Page | 1

Benefits Planning Query Handbook

(BPQY)

Distributed by

Office of Retirement and Disability Policy

Office of Research, Demonstration, and Employment Support

July 2023

Version 2

Page | 2

Table of Contents

Introduction ................................................................................................................................................................... 3

How to Request a BPQY ................................................................................................................................................. 3

Beneficiary Requests .................................................................................................................................................. 3

Third Party Requests .................................................................................................................................................. 3

The Red Book ................................................................................................................................................................. 4

Understanding the BPQY ................................................................................................................................................ 4

Example of BPQY Cover letter .................................................................................................................................... 5

Example of BPQY Statement ...................................................................................................................................... 6

Definitions of Each Field ............................................................................................................................................. 8

SSN ......................................................................................................................................................................... 8

Record .................................................................................................................................................................... 8

Cash ........................................................................................................................................................................ 8

Others Paid on the Record ..................................................................................................................................... 9

Medical Reviews .................................................................................................................................................... 9

Representation ..................................................................................................................................................... 10

Health Insurance .................................................................................................................................................. 10

SSI Work Exclusions .............................................................................................................................................. 11

SSDI Work Activity ................................................................................................................................................ 11

Demonstration Project Information ..................................................................................................................... 12

Earnings Record ................................................................................................................................................... 12

