AN ERISA COMPLIANCE HANDBOOK

FOR ASSET MANAGERS

Updated November 2019

2 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

TABLE OF CONTENTS

Introduction ..................................................................................................................... 3

Basics

CHAPTER 1: When Does ERISA Apply? ........................................................................................ 4

CHAPTER 2: Fiduciary Duties ..................................................................................................... 7

CHAPTER 3: Prohibited Transactions ........................................................................................... 9

Qualifications

CHAPTER 4: QPAM Exemption .................................................................................................. 11

CHAPTER 5: Alternatives for Non-QPAMs ................................................................................... 15

CHAPTER 6: Non-U.S. Assets ................................................................................................... 17

CHAPTER 7: Fidelity Bonds ...................................................................................................... 18

Documentation

CHAPTER 8: Client Intake and Subscriptions .............................................................................. 21

CHAPTER 9: Investment Management Agreements ...................................................................... 23

CHAPTER 10: Prime Brokerage and Derivatives ........................................................................... 25

Client Relations

CHAPTER 11: Reporting and Disclosure ..................................................................................... 27

CHAPTER 12: Gifts and Entertainment ....................................................................................... 31

Transactions

CHAPTER 13: Trading Basics .................................................................................................... 34

CHAPTER 14: Affiliated Brokers ................................................................................................ 36

CHAPTER 15: Affiliated Underwriters ......................................................................................... 37

CHAPTER 16: Affiliated Funds .................................................................................................. 38

CHAPTER 17: Cross-Trades and Other Conflicts of Interest ........................................................... 39

CHAPTER 18: Foreign Exchange ................................................................................................ 41

CHAPTER 19: Asset-Backed and Mortgage-Backed Securities ....................................................... 42

CHAPTER 20: ERISA-Restricted Securities ................................................................................. 43

CHAPTER 21: Corrections ......................................................................................................... 45

Appendix

Parties in Interest Diagram .................................................................................................... 48

3 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

Introduction

This is the 2019 revised and updated edition of Ropes & Gray’s ERISA Compliance

Handbook for Asset Managers. Like the original Handbook, this new edition is intended

to familiarize managers of U.S. private pension assets with the basic rules and requirements

of ERISA and help them make the best use of their ERISA compliance resources.

One purpose of this Handbook is to serve as a reference guide for specific situations

governed by special rules under ERISA. The objective is to provide a practical resource

that can be taken o the shelf as circumstances create a need for information regarding

compliance with ERISA. A further purpose of this Handbook is to encourage the adoption

and implementation of robust ERISA compliance policies and procedures. To facilitate the

adoption of appropriate policies, this Handbook includes “Sample Compliance Policy”

language at the end of many chapters, set o in a separate text box. Of course, to be useful

in reducing compliance risk, a manager’s policies and procedures should be carefully

tailored to its business and operations and regularly reviewed to ensure they reflect

current business needs. Legal counsel should be consulted when adopting or reviewing

compliance policies and procedures.

The first Section of this Handbook, “Basics,” reviews basic rules governing fiduciary conduct

under ERISA and discusses the methodology for determining when you are managing

ERISA plan assets. The next two Sections, “Qualifications” and “Documentation,”

address standard requirements for a manager that undertakes to manage ERISA plan assets

and customary documentation a manager should have in place before accepting ERISA

plan assets for management. The fourth Section, “Client Relations,” details reporting and

disclosure requirements in connection with the relationship between a manager and its

ERISA clients and explains rules that apply to gifts and entertainment provided between a

manager and its ERISA clients. The fifth Section, “Transactions,” explains rules that apply

to specific transactions and to transactions involving specific assets.

Although every eort has been made to reflect current guidance on key issues, new

guidance appears on a regular basis. We advise the readers of this Handbook to continue

to watch for developments in this area.

The following Ropes & Gray partners are responsible for creating and maintaining this Handbook:

Bill Jewett: +1 617 951 7070 | [email protected]

Josh Lichtenstein: +1 212 841 5788 | [email protected]

If you have particular questions regarding the content in this Handbook, please contact any of the above or

your usual Ropes & Gray advisor.

Communicating with Ropes & Gray LLP or a Ropes & Gray lawyer does not create a client-lawyer

relationship. The ERISA Compliance Handbook is intended to be used for informational purposes only.

It is not intended to be and should not be relied upon as legal advice with respect to any particular set of facts.

© 2019 Ropes & Gray LLP. All rights reserved.

4 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

Basics

CHAPTER 1

When Does ERISA Apply?

A threshold condition for an investment or an account to be subject to ERISA is whether a

“benefit plan investor,” as defined in ERISA, is involved. “Benefit plan investors” include:

n

Employee benefit plans subject to ERISA (and related trusts), such as pension plans,

401(k) plans and Taft-Hartley (multiemployer) plans, but not:

–

governmental plans and public retirement systems, or

–

non-U.S. plans and pension systems, or

–

church plans, unless a special election has been made to be subject to ERISA.

n

IRAs and other plans that are not subject to ERISA but that are subject to section 4975

of the Internal Revenue Code (the “Code”).

n

Entities such as collective funds, group trusts, or insurance company general or separate

accounts that are deemed to hold plan assets by reason of investments in the entity by

benefit plan investors, as described below.

A client account will be subject to ERISA if the client is a “benefit plan investor” that is

subject to ERISA. However, if the only benefit plan investors in a client account are IRAs

or other nonemployer-sponsored plans or accounts that are subject to the prohibited

transaction rules under Section 4975 of the Code, but not to Title I of ERISA, then that

client account will be subject to the prohibited transaction rules, but not to the additional

requirements of ERISA.

As noted above, entities such as collective funds likewise can be subject to ERISA. If a

“benefit plan investor” invests in any pooled investment vehicle, then, unless one or more

of the exceptions described below apply, the underlying assets of the fund are deemed

to be “plan assets” for purposes of ERISA, as though an undivided interest in each asset

were held by the benefit plan investor. In that case, if any benefit plan investor is subject to

ERISA, the fund itself becomes subject to ERISA, and the fund’s manager (or, as applicable,

its general partner, managing member, trustee, adviser or similar entity) becomes an ERISA

fiduciary with respect to the assets attributable to investors that are subject to ERISA.

A benefit plan investor’s investment in an entity will cause the assets of the entity to be

treated as plan assets unless one or more of the following exceptions apply:

n

Interests in the entity constitute a “publicly oered security”— generally, a freely

transferable security that is part of a class of securities that is widely held and registered

under Section 12(b) or (g) of the Securities Exchange Act. This exception eectively

requires a U.S. listing, so publicly listed companies outside of the United States cannot

rely on this exception.

Note: This can make it challenging for ERISA plans and IRAs to invest in non-U.S.

exchange-traded funds, including UCITS.

5 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

n

The entity is an investment company registered under the Investment Company Act of

1940 (e.g., a mutual fund, but not a Business Development Company).

n

The entity is an “operating company” because it is primarily engaged, either directly or

through majority-owned subsidiaries, in the production or sale of a product or service

other than the investment of capital (e.g., the entity’s primary business is conducted

through a majority-owned manufacturing company).

n

The entity is not itself an operating company but qualifies as either a “venture capital

operating company” (VCOC) or a “real estate operating company” (REOC). To qualify

as a VCOC or REOC, the entity would need to invest primarily in operating companies

(in the case of a VCOC) or managed real estate (in the case of a REOC), and would need

to obtain and exercise management rights with respect to those investments.

n

Less than 25% of the total value of each class of equity interests in the entity is held by

benefit plan investors, in which case participation by benefit plan investors is treated

as not “significant” and is disregarded for purposes of determining whether the entity

holds plan assets. The Department of Labor has not issued guidance on what constitutes

a separate “class” of equity for this purpose, so ERISA counsel should be consulted

in any doubtful cases. Moreover, various technical rules apply in determining whether

benefit plan investor participation is significant. Notably, for purposes of applying this

25% test, interests held by the manager or its aliates are excluded from the calculation,

unless the manager or aliate is itself a benefit plan investor. The determination of who

an aliate is can be highly fact-dependent, so care should be given in applying this

aspect of the 25% test.

