i

Uniform CPA Examination Blueprints

Uniform CPA

Examination

®

Financial Accounting and

Reporting (FAR)

Blueprint

Approved by the Board of Examiners

American Institute of CPAs

May 31, 2018

Effective date: Jan 1, 2019

Note: This document only contains information

related to the FAR section. Download the other

Exam section Blueprints or the complete Exam

Blueprints at aicpa.org/examblueprints.

1

Uniform CPA Examination Blueprints

Table of contents

Uniform CPA Examination Blueprints

2 Introduction: Uniform CPA Examination Blueprints

AUD1 Auditing and Attestation (AUD)

AUD2 Section introduction

AUD6 Summary blueprint

AUD7 Area I — Ethics, Professional Responsibilities

and General Principles

AUD12 Area II — Assessing Risk and Developing

a Planned Response

AUD18 Area III — Performing Further Procedures

and Obtaining Evidence

AUD23 Area IV — Forming Conclusions and Reporting

BEC1 Business Environment and Concepts (BEC)

BEC2 Section introduction

BEC6 Summary blueprint

BEC7 Area I — Corporate Governance

BEC9 Area II — Economic Concepts and Analysis

BEC11 Area III — Financial Management

BEC13 Area IV — Information Technology

BEC15 Area V — Operations Management

FAR1 Financial Accounting and Reporting (FAR)

FAR2 Section introduction

FAR6 Summary blueprint

FAR7 Area I — Conceptual Framework, Standard-Setting

and Financial Reporting

FAR13 Area II — Select Financial Statement Accounts

FAR19 Area III — Select Transactions

FAR24 Area IV — State and Local Governments

REG1 Regulation (REG)

REG2 Section introduction

REG5 Summary blueprint

REG6 Area I — Ethics, Professional Responsibilities

and Federal Tax Procedures

REG8 Area II — Business Law

REG12 Area III — Federal Taxation of Property Transactions

REG15 Area IV — Federal Taxation of Individuals

REG18 Area V — Federal Taxation of Entities

2

Uniform CPA Examination Blueprints

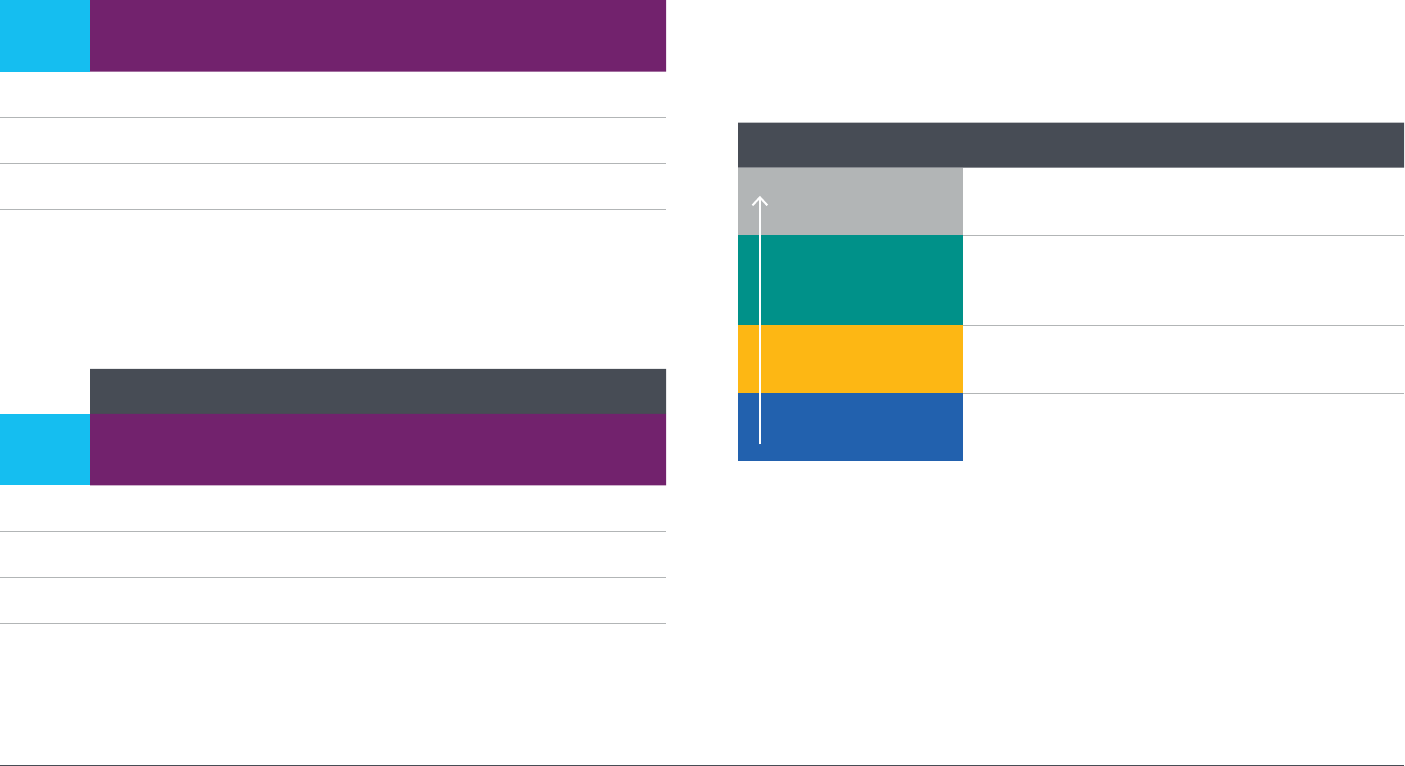

The Uniform CPA Examination (the Exam) is comprised of four sections, each

four hours long: Auditing and Attestation (AUD), Business Environment and

Concepts (BEC), Financial Accounting and Reporting (FAR) and Regulation (REG).

The table below presents the design of the Exam by section, section time and

question type.

The table below presents the scoring weight of multiple-choice questions

(MCQs), task-based simulations (TBSs) and written communication for each

Exam section.

The AICPA has adopted a skill framework for the Exam based on the revised

Bloom’s Taxonomy of Educational Objectives. Bloom’s Taxonomy classies a

continuum of skills that students can be expected to learn and demonstrate.

Approximately 600 representative tasks that are critical to a newly licensed

CPA’s role in protecting the public interest have been identied. The

representative tasks combine both the applicable content knowledge and skills

required in the context of the work of a newly licensed CPA. Based on the nature

of a task, one of four skill levels, derived from the revised Bloom’s Taxonomy,

was assigned to each of the tasks, as follows:

Introduction

Uniform CPA Examination Blueprints

Section

Section

time

Multiple-choice

questions (MCQs)

Task-based

simulations (TBSs)

Written

communication

AUD 4 hours 72 8 —

BEC 4 hours 62 4 3

FAR 4 hours 66 8 —

REG 4 hours 76 8 —

Score weighting

Section

Multiple-choice

questions (MCQs)

Task-based

simulations (TBSs)

Written

communication

AUD 50% 50% —

BEC 50% 35% 15%

FAR 50% 50% —

REG 50% 50% —

Skill levels

Evaluation

The examination or assessment of problems, and

use of judgment to draw conclusions.

Analysis

The examination and study of the interrelationships

of separate areas in order to identify causes and nd

evidence to support inferences.

Application

The use or demonstration of knowledge, concepts

or techniques.

Remembering and

Understanding

The perception and comprehension of the

signicance of an area utilizing knowledge gained.

Introduction

3

Uniform CPA Examination Blueprints

The skill levels to be assessed on each section of the Exam are included in the

table below.

*Includes written communication

The purpose of the blueprint is to:

• Document the minimum level of knowledge and skills necessary for initial

licensure.

• Assist candidates in preparing for the Exam by outlining the knowledge and

skills that may be tested.

• Apprise educators about the knowledge and skills candidates will need to

function as newly licensed CPAs.

• Guide the development of Exam questions.

The tasks in the blueprints are representative and are not intended to be (nor

should they be viewed as) an all-inclusive list of tasks that may be tested on

the Exam. It also should be noted that the number of tasks associated with a

particular content group or topic is not indicative of the extent such content

group, topic or related skill level will be assessed on the Exam.

Section

Remembering and

Understanding Application Analysis Evaluation

AUD 30–40% 30–40% 15–25% 5–15%

BEC 15–25% 50–60%* 20–30% —

FAR 10–20% 50–60% 25–35% —

REG 25–35% 35–45% 25–35% —

Each section of the Exam has a section introduction and a corresponding

section blueprint.

• The section introduction outlines the scope of the section, the content

organization and tasks, the content allocation, the overview of content areas,

the skill allocation and a listing of the section’s applicable reference literature.

• The section blueprint outlines the content to be tested, the associated skill

level to be tested and the representative tasks a newly licensed CPA would

need to perform to be considered competent. The blueprints are organized by

content AREA, content GROUP, and content TOPIC. Each topic includes one

or more representative TASKS that a newly licensed CPA may be expected to

complete.

Revised taxonomy see Anderson, L.W. (Ed.), Krathwohl, D.R. (Ed.), Airasian, P.W., Cruikshank, K.A., Mayer, R.E., Pintrich, P.R., Raths, J., & Wittrock, M.C. (2001). A taxonomy for learning, teaching, and assessing: A revision of Bloom’s Taxonomy of

Educational Objectives (Complete Edition). New York: Longman. For original taxonomy see Bloom, B.S. (Ed.), Engelhart, M.D., Furst, E.J., Hill, W.H., & Krathwohl, D.R. (1956). Taxonomy of educational objectives: The classication of educational

goals. Handbook 1: Cognitive domain. New York: David McKay.

Introduction

Uniform CPA Examination Blueprints (continued)

FAR1

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Uniform CPA Examination

Financial Accounting and

Reporting (FAR)

Blueprint

FAR2

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

The Financial Accounting and Reporting (FAR) section of the Uniform CPA

Examination (the Exam) assesses the knowledge and skills that a newly licensed

CPA must demonstrate in the nancial accounting and reporting frameworks

used by business entities (public and nonpublic), not-for-prot entities and state

and local government entities.

The nancial accounting and reporting frameworks that are eligible for

assessment within the FAR section of the Exam include the standards and

regulations issued by the:

• Financial Accounting Standards Board (FASB)

• U.S. Securities and Exchange Commission (U.S. SEC)

• American Institute of Certied Public Accountants (AICPA)

• Governmental Accounting Standards Board (GASB)

• International Accounting Standards Board (IASB)

A listing of standards and regulations promulgated by these bodies, and other

reference materials that are eligible for assessment in the FAR section of the

Exam are included under References at the conclusion of this introduction.

Content organization and tasks

The FAR section blueprint is organized by content AREA, content GROUP and

content TOPIC. Each group or topic includes one or more representative TASKS

that a newly licensed CPA may be expected to complete in practice.

Tasks in the FAR section blueprint are representative. The tasks are not

intended to be (nor should they be viewed as) an all-inclusive list of tasks that

may be tested in the FAR section of the Exam. Additionally, it should be noted

that the number of tasks associated with a particular content group or topic

is not indicative of the extent such content group, topic or related skill level

will be assessed on the Exam. For example, the topic titled “Notes to nancial

statements” in Area I includes two tasks that are intended to encompass the

required disclosures for any topic in the FASB Accounting Standards Codication,

while the group titled “Leases” in Area III includes eight tasks that are limited to

the accounting requirements in Leases Topic of the FASB Accounting Standards

Codication. The number of tasks included in the blueprint for this group and

this topic is not intended to suggest that “Leases” are more signicant to newly

licensed CPAs or will be tested more than the “Notes to nancial statements.”

Similarly, examples provided within the task statements should not be viewed as

all-inclusive.

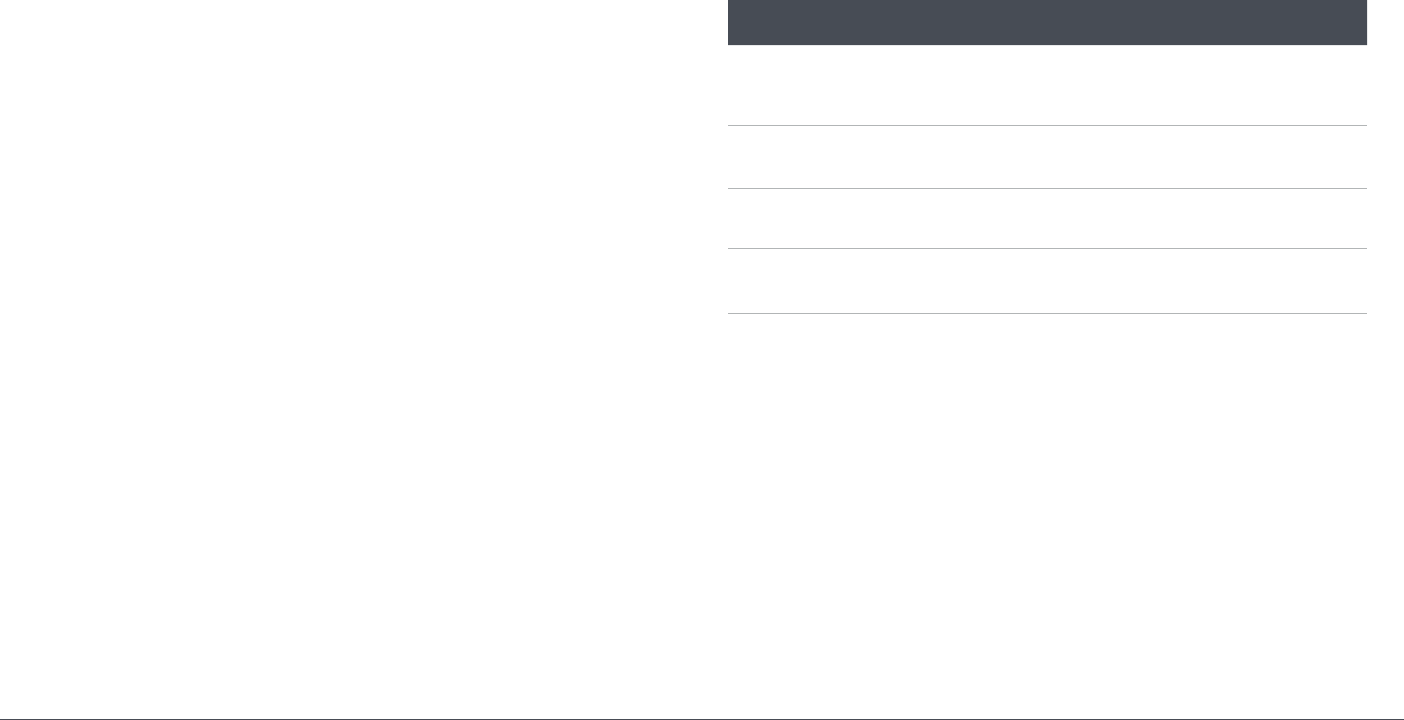

Content allocation

The following table summarizes the content areas and the allocation of content

tested in the FAR section of the Exam:

Overview of content areas

Area I of the FAR section blueprint covers FASB’s Conceptual Framework, FASB’s

standard-setting process and several different nancial reporting topics. The

nancial reporting topics include the following:

• General-purpose nancial statements applicable to for-prot entities,

not-for-prot entities and employee benet plans under the FASB Accounting

Standards Codication

• Disclosures specic to public companies including earnings per share

and segment reporting under the FASB Accounting Standards Codication

and the interim, annual and periodic ling requirements for U.S. registrants in

accordance with the rules of the U.S. SEC

• Financial statements prepared under special purpose frameworks as described

in AU-C Section 800 of the Codication of Statements on Auditing Standards

Section introduction

Content area Allocation

Area I

Conceptual Framework, Standard-Setting

and Financial Reporting

25–35%

Area II

Select Financial Statement Accounts

30–40%

Area III

Select Transactions

20–30%

Area IV

State and Local Governments

5–15%

Financial Accounting and Reporting

FAR3

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Area II of the FAR section blueprint covers the nancial accounting and

reporting requirements in the FASB Accounting Standards Codication that are

applicable to select nancial statement accounts.

