3

See Corsetti and Pesenti (2001), Benigno and Benigno (2003), De Paoli (2009) and Forlati (2015) for

different perspectives on the terms-of-trade externality in the context of monetary policy.

2

response to a union-wide contractionary shock, because it is constrained by an ELB.

4

We determine the optimal discretionary adjustment of government spending in the crisis

scenario. Under coordination fiscal policies are set to maximize union-wide welfare. In the

absence of coordination fiscal policy makers maximize country-specific welfare. We find that—

in line with the conjecture above—countries provide too little stimulus at the ELB in the

absence of coordination. Intuitively, local policymakers are keen to avoid the terms of trade

appreciating too much with higher spending, as this lowers the demand for domestically

produced goods at times of economic slack. Conversely, the increase of government spending

is higher under coordination, because policy makers anticipate that the terms of trade remain

unaffected by a policy response which is common across countries. At the same time, such a

response is expected to boost union-wide inflation (rather than an individual country’s terms

of trade). This is desirable at the ELB, because expected inflation lowers the real interest rate.

We illustrate that the fiscal stimulus gap due to the lack of coordination can be quantitatively

significant.

Within our framework we recoup two results which have already been established in the

literature, but are crucial to put our main result into perspective. First, we confirm an

earlier finding of Turnovsky (1988) and Devereux (1991): absent cooperation policy makers

choose too high a level of government spending in steady state. This is because governments

seek to improve their country’s terms of trade through purchases of domestically produced

goods.

5

Hence, in steady state the terms-of-trade externality has the opposite effect than

in the crisis scenario, because stronger terms of trade are beneficial in the long run, as the

economy operates at full capacity.

Second, we also contrast government spending multipliers, that is, the percentage change

of domestic output given a (possibly non-optimal) increase of government spending by one

percent of GDP in the entire union and in the domestic economy only. In line with earlier

work by Fahri and Werning (2016), we find that the multiplier is larger than unity in the

first case, provided the ELB binds, but smaller than unity in the second case.

6

This result

4

We abstract from non-conventional policies such as forward guidance (Eggertsson and Woodford, 2003)

or credit policies by the central bank (see, e.g., C´urdia and Woodford, 2011). These policies are arguably an

imperfect substitute for conventional policies, if only because they are not very well understood and hence

controversial (see, e.g., Rogoff, 2016). The effectiveness of forward guidance, in particular, appears to be

limited (Giannoni et al., 2016).

5

Epifani and Gancia (2009) find that this mechanism may account for the size of the public sector in open

economies. In particular, their findings suggest that the terms-of-trade externality rather than a demand for

insurance causes the public sector to grow with trade openness.

6

Erceg and Lind´e (2012) also compute spending multipliers for a small open economy. Assuming an exchange

rate peg, they show that multipliers are always below unity. Assuming a specific scenario under which the

ELB binds, they find that for multipliers to exceed unity prices need to be sufficiently flexible. Nakamura

and Steinsson (2014), in turn, show that multipliers are high within a currency union when compared to the

multiplier at the union level in the absence of a binding ELB constraint. Acconcia et al. (2014) find for Italian

3

obtains because a unilateral increase of government spending appreciates the terms of trade

and thus crowds out private expenditure. Instead, the cooperative policy, common to all

countries, raises expected inflation at the union level, thus crowding-in private expenditure

at the ELB.

7

Our analysis also relates to a number of other recent studies. Cook and Devereux (2011)

study optimal fiscal policy in a two-country model when monetary policy is stuck at the

ELB. However, they focus on the case of coordination, rather than on a possible coordination

failure. Blanchard et al. (2016) calibrate a two-country model to capture key features of

the euro area, notably of its core and periphery. They share our focus on the gains from

cooperation. However, because their model is more complex than ours, their analysis is limited

to numerical evaluations of an ad-hoc welfare criterion. Evers (2015) studies the performance

of alternative fiscal arrangements in a quantitative model of a currency union. He finds that

a centralized fiscal authority dominates a regime of fiscal transfers as well as a regime of

decentralized fiscal decision making. Other work has focused on the coordination of debt and

deficit policies in currency unions (Beetsma and Uhlig, 1999; Krogstrup and Wyplosz, 2010).

We abstract from this aspect, as Ricardian equivalence obtains in our model. Moreover, we

stress that our analysis disregards complications due to sovereign risk. However, both aspects

are likely to further strengthen the case for coordination in currency unions stuck at the ELB

(Corsetti et al., 2014).

The remainder of the paper is structured as follows. In Section 2 we describe the basic

setup of the model. It also contrasts government spending multipliers at the union and the

country level, once the ELB binds. In Section 3 we analyze the need for coordination by

determining optimal government spending with and without coordination. Section 4 provides

a quantitative assessment. Section 5 concludes.

2 Model

Our analysis is based on the model of Gal´ı and Monacelli (2008). There is a currency union

which consists of a continuum of countries, each a small open economy indexed by i ∈ [0, 1].

Each economy features a representative household, a continuum of monopolistically competi-

tive firms and a fiscal authority. Monetary policy is conducted at the union level. We consider

two dimensions which are absent in Gal´ı and Monacelli (2008). First, we allow for the possi-

data that variations in local government spending have fairly strong output effects.

7

An alternative perspective emphasizes monetary conditions: at the country level there is a de facto target

for the price level, given by purchasing power parity. Any inflationary impulse due to fiscal policy thus triggers

an offsetting deflationary tendency and causes the long term real interest rate to rise on impact (Corsetti et al.,

2013b). At the union level, absent a price level target, the inflationary impulse due to higher government

spending reduces real interest rates at the ELB.

4

bility that the ELB constrains monetary policy because of a union-wide contractionary shock.

Second, we compute optimal fiscal policies when there is no coordination across countries.

8

Our exposition focuses on the model structure in terms of preferences and technology. In a

second step, we state the linearized equilibrium conditions at the country and the union level.

Readers may consult Gal´ı and Monacelli (2008) for further details on the derivations.

2.1 Model structure

In what follows we briefly outline the problem of households, the fiscal authority, firms and

monetary policy.

Households

A representative household in country i has preferences over private consumption, C

i

t

, public

consumption, G

i

t

, and labor, N

i

t

, given by

U(C

i

t

, N

i

t

, G

i

t

) = (1 − χ) log C

i

t

+ χ log G

i

t

−

N

i

t

1+ϕ

1 + ϕ

,

where parameter χ ∈ (0, 1) determines the relative weights of private and public consumption.

ϕ > 0 is the inverse of the Frisch elasticity of labor supply. Private consumption is a composite

of domestically produced goods, C

i

i,t

, and imported goods, C

i

F,t

:

C

i

t

≡

C

i

i,t

1−α

C

i

F,t

α

(1 − α)

1−α

α

α

.

Parameter α ∈ (0, 1) measures the openness of the economy. Because country i has zero

weight in the union, α < 1 implies that there is home bias in consumption which accounts for

deviations from purchasing power parity in the short run. Domestically produced goods are

a CES basket of product varieties:

C

i

i,t

≡

Z

1

0

C

i,t

(j)

ε−1

ε

dj

ε

ε−1

, with ε > 1. (1)

Here C

i,t

(j) denotes consumption of variety j ∈ [0, 1] in country i. Parameter ε > 1 denotes

the elasticity of substitution between different varieties of goods produced within each country.

Imported goods, in turn, are defined as follows:

C

i

F,t

≡ exp

Z

1

0

c

i

f,t

df,

8

Forlati (2009) also analyzes optimal fiscal policy in the absence of coordination within the Gal´ı-Monacelli

model. Her focus is on the interaction of monetary and fiscal policy without considering an ELB.

5

with c

i

f,t

≡ log C

i

f,t

and f ∈ [0, 1]. The index C

i

f,t

is defined analogously to (1), with an

appropriate normalization.

9

Given the definitions above, minimizing expenditures gives rise to demand functions for prod-

uct varieties. For instance, domestic demand for generic good j is given by

C

i

i,t

(j) =

P

i

t

(j)

P

i

t

−ε

C

i

i,t

,

where P

i

t

(j) is the price of good j and P

i

t

≡

R

1

0

P

i

t

(j)

1−

dj

1

1−

is the domestic (producer)

price index. Similarly, country-i demand for a generic country-f good j is given by

C

i

f,t

(j) =

P

f

t

(j)

P

f

t

!

−ε

C

i

f,t

.

Here P

f

t

(j) and P

f

t

have the same interpretation as the domestic counterparts. The optimal

allocation between domestic and foreign goods requires

C

i

t

= (1 − α)

P

i

t

P

i

c,t

!

−1

C

i

t

, C

i

F,t

= α

P

∗

t

P

i

c,t

!

−1

C

i

t

,

where P

∗

t

≡ exp

R

1

0

p

f

t

df is the union-wide price index. The consumer price index (CPI) is

given by P

i

c,t

≡ (P

i

t

)

1−α

(P

∗

t

)

α

. In the following we focus on the producer price index, P

i

t

,

which is related to the CPI according to P

i

t

= P

i

c,t

(S

i

t

)

α

, where S

i

t

≡ P

∗

t

/P

i

t

denotes the terms

of trade.

Households trade a complete set of state-contingent securities which provides insurance against

country-specific shocks.

10

They maximize expected discounted lifetime utility subject to a

sequence of budget constraints:

max

{C

i

t

,N

i

t

,A

i

t

}

∞

t=0

E

0

∞

X

t=0

β

t

U(C

i

t

, N

i

t

, G

i

t

)

s.t. P

i

c,t

C

i

t

+ E

t

{Q

t,t+1

A

i

t+1

} ≤ A

i

t

+ W

i

t

N

i

t

+ P

i

t

− T

i

t

.

where A

i

t

denotes the portfolio of nominal assets and Q

t,t+1

is the nominal stochastic discount

factor (common across countries). Ponzi schemes are not permitted. W

i

t

is the nominal wage

and P

i

t

are firm profits, rebated to households in a lump-sum fashion. T

i

t

are lump-sum taxes.

Parameter β ∈ (0, 1) is the subjective discount factor.

9

See Gal´ı and Monacelli (2015). Without normalization either consumption of foreign goods or total

consumption goes to zero (Hellwig, 2015).

10

For instance, idiosyncratic technology shocks as in Gal´ı and Monacelli (2008). As we analyze optimal policy

in response to an aggregate shock that pushes the currency union at the ELB we abstract from country-specific

shocks in our analysis.