The requirement to exclude capital of or under the control of the manager and its aliates

for purposes of the 25% test can create diculty when a fund is structured as a master-

feeder fund where multiple feeder vehicles all invest into the master fund and each vehicle

is controlled by an aliate of the manager. This type of structure is common if tax-

exempt or non-U.S. investors and taxable U.S. investors are all permitted to invest in a

strategy. If the manager has discretion to choose how the feeder vehicles are invested, then

there is an argument that the feeder funds should be treated as being under the control of

the master fund manager or its aliate, which would require the master fund to calculate

the 25% test based on the direct investments into the master fund and the benefit plan

investor money invested into the feeder funds. In practice, this would cause many funds to

be treated as being subject to ERISA despite those funds having sucient third-party non-

ERISA capital to pass the 25% test on an aggregated “look through” basis. To address

this concern, many funds are structured as “hardwired” master-feeder funds where each

feeder fund is required to invest only into the master fund. Please note that hardwiring is a

market-based practice and there is no statutory or Department of Labor guidance on this

topic, so funds normally try to adhere to market standards when structuring a hardwired

fund. These market standards are constantly evolving based on commercial trends and

developments under other laws, so ERISA counsel should be consulted before launching

a new hardwired structure based on previous documents.

6 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

A client cannot elect in its investment management agreement or subscription documents

to be subject to ERISA, although governmental pension systems and certain other investors

that are not benefit plan investors frequently ask to be treated, for various purposes, as

if they were subject to ERISA. A fund, likewise, cannot elect to be subject to ERISA—

it either is or isn’t, as a matter of law. It is not uncommon, however, for a manager

to decide to operate a fund as though it were subject to ERISA, to ensure compliance

in case the fund becomes subject to ERISA and to avoid the need for continual testing

to see if participation of benefit plan investors at any given time is “significant.” It is

also common for union-sponsored “Taft-Hartley” multiemployer plans to request that a

manager act as an ERISA fiduciary when the plan invests into a fund that is not subject to

ERISA. Care should be given in negotiating the language for any such acknowledgement,

since a contractual agreement can bind a manager to an ERISA-like standard of care but

cannot actually make a manager take on ERISA fiduciary status. In all cases where a

manager elects by contract to take on ERISA-based fiduciary responsibilities with respect

to a fund that is not expected actually to be subject to ERISA, it is advisable to limit these

contractual undertakings to the standard of care, and not to agree to comply with ERISA’s

prohibited transaction rules or other requirements. In particular, it would be dicult for

a manager to comply with a contractual version of the ERISA prohibited transaction rules

when a fund is not subject to ERISA, because the prohibited transaction exemptions that

apply under ERISA would not be available as a technical matter.

SAMPLE COMPLIANCE POLICY

ERISA Status

Responsibilities for accounts

Each person who participates in the management of a client account is responsible for knowing whether

the client is an ERISA client and should be aware of the potential consequences for the person and the

Firm. If you do not know whether a client is an ERISA client, please consult with the Chief Compliance

Officer.

Responsibilities for funds

The Chief Compliance Officer is responsible for monitoring the level of investment by benefit plan in-

vestors in the funds or confirming the availability of one or more exceptions under the plan asset rules.

Monitoring of benefit plan investor participation percentages should be done in connection with each new

investment, redemption, or transfer of an interest in a fund.

7 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 2

Fiduciary Duties

A manager of ERISA plan assets is a fiduciary with respect to those assets and must satisfy

ERISA’s fiduciary standards, which are generally regarded as the highest fiduciary standards

under U.S. law. This means that:

n

The manager must act solely in the interest of the ERISA investor’s participants and

beneficiaries. For example, the manager cannot, acting in its fiduciary capacity, use plan

assets to benefit its other clients, and cannot benefit its other clients at the expense of an

ERISA investor or a fund holding plan assets.

n

The manager must act prudently with respect to decisions aecting the plan—that is,

with the care, skill, prudence and diligence under the circumstances then prevailing that

a prudent person acting in a like capacity and familiar with such matters would use. This

is often referred to as a “prudent expert” standard.

n

The manager must diversify the plan assets under its management so as to minimize the

risk of large losses, unless under the circumstances it is clearly prudent not to do so.

n

The manager must act in accordance with the documents and instruments governing the

plan insofar as those documents are consistent with ERISA.

ERISA clients will typically make a formal appointment of the manager and require that

the manager acknowledge in writing that it is a fiduciary, so that they will have properly

delegated their fiduciary authority to an “investment manager” as defined in ERISA section

3(38) and so that the manager will be able to use the QPAM Exemption (see Chapter 4).

Unless a named fiduciary has properly delegated its authority to the investment manager

and continues to ensure that the delegation is appropriate, the named fiduciary will remain

liable as a “co-fiduciary” for losses caused by the manager’s breach of its fiduciary duties.

ERISA imposes a few other technical requirements on fiduciaries managing plan assets:

n

The manager must be bonded under a fidelity bond in an amount determined according

to the value of the assets of each plan with assets under management (and whether

the plan holds employer securities). A manager should confirm that any fidelity bond

obtained clearly covers third-party ERISA plans for which the manager is responsible

(certain bonds only apply to the purchaser’s own plans). See Chapter 7 for further details.

n

An account or fund that holds plan assets may not indemnify the manager for any breach

of the manager’s fiduciary duties. A fiduciary may be indemnified or insured outside the

plan, however, including by the plan sponsor.

n

The manager must maintain the “indicia of ownership” of the assets being managed

within the jurisdiction of the U.S. district courts, with certain exceptions. This means that

if the fund intends to invest internationally, certain structural considerations may need to

be taken into account. See Chapter 6 for further details.

“Prudence is process” is an old adage among ERISA practitioners. This means that the

best way to demonstrate that a manager has acted in accordance with ERISA’s fiduciary

8 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

SAMPLE COMPLIANCE POLICIES

Fiduciary Duties

Exclusive Benefit

The Firm’s Compliance Department will review each ERISA account at least annually and more frequently

as appropriate to determine whether investment decisions are being made without consideration of

benefits to the portfolio manager or third parties.

Prudence

The Firm should communicate periodically with each ERISA client regarding the particular needs of the

ERISA plan, such as liquidity requirements, and should retain all records of such communications. The

Firm retains all internal written memoranda relating to investment analysis or recommendations and other

records of meetings where particular investments are discussed, and other documentation relating to

investment decisions. The Firm’s Compliance Department will review each ERISA account at least an-

nually (and more frequently, as appropriate) to determine whether investment decisions are being made

with the care, skill, prudence and diligence that a prudent person acting in a like capacity and familiar

with such matters would use under the circumstances in the conduct of an enterprise of a like character

and with like aims.

