403(b) RETIREMENT

PLANS

Department of Labor

Should Update

Educational Materials

to Better Inform Plan

Sponsors and

Participants

Report to the Ranking Member,

Committee on Education and the

Workforce, House of Representatives

June 2023

GAO-23-105620

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-23-105620, a report to the

Ranking Member

, Committee on Education

and

the Workforce, House of Representatives

June 2023

403(b) RETIREMENT PLANS

Department of Labor Should Update

Educational

Materials

to Better Inform Plan Sponsors and

Participants

What GAO Found

Millions of teachers and employees of tax-exempt organizations invest in 403(b)

retirement plans. The Department of Labor (DOL), Securities and Exchange

Commission (SEC), and Internal Revenue Service (IRS) take steps to oversee

some 403(b) plans or their investment options, or both. Specifically, DOL

oversees 403(b) plans subject to the Employee Retirement Income Security Act

of 1974, as amended (ERISA), and uses a range of strategies to identify plans to

investigate for compliance with the law. For example, DOL has investigated

instances of self-dealing—when a plan fiduciary uses plan assets for the

fiduciary’s own interest or own account. The SEC’s oversight focuses on

compliance with securities laws and regulations, while the IRS’s oversight

focuses on compliance with the Internal Revenue Code. DOL, SEC, and IRS also

conduct outreach and provide educational materials to 403(b) plan sponsors and

participants. However, DOL’s website does not contain targeted educational

materials that could help participants understand 403(b) plan fees. Updated DOL

information on 403(b) plans could help participants make more informed

decisions.

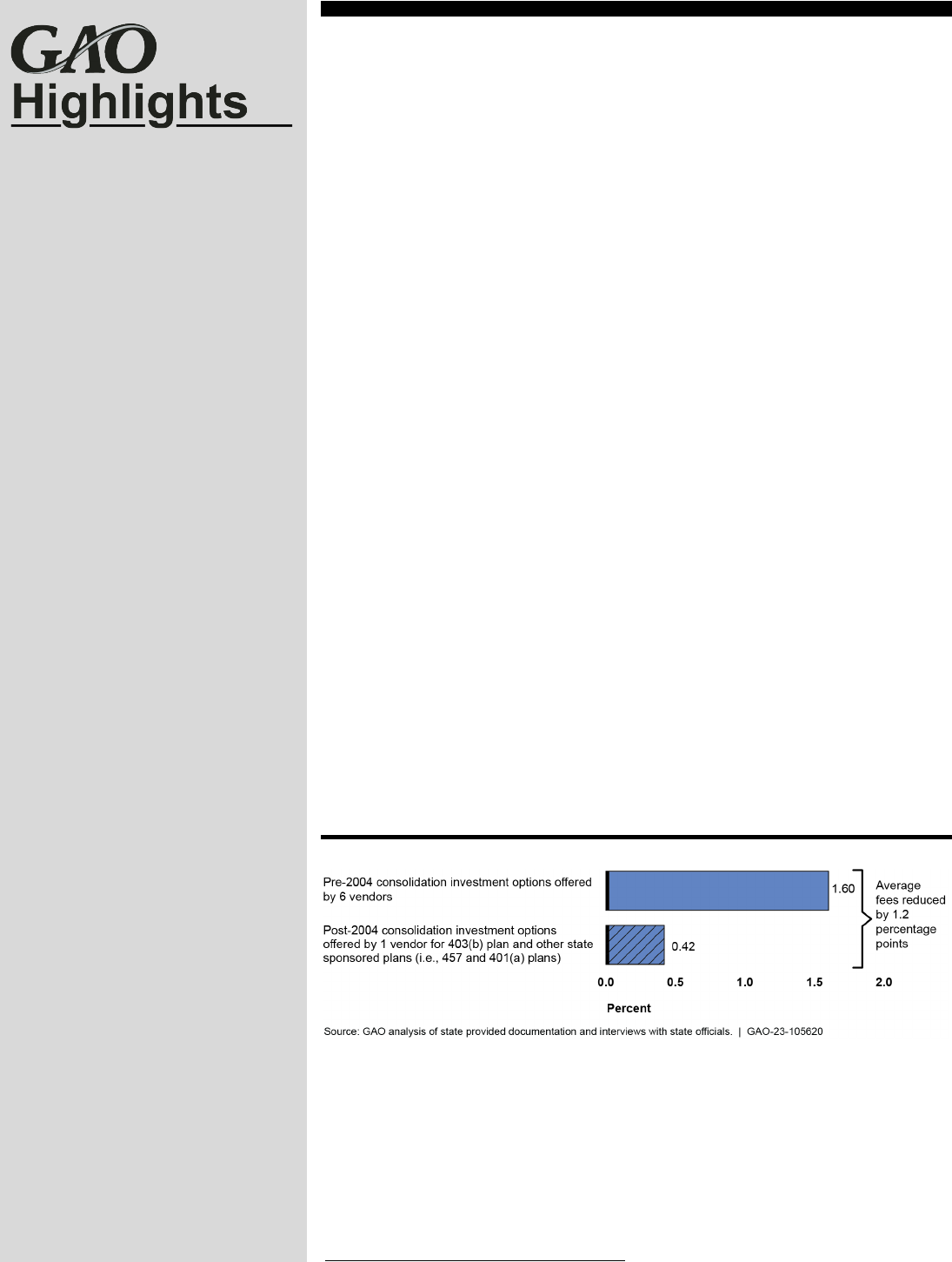

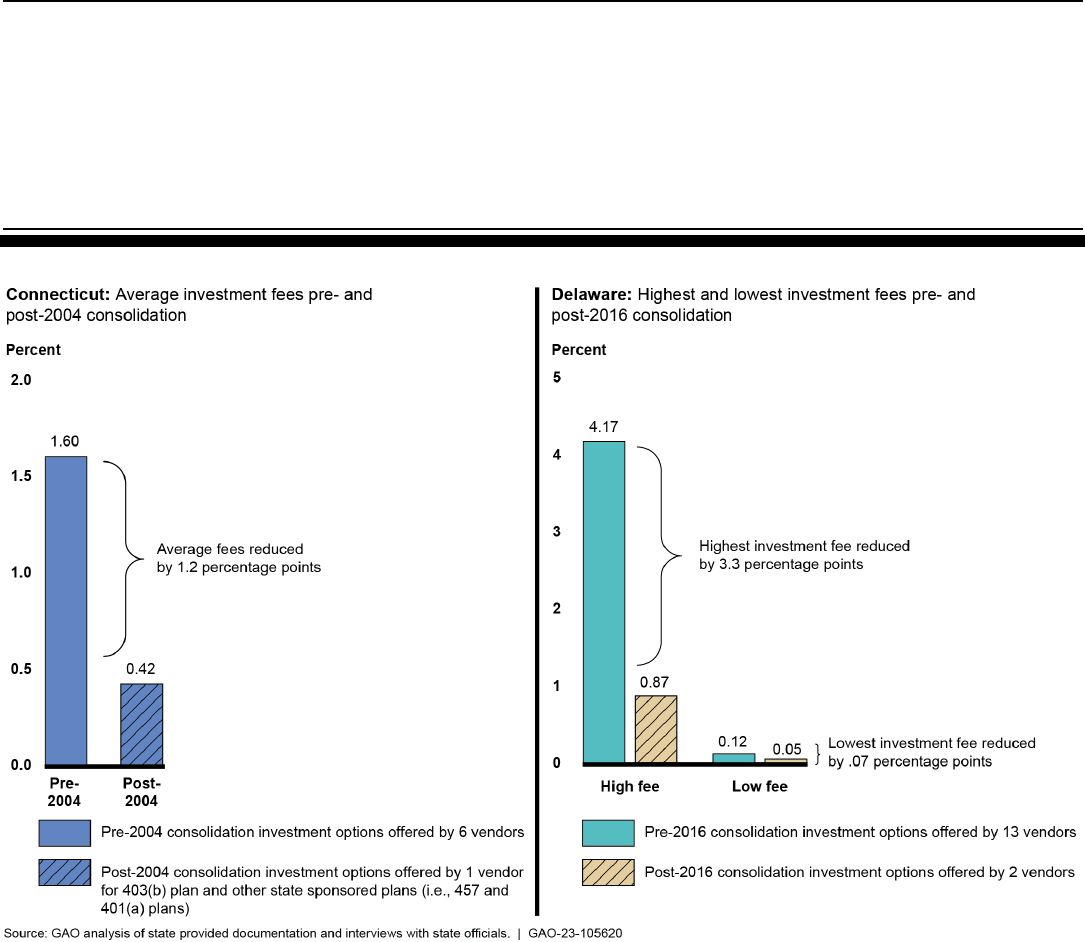

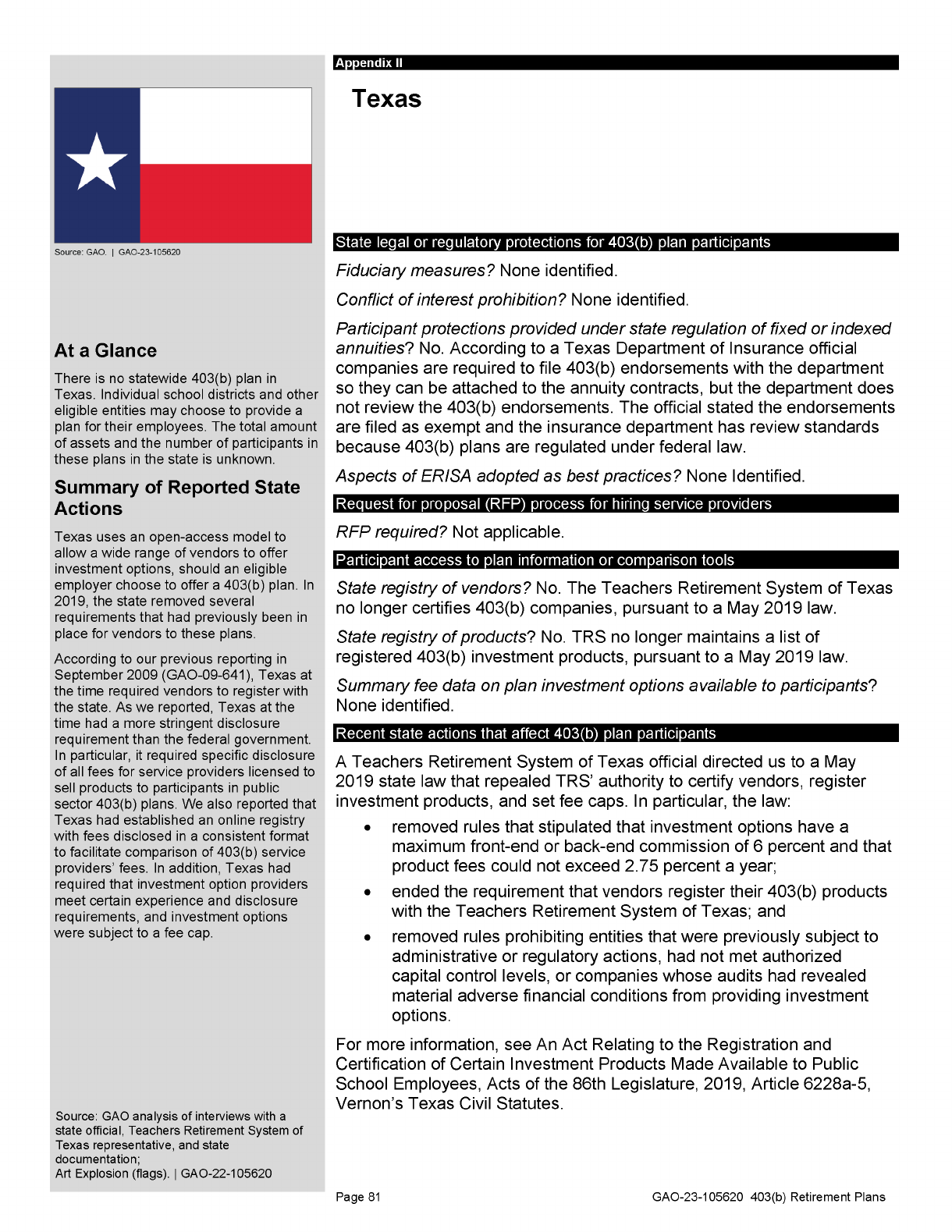

GAO reviewed how five selected states worked to improve outcomes—including

in some cases reducing fees participants pay—in 403(b) plans that are not

subject to ERISA requirements. Officials in three of the states said they had

consolidated the number of service providers offering investment options, which

strengthened oversight by reducing the number of service providers they had to

oversee. Officials in Connecticut told GAO consolidating service providers also

resulted in lower annual fees for participants (see figure). Officials in four of the

selected states said they enhanced transparency by providing participants with

additional information on plans’ investment options and fees or by making it

available elsewhere.

