©2022-2023 Arthur J. Gallagher & Co. All rights reserved.

Electronic Disclosure of Required Health & Welfare

Plan Notices

This resource provides the electronic disclosure rules for health & welfare related

federal notices for both ERISA and non-ERISA plans.

Fundamentally, employers and plans must provide notices related to their health and

welfare plans that fall into six categories – ERISA; Patient Protection and Affordable

Care Act (ACA); COBRA; HIPAA (both Portability and Privacy and Security); Internal

Revenue Code (IRC) disclosures; and Other Notices required under several different

federal laws. Following is a summary of the types of notices that fall into each of the six

categories and how those notices may be provided electronically.

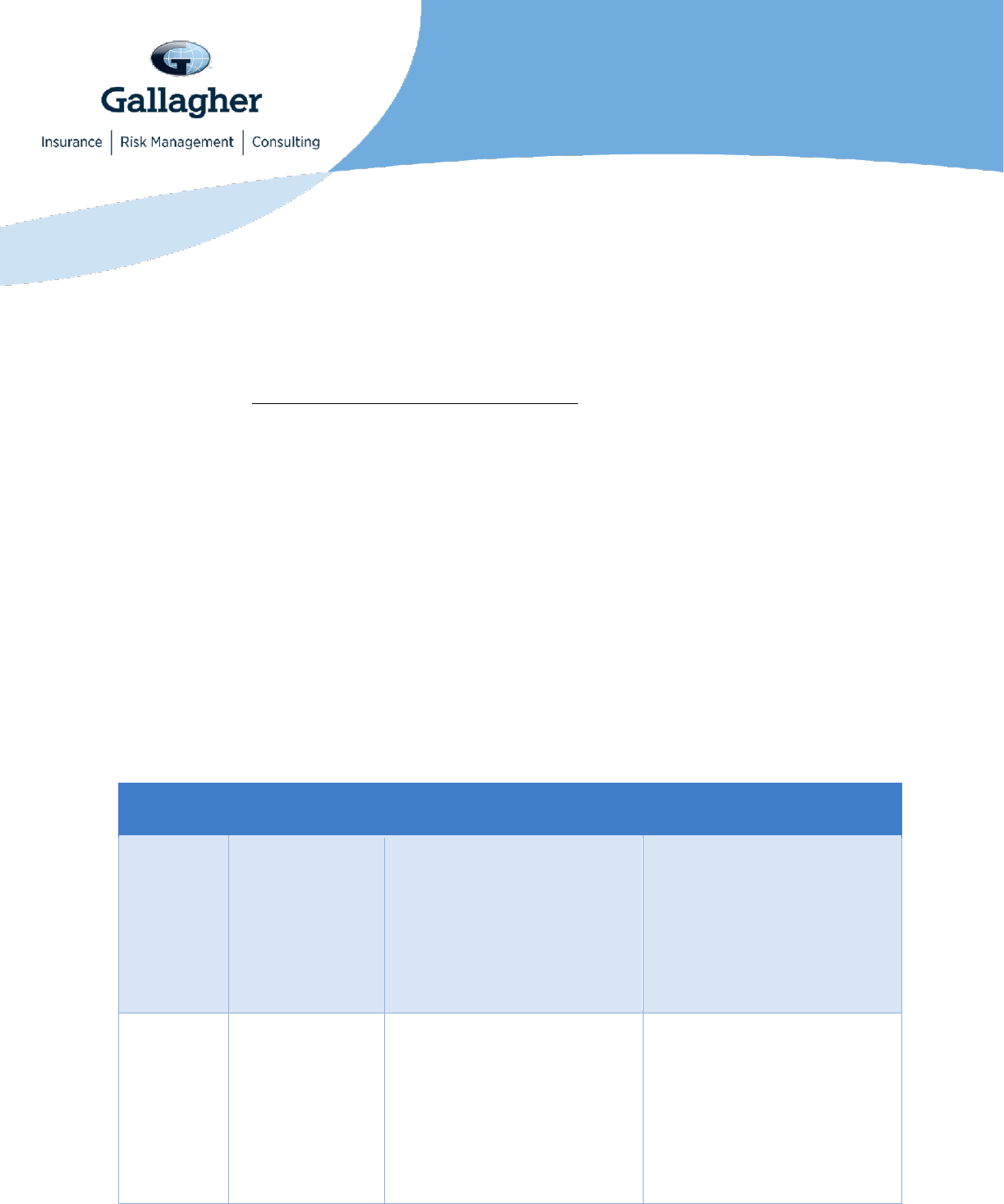

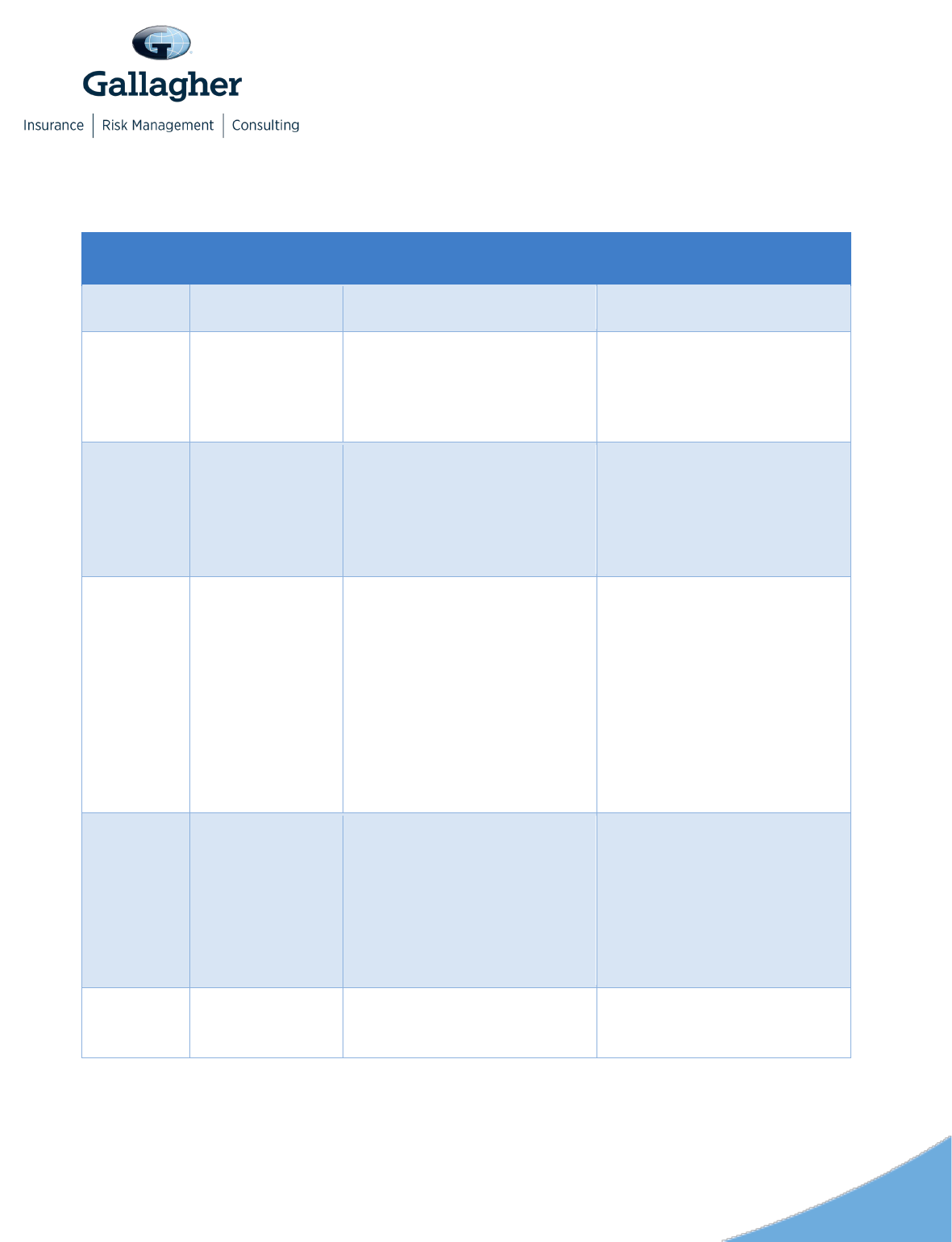

Summary of Required Participant Notices by Type

As discussed below, the rules regarding electronic delivery of required information vary

by the type of plan and notice. Employers have a variety of options to deliver materials

electronically depending on the circumstances. However, some notices require prior

consent from the recipient before electronic distribution. The below chart summarizes

which types of notices require prior consent. The specific rules are explained further in

separate sections below the chart.