Diversification

Client Intake will request an agreement from each ERISA client that the Firm is responsible for managing

only a portion of the ERISA plan’s assets and that the client will be solely responsible for overall diversifi-

cation of the ERISA plan’s assets. The Firm will document any specific guidelines regarding diversification

of each ERISA account. For accounts that are highly concentrated in a particular security or industry, the

Firm will document those weightings and discuss these findings with the portfolio manager.

Plan Documents

Client Intake will request copies of all relevant plan documents. The plan documents will be retained and

reviewed at least annually (and more frequently, as appropriate) to determine whether the plan’s portfolio

is being invested in accordance with the plan documents. Client Intake will also request from each ERISA

client a representation that the powers and duties of the Firm set forth in the investment management

agreement are consistent with the governing plan documents. Each account will be reviewed at least

annually (and more frequently, as appropriate) to determine whether investment decisions are being

made in conformity with the client’s investment objectives and any investment restrictions as stated in

the client agreement.

Bonding

The Compliance Department will review the Firm’s fidelity bond at the outset of each ERISA client

engagement and annually to confirm adequacy of coverage. Where coverage is agreed to be provided

under the bond of the ERISA client, the Compliance Department will review the bond to determine that

the Firm is named as an insured and that the coverage is satisfactory.

standards is to establish compliance policies and procedures and to maintain robust

documentation of how those policies and procedures were followed. Any policies or

procedures should be reviewed on a periodic basis to ensure that they remain appropriate

in light of changing market practices and conditions. Care should also be given to written

communications regarding ERISA accounts, including emails.

9 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 3

Prohibited Transactions

Rules governing “prohibited transactions” are set forth in Sections 406, 407 and 408

of ERISA and Section 4975 of the Code. The regulatory scheme surrounding prohibited

transactions is based on (i) broad prohibitions coupled with (ii) conditional exemptions.

Accordingly, many ordinary course arrangements are swept up in the prohibited transaction

definitions, but are permitted under applicable exemptions that require satisfaction of a

variety of conditions.

Most prohibited transactions are subject to penalty taxes—initially, 15% of the amount

involved for each year that the transaction continues. This tax is imposed on the person

dealing with the plan, which may be the manager or a third party on the other end of a

trade. If the tax is imposed on another person, the manager might nevertheless be subject

to liability by reason of indemnification or other contractual obligations. This tax regime

requires self-reporting and payment. Failure to pay the required taxes and correct the

prohibited transaction can result in an additional tax of 100% of the amount involved.

Additionally, a fiduciary that is involved in a prohibited transaction is required under

ERISA to take action to correct that prohibited transaction, which may involve disgorging

fees or otherwise making payments to the plan to make it whole. Plans involved in non-

exempt prohibited transactions are required to publicly disclose them on their annual

reports (Form 5500).

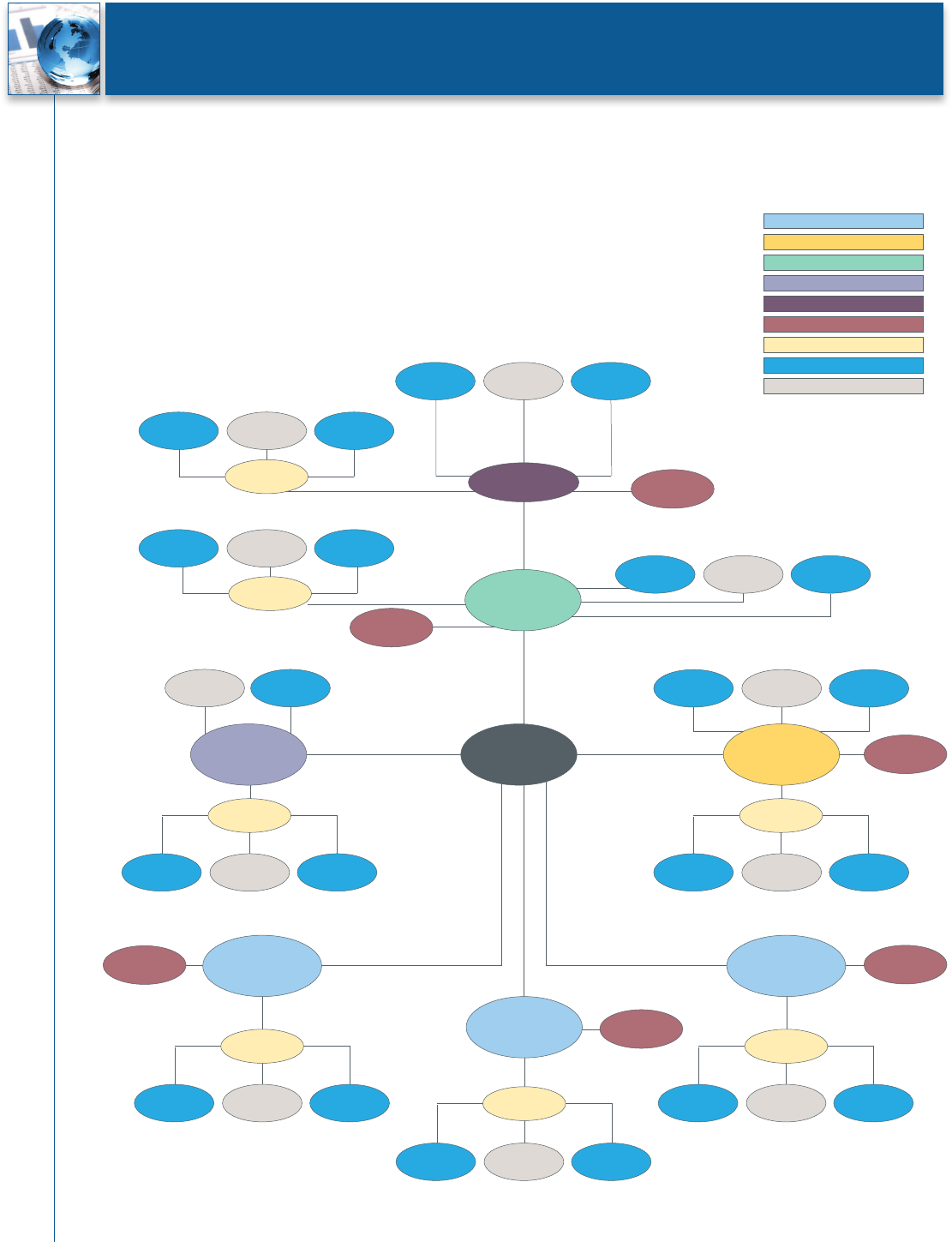

Party-in-Interest Transactions

A fiduciary that manages ERISA assets may not—unless an exemption applies—use those

assets to engage in a sale or exchange, leasing of property, loan or extension of credit,

or furnishing of goods, services or facilities with any “party in interest” to an ERISA

plan with an interest in those assets. A “party in interest” with respect to an ERISA plan

includes any fiduciary of the plan, any person providing services to the plan, any employer

whose employees are covered by the plan and any of certain aliates. A chart showing

the complete array of potential parties in interest can be found in the Appendix. Party-in-

interest transactions are determined on a “strict liability” basis.

Self-Dealing Transactions

A fiduciary may not—again, unless an exemption applies—allow plan assets to be

transferred to or used by or for the benefit of itself or any person (such as an aliate) in

which the fiduciary has an interest that could aect the exercise of its best judgment as

a fiduciary. Moreover, a fiduciary may not, absent an exemption, stand on both sides of

a transaction involving plan assets, whether acting for itself or for client accounts. This

generally prohibits cross-trades, including most rebalancing and warehousing transactions.

