1

Value of Data:

There’s No Such Thing as a Free Lunch in the Digital Economy

Wendy C.Y. Li (U.S. Bureau of Economic Analysis)

1

Makoto Nirei (University of Tokyo)

Kazufumi Yamana (Kanagawa University)

First Version Date: September 14, 2018

Latest Revised: February 6, 2019

2

SUMMARY

The Facebook-Cambridge Analytica data scandal demonstrates that there is no such thing as a free

lunch in the digital world. Online platform companies exchange “free” digital goods and services

for consumer data, reaping potentially significant economic benefits by monetizing data. The

proliferation of “free” digital goods and services pose challenges not only to policymakers who

generally rely on prices to indicate a good’s value but also to corporate managers and investors

who need to know how to value data, a key input of digital goods and services. In this research,

we first examine the data activities for seven major types of online platforms based on the

underlying business models. We show how online platform companies take steps to create the

value of data, and present the data value chain to show the value-added activities involved in each

step. We find that online platform companies can vary in the degree of vertical integration in the

data value chain, and the variation can determine how they monetize their data and how much

economic benefits they can capture. Unlike R&D that may depreciate due to obsolescence, data

can produce new values through data fusion, a unique feature that creates unprecedented

challenges in measurements. Our initial estimates indicate that data can have enormous value.

Online platform companies can capture most benefits of the data, because they create the value of

data and because consumers lack knowledge to value their own data. As trends such as 5G and the

Internet of Things are accelerating the accumulation speed of data types and volume, the valuation

of data will have important policy implications for investment, trade, and growth.

Keywords: Artificial Intelligence, Data, Data Monetization, Data-driven Business Model,

Intangible Capital, Innovation, Online Platform, and Value of Data

1

The views expressed are those of the author and do not necessarily reflect those of the U.S. Department of

Commerce or the Bureau of Economic Analysis.

2

We thank Daniel Levinthal, Sadao Nagaoka, Dylan Rassier, Paul Roberts, Gabriel Quiros Romero, Rahul Telang,

and participants in the 2018 IP Statistics for Decision Makers Conference and the Sixth IMF Statistical Forum for

helpful comments.

© 2018 by Wendy C.Y. Li, Makoto Nirei, and Kazufumi Yamana. All rights reserved. Short sections of text, not to

exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is

given to the source.

2

1. Introduction

Because of improved programming capabilities and the rapid price decline of information

technology hardware and services, new business models have emerged and many of them are

embodied in online platforms. For example, online sharing platforms like Uber increase the

efficiency of underutilized assets and lower the consumption prices of the services. E-commerce

platforms, such as Amazon Marketplace, have greatly reduced transaction costs for many small

and medium sized enterprises (SMEs) to sell products across states and borders. Online platforms,

mostly created and run by young companies, are physical-asset-light but have grown fast and

deeply disrupted many industries (Li, Nirei and Yamana, 2017, 2018). A prominent example is

Airbnb, a company that has only 1.7% of the employee size of Marriott International, but more

listed properties than the top five global hotel groups combined (Hartmans, 2017). Moreover,

online platforms have been growing rapidly in scale. For example, based on Census data,

Hathaway and Muro (2017) show that the U.S. ridesharing service has been experiencing a hyper-

growth rate and can take over the taxi services in the near future.

Most online platforms have been providing digital goods and services to consumers at

seemingly zero monetary cost, and economists have been attempting to measure the welfare effects

related to “free” digital goods and services. For example, Brynjolfsson et al. (2018) estimate that

Wikipedia creates US $50 billion consumer surplus per year in the U.S. alone. However, the

Facebook-Cambridge Analytica data scandal demonstrates that there is no such thing as a free

lunch in the digital world. In fact, consumers exchange their personal data for “free” digital goods

and services. As large data holders, online platform companies like Google and Facebook can reap

potentially significant economic benefits by providing data targeting services and/or licensing the

use of the data to third parties. Therefore, phrases such as “free goods” are misnomers. Welfare

3

analysis on digital goods and services without considering the value of data can mislead policy

analysis.

Online platform companies are physical-asset-light but can be extremely profitable. They

have collected copious amounts of rich data through their online platforms, monetized the data,

and created vast amounts of value from data. For example, Booking Holdings, the world’s leading

online travel platform company, reported a gross profit margin of 98% in 2017 and of 95%

averaged over three years (SEC, 2017). At its Amsterdam headquarters, 90% of Booking’s

employees are engineers (Yin, 2018). While being a data company, Booking outsources its data

centers to take advantage of cheap cloud services. Another example is Facebook: when it went

public in 2011, the value of its total assets was reported at US $6.3 billion, but its market valuation

reached as high as US $104 billion (SEC, 2012). The huge gap between the two numbers implies

the enormous value of its intangible assets, including the value of data. Facebook exchanges free

social media services for user data, and conducts analytics on user data to provide third parties

with data targeting services, currently mainly data targeted advertising. In 2017, its advertising

revenue was US $39.9 billion, contributing to 40% of its annual sales growth (Forbes, 2017).

Data are crucial for AI revolution and firms’ competitiveness, but they are intangible

capital whose value is very difficult to measure. On the one hand, data are not tangible capital that

suffers wear and tear. On the other hand, data are not regular intangibles like R&D capital that

may depreciate due to obsolescence (Li and Hall, 2018). The aggregation and recombination of

data can create new value. Furthermore, it is well known that getting data and information from

online platform companies is difficult (Demunter, 2018). These unique features of data pose

challenges to valuing data.

4

Nevertheless, what gets measured gets managed. Two examples can help us visualize the

size of the value of data. The first example is Apple. By charging app developers 30% commission

of their sales for accessing Apple’s consumer data, Apple has earned US $42.8 billion in revenue

in the past decade (Frier, 2018). The second example is ITA Software versus Farecast. ITA

Software is a large airline reservation network collecting the detailed transaction data of U.S.

airline tickets. When Farecast was an independent company, it purchased data from ITA Software

and conducted analytics to predict airfares (Mayer-Schönberger and Cukier, 2014). Farecast was

acquired by Microsoft in 2006 for US $110 million. However, ITA Software, the data owner, was

acquired by Google two years later for US $700 million. The acquisition price difference between

the two firms implies that data can potentially be more valuable than analytics capabilities. In the

age of AI implementation, as AI is becoming cheap, data are emerging as the core to govern the

overall power and accuracy of an algorithm (Agrawal et al., 2018; Beck and Libert, 2019; Lee,

2018). Moreover, how firms utilize their data analytics to monetize data relies on their business

models. When Google purchased ITA Software, it might already have a business plan to monetize

the data. In 2011, three years after the purchase of ITA Software, Google launched Google Flights,

which has become the most popular flight search online platform in the U.S. (Whitmore, 2018).

The substantial market valuation of data shown in the ITA Software-Farecast-Google

Flights example highlights the importance of measuring data activities related to online platforms.

The measurement of the value of data can provide important information not only for public

policies such as digital trade and national data policies, but also for corporate strategies such as

investment and outsourcing decisions in data and data-driven decision making processes.

Moreover, this kind of information is also important for investors to understand firm fundamentals

and facilitates capital flows to innovative firms in the era of data-driven economy.

5

Online platforms can differ in their underlying business models. Business model represents

how a firm creates and delivers value for its customers while also captures value for itself in a

repeatable way (Johnson, 2018). Online platform companies are data companies, and their

underlying business models determine what type of data they collect, how data flow within online

platform networks, how the companies monetize the data, and what consumers can gain by

exchanging their data. Therefore, it is necessary to examine the value creation in different types of

online platforms to understand the common characteristics or possible variations.

In this paper, we conduct case studies to analyze data activities in seven major types of

online platforms classified by the Organization for Economic Co-operation and Development

(OECD, 2018a). We show how online platform companies take steps to create the value of data,

and present a data value chain to show the value-added data activities involved in each step. We

also present a physical supply chain of data monetization to illustrate what investment and

outsourcing options the companies face at each stage. We find that online platform companies can

vary in the degree of vertical integration in the data value chain, and the variation can determine

how they monetize their data and how much economic benefits they can capture. Our initial

estimates show that the value of data is enormous and depends crucially on online platform

companies’ data-driven business models. Moreover, online platform companies can capture most

benefits of the data, because they create the value of data and because consumers lack knowledge

to value their own data.

2. Online Platforms: Major Types and Data Activities

2.1 Typologies of Online Platforms

In this research, we adopt the OECD definition that an online platform is “digital services

that facilitate interactions between two or more distinct but interdependent sets of users (whether

6

firms or individuals) who interact through the service via the internet” (OECD, 2018a). For

example, based on this definition, Amazon Marketplace is an online platform, but Amazon direct

sales is not (OECD, 2018b).

In addition to some studies attempting to classify online platforms (Chen et al., 2018;

Demunter, 2018; van de Ven, 2018), OECD conducted a multiple-year project on online platforms

and has identified several typologies (OECD 2018a). As indicated in this official document that

has been reviewed by OECD countries, there are many typologies of online platforms, and the

choice among them depends on the research or practice need at hand. In some situations, it may

be useful to apply several topologies at once. Since online platforms continue to evolve in different

industry sectors across the globe, no single typology can cover all online platforms. Moreover,

some typologies use the same name for a certain type of online platforms, but the included

companies differ. Therefore, one should pay attention to the companies involved when comparing

the typologies from different studies.

We select the following seven major types of online platforms identified by OECD to study

the associated data activities and the data monetization strategies:

Type I: E-commerce Platform

Type II: Online Sharing Platform

Type III: Fintech Platform

Type IV: Online Social Network Service Platform

Type V: Online Matchmaking Platform

Type VI: Online Crowdsourcing Platform

Type VII: Online Search Platform

7

These types of online platforms have different underlying business models. For each type

of online platform, we conduct a case study to examine its underlying data-driven business model:

data flow, value creation for consumers, value creation for third parties, and how an online

platform company monetizes its data. Due to the serious limitation in publicly accessible

information, we focus on the companies for which some public data or reports are available.

