EN EN

EUROPEAN

COMMISSION

Brussels, 8.3.2023

COM(2023) 141 final

COMMUNICATION FROM THE COMMISSION TO THE COUNCIL

Fiscal policy guidance for 2024

1

COMMUNICATION FROM THE COMMISSION TO THE COUNCIL

Fiscal policy guidance for 2024

1. Introduction

The European economy entered 2023 on a healthier footing than projected in autumn.

The European gas benchmark price has fallen below levels that prevailed before the Russian

invasion of Ukraine, helped by demand restraint and the continued diversification of supply.

Labour markets have also continued to perform strongly, with the unemployment rate in the

EU remaining at an all-time low in December 2022. Three months of falling inflation rates

suggest that the peak is now behind us, while core inflationary pressures remain high and

risks are to the upside. Economic sentiment has also continued to improve, indicating that EU

economic activity may avoid a contraction in the first quarter of 2023 and narrowly avoid the

recession that was previously expected.

At the same time, the European economy continues to face headwinds and high levels of

uncertainty. With inflationary pressures persisting, monetary policy tightening is set to

continue, dampening demand. Growth is thus expected to remain subdued in 2023, though

the Commission 2023 winter forecast has lifted the growth outlook for this year. In the

context of the current geopolitical landscape, uncertainty remains high.

In 2023-24, fiscal policies should aim at ensuring medium-term debt sustainability as

well as raising potential growth in a sustainable manner. Fiscal measures have mitigated

the impact of the energy crisis on businesses and consumers. However, broad-based fiscal

stimulus to aggregate demand is unwarranted and costly support measures cannot continue

indefinitely: the focus must now be on strengthening fiscal sustainability through gradual

fiscal consolidation and, where still needed, on targeted fiscal measures that support

vulnerable households and firms affected by high energy prices. Prudent fiscal policy will

help to ensure the stability of the European economy and facilitate the effective transmission

of monetary policy in a high inflation environment, while raising potential growth.

This Communication sets out guidance for Member States on the conduct and

coordination of fiscal policy, in light of the challenges facing public finances and the

economy and the discussions on the future economic governance framework. The

Commission Communication of 9 November 2022 on orientations for a reform of the EU

economic governance framework (hereafter “reform orientations”) stated that the

Commission will provide Member States with fiscal guidance for 2024 in the first quarter of

2023. (

1

) The EU fiscal framework is currently in a transitionary phase. The economic

governance review was initially launched in February 2020, recognising areas of the

framework that needed improvement. A return to the sole implementation of the rules of the

existing legal framework would also fail to acknowledge the new post-pandemic reality. As a

(

1

) European Commission ‘Communication on orientations for a reform of the EU economic governance

framework,’ COM(2022) 583 final of 9 November 2022.

2

new legal framework, based on the outcome of the ongoing economic governance review, is

not yet in place, the current legal framework continues to apply. At the same time, to allow

for an effective bridge to the operation of the future set of EU fiscal rules and to take into

account the current challenges, some elements of the Commission’s reform orientations could

be incorporated into the fiscal surveillance cycle that will start in spring 2023. Therefore, as

indicated in the Commission Communication of 9 November 2022, the guidance reflects the

economic situation and the specific situation of each Member State as well as those elements

of the Commission reform orientations that are consistent with the spirit of the existing legal

framework. It will be crucial to reach agreement on the future economic governance

framework as quickly as possible to have a set of EU fiscal rules that fully takes into account

the new post-pandemic reality.

The guidance seeks to inform Member States’ preparations of their Stability and

Convergence Programmes. It will be followed in spring with fiscal country-specific

recommendations (CSRs) for 2024 that will also guide the preparation and assessment of the

Draft Budgetary Plans in autumn.

The remainder of the Communication consists of six sections. Section 2 outlines the

economic outlook for this year and next, based on the Commission 2023 winter forecast.

Section 3 provides a state of play on the ongoing economic governance review. Section 4

discusses the fiscal policy response to the energy crisis. Section 5 discusses the implications

for fiscal guidance in 2024 of deactivation of the general escape clause. Section 6 discusses

the opening of Excessive Deficit Procedures (EDPs). Finally, Section 7 outlines the next

steps.

