2023 Iowa State University Land Value Survey:

Overview

Rabail Chandio

Working Paper 23-WP 655

December 2023

Center for Agricultural and Rural Development

Iowa State University

Ames, Iowa 50011-1070

www.card.iastate.edu

Rabail Chandio is Assistant Professor of Economics, Department of Economics, Iowa State

University, Ames, Iowa, 50011. E-mail: rchandio@iastate.edu.

This publication is available online on the CARD website: www.card.iastate.edu. Permission is

granted to reproduce this information with appropriate attribution to the author and the Center for

Agricultural and Rural Development, Iowa State University, Ames, Iowa 50011-1070.

For questions or comments about the contents of this paper, please contact Rabail Chandio,

rchandio@iastate.edu.

Iowa State University does not discriminate on the basis of race, color, age, ethnicity, religion, national origin,

pregnancy, sexual orientation, gender identity, genetic information, sex, marital status, disability, or status as

a U.S. veteran. Inquiries regarding non-discrimination policies may be directed to Office of Equal Opportunity,

3410 Beardshear Hall, 515 Morrill Road, Ames, Iowa 50011, Tel. (515) 294-7612, Hotline: (515) 294-1222, email

eooffice@iastate.edu.

1

2023 IOWA STATE UNIVERSITY LAND VALUE SURVEY:

OVERVIEW

Rabail Chandio

Assistant Professor and Extension Economist

Department of Economics, Center for Agricultural and Rural Development, and

Iowa State University Extension and Outreach

Iowa State University

481 Heady Hall, 518 Farmhouse Lane, Ames, Iowa

Email: rchandio@iastate.edu

Phone: 515-294-6181

Abstract: Fluctuations in land values can signal changes in market conditions, impact farmers' financial well-

being, and influence policy decisions, making it essential to record and analyze them. Since 1950, the Iowa State

University Land Value Survey has been the only data source that provides a county-level land value estimate for

each of the 99 counties in Iowa. The 2023 Iowa State University Land Value Survey reported a 3.7% increase to

$11,835 per acre for average Iowa farmland values from November 2022 to November 2023. This continues the

increase in land values from last year, and the $11,835/acre nominal land value is the highest ever since data

collection began in the 1940s. However, the pace of the increase has slowed down. The inflation-adjusted value,

$9,131/acre in 2015 dollars, also the highest recorded, saw a very modest increase of 0.5%. While the overall

increase is supported by limited land supply, stronger-than-expected crop yields, and ample cash reserves on the

farm, the slowing pace and, in some places, the fall in land values is largely attributable to the recent hikes in

interest rates, decreasing commodity prices and increasing input costs. All crop reporting districts except the

Northwest district reported an increase in land values. The Southeast and South Central districts reported the

largest growths of 12.8% and 9.6%, respectively, with all other increases falling below 5%. The Northwest

district reported a small decrease of 0.8% in land values. High-quality land saw a 3.5% increase, while medium-

and low-quality land increased 3.8% and 4.0%, respectively. In general, the 2023 Iowa State University Land

Value Survey results echo other surveys, which all showed relatively stable farmland market values.

Key Words: Land Values, Iowa, Land Ownership, Interest Rate, Farm Income, Ag Credit, Real Estate,

Commodity Prices, Expert Opinion Survey, Agricultural Trade, Inflation

JEL Codes: Q15, Q13, Q14, Q18

Citation suggestion: Chandio, R. 2023. “2023 Iowa State University Land Value Survey: Overview.” CARD

working paper 23-WP 655, Iowa State University Extension and Outreach, Center for Agricultural and Rural

Development.

Acknowledgement:

The author gratefully acknowledges the support of all CARD staff, especially Karen Kovarik and

Nathan Cook. This paper also benefited significantly from data entry research assistance from Trinydee Prins and Madhav

Dhimal, and from feedback and discussions with Ann Johanns, Chad Hart, Lee Schulz and ISU Extension and Outreach farm

management specialists.

I also want to thank the continuous and great assistance from several agricultural professional organizations, such as the

ASFMRA Iowa Chapter, RLI Iowa Chapter, Iowa Bankers Association, and USDA Farm Service Agency.

2

2023 IOWA STATE UNIVERSITY LAND VALUE SURVEY:

OVERVIEW

History and Purpose of the ISU Land Value Survey

The survey was initiated in 1941 and is sponsored annually by Iowa State University. Only the state

average and the district averages are based directly on Iowa State survey data. County estimates are derived

using a procedure that combines Iowa State survey results with data from the US Census of Agriculture.

Since 2014, the survey has been conducted by the Center for Agricultural and Rural Development in the

Department of Economics at Iowa State University and Iowa State University Extension and Outreach.

The survey is intended to provide information on general land value trends, geographical land price

relationships, and factors influencing the Iowa land market. The survey is not intended to provide a direct

estimate for any particular piece of property.

The survey is an expert opinion survey based on reports by licensed real estate brokers, farm managers,

appraisers, agricultural lenders, county assessors, and selected individuals considered to be knowledgeable

of land market conditions. Respondents were asked to report for more than one county if they were

knowledgeable about the land markets in multiple counties. The 2023 ISU Land Value Survey is based on

417 usable county-level land value estimates provided by 282 agricultural professionals.

Of the 282 respondents, 41% completed the survey online. Online responses allow participants to provide

estimates for up to 12 counties. A web portal has been developed to facilitate the visualization and analysis

of Iowa farmland values by pooling data from ISU, USDA, Federal Reserve Bank of Chicago, and the

REALTORS® Land Institute Iowa Chapter, as well as by making use of charts over time and interactive

county maps. The portal can be accessed at https://www.card.iastate.edu/farmland.

Participants in the survey are asked to estimate the value of high-, medium-, and low-quality land in their

county. Comparative sales and other factors are taken into account by the respondents in making these

value estimates. This survey is the only data source that provides an annual land value estimate at the

county level for each of the 99 counties in Iowa. In addition, this survey provides estimates of high-,

medium-, and low-quality land at the crop reporting district and state level.

Analysis by State

The 2023 state average for all land of all quality was estimated to be $11,835 per acre as of November 1,

2023.

The statewide average value increased $424 per acre from November 2022.

The statewide average value increased 3.7% from November 2022.

December 12, 2023

3

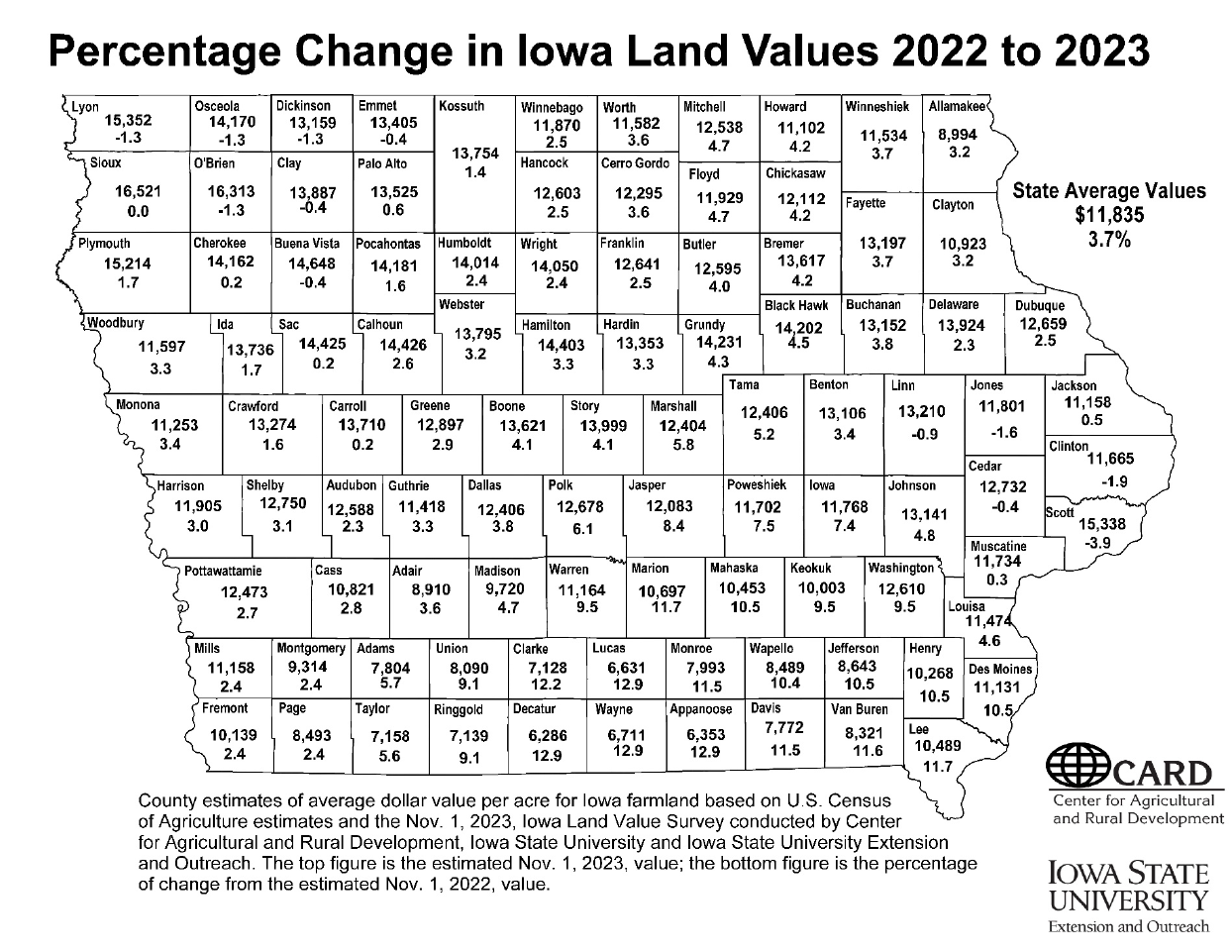

Analysis by Crop Reporting District

The highest average land values were reported in Northwest Iowa, $14,753 per acre.

The lowest average land values were reported in South Central Iowa, $7,482 per acre.

Land values increased across all crop reporting districts except Northwest Iowa, with a decrease of 0.8%.

The largest percentage increases were in the Southeast and South Central districts, at 12.8% and 9.6%,

respectively. The East Central and Southwest districts, which saw the smallest percentage changes,

reported increases of 0.7% and 2.6%, respectively.

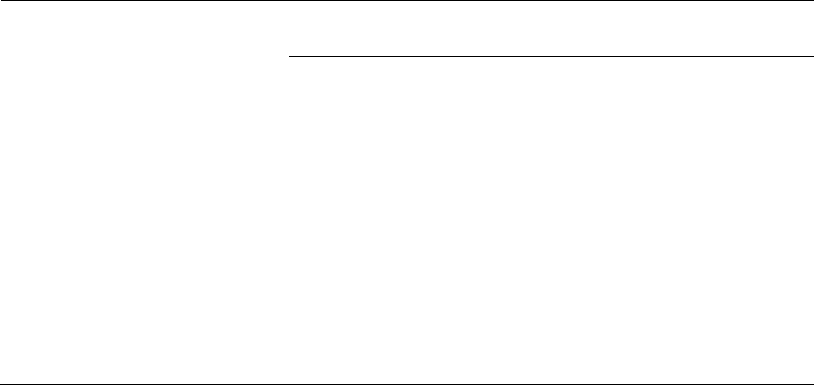

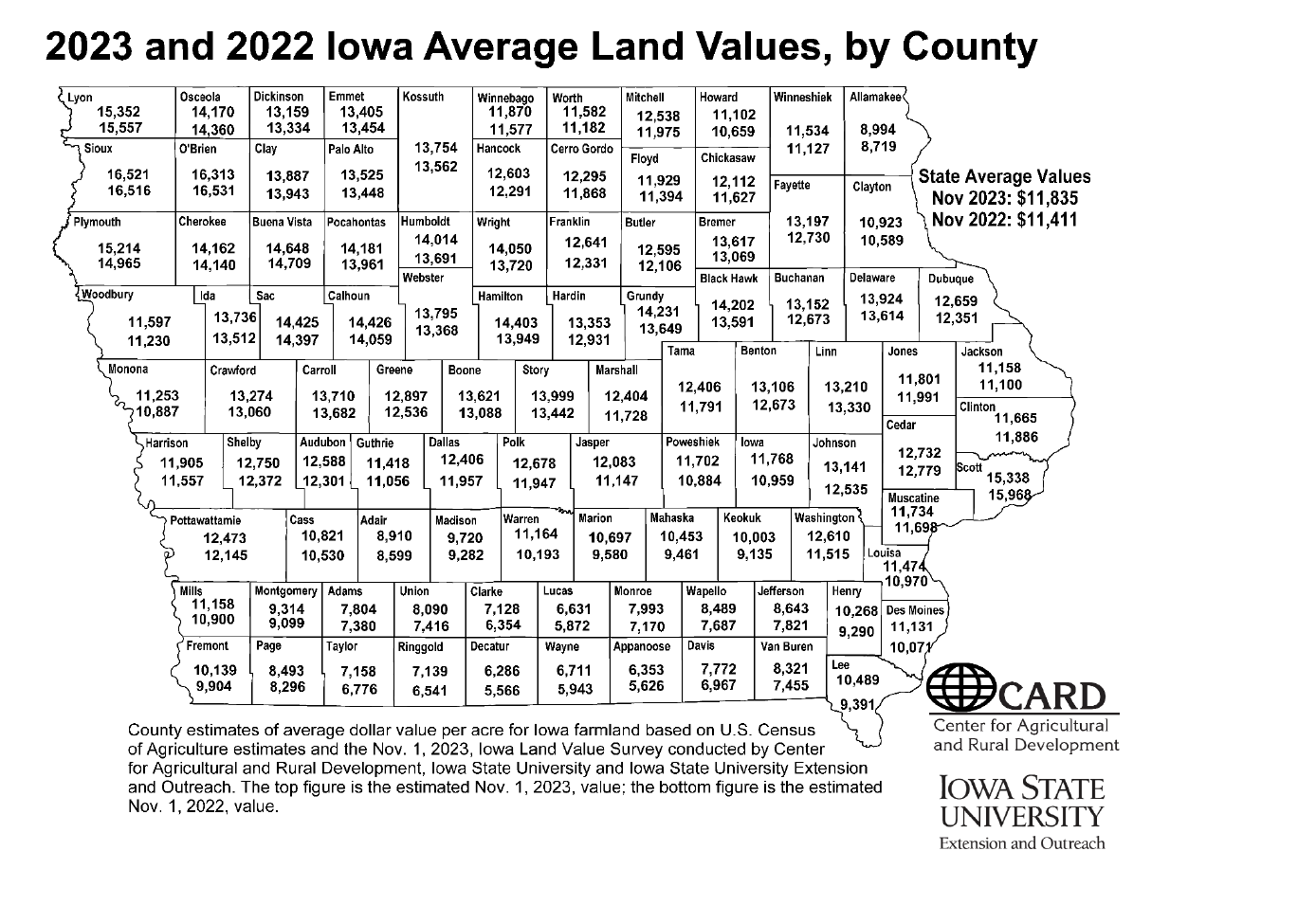

Analysis by Counties

The highest value was estimated for Sioux County, $16,521 per acre.