• To the extent applicable, each group and topic in the area is eligible for testing

within the context of both for-prot and not-for-prot entities.

– If signicant accounting or reporting differences exist between for-prot

and not-for-prot entities for a given group or topic, such differences are in

representative not-for-prot tasks in the blueprint.

Area III of the FAR section blueprint covers the nancial accounting and

reporting requirements for select transactions that are applicable to entities

under the FASB Accounting Standards Codication and the IASB standards

• The testing of content under the IASB standards is limited to a separate group

titled, “Differences between IFRS and U.S. GAAP.”

• To the extent applicable, the remaining groups in the area are eligible for

testing within the context of both for-prot and not-for-prot entities.

– If signicant accounting or reporting differences exist between for-prot and

not-for-prot entities, such differences are in representative not-for-prot

tasks in the blueprint.

Area IV of the FAR section blueprint covers GASB’s conceptual framework as

well the nancial accounting and reporting requirements for state and local

governments under the GASB standards and interpretations.

Section assumptions

The FAR section of the Exam includes multiple-choice questions, task-based

simulations and research prompts. When completing questions in the FAR

section of the Exam, candidates should assume that all of the information

provided in each question is material. In addition, candidates should assume

that each question applies to a for-prot business entity reporting under U.S.

GAAP unless otherwise stated in the fact pattern for a question. For example,

questions that apply to not-for-prot entities specify the nature of these entities

Section introduction

as “not-for-prot” or “non-governmental, not-for-prot.” Questions that apply to

IFRS include phrases such as “under IFRS” or “according to IFRS.” Questions

that apply to the state and local governments include phrases such as “local

government,” “state,” “municipality” or “city.”

Skill allocation

The Exam focuses on testing higher order skills. Based on the nature of

the task, each representative task in the FAR section blueprint is assigned

a skill level. FAR section considerations related to the skill levels are

discussed below.

Skill levels

Evaluation

The examination or assessment of problems, and

use of judgment to draw conclusions.

Analysis

The examination and study of the interrelationships

of separate areas in order to identify causes and nd

evidence to support inferences.

Application

The use or demonstration of knowledge, concepts

or techniques.

Remembering and

Understanding

The perception and comprehension of the

signicance of an area utilizing knowledge gained.

Financial Accounting and Reporting (continued)

FAR4

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Section introduction

Financial Accounting and Reporting (continued)

• Remembering and Understanding tasks are in all four areas of the FAR blueprint.

These tasks, such as identifying transactions and nancial reporting requirements,

frequently require newly licensed CPAs to demonstrate their comprehension of

accounting concepts and standards. Area IV has the highest concentration of

remembering and understanding tasks.

• Application tasks are in all four areas of the FAR blueprint. These tasks, such as

preparing journal entries and nancial statements, frequently require newly licensed

CPAs to use accounting concepts and standards to measure and recognize nancial

statement amounts.

• Analysis tasks are in Area I, Area II and Area III of the FAR blueprint. These tasks,

such as reconciling account balances, interpreting agreements and detecting

nancial reporting discrepancies, frequently require newly licensed CPAs to

demonstrate a higher level of interpretation. Area I and Area II have the highest

concentration of analysis tasks.

The representative tasks combine both the applicable content knowledge and the

skills required in the context of the work that a newly licensed CPA would reasonably

be expected to perform. The FAR section does not test any content at the Evaluation

skill level as newly licensed CPAs are not expected to demonstrate that level of skill in

regards to the FAR content.

FAR5

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Section introduction

Financial Accounting and Reporting (continued)

References — Financial Accounting and Reporting

• Financial Accounting Standards Board (FASB) Accounting Standards Codication

• FASB Concepts Statements

• U.S. Securities and Exchange Commission References:

- Securities Exchange Act of 1934

- Regulation S-X of the Code of Federal Regulations (17 CFR Part 210)

- Regulation S-K of the Code of Federal Regulations (17 CFR Part 229)

• Codication of Statements on Auditing Standards: AU-C Section 800, Special

Considerations – Audits of Financial Statements Prepared in Accordance with Special

Purpose Frameworks

• AICPA Accounting and Auditing Guides

• International Financial Reporting Standards (IFRS) References:

- International Financial Reporting Standards

- International Accounting Standards

- Interpretations issued by the IFRS Interpretations Committee

- Interpretations issued by the Standing Interpretations Committee

• State and Local Government References:

- Governmental Accounting Standards Board (GASB) Codication of

Governmental Accounting and Financial Reporting Standards

- GASB Statements, Interpretations, Technical Bulletins and Concepts Statements

- National Council on Governmental Accounting (NCGA) Statements and

Interpretations

• Current textbooks on accounting for business entities, not-for-prot entities, and state

and local government entities

FAR6

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Content area allocation Weight

I. Conceptual Framework, Standard-Setting and Financial Reporting

25–35%

II. Select Financial Statement Accounts

30–40%

III. Select Transactions

20–30%

IV. State and Local Governments

5–15%

Skill allocation Weight

Evaluation —

Analysis 25–35%

Application 50–60%

Remembering and Understanding 10–20%

Financial Accounting and Reporting (FAR)

