Ag Decision Maker

extension.iastate.edu/agdm

File C1-10

2023 Iowa Farm

Costs and Returns

FM 1789 Revised June 2024

The farm record data utilized in this report were

obtained from the Iowa Farm Business Association.

The average of all farms in each table represents

a weighted average of the values for each size

group listed. Weighting factors are based on the

number of farms in each size group in the state,

as computed from the most recent Census of

Agriculture. Only farms with sales of $100,000 or

more were counted in making the weighting. Thus,

overall averages should be representative of mid-

size to large, commercial Iowa farms.

All records were kept on the accrual, or inventory,

basis. On rented farms, only operator income and

expenses were recorded. Data for ending assets and

liabilities represent those of the operator only, and

do not include the value of rented land.

Definition of Terms Used

Net farm income, cash–Total sales and other cash

income minus cash expenses, including purchases

of livestock and feed. Does not include principal

borrowed or repaid, sales and purchases of capital

assets, or nonfarm income and expenses.

Net farm income, accrual–Cash net income adjusted

for inventory changes and accrued expenses.

Represents a return to unpaid labor, net worth

(equity), management, and profit.

Value of farm production–Value of crops produced

(at market price), livestock production (net of feed

and purchased livestock), inventory value gain or

loss, and miscellaneous income. This measures the

total production per farm.

Management return–Accrual net farm income less

4% interest on value of equity (net worth) and

wages for operator and family labor. The wage rate

used for operator labor was $2,500 per month.

Inventory value gain or loss–Change in value of

crops or livestock sold due to differences in opening

inventory price and final sale price.

Livestock returns per $100 feed fed–Value of

livestock production minus livestock purchases,

divided by value of feed fed, multiplied by 100.

Machinery cost per crop acre–Total of machinery

repairs, fuel, custom machine hire, utilities,

machinery depreciation, and auto expense, less

75% of all custom hire income received, divided

by crop acres. Depreciation is estimated at 10%

of current value of the machinery. Interest is not

included.

Return on assets–Net farm income, plus interest

expense, minus value of operator and family labor,

divided by total farm assets owned.

Return on equity–Net farm income minus value of

operator and family labor, divided by net worth.

Operating profit margin ratio–Net farm income,

plus interest expense, minus value of operator and

family labor, divided by value of farm production.

Working capital–Current assets minus current

liabilities.

The data for this report were collected by Iowa Farm Business

Association consultants and compiled by Iowa State University

Extension and Outreach.

Page 2

2023 Iowa Farm Costs and Returns

Iowa Farm Costs and Returns 2019-2023

The following summary is intended to provide a general picture of costs and returns to well-managed, full-time Iowa farms. The

values presented are averages; however, results vary widely from one farm to the next. Farms are grouped according to Total Value

of Gross Sales, and the State Averages for 2023 and 2022 are calculated using the number of Iowa farms in each group as reported

in the 2022 Census of Agriculture.

The average number of crop acres per farm increased by 11 acres to 587 acres in 2023, the second lowest mark since 2012.

The average value of farm net worth decreased by $4,559 (-0.2%), driven by a larger increase in total farm liabilities ($119,987)

than in total farm assets ($115,428). Consequently, the farm net worth per acre farmed decreased by 2% to $3,391.

The average accrual net farm income dropped by 78% to $64,583 in 2023, the lowest value since 2018, accumulating a reduction

of $277,251 from the 2021 peak. The average value of farm production declined by 18% to $710,030 in 2023, driven mostly by a

crop inventory value loss of $90,838.

Livestock returns per $100 feed fed increased by 21% to $188 in 2023, the highest value since 2014. The average sale price for

corn declined by 2% to $6.27 in 2023, and the average corn yield was 214 bushels per acre (2% higher than in 2022). The average

debt-to-asset ratio increased slightly to 0.23 in 2023, but remained below its long-term average. The average current asset-to-debt

ratio, a relative measure of liquidity, declined from 6.87 in 2022 to 4.31 in 2023, but remained above its long-term average.

Table 1. Comparison by Years.

