LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 1 of 7 August 27, 2018

TITLE:

Donations

ROUTING

Local District

Superintendents

& Administrators

Principals

School Administrative

Assistants

Fiscal Services Managers

Central Office Fiscal Staff

Fiscal Specialists

NUMBER:

BUL-5895.2

ISSUER:

V. Luis Buendia, Controller

Accounting and Disbursements Division

DATE:

August 27, 2018

PURPOSE:

MAJOR

CHANGES:

The purpose of this Bulletin is to provide updated information on receiving and

accounting for donations. It replaces BUL-5895.1, “Donations”, dated February 10,

2016.

Forms have been revised to separate cash donations from in-kind donations.

Additional guidance has been added on distinguishing donations and grants. Unit

heads now certify that the donation does not include matching or reporting

requirements.

GUIDELINES:

Education Code Section 41032 allows the governing board of any school district to

accept donations for its benefit or for the benefit of any of its schools, subject to any

conditions or restrictions that the Board of Education may prescribe. It is, and has

been, the intent of the Board of Education that no donation shall provide a substantial

advantage in educational benefits to a school if such benefits cannot be balanced in

all schools.

I. Review of Funds

To ensure proper accounting of funds, the intent, purpose, and source of the monies

should be examined closely. All documentation associated with the funding,

including checks, memos, letters, etc. should be reviewed to determine whether the

funds are a donation or not. Key words such as grant, reimbursement, scholarship,

lease, invoice, commission, auxiliary services, and the like may indicate that the

funds are not a donation. In order to determine with certainty whether the funding

should be considered a donation, obtain additional information from the originator of

the funds, and/or contact the Accounting and Disbursements Division at (213) 241-

7889.

It is important to distinguish donations from grants and sponsorships. Agreements

which provide the District with funds but require matching funds, status or expense

reports, and/or delineate the use of funds beyond just a general intent (i.e. “for

computers”, etc.) constitute grants not donations. Agreements which provide funds

to the District with the requirement for recognition through signage or other means

constitute sponsorships. Please see BUL-6876.1 for more information on

Sponsorships.

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 2 of 7 August 27, 2018

Donations provided by a vendor who has been contracted for a student body activity,

(e.g. school photography, yearbooks, fundraiser) should belong to the school’s

Associated Student Body and be deposited into the student body account following

the procedures in Publications 464 (elementary schools), 465 (secondary schools),

and 469 (adult schools).

II. Procedures for Acceptance of Donation

District policy authorizes administrators to accept donations of cash, services,

equipment, or real property. However, accepting donations is voluntary and

donations should only be accepted where there is a legitimate use in the school

program and the donation would not cause a hardship to the receiving site.

Procedures and policies are outlined below and must be followed when accepting

donations.

Contributions of money linked matching funds or required reporting are grants, not

donations. Accordingly, the person submitting the donation to be processed will be

required to certify that there are no matching funds or reporting requirements.

The donation account should not be used as a clearing account. For example:

collections for employees for retirement celebrations, or collections to purchase

award recognition for employees, etc, should not be recorded in the donation account.

This does not apply for donations received from outside sources that may specifically

be for employee or student recognition. For example: The “Target Take Charge for

Education” program, Booster clubs, Parent Teacher Association (PTA), etc.

1. Cash Donations - District

A. When a donation is received, the administrator must prepare the “Request to

Process a Donation” form (Attachment A), attach the check made payable to

Los Angeles Unified School District, and forward as follows:

K-12 Schools, including Special Education……Fiscal Specialist

Early Childhood Education Centers……………Early Childhood Education

Fiscal Services

Beaudry Building, 11

th

floor

Adult Education, ROP/ROC, Skills Centers…...Adult Education

Fiscal Services

Beaudry Building, 18

th

floor

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 3 of 7 August 27, 2018

Local District ..................................................................Fiscal Services Manager

All Other Offices ............................................................Budget Services Branch

Beaudry Building, 26

th

floor

Cash donations will be placed in the following accounting lines (Program Codes):

K-12 Schools 010-0000 1110-1000-13938

Special Education Schools 010-6500 5750-2700-12538

Adult Education Schools 110-0000 4110-1000-13717

ROP/ROC/Skills Centers 010-0000 6000-1000-14806

Early Childhood Education Centers 120-0000 0001-2700-17623

Offices 010-0000 0000-7200-13237

B. The administrator should provide the donor with an official

acknowledgement of the donation (Attachment B – sample letter).