2.2 Type I: E-commerce Platform

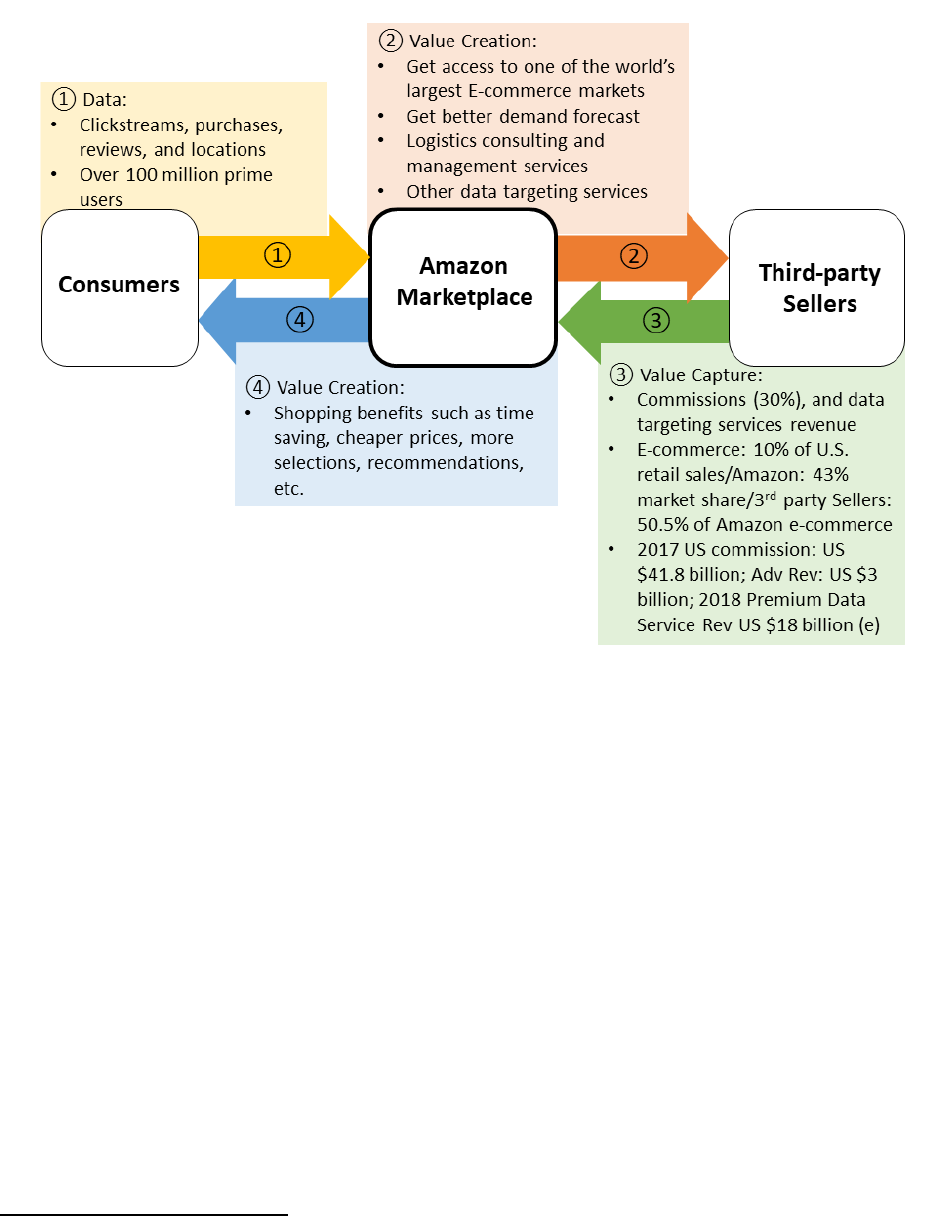

Type I is the e-commerce platform, and our case study is Amazon Marketplace (Figure 1).

Amazon Marketplace is an online platform that facilitates sales between consumers and third-party

sellers. On the one hand, it offers consumers a place to purchase a wide range of products from

more selections with cheaper prices. On the other hand, it allows third-party sellers to access one

of the world’s largest e-commerce markets in a cost-effective and time-efficient way.

Amazon charges third-party sellers a commission of approximately 30% of their sales

(WSJ, 2018). The commission pays for not only the cost of accessing one of the world’s largest e-

commerce markets but also the cost of “basic” access to Amazon’s consumer data. For example,

when a consumer purchases a good by cash in an offline supermarket, the supermarket and the

third-party seller that offers the good do not obtain data about the consumer. However, if the

customer pays by a credit or debit card, the supermarket but not the third-party seller will have

some data about the consumer. By contrast, when a consumer purchases a good online through

Amazon Marketplace, not only Amazon but also the third-party seller can acquire the consumer

data. Nonetheless, there is a difference in the degree and the details of the data. The third-party

seller can get the data displayed in the transaction; however, Amazon can obtain consumer data

beyond the transaction data, including browsing history and clickstreams. Moreover, Amazon has

all transaction data related to third-party sellers.

8

Figure 1: Type I: E-commerce Platform

Case Study: Amazon Marketplace

In terms of data flow, Amazon collects data on clickstreams, purchases, reviews, and

locations from consumers.

3

Then, it conducts data analytics to provide data-targeting services to

third-party sellers. For example, based on the geolocation data of consumers and demand forecast,

it can provide third-party sellers with logistics consulting services such as where to build the

warehouse. Bond (2018) reports that Amazon offers corporate clients premium data services,

which include demand and trend forecasts, and the price for such premium data services starts

from US $100,000 per year. In addition, Amazon gathers information of consumer price sensitivity

3

Note that online platform companies can also collect data from third-party sellers such as where they ship the

products if they choose to fulfill the orders by themselves. When online platform companies provide data targeting

services, they can incorporate the profile of their third-party sellers.

9

by funding discounts on third-party products. Combining this price sensitivity data and other data,

Amazon can conduct detailed profiling of each consumer and provide data-driven pricing strategy

services to third-party sellers.

In 2017, e-commerce accounts for 10% of U.S. retail sales, and Amazon has 43% of the

U.S. e-commerce market share (Molla, 2017). In addition, 50.5% of its e-commerce sales are

conducted through third-party sellers on Amazon Marketplace (Statista, 2018). Based on the 2017

Amazon Marketplace’s sales, US $139.5 billion, and the 30% commission charge to third-party

sellers, Amazon’s estimated annual revenue from the commission is US $41.8 billion (Amazon

10K report). While growing fast, Amazon’s data targeted advertising revenue in 2017 amounted

only to US $3 billion, merely 2.2% of its total revenue in that year. Compared to Facebook and

Google, Amazon does not rely on advertising revenue.

2.3 Type II: Online Sharing Platform

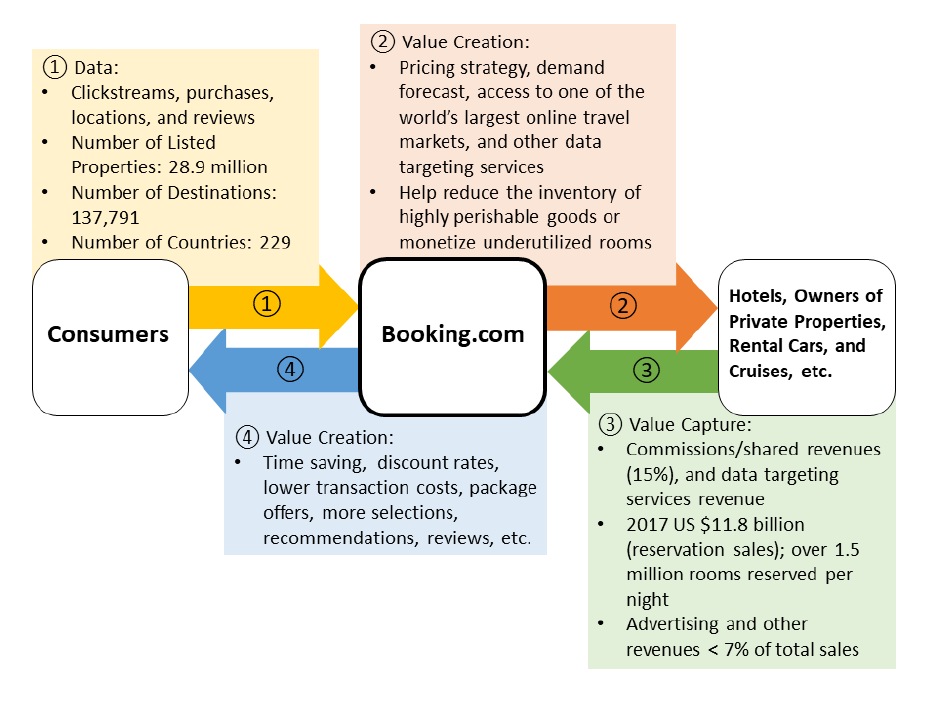

Type II is the online sharing platform, and our case study is Booking.com (Figure 2).

Booking.com is a leading online travel sharing platform that facilitates sales between consumers

and property owners. On the one hand, it offers consumers a place to reserve rooms from many

properties with discounted rates. On the other hand, it allows hotels or property owners to access

one of the world’s largest online travel markets and to reduce the inventory of their highly

perishable goods or monetize their underutilized private rooms. Booking.com charges a 15%

commission of the sales revenue from third-party sellers.

In terms of data flow, Booking.com collects data on clickstreams, purchases, reviews, and

locations from consumers. It also conducts data analytics to provide third-party sellers with data

targeting services, such as pricing strategy, demand forecast, and consulting services. It was

reported that Booking.com’s data analytics service on pricing strategy on average increased third-

10

party sellers’ sales revenue by 7% (Yin, 2018). The total number of its listed available private

rooms is larger than that of Airbnb. Since Booking.com charges third-party sellers a 15%

commission on their sales revenue, the 2017 estimated revenue from commissions alone is US

$11.8 billion. At its Amsterdam headquarters, Booking has 1,800 engineers that account for 90%

of its employees. The company outsources its data centers and benefits from cheap cloud services,

another business strategy that makes it physical-asset-light but extremely profitable.

Figure 2: Type II: Online Sharing Platform

Case Study: Booking.com

What is the difference between Booking.com and Marriott International, the world’s largest

hotel chain and a middleman in the hotel industry? In the early 1980s, Marriott invented a business

11

model by licensing its franchise and providing management services to real estate developers who

own hotel properties. However, Booking.com’s online platform and business model have allowed

it to reach a much broader range of property owners and to have a greater scalability within and

across regions. With more listed properties and a greater scalability, Booking.com can better

collect consumer data than Marriott in terms of volume, type, and speed. Moreover, Marriott’s

2017 gross profit margin, 16%, is far less than the 98% of Booking Holdings.

