The European Semester for

economic policy coordination:

A reflection paper

Economic Governance Support Unit (EGOV)

Authors: K. HAGELSTAM, C. DIAS, J. ANGERER, A. ZOPPÈ

Directorate-General for Internal Policies

PE 624.440 – October 2019*

EN

STUDY

IPOL | Economic Governance Support Unit

2 PE 624.440

DO NOT DELETE PAGE BREAK

The European Semester for economic policy coordination: A reflection paper

PE 624.440 3

The European Semester for

economic policy coordination:

A reflection paper

Subtitle (optional)

Abstract

This paper provides an overview of the current EU economic

governance framework, in particular of the so-called EU ‘rule-

based’ surveillance framework of national budgetary, economic

and social policies. It raises some broad questions on the lessons

learned and proposes some reflections for the future.

This document was prepared by the Economic Governance

Support Unit of the European Parliament and the opinions

expressed are the sole responsibility of the authors and do not

necessarily represent the official position of the European

Parliament.

IPOL | Economic Governance Support Unit

4 PE 624.440

AUTHORS /ADMINISTRATORS RESPONSIBLE

K. HAGELSTAM, C. DIAS, J. ANGERER, A. ZOPPÈ,

European Parliament

EDITORIAL ASSISTANT

M. CIUCCI and J. VEGA BORDELL

European Parliament

LINGUISTIC VERSIONS

Original: EN *Linguistic revision in January 2020

ABOUT THE PUBLISHER

The Economic Governance Support Unit provides in-house and external expertise to support EP

committees and other parliamentary bodies in shaping legislation and exercising democratic scrutiny

over EU internal policies.

To contact the Economic Governance Support Unit or to subscribe to its newsletter please write to:

Economic Governance Support Unit

European Parliament

B-1047 Brussels

E-mail: [email protected]pa.eu

Manuscript completed in October 2019

© European Union, 2019

This document and other supporting analyses are available on the internet at:

http://www.europarl.europa.eu/supporting-analyses

DISCLAIMER AND COPYRIGHT

The opinions expressed in this document are the sole responsibility of the authors and do not

necessarily represent the official position of the European Parliament.

Reproduction and translation for non-commercial purposes are authorised, provided the source is

acknowledged and the European Parliament is given prior notice and sent a copy.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 5

CONTENTS

LIST OF ABBREVIATIONS 6

LIST OF BOXES 7

LIST OF FIGURES 7

EXECUTIVE SUMMARY 8

AN EVOLUTIONARY DESIGN OF THE EMU GOVERNANCE 9

1.1. From Maastricht until today: two complementary approaches? 9

1.2 The EU and US economic governance frameworks: comparing apples and pears? 12

1.3 Some broad questions on lessons learned and possible ways forward 15

THE EUROPEAN SEMESTER AT A GLANCE 17

2.1. A rule-based coordination and surveillance framework 17

2.2. The role of the Country Specific Recommendations 19

3. SOME REFLECTIONS ON THE EUROPEAN SEMESTER FRAMEWORK IN GENERAL 21

3.1. What relationship between policy objectives and underlying tools? 21

3.2. A reinforced EU coordination framework for sustainable growth and jobs? 21

3.3. Specific policy instruments aiming at preventing unsustainable policies inside the monetary

union 23

3.4. How to go beyond the rules in the Semester framework? 24

4. THE FISCAL SURVEILLANCE FRAMEWORK 27

4.1. A detailed EU rules-based fiscal surveillance framework 27

4.2. What are the underlying reasons for the complexity? 28

4.3. The debate on structural balances 29

4.4 The debate on pro-cyclical fiscal policies 30

4.5 The debate on simplification 31

5. THE MACROECONOMIC IMBALANCES FRAMEWORK 33

6. WHAT CAN BE CONCLUDED? 36

ANNEX 1: DEFINITION OF THE EUROPEAN SEMESTER (ARTICLE 2-A OF REGULATION 1466/2011)

43

IPOL | Economic Governance Support Unit

6 PE 624.440

LIST OF ABBREVIATIONS

CSR

Country Specific Recommendations

ECB

European Central Bank

EFSF

European Financial Stability Facility

EMU

Economic and Monetary Union

ESM

European Stability Mechanism

IMF

International Monetary Fund

MIP

Macroeconomic Imbalance Procedure

SGP

Stability and Growth Pact

GDP

Gross Domestic Product

The European Semester for economic policy coordination: A reflection paper

PE 624.440 7

LIST OF BOXES

Box 1: Why an EU-level economic governance framework? 9

Box 2: A simplified comparison of EA and US economic governance frameworks 14

Box 3: The legal basis of the CSRs 17

Box 4: The EU integrated policy guidelines 22

Box 5: The SGP in a nutshell 27

Box 6: External experts’ papers for the EP: ‘Are the current automatic stabilisers in the euro area Member

States sufficient to smooth economic cycles?’ (May 2019) 30

Box 7: External experts’ papers for the EP on ‘The simplification of the SGP’ (April 2018) 31