2. Economic situation and outlook

The Commission 2023 winter forecast lifted the growth outlook for 2023. The energy

crisis and resulting terms of trade loss have impacted production and eroded households’

purchasing power, weighing on economic confidence. However, households and firms have

shown remarkable resilience and inflation now appears to have peaked, which should allow

growth to pick up in spring. Labour markets are expected to remain strong despite the

challenging environment, although inflation continues to outpace wage growth, weakening

consumption. Expenditure under the Recovery and Resilience Facility (RRF) and the

implementation of Cohesion Policy programmes are set to continue increasing, supporting

public investment. After a broad stagnation in the last quarter of 2022, rather than falling as

expected, real GDP growth is forecast at 0.8% in the EU in 2023, alongside inflation of 6.4%.

In 2024, EU GDP growth is expected to reach 1.6% and inflation would moderate to 2.8%.

The combination of slow economic growth and high inflation in the short term calls for

strong EU and euro area fiscal policy coordination, based on clear guidance that can be

monitored in a transparent manner. This will also help ensure a consistent policy mix.

Uncertainty surrounding the European economic outlook remains high, although risks

to growth are broadly balanced. Risks to the growth outlook are no longer tilted to the

downside. Domestic demand could surprise positively, particularly if recent falls in wholesale

gas prices are passed on more strongly to consumers, and while the threat of gas shortages

3

remains significant, it appears less serious than previously. Nonetheless, adjustment to the

high interest rate environment could prove challenging and uncertainty remains high, given

Russia’s ongoing war against Ukraine. Upside risks to inflation remain largely linked to

developments in energy markets – whereby we must remain vigilant as regards the future

evolution of energy prices. In 2024 in particular, upside risks to inflation prevail, as wage

growth could settle at above-average rates for a sustained period.

The medium-term challenges facing the European economy have not abated. Economic

challenges that were evident prior to the pandemic, including the need to strengthen potential

growth, to accelerate the twin transition in a fair way and to improve resilience, coupled with

demographic developments, will increase the demands on public finances in the medium

term. These challenges have highlighted the importance of social cohesion and resilience, as

targeted by the European Pillar of Social Rights. In this context, fiscal policies should aim at

preserving debt sustainability as well as raising growth potential in a sustainable and

inclusive manner, thus also facilitating the task of monetary policy. Maintaining a high level

of public investment, while reducing debt-to-GDP ratios in a sustained manner, reinforces the

need to prioritise expenditure and build fiscal buffers. Taking a longer perspective, the last

decade has been characterised by major shocks, notably the economic and financial crisis, the

COVID-19 crisis, the Russian invasion of Ukraine and the ensuing energy crisis and surge in

inflation. This uncertainty means that fiscal policy will need to remain agile going forward.

3. State of play of the economic governance review

The Commission published its orientations for a reform of the economic governance

framework in November 2022 after an extensive consultation process. The reform

orientations build on the Commission’s experience with and analysis of the implementation

of the framework before the pandemic, as well the lessons drawn from the EU’s response to

the pandemic. It also takes account of the outcome of a public consultation that was

relaunched in October 2021, involving a wide range of stakeholders including Member

States, the other EU institutions, social partners, citizens, and academia, amongst others. The

proposed revised framework seeks to strengthen debt sustainability and reduce high public

debt ratios while promoting sustainable and inclusive growth in all Member States. The key

objectives of the proposal are to improve national ownership, simplify the framework and

move towards a greater medium-term focus, combined with stronger and more coherent

enforcement. National medium-term fiscal-structural plans that integrate fiscal, reform and

investment objectives are the cornerstone of the revised framework. This will provide

Member States with greater leeway in setting their fiscal adjustment path, within a common

EU framework that would go hand-in-hand with stronger enforcement.