6

Fiscal authority

Public consumption is composed of domestically produced goods as in (1) and the fiscal

authority allocates expenditures in a cost minimizing manner. The resulting demand function

for a generic good j is given by:

G

i

t

(j) =

P

i

t

(j)

P

i

t

−ε

G

i

t

,

where G

i

t

is aggregate expenditure, the level of which remains to be determined below. Taxes

adjust to balance the budget in each period:

T

i

t

= P

i

t

G

i

t

+ τ

i

W

i

t

N

i

t

.

where τ

i

is a (constant) employment subsidy paid to domestic firms. If set appropriately it

ensures the efficiency of the steady state under monopolistic competition.

Firms

In each country, there is a continuum of monopolistically competitive firms, each of which

produces a differentiated good Y

i

t

(j). These goods are traded across countries and the law

of one price is assumed to hold. Firms cannot adjust their price P

i

t

(j) every period. Instead,

as in Calvo (1983) they may reset prices in a given period with probability 1 − θ, while their

current price remains in effect with probability θ ∈ (0, 1). The probability of resetting the

price is independent of a firm’s last adjustment. Firms hire labor N

i

t

(j) and produce with

a linear technology Y

i

t

(j) = N

i

t

(j) in order to satisfy the level of demand at a given price.

The objective of a generic firm j ∈ [0, 1] is to maximize discounted, expected nominal payoffs

taking the demand for its product into account:

max

¯

P

i

t

(j)

∞

X

k=0

θ

k

E

t

Q

t,t+k

Y

i

t+k

(j)(

¯

P

i

t

(j) − (1 − τ

i

)W

i

t+k

)

s.t. Y

i

t+k

(j) =

¯

P

i

t

(j)

P

i

t+k

!

−ε

Y

i

t+k

,

where

¯

P

i

t

(j) is the optimal price, set in period t.

Monetary policy

Monetary policy is conducted at the union level. The policy instrument is the nominal interest

rate, that is, the yield on a nominally riskless one-period discount bond: 1 + i

∗

t

≡

1

E

t

Q

t,t+1

.

The objective of monetary policy is to maintain price stability, that is, zero inflation at the

7

union level.

11

Importantly, monetary policy may be constrained by an ELB. Specifically, in

what follows we assume that i

∗

t

≥ 0, that is, we assume the effective lower bound to be zero.

While the actual lower bound is arguably somewhat below zero, this is of little consequence

in the context of our analysis. Below we specify an interest-rate rule which implements price

stability subject to the ELB constraint.

2.2 Equilibrium conditions for approximate model

We consider a log-linear approximation to the optimality and market-clearing conditions

around a symmetric, zero-inflation steady state. We use hats to denote log-deviations of a

variable from its steady-state value. For a generic variable X

t

we define x

t

≡ log X

t

and

ˆx = log(X

t

/X). Union-wide variables are obtained by integrating over all countries in the

union: ˆx

∗

t

=

R

1

0

ˆx

i

t

di.

First, goods-market clearing and integrating over all goods gives for country i

ˆy

i

t

= (1 − γ)(ˆc

i

t

+ αs

i

t

) + γˆg

i

t

. (2)

Parameter γ denotes the steady-state ratio of government consumption to output. The above

equation links domestic output ˆy

i

t

to domestic consumption ˆc

i

t

, the terms of trade s

i

t

and

domestic government spending ˆg

i

t

. Further, the assumption of complete markets gives rise to

the following risk sharing condition:

ˆc

i

t

= ˆc

∗

t

+ (1 − α)s

i

t

. (3)

Combining it with (2) gives

ˆy

i

t

= γˆg

i

t

+ (1 − γ)ˆc

∗

t

+ (1 − γ)s

i

t

. (4)

Equation (4) is an equilibrium condition at the country level which replaces the conventional

dynamic IS-equation (which still operates at the union level, see below). Integrating equation

(4) over all countries i ∈ [0, 1] and noting that

R

1

0

s

i

t

di = 0 leads to the union-wide market

clearing condition

ˆy

∗

t

= γˆg

∗

t

+ (1 − γ)ˆc

∗

t

. (5)

The second equilibrium condition at the country level accounts for the price-setting behavior

of firms and the law of motion for the price level. Specifically, we obtain the following variant

of the New Keynesian Phillips curve:

π

i

t

= βE

t

{π

i

t+1

} + λ

1

1 − γ

+ ϕ

ˆy

i

t

−

λγ

1 − γ

ˆg

i

t

, (6)

11

In the context of our model this is the optimal discretionary policy under fiscal coordination.

8

with λ ≡

(1−βθ)(1−θ)

θ

and where π

i

t

= p

i

t

− p

i

t−1

denotes the inflation rate. From the definition

of the terms of trade it follows that

π

i

t

= π

∗

t

− s

i

t

+ s

i

t−1

. (7)

Equations (4), (6) and (7) characterize the equilibrium in the small open economy given a

process for government spending and union-wide variables.

The union-wide equilibrium conditions are given by an aggregate Phillips curve:

π

∗

t

= βE

t

{π

∗

t+1

} + λ

1

1 − γ

+ ϕ

ˆy

∗

t

−

λγ

1 − γ

ˆg

∗

t

, (8)

which is obtained by integrating over the country-specific Phillips curves (6) and by a dynamic

IS curve:

ˆy

∗

t

= E

t

{ˆy

∗

t+1

} − (1 − γ)(i

∗

t

− E

t

{π

∗

t+1

} − r

t

) − γE

t

{ˆg

∗

t+1

} + γˆg

∗

t

(9)

with r

t

≡ − log β − ∆

t

. As in Woodford (2011), ∆

t

denotes a spread between the interest rate

set by the central bank and the one relevant for private sector decisions. It reflects frictions in

financial intermediation which we do not model explicitly, but permit to vary exogenously.

12

If this spread becomes large enough, monetary policy becomes constrained by the ELB. In

what follows, we thus assume that the conduct of monetary policy can be described by the

following rule

i

∗

t

= max {r

t

+ φ

π

π

∗

t

, 0} . (10)

By following this rule monetary policy fully stabilizes inflation and output at the union level

(as long as ˆg

∗

t

= 0), unless the ELB binds.

Effective-lower-bound scenario. In our analysis below, we consider a scenario where the

ELB binds because the interest rate spread increases temporarily. Specifically, as in Woodford

(2011), we assume a Markov structure for r

t

. It declines temporarily to a value r

L

< 0. The

shock remains operative with probability µ and is sufficiently large for the ELB to become

binding. Hence, (10) implies that i

∗

t

= 0 for as long as the shock lasts, independently on the

conduct of fiscal policy.

13

With probability 1 − µ the spread disappears (and thus the whole

economy) returns permanently to the steady state. Moreover, defining κ ≡ λ

1

1−γ

+ ϕ

,

we impose the parametric restriction (1 − µ)(1 − βµ) > (1 − γ)µκ for the equilibrium to be

uniquely determined (Woodford, 2011).

12

C´urdia and Woodford (2015) provide a microfoundation in a model which accounts for household hetero-

geneity and borrowing and lending across households.

13

Schmidt (2013) and Erceg and Lind´e (2014) consider endogenous exit from the ELB due to fiscal-policy

measures. We assume instead that the decline of r

t

is sufficiently large for the ELB to remain binding also in

the presence of optimal fiscal stabilization.

9

Definition of equilibrium. Given initial conditions (s

−1

) as well as {r

t

}

∞

t=0

an equilibrium

is a collection of

1. country-specific stochastic processes {ˆy

i

t

, π

i

t

, s

i

t

}

∞

t=0

for all i ∈ [0, 1]

2. union-wide stochastic processes {ˆy

∗

t

, π

∗

t

}

∞

t=0

with ˆy

∗

t

=

R

1

0

ˆy

i

t

di, π

∗

t

=

R

1

0

π

i

t

di

such that for given {ˆg

i

t

}

∞

t=0

for all i ∈ [0, 1] with ˆg

∗

t

=

R

1

0

ˆg

i

t

di and the path for the nominal

interest rate {i

∗

t

}

∞

t=0

determined by (10)

3. equilibrium conditions (4), (6) and (7) are satisfied for each country i and

4. equilibrium conditions (8) and (9) are satisfied on the union level.

For later purposes, we note that the equilibrium conditions imply the following second order

stochastic difference equation for the terms of trade (see Gal´ı and Monacelli, 2005)

s

i

t

= ωs

i

t−1

+ ωβE

t

{s

i

t+1

} − ωλϕγ(ˆg

i

t

− ˆg

∗

t

),

where ω ≡

1

1+β+λ[1+ϕ(1−γ)]

∈ [0,

1

1+β

). The above equation has a unique stable solution

s

i

t

= δs

i

t−1

+ δλϕγ

∞

X

k=0

(βδ)

k

E

t

{ˆg

∗

t+k

− ˆg

i

t+k

}, (11)

with δ ≡

1−

√

1−4βω

2

2ωβ

∈ (0, 1).

2.3 Impact multipliers: union-wide vs country-specific fiscal impulse

In this section, to set the stage for our main results in Section 3, we solve for the government

spending multiplier on output. That is, we determine by how much country-specific output

changes, given an increase of government consumption by one percent of output. Our focus is

on how the multiplier differs depending on whether there is a union-wide or a country-specific

variation of government consumption. As a union-wide fiscal impulse impacts the individual

countries symmetrically, this scenario is equivalent to the closed-economy setting in Woodford

(2011). Instead, a country-specific fiscal impulse impacts domestic output directly, but also

indirectly via the terms of trade. This scenario is thus equivalent to the small-open-economy

settings in Corsetti et al. (2013b) and Fahri and Werning (2016). We briefly revisit their

results within our framework.

Consider first the union-wide fiscal impulse in the ELB scenario. We assume that government

spending is increased in every country by the same amount as long as the ELB remains

binding. In this case, given the assumptions spelled out above, union-wide variables take a

10

constant value x

∗

L

, as long as the shock persists. In this case, the union-wide Phillips curve

and the IS equation simplify to

π

∗

L

=

1

1 − βµ

κ(ˆy

∗

L

−

¯σγ

¯σ + ϕ

ˆg

∗

L

), (12)

(1 − µ)(ˆy

∗

L

− γˆg

∗

L

) = (1 − γ)µπ

∗

L

+ (1 − γ)r

L

, (13)

with ¯σ ≡

1

1−γ

.

