Financial Accounting &

Reporting (FAR)

AICPA

Released Questions -

2022

Material from Uniform CPA Examination Selected Questions

and Unofficial Answers, 2022, copyright by American Institute

of Certified Public Accountants, Inc., is reprinted and/or

adapted with permission

Note: Any knowing solicitation or disclosure of any questions or

answers included on any CPA examination is prohibited

Multiple Choice Question #1:

It can be reasonably assumed that the FASB has made an amendment to generally accepted

accounting principles when the FASB issues

A. An exposure draft.

B. A staff accounting bulletin.

C. An accounting standards update.

D. A statement on standards for attestation engagements.

Correct Answer: C

1

Multiple Choice Question #2:

In a company's notes to its financial statements, the first note described significant changes in

accounting policies related to valuations of inventory and plant assets. Subsequent notes

included a separate note detailing inventories and a separate note detailing plant assets. For

which of these subsequent notes, if any, should the company duplicate a description of its

changes to significant accounting policies?

A. The plant assets note, but not the inventory note.

B. The inventory note, but not the plant assets note.

C. Both the plant assets note and the inventory note.

D. Neither the inventory note nor the plant assets note.

Correct Answer: D

2

Multiple Choice Question #3:

Pardelle, Inc. acquired 80% of Soran Co.'s outstanding common stock on December 31, year 1.

Pardelle's retained earnings total $600,000 and Soran's retained earnings total $400,000 on the

acquisition date. What amount should be reported for consolidated retained earnings in the

consolidated statement of financial position on the acquisition date?

A. $600,000

B. $680,000

C. $920,000

D. $1,000,000

Correct Answer: A

3

Multiple Choice Question #4:

In year 1, a donor promised to give $100,000 to a nongovernmental, not-for-profit kitchen if it

provides 20,000 meals by March 31, year 2. At the end of year 1, the kitchen had provided

20,000 meals. In which line item, if any, should the contribution be reported in the kitchen's

statement of financial position at the end of year 1?

A. Cash.

B. Deferred revenue.

C. Contributions receivable.

D. The contribution should not be reported in the statement of financial position.

Correct Answer: C

4

Multiple Choice Question #5:

Bramble, Inc. reported the following at the end of year 1: revenue, $100,000; assets, $300,000;

and operating profit, $50,000. One of Bramble's product lines reported the following at the end

of year 1: revenue, $10,000; assets, $35,000; and operating profit, $3,000. Which of the

following classifications should Bramble use to describe this product line for financial statement

presentation purposes?

A. Operating segment.

B. Reportable segment.

C. Subsidiary.

D. Asset group.

Correct Answer: B

5

Multiple Choice Question #6:

A company entered into a loan with a lender for $100,000 and pledged $120,000 of the

company's accounts receivable as collateral. The lender does not have the right to sell or

repledge the accounts receivable. When the company receives the cash for the loan proceeds,

what entry, if any, should be made to accounts receivable?

A. Credit accounts receivable $20,000.

B. Credit accounts receivable $100,000.

C. Credit accounts receivable $120,000.

D. No entry is made to accounts receivable.

Correct Answer: D

6

Multiple Choice Question #7:

On December 31 of the current year, Letterman Co.‘s cost of goods sold amounted to

$1,050,000. However, Letterman's auditors determined the beginning merchandise inventory

was understated by $20,000 and the ending merchandise inventory was overstated by $12,000.

What is the correct cost of goods sold for the current year?

A. $1,018,000

B. $1,042,000

C. $1,058,000

D. $1,082,000

Correct Answer: D

7

Multiple Choice Question #8:

At the beginning of the current year, a company held trading debt securities with a fair value of

$250,000. During the year, the company received interest income of $25,000 from the

securities and purchased an additional $50,000 of trading debt securities. At the end of the

current year, the company recognized an unrealized loss of $20,000 on the trading debt

securities held as of the end of the year. What amount should the company report for the

trading debt securities in its statement of financial position at the end of the current year?

A. $280,000

B. $300,000

C. $305,000

D. $325,000

Correct Answer: A

8

Multiple Choice Question #9:

A public business entity has a December 31 year-end reporting period and is aware that a

goodwill impairment test must be performed at least once during each reporting period. The

entity's controller has compiled a list of four potential dates in year 1 and year 2 to test for

goodwill impairment. Assuming that there are no events or circumstances requiring impairment

testing between the two scheduled dates, which of the following dates in year 1 and year 2,

when viewed together, would comply with appropriate guidance?

A. Year 1, June 20; year 2, December 20.

B. Year 1, December 31; year 2, June 30.

C. Year 1, December 31; year 2, March 31.

D. Year 1, April 15; year 2, April 15.

Correct Answer: D

9

Multiple Choice Question #10:

A company issued a financial instrument that unconditionally requires the company to settle

the obligation by issuing common stock with a value of $500,000 on the settlement date. How

should the company report this instrument in its financial statements?

A. As a liability in the balance sheet.

B. As an equity instrument in the balance sheet.

C. By only disclosing a liability in the notes.

D. By only disclosing an equity instrument in the notes.

Correct Answer: A

10

Multiple Choice Question #11:

Which of the following items is considered a permanent book to tax difference?

A. Warranty payable.

B. Prepaid insurance.

C. Tax penalties paid to tax authorities.

D. Accounting for sales of property under the installment method.

Correct Answer: C

11

Multiple Choice Question #12:

A defendant has three outstanding lawsuits at the end of year 1. The estimated loss for the

first, second, and third cases are $5,000,000, $2,000,000, and $1,000,000, respectively. The

likelihood that the plaintiff will lose the first case is highly probable. The chance of losing the

second case is reasonably possible, but not probable. The chance of losing the third case is

remote. What amount should the defendant accrue as a contingent liability at the end of year

1?

A. $8,000,000

B. $7,000,000

C. $5,000,000

D. $2,000,000

Correct Answer: C

12

Multiple Choice Question #13:

A company that is translating account balances from another currency into U.S. dollars for year-

end financial statements should use the current exchange rate as of the date of the balance

sheet for which of the following accounts?

A. Revenue.

B. Accounts receivable.

C. Capital stock.

D. Retained earnings.

Correct Answer: B

13

Multiple Choice Question #14:

Which of the following types of agreement represents a split-interest arrangement?

A. A perpetual trust naming ABC as sole beneficiary.

B. A charitable remainder trust.

C. A direct bequest to ABC in the donor's will.

D. A direct gift to ABC to be made by the donor next year.

Correct Answer: B

14

Multiple Choice Question #15:

In year 1, a corporation incurred $3,500,000 of costs related to the development of a new

software product. Of these costs, $1,000,000 was incurred after technological feasibility was

established. The product development was completed and the product was available for sale to

customers early in year 2. The corporation estimated that revenues from the sale of the new

product would be $1,200,000 over five years. What amount of expense should the company

report for year 1?

A. $500,000

B. $700,000

C. $2,500,000

D. $3,500,000

Correct Answer: C

15

Multiple Choice Question #16:

Old Town added a water and sewer department to its municipal services. The department

provided the services to the residents of Old Town and issued quarterly billings to customers. In

which of the following types of funds would this activity be recorded?

A. Special revenue.

B. Capital projects.

C. Permanent.

D. Enterprise.

Correct Answer: D

16

Multiple Choice Question #17:

A local government should report expenses, excluding special or extraordinary items, by which

of the following in its government-wide statement of activities?

A. Function.

B. Major source.

C. Major then minor funds.

D. Descending order by amount.

Correct Answer: A

17

Multiple Choice Question #18:

Which of the following is a qualitative characteristic that enhances the usefulness of financial

information?

A. Neutrality.

B. Materiality.

C. Verifiability.

D. Confirmatory value.

Correct Answer: C

18

Multiple Choice Question #19:

A company reported the following for the current year:

Retained earnings appropriated for plant expansion $32,500

Correction of understated depreciation expense from prior periods 9,300

Unrealized loss on available-for-sale debt securities 8,100

Unrealized gain on foreign currency translation 3,400

The company's current-year net income was $86,500, and the company has a 30% effective

income tax rate. What amount of comprehensive income should be reported for the current

year?