Discussions on the revised fiscal framework are progressing. The fiscal elements of the

proposal have been discussed at the Economic and Financial Committee, as well as at

ministerial level at the ECOFIN Council and, for issues specifically relevant to the euro area,

at the Eurogroup. The Commission has also discussed its orientations with the European

Parliament, the European Economic and Social Committee, the European Committee of the

Regions, and other stakeholders. The exchanges have focused on various issues, including:

4

the differentiation of fiscal requirements across Member States based on the assessment of

debt challenges (using the Commission debt sustainability analysis); a stronger focus on the

medium to long term through Member States committing to country-specific medium-term

fiscal-structural plans based on the Commission’s guidance; the assessment and monitoring

of those plans; the need to retain deficit-based EDP while reinforcing the debt-based EDP;

the use of efficient monitoring and enforcement instruments, including a control account,

smaller but more credible financial sanctions, and reputational sanctions; the role of

independent fiscal institutions; and the role of investment and reforms in extending

adjustment paths and a new tool to enforce these commitments.

A convergence of views is emerging on several key issues, while others remain to be

clarified. There is agreement that the 3% and 60% of GDP reference values of Protocol No

12 to the Treaties should remain unchanged. Views are converging on a number of issues:

that the proposed medium-term approach, while maintaining annual surveillance, is

appropriate to ensure a sustained reduction in high debt ratios and that medium-term fiscal

structural plans prepared by Member States would be the cornerstone of the revised

framework; the need for greater incentives for investment and reforms, reflecting the lessons

learned from the impact of the global financial crisis on investment and the significant

investment needs for the green and digital transitions; that more effective enforcement of the

rules is needed, including by retaining financial sanctions but lowering their amounts, while

enhancing their reputational impact; that the existing rules for the opening and closing of a

deficit-based EDP would remain unchanged, while the debt-based EDP would need to be

reinforced; respecting the key principles of ensuring national ownership and equal treatment;

and the need for an appropriate differentiation of fiscal efforts. Further discussions are needed

on the operationalisation of these principles.

The Commission intends to table legislative proposals following the upcoming ECOFIN

Council and the European Council in March 2023, which will aim at reaching agreement

on key elements of the future economic governance framework.

4. Fiscal policy reaction to the energy crisis

The surge of energy prices prompted Member States to implement fiscal policy

measures, with sizeable fiscal costs. These measures mitigated the social and economic

impact of the sudden rise in energy prices, in particular gas and electricity, on households and

firms. According to the Commission 2022 autumn forecast, the net cost of these measures in

2022 amounted to 1.2% of annual EU GDP. Based on the available information in autumn,

the net cost of energy measures was projected to decrease to 0.9% of EU GDP in 2023.

However, this requires the planned phasing out of most support measures to be undertaken by

Member States. In some cases, the phasing out is taking place, while in other cases Member

States have since autumn extended some existing measures or adopted new ones. Extending

existing energy measures until the end of 2023 would entail a substantial increase in the

related budgetary costs.

The outlook for energy prices has improved. Since January 2023, European wholesale gas

spot prices have fallen back to well-below pre-war levels, albeit still more than three times

5

2019 prices. As the pass-through from wholesale gas and electricity prices to consumer prices

is typically slower than for fuels, the impact of the recent steep fall in wholesale prices for

gas and electricity inflation is yet to be seen in retail prices. Domestic demand could turn out

higher than projected if the recent declines in wholesale gas prices pass through to consumer

prices more strongly. At the same time, gas prices were exceptionally volatile in 2023 and a

reversal of recent downward pressure cannot be ruled out ahead of next winter.