The lowest value was in Decatur County, $6,286 per acre.

Twelve of the 99 counties reported decreases in nominal land values and 45 counties reported a decrease in

inflation-adjusted values, but 87 counties still report the highest nominal land values since 1950, and, for

42 counties, the inflation-adjusted values are also record-high—topping the previous peak in 2013.

The largest percentage decrease, 3.9%, was reported in Scott County, while the largest increase, 12.9%, was

reported in Appanoose, Decatur, Lucas, and Wayne counties. Sioux County reported the lowest percentage

increase at less than 1%. The largest dollar decrease was reported in Scott County, $630 per acre, while

Marion County saw the largest dollar increase, $1,117 per acre. The smallest dollar increase was reported

in Sioux County, $5 per acre.

Analysis by Quality of Land

Low-quality land statewide averaged $7,664 per acre, a 4% or $296 per acre increase from November

2022. Low-quality land in the Southeast, South Central, and West Central saw increases of 17.6%,

16.6%, and 11.3%, respectively; and low-quality land in the Northwest, Northeast, Central and East

Central districts posted decreases in land values with the largest percentage decrease in the East Central

district at 4.2%.

Medium-quality land averaged $11,075 per acre, an increase of 3.8% or $401 per acre, with a minor decrease in

its value reported in East Central district at 0.1%.

High-quality land averaged $14,296 per acre, an increase of 3.5% or $479 per acre. High-quality land in three

of nine districts (Northeast, Central, and Southeast) saw increases over 5%, while the Northwest district

reported a modest decrease of 1.1%.

Regardless of land quality, the South Central and Southeast districts saw larger increases, while the East

Central, West Central, and Southwest districts reported smaller increases with only the Northwest district

reporting a decrease in land values this year.

Major Factors Influencing the Farmland Market

Most survey respondents listed positive and/or negative factors influencing the land market. Of all

respondents, 90% listed at least one positive factor, and 86% listed at least one negative factor. In most

cases, respondents listed multiple factors.

There were three positive factors listed by over 50% of respondents who provided at least one positive

factor. The most frequently mentioned factor was limited land supply, mentioned by 15.5% of respondents.

4

Strong yields and the combination of cash on hand and credit availability were the next most-frequently

mentioned positive factors, mentioned by 12.6% and 12.1% respondents, respectively. Other frequently

mentioned positive factors included higher commodity prices (11.3%) strong land demand including from

investors (11.3%), a good farm economy (5.4%), and a recent history of favorable interest rates (2.8%).

There were also three negative factors listed by more than 40% of respondents who identified at least one

negative factor. The most frequently mentioned negative factor affecting land values was the series of

interest rate hikes over the past two years, mentioned by 23.4% of respondents, and the fall of commodity

prices during 2023 was the second-most important concern with 22.7% responses identifying it. Concerns

about higher input costs, weather uncertainty, and stock market volatility and economic uncertainty were

the next most frequently mentioned negative factors, mentioned by 11.4%, 7.2% and 5.1% of respondents,

respectively. Land availability and uncertainty in agricultural profitability were each mentioned by roughly

3.6% of respondents.

Number of Sales Compared to the Previous Year

In 2023, 39.5% of respondents reported fewer sales relative to 2022, which signals the slowing place of the

land market. On the other hand, 21% reported more sales, and 39.5% reported the same level of sales in

2023 compared to 2022.

The South Central district has the lowest percentage of respondents who reported more sales, at 11%,

while the East Central district has the highest percentage of respondents who reported more sales, with

28%. On the other hand, in six of the nine districts, more than 40% of respondents indicated fewer sales in

2023 than 2022.

Land Sales by Buyer Category

The survey asked respondents what percent of the land was sold to six categories of buyers: existing local

farmers, existing relocating farmers, new farmers, local investors, non-local investors, or other.

The majority of farmland sales, 70%, were to existing farmers, of which existing local farmers captured

69% of land sales. Only 1% of sales were to existing relocating farmers. New farmers represented 4% of

sales. Investors represented 24% of land sales, with 12% going to local investors and 12% to non-local.

Other purchasers were 2% of sales.

Sales to existing local farmers by crop reporting district ranged from 58% in the South Central district to

77% in the West Central district.

Sales to investors were highest in the South Central district (34%). The West Central district reported the

lowest investor activity (17%). Four districts, Northwest, West Central, Central, and East Central, reported

more local investor sales than non-local investor sales.

Land Sales by Seller Category

The survey also asked respondents what percent of land was bought from six categories of sellers: active

farmers, retired farmers, estate sales, local investors, non-local investors, or other.

The majority of farmland sales, 57%, were from estate sales, followed by retired farmers at 23%. Active

farmers accounted for 7% of sales, while local and non-local investors accounted for 4% and 7%,

respectively.

Estate sales by crop reporting district ranged from 40% in the South Central district to 70% in the West

Central district.

Sales by investors were highest in the South Central district (24%), with local investors representing 10%

of sales and non-locals representing 14%. The Northeast and East Central districts reported the lowest

5

investor sale activity (6% each), with local investors representing 2% and 3% of sales and non-locals

representing 4% and 3%, respectively.

Respondents by Occupation and by Mode of Survey

The survey asked the main occupation of the respondent: farm manager, appraiser, agricultural lender,

broker/realtor, government, farmer/landowner, and other, along with the respondents’ number of years of

experience and the number of counties in which they offer services.

In total, 282 agricultural professionals completed the survey, providing 417 county land value estimates.

Of these 282, agricultural lenders represented the largest group, accounting for 41% of all respondents.

Brokers/realtors and farm managers were the next largest groups, representing 14.2% and 13.1% of

respondents, respectively.

Of all respondents, the percentage of agricultural lenders ranged from 25% in the Southwest district to

more than 45% in the Northwest, Northeast, West Central, and Southeast districts.

Our respondents, on average, have 27 years of experience in their current profession and offer professional

services to an average of six counties. While government officials typically only serve one county,

appraisers, agricultural lenders, farm managers, and realtors/brokers offer services, on average, to 15, 10,

10, and 4 counties, respectively.

The survey was completed online by 41% of the 282 respondents.

Farmland Value and Cash Crop Price Predictions by Respondents

This year’s survey asked respondents to predict land values and cash crop prices one and five years from

now, as well as the prevailing interest rates for a 20-year farmland mortgage and a one-year operating loan.

Respondents had optimistic views regarding the strength of the farmland market five years from now, and

generally expect stable or even higher land values, with the one year expectation tilting towards a fall in

land values. Forty-eight percent of respondents forecasted a decrease in their local land market in one year,

while 30% expected a higher land value and 22% forecasted no change. While the most popular response

was for the one-year land price forecast to decrease by 5% or less, the second-most popular answer was for

land values to remain the same as the current situation. Looking five years ahead, 16% of respondents

forecasted a decline, much smaller than the 48% forecasting a decline 12 months from now. Meanwhile,

70% of respondents expect an increase in land values in the long term, with an increase of 10%–20%

selected by most respondents.

To better gauge the respondents’ views of current farmland values, the survey also asks them to rate the

current farmland values in their primary county as way too low, too low, just right, too high, or way too

high. Fifty-nine percent and 10% of respondents think the current land values are too high or way too

high, respectively, while only 5% of respondents think the current land values are too low. Twenty-five

percent of respondents think the land values are just right.

Respondents expect corn and soybean cash crop markets to remain relatively stable. In particular, the

predicted state average cash corn prices for November 2024 (one year from now) and 2028 (five years from

now) are $4.69/bu. and $5.33/bu., respectively. The statewide average soybean price predictions are

$12.42/bu. in one year and $13.36/bu. five years from now.

Respondents reported typical interest rates for 20-year farmland mortgages and one-year operating loans

are 7.59% and 8.54%, respectively. These are significantly higher than one-year-ago levels due to the

multiple interest rate hikes by the Federal Reserve to combat inflation.

Land Quality and Corn Suitability Rating 2

6

To gauge how each respondent defined high-, medium-, and low-quality land for their county, we asked

for estimated average CSR2 (Corn Suitability Rating 2) for high-, medium-, and low-quality land. We also

asked for estimates of the percent of land area for each land quality class.

Approximately 90% of participants provided at least one CSR2 estimate for the corresponding land quality

classes. The estimated average CSR2 values statewide for high-, medium-, and low-quality land are 83, 70,

and 56 points, respectively. The estimated percent of land area for high-, medium-, and low-quality land is

35%, 40%, and 25%, respectively.

In addition, respondents ranked high-, medium-, and low-quality land based on relative conditions in their

region. For example, the average CSR2 for high-quality land in the South Central district is 72, which is

only slightly larger than the CSR2 for low-quality land in the Northwest district (70).

7

Interpretation of the 2023 Survey Results

The 2023 Iowa State University Land Value Survey reported a 3.7% increase to $11,835 per acre for average

Iowa farmland values from November 2022 to November 2023. This represents a modest increase from last

year, and the $11,835/acre nominal land value is the highest-ever recorded by the survey. The 2023

nominal land value is 36% higher than the 2013 peak in nominal land values, and the inflation-adjusted

value, $9,131/acre in 2015 dollars, saw a 0.5% increase and is also the highest on record.

The declining rate of increase in land values, along with falling values in select regions, is revealing a

possible plateauing in the land market. The downward pressures on land values are largely attributable to

interest rate hikes, lower commodity prices, increasing input prices, and weather uncertainty. At the same

time, limited land supply, stronger-than-expected crop yields, readily available cash and credit, higher

commodity prices earlier in the year, strong demand, including from investors, and a good farm economy

supported the overall growth in Iowa land values. In general, nearly half of the respondents expect modest

declines in land values within the next year but are optimistic about the future of the land market,

forecasting increases in five-year land values.

The 2023 Iowa State University Land Value Survey revealed a geographic pattern in land value changes

across crop reporting districts, counties, and land quality classes. Land values increased in eight of the nine

crop reporting districts, with the largest percentage increases in the South Central and Southeast districts,

12.8% and 9.6%, respectively. All other districts reported increases less than 5% except for the Northwest

district, where land values decreased by 0.8%. Across land quality classes, low-quality land saw the greatest

increase, 4%, while high- and medium-quality land experienced 3.5% and 3.8% increases, respectively.

Within the districts, high quality land decreased in value by 1.1% in the Northwest district, medium-

quality land value decreased in the East Central district by 0.1%, while low-quality land values fell in the

Northwest, Northeast, Central, and East Central districts by 0.8%, 1%, 0.1%, and 4.2%, respectively.

Twelve of Iowa’s 99 counties reported decreases in nominal land values and 45 counties reported a

decrease in inflation-adjusted values, but 87 counties still report the highest nominal land values since

1950, and, for 42 counties, the inflation-adjusted values are also record-high—topping the previous peak

in 2013. The largest percentage increase, 12.9%, was reported in Appanoose, Decatur, Lucas, and Wayne

Counties while the largest percentage decreases were reported in Scott and Clinton Counties at 3.9% and

1.9%, respectively.

In general, the results from the 2023 Iowa State University Land Value Survey are similar to the results

from other surveys, which all highlight the slowing pace of the farmland market due to higher interest

rates and lower commodity prices. In November 2023, the Federal Reserve Bank of Chicago reported no

change in Iowa‘s “good” farmland values from October 2022 to October 2023. In September, the

REALTORS® Land Institute reported an overall 0.6% increase in Iowa cropland values from September

2022 to September 2023, with decreases reported in Northwest, North Central, and West Central district

values. The US Department of Agriculture June Area Survey reported a 5.6% rise in Iowa‘s agricultural real

estate values (land and building) from June 2022 to June 2023.