We solve the above system for ˆy

∗

L

as a function of r

L

and ˆg

∗

L

. This gives:

ˆy

∗

L

=

(1 − γ)(1 − βµ)

(1 − µ)(1 − βµ) − (1 − γ)µκ

r

L

+

(1 − µ)(1 − βµ)γ − (1 − γ)µκ

γ¯σ

¯σ+ϕ

(1 − µ)(1 − βµ) − (1 − γ)µκ

ˆg

∗

L

. (14)

In order to determine the multiplier, we divide the derivative of ˆy

∗

L

with respect to ˆg

∗

L

by the

steady-state share of government spending, γ:

1

γ

∂ˆy

∗

L

∂ˆg

∗

L

=

(1 − µ)(1 − βµ) − (1 − γ)µκ

¯σ

¯σ+ϕ

(1 − µ)(1 − βµ) − (1 − γ)µκ

≥ 1.

At the union level, we thus find that the multiplier is bound from below by unity (Woodford,

2011). Intuitively, higher government spending reduces real interest rates at the ELB, because

the expected inflationary impact of higher spending is not matched by higher nominal interest

rates. Hence, private-sector spending is crowded in.

We now turn to the effect of a country-specific fiscal impulse. In this case, for simplicity but

without loss of generality we set union-wide variables to zero and assume that government

spending in country i follows a two-state Markov switching process. Initially, government

spending exceeds its steady state level ˆg

i

L

> 0; it does so with probability µ in the next period

too and returns to steady state with probability 1 − µ.

Specifically, equations (4) and (11), evaluated in the impact period of the spending increase

read as follows

ˆy

i

1

= γˆg

i

L

− (1 − γ)p

i

1

p

i

1

=

δλϕγ

1 − βδµ

ˆg

i

L

.

Combining both equations, we obtain the government spending multiplier in the impact

period.

14

It is given by

1

γ

∂ˆy

i

1

∂ˆg

i

L

= 1 − (1 − γ)

δλϕ

1 − βδµ

| {z }

≥0

≤ 1.

14

Because a country-specific fiscal impulse impacts the terms of trade, the output effect of government

spending changes over time even though the size of the impulse does not. We focus on the impact effect.

11

The upper bound of unity is reached when prices are completely sticky (λ → 0). To the extent

that prices are somewhat flexible, private-sector spending at the country level is crowded out

by higher government consumption. Its inflationary impact appreciates the terms of trade

which, in turn, calls for reduced consumption in country i, see equation (3). Equivalently,

(relative) purchasing power parity requires that the price level reverts back to its pre-shock

level in the long run. Given unchanged nominal interest rates in the currency union, future

deflation induces long-term real interest rates to rise on impact. Still, the crowding-out

effect of country-specific stimulus in a currency union is limited relative to when the country

operates a flexible exchange rate system (see, for further discussion and evidence, Corsetti

et al., 2013b; Born et al., 2013).

Taken together, we obtain the following ranking of the government spending multiplier on

country-specific output, considering a union-wide and country-specific spending increase, re-

spectively:

1

γ

dˆy

i

1

dˆg

i

L

≤ 1 ≤

1

γ

dˆy

∗

L

dˆg

∗

L

.

Fahri and Werning (2016) obtain this result as a closed-form solution of the continuous-time

version of the New Keynesian model.

3 Optimal policy

We now turn to optimal fiscal policy. In particular, we distinguish between a scenario of

coordination and one without, both with regards to the steady state and to the ELB scenario.

In each case, policy makers chose government consumption in order to maximize household

welfare.

3.1 Steady state

We consider optimal fiscal policy in the steady state first. We compute the steady state as the

solution to the social planer problem and discuss how it can be decentralized in a symmetric,

zero-inflation steady state.

Under coordination the social planner (of the union) maximizes union-wide welfare subject

to the production function, the goods-market-clearing condition and the risk-sharing condi-

tion in every country i ∈ [0, 1]. The planner also accounts for the effect of country-specific

12

consumption levels on union-wide consumption. Formally, we have

max

Z

1

0

(1 − χ) log C

i

+ χ log G

i

−

N

i

1+ϕ

1 + ϕ

!

di (15)

s.t. Y

i

= N

i

Y

i

= C

i

(S)

α

+ G

i

C

i

= C

∗

(S)

1−α

C

∗

=

Z

1

0

C

i

di.

In addition, optimality requires that varieties are produced and consumed in equal quantities

in a given country. Solving the planner problem gives rise to the following steady state

relations (for each country i ∈ [0, 1]), see Appendix A:

γ

Coord

≡

G

Y

Coord

= χ; Y

Coord

= 1. (16)

The social planer solution can be decentralized as a symmetric, zero-inflation steady state

by letting the government provide public goods according to (16) and by choosing the labor

subsidy which offsets distortions due to monopolistic competition (see Gal´ı and Monacelli,

2008):

τ

Coord

=

1

ε

.

We now turn to the case without coordination. Here, the social planner (in a given country

i) maximizes domestic welfare only, subject to the production function, the market-clearing

condition and the risk-sharing condition. The planner does not take effects on union-wide con-

sumption into account, but takes consumption in the rest of the union C

∗

t

as given. Formally,

we have

max U(C

i

, N

i

, G

i

) = (1 − χ) log C

i

+ χ log G

i

−

N

i

1+ϕ

1 + ϕ

(17)

s.t. Y

i

= N

i

Y

i

= C

i

(S)

α

+ G

i

C

i

= C

∗

(S)

1−α

.

Again, optimality requires that varieties are produced and consumed in equal quantities in a

given country. In a symmetric Nash equilibrium, optimality requires the following to hold in

steady state in every country i ∈ [0, 1], see Appendix B.1:

γ

Nash

≡

G

Y

Nash

=

χ

(1 − α)(1 − χ) + χ

∈ (0, 1) (18)

Y

Nash

= [(1 − α)(1 − χ) + χ]

1

1+ϕ

.

13

Comparing the outcome under coordination and without, we observe that the government-

consumption-to-output ratio is higher in the latter case: γ

Nash

> γ

Coord

. Furthermore the

level of government spending without coordination exceeds the level under coordination:

G

Nash

> G

Coord

, even though output is lower Y

Nash

< Y

Coord

, see also Appendix B.1.

This confirms earlier findings by Turnovsky (1988) and Devereux (1991) according to which

government consumption without coordination accounts for an excessively large share of out-

put. Intuitively, each government tries to improve the domestic terms of trade by increasing

domestic demand. In a symmetric Nash equilibrium, however, the terms of trade are equal to

unity. Government consumption is higher and output is lower relative to the case of coordi-

nation. Because of the terms-of-trade externality, the Nash steady state is inefficient: welfare

is lower than in case of coordination.

The social planer solution in the absence of coordination can be decentralized as a symmetric,

zero-inflation steady state by letting the government provide public goods according to (18)

and by choosing the following labor subsidy (see Appendix B.2):

1 − τ

Nash

=

1 −

1

ε

(1 − α)

−1

.

Again, zero-inflation ensures that the same amount of each variety is produced and consumed.

3.2 Effective lower bound

In order to determine the optimal policy at the ELB, we pursue a linear-quadratic approach.

First, we approximate household welfare up to second order around the steady state with

and without coordination. Gal´ı and Monacelli (2008) provide such an approximation for the

case of coordination. We provide details on the derivation in the absence of coordination in

Appendix C.

15

Second, we determine the optimal discretionary fiscal policy in the dynamic

model approximated around each steady state. For this purpose, we maximize the welfare

functions subject to the equilibrium conditions.

Consider first the case of coordination. Here we focus on the symmetric solution, that is,

x

i

t

= x

∗

t

for all i ∈ [0, 1], because we analyze the effects of a union-wide shock and assume

that countries are identical. Under coordination the single policymaker maximizes union-

wide welfare by choosing government consumption in a discretionary way subject to the New

Keynesian Phillips curve, (8), and an inequality constraint which consolidates the dynamic

IS equation, (9) and the interest-rate rule (10). Hence, optimization is subject to the ELB.

15

In the absence of coordination there are linear terms in a second-order approximation to household utility.

We rely on the approach of Benigno and Woodford (2006) and substitute for these terms using a second-order

approximation to the market-clearing condition.

14

Formally, assuming discretionary policy making, the optimization problem is given by

max

π

∗

t

,ˆy

∗

t

,ˆg

∗

t

W

∗

t

' −

1

2

ε

λ

(π

∗

t

)

2

+ (1 + ϕ)(ˆy

∗

t

)

2

+

γ

Coord

1 − γ

Coord

(ˆg

∗

t

− ˆy

∗

t

)

2

(19)

s.t. π

∗

t

= λ

1

1 − γ

Coord

+ ϕ

ˆy

∗

t

−

λγ

Coord

1 − γ

Coord

ˆg

∗

t

+ ν

∗

0,t

ˆy

∗

t

≤ γ

Coord

ˆg

∗

t

+ ν

∗

1,t

,

where ν

∗

0,t

and ν

∗

1,t

collect expectation terms which are beyond the control of the policy maker

under discretion. In Appendix D we show that the solution to (19) requires π

∗

t

= ˆy

∗

t

= ˆg

∗

t

= 0

as long as the monetary authority is not constrained by the ELB. Hence, in this case the

economy is perfectly stabilized at the steady state—and optimal government spending at its

steady-state level. When the ELB is binding, π

∗

t

= ˆy

∗

t

= ˆg

∗

t

= 0 is no longer feasible. In that

case we find that optimal government spending is characterized by the following condition:

π

∗,Coord

t

+

1

ε

ˆy

∗,Coord

t

= −ψ

Coord

g

ˆg

∗,Coord

t

, (20)

where ψ

Coord

g

≡

1

εϕ

> 0 (see case 2 in Appendix D). Intuitively, as long as output and inflation

drop in the ELB scenario, equation (20) calls for an increase of government spending. The

following proposition states the solution for optimal government spending.

Proposition 1. Given the effective-lower-bound scenario under consideration (see Section

2.2), the solution for the optimal fiscal response under coordination is given by:

ˆg

∗,Coord

L

= −Θ

Coord

r

L

> 0,

with Θ

Coord

≡

(1−γ

Coord

)(κ

Coord

ε+(1−βµ))

ψ

Coord

g

ε[(1−µ)(1−βµ)−(1−γ

Coord

)µκ

Coord

]+(1−µ)γ

Coord

λϕε+γ

Coord

[(1−µ)(1−βµ)−µλ]

> 0

and κ

Coord

≡ λ

1

1−γ

Coord

+ ϕ

.