Applicable

Law

Notice

ERISA Consent

Requirements

Non-ERISA Consent

Requirements

ERISA

All notices

required by

ERISA (SPDs,

SMMs, SMRs,

SARs)

Prior consent only required

for individuals without

worksite access to electronic

materials

Prior consent is not required

for individuals with worksite

access to electronic materials

Not applicable to non-ERISA

plans; however, these rules

may be used by non-ERISA

plans to prove disclosure, as

noted below.

ACA

Marketplace

Use the ERISA disclosure

rules:

• Employees with worksite

access do not have to

provide consent to

receive Marketplace

notice if using ERISA

disclosure rules.

Non-ERISA plans may use

the ERISA rules.

Non-federal governmental

plans may also follow the

electronic disclosure rules

that apply in the individual

insurance market.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

2

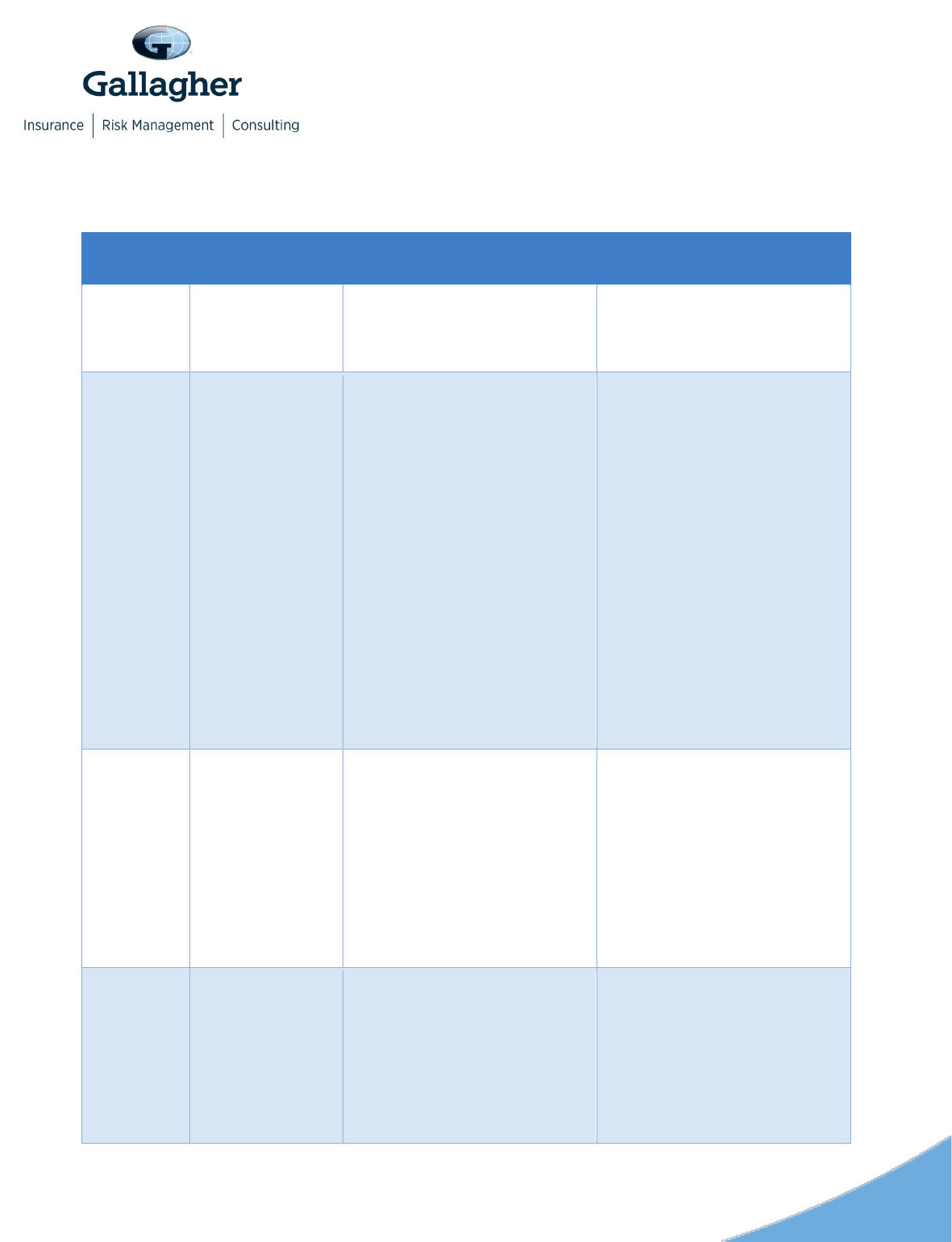

Applicable

Law

Notice

ERISA Consent

Requirements

Non-ERISA Consent

Requirements

• Employees without

worksite access may only

receive electronically after

providing consent.

Summary of

Benefits and

Coverage (SBC)

• Electronic delivery

permitted for participants

who enroll online or who

request the SBC online.

• Individuals with worksite

access do not have to

provide consent to

receive SBC.

• Individuals without

worksite access may

receive only after

providing consent using

ERISA disclosure rules.

• Internet posting permitted

as long as employees

notified in writing that

material available and

internet address provided.

Non-ERISA plans may use

the ERISA rules.

Self-insured non-federal

governmental plans may also

use the state’s rules for

individual medical insurance.

Grandfather

Status

Use the ERISA disclosure

rules:

• Prior consent only

required for individuals

without worksite access to

electronic materials

• Prior consent is not

required for individuals

with worksite access to

electronic materials.

Non-ERISA plans may use

the ERISA rules.

Patient

Protection

Notice

Use the ERISA disclosure

rules:

• Prior consent only

required for individuals

without worksite access to

electronic materials

• Prior consent is not

required for individuals

Non-ERISA plans may use

the ERISA rules.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

3

Applicable

Law

Notice

ERISA Consent

Requirements

Non-ERISA Consent

Requirements

with worksite access to

electronic materials.

No Surprises Act

Post notice on public website

of the plan. No requirement to

disclose individually except

on EOBs.

Post notice on public website

of the plan. No requirement to

disclose individually except

on EOBs.

COBRA

COBRA

general/initial

notice

Election notice

Notice of

unavailability

Notices of early

termination

Electronic disclosure may be

problematic. Read the

COBRA section below for

more detail.

For electronic disclosure, use

the ERISA disclosure rules:

• Prior consent only

required for individuals

without worksite access to

electronic materials

• Prior consent is not

required for individuals

with worksite access to

electronic materials.

Non-ERISA plans may use

the ERISA rules.

Church plans are not subject

to COBRA.

HIPAA

Children’s

Health

Insurance

Program

Reauthorization

Act (CHIP)

Use the ERISA disclosure

rules:

• Prior consent only

required for individuals

without worksite access to

electronic materials

• Prior consent is not

required for individuals

with worksite access to

electronic materials.

Non-ERISA plans may use

the ERISA rules.