Nearly 40% of respondents reported less sales in 2023 relative to 2022, another 39% reported the same

level of sales, while only 21% reported more sales compared to 2022. Limited land supply is reported as the

most common factor selected as a positive influence on land values.

The majority of farmland sales, 70%, were to existing farmers, of which existing local farmers captured

69% of land sales. Only 1% of sales were to existing relocating farmers. New farmers represented 4% of

sales. Investors represented 24% of land sales, with 12% going to local investors and 12% to non-local.

Other purchasers were 2% of sales.

The farmland value estimates from the Iowa State survey are average estimates for all farmland in a county,

including cropland, pasture, CRP, and timberland. Specifically, we asked respondents to estimate “farmland

value for average-sized farms in your county as of November 1, 2023.”

An opinion survey is just that—it represents the collective opinion of the survey respondents. Most of the

respondents will use actual sales to formulate their opinions but each person can choose to weigh or

8

discount particular sales as they deem necessary. The Iowa State Land Value Survey is an opinion survey,

as are the surveys conducted by Federal Reserve Bank, USDA, and the REALTORS® Land Institute. It is

important to consider the survey respondents, the questions asked, the time period covered, and other

factors relating to a particular survey. As a result, it is important to note that when comparing results

across surveys for Iowa and neighboring states, it is better to compare percentage change over time as

opposed to dollar amount per acre.

The Iowa State Land Value Survey is intended to provide information on general land value trends and

factors influencing the Iowa land market, it is not intended to provide a direct estimate for any particular

piece of property. We recommend interested buyers or sellers hire an appraiser to conduct a formal

appraisal of a particular parcel, go to county assessor websites, or examine recent auction results for

comparable parcels in their region.

9

Outlook for Land Values in 2023 and Beyond

The slowing pace of the growth in Iowa farmland values is not really a surprise for some – in November

2022, over 30% of the 2022 Iowa State survey respondents thought land values in their territory would

either remain the same or modestly increase in 2023. The small increase of 3.7% falls within that

expectation. On the other end of the spectrum, nearly 70% of the respondents believe that land values are

higher than they should be and about 50% expect a decline in the next year. This is explained by the

downward pressures by rising interest rates, lower commodity prices, and higher input costs.

The estimated $11,835 per acre statewide average for all qualities of land in Iowa represents a 3.7%

increase in nominal land values from November 2022. This modest increase, following the dramatic 17%

surge last year, means that Iowa farmland values, still at an all-time high since Iowa State started tracking

the land value information in the 1940s, have started to cool off. After adjusting for inflation, the overall

inflation-adjusted land values rose only 0.5%, and the inflation-adjusted land values fell in 45 counties.

Despite the slowing pace, there is a variation in the change and inflation-adjusted land values in 42 out of

99 counties in Iowa are still at an all-time high.

Many of the factors behind the large surge in values last year continue to support this increase at the

beginning of the year—interest rates were lower through the first half of the year, commodity prices were

still elevated as weather and geopolitical uncertainty created crop production concerns, crop yields once

again were a positive surprise despite the weather challenges throughout the growing season, cash and

credit availability has remained ample and allowed farmers to stay aggressive in the land market, and

investor demand grew stronger nudged by inflation concerns and lack of alternative investment options.

According to USDA Economic Research Service’s December 2023 farm income forecast, US net farm

income is forecast to decrease $31.8 billion (17.4%) from 2022 levels to $151.1 billion in 2023 (in

inflation-adjusted terms, a 20% fall). Despite the decline, US net farm income in 2023 is higher than the

2020 net farm income by 38%, and its 20-year average (2003–2022) by 36%. The decrease is driven by

falling commodity prices and cash receipts from farming, along with lower direct government payments

and higher production costs. In particular, both crop receipts and animal or animal product receipts are

expected to decrease by 4% and 5%, respectively. Even though the direct government payments continue

to fall, the 2023 direct government payments are forecasted at $12.1 billion, reflecting the reduction in

COVID-related assistance in 2023. As farm production expenses are rising, with the largest increases this

year coming from interest expenses, the growth in expenses has caught up to the growth in revenues,

making for tighter margins.

Put simply, land value is the net present value of all discounted future income flows. With certain

assumptions imposed, one could think of land value being net income divided by the interest (discount)

rate. To understand the changes in land value over time and across space, it is useful to examine how net

income and interest rates will change over the next few years. Improving commodity prices, rising farm

income, and lower interest rates tend to exert upward pressures on land values; while lower prices and

incomes and higher interest rates tend to press downward on land values.

From this perspective, the annual 3.7% increase in farmland values is consistent with reports on stabilizing

farm incomes as well as several other underlying supply and demand factors. First, commodity prices,

although falling, are at par with the pre-pandemic levels—USDA forecasts the 2023 season-average corn

and soybean prices at $4.85/bu. and $12.90/bu., respectively. These prices are 28% and 8% lower than

year-ago levels, respectively, but are still higher than 2020. However, production costs have also risen,

leading to tighter profit margins based on the 2023 Iowa Cost of Production estimates. Corn per bushel

cost of production has, in fact, exceeded the season average price. The lowering profitability, which is a

combination of prices and input costs, is placing downward pressure on land values. Many respondents

cited low commodity prices and high input costs as a key negative factor for farmland markets.

Second, despite the weather challenges throughout the growing season, the Iowa and national corn and

soybean yields are much stronger than expected, with Iowa at 200 and 58 bushels per acre, respectively,

and the nation at 174.9 and 49.9 bushels per acre, respectively. These yields are very similar to last year’s

levels, but are still surprisingly high given the extent of drought conditions within the state and across the

growing season, making this a positive influence on land values.

10

Third, the Federal Reserve continued their interest rate hikes throughout the year in response to the

inflationary pressures that had begun to build in 2021. By the second quarter of 2022, the US Bureau of

Labor Statistics reported that the US inflation rate rose to its highest level since 1982. While inflation has

driven some investors to consider farmland as an alternative investment asset because farmland value tends

to rise with higher inflation, that demand has also slowed down with inflation. Moreover, higher interest

rates from the summer of 2022 increased the contribution of interest expenses to production costs and

decreased farm profitability. Previous research shows that the realization of the interest rate hikes in the

land market is often delayed. The hikes in interest rates since the second half of 2022 are now influencing

land values as we move into 2024 and 2025.

Finally, despite the fall in sales activity, many respondents noted the strong demand for farmland,

including from investors. As noted earlier, some investors are nudged by the higher inflation rate when

looking for alternative investment options, some look for undervalued assets or a bargain, and others are

also attracted to rural acreage or land with recreational potential. However, there is still limited farmland

supply, which was noted to have helped buoy market prices in many areas across the state, and kept the

overall Iowa land values increasing despite substantial downward pressure with lowering incomes and

rising interest rates.

Eight of the nine crop reporting districts saw growth in their land values, with the Southeast and South

Central districts reporting the highest percentage increases of nearly 10% or more. While these two

districts have the highest percentage increases this year compared to other districts, the percentage increase

in their values is almost the same as last year. The regional trends suggest that the surging land values are

cooling off first in the northern and central districts, where they surged with a much higher magnitude,

whereas the southern areas are following with a lag. While land values could be thought of as net income

divided by interest rates, net income tends to be localized while interest rates are more universal. The

strength in these districts reflected the competitiveness of the land market, more investor influence

(especially for recreational land use in South Central Iowa), lower land availability (with roughly half of

the regional respondents indicating fewer land sales), as well as the positive impacts of better-than-

expected crop yields. While low-quality land experienced the largest percentage increase, specifically in the

South Central and Southeast districts, the medium-quality land value change was only slightly smaller,

with high-quality land capturing the smallest increase. Furthermore, previous research shows that experts’

estimates are less informative and noisier for low-quality land, suggesting that more trust should be put in

the Iowa State University Land Value Survey for high-quality land values than for low-quality land values.

It is also worth noting that low-quality farmland in the Iowa State survey includes pasture, timber, and

recreational tracts.

All Iowa counties except for 12 reported growth in nominal land values, although the magnitudes of

increases are much smaller than in the previous two years—the largest percentage increase, 12.9%, was

reported in Appanoose, Decatur, Lucas, and Wayne counties. Scott and Clinton counties reported the

largest decreases at 3.9% and 1.9%, respectively. The 12 counties reporting a decrease in nominal land

values are all located in Northwest and East Central districts, while the 45 counties reporting a decrease in

inflation-adjusted values are distributed well in seven Iowa districts except for the South Central and

Southeast districts where all counties report an increase. Moreover, in inflation-adjusted values, 68

counties have values that exceed the peaks from 2012 and 2013, and 42 of these counties have record-high

inflation-adjusted land values. The 42 record-setting counties that truly posted historically high land

values, include all counties from the Southeast, no counties from the Northwest and North Central

districts, and a more equal distribution across other crop reporting districts.

Across the Corn Belt and Great Plains, the land market saw consistent, yet more modest, increases. Many

neighboring states also experienced recent large increases in land values, especially in surveys conducted in

recent months in light of commodity market rallies. The Illinois Society of Professional Farm Managers and

Rural Appraisers and University of Illinois reported in March 2023 that Illinois land values for excellent

quality land increased 15.3% from January 2021 to January 2022. The February 2023 Nebraska report

indicated the average market value of dryland non-irrigated cropland increased by 13% compared to one

year earlier. The 2023 land value survey conducted by Purdue University reported a 7.3%, 5.8%, and 0.7%

increase for Indiana’s statewide top-, medium-, and low-quality farmland values, respectively, from June

2021 to June 2022. The quarterly AgLetter report by the Chicago Federal Reserve Bank issued in November

2023 indicated a 6% increase in Illinois, no change in Iowa, and 9% and 16% growth for Wisconsin and

11

Indiana, respectively, for the period of October 1, 2022, to October 1, 2023. It also reported an overall 1%

growth over the last quarter for the seventh district, a 1% increase for Illinois and Iowa land values, and no

change for Indiana values. The quarterly Ag Credit survey conducted by the Kansas City Federal Reserve

Bank, published in August 2023, showed that non-irrigated cropland values in their district grew by

roughly 8% from the previous year.

While there has been a tempering of land value growth potential in the short run, generally, respondents

expect higher land values in the future. Nearly half, 49%, of respondents forecasted a decrease in their local

land market in one year, while the most selected answer (29%) was for less than a 5% fall in land values.

Looking five years ahead, 16% of respondents forecast a decline, growing from the 11% that forecasted a

decline 12 months ago and the 6% that forecasted a decline two years ago. However, roughly 60% of

respondents still expect a further increase in land values, with an increase of 10%–20% selected by the

largest number of respondents (30%). This is consistent with respondents’ corn and soybean price

forecasts—respondents expect stable to slightly rising corn and soybean cash crop prices. The Ag Economy

Barometer led by Purdue University, a nationwide monthly agricultural producer survey, showed that the

most surveyed farmers expect higher farmland prices 12 months from now, mostly due to strong investor

demand which is expected to outweigh the rising costs, lowering prices, and higher interest rates.

The inflation concerns that arose last year continued to strengthen through the early part of this year.

Although the inflation rate peaked in 2022, we experienced quite high inflation rates earlier this year. Since

the fall of 2022, the Federal Reserve conducted a series of interest rate hikes to curb inflation. Research

suggests that farmland values are very sensitive to interest rate changes. It is also worth noting that changes

in the federal funds rate have long-lasting impacts on farmland values, as it takes at least a decade for the

full effects of an interest rate change to be capitalized in farmland values. So, although interest rates are

expected to stabilize and then ease in 2024, the land market will continue to react to the interest rate hikes

in 2022 and 2023. But within the current land market environment, the interest rate increases are fighting

against other factors, such as relatively strong farm incomes, which continue to support higher values.

The concerns about inflation and the credibility of land as a strong inflation hedge has nudged more

investors to consider farmland as an investment option due to the strong positive correlation between

farmland returns and inflation. Farmland has historically been a fairly robust investment that generates

relatively stable returns, especially when compared with other investments, such as stocks. The 2023

survey reported that investors represented 24% of land sales, which is slightly lower than the 27% in 2022,

coinciding with the fall in inflation. Sales to investors were highest in the South Central district (34%).

Consistent with previous years, the majority of farmland sales, 70%, were still to existing farmers, of which

existing local farmers captured 69% of land sales. The cash infusion from COVID-19-related assistance

programs and a good agricultural economy over the last couple of years are still supporting land values

enough to maintain an increase, though modest, in land values despite the recent interest rate hikes.

Moreover, respondents are also concerned about the negative impact of lower commodity prices and higher

input costs on the land market. Producers already saw rising costs in many factors of their production,

including fertilizers, machinery, and fuel over the past two years. For producers who rely significantly on

rented acres, they have seen their cropland rents increase, with additional concerns for next year’s rent as

well. The current projections of crop prices and production costs show that overall producers are expected

to have a profitable crop year in 2024 with much tighter margins, with corn potentially being grown at a

loss, but the uncertainty about higher input costs and the decreases in commodity prices has already

eroded profitability and broken the momentum of farmland value increases. However, there are several

factors supporting the seemingly high land values: farm income, though lower than last year, is still higher

than the pre-pandemic levels, the relative stability from at least 84% of Iowa farmland being fully paid for,

and the fact that farmland is increasingly viewed as a more stable and robust investment option given

greater general economy and geopolitical uncertainty. Although the land market is likely to face declines in

the short run, we do not foresee a sudden collapse of the agricultural land markets in the near future.