Connecticut: Average Investment Fees Pre- and Post-2004 Consolidation

Stakeholders and experts identified actions they said could improve 403(b)

participant outcomes. For example, they suggested establishing fiduciary duties

for

non-ERISA plans in some states that are not subject to such protections can

help protect participants’ interests. Also, they said requiring distribution of

standardized information on investment options’ returns and fees for participants

in non-ERISA plans would promote transparency. Multiple experts also

suggested that allowing 403(b) plans to use certain other investment vehicles

could reduce fees.

View GAO-23-105620. For more information,

contact

Tranchau (Kris) T. Nguyen at (202)

512

-7215 or [email protected].

Why GAO Did This Study

Like 401(k) plans, 403(b) plans are

account

-based defined contribution

plans sponsored by employers. Many

403(b)

plans are subject to ERISA

requirements

and are intended to

protect the

interests of plan

participants.

However, some 403(b)

plans are not covered by ERISA.

GAO was asked to review

(1) the

extent

of federal agencies’ 403(b)

plan

oversight, (2) actions by

selected

states t

hat could improve 403(b)

participant outcomes, and (3) options

stakeholders and experts have

identified t

hat could improve

outcomes for 403(b) participants.

GAO analyzed

DOL, SEC, and IRS

data

and documentation; reviewed

documentation

from five selected

states

identified as taking actions to

improve participant outcomes

;

interviewed federal and state agency

officials and experts

; and conducted

and

analyzed results from surveys of

plan sponsors and service providers

about options

to improve participant

outcomes

. The analysis of state

actions and survey results

offer a

range of perspectives on improving

participant outcomes but

are not

generalizable.

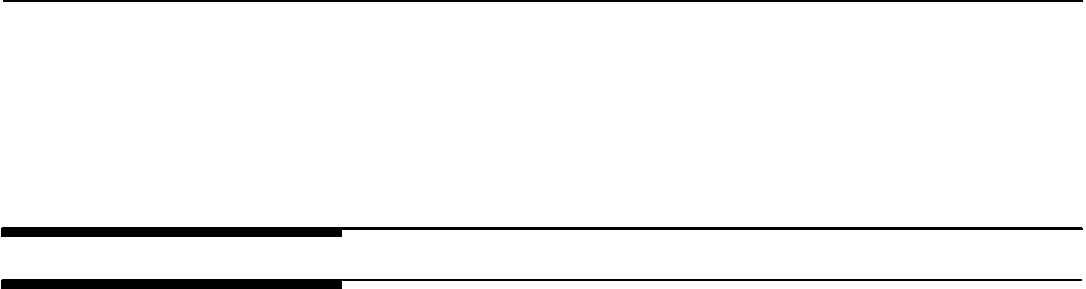

What GAO Recommends

GAO recommend

s that DOL update

educational

materials to contain

inform

ation relevant to 403(b) plans,

including information that could

help

participants understand plan fees.

In

commenting on the report, DOL

neither agreed nor disagreed with our

recommendation

. DOL stated that it

would review its relevant publications

to see

if they should more specifically

reference 403(b) plans.

Page i GAO-23-105620 403(b) Retirement Plans

Letter 1

Background 6

Several Federal Agencies Take Steps to Oversee 403(b) Plans

and Investment Options, but DOL Has Limited Educational

Materials Targeted to These Plans 14

Selected States Reported Taking Actions to Strengthen Plan

Oversight and Transparency of Investment Options for Non-

ERISA 403(b) Plans 33

Stakeholders and Experts Identified Multiple Options They Said

Could Improve 403(b) Participant Outcomes 46

Conclusions 59

Recommendation for Executive Action 60

Agency Comments 60

Appendix I Objectives, Scope, and Methodology 62

Appendix II Selected Features of State 403(b) Regulatory Environments 72

Appendix III Results of GAO’s Surveys of 403(b) Plan Sponsors and Service

Providers 82

Appendix IV Comments from the Department of Labor 86

Appendix V GAO Contact and Staff Acknowledgments 87

Tables

Table 1: Selected Disclosure Documents Generally Required by

ERISA That Include Information on Fees That Participants

in 403(b) Plans May Receive 7

Table 2: Most Frequent Violations the Department of Labor (DOL)

Identified for 403(b) Plan Cases Closed, Fiscal Years

2010–2021 17

Contents

Page ii GAO-23-105620 403(b) Retirement Plans

Table 3: Summary of Selected Terms Included in 13 Settlements

Agreements from 2015 through 2022 Involving 403(b)

Plan Sponsors 56

Figures

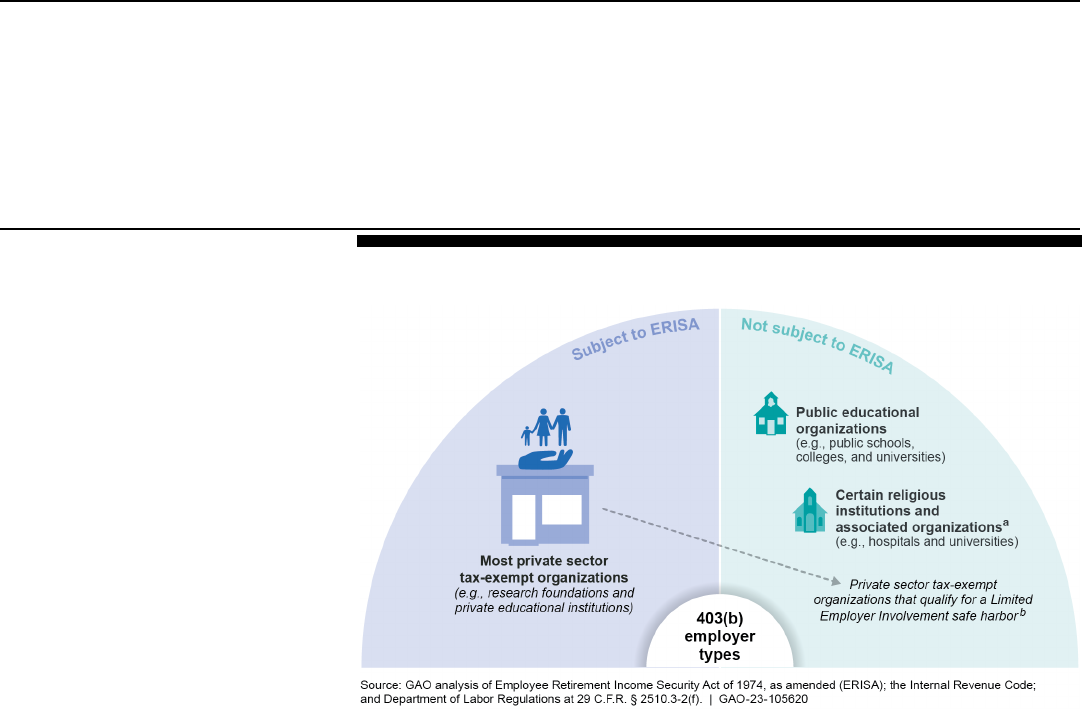

Figure 1: The Type of Employer and Extent of the Employer’s

Involvement in the Plan Can Determine Whether a 403(b)

Plan Is Subject to ERISA 9

Figure 2: Summary of Federal Roles in Regulating and

Overseeing 403(b) Plans and Investment Options 12

Figure 3: Information on Department of Labor’s (DOL)

Enforcement of 403(b) Plan Cases, Fiscal Years 2010–

2021 16

Figure 4: Educational Materials on the Department of Labor’s

(DOL) Website Regarding Reporting and Coverage for

403(b) Plans 24

Figure 5: Educational Materials on the Department of Labor’s

Website Regarding Reporting and Coverage for 401(k)

Plans 27

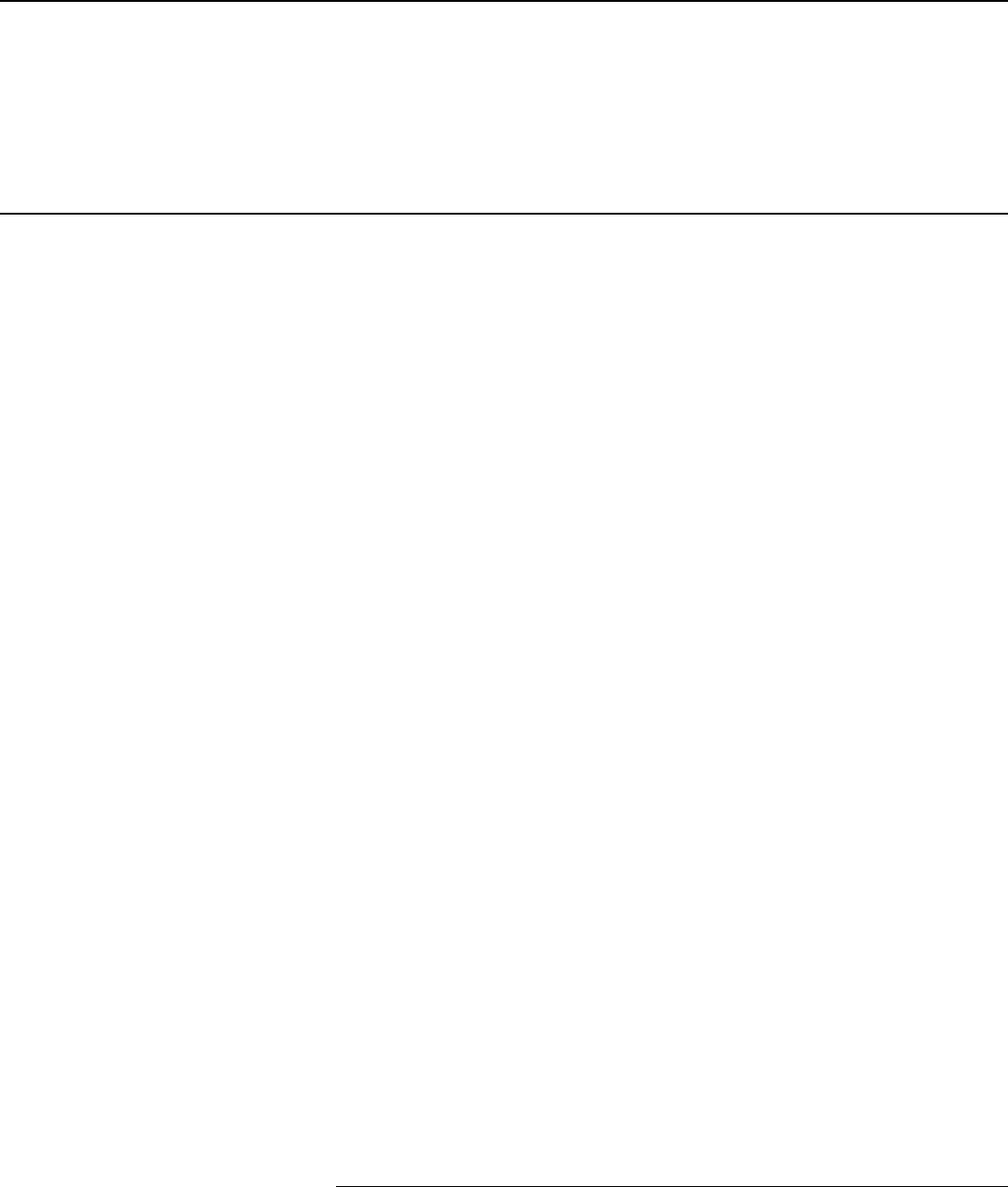

Figure 6: Securities and Exchange Commission (SEC)