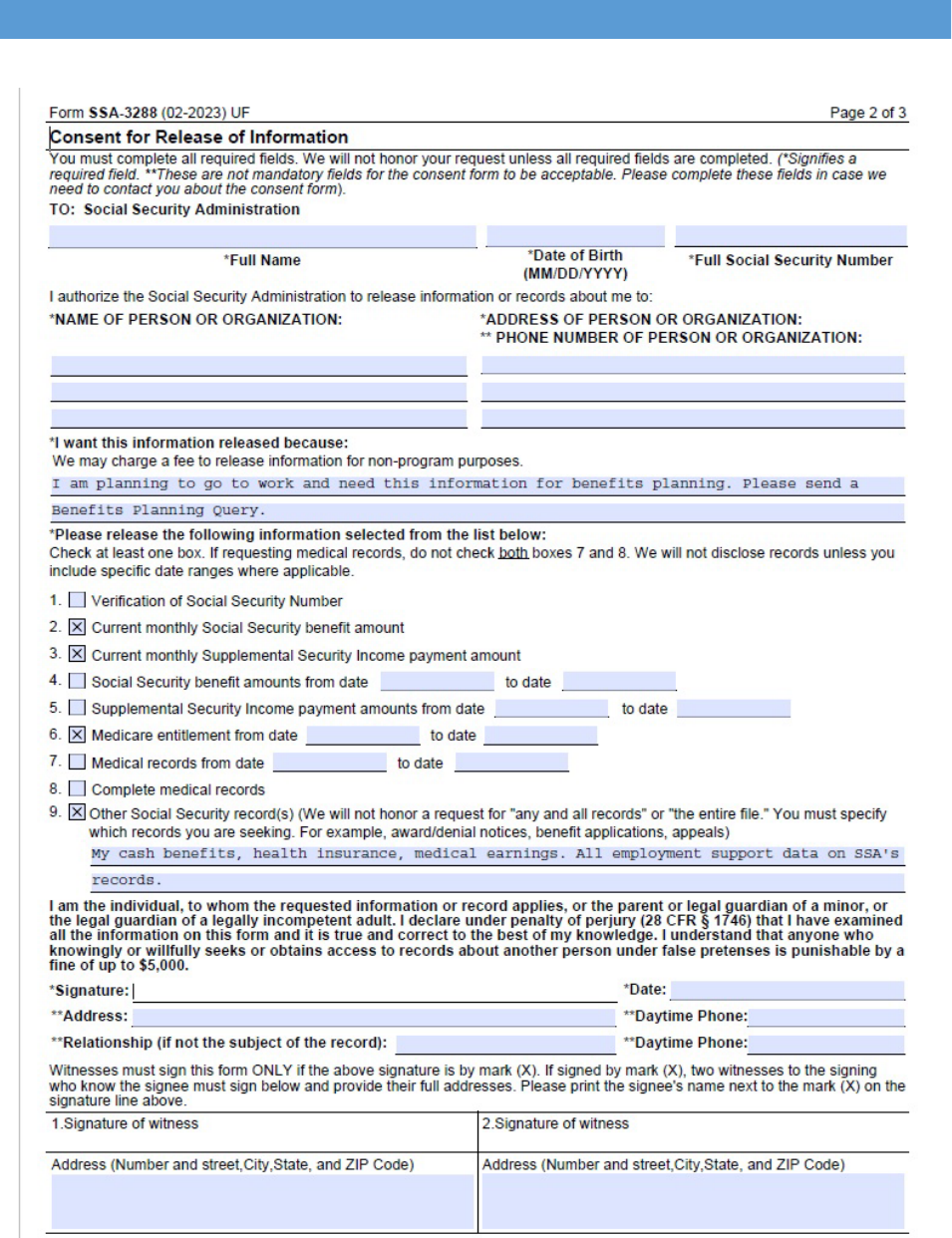

Exhibit – Consent for Release of Information Form (SSA-3288) ................................................................................... 13

CONTENTS

Page | 3

The Benefits Planning Query (BPQY) is part of the Social Security Administration’s (SSA) efforts

to inform Social Security Disability Insurance (SSDI) beneficiaries and Supplemental Security

Income (SSI) recipients about their disability benefits and the use of work incentives. A BPQY

statement contains detailed information about the status of a beneficiary's disability cash

benefits, scheduled medical reviews, health insurance, and work history. In essence, the BPQY

provides a snapshot of the beneficiary's benefits and work history as stored in SSA's electronic

records.

The BPQY is a tool used by Area Work Incentive Coordinators (AWIC), the Plan to Achieve Self-

Support (PASS) Cadre members, advocates, beneficiaries, and other individuals. The

information contained in a BPQY provides customized information on SSA’s employment

support programs to beneficiaries with disabilities who want to start or keep working. Analysis

of a beneficiary’s disability and work status is the first step when planning a successful return to

work.

We give the BPQY statement to beneficiaries and their representatives upon request with

proper authorization.

Beneficiaries can request a BPQY by contacting their local office, or calling 1-800-772-1213 from

8 a.m. to 7 p.m., Monday through Friday. People who are deaf or hard of hearing may call our

toll-free TTY/TDD number, 1-800-325-0778, between 8 a.m. and 7 p.m., Monday through

Friday. A telephone representative will either help you themselves, or put you in contact with

your local office. Many local telephone directories list local offices under “Social Security.”

If you have internet access, use the Social Security Office Locator on our home page, Social

Security Online, at www.socialsecurity.gov. Enter your postal ZIP code and we will give you the

address, telephone number, and directions to your local office.

A signed consent form is required when the BPQY will be sent to someone other than the

beneficiary (for example, to the beneficiary’s Representative Payee, Authorized Representative,

HOW TO REQUEST A BPQY

BENEFICIARY REQUESTS

THIRD PARTY REQUESTS

INTRODUCTION

Page | 4

advocates, benefits counselors, or an organization). These individuals/organizations must

submit a Consent for Release of Information form (SSA-3288) that has been appropriately

signed by the beneficiary (See Exhibit). The Consent for Release of Information is needed to

release information from Social Security records, and must contain the beneficiary’s Social

Security Number (SSN) or the Claim Number. THE CONSENT FORM REQUIRES A WET

SIGNATURE FROM THE BENEFICIARY.

The Red Book (Publication No. 64-030) is a general reference tool designed to provide a

working knowledge of the employment support provisions for individuals with disabilities under

the SSDI and SSI programs. The Red Book is primarily for educators, advocates, rehabilitation

professionals, and counselors who serve persons with disabilities. We also expect that

applicants and beneficiaries will use it as a self-help guide. Its purpose is to provide a working

knowledge or our work incentives so that users can advise individuals with disabilities

appropriately and recognize when to seek case-specific guidance from SSA.