Box 8: The MIP in a nutshell 33

LIST OF FIGURES

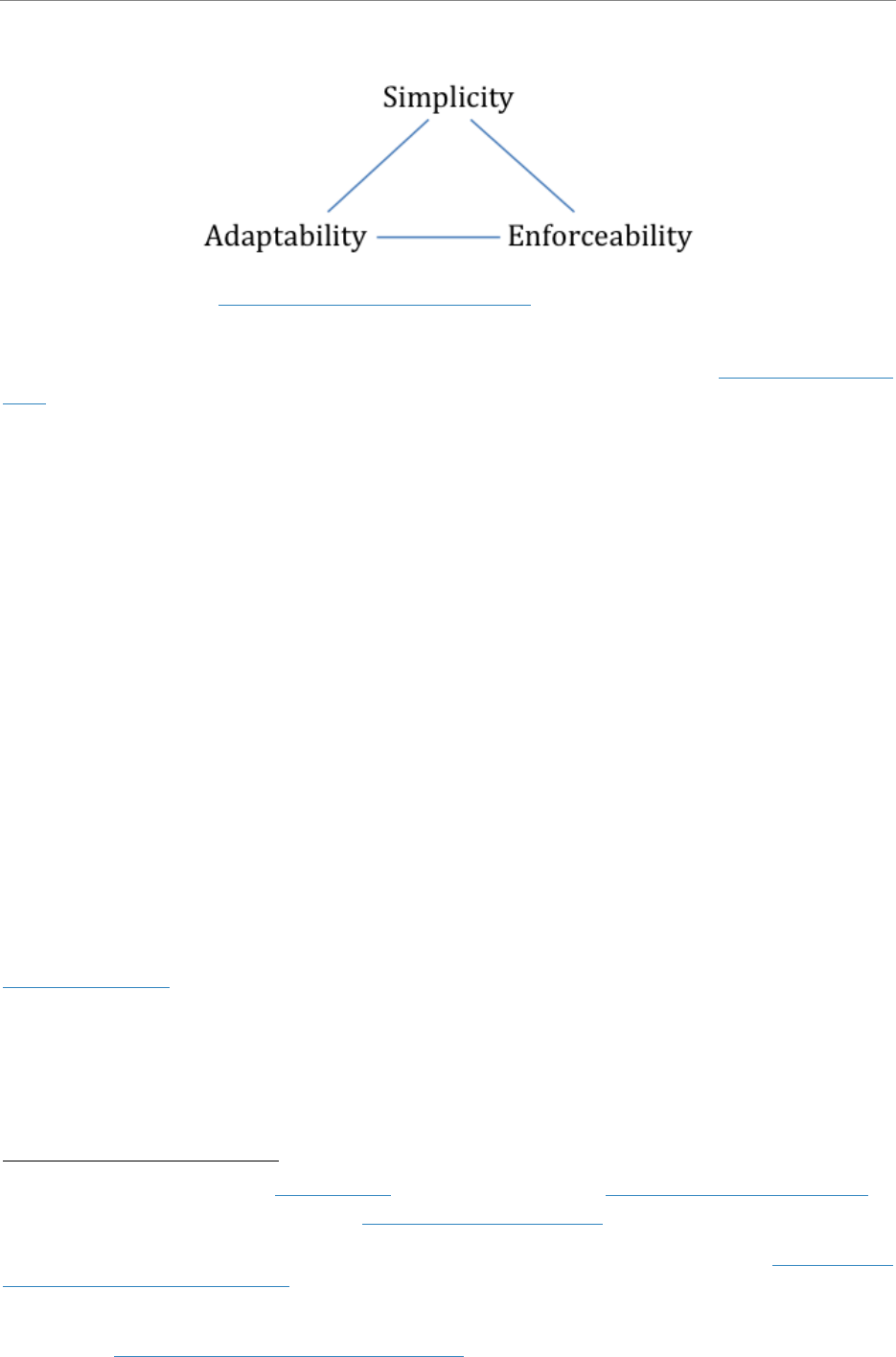

Figure 1: A trilemma for EU fiscal rules 29

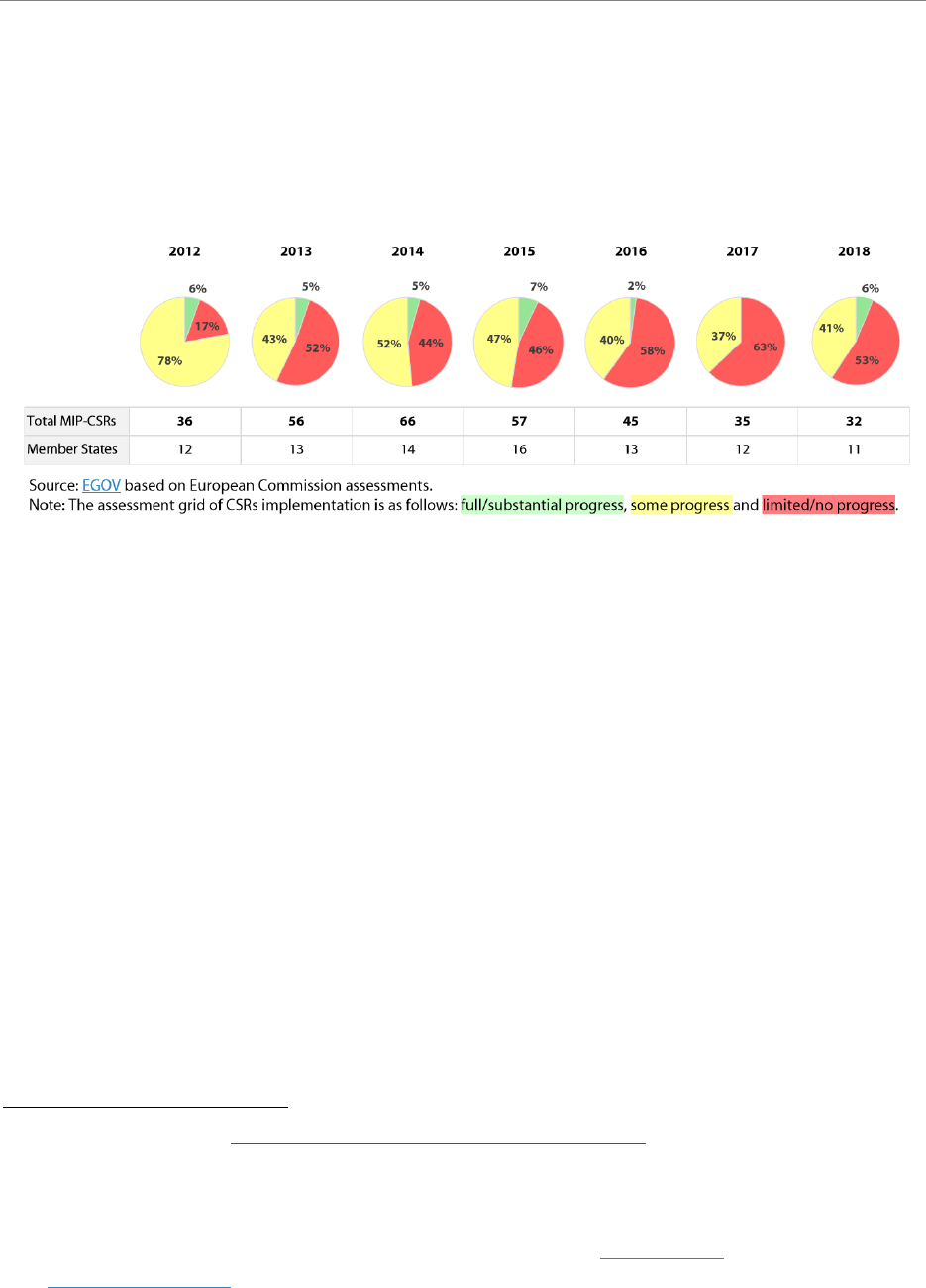

Figure 2: Annual assessment of the implementation rate of MIP-CSRs 34

LIST OF TABLES

Table 1: Distribution of CSRs from a legal basis perspective 19

IPOL | Economic Governance Support Unit

8 PE 624.440

EXECUTIVE SUMMARY

This paper provides an overview of the current EU economic governance framework, in particular with

a view to assessing the experiences gained from the EU ‘rule-based’ surveillance framework of national

budgetary, economic and social policies (i.e. the European Semester for economic policy coordination).

Section 1 sets out the main features of the EU economic governance framework, compares it to that of

the United States, and presents a number of topical questions. This section also notes that two

principles are inherent to the EMU governance design:, i.e. (1) fiscal responsibility lies ultimately with

the Member States (‘no bailout clause’ and ‘no monetary financing clause’) and (2) a ‘rule-based’

surveillance framework that aims at ensuring sound public finances and setting ceilings for budget

deficit and debt levels. The section also provides an overview of the evolution of these principles since

the start of the monetary union. In particular, it shows how the main principles have recently been

complemented with (1) additional EU-level governance instruments (e.g. for macroeconomic

imbalances, banking union legislation) and institutions (e.g. permanent backstop for sovereign debt,

banking supervision and resolution) and (2) the introduction of new instruments at national level (e.g.

balanced budget rules) and institutions (e.g. independent fiscal councils and productivity boards).

Section 2 provides a brief overview of the main characteristics and functioning of the European

Semester, in particular the so-called Country Specific Recommendations.

Section 3 presents a reflection on the overall design of the European Semester, with special attention

to the relationship between its policy objectives and the surveillance tools for achieving them. It poses

questions on the respective objectives and instruments that can be used to pursue a sustainable

growth strategy for the EU and the specific needs for the good functioning of the euro area.

Section 4 looks at some aspects of the EU fiscal surveillance system (the Stability and Growth Pact) and

highlights a number of questions regarding its functioning that have been raised in the public domain

and may be part of any debate on a future review.

Section 5 does the same for the Macroeconomic Imbalance Procedure.

Finally, section 6 draws general conclusions.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 9

AN EVOLUTIONARY DESIGN OF THE EMU GOVERNANCE

1.1. From Maastricht until today: two complementary approaches?

The Maastricht Treaty introduced two main principles that Member States are bound to observe when

deciding their economic and fiscal policies: that the final fiscal responsibility lies with the Member

States (i.e. the ‘no bailout clause’ and the ‘no monetary financing clause’); and that of an EU surveillance

framework aimed at avoiding excessive budget deficit and debt (coupled with strict quantitative

thresholds). Since then, the latter has become the main building block of an EU ‘rule-based fiscal

surveillance system’, the Stability and Growth Pact (SGP).

The dichotomy between these two governing principles, i.e. giving the EU level the role of steering

national policies and at the same time expecting Member States to take full final responsibility

(economic, fiscal and political) for their national policies, has been part of the overall design of the

Economic and Monetary Union (EMU) since its inception. In principle, one could argue that one of these

principles should, if fully effective, be a sufficient condition for the smooth functioning of the currency

union. Nevertheless, looking at the unique design of the EMU, it was considered necessary to introduce

both these principles into the EMU governance framework as mutually reinforcing (a sort of ‘belts and

bolts’ arrangement). It is a matter of debate which of the two principles has been more effective, in

relative terms, for the stability of the euro.

During the sovereign debt crisis, both principles came under stress and their effectiveness to safeguard

the smooth functioning of the EMU was questioned. Neither of them was able to detect or prevent the

crisis from emerging in the first place and, once the crisis was installed, both principles had to adjust to

the reality in a rather flexible way. Because of the crisis, public debt levels rose dramatically in many

Box 1: Why an EU-level economic governance framework?

The institutional framework for economic policy-making in the European Union is unique. Fiscal, economic

and social policies are national competences, while the EU Treaties oblige Member States to coordinate them

at the EU level in various forms. This is, in particular, the case for the Member States that have adopted the

euro and are therefore fully sharing the single monetary policy (and currency exchange rates) inside the EMU.

This unique design is rooted in a number of reasons.

Firstly, as learned from the first decade of the single currency area, economic growth may not always be

supported by the economic fundamentals. For instance, nominal wages may develop in a way that is not

compatible with growth potential. In some cases, strong nominal growth in one country may even be fuelled

by diverging real interest rates among the participating Member States, possibly resulting in ‘assets bubbles’

in one or more Member States.

Secondly, countries inside a monetary union cannot rely on individual monetary policy and nominal

exchange rate to absorb adverse country-specific shocks, country-specific effects of common shocks, or

different country-specific economic developments. These constraints place a greater burden on other

mechanisms, such as fiscal, labour and product market policies, in their role of compensating for shocks and

facilitating adjustments. According to the IMF, in order to ensure the long-term viability of the EMU member

countries’ resilience to shocks – whether temporary or permanent – must be improved (see e.g.

IMF Staff

Discussion Note No 19/05, June 2019).

Thirdly, the importance of avoiding pro-cyclical fiscal policies (during both upturns and downturns) may be

even greater for members of a monetary union. A fiscal framework that supports the building of fiscal buffers

in good economic times could help to avoid a detrimental fiscal consolidation during economic recessions

that would undermine sustainable growth.

Finally, inside a monetary union unsustainable national economic and fiscal policies (or the absence of some

policies) in one Member State may, if not addressed in time, have strong externalities (or spillover effects) on

other Member States.

IPOL | Economic Governance Support Unit

10 PE 624.440

Member States and the ‘no bailout clause’ had to be applied in a rather pragmatic way in order to

safeguard the financial stability of the euro area.

Debates on how to reform the governance of the EMU started immediately and are still ongoing. The

unique design of the EMU governance framework has rendered it difficult to find a common vision for

a long-term ‘steady-state’ governance framework. Policies to strengthen EMU governance have instead

gone ahead step by step on various fronts

1

2

.