2023 2022 2021 2020 2019

Financial Returns

Net farm income, accrual

$64,583 $294,202 $341,834 $132,339 $77,946

Return to management

-54,147 181,005 232,912 25,327 -31,252

Net farm income, cash

141,484 206,891 153,383 134,119 85,097

Resources Used

Acres in crops

587 577 599 647 674

Labor months

21 19 20 20 21

Livestock, feed, supplies

$762,448 $831,441 $746,988 $579,074 $600,110

Machinery and equipment

499,392 443,804 429,761 446,602 472,898

Land and improvements

1,427,976 1,299,143 1,426,445 1,497,413 1,470,496

Total farm assets

$2,689,816 $2,574,388 $2,603,195 $2,523,089 $2,543,504

Farm net worth

$1,991,341 $1,995,900 $1,899,545 $1,803,078 $1,791,128

Value of Farm Production

Livestock income less feed,

purchases for resale

$58,097 $59,320 $72,602 $34,389 $64,130

Crop production

622,649 638,567 491,399 418,614 427,857

Miscellaneous

120,122 95,762 121,544 193,776 127,320

Crop inventory gain or loss

-90,838 71,904 179,911 9,954 15,247

Value of farm production

$710,030 $865,552 $865,456 $656,733 $634,555

Cash Expenses

Operating

$372,481 $325,753 $279,820 $279,869 $301,941

Fixed

272,965 245,597 243,802 244,525 254,668

Efficiency

Corn yield (bushels per acre)

214 210 218 189 199

Average sale price for corn, per bushel

$6.27 $6.42 $5.01 $3.44 $3.68

Crop value per acre

$1,006 $1,078 $777 $605 $606

Machinery cost per crop acre

$211 $196 $172 $149 $145

Livestock returns per $100 feed fed

$188 $155 $184 $122 $158

Gross revenue per person

$471,017 $558,975 $540,232 $435,641 $416,983

Gross revenue per $1 expense

$1.11 $1.45 $1.59 $1.21 $1.13

Gross revenue per $1 assets

$0.30 $0.36 $0.34 $0.28 $0.28

Return on assets (ROA)

2.1% 9.6% 11.5% 4.5% 2.7%

Return on equity (ROE)

1.5% 11.2% 14.2% 4.6% 2.1%

Financial

Debt-to-asset ratio

0.23 0.19 0.23 0.25 0.25

Current asset-to-debt ratio

4.31 6.65 4.62 3.06 2.69

Farm net worth per acre farmed

$3,391 $3,462 $3,170 $2,786 $2,659

Page 3

2023 Iowa Farm Costs and Returns

Assets and Liabilities

A breakdown of farm assets and liabilities by value of gross sales per farm is shown in Table 2. Total assets, total

liabilities, and the total debt-to-asset ratio indicate that larger farms tend to utilize relatively more credit and be more

leveraged than smaller farms. Total liabilities in 2023 were larger than in 2022 for all groups of farms. Total assets for

farms with $100,000-$199,999 and $800,000 and above in gross sales increased in 2023, while total assets for farms with

gross sales in the range of $200,000-$799,999 declined. Net worth increased only for the group of smaller farms, driven

mostly by increases in the land and improvements category. A major challenge in comparing Table 2 results across years

is that the farms included in each of the groups vary through time. Despite lower working capital across all categories in

2023 compared to 2022, liquidity measures suggest that all groups were well-positioned to cover short-term liabilities

with short-term assets in December 2023.

Table 2. Assets and Liabilities by Size of Farm, End of Year Values.