Summary blueprint

FAR7

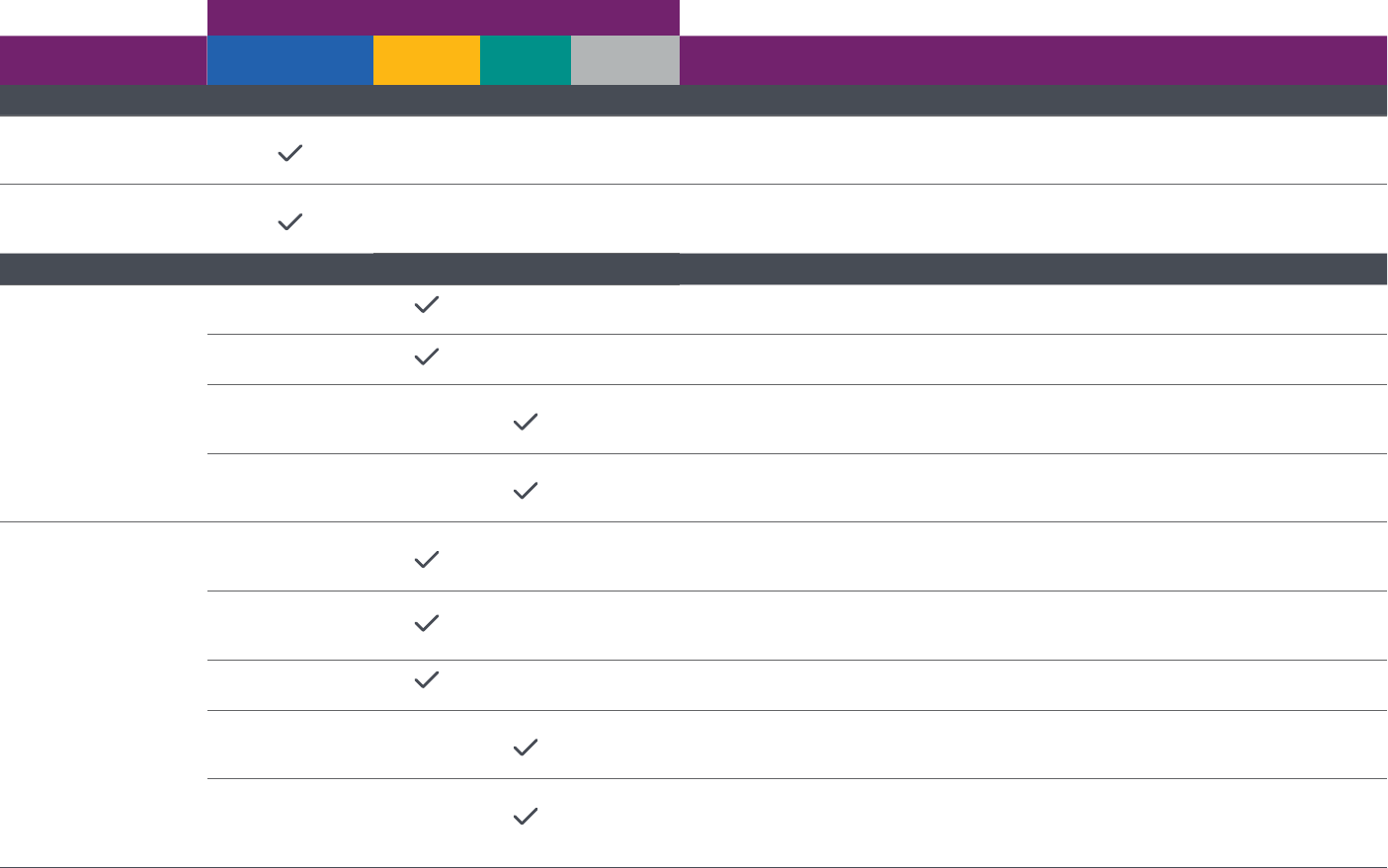

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

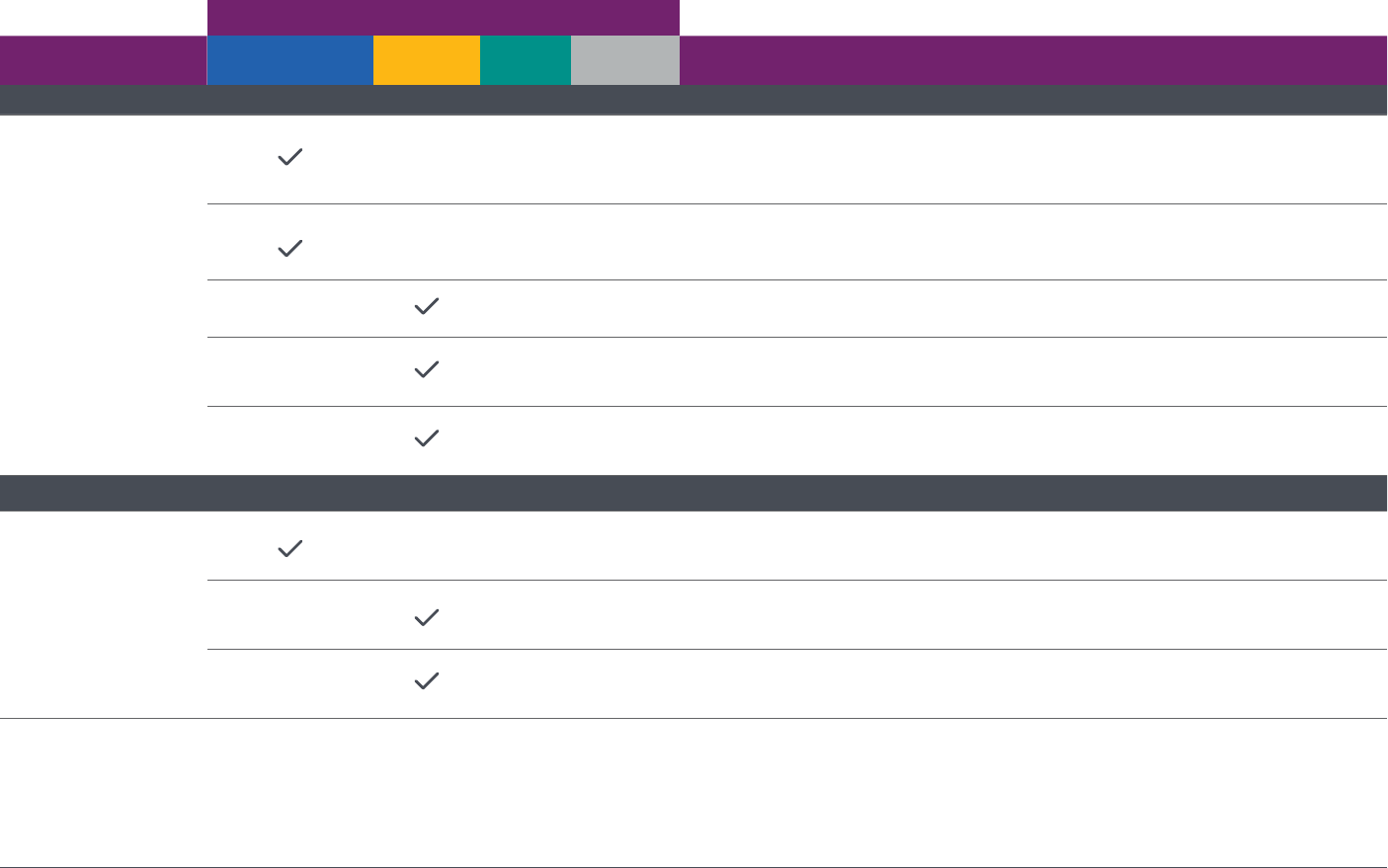

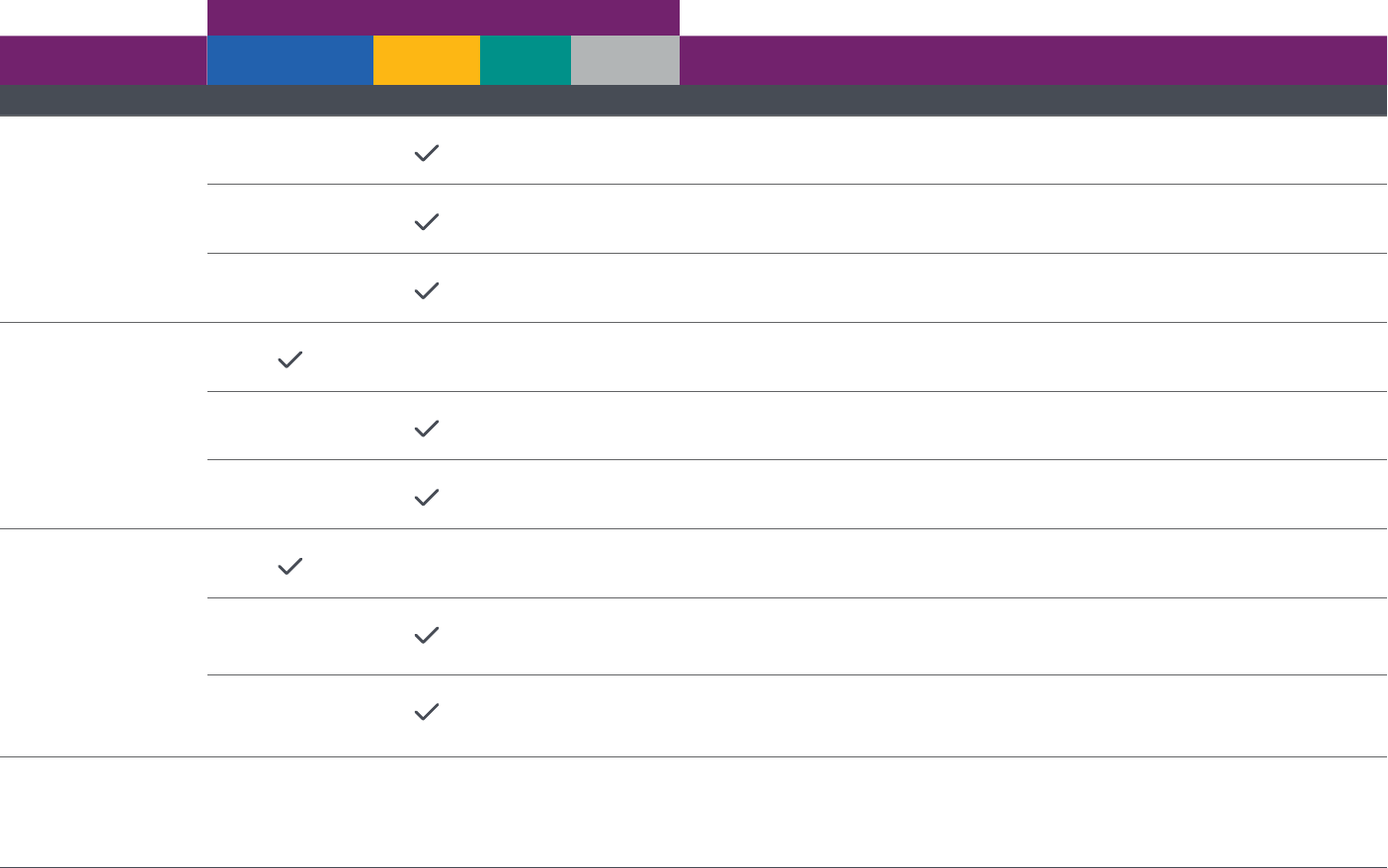

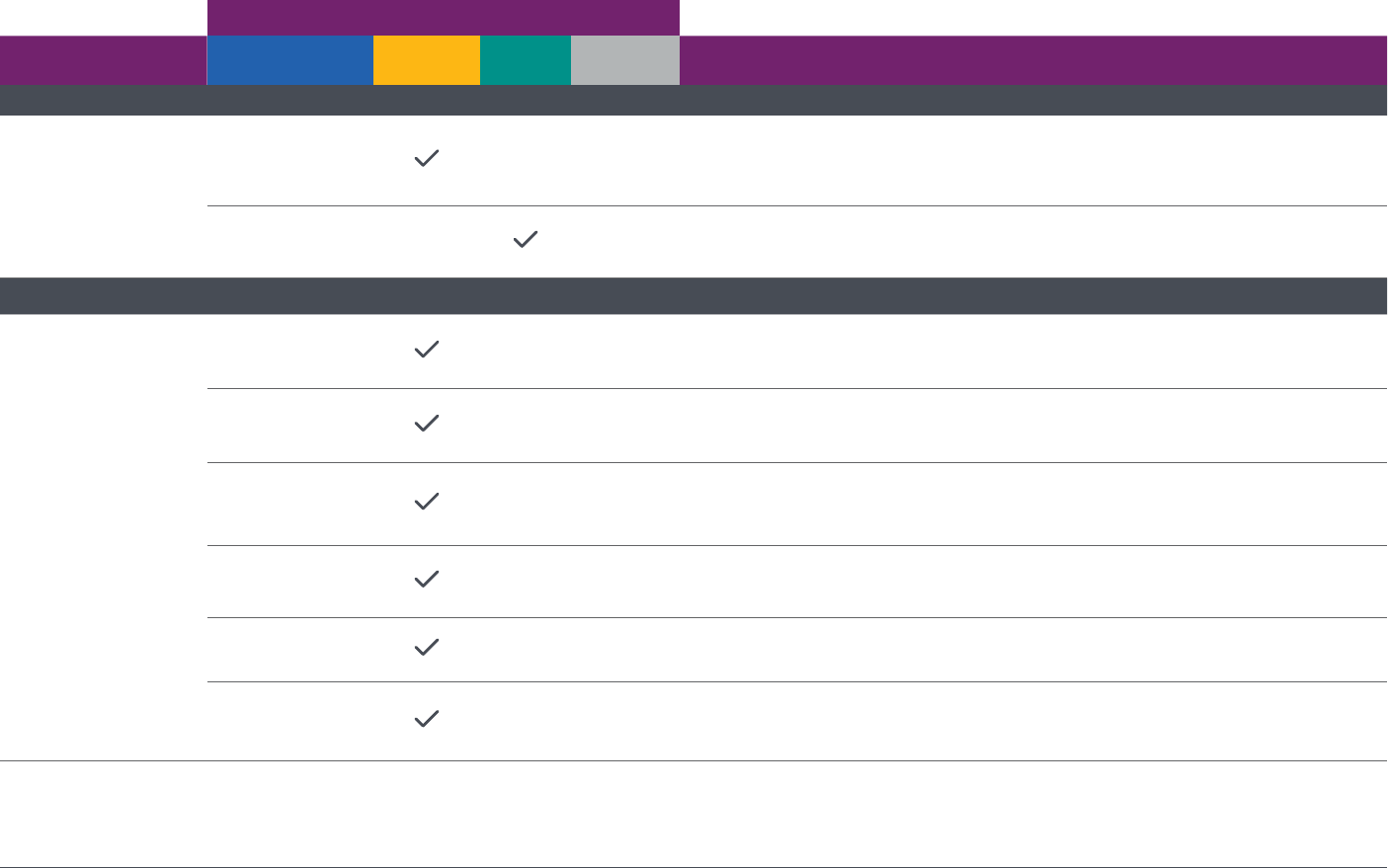

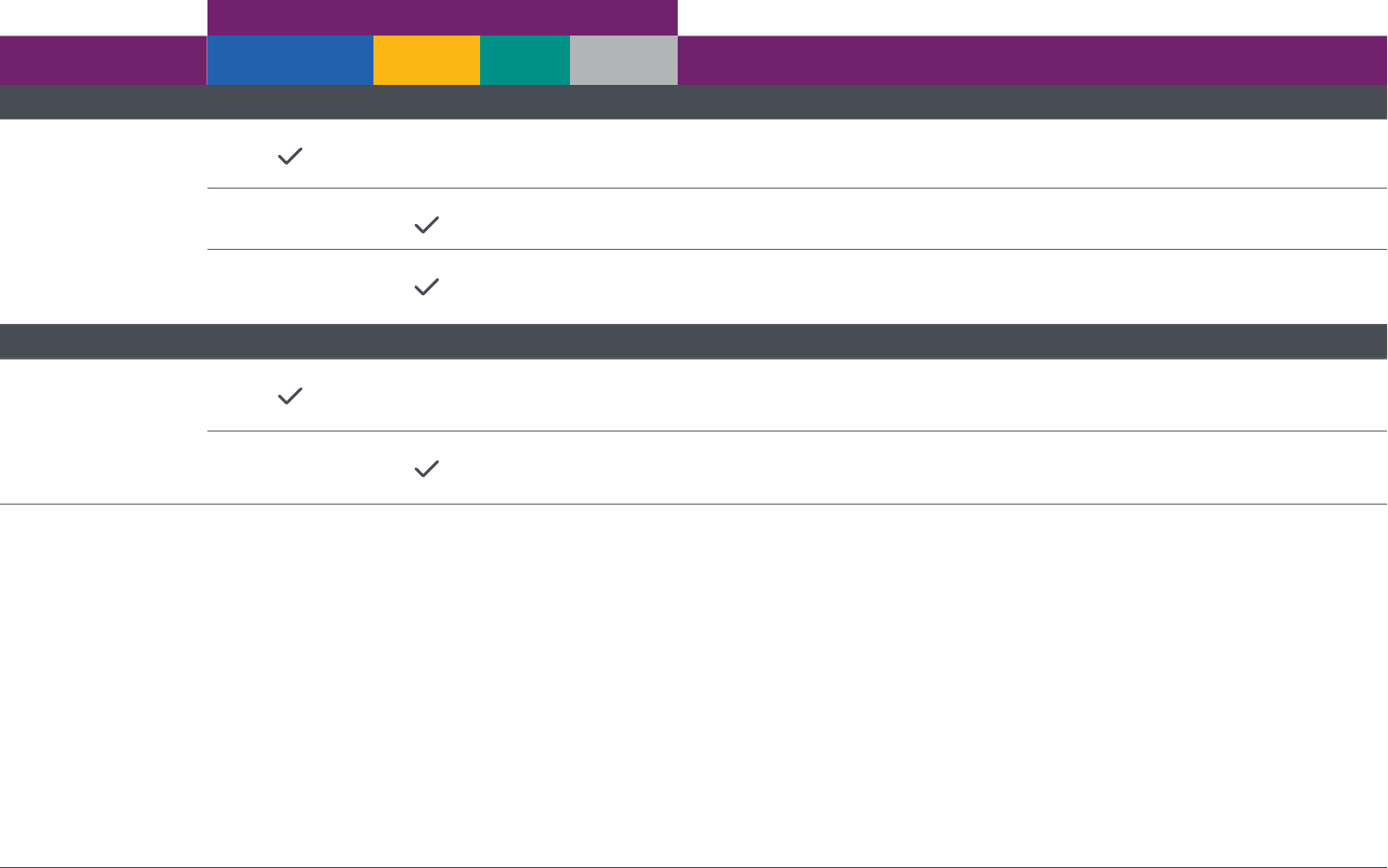

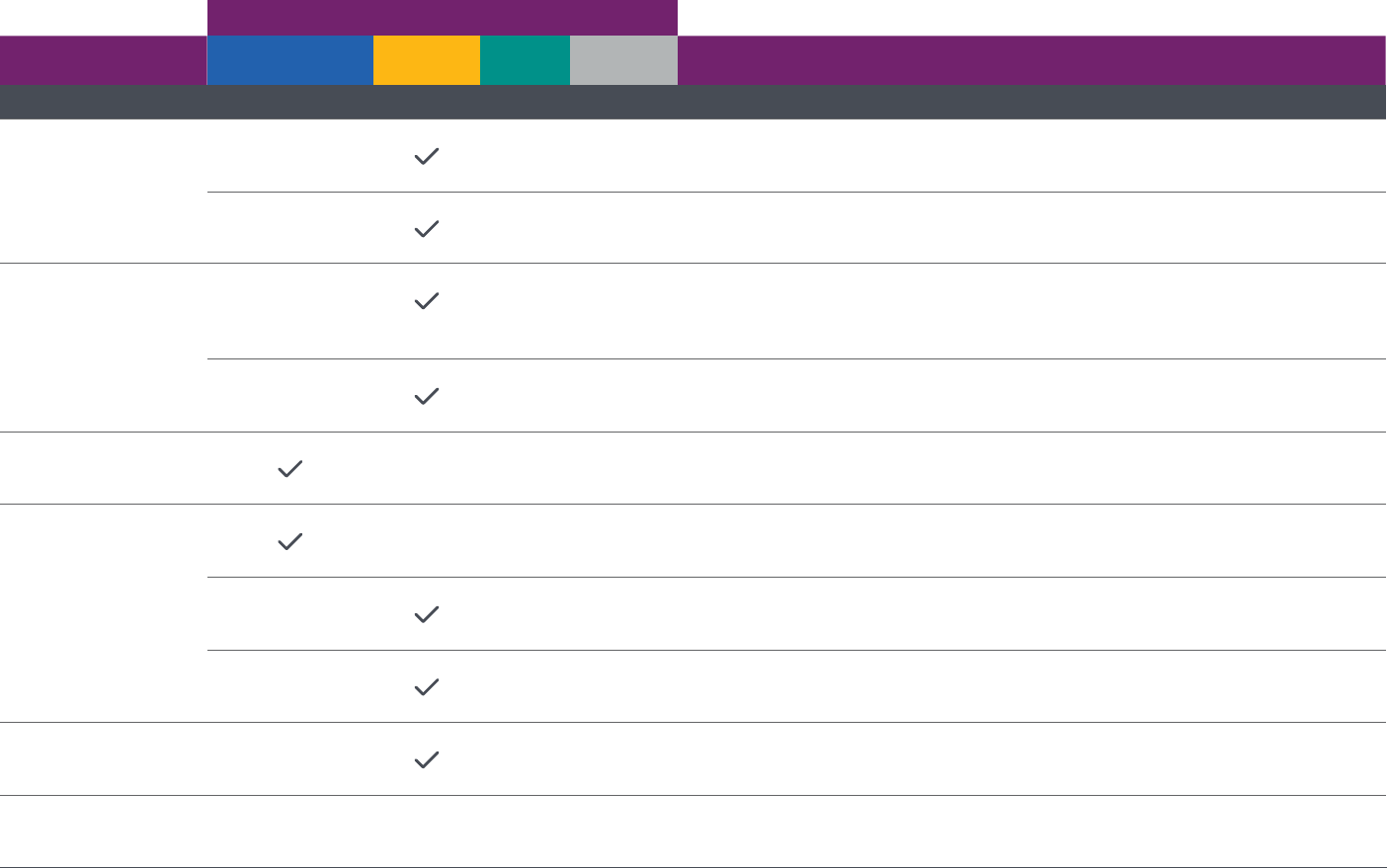

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

A. Conceptual framework and standard-setting for business and nonbusiness entities

1. Conceptual

framework

Recall the purpose and characteristics in the conceptual framework for business and

nonbusiness entities.

2. Standard-setting

process

Recall the due process steps followed by the FASB to establish nancial accounting and

reporting standards.

B. General-purpose nancial statements: for-prot business entities

1. Balance sheet/

statement of

nancial position

Prepare a classied balance sheet from a trial balance and supporting documentation.

Adjust the balance sheet to correct identied errors.

Detect, investigate and correct discrepancies while agreeing the balance sheet amounts

to supporting documentation.

Calculate uctuations and ratios and interpret the results while reviewing comparative

balance sheets.

2. Income statement/

statement of prot

or loss

Prepare a multiple-step income statement from a trial balance and supporting

documentation.

Prepare a single-step income statement from a trial balance and supporting

documentation.

Adjust the income statement to correct identied errors.

Detect, investigate and correct discrepancies while agreeing the income statement

amounts to supporting documentation.

Calculate uctuations and ratios and interpret the results while reviewing comparative

income statements.