C. The administrator must maintain detailed records documenting how and

when the donated funds were spent. Such documentation may include vendor

receipts or invoices, cancelled checks, or printed reports. Expenditures which

may be “charged to” or “made from” the above accounts include a wide

variety of items including material, equipment, salaries, contracts, bus trips,

repairs, and alterations of buildings. For donations with specific donor intent,

a control sheet should also be completed to document that the donation was

spent in accordance with the donor’s intent. See Attachment C for a sample

control sheet.

D. For audit purposes, administrators must retain a copies of the completed

“Request to Process a Donation” form, the donation check, the

acknowledgement letter, and detailed accounting records to show that the

donated funds were spent according to the intent of the donor. These records

must be kept five years the time the donation has been fully spent.

2. In-Kind Donations (Equipment, Computers, Materials, Real Property, Library

Books, Services, or Artwork/Valuables)

A. Administrators may accept donations of equipment, materials, real property,

library books, services, and/or artwork valuables. However, no donations

should be accepted if the cost for maintenance and operation of the asset

would be excessive. Moreover, to ensure the safety of students and staff, it is

the responsibility of the administrator to have the following offices review

and approve donated items and/or services for compliance as listed below.

Administrators will be liable for consequences of not following the

guidelines below.

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 4 of 7 August 27, 2018

i. Maintenance & Operations Branch – Review and approve donations of

new and used equipment or modifications of facilities to ensure that

equipment is Underwriters Laboratory (UL) approved and safe to

operate. Review and approve donations of services to determine and

verify if appropriate insurance, contractor licenses, and safety

prequalification are required.

ii. Environmental Health and Safety – Review donations of chemical

products and playground equipment.

iii. Transportation Services Division – Review donations of new or used

motor vehicles to ensure that vehicles are properly inspected for safety,

that ownership (i.e. pink slip) is transferred to the District, that proper

license plates are obtained, and that funding lines are provided for

preventive maintenance.

iv. Office of the General Counsel and Risk Management Division – Review

donations of real property and other assets, including building, facility,

and land, for any legal concerns, or where the person receiving the

donation believes there may be a legal issue.

B. For donations of equipment, computers, real property, and other assets

valued at $5,000 or more, the administrator must submit all documents

related to the donation to Fixed Asset Accounting Section, for proper

recording.

C. For donations of computers and computer software, it is the responsibility of

the administrator to complete all information contained on the “Request for

Licensing Information for Donations of Computers and/or Computer

Software” form. (Attachment D). Any District staff member who donates

software must also complete this form. The form must be kept on file as

evidence of proper copyright licensing in the event of an audit. The

documentation must be kept until five years after the equipment has been

taken out of service. For additional information, please review Information

Technology Division’s BUL-716.2, “Compliance with the 1976 United

States Copyright Law- Computer Software,” dated October 1, 2005.

It is the responsibility of the administrator to ensure that their computer

inventory is updated in Remedy Asset Manager. For instructions, please

refer to the IT Asset Management System Handbook which can be accessed

by visiting the IT Asset Management’s website:

https://achieve.lausd.net/itam.

The Information Technology Division may provide support for donated

computer equipment. The donated equipment will be deemed as salvaged if

the cost to support and/or repair is greater than the value of the equipment

donated.

D. Donations of artwork must include a written statement from the artist or

his/her agent indicating that both the artwork and the copyright to its image

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 5 of 7 August 27, 2018

belong to the District. For additional information on artwork, please refer to

Office of the Superintendent’s BUL-Q-17 (Rev.), “Protection of Valuable

Works of Art and Restrictions on Their Sale”, dated June 1, 2000.

E. The administrator should provide the donor with an official

acknowledgement of the donation (Attachment B – sample letter). If item

donated is a vehicle, either for use or resale, please contact the Controller’s

Office to ensure the District complies with IRS regulations.

F. Donated equipment, computer software, and artwork must be recorded on the

site’s inventory records if the value is $500 or greater.

G. If the donor does not provide delivery of items donated, it is the

responsibility of the administrator to arrange and pay for pickup/delivery.