The Red Book is available online at: www.socialsecurity.gov/redbook/. En Espanol at:

segurosocial.gov/espanol/librorojo/main-sp.html. Alternative media is also available (Braille,

audio CD, or enlarged print) at: http://www.ssa.gov/pubs/alt-pubs.html/.

The BPQY is designed to provide information based on SSA records to help a successful return

to work effort. Any plan for returning to work should begin with knowing existing disability

status and having an understanding of how work will impact disability benefits. A BPQY is an

excellent starting point.

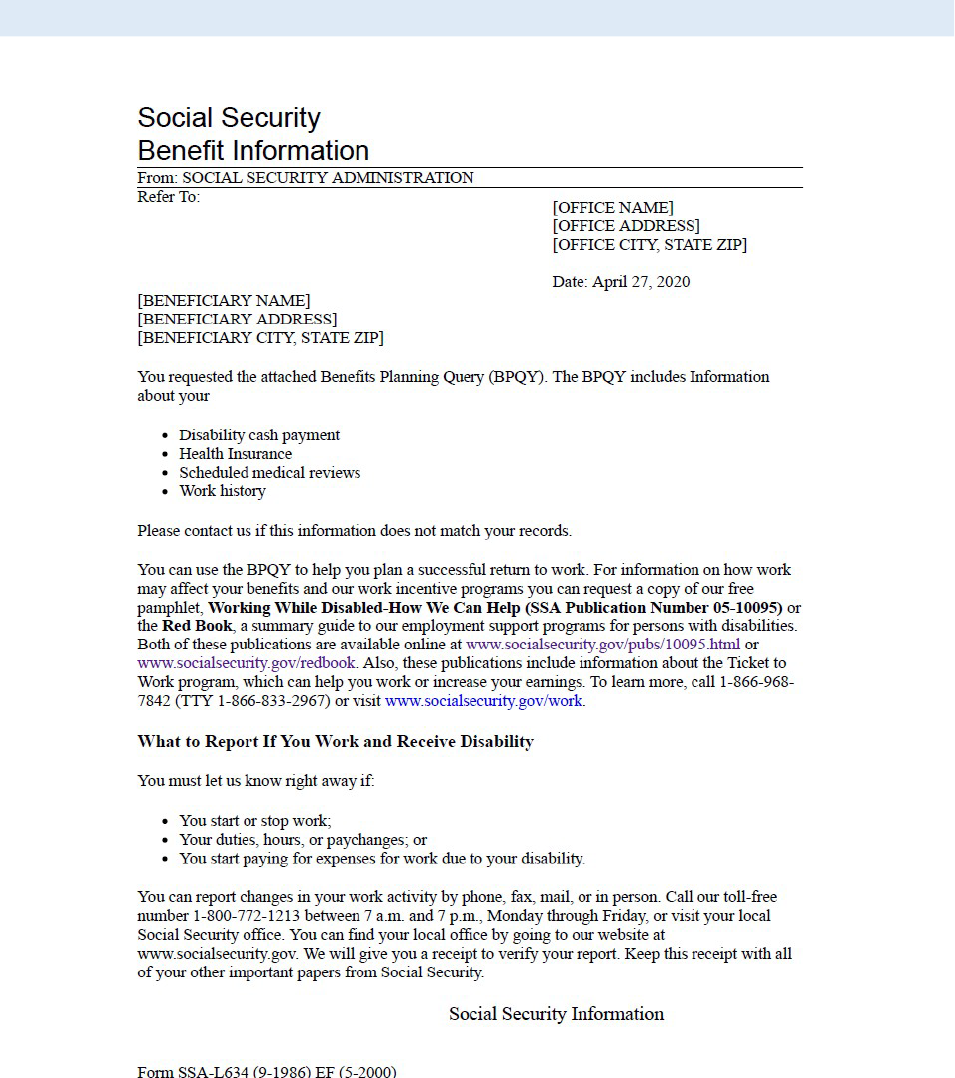

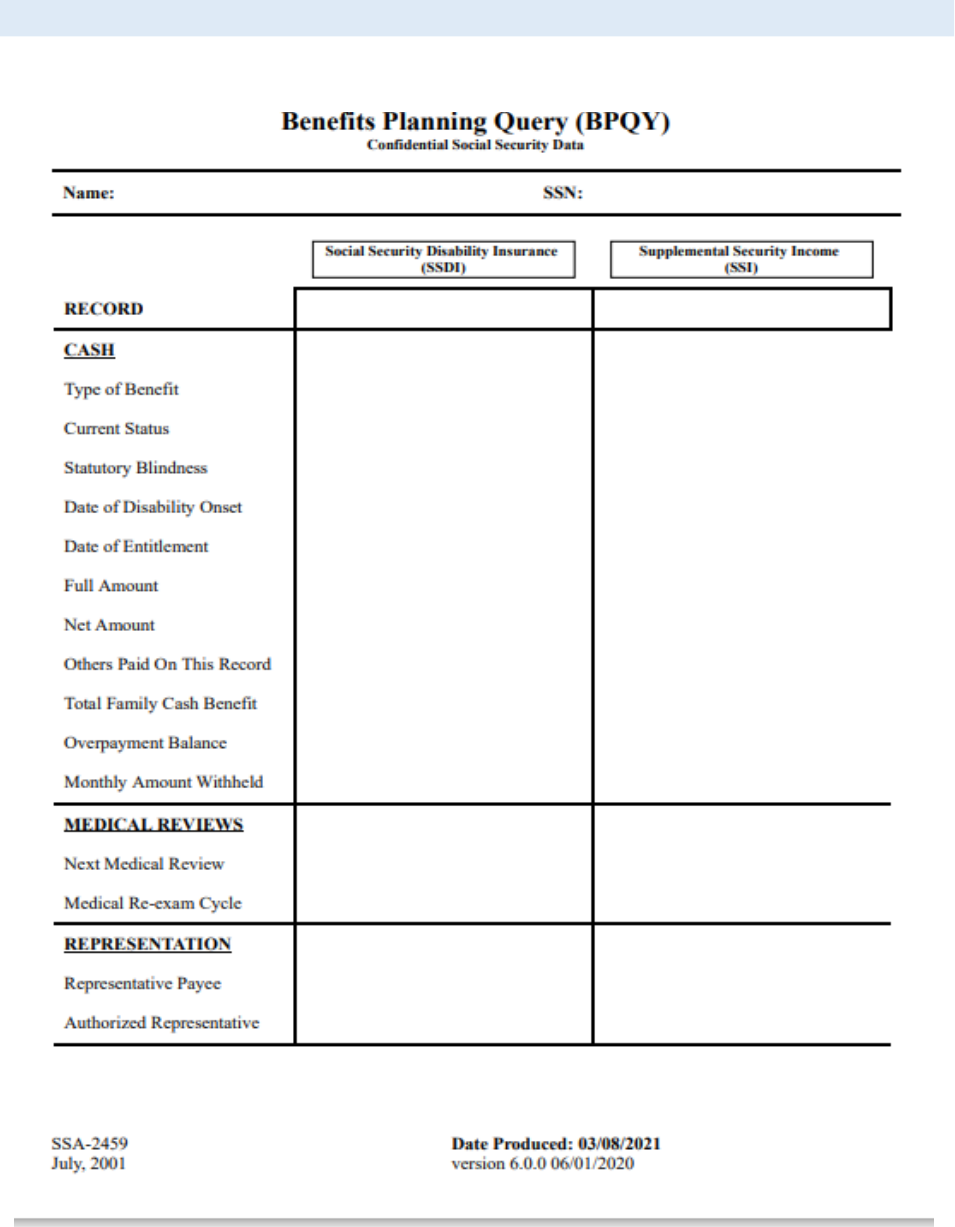

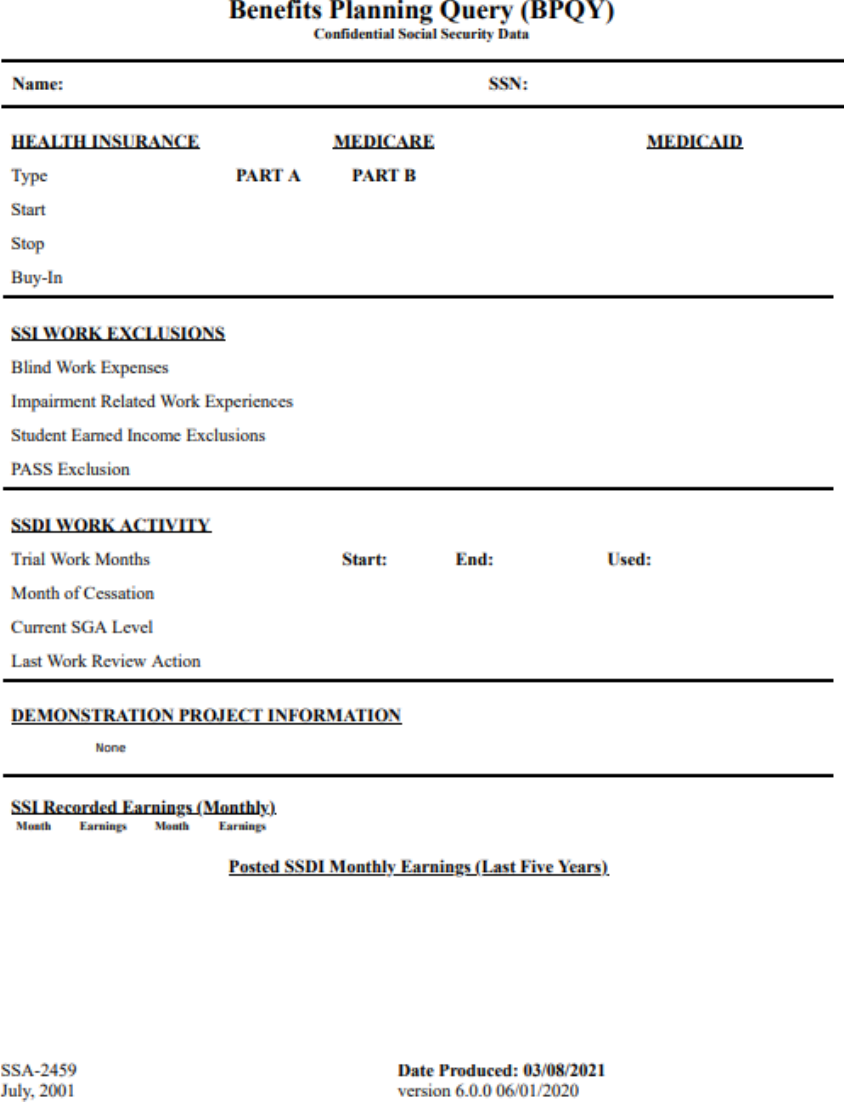

The following pages show an example of a BPQY Cover Letter and BPQY statement, with an

explanation of the information contained in each section.

THE RED BOOK

UNDERSTANDING THE BPQY

Page | 5

EXAMPLE OF BPQY COVER LETTER

Page | 6

EXAMPLE OF BPQY STATEMENT

Page | 7

Page | 8

SSN

BPQY gives the last four of the SSN of the individual who is the subject of the statement, even if

benefits are being paid from a parent or spouse’s record under a different SSN.

RECORD

The first column provides the categories broken into sections for Cash, Medical Reviews,

Representation, Health Insurance, SSI work Exclusions, SSDI Work Activity, and Demonstration

Project Information. We provide the IRS recorded earnings in a yearly total, and the SSI

recorded earnings in monthly totals. If available, we also provide the posted SSDI monthly

earnings for the last five years.

CASH

Under the cash category, this section details the type and status of benefits and payment

amounts.