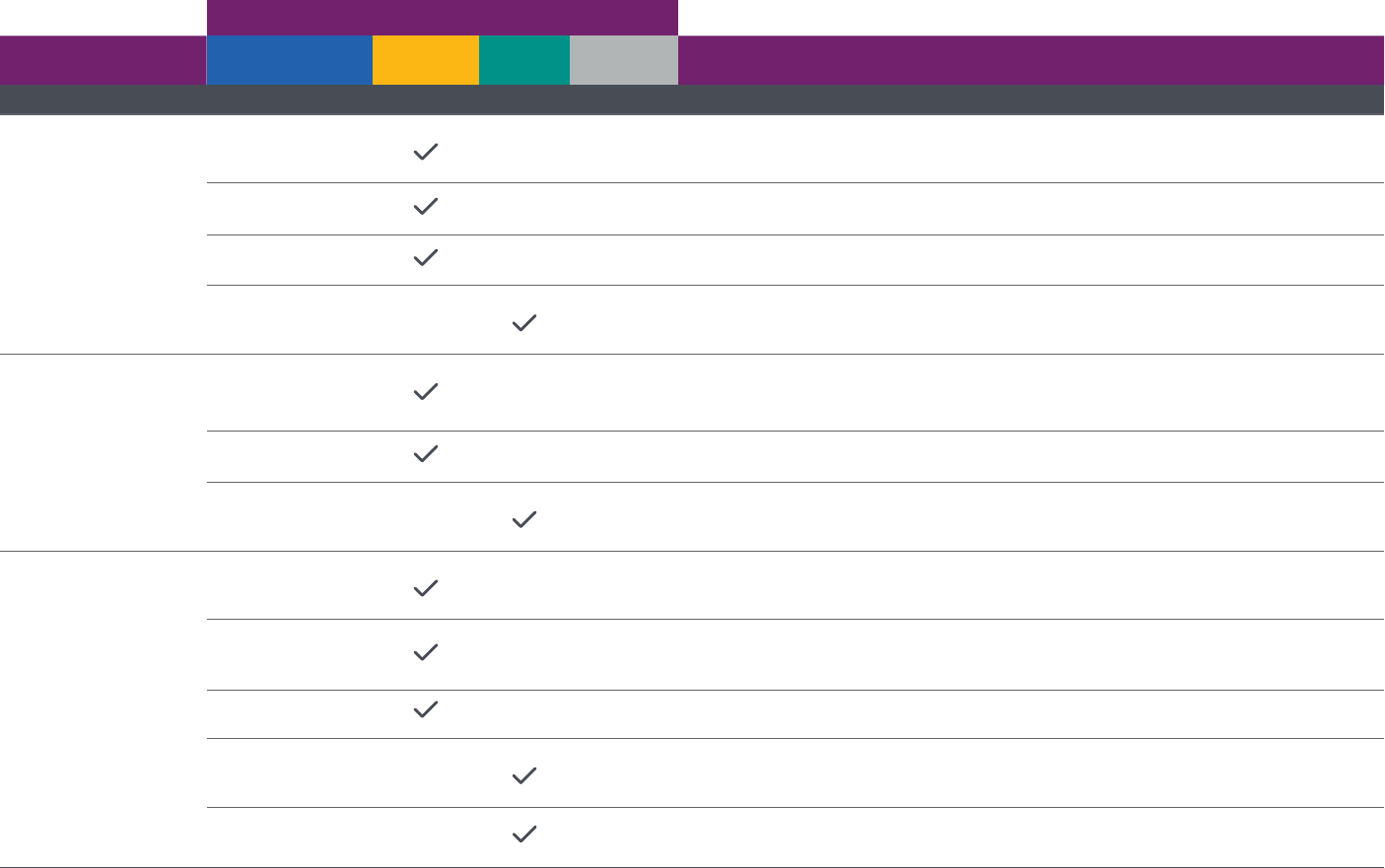

FAR8

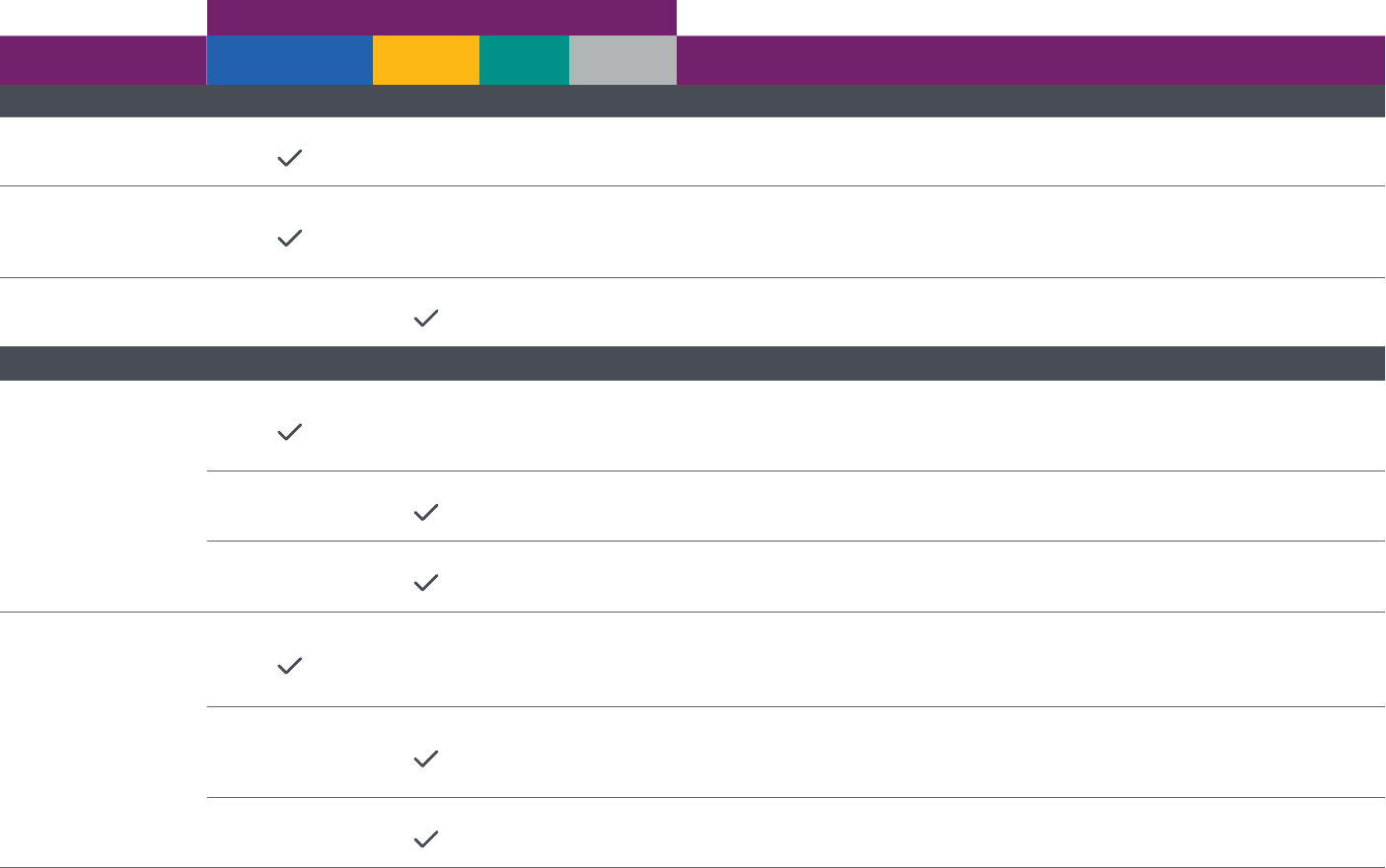

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

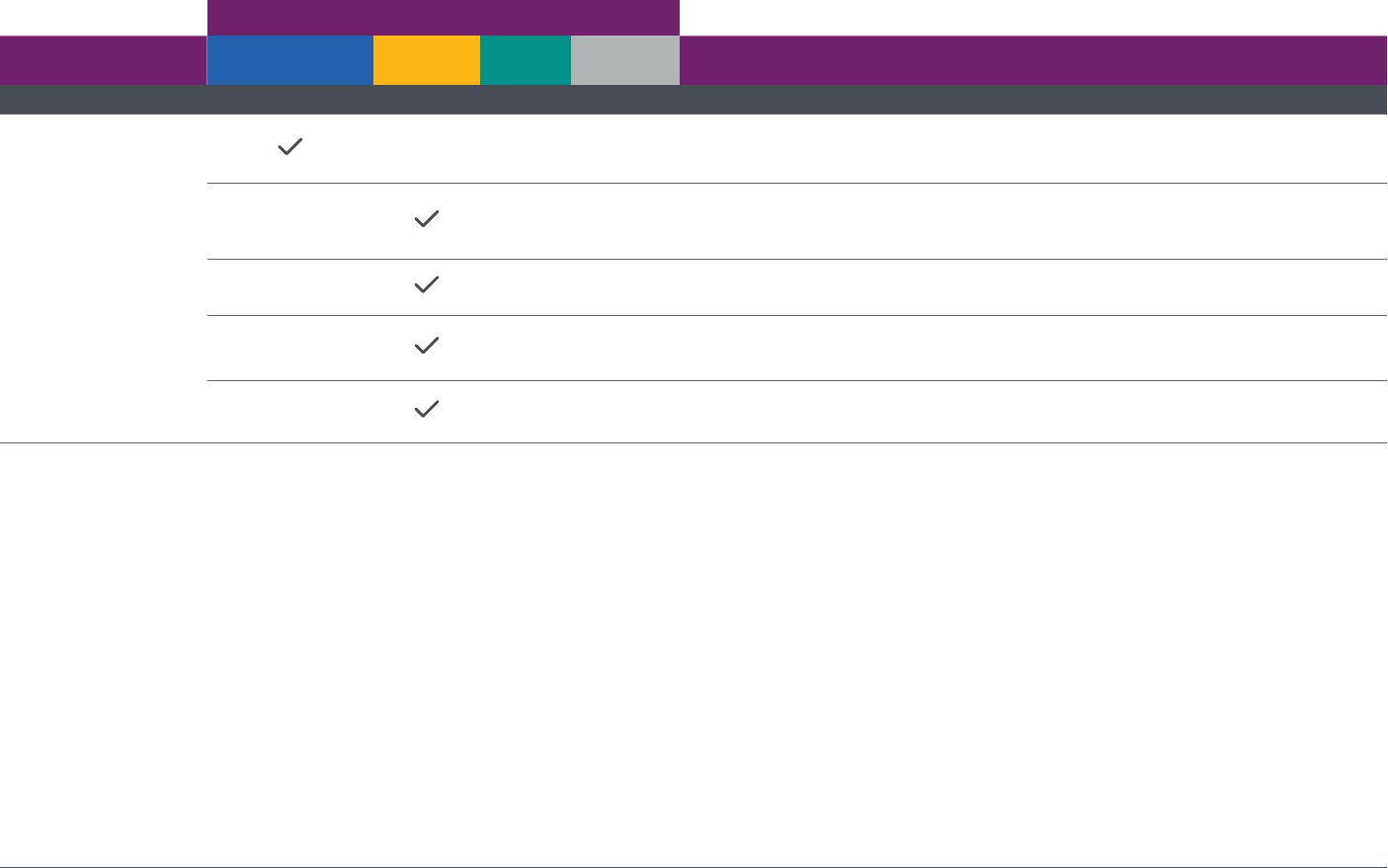

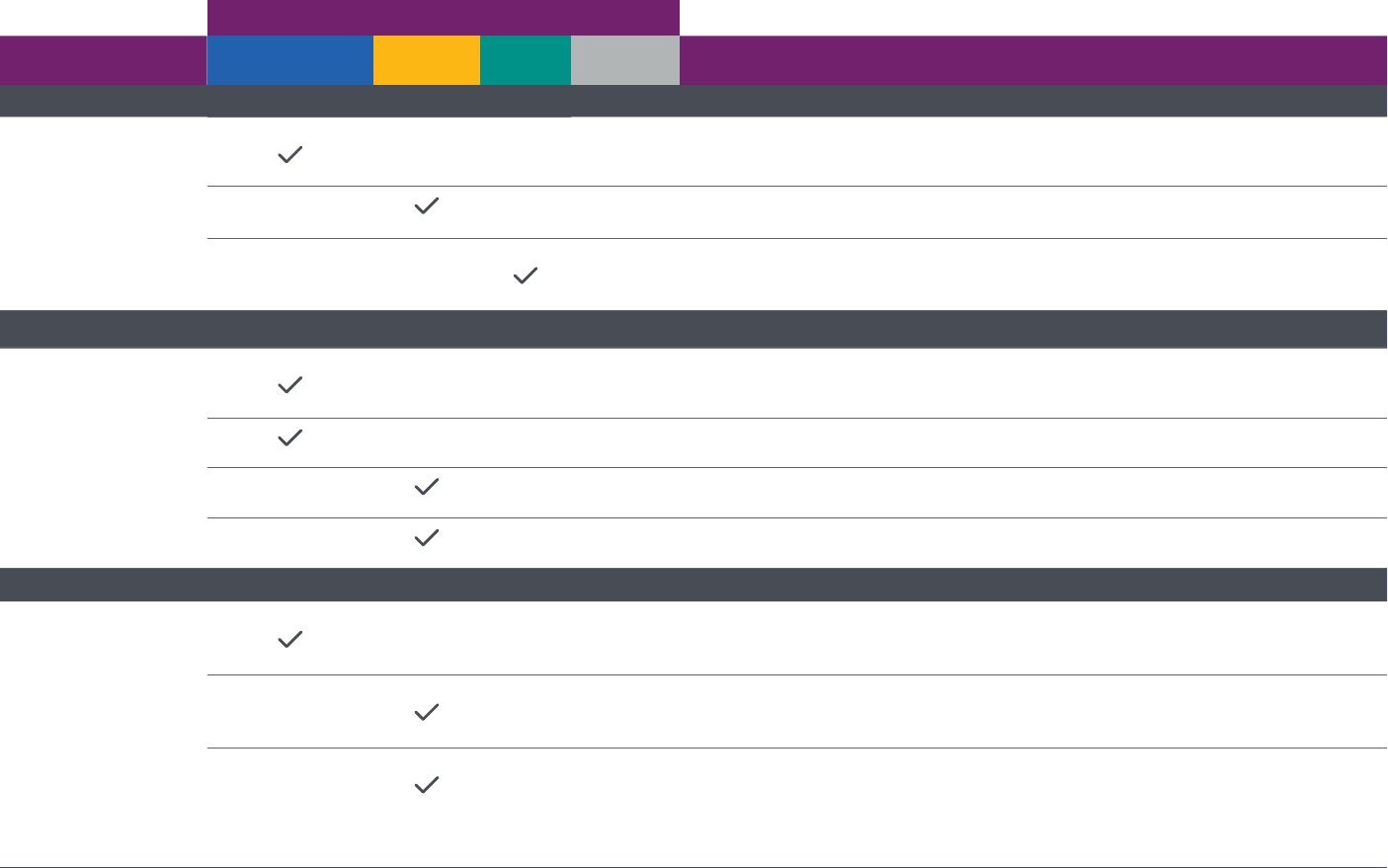

B. General-purpose nancial statements: for-prot business entities (continued)

3. Statement of

comprehensive

income

Prepare a statement of comprehensive income from a trial balance and supporting

documentation.