A. $40,000

B. $76,700

C. $81,800

D. $83,210

Correct Answer: D

19

Multiple Choice Question #20:

A U.S. company owns 80% of a non-U.S. company located in a foreign country with a very

unstable political and economic climate. In which of the following situations should the U.S.

company not consolidate its financial statements with the non-U.S. company?

A. The foreign country has currency exchange rate fluctuations on a daily basis.

B. The government of the foreign country has increased the tax rate for all companies that

are majority-owned by U.S. companies.

C. The government of the foreign country has required all companies operating within its

borders to implement International Financial Reporting Standards.

D. The government of the foreign country has recently imposed a number of severe

sanctions and controls on all companies that are majority-owned by U.S. companies.

Correct Answer: D

20

Multiple Choice Question #21:

In the current year a nongovernmental, not-for-profit entity incurred $630,000 in expenditures

during the year. It also received donated legal services, which otherwise would have cost

$40,000, and consumed donated supplies with a value of $15,000. What should the entity

report as total expenses in its statement of activities for the current year?

A. $630,000

B. $645,000

C. $685,000

D. $670,000

Correct Answer: C

21

Multiple Choice Question #22:

A company provides a defined-contribution pension plan for its employees. For the plan

administrator to report contributions from the company, contributions from participants,

benefits paid to participants, and changes in fair value of investments, which of the following

financial statements is required?

A. Statement of net assets available for benefits.

B. Statement of cash flows.

C. Statement of changes in net assets available for benefits.

D. Statement of changes in financial position.

Correct Answer: C

22

Multiple Choice Question #23:

On the first day of the year, a donor established a $100,000 irrevocable perpetual trust with a

third-party trustee naming a not-for-profit entity as the sole income beneficiary in perpetuity.

During the year, the trust earned and distributed $4,000 in income to the entity for unrestricted

use. On the last day of the year, the fair value of the trust had increased by $5,000. What

amount should the entity report in its year-end statement of financial position as beneficial

interest in perpetual trust?

A. $96,000

B. $100,000

C. $101,000

D. $105,000

Correct Answer: D

23

Multiple Choice Question #24:

In which of the following circumstances would trademarks acquired by an entity most likely be

deemed to have an indefinite useful life?

A. The entity pays substantial amounts of money to renew the trademarks.

B. The entity operates in an industry with a rapidly changing regulatory environment

governing trademarks.

C. The entity plans to use the trademark until the planned phase-out date of the

underlying asset.

D. The entity's trademark has a remaining legal life of five years but is renewable at very

little cost.

Correct Answer: D

24

Multiple Choice Question #25:

A nongovernmental, not-for-profit entity calculated a $4,000 increase in net assets with donor

restrictions for the current fiscal year before consideration of the following:

A cash donation designated by the donor as an endowment in perpetuity $28,000

Net assets released from restrictions 12,000

A donation received that was designated as a quasi-endowment 21,000

Which of the following should be reported as the increase in net assets with donor restrictions

in the current-year statement of activities?

A. $16,000

B. $20,000

C. $37,000

D. $41,000

Correct Answer: B

25

Multiple Choice Question #26:

A company signed a five-year contract with a customer in year 1 and agreed to modify the

contract at the beginning of year 2. Which of the following is a condition that must be present

in order for the contract modification to be accounted for as a separate contract?

A. The original contract is terminated.

B. The price of the original contract remains the same.

C. The performance obligations of the original contract are partially satisfied.

D. The scope of the original contract increases through the addition of distinct goods or

services.

Correct Answer: D

26

Multiple Choice Question #27:

Which of the following statements is correct regarding the Black-Scholes-Merton option-pricing

model used to estimate the fair value of stock options granted to employees as part of a

company's compensatory stock option plan?

A. The model's formula assumes that option exercises occur at the beginning of an option's

contractual term.

B. The model's formula assumes that expected dividends vary over the option's term.

C. The model's formula assumes that risk-free interest rates are constant over the option's

term.

D. The model is referred to as a lattice model.

Correct Answer: C

27

Multiple Choice Question #28:

A company reported $130,000 in income from continuing operations for its first year of

operations. The tax-basis depreciation deduction for the year exceeded GAAP depreciation

expense by $12,500, and the warranty accrual exceeded the amount spent for warranty repairs

by $8,300. The company properly calculated a $840 increase in its deferred tax liability for the

year. If the enacted tax rate for the current year is 20%, what amount of income taxes payable

should be reported in the year-end balance sheet?

A. $24,340

B. $25,160

C. $26,000

D. $26,840

Correct Answer: B

28

Multiple Choice Question #29:

With regard to a fair value hedge, hedge effectiveness is a measure of the extent to which the

A. Cash flows from the hedge transaction offset cash flows from the hedged risk.

B. Hedge transaction results in eliminating changes in fair value of the hedged item.

C. Hedge transaction offsets the exposure to changes in the hedged item's fair value.

D. Actual change in the hedge's fair value corresponds to the expected change in the

hedge's fair value.

Correct Answer: C

29

Multiple Choice Question #30:

The lessee should recognize amounts probable of being owed under a residual value guarantee

as a component of lease payments

A. At the conclusion of the lease.

B. At no time during the lease term.

C. On a straight-line basis during the lease.

D. On the commencement date of the lease.

Correct Answer: D

30

Multiple Choice Question #31:

In year 4, a nongovernmental, not-for-profit school began a campaign to raise funds for a

proposed capital addition. The following information is available as of June 30, year 4:

Information Amount

Received on February 1, year 4: cash contributions from parents

and alumni $450,000

Received on February 1, year 4: unconditional promises to

give, of which $300,000 was received as of June 30, year 4 600,000

Received on March 1, year 4: a promise from a year 1 alumnus

to give $50,000 if other year 1 alumni give a total of $50,000

before September 30, year 5 50,000

Received on June 30, year 4: cash contributions from year 1 alumni

in response to March 1, year 4, alumni challenge 20,000

What amount of cash contributions for this campaign should the school report in its June 30,

year 4, statement of activities?

A. $770,000

B. $1,050,000

C. $1,070,000

D. $1,090,000

Correct Answer: C

31

Multiple Choice Question #32:

When the recoverability of a building's carrying amount is determined to be impaired, the

building's fair value is best measured as the

A. Price the building can be sold for in an advantageous market.

B. The selling price less transaction costs to complete the sale for this type of building in its

principal market.

C. Price that would be received for this type of building based on observable inputs in its

principal market.

D. Price determined using internal cost estimates to construct a similar building.

Correct Answer: C

32

Multiple Choice Question #33:

A local government recorded revenues as follows: personal income tax, $200,000; sales taxes,

$100,000; and property taxes, $150,000. What should the local government report as total

derived tax revenue?

A. $100,000

B. $150,000

C. $300,000

D. $450,000

Correct Answer: C

33

Multiple Choice Question #34:

Which of the following is not required in the budgetary comparison schedule presented by a

state or local government as part of required supplementary information?