HIPAA Special

Enrollment

Rights

Use the ERISA disclosure

rules:

• Prior consent only

required for individuals

without worksite access to

electronic materials

• Prior consent is not

required for individuals

Non-ERISA plans may use

the ERISA rules.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

4

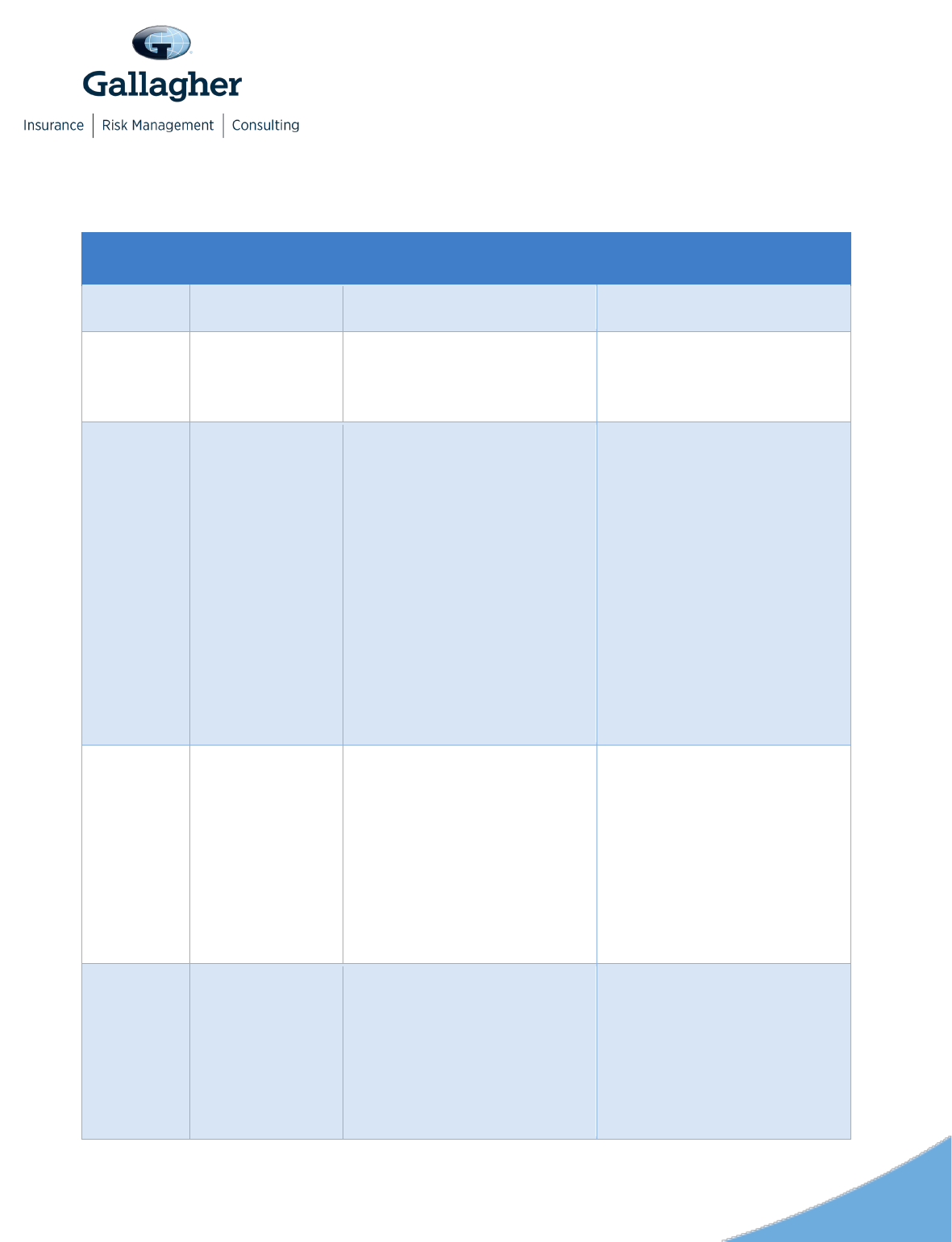

Applicable

Law

Notice

ERISA Consent

Requirements

Non-ERISA Consent

Requirements

with worksite access to

electronic materials.

Self-insured

non-federal

government plan

HIPAA Opt-Out

Election Notice

Not applicable to ERISA

plans.

Notices may be sent via

email if ERISA disclosure

rules are satisfied.

Notice of Privacy

Practices and

Reminder

Prior consent required for all

recipients. Notice may only

be distributed via email when

distributing electronically.

Prior consent required for all

recipients. Notice may only

be distributed via email when

distributing electronically.

IRS

Forms

1095-B or -C

May be provide electronically

if employee has consented

electronically and not

withdrawn the consent before

the statement is furnished.

The consent may be provided

via paper provided the

employee confirms consent

electronically in a way that

shows that the employee can

access the Form in the

electronic format in which it

will be furnished.

Same rules apply for non-

ERISA plans. See column to

the left for specific rules.

Evergreen

cafeteria plan

election notice

Prior consent not required for

those with effective access to

electronic materials

Prior consent only required

for individuals without

effective access to electronic

materials.

The consent may be provided

via paper provided the

employer confirms consent

electronically in a way that

shows that the employee can

access the Form in the

Same rules apply to non-

ERISA plans. See column to

the left for specific rules.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

5

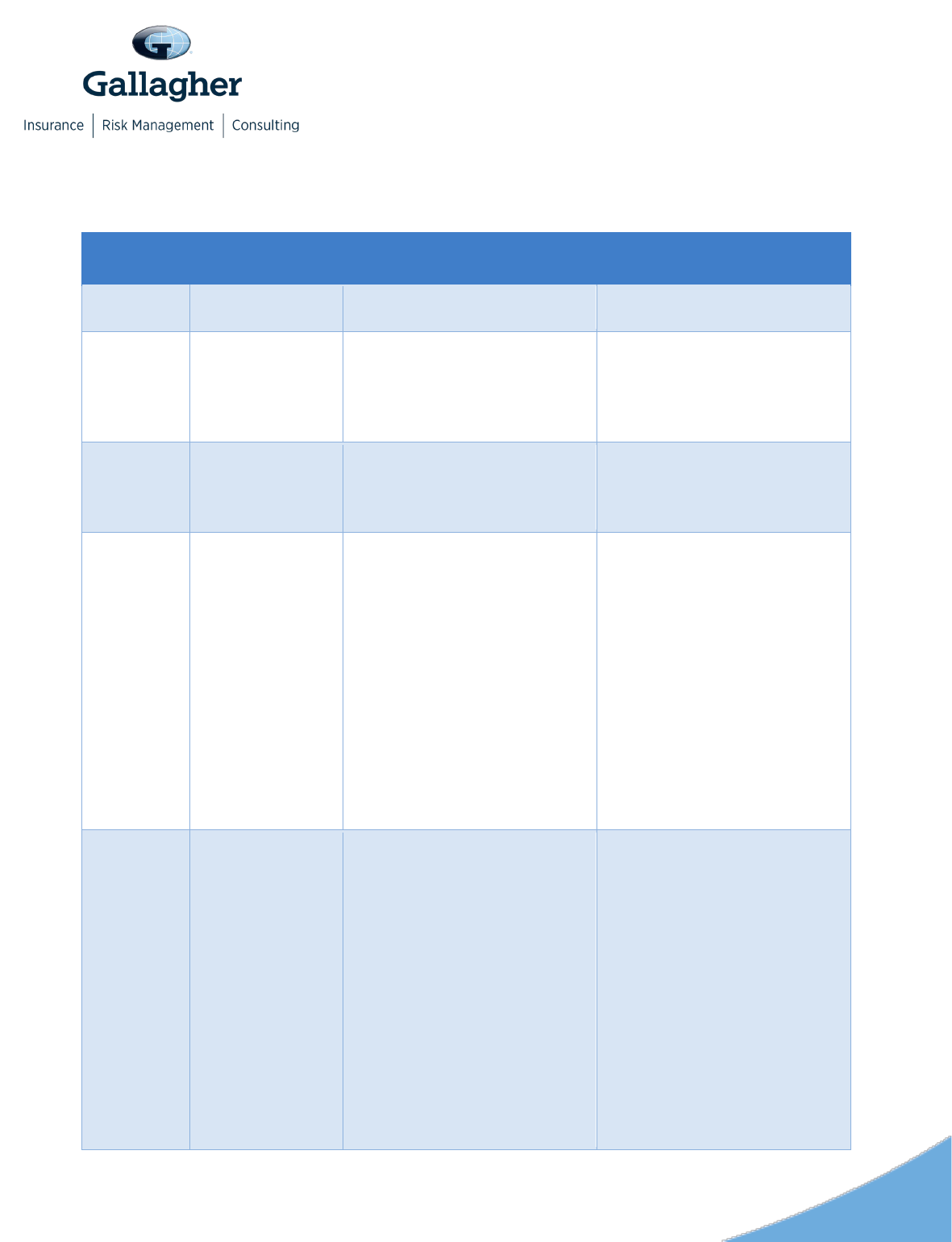

Applicable

Law

Notice

ERISA Consent

Requirements

Non-ERISA Consent

Requirements

electronic format in which it

will be furnished.