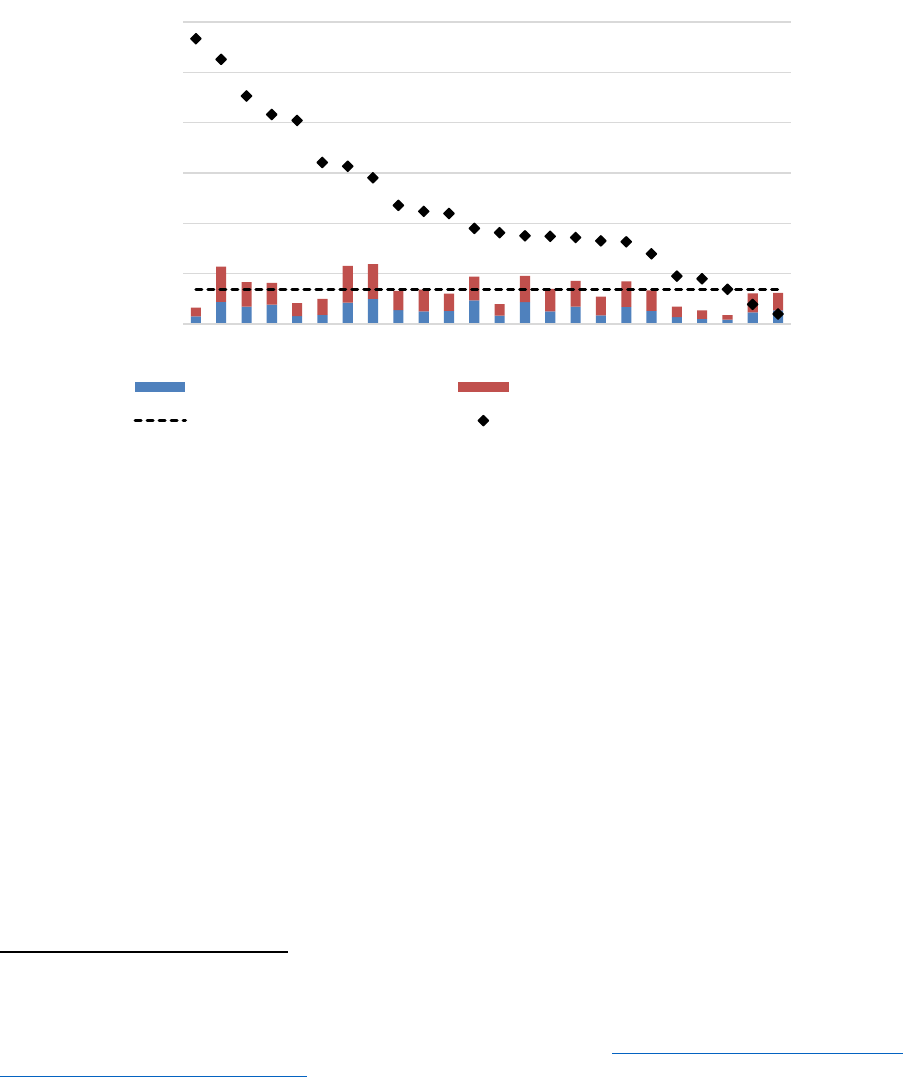

Graph 1: The budgetary cost of energy measures has exceeded

the increase in energy spending of vulnerable households

Note: The chart shows the estimated increase in energy spending of lower income households (on residential

and transport fuel) compared to the total budgetary cost of energy measures in 2022, net of revenues from taxes

and levies on windfall profits. Portugal and Sweden are omitted due to limited data availability. Malta is omitted

as the energy component of inflation (HICP measure) shows no price increase.

Source: Commission services

The focus should now shift to the phasing out of national fiscal measures introduced to

protect households and firms from the energy price shock. Member States should phase

out energy support measures, starting with the least targeted ones. If an extension of support

measures would be necessary because of renewed energy pressures, Member States should

target their measures much better than in the past, refraining from generalised support and

only protecting those who need it, namely vulnerable households and firms. This will limit

fiscal costs and, importantly, also ensure incentives to limit energy consumption and increase

energy efficiency. In 2022, more than 70% of the amounts dedicated to energy support

corresponded to measures that were not sufficiently targeted to the most vulnerable

households and firms. (

2

) Furthermore, two thirds of the measures have distorted the price

(

2

) The Commission uses the following criteria to assess the quality of fiscal measures related to energy:

measures should be fiscally affordable, targeted to the most vulnerable, preserve the price signal (i.e., encourage

the reduction of energy consumption or improve energy efficiency) and be easily implementable across Member

States without excessive administrative burden. European Commission, ‘Communication on the 2023 Draft

Budgetary Plans: Overall Assessment,’ COM(2022) 900 final of 22 November 2022.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

BG IT EL PL LV ES AT LT LU DE CZ NL HU BE SI EE HR FR CY SK RO IE FI DK

per cent of GDP

First Income Quintile Second Income Quintile

First + Second Quintiles (Average) Budgetary Cost of Energy Measures

6

signal and may have reduced incentives to contain energy consumption and increase energy

efficiency. The design of measures has nonetheless been improving with time, based on the

experience since the initial rapid response to the abrupt increase in energy prices.

The lasting solution to the energy crisis is to reduce dependence on imported fossil fuels.