Proof. See Appendix F.

Hence, we find that it is optimal to raise government spending under coordination, once the

ELB binds. Our result is in line with Woodford (2011), because in the present context the

currency union under coordination is isomorphic to his closed-economy model.

We now turn to optimal government spending in the absence of coordination. In this case,

policy choices may differ across countries from an ex-ante perspective and, hence, are ex-

pected to impact a country’s terms of trade. Given price stickiness, the terms of trade adjust

sluggishly in a currency union, while their long-run value is determined by purchasing power

15

parity. As a result the (lagged) terms of trade are an endogenous state variable and the

policy problem is inherently dynamic in the absence of coordination—even under discretion.

In this case, even though a policy maker may not directly steer private-sector expectations,

current policy decisions impact expectations indirectly via endogenous state variables—an

effect which is internalized by the policy maker (see, e.g. Svensson, 1997).

We further note that, since the policy maker takes union-wide variables as given, including

the nominal interest rate, the union-wide IS curve is not a constraint to the decision maker

and neither is the ELB. Instead, optimization is subject to the market-clearing condition,

(4), the country-specific New Keynesian Phillips curve, (6), and the evolution of the terms of

trade, (7). Specifically, under discretion the optimization problem is given by

V (s

i

t−1

, π

∗

t

, ˆc

∗

t

) = max

π

i

t

,ˆy

i

t

,ˆg

i

t

,s

i

t

−

1

2

ε

λ

(π

i

t

)

2

+ (1 + ϕ)(ˆy

i

t

)

2

+

γ

1 − γ

ˆg

i

t

− ˆy

i

t

2

+ βE

t

V (s

i

t

, π

∗

t+1

, ˆc

∗

t+1

)

(21)

s.t. ˆy

i

t

= γˆg

i

t

+ (1 − γ)ˆc

∗

t

+ (1 − γ)s

i

t

π

i

t

= βE

t

{π

i

t+1

} + λ

1

1 − γ

+ ϕ

ˆy

i

t

−

λγ

1 − γ

ˆg

i

t

π

i

t

= π

∗

t

− s

i

t

+ s

i

t−1

and E

t

π

i

t+1

given.

In the expression above V is the value function. The solution to (21) requires the following

(consolidated) first-order condition to be satisfied (see Appendix E):

−λβE

t

∂V (s

i

t

, π

∗

t+1

, ˆc

∗

t+1

)

∂s

i

t

+ β

1

ϕ

ˆg

i

t

+ ˆy

i

t

∂E

t

π

i

t+1

∂s

t

+

1

ε

ˆy

i

t

+ π

i

t

= −ψ

Nash

g

ˆg

i

t

(22)

with ψ

Nash

g

≡

1

εϕ

(λϕ + (1 + λ)).

To develop some intuition, it is instructive to contrast optimality condition (22) with the one

derived under coordination, eq. (20). For this purpose we abstract in a first step from the dy-

namic terms on the left of eq. (22). We observe that for a given drop of output and inflation in

the ELB scenario under consideration, the optimal policy response entails a smaller increase

of government spending than in case of coordination, since ψ

Nash

g

> ψ

Coord

g

. Intuitively, in

the absence of coordination, a local policy maker anticipates that higher government spending

appreciates the terms of trade which, in turn, lowers the demand for domestic goods. This

effect is absent when government spending is raised simultaneously in all countries under

coordination. A non-cooperative policy maker will therefore tend to opt for less fiscal stimu-

lus.

16

The following proposition establishes this formally for the special case which eliminates

the dynamic terms in eq. (22).

16

Absent commitment there are also benefits from coordinating fiscal policy measures intertemporally. In

16

Proposition 2. Consider the effective-lower-bound scenario and a symmetric equilibrium,

while β → 0. In this case optimal government spending is raised less without coordination

than with coordination (in percentage terms of steady state spending). Formally, we have

ˆg

∗,Nash

L

< ˆg

∗,Coord

L

.

Proof. See Appendix G.

In the general case for β ∈ (0, 1), the optimal policy also reflects the fact that the terms of

trade operate as an endogenous state variable. The first term on the left of eq. (22) captures

the effect that, all else equal, stronger terms of trade (that is, a lower s

t

) are expected to

persist and to reduce expected future welfare when foreign demand and foreign inflation are

weak (as in the ELB scenario). To the extent that higher government spending appreciates

the terms of trade, there is thus an additional incentive to opt for less spending in the absence

of coordination. This effect reinforces the ordering established in Proposition 2.

Turning to the second term on the left of eq. (22), note that stronger terms of trade (that

is, a lower s

t

) reduce inflation expectations, because, as they persist, they will raise the

purchasing power of workers and induce downward pressure on wages and inflation (that is,

∂E

t

π

i

t+1

/∂s

t

> 0). Via the Phillips curve, lower expected inflation reduces inflation today.

This dynamic terms-of-trade channel attenuates the appreciation of the terms of trade in

response to higher government spending (and output) and makes a fiscal stimulus in the ab-

sence of cooperation relatively more attractive.

17

Yet this dynamic channel does not overturn

the ordering established in Proposition 2 because it merely dampens the appreciation of the

terms of trade.

Overall, we thus find that the terms of trade are crucial for optimal policy design, not only

in steady state, but also off steady state. Intuitively, absent cooperation there is excessive

government consumption in steady state, because better terms of trade are beneficial in the

long run, as the economy operates at full capacity. In the short-run, local policy makers are

keen to avoid the terms of trade appreciating too much with higher spending, as it reduces

the demand for domestic goods in times of economic slack.

particular, Schmidt (2016) shows in a closed-economy setup that it may be desirable to appoint a fiscally

activist policy maker, because anticipation of aggressive fiscal expansions at the ELB mitigates the adverse

implications of the ELB today.

17

The sluggish adjustment of the terms of trade has been identified as a key determinant of the macroeco-

nomic adjustment mechanism in monetary unions. Benigno (2004) and Pappa (2004) stress how it distorts the

adjustment. Groll and Monacelli (2016), in contrast, relate it to the “intrinsic benefits of monetary unions” in

the absence of commitment.

17

Table 1: Parameter values

χ 0.148 Public consumption-GDP ratio

α 0.2874 Import-share in steady state

β 0.99 Discount factor

θ 0.925 Degree of price stickiness

ε 6 Elasticity of substitution

ϕ 4 Inverse of Frisch elasticity of labor supply

φ

π

1.5 Taylor coefficient

r

L

-0.01 ELB scenario

4 Quantitative assessment

In what follows we explore to which extent our result matters quantitatively. We assign

parameter values by targeting observations for the euro area and the US for the period 1999–

2006. We treat the US as a benchmark for a currency union in which government spending

is set cooperatively. For the euro area, in contrast, we assume that government expenditures

are set non-cooperatively.

18

A period in the model corresponds to one quarter. We set χ = 0.148 in order to match the

average share of exhaustive government consumption relative to GDP in the US (see Figure

1 above). To match the share of government consumption in the euro area which is equal to

0.196, we set the openness parameter α to 0.2874, see equation (18).

19

Further, we set the

time-discount factor β to 0.99 and θ = 0.925. Such a high degree of price stickiness appears

to be justified in light of the inflation dynamics observed in the context of the crisis (Corsetti

et al., 2013a). Moreover, as we illustrate by means of a sensitivity analysis below, understating

the extent of price rigidity biases results in favor of fiscal policy coordination. A high degree

of price rigidity is thus a conservative choice. We set the elasticity of substitution among

varieties to ε = 6. This implies an average markup of 20 percent. We assume ϕ = 4, such

that the Frisch elasticity is moderate, in line with recent evidence (Chetty et al., 2011). We

explore below to what extent results vary with β, θ, ϕ and α. We further assume φ

π

= 1.5.

In terms of the shock, we assume that r

L

= −0.01. This implies a natural rate of interest of

18

According to NIPA data 36.3% of all exhaustive government expenditures in the US are determined at the

federal level. In the EU there is a common budget. However, it is very small and consists mostly of transfers.

There is basically no exhaustive government spending administrated at the area-wide level.

19

The average import share in the euro area during 1999–2006 is closer to 50 percent, but this accounts for

trade with countries outside of the euro area. The share of intra-euro area imports in GDP is about 17 percent

according to the Monthly Foreign Trade Statistics of the OECD.