Calculate reclassication adjustments for items of other comprehensive income.

Adjust the statement of comprehensive income to correct identied errors.

Detect, investigate and correct discrepancies while agreeing the statement of

comprehensive income amounts to supporting documentation.

4. Statement of

changes in equity

Prepare a statement of changes in equity from a trial balance and supporting

documentation.

Adjust the statement of changes in equity to correct identied errors.

Detect, investigate and correct discrepancies while agreeing the statement of changes in

equity amounts to supporting documentation.

5. Statement of

cash ows

Prepare a statement of cash ows using the direct method and required disclosures from

supporting documentation.

Prepare a statement of cash ows using the indirect method and required disclosures

from supporting documentation.

Adjust a statement of cash ows to correct identied errors.

Detect, investigate and correct discrepancies while agreeing the statement of cash ows

amounts to supporting documentation.

Derive the impact of transactions on the statement of cash ows.

FAR9

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

B. General-purpose nancial statements: for-prot business entities (continued)

6. Notes to nancial

statements

Adjust the notes to the nancial statements to correct identied errors and omissions.

Compare the notes to the nancial statements to the nancial statements and supporting

documentation to identify inconsistencies and investigate those inconsistencies.

7. Consolidated

nancial

statements

(including wholly

owned subsidiaries

and noncontrolling

interests)

Recall basic consolidation concepts and terms (e.g. controlling interest, noncontrolling

interest, primary beneciary, variable interest entity).

Prepare consolidated nancial statements (includes adjustments, eliminations and/or

noncontrolling interests) from supporting documentation.

Adjust consolidated nancial statements to correct identied errors.

Detect, investigate and correct discrepancies identied while agreeing the consolidated

nancial statement amounts to supporting documentation.

8. Discontinued

operations

Prepare the discontinued operations portion of the nancial statements from a trial

balance and supporting documentation.

9. Going concern

Recall the requirements for disclosing uncertainties about an entity’s ability to continue

as a going concern.

FAR10

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

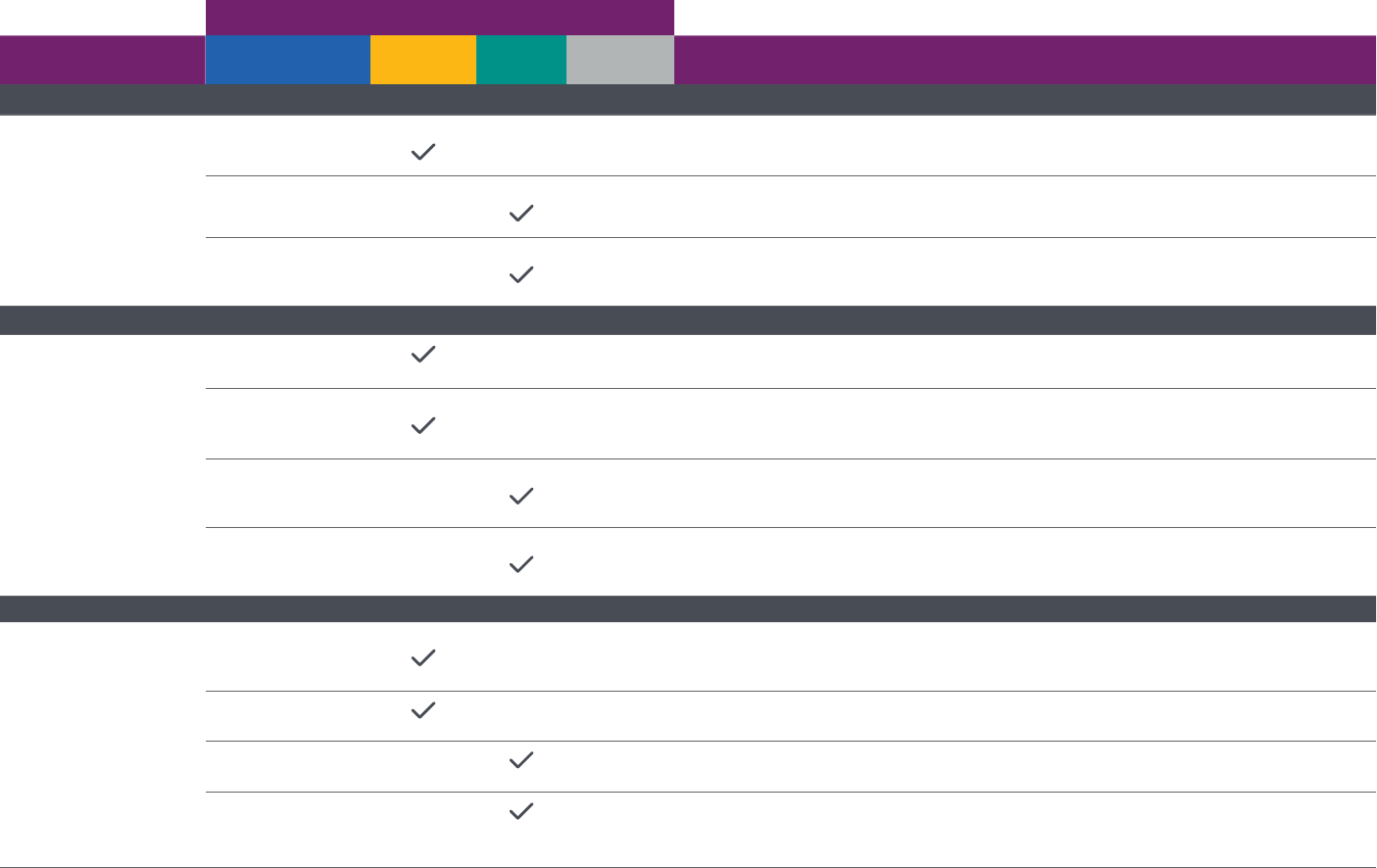

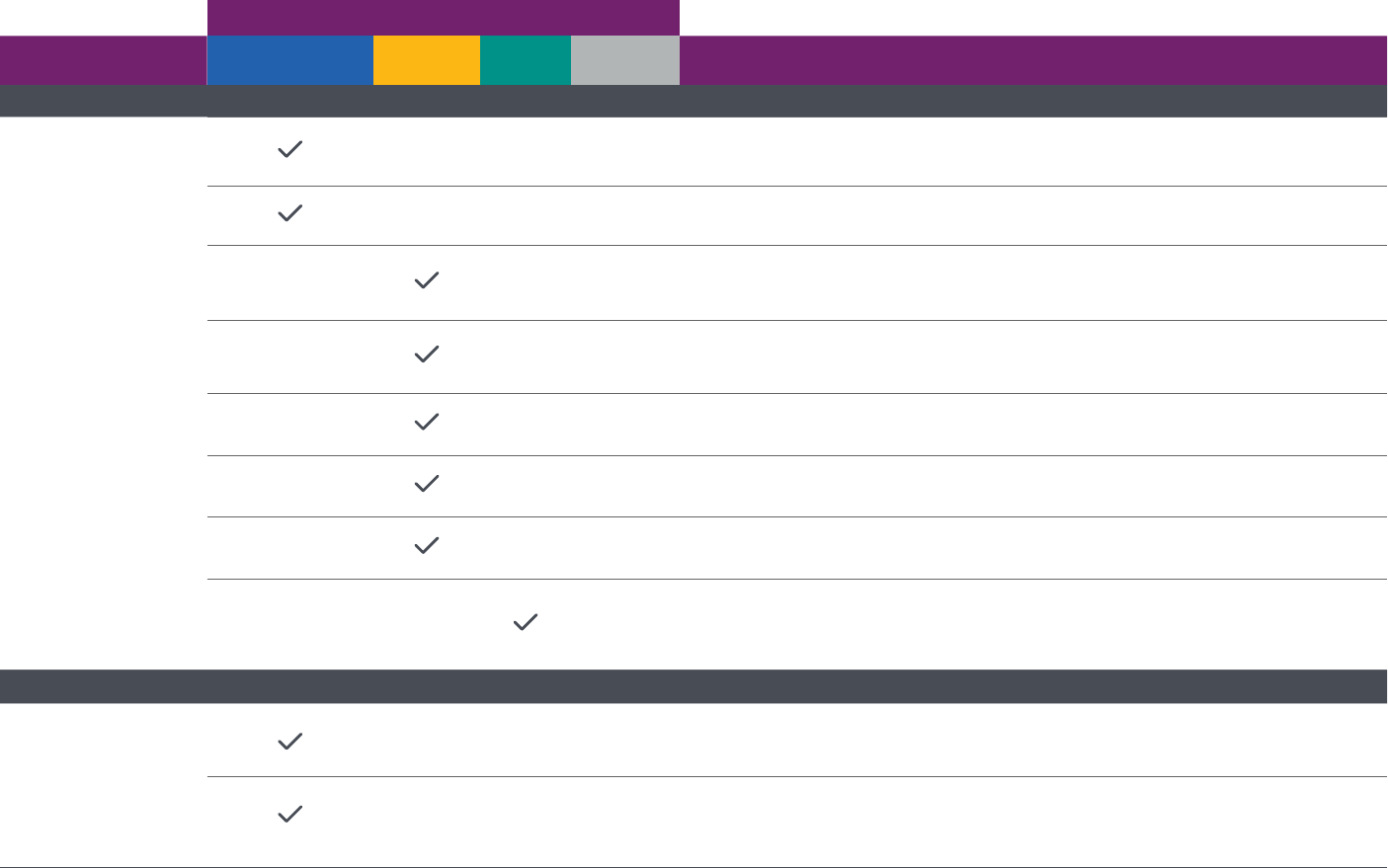

C. General-purpose nancial statements: nongovernmental, not-for-prot entities

1. Statement of

nancial position

Recall the purpose and objectives of the statement of nancial position for a

nongovernmental, not-for-prot entity.

Prepare a statement of nancial position for a nongovernmental, not-for-prot entity from

a trial balance and supporting documentation.

Adjust the statement of nancial position for a nongovernmental, not-for-prot entity to

correct identied errors.

2. Statement of

activities

Recall the purpose and objectives of the statement of activities for a nongovernmental,

not-for-prot entity.

Prepare a statement of activities for a nongovernmental, not-for-prot entity from a trial

balance and supporting documentation.

Adjust the statement of activities for a nongovernmental, not-for-prot entity to correct

identied errors.

3. Statement of

cash ows

Recall the purpose and objectives of the statement of cash ows for a nongovernmental,

not-for-prot entity.

Prepare a statement of cash ows and required disclosures using the direct method for

a nongovernmental, not-for-prot entity.

Prepare a statement of cash ows and required disclosures using the indirect method

for a nongovernmental, not-for-prot entity.

Adjust the statement of cash ows for a nongovernmental, not-for-prot entity to correct

identied errors.

4. Notes to nancial

statements

Adjust the notes to the nancial statements to correct identied errors and omissions.

FAR11

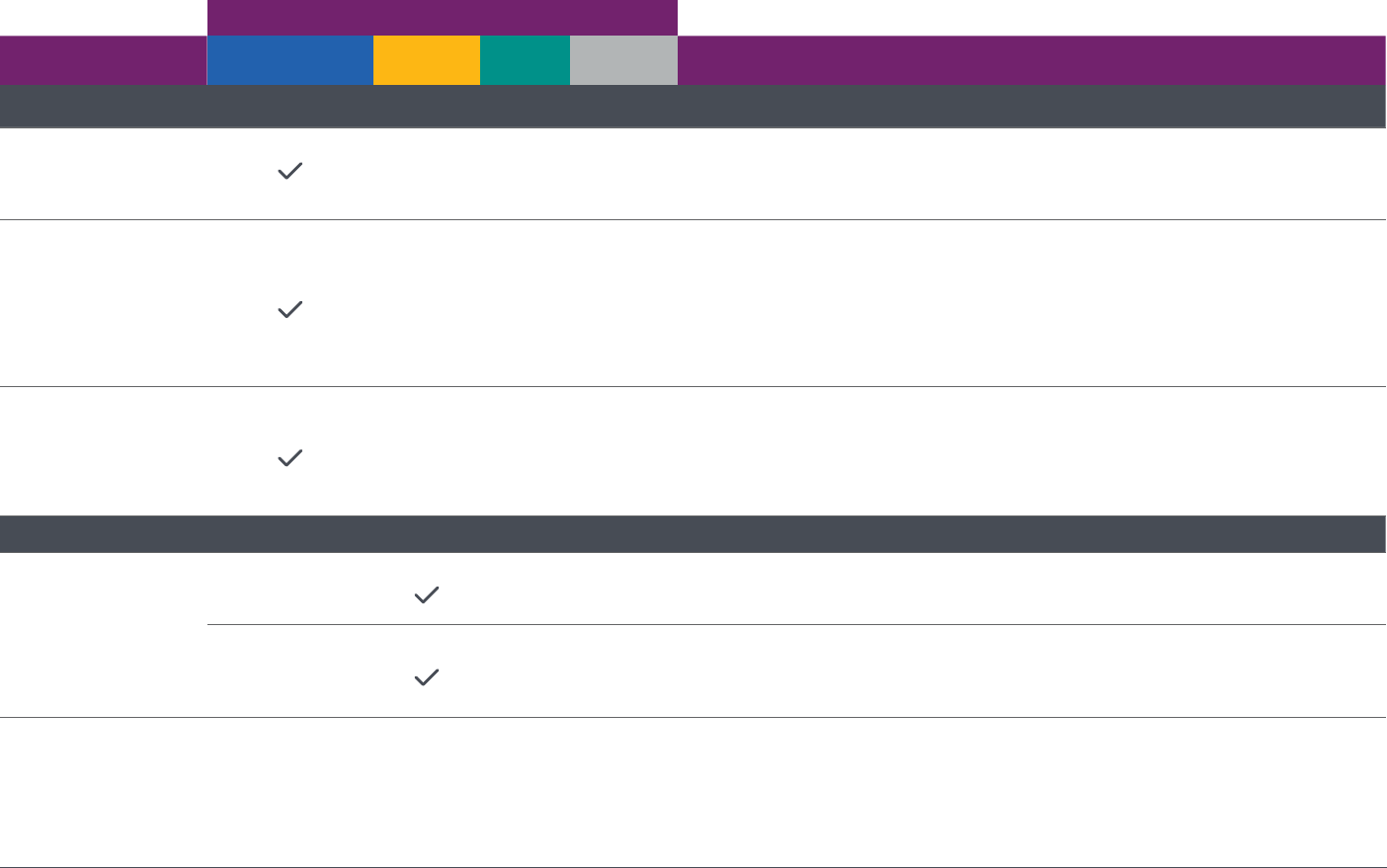

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

D. Public company reporting topics (U.S. SEC reporting requirements, earnings per share and segment reporting)

Recall the purpose of forms 10-Q, 10-K and 8-K that a U.S. registrant is required to le with

the U.S. Securities and Exchange Commission under the Securities Exchange Act

of 1934.

Identify the signicant components of Form 10-Q and Form 10-K led with the U.S.