In this context, efforts should focus on ensuring the timely implementation of reforms and

investments to increase energy efficiency, diversify energy supply and accelerate the

development of renewable energy sources, as outlined in the framework of the RRF and to be

further strengthened under REPowerEU. (

3

) The Green Deal Industrial Plan will also help to

enhance the competitiveness of Europe's net-zero manufacturing industry and support the fast

transition to climate neutrality, including by the transformation of our energy systems. (

4

)

5. Moving out of the general escape clause: implications for fiscal guidance

The general escape clause of the Stability and Growth Pact will be deactivated at the

end of 2023. The Commission Communication on the 2022 European Semester in May 2022

stated that the conditions to deactivate the general escape clause would be considered met as

of 2024. (

5

,

6

) The Annual Sustainable Growth Survey of November 2022 confirmed this

assessment, noting that the European economy is out of a period of severe economic

downturn. (

7

) It has recovered beyond its pre-pandemic level and has now weathered the

acute phase of the energy price shock caused by Russia’s aggression against Ukraine,

although uncertainty remains high.

Key principles to guide Member States in the preparation of their Stability and

Convergence programmes are needed in the context of the deactivation of the general

escape clause as of 2024 and the need for prudent fiscal policies. As we move out of the

period during which the general escape clause was in force, a resumption of differentiated

CSRs formulated in quantitative terms as well as qualitative guidance on investment and

energy measures will help to provide the necessary clarity for Member States. At the same

time, in the period until a new fiscal framework comes into operation and given the specific

economic situation characterised by high uncertainty, it would not be appropriate to return to

(

3

) See Regulation (EU) 2023/435 of the European Parliament and of the Council of 27 February 2023 amending

Regulation (EU) 2021/241 as regards REPowerEU chapters in recovery and resilience plans (OJ L 63 of

28.2.2023, p. 1).

(

4

) See European Commission ‘A Green Deal Industrial Plan for the Net-Zero Age’, COM(2023) 62 final of 1

February 2023.

(

5

) European Commission ‘2022 European Semester - Spring Package,’ COM(2022) 600 final of 23 May 2022.

(

6

) Specific provisions in the EU fiscal rules allow for a coordinated and orderly temporary deviation from the

normal requirements for all Member States in a situation of generalised crisis caused by a severe economic

downturn of the euro area or the EU as a whole (see art. 5(1), 6(3), 9(1) and 10(3) of Regulation (EC) 1466/97

and art. 3(5) and 5(2) of Regulation (EC) 1467/97).

(

7

) European Commission (2022) ‘Annual Sustainable Growth Survey 2023,’ COM(2022) 780 final of 22

November 2022.

7

the ‘matrix of adjustment requirements’ that was used in the context of the preventive arm of

the Stability and Growth Pact between 2015 and 2020. (

8

)

The fiscal surveillance cycle would reflect the spirit of the Commission reform

orientations. As the debate on reform of the economic governance framework is still

ongoing, the current legal framework continues to apply. The Commission does not propose

to shift to a new system of fiscal surveillance in 2024. At the same time, to allow for an

effective bridge to the operation of the future set of EU fiscal rules and to take account of the

post-pandemic reality, some elements of the Commission reform orientations could be

incorporated into the fiscal surveillance cycle starting in spring 2023. Therefore, in the spirit

of the Commission reform orientations, Member States are invited to submit Stability and

Convergence Programmes that include their medium-term fiscal and structural plans.

Furthermore, the Commission stands ready to propose fiscal CSRs for 2024 including a

quantitative requirement as well as qualitative guidance on investment and energy measures,

consistent with the criteria proposed in its reform orientations, while also remaining

consistent with those of the current legislation under the Stability and Growth Pact. This

would be the basis for the Commission’s monitoring of fiscal outcomes against the fiscal

recommendations, starting with euro area Member States’ Draft Budgetary Plans for 2024 to

be assessed by the Commission in the autumn.