18

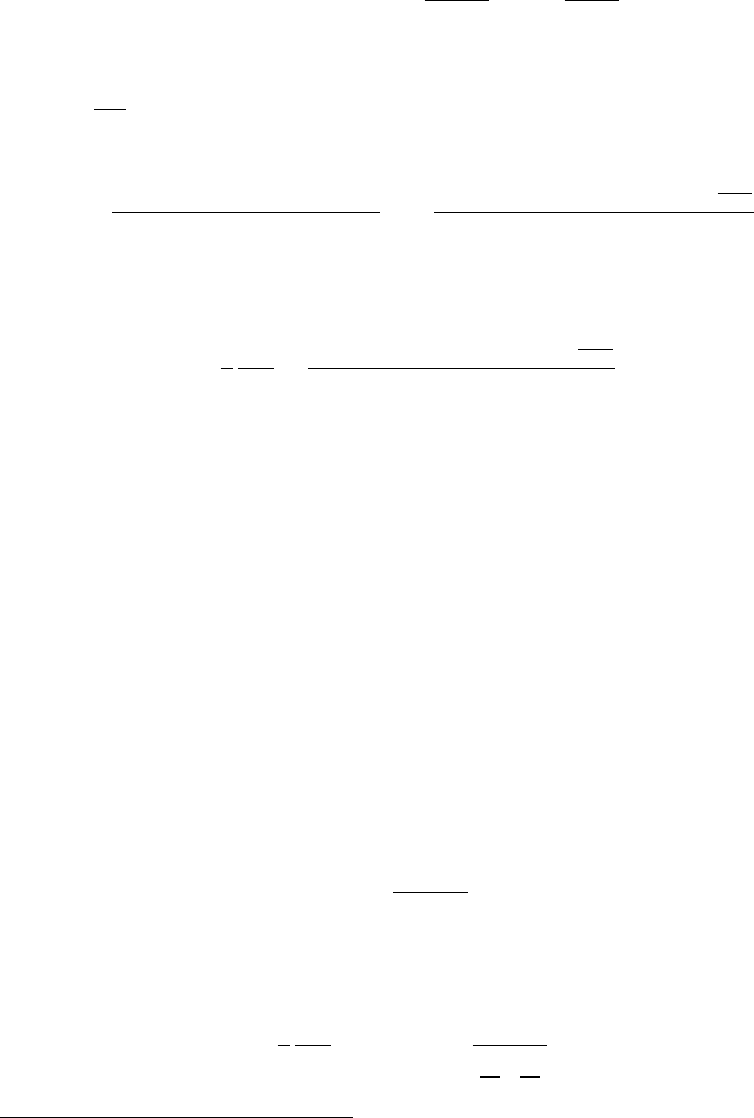

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

-15

-10

-5

0

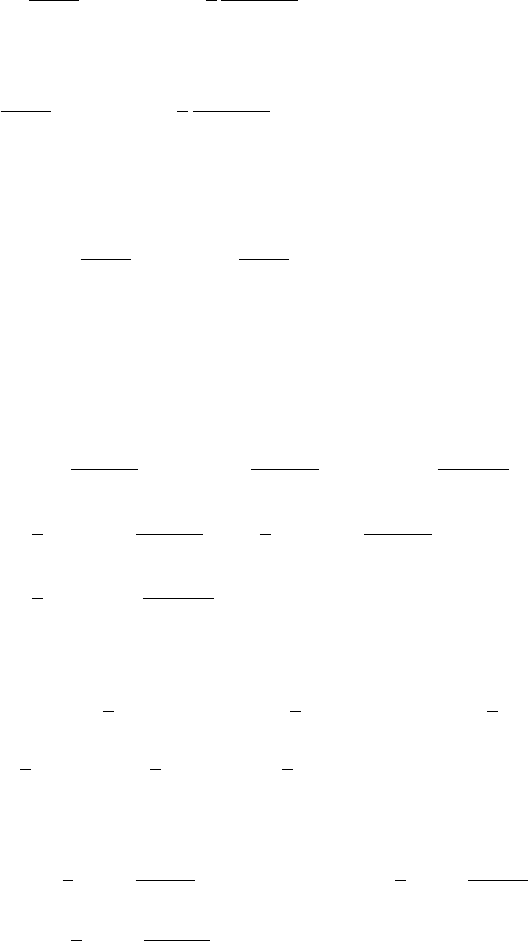

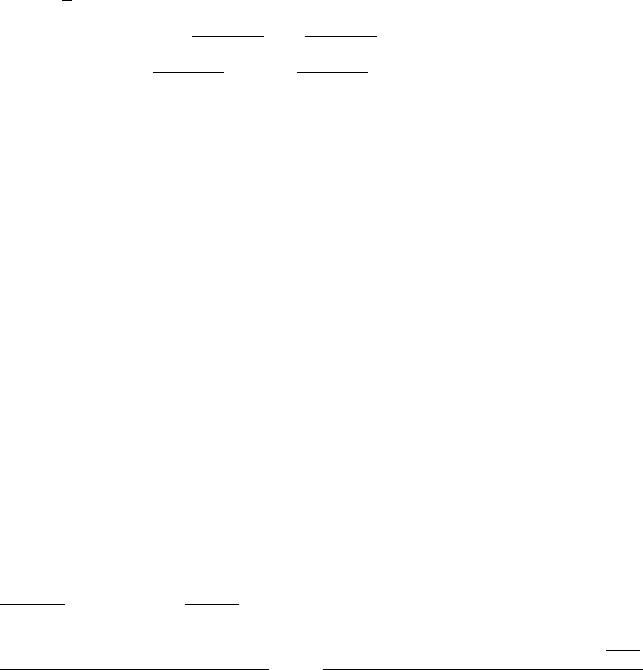

Figure 2: Fiscal stimulus gap at the ELB. Difference of optimal increase of government

consumption without and with coordination, measured in percentage points along the vertical

axis (ˆg

∗,Nash

L

− ˆg

∗,Coord

L

), horizontal axis measures probability that the ELB remains binding

for another period (µ).

−4% (annualized) for the ELB scenario. For all experiments we verify that the ELB remains

binding also as government spending is raised in response to the shock. Table 1 summarizes

the parameter values.

Given these parameter values, we solve the model in the absence of coordination numerically

as in Soderlind (1999). Appendix H provides details. As in our analysis above, we focus on

the ELB scenario and, in particular, on the optimal adjustment of government spending. In

the case of coordination, Proposition 1 provides an analytic solution. Figure 2 displays the

fiscal stimulus gap at the ELB: the difference of the optimal increase of government spending

without and with coordination. Specifically, the vertical axis measures the difference of the

percentage change of government spending in percentage points (ˆg

∗,Nash

L

− ˆg

∗,Coord

L

). The

horizontal axis measures the probability µ that the ELB remains binding for another period.

20

The figure illustrates that whether fiscal policies are coordinated or not hardly matters if the

20

We restrict the range of µ to values for which we obtain a locally unique equilibrium.

