Everything you need to know

about sitting for the CPA exam

as an Illinois candidate.

Revised 1.22.24

overview

This guide is intended to inform Illinois candidates about the application process, administration, and structure of the certified public

accountant (CPA) exam.

The American Institute of Certified Public Accountants (AICPA) develops, maintains, and scores the CPA exam.

States individually establish the requirements for CPA exam candidates and CPA licensing. Since state regulations vary, domestic (U.S.)

CPA exam candidates are encouraged to apply to test in the state in which they plan to practice and obtain licensure.

Candidates submitting transcripts from an institution located outside of the U.S. are considered international candidates. International

candidates are encouraged to apply to test in the state in which they plan to practice and obtain licensure.

The Illinois Board of Examiners (ILBOE) has sole responsibility for setting policy and rules for Illinois CPA exam candidates.

resources

The CPA exam format and content does change. Candidates should

also review the information posted by the organizations listed below.

CPA EXAM Frequently Asked Questions

Organization Site Content

Illinois CPA Society (ICPAS)

www.icpas.org/cpa-exam-resources

Email: [email protected]

Phone: 800.993.0407

CPA Exam Award scholarships

Discounts on review courses, tutoring,

and ethics exam

Illinois Board of Examiners (ILBOE)

www.ilboe.org

Email: [email protected]

Phone: 815.753.8900

Illinois educational requirements to take

the CPA exam

Illinois credential evaluation form, CPA exam

application form, and related fees

Illinois Department of Financial and

Professional Regulation (IDFPR)

www.idfpr.com

Illinois CPA licensing requirements

Continuing professional education requirements

American Institute of CPAs (AICPA)

ThisWayToCPA.com

General structure, content, and length of each

section of the CPA exam

CPA exam tutorial and sample exams

National Association of State

Boards of Accountancy (NASBA)

www.nasba.org

Email: [email protected]

Phone: 800.CPA.Exam

Pay fees for taking CPA exam

Links to state boards of accountancy or examiners

Transcript review for international candidates

The Candidate Bulletin: Roadmap to

CPA Success

Request access to professional literature:

www.nasba.org/proflit

CPA EXAM Frequently Asked Questions

general information

What is the structure, length, and content of the exam?

The CPA exam is comprised of four sections, each four hours long. All candidates are required to pass three core exam sections and one

discipline exam section of a candidate’s choosing. The three core exam sections are Auditing and Attestation (AUD), Financial Accounting

and Reporting (FAR), and Taxation and Regulation (REG). The three discipline sections are Business Analysis and Reporting (BAR),

Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP).

The Uniform CPA Examination Blueprints (Blueprints) list the skills tested, content, weighting, and reference sources for each section of the

exam. Access the latest Blueprints at www.aicpa.org/becomeacpa/cpaexam/examinationcontent.

The table below summarizes the information set forth in the Blueprints.

Which discipline should I choose?

Upon licensure, you will be able to practice professionally in any area regardless of which discipline

you choose. No discipline is inherently better than the others, and you are free to pick whichever

discipline interests you the most. Below, each discipline is broken down into specializations within the

accounting profession:

BAR will assess knowledge and skills a newly licensed CPA must demonstrate with respect to

analyzing financial statements and financial information (including the use of data); select technical

accounting and reporting requirements applicable to for-profit business entities (e.g. stock

compensation, business combinations, derivatives) and higher order skills related to revenue recognition

and lease accounting, and state and local government accounting and reporting requirements.

ISC will assess knowledge and skills a newly licensed CPA must demonstrate with respect to IT audit

and advisory services, including SOC engagements, data management, including data collection,

storage, and usage throughout the data life cycle.

TCP will assess knowledge and skills a newly licensed CPA must demonstrate with respect to U.S.

federal tax compliance for individuals and entities with a focus on nonroutine and higher complexity

transactions, U.S. federal tax planning for individuals and entities, and personal financial planning.

