NC 1

st

Home Advantage

Down

Payment

TM

Guide

($8,000 DPA)

North Carolina Housing

Financing Agency

3508 Bush Street

Raleigh, NC 27609-7509

(919) 877-5700

www.nchfa.com

5 | P a g e R e v 1 2 / 2 0 2 1

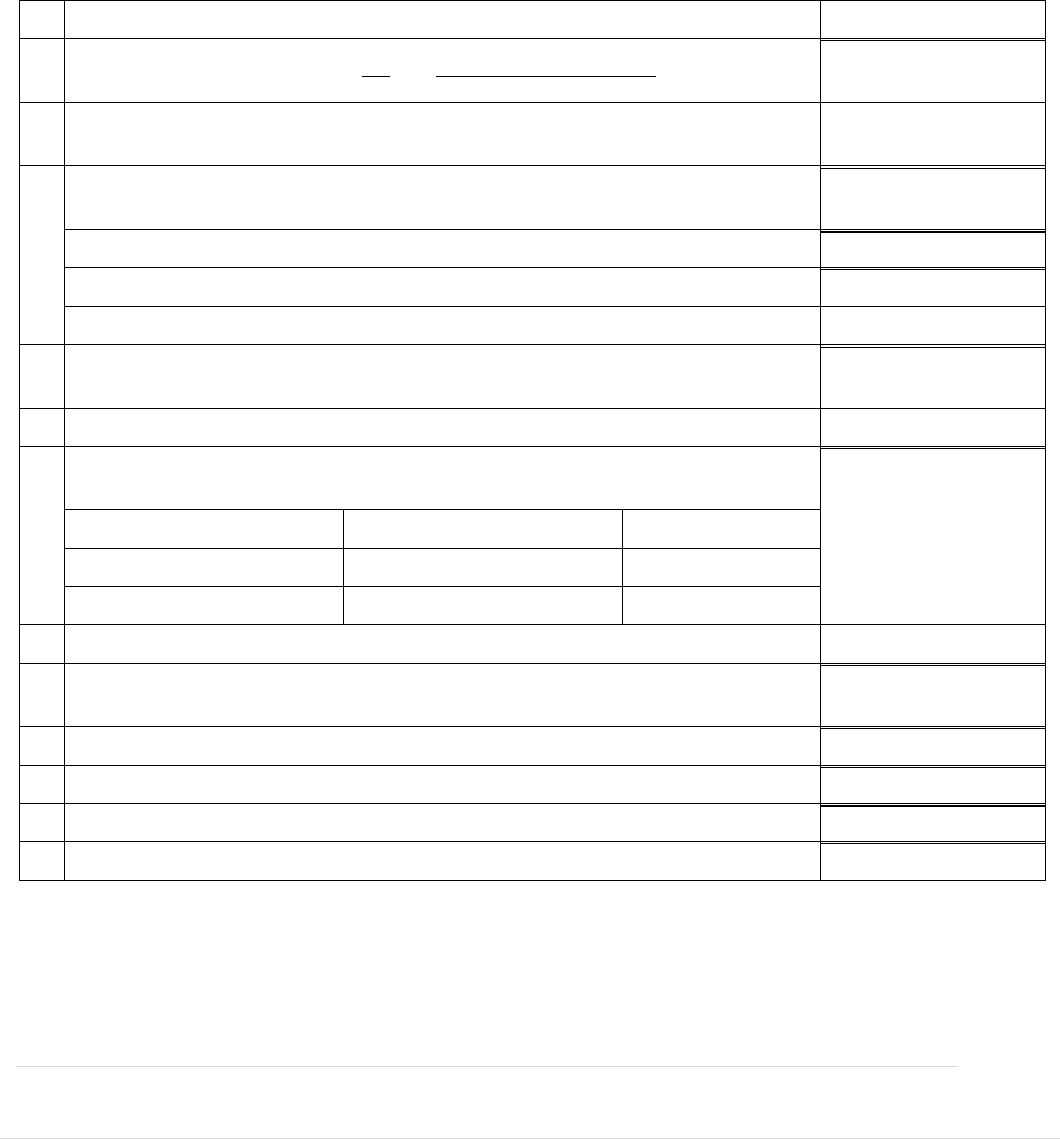

Contents

Section 1: Introduction .................................................................................................................................... 9

1.1

About NCHFA ................................................................................................................................... 9

1.2

Purpose ............................................................................................................................................ 9

1.3

Program Contact Information ....................................................................................................... 11

Section 2: Definitions ..................................................................................................................................... 12

Section 3: Lender Participation Guidelines .................................................................................................... 17

3.1

Lender Participation Guidelines .................................................................................................... 17

3.2

Annual Recertification Requirements ........................................................................................... 19

3.3

Online Lender Services System (OLS)............................................................................................ 19

3.4

Record Retention ........................................................................................................................... 20

3.5

Master Servicer Contact Information ........................................................................................... 20