A. The original budget.

B. The final appropriated budget.

C. Variances between the final budget and actual amounts.

D. Actual inflows, outflows, and balances stated on a budgetary basis.

Correct Answer: C

34

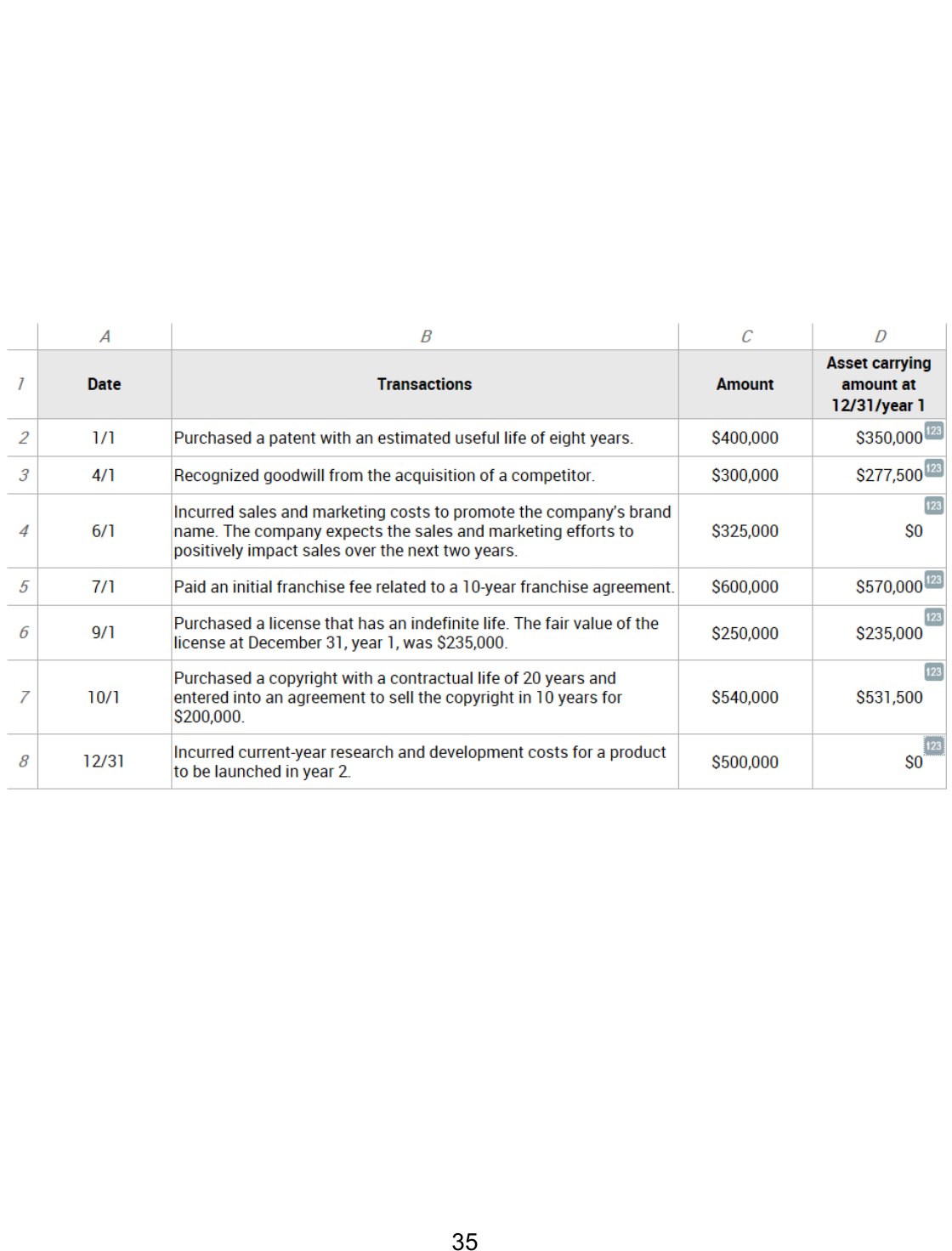

Item: 500178

Scroll down to complete all parts of this task.

A company has the following information relating to transactions in year 1, its first year of

operations. The company applies the straight-line method to amortize its intangible assets. The

company elected the private company alternative for the subsequent measurement of goodwill and

concluded that the maximum amortization period permitted under the alternative was appropriate.

For each transaction, enter the asset carrying amount at December 31, year 1. If an amount is zero,

enter a zero (0). Round all amounts to the nearest dollar.

END OF CONTENT - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Simulation #1:

35

Exhibits Information

There are no exhibits for this item.

36

Blueprint Information

CSO: 002.006.000

Skill: Application

Representative task: Calculate the carrying amount of finite-lived intangible assets reported in the

financial statements (initial measurement, amortization and impairment) and prepare journal entries.

37

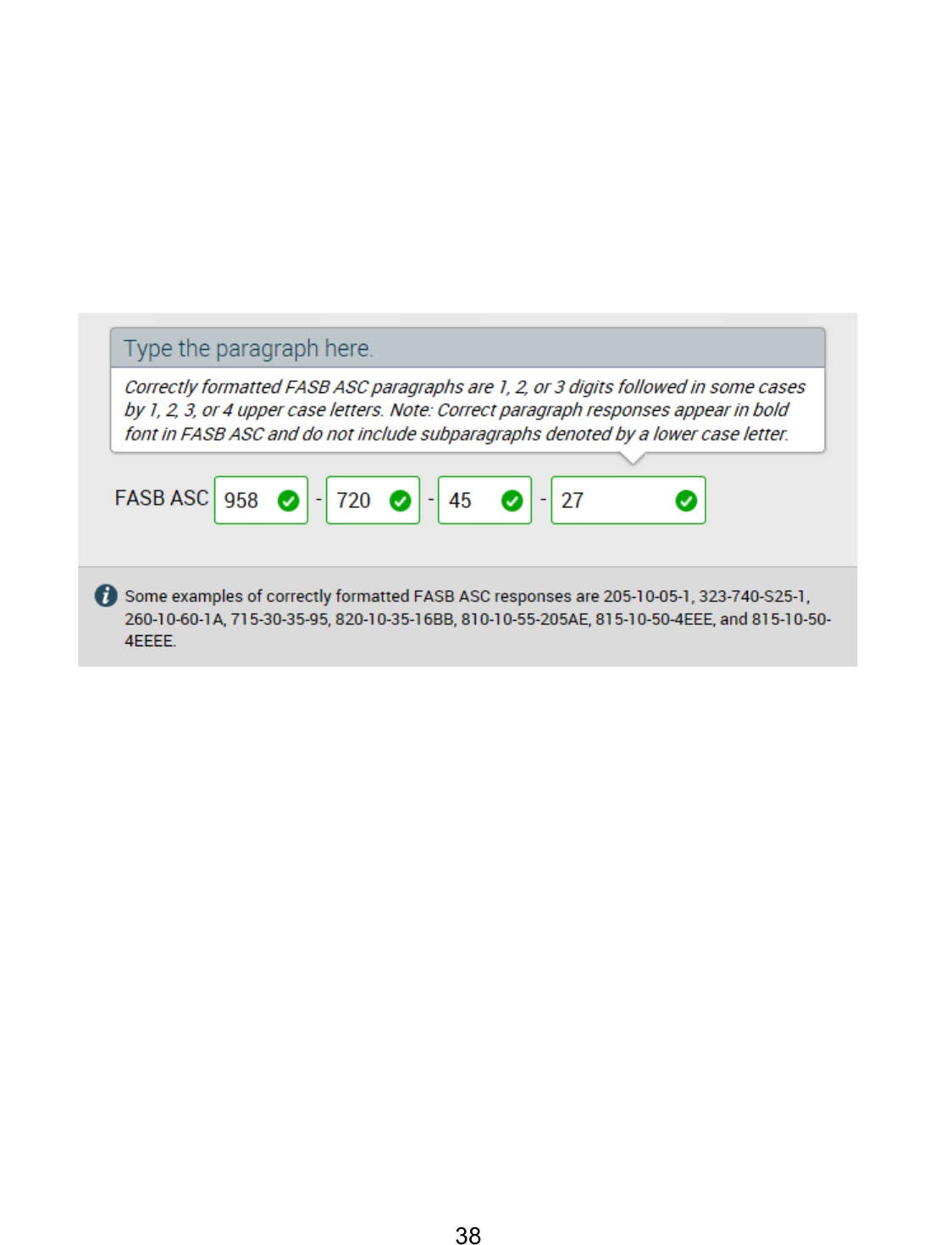

Item: 500713

A nongovernmental, not-for-profit federated fundraising entity spent $50,000 on an annual

fundraising campaign for the benefit of a local charity. Which section of the authoritative literature

best supports the entity's decision to report the $50,000 as fundraising expenses?

Enter your response in the answer fields below. Unless specifically requested, your response should

not cite implementation guidance. Guidance on correctly structuring your response appears above

and below the answer fields.

END OF CONTENT - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Simulation #2:

38

Exhibits Information

There are no exhibits for this item.