2.4 Type III: Fintech Platform

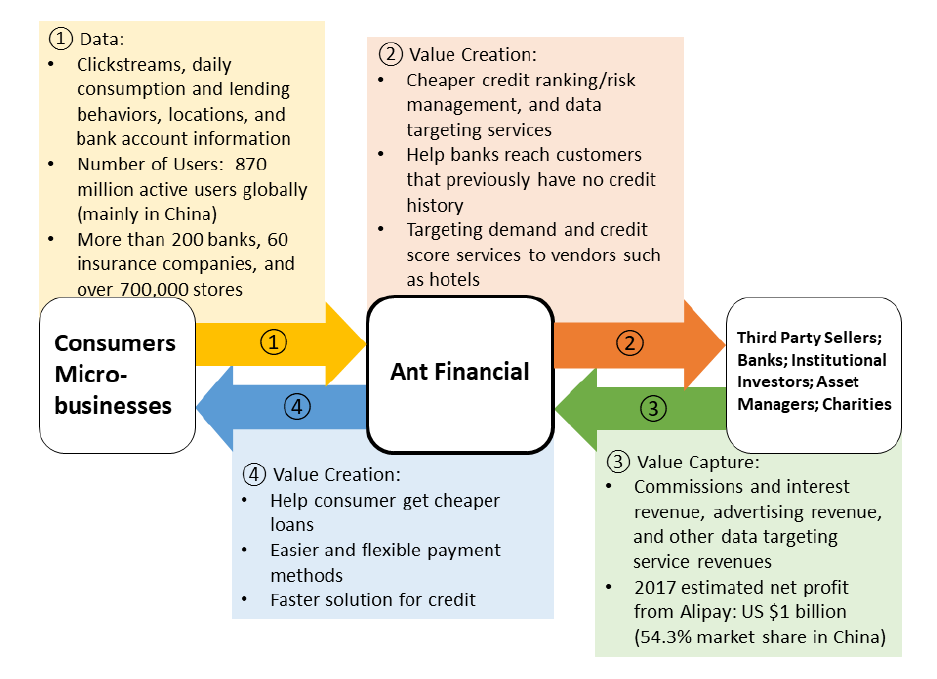

Type III is the Fintech platform, and our case study is Ant Financial (Figure 3). Ant

Financial is China’s largest online financial platform that facilitates financial transactions among

financial institutions, merchants, and consumers. On the one hand, it offers consumers and

microbusinesses a way to access the credit that was previously unavailable. On the other hand, it

allows financial institutions to reach customers who previously have no credit history. To date,

there are 870 million active users globally and the majority of them are in China.

In terms of data flow, Ant Financial collects data on clickstreams, daily consumption and

lending behaviors, locations, and bank account information from consumers and microbusinesses.

It conducts data analytics to provide data targeting services to corporate clients, such as credit

scoring services to financial institutions and demand forecast to hotels. Currently, its third-party

institutions include more than 200 banks, 60 insurance companies, and 700,000 stores. The

reported revenue from Alipay, its online payment platform, is US $1 billion in 2017.

12

Figure 3: Type III: Fintech Platform

Case Study: Ant Financial

2.5 Type IV: Online Social Network Service Platform

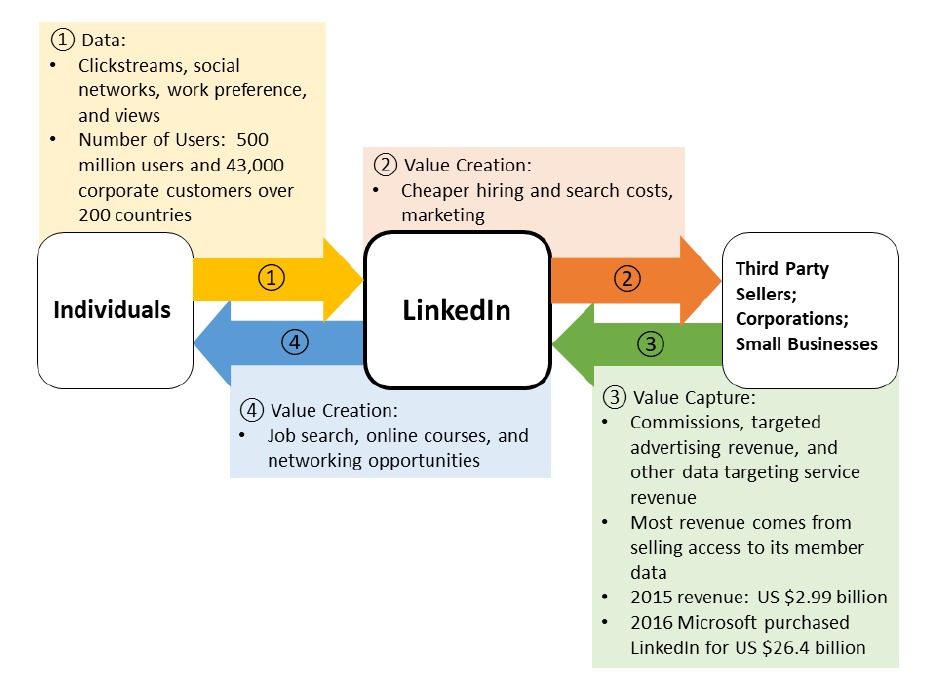

Type IV is the online social network service platform, and our case study is LinkedIn

(Figure 4). LinkedIn is a leading business and employment-oriented service platform that

facilitates professional networking. On the one hand, it allows individuals to post their résumés

and connect with professional friends. The professional network may also facilitate job search. On

the other hand, it allows employers to post jobs and search potential candidates. To date, there are

approximately 500 million users in over 200 countries.

13

In terms of data flow, LinkedIn collects data on clickstreams, work experience,

qualifications, professional networks, work preference, and views from its members. LinkedIn

then sells access to its member data to recruiters and sales professionals. Before it was acquired

by Microsoft, its revenue came mostly from selling access to its member data. LinkedIn’s revenue

in 2015 was US $2.99 billion and in 2016, Microsoft purchased LinkedIn for US $26.4 billion.

Figure 4: Type IV: Online Social Network Service Platform

Case Study: LinkedIn

2.6 Type V: Online Matchmaking Platform

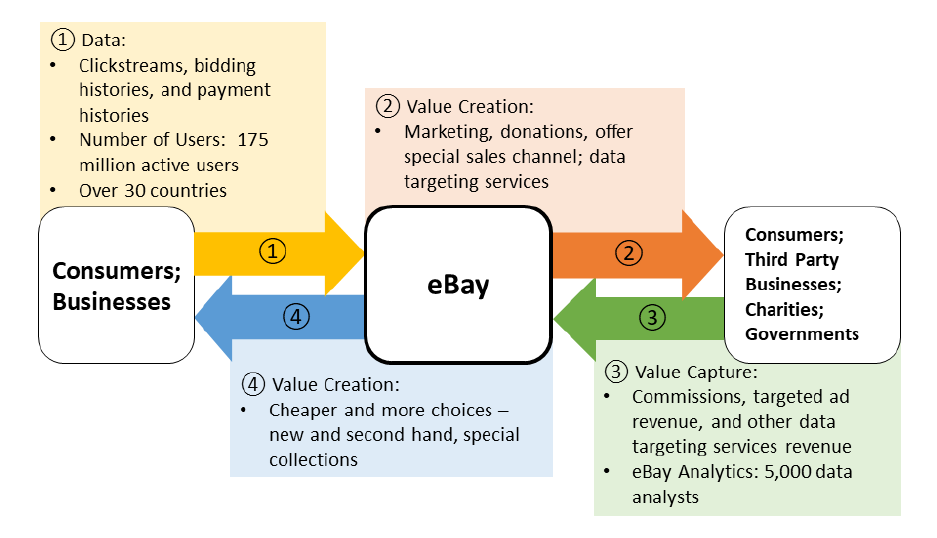

Type V is the online matchmaking platform, and our case study is eBay (Figure 5). Some

characteristics of eBay are similar to those in the type of e-commerce platform, but OECD

14

classifies the company as a matchmaking online platform. eBay is a leading online auction

platform that facilitates consumer-to-consumer, business-to-consumer, and business-to-business

sales. It is free for buyers to use, but sellers are charged fees for listing items (after a limited number

of free listings) as well as the sale. On the one hand, it provides the buyer with a convenient and

cheaper way to purchase products and special collection items. On the other hand, it allows sellers

to access a large online auction demand market. To date, there are 175 million active users in over

30 countries.

In terms of the data flow, eBay collects data on clickstreams, bidding histories, and

payment histories from users. It then conducts data analytics to sell data targeting services.

Employing approximately 5,000 data analysts, eBay reportedly has already experienced significant

business successes through its data analytics (Ovenden, 2016).

Figure 5: Type V: Online Matchmaking Platform

Case Study: eBay

15

2.7 Type VI: Online Crowdsourcing Platform

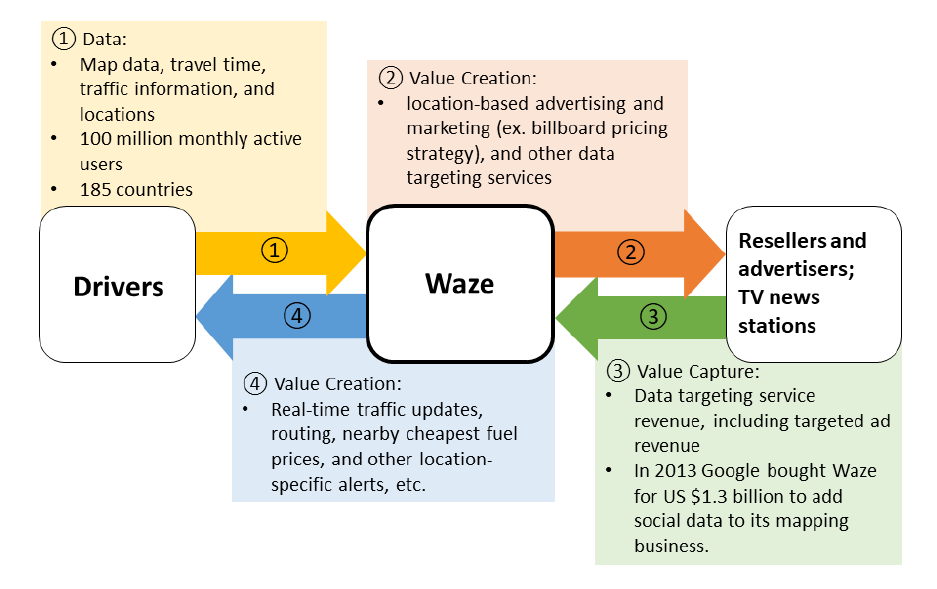

Type VI is the online crowdsourcing platform, and our case study is Waze (Figure 6). Waze

is a popular crowdsourcing platform that facilitates data sharing among drivers. Drivers report

accidents, traffic jams, speed and other information about road conditions. It provides drivers with

real-time traffic updates, routing, nearby cheapest fuel prices, and other location-specific alerts.