Average

Total Value of Gross Sales

$100,000

to

$199,999

$200,000

to

$399,999

$400,000

to

$799,999

$800,000

and

above

Farm Assets

Feeding livestock

$149,819 $9,622 $4,195 $24,610 $411,548

Crop inventory

451,201 107,781 195,695 352,971 886,083

Cash

48,601 13,184 31,022 67,615 68,387

Supplies, prepaid expenses, other

1/

112,826 20,758 47,744 86,530 226,995

Total short-term assets

$762,448 $151,345 $278,656 $531,726 $1,593,013

Breeding livestock

$33,916 $11,706 $7,746 $16,835 $75,764

Machinery, equipment

457,836 86,053 170,316 319,951 956,752

Other intermediate assets

2/

7,640 7,735 10,775 4,105 7,685

Total intermediate assets

499,392 $105,494 $188,836 $340,891 $1,040,201

Land and improvements

$1,427,976 $784,506 $778,011 $1,370,185 $2,280,883

Total assets

$2,689,816 $1,041,345 $1,245,503 $2,242,802 $4,914,097

Farm Liabilities

Operating notes, accounts payable

$206,569 $36,503 $44,808 $118,055 $472,495

Intermediate and long-term due

4,413 0 3,369 2,580 8,800

Other short-term debt

3/

423 0 0 340 1,010

Total short-term debt

$211,405 $36,503 $48,178 $120,976 $482,305

Intermediate-term debt

$289,563 $19,726 $105,889 $193,159 $631,763

Long-term debt

$197,507 $113,201 $93,246 $217,959 $304,457

Total liabilities

$698,475 $169,430 $247,313 $532,094 $1,418,525

Farm Net Worth $1,991,341 $871,916 $998,191 $1,710,708 $3,495,571

Net worth change from last year

-$4,559 $379,674 -$150,730 -$168,821 -$10,378

Working capital

$551,043 $114,842 $230,478 $410,750 $1,110,707

Current asset-to-debt ratio

4.31 4.15 5.78 4.40 3.30

Working capital per $1 of gross revenue

$0.67 $0.70 $0.81 $0.75 $0.49

Total debt-to-asset ratio

0.23 0.16 0.20 0.24 0.29

Total crop acres farmed

587 149 276 474 1,124

Months of labor used

21 7 10 14 40

Farm net worth per acre farmed

$3,391 $5,869 $3,615 $3,610 $3,109

1/

Purchased feed, accounts receivable, hedging accounts, sealed grain, investment in growing crops, short-term loans.

2/

Capital leases, investment in cooperatives.

3/

Labor related liabilities, accrued interest, taxes payable, and other current liabilities.

Page 4

2023 Iowa Farm Costs and Returns

Income and Expenses

A summary of operating and fixed cash expenses by value of gross sales per farm is shown in Table 3. Crop expenses

include seed, fertilizer, pesticides, and other expenses related to crop production. The average farm generated a net farm

cash flow of $170,944 for replacement of capital assets, expansion, savings, living expenses, and income taxes. Such

amount was 19% or $39,500 lower than in the previous year, driven mainly by higher crop and livestock expenses and

lower crop sales. Only livestock sales and government payments generated higher cash income ($42,852 and $26,933,

respectively) in 2023 than in the previous year. On average, farms increased their level of net operating debt (loans

received minus loans repaid) by $29,460 in 2023, after a year of only minor increases in net operating debt ($3,552) in

2022. Average interest expense increased by $8,656 in 2023, more than offsetting the $7,761 decline observed in 2022.

Table 3. Summary of Cash Income and Expenses by Size of Farm.