3.6

Lender Compensation ................................................................................................................... 21

3.7

Fraud / Lender Violations / Lender Self-Reporting ...................................................................... 21

Section 4: Loan Eligibility Guidelines ............................................................................................................. 22

4.1

NC 1

st

Home Advantage Down Payment™ Loan Program Overview ......................................... 22

4.2

Down Payment Assistance (DPA) – $8,000 Overview .................................................................. 23

4.3

Eligible Loan Types ........................................................................................................................ 23

4.4

Ineligible Loans / Loan Types ........................................................................................................ 25

4.5

Mortgage Insurance Coverage Requirements .............................................................................. 25

4.6

Escrow Holdbacks and Repairs ...................................................................................................... 26

4.7

Repurchase Conditions .................................................................................................................. 26

4.8

Minimum Borrower Investment / Cash Back Limits .................................................................... 27

4.9

Assets ............................................................................................................................................. 27

4.10

Gift Funds ....................................................................................................................................... 27

4.11

Lien Position Policy ........................................................................................................................ 27

4.12

Principal Reduction Policy ............................................................................................................. 27

4.13

Eligibility with Other DPA Options ................................................................................................ 28

4.14

Down Payment Assistance (DPA) – General Guidelines .............................................................. 28

4.15

Funding of the DPA by Participating Lender ................................................................................. 29

6 | P a g e R e v 1 2 / 2 0 2 1

4.16

Loan Terms and Fees ..................................................................................................................... 29

4.17

Subordination Policy for Refinances (DPA) .................................................................................. 30

4.18

Special High-Needs Rural Closing Cost Assistance Options (Fannie Mae loans only) ................... 31

Section 5: Borrower Eligibility Guidelines .................................................................................................... 32

5.1

Borrower Requirements ................................................................................................................. 32

5.2

Pre-Purchase Education Requirement for First-Time Homebuyers ............................................... 33

5.3

Income Limits ................................................................................................................................. 33

5.4

Section 8 Vouchers......................................................................................................................... 34

5.5

Ratios ............................................................................................................................................. 34

5.6

Credit Score Requirements ............................................................................................................ 34

5.7

Collections Policy / Liens / Judgments / Student Loans ................................................................. 35

5.8

Bankruptcy Policy ........................................................................................................................... 35

5.9

Short Sales/Foreclosures ................................................................................................................ 35

5.10

Flip Properties ................................................................................................................................ 35

Section 6: Property Eligibility Guidelines (NC 1st Home Advantage $8,000 DPA only) ................................. 37

6.1

Property Requirements .................................................................................................................. 37

6.2

Repairs and Escrows for Completion ............................................................................................. 38

6.3

Owning More Than One Home ...................................................................................................... 38

6.4

Property Appraisal Condition Requirements ................................................................................. 38

6.5

Maximum Acreage ......................................................................................................................... 39

6.6

Business Use of Property ............................................................................................................... 39

Section 7: Loan Origination and Underwriting Steps ..................................................................................... 41

7.1

General ........................................................................................................................................... 41

7.2

NCHFA Normal Review Time .......................................................................................................... 41

7.3

Loan Origination ............................................................................................................................. 41

7.4

Pre-Approval Forms/Documents Required .................................................................................... 43

7.5

NCHFA Forms and Documents Required ....................................................................................... 43

7.6

Loan Closing After NCHFA Issues Commitment ............................................................................. 45

7.7

Interest Credit ................................................................................................................................ 46

7.8

Interim Servicing ............................................................................................................................ 46

7.9

Hazard/Flood Insurance Requirements ........................................................................................ 46

7.10

Electronic Signatures ...................................................................................................................... 47

7 | P a g e R e v 1 2 / 2 0 2 1

7.11

Power of Attorney (POA) Guidelines.............................................................................................. 47

Section 8: Income Eligibility Guideline ........................................................................................................... 50

8.1

Income Limits ................................................................................................................................. 50

8.2

Tax Returns/Transcripts and Program Compliance ...................................................................... 50

8.3

If Federal Income Tax Returns/Transcripts Are Not Available .................................................... 51

8.4

Income Calculation for Compliance Underwriting ....................................................................... 52

8.5

Recertification of Income .............................................................................................................. 58

8.6

Compliance Certification for Non-Borrower Occupant ................................................................ 58

8.7

Separation Agreement and/or Divorce Decrees; Free-Trader Agreement ................................. 58

Section 9: Rate Extensions, Changes to Lock-In and Loan Withdrawal Guidelines ....................................... 60

9.1

Late File Submission ...................................................................................................................... 60

9.2

Interest Rate Lock-In Policy ........................................................................................................... 61

9.3

Requesting an Extension ............................................................................................................... 62

9.4

Changes to a Lock-In ...................................................................................................................... 63

9.5

Withdrawal of Loan Locks ............................................................................................................. 63

9.6

Duplicate Locks or Borrowers ....................................................................................................... 63