Securities and Exchange Commission.

Prepare nancial statement note disclosures for reportable segments.

Calculate basic earnings per share.

Calculate diluted earnings per share.

E. Financial statements of employee benet plans

Identify the required nancial statements for a dened benet pension plan and a dened

contribution pension plan.

Prepare a statement of changes in net assets available for benets for a dened benet

pension plan and a dened contribution pension plan.

Prepare a statement of net assets available for benets for a dened benet pension plan

and a dened contribution pension plan.

FAR12

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area I — Conceptual Framework, Standard-Setting

and Financial Reporting (25–35%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

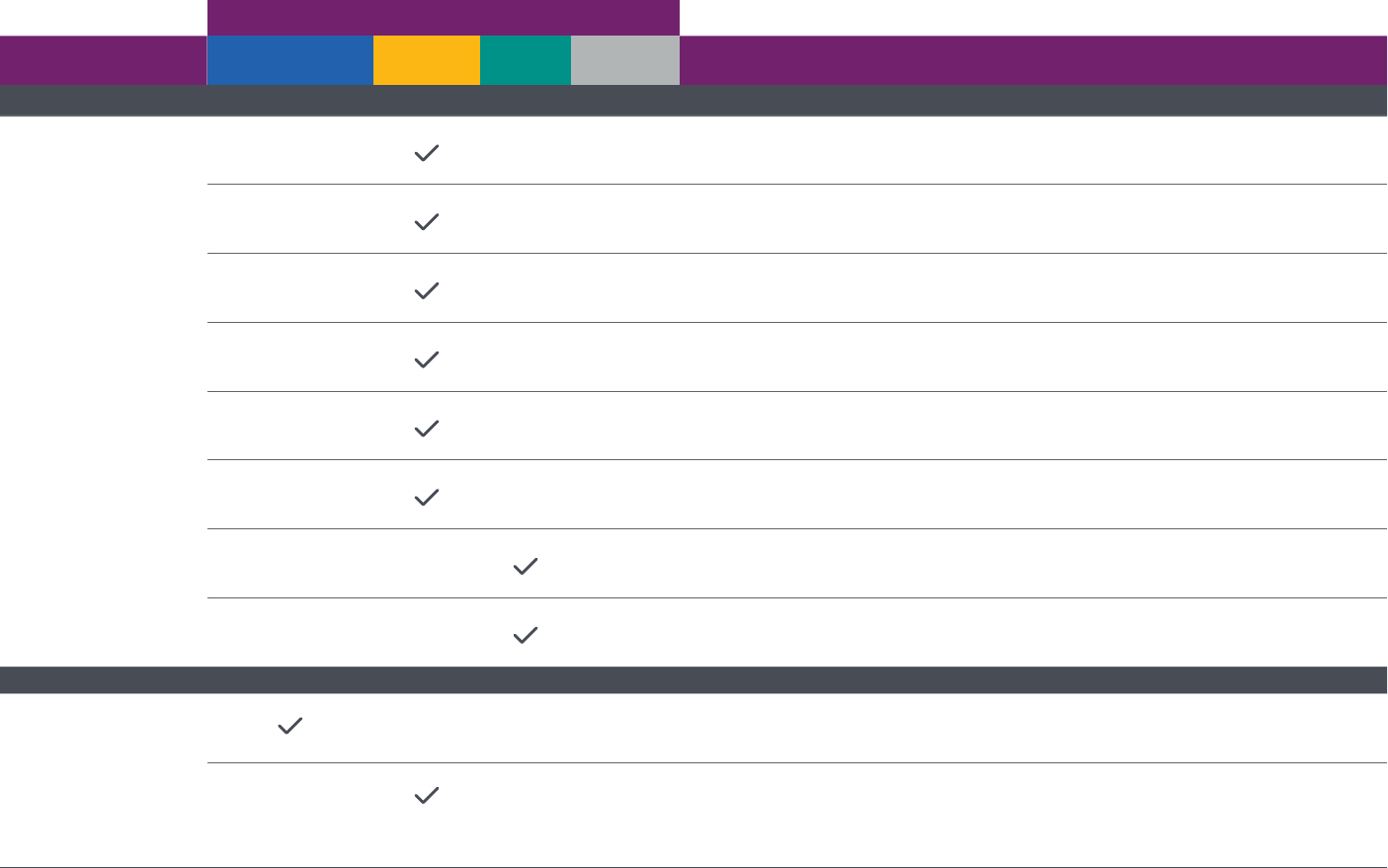

F. Special purpose frameworks

Recall appropriate nancial statement titles to be used for the nancial statements

prepared under a special purpose framework.

Perform calculations to convert cash basis or modied cash basis nancial statements

to accrual basis nancial statements.

Prepare nancial statements using the cash basis of accounting.

Prepare nancial statements using a modied cash basis of accounting.

Prepare nancial statements using the income tax basis of accounting.

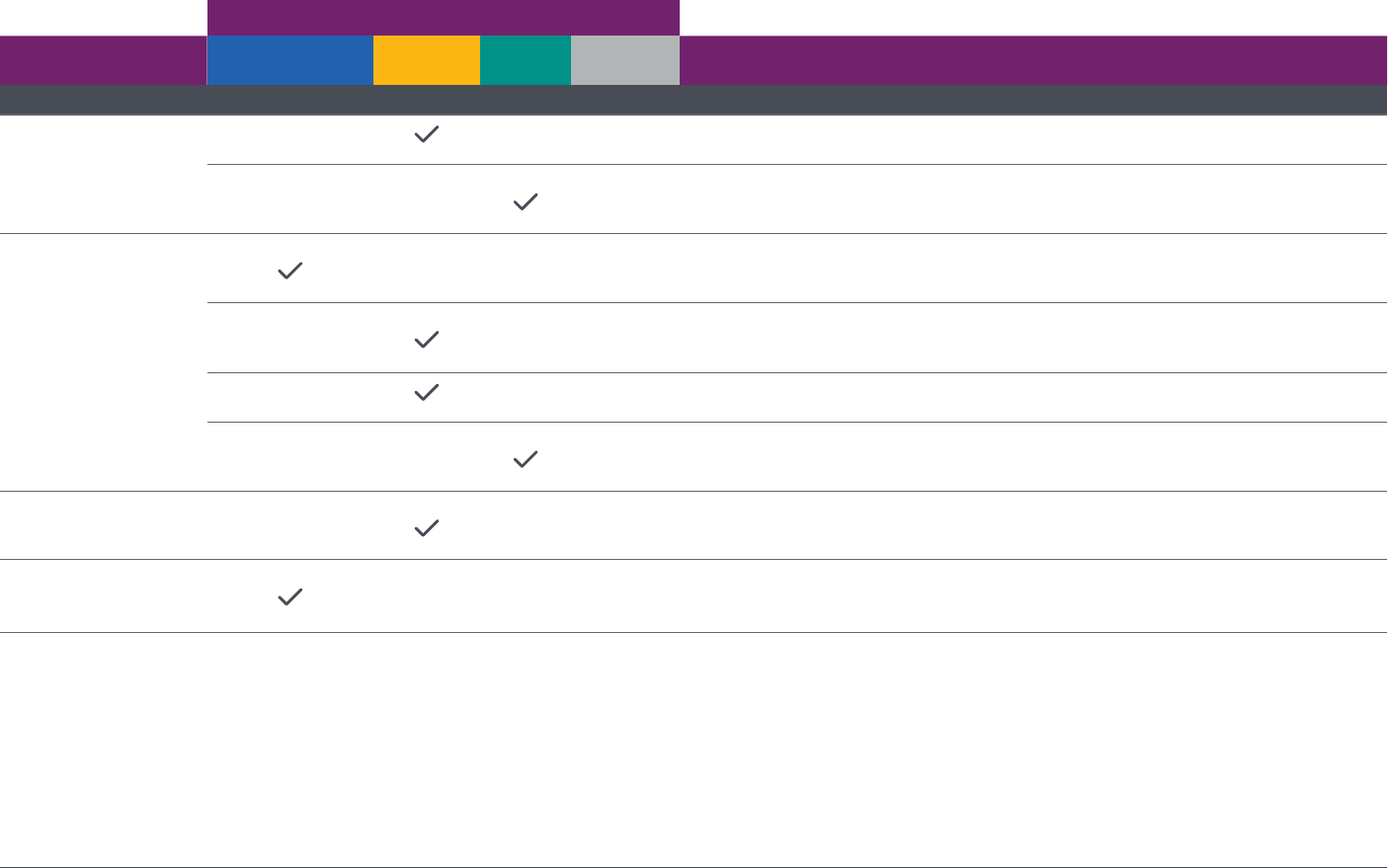

FAR13

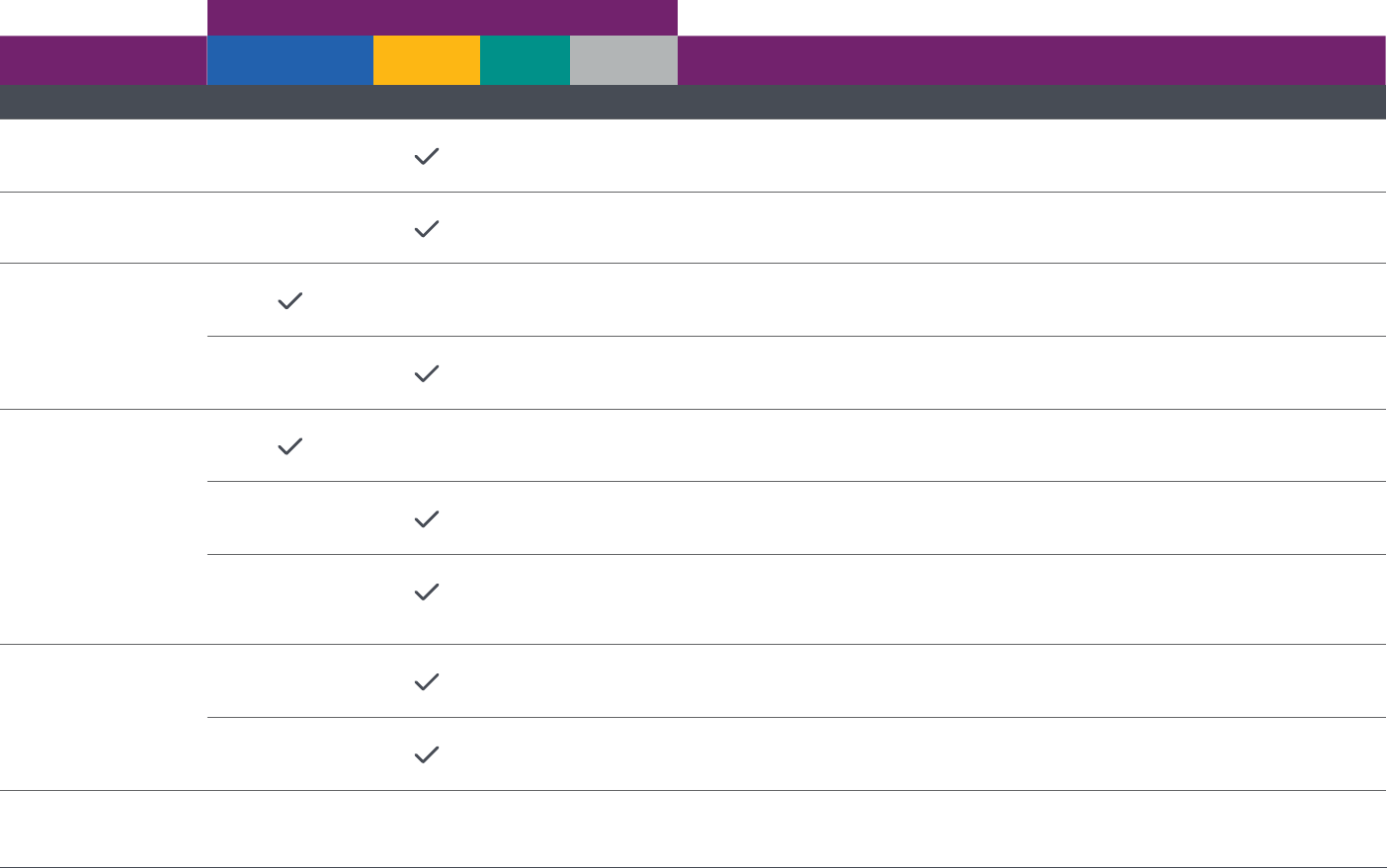

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area II — Select Financial Statement Accounts

(30–40%)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

A. Cash and cash equivalents

Calculate cash and cash equivalents balances to be reported in the nancial statements.

Reconcile the cash balance per the bank statement to the general ledger.

Investigate unreconciled cash balances to determine whether an adjustment to the

general ledger is necessary.

B. Trade receivables

Calculate trade receivables and allowances and prepare journal entries.

Prepare any required journal entries to record the transfer of trade receivables (secured

borrowings, factoring, assignment, pledging).

Prepare a rollforward of the trade receivables account balance using various sources of

information.

Reconcile and investigate differences between the subledger and general ledger for trade

receivables to determine whether an adjustment is necessary.

C. Inventory

Calculate the carrying amount of inventory and prepare journal entries using various costing

methods.

Measure impairment losses on inventory.

Prepare a rollforward of the inventory account balance using various sources of information.

Reconcile and investigate differences between the subledger and general ledger for

inventory to determine whether an adjustment is necessary.

FAR14

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area II — Select Financial Statement Accounts

(30–40%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

D. Property, plant and equipment

Calculate the gross and net property, plant and equipment balances and prepare

journal entries.

Calculate gains or losses on the disposal of long-lived assets to be recognized in the

nancial statements.

Measure impairment losses on long-lived assets to be recognized in the nancial

statements.

Calculate the amounts necessary to prepare journal entries to record a nonmonetary exchange.

Determine whether an asset qualies to be reported as held for sale in the nancial

statements.

Adjust the carrying amount of assets held for sale and calculate the loss to be recognized

in the nancial statements.

Prepare a rollforward of the property, plant and equipment account balance using various

sources of information.

Reconcile and investigate differences between the subledger and general ledger for

property, plant and equipment to determine whether an adjustment is necessary.

E. Investments

1. Financial assets

at fair value

Identify investments that are eligible or required to be reported at fair value in the

nancial statements.

Calculate the carrying amount of investments measured at fair value and prepare

journal entries (excluding impairment).

FAR15

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area II — Select Financial Statement Accounts

(30–40%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

E. Investments (continued)

1. Financial assets

at fair value,

(continued)

Calculate gains and losses to be recognized in net income or other comprehensive income

for investments measured at fair value and prepare journal entries.

Calculate investment income to be recognized in net income for investments measured

at fair value and prepare journal entries.

Measure impairment losses to be recognized on applicable investments reported at

fair value in the nancial statements.

2. Financial assets

at amortized cost

Identify investments that are eligible to be reported at amortized cost in the nancial

statements.

Calculate the carrying amount of investments measured at amortized cost and prepare

journal entries (excluding impairment).

Measure impairment losses to be recognized on investments reported at amortized cost

in the nancial statements.

3. Equity method

investments

Identify when the equity method of accounting can be applied to an investment.