There have been three ‘golden’ eras for Iowa land values over the past 100 years. The first one ended in a

long, drawn-out decline in land values from 1921 to 1933, the second golden era ended with a sudden

collapse from 1981 to 1986. The third golden era ended with an orderly adjustment in values from 2014

onwards as opposed to a sudden collapse. We are now at the cusp of another great period of farmland

values, and if the economy bypasses a recession as planned, we should be able to end this era without a

12

rapid collapse in land values.

13

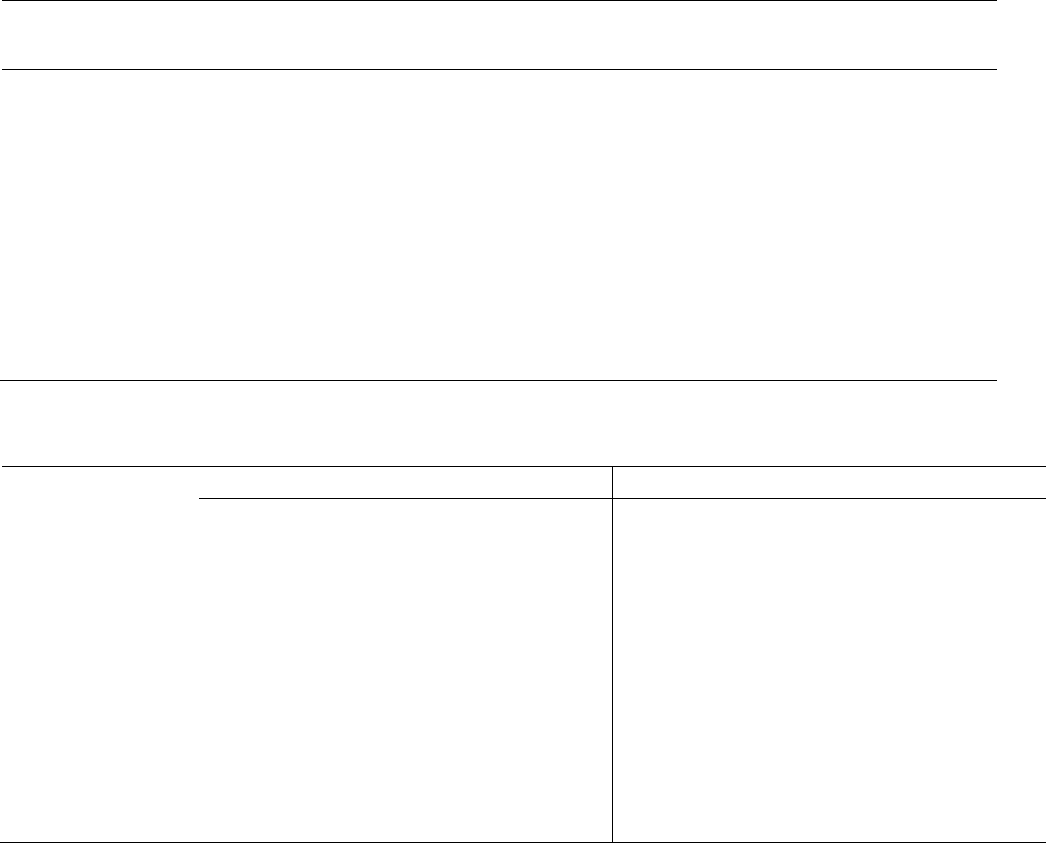

Table 1. Recent Changes in Iowa Farmland Values, 1974–2023

Value

Per Acre

Dollar

Change

%

Change

Value

Per Acre

Dollar

Change

%

Change

1974 834 153 31.7 1999 1781 -20 -1.1

1975 1095 261 31.3 2000 1857 76 4.3

1976 1368 273 24.9 2001 1926 69 3.7

1977 1450 82 6.0 2002 2083 157 8.2

1978 1646 196 13.5 2003 2275 192 9.2

1979 1958 312 19.0 2004 2629 354 15.6

1980 2066 108 5.5 2005 2914 285 10.8

1981 2147 81 3.9 2006 3204 290 10.0

1982 1801 -346 -16.1 2007 3908 704 22.0

1983 1691 -110 - 6.1 2008 4468 560 14.3

1984 1357 -334 -19.8 2009 4371 -97 -2.2

1985 948 -409 -30.1 2010 5064 693 15.9

1986 787 -161 -17.0 2011 6708 1644 32.5

1987 875 88 11.2 2012 8296 1588 23.7

1988 1054 179 20.5 2013 8716 420 5.1

1989 1139 85 8.1 2014 7943 -773 -8.9

1990 1214 75 6.6 2015 7633 -310 -3.9

1991 1219 5 .4 2016 7183 -450 -5.9

1992 1249 30 2.5 2017 7326 143 2.0

1993 1275 26 2.1 2018 7264 -62 -0.8

1994 1356 81 6.4 2019 7432 168 2.3

1995 1455 99 7.3 2020 7559 127 1.7

1996 1682 227 15.6

2021

9751

2192

29.0

1997 1837 155 9.2

2022 11411 1660 17.0

1998 1801 -36 -2.0

2023 11835 424 3.7

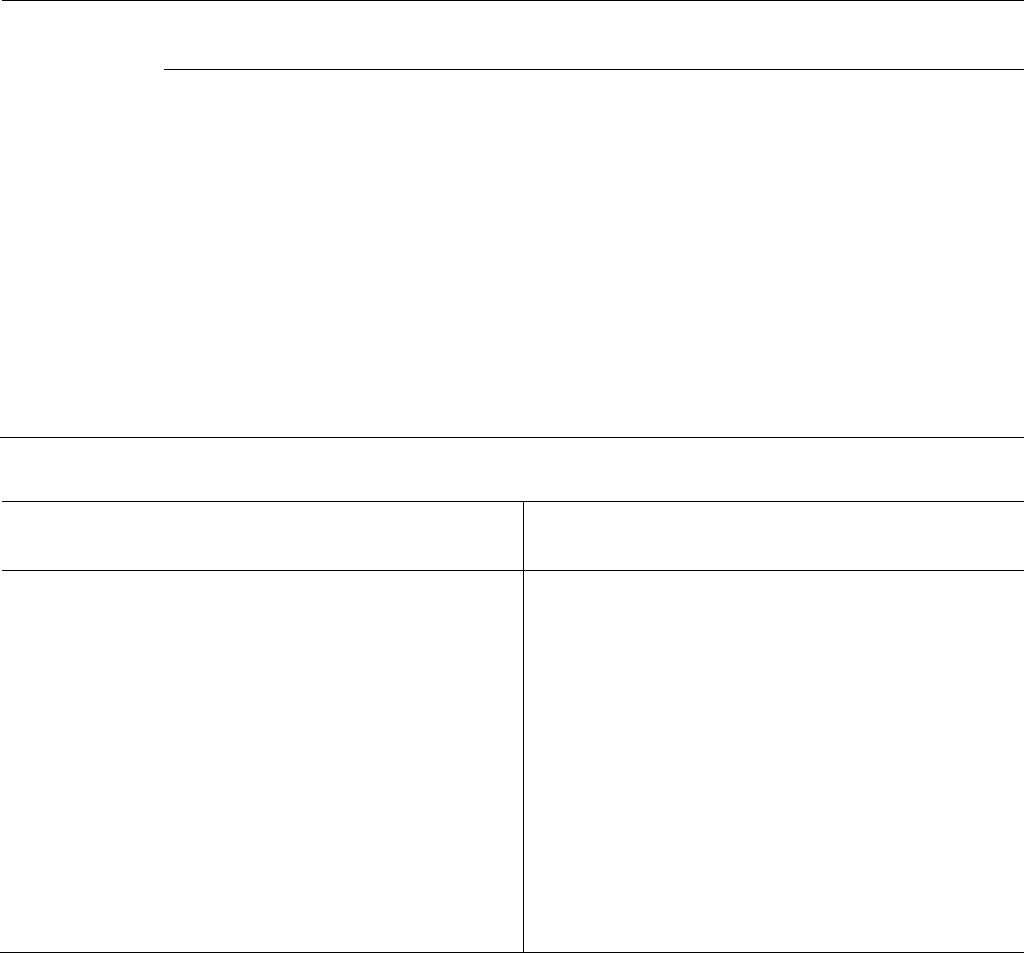

Table 2. Iowa Farmland Values and Percentage Change by District and Land

Quality as of November 2023

District

Average

Value

%

Change

High

Quality

%

Change

Medium

Quality

%

Change

Low

Quality

%

Change

Northwest

$14,753

-0.8%

$16,938

-1.1%

$13,731

0.2%

$9,497

-0.8%

North Central

$12,818

3.0%

$14,719

3.1%

$11,512

3.1%

$8,045

2.5%

Northeast

$12,060

3.7%

$14,617

5.9%

$11,364

2.2%

$7,965

-1.0%

West Central

$12,741

2.7%

$14,950

0.9%

$12,018

3.1%

$9,084

11.3%

Central

$13,014

3.4%

$15,531

5.5%

$11,807

2.4%

$7,917

-0.1%

East Central

$12,678

0.7%

$15,593

3.3%

$11,862

-0.1%

$8,087

-4.2%

Southwest

$9,505

2.6%

$11,884

4.1%

$9,102

3.8%

$6,131

0.8%

South Central

$7,482

9.6%

$9,718

2.5%

$7,498

9.1%

$5,105

16.6%

Southeast

$10,460

12.8%

$14,157

10.4%

$9,858

13.6%

$6,357

17.6%

STATE (avg)

$11,835

3.7%

$14,296

3.5%

$11,075

3.8%

$7,664

4.0%

14

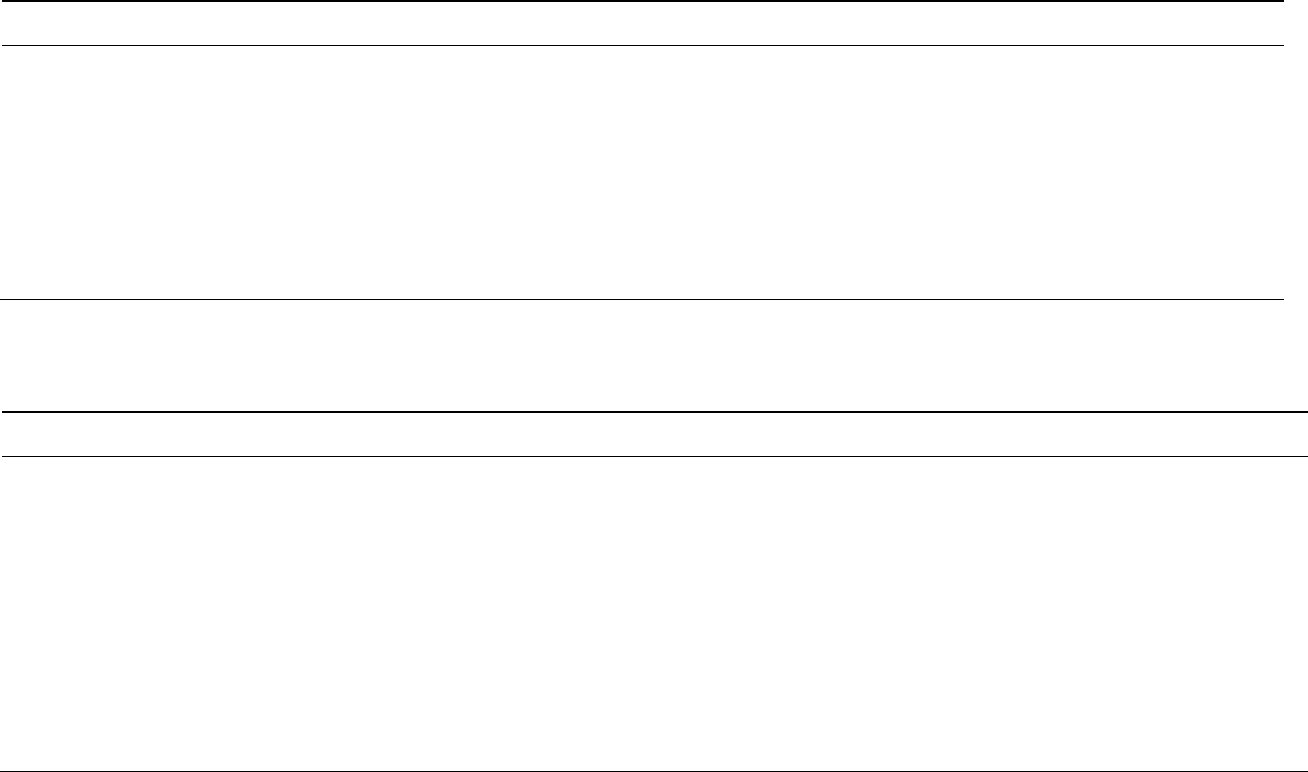

Table 3. Iowa Farmland Values by Crop Reporting District and Quality of Land, 2009–2023 ($)