The first, most urgent and immediate policy response focused on crisis management. It included the

establishment of a sovereign debt backstop, namely the European Stability Mechanism (ESM) and its

predecessor, the European Financial Stability Facility (EFSF), and a more dynamic approach of the

European Central Bank (ECB) in terms of monetary policy. Those policies were complemented by clear

steps to better supervise and resolve banks inside the euro area (through the setting-up of the Banking

Union)

3

. The establishment of the ESM (and its predecessors) and the rulings of the European Court of

Justice

4

allowed providing financial assistance to a euro area Member State, under strict conditionality

and without breaching the ‘no bailout clause’.

As a follow-up to the sovereign debt crisis, the EU system for surveillance of national economic

policies has been enhanced. Today, it is a rather comprehensive framework, extending well beyond

surveillance of mere rules of public finances. The current EU surveillance framework covers numerous

policy areas, and is aimed at preventing unsustainable economic developments beyond fiscal targets,

such as those that occurred in several euro area Member States before the sovereign debt crisis. The

extent and format of this EU-level guidance - or steering framework - have evolved, depending on the

nature of the policies targeted, the most far-reaching being those for national budgetary policies.

Recently, policies aimed at also making the principle of ‘no bailout’ of a Member State’s finances

more effective have been discussed and gradually developed. These included policies aimed at

weakening the doom-loop linking sovereigns and their banks, inter alia by moving banking supervision

and resolution to the EU level (i.e. establishing the Banking Union for the euro area), introducing

‘collective action clauses’ in sovereign debt issued by euro area Member States, and emphasising the

conditionality attached to any financial assistance granted (namely by stressing the importance of a

debt sustainability analysis

5

and of ‘voluntary’ debt restructuring

6

). The possibility to introduce some

1

For an overview of the various ways to strengthen the EMU governance framework, see a previous EGOV document: ‘An

evolutionary approach to a genuine Economic and Monetary Union’ (September 2017).

2

Analysing EMU reform proposals may be complemented by a better understanding of how policies are formed during non-

crisis times at national level in relation to EU affairs, in particular euro area governance and reform. For some interesting

discussions of national policy formation in EMU in times of crisis, see the recent papers published by the EMU Choices research

project, funded by the EU under Horizon 2020: https://emuchoices.eu/

.

3

For a recent ESM discussion paper on the Banking Union, see ‘Completing the banking union to support the Economic and

Monetary Union’ (October 2019).

4

See in particular the Pringle case.

5

See, for instance, two papers commissioned by the EP on ‘Debt Sustainability Assessments: The state of the art’, by C. Alcidi

and D. Gros (November 2018) and G. Corsetti (November 2018).

6

Reforms in this direction are included in the revised draft ESM Treaty; a recent report by the chair of the High-level Working

Group on a Common Deposit Guarantee Scheme mentions further initiatives in this domain aimed at reaching a ‘steady-state

Banking Union’. See also two papers commissioned by the EP: E. Jones (May 2019) and S. Rossi (May 2019).

The European Semester for economic policy coordination: A reflection paper

PE 624.440 11

limits on banks’ sovereign debt holdings

7

and the introduction of some kind of ‘safe asset’

8

have also

been discussed

9

10

.

Enhancing the capacity at EU (or euro area) level to provide some kind of macroeconomic

stabilisation function in case of major shocks in one Member State or in several has also been

discussed. Various options have been suggested in this respect, such as a euro area budget for fiscal

stabilisation (‘rainy day fund’), funds to support national reforms and investments, and unemployment

reinsurance schemes, among others. On some of these, formal proposals have already been made

11

.

Finally, there have also been policy initiatives to introduce ‘self-imposed’ national rules and

institutions, aimed at limiting the fiscal and economic policies of the euro area Member States.

Examples of these are the contractual obligation

12

for Member States to introduce so-called balanced

budget rules into national law, as well as the establishment of independent fiscal institutions and

national productivity boards.

These various policy initiatives to strengthen the governance of the EMU do not necessarily conflict

with each other. Instead, in an optimal situation, they should aim at reinforcing each other

13

.

7

See papers commissioned by the European Parliament on ‘Sovereign Concentration Charges: A New Regime for Banks’

Sovereign Exposures’, by N. Véron (November 2017) and Y. M. Schneider and S. Steffen (November 2017)

.

8

See EGOV paper on sovereign bond backed securities for an overview of this discussion.

9

See for example the report by the chair of the High-Level Working Group on the European Common Deposit Insurance, as

mentioned above.

10

Relying on a stronger role of ‘market forces’ in the current institutional set-up of the EMU may also have its limitations, at

least in practice. On the basis of the experience of the first decades of the euro, the role that financial markets can play in

giving ‘preventive signals’ for possible unsustainable policies may have its limitations (or in some cases even be counter-

productive), due to numerous factors, such as the tendency of markets to undershoot in good economic times and potentially

overshoot in bad economic times, as well as not being very good at making a distinction between a possible liquidity problem

and an insolvency problem of an individual government inside a monetary union.

11

For budgetary support for national reforms, a budgetary instrument for convergence and competitiveness (BICC) for the

euro area and ERM II Member States on a voluntary basis and a possible instrument for the non-euro area Member States, the

Convergence and Reform Instrument (CRI), are under discussion. The CRI would aim at supporting the convergence of non-

euro area Member States towards the euro area, by providing financial support for structural reforms. The CRI would draw on

the coordination mechanisms of the European Semester, including the Country Specific Recommendations (see

letter from

the President of the Eurogroup of 10 October 2019). Furthermore, in her political guidelines as candidate for Commission

President, Ursula von der Leyen committed to proposing ‘a European Unemployment Benefit Reinsurance Scheme [which]

will protect our citizens and reduce the pressure on public finances during external shocks.’ See a paper by B. Miroslav and L,

Karolien (2017) on the ‘feasibility and added value of a European unemployment benefit scheme’. For a recent paper on

possible lessons from unemployment insurance schemes in the US, see C. Luigjes, G. Fischer, F. Vandenbroucke, October 2019:

‘The US Unemployment Insurance Scheme: A Model for the EU?’. The authors caution against an oversimplified comparison

between the American system and a possible European reinsurance scheme. However, some lessons may be learned from the

US experience.

12

This obligation stems from the so-called ‘Fiscal Compact’ (the Treaty on Stability, Coordination and Governance in the

Economic and Monetary Union (TSCG)), an intergovernmental agreement aimed at introducing a balanced budget rule in

domestic legal orders. Out of the 25 Contracting Parties to the TSCG, 22 are formally bound by the Fiscal Compact (the 19 euro

area Member States plus Bulgaria, Denmark and Romania). It was formally concluded on 2 March 2012, and entered into force

on 1 January 2013.

13

Many proposals have been put forward by academics and EU institutions to establish a comprehensive ‘roadmap’ for EMU

reform. For instance, the Five Presidents’ Report on completing the EMU of June 2015 suggested a road map covering the

following policy domains: ‘Towards an Economic Union’, ‘Towards Financial Union’, ‘Towards Fiscal Union’ and ‘Democratic

accountability, legitimacy and institutional strengthening’. A paper by seven French and seven German economists on

‘Reconciling risk sharing with market discipline: A constructive approach to euro area reform’ (CEPR January 2018) argues that

market discipline and risk sharing should be viewed as complementary pillars of the euro area’s financial architecture, rather

than as substitutes. For instance, the authors argue: ‘Creating such incentives requires a credible application of the no bailout

rule of the European treaty. Countries with unsustainable debt levels should not expect, and not be expected, to receive fiscal

assistance – whether through the European Stability Mechanism (ESM) or any other mechanism — unless they restructure

their debts. But this requires an environment in which debt restructuring becomes feasible without large collateral economic

damage. In turn, this necessitates more effective euro area-level protection of the viable part of the financial sector, re-walls,

stronger macroeconomic stabilisation, more predictable liquidity support when needed, and more risk sharing – through both

IPOL | Economic Governance Support Unit

12 PE 624.440

In order to complement the overview of the EU economic governance framework, the following section

provides a simplified outline of the ‘economic governance framework’ in the United States (US)

compared, in particular, to the euro area (EA). The objective of the comparison is to better frame the

uniqueness of the EMU design and facilitate a broader discussion in relation to its reform agenda.

1.2 The EU and US economic governance frameworks: comparing apples

and pears?

In the US, there is no ‘American Semester for economic policy coordination’ covering the economic

policies of the constituent States, nor is there an ‘American Stability Fund’ to act as a possible backstop

for individual states in times of crisis (see Box 2 below). Why not? There are many institutional

differences between the two systems, and the obvious one is that the US is a federal country, while the

EU is not. That, in turn, has many consequences for the design and functioning of the economic

governance framework

14

15

.

In the US, a supranational (centralised, or in the US terminology, federal) surveillance of the constituent

states’ economies may not be warranted because of the relative size of the public sector at the state

level, including outstanding debt stock. On average, state and local level budgets in the US account for

around 15-25 % of GDP (average in 2016: 19.8 %), while in the EU national budgets range from 26 % to

56 % (the average in the euro area in 2018 was 47 %). The aggregate US budget (federal, state, and

local) amounts to around 36 % of US GDP. In other words, half of the total public budget is controlled

by the federal level, and half by the state and local level. Therefore, potential ‘contagion effects’ from

one state to another may be less severe (than in the euro area) in times of distress in a specific state.