A fiduciary also may not receive payments from third parties in connection with a

transaction involving plan assets, again, unless an applicable exemption is available. The

determination of whether a transaction is a self-dealing prohibited transaction (other than

a cross-trade) must be made based on the prevailing facts and circumstances. Under ERISA

section 408(c)(2), a fiduciary will not be treated as having breached these prohibitions on

self-dealing if it receives reasonable compensation for services rendered.

10 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

SAMPLE COMPLIANCE POLICY

Employer Securities

All Client Intake documents require ERISA clients to identify all employer securities and to state whether

or not they are “qualifying employer securities.” The Firm will not invest more than 10% of the assets of

any ERISA account or plan asset fund in identified employer securities. Client Intake will forward CUSIPs

for all identified employer securities to Compliance for correlation with the appropriate account’s or fund’s

compliance obligations matrix. Compliance and portfolio managers will be responsible for monitoring

investments in such securities.

Employer Securities

It is prohibited for an ERISA plan to acquire “employer securities” or “employer real

property” except in accordance with ERISA section 407(a). Employer securities are

securities issued by an employer of employees covered by a plan or by an aliate of the

employer, and employer real property is real property (and related personal property)

leased to such an employer or aliate. ERISA section 407(a) prohibits a plan from

acquiring employer securities that are not “qualifying employer securities,” defined to

include stock and certain marketable obligations. Moreover, generally, even qualifying

employer securities may not be acquired if, immediately after the acquisition, the aggregate

fair market value of the employer securities held by the plan exceeds 10% of the fair

market value of the plan’s assets. These prohibitions can be particularly challenging for

union-sponsored Taft-Hartley multiemployer plans. ERISA clients may request assistance

from managers in abiding by these restrictions, and managers may require clients to

provide lists of restricted securities to assist with this compliance.

11 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

Qualifications

CHAPTER 4

QPAM Exemption

The QPAM Exemption (Prohibited Transaction Class Exemption 84-14) is a status-based

class exemption that enables qualifying registered investment advisers, banks, savings and

loan associations, and insurance companies to engage in a wide range of transactions with

parties in interest. To be in a position to manage ERISA assets, it is generally helpful to qualify

as a “qualified professional asset manager,” or QPAM, and to satisfy the other conditions for

using the QPAM Exemption.

The QPAM Exemption prescribes two sets of rules: one establishing the requirements for

becoming a QPAM, the other limiting the transactional settings in which the exemption will

apply. This summary focuses on the requirements as they apply to registered investment

advisers. In brief summary, the requirements are as follows:

1. The manager must meet tests for assets under management and shareholder equity.

2. The party in interest cannot have certain types of authority over the manager.

3. The plan must not make up more than 20% of the manager’s assets under management.

4. The manager must make the decision to enter into the transaction.

5. The party in interest cannot be the manager or a person “related” to the manager.

6. The terms of the transaction must be at arm’s length.

7. The manager and its aliates must not have done certain disqualifying acts.

A more detailed discussion of each requirement follows below.

1. The manager must meet the definition of a “QPAM” at the time of the transaction or, in

the case of a continuing transaction, at the time the transaction is entered into or renewed.

This means that, at the relevant times, a manager that is a registered investment adviser:

– Must have more than $85,000,000 of total client assets under its management and

control as of the last day of its most recent fiscal year. The timing of the test means

that a new manager cannot qualify as a QPAM until after its first year closes.

– Must have shareholders’ or partners’ equity, as shown in the most recent balance

sheet prepared within the two years immediately preceding the transaction, in

accordance with GAAP, in excess of $1,000,000 or an unconditional guarantee by

an aliate with more than $1,000,000 in equity of payment of all the manager’s

liabilities.

– Must have acknowledged in a written management agreement that it is a “fiduciary”

with respect to the relevant ERISA clients.

12 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

2. At the time of a transaction (or when the transaction is entered into or renewed, in the

case of a continuing transaction), neither the party in interest on the other side of the

transaction nor any of its “aliates” (defined below) can have the authority to:

– Appoint or terminate the manager as a manager of the plan assets involved in the

transaction (including, for example, by acquiring or redeeming an interest in a fund

managed by the manager); or

– Negotiate the terms of a management agreement with the manager (including

renewals or modifications) on behalf of the ERISA client with respect to the assets

involved in the transaction.

However, these restrictions do not apply if there are two or more plans in a fund

and the assets of the investing plan, together with assets of other plans of the same

employer and aliates, account for less than 10% of the total assets of the fund. This

means that a fund’s manager will generally have to inquire into who has investment

authority over an ERISA investor’s assets only if the investor holds a 10% or more

interest in the fund. For purposes of these rules, an “aliate” of a party in interest

includes, among others:

–

any person directly or indirectly, through one or more intermediaries, controlling,

controlled by or under common control with the party in interest;

–

any corporation, partnership, trust or unincorporated enterprise of which the party

in interest is an ocer, director, or 10% or more partner;

– any director or employee who earns 10% or more of the wages paid by the party in

interest or who has direct or indirect authority, responsibility or control regarding

the custody, management or disposition of plan assets.

This condition—sometimes referred to as the “hire/fire” condition or the “power of

appointment” condition—is generally the most challenging for managers to be certain

they have satisfied. While in most cases they will know the identity of the authorized

person responsible for placing a plan’s assets under their management, they will not

necessarily know the identity of all of that person’s aliates, particularly if the person

is aliated with a major financial institution. In certain situations, responsibility for

compliance with this condition is contractually split between the manager and the

counterparty, who may be in a better position than the manager to determine whether

it has aliates with “hire/fire” power over the assets being managed. In general,

managers are most concerned with knowing the identities of any financial institutions

(such as banks) that have hire/fire authority, but the broader net of aliates may be

important to certain funds, such as direct lending funds that may need to avoid lending

to any aliate of an entity with hire/fire authority.

3. The assets of the plan in question and all other plans of the same employer and its

aliates must represent no more than 20% of the total client assets managed by the

manager. In this context, an employer’s “aliate” means only a person directly or

13 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

indirectly, through one or more intermediaries, controlling, controlled by, or under

common control with the employer. This limitation is designed to ensure that a

QPAM is not so beholden to the plan whose assets are under management that it lacks

independence. A manager will not be prohibited from acting as a QPAM with respect

to plans that make up 20% or less (determined as described above) of a manager’s

assets, which means a manager may be able to act as a QPAM with respect to some

clients but not others.

4. The terms of the transaction must be negotiated by or under the authority and

general direction of the manager; the manager must make the decision to enter into

the transaction; and the transaction must not be part of an agreement, arrangement

or understanding designed to benefit the party in interest. This requirement means

that a QPAM cannot serve merely to rubber-stamp a decision that has been made by

others. However, the language that permits the transaction to be negotiated “under the

authority and general direction” of the manager gives non-QPAM fiduciaries some room

to involve themselves in the transaction, and accommodates agents and subadvisers.

5. The party in interest cannot be either the manager or a person or entity “related” to the

manager. An entity is “related” to the manager if, as of the last day of its most recent

calendar quarter:

– The manager owns 10% or more of the entity;

– A person controlling or controlled by the manager owns 20% or more of the entity;

– The entity owns 10% or more of the manager; or

– A person controlling or controlled by the entity owns 20% or more of the manager.

For purposes of these tests, interests held in a fiduciary capacity are not counted

when applying the 10% or 20% test. In addition to these bright-line rules, ownership

interests between 10% and 20% may also cause parties to be considered “related” if

one party exercises control over the management or policies of the other by reason of

its ownership interest.