Average

Total Value of Gross Sales

$100,000

to

$199,999

$200,000

to

$399,999

$400,000

to

$799,999

$800,000

and

above

Income

Livestock sales

$312,748 $18,837 $4,400 $37,162 $872,081

Corn sales

351,043 84,608 156,710 277,253 684,135

Soybean sales

199,995 41,655 101,400 171,082 376,411

Other crop sales

14,110 874 7,525 11,505 27,816

Other cash income

127,397 19,649 42,153 90,954 271,050

Total Cash Income $1,005,292 $165,624 $312,187 $587,956 $2,231,493

Expenses

Machinery and equipment repairs

$34,686 $9,135 $17,183 $25,342 $67,307

Fuel and oil

23,822 5,387 6,983 15,676 51,221

Machine hire

21,442 6,020 14,328 13,972 39,901

Auto and truck expense

6,141 2,390 3,652 5,240 10,569

Utilities

9,469 3,535 4,207 6,919 18,130

Labor hired

22,574 176 683 9,886 58,676

Livestock expense

35,719 1,949 574 4,388 99,571

Crop expense

211,970 51,541 101,979 167,798 407,445

Miscellaneous

6,658 612 2,367 4,972 14,141

Total cash operating expense

$372,481 $80,744 $151,955 $254,193 $766,961

Cash rent

$108,508 $12,491 $36,339 $67,509 $239,393

Property taxes

9,301 4,702 5,754 9,668 14,120

Insurance

29,093 7,976 12,403 21,822 57,320

Building repairs

10,453 4,184 3,529 6,352 21,474

Interest

31,005 6,772 9,331 21,099 66,178

Other overhead expenses

16,774 2,893 5,399 16,597 32,624

Total cash fixed expense

$205,134 $39,018 $72,755 $143,047 $431,108

Feed purchased

$157,325 $8,163 $2,669 $25,079 $434,963

Livestock purchased

128,867 1,046 614 15,340 363,918

Total Cash Expenses $863,808 $128,970 $227,994 $437,658 $1,996,950

Cash Net Farm Income $141,484 $36,654 $84,194 $150,297 $234,543

Loans received minus loans repaid

$29,460 $1,679 $8,146 $29,652 $59,809

Net Farm Cash Flow $170,944 $38,333 $92,340 $179,949 $294,351

Page 5

2023 Iowa Farm Costs and Returns

A more accurate measure of net farm income is achieved by netting out changes in the values of beginning and ending

inventories, subtracting a depreciation charge for farm assets and including accrued income and expenses.

A summary of income and expenses using accrual accounting is shown in Table 4. The 2023 accrual net farm income

ranged from an average of $21,231 among the smallest farms to an average of $114,034 among the largest farms, and

averaged $64,583 across all farms. The latter was 78% lower than in 2022, driven by a 226% drop in crop inventory

values (-$162,742). Return to management, obtained after subtracting a return to unpaid labor and equity capital

invested, was negative for all groups and averaged -$54,147 across all farms in 2023. It was the first year with negative

returns after a three-year run of positive net returns. The operating expense ratio for the average Iowa farm increased by

18 percentage points in 2023 to 79%, and the net farm income ratio decreased by 21 percentage points to 9%.

Table 4. Summary of Accrual Income and Expenses by Size of Farm.

1/

Average

Total Value of Gross Sales

$100,000

to

$199,999

$200,000

to

$399,999

$400,000

to

$799,999

$800,000

and

above

Income

Total cash income

$1,005,292 $165,624 $312,187 $587,956 $2,231,493

Change in crop inventory

-90,838 -13,125 -31,594 -58,557 -196,771

Change in livestock inventory

24,476 6,092 3,846 6,062 61,166

Feed credits, change in other inventories

57,292 4,814 1,779 9,818 156,359

Total accrual income (gross revenue) $996,222 $163,405 $286,218 $545,279 $2,252,247

Total cash expenses

$863,808 $128,970 $227,994 $437,658 $1,996,950

Depreciation

67,831 13,204 24,513 48,538 141,262

Total accrual expenses $931,639 $142,174 $252,507 $486,197 $2,138,213

Accrual net farm income $64,583 $21,231 $33,711 $59,082 $114,034

Charge for unpaid labor

27,371 18,125 23,929 27,937 34,588

Charge for equity capital (4%)

91,358 38,981 55,095 78,554 154,376

Return to Management -$54,147 -$35,875 -$45,312 -$47,409 -$74,930

Allocation of Gross Revenue

Operating expense

79% 75% 76% 76% 86%

Interest expense

3% 4% 3% 4% 3%

Depreciation expense

8% 8% 9% 9% 6%

Net farm income

9% 13% 12% 11% 5%

100% 100% 100% 100% 100%

The value of all crops and livestock produced on the farm is shown in Table 5. The value of farm production decreased

by 18% or $155,522, driven mainly by changes in crop inventory values, followed by a lower value of crop production,

and a slightly lower net value of livestock production, to an average of $710,030 in 2023.

Table 5. Value of Farm Production by Size of Farm.

2/

Average

Total Value of Gross Sales

$100,000

to

$199,999

$200,000

to

$399,999

$400,000

to

$799,999

$800,000

and

above

Value of livestock production

$344,290 $25,095 $8,501 $48,729 $949,958

Less purchase for resale

128,867 1,046 614 15,340 363,918

Less purchased feed fed

157,325 8,163 2,669 25,079 434,963

Net value of livestock production

58,097 15,886 5,218 8,309 151,077

Value of crop production (incl. feed credits)

622,649 131,952 267,414 469,951 1,245,138

Miscellaneous income

120,122 19,484 41,898 85,155 253,921

Crop inventory change

-90,838 -13,125 -31,594 -58,557 -196,771

Value of Farm Production

$710,030 $154,197 $282,935 $504,859 $1,453,366

1/

Accrual net farm income = value of farm production - total cash fixed expense - total cash operating expense - depreciation.

2/

Value of farm production = gross revenue - livestock purchase for resale - purchased feed fed.