Year

State

Avg

Northwest

North

Central

Northeast

West

Central

Central

East

Central

Southwest

South

Central

Southeast

All Quality

2009

4371

5364

4827

4464

4652

5026

4796

3559

2537

3832

2010

5064

6356

5746

5022

5466

5901

5447

4325

2690

4296

2011

6708

8338

7356

6602

7419

7781

7110

5905

3407

5705

2012

8296

11404

9560

8523

9216

9365

8420

7015

4308

6172

2013

8716

10960

9818

9161

9449

9877

9327

7531

4791

6994

2014

7943

9615

8536

8151

8424

9087

9008

6513

4475

7215

2015

7633

9685

7962

7861

8061

8505

8506

6372

4397

6892

2016

7183

9243

7562

7313

7358

7841

7917

6060

4241

6716

2017

7326

9388

7802

7543

7377

8097

8218

6058

4172

6864

2018

7264

9311

7789

7543

7413

7899

8004

6060

4329

6619

2019

7432

9352

7912

7325

7564

8336

8475

6166

4487

6868

2020

7559

9536

7927

7525

7859

8485

8524

6112

4658

6935

2021

9751

12164

10664

9958

10461

10744

11051

7582

6035

8451

2022

11411

14878

12449

11627

12411

12582

12595

9264

6824

9276

2023

11835

14753

12818

12060

12741

13014

12678

9505

7482

10460

High Quality

2009

5321

6129

5371

5349

5552

5939

5738

4539

3710

5306

2010

6109

7283

6397

6076

6585

7026

6152

5335

3892

5862

2011

8198

9649

8601

7994

8889

9332

8675

7418

5109

7721

2012

10181

12890

10765

10708

11128

11139

10201

8818

6437

8879

2013

10828

12824

11159

11423

11591

11803

11631

9591

7150

9785

2014

9854

11201

9630

10083

10275

10780

11034

8482

6663

10150

2015

9364

11229

8976

9575

9684

10087

10289

8031

6445

9536

2016

8758

10650

8442

8892

8874

9299

9502

7527

5980

9265

2017

8933

10829

8730

9151

8881

9568

9900

7571

5908

9471

2018

8863

10767

8699

9198

8834

9313

9768

7738

6055

9063

2019

9078

10757

8858

9050

9017

9749

10421

7768

6416

9341

2020

9068

10780

8889

9182

9159

9800

10199

7484

6408

9299

2021

11834

13997

12064

12308

12289

12512

13503

9424

8194

11628

2022

13817

17121

14271

13806

14821

14720

15097

11419

9478

12829

2023

14296

16938

14719

14617

14950

15531

15593

11884

9718

14157

Medium Quality

2009

4076

4977

4450

4193

4371

4615

4465

3386

2443

3535

2010

4758

5883

5300

4664

5111

5386

5445

4140

2596

4053

2011

6256

7708

6713

6290

6981

7029

6510

5553

3353

5468

2012

7773

11011

8691

7815

8619

8466

8128

6732

4219

5685

2013

8047

9918

8824

8573

8725

8930

8567

7137

4715

6605

2014

7359

8698

7874

7591

7827

8327

8388

6108

4318

6715

2015

7127

8834

7352

7460

7581

7758

7934

6038

4282

6525

2016

6705

8468

6992

6994

6870

7186

7396

5683

4128

6283

2017

6849

8555

7218

7236

6824

7426

7674

5756

4079

6548

2018

6805

8548

7214

7116

6935

7341

7452

5671

4244

6353

2019

6938

8633

7248

6833

7076

7649

7823

5841

4371

6616

2020

7119

8993

7350

6980

7433

7883

7959

5843

4563

6639

2021

9071

11042

9641

9122

9700

9980

10179

7145

6094

8169

2022

10673

13710

11171

11122

11654

11527

11876

8769

6872

8677

2023

11075

13731

11512

11364

12018

11807

11862

9102

7498

9858

Low Quality

2009

2884

3490

3281

3177

3134

3203

3240

2286

1685

2281

2010

3357

4161

3976

3517

3542

3724

3840

2868

1794

2620

2011

4257

5196

4900

4352

4766

4848

4671

3824

1984

3335

2012

5119

7162

6303

5288

5877

5718

5013

4484

2562

3226

2013

5298

6845

6421

5670

5926

5918

5449

4592

2843

3651

2014

4878

6091

5428

5256

5173

5582

5479

3860

2808

3891

2015

4834

6252

5372

5242

5082

5292

5366

4070

2750

3797

2016

4665

6019

5164

4847

4577

5158

5153

4189

2892

3783

2017

4689

6216

5265

4965

4684

4993

5305

3935

2824

3768

2018

4609

6018

5161

5056

4720

4932

4911

3790

2953

3656

2019

4759

6099

5325

4803

4950

5467

5279

3844

2955

3790

15

2020

5078

6486

5297

5213

5492

5793

5599

4055

3262

4134

2021

6397

8088

6992

6717

7044

7136

7215

5155

4058

4734

2022

7369

9569

7849

8047

8161

7927

8441

6081

4379

5406

2023

7664

9497

8045

7965

9084

7917

8087

6131

5105

6357

16

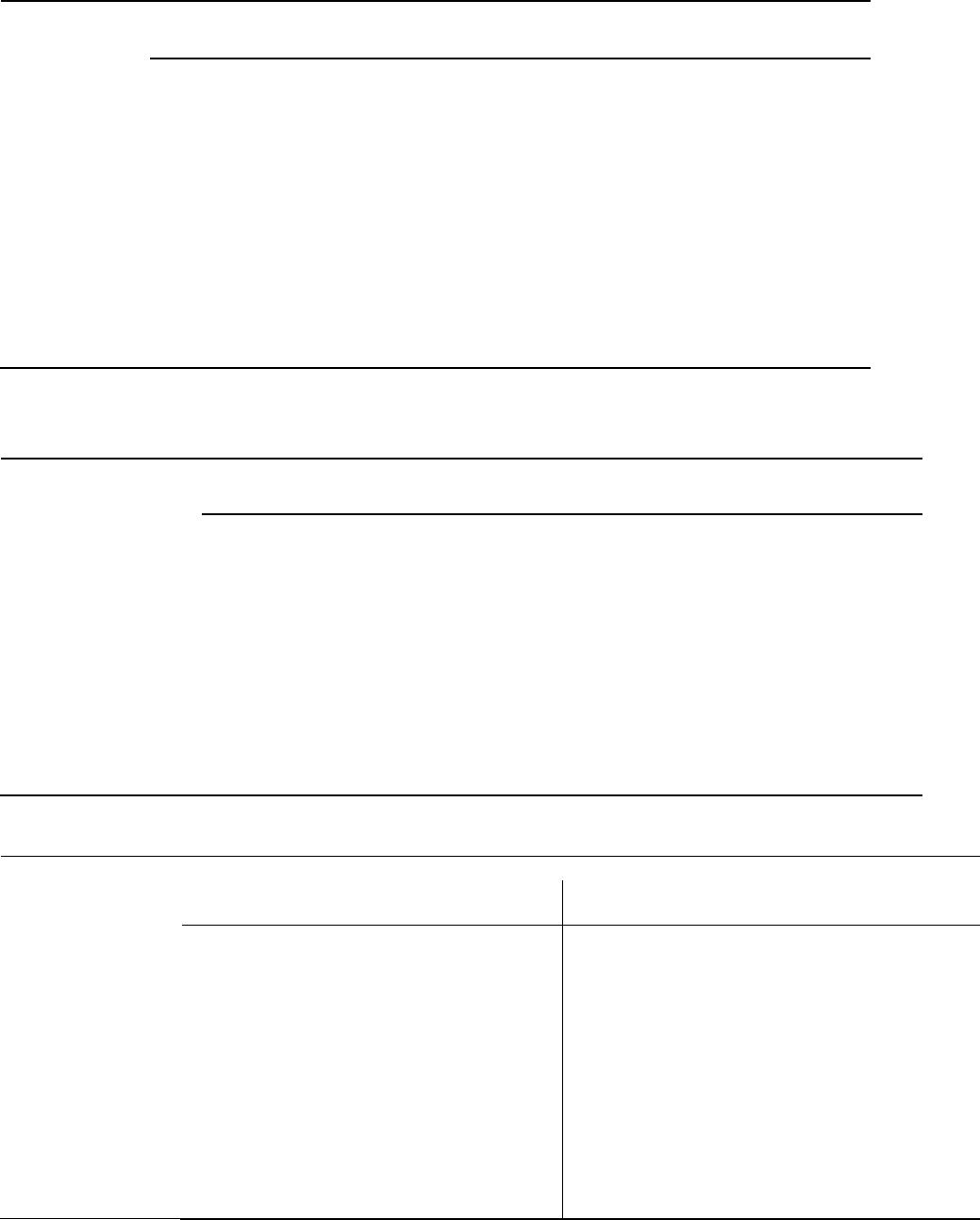

Table 4. Level of Sales Activity, 2023 (Percent)

More

Less

Same

Northwest

18

30

52

North Central

33

27

39

Northeast

24

37

39

West Central

26

41

32

Central

18

44

38

East Central

28

41

31

Southwest

15

46

38

South Central

11

46

43

Southeast

16

50

34

STATE

21

39

39

Table 5. Iowa Land Purchases by Buyer Type, 2023 (Percent)

Existing Local

Farmers

Existing

Relocating

Farmers

New Farmers

Local

Investors

Non-local

Investors

Other

Northwest

73

1

2

12

9

3

North Central

65

1

5

13

15

1

Northeast

72

2

5

9

10

2

West Central

77

1

4

9

8

1

Central

66

1

3

15

14

1

East Central

72

1

4

13

7

3

Southwest

63

2

3

15

16

1

South Central

58

2

3

14

20

3

Southeast

67

1

6

10

13

3

STATE

69

1

4

12

12

2

17

Table 6. Iowa Land Purchases by Seller Type, 2023 (Percent)

Active Farmers

Retired Farmers

Estate Sales

Local

Investors

Non-

local

Investors

Other

Northwest

7

15

67

4

4

3

North Central

5

21

60

2

9

3

Northeast

9

34

51

2

4

0

West Central

1

17

70

4

6

2

Central

10

19

60

4

6

1

East Central

9

32

51

3

3

2

Southwest

8

24

52

6

9

1

South Central

6

25

40

10

14

5

Southeast

3

26

56

4

9

2

STATE

7

23

57

4

7

2

Table 7. Survey Respondents and Responses by Mode, 2023

(Some respondents report on more than one county)

Paper

Online

# Responses

Paper

Online

# Respondents

(Percent)

(Percent)

Northwest

45

55

64

48

52

50

North Central

44

56

41

47

53

32

Northeast

59

41

46

60

40

30

West Central

38

62

47

47

53

32

Central

28

72

47

27

73

33

East Central

35

65

37

32

68

31

Southwest

23

77

48

35

65

23

South Central

29

71

41

36

64

28

Southeast

41

59

46

26

74

23

STATE

38

62

417

41

59

282

18

Table 8. Survey Respondents by Occupation, 2023 (Percent)

Farm

manager

Appraiser

Ag

lender

Broker/

Realtor

Farmer/

Landowner

Government

(Assessors and

FSA Officers)

Other

Northwest

18

4

51

10

4

12

0

North Central

12

9

39

6

18

15

0

Northeast

3

3

47

27

3

10

7

West Central

12

6

53

15

12

3

0

Central

18

9

33

18

12

9

0

East Central

18

18

32

7

7

11

7

Southwest

14

19

29

24

5

10

0

South Central

10

21

31

21

10

7

0

Southeast

9

22

48

4

9

9

0

STATE

13

11

41

14

9

10

1

Table 9. Experience and Service Area by District and Respondent Occupation, 2023

Crop reporting

district

Years of

experience

Number of

counties served

Occupation

Years of

experience

Number of

counties

served

Northwest

26

6

Ag lender

25

10

North Central

32

4

Appraiser

27

15

Northeast

26

4

Broker/Realtor

24

4

West Central

28

5

Farm manager

31

10

Central

29

12

Farmer/Landowner

42

2

East Central

24

7

Government

21

1

Southwest

24

6

Other

22

2

South Central

29

6

Southeast

25

5

STATE

27

6

STATE

27

6

Table 10. Predicted Percent Change in Local Land Value One Year from Now (November 2023 to November 2024)

Drop >20%

Drop 10-

20%

Drop 5-

10%

Drop <5% the Same

Increase

<5%

Increase 5-

10%

Increase

10-20%

Increase

20%+

(Percent)

Northwest

0

0

22

24

15

17

13

9

0

North Central

0

4

18

36

18

14

4

4

4

Northeast

7

11

19

33

15

7

4

0

4

West Central

0

3

23

32

23

16

0

3

0

Central

0

3

3

25

19

28

16

3

3

East Central

0

4

8

29

33

13

8

4

0

Southwest

0

0

19

22

19

33

4

4

0

South Central

0

7

7

33

26

22

4

0

0

Southeast

0

0

19

24

38

14

5

0

0

STATE

1

3

16

29

22

19

7

3

1

Table 11. Predicted Percent Change in Local Land Value Five Years from Now (November 2023 to November 2028)

Drop >20%

Drop 10-

20%

Drop 5-10% Drop <5% the Same

Increase

<5%

Increase 5-

10%

Increase 10-

20%

Increase

20%+

(Percent)

Northwest

0

2

9

2

20

2

20

27

16

North Central

0

4

4

11

15

0

22

33

11

Northeast

4

4

13

9

22

4

26

17

0

West Central

4

14

0

7

4

7

18

32

14

Central

0

6

0

3

9

9

28

28

16

East Central

0

8

4

0

13

17

13

33

13

Southwest

0

0

10

0

10

24

10

33

14

South Central

0

0

0

4

9

9

17

35

26

Southeast

5

10

10

5

14

0

14

33

10

STATE

1 5 5 5 13 7 19 30 14

Table 12. Views of Current Farmland Values

View of Current Farmland Values (Percent)

Way too Low Too Low Just Right Too High Way Too High

(percent of respondents)

Northwest

4

0

26

67

2

North Central

0

4

19

70

7

Northeast

4

0

7

63

26

West Central

0

0

28

69

3

Central

0

0

38

53

9

East Central

0 0 17 71 13

Southwest

7

22

37

30

4

South Central

0

15

22

52

11

Southeast

0

5

30

45

20

STATE

2

5

25

59

10

Table 13. Iowa Cash Crop Price Predictions for November 2024 and 2028 ($/bu.)