Whatever Discipline track you choose to follow, be sure to not only do your own research but consult

instructors and advisors on what they think may be the best route for you. If you select a discipline and

do not pass that section, you are able to select a different discipline section until you pass one discipline

section. Also, after you pass your discipline and core sections along with your other requirements, you

will receive a general CPA license which will not reference the discipline that you selected. If you want to

change the focus of your career, the discipline that you passed will not hold you back.

Section

Section

Time

Multiple-Choice

Question (MCQs)

Task-Based

Simulations (TBSs)

AUD - Core 4 hours 78 7

FAR - Core 4 hours 50 7

REG - Core 4 hours 72 8

BAR - Discipline 4 hours 50 7

ISC - Discipline 4 hours 82 6

TCP - Discipline 4 hours 68 7

CPA EXAM Frequently Asked Questions

eligibility

What are the educational requirements to

sit for the exam as an Illinois candidate?

Fulfilling the following requirements allows you to sit for the CPA Exam:

1. Graduate degree in accounting

Accounting program must be accredited by AACSB or ACBSP

Completion of 120 semester credit hours (SCH) or 180 quarter credit hours (QCH)

2. Graduate degree in business

Business program must be accredited by AACSB or ACBSP

Completion of 120 SCH or 180 QCH

Minimum of 24 SCH in accounting

At least one course each in taxation and auditing

3. A bachelor’s degree in any field or a graduate degree in a discipline other than

accounting or business not accredited by AACSB or ACBSP

Completion of 120 SCH or 180 QCH

Minimum of 24 SCH in accounting

At least one course in taxation and auditing

Minimum of 12 SCH in business other than accounting

* For purposes of meeting the accounting hours requirement, one graduate accounting SCH is

equivalent to 1.6 SCH.

** Candidates may submit internships and life experience for review. These must appear as credit

received on official transcripts from accredited or equivalent institutions (foreign) for consideration

toward required SCH.

More information is available at www.ilboe.org.

What are the educational requirements

to become licensed in Illinois?

Fulfilling the requirements as defined under the options below allows you to obtain certification,

which is required for the CPA license:

1. A graduate degree in accounting as defined under the education requirements and completion of

150 SCH or 225 QCH.

2. A graduate degree as defined under the education requirements and: completion of 150 SCH or

225 QCH; completion of 30 SCH in accounting with at least one course each in taxation, auditing,

financial accounting, and managerial accounting.

3. A bachelor's or higher degree as defined under the education requirements and: completion

of 150 SCH or 225 QCH; completion of 30 SCH in accounting with at least one course each

in taxation, auditing, financial accounting, and managerial accounting; completion of 24 SCH in

business with at least 2 SCH in Business Communication and 3 SCH in Business Ethics

CPA EXAM Frequently Asked Questions

Is a candidate allowed to take one or more exam

sections prior to completing their coursework?

Candidates can apply to take the exam before meeting all the educational requirements. In order to

be approved under provisional status, a candidate must be enrolled in their last academic term

with the courses necessary to complete the educational requirements to sit for the exam as an

Illinois candidate.

Candidates can submit an Initial Examination Application during the term in which they expect to

complete the educational requirements to sit for the exam as an Illinois candidate. They must fill out the

“Courses in Progress” section and can list only the courses being taken in their last academic term.

Courses in progress will be counted in addition to completed courses toward meeting the educational

requirements. Only one Authorization to Test (ATT) will be issued to a candidate. Once approved,

the candidate is referred to as a provisional candidate and becomes eligible to take one or more

exam sections.

Provisional candidates must take the first exam section within a specific timeframe or provisional status

will be revoked. Provisional candidates may view their scores online before all final, official transcripts

have been reviewed. However, the hard copy score notices will not be mailed until the provisional

status has been cleared. Provisional candidates must submit final, official transcripts verifying eligibility

to ILBOE within 150 days of taking the first exam section or scores for all exam sections authorized with

provisional approval will be voided.