Educational Materials for 403(b) Plan Sponsors and

Participants 31

Figure 7: Investment Fees Pre- and Post-403(b) Plan

Consolidation, as Reported by Two Selected States 36

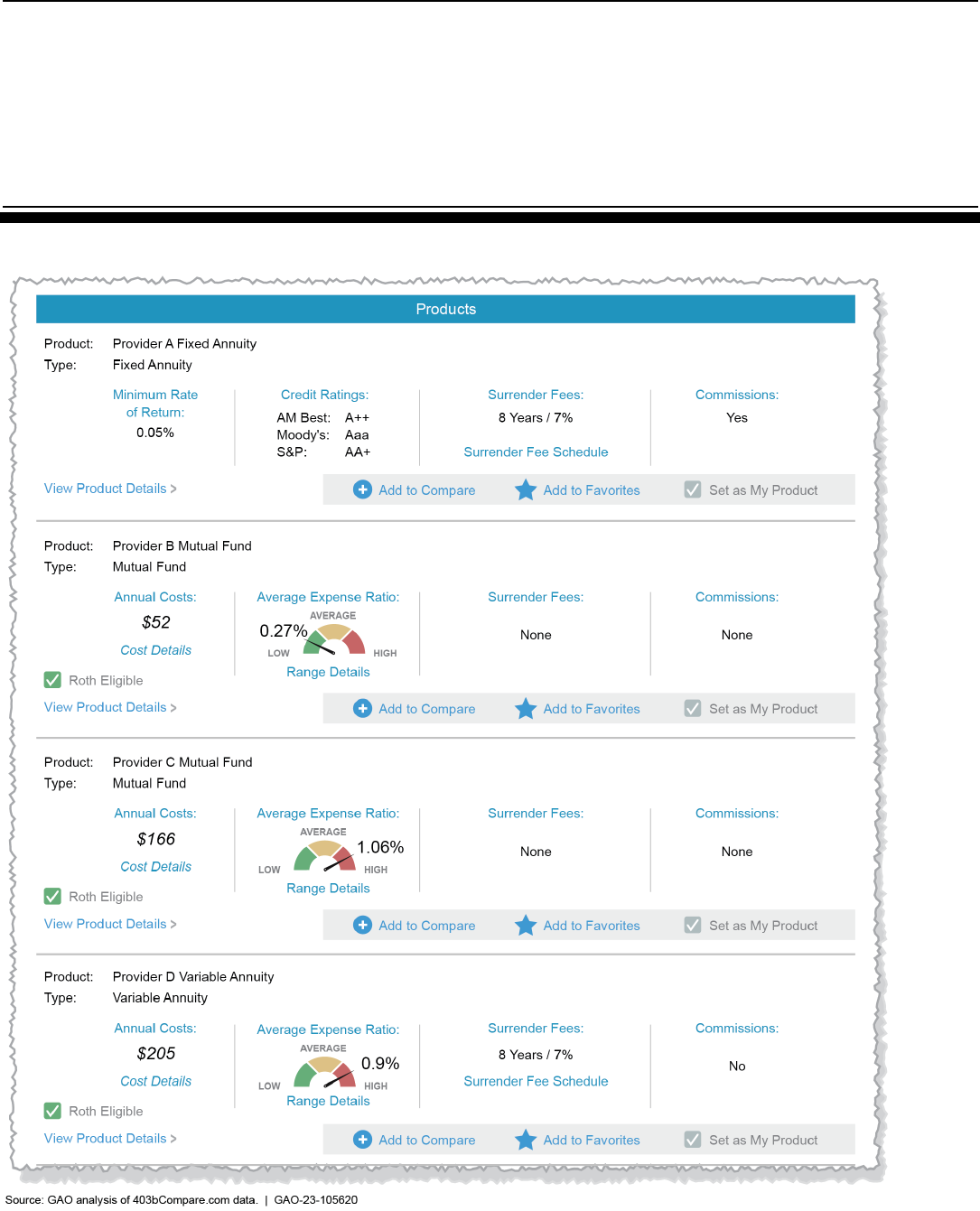

Figure 8: Selected Comparative Information Regarding 403(b)

Investment Options Offered in California, as Detailed on

Its Public Website 42

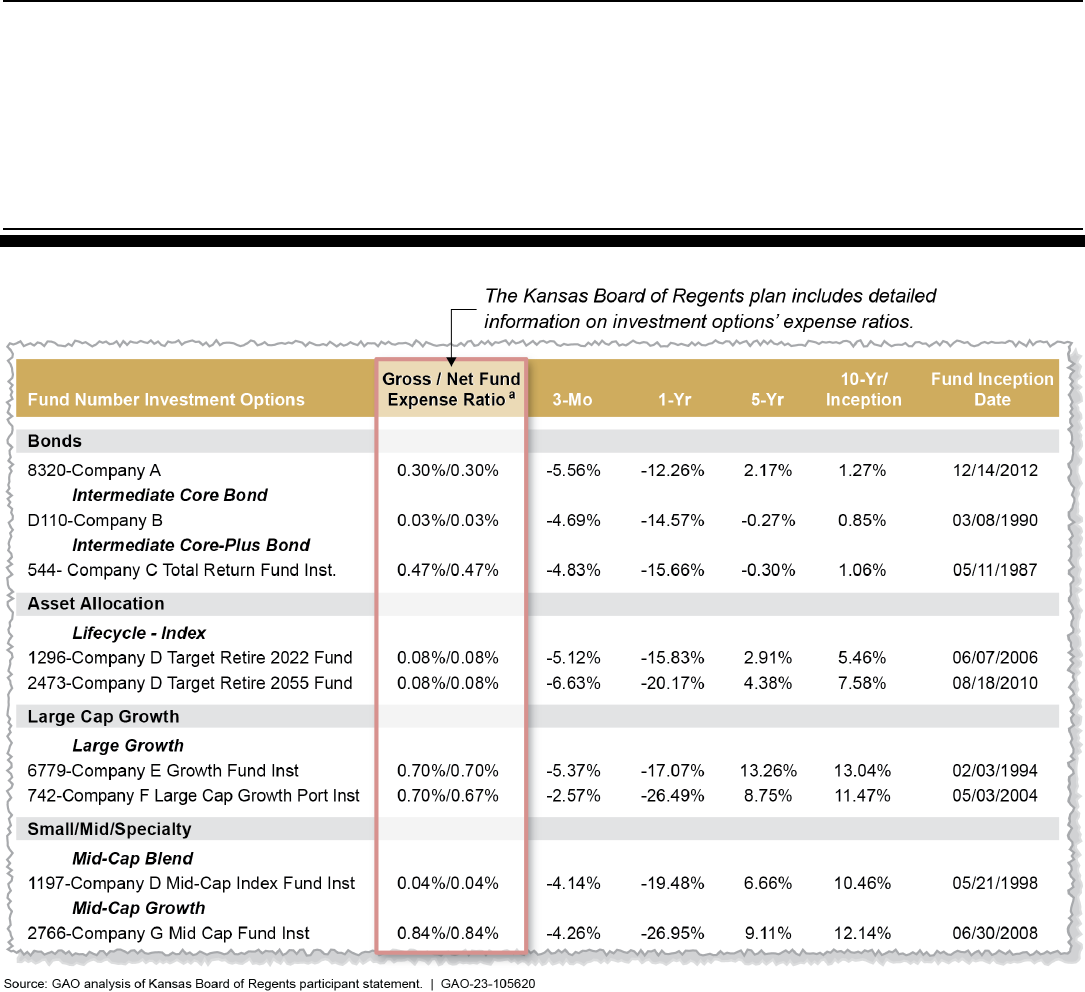

Figure 9: Example of Investment Options’ Fee Information

Provided to Non-ERISA 403(b) Plan Participants 44

Figure 10: Results of GAO Survey of 403(b) Plan Sponsors and

Service Providers Concerning Policy Options to Improve

403(b) Plan Participant Outcomes 83

Page iii GAO-23-105620 403(b) Retirement Plans

Abbreviations

CalSTRS California State Teachers Retirement System

CIT collective investment trust

DOL Department of Labor

EBSA Employee Benefits Security Administration

ERISA Employee Retirement Income Security Act of 1974, as

amended

FINRA Financial Industry Regulatory Authority, Inc.

IRA Individual Retirement Account

IRC Internal Revenue Code

IRS Internal Revenue Service

KBOR Kansas Board of Regents

NAIC National Association of Insurance Commissioners

NTSA National Tax-Deferred Savings Association

Safe harbor Limited Employer Involvement safe harbor

SEC Securities and Exchange Commission

SFRO San Francisco Regional Office

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-23-105620 403(b) Retirement Plans

441 G St. N.W.

Washington, DC 20548

June 21, 2023

The Honorable Robert C. “Bobby” Scott

Ranking Member

Committee on Education and the Workforce

House of Representatives

Dear Mr. Scott:

Millions of teachers and employees of tax-exempt organizations save for

retirement through 403(b) plans. The regulation and oversight of these

plans vary based on the extent to which the plan is subject to the

Employee Retirement Income Security Act of 1974, as amended

(ERISA).

1

Some 403(b) plans sponsored by certain private sector tax-

exempt organizations, such as hospitals, are generally covered by ERISA

and subject to its requirements, including those related to fiduciary duties.

However, some 403(b) plans, such as 403(b) plans for public school

teachers, are not subject to ERISA, including ERISA’s fiduciary

requirements, although, these “non-ERISA” plans may be subject to state

consumer protection laws or other state-specific fiduciary laws.

As we reported in March 2022, savings in 403(b) plans amounted to more

than $1.1 trillion in assets in 2020, and about one-half of these assets

were held in non-ERISA plans. Moreover, we found that the fees

participants were paying in both ERISA and non-ERISA 403(b) plans

varied widely from plan to plan.

2

1

ERISA establishes certain minimum standards and requirements for most private sector

employer-sponsored retirement plans. As such, it does not apply to governmental plans,

including federal and state government retirement plans. Title I of ERISA focuses primarily

on the protection of participants’ benefits under a plan and includes requirements

regarding reporting and disclosure, fiduciary responsibility, participation and vesting, and

funding. For example, under ERISA a plan fiduciary must act solely in the interest of

participants and beneficiaries and for the exclusive purpose of providing benefits and

paying plan expenses, among other things.

2

Additionally, our March 2022 report found that several school districts did not know the

number of investment options or the fees associated with the 403(b) plans offered to

participants in their districts. Our survey of 403(b) plan sponsors found that investment

option fees ranged from 0.02 percent to 2.37 percent. See GAO, Defined Contribution

Plans: 403(b) Investment Options, Fees, and Other Characteristics Varied,

GAO-22-104439 (Washington, D.C.: Mar. 4, 2022).

Letter

Page 2 GAO-23-105620 403(b) Retirement Plans

Like 401(k) plans, 403(b) plans are account-based defined contribution

plans sponsored by employers, and generally individuals who participate

in the plans make investment decisions and bear the investment risk.

3

Certain aspects of 403(b) plans’ structure and regulation differ from

401(k) and other defined contribution plans in key ways. For example,

investment options are generally more limited for 403(b) plans than they

are for other defined contribution plans in that amounts contributed into

403(b) accounts may generally be invested only in annuity contracts or

custodial accounts that hold mutual funds.

4

Given questions that have been raised regarding 403(b) plans and the

protections afforded to participants, you asked us to examine these

plans.

5

This report examines: (1) the extent to which federal agencies

conduct oversight of 403(b) plans, (2) actions selected states have

undertaken that could improve 403(b) participant outcomes, and (3)

options stakeholders and experts have identified that could improve

outcomes for 403(b) participants.

To assess the extent to which federal agencies conduct oversight of

403(b) plans, we obtained and analyzed federal agency and regulatory

3

A defined contribution plan is an employer-sponsored account based retirement plan,

such as a 401(k) plan, that allows individuals to accumulate tax-advantaged retirement

savings in an individual account based on employee or employer contributions, or both,

and the investment returns (gains and losses) earned on the account. A defined benefit

plan is an employer-sponsored retirement plan that typically provides a lifelong stream of

payments beginning at retirement, based on a formula specified in the plan that takes into

account factors such as the employee’s salary, years of service, and age at retirement.

See GAO, The Nation’s Retirement System: A Comprehensive Re-evaluation Is Needed

to Better Promote Future Retirement Security, GAO-18-111SP (Washington, D.C.: Oct.

18, 2017).

4

See 26 U.S.C. § 403(b)(1) & (7). In addition, 401(k) plans can offer a wider range of

investment products such as treasury notes or collective investment trusts. 403(b) assets

may be invested in tax-preferred fixed or variable annuity contracts. With a fixed annuity,

participants are guaranteed a specified rate of return on their contributions. For an

indexed annuity, the income stream tracks with a specified index, such as the Standard &

Poor’s 500 Index. With a variable annuity, participants can direct their plan contributions to

different investment options, usually mutual funds, to be held in their annuity account. For

annuities, the amount of money participants receive in retirement will vary depending on

various factors, which can include how much participants contribute, the type of

investment options offered by the plan, the options selected by participants, the rate of

return on the investments, and plan fees and expenses. For more information, see

GAO-22-104439.