This is also due to the fact that the federal government has direct taxation rights and provides some

public services, both directly to US citizens (e.g. defence, foreign affairs, and to some extent justice) and

indirectly through federally funded programmes. Due to the division of taxation rights between state

and federal levels, the use of debt financing is very different in our two cases. The aggregated public

debt level for EA Member States was 85.1 % of GDP in 2018 (ranging from 8.4 % in Estonia to 181 % in

Greece), while the aggregated public debt level of the US states was 14.6 % in 2018 (ranging from 4.6 %

in Wyoming to 23.5 % in New York). In the EA, the supranational debt level is minimal (the EU budget

is not allowed to be in deficit), while in the US the federal debt level is around 104.2 % of GDP.

Moreover, in the US the states act as sovereign entities, with their own financial/budgetary

responsibilities, as defined in the US Constitution. The common understanding, based on historical

experience, is that the federal level (or another state) should not ‘bail-out’ a state in distress. Instead, a

state is expected to save in economic good times (e.g. via rainy day funds) and to adjust its expenditure

to revenue, or else to obtain extra funding from the markets in times of distress. This has also implied

major economic and social consequences for the states concerned. Nevertheless, some services

provided by the federal level would be guaranteed even during times of distress

16

. The Federal Reserve

private and fiscal channels.’ Recently, Mario Draghi wrote (October 2019): ‘All this should make it clear that deepening public

insurance by completing the banking union and strengthening fiscal union is not about creating a transfer union. It is about

creating a euro area in which there is less need for public risk-sharing in future, because we have the instruments in place to

stabilise crises more quickly, and because we have the right framework to allow private sector risk-sharing to develop more

sustainably.’

14

In some respects, one can argue that the objective of the EU economic governance surveillance framework is to be a

surrogate for federal economic and budgetary policies.

15

See also: ‘Fiscal rules in the euro area and lessons from other monetary unions’, by N. Leiner-Killinger and C. Nerlich (ECB

Economic Bulletin, Issue 3/2019).

16

In early 2009, the US Congress adopted an American Recovery and Reinvestment Act (ARRA) with the purpose of stimulating

the national economy. As part of that legislation the federal government provided USD 223 billion for three years of fiscal

The European Semester for economic policy coordination: A reflection paper

PE 624.440 13

(FED) does not have the right to buy or keep bonds issued by the states on its balance sheet (only bills

with a maturity shorter than 6 months)

17

. This means that the FED cannot play a lender of last resort

role for the individual states. This has the advantage that, in case of a possible default by a single state,

the financial consequences for the FED would be very limited. Again, this feature of the US system is a

consequence of the federal governance structure of the country. The FED uses Treasury bonds issued

by the federal government for its monetary policy interventions. Furthermore, one may notice that the

federal government bonds attract a 0 % risk weight in banks’ supervisory/regulatory rules, while

individual states’ and municipalities’ bonds are 20 % risk-weighted in the US’s implementation of the

Basel 3 Accord

18

.

Furthermore, the implicit link between the states’ budget and the financial sector is smaller in the US

than in the EA, and has therefore potentially fewer financial consequences for an individual state during

a financial crisis. In the US, capital markets also play a bigger role in the intermediation between

creditors and debtors, and thereby in private risk sharing, and the federal institutions play a stronger

role in supervising and cleaning up banks (and providing deposit insurance). In the EA, the Banking

Union is making progress in this direction.

The above-described specific features of the US governance structures limit the potential systemic risk

in the US as a whole in the case of financial distress in one or more states.

relief for state and local governments in support of core state services. See R. P. Inman (June 2010): ‘To get money into the

national economy, the federal government must use existing government agencies and government programs. States are effectively

federal “agencies” for the purpose of spending federal money, and education aid to states, Medicaid funding, and highway

construction grants are three prominent federal programs. Education aid is the most important component of ARRA assistance

called “stability aid”. Together these three spending categories – stability, Medicaid, and highway aid – account for just over two-

thirds of all state ARRA funding’.

17

See J.F. Kirkegaard (2015) on ‘Economic Governance Structures in the United States’.

18

See https://www.fdic.gov/news/news/financial/2012/fil12027.html#cont.

IPOL | Economic Governance Support Unit

14 PE 624.440

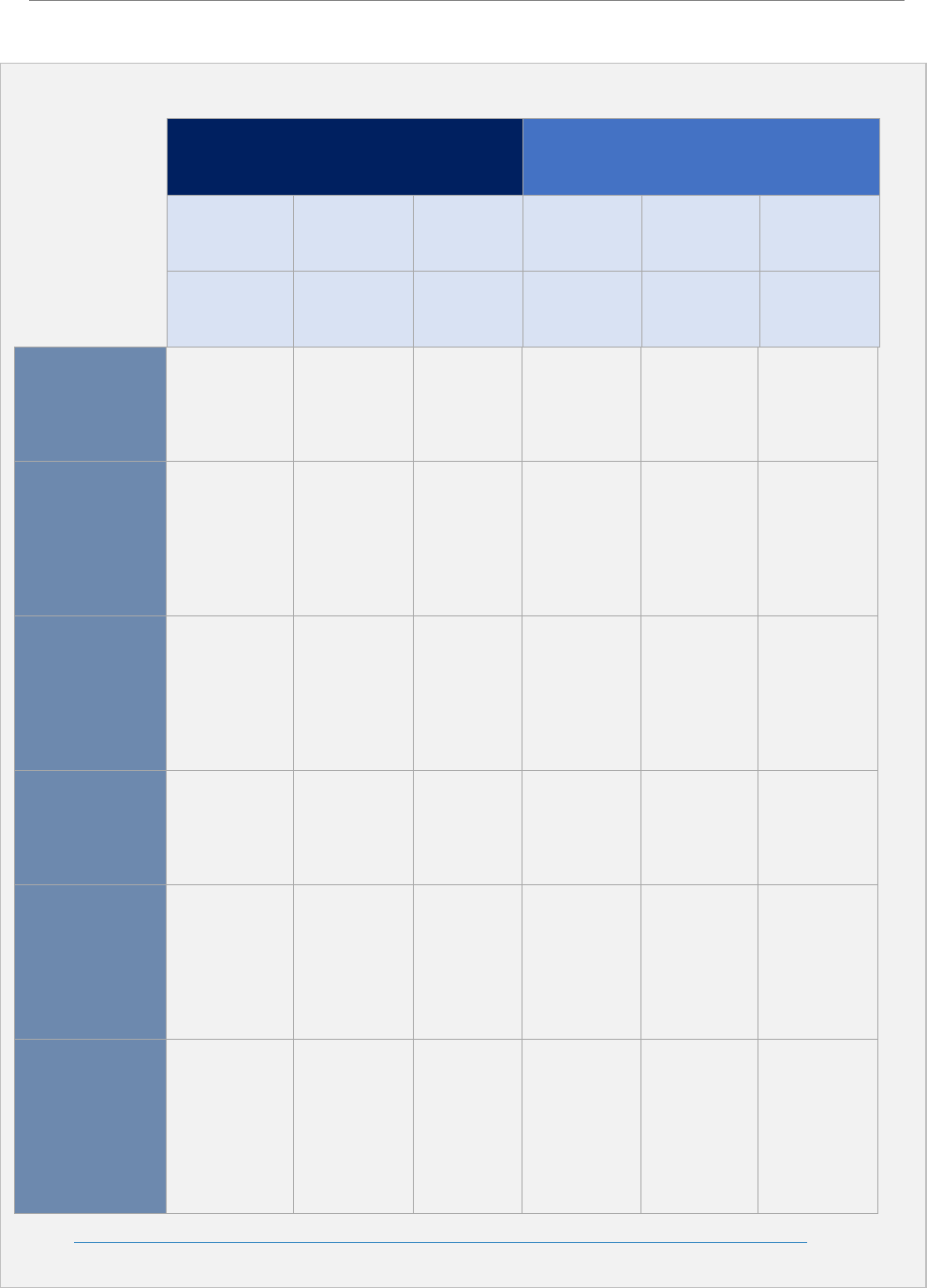

Box 2: A simplified comparison of EA and US economic governance frameworks

EA US

Supranationa

l instruments

Supranational

instruments

National

level

Supranation

al level

Supranational

level

State

level

Targeting

supranational

policies

Targeting

national policies

Targeting

national

policies

Targeting

supranational

policies

Targeting

national policies

Targeting

national

policies

Surveillance of

fiscal and

economic

policies

(‘prevention’)

N.A.

Yes

(European

Semester)

Yes

(‘balanced

budget

rules’, ‘IFIs’)

No No Yes

(‘balanced

budget rules’;

‘rainy day

funds’ )

Fiscal policy

(provision of

‘public goods’,

‘transfers’ and

‘stabilisation’)

No/Limited

(only the EU

budget)

N.A.

(only ‘EA

recommendatio

n on the

aggregated

fiscal stance of

the state’)

Yes

(rather

large, but

often pro-

cyclical)

Yes

Yes Yes

(but smaller

than in EA on

average)

Principle of ‘no

bailout’ of other

sovereign states

N.A.

(EU not

allowed to be

in deficit)

Yes

(incl. assistance

subject to strict

conditionality)

Yes

(incl.

assistance

subject to

strict

conditionali

ty)

N.A.

Yes

(de facto)

Yes

(de facto)

A permanent

public backstop

for sovereign

debt

N.A.

Yes

(possible ESM

financial

assistance under

strict conditions)

N.A. N.A.

No

(no permanent

mechanism)

N.A.

Principle of no

monetary

financing of

fiscal policies

Yes/N.A.