Member States are invited to set out in their Stability and Convergence Programmes

how their fiscal plans will ensure the respect of the 3% of GDP deficit reference value as

well as plausible and continuous debt reduction, or for debt to be kept at prudent levels,

in the medium term. Member States are invited to set fiscal targets in the 2023 Stability and

Convergence Programmes that comply with the fiscal adjustment criteria set out in the

Commission reform orientations. More precisely, Member States with substantial or

moderate public debt challenges are invited to set fiscal targets that ensure plausible and

continuous debt reduction or that debt is kept at prudent levels in the medium term. (

9

) In

addition, all Member States are invited to set fiscal targets that ensure that the deficit does not

exceed 3% of GDP or is brought below 3% of GDP within the period covered by the Stability

or Convergence Programme, and credibly ensure that the deficit is maintained below 3% of

GDP at unchanged policies over the medium term. Member States are also invited to report in

their Stability and Convergence Programmes on their planned energy support measures,

including their budgetary impact, their phasing-out, and the underlying assumptions on

energy price developments. Finally, Member States are invited to discuss in their Stability

and Convergence Programmes how their reform and investment plans, including those

outlined in their Recovery and Resilience Plans, are expected to contribute to fiscal

sustainability and sustainable and inclusive growth, in line with the criteria set out in the

Commission reform orientations.

(

8

) See Box 1.6, p. 16, of the 2019 Edition of the Vade Mecum on the Stability and Growth Pact and European

Commission ‘Making the best use of the flexibility within the existing rules of the Stability and Growth Pact’,

COM(2015) 12 final of 13 January 2015.

(

9

) As set out in Box 1 of the Commission Communication on orientations for a reform of the economic

governance framework (see Footnote 1), the Commission proposes that the classification of Member States on

the basis of their debt challenges would be done using the Commission’s debt sustainability analysis framework.

8

The Commission stands ready to propose fiscal CSRs for 2024 that are in line with

Member States’ own targets, so long as those targets are consistent with ensuring that

the public debt ratio is put on a downward path or stays at a prudent level and the

budget deficit is below the 3% of GDP reference value over the medium term. In line

with the medium-term approach and emphasis on national ownership, the Commission stands

ready to base the fiscal CSRs on the fiscal targets set out in Member States’ own Stability and

Convergence Programmes. Member States are therefore invited to ensure that the fiscal

targets in their Stability and Convergence Programmes are consistent with the criteria

proposed in the Commission reform orientations. When a Member State’s fiscal targets are

not sufficiently ambitious, the Commission would propose a fiscal CSR that is consistent

with the criteria proposed in its reform orientations, while remaining consistent with those of

the current legislation under the Stability and Growth Pact. At this juncture, the quantified

requirement of the CSR will focus on 2024.

The Commission’s proposals for fiscal CSRs for 2024 would be quantified and

differentiated on the basis of Member States’ public debt challenges. This will bring into

focus the need for Member States with substantial or moderate public debt challenges to put

public debt on a plausibly and continuously downward path. More precisely, Member States

with substantial or moderate public debt challenges (based on the Commission debt

sustainability analysis) would be recommended fiscal targets that ensure a plausible and

continuous debt reduction or that debt is kept at prudent levels in the medium term, while

remaining consistent with the current legislation under the Stability and Growth Pact.

Member States with low public debt challenges would be recommended to maintain or bring

their deficit below 3% of GDP within the period covered by the Stability or Convergence

Programme, and ensure that the deficit is maintained below 3% of GDP at unchanged

policies over the medium term.

The fiscal CSRs would be formulated on the basis of net primary expenditure as

proposed in the Commission reform orientations. (

10

) Moving towards this indicator will

represent a shift in focus compared to the period when the general escape clause was in place,

when fiscal surveillance was focused on net nationally financed primary current expenditure

and the preservation of nationally financed investment.

Given its essential role, the Commission will continue to emphasise public investment in

its fiscal recommendations. All Member States should continue to protect nationally

financed investment and ensure the effective use of the RRF and other EU funds, in particular

in light of the green and digital transitions and resilience objectives. A high quality of public

investment should be ensured, including via a thorough implementation of investment

financed from the RRF. Fiscal policies should support the twin transition in order to achieve

sustainable and inclusive growth. The fiscal adjustment of Member States with substantial or

moderate public debt challenges should not weigh on investment but rather be delivered

through limiting the growth of nationally financed current expenditure relative to medium-

(

10

) Net primary expenditure is defined as nationally financed expenditure net of discretionary revenues

measures and excluding interest expenditure as well as cyclical unemployment expenditure.