In terms of the data flow, Waze collects data on map data, travel times, traffic information,

and locations from drivers. It then conducts data analytics to provide data targeting services. For

example, Waze can use data on traffic flow to provide a pricing strategy service to billboard owners.

In 2013, Google bought Waze for US $1.3 billion to add social data to its mapping business (Cohan,

2013).

Figure 6: Type VI: Online Crowdsourcing Platform

Case Study: Waze

16

2.8 Type VII: Online Search Platform

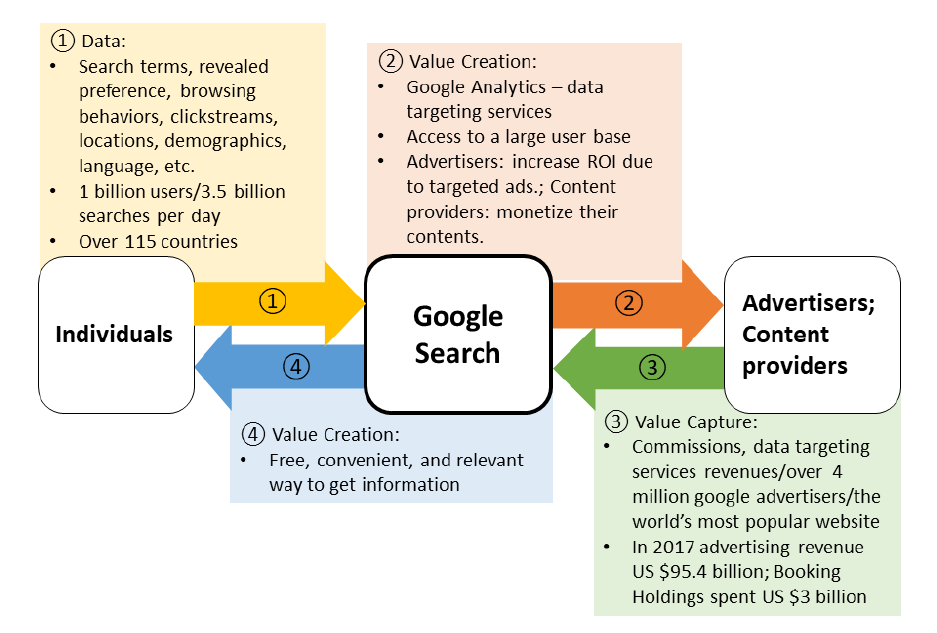

Type VII is the online search platform, and our case study is Google Search (Figure 7).

Google Search is currently the most popular online platform in the world. On the one hand, it

provides individuals with a free, convenient, and relevant way to get information instantly. On the

other hand, it allows advertisers and content providers to reach one of the world’s largest user

bases in an effective fashion. It also allows content providers to add search functionality to their

web pages and monetize their content.

Figure 7: Type VII: Online Search Platform

Case Study: Google Search

In terms of data flow, Google Search collects user data on search terms, revealed

preferences, browsing behaviors, locations, demographics, languages, etc. It then conducts data

17

analytics to provide data targeting services, such as data targeted advertising and demand forecast.

For example, in 2017, Booking Holdings paid Google US $3 billion for AdWords advertising.

Google’s revenues come mostly from data targeted advertising services, such as 87% in 2017.

3. Creation of the Value of Data, Data Value Chain, and Vertical Integration

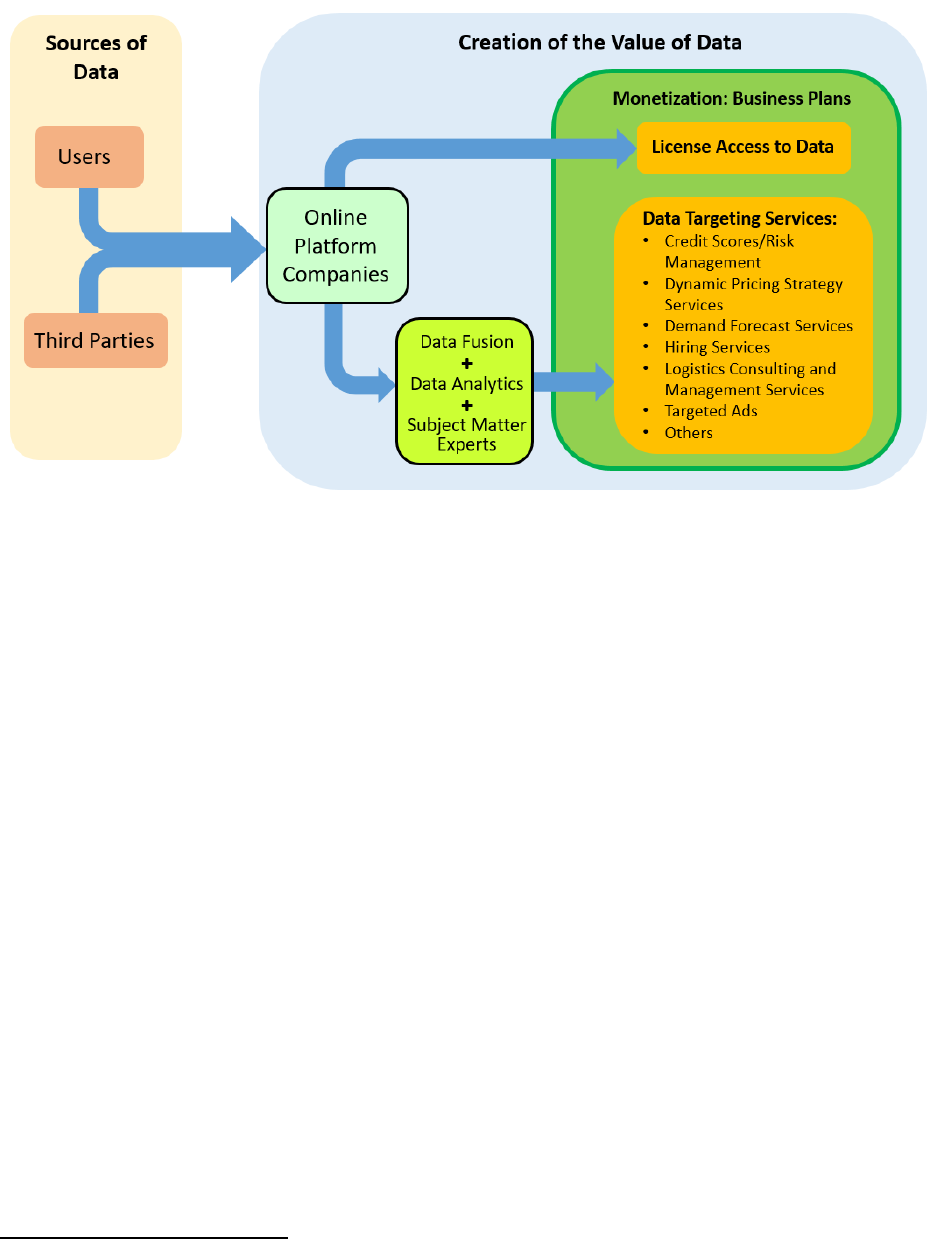

Based on the understanding from the study of the seven major types of online platforms

described in Section 2, Figure 8 summarizes how the value of data is created. Generally speaking,

online platform companies collect data from users and third parties, and use two ways to monetize

the data. One way is to license access to the data to clients, such as data analytics firms. Because

it is highly unlikely for one company to unveil and use the full potential of data, firms without in-

house data analytics capabilities and/or data monetization strategies tend to license the use of data.

The other way is to provide data targeting services to clients, such as third-party sellers. This option

requires internal technical skills in data fusion, data analytics, and subject matter experts to

produce a data-driven business plan for a data targeting service that can produce revenue for the

firm. Depending on its capabilities of data fusion and analytics and business expertise, an online

platform company can offer a variety of data targeting services that produce revenues. Even within

the same type of online platforms, companies can differ in the services they offer.

18

Figure 8: Creation of the Value of Data

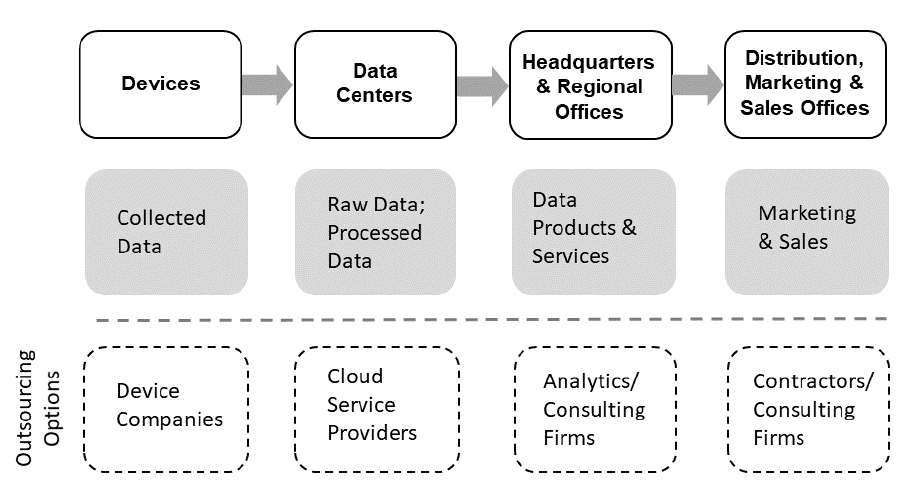

Figure 9 presents the physical supply chain of data monetization and indicates that online

platform companies have outsourcing options in each stage of the chain. For example, in the stage

of devices, Google pays Apple traffic acquisition costs (TACs) for the rights to be the default

search engine for the Safari web browser on iPhone, iPad, and Mac devices. TACs are the costs of

accessing a pool of consumers and acquiring their data. While the growth of iPhone users has been

slowed significantly, TACs paid by Google to Apple have increased 12-fold within 5 years and

will reach US $12 billion in 2019, which is equal to over 10% of Google’s data-targeted advertising

revenue in 2018 (Reisinger, 2017; Williams, 2018; D’Onfro, 2018).