9.7

Lock Expiration .............................................................................................................................. 63

9.8

Re-locking a Cancelled/Withdrawn Loan ..................................................................................... 63

Section 10: Post-Closing Processing Steps ..................................................................................................... 64

10.1

General .......................................................................................................................................... 64

10.2

Closing of DPAs in NCHFA’s Name ................................................................................................ 67

10.3

Signatures on the DOT and Promissory Note ............................................................................... 67

10.4

Uploading the Closing Package (Required to BOTH NCHFA and ServiSolutions) ........................ 67

10.5

Loan Purchase Review and Funding ............................................................................................. 68

10.6

Shipping the Final Documents to Master Servicer ....................................................................... 69

10.7

Closing Date / Funding Date / Recording Date ............................................................................. 70

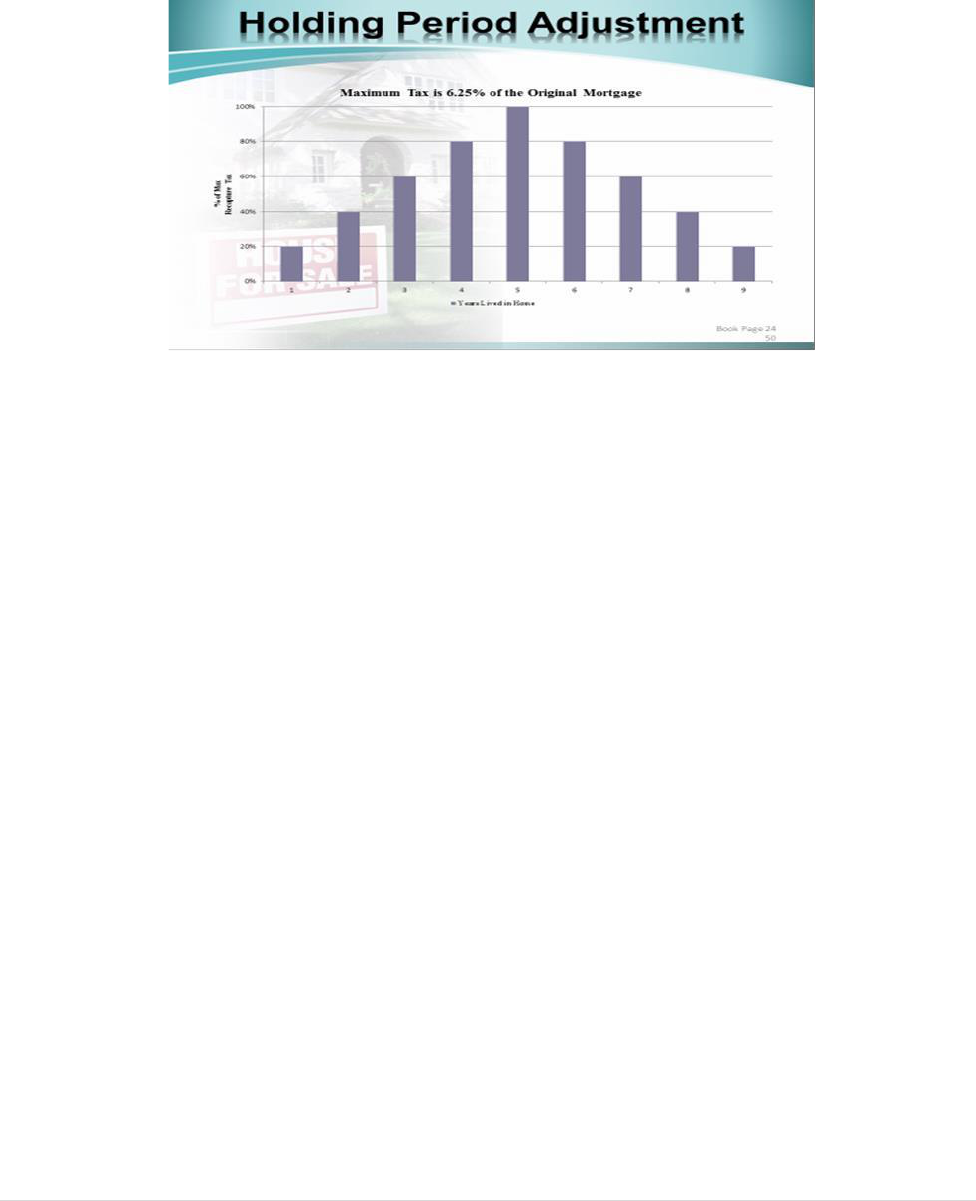

Section 11: IRS Recapture Tax Provisions and Disclosures – Applicable to NC 1

st

Home Advantage $8,00071

11.1

Summary of Recapture Requirements .......................................................................................... 71

11.2

The Basics of Recapture ................................................................................................................ 72

11.3

Recapture Provision ...................................................................................................................... 72