5

GAO issued a first report on the characteristics of and fees associated with 403(b) plans

in March 2022; see GAO-22-104439.

Page 3 GAO-23-105620 403(b) Retirement Plans

information on the number and types of violations relevant to 403(b) plans

and service providers, investment vendors, broker dealers, or other

service providers for 403(b) plans. Specifically, we obtained information

on these violations from the Department of Labor’s (DOL) Employee

Benefits Security Administration (EBSA); the Securities and Exchange

Commission (SEC); and the Internal Revenue Service (IRS). We also

obtained information on violations from the Financial Industry Regulatory

Authority, Inc. (FINRA), a nongovernmental self-regulatory organization

registered with SEC as a national securities association.

In addition, we reviewed relevant federal laws and regulations. We also

reviewed our prior work that discussed 403(b) plans.

6

We obtained and

analyzed guidance and educational materials provided by DOL and other

relevant federal agencies, such as checklists, guidance documents, and

other types of outreach to 403(b) plan sponsors and participants. We

interviewed officials from DOL, IRS, SEC, and representatives from

FINRA. We compared information we collected to the agencies’ missions

and Standards for Internal Control in the Federal Government.

7

The

Information and Communication component of internal control—

particularly the principle of using quality information—was significant to

this objective.

To describe actions selected states have undertaken that could improve

403(b) participant outcomes, we selected five states for review, spoke

with state officials, and analyzed available information. We aimed to

provide a range of state experiences and regulatory approaches by using

the following criteria to select our states: whether or not the state limits

the number of service providers of investment options (for the purposes of

this report, referred to as open-access versus closed-access system);

recent regulatory activity and reorganization regarding 403(b) plan

administration in the state; and availability of fee data and plan provider

6

In particular, see our September 2009 report. GAO, Retirement Savings: Better

Information and Sponsor Guidance Could Improve Oversight and Reduce Fees for

Participants, GAO-09-641 (Washington, D.C.: Sept. 4, 2009); and GAO-22-104439.

7

See GAO, Standards for Internal Control in the Federal Government, GAO-14-704G

(Washington, D.C.: September 2014).

Page 4 GAO-23-105620 403(b) Retirement Plans

information.

8

We selected the following five states: California,

Connecticut, Delaware, Kansas, and Texas. We asked officials in each

selected state to identify relevant state laws. We reviewed available

information including, where feasible, state 403(b) plan fees, policies, and

other documentation from selected states. We did not conduct an

independent legal analysis to verify the information provided about

selected states’ laws, regulations, or policies. We also interviewed

officials in these five states. We submitted key report excerpts to agency

officials in each state, as appropriate, for their review and verification, and

we incorporated their technical corrections as appropriate. These case

studies are not generalizable to the broader universe of 403(b) plans.

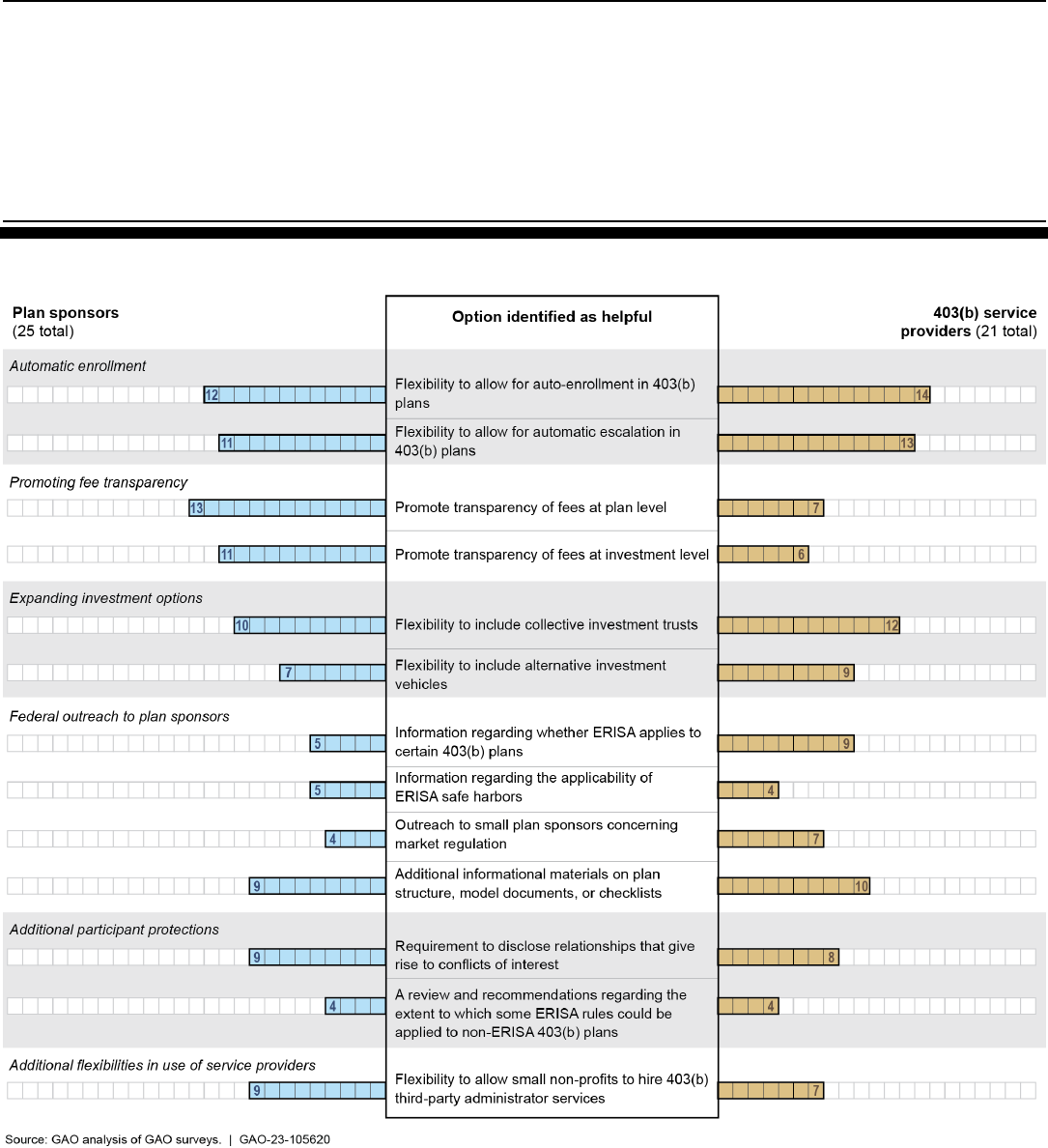

To discuss options that could improve outcomes for 403(b) participants,

we interviewed stakeholders and experts in the retirement planning

industry to identify and discuss such options. These stakeholders and

experts included representatives of industry associations, research

organizations, a national teacher’s association, and service providers to

403(b) plans that we identified as being knowledgeable about 403(b)

plans based on their published research or other documentation, or

based on referrals from other organizations that we interviewed.

9

Because we selected stakeholders and experts to interview, information

obtained by these interviews is not generalizable.

To obtain more information about the feasibility and desirability of these

identified options, we also analyzed responses from two surveys of

8

We analyzed two studies that describe the different states’ approaches to regulation of

403(b) broadly as being either open-access or closed-access systems. See TIAA-CREF

Institute, Trends and Issues – Who’s Watching the Door? How Improving 403(b)

Administrative Oversight Can Improve Educators’ Retirement Outcomes (November

2010), accessed June 15, 2022,

https://www.tiaa.org/public/institute/publication/2010/whos-watching-door-how-improving-

403b; and TIAA-CREF Institute, Research Dialogue – 403(b) Plans for Public School

Teachers: How They Are Monitored and Regulated in Each State (March 2013), accessed

June 15, 2022, https://www.tiaa.org/public/institute/publication/2013/403b-plans-public-

school-teachers. We also reviewed a list from the National Tax-Deferred Savings

Association (NTSA) that identifies the 17 state-sponsored 403(b) plans. See Michael

Webb, State Sponsored Plans: A Closer Look (Arlington, Va.: National Tax-Deferred

Savings Association), accessed Aug. 20, 2020, https://www.ntsa-net.org/state-sponsored-

403b-plans-closer-look.

9

In total, we interviewed stakeholders or experts from 23 organizations. Sixteen of these

23 organizations were interviewed in connection with data collection for our March 2022

report (GAO-22-1044339). Some of the information obtained in those interviews

contributed to this report’s findings. In this report, we use the term “several” to refer to

three or four stakeholders and the term “multiple” to refer to five or more stakeholders.

Page 5 GAO-23-105620 403(b) Retirement Plans

403(b) plan sponsors and service providers.

10

Because no

comprehensive source of data on 403(b) plans sponsors or service

providers exists, we used multiple sources to select our survey

populations, as detailed in our March 2022 report, and surveyed these

populations.

11

Our surveys included questions about actions, options, or

policies that federal agencies could undertake to improve outcomes for

403(b) plan participants.

12

Because we actively selected survey

populations and did not generate random samples in some populations,

the results of the surveys are not generalizable.

In addition, to identify illustrative examples of approaches that different

parties have undertaken to address participant concerns in 403(b)

retirement plans, we identified and reviewed 18 settlement agreements

from 2015 onward involving ERISA 403(b) plan participants, sponsors, or

service providers.

13

Because the nature of a settlement agreement

depends on the specific facts and circumstances involved in the dispute,

the results of our review of these settlement agreements are not

generalizable. See appendix I for more details of our objectives, scope,

and methodology.

We conducted this performance audit from December 2021 through June

2023 in accordance with generally accepted government auditing

standards. Those standards require that we plan and perform the audit to

10

The surveys we conducted pertained to both our March 2022 report, GAO-22-104439,

as well as this report.

11

See GAO-22-104439.

12

We analyzed responses from our surveys of a total of 26 403(b) plan sponsors and 19

service providers. For the purposes of this report, we did not count one plan sponsor that

was included in the previous report’s plan sponsor survey reporting totals, because this

plan sponsor did not answer either of the two questions relevant to this report. We did, in

addition to those service providers included in the March 2022 report, include an

additional two service providers who answered both of the relevant questions for this

report but did not otherwise participate in the survey (and its applicable information for the

March 2022 report).

13

To identify settlements for analysis, we searched a legal database for cases concerning

403(b) plans, as well as performed a series of internet searches for 403(b)-related

litigation, looking for cases that were settled, or where a judgment was entered, from 2015

onward. In addition, for context, we interviewed a representative of a plaintiffs’ law firm

involved in some of these cases who supplied us settlement agreements in which the firm

was involved. According to this representative, the first case involving a 403(b) plan

sponsor being sued by participants over alleged excessive fees or poorly performing

investment options was settled in 2015. None of the settlement agreements we reviewed

contained admissions of liability or wrongdoing by the parties.

Page 6 GAO-23-105620 403(b) Retirement Plans

obtain sufficient, appropriate evidence to provide a reasonable basis for

our findings and conclusions based on our audit objectives. We believe

that the evidence obtained provides a reasonable basis for our findings

and conclusions based on our audit objectives.

403(b) plans sponsored by certain private sector tax-exempt

organizations, such as hospitals, research foundations, and private

educational institutions, are generally covered by ERISA.

14

ERISA

outlines federal requirements that these ERISA 403(b) plans must meet,

including requirements related to fiduciary duties.

15

ERISA plan fiduciaries

must act solely in the interest of participants and beneficiaries and for the

exclusive purpose of providing benefits and paying plan expenses.

16

ERISA also requires that plan fiduciaries act in a manner that generally

avoids conflicts of interest.

17

In other words, plan fiduciaries may not

14

In certain circumstances, a 403(b) plan that meets certain criteria may qualify for a safe

harbor exemption and as such would not be subject to ERISA. In order to fall under what

we will refer to in this report as the “Limited Employer Involvement” safe harbor, employer

involvement in the plan must be limited. See 29 C.F.R. § 2510.3-2(f); see also Department

of Labor (DOL) Field Assistance Bulletin 2007-02 (July 24, 2007).

15

Under ERISA, plan fiduciaries are individuals or entities who (1) exercise discretionary

authority or discretionary control respecting management or a plan or exercise any

authority or control respecting management or disposition of its assets; (2) provide

investment advice for a fee or other compensation, direct or indirect, with respect to any

moneys or other property of the plan or who have any authority or responsibility to do so;

or (3) have any discretionary authority or discretionary responsibility for the administration

of a plan.. According to DOL, plan fiduciaries generally include plan trustees, plan

administrators, and members of a plan’s investment committee.