H. Installation, maintenance and upkeep of the donated equipment are the

responsibility of the site’s administrator.

I. The administrator must keep a copy of all documents related to the donation

must be kept on file at the site accepting the donation until five years after

final disposition of the items/equipment.

J. For additional information on the donation of library books, please refer to

Integrated Support and Intervention’s Bulletin 6222, “Criteria for

Acceptance of Library Book Donations,” dated February 6, 2014.

3. Donations of Gift Cards/Pre-Funded Debit Cards

A. When a donation of gift cards/pre-funded debit cards is received, the

administrator must prepare the “Request to Process a Donation” form

(Attachment A). At the time of processing, Accounting and Disbursements

Division will reflect both the donation income and expenditure of the funds

using the same accounting lines listed for cash donations.

B. The administrator should provide the donor with an official

acknowledgement of the donation (Attachment B – sample letter).

C. The administrator must maintain detailed records. Please see REF-055300

for information on documenting how the donated card was spent and any

potential tax effects.

D. The administrator must keep a copy of all documents related to the donation

until five years after the donation was fully spent.

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 6 of 7 August 27, 2018

III. Approval Process

For internal control purposes, further review and approval of donations are required

as indicated below.

Amount

Reviewed and Approved By

Any

Fiscal Specialist

$5,001 to $15,000

Fiscal Services Manager

$15,001 to $20,000

Deputy Controller

$20,001 and above

Controller

If a donation exceeds $25,000, the Accounting and Disbursements Division will

prepare a quarterly Board Report ratifying the acceptance of the donation.

IV. Refund of Donations

Donations will not be refunded unless otherwise provided below.

Cash Donations that have been spent consistent with the donor’s stated intent should

not be returned to the donor. Donated funds may only be returned to the donor if, for

any reason, said funds were not spent in accordance with the donor’s stated specified

intent. Nothing shall preclude the District from contacting the donor to request

modification to the intent if it appears that the District may not be able to fulfill the

donor’s intent. If the donor did not express a specific purpose and the funds were

spent as determined by the administrator, then funds should not be returned to the

donor.

Non-cash donations should not be returned to the donor if such donations were used

in accordance with the donor’s intent. If the donor did not express a specific

purpose, and the donated items were used as determined by the administrator, then

such donated items should not be returned to the donor. If a gift of land and/or

building has been accepted by the Board upon condition or agreement that it be

devoted to school purposes of the District, whether that condition or agreement is

written or oral and whether the terms thereof are recited or referred to in any

instrument executed in connection with the conveyance of the gift, and the Board

subsequently determines that the land and/or building cannot be feasibly utilized for

any school purpose of the District, the Board may cause it to be reconveyed to the

donor without consideration to the District; provided that failure to do so shall not

affect the rights of any bona fide purchaser or encumbrancer of the land.

RELATED

RESOURCES:

BUL-1378, “Criteria for Acceptance of Library Book Donations”, Instructional

Services, dated October 25, 2004

LOS ANGELES UNIFIED SCHOOL DISTRICT

POLICY BULLETIN

BUL-5895.2

Accounting and Disbursements Division Page 7 of 7 August 27, 2018

BUL-Q-17 (Rev.), “Protection of Valuable Works of Art and Restrictions on Their

Sale”, Office of the Superintendent, dated June 1, 2000.

BUL-716.2, “Compliance with the 1976 United States Copyright Law – Computer

Software”, Information Technology Division, dated October 1, 2005.

BUL-953.1, “Control of Site Equipment”, Accounting and Disbursements Division,

dated August 23, 2010.

BUL-6222, “Criteria for Acceptance of Library Book Donations”, Integrated Support

and Intervention, dated February 6, 2014.

REF-055300, “Tax Implications on Employee Receipt of Gift Cards, Tickets, and

Other Fringe Benefits”, Accounting and Disbursements Division, dated August 17,

2018.

ASSISTANCE:

• For assistance with donations to school sites, please contact your Fiscal

Specialist. For assistance with donations to Local Districts, please contact your

Fiscal Services Manager.

• For assistance with donations to Associated Student Body, please call Student

Body Finance Support at (213) 241-2150.

• For assistance with donations to Early Childhood Education Centers, please call

(213) 241-1043.

• For cash donations to all other offices, please contact the Budget Services and

Financial Planning Division at (213) 241-2154.