TYPE OF BENFIT

Shows the type of benefit received. NOTE: In SSDI cases, a beneficiary may receive benefits on

more than one record (SSN), but only the current benefit is reported on the BPQY.

POSSIBLE SSDI ENTRIES

Disabled Worker, Disabled Adult Child, Disabled Widow, Disabled Widower, Disallowed

Claim, Denied Claim-Medical Denial

POSSIBLE SSI ENTRIES

Disabled Individual, Disabled Spouse, Disabled Child, Blind Individual, Blind Spouse, Blind

Child, Disabled Student, Blind Student

CURRENT STATUS

A beneficiary may be in a current pay status (getting a check), suspended, or terminated

entitlement.

STATUTORY

BLINDNESS

Yes means that SSA has determined that the beneficiary’s visual impairment meets the

definition of Statutory Blindness, under the Social Security Act for SSDI/SSI benefit purposes.

The substantial gainful activity (SGA) level is higher for statutory blindness than for other types

of disabilities.

DATE OF DISABILITY ONSET

The most recent medical disability onset date established by SSA.

DATE OF ENTITLEMENT

The most recent date of entitlement to SSDI benefits and/or the most recent date of eligibility

for SSI. Earlier periods of entitlement and/or eligibility are not displayed.

DEFINITIONS OF EACH FIELD

Page | 9

FULL AMOUNT

The full amount of the monthly cash benefit before any deductions or reductions for Medicare

premiums, overpayment collections, etc.

Possible entries are: Monthly cash benefit amount, suspended, deferred, or terminated.

The SSI full amount includes any federally administered state supplement, but does not include

any state administered state supplement payment.

NET AMOUNT

The amount of cash benefits paid by check or electronic funds transfer to the beneficiary’s

financial institution. This is the cash amount received after deducting any Medicare premium,

overpayment recovery, garnishment, etc. from the Full Amount.

Others Paid on the Record

Indicates if other people are entitled to benefits on this record. Other beneficiary’s cash or

medical benefits may be affected when the disabled individual’s work activity results in

termination of cash benefits. If a disabled adult child/widow(er) benefit is listed as a "Type of

Benefit", other beneficiaries on this record will not have their benefits reduced due to the work

activity of the disabled adult child/widow(er) but others’ benefits may increase.

TOTAL FAMILY CASH BENEFITS

The full amount of cash benefits paid to the disability beneficiary and other entitled family

members on this record for SSDI. Not Applicable will print under the SSI column since SSI is an

individual entitlement.

OVERPAYMENT BALANCE

The current balance of any outstanding monies owed to SSA for incorrect cash payments.

MONTHLY AMOUNT WITHHELD

The amount of cash benefits that SSA is withholding to apply towards a past overpayment of

benefits.

MEDICAL REVIEWS

NEXT MEDICAL REVIEW

The date scheduled to review the beneficiary’s medical condition. If unknown is displayed, no

medical review is scheduled.

MEDICAL RE-EXAM CYCLE

There are three types of medical review diaries. The letter codes represent the reason for

establishing a periodic review diary of less than 3 years, while the numeric codes represent

periodic review diaries of 3 years or longer. Possible entries are:

Page | 10

Code

Description

A thru U+

Periodic review diary of less than 3 years (medical improvement is

expected)

3+

3-year periodic review diary (non-permanent disability)

5+

5-year periodic review diary (permanent disability)

7+

7-year periodic review diary (permanent disability)

NOTE: There may be different periodic review diaries and scheduled dates for SSDI and SSI. The entries will show

that the medical diary is deferred due to Ticket to Work.

REPRESENTATION

REPRESENTATIVE PAYEE

A no indicates that the disabled beneficiary receives cash benefits directly; a yes means that

he/she has a Representative Payee.

AUTHORIZIED REPRESENTATIVE

A no indicates that the disabled beneficiary does not have an authorized representative; a yes

means that he/she has appointed an Authorized Representative.