16

See 29 U.S.C. § 1104.

17

See 29 U.S.C. §§ 1106 and 1108.

Background

ERISA 403(b) Plans

Page 7 GAO-23-105620 403(b) Retirement Plans

engage in transactions on behalf of the plan that benefit the fiduciaries or

other parties related to the plan, such as other service providers.

18

Under ERISA, participants have the right to sue their plan fiduciaries

(which may include the plan sponsor), for breach of fiduciary duty. In

recent years, 403(b) participants have filed legal claims alleging that

403(b) plan sponsors breached fiduciary duties by failing to sufficiently

monitor fees being charged by service providers or the performance of

investment options.

Sponsors of ERISA 403(b) plans are required to provide participants with

certain documents, including a summary plan description, as well as other

documents that contain fee information, such as pension benefit

statements, a summary comparison table that outlines administrative and

individual account expenses, and a summary annual report.

19

These

documents may disclose additional information on fees individual

participants pay, as shown in table 1.

Table 1: Selected Disclosure Documents Generally Required by ERISA That Include Information on Fees That Participants in

403(b) Plans May Receive

Document

Document purpose

Information on fees

Summary plan

description

To explain to participants how the plan

operates, outlining participant rights

and benefits under the plan

May contain information on how various fees such as investment,

recordkeeping, and loan fees are charged to participants.

Pension benefit

statement

To show the account balance due to a

participant

Typically identifies fees, such as for loans, that are directly

attributable to an account during a specific period. Also, may

show investment and record-keeping fees.

Summary annual report

To disclose the financial condition of

the plan to participants

Contains total plan costs incurred by plan participants during the

year.

18

For example, someone in a position of trust, such as a pension plan adviser, may have

competing professional or personal financial interests or incentives. A conflict of interest

could occur should the structure of advisers’ compensation and their other business

arrangements create competing interests that may bias their investment recommendations

to plan sponsors or participants. If left unchecked, conflicts of interest could lead plan

sponsors or participants to select investment options with higher fees or that are not in line

with their retirement goals, which, while beneficial to the service provider, could amount to

a significant reduction in retirement savings over a worker’s career. For more information,

see GAO, 401(k) Plans: Improved Regulation Could Better Protect Participants from

Conflicts of Interest, GAO-11-119 (Washington, D.C.: Jan. 28, 2011).

19

See, for example, 29 C.F.R. § 2550.404a-5.

Page 8 GAO-23-105620 403(b) Retirement Plans

Document

Document purpose

Information on fees

Participant fee

disclosures—

administrative expenses

To disclose a plan’s administrative and

individual fees (e.g., account

maintenance fees, participant loan

fees)

Requires plan administrators to furnish at least annually

information about administrative costs that may be charged to

participants and beneficiaries in participant-directed individual

account plans. Plan administrators also must disclose, at least

quarterly, administrative and individual fees actually paid by

participants and beneficiaries during the preceding quarter.

Participant fee

disclosures—investment

comparison chart

To ensure that participants are

provided sufficient information

regarding the plan’s investment

options, including fees and expenses

Requires plan administrators to furnish information about a plan’s

investment options including historical returns and associated

fees and expenses, which must be presented in a format

intended to facilitate comparisons between investment options.

Investment information must be furnished to participants or

beneficiaries on or before the date they can first direct their

investments, and then annually thereafter. The Department of

Labor (DOL) provides a model comparative chart, which may be

used by the plan administrator to satisfy the requirement that a

plan’s investment information be provided in a comparative

format.

Source: GAO analysis of the Employee Retirement Income Security Act of 1974, as amended (ERISA), and DOL information. l GAO-23-105620

As noted earlier, not all 403(b) plans are subject to ERISA. The type of

employer and, in certain cases, the extent to which the employer is

involved in the plan can determine whether a plan is subject to ERISA.

While ERISA plans must comply with ERISA-specific fiduciary duties,

403(b) plans that are not covered by ERISA (non-ERISA plans) are not

subject to those requirements.

20

In addition, 403(b) plans sponsored by

private sector tax-exempt organizations may qualify for a “Limited

Employer Involvement” safe harbor (safe harbor) exemption and, as such,

would not be subject to ERISA unless the plan fails to meet specific

criteria.

21

To fall under this safe harbor, participation in the plan must be

voluntary, and employers are not allowed to contribute to the plan or

make discretionary determinations in administering the plan, such as

processing distributions, authorizing plan-to-plan transfers, or making

determinations of eligibility for loans or hardship distributions. See figure 1

below for more details.

20

Non-ERISA plans may be required to comply with additional state consumer protection

laws or other state-specific laws.

21

As we reported in September 2009, DOL defined a “safe harbor” for 403(b) plans

sponsored by tax-exempt organizations. Sponsors that follow the safe harbor guidelines

are not considered subject to Title I of ERISA because the plan is considered not to have

been “established or maintained by an employer.” Sponsors of these plans must restrict

their involvement in the plan to certain actions, or they will become subject to Title I of

ERISA. See GAO-09-641.

Non-ERISA 403(b) Plans

Page 9 GAO-23-105620 403(b) Retirement Plans

Figure 1: The Type of Employer and Extent of the Employer’s Involvement in the

Plan Can Determine Whether a 403(b) Plan Is Subject to ERISA

a

A retirement plan, including a 403(b) plan, may be what is commonly known as a “church plan.”

Federal law defines a church plan as a plan established and maintained for its employees or

beneficiaries by a church or by a convention or association of churches that are tax exempt under

Internal Revenue Code section 501(a). This definition includes plans maintained by an organization

whose principal purpose or function is the administration and/or funding of the plan for the employees

of a church or convention or association of churches which is exempt under section 501 of the

Internal Revenue provided that the organization is controlled by or associated with a church or

association of churches (e.g., a pension board that administers benefits for plan participants). See 26

U.S.C. § 414(e) and 29 U.S.C. § 1002(33).

b

In certain circumstances, a 403(b) plan that meets certain criteria may qualify for a safe harbor

exemption and as such not be subject to ERISA. To fall under the Limited Employer Involvement safe

harbor, employer involvement in the plan must be limited. See 29 C.F.R. § 2510.3-2(f); see also

Department of Labor Field Assistance Bulletin 2007-02 (July 24, 2007).

Non-ERISA 403(b) plans are subject to state laws and regulations, which

may vary. For example, some states may have fiduciary laws that apply

to certain 403(b) plans, while other states may not have such

requirements. Different entities within a state may sponsor different

403(b) plans; for example, there may be one 403(b) plan for a state

university system and other plans for K-12 school districts. In other cases,

one 403(b) plan may cover multiple entities within a state. The rules that

govern those 403(b) plans may differ; for example, according to two large

Page 10 GAO-23-105620 403(b) Retirement Plans

providers with whom we spoke, some state regulations may apply to

public universities but not K-12 schools in certain states.

22

States generally take one of two key approaches to regulating non-ERISA

403(b) plans, many of which are for state university and public K-12

school plans. For the purposes of this report, we will refer to these

approaches as “closed- or open-access systems.” Specifically:

• Closed-access system. The plan selects one or a small number of

service providers, known as “vendors,” to offer investment options to

participants. In closed-access systems, plan participants select

options from a range of investment products, offered by the selected

vendor or vendors, which may or may not include the vendors’

proprietary products. Pooling assets together into a more limited

number of investment products may allow the plan sponsor to obtain

administrative cost efficiencies and economies of scale. In closed-

access systems, the relationships between plan sponsors,

participants, and vendor resemble those typical of 401(k) plans,

according to two experts and one stakeholder we interviewed.

• Open-access system. States do not restrict the number of vendors

that can sell investment products to a potential participant. States

using open-access systems may have laws with an “any willing

vendor” provision that requires 403(b) plans for public sector workers

to allow any vendor selected by a participant to provide investment

options for the plan. A participant could be selecting from among

dozens or even hundreds of investment options from potentially

dozens of vendors; in March 2022 we reported that one 403(b) plan

from a sponsor who had responded to our survey had once contained

as many as 1,600 investment options.

23

The relationship between a

participant and a plan’s service providers may, according to several

stakeholders we interviewed, more closely resemble Individual

22

For additional information, see National Tax-Deferred Savings Association, State

Sponsored 403(b) Plans: A Closer Look (Arlington, Va.: 2020). In many states, the primary

retirement savings plan for public sector workers is a defined benefit pension and the

403(b) plan is supplemental.

23

GAO-22-104439.

Page 11 GAO-23-105620 403(b) Retirement Plans

Retirement Accounts (IRA) than what one typically would find in

401(k) plans.

24

Whether a state uses a closed- or open-access system generally

determines if the employer (i.e., the plan sponsor) or the participant

controls the contract with the investment provider (see sidebar). In a

closed-access state, where the state or a designated entity within it acts

as the employer and administrator of the state’s 403(b) plan investment

options, contracts are generally employer controlled, whereas in an open-

access state where participants can work with any vendor, the contracts

are generally participant controlled, according to stakeholders we

consulted.

Employer-controlled vs. Non-employer-controlled 403(b) Contract Systems

According to a service provider and an expert we interviewed, in an employer-controlled

contract, the employer has the unilateral right to move money out of a contract to

another provider or investment. By contrast, in a participant-controlled contract, the

participant controls the movement of assets, and if an employer wants to move assets,

it must obtain the participant’s permission to do so.

In an open-access state, employees generally have the legal right to any provider, as

long as other conditions are met, such as a minimum number of participants opting for

that provider. A closed-access state allows the employer to limit the number of

providers.

According to a large service provider, open states’ contracts are individually participant

controlled; they are not group contracts. For example, a school district in a certain state

may have 30 payroll providers. Managing 30 payroll providers may be unwieldy, so the

school or plan may let them be managed individually. By contrast, a large university is

more likely to choose a dedicated provider for its investment options, according to

experts we spoke with.

Source: GAO interviews with 403(b) plan experts and stakeholders. I GAO-23-105620

In addition, sponsors of non-ERISA 403(b) plans are not subject to

disclosure requirements under ERISA—such as the fee comparison

described in table 1 above—although these plans may be subject to state

laws on disclosures.

25

As a result, the information about fees that

24

In this report, we use the term “several” to refer to three or four stakeholders we

interviewed, the term “multiple” to refer to five or more stakeholders we interviewed.

Though we asked about many of these options in our surveys, we did not systemically ask

all of our interview subjects about each of the options. For more information on our

methodology, see appendix I.

25

See GAO-09-641, which further notes that this applies to all plans not subject to Title I of

ERISA.

Page 12 GAO-23-105620 403(b) Retirement Plans

participants in different state and local government plans receive may

vary, depending on the state and locality in which they are employed. As

mentioned below, broker-dealers that make recommendations to 403(b)

plan participants are covered by SEC rules that mandate other

disclosures and other investor protections.

26

Federal agencies and Financial Industry Regulatory Authority, Inc.

(FINRA) have a role in regulating and overseeing both ERISA and non-

ERISA 403(b) plans or investment options provided to participants, as

described in figure 2.

Figure 2: Summary of Federal Roles in Regulating and Overseeing 403(b) Plans and Investment Options

Federal agency or self-regulatory organization

Role in regulating and overseeing 403(b) plans

The Department of

Labor (DOL)

DOL’s Employee Benefits Security Administration (EBSA) administers and

enforces Title I of ERISA. EBSA’s mission includes ensuring the security of

the retirement, health, and other workplace-related benefits of private-sector

workers and their families. EBSA has stated it accomplishes this mission by

developing regulations, assisting and educating plan sponsors, fiduciaries,

and service providers, as well as enforcing the law. DOL also conducts

enforcement of ERISA through civil and criminal investigations of retirement

and health plans and by encouraging plans to voluntarily remedy any

violations identified by EBSA’s regional office investigative staff, such as by

restoring plan or participant assets, paying for erroneously denied services,

and making needed administrative changes.

26

Broker-dealers are persons or entities who are in the business of buying or selling

securities on behalf of customers, on behalf of their own account, or both. Under

Regulation Best Interest, broker-dealers that make recommendations of securities or

investment strategies to retail customers have a general obligation to act in a retail

customer’s best interest, which is satisfied only if the broker-dealer complies with four

specified component obligations: disclosure, care, conflict of interest, and compliance.