9

term potential output growth. Member States should also factor in the temporary nature of the

support provided by RRF non-repayable financial support (“grants”). The Commission will

take into account the need to sustain investment when monitoring fiscal outcomes against the

fiscal recommendations.

The CSRs for 2024 will also provide guidance regarding the fiscal cost of energy

measures. If wholesale energy prices remain stable and lower energy costs are passed on to

retail prices as currently foreseen, government energy support measures should be further

phased out in 2024 and related savings should contribute to reducing government deficits. If

energy prices increase again and support cannot be fully discontinued, targeted measures

should only protect vulnerable households and firms, while broader measures, such as the

ones implemented in 2022, should be avoided. Such a move would reduce fiscal costs,

incentivise energy savings and allow the economy to adjust in a gradual and sustainable way

over a limited period.

The Commission invites the Council to endorse this approach.

6. A consistent implementation of the Excessive Deficit Procedure (EDP)

In spring 2022, the Commission committed to assess the relevance of proposing the opening

of Excessive Deficit Procedures in spring 2023, in particular taking into account compliance

with the fiscal CSRs addressed to the Member States by the Council on 12 July 2022. The

Commission is continuously monitoring Member States’ economic and budgetary situation,

recalling also the Commission’s Opinions on euro area Member States’ Draft Budgetary

Plans, which called for taking the necessary measures within the national budgetary process

to ensure that the 2023 budget is consistent with the CSRs adopted by the Council on 12 July

2022. The Commission will assess compliance with the deficit and debt criteria in accordance

with Article 126(3) of the TFEU as a part of the spring surveillance round. Taking into

consideration the persistently high uncertainty for the macroeconomic and budgetary outlook

at this juncture, the Commission considers that a decision on whether to place Member States

under the Excessive Deficit Procedure should not be taken this spring. At the same time, the

Commission will propose to the Council to open deficit-based Excessive Deficit Procedures

in spring 2024 on the basis of the outturn data for 2023, in line with existing legal provisions.

Member States should take account of this in the execution of their 2023 budgets and in

preparing their Stability and Convergence Programmes this spring and the Draft Budgetary

Plans for 2024 this autumn.

10

7. Next steps

This Communication sets out preliminary fiscal policy guidance for 2024, which will be

updated as necessary as part of the European Semester Spring Package in May 2023.

Updated guidance will continue to reflect the global economic situation, the specific situation

of each Member State, progress on the discussion on the ongoing economic governance

review and policy debates in the Council. The development of the economic and budgetary

outlook will be monitored closely and duly taken into consideration. Member States are

invited to reflect this guidance in their Stability and Convergence Programmes.