More information is available at www.ilboe.org.

apply

Where should candidates apply to take the exam?

CPA exam candidate and CPA licensing requirements differ from state to state, so candidates should

apply to take the exam in the state in which they plan to practice and become licensed. Candidates

who plan to be licensed in Illinois need to apply to ILBOE to take the exam. Candidates must create an

online user ID at www.ilboe.org by clicking on the “Get Approved” dropdown tab in the website’s

navigation menu, then clicking on the “Open an Account & FAQ” link.

States have different educational requirements to take the exam. Generally, if a candidate wishes

to become licensed in another state, the candidate must have fulfilled that state’s educational

requirements by the date they take the first section of the exam. Candidates who took or take the

exam in other states prior to meeting the Illinois educational requirements will not be able to transfer

their exam scores to Illinois. These candidates will be required to retake the exam unless they are able

to transfer a CPA license from another state. Such candidates should contact that state’s board of

accountancy or examiners.

Contact information is available at www.nasba.org/stateboards.

CPA EXAM Frequently Asked Questions

What is the Academic Credentials Evaluation Application

and when should candidates complete this process?

The Academic Credentials Evaluation Application determines a candidate’s academic eligibility and

must be submitted prior to completing the exam application. Candidates will be required to submit their

official transcripts from every institution attended, even if transfer courses appear on the transcripts of

another institution.

Domestic candidates who understand the terms and eligibility requirements may submit their

evaluation application and $200 fee via their ILBOE online account at any time.

Foreign candidates who understand the terms and eligibility requirements may submit their foreign

evaluation application and appropriate fees to NASBA’s International Evaluation Services (NIES), and,

if applicable, their domestic evaluation application and appropriate fees to ILBOE. Foreign candidates

who have passed all four parts of the exam in another jurisdiction and who wish to be licensed in

Illinois must apply for transcript evaluation through NASBA and pay the total transfer credit fee of

$345 online to ILBOE.

Candidates may submit a hard copy pre-evaluation application and $50 fee via mail if they want to

verify which of their completed courses meet Illinois’ requirements for CPA candidates. However, this

fee will not be credited toward the full evaluation application fee.

More information is available at www.ilboe.org.

How do Illinois candidates (domestic or foreign)

apply for the exam?

After you have submitted your Academic Credentials Evaluation Application, candidates can:

1. Submit an Initial Examination Application to identify the section(s) of the exam that you intend to take

within six months of paying NASBA fees. Candidates with mental and/or physical impairments

should indicate so on their application and submit the “Request for Special Accommodations” form.

2. ILBOE will email an approval letter, which includes your unique jurisdiction code or JUR Code (IL)

and jurisdiction ID or JUR ID (six-digit number assigned by ILBOE).

3. NASBA will email instructions on how to create the Gateway account using the JUR Code and JUR

ID. NASBA will email a notification that a payment coupon is ready for payment, and this lists the

testing fees for each exam section that you specified on your application. You will receive one

payment coupon for each test you apply for.

4. Pay the related fees to NASBA within 90 days of issuance of the payment coupon. NASBA will email

you stating that the Notice to Schedule (NTS) is ready. You will receive one NTS for every exam

section that you pay for; if you receive more than one NTS, all will require individual transactions.

5. Upon receiving an NTS, which is valid for six months for Illinois candidates, candidates may

schedule the exam section listed on the NTS. If you fail to pay for your NTS within six months of

receiving it, you will need to reapply for the exam and repay the Initial Examination Application fees.

6. We recommend printing your NTS for your records. It must be presented in hard copy or electronic

form at the Prometric testing location for each exam section.

Is it advisable to apply for all four exam sections

on the initial application?

If a candidate does not intend to take all four sections within six months of paying NASBA fees,

then they should only indicate on the application which exam section(s) they plan to take within

the six-month period.