4

These numbers indicate the

importance of the online traffic in Apple’s ecosystem to Google’s data-targeting services, and

explain why Google purchased HTC’s smartphone division in 2018 (Bergen and Sherman, 2017).

4

Here, we use the compound quarterly growth rate of Google’s advertising revenue from the first quarter of 2014 to

the third quarter of 2018 to estimate its advertising revenue in the fourth quarter of 2018.

19

Online platform companies can also outsource data storage to cloud service providers. Cloud

services, sold like utility, allows companies to tap the benefits of cost saving and high flexibility

in time and capacity. Moreover, companies can even outsource the management of customer

relations to firms such as Salesforce and the management of user support to firms such as ZenDesk.

Figure 9. Physical Supply Chain of Data Monetization

Online platform companies perform a series of value-added activities to create value from

data. Several studies have defined the big-data value chain from the engineering perspectives (e.g.,

Miller and Mork, 2013) but do not consider data monetization. Visconti et al. (2017) included the

monetization of data as a stage that is confined only to financial planning and cash flow forecasts

without organizational planning. They also consider data fusion as the main source of value

creation and a new business model, a definition different from what is generally used in business

management. The big-data value chains developed by these previous studies cannot well

characterize the mechanisms of data monetization found in our case studies.

20

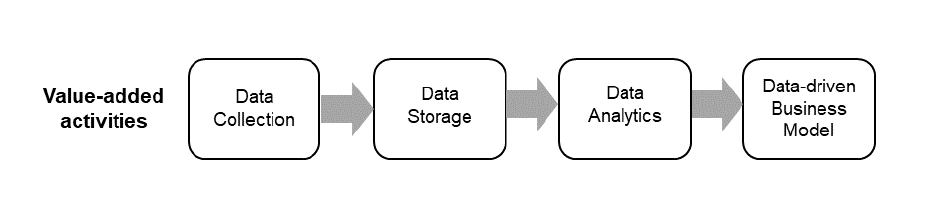

Based on the value creation of data and the physical supply chain identified in Figures 8

and 9, the data value chain is illustrated in Figure 10 and composed of four stages: data collection,

data storage, data analytics, and data-driven business model. Data collection can include intended

and unintended data collection activities. The collected data in this first stage are not limited to

unstructured and uncorrelated data. Data analytics includes data processing and visualization, and

the stage of data-driven business models includes business plans that guide the firm to use and

monetize data. The four stages do not contribute to the creation of the value of data equally. If

online platform companies cannot license the use of data and do not have capabilities in providing

data-targeting services, data itself may not contain much value. Data collection and storage

generate only small amounts of value and greater value is created when a firm has a data-driven

business model, which is a business plan that contains monetization-driven organizational

planning and cash flow forecasts. In other words, an online platform company can make some

profit by licensing the use of data, but having a data-driven business model can bring the most

return.

Figure 10. Data Value Chain

Two online platforms well exemplify the concept of data value chain and the vertical

integration within the chain. Before being acquired by Google, ITA Software focused its business

on the first two stages of the data value chain and licensed the use of data to companies such as

21

Farecast. Farecast focused its business on the last two stages by providing data-driven prediction

services of airfares to consumers. After acquiring ITA Software, Google has obtained the highest

degree of vertical integration in this data value chain. Another example is Twitter. Unlike Google

or Amazon, Twitter lacks strong in-house data analytics capabilities and monetization strategies

to vertically integrate into the data value chain fully. Even with vast amounts of data, it chose to

license the use of data before 2010. After 2010, when data targeted advertising services became a

popular monetization strategy, Twitter also adopted this business model to monetize its data. In

the first quarter of 2018, 12.3% of Twitter’s sales came from licensing the use of data, and the rest

from data targeted advertising services. But, the recent growth of Twitter’s earnings relies on its

high-margin and fast-growing business of licensing the use of data (Bary, 2018). An understanding

of the data value chain can help identify the right approach to value data.

4. Measurement of the Value of Data: Methodology and Case Studies

Since new values of data can be created through data fusion, including the fusion of

different types of independent datasets, data do not depreciate differently by the type of data. New

values of data can also be created through innovations in data-driven business models. These

unique features of data pose challenges to valuing data. Three conventional approaches can be

useful in measuring the value of data: the cost-based approach, the market-based approach, and

the income-based approach (Slotin, 2018). Using the cost-based approach, such as using the

salaries of data analysts and the costs of data centers, is likely to significantly underestimate the

value of data. Such a problem is clear as many online platform companies outsource data centers

to companies like Amazon and Microsoft to tap the benefits of cheap and flexible cloud services.

To assess the market-based approach, we used a difference-in-difference method and the state

22

space model (Varian, 2014; Scott and Varian, 2014; Brodersen et al., 2015) to assess the causality

between the merger and acquisition (M&A) deals and the stock prices of the acquiring firms in our

case studies. We did not find any statistically significant causality effect; however, the reason may

be due to the deal sizes being too small to affect the market caps of acquiring firms. In addition,

there is likely a mispriced issue because neither sellers nor buyers know the precise value of the

data. Akerd and Samani (2018) point out that, during an M&A, assuming the value of data captured

only by sales figures may understate the overall value of a transaction to the benefits of the buyer

and to the detriment of the seller. Moreover, it is impossible to visualize all the possible ways to

create values from the data in the future, especially when significant value can possibly be

generated through data fusion. The usefulness of the income-based approach is rather limited,

because it only applies to the cases for licensing the use of data and where transaction data are

available.

Given the serious drawbacks and limitations of three conventional approaches, we consider

a new approach to value data. Since most value of data is generated when a firm has a data-driven

business model, this part of investments heavily rely on online platform companies’ investments

in business models, which can be measured by their investments in organization capital. To

measure intangibles, economists generally encounter the problems that there is no arms-length

market for most intangibles and that the majority of them are developed for a firm’s own use.

Following earlier studies, we use the sales, general, and administrative (SG&A) expense, reported

in annual income statements, as a proxy for a firm’s investment in organizational capital (Lev and

Radhakrishnan, 2005; Eisfeldt and Papanikolaou, 2013; Brynjolfsson et al., 2018). SG&A

expenditures include most of the expenditures that generate organization capital, such as employee

training costs, brand enhancement costs, consulting fees, and the installation and management

23

costs of supply chains. Because SG&A expenditures may include some items unrelated to

improving a firm’s organizational efficiency, Eisfeldt and Papanikolaou (2013) use five ways to

validate the approach of using SG&A expenditures as a proxy for a firm’s investment in

organizational capital and their results show a clear support for this approach.

Moreover, the inefficiency of the investment in organization capital by definition should

show in the depreciation rate of organization capital. That is, if a firm’s investment in organization

capital has significant inefficiency, the value of its organization capital cannot be maintained well,

resulting in a higher depreciation rate of organization capital. As shown in Li (2015), across U.S.

high-tech industries, market leaders in general have a smaller depreciation rate than their followers.

We adopt the R&D depreciation model developed by Li and Hall (2018) to estimate the

depreciation rates of organization capital for four online platform companies, including Amazon,

Booking Holdings, eBay, and Google, for which public data are available. This new model is a

forward-looking profit model that uses a firm’s data on sales and investments in intangible capital

to identify its depreciation rate of intangible capital, a new approach that can be very useful in

estimating the value of intangibles.

Following Hall (1993), we use the perpetual inventory method to construct the stocks of

organization capital and the associated growth rates for the four firms. The data cover the years of