• For assistance with grant approval process concerning delegation of authority for

grant applications (Board Resolution 254), please contact the Division of

Instruction at (213) 241-4822.

• For assistance with donations of computers and computer software, please call

Information Technology Division Helpdesk at (213) 241-5200.

• For assistance with donations of artwork, please call the Arts Education Branch at

213-241-8222.

Telephone _________________________

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________

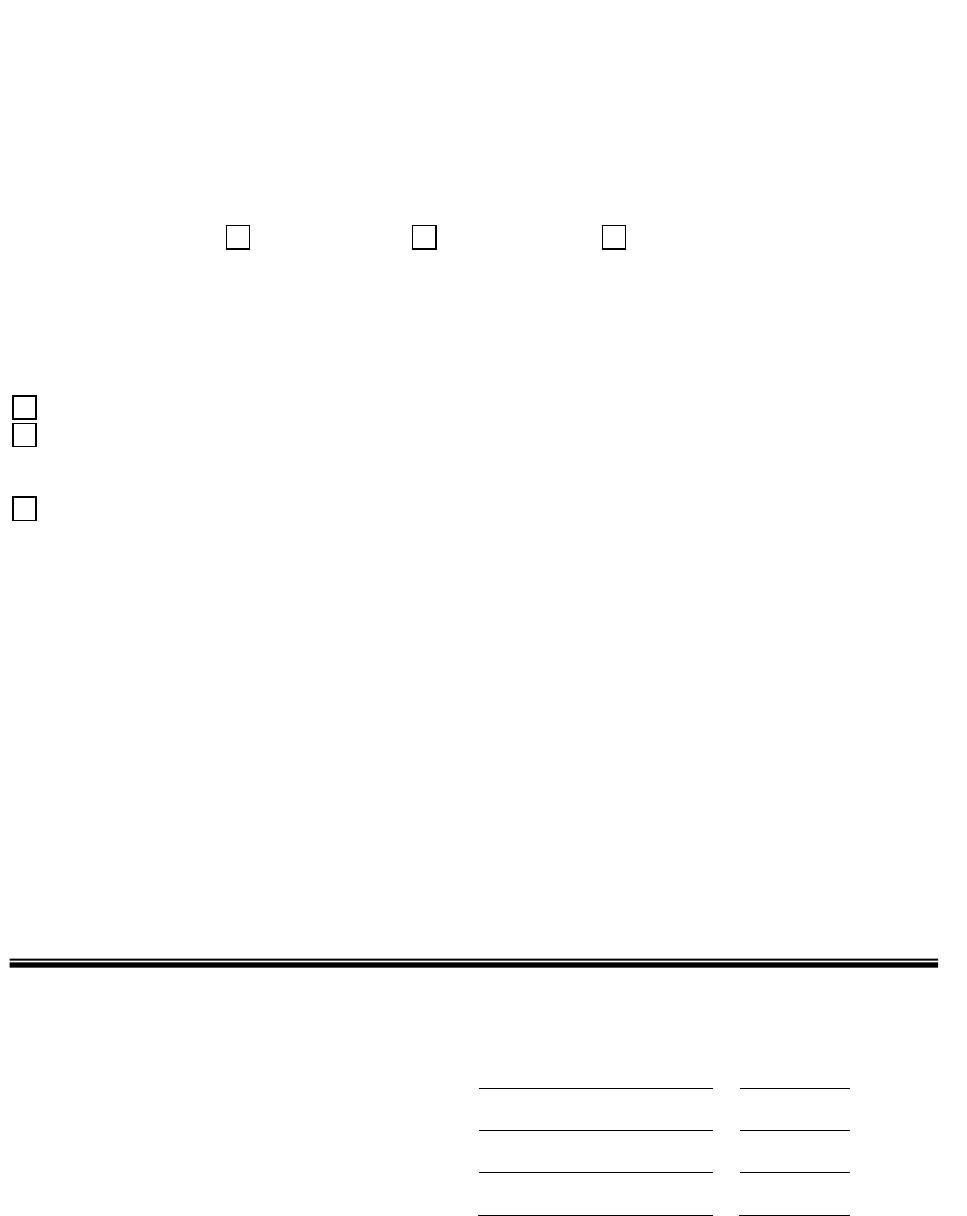

LOS ANGELES UNIFIED SCHOOL DISTRICT

Accounting and Disbursements Division

BUL-5895.2 ATTACHMENT A

August 27, 2018

REQUEST TO PROCESS A DONATION

School/Office:____________________________ Cost Center _________________________

Contact Person ___________________________

DONOR INFORMATION

Name of Individual/Group/Company _______________________________ Telephone _____________________