CPA EXAM Frequently Asked Questions

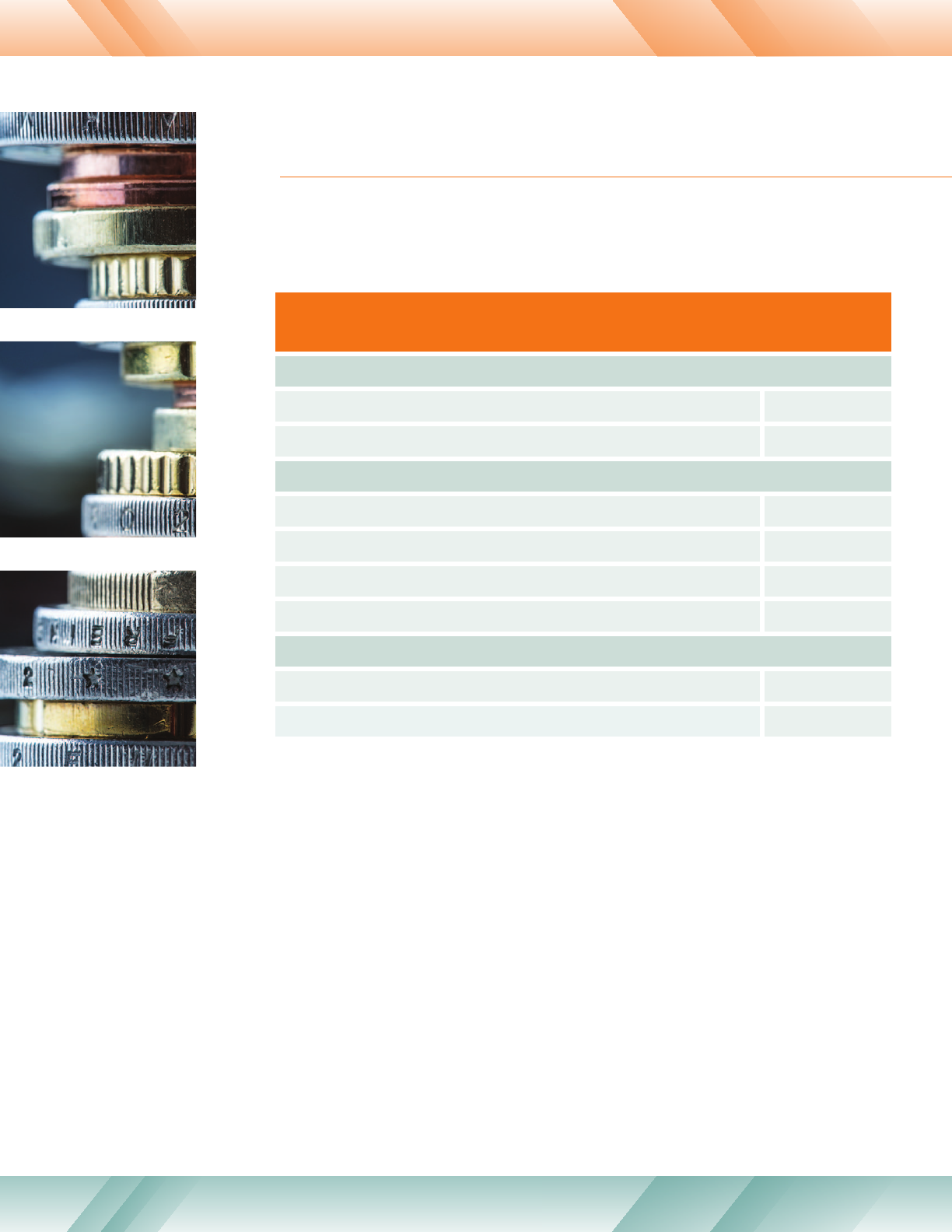

fees

What fees do Illinois candidates pay to take the exam?

The fees paid when applying depend on the number of exam sections indicated on a

candidate’s application.

Is funding available to help with the costs of the

exam for Illinois candidates?