Page 6

2023 Iowa Farm Costs and Returns

Efficiency Factors

Selected efficiency factors are shown in Table 6 for the four farm size groups. Gross revenue per person and per dollar

of assets tend to increase with farm size, while gross revenue per dollar of expense tends to decline with farm size. The

rates of return on equity and assets averaged 1.5% and 2.1%, respectively, across all farm groups and marked the lowest

returns since 2017. The average interest rate on debt across all farms was 4.2% in 2023, 0.4% higher than in 2022.

Table 6. Overall Efficiency Factors by Size of Farm.

Total Value of Gross Sales

Average

$100,000

to

$199,999

$200,000

to

$399,999

$400,000

to

$799,999

$800,000

and

above

Crops

Acres in crops

587 149 276 474 1,124

Crop value per acre

$1,006 $888 $968 $992 $1,108

Crop acres per person

333 242 331 402 340

Machinery cost per crop acre

$211 $214 $249 $191 $197

Machinery investment per crop acre

$598 $464 $698 $592 $605

Livestock

Livestock returns per $100 feed fed

$188 $191 $256 $165 $152

Financial

Gross revenue per person

$471,017 $265,880 $343,462 $462,661 $680,562

Gross revenue per $1 expense

$1.11 $1.15 $1.13 $1.12 $1.05

Gross revenue per $1 assets

$0.30 $0.16 $0.23 $0.24 $0.46

Value of farm production per $1 assets

$0.24 $0.15 $0.23 $0.23 $0.30

Return on assets (ROA)

2.1% 0.9% 1.5% 2.3% 3.0%

Return on equity (ROE)

1.5% 0.4% 1.0% 1.8% 2.3%

Operating profit margin ratio

(as % of gross revenue)

1/

7.1% 6.0% 6.7% 9.6% 6.5%

Operating profit margin ratio

(as % of value of farm production)

8.6% 6.4% 6.8% 10.3% 10.0%

Average interest rate on debt

4.2% 4.0% 3.8% 4.0% 4.7%

1/

(Accrual net farm income + interest - unpaid labor) / gross revenue.

High-, Middle-, and Low-profit Farms

Profits vary greatly among farms. In Table 7, farms were ranked by return to management and sorted into three groups

of similar sizes. The high-third group was the one with the fewest crop acres per person, the lowest machinery cost

and investment per acre, and the highest gross revenue per dollar of expense and per dollar of assets, and its return to

management averaged $143,854 in 2023. This group also had the lowest net worth per acre farmed across the three

groups.

The middle-third group had the lowest gross revenue, the lowest total expenses, the lowest area in crop production,

the highest machinery cost and investment per crop acre, and the highest livestock returns per $100 of feed fed, and its

return to management averaged -$53,863. The lowest-third group had the largest area in crops, the largest loss in other

income and inventory, and the highest total expenses, and its return to management averaged -$280,138. However, their

net worth per acre was the highest among the three groups, and their debt-to-asset ratio was the lowest.

Page 7

2023 Iowa Farm Costs and Returns

High-, Middle-, and Low-profit Farms

Table 7. Comparison of High-, Middle-, and Low-profit Farms, Ranked by Return to Management.

1/

High Third Middle Third Low Third Your Farm

Farm Income

Crop sales

$709,006 $577,308 $1,091,941

Livestock sales

565,871 174,166 857,030

Other income and inventory

296,445 7,029 -65,952

Feed credits

73,198 37,094 174,335

Gross revenue

$1,644,520 $795,598 $2,057,355

Operating expenses

$500,764 $345,114 $761,531

Fixed expenses (incl. depreciation)

382,773 244,009 568,485

Feed purchased

200,071 92,714 492,972

Livestock purchased

291,228 60,456 298,422

Total expenses

$1,374,835 $742,293 $2,121,410

Accrual net farm income

$269,685 $53,305 -$64,055

Operator and family labor charge

$29,423 $27,634 $35,811

Charge for equity capital

96,408 79,534 180,273

Return to management

$143,854 -$53,863 -$280,138

Crops

Acres in crops

764 579 1,116

Crop value per acre

$1,024 $1,061 $1,135

Crop acres per person

311 342 379

Machinery cost per crop acre

$182 $217 $204

Machinery investment per crop acre

$503 $667 $639

Livestock

Livestock returns per $100 feed fed

$170 $179 $143

Value of Farm Production $1,153,222 $642,428 $1,265,961

Financial

Gross revenue per person

$670,268 $470,213 $698,404

Gross revenue per $1 expense

$1.20 $1.07 $0.97

Gross revenue per $1 assets

$0.51 $0.33 $0.39

Value of farm production per $1 assets

$0.36 $0.27 $0.24

Return on assets (ROA)