6. The terms of the transaction must be at least as favorable to the fund as terms generally

available in arm’s length transactions between unrelated parties. This test is applied

both at the time the transaction is entered into and at the time of any subsequent

renewal or modification that requires consent of the manager.

7. Neither the manager, nor any “aliate,” nor any direct or indirect 5% owner of the

manager, may be a person convicted of or released from prison with respect to a list of

specified felonies or other major crimes within the 10 years preceding the transaction.

This means that the bad acts of even certain remotely related parties can disqualify

the QPAM from using the QPAM Exemption. The Department of Labor has granted a

number of individual exemptions (i.e., exemptions available only to the applicant and

specified others) permitting use of the QPAM Exemption in such situations, subject to

certain additional conditions. Recent individual exemptions contain extensive lists of

14 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

additional conditions, and it is currently unclear whether the Department of Labor

will continue to grant such individual exemptions in all cases. A plan fiduciary should

confirm that all of the requirements are or will be met before transacting under the

QPAM Exemption with fiduciaries relying on one of these individual exemptions.

The QPAM Exemption does not provide an exemption from the self-dealing prohibitions

of Section 406(b) of ERISA. It also does not provide an exemption for securities lending

or the acquisition of interests in mortgage pools or mortgage financing arrangements.

These transactions must meet the requirements of separate class exemptions.

SAMPLE COMPLIANCE POLICY

QPAM Exemption

The Chief Compliance Officer will be responsible for determining on at least an annual basis that the Firm

is a QPAM and for identifying any clients or circumstances with respect to which the QPAM Exemption

is unavailable.

All Client Intake documents require ERISA clients to identify any parties who have (or whose affiliates

in the financial services industry have) the power to appoint or terminate the Firm as manager over the

ERISA client’s assets managed by the Firm, or to negotiate the terms of an investment management

agreement with the Firm with respect to such assets.

15 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 5

Alternatives for Non-QPAMs

It is sometimes not possible for a manager to qualify as a QPAM, or a manager that is a

QPAM may be unable to use the QPAM Exemption for certain accounts or transactions.

For example, new managers may have a period of time before they meet the assets under

management test, or may have ERISA clients that account for more than 20% of their

assets under management. Managers in this situation may still manage investments under

other exemptions.

Other Status-Based Exemptions

Apart from the QPAM Exemption, there are four additional status-based class exemptions,

each of which covers a broad range of transactions. They are:

– PTE 90-1 – insurance company separate accounts

– PTE 91-38 – bank collective investment funds

– PTE 95-60 – insurance company general accounts

– PTE 96-23 – in-house asset managers

These exemptions are not covered by this Handbook. Managers that do not qualify as

QPAMs, but may qualify for use of one of these alternative status-based exemptions, should

contact counsel for advice.

Service Provider Exemption

A manager, whether or not it is a QPAM, can rely on the so-called Service Provider Exemption

set forth in Section 408(b)(17) of ERISA and Code section 4975(d)(20) for a wide variety

of transactions with parties in interest. The Service Provider Exemption applies only to

transactions between a plan and a party in interest that is a service provider but not a fiduciary

that exercises any discretionary authority or control with respect to the investment of the plan

assets involved in the transaction or that renders investment advice (or an aliate of such

a fiduciary). The Service Provider Exemption applies to the following types of transactions:

(1) the sale, exchange or lease of property between a plan and a party in interest; (2)

lending or money or other extension of credit between a plan a party in interest; or (3) the

transfer to, or use by or for the benefit of, a party in interest, of any assets of a plan.

The Service Provider Exemption will apply only if the plan receives no less, and pays no

more, than “adequate consideration.” The definition of “adequate consideration” for a

security for which there is a generally recognized market depends on whether such security

is traded on a registered national securities exchange:

n

Securities Traded on a National Securities Exchange. “Adequate consideration” means

the price of the security prevailing on a national securities exchange that is registered

under § 6 of the Securities Exchange Act of 1934, taking into account factors such as

the size of the transaction and marketability of the security.

16 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

n

Securities Not Traded on a National Securities Exchange. If the security is not traded

on a national securities exchange but is still traded on a generally recognized market,

“adequate consideration” means a price not less favorable to the plan than the oering

price for the security as established by the current bid and asked prices quoted by persons

independent of the issuer and of the party in interest, taking into account factors such as

the size of the transaction and marketability of the security.

n

Assets Other than Securities for Which There Is a Generally Recognized Market. In the

case of an asset other than a security for which there is a generally recognized market,

the fair market value of the asset is determined in good faith by a fiduciary or fiduciaries

in accordance with regulations prescribed by the Secretary. These regulations have not

been promulgated.

Broker-dealer and bank counterparties may have varying levels of comfort relying on this

exemption if another exemption is available because, in the absence of regulations, in

some cases there is uncertainty about what counts as “adequate consideration.” Market

practice is evolving in this regard, so it may be worthwhile to discuss the exemption with

counterparties even if they have expressed discomfort with using it in the past.

Special-Purpose Exemptions

See the Section of this Handbook on “Transactions” for descriptions of commonly used

special-purpose exemptions, most of which can be used whether or not the manager is

a QPAM.

17 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 6

Non-U.S. Assets

Generally, managers of plan assets subject to ERISA have an obligation under Section 404(b)

of ERISA not to maintain the “indicia of ownership” of plan assets outside the jurisdiction of

the district courts of the United States, subject to limited exceptions. The indicia of ownership

rules may require, for example, a deed for non-U.S. real property, or subscription agreements

and similar documentation for non-U.S. partnership interests, to be held in the manager’s

U.S. oces.

Regulations provide several exceptions to this requirement that permit the indicia of

ownership of non-U.S. securities and non-U.S. currencies to be held outside the United

States. The simplest exception applies where the manager is a registered investment adviser

that is organized in the United States and has its principal place of business in the United

States and that has more than $50 million in assets under management and $750,000 in

shareholder or partner equity. Another exception applies where indicia of ownership are

physically held by (or are in transit to) a branch of a U.S. bank or a U.S.-registered broker

or dealer with net worth in excess of $750,000. A third exception applies where indicia of

ownership are maintained by a U.S. bank in the custody of a non-U.S. bank and certain

conditions are satisfied, including that the U.S. bank is liable to the ERISA plan to the

same extent it would be if it retained the physical possession of the indicia of ownership

within the United States.

A manager that is not organized in the United States or does not have its principal place

of business in the United States will not be able to take advantage of the first exception

described above. In order to maintain the indicia of ownership of non-U.S. securities and

non-U.S. currencies outside the United States, such a manager would need to satisfy another

exception, such as the exception that permits indicia of ownership to be maintained by a

U.S. bank in the custody of a non-U.S. bank.

It is not clear how the exception that permits indicia of ownership to be maintained in the

custody of a non-U.S. bank works for certain commonly traded types of securities, because

the indicia of ownership rules have not kept pace with the way in which assets are held.

In particular, questions have been raised about what constitutes the indicia of ownership

for uncertificated securities and certain new forms in which securities are traded, such as

A Shares traded on the Hong Kong, Shanghai and Shenzhen Stock Connect. There is no

guidance addressing this question. Ideally, responsibility for satisfying these rules should

be allocated to the ERISA client itself, together with its custodian and the custodian’s

non-U.S. sub-custodial network, because they are in a better position than the non-U.S.

manager to satisfy an applicable exception.