(EU not

allowed to be

in deficit)

Yes

Yes Yes

(but FED may

at its

discretion act

as LLR to the

Treasury at

federal level)

Yes Yes

Government

bonds eligible in

central bank’s

open market

operations

N.A.

(no real

supranational

level debt

instrument -

even if ECB

buys ESM and

EIB bonds)

Yes

(national

government

bonds as the

main

instrument)

N.A.

Yes

(bonds of the

Treasury as

the main

instrument)

No

(FED may only

hold short-

term

bills issued by

the states)

N.A.

Source: The Fiscal Governance Frameworks of the US and the EU: comparing ‘apples and pears’. EGOV, May 2017.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 15

1.3 Some broad questions on lessons learned and possible ways forward

This section poses some broad questions on the experience gained from applying the two main

economic governance principles described in section 1.1. The questions look backwards and ask how

well the governance framework has worked in practice. They also aim at reflecting on what role and

weight such principles should play in the future. This could contribute to a wider reflection on the

broad governance principles before undertaking a more detailed discussion on whether and how the

relevant EU rules themselves could be revised.

Optimally, policymakers would first agree on the desired design of the governance of the EMU and

then identify the gradual steps required to reach it. The following questions provide a frame of

reference for the subsequent sections, which discuss the current legal framework of the European

Semester, the SGP and the Macro Imbalances Procedure (MIP).

What role for the EU surveillance framework?

Is there a general trust that an EU rule-based system has provided and should provide proactive

useful ‘preventive’ policy guidance (beyond expert advice) for national policymaking, even if it

cannot by itself prevent a financial crisis from occurring in an individual Member State?

If this is the case, one could broaden the questions to other aspects that could make the EMU

surveillance framework more effective in its preventive nature:

In general, how broad should the scope of the European Semester be? Which specific national

policies should the EU economic surveillance framework cover? Is it possible to identify a selection

of national developments and policies that are core for the stability of the euro? Could EU

recommendations be made more effective at an early stage, notably during ‘good economic times’?

How exactly could fiscal buffers be built up? How could the risk of emerging macroeconomic

imbalances be prevented?

And more specifically, how could the political acceptance of EU policy recommendations be

improved? How could policy recommendations stemming from the Semester be better integrated

into national policymaking? How would the legitimacy of and democratic control over the

economic and political cycles be improved at EU and national level? What should the balance

between discretion and automaticity be in the formulation of the rules? What role should sanctions

in the case of non-compliance play? What role could financial incentives linked to the policy

recommendations play?

If the actual impact of the EU-level policy recommendations seems doubtful, one can expand the scope

of the questions above to other polices that could facilitate the ‘adjustment capacity’ of the euro area

Member States, with a view to avoiding and/or adjusting to economic shocks. In other words: inside a

monetary union there are basically only two ways for national policymakers - prevention of

unsustainable policies and enhancing resilience ex ante or internal adjustment ex post to an economic

shock.

What role for other policies beyond the EU surveillance framework?

What other EU or national instruments could improve the capacity of Member States to adjust to a

crisis? Which EMU reforms would support each other over time? What priority should be given to

other policy initiatives such as the completion of the Banking Union and/or Capital Markets Union?

Are there ways to enhance o the role of the ‘no bailout clause’ in order to steer the policies of Member

States? Would a stronger fiscal stabilisation instrument or common insurance mechanism at the

EU/EA level be useful as a tool to assist Member States to adjust to crises, including in the case of a

sovereign debt crisis/debt restructuring? What role can the ESM play in assisting a Member State in

adjusting to crisis/shocks?

One may also reflect upon the relative weight given to the EMU governance principles and how they

should evolve over time - i.e. having an EU surveillance system aiming at preventing and improving

IPOL | Economic Governance Support Unit

16 PE 624.440

resilience and adjustment capacity ex ante - and/or an EU crisis management mechanism, aiming at

supporting adjustment ex post or during a crisis. Therefore, what kind of EMU governance reforms

should be pursued that would improve the feasibility and actual functioning of the available

instruments over time?

The next sections will offer a short overview of how the EU’s rule-based surveillance framework, i.e. the

European Semester, has worked in practice, and will present some ‘food for thought’ with a view to

assessing the current economic governance regime

19

.

19

The regulations currently detailing the economic governance rules (the so-called ‘six-pack’ and ‘two-pack’) require periodic

reports evaluating their application. Such assessment takes place every five years and aims to evaluate, inter alia, the

effectiveness of the regulations and progress made to ensure closer coordination of economic policies and sustained

convergence of economic performances. The first review took place at the end of 2014 and concluded: ‘The ability to draw

conclusions on the effectiveness of the regulations is limited by the short experience of their operation, with the six-pack entering

into force in end 2011 and the two-pack only in mid-2013. Not only is this time period short, but it has also been characterised by a

severe economic crisis. This leaves the rules untested in normal economic times.’.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 17

THE EUROPEAN SEMESTER AT A GLANCE

2.1. A rule-based coordination and surveillance framework

Today, the EU economic governance tools are integrated in the European Semester for economic policy

coordination (‘European Semester’)

20

, resulting mainly in multilateral and bilateral surveillance at EU

level of Member States’ fiscal policies under the SGP, economic and structural policies under the MIP,

and employment policies under the so-called Employment Guidelines

21

. Under the European Semester

framework, and on the basis of these EU economic governance instruments and the national reform

programmes and planned fiscal policies of the Member States, each year the Commission proposes

and the Council adopts policy recommendations (the so-called Country Specific Recommendations)

addressed to the Member States.

In addition to the CSRs, the Commission proposes

recommendations regarding the economic policy of the

euro area as a whole, based on Article 136 of the TFEU; as

of the 2016 European Semester, these proposals are

published at the start of the Semester cycle (in

November) so as to better integrate the euro area

dimension into the national dimension

22

.

There are a number of actors involved in the European

Semester at the EU level, the most important being the

European Commission, which proposes the priorities of

each annual economic cycle (mostly through the Annual

Growth Survey), and the Member States, in Council and in

the Eurogroup, which are responsible for approving the

EU policy orientations and recommendations. The

Eurogroup has become de facto the forum for political

discussion on Semester-related matters

23

.

The European Parliament is involved in the Semester

through its political resolutions and in particular through

the Economic Dialogues. These dialogues allow

Parliament to be informed on the results of the

multilateral surveillance and to scrutinise the European

institutions involved in establishing priorities and

policies: the Presidents of the Council, of the Eurogroup

and the Commission must appear before Parliament to

provide information and answer questions. Parliament

can also invite a Member State to an exchange of views in

20

The concept of the European Semester was introduced by EU Regulation 1175/2011 as part of the 2011 revision of the

Stability and Growth Pact (a new Section 1-A of EU Regulation 1466/97; see also the Annex to this paper). For an overview of

the European Semester and its main actors, see EGOV paper ‘The European Semester: Main steps at the EU level‘.

21

Each year the Council updates the employment guidelines.

22

See a separate EGOV note on the Euro Area recommendations for more details.

23

See, for instance, the ‘Term sheet on the budgetary instrument for convergence and competitiveness (BICC)‘ as agreed by the

Eurogroup on 10 October 2019. The role of the Eurogroup in economic policy coordination has been analysed by E. Enderlein

et al. (

September 2016).

Box 3: The legal basis of the CSRs

From a legal perspective, the CSRs are

underpinned by EU

primary legislation

(Articles 121 and 148 of the TFEU) , as well

as by the following secondary legislation:

Council Regulation (EC) 1466/97 on the

strengthening of the surveillance of

budgetary positions and the surveillance

and coordination of economic policies for

CSRs referring to the Stability and Growth

Pact (SGP);

Regulation (EU) 1176/2011

on the

prevention and correction of

macroeconomic imbalances for CSRs

referring to the Macroeconomic Imbalance

procedure (MIP);

Integrated guidelines for implementing the

Europe 2020 strategy – these guidelines

consist of two legislative documents:

(1) a Council recommendation on broad

guidelines for the economic policies of the

Member States and of the Union; and (2) a

Council decision on guidelines for the

employment policies of the Member States

(together, the ‘Integrated Guidelines’).

IPOL | Economic Governance Support Unit

18 PE 624.440

specified circumstances. The EU’s underlying rules concerning the SGP and the MIP are also co-decided

with the EP

24

.

One could ask what the difference is between the EU policy recommendations made under the

European Semester (see section below on CSRs) and similar recommendations issued by the OECD or

the IMF to the participant countries. The main difference from a procedural point of view is that the

CSRs are partly based on EU primary and secondary legislation (i.e. the TFEU, the SGP and the MIP) and

are adopted by the Member States themselves in Council (even endorsed by the heads of state in the

European Council). In addition, the Member States have agreed in EU legislation that in case of non-

compliance financial penalties can ultimately be imposed. In this respect, EU policy recommendations

are formally clearly different from policy advice provided by external institutions such as the OECD and

the IMF.

For these reasons, the Semester framework is often called an EU ‘rule-based’ governance system.

However, it cannot replace economic policymaking at the national level. It can, at most, provide a more

or less ‘intrusive’ framework within which Member States are expected to conduct their policies with a

view to respecting the common objectives set out in the EU Treaties

25

.

While being a surveillance system based on commonly agreed EU rules and procedures, the framework

inevitably relies to a certain extent for its application on discretionary elements. This applies to the

Commission and Council and, as regards actual implementation, also to the actual Member States

concerned. The deeper and wider scope of the EU surveillance framework that emerged from the euro

crisis has, in parallel, required more room for interpretation in its day-to-day application. This has been

a consequence of a reality check that the rule-based framework faced in both economic and political

terms

26

.