11.4

Recapture Formula ........................................................................................................................ 74

11.5

Recapture Examples ...................................................................................................................... 76

8 | P a g e R e v 1 2 / 2 0 2 1

11.6

Federal Subsidized Amount and Family Income Limits ................................................................ 77

11.7

Recapture Calculation ................................................................................................................... 79

11.8

Recapture Threshold Income ........................................................................................................ 81

11.9

Recapture Provision Federal Family Income Limits Table (Example) .......................................... 82

11.10

Notice to Mortgagors of Potential Recapture of Federal Subsidy ............................................... 84

11.11

Notice to Mortgagors of Maximum Recapture Tax and Method to Compute Recapture Tax on

Sale of Home .................................................................................................................................. 85

Section 12: FAQ and $8,000 DPA Program Summary .................................................................................... 89

12.1

Preliminary Lender Participation Guidelines ................................................................................ 89

12.2

Eligibility Criteria ........................................................................................................................... 89

12.3

Down Payment Assistance ($8,000 DPA) Offered Under NC 1

st

Home Advantage Down

Payment Mortgage™ ..................................................................................................................... 90

12.4

Closing/Purchase Guidelines ......................................................................................................... 91

12.5

Operations Process ........................................................................................................................ 91

12.6

Documentation Matrix - NC Home Advantage Mortgage™ & MCC-Assisted Loans ................... 92

12.7

Frequently Asked Questions ......................................................................................................... 93

9 | P a g e R e v 1 2 / 2 0 2 1

Section 1: Introduction

1.1

About NCHFA

NCHFA was created in 1973 by North Carolina General Statutes Chapter 122-A as a

corporate body with responsibility to provide affordable housing opportunities for low- and

moderate-income North Carolina households.

NCHFA has office hours between 8:00 a.m. and 5:00 p.m., Monday through Friday. The

telephone number is (919) 877-5700. The mailing address for NCHFA is the following:

North Carolina Housing Finance Agency

Home Ownership Lending Group

P.O. Box 28066

Raleigh, North Carolina 27611-8066

or

North Carolina Housing Finance Agency

Home Ownership Lending Group

3508 Bush Street

Raleigh, North Carolina 27609

This Program Guide and other resource materials may be downloaded from the NCHFA

website at www.nchfa.com. Marketing brochures and flyers may be available from time to

time and will be provided to lenders when available.

1.2

Purpose

The purpose of the NC 1

st

Home Advantage Down Payment™ Program Guide is to provide

a basic overview of the key operational and program details of the $8,000 NC 1

st

Home

Advantage Down Payment Mortgage™ and associated programs regarding borrower and

property eligibility, credit, underwriting, and closing procedures. Lenders must review and

understand all program requirements.

10 | P a g e R e v 1 2 / 2 0 2 1

This guide is not a substitute for lender training classes offered by NCHFA on a recurring

basis for the benefit of loan officers, operations personnel, and other mortgage staff.

NCHFA requires all participating lender personnel to attend one of these regular training

classes to get a more in-depth understanding of these programs. When changing employers,

OPS staff will be required to complete an on-line quiz.

Information contained in the NC 1

ST

Home Advantage Down Payment Mortgage™

Program Guide is subject to change. Revisions of or supplements to this Program Guide

may be made from time to time. To ensure prompt notification of any changes, it is the

lender’s responsibility to provide NCHFA with correct e-mail contact information.

Lenders wishing to use the Mortgage Credit Certificate (MCC) program alone or in

conjunction with the NC Home Advantage Mortgage™ program must refer to the MCC

Program Guide on the NCHFA website.

The Program Guide and Mortgage Origination Agreement signed by lender with Master

Servicer, together, govern the rules, policies, and procedures under this program. It is

lenders responsibility to understand these agreements in their entirety.