19

0.9 0.92 0.94 0.96 0.98 1

-15

-10

-5

0

0 2 4 6 8

-15

-10

-5

0

0 0.2 0.4 0.6 0.8 1

-10

-8

-6

-4

-2

0 0.2 0.4 0.6 0.8 1

-25

-20

-15

-10

-5

0

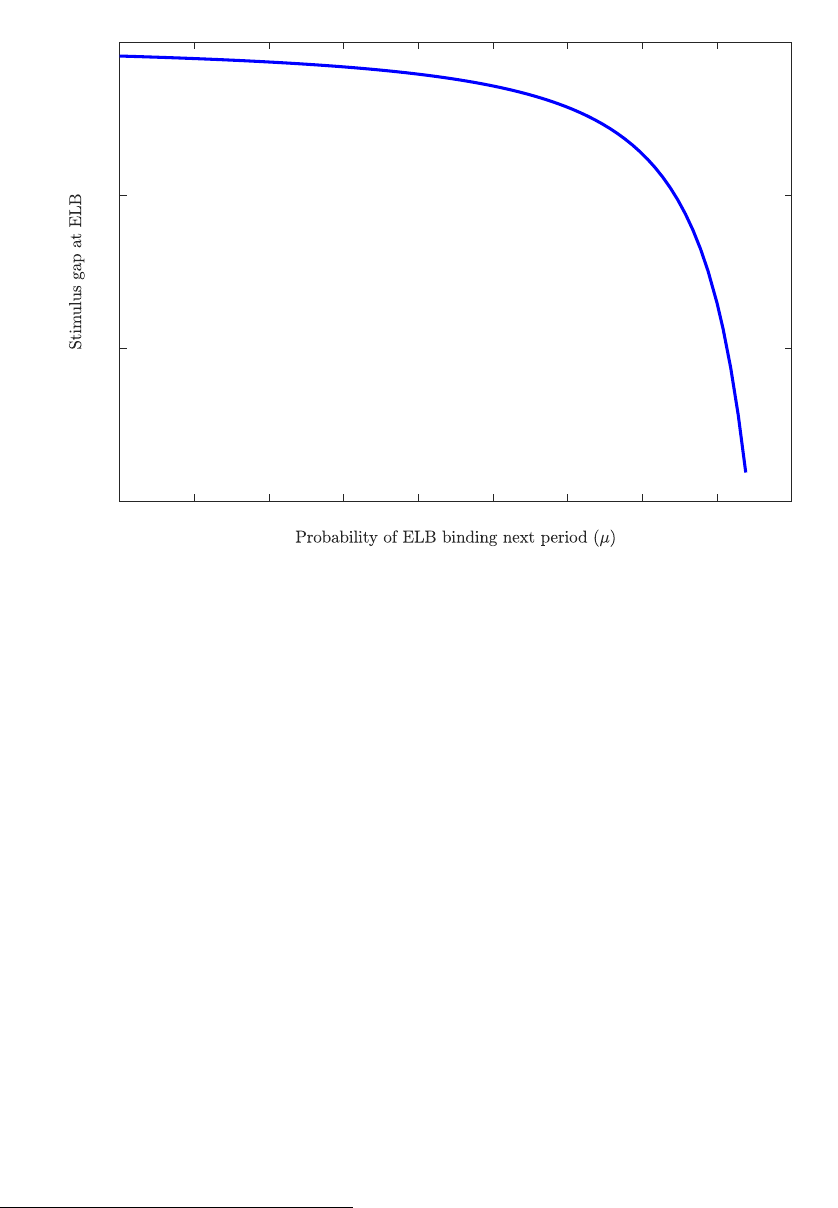

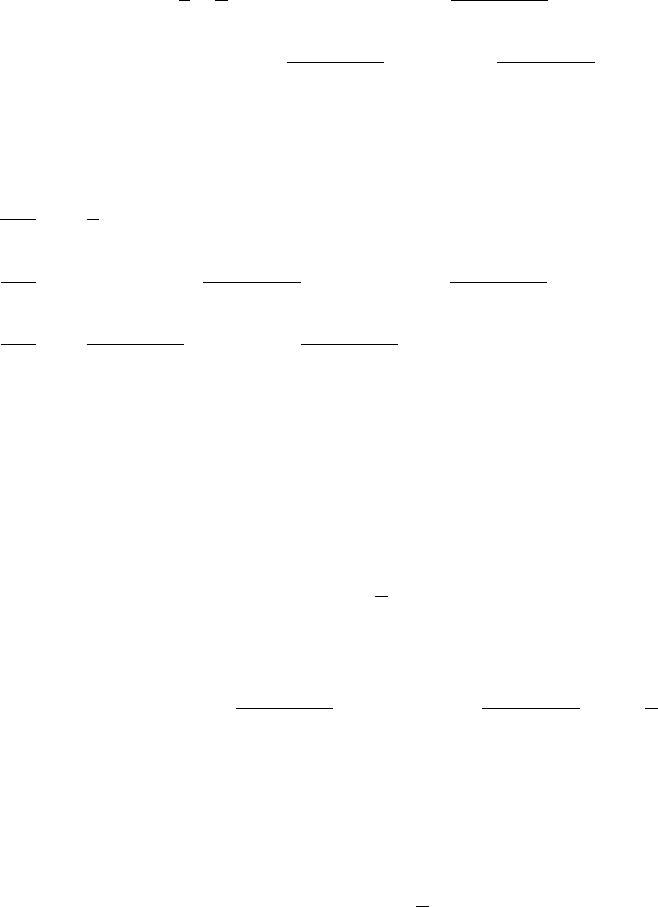

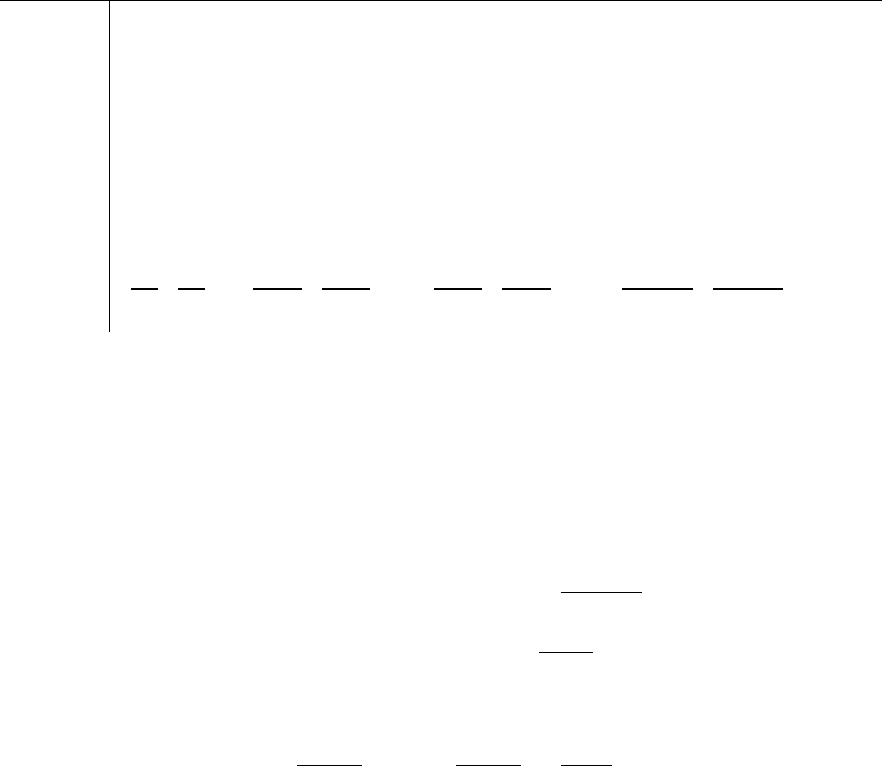

Figure 3: Stimulus gap conditional on the discount factor β (upper-left panel), the degree

of price stickiness (upper-right panel), the inverse of the Frisch elasticity of labor supply ϕ

(lower-left panel) and openness α (lower-right panel) for µ = 0.8, see Figure 2. We only

consider parameter values for which the equilibrium is locally unique. A diamond indicates

parameter values under the baseline parameterization.

expected duration of the ELB episode is short. However, for larger values of µ the stimulus

gap is sizable. If, for instance, the expected duration is five quarters (µ = 0.8), the difference

amounts to 8.5 percentage points.

We now illustrate to what extent this result depends on specific parameter values. For this

purpose we vary one parameter at a time, while keeping µ fixed at 0.8 throughout. We

first consider alternative values for the discount factor β. It determines how the dynamics

of the terms of trade (as endogenous state variable) impact optimal policy in the absence

of coordination (see the discussion in Section 3.2 above).

21

The upper-left panel of Figure

3 shows the stimulus gap as a function of β. We find that the stimulus gap increases as β

increases or, put differently, the desire to avoid a persistent appreciation of the terms of trade

increases with β in the absence of coordination.

21

At the same time β matters also for the slope of the Phillips curve. Yet, as we vary the value of β, we keep

κ constant (just like all other parameters) in order to focus on the role of the dynamic terms of trade effect.

20

The upper-right panel of Figure 3 shows the stimulus gap as a function of the degree of price

stickiness θ. We find that the lower the degree of price stickiness, the larger the gap between

the optimal policy under coordination and Nash. To understand this finding, note that

inflation responds more strongly to higher government spending if prices are more flexible.

Higher inflation at the union level reduces real interest rates and thus stimulates aggregate

demand at the union level. At the country level, instead, higher inflation appreciates the

terms of trade and thus reduces the demand for domestically produced goods. Hence, the

more flexible prices, the more negative the stimulus gap.

The lower-left panel of Figure 3 shows the stimulus gap conditional on the inverse of the

Frisch elasticity of labor supply ϕ. As the Frisch elasticity declines (that is, as ϕ increases),

marginal costs and, hence, inflation respond more strongly to higher government spending.

Put differently, the Phillips curve becomes steeper as ϕ increases, just like when θ declines,

see equation (6). We therefore find the stimulus gap more negative, the larger the Frisch

elasticity.

The lower-right panel of Figure 3 shows the stimulus gap conditional on openness parameter

α. It is possible to show that, the higher the degree of openness, the stronger the impact of

government spending on the terms of trade. Consequently, in a more open economy policy

makers seek to avoid a stronger appreciation of the terms of trade in the midst of a severe

recession and provide a lower stimulus in the absence of policy coordination. Note that the

stimulus gap does not vanish in the closed economy limit (α = 0) since monetary regimes

still differ. While there is an implicit price-level target in place at the country-level, the price

level features a unit root at the union level. This difference has a strong bearing on the

transmission of fiscal policy (Corsetti et al., 2013b).