18 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 7

Fidelity Bonds

Section 412 of ERISA requires that every fiduciary of an employee benefit plan and every

person who handles funds or other property of such a plan be covered by a fidelity bond.

Personnel with discretionary authority to invest plan assets are treated as handling funds of

the plan. Persons whose duties with respect to plan investments are essentially advisory are

not treated as handling funds of the plan. The requirement will apply with respect to every

client that is a retirement plan, a master trust, or a commingled fund if the plan, trust or

fund is subject to Title I of ERISA.

A plan must be bonded for at least 10% of the amount of funds handled, subject to a

maximum of $500,000. If the plan holds employer securities, then a maximum of $1,000,000

applies. An “employer security” is a security issued by an employer of employees covered

by the plan, or by an aliate of such employer. Note that a plan is not considered to be

holding employer securities for this purpose merely because the plan invests in a broadly

diversified common or pooled investment vehicle that holds employer securities but that is

independent of the employer and its aliates. Thus, a manager’s purchase of an employer

security for a broadly diversified plan asset fund in which an ERISA client holds an interest

should not cause the relevant plan to be treated as holding employer securities for bonding

purposes. However, if the manager purchases an employer security for an ERISA client’s

separate account, the relevant ERISA plan would be treated as holding employer securities

for bonding purposes.

With respect to situations where assets of more than one plan are held together, the rules

state: “Where the funds or other property of several plans are commingled (if permitted by

law) with each other or with other funds, [the bonding] arrangement shall allow recovery to

be attributed proportionately to the amount for which each plan is required to be protected.”

Thus, for example, in the case of a client that is a master trust, the manager should look

through the master trust to determine the coverage required for each plan investing (directly

or indirectly) through the master trust.

Examples

1. Manager manages a $20 million separate account for a client that is a trust holding assets

of one plan, with no employer securities. The bond required for this client is the lesser of

(i) 10% of $20 million (i.e., $2 million) and (ii) $500,000. Thus the bond required for

this client is $500,000.

2. Manager manages a $20 million separate account for a client that is a master trust holding

assets of two plans, Plan A (which makes up 20% of the trust) and Plan B (which makes

up 80% of the trust), neither of which holds employer securities. The bond required for

this client must cover separately the $4 million that is attributable to Plan A and the $16

million that is attributable to Plan B. The bond required for Plan A is the lesser of (i) 10%

of $4 million (i.e., $400,000) and (ii) $500,000, or $400,000; the bond required for Plan

B is the lesser of (i) 10% of $16 million (i.e., $1,600,000) and (ii) $500,000, or $500,000.

Thus, the bond required for this client is $400,000 plus $500,000, or $900,000.

19 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

The same reasoning applies to fidelity bonds for commingled funds that are subject to

ERISA. That is, a manager should look through a commingled fund to determine the

coverage required for each plan investing (directly or indirectly) in the commingled fund.

Examples

1. Manager manages an $80 million commingled fund that has one ERISA investor, a

trust holding assets of one plan, with no employer securities. This ERISA investor holds

25% of the fund. The bond required for this commingled fund is the lesser of (i) 10%

of $20 million (i.e., $2 million) and (ii) $500,000. Thus, the bond required for this

commingled fund is $500,000.

2. Manager manages an $80 million commingled fund that has two ERISA investors,

Plan A (which holds a 5% interest) and Plan B (which holds a 20% interest), neither

of which holds employer securities. The bond required for this commingled fund must

cover separately the $4 million that is attributable to Plan A and the $16 million

that is attributable to Plan B. The bond required for Plan A is the lesser of (i) 10%

of $4 million (i.e., $400,000) and (ii) $500,000, or $400,000; the bond required for

Plan B is the lesser of (i) 10% of $16 million (i.e., $1,600,000) and (ii) $500,000,

or $500,000. Thus the bond required for this commingled fund is $400,000 plus

$500,000, or $900,000.

If commingled funds and/or master trusts invest in other commingled funds and/or

master trusts, the rules apply on a look-through basis in a manner analogous to the

foregoing examples.

Managers should double-check their fidelity bond documentation to make sure the bond

covers client assets, not just plans sponsored by the manager for its own employees.

20 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

SAMPLE COMPLIANCE POLICY

Fidelity Bonds

Separate Accounts

If the client is a single ERISA plan, the firm must determine whether the plan holds employer securities.

Generally, the firm should obtain a bond equal to 10% of the plan assets managed by the firm subject

to a $1 million maximum for plans holding employer securities and a $500,000 maximum for plans not

holding employer securities.

n

For new clients, information on whether the plan holds employer securities should be provided as part

of the intake process.

n

For existing clients, the firm should review the most recently filed Form 5500 for the plan to determine

whether the plan held employer securities during the plan year for which the form was filed (unless the

firm is itself holding employer securities for the plan). If the Form 5500 review shows that the plan did

not hold employer securities, the firm should contact the client asking for confirmation, stating that

the firm will assume the plan does not hold employer securities unless the client provides different

information.

If the client is a master trust holding assets of more than one ERISA plan, the firm should contact the

client to determine (i) how many plans hold interests in the master trust, (ii) what percentages of the

master trust each plan holds, and (iii) whether the underlying plans hold employer securities.

n

For new clients, this information should be provided as part of the intake process.

n

For existing clients, the firm should contact the client to obtain this information, stating that the firm

will assume that only a single plan holds an interest in the master trust and that no employer securities

are held unless the client provides different information.

For each underlying plan, the firm should generally obtain a $1 million bond if the plan holds employer

securities; otherwise, the firm should obtain a $500,000 bond. However, the firm should determine

whether any underlying plan’s interest in the separate account is less than $5 million ($10 million if the

plan holds employer securities). If so, the firm may limit the bond for such a plan to 10% of the plan’s

interest in the separate account.

Commingled Funds

For commingled funds that are subject to ERISA, the firm should determine the dollar value of the portion

of the fund attributable to each ERISA client. The firm can then determine the proper amount of the

fidelity bond to be obtained with respect to each ERISA client by treating such ERISA client’s investment

in the fund as if it were a separate account and following the procedures outlined above. However, the

firm should not treat an ERISA client (or an underlying plan) as holding employer securities merely

because the fund in which the ERISA client invests holds employer securities.

Updates

All determinations made and client information obtained for compliance with this policy should be

updated on an annual basis.

21 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

Documentation

CHAPTER 8

Client Intake and Subscriptions

Individual Clients

It is standard practice to require new clients to complete forms designed to determine

their ERISA status and document any particular requirements that may apply to their

account, including information necessary to avoid prohibited transactions and/or ensure

the availability of needed exemptions.

Fund Investors

It is also standard practice to require all investors in a fund to complete a subscription

agreement that includes a questionnaire designed to determine the investor’s ERISA status.

In addition, each ERISA investor will generally be required to represent that (i) it is aware

of and has taken into consideration its fiduciary duties, including the diversification

requirements of Section 404(a)(1)(C) of ERISA; (ii) it has concluded that its proposed

investment in the fund is a prudent one; and (iii) the terms of the investment (including the

incentive fee and any restrictions on withdrawal) are in accordance with all requirements

applicable to the investor under its governing instruments and ERISA. ERISA investors

will generally also be required to acknowledge and agree that, for so long as the fund

is not deemed to hold plan assets, the general partner or managing member will not be

a “fiduciary” and that the investor is not relying on the general partner or managing

member to provide any kind of investment advice with respect to the investor’s purchase

of fund interests.