11 | P a g e R e v 1 2 / 2 0 2 1

1.3

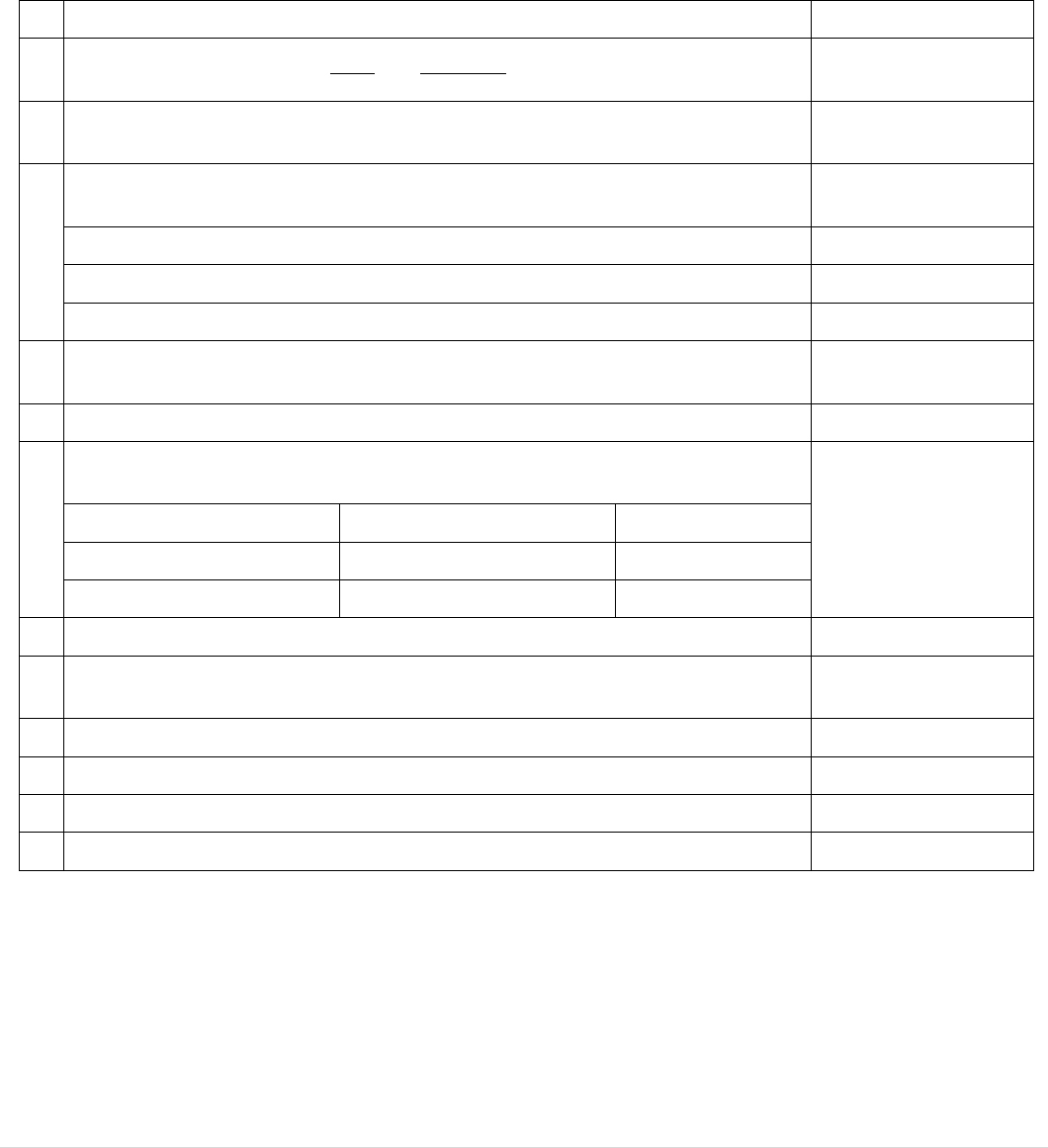

Program Contact Information

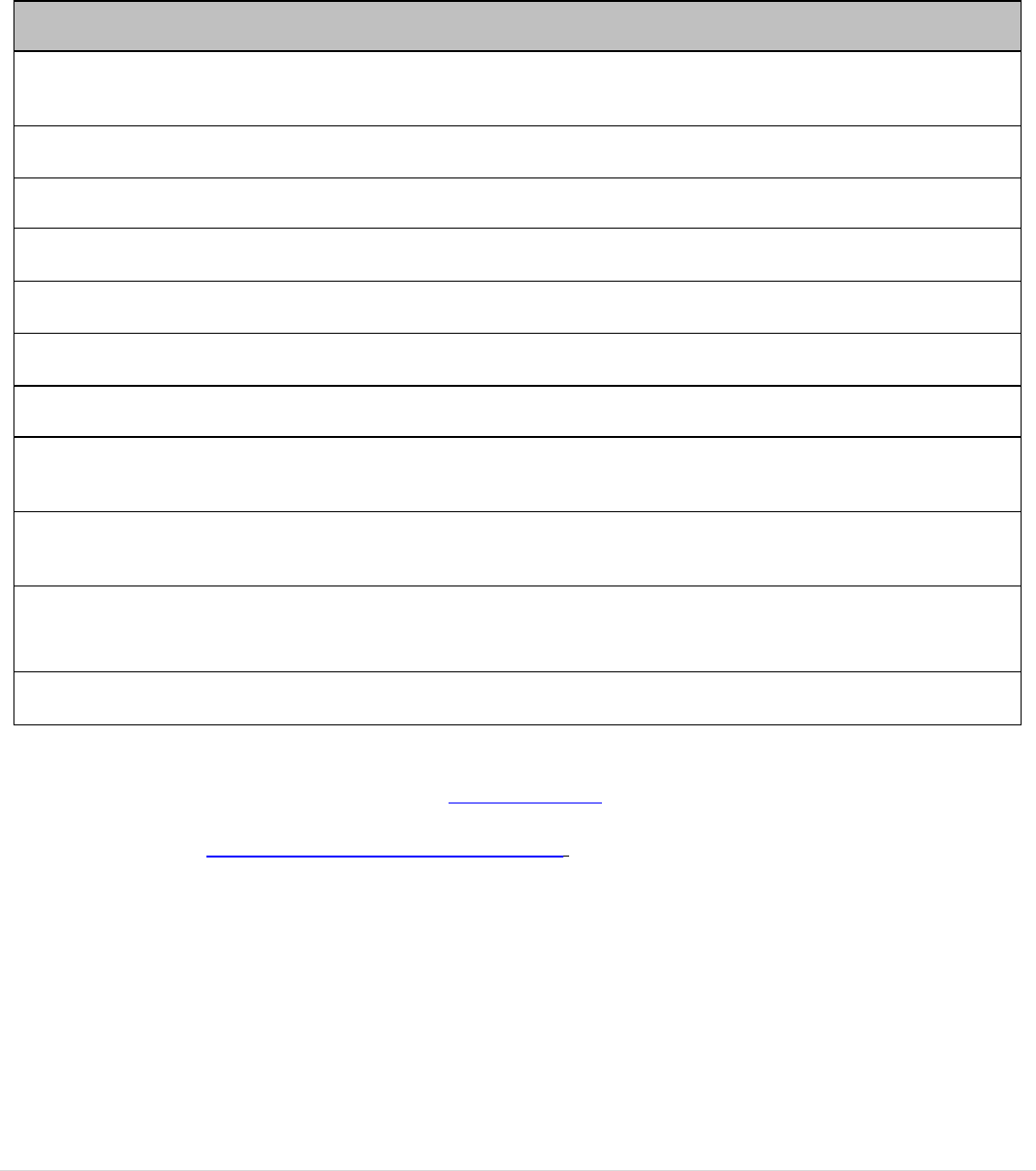

Name

E-mail Address

Telephone

(919 area code)

Responsibilities

Donna Pruitt

Loan Production

Coordinator

dmpruitt@nchfa.com

877-5692

Underwriting and program questions

Rajeshree Patel-Howard

Underwriter

981-2688

Underwriting and program questions

Amber Smith

Underwriter

981-2660

Underwriting and program questions

Justin Cuevas

Underwriter

jacuevas@nchfa.com

981-4473

Underwriting and program questions

Lori Purser

Underwriter

981-2608

Underwriting and program questions

Nicole Wivell

Underwriter

nmwivell@nchfa.com

877-5677

Underwriting and program questions

Bill Hobbs

Lender Liasion

850-2779

Lender outreach, lender visits, support

Open

Training & Outreach

Coordinator

@nchfa.com

877-5683

Lender and realtor training classes

Jan Ott

MCC/Bond

Closing Specialist

877-5632

MCC and Bond closing documents

Rob Rusczak

Manager Home

Ownership Group

875-3777

Home Ownership Group Manager

Margie Rivera

Customer Service

mbrivera@nchfa.com

877-5710

Customer Service, Locks, User IDs,

New Lender Agreements

NCHFA displays current interest rates, loan types and other program information on the NCHFA

website. The NCHFA website address is www.nchfa.com. Participating lenders must use

NCHFA’s Online Lender Services System (OLS) to reserve loans and maintain their pipeline. It

can be accessed via https://www.nchfa.org/OLS/login.aspx.

12 | P a g e R e v 4 / 2 0 2 2