Calculate the carrying amount of equity method investments and prepare journal entries

(excluding impairment).

Measure impairment losses to be recognized in the nancial statements on equity

method investments.

FAR16

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area II — Select Financial Statement Accounts

(30–40%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

F. Intangible assets – goodwill and other

Identify the criteria for recognizing intangible assets in the statement of nancial position and

classify intangible assets as either nite-lived or indenite-lived.

Identify impairment indicators for goodwill and other indenite-lived intangible assets.

Calculate the carrying amount of nite-lived intangible assets reported in the nancial

statements (initial measurement, amortization and impairment) and prepare journal entries.

Calculate the carrying amount of goodwill and other indenite-lived intangible assets reported

in the nancial statements (includes initial measurement and impairment) and prepare journal

entries.

G. Payables and accrued liabilities

Calculate the carrying amount of payables and accrued liabilities and prepare journal entries.

Identify and calculate liabilities arising from exit or disposal activities and determine the

timing of recognition in the nancial statements.

Calculate the liabilities and assets resulting from asset retirement obligations and prepare

journal entries.

Reconcile and investigate differences between the subledger and general ledger for accounts

payable and accrued liabilities to determine whether an adjustment is necessary.

H. Long-term debt (nancial liabilities)

1. Notes and bonds

payable

Classify a change to a debt instrument as either a modication of terms or an extinguishment of debt.

Understand when a change to the terms of a debt instrument qualies as a troubled debt

restructuring.

Classify a nancial instrument as either debt or equity, based on its characteristics.

FAR17

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area II — Select Financial Statement Accounts

(30–40%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

H. Long-term debt (nancial liabilities) (continued)

1. Notes and

bonds payable,

(continued)

Calculate the interest expense attributable to notes and bonds payable reported in the nancial

statements (including discounts, premiums or debt issuance costs).

Calculate the carrying amount of notes and bonds payable and prepare journal entries.

2. Debt covenant

compliance

Perform debt covenant calculations as stipulated in a debt agreement to ascertain compliance.

I. Equity

Prepare journal entries to recognize equity transactions in the nancial statements.

Calculate net asset balances for a nongovernmental, not-for-prot entity and prepare

journal entries.

J. Revenue recognition

Recall concepts of accounting for revenue.

Determine the amount and timing of revenue to be recognized under a contract and prepare

journal entries.

Determine revenue to be recognized by a nongovernmental, not-for-prot entity for contributed

services received and prepare journal entries.

Interpret agreements, contracts and/or other supporting documentation to determine the amount

and timing of revenue to be recognized in the nancial statements.

Reconcile and investigate differences between the sales subledger and the general ledger to

determine whether an adjustment is necessary.

FAR18

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

K. Compensation and benets

1. Compensated

absences

Calculate the carrying amount of the liability for compensated absences and prepare journal

entries.

2. Retirement

benets

Use actuarial outputs to calculate the costs and the funded status for a dened benet

pension plan or a dened benet postretirement plan and prepare journal entries.

3. Stock

compensation

(share-based

payments)

Recall concepts associated with share-based payment arrangements (grant date, vesting

conditions, inputs to valuation techniques, valuation models).

Calculate compensation costs to be recognized for a share-based payment arrangement

classied as equity and prepare journal entries.

Calculate compensation costs to be recognized for a share-based payment arrangement

classied as a liability and prepare journal entries.

L. Income taxes

Recall the accounting treatment for uncertainty in income taxes.

Recall the criteria for recognizing or adjusting a valuation allowance for a deferred tax

asset in the nancial statements.

Calculate the income tax expense, current taxes payable/receivable and deferred tax

liabilities/assets to be reported in the nancial statements.

Prepare journal entries to record the tax provision in the nancial statements.

Area II — Select Financial Statement Accounts

(30–40%) (continued)

FAR19

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

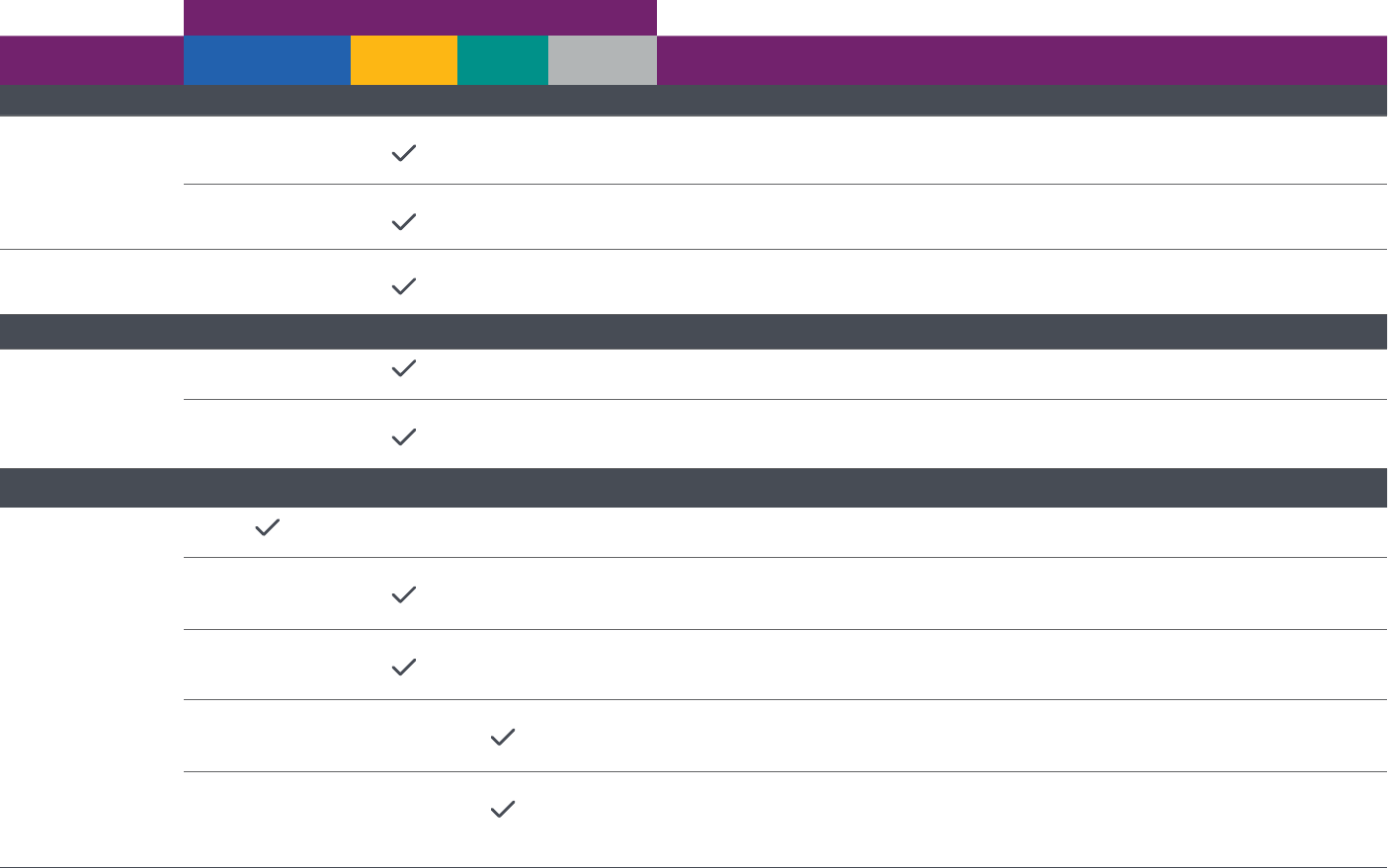

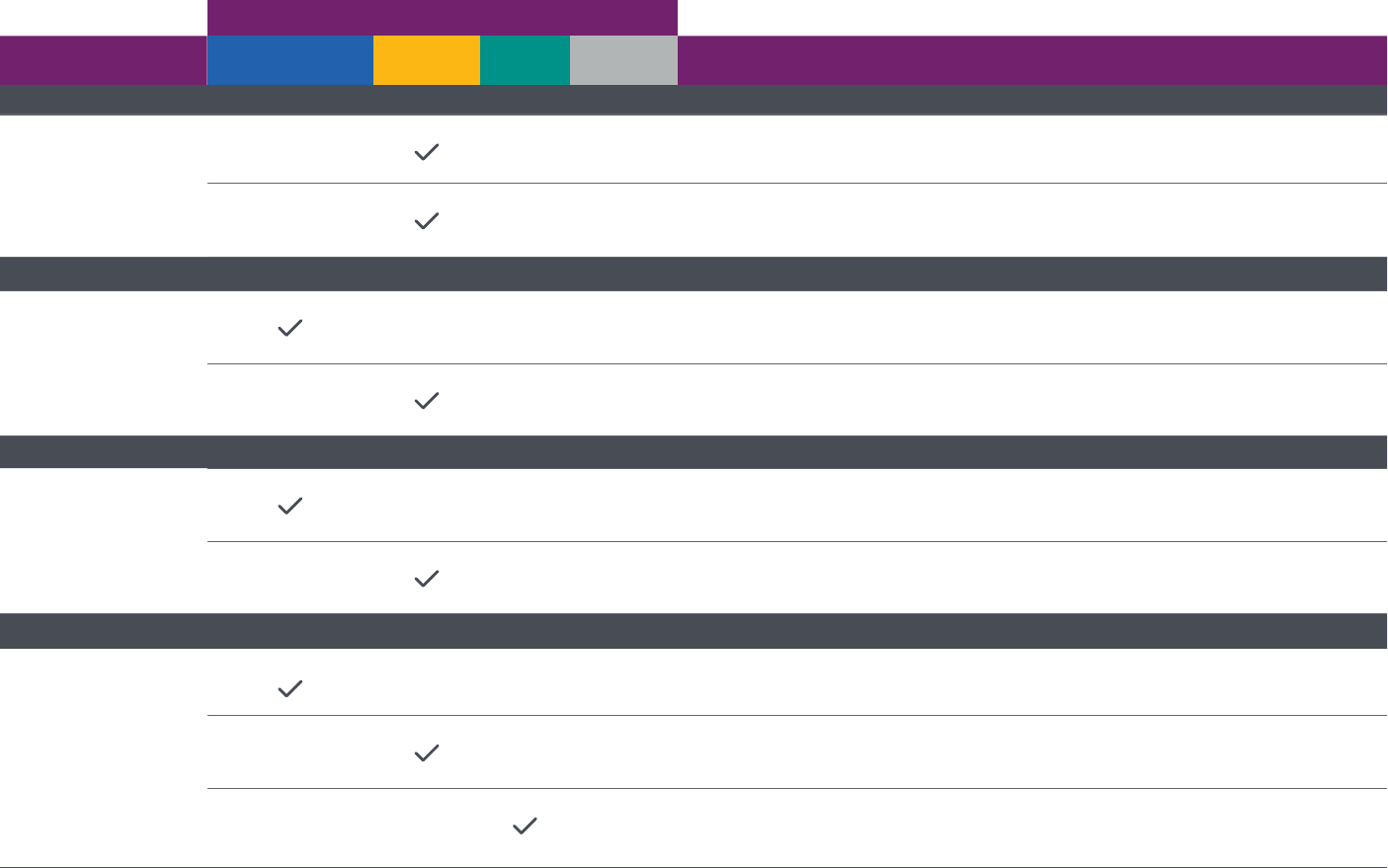

Financial Accounting and Reporting (FAR)

Area III — Select Transactions

(20–30%)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

A. Accounting changes and error corrections

Calculate a required adjustment to the nancial statements due to an accounting change

or error correction and determine whether it requires prospective or retrospective

application.

Derive the impact to the nancial statements and related note disclosures of an

accounting change or an error correction.

B. Business combinations

Prepare journal entries to record the identiable net assets acquired in a business

combination that results in the recognition of goodwill.

Prepare journal entries to record the identiable net assets acquired in a business

combination that includes a noncontrolling interest.

Prepare journal entries to record the identiable net assets acquired in a business

combination that results in the recognition of a bargain purchase gain.

Adjust the nancial statements to properly reect changes in contingent consideration

related to a business combination.

Calculate the consideration transferred in a business combination.

Adjust the nancial statements to properly reect measurement period adjustments

related to a business combination.

FAR20

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area III — Select Transactions

(20–30%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

C. Contingencies and commitments

Recall the recognition and disclosure criteria used to identify commitments and

contingencies.

Calculate amounts of contingencies and prepare journal entries.

Review supporting documentation to determine whether a commitment or contingency

requires recognition or disclosure in the nancial statements.

D. Derivatives and hedge accounting (e.g., swaps. options, forwards)

Identify the characteristics of a freestanding and/or embedded derivative nancial

instrument to be recognized in the nancial statements.

Identify the criteria necessary to qualify for hedge accounting.

Prepare journal entries for hedging transactions.

Prepare journal entries for derivative nancial instruments (swaps, options and forwards).

E. Foreign currency transactions and translation

Recall the basic functional currency concepts including the indicators to be considered

when determining an entity's functional currency.

Calculate transaction gains or losses recognized from monetary transactions

denominated in a foreign currency.

Adjust an entity's nancial statements (local currency to functional currency or functional

currency to reporting currency) and recognize the effect on equity through net income or

other comprehensive income.

FAR21

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area III — Select Transactions

(20–30%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

F. Leases

Recall the appropriate accounting treatment for residual value guarantees, purchase options

and variable lease payments included in leasing arrangements.

Identify the criteria for classifying a lease arrangement.

Calculate the carrying amount of lease-related assets and liabilities and prepare journal entries

that a lessee should record.

Calculate the carrying amount of lease-related assets and prepare journal entries that a lessor

should record.

Calculate the lease costs that a lessee should recognize in the income statement.

Prepare journal entries that the seller/lessee should record for a sale-leaseback transaction.

Calculate the amount of lease income that a lessor should recognize in the income statement.

Interpret agreements, contracts and/or other supporting documentation to determine the

appropriate accounting treatment of a leasing arrangement and prepare the journal entries that

the lessee should record.

G. Nonreciprocal transfers

Recall the recognition requirements associated with conditional and unconditional

promises to give (pledges) for a nongovernmental, not-for-prot entity.

Identify transfers to a nongovernmental, not-for-prot entity acting as an agent or

intermediary that are not recognized as contributions in the statement of activities.

FAR22

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area III — Select Transactions

(20–30%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

G. Nonreciprocal transfers (continued)

Calculate the carrying amount of donated assets (nancial assets or long-lived assets)

to be reported in the statement of nancial position.

Calculate increases in net assets attributable to contributions for a nongovernmental,

not-for-prot entity.

H. Research and development costs

Identify research and development costs and classify the costs as an expense in the nancial

statements.

Calculate the research and development costs to be reported as an expense in the nancial

statements.

I. Software costs

Identify the criteria necessary to capitalize software costs (software for internal use or

sale) in the nancial statements.

Calculate capitalized software costs (software for internal use or sale) to be reported in

the nancial statements and the related amortization expense.

J. Subsequent events

Identify a subsequent event and recall its appropriate accounting treatment.