Systems Coding and Review

Despite a lack of guidance from the Department of Labor on requirements for compliance

and trading systems coding, proper compliance system and trading system coding is one

of the most important steps in avoiding ERISA compliance problems, including prohibited

transactions. Whenever a new ERISA account is established, the manager should ensure

that the account is coded as subject to ERISA, and that appropriate restrictions, such as

blocks on cross-trading, limitations on employer securities, and restrictions on trading

with parties that have “hire/fire” authority over the account (including their aliates) have

been properly entered into the system. It is also advisable for the manager to verify that all

of the restrictions are working properly on a periodic basis, or any time that the trading or

compliance systems are updated or changed.

22 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

SAMPLE COMPLIANCE POLICY

Client Information

All separate account clients have completed intake forms indicating whether they are benefit plan

investors. Each Client Intake form should be reviewed by external counsel to confirm ERISA status and

identify any special issues.

All investors in the funds have completed subscription agreements indicating whether they are benefit plan

investors and, if so, the extent to which their invested assets are plan assets. The subscription agreements

further require the investor to notify the Firm of any changes. Each new subscription agreement should be

reviewed by external counsel to ascertain whether the responses to the ERISA section of the subscription

agreement appear on their face to be appropriate.

Each ERISA Client will be coded as subject to ERISA and/or Section 4975 of the code in the Firm’s trade

management and compliance systems, and all appropriate restrictions related to the account will be

coded and subject to review by a supervisor. All ERISA-related coding will be checked on a periodic basis.

23 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 9

Investment Management Agreements

Investment management agreements (IMAs) with ERISA clients generally will contain

certain provisions to accommodate the client’s ERISA-related needs and to avoid imposing

unnecessary burdens on the manager. A summary of relevant provisions is provided below.

The appointing fiduciary should expressly appoint the manager as an investment manager,

as defined in Section 3(38) of ERISA. The appointing fiduciary should represent that it is

a “named fiduciary” under ERISA. The appointing fiduciary should also represent that

the appointment of the manager is consistent with the plan’s documents.

The manager should acknowledge that it is a “fiduciary” under ERISA with respect to the

plan assets that it is managing.

The investor will generally represent that all actions contemplated under the IMA are

consistent with the plan’s documents and that the investor will notify the manager if

any plan provision changes in a way that would make that representation untrue. The

manager may agree to act in accordance with the plan documents.

The manager may represent that it is qualified to act as a QPAM. The QPAM Exemption

does not require a manager to agree that it will act in accordance with the requirements of

the Exemption or that each transaction will be exempt by application of the Exemption,

but managers commonly do so agree.

The manager may undertake to vote proxies in accordance with its fiduciary duties under

ERISA, unless the IMA specifically identifies another party as responsible for voting the

proxies or reserves the right to the named fiduciary of the investing plan.

The manager generally should avoid having discretionary authority to value assets on which

a management fee or performance fee is based. The manager also generally should not have

the ability to increase its fees by allocating assets to a particular investment strategy.

The manager may agree to diversify the account in accordance with ERISA, but the

manager would normally not make any commitment with respect to the overall

investment strategy of the plan. Some managers seek to disclaim the duty of diversification,

particularly with very targeted investment strategies.

A U.S.-based manager may agree to comply with the “indicia of ownership” requirements

under ERISA. A non-U.S. manager generally should consult with counsel with regard to

these requirements and any related contractual undertakings.

With respect to any client-directed brokerage arrangement, the investor generally will

be required to represent that the direction of its account to a specified broker and the

brokerage commission rate (i) are in the best interest of the account; (ii) are for the

exclusive purpose of providing benefits to participants and beneficiaries of the plan; and

(iii) are not, and will not cause the account to be engaged in, a prohibited transaction.

The investor will generally also represent that it has determined, and will monitor the

24 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

account to ensure, that the directed broker is capable of providing best execution for the

account’s brokerage transactions and that the commission rates that have been negotiated

are reasonable in relation to the value of the brokerage and other services received.

If referenced in the IMA, any “soft dollars” arrangement must comply with the safe harbor

standards under Section 28(e) of the Securities Exchange Act of 1934.

The manager generally will agree to be bonded as required under ERISA, unless the

investor agrees to cover this obligation.

The manager may not be indemnified out of plan assets for any breach of its fiduciary

duties. Therefore, the indemnification provisions of the IMA should permit indemnification

only to the extent permitted by applicable law, including ERISA.

The manager generally will not agree to avoid or monitor transactions in employer

securities unless the investor provides a list of such employer securities and/or guidelines

for handling such securities.

SAMPLE COMPLIANCE POLICY

Investment Management Agreements

The Firm maintains a standard form of investment management agreement for ERISA clients that has

been reviewed by outside counsel for compliance with ERISA. All client agreements can be accessed

through Client Intake. The Firm will have outside counsel comment on any alternative terms or conditions.

Any comments will be retained with the client files.

25 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

CHAPTER 10

Prime Brokerage and Derivatives

Managers of plan asset funds often will enter into so-called prime brokerage arrangements

that cover a suite of services in addition to execution of trades. Other services may include

margin loans, foreign exchange transactions, and securities lending, and the prime broker

may in some cases act as counterparty in swap transactions.

Special considerations arise from the prime broker’s holding and use of assets pledged

as collateral in connection with certain transactions. Similar considerations arise in

connection with ISDA agreements governing swap transactions and GMRAs governing

repurchase transactions. Two recurrent questions that arise in connection with these

arrangements are whether the collateral held by the broker or counterparty remains

subject to ERISA in the hands of the broker or counterparty and what permits the broker

or counterparty to exercise certain agreed rights over assets in the account, such as oset

and closeout rights.

The Department of Labor has addressed these issues in limited contexts in a manner that

has given practitioners comfort that assets pledged as collateral do not retain their plan

asset character in the hands of the counterparty. Specifically, the Department has stated

that when assets are held by a futures commission merchant (FCM) to fund a plan’s

margin account, the assets in the account are not plan assets; rather, when a plan engages

in a futures transaction, “its assets are the rights embodied in the futures contract as

evidenced by a written confirmation and outlined in its agreement with its FCM. . . .”

Similarly, the Department has stated that when assets being used for cleared swaps are

held in a margin account, the assets in the account are not plan assets; rather, when a

plan engages in cleared swaps, “its assets are the rights embodied in the swap contract as

evidenced by the written agreement” between the plan and its clearing member.

The Department of Labor has also opined that the exercise of closeout rights over

amounts in an ERISA account can be treated as exempt under the QPAM Exemption, if

the rights have been spelled out in detail in the agreement. Specifically, the Department

has stated in the cleared swaps context that the QPAM Exemption provides relief for such

transactions as “subsidiary transactions” if the agreement governing the swap clearing

services contains enough specifics of such subsidiary transactions that the potential

outcomes are reasonably foreseeable by the QPAM when negotiating and entering into

the agreement.

In view of the foregoing considerations, managers entering into prime brokerage and

derivatives agreements on behalf of ERISA accounts will typically need to consider the

following:

1. The agreement will usually require that the manager represent that it is a QPAM and

represent that the QPAM Exemption is available for transactions under the agreement.

Sometimes this representation is made on the basis of assumed conditions agreed by

the parties.

26 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

2.

In the case of a prime brokerage agreement, the prime broker is a service provider to

the ERISA customer, so its compensation needs to be reasonable and it needs to give

the customer a full fee disclosure to satisfy the exemption under ERISA for reasonable

compensation paid for necessary services. (See Chapter 11.)

3.