Section 2: Definitions

The following words are used in this Program Guide with these meanings:

ACH— Automated clearing house. Direct deposit transfer of funds from one bank to another.

APOR— Average Prime Offer Rate (APOR) is an index published by the Federal Reserve Board.

Award Letter— Letter related to the Down Payment Assistance (DPA) on FHA loans only,

provided with Commitment intended by NCHFA to satisfy the requirements of HUD Handbook

4000.1 II.A.4.d.ii (C).

AUS— Automated Underwriting System.

Co-borrower— An individual who is listed on loan documents and whose income and credit are

used to qualify for the loan. A co-borrower must meet the annual income limits and must have or

establish North Carolina residency within 60 days of closing.

Co-signer/Co-Signor— A non-occupant who is co-signing the Note for a particular loan. Not

allowed on the NC 1

st

Home Advantage program.

Commitment— Letter provided to lender via OLS upon NCHFA’s review and approval of pre-

closing documents. Under no circumstances may a lender close any NC Home Advantage

Mortgage™ loan until a Commitment has been issued. The Commitment to purchase the loan is

subject to the Master Servicer’s review of the closing documents for compliance with GNMA,

FNMA, or Freddie Mac regulatory guidelines in addition to any requirements of the Master

Servicer.

CPLP— Community Partners Loan Pool (“CPLP”), which offers a deferred 0% interest

subordinate lien administered by NCHFA, which can be used as down payment or for closing

costs.