8.8% 2.2% -0.7%

Return on equity (ROE)

10.8% 1.5% -2.5%

Operating profit margin ratio

(as % of gross revenue)

1/

0.17 0.07 -0.02

Operating profit margin ratio

(as % of value of farm production)

0.25 0.08 -0.03

Debt-to-asset ratio

0.31 0.27 0.25

Net worth per acre farmed

$2,921 $3,000 $3,567

Allocation of Value of Gross Revenue

Operating expense

75% 82% 93%

Interest expense

3% 3% 3%

Depreciation expense

6% 8% 7%

Net farm income

16% 7% -3%

1/

Values have not been adjusted for size of business.

Page 8

2023 Iowa Farm Costs and Returns

Crop Production

Details of crop production income and expenses per acre are summarized in Table 8. Some expenses, such as cash rent,

did not occur on all farms or on all acres, but are shown as the average cost over all acres. Total economic costs include

a 4% opportunity cost charge for the farm net worth capital, a depreciation charge, and a charge for operator and family

labor. The numbers presented in Table 8 refer to simple, unweighted averages across all farms included in the Iowa Farm

Business Association Summary Report. The selling price for corn exceeded its total economic cost by $0.80 per bushel,

but the selling price for soybeans was lower than its total economic cost by $0.99 per bushel. Each bushel of corn and

soybeans contributed, on average, $2.06 and $3.41 to the net cash flow of the operation.

Table 8. Crop Production.