Address _____________________________________________________________________________________

FORM OF DONATION: Check (Attach) Prefunded Card Materials/Equipment/Services

AMOUNT OF CASH (VALUE OF NON-CASH) DONATION $____________________

ACCOUNTING LINE ____________________________

TYPE OF DONATION (Select one)

CASH without donor-specified intent. Please describe below how this donation is intended to be used

CASH with donor-specified program intent. Donors may stipulate that the donation should be used for a

specific purpose or program only. Please describe below how this donation is to be used. Schools/offices

should use the control sheet (Attachment C) to track expenditures.

MATERIALS, EQUIPMENT, COMPUTERS, ART WORK, LIBRARY BOOKS, OR SERVICES

(Complete this form only for those items or services with a value of more than $5,000. Be sure to list items

whose value is $500 or more on the annual inventory listing.) Please provide description of the non-cash

donation

I understand that money received pursuant to an agreement that requires matching funds, expenditure reporting,

and/or return of funds not spent within a specific period constitutes a grant, not a donation. I hereby certify that

there is no agreement for matching funds, expenditure reporting, or return of funds in regard to this donation.

APPROVAL: Site Administrator __________________________ Date: _________________

Please retain copies of all documentation, including letters from donors, related to the donation at the site as

evidence that the donation has been spent in accordance with the donor’s intent.

Local District/Central Office Approvals

Amount

Reviewed By

Signature

Date

Any

Fiscal Specialist

$5,001 to $15,000

Fiscal Services Mgr

$15,001 to $20,000

Deputy Controller

$20,001 and above

Controller

LOS ANGELES UNIFIED SCHOOL DISTRICT

Accounting and Disbursements Division

BUL-5895.2 ATTACHMENT B

August 27, 2018

SAMPLE ACKNOWLEDGEMENT OF DONATION

DATE

Donor Information

On behalf of the Los Angeles Unified School District, (name of school/office) accepts

with gratitude your donation of

(specify amount of cash, or description of equipment, materials, or services donated)

for use at our school.

We wish to express our appreciation for your interest in our educational program.

For your records, the Los Angeles Unified School District’s federal tax identification

number is 95-6001908. As a duly constituted political subdivision of the State of

California, it is considered a qualified organization to receive deductible donations.

Sincerely,

(Administrator)