Other

Notices

Part D

Certificate of

Creditable (or

Non-Creditable)

Coverage

May be sent electronically

using the ERISA disclosure

rules.

Non-ERISA plans may use

the ERISA rules.

Michelle’s Law

May be sent electronically

using the ERISA disclosure

rules.

Limited applicability. See

Michelle’s Law section below.

Non-ERISA plans may use

the ERISA rules.

Limited applicability. See

Michelle’s Law section below.

Wellness

Program notices

required by

HIPAA/ACA,

ADA, & GINA

HIPAA/ACA Notice: ERISA

plans may use the ERISA

disclosure rules.

ADA & GINA Notices: may be

sent electronically in any

format that will be effective in

reaching employees. Email

may be used if the subject

line refers to the wellness

program.

HIPAA/ACA Notice: non-

ERISA plans may use the

ERISA disclosure rules.

ADA & GINA Notices: may be

sent electronically in any

format that will be effective in

reaching employees. Email

may be used if the subject

line refers to the wellness

program.

Newborns’ and

Mothers’ Health

Protection Act

Disclosure

Plans subject to ERISA will

generally include the

Newborns’ and Mothers’

Health Protection Act notice

in their SPDs.

ERISA plans should follow

the ERISA disclosure rules.

Non-ERISA plans will provide

the notice in their plan

documents.

Plans may follow the ERISA

disclosure rules.

Women’s Health

and Cancer

Rights Act

ERISA plans should follow

the ERISA disclosure rules.

Non-ERISA plans may use

ERISA disclosure rules.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

6

Requirements by Type of Notice

ERISA

Information that needs to be provided to newly eligible employees (returning employees

and newly hired employees) includes:

•

A Summary Plan Description (SPD) – or comparable document for non-ERISA plans

– for health and welfare and cafeteria plans

• Summaries of Material Modification (SMMs) or Material Reduction (SMRs) that have

not been incorporated into an SPD, and

• Summary Annual Report (SAR) for insured and funded plans required to file Form

5500

There are additional notices required by ERISA, such as a HIPAA special enrollment

rights notice, a CHIP notice, and the Women’s Health and Cancer Right Act Notice.

These notices are also required for non-ERISA plans and are discussed below. Each

section indicates which notices are subject to the ERISA disclosure rules.

The SPD must be provided within 90 days for newly covered participants and within 120

days for new plans. Updated SPDs are also required every five years if material

changes are made, or within 10 years if no material changes are made.

An SMM is provided within 210 days after the plan year in which a material modification

occurs. An SMR is required for material reductions to the plan and must be provided

within 60 days after the plan sponsor amends the plan. There is no model form for the

SMM or SMR, so employers are generally free to choose the content of those notices.

As a best practice, the notice should communicate what plan is affected by the change,

when the change is effective, a contact information for questions, and that the SMM or

SMR should be kept with the most recently issued SPD to provide a complete summary

of the plan. Practically, it is typically easier to align changes with annual enrollment and

use the annual enrollment guide as the SMM or SMR by inserting language in the

annual enrollment guide that designates it as an SMM or SMR.

Applies to: private employers, including for profit and non-profit (e.g., corporations,

S-Corporations, LLCs, etc.) that sponsor health or welfare benefits for their

employees and electing church plans (i.e., church plans that have made an IRC

410(d) election to be subject to ERISA).

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

7

The SAR must be provided to participants if the employer has a plan that is insured or

funded and is required to file Form 5500. Self-insured health and welfare plans with 100

or more participants on the first day of the plan year are required to file Form 5500, but

are not required to provide an SAR. The content that must be included in the SAR is

provided in the Department of Labor (DOL) SAR template.

Employers may also distribute additional materials such as enrollment guides or

workbooks used to help employees understand the employers’ plans and make benefit

selections.

Given the complexities involved in using different methods for different types of notices,

many employers (including those not subject to ERISA) use the ERISA requirements for

electronic disclosure for the majority of their notices. Employers who use this approach

will want to make sure that they are complying with all of the requirements for the

ERISA requirements for electronic disclosure, which can be burdensome.

For individuals who do not have worksite access, the ERISA requirements provide that

the individual must consent in a manner intended to demonstrate the individual’s ability

to access the materials. While individuals may be willing to provide their personal email

address to receive the materials, employers often find that many employees do not

consent in a manner that demonstrates the individual’s ability to access information in

the electronic format used thereby causing the delivery to fail to satisfy all of the

electronic disclosure requirements.

Employers have found the following approaches to be useful for some of their

employees who do not have worksite access.

• Requesting consent when employees are newly hired. Some employers have

addressed this challenge by asking individuals to consent when they are newly hired

as employees, as they are more likely to consent in a manner that demonstrates the

individual's ability to access information in the electronic form that will be used.

• Requesting consent as part of open enrollment. Employers can often increase

the number of employees who can be provided materials electronically by requesting

consent annually as part of open enrollment for those who have not previously

consented in accordance with the requirements.

• Providing materials in person. As an alternative to electronic disclosures, some

employers bring copies of the required notices to in-person open enrollment

meetings. Employees are provided with the materials and sign an acknowledgment

that the materials have been provided to them. Employees who do not wish to retain

these materials often leave them at the meetings and employers can provide these

paper copies to other employees. Under this approach, employers will typically also

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

8

have these materials available electronically and also provide them to employees

who request them in the future.

Please note that the following approaches do not satisfy the ERISA requirements

unless additional conditions are satisfied.

• Posting materials on a company website or in a benefits administration system.

Under this approach, the employer must also notify employees that the materials are

available. If the employees do not have worksite access, the employer would also

need the employee’s consent for electronic distribution.

• Sending a postcard with a link to a company website or benefits administration

system.

• Putting materials in a break room for employees to take if wanted.

• Having materials available at open enrollment meetings (unless the conditions

described above are satisfied).

• Having a kiosk where employees can print materials.

Given the challenges that can arise with electronic distributions of materials, employers

will want to work closely with their consultants to make sure that they are satisfying all of

the requirements.

For plans subject to ERISA, the DOL guidelines specify how plan materials may be

distributed electronically. In general, electronic disclosures must satisfy four general

requirements:

• The plan must use reasonable measures to insure receipt of the materials, such as

an automatic notice of non-delivery from an email system or periodic surveys to

confirm receipt.

• The style, format, and contents requirements for ERISA disclosures applies.

• Paper copies of the documents must be available upon request, generally at no

charge.

• The plan must take reasonable and appropriate steps to safeguard the

confidentiality of the information when a disclosure includes personal information

relating to an employee’s accounts and benefits.

The DOL regulations contain different requirements for distributing materials to

individuals who have worksite access to electronic materials, and others who do not

have worksite access, as well as a safe harbor for use of the employer’s website.

Below, we address each set of rules.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

9

Individuals with Worksite Access may receive ERISA notices without

providing prior consent

Documents may be provided electronically automatically (i.e., without prior consent) to

an employee who regularly accesses the employer’s electronic system as an integral

part of the employee’s job. Access may be an employer’s worksite, or it may be from

home for workers who telework.