Predicted Cash Corn Prices Predicted Cash Soybean Prices

November 2024 November 2028 November 2024 November 2028

Northwest

$4.75

$5.47

$12.28

$13.32

North Central

$4.72

$5.52

$12.58

$13.68

Northeast

$4.63

$5.19

$12.30

$13.14

West Central

$4.58

$4.93

$12.20

$12.72

Central

$4.70

$5.27

$12.33

$13.37

East Central

$4.60

$5.44

$12.62

$13.75

Southwest

$5.01

$5.99

$12.70

$14.09

South Central

$4.55

$5.24

$12.50

$13.68

Southeast

$4.63

$4.73

$12.50

$12.35

STATE

$4.69

$5.33

$12.42

$13.36

Table 14. Estimated Average CSR2 and Percent of Land Area by Land Quality, 2023

Reported Average CSR2

Reported Percent of Land Area

High

Quality

Medium

Quality

Low

Quality

High

Quality

Medium Quality

Low

Quality

Northwest

90

81

70

45

36

19

North Central

85

74

60

39

40

21

Northeast

82

67

50

35

41

24

West Central

82

70

58

39

39

22

Central

85

76

62

39

38

23

East Central

84

69

52

38

38

24

Southwest

81

66

51

25

46

29

South Central

72

57

43

21

42

37

Southeast

85

72

54

32

40

28

STATE

83

70

56

35

40

25

21

Table 15. Estimated Average Mortgage and Operating Loan Rate, 2023 (Percent)

Interest Rates

20-Year Farmland Mortgage 1-Year Operating Loan

Northwest

7.42

8.44

North Central

7.41

8.46

Northeast

7.83

8.55

West Central

7.75

8.88

Central

7.51

8.46

East Central

7.68

8.25

Southwest

7.60

8.70

South Central

7.52

8.47

Southeast

7.58

8.66

STATE

7.59

8.54

Table 16. Comparative Iowa Land Values, 2022–2023

2023 2022

2023

2022

County Name

$/acre $/acre $ change % change

Dis tr ict Nam e $/acre $/acre $ change % change Harrison 11,905$ 11,557$ $348 3.0%

Northw est $14,753 $14,878 -$125 -0.8% Henry 10,268$ 9,290$ $979 10.5%

North Central $12,818 $12,449 $370 3.0% How ard 11,102$ 10,659$ $443 4.2%

Northeast $12,060 $11,627 $433 3.7% Humboldt 14,014$ 13,691$ $323 2.4%

West Central $12,741 $12,411 $330 2.7% Ida 13,736$ 13,512$ $224 1.7%

Central $13,014 $12,582 $432 3.4% Iow a 11,768$ 10,959$ $809 7.4%

East Central $12,678 $12,595 $83 0.7% Jackson 11,158$ 11,100$ $58 0.5%

Southw est $9,505 $9,264 $241 2.6% Jasper 12,083$ 11,147$ $935 8.4%

South Central $7,482 $6,824 $657 9.6% Jef ferson 8,643$ 7,821$ $822 10.5%

Southeast $10,460 $9,276 $1,183 12.8% Johnson 13,141$ 12,535$ $607 4.8%

State Average $11,835 $11,411

$424 3.7%

Jones 11,801

$

11,991$

-$190 -1.6%

Keokuk

10,003

$

9,135$

$868 9.5%

Kossuth 13,754

$

13,562

$

$192

1.4%

2023 2022 Lee 10,489$ 9,391$ $1,098 11.7%

County Name $/acre $/acre $ change % change Linn 13,210$ 13,330$ -$120 -0.9%

Adair 8,910$ 8,599$ $310 3.6% Louisa 11,474$ 10,970$ $505 4.6%

Adams 7,804$ 7,380$ $424 5.7% Lucas 6,631$ 5,872$ $759 12.9%

Allamakee 8,994$ 8,719$ $276 3.2% Lyon 15,352$ 15,557$ -$205 -1.3%

Appanoose 6,353$ 5,626$ $727 12.9% Madison 9,720$ 9,282$ $438 4.7%

Audubon 12,588$ 12,301$ $287 2.3% Mahaska 10,453$ 9,461$ $992 10.5%

Benton 13,106$ 12,673$ $433 3.4% Marion 10,697$ 9,580$ $1,118 11.7%

Black Haw k 14,202$ 13,591$ $611 4.5% Marshall 12,404$ 11,728$ $676 5.8%

Boone 13,621$ 13,088$ $532 4.1% Mills 11,158$ 10,900$ $258 2.4%

Bremer 13,617$ 13,069$ $549 4.2% Mitchell 12,538$ 11,975$ $563 4.7%

Buchanan 13,152$ 12,673$ $479 3.8% Monona 11,253$ 10,887$ $367 3.4%

Buena Vista 14,648$ 14,709$ -$62 -0.4% Monroe 7,993$ 7,170$ $823 11.5%

Butler 12,595$ 12,106$ $489 4.0% Montgomery 9,314$ 9,099$ $215 2.4%

Calhoun 14,426$ 14,059$ $367 2.6% Muscatine 11,734$ 11,698$ $36 0.3%

Carroll 13,710$ 13,682$ $28 0.2% O'Brien 16,313$ 16,531$ -$218 -1.3%

Cas s 10,821$ 10,530$ $291 2.8% Osceola 14,170$ 14,360$ -$189 -1.3%

Cedar 12,732$ 12,779$ -$47 -0.4% Page 8,493$ 8,296$ $196 2.4%

Cerro Gordo 12,295$ 11,868$ $426 3.6% Palo Alto 13,525$ 13,448$ $76 0.6%

Cherokee 14,162$ 14,140$ $22 0.2% Plymouth 15,214$ 14,965$ $249 1.7%

Chickasaw 12,112$ 11,627$ $485 4.2% Pocahontas 14,181$ 13,961$ $220 1.6%

Clarke 7,128$ 6,354$ $773 12.2% Polk 12,678$ 11,947$ $731 6.1%

Clay 13,887$ 13,943$

-$57 -0.4% Pottaw attamie 12,473$ 12,145$ $327 2.7%

Clayton 10,923$ 10,589$ $335 3.2% Pow eshiek 11,702$ 10,884$ $818 7.5%

Clinton 11,665$ 11,886$ -$221 -1.9% Ringgold 7,139$ 6,541$ $598 9.1%

Craw ford 13,274$ 13,060$ $214 1.6% Sac 14,425$ 14,397$ $29 0.2%

Dallas 12,406$ 11,957$ $448 3.7% Scott 15,338$ 15,968$ -$630 -3.9%

Dav is 7,772$ 6,967$ $804 11.5% Shelby 12,750$ 12,372$ $378 3.1%

Decatur 6,286$ 5,566$ $719 12.9% Sioux 16,521$ 16,516$ $5 0.0%

Delaw are 13,924$ 13,614$ $310 2.3% Story 13,999$ 13,442$ $557 4.1%

Des Moines 11,131$ 10,071$ $1,060 10.5% Tama 12,406$ 11,791$ $615 5.2%

Dickinson 13,159$ 13,334$ -$176 -1.3% Taylor 7,158$ 6,776$ $382 5.6%

Dubuque 12,659$ 12,351$ $308 2.5% Union 8,090$ 7,416$ $674 9.1%

Emmet 13,405$ 13,454$ -$49 -0.4% Van Buren 8,321$ 7,455$ $866 11.6%

Fayette 13,197$ 12,730$ $466 3.7% Wapello 8,489$ 7,687$ $802 10.4%

Floyd 11,929$ 11,394$ $536 4.7% Warren 11,164$ 10,193$ $971 9.5%

Franklin 12,641$ 12,331$ $309 2.5% Washington 12,610$ 11,515$ $1,095 9.5%

Fremont 10,139$ 9,904$ $234 2.4% Wayne 6,711$ 5,943$ $768 12.9%

Greene 12,897$ 12,536$ $360 2.9% Webster 13,795$ 13,368$ $428 3.2%

Grundy 14,231$ 13,649$ $582 4.3% Winnebago 11,870$ 11,577$ $294 2.5%

Guthrie 11,418$ 11,056$ $363 3.3% Winneshiek 11,534$ 11,127$ $407 3.7%

Hamilton 14,403$ 13,949$ $453 3.2% Woodbury 11,597$ 11,230$ $367 3.3%

Hancock 12,603$ 12,291$ $312 2.5% Worth 11,582$ 11,182$ $400 3.6%

Hardin 13,353$ 12,931$ $422 3.3% Wright 14,050$ 13,720$ $330 2.4%

By County:

2022-2023

By Crop Reporting District:

2022-2023

2022-2023

Figure 1. 2023 (top) and 2022 (bottom) Iowa average land values, by county.

24

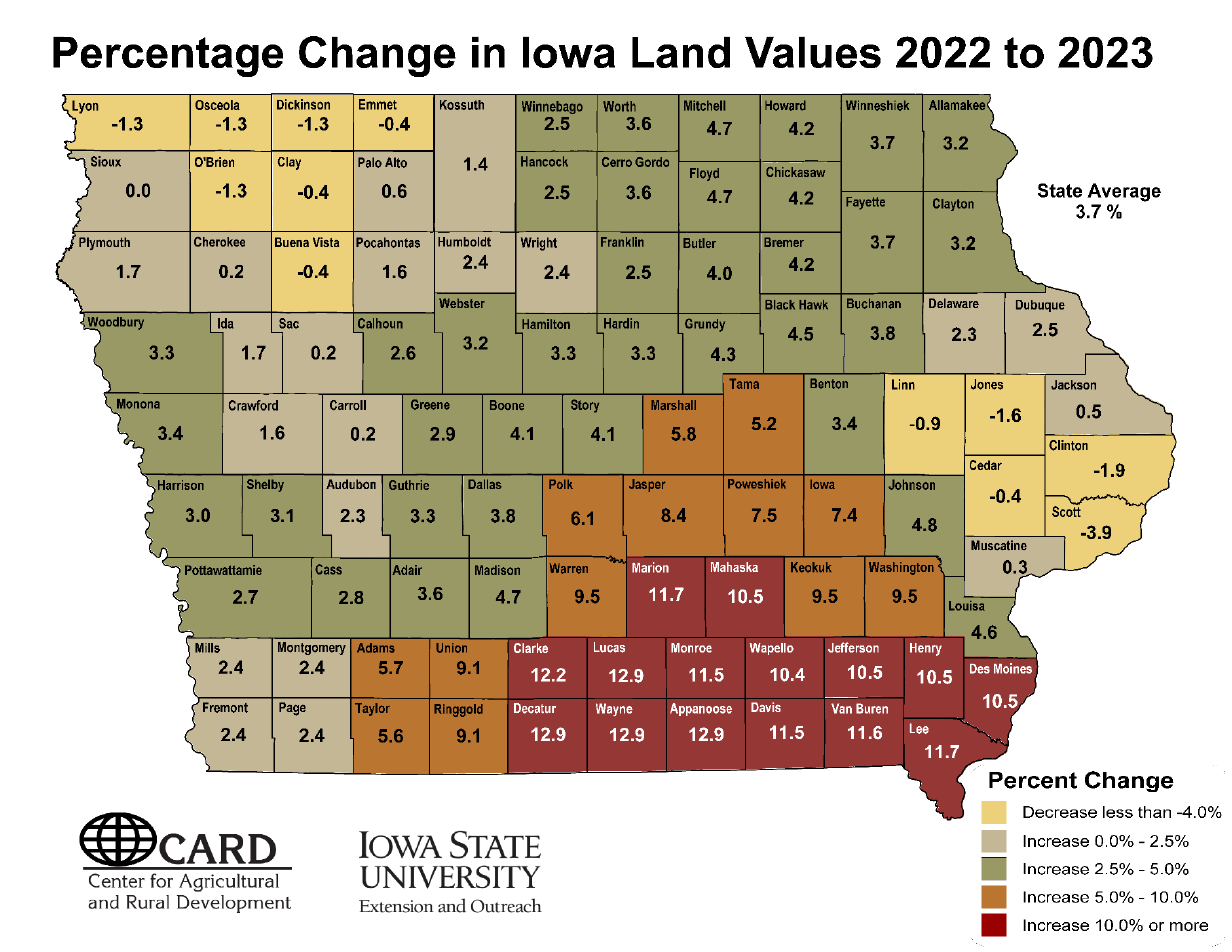

Figure 2. Percentage change in Iowa land values from 2022 to 2023.

25

Figure 3. 2023 Iowa land values by crop reporting district.

26

Figure 4. Percent change in Iowa land values from 2022 to 2023.