HEALTH INSURANCE

TYPE

Shows the type of Medicare and/or Medicaid health insurance entitlement and/or eligibility on

SSA’s records. It includes Medicare Part A (hospital), Part B (medical), and Medicaid eligibility

status under SSI.

START

Date current coverage began.

STOP

Date coverage ended.

NOTE: When an SSDI beneficiary reaches age 65, Medicare converts from Medicare based on disability to Medicare

based on age. This occurs even though cash benefits will not convert to retirement benefits until full retirement age.

In these situations, the BPQY incorrectly displays a MEDICARE stop date effective with the month of the 65th

birthday.

BUY-IN

Shows yes or no for Parts A & B. A yes means the state of residency pays the premium for this

beneficiary. No means the premium is either deducted from his or her monthly check or paid by

premium billing.

Page | 11

Part A is premium free except for extended Medicare eligibility through Medicare for the

Working Disabled.

CAUTION: There are sources of eligibility to Medicaid that are unknown to SSA. If an SSI recipient resides in a state

that allows Medicaid eligibility with SSI eligibility (i.e., a 1634 state), the BPQY will show the Medicaid eligibility

information. For all other situations (i.e., 209b states or SSI criteria states), verify Medicaid eligibility through the

local or state Medicaid Agency.

SSI WORK EXCLUSIONS

Details SSI Work Incentives that exclude earned income from the calculation of the SSI payment

amount.

Blind Work Expenses, Impairment-Related Work Expenses, Student Earned Income Exclusions,

and PASS Exclusion. If a work exclusion does not apply, the entry will be blank. If a work

exclusion applies, the dollar amount of the exclusion and the month when it was excluded will

be provided.

NOTE: A Plan to Achieve Self-Support (PASS) can also result in an exclusion of unearned income.

SSDI WORK ACTIVITY

Details a beneficiary’s work activity as recorded in SSDI electronic records.

TRIAL WORK MONTHS

• Start: Month and year of the first month of Trial Work Period (TWP)

• End: Month and year of last month of TWP

• Used: Total number of months of the TWP completed

This information is based on the most recent work continuing disability review (CDR)

determination. In some cases, a work CDR may be pending or overdue, so the information

provided may not be current. If you suspect that this information is outdated or incorrect,

contact a Social Security representative as soon as possible.

MONTH OF CESSATION

The first month after the TWP that, based on SSA records, the beneficiary performed SGA.

Payment of cash benefits after the cessation month depends on the beneficiary’s work activity.

The beneficiary is entitled to benefits for that month, and the next two months (grace period).

It is possible for a beneficiary to have a cessation date but continue receiving benefits if the

gross monthly earnings during the extended period of eligibility are not SGA.

CURRENT SGA LEVEL

Page | 12

The SGA amount appropriate for this beneficiary. The current SGA amount for beneficiaries

with disabilities other than blindness and for individuals with blindness may be found in The

Red Book at http://www.ssa.gov/redbook/eng/main.htm. SGA amounts are annually in

January.

LAST WORK ACTION

The last work action review represents either the last work review decision date or the date we

started a current review.

DEMONSTRATION PROJECT INFORMATION

Provides information about any applicable demonstration project such as a Benefit Offset

National Demonstration.

EARNINGS RECORD

Provides a synopsis of work-related earnings as shown in our records.

SSI RECORDED EARNINGS (MONTHLY)

The right columns display monthly earnings for the most recent 2 years posted on the SSI

record. Verified earnings have a V code and estimated earnings have an E code.

POSTED SSDI MONTHLY EARNINGS (LAST FIVE YEARS)

Provides a listing of the last five years of monthly SSDI earnings.

GROSS WAGES

The monthly earnings for the five most recent years as posted on the SSDI record.

GROSS VERIFICATIONS

Y indicates earnings have been verified. If gross earnings are unverified, they are coded with an

N.

TOTAL COUNTABLE EARNINGS

The total amount of earnings after deductions for subsidies, special conditions, unincurred

business expenses, and impairment-related work expenses.

Page | 13

EXHIBIT – CONSENT FOR RELEASE OF INFORMATION FORM (SSA-3288)