One may note that Mario Draghi, as President of the ECB, has advocated the need to move from a ‘rule-

based system’ towards an ‘institutions-based system’ also in the area of EU economic governance

27

.

24

‘Economic governance and democratic accountability must go hand in hand if we want to strengthen ownership of our common

decisions. In this spirit, I want the European Parliament to have a louder voice when it comes to the economic governance of our

Union. Members of the Commission in charge of economic matters will come to the European Parliament before each key stage in

the European Semester cycle’ (Policy objectives set out as candidate for President of the European Commission

by Ursula von

der Leyen).

25

C. Wyplosz has been for a long time sceptical on the effectiveness of a EU rule-based surveillance system: ‘Fiscal indiscipline

in a member country is the outcome of unsatisfactory national political processes. Other member countries rightly observe that fiscal

discipline creates serious risks for the whole euro area and, therefore, for the whole Union. The SGP is a natural response, if it can be

made to work. Similarly, poor institutions that hamper growth in a member country have a detrimental effect on the Union as a

whole. Since economic reforms are always politically difficult, it makes sense to seek to counteract national private interest groups

with peer pressure. The experience shows that none of these two approaches have worked. The temptation is to try again, and

harder. This is bound to fail for a fundamental reason: national polities will not give in to European level pressure if it runs against

their own interests. This is why the contradiction between Articles 5 and 121 will always lead to outcomes where national sovereignty

prevails over common interests, no matter how justified the latter are ‘ (Wyplosz, September 2010

).

26

See also P. Leino and T. Saarenheimo, ‘On the limits of EU economic policy coordination’ (September 2016): ‘We will

demonstrate how it has evolved from a relatively narrow, rule-based exercise into a largely discretionary process that reaches even

the most politically salient areas of the Member States’ economic policies. We will then show that while the framework formally

grants the EU strong coercive powers, such powers have turned out to be difficult to use in practice. Instead of coercion,

implementation has been based on persuasion and cooperation and has been highly sensitive to the political context. Our

interpretation is that this reflects the fundamental limits of the EU’s legitimate use of power over its Member States set by its current

level of political and cultural integration.’

27

For instance, in his speech (Draghi, February 2019), he returned to this issue: ‘By contrast, rules lose credibility if they are applied

with discretion. Rules will be undermined if countries find reasons to circumvent them or rewrite them as soon as they bind. But

circumstances will always arise which were not foreseen at the time the rules were written and which call for flexibility. In the case

of rules, there is an inevitable trade-off between credibility and flexibility. This is why there are always tensions when it comes to

economic policies that follow the rules-based approach. But the transition to an institutions-based approach requires trust between

countries. And trust is based on strict compliance with the existing rules, but also on the ability of governments to reach mutually

satisfactory compromises when the circumstances call for flexibility and to explain them adequately to their citizens.’

The European Semester for economic policy coordination: A reflection paper

PE 624.440 19

This EU rules-based economic governance framework was revised most recently in 2011-2013,

following the sovereign debt crisis in the euro area. Considering the severity of the euro debt crisis, the

harshest in many decades, it is difficult to assess whether it could have partly been avoided had the

Semester been in place in the decade before the crisis. Now, nearly ten years after the introduction of

the Semester, the rules-based economic governance framework is up for assessment and review in the

coming months

28

29

.

2.2. The role of the Country Specific Recommendations

The CSRs, adopted annually as part of the European Semester, provide policy guidance to EU Member

States on macroeconomic, budgetary and structural policies in accordance with Articles 121 and 148

of the Treaty on the Functioning of the EU (TFEU). These recommendations aim at attaining the

economic objectives of the EU, namely, boosting economic growth and job creation, while achieving

or maintaining sound public finances and preventing excessive macroeconomic imbalances. The

content and scope of the recommendations have evolved over the years, depending on economic

developments and priorities. The CSRs provide guidance for national policies over the following twelve

to eighteen months.

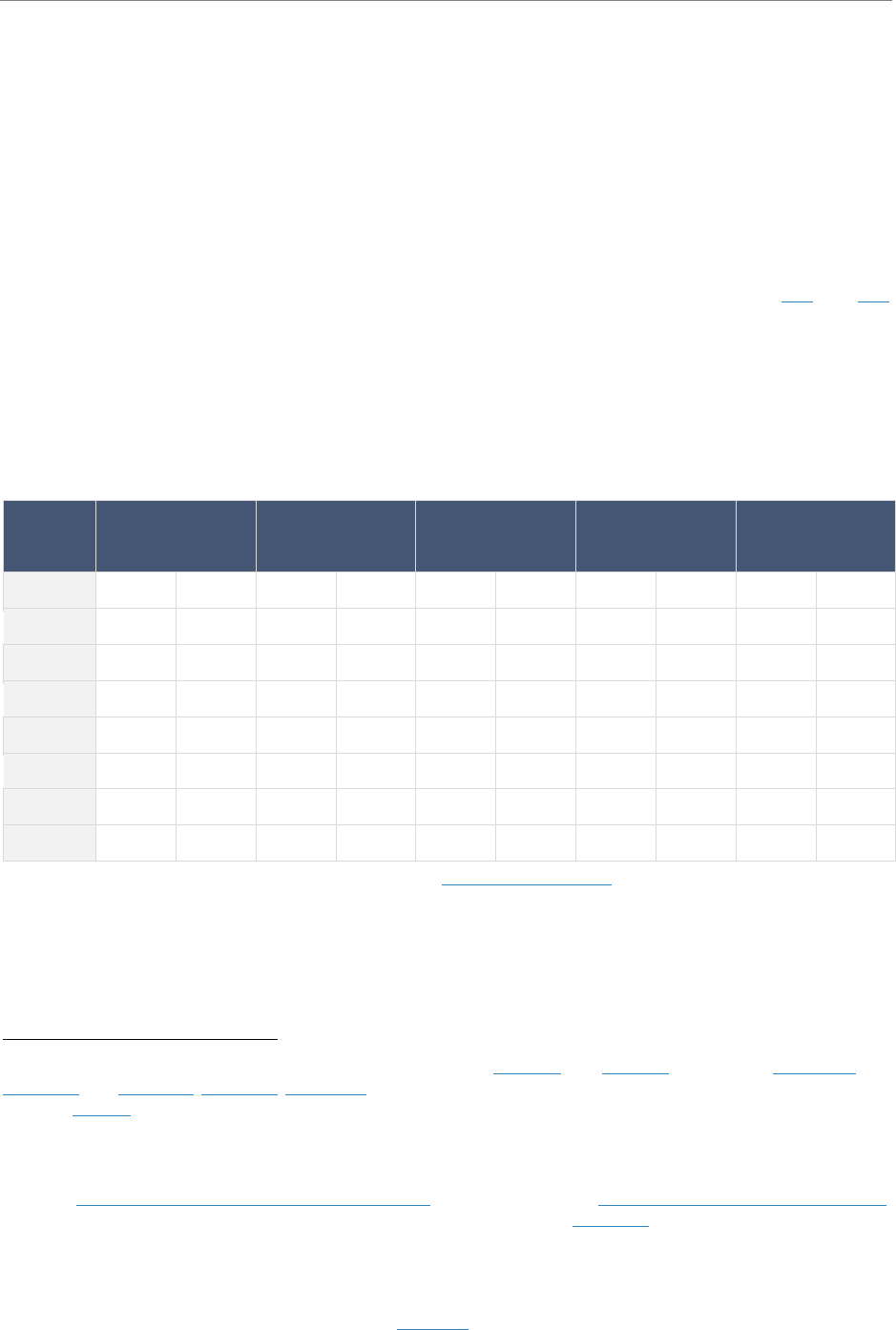

Table 1: Distribution of CSRs from a legal basis perspective

European

Semester

SGP + Integrated

Guidelines

MIP + Integrated

Guidelines

Jointly SGP and MIP

Exclusively

Integrated

Guidelines

Total

2012

18 (13%) 31 (22%) 5 (4%) 84 (61%) 138 (100%)

2013

18 (13%) 50 (35%) 6 (4%) 67 (48%) 141 (100%)

2014

19 (12%) 58 (37%) 8 (5%) 72 (46%) 157 (100%)

2015

11 (11%) 48 (47%) 10 (10%) 33 (32%) 102 (100%)

2016

13 (15%) 36 (40%) 9 (10%) 31 (35%) 89 (100%)

2017

12 (15%) 27 (35%) 8 (10%) 31 (40%) 78 (100%)

2018

11 (15%) 27 (37%) 5 (7%) 30 (41%) 73 (100%)

2019

9

(9%)

35

(36%)

5

(5%)

48

(50%)

97

(100%)

Source: EGOV calculations (European Commission). See also EGOV database on CSRs. Note: share of CSRs by secondary legal

base for a given Semester cycle is in brackets.

As to the process, CSRs are proposed by the Commission in May each year and discussed by the various

Council formations. As a rule, the Council is expected to follow the Commission proposals or explain its

28

The wording of the review clauses in the relevant regulations (473/2013 and 472/2013, amended by 1175/2011 and

1177/2011, and 1173/2011, 1174/2011, 1176/2011), is identical, and revision is required by 14 December 2019. The review of

Directive 2011/85 was due on 14 December 2018, but has been postponed in order to fit better with the review of the

remainder of the economic governance framework. The Commission is required in overall terms to assess effectiveness and

progress made as regards ensuring the closer coordination of economic policies and the sustained convergence of economic

performances.