Under the care obligation, broker-dealers must exercise reasonable diligence, care, and

skill when making a recommendation to a retail customer to, among other things,

understand the potential risks, rewards, and costs associated with the recommendation,

and have a reasonable basis to believe that the recommendation could be in the best

interest of at least some retail customers. See 17 C.F.R. § 240.15l-1 (a)(2)(ii)(A). Further,

the broker-dealer must have a reasonable basis to believe the recommendation is in the

best interest of a particular retail customer based on that retail customer’s investment

profile. See 17 C.F.R. § 240.15l-1(a)(2)(ii)(B). In addition, the conflict of interest obligation

requires broker-dealers to establish, maintain, and enforce written policies and procedures

reasonably designed to, among other things, identify and at a minimum disclose, or

eliminate, all conflicts of interest associated with a recommendation and identify and

mitigate (i.e., modify practices to reduce) conflicts of interest at the associated person

level. See 17 C.F.R. § 240.15l-(a)(2)(iii).

Roles of Federal and State

Agencies

Page 13 GAO-23-105620 403(b) Retirement Plans

Federal agency or self-regulatory organization

Role in regulating and overseeing 403(b) plans

Securities and

Exchange Commission

(SEC)

The SEC regulates fee disclosure for some vehicles that are offered as

retirement plan investment options, such as variable annuity products and

mutual funds. The SEC requires these vehicles to disclose fees in a

prospectus, a document that provides key information to help investors make

informed investment decisions. A mutual fund’s prospectus contains fund

information such as the investment objectives or goals, strategies for

achieving those goals, risks of investing in the fund, expenses (including

fees), and past performance. Through Regulation Best Interest, the

Investment Advisers Act of 1940, and the Investment Company Act of 1940,

the SEC regulates certain activities, including providing advice and

recommendations, in connection with securities and investment strategies

involving securities offered by entities registered under the Investment

Company Act of 1940, including mutual funds and variable annuities. The

SEC’s Division of Examinations administers the SEC’s nationwide

examination and inspection program for registered self-regulatory

organizations, broker-dealers, transfer agents, clearing agencies, investment

companies, and investment advisers. The SEC may also bring enforcement

actions under the antifraud provisions of the Securities Act of 1933 and the

Securities Exchange Act of 1934.

The Financial Industry

Regulatory Authority,

Inc. (FINRA)

FINRA is a nongovernmental, self-regulatory organization, authorized by

statute and registered with the SEC as a national securities association.

Among other things, FINRA writes and enforces rules governing the activities

of securities broker-dealer firms and their representatives, and examines

broker-dealers for compliance with FINRA rules and federal securities laws.

FINRA also provides regulatory services to other self-regulatory organizations

such as compliance examinations and enforcement.

Internal Revenue

Service (IRS)

The IRS administers the Internal Revenue Code (IRC), including provisions

related to 403(b) retirement plans. Among its responsibilities, the IRS is to

ensure that taxpayers comply with the tax law, including requirements related

to maintaining a plan’s tax-deferred status. The IRS has an examination

program to ensure employee benefit plans comply with the IRC. During its

examinations of 403(b) plans, the IRS determines whether the plan is

maintained in accordance with IRC requirements, including having a written

plan document, following universal availability rules

a

and ensuring that

elective deferrals do not exceed IRC limits.

Source: GAO analysis of DOL, SEC, FINRA, and IRS information. l GAO-105620

a

26 U.S.C. § 403(b)(12)(A)(ii). According to IRS information, if any employee of the employer

maintaining the 403(b) plan may defer more than $200 of salary into the plan, then all of the

employer’s employees must be given the opportunity to defer more than $200 of salary into the plan

unless a permitted exclusion applies.

In addition to these federal agencies, state insurance officials may also be

in charge of administering and enforcing state laws regarding certain

Page 14 GAO-23-105620 403(b) Retirement Plans

investment options offered in 403(b) plans—including fixed and indexed

annuities—which may vary by state.

27

DOL conducts some oversight through enforcement activities related to

ERISA 403(b) plans and service providers, along with 401(k) and other

ERISA plans and service providers.

28

As we have previously reported,

DOL conducts oversight through enforcement of ERISA plans using a

27

With a fixed annuity, participants are guaranteed a specified rate of return on their

contributions. Indexed annuities are a particular type of annuity that combines features of

securities and insurance products. In this type of annuity, an insurance company promises

that participants’ contributions will grow at a rate of return based on a market index, such

as the Standard & Poor’s 500 Index. According to SEC officials, most fixed and indexed

annuities are not securities and so are not subject to the federal securities laws or SEC

regulation.

28

DOL officials stated that many investigations are directed not at the plan level, but at the

service providers of multiple plans. For example, a national enforcement initiative

investigating issues related to fiduciary service provider compensation and conflicts of

interest in relation to plan assets identified a service provider as having violations in this

area in its administration of a university 403(b) plan and a health care system 403(b) plan.

As noted earlier, non-ERISA plans are not subject to ERISA’s fiduciary requirements,

although these plans may be subject to state consumer protection laws or other state-

specific fiduciary laws. Accordingly, DOL administers and enforces reporting and

disclosure and fiduciary provisions for retirement plans, including ERISA 403(b) plans.

Several Federal

Agencies Take Steps

to Oversee 403(b)

Plans and Investment

Options, but DOL Has

Limited Educational

Materials Targeted to

These Plans

Multiple Federal Agencies

Oversee and Enforce

Different Aspects of 403(b)

Plans and Investment

Options

DOL

Page 15 GAO-23-105620 403(b) Retirement Plans

range of strategies to identify plans to investigate.

29

For example, DOL

targets enforcement investigations for greater impact, by, among other

things, prioritizing plans that have large numbers of participants or

amounts of assets. According to agency officials, DOL includes 403(b)

plans through these larger enforcement investigation strategies rather

than focusing solely on 403(b) plans. These officials told us that DOL

identifies violations in ERISA 403(b) plans through its more general

enforcement investigations for defined contribution plans.

DOL’s enforcement investigations have included ERISA 403(b) plans,

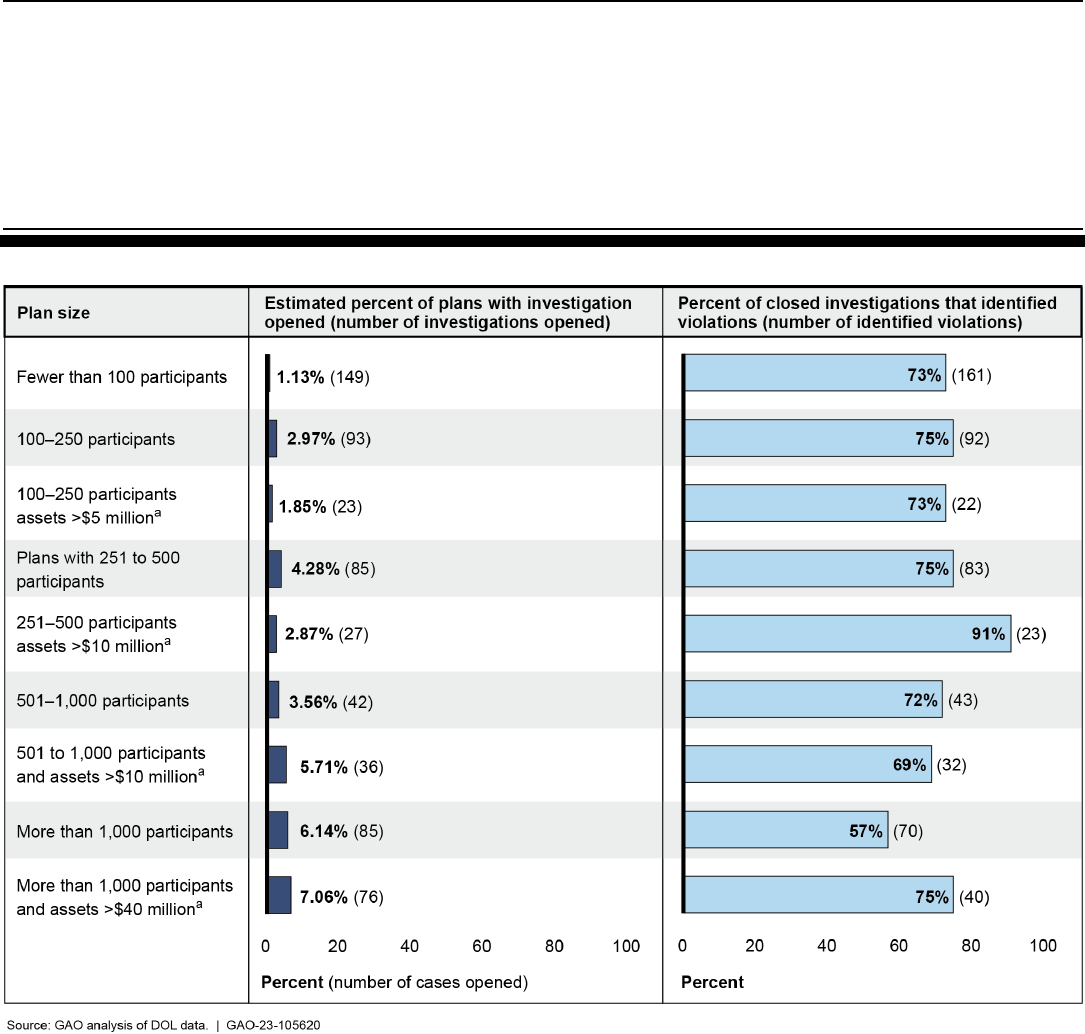

which in some cases have resulted in monetary recoveries. Specifically,

from fiscal years 2010 through 2021, DOL identified violations in about 70

percent of its 454 enforcement investigations of ERISA 403(b) plans.

30

DOL’s actions resulted in more than $35 million in monetary recoveries

from its enforcement investigations of 403(b) plans during this time

period, of which about $13 million, or 38 percent, were from major

cases.

31

According to DOL’s data for fiscal year 2019, the agency

examined less than 1 percent of ERISA 403(b) plans.

32

Figure 3 presents

additional information regarding DOL’s enforcement investigations that

have included 403(b) plans.

29

DOL officials stated the agency has about one investigator for every 10,000 to 12,000

plans. DOL establishes investigation processes and provides policy direction, technical

investigative assistance, and oversight to about 400 enforcement personnel at national

and regional offices. For more information on DOL’s organizational structure and

processes for monitoring and enforcing employer-sponsored retirement plans, see GAO,

Employee Benefits Security Administration: Enforcement Efforts to Protect Participants’

Rights in Employer-Sponsored Retirement and Health Benefit Plans, GAO-21-376

(Washington, D.C.: May 27, 2021).

30

Similarly, according to data provided from DOL, from fiscal years 2010 through 2021,

DOL identified violations in about 77 percent of its closed cases involving 401(k) plans.

31

For 403(b) investigations, 162, or 36 percent, during the time period met participant and

asset thresholds to be classified as major cases. DOL identified major cases as those that

result in a loss recovery plan of $5 million or more; for defined contribution plans with 100–

250 participants, a recovery of 10 percent of plan assets (for which recovery is at least

$500,000), among other conditions. DOL officials said that other criteria besides the

described participant and asset thresholds could constitute a major case.

32

Agency data show that in fiscal year 2019, DOL opened an investigation on 35, or 0.17

percent, of ERISA 403(b) plans.

Page 16 GAO-23-105620 403(b) Retirement Plans

Figure 3: Information on Department of Labor’s (DOL) Enforcement of 403(b) Plan Cases, Fiscal Years 2010–2021

a

Met DOL participant and asset thresholds to be classified as major cases. DOL identified major

cases as those that result in a loss recovery plan of $5 million or more; payments to plan participants

totaling $1 million or more; and for defined contribution plans with 100–250 participants, a recovery of

10 percent of plan assets (for which recovery is at least $500,000), among other conditions. DOL

officials said that other criteria besides the described participant and asset thresholds could constitute

a major case.

Notes: GAO tabulated the total number of plans of a particular plan size using 2019 Form 5500 data.

The Form 5500 data were used to estimate the percentage of plans investigated.

According to DOL’s enforcement data, among the most common

violations found from fiscal years 2010 through 2021 were breaches of

fiduciary duties, imprudent administration, and failure to discharge duties

for the exclusive purpose of providing benefits to participants and

Page 17 GAO-23-105620 403(b) Retirement Plans

beneficiaries.

33

For example, during this time period, DOL identified 200

violations for fiduciary self-dealing, which DOL officials told us could

happen when a fiduciary uses plan assets for the fiduciary’s own interest

or own account. Table 2 presents the results for this and other types of

violations DOL frequently identified during its enforcement investigations

that have included 403(b) plans.