Calculate required adjustments to nancial statements and/or note disclosures based on

identied subsequent events.

Derive the impact to the nancial statements and required note disclosures due to identied

subsequent events.

FAR23

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area III — Select Transactions

(20–30%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

K. Fair value measurements

Identify the valuation techniques used to measure fair value.

Use the fair value hierarchy to determine the classication of a fair value measurement.

Use the fair value concepts (e.g. highest and best use, market participant assumptions,

unit of account) to measure the fair value of assets and liabilities.

L. Differences between IFRS and U.S. GAAP

Identify accounting and reporting differences between IFRS and U.S. GAAP.

Determine the impact of the differences between IFRS and U.S. GAAP on the

nancial statements.

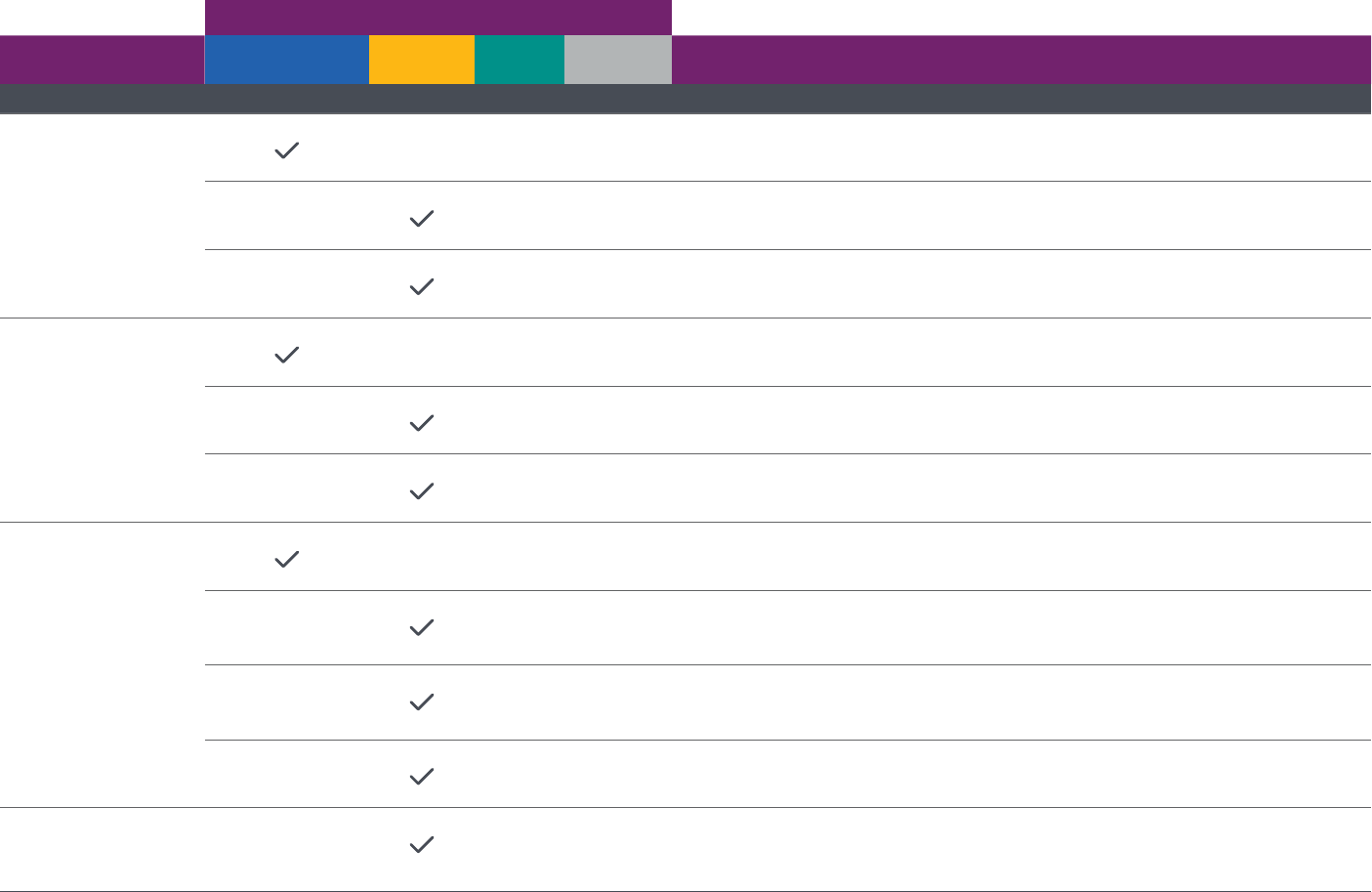

FAR24

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

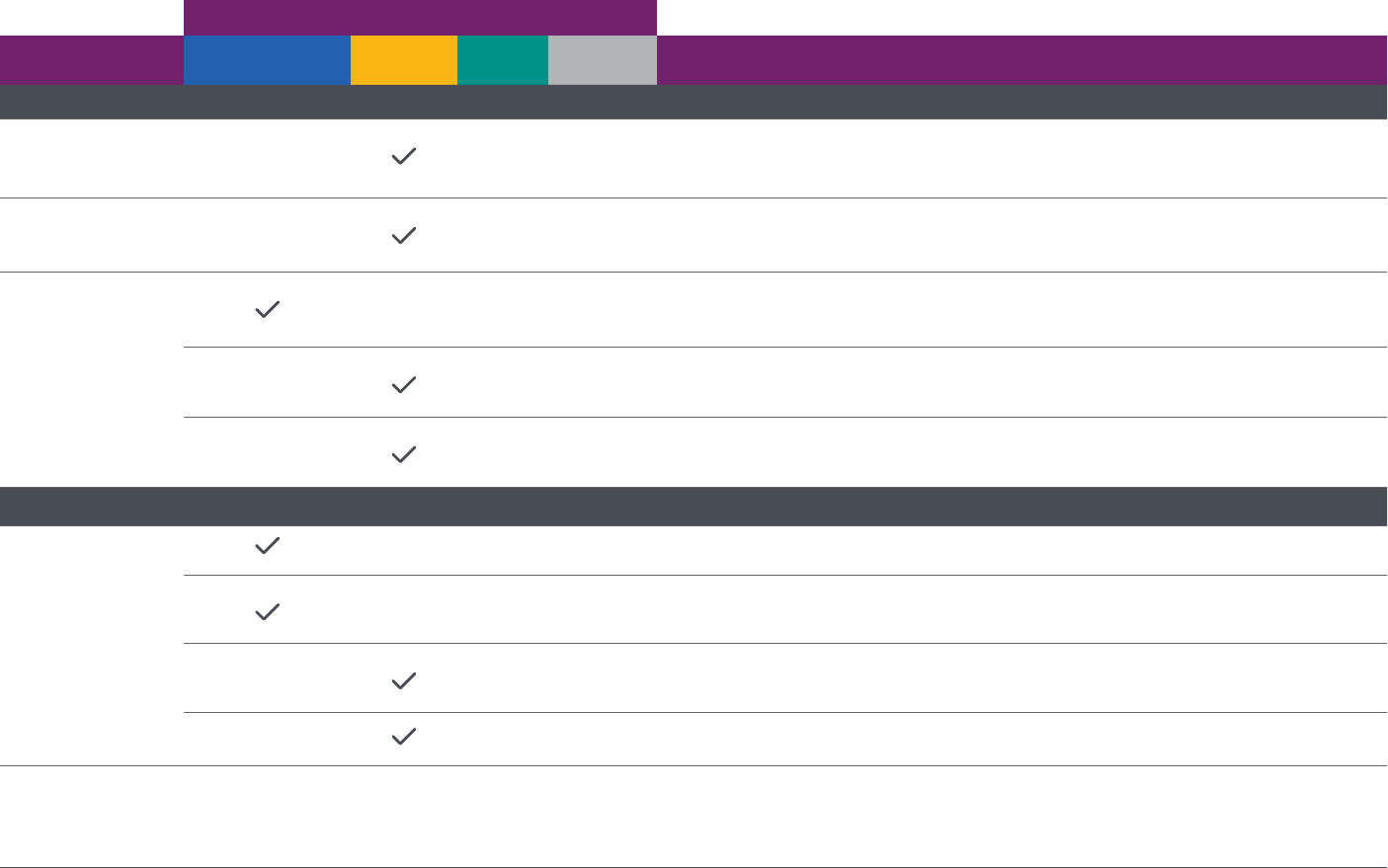

Financial Accounting and Reporting (FAR)

Area IV — State and Local Governments

(5-15%)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

A. State and local government concepts

1. Conceptual

framework

Recall the purpose and characteristics of the conceptual framework for state and local

governments.

2. Measurement focus

and basis of

accounting

Recall the measurement focus and basis of accounting used by state and local

governments for fund and government-wide nancial reporting.

3. Purpose of funds

Determine the appropriate fund(s) that a state or local government should use to record

its activities.

B. Format and content of the nancial section of the comprehensive annual nancial report (CAFR)

1. Government-wide

nancial statements

Identify and recall basic concepts and principles associated with government-wide

nancial statements (e.g., required activities, nancial statements and nancial statement

components).

Prepare the government-wide statement of net position for a state or local government

from trial balances and supporting documentation.

Prepare the government-wide statement of activities for a state or local government from

trial balances and supporting documentation.

2. Governmental funds

nancial statements

Identify and recall basic concepts and principles associated with governmental fund

nancial statements (e.g., required funds, nancial statements and nancial statement

components).

Prepare the statement of revenues, expenditures and changes in fund balances for the

governmental funds of a state or local government from trial balances and supporting

documentation.

Prepare the balance sheet for the governmental funds of a state or local government

from trial balances and supporting documentation.

FAR25

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area IV — State and Local Governments

(5-15%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

B. Format and content of the nancial section of the comprehensive annual nancial report (CAFR) (continued)

3. Proprietary funds

nancial statements

Identify and recall basic concepts and principles associated with proprietary fund

nancial statements (e.g., required funds, nancial statements and nancial statement

components).

Prepare the statement of revenues, expenses and changes in fund net position for the

proprietary funds of a state or local government from trial balances and supporting

documentation.

Prepare the statement of net position for the proprietary funds of a state or local

government from trial balances and supporting documentation.

Prepare the statement of cash ows for the proprietary funds of a state or local

government.

4. Fiduciary funds

nancial statements

Identify and recall basic concepts and principles associated with duciary fund

nancial statements (e.g., required funds, nancial statements and nancial statement

components).

Prepare the statement of changes in duciary net position for the duciary funds of a

state or local government from trial balances and supporting documentation.

Prepare the statement of net position for the duciary funds of a state or local

government from trial balances and supporting documentation.

5. Notes to nancial

statements

Recall the disclosure requirements for the notes to the basic nancial statements of state and

local governments.

6. Management’s

discussion and

analysis

Recall the objectives and components of management's discussion and analysis in the

comprehensive annual nancial report for state and local governments.

FAR26

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area IV — State and Local Governments

(5-15%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

B. Format and content of the nancial section of the comprehensive annual nancial report (CAFR) (continued)

7. Budgetary

comparison

reporting

Recall the objectives and components of budgetary comparison reporting in the comprehensive

annual nancial report for state and local governments.

8. Required

supplementary

information

(RSI) other than

management’s

discussion and

analysis

Recall the objectives and components of required supplementary information other than

management’s discussion and analysis in the comprehensive annual nancial report for

state and local governments.

9. Financial reporting

entity, including

blended and

discrete component

units

Recall the criteria for classifying an entity as a component unit of a state or local

government and the nancial statement presentation requirements (discrete or blended).

C. Deriving government-wide nancial statements and reconciliation requirements

Prepare worksheets to convert the governmental fund nancial statements to the

governmental activities reported in the government-wide nancial statements.

Prepare the schedule to reconcile the total fund balances and the net change in fund

balances reported in the governmental fund nancial statements to the net position and

change in net position reported in the government-wide nancial statements.

FAR27

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area IV — State and Local Governments

(5-15%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

D. Typical items and specic types of transactions and events: measurement, valuation, calculation and presentation in governmental entity nancial statements

1. Net position and

components thereof

Calculate the net position balances (unrestricted, restricted and net investment in capital

assets) for state and local governments and prepare journal entries.

2. Fund balances and

components thereof

Calculate the fund balances (assigned, unassigned, nonspendable, committed and

restricted) for state and local governments and prepare journal entries.

3. Capital assets and

infrastructure

assets

Identify capital assets reported in the government-wide nancial statements of state and

local governments.

Calculate the net general capital assets balance for state and local governments and prepare

journal entries (initial measurement and subsequent depreciation and amortization).

4. General and

proprietary

long-term

liabilities

Identify general and proprietary long-term liabilities reported in the government-wide

nancial statements of state and local governments.

Calculate the total indebtedness to be reported in the government-wide nancial

statements of a state or local government.

Calculate the net general long-term debt balance for state and local governments

and prepare journal entries (debt issuance, interest payments, issue premiums or

issue discounts).

5. Interfund activity,

including transfers

Prepare eliminations of interfund activity in the government-wide nancial statements

of state and local governments.

Prepare journal entries to recognize interfund activity within state and local governments.

FAR28

Uniform CPA Examination Blueprints: Financial Accounting and Reporting (FAR)

Financial Accounting and Reporting (FAR)

Area IV — State and Local Governments

(5-15%) (continued)

Skill

Content group/topic

Remembering and

Understanding

Application Analysis Evaluation Representative task

D. Typical items and specic types of transactions and events: measurement, valuation, calculation and presentation in governmental entity nancial statements (continued)

6. Nonexchange

revenue

transactions

Calculate the amount of nonexchange revenue to be recognized by state and local

governments using the modied accrual basis of accounting and prepare journal entries.

Calculate the amount of nonexchange revenue to be recognized by state and local

governments using the accrual basis of accounting and prepare journal entries.

7. Expenditures and

expenses

Calculate expenditures to be recognized under the modied accrual basis of accounting

(paid from available fund nancial resources) for state and local governments and prepare

journal entries.

Calculate expenses to be recognized under the accrual basis of accounting for state and

local governments and prepare journal entries.

8. Special items

Identify transactions that require presentation as special items in government-wide

nancial statements for state and local governments.

9. Budgetary

accounting and

encumbrances

Recall and explain the types of budgets used by state and local governments.

Prepare journal entries to record budgets (original and nal) of state and local

governments.

Prepare journal entries to record encumbrances of state and local governments.

10. Other nancing

sources and uses

Calculate the amount to be reported as other nancing sources and other nancing uses in

the governmental funds nancial statements.

29

Uniform CPA Examination Blueprints

Examinations Team

American Institute of CPAs

100 Princeton South, Suite 200

Ewing, NJ 08628

888.777.7077 | aicpa.org

© 2018 American Institute of Certied Public Accountants. All rights reserved. AICPA and American Institute of CPAs are trademarks of the American Institute of Certied

Public Accountants and are registered in the United States, the European Union and other countries. The Globe Design is a trademark owned by the Association of

International Certied Professional Accountants and licensed to AICPA. The Uniform CPA Examination is a registered trademark of the American Institute of Certied

Public Accountants and is registered in the United States. 1807-4898