To determine whether individuals have worksite access, employers should consider: (1)

the individual’s ability to access documents at any location where he or she is

reasonably expected to perform job duties; (2) the frequency with which an individual

uses a computer to perform his or her daily job duties; and (3) the likelihood an

individual would be able to access documents if provided electronically. Traditionally,

workers such as assembly line workers or cashiers would likely not have worksite

access. Workers who report to an employer’s office regularly and use their computers to

access the employer’s electronic system on a daily basis generally have access.

Recent changes in the way employers conduct business may result in fewer employees

with worksite access. Some employees who reported to a worksite where they had

regular computer access may not be able to go to their worksites. Others may be

working remotely such as from home, but may only be able connect with work via phone

or email using their home computers. In other cases, the employer may have enabled

more employees to telework and as a result, more employees have regular, albeit

remote, access to the employer’s electronic system.

So long as an employee has worksite access as described above, then an employer

may disclose appropriate notices electronically without prior consent from the employee.

Individuals without Worksite Access may only receive ERISA notices

after providing consent

Documents may be provided electronically to an individual without worksite access only

if the individual receives a pre-consent statement with specific information, and

affirmatively consents to receiving the electronic material in a manner that demonstrates

the individual’s ability to access information in the electronic form that will be used.

Individuals without worksite access may include the following:

• Employees who do not access the employer’s electronic information system as an

integral part of their job duties – whether from a worksite or teleworking from home;

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

10

• Employees on a leave of absence such as Family Medical Leave Act (FMLA) leave;

• COBRA Qualified Beneficiaries;

• Former employees such as retirees;

• Alternate recipients under Qualified Medical Child Support Orders (QMCSOs); and

• Other individuals covered under the plan who may need to receive an SPD, such as

surviving spouses.

The pre-consent statement may be provided in electronic or non-electronic form;

however, individuals must consent “in a manner that reasonably demonstrates the

individual’s ability to access information in the electronic form that will be used.” For

example, if the employer plans to send electronic material through e-mail, the individual

should consent electronically through email. The pre-consent statement must include all

of the following information:

• The hardware and software requirements for receiving and viewing the material.

• Identification of the documents available with a description of the significance of

those documents.

• A description of the procedures for withdrawing consent with a statement that

consent may be withdrawn at any time.

• The process for updating contact information such as an email address.

• How to obtain a paper copy of the information at no charge.

If there is a change in either the hardware or software requirements that may materially

affect the transmission of the electronic information, the employer must notify

participants about the change in the requirements, remind individuals about their right to

withdraw consent without penalty, and obtain a new consent form using the modified

system.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

11

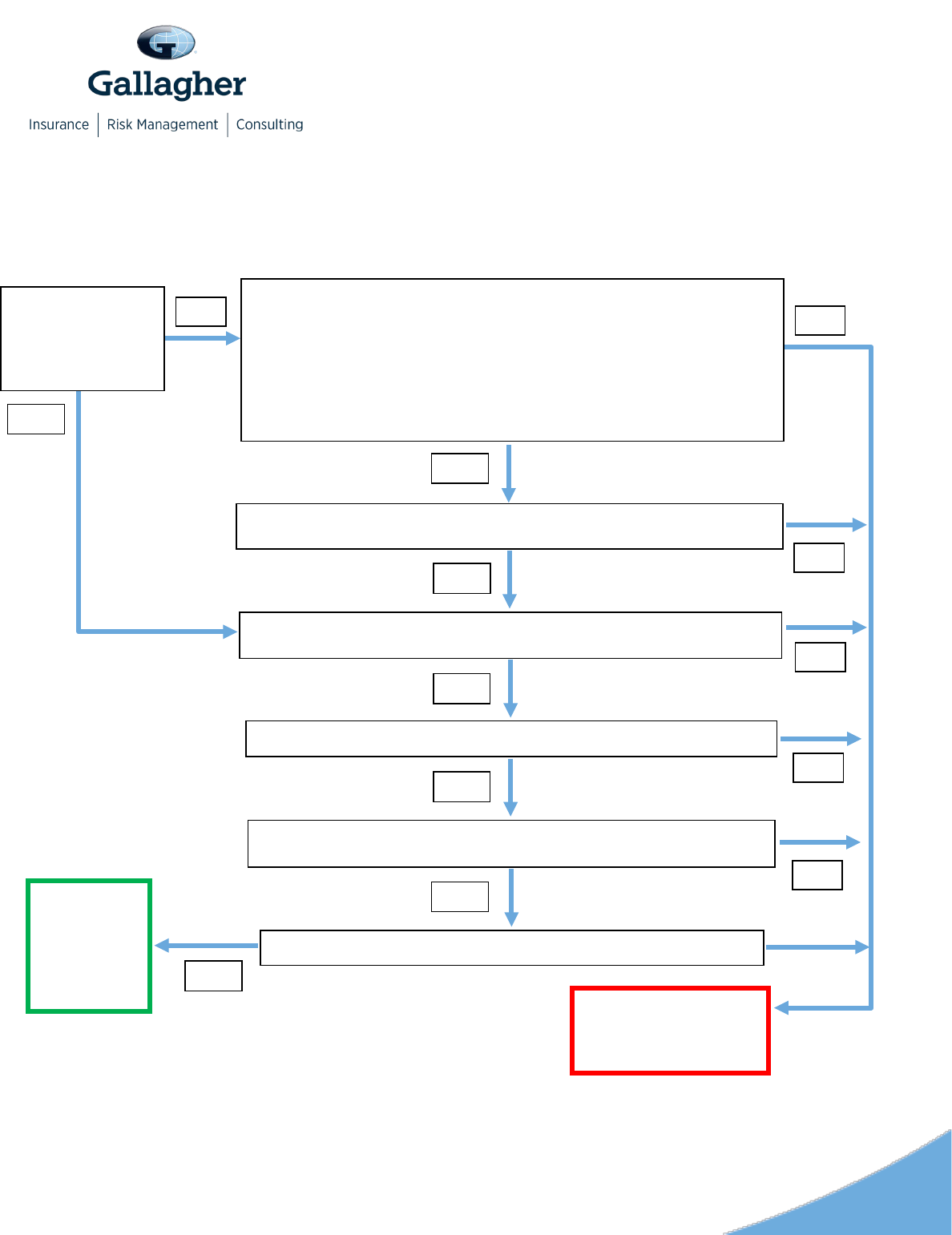

ERISA Requirements for Electronic Disclosure Flow Chart

*The DOL regulations indicate that “actual receipt” could include: (1) Adding a prominent link from the website's homepage to the

separate section that contains the material; (2) Providing directions on the website for how to replace a lost or forgotten password to

the extent one is needed; and/or (3) Maintaining the material on the website for a reasonable period of time following notice to

employees of their availability.

Does the employee

regularly access his or

her employer’s

electronic system as an

integral part of his or her

job?

Has the individual received a pre-consent statement that includes:

• Hardware and software requirements for material;

• Identification of available documents and their significance;

• Description of procedures for withdrawing consent and statement that consent may be

withdrawn at any time;

• Process for updating contact information; and

• How to obtain a paper copy of the information at no charge?

NO

Has the individual affirmatively consented in a manner that reasonably demonstrates the

individual's ability to access information in the electronic form that will be used?

YES

Has the individual been provided with a notice indicating where the material is located, the

nature of the material, and the significance of the information?

YES

Has the employer taken appropriate measures to ensure actual receipt of the material?*

Is a paper copy provided upon request and without charge?

Are the materials prepared and furnished in accordance with all applicable requirements

(e.g., timing and format requirements)?

YES

YES

YES

YES

The information

can be provided

electronically to

this individual in

accordance with

the ERISA

requirements.

YES

The information cannot be

provided electronically to this

individual under the ERISA

requirements.

NO

NO

NO

NO

NO

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

12

Posting on Employer’s Website

Employers can provide ERISA required disclosures on their websites provided that the

four general requirements (e.g., the style, format and contents for ERISA disclosures

applies) listed on page 6 are satisfied, and:

• The individual is provided with a notice indicating where the material is located, the

nature of the material, and the significance of the information. For example, the

employer may send an email or a postcard alerting the participant to the material

that is being posted to the website.