Table 2: Most Frequent Violations the Department of Labor (DOL) Identified for 403(b) Plan Cases Closed, Fiscal Years 2010–

2021

Violation type Explanation of violation type

Number of cases

cited with that

violation

Not providing benefits

prudently and for exclusive

purpose of providing benefits

to participants and

beneficiaries

See 29 U.S.C. §

1104(a)(1)(A), (B)

The fiduciary did not discharge duties solely in the interests of the participants

and beneficiaries, for the exclusive purpose of providing benefits to participants

and their beneficiaries and defraying reasonable expenses of administering the

plan, and with the care, skill, prudence, and diligence under the circumstances

that a prudent person acting in a like capacity and familiar with such matters

would use.

321

Other substantive imprudence

See 29 U.S.C. § 1104

(a)(1)(B)

Not acting in accordance with the care, skill, prudence, and diligence under the

circumstances that a prudent person acting in a like capacity and familiar with

such matters would use.

255

Fiduciary self-dealing

See 29 U.S.C. §1106(b)(1)

Fiduciaries dealt with plan assets for their own self-interest, among other things.

200

Other 406(b)(2)

See 29 U.S.C. §1106(b)(2)

The fiduciary acted in any transaction involving the plan on behalf of a party

whose interests were adverse to the interests of the plan or the interests of its

participants or beneficiaries.

199

Plan assets not to inure to

benefit of employer See 29

U.S.C. § 1103(c)(1)

The assets of a plan were used improperly for the benefit of an employer or were

not held for the exclusive purpose of providing benefits to participants in the plan

and their beneficiaries and defraying reasonable expenses of administering the

plan.

172

Delinquent contributions See

29 U.S.C. § 1106(a)(1)(D)

Failure to timely remit contributions to the plan.

172

Disclosure violation

See e.g., 29 U.S.C. §

1021(a); 29 C.F.R. §

2520.104b-2

Summary plan description or other required information not furnished to

participants and beneficiaries.

60

Failure to establish trust See

29 U.S.C. § 1103(a)

Assets of an employee benefit plan were not held in trust by one or more trustees,

who are to be named in the plan or trust instrument or appointed by a person who

is a named fiduciary.

56

Source: GAO analysis of DOL data. | GAO-23-105620

33

DOL officials stated that the types of violations identified for 403(b) plan administration

were similar for 401(k) and other defined contribution plans.

Page 18 GAO-23-105620 403(b) Retirement Plans

Note: The table presents information on cases that DOL closed during the time period; there may be

some cases conducted during this time frame that have identified violation but are still open.

DOL’s enforcement efforts do not include verifying whether certain 403(b)

plans comply with the conditions of the safe harbor. As previously noted,

403(b) plans from private sector tax-exempt organizations that fall within

the conditions for the Limited Employer Involvement safe harbor are

exempt from ERISA.

34

In our September 2009 report, we found that DOL

did not have the specific authority to collect information to help ensure

that sponsors of certain 403(b) plans protect participants’ interests—

including those of tax-exempt organizations—and may fall outside the

safe harbor.

35

We recommended that Congress consider giving DOL

specific authority to collect information to systematically monitor safe

harbor 403(b) plans. Such authority would allow DOL to identify and

determine whether any such plans are operating outside the safe harbor

conditions and are subject to ERISA and the protections it affords to

participants.

36

As of March 2023, Congress has not addressed this

matter. We continue to believe that giving DOL this specific authority

would help the agency conduct its oversight.

SEC’s examination and enforcement activities focus on overseeing

investment vehicles, like mutual funds and variable annuities, and

ensuring that broker-dealers and associated persons involved in the sales

of 403(b) investment options comply with applicable federal securities

laws and regulations.

37

These efforts include helping to ensure that the

34

See 29 C.F.R. § 2510.3-2(f).

35

GAO-09-641.

36

For example, DOL might be able to coordinate with the IRS to help identify private

sector tax-exempt organizations that sponsor a 403(b) plan and may be using the Limited

Employer Involvement safe harbor. Specifically, using information from certain tax filings,

including Form W-2, Employer Identification Number (EIN), and Exempt Organizations

Business Master File Extract data, agencies could identify if an organization is a tax-

exempt, nongovernmental, and nonchurch entity with a 403(b) plan. In addition to these

data, ERISA 403(b) plans annually file a Form 5500 while non-ERISA safe harbor plans

do not. By combining these data, DOL could identify 403(b) plans sponsored by tax-

exempt organizations that do not file the Form 5500. These plans would include those

potentially using the safe harbor. DOL and IRS officials said the agencies share some

information and may refer specific cases as part of their oversight responsibility for 403(b)

plans, but these efforts do not include information to systematically identify plans

potentially using the safe harbor.

37

In some cases, the results of SEC examinations are referred to the SEC’s Division of

Enforcement for potential enforcement activity. This report discusses and covers the

SEC’s oversight through its examination process, and selected results of SEC

enforcement activities are also provided.

SEC

Page 19 GAO-23-105620 403(b) Retirement Plans

recommendations and actions of registered broker-dealers who may be

selling those securities to 403(b) plan participants comply with applicable

requirements. For example, the SEC oversees whether conflicts of

interest when a broker-dealer recommends a security are properly

disclosed, and mitigated (that is, reduced) or eliminated, if necessary, in

the sale of a security.

38

The SEC also oversees whether fees in

connection with the sale of a security are properly disclosed.

39

According to SEC officials and agency documentation, the agency

completes about 3,000 examinations each year, and many of these

examinations of broker-dealers and investment advisers involve

investment products included in 403(b) plan accounts. SEC officials told

us the agency generally does not collect data to identify whether 403(b)

investment options or service providers were involved in any specific SEC

examination of an SEC registered entity because examinations are

generally scoped to look at broader compliance issues or investment

options, or both.

40

The SEC also has filed enforcement actions related to misconduct by

403(b) providers. For example, in July 2022, the SEC announced fraud

charges against a life insurance company for providing account

statements to about 1.4 million variable annuity investors that included

materially misleading statements and omissions concerning investor fees.

As described in the SEC’s order, since at least 2016, the insurance

company gave investors the false impression that their quarterly account

statements listed all fees paid during the period. The SEC’s investigation

found that, in reality, the statements listed only certain types of fees that

investors infrequently incurred and that more often than not the

statements had $0.00 listed for fees. The insurance company agreed to

pay $50 million to harmed investors, most of whom are public school

teachers and staff members, to settle the charges.

Additionally, in July 2020, the SEC charged a financial services company

in a pair of actions for failing to disclose to teachers and other investors

practices that generated millions of dollars in fees and other financial

38

According to SEC officials, retirement products offered by vendors without any

recommendation are not subject to Regulation Best Interest.

39

See 17 C.F.R. § 240.15l-1(a)(2)(i)(A)(2); SEC v. Capital Gains Research Bureau, Inc.,

375 U.S. 180, 194 (1963).

40

Accordingly, the SEC’s examinations include examinations of broker-dealers and

investment advisers.

Page 20 GAO-23-105620 403(b) Retirement Plans

benefits for the company. In the first action, according to documentation

we reviewed, the SEC found that the financial services company failed to

disclose that its parent company paid a for-profit entity owned by Florida

K-12 teachers’ unions to promote the financial services company and its

parent company services to teachers. In the second action, the SEC

found that the financial services company failed to disclose conflicts of

interest regarding its receipt of millions of dollars of financial benefits that

directly resulted from advisory client mutual fund investments that were

generally more expensive for clients than other mutual fund investment

options available to clients. SEC officials said they expect these actions

will result in significant savings for thousands of teachers.

FINRA’s oversight activities focus on ensuring that broker-dealers and

their associated persons—who may be involved in the sales of 403(b)

investment options—comply with applicable FINRA rules and federal

securities laws and regulations.

41

For example, FINRA’s efforts include

oversight of broker-dealers’ compliance with FINRA Rule 2330, which

requires broker-dealers, when recommending purchases or exchanges of

deferred variable annuities, to meet specified obligations. These

obligations include appropriately informing customers (including those

who are participants in 403(b) plans) about any applicable fees, among

other things.

42

FINRA representatives told us that since 2005, FINRA has

41

FINRA is a nongovernmental, self-regulatory organization, authorized by statute and

registered with the SEC as a national securities association.

42

FINRA Rule 2330 governs recommended purchases and exchanges of deferred

variable annuities and recommended initial subaccount allocations. Further, Rule 2330

applies to 403(b) plans where a firm or its representatives makes recommendations to an

individual plan participant regarding a deferred variable annuity. The rule specifies that no

member or person associated with a member shall recommend to any customer the

purchase or exchange of a deferred variable annuity unless such member or person

associated with a member has a reasonable basis to believe, among other things, that (1)

the customer would benefit from certain features of deferred variable annuities, such as

tax-deferred growth, annuitization, or a death or living benefit; and (2) the customer has

been informed in general terms of various features of deferred variable annuities, such as

the potential surrender period and surrender charge, potential tax penalty if customers sell

or redeem deferred variable annuities before reaching the age of 59½, investment

advisory fees, and market risk, among other things.

FINRA

Page 21 GAO-23-105620 403(b) Retirement Plans

brought 28 disciplinary actions against broker-dealers and associated

persons that mention 403(b) retirement accounts.

43

According to FINRA representatives, the largest sanction imposed

against a broker-dealer was an $8 million fine plus payment of $89 million

in restitution to affected customers for violations. These violations

included the firm’s failure to identify and apply sales charge waivers to

eligible retirement accounts, including 403(b) accounts, and weaknesses

in the broker-dealers’ supervisory systems. Ten of the disciplinary actions

resulted in bars against individuals and 12 involved charges against

individuals for forging customer signatures or otherwise altering 403(b)

account-related documents, according to FINRA representatives.

According to FINRA representatives, two of the 28 cases that mention

403(b) plans involved violations of FINRA’s rule regarding selling variable

annuities (FINRA Rule 2330). One, a March 2021 settlement with a firm,

resulted in a censure and fine of $15,000 for violations including FINRA

Rule 2330. The other was an August 2015 decision by FINRA’s Office of

Hearing Officers against a different firm, imposing a $50,000 fine for

violations of FINRA rules, including FINRA Rule 2330, as well as

applicable costs for the proceeding.

The IRS’s oversight activities focus on ensuring that 403(b) plans comply

with Internal Revenue Code requirements through its examination

program for 403(b) plans. For example, The IRS ensures that participants

are not contributing to tax qualified retirement plans, including 403(b)

plans, in higher-than-permissible amounts. IRS data indicate the agency

completed 1,912 examinations involving 403(b) plans from fiscal years

2011 through 2020. Its examinations identified tax compliance issues in

43

FINRA representatives compiled and provided GAO summary data in May 2022 that

they stated were those cases that mentioned 403(b) plans from 2005 onward from

FINRA’s publicly available enforcement database. GAO conducted its own search of the

database and identified 32 documents that mentioned 403(b) plans from 2005 through

December 2022. According to FINRA representatives, there are more entries in the

FINRA database than the number of cases because a few cases have more than one

related document (e.g., Complaint and Offer of Settlement or Decision) in the database.

IRS

Page 22 GAO-23-105620 403(b) Retirement Plans

about 82 percent of these examinations.

44

IRS officials stated that the IRC

is complicated and highly nuanced, and that it is challenging for a plan or

service provider to be in full compliance with all of its provisions. The top

three tax compliance issues IRS examinations identified during the time

period were universal availability (328 instances), non-return unit 403(b)

plan, other concern (261 instances), and excessive contributions (209

instances).

45

In addition, IRS officials told us that if the agency discovers

a possible breach of fiduciary duty by a 403(b) plan under ERISA, the IRS

has a program to refer the issue to DOL.

46

As part of their oversight activities, DOL, SEC, and IRS provide outreach

and educational materials to 403(b) plan sponsors and participants.

47

However, we found that DOL’s guidance on retirement plans focused

primarily on 401(k) plans and that references to 403(b) plans may not be

easily identified by plan sponsors and participants.

44

According to IRS officials, the agency has identified higher rates of tax compliance

issues in 403(b) plans than in 401(k) plans. Officials stated that the higher rate of tax

compliance issues among 403(b) plans may be due to small employers that have a more

difficult time understanding and complying with the relevant laws. IRS officials told us the

issues the agency generally sees in smaller 401(k) and 403(b) plans are specific to each

type of plan.