27

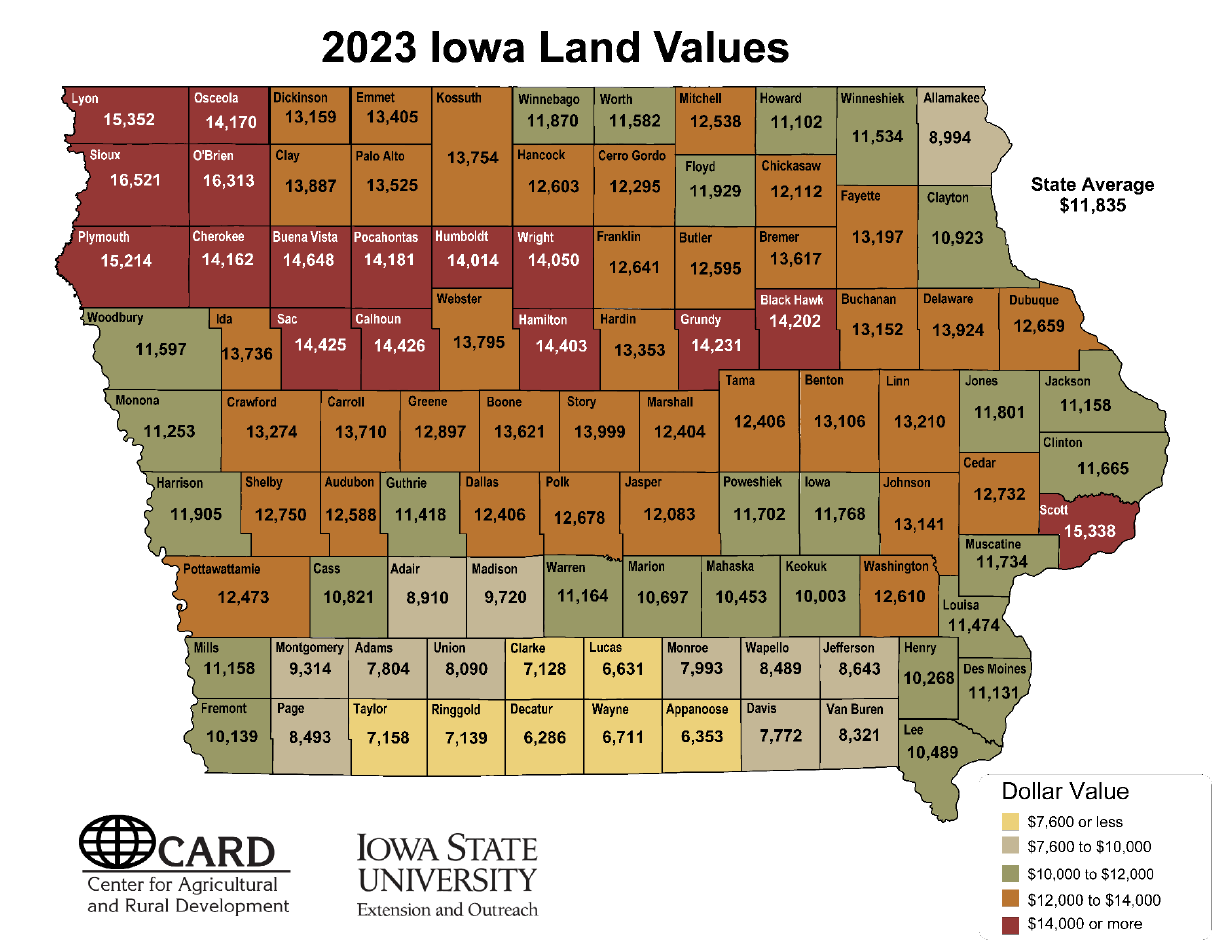

Figure 5. 2023 Iowa land values as of November 1, 2023.

28

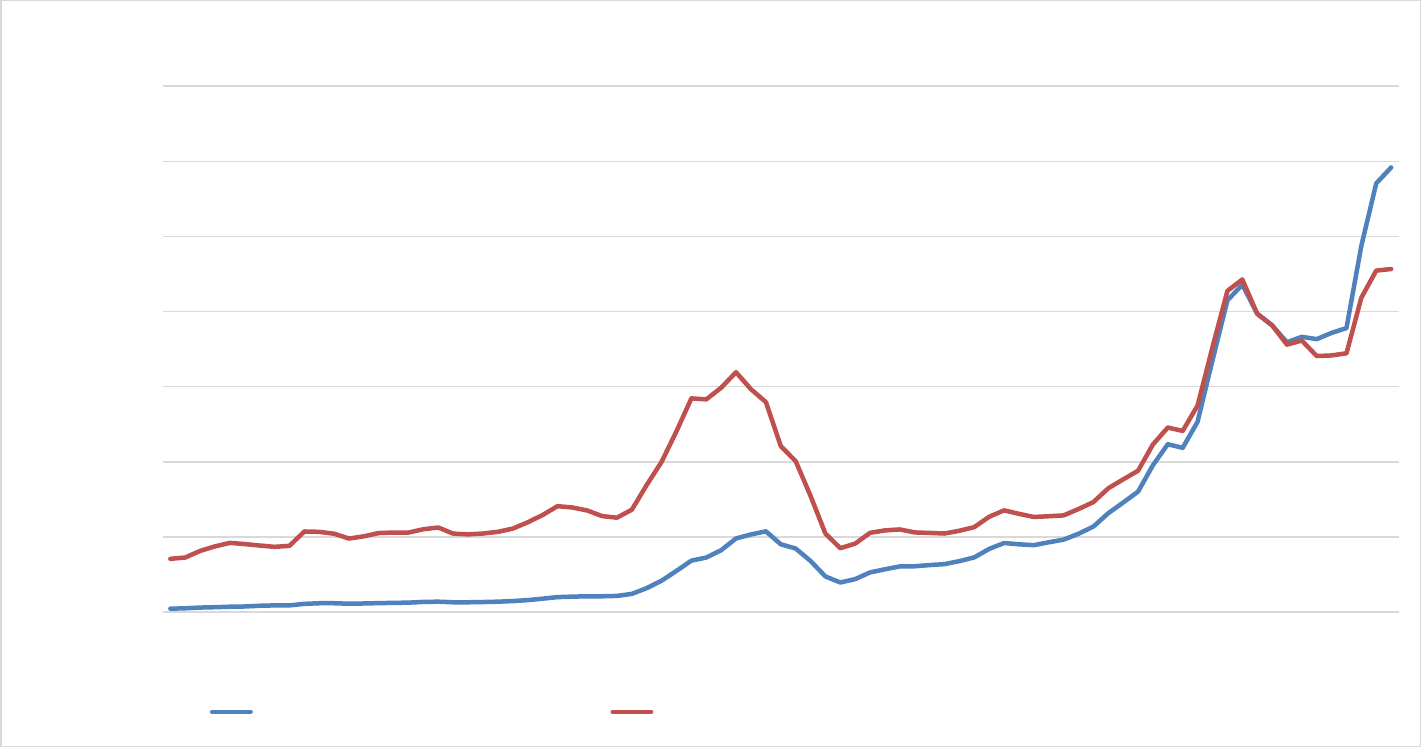

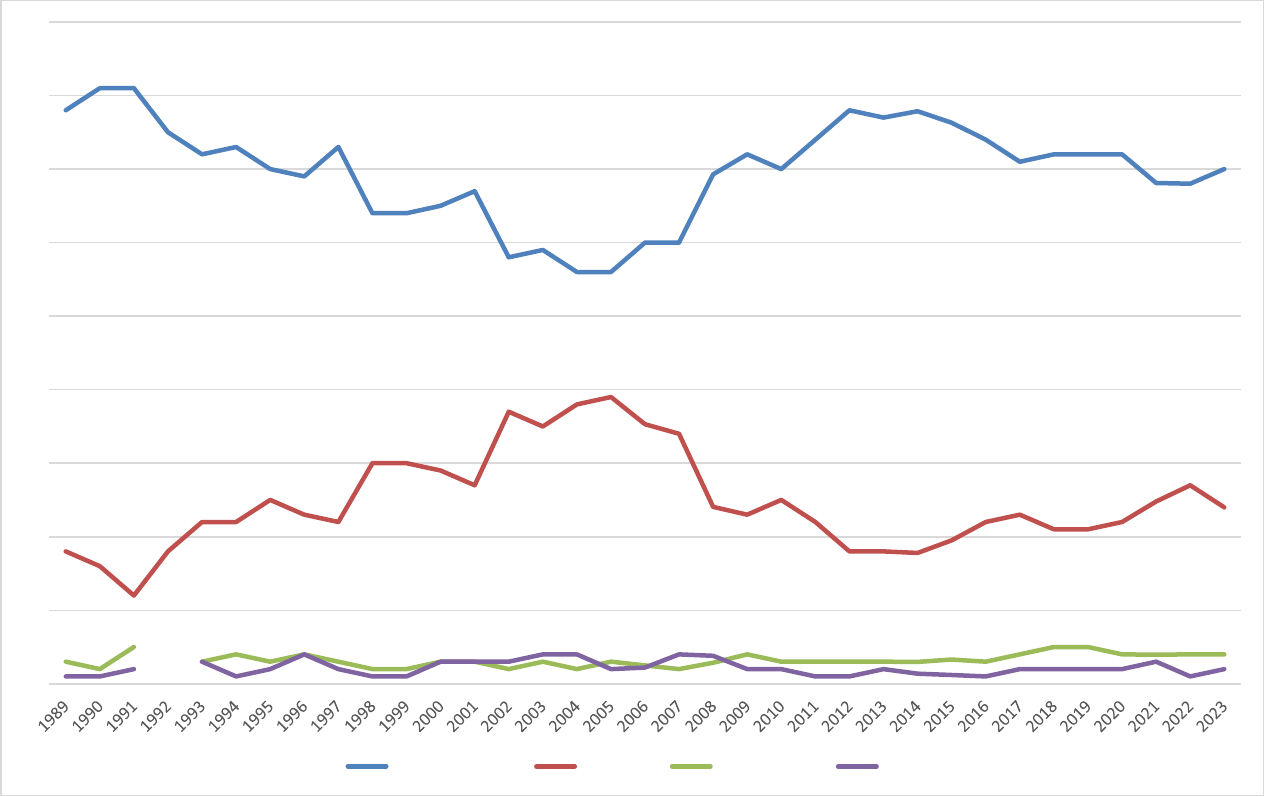

Figure 6. Iowa nominal and inflation-adjusted average value per acre of farmland, 1941–

2023.

0

2000

4000

6000

8000

10000

12000

14000

1941

1943

1945

1947

1949

1951

1953

1955

1957

1959

1961

1963

1965

1967

1969

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

Farmland Values ($/acre)

Nominal and Inflation-adjusted Iowa Farmland Values

Nominal Iowa Land Value Inflation-adjusted Iowa Land Value (2015 Dollars)

29

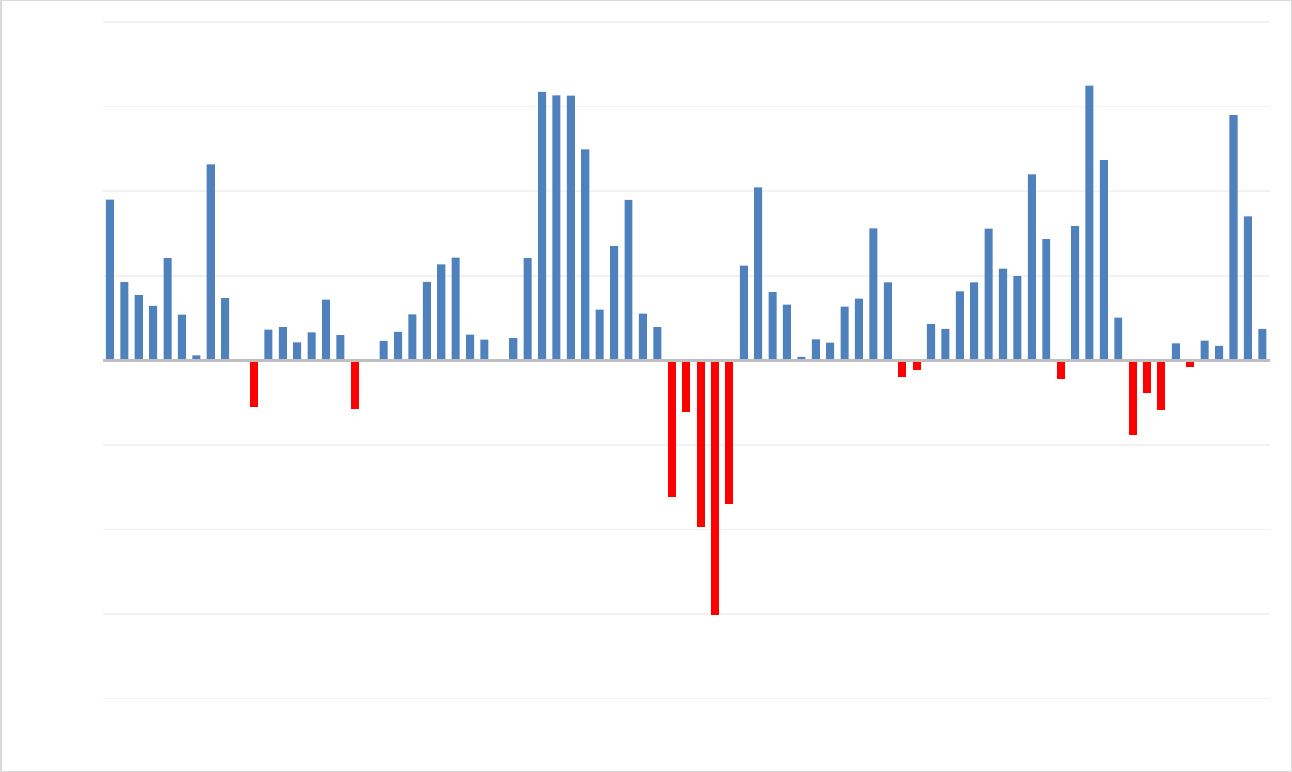

Figure 7. Annual percentage change in nominal Iowa farmland values, 1942–2023.