• The employer takes appropriate measures to ensure actual receipt of the material.

• The materials are prepared and furnished in accordance with all applicable

requirements (e.g., timing and format requirements).

• A paper copy is provided upon request and without charge.

The DOL regulations indicate that “actual receipt” could include:

• Adding a prominent link from the website's homepage to the separate section that

contains the material.

• Providing directions on the website for how to replace a lost or forgotten password to

the extent one is needed.

• Maintaining the material on the website for a reasonable period of time following

notice to employees of their availability.

Employers that choose to post material on their websites that may include confidential

information must take additional steps to safeguard any personal information.

The DOL regulations include an example of material contained in a separate section of

an employer’s website, which is easily accessible from the employer’s home page. The

separate section is restricted with access based on the use of either a password or PIN.

However, no formal guidance has been provided on what constitutes adequate

safeguards.

Note: Posting information to a website without also sending a separate notification such

as an email or post-card alerting the participant will not be sufficient. Failure to provide

notice of the posting is similar to just putting materials in a breakroom where they are

available to employees which is not an acceptable method of distributing materials

under the DOL regulations.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

13

Gallagher’s article “Electronic Communication Rules and Sample Language” contains a

description of the rules, sample language, and a sample consent that may be modified

and used when distributing ERISA disclosures electronically. In some cases, an

employer may not be able to provide materials electronically. In those situations,

employers will need to provide paper materials via the U.S. mail.

ACA

With the exception of the Marketplace notices, these notices must be provided when an

employee becomes eligible for the plan and annually. The SSBC must also be provided

when there is a mid-plan year material change that affects the contents of the SBC.

Notices include the following:

• Marketplace notice

• SBC for each medical plan option

• Notice of grandfathered status (if applicable)

• Patient protection notice

• No Surprises Act notice

Marketplace Notice

The Marketplace Notice must be provided by all employers subject to the Fair Labor

Standards Act (FLSA) to all newly hired employees within 14 days of hire. Two model

notices are available; one for employers that offer a medical plan and one for employers

that do not offer a medical plan.

SBC

The SBC must be created using the DOL’s template. The DOL website contains the

template with specific instructions for creating the SBC. For some fully insured plans,

the insurer may create the SBC, but it will generally be the employer that must distribute

the SBC. Employers with self-insured plans must both create and distribute an SBC.

ERISA plans must follow the DOL rules for electronic disclosure of the SBC.

Applies to: all group health plans sponsored by private employers, non-federal

governmental employers, and church plans that are not excepted benefits

1

or

retiree-only plans.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

14

Non-ERISA plans such as non-federal governmental and church plans may satisfy the

notice requirement by using the ERISA rules. Alternatively, non-federal governmental

plans may satisfy the distribution requirement by following the rules for electronic

disclosure that apply in the individual insurance market.

The SBC must be provided to the participant; separate notices for other family members

are not required unless the plan is aware of the fact that a family member has a different

address.

Grandfathered Notice

For grandfathered medical plans, the notice of grandfathered status must be provided

annually and may be provided in the SPD or similar document for non-ERISA plans.

Sample language is available. In addition, plans that lose grandfathered status must

notify employees that the plan’s grandfathered status has been lost.

Patient Protection Notice

All group health plans must provide a Patient Protection Notice. This notice summarizes

the rules for the selection of a Primary Care Physician (PCP) (including pediatrician)

where designation of a PCP is required by the plan, coverage for routine obstetrical and

gynecological services, and a description of minimum coverage of services in an out-of-

network hospital emergency room. The notice must be provided annually and may be

provided via the SPD (or similar document for non-ERISA plans). The DOL has

provided sample language.

Prior to 2022, only non-grandfathered group health plans were required to provide this

notice.

No Surprises Act Notice

Beginning in plan years on or after January 1, 2022, a group health plan must make

publicly available, post on a public website of the plan, and include in the explanations

of benefit (EOBs) the protections against surprise billing under both the federal No

Surprises Act and any applicable state surprise billing laws. There is no requirement to

disclose this notice annually. A model notice is available.

Electronic Distribution Rules

Marketplace Notice

The Marketplace Notice may be provided electronically as long as the ERISA

requirements for electronic disclosure are satisfied.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

15

Summary of Benefits and Coverage (SBC)

Gallagher has created a summary of the electronic distribution requirements for

providing the SBC, which includes a flowchart and describes separately the rules for

private, non-federal governmental and church plans.

Electronic delivery is permitted for participants who enroll online and for individuals

(employees or family members) who request the SBC online. In either case, the plan

must provide a paper copy if requested. For employees covered under the plan who do

not enroll online, the SBC may be distributed using the ERISA rules for electronic

disclosure. For employees eligible, but not enrolled, the SBC may be provided

electronically if the format used is readily accessible and a paper version is provided

upon request at no charge. In addition, an Internet posting is permitted as long as

employees are notified in a paper form such as a postcard or via email that the material

is available on the Internet along with the Internet address. In all cases, paper copies

must be provided upon request at no charge.

Self-insured non-federal governmental plans may either use the ERISA rules or the

rules required for individual health insurance.

Grandfathered Notice

Grandfathered medical plans subject to ERISA must use the DOL’s rules for electronic

disclosure for distribution of the grandfather plan status notice. Non-ERISA plans may

also use the DOL’s rules.

Patient Protection Notice

Group health plans subject to ERISA must use the DOL’s rules for electronic disclosure.

Non-ERISA plans may also use the DOL’s rules.

No Surprises Act

There is no requirement to individually disclose this notice except on EOBs. Employers

sponsoring group health plans should post the notice on the public website of the plan.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

16

COBRA

The COBRA rules apply to all health coverage including excepted benefits such as

dental, vision, hearing, health FSA, EAP, wellness programs, and onsite clinics. The

primary required notices are:

• General/initial notice

• Election notice

• Notice of unavailability

• Notices of early termination

The COBRA general/initial notice must be distributed to the employee upon enrollment,

or the employee and the employee’s spouse if the spouse is covered. The election

notice or notice of unavailability of COBRA continuation must be provided when the plan

receives a notice of a qualifying event such as termination of employment or divorce.

The notice of early termination of COBRA coverage must be sent if coverage will be

terminated before the end of the 18, 29, or 36 month maximum period. Model

general/initial and election notices are available on the DOL’s website. The DOL has not

provided samples for the other two notices. However, Gallagher has sample language

that you may wish to use.

Electronic Distribution Rules

For all plans subject to ERISA, COBRA notices may be sent electronically using the

DOL’s rules described earlier. Non-ERISA plans may also use those rules.

While allowed, electronic distribution may be problematic. For example, the initial

COBRA notice must be provided to the employee and, if enrolled, to the spouse. In

many cases, the employer can provide the initial notice to the employee using the

employer’s email system or intranet, but will not be able to provide the notice to the

employee’s spouse using the same system. The employer would need to provide a pre-

consent notice and obtain an electronic consent from the spouse to use electronic

delivery. When there is a qualifying event, the plan must provide an election notice to

each qualified beneficiary. Providing election notices to other COBRA qualified

beneficiaries, such as the employee’s spouse and any adult dependents, would also

require following the electronic notice and consent rules for each qualified beneficiary.

Applies to: all group health plans sponsored by private and public employers that

have at least 20 employees. Church plans are exempt from COBRA.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

17

Provision of the election notice using the employer’s intranet or email may not work

where the qualifying event is the termination of employment. Sending an election notice

to the employee under other circumstances – such as a loss of coverage when the

employee’s hours are reduced – may be feasible.

HIPAA Portability

HIPAA portability regulations contain several requirements applicable to medical plans

including special enrollment rights for employees in the event of marriage, birth, or

adoption (including placement) of a child, loss of other medical coverage, gain of

eligibility for premium assistance under Medicaid or CHIP, or loss of eligibility under

Medicaid or CHIP. HIPAA Privacy regulations contain specific rules designed to protect

the privacy of an employee and beneficiary’s protected health information (PHI). PHI

includes the employee’s (or a beneficiary’s) individually identifiable health information

that is received, maintained, or transmitted by a health plan.