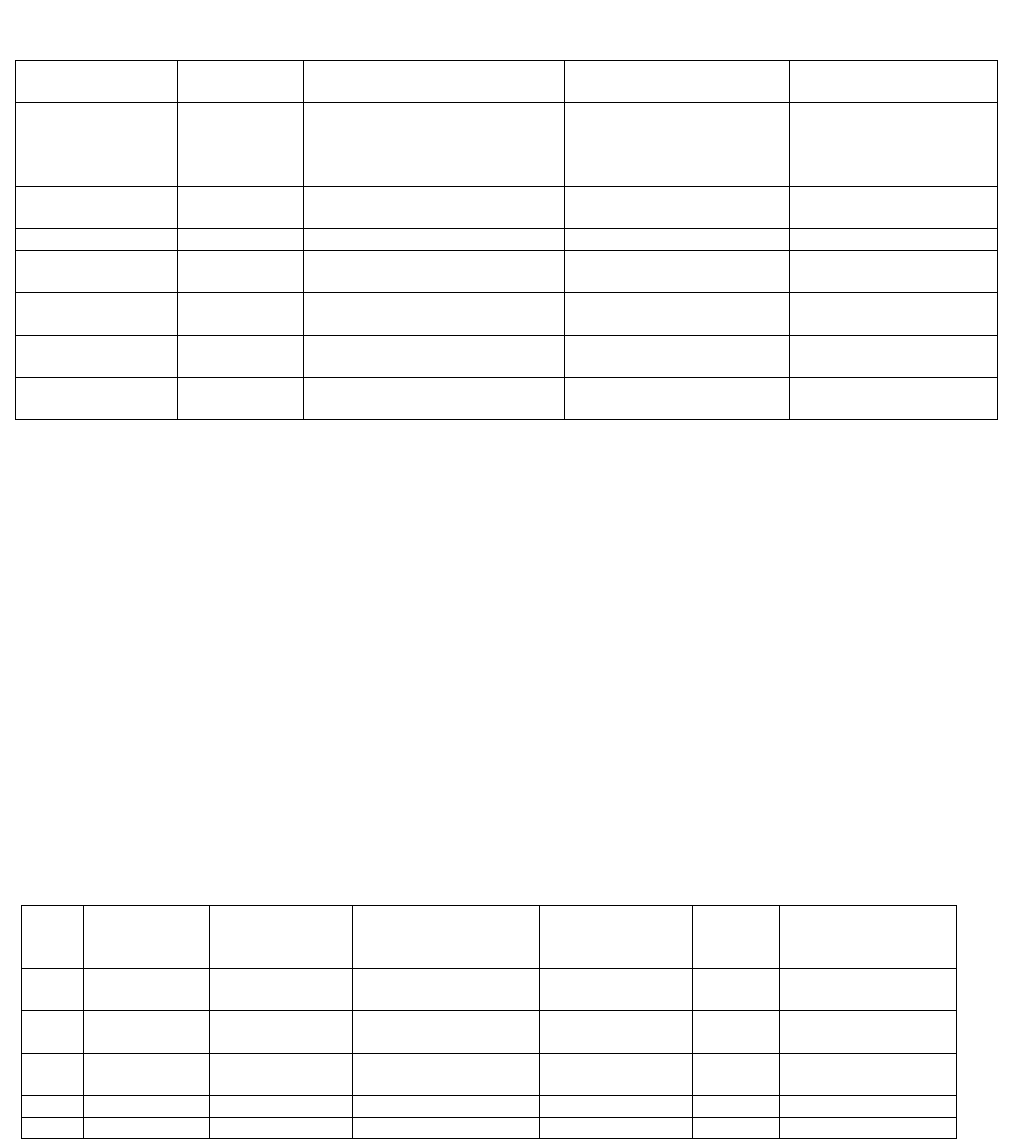

2000 to 2017. Table 1 shows the estimated results (see column 4

th

), annual commission or licensing

revenue, and M&A prices associated with our case studies. For example, in 2017, Amazon’s

estimated annual commission derived from data is US $41.8 billion, and the estimated value of

data derived from a data-driven business model is US $125 billion.

24

Tables 2 to 4 list the M&A histories of Amazon, eBay, and Google, respectively. It is clear

that the purpose in most M&A cases is related to data, indicating that these online platform

companies are aggressively expanding the types of the data they collect.

Table 2: Merger & Acquisition Cases by Amazon

Year

Acquired

Firm

Purchased

Price

Purchased Price

/Amazon Market

Cap

Business

Country

Purpose of M&A

2009

Zappos

US $1.2 billion

0.0228

Online Shoe and

Apparel Retailer

USA

Data

2014

Twitch

US $0.97 billion

0.0062

Live Streaming,

Streaming Video

USA

Data

2017

Whole Foods

US $13.7 billion

0.0281

Supermarket

Chain

USA

Online to Offline;

Data

2018

Ring

US $1.8 billion

0.0023

Video Doorbells

USA

IoT; Data

2018

PillPack

US $1 billion

0.0011

Pharmacy

USA

Data

Table 1: Measurement of the Value of Data: Case Studies

Type of Online

Platform

Company

Annual Commission or

Licensing Access to Data

Value Based on Data-

driven Business Model

Merger & Acquisition

Price

E-commerce

Amazon

Commission Revenue: US $41.8

billion (2017)

Premium Data Service Revenue:

US $18 billion (2018)*

US $125 billion; Annual

Growth Rate: 35%

Online Sharing

Booking

US $11.8 billion (2017)

US $15.7 billion; Annual

Growth Rate: 40%

Fintech

Ant Financial

No public financial statement.

Social Network

Service

LinkedIn

US $2.99 billion (2015)**

US $26.4 billion by

Microsoft in 2016

Matchmaking

eBay

US $16 billion; Annual

Growth Rate: 30%

Crowdsourcing

Waze

No public financial statement.

US $1.3 billion by

Google in 2013

Search

Google

US $95.4 billion (2017)***

US $48.2 billion; Annual

Growth Rate: 21.8%

* Assume third-party sellers with annual sales over US$10 million order the premium data service. There are 19% of

third-party sellers that have sales over US $10 million per year.

**Most of the revenue number from selling access to the data of its members to recruiters and sales professionals.

*** Data targeting service revenue: Data targeted advertising revenue

25

Table 3: Merger & Acquisition Cases by eBay

Year

Acquired

Firm

Purchased

Price

Purchased Price

/eBay Market Cap

Business

Country

Purpose of

M&A

2002

PayPal

US $1.5 billion

0.1834

Online Payment

Systems

USA

Data

2009

Skype

US $2.6 billion

0.1163

Software for Voice;

Video Calls

Luxembourg

Data

2008

Bill Me Later

US $1.2 billion

0.1228

E-commerce

USA

Data

2011

GSI Commerce

US $2.4 billion

0.1423

Marketing;

Fulfillment

USA

Data Analytics

Table 4: Merger & Acquisition Cases by Google

Year

Acquired

Firm

Purchased Price

Purchased Price

/Google Market Cap

Business

Country

Purpose of

M&A

2006

Youtube

US $1.65 billion

0.0124

Video Sharing

USA

Data

2007

DoubleClick

US $3.1 billion

0.0212

Online Advertising

USA

Data Analytics

2012

Motorola

US $12.5 billion

0.0692

Mobile Device

USA

Data Device;

Data;

Reduce TACs

2013

Waze

US $1.3 billion

0.0044

GPS Navigation

Software

Israel

Data

2014

Nest Labs

US $3.2 billion

0.0077

Home-security

Cameras and

Thermostats

USA

IoT; Data

2018

HTC

Smartphone

Division

US $1.1 billion

0.0015

Mobile Device

Taiwan

Data Device;

Data;

Reduce TACs

5. Discussion

Policy analysis on digital goods and services should consider the value of data. Lacking

understanding of the value of data may hinder managers’ ability to make good investment,

management, and outsourcing decisions related to data. Moreover, in the rising data-driven

economy, no information about the value of data may mislead investors about firm fundamentals

and inhibit capital flows to innovative firms or good investment opportunities.

For example, transactions through an e-commerce platform can generate an enormous

amount of data and of the value of data. Whereas a transaction itself creates a conventional

economic benefit known as gains from trade, the data generated through the transaction also

contains economic value. The value of such transaction data has traditionally been accumulated

26

within a firm as firm-specific knowledge on consumers, business partners, and employees. The

specific knowledge derived from the value of transaction data can then be utilized for various

management departments, such as marketing, procurement, and human resource, within a firm.

However, transaction data collected through online platforms are accumulated digitally and can,

nowadays, easily be recombined and aggregated with other datasets. This new and unique nature

of digital data allows an online platform company to utilize it to a degree that far exceeds its offline

counterparts not only in scale but also in scope.

The economic value and policy implications of digital transaction data can be discussed in

two scenarios, depending on whether or not the consumer’s identity in a transaction is disclosed.

The first scenario considers the condition where the consumer’s identity is disclosed may cause

potential welfare loss such as identity theft or privacy breach as reviewed in Acquisti et al. (2016).

A more subtle effect is dynamic price discrimination. For example, online platform

companies can provide data targeting pricing strategy services to third-party sellers. Based on a

consumer’s data on transaction records and clickstreams, an online platform company can suggest

a third-party seller to raise its product price for a specific customer whose data reveal that she

would accept the higher price. Acquisti et al. (2016) argue that “the evidence of systematic and

diffuse individual online price discrimination is, currently, scarce.” However, Booking.com

reportedly can on average increase the revenue of its corporate clients by 7% through its data-

driven pricing strategy service. Other examples include Uber’s surging pricing strategy and

Amazon’s dynamic pricing program.

Price discrimination can be efficient and not necessarily implies welfare loss. Price

discrimination does reduce consumer surplus by reducing the margin between the consumer’s

willingness to pay and the purchase price. However, the reduced consumer surplus merely transfers

27

to the firm as an increased profit, and, in a general equilibrium, the firm’s increased profit is

distributed to households as income. Therefore, the price-discriminated customer loses some

consumer surplus, while households in the economy as a whole receive the equivalent value of

additional income.

The price discrimination can also be redistributive. Provided that a high-income consumer

tends to have a higher willingness to pay for goods or services, the price discrimination results in

a transfer from high-income households to the representative household. If the firm’s increased

profits are distributed equally among households, the resulting distribution may become more

egalitarian than before. However, if the increased profits accrue to only a handful of entrepreneurs,

the transfer through the price discrimination does not necessarily lead to a more equal distribution.

The resulting distribution depends on the ownership of emerging business models.

The second scenario considers the condition where the consumer’s identity in a transaction

is not disclosed or used by the service provider. For example, a consumer can enjoy the benefits

gained by revealing personal attributes, but the service provider cannot identify the customer as a

person. In this case, as long as the customer has an option of staying in the status quo in receiving

conventional goods and services, the customer bears no surplus costs in supplying personal

attributes and transaction records as an observation in data. Namely, the marginal cost of data

provision is zero when anonymity is preserved.

A single data point that a data subject provides under anonymity has little value. However,

a collection of them can generate a significant amount of value. That is because a collection of

data can reveal statistical regularities. In this sense, an observation of customer data has a positive

externality: a single observation has no value, but a collection of them potentially does. This type

28

of externality might be called a “data network effect” mentioned by lawyers and regulators, which

was dismissed by Varian (2018) as a misnomer of learning-by-doing.

The data network effect can be formulated as an externality in two-sided markets. Rochet

and Tirole (2003, 2006) consider a usage externality in two-sided markets, such as the case where

a video game user’s participation unintentionally benefits another user on the same platform.

Similarly, a consumer’s transaction record on an online platform can benefit other consumers by

improving the predictive power of the platform’s algorithm. The data-driven online platform

service allows not only a consumer to search a good or service that fits personal needs more

efficiently but also a third party seller to serve its target customers more effectively. That is, the

transaction data accumulated through an online platform can increase the predictive power of its

matching algorithm, an increased productivity in the algorithm that reduces transaction costs for

both consumers and producers. In this case, the combined transaction costs needed for facilitating

the same matching outcome without online platforms can be formulated as the social value of data,

which in fact is an increasing function of the combined transaction costs (Appendix A). Online

platform companies may capture a significant portion of the social value of data by internalizing

the positive externality from the data network effect. The captured value can not only cover their

investment costs in developing AI algorithms but also be very profitable. From the perspective of

an online platform company, the accumulation of transaction data can increase the productivity of

its matching algorithm, and the increased productivity through data accumulation is a byproduct

of business operation. However, data are certainly an asset, given that data are one of the key inputs

for online platform companies to produce data products and services and they have earned

significant revenues through monetizing data repeatedly.