All Corn Soybean

Total operator acres per crop

477 383

Yield, bushels per acre

214 62

Selling price per bushel

$6.27 $13.80

Crop value per acre

$1,344 $855

Crop Expenses per Acre

Seed

$124.98 $64.36

Fertilizer and lime

225.52 58.08

Herbicide

65.37 75.64

Insecticide

11.96 10.43

Drying and storage

13.82 2.50

Machinery, fuel, repairs, machine hire

126.34 117.91

Utilities

10.79 9.70

Insurance

44.04 41.03

Hired labor

14.11 12.21

Interest

37.13 32.86

Cash rent

174.22 170.59

Property taxes and building repairs

27.31 25.93

Other crop expenses

27.07 23.00

Total cash crop expenses per acre

$902.65 $644.21

Machinery depreciation

$74.49 $74.76

Building depreciation

18.97 17.43

Charge for equity capital

133.05 136.02

Unpaid labor value

44.51 43.81

Total economic cost per acre

$1,173.68 $916.24

Total economic cost per bushel

$5.48 $14.79

Total cash flow needed per acre

$902.65 $644.21

Total cash flow needed per bushel

$4.21 $10.40

Page 9

2023 Iowa Farm Costs and Returns

Trends

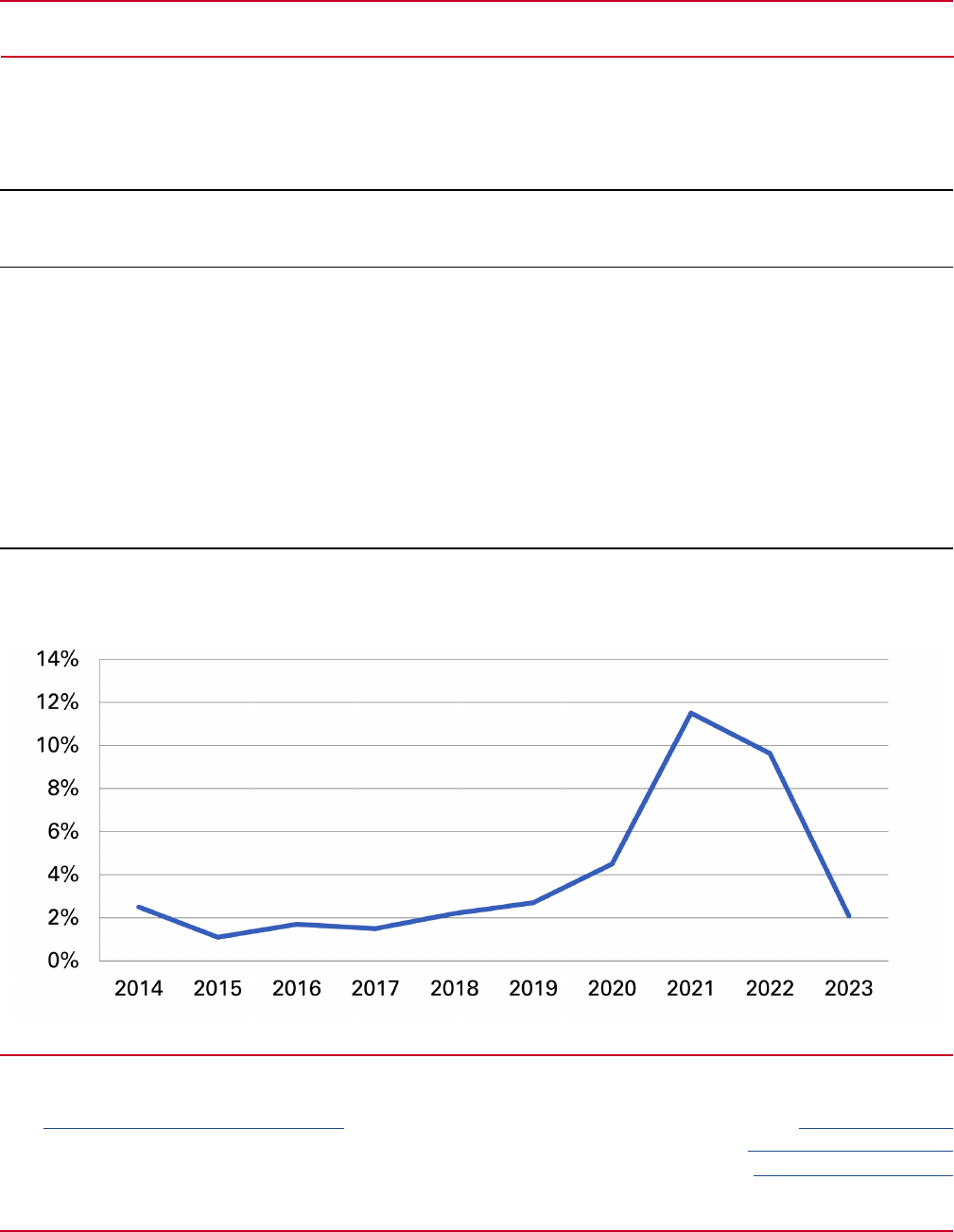

Table 9 illustrates trends in production and financial efficiency over the past 10 years. Livestock income per $100 feed

fed shows a cyclical pattern, and in 2023 it was 16% higher than its 10-year average. The average corn yield of 214

bushels was 2% higher than in 2022 and 5% higher than the 10-year average. The rate of return to owned assets averaged

2.1% in 2023, or 1.9 percentage points below the 10-year average.

Table 9. Trends in Production and Financial Efficiency on Iowa Farms.

Year

Livestock

Income per

$100 Feed Fed

Corn Yield

Bushels

per Acre

Value of Farm

Production

per $1 Expense

Crop Value

per Acre

Percent Return

to Owned Assets

2014 $223 184 $1.20 $667 2.5%

2015

1/

133 200 1.09 588 1.1%

2016 117 209 1.12 635 1.7%

2017

2/

179 214 1.08 604 1.5%

2018 161 201 1.12 617 2.2%

2019 158 199 1.13 606 2.7%

2020 122 189 1.21 605 4.5%

2021 184 218 1.59 777 11.5%

2022

3/

155 210 1.45 1,078 9.6%

2023 188 214 1.11 1,006 2.1%

10-year average $162 204 $1.21 $718 3.9%

1/

Revised with additional farm data.

2/

Revised using weights from the 2017 Census of Agriculture.

3/

Revised using weights from the 2022 Census of Agriculture.

Percent Return to Owned Assets

Prepared by Alejandro Plastina

extension economist,

extension.iastate.edu/agdm

store.extension.iastate.edu

This institution is an equal opportunity provider. For the

full non-discrimination statement or accommodation inquiries,

go to www.extension.iastate.edu/diversity/ext.