29

See the autumn 2019 work programme of the Eurogroup and the discussions of the informal ECOFIN of September 2019.

Already in December 2017, J. Dijsselbloem, as the President of the Eurogroup, concluded after the Eurogroup meeting: ‘As

regards fiscal governance, there was broad agreement that the credibility of our fiscal framework should be enhanced by making it

more effective, less complex, and by increasing shared ownership while some have been advocating a stronger reliance on

developing market-based fiscal discipline mechanisms. In my view, a possible way forward, which could merit further discussions,

could be to ask a high-level working group of independent experts to provide advice along those criteria.’ However, no working

group was established, while the European Parliament

published in spring 2018 three expert papers on ways to simplify the

SGP (see Section 4 of this paper).

IPOL | Economic Governance Support Unit

20 PE 624.440

position publicly (i.e. the ‘comply or explain’ principle)

30

. Every year, after being endorsed by the

European Council and formally adopted by the ECOFIN Council, CSRs are to be taken into account by

Member States in their national decision-making processes, especially when preparing their national

budgets and national reform programmes.

A failure to implement the recommendations might result in further procedural action under the

relevant EU law and ultimately in sanctions under the SGP and the MIP. These sanctions might include

fines and/or suspension of European funds. The Commission has proposed, as part of the Multiannual

Financial Framework 2021-2027, to strengthen the link between the policy recommendations of the

Semester and the use of the EU budget

31

.

From the regular annual assessment published by the COM in its Country Reports

it emerges that more

than half of CSRs (53 %) were implemented, on average, with at least some progress over the period

2012-2018. The annual implementation rate of the CSRs followed a downward trend over the period

2012-2016, before showing first signs of improvement in 2017 and a decline again in 2018. The

implementation record has been uneven across policy areas and countries (for further information, see

separate

EGOV briefing: ‘Overview of the Country Specific Recommendations, September 2019)

32

33

34

.

30

One may note, as an example, that the Council made only very limited modifications to the draft 2019 CSRs as proposed by

the Commission (see separate EGOV comparison table). This may have reflected the uncontroversial nature of the analyses of

the economic challenges facing the respective Member States, or else the existence of close consultation of the respective

Member States’ authorities during the preparatory stage, or, again, the fact that the annual recommendations, due to their

generic nature, have attracted less political attention over time.

31

The Commission proposed the establishment of the Reform Support Programme (RSP) and Investment Stabilisation

Function to strengthen Europe’s Economic and Monetary Union on 31 May 2018, as part of the package for the upcoming

multiannual financial framework for 2021-2027. RSP will provide financial and technical support for Member States to

implement reforms aimed at increasing the resilience of their economies and modernising them, including priority reforms

identified in the European Semester. On 24 July 2019, the Commission put forward a

proposal for a Council and Parliament

Regulation on the governance framework for a budgetary instrument for convergence and competitiveness for the euro area

(BICC). The Eurogroup agreed on the main features of the BICC on 10 September 2019. The need for a ‘euro area budget’ has

long been debated: see, e.g. , H. Enderlein et al (September 2016), who argue that a ‘small but flexible investment fund used to

incentivise reforms’ could help reinforce the role of the Eurogroup in economic policy coordination.

32

Recognising that a number of CSRs relate to long-term structural issues, the Commission included in its Communication on

the 2018 European Semester an assessment of the implementation of CSRs from both yearly and multiannual perspectives

(including progress on compliance with the SGP). The latter approach was introduced in 2017, and according to this yardstick

‘more than two thirds of CSRs have been implemented with at least ‘some progress’ ‘ over the period 2011-2017, leading therefore

to a somewhat more favourable picture of the CSRs’ implementation record when compared with the year-by-year

assessment. However, the Commission has not published the methodology underpinning its multiannual assessment, and

this renders the link between the annual recommendations and their multiannual assessment by the Commission unclear.

33

H. Enderlein et al (September 2016) argue that CSRs are not efficient benchmarking instruments to measure progress on

converging and implementing economic policies (‘Benchmarking could help in monitoring reform progress if CSRs were

formulated in a way that makes progress measurable, and the convergence process was defined clearly. Currently, these elements

are still missing.’).

34

See a recent IMF staff working paper by IMF staff (October 2019) on ‘The Political Costs of Reforms: Fear or Reality?’). In the

paper it is argued that structural reforms are motivated by multiple policy objectives. They can foster medium-term economic

prospects and living standards by raising productivity and employment, improving debt sustainability, and enhancing the

resilience of the economy to shocks. The results of the empirical analysis suggest that, while on average reforms are associated

with electoral costs, specific effects depend on the type of reform and on when in the electoral cycle reforms are implemented.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 21

3. SOME REFLECTIONS ON THE EUROPEAN SEMESTER

FRAMEWORK IN GENERAL

3.1. What relationship between policy objectives and underlying tools?

The current main EU economic governance tools (mainly the SGP, the MIP and the Integrated

Guidelines) are all part of the annual Semester cycle of economic policy coordination.

However, the objectives to be achieved (namely, sustainable public finances and reforms for

sustainable growth, but more recently, additional socially oriented objectives) and their relationship to

the underlying governance tool may not always be clear for policymakers and citizens. Such disconnect

may hamper their effectiveness in practice. The number of policy objectives that can be realistically

attained within one governance framework would also need to be taken into account.

In the event that the Semester remains the main framework for economic policy coordination and

surveillance, it would be useful to be as clear as possible regarding the link between each specific EU

tool and the objectives to be achieved. This could help enhance the public understanding and

legitimacy of these EU tools and, thereby, the effectiveness of the related policies pursued under the

Semester.

The general observation may be made that the objective of the main EU economic governance tools,

the SGP and the MIP, is to try to ‘prevent’ unsustainable fiscal, economic and social policies, while the

objectives of the policies under the integrated guidelines are more targeted towards ‘promoting’

sustainable policies and practices. For instance, the integrated policy guidelines are mostly targeted in

such a way as to promote ‘best practices’ under the so-called ‘open method of coordination’ (e.g. the

Europe 2020 targets - see Box 4)

35

.

However, today, only a few annual policy recommendations are adopted by the Council under a single

EU instrument (e.g. SGP or MIP or Integrated guidelines). Instead the CSRs are underpinned by a joint

legal basis (e.g. SGP and the integrated guidelines or MIP and the integrated guidelines - see separate

EGOV briefing). This risks rendering unclear the assessment of compliance with the recommendations

under the respective EU instrument. Trying to separate better the underlying surveillance tool in

accordance with its core objective (e.g. ‘trying to prevent’ versus ‘trying to promote’ certain policies)

could make the framework more transparent.

3.2. A reinforced EU coordination framework for sustainable growth and

jobs?

One option would be to transform the European Semester into the main policy coordination

framework, supporting a comprehensive EU strategy for sustainable (and inclusive) growth, with

corresponding annual and/or multiannual policy recommendations (hence ‘renewed Semester’)

36

.

35

The open method of coordination (OMC) may be described as a form of ‘soft’ law. It is a form of intergovernmental policy-

making that does not result in binding EU legislative measures and does not require EU countries to introduce or amend their

laws. It provided a new framework for cooperation among the EU countries, whose national policies can thus be directed

towards certain common objectives. Under this intergovernmental method, the EU countries are evaluated by one another

(peer pressure), with the Commission’s role being limited to surveillance. The European Parliament and the Court of Justice

play virtually no part in the OMC process. The OMC takes place in areas which fall within the competence of EU countries, such

as employment, social protection, education, youth and vocational training (Glossary of summaries, EU LEX

).

36

The European Parliament emphasised in its resolution of 10 October 2019 that ‘the Union’s social and economic goals should

have equal priority and secured financial resources within the next budget, and that the European Semester should be enhanced to

include a social dimension all throughout its cycle involving the competent bodies of the EU and Member States which deal with

social policies’. It went on to urge the Commission to ‘enhance the CSRs for Eurozone members by creating a matrix framework

where social policies related to the European Pillar of Social Rights, such as inclusive access to education, health, nutrition,

employment and housing, and the preservation of social rights, are analysed by social segment, for example children, young people,

IPOL | Economic Governance Support Unit

22 PE 624.440

The reviewed framework would be based on the ‘open

method of coordination’ (e.g. ‘peer support and peer

pressure’) and possibly, in some cases, linked to the use of

EU funds. This would enable positive peer pressure based on

best practices on a wider set of policies. It could be built on

the integrated guidelines as set out in the TFEU in order to

be backed by an EU legal framework.

It could take the form of an EU act framing the respective

roles of the competent bodies at EU and national level,

developed on the basis of the current legal definition of the

Semester (see Annex to this paper). This upgraded

coordination framework could include a set of long-term

objectives (going beyond the Europe 2020 strategy),

indicators to measure progress, and annual or multiannual

policy recommendations on a variety of policy objectives

(e.g. green investment, social inclusion, education systems,

public administration, labour productivity, etc). For instance,

in the 2019 CSRs proposed by the Commission in June 2019,

recommendations on how to address possible ‘investment

gaps’ have been included. Policy measures to promote

private and public investment will surely remain a high

priority in the coming years, notably as part of the

modernising and greening of the European economies

37

.

This renewed Semester framework would aim for policy recommendation targeting ‘upward

convergence’ among and inside the Member States. The Social Rights Pillar could be fully integrated

into this new EU policy guidance framework.