29

In terms of the statistical value of data, Varian (2018) argues that it exhibits decreasing

returns to scale, citing that an increase in the size of training data attains only diminishing gains in

prediction accuracy. This is true for an objective with a single dimension. However, an extension

of data to multiple dimensions may not suffer decreasing returns. For example, merging the data

on two attributes of households can enhance the prediction power on both attributes. Hence, as

long as a household is a “statistical” subject, a collection of data is likely to have a positive welfare

effect. This is the case where a household can access the knowledge generated by the data without

disclosing its identity. A person and a firm can share the increased value added.

In addition to the business-to-consumer redistribution effect we have discussed above, a

business-to-business redistribution effect may arise as a result of an accumulation of valuable data.

An accumulation of data and an introduction of new online platform business models may cause

business-stealing effects and hurt incumbents, a creative destruction phenomenon analyzed by Li,

Nirei, and Yamana (2018) for the U.S. and Japan’s hospitality and transportation industries. In our

analysis, an introduction of new online platform business models speeds up the obsolescence of

conventional business models. As a result, the accumulated intangible capital of conventional

businesses depreciates faster.

The creative destruction process has a redistributive effect but not necessarily implies

welfare loss. For example, an online platform company can accumulate an enormous amount of

data to gain a great competitive advantage and render the business models of its conventional

counterparts obsolete. Consequently, the consumer surplus, income, and rent generated by

conventional businesses decline, but those generated by new businesses increase. Li, Nirei, and

Yamana (2018) estimate a lower bound of the redistributed value by conducting case studies on

the gains and losses of firms’ market valuations.

30

Lastly, data are information goods and act like knowledge. Therefore, many arguments on

knowledge can also apply to data. A negative externality on data production is a duplicated

investment, or the “stepping on toes effect” (Jones and Williams, 2000). A firm’s data generation

may overlap with those by other firms, which causes a duplicated investment and pure welfare

loss. In fact, because data is non-rival, there are potentially large gains by sharing data, the

information externality effect of data (Jones and Tonetti, 2018). However, the rising data privacy

and security concerns have become the main obstacle for firms to share data. To cope with the

rising concerns, firms have invested in new technologies allowing individuals and organizations

across industries to share data to gain greater insights from larger datasets and co-develop new

data products and services without sacrificing privacy. For example, JPMorgan invests in Inpher,

whose zero-knowledge computing technology allows analysis on encrypted data (Castellanos,

2018). Moreover, as data are emerging as the key differentiator for companies in the AI race, data

have become a concern of impeding the entry of SMEs. New market developments may mitigate

the concern. Data brokers like Experian sell personal data to individuals and firms at competitive

prices, and firms like Nasdaq make efforts to establish markets for data (Wigglesworth, 2018; Ram

and Murgia, 2019). Furthermore, the world’s first data exchange market, for trading data such as

court and medical records, started operation in China in 2015. Members with government

approvals to trade, including Alibaba and Tencent, increased 20-fold to more than 2000 within

three years (Kang, 2015; China Daily, 2018). More importantly, data sharing across countries

matters because there is a limitation of a country’s data on AI development. For example, the

patterns recognized in Chinese consumer data will not necessarily be able to apply to consumers

in the U.S. (Dvorak, 2018).

31

6. Conclusion

Online platform companies are data companies, normally physical-asset-light but highly

profitable. They exchange “free” digital goods and services for consumer data. Data are an

intangible, and its value is very difficult to measure. In this study, we propose a way to estimate

the value of data for several representative firms in the seven types of online platforms. Our initial

results indicate that data can have enormous value: for example, in 2017, the value of Amazon’s

data can account for 16% of Amazon’s market valuation and has an annual growth rate of 35%.

Online platforms can differ in the underlying business model, which determines what types

of data they collect, how data flow within online platform networks, how online platform

companies monetize data, and what consumers gain from exchanging their data. We select seven

major types of online platforms, and conduct case studies to understand the data activities related

to them and to examine whether the data monetization strategies vary by the type of online platform.

Based on the understanding from those case studies, we derive a flow chart to show the steps by

which online platform companies create the value of data. We also present the data value chain to

demonstrate the value-added activities involved in each step.

We find that online platform companies can differ in the degrees of vertical integration in

the data value chain, a difference which determines how they monetize data and how much

economic benefits they can capture. Online platform companies with in-house data analytics

capabilities and monetization strategies can produce much greater values of data than do those that

outsource data analytics work. More importantly, online platform companies are at the forefront

of AI adoption, and data are emerging as a key differentiator in the AI race. Greater vertically

integrated online platform companies can benefit more from data. Their businesses can be

strengthened by the virtuous cycle between AI’s relationship with data (Lee, 2018). That is, more

32

data can lead to better digital goods and services, which in turn attracts more users to their online

platforms, generating even more data that further improve their digital goods and services.

Currently, there is no definitive answer to the welfare implications of online platforms and

data. For example, on the one hand, we find that online platform companies can offer data-driven

pricing discrimination strategies for its corporate clients to maximize their revenues; on the other

hand, the households in the economy as a whole can receive the equivalent value of additional

income. The price discrimination can also be redistributive, and the resulting distribution depends

on the ownership of emerging business models.

Moreover, there is a positive externality from the data network effect derived from

consumer data. Because a collection of data can reveal statistical regularities, a consumer’s

transaction record can benefit other consumers by improving the predictive power of the platform’s

matching algorithm, an increased productivity in the algorithm that reduces transaction costs for

both consumers and producers. In this case, the combined transaction cost needed for facilitating

the same matching outcome without online platforms is the social value of data. Online platform

companies may capture a significant portion of the social value of data by internalizing the positive

externality from the data network effect. The captured value can not only cover their investment

costs in developing AI algorithms but also be very profitable.

Nevertheless, an accumulation of data and new online platform business models may cause

business-stealing effects and speed up the obsolescence of conventional business models. Data

have also become a concern of impeding the entry of SMEs and companies may make duplicate

investments in data. Since there are potentially large gains by sharing data, new technologies

facilitating data sharing without sacrificing privacy and market institutions such as data exchange

market can help mitigate the concern and encourage innovation.

33

Online platforms are evolving rapidly. To seek growth, online platform companies may

expand their business models to cover multiple types of online platforms. The degree of hybrid

online platforms can vary across countries. Compared with less hybrid U.S. counterparts, some

Chinese online platform companies have developed super online platforms that bundle many

online platform functionalities similar to Facebook, Uber, Expedia, PayPal, Amazon and more

combined, an outcome called “The App Constellation Model” (Lee, 2018). Moreover, though

online platforms in general have two ways to monetize data, they differ in the type of collected

data and the difference may affect their diversification strategies. For example, compared with

LinkedIn, Amazon can more easily enter the data-targeted advertising market because of its greater

advantage in real-time browsing and shopping data. More research is needed to understand the

impacts of the rapidly evolving trend of online platforms on areas including data collection, market

competition, and consumer welfare.

Lastly, data is new oil. At present, the pipelines of new oil are controlled by online platform

companies. In the future, blockchain technology may allow consumers to have their own pipelines,

to take control of their ownership, and to decide whether and how to sell personal data to

companies. However, since the value of data is created by companies and depends on data analytics

and the associated business model, consumers lack the knowledge to value their personal data.

Nevertheless, how fast various industries can adopt blockchain technology may affect the future

competition of online platform companies. Currently, data volume doubles every three years

(Mayer-Schönberger and Cukier, 2014), but trends such as the fifth generation of mobile networks

and the Internet of Things are rapidly accelerating the accumulation speed of data types and

volume. Therefore, the capability to value data is very important not only at the firm level but also

at the national level. At the firm level, a proper valuation of data is important for firms to derive

34

important investment and outsourcing decisions on data, decide how to monetize data, and gain a

competitive edge through data. At the national level, it is important for National Accounts to

incorporate this increasingly important new asset into the calculation of GDP and productivity

growth. Moreover, countries differ in the ownership and collection right of personal data such as

Europe’s strict General Data Protection Regulation and China’s extreme openness of personal data.

Additionally, the U.S. allows foreign firms to collect personal data domestically but China

prohibits it. How do the differences in data policy affect trade? Given the virtuous cycle between

AI’s relationship with data, the degree of openness of a country’s data policy may affect relative

competitiveness between domestic and foreign firms. Therefore, the valuation of data will provide

important policy implications for trade and growth.

35

References

Acquisti, A., Taylor, C., & Wagman, L. 2016. The Economics of Privacy, Journal of Economic

Literature, 54(2), June, pp: 442-92.

Akred, J., & Samani, A. 2018. Your Data Is Worth More Than You Think. MIT Sloan Management

Review. January 18

th

.

Agrawal, A., Gans, J., & Goldfarb, A. 2018. Prediction Machines: The Simple Economics of

Artificial Intelligence. Harvard Business Review Press.

Bary, E. 2018. Twitter Earnings Growth Relied on Selling User Data, Market Watch, April 25

th

.

Beck, M., & Libert, B. 2019. The Machine Learning Race Is Really a Data Race, MIT Sloan

Management Review, Winter.

Bergen, M. and Sherman, A. 2017. Google Is Close to Buying HTC Assets to Bolster Hardware,

Bloomberg, September 20

th

.

Bond, S. 2018. Amazon’s Ever-increasing Power Unnerves Vendors, Financial Times, September

21

st

.

Brodersen, K.H., Gallusser, F., Koehler, J., Remy, N., and Scott, S.L. 2015. Inferring Causal

Impact Using Bayesian Structural Time-series Models. Annals of Applied Statistics, 9, pp:

247-274.

Brynjolfsson, E., Eggers, F., & Gannamaneni, A. 2018. New Measures of the Economy:

Measuring Welfare with Massive Online Choice Experiments: A Brief Introduction, AEA

Papers and Proceedings, 108: 473-476.

Brynjolfsson, E., Hui, X., Liu, M. 2018. Does Machine Translation Affect International Trade?

Evidence from a Large Digital Platform, National Bureau of Economic Research Working

Paper No. 24917, August.