45

According to IRS information, under the universal availability requirement, if any

employee of the employer maintaining the 403(b) plan may defer more than $200 of salary

into the plan, then all of the employer’s employees must be given the opportunity to defer

more than $200 of salary into the plan unless a permitted exclusion applies. Non-return

unit plans are those that have compliance or tax qualification requirements that did not file

a Form 5500; IRS officials stated these were often small 403(b) plans that had difficulty

understanding and complying with the requirements for operating a 403(b) plan, and noted

not all—particularly non-ERISA plans—were required to file a Form 5500. Excess

contributions are contributions to a participant’s 403(b) retirement account in excess of the

limit on annual additions (the combination of all employer contributions and employee

elective salary deferrals to all 403(b) accounts.

46

IRS officials stated that the IRS has had a list of referrals to DOL since the beginning of

2021. However, the list is not broken down by plan type so it cannot specifically identify

403(b) plans. Officials said the IRS began tracking referrals in 2021 because of a request

by DOL. However, IRS officials stated it does not see a business need to track referrals

since it does not impact the agency’s examination cases.

47

We did not review FINRA because its activities are oriented toward the rules and

regulations applicable to registered broker-dealers and their associated persons. FINRA

representatives did tell us that they have a department focused on investor education and

a wholly owned subsidiary, the FINRA Investor Education Foundation, that focuses on

financial well-being more broadly.

Federal Agencies Provide

Outreach and Educational

Materials, but DOL Has

Limited Information

Targeted to 403(b) Plans

Page 23 GAO-23-105620 403(b) Retirement Plans

DOL’s benefits advisors conduct education and outreach events for

workers, employers, and plan sponsors. DOL data indicate that the

agency conducted 20,673 outreach events of various types from fiscal

year 2012 through March of fiscal year 2022. About 4,190 (or 20 percent)

of these events were public awareness events.

48

Agency officials told us

these events are not specific to 403(b) plans, and are aimed at enhancing

a general understanding of retirement and other workplace-based

benefits.

49

DOL officials told us that the audiences at its outreach events—small

businesses and participants—are not familiar with the law, so the

outreach is done at a basic level with information that applies across

defined contribution plans and other workplace-based benefits.

50

DOL

officials said attendees can ask questions related to their specific types of

plans, and stated this approach is effective given their limited resources.

In addition to outreach efforts, DOL also provides guidance and

educational materials on its website related to 403(b) plans, as shown in

figure 4.

48

In addition, DOL conducted 13,091 participant outreach events between fiscal years

2012 and 2022. DOL officials said compliance assistance event audiences include

fiduciaries, service providers, and employers. Other outreach events are participant

assistance activities, including rapid response events designed to educate employees

facing job loss about their rights. DOL officials also told us the agency fields around

200,000 inquiries from the general public per year. Fewer than 1,000 of those inquiries per

year concern 403(b) plans, according to DOL officials.

49

As we reported in May 2021, EBSA dramatically increased the number of dedicated

worker events in fiscal year 2020, designed to educate employees facing job loss, among

other items. See GAO-21-376.

50

Five of the 25 plan sponsors that responded to our survey stated that they would like

more information regarding whether ERISA applies to certain 403(b) plans, and also

stated they would like more information regarding the applicability of safe harbors. For full

results of our surveys of 403(b) plan sponsors and service providers, see appendix III.

DOL

Page 24 GAO-23-105620 403(b) Retirement Plans

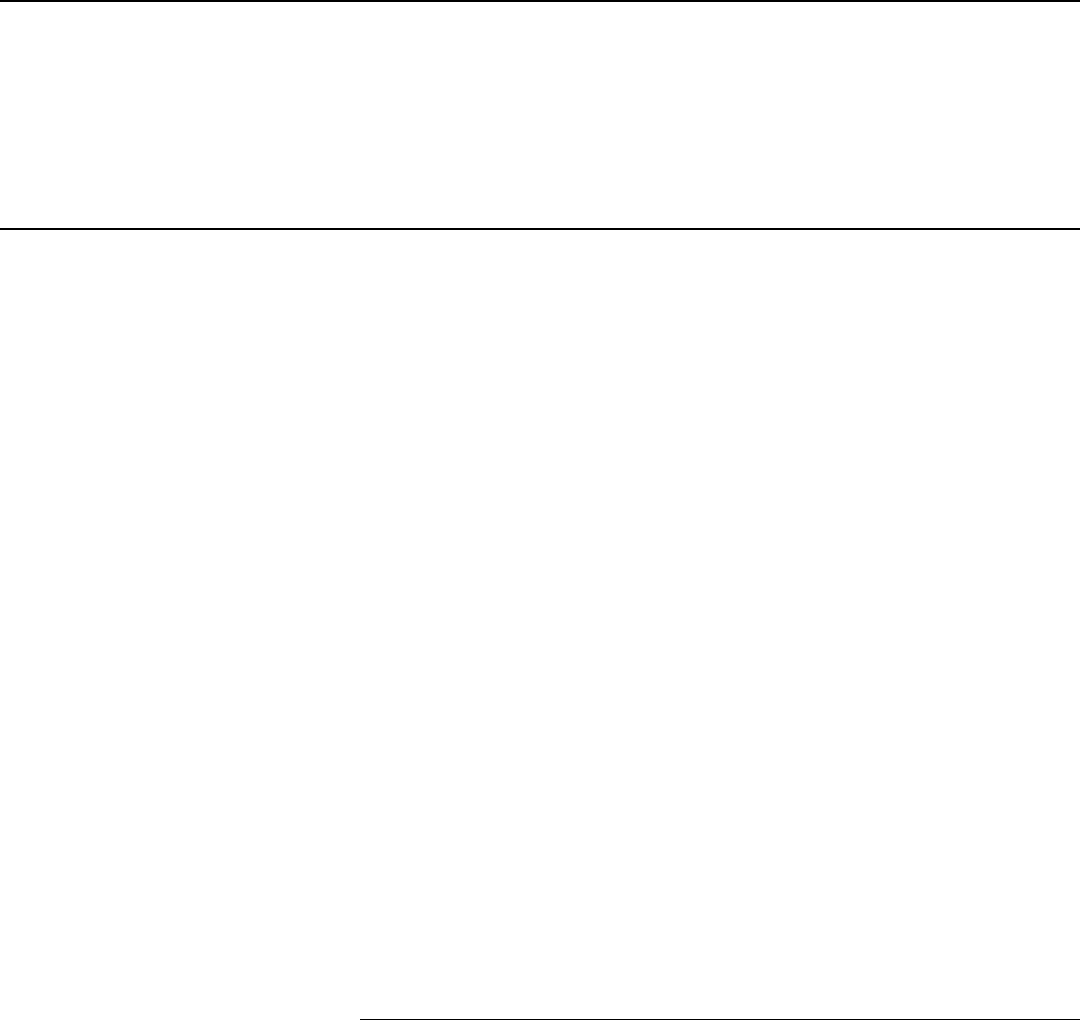

Figure 4: Educational Materials on the Department of Labor’s (DOL) Website Regarding Reporting and Coverage for 403(b)

Plans

Page 25 GAO-23-105620 403(b) Retirement Plans

Notes: DOL’s website for 403(b) plans is at https://www.dol.gov/agencies/ebsa/employers-and-

advisers/plan-administration-and-compliance/retirement/reporting-and-coverage-for-403b-plans.

Figure information is current as of April 2023.

Specifically, the website includes three Field Assistance Bulletins on

403(b) plans,

51

and a number of publications intended to educate plan

fiduciaries and participants on defined contribution plans and other

workplace-based plans more generally, such as publications entitled

Meeting Your Fiduciary Responsibilities and Reporting and Disclosure

Guide for Employee Benefit Plans.

52

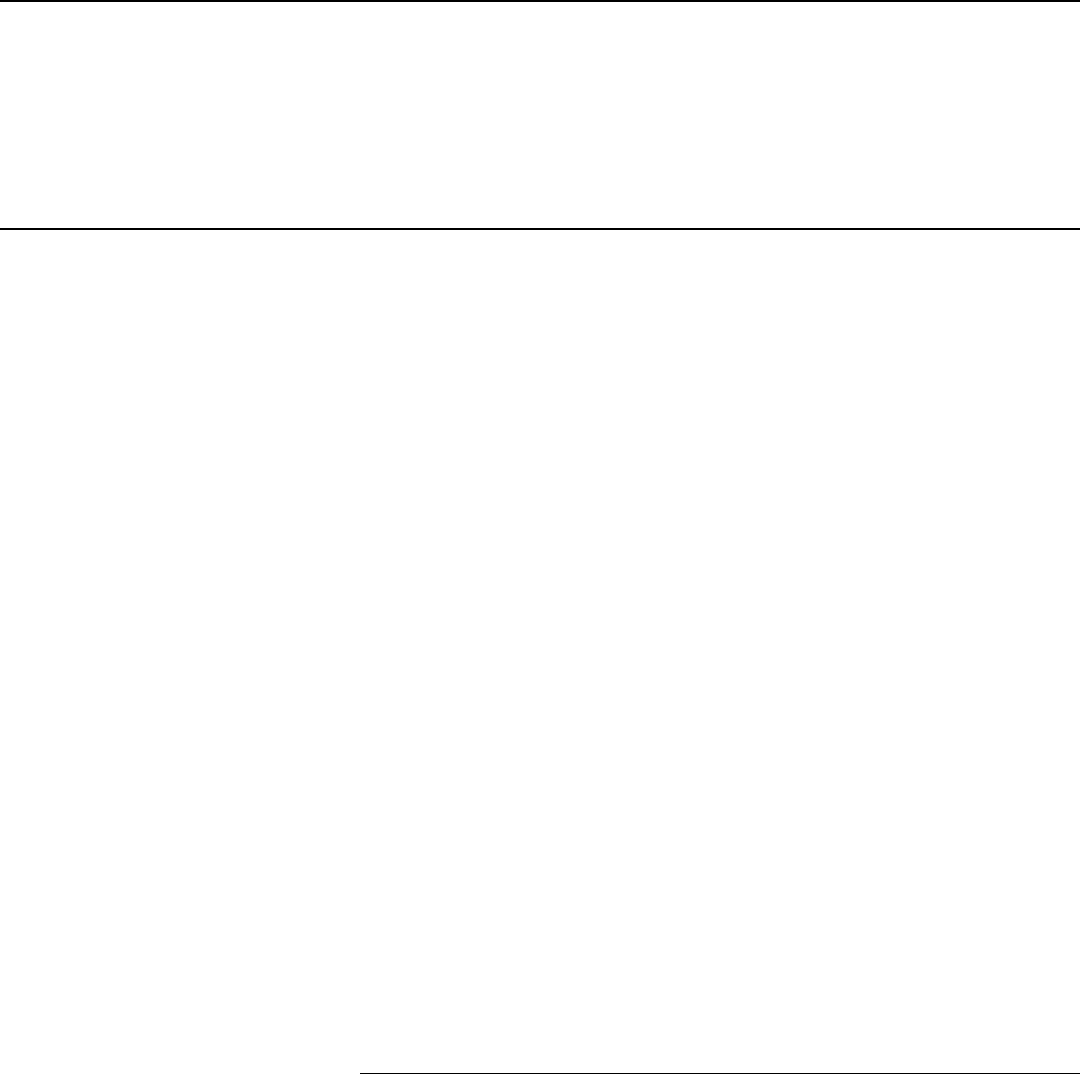

However, we found that the educational materials on DOL’s website lack

the same level of detailed information on 403(b) plans as for 401(k) plans.

Moreover, this information may not provide details that 403(b) plan

sponsors or participants find useful for making informed decisions

involving plan fees. For example, EBSA’s website, Understanding Your

Retirement Plan Fees, and its brochure, What You Should Know About

Your Retirement Plan, refer only to 401(k) plan fees.

53

In addition, another

guide EBSA developed to help participants understand their plan fees, A

Look at 401(k) Plan Fees, does not reference 403(b) plans. However,

many of the fees described in this guide, such as administrative fees and

expense ratios, are also applicable to 403(b) plans.

Similarly, our review of other content on the agency’s website found that

much of its educational materials could be relevant to several types of

retirement plans, including ERISA 403(b) plans. However, these materials

do not highlight 403(b) plans or make these commonalities among

retirement plans clear to readers. For example, the information in EBSA

guides for plan sponsors, such as FAQs about Retirement Plans and

ERISA and Target Date Retirement Funds –Tips for ERISA Plan

Fiduciaries, are also applicable to any 403(b) plan sponsor looking for

51

See Department of Labor, Field Assistance Bulletin 2007-02 (July 24, 2007); Field