The upgraded framework should build on the lessons learned from the current European Semester.

However, it would be useful to better frame the relationship between the policy recommendations and

the expected timeframe and deliverables for achieving them

38

, with a view to attaining the long-term

objectives (as explained above under 3.1). This may become even more relevant with the introduction

of EU budgetary resources linked to the implementation of national reforms under the guidance of the

Semester.

older people, minorities, migrants and people with disabilities, thereby creating a much more accurate image of the economic and

social health of the Member States, and to examine the possible extension of this new component of the CSRs to non-Eurozone

members; points out that CSRs should be coherent with economic, social and environmental EU objectives and should reinforce

rather than contradict each other; calls on the Commission and the Member States to define a European sustainability strategy to

overcome social, economic and climate challenges’; See also the policy

objectives set out by the then President-elect of

the European Commission, Ursula von der Leyen: ‘I will refocus the European Semester into an instrument that integrates the

United Nations Sustainable Development Goals’; the Commission’s reflection paper of January 2019 ‘Towards a sustainable

Europe by 2030’; the opinion of 26 June 2019 (CDR 239/2019, point 45) of the Committee of the Regions; and the opinion

(ECO/495-EESC-2019) of 24 July 2019 of the European Economic and Social Committee, which ‘notes that a strengthened

Semester process should be the most important element of economic policy coordination’, adding that ‘key issues include the

implementation of the European Pillar of Social Rights, sustainable employment, the introduction of minimum social standards, on

the basis of a common European framework, set by the European Semester, and also more ambitious climate targets and better

protection of biodiversity.’).

37

In her political guidelines as Commission President candidate, Ursula von der Leyen committed to deliver a Green Deal.

38

Along the same lines (with a view to introduce milestones and calendars for implementation of policies underpinning CSRs),

see as an example, X. Ragot (November 2017): ‘For each recommendation, there should be a clear initial date of the initial

formulation and expected date of achievement and final evaluation.’ and his concrete recommendation to ‘Add a temporal

dimension to recommendations, with a possible medium-run time horizon. This horizon does not exclude yearly assessment of the

advances. It would help distinguish between intermediate steps and final goals.’.

Box 4: The EU integrated policy

guidelines

The Broad Economic Policy Guidelines

(BEPGs) and the

Guidelines for

Employment Policies (EGs) lay down the

general scope and direction of

economic policy coordination of the EU

Member States. At the same time, they

are intended to support the goals of the

Europe 2020 strategy.

Concerning the legal basis, the TFEU

contains one article on BEPGs and one

on EGs, Articles

121 and 148

respectively. Given the two distinct

articles, two distinct EU legal

instruments are used: a Council

Recommendation on BEPGs and a

Council Decision on EGs.

These so-called ‘integrated guidelines’

form part of the European Semester and

therefore also serve as a reference for

the Country Specific Recommendations.

The European Semester for economic policy coordination: A reflection paper

PE 624.440 23

Also, some attention would be required concerning the timeframe of the recommendations issued

under the European Semester. In some cases, it may be more important to have annual

recommendations and targets, and in other cases a multiannual approach could provide more tangible

results. In this respect, it would also be important to ensure that both the policy initiatives proposed by

Member States (in their ‘national programmes’) and the recommendations adopted at EU level are well

integrated into the concrete work programmes of each national government

39

.

3.3. Specific policy instruments aiming at preventing unsustainable policies

inside the monetary union

As clearly identifiable instruments of the ‘renewed Semester’, the policy recommendations under the

SGP

40

and the MIP

41

would focus on those national developments and policies that may need specific

attention due to the fact of belonging to a common currency area (or planning to join it)

42

. This should

not be seen as downgrading the importance of other Semester-related objectives that need also to be

addressed as a matter of ‘common concern’, such as tackling climate change as part of any sustainable

economic policies.

Those core EMU economic governance tools would aim to target economic policies that, if not

addressed in time, could potentially have a significant negative impact on the stability of the euro

(‘common concern for the euro area as a whole’), and are essentially due to the disappearance of

monetary and exchange rate policies at country level (see also Box 1 on the specific features of the

monetary union ).

These EU policy guidance tools of ‘preventive nature’ could be clearly identified as part of the broader

Semester framework. Policy recommendations should only be made based on country-specific

analyses and should target potentially large or lasting ‘policy mistakes’ from a joint euro area

perspective

43

. This approach would need a strong common understanding of the policies that would

deserve special attention. In this respect, the policy recommendations for the euro area would be

targeted to specific needs of the euro area and its members and would aim at restraining Member

States from adopting certain policies that could in the longer run jeopardise financial stability

44

.

39

For an overview by the Council of lessons learned from the 2019 Semester cycle, see the note prepared by the EPC and

EFCalternates (Council document 12465/19).

For example, the authors conclude: ‘When addressing less severe challenges or

addressing challenges where Member States have shown decisive reform action in previous years, the CSRs could be less prescriptive.

While allowing for more room for the Member States to tailor their response to country specificities, they should remain sufficiently

specific to be amenable to an ex-post evaluation. At the same time, if a Member State has not responded to recommendations with

decisive reform action in previous years, new recommendations could be more prescriptive. Some CSRs could be formulated as

multiannual due to the expected length of their implementation.’

40

Article 1 of the Regulation (No 1466/97) on the preventive arm of the SGP ‘sets out the rules covering the content, the

submission, the examination and the monitoring of stability programmes and convergence programmes as part of multilateral

surveillance by the Council and the Commission so as to prevent, at an early stage, the occurrence of excessive general government

deficits and to promote the surveillance and coordination of economic policies thereby supporting the achievement of the Union’s

objectives for growth and employment.’

41

Article 1.1 of the MIP-Regulation (No 1176/2011) ‘sets out detailed rules for the detection of macroeconomic imbalances, as well

as the prevention and correction of excessive macroeconomic imbalances within the Union.’.

42

See for instance, a working paper by IMF staff (January 2018) on ‘Economic Convergence in the Euro Area: Coming Together or

Drifting Apart?’.

43

See D.J. Bokhorst (May 2019) on ‘Governing imbalances in the Economic and Monetary Union’.

44

See recent Commission technical note on ‘Competitiveness and external balances, Main drivers and challenges ahead’: ‘The

building up of current account imbalances and price competitiveness divergences in the euro area before the financial crisis was

followed by their abrupt unwinding. Current account reversals were accompanied by major recessions and soaring unemployment

in countries with large current account deficits; euro area convergence came to a halt. With hindsight, the potentially harmful

implications of current account imbalances and price competitiveness divergences at euro area level were underestimated in the

first EMU decade’.

IPOL | Economic Governance Support Unit

24 PE 624.440

Therefore, any decisions to trigger policy action in a given Member State would need to have broad

support at both national and EU level before any final decision is taken at the EU level, notably by the

Commission and the Eurogroup/Council. This broad consultation, as part of the preparatory phase,

could involve opinions of various competent bodies at the EU level (e.g. the European Fiscal Board (EFB)

for public finances and the European Systemic Risk Board (ESRB) for potential macro-prudential risks),

and similarly at the national level (e.g. national fiscal councils and national productivity boards). An EU-

level independent body, mandated to coordinate the work of the national productivity boards, could

be envisaged

45

. As today, these policy recommendations of a ‘preventive nature’ would be adopted by

the Member States in Council, on the basis of a proposal by the Commission.

These preventive tools would still be assessed in light of the need not to endanger the long-term

objectives of the renewed Semester framework. In other words, the broader Semester framework

should aim at upward convergence among the EU Member States

46

, while the SGP and MIP should aim

at avoiding major divergence or imbalances in the euro area Member States. Under these procedures,

the right balance between ‘peer support’, ‘peer pressure’, ‘financial benefits’ and ‘financial penalties’

should be sought. In addition, some kind of ‘positive consequences’ could be established for the

reforms and measures undertaken by the Member States under the revised European Semester

framework

47

. Some form of ‘negative consequences’ could also be envisaged, in particular should there

occur a clear case of repeated non-respect of policy recommendations aimed at avoiding certain

policies that could ultimately endanger the ‘shared responsibility’ for the stability of the euro.

3.4. How to go beyond the rules in the Semester framework?

Today, the regular assessment by the Commission of CSR implementation per Member State gives

indications on how the Semester is helping to steer, notably in a preventive manner, fiscal, economic

and social policies in the EU.

The effectiveness of these EU rule-based recommendations depends largely on Member States’

willingness and ownership of the recommendations and the shared belief that the commonly agreed

policies are the ones appropriate for the EU and each of its Member States. Therefore, a debate around

reforming the Semester – with a view to making it an integral part of national policymaking - may need

to go well beyond its underlying legal instruments, in order for the related policy recommendations to

be politically accepted and implemented over the economic and political cycles in the EU and its

Member States

48

.

At the EU level, one could consider ways to anticipate and make more transparent the debate on the

EU policy recommendations, to increase peer support and pressure. One option could be to give more

45

E.g. S. Sapir and G. Wolf (February 2015) on ‘Euro-area governance: what to reform and how to do it’.

46

For possible definitions of convergences in the EMU and the policy tools to achieve them, see also two papers commissioned

by the EP: J. Creel (2018) and M. Dolls, C. Fuest et al. (2018)

on ‘Convergence in the EMU: what and how?’. Convergence can

be analysed from many perspectives: among others, real convergence addresses convergence in income levels and living

standards, nominal convergence covers nominal indicators such as interest rates and inflation rates, and cyclical convergence