The Illinois CPA Society CPA Exam Award, funded by donations to the CPA Endowment Fund of

Illinois, was created to help bridge the gap between the number of graduating accounting majors

and new CPAs. Selected recipients will be awarded up to $1,000 for expenses related to preparing

for or taking the CPA exam. Application deadlines are January 30 and June 30. More information

is available at www.icpas.org/scholarships.

All fees are subject to change.

Go to www.ilboe.org and www.nasba.org for current fee information.

One-time credential evaluation fee paid to ILBOE:

Domestic credential evaluation $200.00

International credential evaluation fee with domestic credits $225.00

CPA exam application fees paid to ILBOE each time a candidate applies:

One exam section listed on application $40.00

Two exam sections listed on application $76.00

Three exam sections listed on application $108.00

Four exam sections listed on application $120.00

Testing fees paid to NASBA:

Each individual section at a U.S. test center $254.80

Each individual section at an international test center $365.55

CPA EXAM Frequently Asked Questions

prepare

Where can candidates obtain free practice exam

questions and tutorial videos?

Before the beginning of any examination session, candidates must attest to the fact that they have

reviewed the tutorial and sample tests, as well as the Candidate Bulletin.

Thus, candidates are required to practice with a sampling of multiple-choice questions, task-based

simulations, and written communications tasks for each section of the exam, which can be found at

www.aicpa.org/becomeacpa/cpaexam.

Are there review courses available to help candidates

prepare for the exam?

There are many CPA exam review course providers and educational institutions that offer a variety of

review materials and formats. ILBOE provides a list of providers and ICPAS offers member discounts.

More information is available at www.ilboe.org/exam/exam-resources or

www.icpas.org/cpa-exam-resources.

schedule

Where does a candidate go to schedule their exam(s)?

Prometric is the company that delivers the exam. For a list of authorized test centers, information on

test center policies and procedures, or to schedule one or more CPA exam section(s) listed on the

NTS, visit www.prometric.com/cpa. Hours of operation will vary among Prometric test centers.

Typically, Saturdays book early.

When is the CPA exam offered?

AICPA has published the tentative 2024 CPA Exam testing schedule and score release schedule.

Please note that these dates are tentative pending further review by AICPA.

2024 Test Administration Schedule/Score Release Timeline*

Quarter

Core

Test Dates

Core Score

Reports

Discipline

Test Dates

Discipline

Score Reports

Q1 2024 Jan. 10 - Mar. 26 June 4 Jan. 10 - Feb. 6 Apr. 24

Q2 2024 Apr. 1 - June 25 July 31 Apr. 20 - May 19 June 28

Q3 2024 July 1 - Sep. 25 Approx. Nov. 2 July 1 - 31 Sept. 11

Q4 2024 Oct. 1 - Dec. 26 Early Feb. 2025 Oct. 1 - 31 Dec. 11

*All dates are subject to change.

CPA EXAM Frequently Asked Questions

Scores are anticipated to only be released once per test section per quarter due to necessary

standard-setting analyses and activities.

Due to the limited testing schedule and delayed score releases, Illinois candidates with CPA exam

credit(s) on January 1, 2024, will have such credit(s) extended to June 30, 2025.

In which order should I take the exams?

The four exam sections may be taken in any order. A candidate can only schedule the section(s)

approved in each application.

Tip: A candidate’s first exam section taken should be the one that they believe is the most difficult for

them. Then, if the candidate does not pass that section the first time it is taken, their 30-month time

period required for passing all four parts (described below under “exam scores”) will not start.

If a candidate is approved to take, and pays for multiple

exam sections at once, by when must the candidate

take these sections?

Candidates should be aware that each ATT and subsequent payment coupon issued by NASBA is

valid for only 90 days, and the NTS is valid for only six months. Therefore, a candidate who applies for

and pays NASBA for multiple sections at one time should take those sections within six months. If the

candidate does not take any section included in the application within six months, the candidate must

reapply and pay ILBOE and NASBA exam fees again (excluding the credential evaluation fee) for any

exam section not taken.