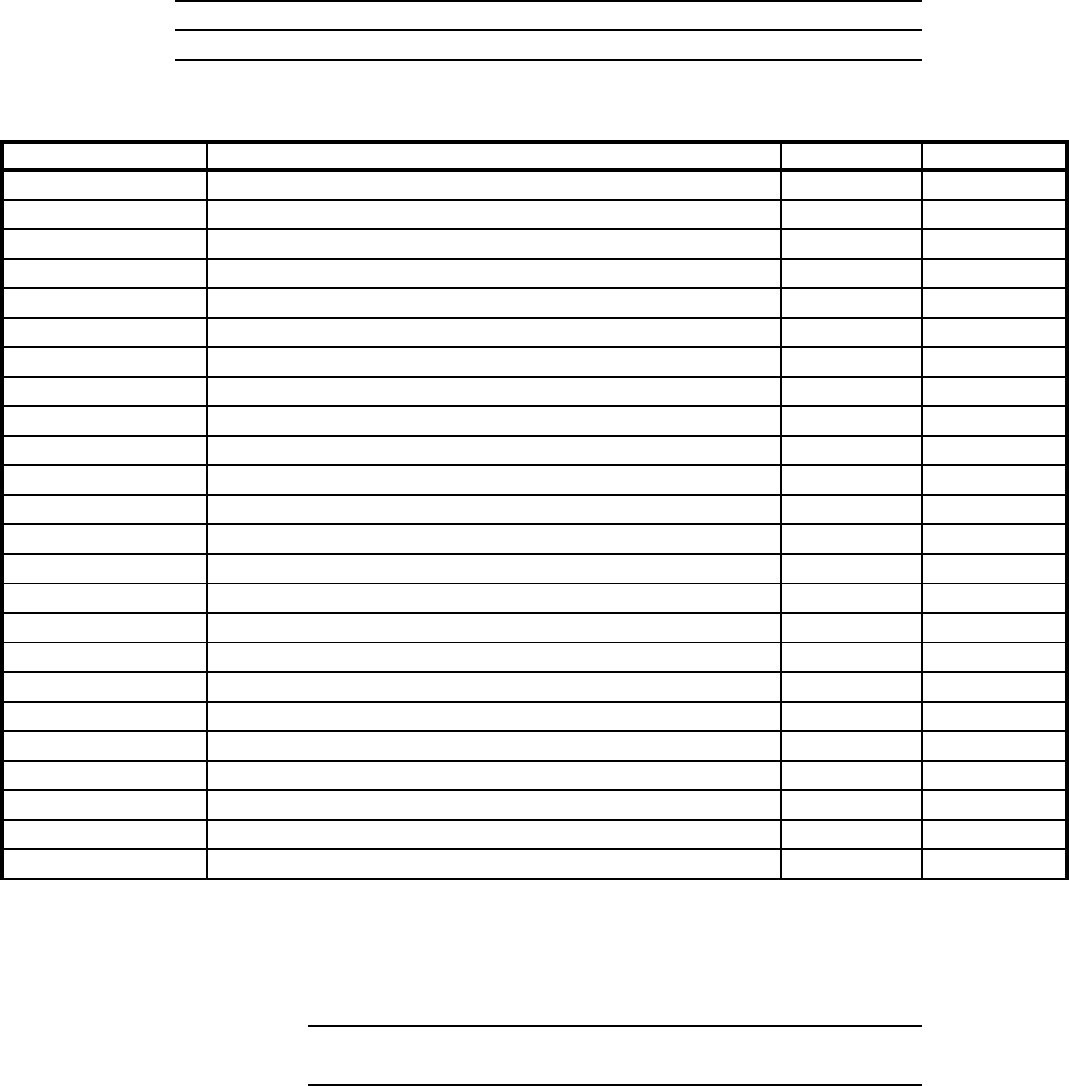

LOS ANGELES UNIFIED SCHOOL DISTRICT

Accounting and Disbursements Division

BUL-5895.2 ATTACHMENT C

August 27, 2018

DONATION CONTROL SHEET

School/Office:

Donor :

(Can attached statement from donor)

Amount Balance

Form Prepared by:

Please attach documentation showing donor's intent and documentation of expenditures (receipts, invoices, etc.) for audit purposes,

and retain with Attachment A.

Amount of Donation: _______________

Date

Expenditure Description

Site Administrator Approval

Intent:____________________________________

Description _____________________________________________________

Make/Model _____________________________________________________

Serial # ______________________________________________________

LOS ANGELES UNIFIED SCHOOL DISTRICT

Accounting and Disbursements Division

BUL-5895.2 ATTACHMENT D

August 27, 2018

REQUEST FOR LICENSING INFORMATION FOR DONATIONS OF COMPUTERS

AND/OR COMPUTER SOFTWARE

School/Office:____________________________ Cost Center ___________

Contact Person ___________________________ Telephone ____________

DONOR INFORMATION

Name of Individual/Group/Company _______________________________ Telephone ___________

Address ___________________________________________________________________________

COMPUTER:

OPERATING

SYSTEM

SOFTWARE

SOFTWARE

In order to avoid potential copyright infringement lawsuits against the District, it is mandatory that

administrators secure from the donor, documentation on PROOF OF PURCHASE for all software

donations. Examples of documentation are:

1.) Software License Number

2.) Software Agreement Statement

3.) Original Installation Diskettes/CD-ROM

I declare that no additional copies of the donated software exist on any other computers.

Donor Name_____________________________ Donor Signature_____________________ Date _____

Any District staff member who donates software to be used on LAUSD computers must also complete this

form.

Title of Software _________________________________________________

Software Company ________________________________________________

Serial/License # __________________________________________________

Description ______________________________________________________

Title of Software _________________________________________________

Software Company ________________________________________________

Serial/License # __________________________________________________

Additional sheets may be attached if more space is needed to detail software

information.