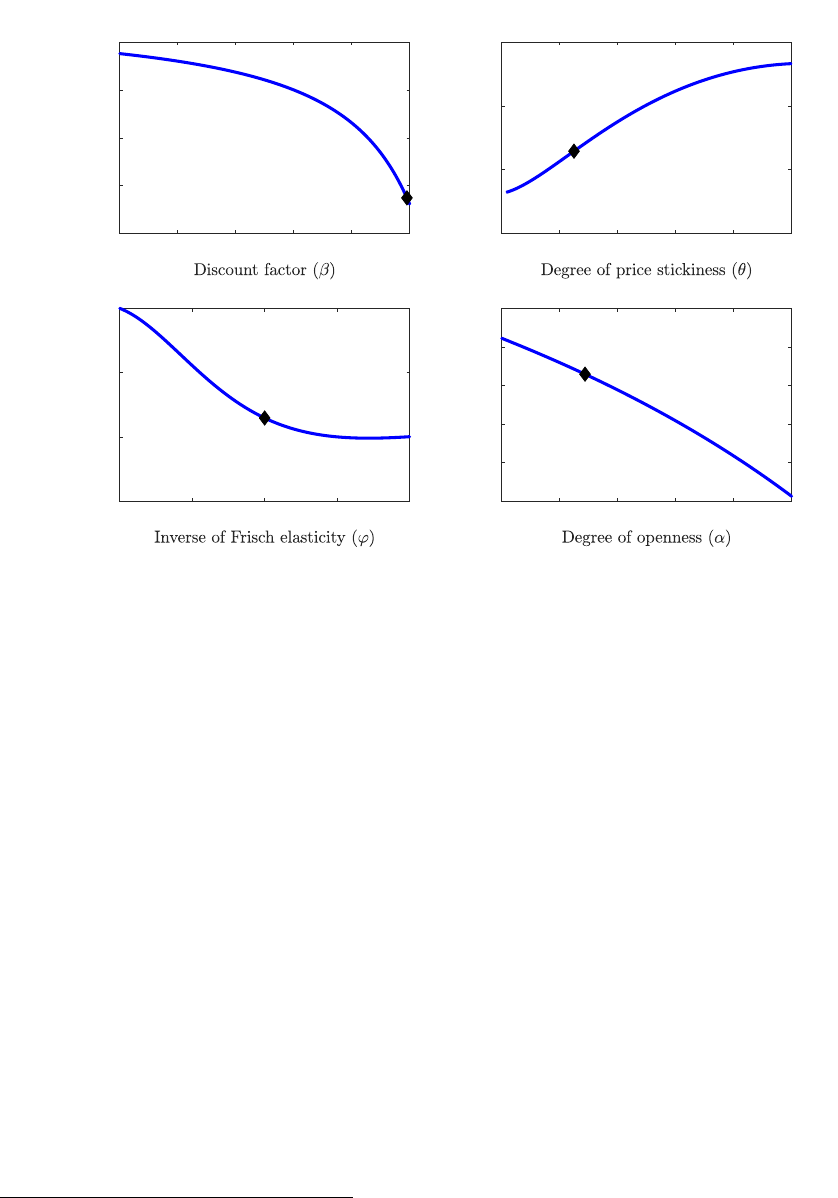

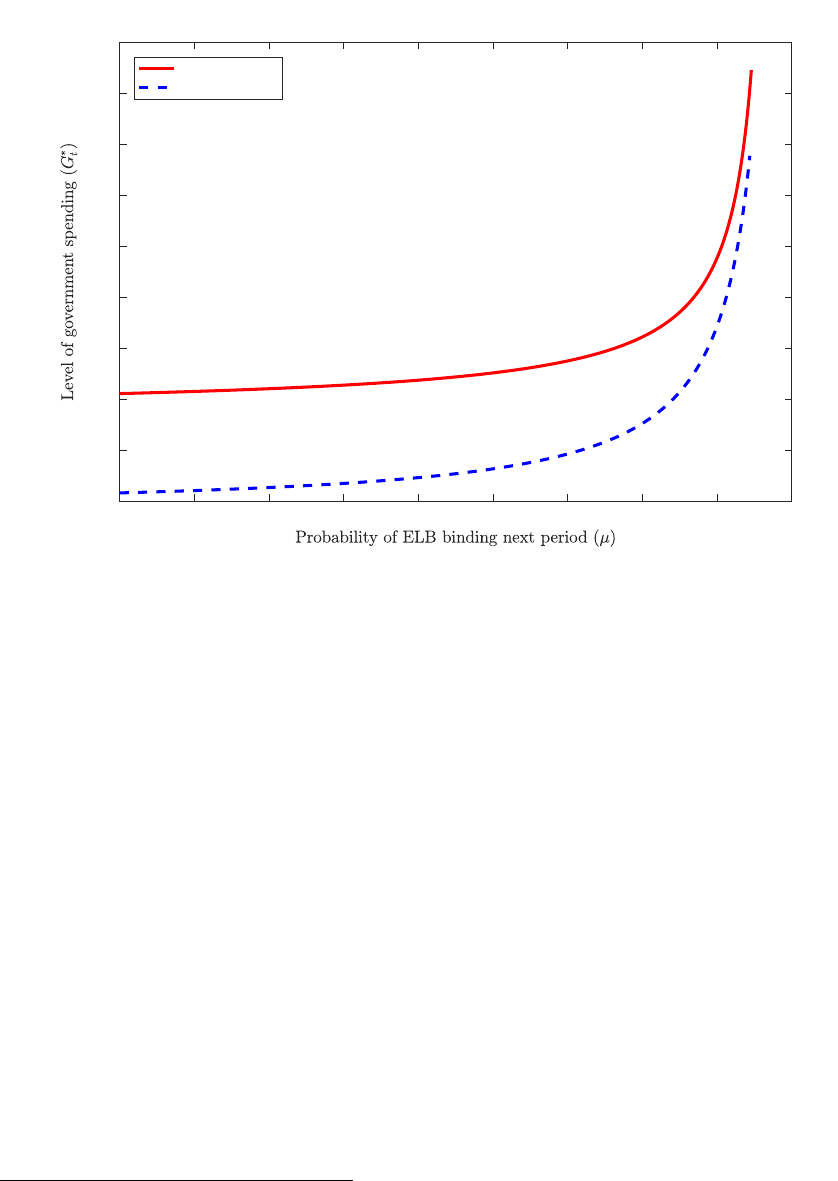

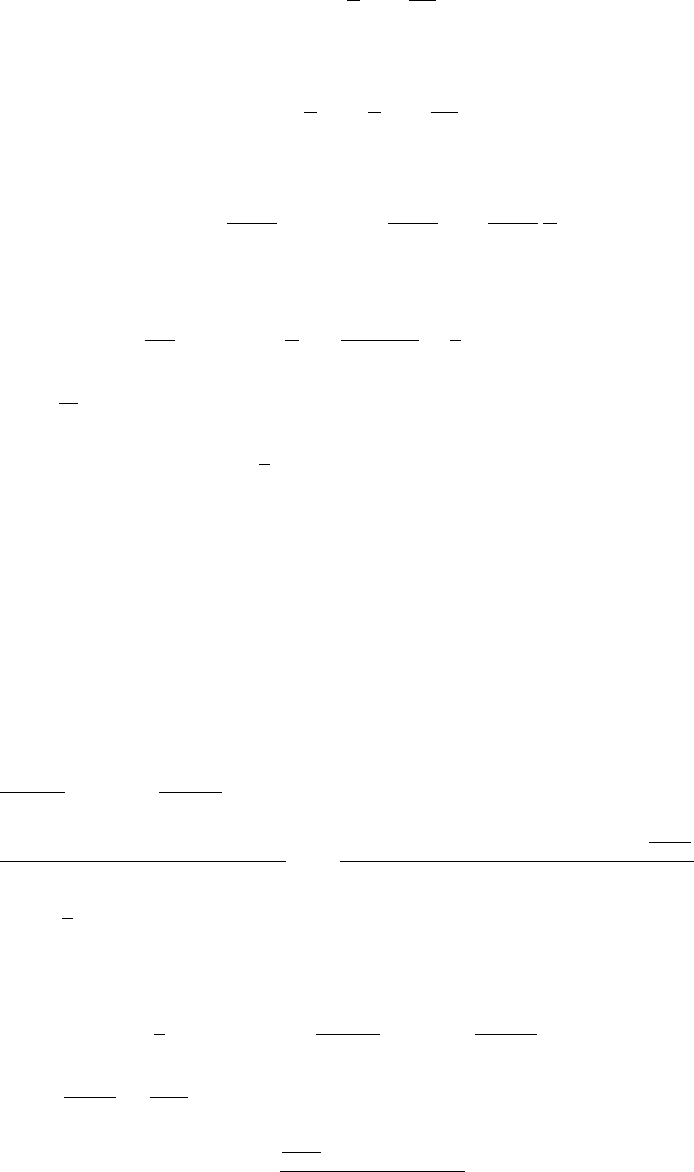

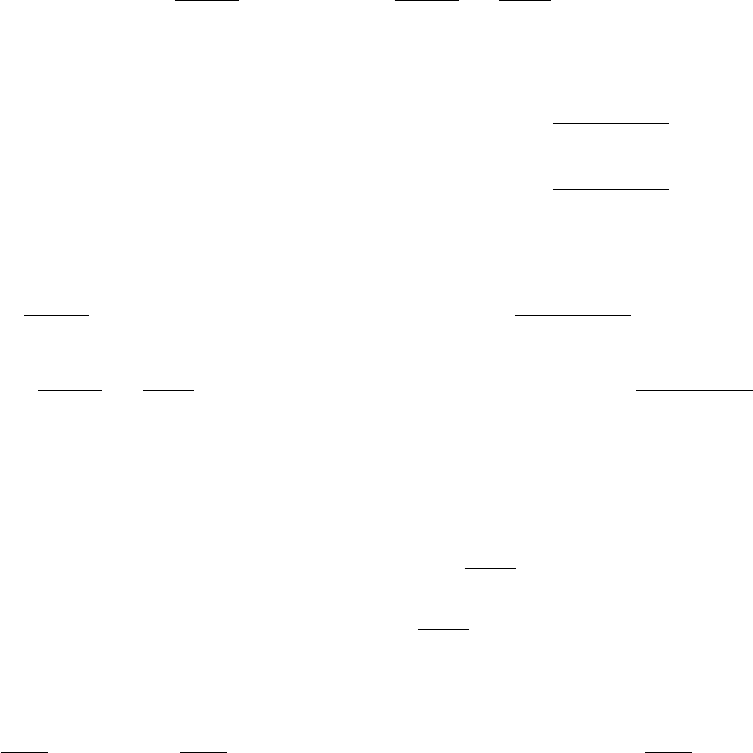

So far we have focused on the stimulus gap, that is for a given steady state we have computed

the percentage point difference in the optimal variation of government spending with and

without coordination. We have illustrated that the gap can be sizable. However, in Section

3.1 we have established that the level of government spending is too high to begin with

in steady state in the absence of coordination. We therefore compute the optimal level of

government spending in the ELB scenario to see which of these effects dominates and report

results in Figure 4. The vertical axis measures the optimal level of government consumption

with (dashed lines) and without (solid lines) coordination. Along the horizontal axis we

measure again the expected duration of the ELB episode. Results are based on the parameter

values listed in Table 1 above. In this case, we find that the steady-state effect dominates:

the level of spending without coordination exceeds the optimal level with coordination for all

21

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

0.15

0.16

0.17

0.18

0.19

0.2

0.21

0.22

0.23

0.24

w/o coordination

coordination

Figure 4: The optimal level of government spending under coordination (dashed lines) and

without (solid lines) (i.e. G

Coord

t

and G

Nash

t

). We only compute results for combinations of

parameters which give rise to a locally unique equilibrium.

values of µ for which we obtain a unique equilibrium.

22

Nevertheless, the distance between

the optimal level of government expenditure with and without coordination becomes smaller.

Against this background, one may conjecture that there is little need to coordinate on fiscal

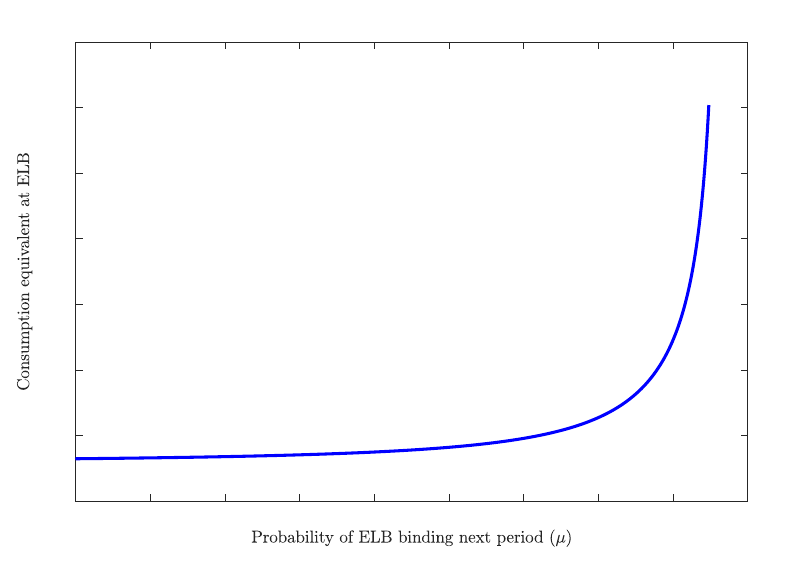

stimulus at the ELB. In order to assess this conjecture formally, we evaluate welfare under

the optimal policy with and without coordination. Specifically, we compute the consumption

equivalent ζ which compensates the household for the lack of coordination (see Appendix

I for details). Figure 5 displays the result. The vertical axis measures the consumption

equivalent in percentage points of steady-state consumption in the absence of coordination.

The horizontal axis measures the probability µ that the ELB remains binding for another

period. The longer the ELB is expected to bind, the higher the consumption equivalent.

Hence, the need for coordination increases in the duration of the ELB—despite the fact that

the distance between the optimal level of spending shrinks as µ increases (see Figure 4). This

22

In principle, it is possible that the optimal level of spending without coordination falls short of the optimal

level with coordination. For instance, assuming ϕ = 0.2 and θ = 0.5 we find this to be the case, provided the

ELB episode is expected to be sufficiently long lasting.

22

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9

1.75

1.8

1.85

1.9

1.95

2

2.05

2.1

Figure 5: Welfare loss due to lack of coordination. Consumption equivalent which compen-

sates for the lack of coordination expressed in percentage points of steady state consumption

in the absence of coordination (see Appendix I).

is because the deviations from the optimal allocation become more costly, the further away

the economy moves from the steady-state under coordination.

Finally, Figure 5 also shows that the largest part of the welfare loss is due to absence of

coordination at steady state (ζ = 1.78 for µ = 0). This is perhaps not surprising since the

economy will return permanently to steady state, once the ELB ceases to bind. Still, when

the expected duration of the ELB is 5 quarters (µ = 0.8) about 15% of the consumption

equivalent are due to lack of coordination at the ELB. This strikes us as sizable, given the

rather short duration of the ELB scenario.