How many times may a candidate take an exam section?

There is no limit on the number of times you can retake an exam section.

scores

Will Illinois candidates receive a numeric score for

each CPA exam section?

Candidates will receive a numeric score for each exam section ranging from zero to 99. A score of 75

or higher indicates successful completion of an exam section. Candidates who do not pass a section

will also receive a candidate performance report (CPR), which is included on the backside of the

mailed hard copy score reports. The report provides candidates with information about the strengths

and weaknesses of their exam performance. To reapply, a candidate must complete a re-examination

form and pay the related ILBOE and NASBA fees.

How do candidates receive their scores?

ILBOE will announce when scores are available. Candidates may access their scores using ILBOE’s

online system at www.ilboe.org. Candidates will receive a hard copy report typically a few weeks later.

For a score release timeline, visit https://www.aicpa-cima.com/resources/article/find-out-when-

youll-get-your-cpa-exam-score.

CPA EXAM Frequently Asked Questions

Is there a time limit for passing all four sections

of the exam?

All exam sections must be passed within 30 months from the date the Illinois candidate sat for the first

passed section. An Illinois candidate who does not pass all four exam sections within the 30-month

time period will be required to retake the earliest section(s) passed until all four sections are passed

within a single 30-month time period.

In response to significant health, economic, education, and travel disruptions resulting in CPA

Examination candidate hardships, ILBOE will consider individual candidate requests on a case-by-case

basis to extend credit periods through June 30, 2025, for CPA Examination credits that expired from

January 30, 2020 through May 11, 2023, which have not been subsequently replaced by new credits

for the same sections.

get licensed

How does a candidate meet the

ethics exam requirement?

Candidates will not be eligible for licensing until they pass a separate ethics exam on the rules of

professional conduct. The requirements are fulfilled by completing Professional Ethics: The AICPA’s

Comprehensive Course, which includes an open-book exam.

Candidates may complete the ethics exam at any point while pursuing CPA licensure (before/after

taking the CPA exam, or during). Tip: Many exam takers prefer to take the ethics exam before they take

the AUD part of the CPA exam since it also covers ethics. A score of at least 90 percent is required

to pass, and the score does not expire.

ICPAS offers a member discount. More information is available at www.icpas.org/ethicsexam.

The ethics course and exam may also be purchased directly from AICPA.

Illinois candidates should request that their scores be forwarded to ILBOE when they register online to

complete the exam or submit the certificate directly to ILBOE for faster processing.

How does a candidate become licensed in Illinois?

The Illinois Department of Financial and Professional Regulation (IDFPR) is the sole authority for CPA

licensing in Illinois. Candidates are required to be licensed before they can practice and hold

themselves out as CPAs (i.e., on resumes, job applications, business cards, letterhead, websites, etc.).

Once a candidate has passed all four sections of the exam within an 30-month period, completed the

ethics exam, and met the one-year experience requirement for “accountancy activities” as defined by

the IDFPR, the candidate may then apply for a CPA license at www.idfpr.com.

If I receive my CPA certification in Illinois,

am I allowed to practice in other states?

Each state has different requirements for CPAs practicing outside of where they were licensed. We

encourage you to contact the individual state board or association for the most accurate information.

You can also visit www.CPAmobility.org, a resource from NASBA and AICPA, for additional background.

The Illinois CPA Society…

Helping you prepare for the

CPA exam and

so much more!

Whether you are working to pass the exam, climb the career

ladder, or expand your professional network, the Illinois CPA

Society is with you every step of the way.

Benefits for future CPAs:

Earn a CPA exam fees

reimbursement award for up to $1,000.

Save $300-$500

on CPA exam review courses.

Pay 40% less for the required ethics exam.

Access to

timely information and frequently asked questions

about the CPA exam and licensing.

Network with accounting and finance young professionals.

Find accounting internships or jobs with our Virtual Fair.

Join today!

www.icpas.org/membership/join