39

Blueprint Information

CSO: 001.003.002

Skill: Application

Representative task: ASC 958-720-45

40

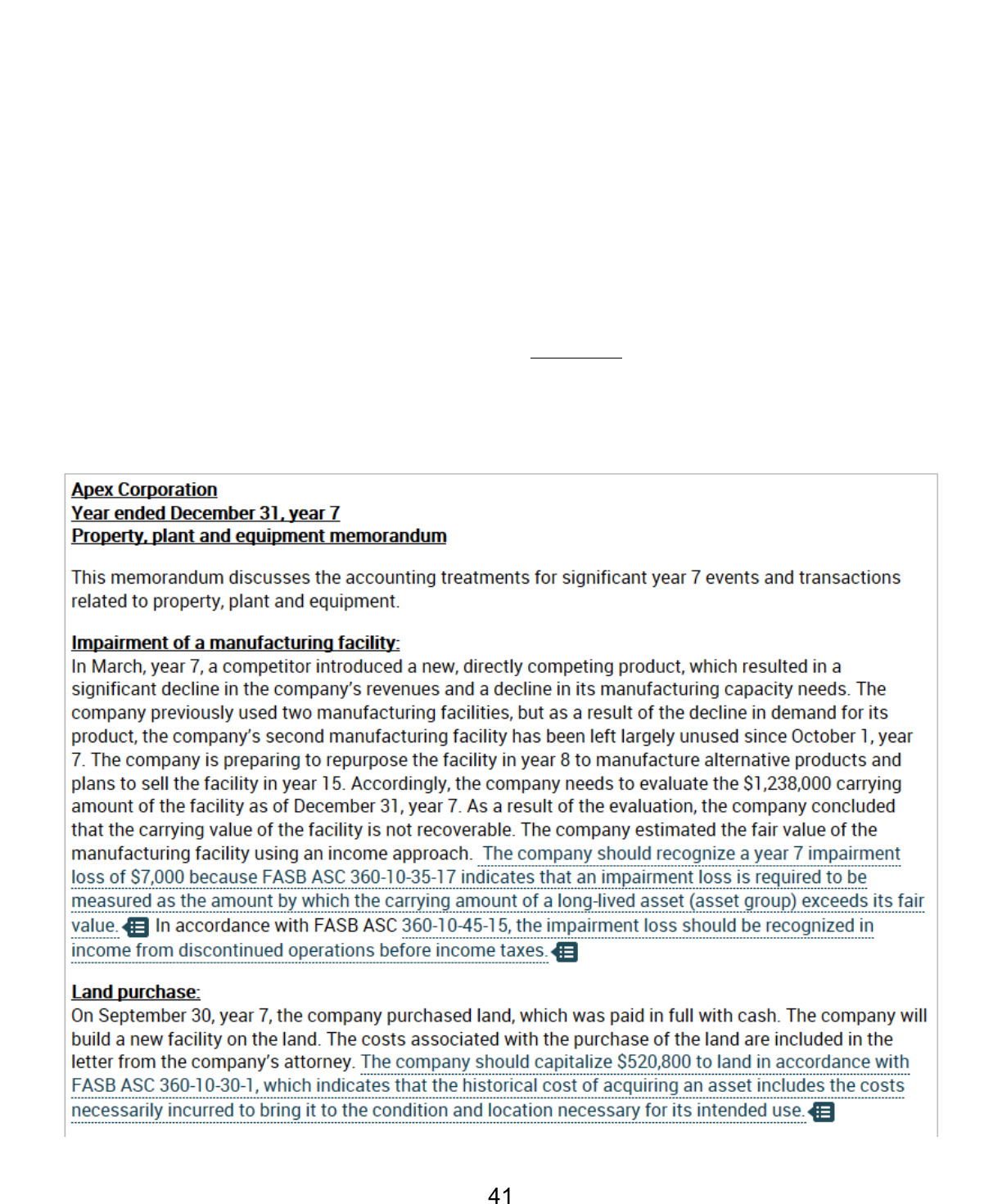

Item: 508395

Scroll down to complete all parts of this task.

Apex Corp. is in the process of determining the appropriate accounting treatment for a number of

year 7 transactions and events related to property, plant and equipment.

Review the draft memorandum below, along with the exhibits above, and make the necessary

corrections, if any, to the proposed accounting treatments and to the supporting authoritative

references in the FASB Accounting Standards Codification (ASC).

To revise the memorandum, click on each segment of underlined text below and select the needed

correction, if any, from the list provided. If the underlined text is already correct in the context of the

memorandum, select [Original text] from the list. Paragraphs may contain more than one segment of

underlined text to be considered for correction.

Simulation #3:

41

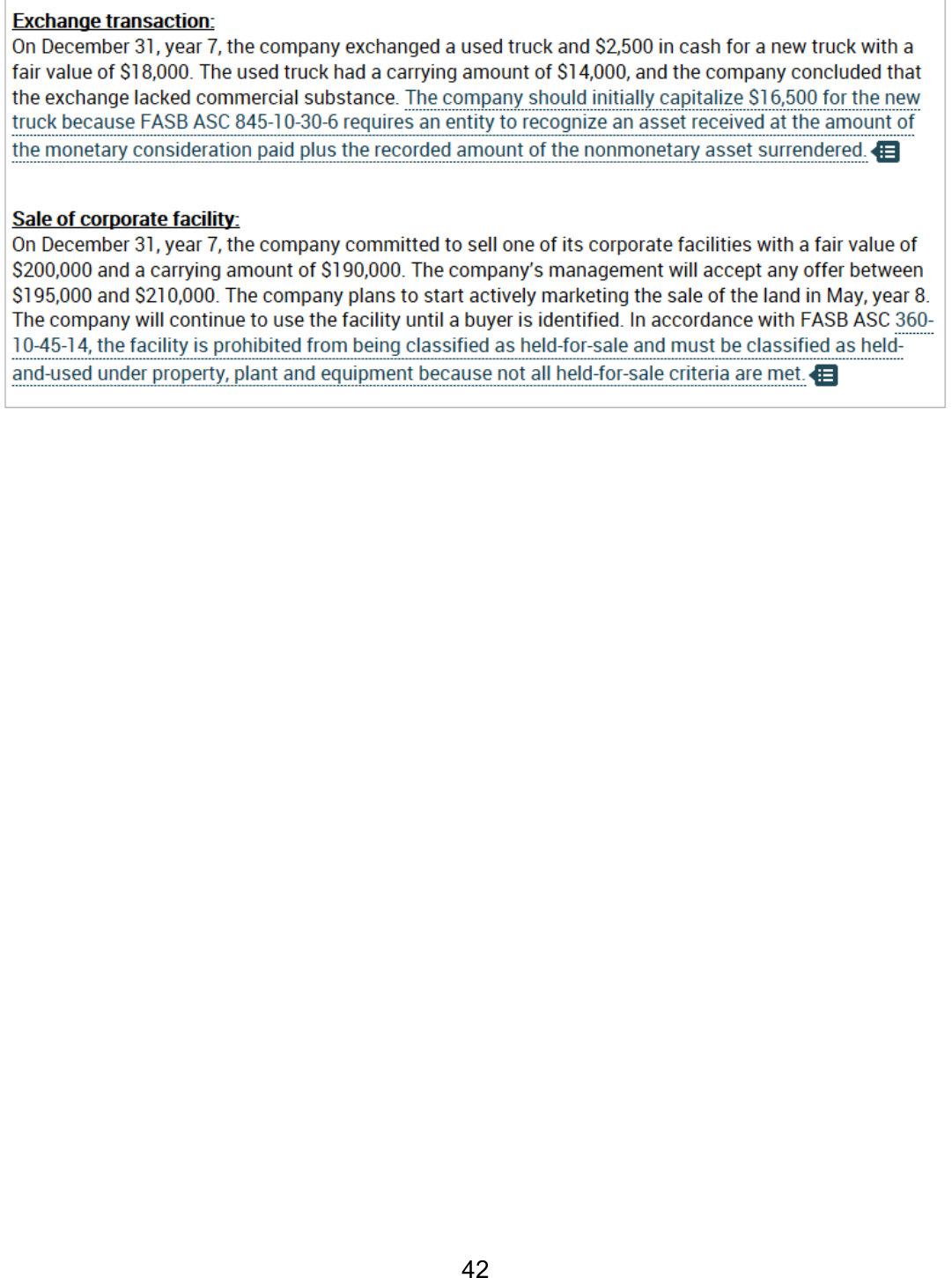

END OF CONTENT - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

42

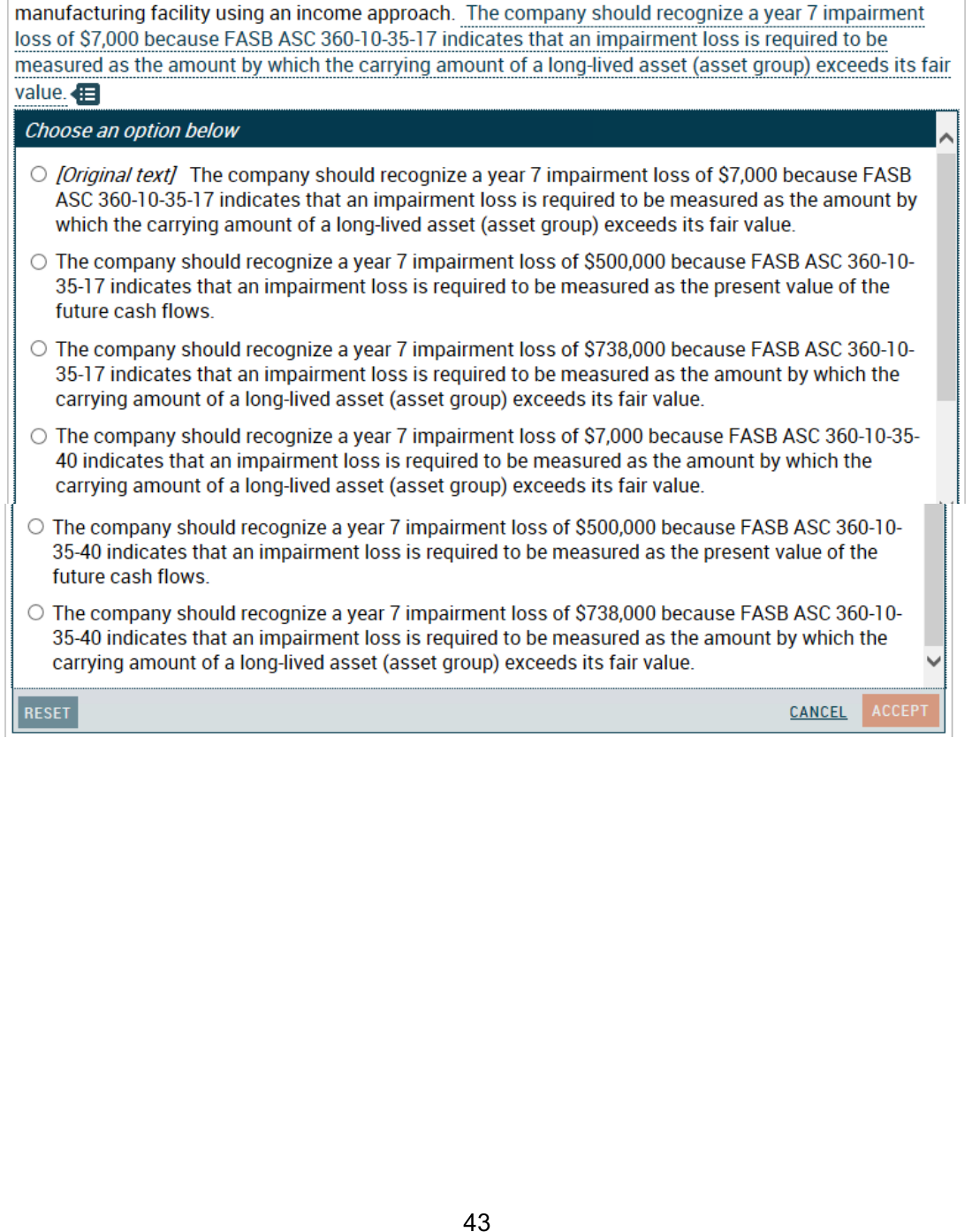

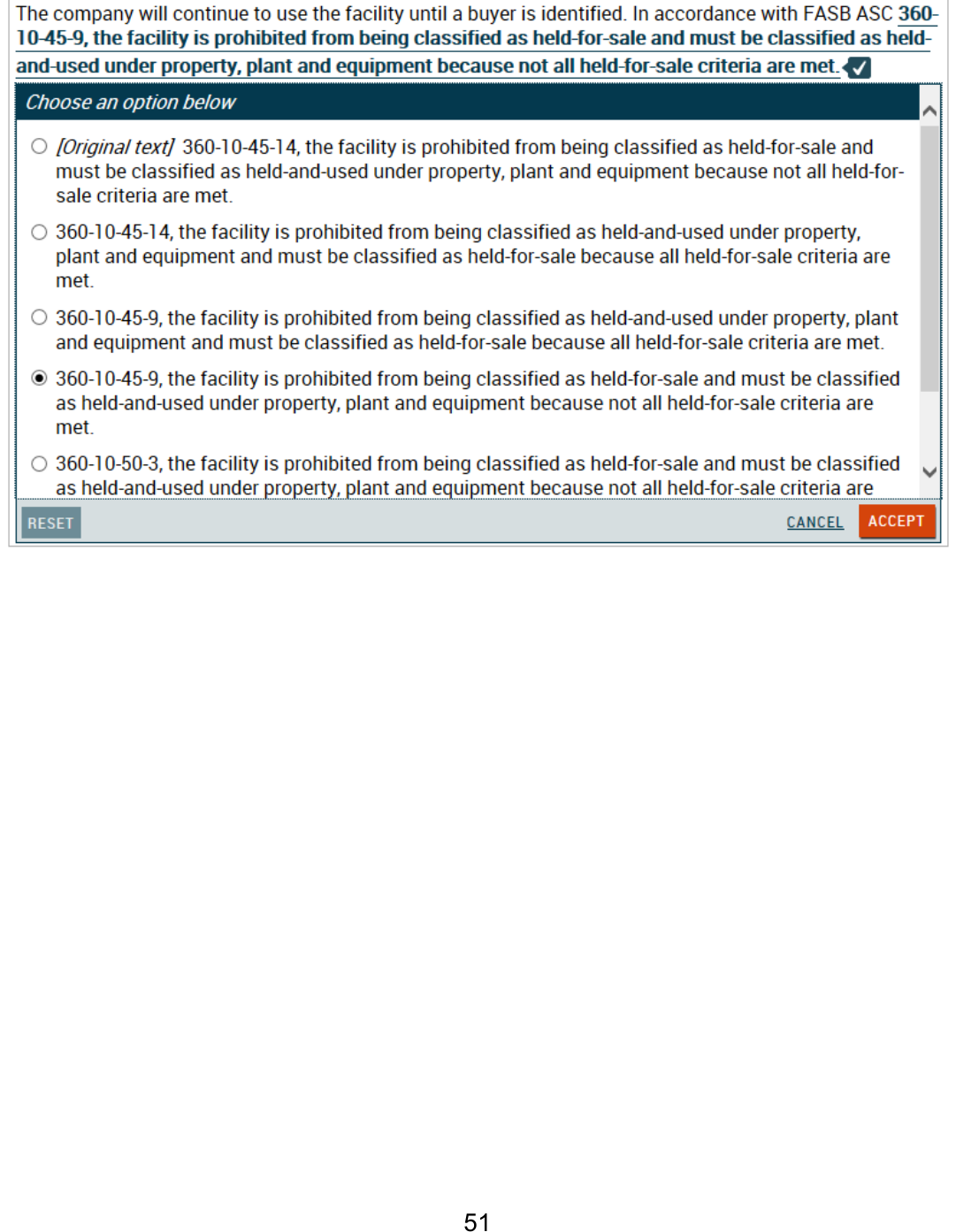

Response 1

43

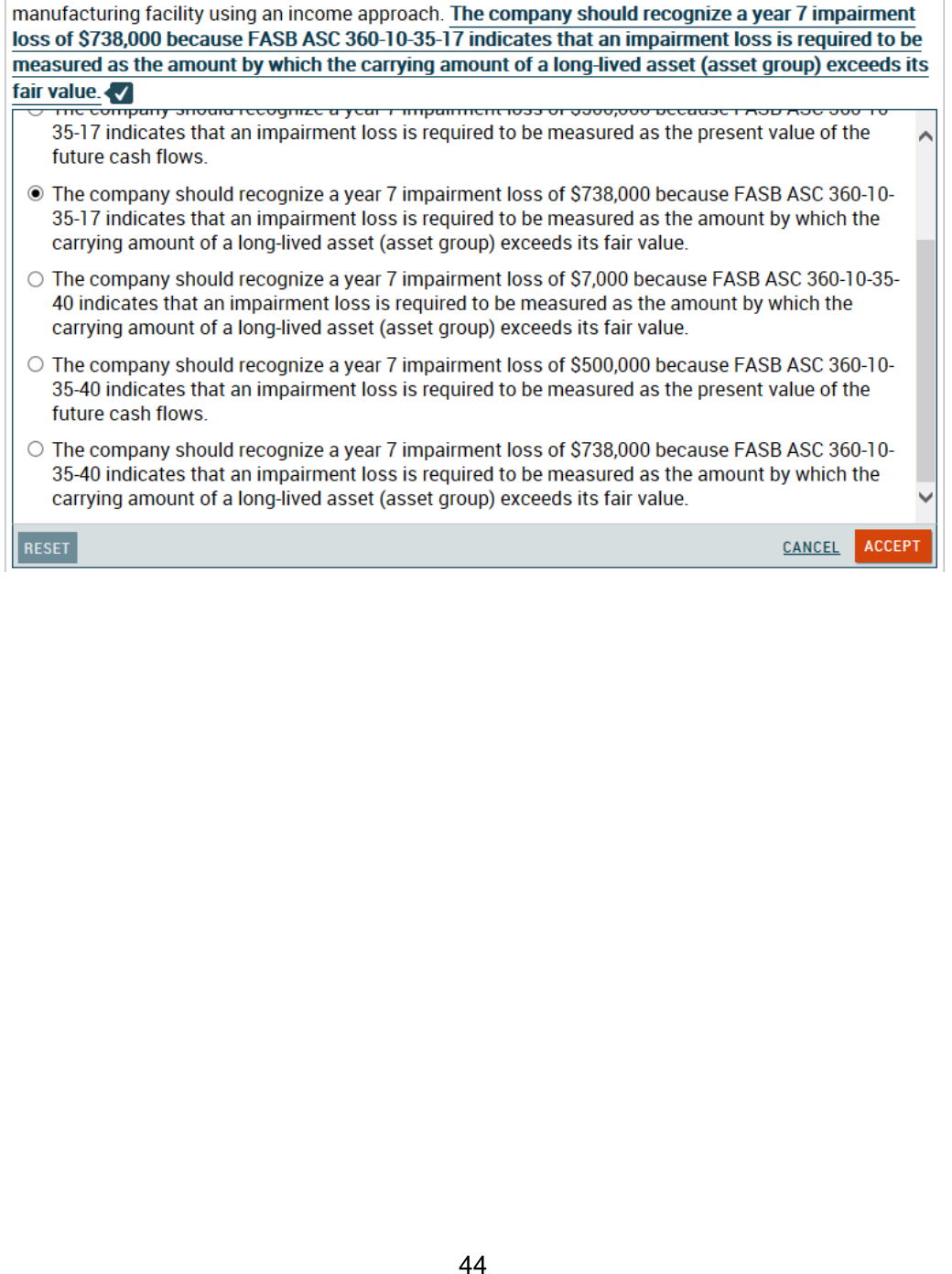

Key

44

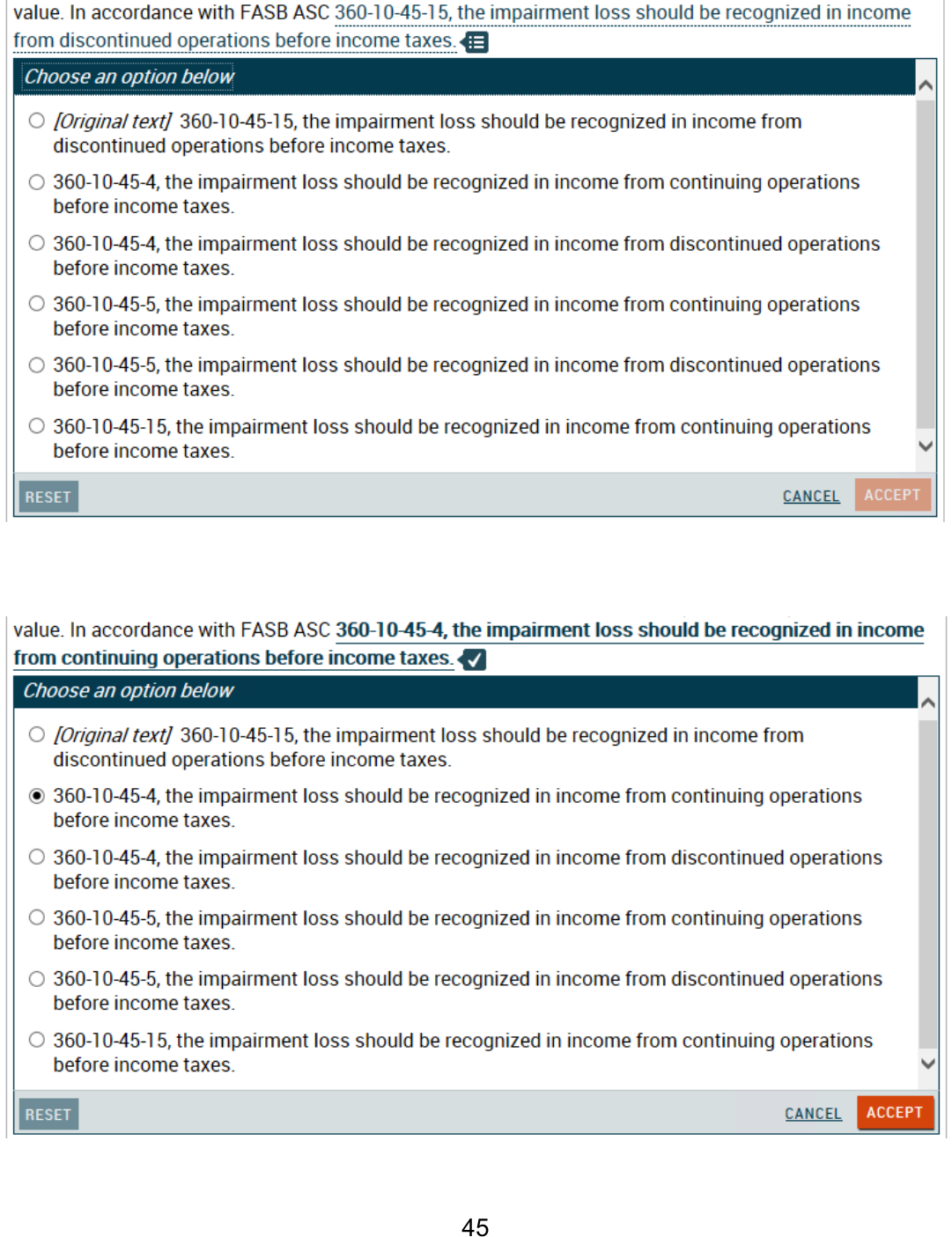

Response 2

Key

45

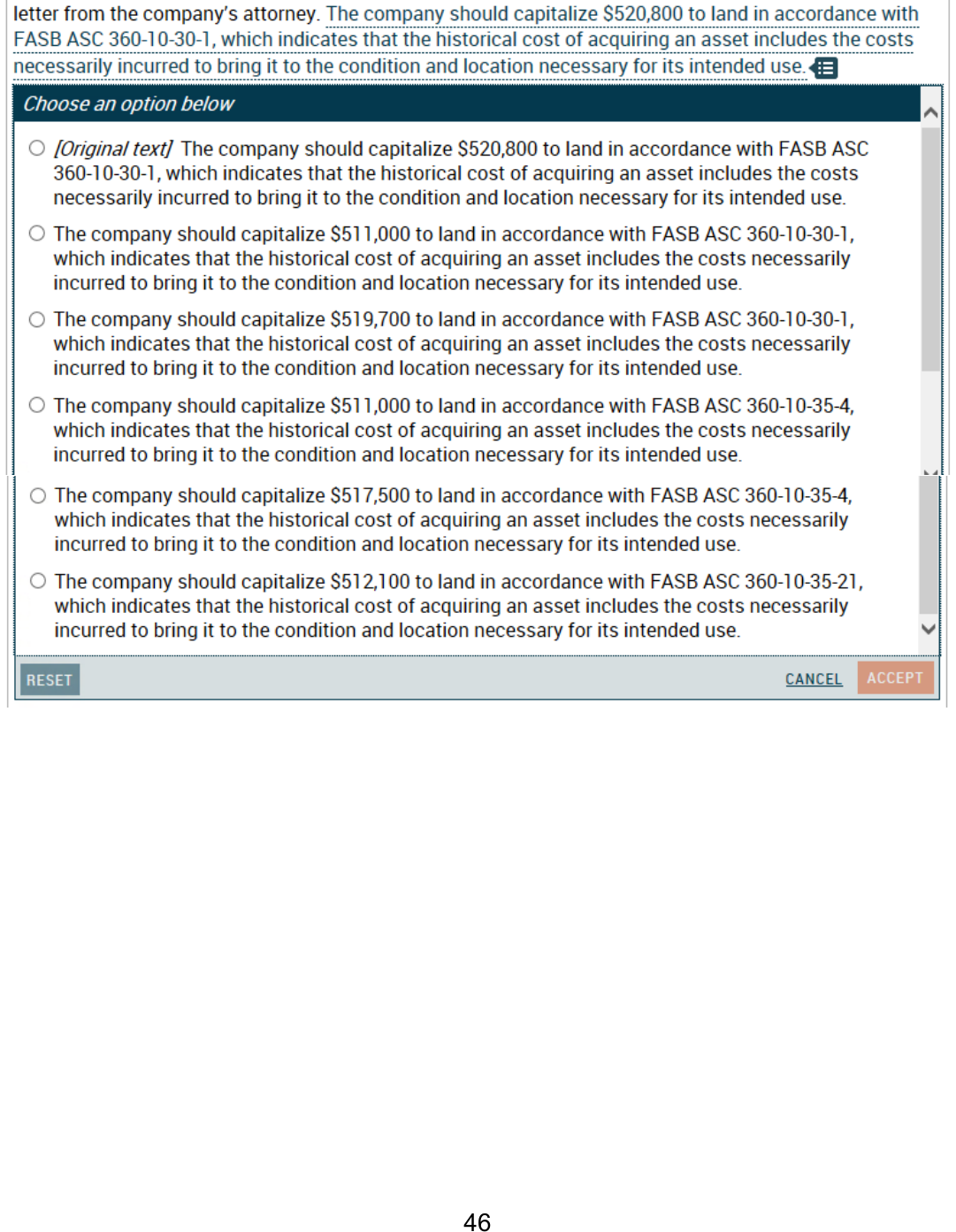

Response 3

46

Key

47

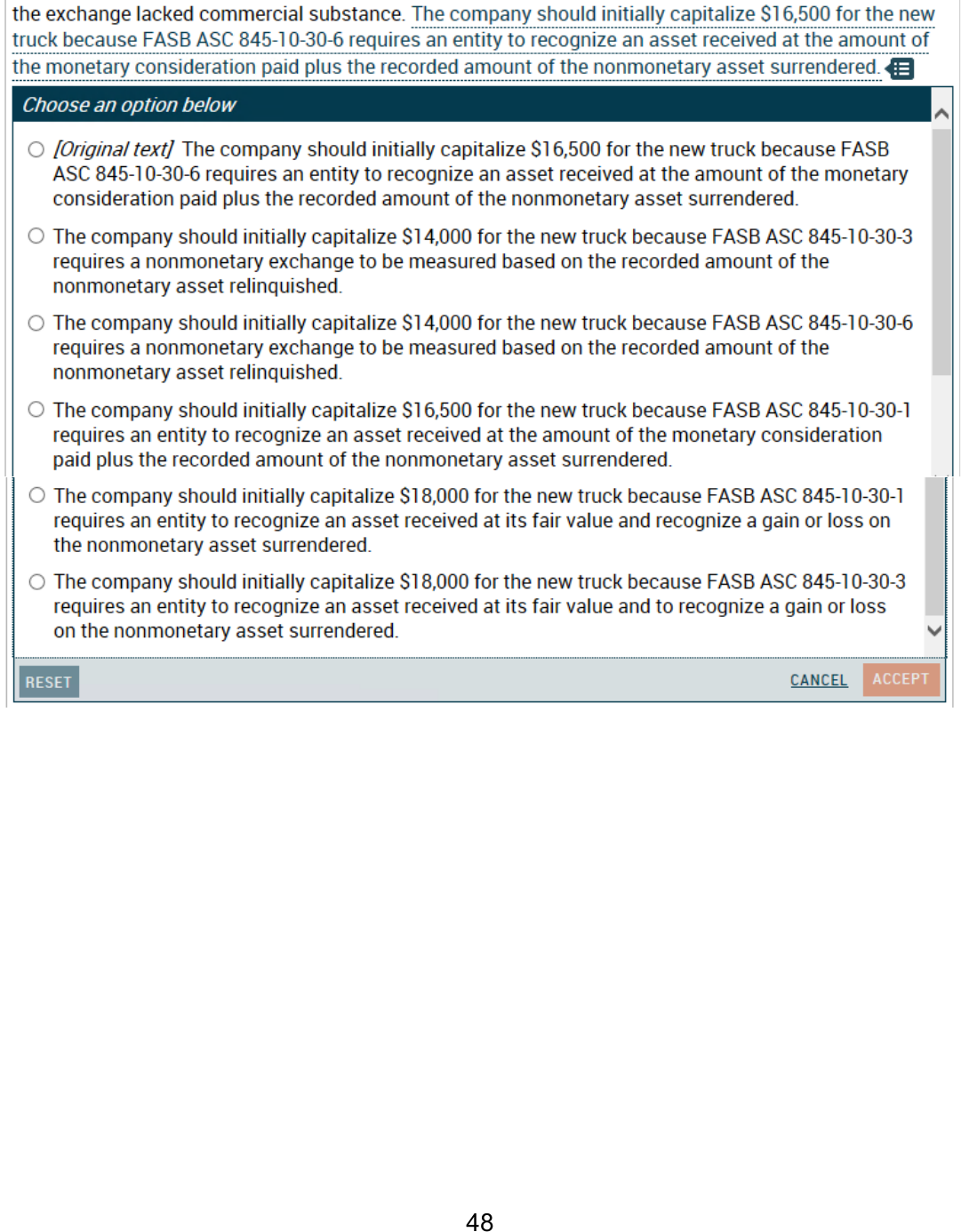

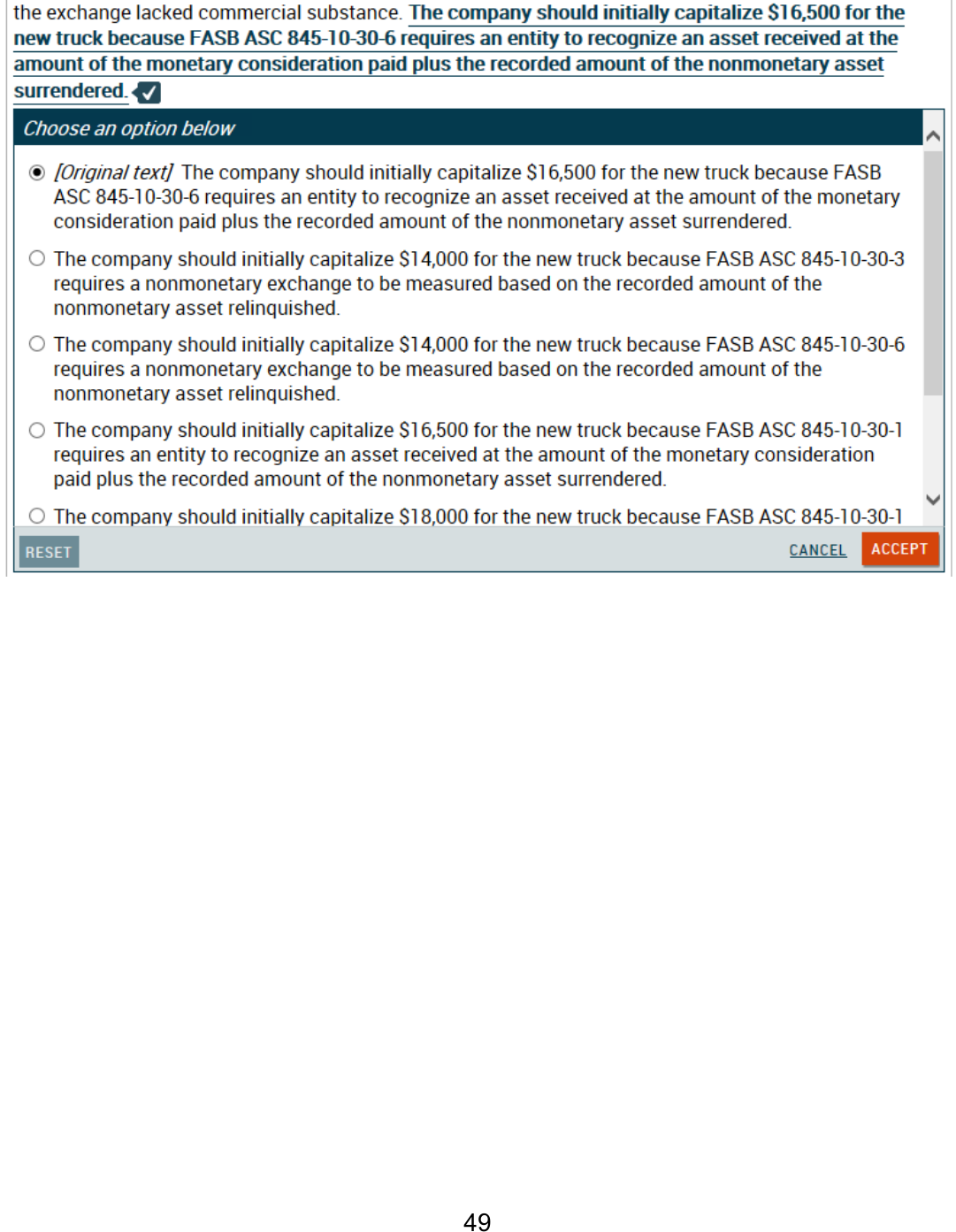

Response 4

48

Key

49