HIPAA rules require employers sponsoring medical plans (portability rules) to provide

the following notices to employees enrolled in the plan:

• Children’s Health Insurance Program Reauthorization Act (CHIP)

• HIPAA Special Enrollment Rights

• HIPAA Opt-Out Election Notice (Self-insured non-federal governmental plans only)

CHIP

The CHIP notice provides contact information for State Children’s Health Insurance

Program in the employee’s state. Employers must provide this notice to employees

eligible for their medical plan on an annual basis. A model notice, which is available on

the DOL’s website, is updated annually.

Special Enrollment Rights

Employers are required to provide employees with a notice explaining their HIPAA

special enrollment rights in the event of marriage, birth or adoption (including

placement) of a child, the loss of other medical coverage, gain of premium assistance

under Medicaid or CHIP, or loss of eligibility under Medicaid or CHIP.. Employees must

Applies to: all group health plans that are not excepted benefits or a retiree-only

plan. Self-insured, non-federal governmental plans that choose to opt-out of certain

HIPAA portability requirements use the Self-Insured Non-Federal Governmental

Plan HIPAA Opt-Out Election Notice below.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

18

be given a notice when they first become eligible to enroll in the medical plan.

Appropriate language must also be contained in an ERISA plan’s SPD (or similar

document for non-ERISA plans). Sample language is available.

Self-Insured Non-Federal Governmental Plan Opt-Out Election Notice

Self-insured medical plans sponsored by non-federal governmental employers are

permitted to opt-out of several of HIPAA’s portability requirements.

1

However, in order to

make an election to opt-out the plan must notify the Consumer Information and

Insurance Oversight (CCIIO), which is part of the Centers for Medicare and Medicaid

Services, and plan participants both when the election is made and on an annual basis.

Gallagher has a page dedicated to the Self-Insured Non-Federal Governmental Plan

Opt-Out.

The employer must provide initial and annual notices before the first day of the plan

year to which the election applies. The notice should be provided to enrollees and

identify the provisions for which the plan is electing the exemption, that the federal law

provides the right to elect an exemption and that the plan has elected the exemption,

identify which parts of the plan are subject to the election, and identify which provisions

continue to apply to the plan. A model notice is available. The plan will be in compliance

if it prints the notice prominently in a benefits summary provided at the time of

enrollment and annually.

Electronic Distribution Rules

CHIP and HIPAA special enrollment right notices may be provided electronically. Plans

subject to ERISA need to follow the DOL’s requirements for electronic distribution

discussed earlier. Non-ERISA plans may also choose to use those rules.

Non-federal governmental employers with self-insured medical plans that have elected

to opt-out of one or more of the HIPAA portability requirements may notify affected

enrollees electronically via email if the CCIIO’s requirements for electronic distribution

are satisfied. Initial notices must be provided prior to the first day of the plan year, and

renewal notices must be provided no later than the last day of each plan year. A model

notice is available.

1

These plans may opt out of the requirements under the Mental Health Parity and Addiction Equity Act, Michelle’s

Law, the Women’s Health and Cancer Rights Act, and the Newborns’ and Mothers’ Health Protection Act.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

19

HIPAA Privacy Notices

Health plans are required to provide the following privacy notices:

• Notice of Privacy Practices

• Notice of the availability of the Notice of Privacy Practices

Employers with self-insured health plans, and insured health plans with access to PHI,

must distribute a Notice of Privacy Practices (NPP) to employees when they enroll in

any of the employer’s health plans. The NPP describes how the plan may use and

disclose PHI and includes information about the plan’s legal obligation to safeguard

employees’ (and other covered individuals’) PHI. Every three years the employer must

provide a notice to covered employees about the availability of the NPP. Finally, the

employer must provide a new NPP when the contents of the NPP have been changed.

Electronic Distribution Rules

The NPP may be provided electronically via email if (and only if) the employee has

agreed to receive the notice electronically and the agreement has not been withdrawn

before the NPP is sent. Note that the NPP may only be distributed via email. It is not

sufficient simply to post a copy of the NPP on an electronic enrollment portal or link to

the NPP from an enrollment platform landing page. The NPP or a link to the NPP must

be provided via email.

If the plan knows that the email transmission did not reach the employee, the plan must

provide a paper copy to the employee. The NPP does not have to be provided as a

separate document; it may be included with other materials such as an SPD or

enrollment materials, but if it is provided electronically with those materials, the prior

consent standard must be met. If the health plan has a website, the NPP must be

posted on the health plan’s website. If the employer maintains a website for its

business, it does not have to post the NPP on that site. Gallagher created a sample

consent form that may be modified, as appropriate, and used to obtain consent to

provide the HIPAA NPP electronically.

Applies to: all health plans, with an exception for self-administered plans with less

than 50 participants

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

20

IRS Required Forms and Notice

Several types of IRS Notices are not necessarily required when an employee first

enrolls in benefits, but for purposes of easing an employer’s administrative burdens, the

employer may wish to obtain consent to provide those notices electronically in

conjunction with enrollment for the following categories of notices:

• Forms 1095 (coverage and/or offers of coverage)

• Evergreen election notice under a cafeteria plan

Forms 1095-B and 1095-C

Employers that are applicable large employers subject to ACA’s Employer Mandate and

employers with self-insured medical plans must provide Forms 1095, which may be

either statements of self-insured medical coverage provided to employees and family

members or statements about offers of coverage to full-time employees (Forms 1095-B

or 1095-C). Statements for the previous calendar year must be provided by January 31

of the subsequent year. Beginning with tax years beginning after December 31, 2020,

proposed regulations an automatic 30-day extension, requiring the notice to be provided

by March 2 of each year.

Cafeteria Plan Evergreen Election Notice

Some cafeteria plans are limited to pre-tax employee contributions for coverage under a

single plan. Employers offering these plans may not have a formal annual enrollment.

Once an employee makes his or her choice, that election remains in effect until the

employee affirmatively changes it – often called an “evergreen” election. For cafeteria

plans that use an evergreen election, IRS rules require that the employer distribute a

notice to employees annually advising employees of their right to make an election

change.

Electronic Distribution Rules

Employers may furnish copies of statements – Forms 1095-B or 1095-C – electronically

if the employee consents to electronic distribution. The employer must obtain the

employee’s consent in a way that demonstrates that the employee can effectively

access the statement. Gallagher has created a sample procedure with sample language

that can be used as a starting point to create a compliant procedure.

Applies to: all employers, although variations exist within each type of disclosure.

See below for more detail.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

21

The required annual notice for cafeteria plans that use an evergreen election may be

provided electronically if the employee has consented electronically. Employee consent

is not required if the employee has the effective ability to access the electronic medium

(for example, the employer’s own email system) that will be used to provide the notice.

The electronic confirmation must be accompanied by a statement that the employee

may request a paper copy at no charge.

Employee Consent Requirements

Where employee consent is required, the employee must consent to electronic delivery

and before consenting must be provided with a statement that includes the following:

• The employee has the right to receive the notice in a paper document rather than

electronically.

• The employee still has the right to receive a paper copy after consenting and

receiving the electronic notice. The plan may charge a reasonable fee for the paper

document. The amount of the fee must be disclosed in the pre-consent statement.

• The employee may withdraw consent (to receive any notice electronically) on a

prospective basis.

• The scope of the consent the employee is being asked to provide. For example,

whether the consent is just for this notice, or whether it also applies to future notices.

• Procedures for updating his/her electronic confirmation information (e.g., email

address).

• The hardware and software needed to access and retain the notice.

The employee’s consent to receiving these documents electronically must be obtained

using one of two methods:

• the employee consents electronically in a manner that demonstrates that he or she

can access the material in the electronic medium that will be used to send the

material; or

• the employee consents using a paper document if the employee confirms consent

electronically in a manner that reasonably demonstrates that the employee can

access the electronic confirmation in the electronic format that will be used.