Generally, a prime broker will ask for assurances that the ERISA customer does not

and will not treat any assets pledged as collateral as “plan assets.” The DOL guidance

on analogous situations described above is generally sucient for managers to be

comfortable operating in this way, but it is more appropriate to word this provision as

an agreement or acknowledgment between the parties rather than as a representation

regarding the legal status of the assets. These assurances are also often made by the

prime broker to the ERISA customer.

4.

A prime broker may also ask for assurances that certain uses of the ERISA customer’s

assets are exempt from the prohibited transaction restrictions. Again, the DOL

guidance on analogous situations described above is often sucient for managers to be

comfortable with their ability to use the QPAM Exemption to cover such transactions,

as subsidiary transactions.

It is common for ISDAs to contain more or less elaborate ERISA-related termination

events, disclosure obligations, and representations. It is generally advisable for a manager

to have ERISA counsel review these sections, perhaps after discussing with counsel what

an appropriate “standard” set of ERISA provisions should include and exclude. Attention

should also be paid to the form of derivative documentation being used and whether all

requirements of any applicable exemptions have been met.

27 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

Client Relations

CHAPTER 11

Reporting and Disclosure

Managers of ERISA accounts have certain disclosure obligations and certain responsibilities

to assist the underlying ERISA plans with their annual reporting obligations. For example,

ERISA plans must report annually on the assets held in plan asset funds in which they

invest; accordingly, the manager of such a fund should be ready to disclose the fund’s

holdings.

The most significant disclosure and reporting obligations relate to compensation received

by service providers, including asset managers. The details are set out below.

Compensation Reporting

Most ERISA plans must file a public report (Form 5500, Schedule C) showing all

compensation received by service providers to the plan, including managers of funds

in which the plan’s assets are invested. Service providers to ERISA plans must provide

information needed to comply with the plan’s reporting obligations. This requirement

applies to all investment funds (other than funds that are treated as operating companies,

such as VCOCs and REOCs) in which an ERISA plan holds an interest, whether or not

assets of the fund are deemed to be “plan assets”—including mutual funds as well as

non-registered funds.

ERISA plans generally must report the following compensation-related information:

–

The identity of any person receiving $5,000 or more for services;

–

Any relationship between such person and the plan sponsor or other parties in

interest to the plan;

–

One or more codes describing the services; and

–

The amount of any compensation paid directly.

If a service provider received indirect compensation—that is, amounts paid by someone

other than the plan in connection with services provided to the plan—the plan must

report the amount of indirect compensation paid, or a formula for calculating it, unless

a special exception described below applies. Additional information must be reported

for certain service providers that may be exposed to conflicts of interest, including

investment managers. For this class of service providers, each source paying $1,000 or

more in indirect compensation must be disclosed, except as described below.

Under a special exception for so-called eligible indirect compensation, no amount needs

to be reported for a recipient of indirect compensation (such as a fund manager) if (i)

the compensation consists of fees or expense reimbursements reflected in the value of the

investment, finder’s fees, soft dollar revenue, float revenue, brokerage commissions or

other transaction-based fees for transactions or services involving the plan, and (ii) the

28 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

plan receives written disclosure of:

– The existence of the indirect compensation;

–

The services provided for the compensation;

– The amount or an estimate of the compensation, or a formula used to determine

the amount; and

– The identity of the parties paying and receiving the compensation.

Managers who want to avoid extensive and detailed public disclosure of fee-related

information will generally try to make sure that ERISA plans receive a written disclosure

satisfying these requirements. The disclosure can be set forth in existing documents

(e.g., an oering memorandum) as long as ERISA investors are told which parts of the

documents are intended to satisfy the requirements. If an investment manager receives

only eligible indirect compensation in connection with plan investments, all the plan

has to report is the identity and EIN or address of the person providing the plan

administrator with the written disclosure. The person providing the disclosure need not

be the investment manager.

The consequences of noncompliance with the obligation to provide information necessary

to complete Schedule C can be severe. A service relationship with an ERISA plan will be

a per se prohibited transaction unless the service provider supplies this information in a

timely manner.

Compensation Disclosure

Certain service providers are obligated to make an up-front disclosure relating to their

compensation. The service provider fee disclosure rules apply to a “covered service

provider,” which means a service provider that enters into a contract with a plan or a

plan-asset fund to provide fiduciary, registered investment advisory, recordkeeping or

certain other services (e.g., accounting, custodial and consulting services), and reasonably

expects to receive at least $1,000 in compensation for the services provided.

All covered service providers must disclose to the contracting plan fiduciary in writing:

– The services to be provided;

– Whether the covered service provider will act as a fiduciary or investment adviser

registered under the Investment Advisers Act of 1940 or state law;

– All compensation reasonably expected to be received, including:

– Direct compensation;

– Indirect compensation, with a description of the arrangement between the

payer and the covered service provider or its aliates or subcontractors;

– Compensation paid among the covered service provider and its aliates or

29 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

subcontractors, if charged on a transaction basis (e.g., commissions, soft dollars,

finder’s fees or other similar incentive compensation paid based on business

placed or retained) or charged directly against the investment and reflected in

the value of the investment (e.g., Rule 12b-1 fees), together with a description

of the services for which such compensation is paid, and the identities of the

payer and recipient;

– Compensation that the covered service provider would receive in connection with

the termination of the contract and how prepaid amounts would be calculated

and refunded upon termination.

If a fund is used as a designated investment alternative under a participant-directed

individual account plan, the plan administrator will have an obligation to make annual

disclosures to participants relating to fees charged by the fund. For this reason, the

following must also be disclosed by the covered service provider, if applicable, on a

regular basis:

– Total annual operating expenses for an investment where the return is not fixed,

and any ongoing expenses (e.g., wrap fees, mortality and expense fees);

– Total annual operating expenses expressed as a percentage and calculated in

accordance with the participant-level fee disclosure rules that apply to plan

administrators; and

– Any other information about the designated investment alternative that is required

for the plan fiduciary to comply with the participant-level fee disclosure rules

and that is within the control of, or reasonably available to, the covered service

provider.

If a covered service provider acts as a fiduciary with respect to the plan or investment

entity that holds plan assets, the following disclosures must be made with respect to

each investment product that holds plan assets and in which the plan has a direct equity

investment:

– Compensation charged against the investment (e.g., commissions, sales loads,

sales charges, deferred sales charges, redemption fees, surrender charges, exchange

fees, account fees and purchase fees) that is not included in the annual operating

expenses of the investment; and

– Annual operating expenses for an investment where the return is not fixed, and

any ongoing expenses (e.g., wrap fees, mortality and expense fees).

Generally, initial disclosures must be provided reasonably in advance of the date the

contract or arrangement is entered into, renewed or extended. Information changes must

be disclosed as soon as practicable, but not later than 60 days from the date the service

provider knows of the change, except that changes to investment-related information

are to be reported at least annually. Certain plans may also request to receive updated

disclosure every year. Compensation information requested by a plan fiduciary for

30 ROPES & GRAY LLP

An ERISA Compliance Handbook for Asset Managers

purposes of complying with reporting and disclosure requirements under ERISA must be

provided reasonably in advance of the date on which the plan fiduciary or administrator

states that it needs the information. There are special timing rules for disclosure with

respect to investments that are later determined to hold plan assets or investments that

later become designated investment alternatives.

There is no required format for written disclosures, and disclosures may be made

through one or more documents. However, the regulations contain a “guide” that service

providers are encouraged by the Department to use when making initial disclosures to

plan fiduciaries.

Covered service providers are protected if errors or omissions are made in good faith and