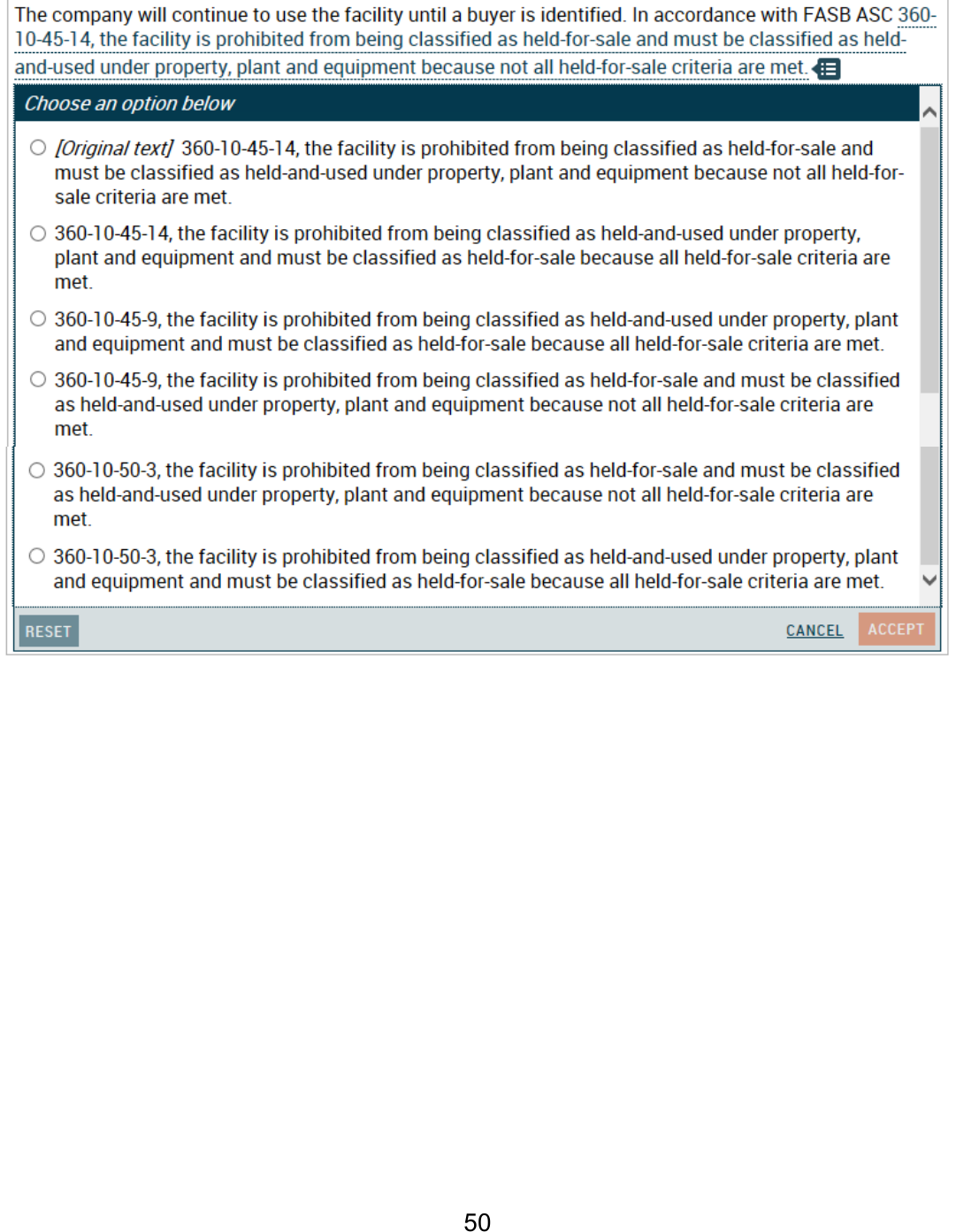

Response 5

50

Key

51

Exhibits Information

Exhibits included in this item

1. Cash Flow Analysis of Manufacturing Facility

2. Attorney Letter

52

Exhibit for Item: 508395

Exhibit 1: Cash Flow Analysis of Manufacturing Facility

USD (in 000’s)

Year

8

Year

9

Year

10

Year

11

Year

12

Year

13

Year

14

Year

15

Total

Undiscounted

net cash flow

(650)

2

75

113

171

142

167

1,211

1,231

Present value

of net cash

flow at 8%

(602)

2

60

83

116

90

97

654

500

53

Exhibit for Item: 508395

Exhibit 2: Attorney Letter

Gordon & Gordon, Attorneys-at-Law

4500 Main Street

Springwell, GA 30089

265-555-1111

December 31, year 7

Dear Controller:

Apex Corp. closed on the purchase of new land on September 30, year 7. Below is a summary of the

costs that Apex has incurred related to this transaction:

•

Purchase price for land

$500,000

•

Closing costs

6,000

•

Transfer tax

5,000

•

Property tax for fourth quarter of year 7

1,100

•

Delinquent property taxes that the prior owner left unpaid

2,200

•

Cost to remove an old building on the land

8,000

•

Proceeds from the sale of materials salvaged from the old building

1,500

It has been our pleasure to assist you in this land purchase.

Very truly yours,

J.P. Gordon

Gordon & Gordon, Attorneys-at-Law

54

Blueprint Information

CSO: 002.004.000

Skill: Analysis

Representative task: Reconcile and investigative differences between the subledger and general

ledger for property, plant and equipment to determine whether an adjustment is necessary

55