Employee Enrollment in a Cafeteria Plan

In addition, when a plan uses electronic enrollment the following additional requirements

apply:

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

22

• The employee must be able to effectively able to access the electronic medium

being used to make the elections.

• The electronic system must be reasonably designed to prevent any person other

than the employee (or other participant such as a COBRA qualified beneficiary) from

making an election such as by use of a password or PIN.

• The system must give the participant making the election a reasonable opportunity

to review, confirm, modify or rescind the election before it becomes effective.

• The employee must receive a confirmation notice of the election. The confirmation

can be provided electronically or as a paper document. The confirmation must be

delivered within a reasonable period. For example, the participant should have

enough time after receiving the confirmation to correct mistakes.

• The employee must have the right to receive the confirmation in a paper document

rather than electronically.

The employer will need to track participant elections and consolidate the results of both

paper and electronic elections into files – either electronic or paper – and transmit

enrollment data to claim administrators and other vendors, such as Pharmacy Benefit

Managers, who will need to upload the enrollment data into their systems. Human

Resources will also need to share the information with payroll so that salary reduction

(pre-tax) and/or deduction (after-tax) amounts can be entered into the payroll system.

To the extent that an employer is able to conduct enrollment electronically, these final

stages of the enrollment process will be much easier to manage.

Other Required Notices

Several additional notices are required for many, but not all, employers under several

different federal laws. The following notices are required for both ERISA and non-ERISA

plans:

• Part D Certificate of Creditable (or Non-Creditable) Coverage

• Michelle’s Law Notice

2

• Wellness Program notices required by HIPAA/ACA, ADA, and GINA

• Newborns and Mothers Health Protection Act Disclosure (NMHPA)

3

• Women’s Health and Cancer Rights Act

3

2

Non-federal governmental employers with self-insured medical plans may elect to opt out of these requirements

subject to the notice requirements that apply to HIPAA opt-outs. (See HIPAA section for more information.)

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

23

Part D Creditable Coverage Notice

Employers are required to provide a notice to Medicare-eligible employees that

indicates if the employer’s drug plan provides “creditable” coverage (i.e., the coverage is

at least as valuable as Medicare Part D drug coverage) or if the coverage is “non-

creditable.”

This notice must be provided when an employee joins the plan and annually prior to the

beginning of Medicare’s open enrollment period each year. Model notices and

instructions are available on the CMS website.

Michelle’s Law

Michelle’s law requires continuation of health coverage when coverage for children is

based on student status. Under the ACA, medical plans must continue coverage until an

employee’s natural, adopted, step, or foster child attains age 26 and may not require

student status. Some plans may provide coverage beyond age 25, but condition

coverage at older ages on student status. Plans that include a student status

requirement for older children should provide a description of the terms of continuation

coverage available during medically necessary leaves of absence. ERISA employers

should consider including in their SPD and in the plan’s open enrollment materials. No

model notice exists.

Wellness Program Notices

Wellness programs may be subject to rules under HIPAA/ACA, the Americans with

Disabilities Act (ADA), and/or the Genetic Information Nondiscrimination Act (GINA). For

assistance in determining which wellness rules may apply to a particular type of

wellness plan, please see Gallagher’s Flowchart: Navigate Wellness Regulations.

Applies to: employers sponsoring medical plans that include coverage for

prescription drugs

Applies to: group health plans that require school enrollment for dependent

eligibility. Self-insured non-federal governmental plans may opt-out of this

requirement by using the opt-out process and notice as described in the HIPAA

Portability section.

Applies to: employer-sponsored wellness plans that feature certain designs as

described below.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

24

The HIPAA wellness notice rules apply to all participants in wellness programs that are

related to a health plan or are themselves a health plan. Under HIPAA/ACA rules, a

reasonable alternative standard must be provided for individuals who cannot satisfy a

standard under a health-contingent wellness program. Notice regarding the availability

of a reasonable alternative standard must be disclosed in plan materials such as the

SPD and to individuals who fail to satisfy the standard.

The ADA applies if the wellness program includes disability-related inquiries or medical

exams including biometric testing. The ADA applies only to employees. Sample ADA

language is available.

GINA applies if the wellness program involves genetic information, for example a

wellness program that includes a Health Risk Assessment that asks about family

medical history. GINA applies to all participants. Sample GINA language is available.

Under the EEOC’s rules for ADA and GINA, the notice may be given in any format that

will be effective in reaching employees.

Newborn and Mothers Health Protection Act

The NMHPA requires medical plans to cover minimum hospital stays for delivery of a

child. Employers sponsoring medical plans are required to provide a disclosure of the

NMHPA coverage rights. Sample language is available.

ERISA plans must include this information in the plan’s SPD. Non-ERISA plans are

required to include appropriate language in the plan document.

If a self-insured non-federal governmental plan has opted out of this requirement, a

notice must be provided to participants when an employee enrolls and at each annual

enrollment. (See HIPAA Portability section for more detail) The notice must be printed

prominently in the SPD (or equivalent document) provided at initial and annual

enrollment

Women’s Health and Cancers Rights Act

Applies to: all group health plans. Self-insured non-federal governmental plans

may opt-out of this requirement by using the opt-out process and notice as

described in the HIPAA Portability section.

Applies to: all group health plans. Self-insured non-federal governmental plans

may opt-out of this requirement by using the opt-out process and notice as

described in the HIPAA Portability section.

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

25

WHCRA requires medical plans to cover breast reconstruction following a mastectomy.

Employers that sponsor medical plans must provide employees with a notice when the

employee enrolls in the medical plan. Sample language is available.

Electronic Distribution Rules

For each of these notices, plans subject to ERISA must use the DOL’s disclosure rules

for these notices. Non-ERISA plans may use the DOL’s disclosure rules.

With regard to the creditable coverage notice, CMS has indicated that it prefers that

these notices be provided in paper format; however, electronic distribution is permitted if

the DOL’s rules for electronic disclosure are satisfied.

For the ADA and GINA wellness notices, EEOC FAQs state that it may be provided in

hard copy or as part of an email as long as the subject lime of the email indicates that

the information being communicated relates to the wellness program. In addition,

employees with a disability may need to have a notice in another format – such as a

large print version for employees with vision impairments. In addition, if notices are

distributed electronically, they should be formatted so that employees who use screen-

reading programs can read them.

Although electronic disclosure is permissible for alternate recipients under a QMCSO or

a NMSN, it may often be impractical. Alternate recipients will not have access to the

employer’s email system or intranet. Materials provided to an alternate recipient will

require a pre-consent notice and consent using the electronic method that will be used

to provide plan and enrollment materials. Employers will need to follow the DOL’s rules

for providing materials to individuals who do not have worksite access. Because the

materials to be provided to alternate recipients are different from those for active

employees, and the rules for providing materials electronically are more complicated

than for active employees, many employers will provide these materials on paper using

U.S. mail.

Employer Action Steps

In the near future, and in some cases for the longer term, employers may need or want

to distribute information about their health and welfare benefits plans electronically.

Employers that have conducted annual enrollments in person or on paper in the past

may want or need to move to an electronic system to the extent possible. Some

employers may be in a position to make this a gradual change. Others may not have

that option, but may need to move to electronic methods now. Employers facing a

change to electronic distribution will want to:

©2020-2022 Arthur J. Gallagher & Co. All rights reserved.

26

• Create a list of materials that will be distributed electronically,

• Identify groups of individuals for whom is it not practical to use electronic disclosure

and determine how materials will be provided,

• Obtain employee consents to provide materials electronically,

• Where feasible obtain consents from other individuals,

• Determine how to provide materials to employees (and others) who do not provide

consent,

• Create the electronic versions of materials to be distributed, and

• Determine to what extent enrollment can be performed electronically.

The intent of this analysis is to provide general information regarding the provisions of current federal

laws and regulation. It does not necessarily fully address all your organization’s specific issues. It should

not be construed as, nor is it intended to provide, legal advice. Your organization’s general counsel or an

attorney who specializes in this practice area should address questions regarding specific issues.