-40

-30

-20

-10

0

10

20

30

40

1943

1945

1947

1949

1951

1953

1955

1957

1959

1961

1963

1965

1967

1969

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

Percent change in nominal land values (%)

30

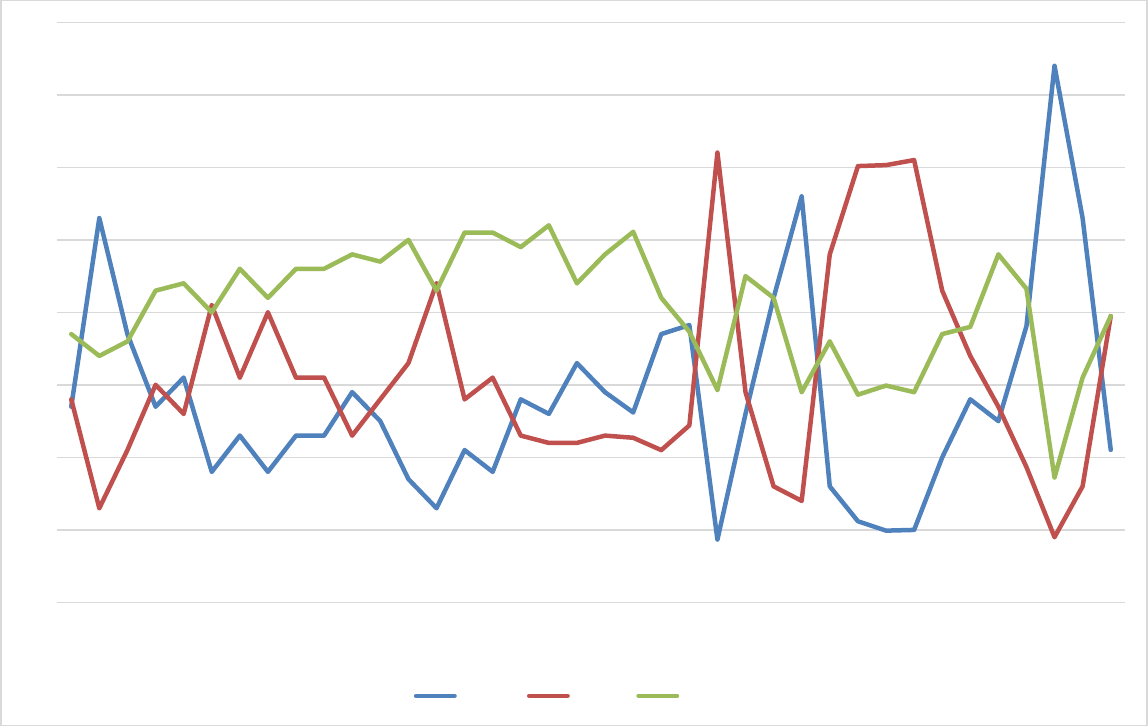

Figure 8. Iowa farmland sale activity (percentages), 1986–2023.

0

10

20

30

40

50

60

70

80

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

More Less Same

31

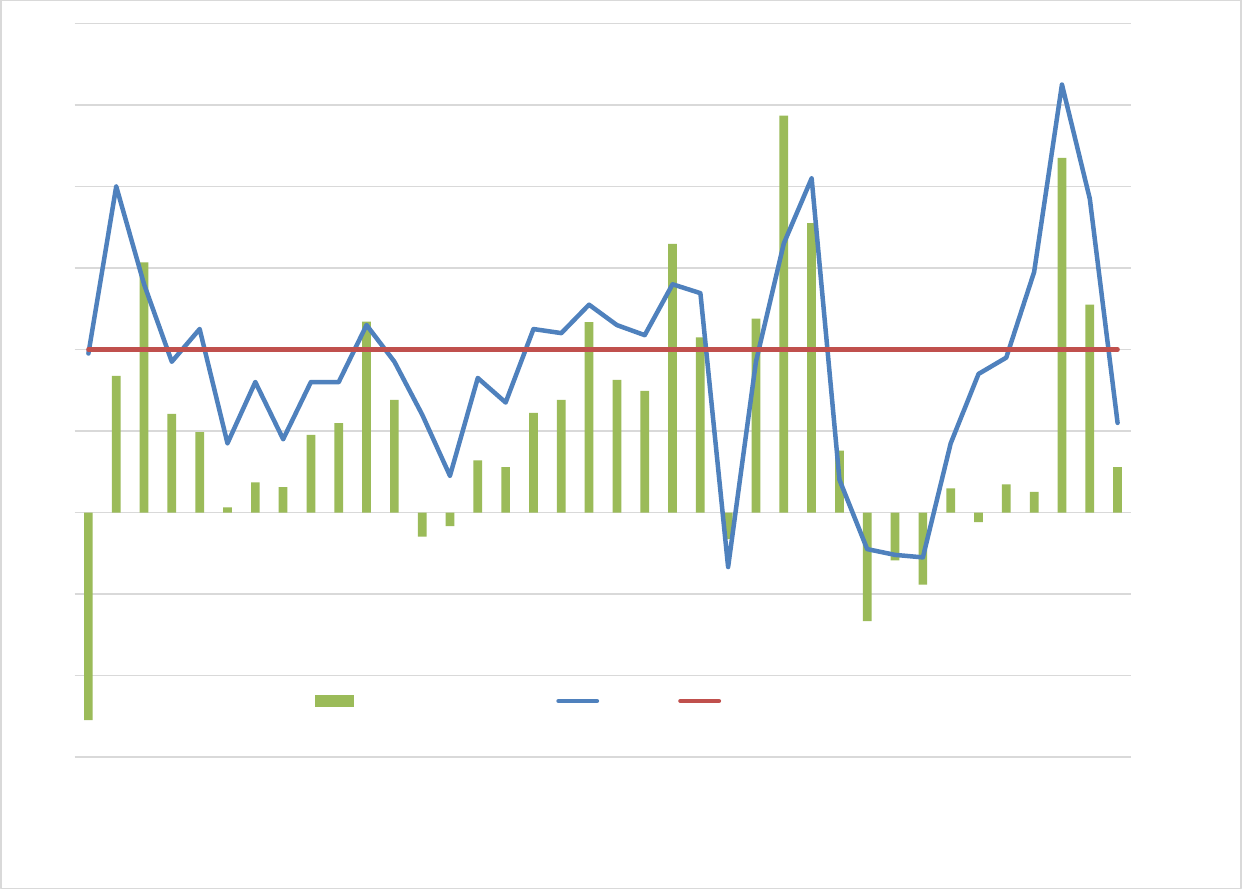

Figure 9. Iowa farmland sale activity index, 1986–2023.

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

0

20

40

60

80

100

120

140

160

180

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Percent_Change Index Benchmark

32

Figure 10. Buyers of Iowa Farmland (percentage by category), 1989–2023.

0

10

20

30

40

50

60

70

80

90

Existing Farmers Investors New Farmers Other

33

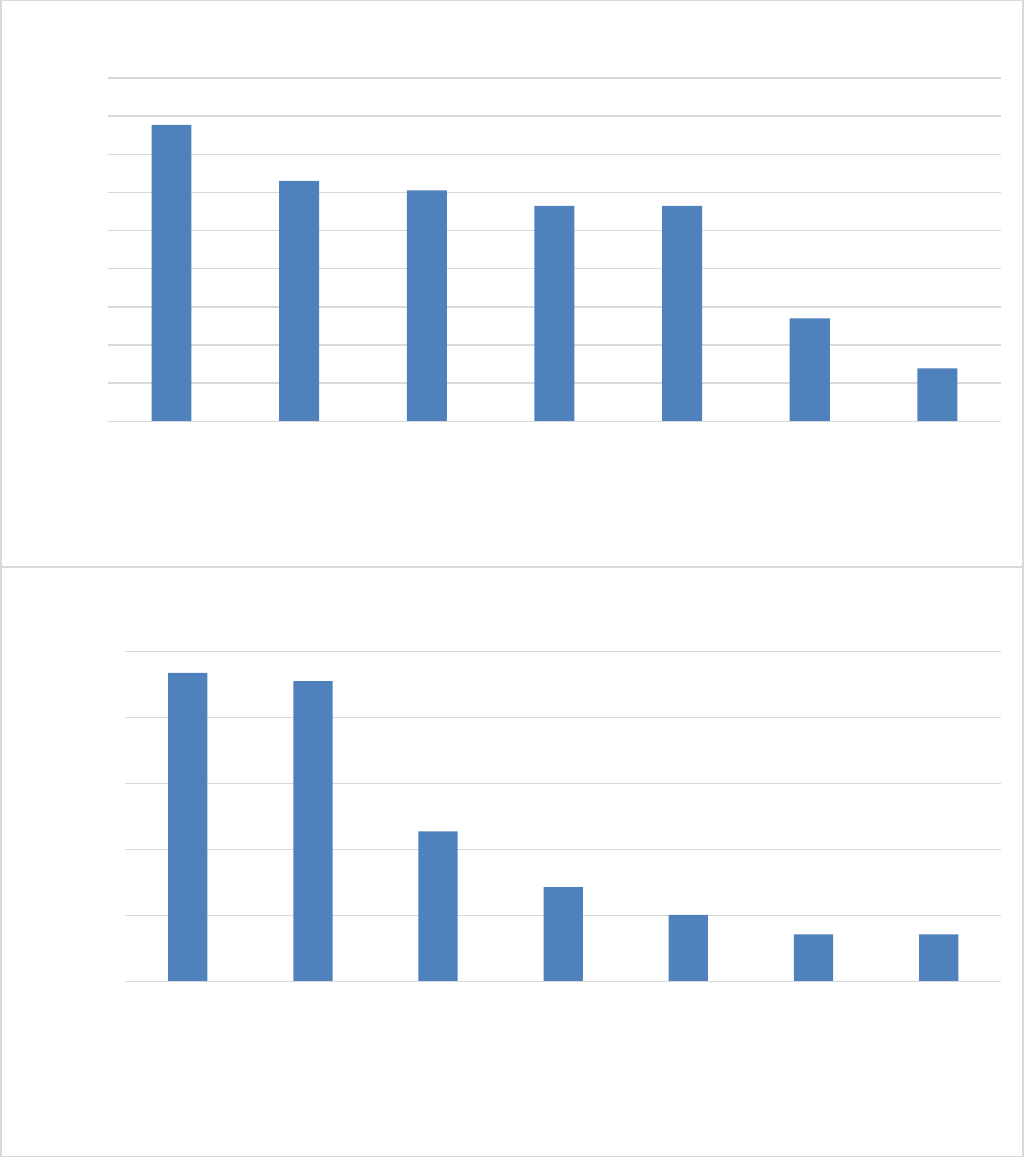

Figure 11. Positive (top) and negative (bottom) factors of the Iowa

farmland market, November 2022–November 2023.

0

2

4

6

8

10

12

14

16

18

Limited

Land Supply

Stronger

Yields

Cash on

Hand & High

Credit

Availability

Higher

Commodity

Prices

Strong

Demand,

incl.

Investors

Good Farm

Economy

Favorable

Interest

Rates

Percent

Positive Factors Affecting 2023 Farmland Market

0

5

10

15

20

25

Interest

Rate Hikes

Lower

Commodity

Prices

Higher Input

Costs

Weather

Uncertainty

Stock

Market

Volatility &

Economic

Uncertainty

Land

Availability

Uncertain

Ag Future

Percent

Negative Factors Affecting 2023 Farmland Market

34

In accordance with Federal law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, this institution is

prohibited from discriminating on the basis of race, color, national origin, sex, age, disability, and reprisal or retaliation for prior civil

rights activity. (Not all prohibited bases apply to all programs.) Program information may be made available in languages other than

English. Persons with disabilities who require alternative means of communication for program information (e.g., Braille, large print,

audiotape, and American Sign Language) should contact the responsible State or local Agency that administers the program or USDA’s

TARGET Center at 202-720-2600 (voice and TTY) or contact USDA through the Federal Relay Service at 800-877-8339. To file a

program discrimination complaint, a complainant should complete a Form AD-3027, USDA Program Discrimination Complaint Form,

which can be obtained online at https://www.ocio.usda.gov/document/ad-3027, from any USDA office, by calling 866-632-9992, or by

writing a letter addressed to USDA. The letter must contain the complainant’s name, address, telephone number, and a written

description of the alleged discriminatory action in sufficient detail to inform the Assistant Secretary for Civil Rights (ASCR) about the

nature and date of an alleged civil rights violation. The completed AD-3027 form or letter must be submitted to USDA by: (1) Mail: U.S.

Department of Agriculture Office of the Assistant Secretary for Civil Rights, 1400 Independence Avenue, SW Washington, D.C. 20250-

9410; or (2) Fax: 833-256-1665 or 202-690-7442; or (3) Email: [email protected]. This institution is an equal opportunity

provider. For the full non-discrimination statement or accommodation inquiries, go to www.extension.iastate.edu/diversity/ext.