Discount Points— A point equals 1% of the loan amount that is used to reduce the interest rate

on a mortgage below prevailing market rates. Discount points are not allowed.

DPA— Down payment assistance or subordinate financing offered by NCHFA of up to 5% of the

first mortgage total loan amount for FHA and VA loans, or up to 3% of the first mortgage loan

amount for conventional loans.

DTI— Debt-to-income ratio, which cannot exceed 45% for any NC Home Advantage

Mortgage™.

13 | P a g e R e v 4 / 2 0 2 2

Early Check— Fannie Mae’s service designed to assist lenders in identifying and correcting

potential eligibility and/or data issues early in the underwriting process and prior to loan delivery.

Electronic Signatures— Are acceptable on NCHFA non-security documents if they meet ESIGN

2

and UETA

federal standards. Also referred to as “E-signatures” or “e-signing.”

Eligible Property— A residence located in North Carolina that is eligible for insurance under

FHA, VA, USDA or conventional guidelines.

Existing Home— A dwelling unit that has been previously occupied.

Extension Fees— Loans may be assessed a 7-day, 15-day or 30-day extension fee at a cost of

0.0625%, 0.1875% or 0.25%, respectively. The extension fees are automatically deducted from

lender compensation at the time the Master Servicer purchases the loan from the lender.

Fannie Mae— Federal National Mortgage Association or FNMA.

Family Income — Defined as the gross annual income of the mortgagor(s) and any other person

who is expected to both live in the residence being financed and to be secondarily liable on the

mortgage. Family income would include the income of 1) the mortgagor(s), 2) the spouse of any

mortgagor(s), 3) titleholders residing in the subject property, and 4) any person who guarantees

the loan and intends to reside in the property.

First Time Home Buyer (FTHB)— A borrower (mortgagor), spouse, or titleholder residing in

property who has not had an ownership interest in a principal residence within three (3) years of

closing on the next home purchase.

FHA— The Federal Housing Administration.

FHA Insurance, FHA-Insured— Insurance provided by FHA for residential mortgages which

protects lenders against some or most of the losses that can occur when a borrower defaults on a

mortgage loan.

FNMA— Federal National Mortgage Association or “Fannie Mae.”

Freddie Mac — Federal Home Loan Mortgage Corporation

Free-Trader Agreement— Legal agreement between married spouses allowing each to purchase

or sell property without the consent of the other party. Must be recorded prior to closing.

GNMA— The Government National Mortgage Association or “Ginnie Mae.”

HUD— The United States Department of Housing and Urban Development.

Industry Standards— The guidelines published and used by FHA, VA, USDA or FNMA to

underwrite mortgage loans for acceptance by these entities.

14 | P a g e R e v 4 / 2 0 2 2

Legally Enforceable Obligation Letter— Letter related to the DPA for FHA loans provided with

Commitment intended by NCHFA to satisfy the requirements of HUD Handbook 4000.1

II.A.4.d.ii(C)

4

.

Lender— Any mortgage lender that is a Fannie Mae or Freddie Mac approved seller/servicer in

good standing (if originating conventional loans); is approved as an FHA mortgage originator (if

originating FHA loans); is approved as a VA mortgage originator (if originating VA loans); or is

approved as a USDA mortgage originator (if originating USDA loans).

Lock-In Expiration Date— Sixty (60) days past the date the loan is first locked in the NCHFA

OLS system. The loan must be purchased by the Master Servicer by the Lock-In Expiration Date

to avoid extension fees.

Manufactured Homes (Mobile Homes)— A manufactured building designed to be used as a

single-family dwelling unit which has been constructed and labeled indicating compliance with

the HUD administered National Manufactured Housing Construction and Safety Standards Act of

1974

5

. NCHFA will only accept manufactured housing that is new, never occupied, doublewide

or larger, and on a permanent foundation for FHA, VA and USDA loans. Manufactured Homes

are not eligible for conventional loans.

Marital Interest— An ownership interest generated solely through marriage to a person who

owned a property.

Mark-to-Market Fee— A fee applied on any loan purchased by the Master Servicer for which

the lock has expired. The mark-to-market fee is based on market conditions at the time the Master

Servicer purchases the loan from the lender. In no circumstance will the mark-to-market fee be

less than what an extension fee would have been had an extension been requested timely.

Master Servicer— Alabama Housing Finance Authority doing business as ServiSolutions

(“ServiSolutions”), the entity designated by NCHFA to purchase and service loans under the NC

Home Advantage Mortgage™ programs and who approves eligible Participating Lenders.

MI Company— Also known as PMI. A private mortgage insurance company providing mortgage

insurance on conventional loans. Only Arch, Essent, Genworth, MGIC, National MI, and Radian

are approved MI providers for NCHFA.

MCC— Mortgage Credit Certificate issued by NCHFA according to the rules and regulations

determined by the IRS.

Modular Home— A manufactured building designed to be used as a single-family dwelling unit

which has been constructed and labeled indicating compliance with the North Carolina State

Uniform Residential Building Code, Volume VII (Look for NC Validation Stamp).