11

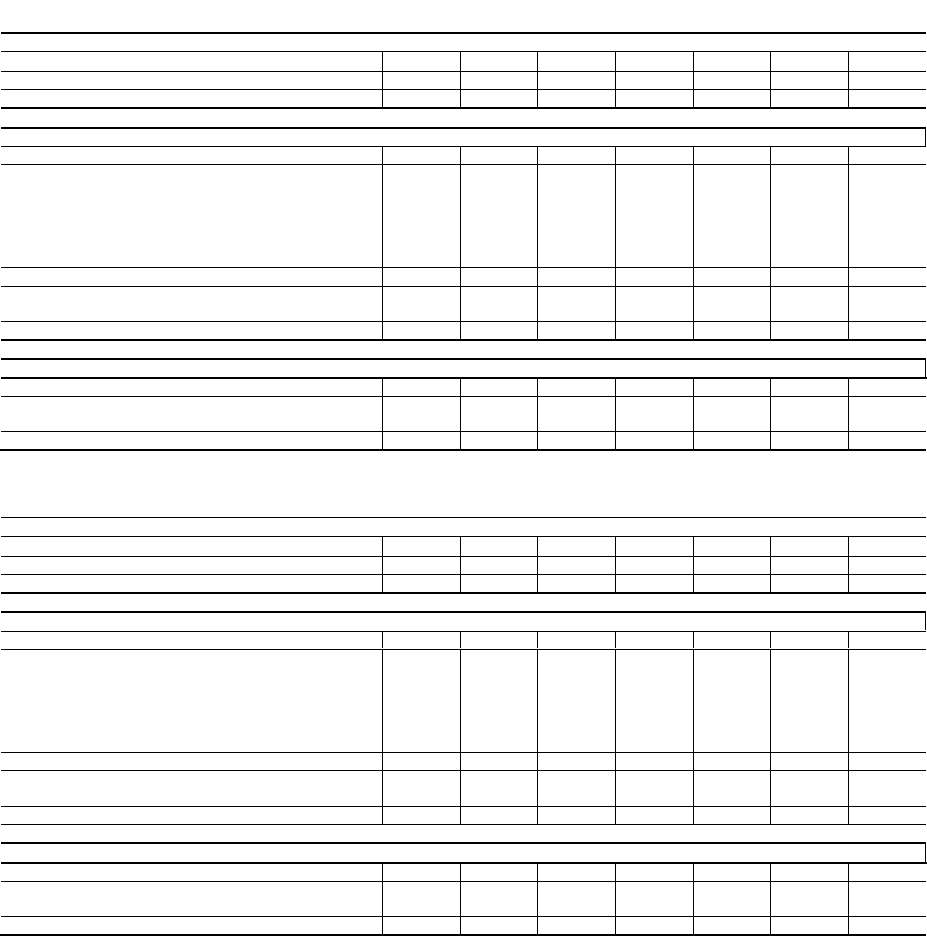

Appendix

A. Additional tables to be included in the 2023 Stability and Convergence Programmes

In addition to the required forecast budgetary data over the horizon of the Stability and Convergence

Programme, the corresponding estimates for the current year should also be included, together with

the outcomes for the period 2020-2022 (consistent with the EDP notification tables). The tables

should preferably be submitted to the Commission by means of the dedicated web application.

Table of the RRF impact on programme's projections - GRANTS

Revenue from RRF grants (% of GDP)

2020

2021

2022

2023

2024

2025

2026

RRF grants as included in the revenue projections

Cash disbursements of RRF grants from EU

Expenditure financed by RRF grants (% of GDP)

2020

2021

2022

2023

2024

2025

2026

Compensation of employees D.1

Intermediate consumption P.2

Social payments D.62+D.632

Interest expenditure D.41

Subsidies, payable D.3

Current transfers D.7

TOTAL CURRENT EXPENDITURE

Gross fixed capital formation P.51g

Capital transfers D.9

TOTAL CAPITAL EXPENDITURE

Other costs financed by RRF grants (% of GDP)

1

2020

2021

2022

2023

2024

2025

2026

Reduction in tax revenue

Other costs with impact on revenue

Financial transactions

Table of the RRF impact on programme's projections - LOANS

Cash flow from RRF loans projected in the programme (% of GDP)

2020

2021

2022

2023

2024

2025

2026

Disbursements of RRF loans from EU

Repayments of RRF loans to EU

Expenditure financed by RRF loans (% of GDP)

2020

2021

2022

2023

2024

2025

2026

Compensation of employees D.1

Intermediate consumption P.2

Social payments D.62+D.632

Interest expenditure D.41

Subsidies, payable D.3

Current transfers D.7

TOTAL CURRENT EXPENDITURE

Gross fixed capital formation P.51g

Capital transfers D.9

TOTAL CAPITAL EXPENDITURE

Other costs financed by RRF loans (% of GDP)

1

2020

2021

2022

2023

2024

2025

2026

Reduction in tax revenue

Other costs with impact on revenue

Financial transactions

Notes: Provision of data on variables in bold characters is required; provision of data on other variables is optional.

12

B. Additional information to be included in the 2023 Stability and Convergence Programmes

Member States are invited to provide information on: (i) the annual budgetary costs related to persons

fleeing Ukraine, spelled out in terms of the main ESA category(-ies) that is (are) directly affected;

and, (ii) the annual number of people hosted. These budgetary costs should be limited to those directly

linked to and as the immediate consequence of the unprecedented influx of persons fleeing Ukraine.

The provision of such information would enable the Commission to take these budgetary costs into

account in its assessment of the 2023 Stability and Convergence Programmes, as well as of the

progress made in implementing the 2022 country-specific recommendations.