5 Conclusion

In the context of the global financial crisis fiscal policy has been rediscovered as a stabilization

tool. A central concern in this regard is that monetary policy may become constrained by the

ELB on nominal interest rates precisely at times when the need for stabilization is particularly

large. In this case it not only seems natural to turn to fiscal policy for additional support,

23

it has also been documented that fiscal policy is likely to be particularly effective under such

circumstances.

Against this background, we consider a currency union where a common monetary policy

operates jointly with many fiscal policies. Assuming that the common monetary policy is

unable to stabilize area-wide inflation and output, we ask whether there is a need to coor-

dinate government spending policies across the member states of the union. This possibility

arises because uncoordinated fiscal policies induce movements of the terms of trade which are

internalized by a coordinated policy response.

Our analysis is based on the model of Gal´ı and Monacelli (2008) which we extend in order

to account for the ELB and the absence of fiscal policy coordination. Absent coordination,

we find—in line with earlier results—that each country seeks to improve its terms of trade as

long as the ELB is not binding. In a symmetric equilibrium, however, the terms of trade are

unchanged and government spending is too high relative to the outcome under coordination.

At the ELB, instead, we find that the optimal fiscal response implies too little fiscal stimulus

in the absence of coordination. In this case governments seek to avoid an appreciation of the

terms of trade in order to prevent a loss of competitiveness in times of economic slack.

Hence, absent coordination, the terms-of-trade externality has a differential impact on the

optimal level of government spending depending on whether the ELB binds or not. Accounting

for both dimensions, we find that the welfare loss due to the lack of coordination increases

in the expected duration of the ELB episode. We thus conclude that there is indeed a case

for coordinating fiscal stabilization policies in a currency union, once monetary policy is

constrained by an ELB.

24

References

Acconcia, A., Corsetti, G., and Simonelli, S. (2014). Mafia and public spending: Evidence on

the fiscal multiplier from a quasi-experiment. American Economic Review, 104(7):2185–

2209.

Beetsma, R. and Jensen, H. (2005). Monetary and fiscal policy interactions in a micro-founded

model of a monetary union. Journal of International Economics, (67):320–352.

Beetsma, R. and Uhlig, H. (1999). An analysis of the stability and growth pact. Economic

Journal, (109):546–571.

Beetsma, R. M. W. J. and Bovenberg, A. L. (1998). Monetary union without fiscal coordi-

nation may discipline policymakers. Journal of International Economics, 45(2):239–258.

Benigno, G. and Benigno, P. (2003). Price Stability in Open Economies. Review of Economic

Studies, 70(4):743–764.

Benigno, P. (2004). Optimal monetary policy in a currency area. Journal of International

Economics, 63(2):293 – 320.

Benigno, P. and Woodford, M. (2006). Optimal taxation in an RBC model: A linear-quadratic

approach. Journal of Economic Dynamics and Control, 30(9-10):1445–1489.

Blanchard, O., Erceg, C., and Lind, J. (2016). Jump-Starting the Euro Area Recovery: Would

a Rise in Core Fiscal Spending Help the Periphery? In NBER Macroeconomics Annual

2016, Volume 31, NBER Chapters. National Bureau of Economic Research, Inc.

Born, B., Juessen, F., and M¨uller, G. J. (2013). Exchange rate regimes and fiscal multipliers.

Journal of Economic Dynamics and Control, 37(2):446–465.

Calvo, G. A. (1983). Staggered prices in a utility-maximizing framework. Journal of Monetary

Economics, 12(3):383 – 398.

Chetty, R., Guren, A., Manoli, D., and Weber, A. (2011). Are micro and macro labor

supply elasticities consistent? a review of evidence on the intensive and extensive margins.

American Economic Review, 101(3):471–75.

Christiano, L., Eichenbaum, M., and Rebelo, S. (2011). When Is the Government Spending

Multiplier Large? Journal of Political Economy, 119(1):78 – 121.

Cook, D. and Devereux, M. B. (2011). Optimal fiscal policy in a world liquidity trap. European

Economic Review, 55(4):443–462.

25

Corsetti, G., Kuester, K., Meier, A., and M¨uller, G. J. (2013a). Sovereign risk, fiscal policy,

and macroeconomic stability. The Economic Journal, 123(566):F99–F132.

Corsetti, G., Kuester, K., and M¨uller, G. (2013b). Floats, pegs and the transmission of fiscal

policy., volume 17 of Fiscal Policy and Macroeconomic Performance, Central Banking,

Analysis, and Economic Policies Book Series, chapter 7, pages 235–281. in C´espedes, L.F.

and J. Gal´ı (eds.), Santiago, Chile, Central Bank of Chile.

Corsetti, G., Meier, A., Kuester, K., and M¨uller, G. J. (2014). Sovereign risk and belief-driven

fluctuations in the euro area. Journal of Monetary Economics, (61):53–73.

Corsetti, G. and Pesenti, P. (2001). Welfare And Macroeconomic Interdependence. The

Quarterly Journal of Economics, 116(2):421–445.

Cotarelli, C. (2012). Fiscal adjustment: Too much of a good thing? Vox EU.

C´urdia, V. and Woodford, M. (2011). The Central-Bank Balance Sheet as an Instrument of

Monetary Policy. Journal of Monetary Economics, (58):54–79.

C´urdia, V. and Woodford, M. (2015). Credit frictions and optimal monetary policy. Journal

of Monetary Economics, forthcoming.

Cwik, T. and Wieland, V. (2011). Keynesian Government Spending Multipliers and Spillovers

in the Euro Area. Economic Policy, (26):493–549.

De Paoli, B. (2009). Monetary policy and welfare in a small open economy. Journal of

International Economics, 77(1):11–22.

Devereux, M. B. (1991). The terms of trade and the international coordination of fiscal policy.

Econmic Inquiry, (102(3)):720–736.

Dixit, A. and Lambertini, L. (2001). Monetary-fiscal policy interactions and commitment

versus discretion in a monetary union. European Economic Review, 45(4-6):977–987.

Dixit, A. and Lambertini, L. (2003). Symbiosis of monetary and fiscal policies in a monetary

union. Journal of International Economics, 60(2):235–247.

Eggertsson, G. B. and Woodford, M. (2003). The Zero Interest-Rate Bound and Optimal

Monetary Policy. Brookings Papers on Economic Activity, 1:139–211.

Epifani, P. and Gancia, G. (2009). Openness, government size and the terms of trade. The

Review of Economic Studies, 76(2):629–668.

26

Erceg, C. J. and Lind´e, J. (2012). Fiscal Consolidation in an Open Economy. American

Economic Review, (102(3)):186–191.

Erceg, C. J. and Lind´e, J. (2014). Is There A Fiscal Free Lunch In A Liquidity Trap? Journal

of the European Economic Association, 12(1):73–107.

Evers, M. P. (2015). Fiscal federalism and monetary unions: A quantitative assessment.

Journal of International Economics, 97(1):59–75.

Fahri, E. and Werning, I. (2016). Fiscal Multipliers: Liquidity traps and currency unions.

In Taylor, J. B. and Uhlig, H., editors, Handbook of Macroeconomics, chapter 31, pages

2417–2491. Elsevier.

Forlati, C. (2009). Optimal monetary and fiscal policy in the emu: Does fiscal policy coor-

dination matter? Center for Fiscal Policy, EPFL, Chair of International Finance (CFI)

Working Paper, (2009-04).

Forlati, C. (2015). On the benefits of a monetary union: Does it pay to be bigger? Journal

of International Economics, 97(2):448–463.

Gal´ı, J. (2008). Monetary policy, inflation, and the business cycle. Princeton Univ. Press.

Gal´ı, J. and Monacelli, T. (2005). Optimal Monetary and Fiscal Policy in a Currency Union.

Working Papers 300, IGIER (Innocenzo Gasparini Institute for Economic Research), Boc-

coni University.

Gal´ı, J. and Monacelli, T. (2008). Optimal monetary and fiscal policy in a currency union.

Journal of International Economics, 76(1):116 – 132.

Gal´ı, J. and Monacelli, T. (2015). A Note on Martin Hellwig’s “The Gal´ı-Monacelli Model of

a Small Open Economy Has No International Trade”. mimeo.

Giannoni, M., Patterson, C., and Negro, M. D. (2016). The Forward Guidance Puzzle.

Technical report.

Groll, D. and Monacelli, T. (2016). The Inherent Benefit of Monetary Unions. CEPR Dis-

cussion Papers 11416, C.E.P.R. Discussion Papers.

Hellwig, M. (2015). The Gal´ı-Monacelli Model of a Small Open Economy Has No International

Trade. mimeo.

Kirsanova, T., Satchi, M., Vines, D., and Wren-Lewis, S. (2007). Optimal Fiscal Policy Rules

in a Monetary Union. Journal of Money, Credit and Banking, 39(7):1759–1784.

27

Krogstrup, S. and Wyplosz, C. (2010). A common pool theory of supranational deficit ceilings.

European Economic Review, 54:273–282.

Krugman, P. (2008). The economic consequences of Herr Steinbrueck. New York Times.

Nakamura, E. and Steinsson, J. (2014). Fiscal stimulus in a monetary union: Evidence from

us regions. American Economic Review, 104(3):753–92.

Pappa, E. (2004). Do the {ECB} and the fed really need to cooperate? optimal monetary

policy in a two-country world. Journal of Monetary Economics, 51(4):753 – 779.

Rogoff, K. S. (2016). The Curse of Cash. Princeton University Press.

Schmidt, S. (2013). Optimal Monetary and Fiscal Policy with a Zero Bound on Nominal

Interest Rates. Journal of Money, Credit and Banking, 45(7):1335–1350.

Schmidt, S. (2016). Fiscal activism and the zero nominal interest rate bound. Journal of

Money, Credit and Banking, forthcoming.

Soderlind, P. (1999). Solution and estimation of RE macromodels with optimal policy. Eu-

ropean Economic Review, 43(4-6):813–823.

Svensson, L. E. O. (1997). Optimal inflation targets, ”conservative” central banks, and linear

inflation contracts. The American Economic Review, 87(1):98–114.

Turnovsky, S. J. (1988). The gains from fiscal cooperation in the two-commodity real trade

model. Journal of International Economics, 25(1-2):111–127.