36

Brynjolfsson, E., Rock, D., & Syverson, C. 2018. The Productivity J-Curve: How Intangibles

Complement General Purpose Technologies, National Bureau of Economic Research

Working Paper No. 25148, October.

Castellanos, S. 2018. JPMorgan Invests in Startup Tech that Analyze Encrypted Data, Wall Street

Journal, November 13

th

.

Chen, L.Y. 2018. Ant Financial Annual Profit Jumps 65% Ahead of Anticipated IPO, Bloomberg,

May 4.

Chen, Y., Dai, T., Korpeoglu, C., Korpeoglu, E., Sahin, O., Tang, C., & Xiao, S. 2018. Innovative

Online Platforms: Research Opportunities, Manufacturing & Service Operations

Management, forthcoming.

China Daily. 2018. After More Than Three-year Exploration, Guiyang Big Data Exchange Market

Innovates New Data Exchange Model, China Daily, July 4

th

, China.

Cohan, P. 2013. Google to Spite Facebook, Buy Wave For $1.3 Billion, Forbes, June 9

th

.

Demunter, C. 2018. Towards a Taxonomy of Platforms in the Collaborative Economy: Outcomes

of a Workshop on Measuring the Collaborative Economy, presented at the 2018 OECD

Workshop on Online Platforms, Cloud Computing, and Related Products, September 6

th

,

OECD, Paris.

D’Onfro, J. Alphabet Stock Sinks on Revenue Miss, CNBC, October 25

th

.

Dvorak, P. 2018. Which Country Is Winning the AI Race – the U.S. or China? Wall Street Journal,

November 12

th

.

Eisfeldt, A., & Papanikolaou, D. 2013. Organizational Capital and the Cross-Section of Expected

Returns, Journal of Finance, 4, August, pp: 1365-1406.

Frier, S. 2018. Is Apple Really Your Privacy Hero? Bloomberg Businessweek, August, 8

th

.

37

Hall, B.H. 1993. The Stock Market’s Valuation of R&D Investment During the 1980’s, American

Economic Review, 83(2), Papers and Proceedings of the Hundred and Fifth Annual

Meeting of the American Economic Association, May, pp: 259-264.

Hartmans, A. 2017. Airbnb Has More Listings Worldwide than the Top Five Hotel Brands

Combined, Business Insider, August 10

th

.

Hathaway, I., & Muro, M. 2017. Ridesharing Hits Hyper-growth, Brookings.

Johnson, M.W. 2018. Reinvent Your Business Model: How to Seize the White Space for

Transformative Growth. Harvard Business Review Press.

Jones, C.I., & Williams, J.C. 2000. Too Much of a Good Thing? The Economics of Investment in

R&D, Journal of Economic Growth, March, 5(1): 65-85.

Jones, I.J., & Tonetti, C. 2018. Nonrivalry and the Economics of Data, Stanford GSB working

paper.

Kang, Y.P. 2015. The World’s First Data Exchange Market with Annual Transaction Amount up

to US $29.4 Million, Business Weekly, 1438, June, Taiwan.

Lee, K.F. 2018. AI Superpowers: China, Silicon Valley, and the New World Order. Houghton

Mifflin Harcourt. September 25

th

.

Lev, B., & Radhakrishnan, S. 2005. The Valuation of Organizational Capital. In Measuring

Capital in a New Economy, Corrado, C., Haltiwanger, J., Sichel, D. (eds). Chicago:

National Bureau of Economic Research and University of Chicago Press: Chicago, IL: 73-

99.

Li, W.C.Y. 2015. Organizational Capital, R&D Assets, and Offshore Outsourcing, Working Paper,

U.S. Bureau of Economic Analysis.

38

Li, W.C.Y., & Hall, B. H. 2018. Depreciation of Business R&D Capital, Review of Income and

Wealth, https://doi.org/10.1111/roiw.12380.

Li, W.C.Y., Nirei, M., & Yamana, K. 2017. Sharing Economy in Japan and the United States, 2017

SEM proceeding papers, July, Cambridge, the United States.

Li, W.C.Y., Nirei, M., & Yamana, K. 2018. Creative Destruction in Organizational Capital:

Evidence from the Online Platform Economy in Japan and the United States, the 2018

IARIW proceeding papers, August, Copenhagen, Denmark.

Mayer-Schönberger, V., & Cukier, K. 2014. Big Data. Mariner Books: Boston and New York.

Miller, H.G., & Mork, P. 2013. From Data to Decisions: A Value Chain for Big Data. IT

Professional.

Molla, R. 2017. Amazon Could Be Responsible for Nearly Half of U.S. E-commerce Sales in 2017,

Recode, October 24

th

.

OECD. 2018a. Online Platforms: A Practical Approach to Their Economic and Social Impacts.

Paris.

OECD. 2018b. Online Platforms: Annex Document. Paris.

Ovenden, J. 2016. Customer Analytics Case Study: eBay, Innovation Enterprise Channels, June

6

th

.

Ram, A., & Murgia, M. 2019. Data Brokers: Regulators Try to Rein in the ‘Privacy Deathstars,’

Financial Times, January 7

th

.

Reisinger, D. 2017. Here’s How Many iPhone Are Currently Being Used Worldwide, Fortune,

March 6

th

.

39

Rochet, J.C., & Tirole, J. 2003. Platform Competition in Two-sided Markets. Journal of the

European Economic Association, Volume 1(4):990-1029.

Rochet, J.C., & Tirole, J. 2006. Two-sided Markets: A Progress Report. The RAND Journal of

Economics, Volume 37(3):645-667.

Scott, S. L., & Varian, H. R. 2014a. Bayesian Variable Selection for Nowcasting Economic Time

Series. Economic Analysis of the Digital Economy.

Scott, S. L., & Varian, H. R. 2014b. Predicting the Present with Bayesian Structural Time Series.

International Journal of Mathematical Modelling and Numerical Optimisation.

SEC. 2012. Facebook, Inc. 10-K Annual Report for the Fiscal Year Ended December 31, 2012.

SEC. 2017. Booking Holding Inc. (BKNG) SEC Filing 10-K Annual Report for the Fiscal Year

Ended December 31, 2017.

Shu, C. 2015. Data from Alibaba’s E-commerce Sites Is Now Powering a Credit-Scoring Service,

techcruch.com, Jan. 28

th

.

Slotin, J. 2018. What Do We Know about the Value of Data? May 3

rd

.

Statista. 2018. Percentage of Paid Units Sold by Third-party Sellers on Amazon Platform as of 2

nd

Quarter 2018.

Tefis Team. 2017. Facebook’s Strong Ad Revenue Growth to Continue, Forbes, October 30

th

.

Varian, H.R. 2014. Big Data: New Tricks for Econometrics, Journal of Economic Perspectives,

28(2), Spring, pp: 3-28.

Varian, H. 2018. Artificial Intelligence, Economics, and Industrial Organization, Chapter in

forthcoming NBER book, The Economics of Artificial Intelligence: An Agenda, edited by

Joshua Gans and Avi Goldfarb. The University of Chicago Press.

40

van de Ven, P. 2018. Online Platforms in a Digital Economy Satellite Account, presented at the

2018 OECD Workshop on Online Platforms, Cloud Computing, and Related Products,

September 6

th

, OECD, Paris.

Visconti, R.M., Larocca, A., and Marconi, M. 2017. Big data-Driven Value Chains and Digital

Platforms: from Value Co-Creation to Monetization, working paper.

Weinland D., and Ju, S.F. 2018. China’s Ant Financial Shows Cashless Is King. Financial Times,

April 13.

Whitmore, G. 2018. How Google Travel Is Changing the Game with Google Flights, Google Trips,

and More, Forbes, February 20

th

.

Wigglesworth, R. 2018. Nasdaq Moves into ‘Alternative Data’ with Quandl Acquistion, Financial

Times, December 4

th

.

Wikipedia. 2018. Topcoder.

Williams, R. 2018. Goldman: Apple Charge Google $12B to Be Default Search Engine in 2019,

Mobile Marketer, October 1st.

Wladawsky-Berger, I. 2018. It’s All about Business Model Innovation, Not New Technology, Wall

Street Journal, November 2

nd

.

Yin, Y.H. 2018. The Most Successful Internet Company after Amazon – From Netherlands,

Business Weekly, 1600, July, Taiwan.

41

Appendix A: Social Value of Data and Transaction Cost

Below we present a simple model to illustrate the relationship between the social value of

data and transaction costs without online platforms.

Suppose that there are a continuum of consumers and a continuum of producers

. When and are matched, a joint surplus value is generated. Suppose that the

surplus value function has a structure:

. Thus,

is

achieved at .

First, we consider the situation where consumers cannot identify the types of producers. A

consumer is randomly matched with a producer. The consumer can accept the match and leave the

matching procedure. If the consumer rejects the match, the consumer loses transaction cost

and draws another match. The consumer maximizes the expected surplus value, which

satisfies the recursive relation:

where is the consumer’s reservation surplus value. If a is above x, the consumer accepts the

match; otherwise, rejects. For the maximization problem, the optimal choice of x satisfies the first

order condition:

,

namely . Note that the producer is distributed uniformly over . By plugging the

value of x back to the recursive equation, we obtain

. By solving this

equation, we obtain

and

. If the transaction cost drops to 0, the

value of v increases to 1. In this scenario, the consumer will draw matches indefinitely until getting

the best match.

42

Next, we consider the situation where consumers can identify the types of producers and

hence a joint surplus value, a, arbitrarily close to supremum 1 can be achieved. The resulting

increase in the expected joint value when the types of producers are known is

. The

increase in the expected joint value arises from (1) the reduction in the expected transaction costs

and (2) the increase in reservation value ( ) which leads to increased expected surplus before

netting the transaction costs.

Now, when an online platform collects transaction records from both consumers and

producers, the collected data can reveal statistical regularities which can then reveal the joint

surplus value structure . Because statistical regularities revealed from collected data can

increase the predictive power of the online platform’s matching algorithm, consumers may achieve

a supremum match without incurring costs. Therefore, even though there is no cost for a consumer

to provide such a transaction record, the collection of records has a social value

, the

increased expected joint surplus value when online platforms exist. The social value of data is an

increasing function of the transaction cost without an online platform. This social value of data

arises from the positive externality of consumer data: a single observation has no value but a

collection of them does.