Mortgage Origination Agreement (“Agreement”)— An agreement describing the mortgage

originator’s rights and responsibilities, made between the North Carolina Housing Finance

Agency, the Master Servicer and lenders participating in the NC Home Advantage Mortgage™

15 | P a g e R e v 4 / 2 0 2 2

program.

Mortgagor— The borrower(s) in a mortgage transaction. A person or persons who borrows

money to finance the purchase of real estate using the value of the property as collateral for the

loan and promises to repay the loan.

Mortgage Revenue Bonds—Tax-exempt financing authorized under IRS and Congressional

regulations and used to finance mortgage loans under the NC Home Advantage programs.

NCHFA— North Carolina Housing Finance Agency.

NC 1st Home Advantage Down Payment— Mortgage loans and/or down payment funded

through tax-exempt mortgage revenue bonds intended for first time homebuyers, qualifying

veterans or homebuyers purchasing a property in certain Qualified Census Tracts, who meet the

property acquisition and income limits set under rules established by the IRS and HUD.

New Construction— A dwelling unit that is new and/or never occupied.

Non-Borrowing Co-Occupant— Any person who is expected to occupy the property and is not

a mortgagor.

Online Lender Services System (OLS)— The system made available by NCHFA to its lending

partners for the lock and confirmation of NC Home Advantage Mortgage™ and MCC-assisted

loans.

PMI Company— Also known as MI Company. A private mortgage insurance company providing

mortgage insurance on conventional loans. Only Arch, Essent, Genworth, MGIC, National MI,

and Radian are approved MI providers for NCHFA.

Participating Lender— A lender that has been approved by NCHFA and the Master Servicer to

originate, process, underwrite, close and fund mortgage loans under NCHFA approved programs.

See Section 4 for lender qualifications.

Permanently Fixed— Refers to a mobile home with the towing hitch or running gear, including

wheels and axles, removed, and which has been attached to a permanent foundation (including

basement, crawl space and slab types of foundations).

POA— A properly recorded, signed, and executed power of attorney legal document.

Prepaid Items— Amounts required by the Participating Lender to be paid at settlement in advance

of their due date. These items may include property taxes, accrued interest, association dues,

mortgage insurance premiums and hazard insurance premiums. Prepaid items do not include loan

origination fees, “Points” or “Discount Points”.

Principal Residence— Housing that the eligible borrower will occupy within 60-days after

closing as a primary residence. The home cannot be used as an investment property or second

16 | P a g e R e v 4 / 2 0 2 2

home.

Program Guidelines— Guidelines used in conjunction with established mortgage industry credit and

property guidelines to determine eligibility for NC Home Advantage Mortgage™ financing.

QM — Qualified Mortgage per Consumer Financial Protection Bureau.

RESPA— The "Real Estate Settlement Procedures Act”.

Secondarily Liable – Refers to a borrower(s), mortgagor, or other person that has or will have a

property interest in the property that will be forfeited in the event there is a foreclosure or default

on the property by the mortgagor(s). A spouse is an example of someone who would be

“secondarily liable” under terms of this program. Secondarily liable on the debt would include

someone who acts as a surety or guarantor if they also intend to live in the residence being financed.

Servicing Agreement— An agreement describing the mortgage servicer’s rights and

responsibilities made between NCHFA, the Participating Lender, and the Master Servicer.

Seller Contribution— Amount the seller may contribute toward the borrower’s closing expenses.

Follow industry guidelines for Loan Type (i.e., FHA, USDA, VA, or Conventional).

The State— The State of North Carolina.

Titleholder— Anyone who holds title to the subject property.

TRID— The TILA RESPA Integrated Disclosures that went into effect October 3, 2015. The Loan

Estimate replaces the initial Truth-in-Lending disclosure and Good Faith Estimate. The Closing

Disclosure replaces the final Truth-in-Lending disclosure and HUD-1 Settlement Statement.

United States Department of Agriculture/Rural Development (USDA)— The USDA home

loan guaranty provides loans in rural areas to finance homes and building sites.

Veterans Administration (VA)— The Servicemen’s Readjustment Act of 1944 authorized this

agency to administer a variety of benefit programs designed to facilitate the adjustment of returning

veterans to civilian life. The VA home loan guaranty program is designed to encourage lenders to

offer long-term, low down payment mortgages to eligible veterans by guaranteeing the lender

against some or all loss caused by default of the borrower.

17 | P a g e R e v 4 / 2 0 2 2

Section 3: Lender Participation Guidelines

3.1

Lender Participation Guidelines

The Program is restricted to lenders who meet the following requirements:

1)

Are approved as Fannie Mae or Freddie Mac sellers/servicers in good standing if

originating conventional loans, approved as FHA mortgage originators if originating

FHA loans, approved as VA mortgage originators if originating VA loans, or approved

as USDA mortgage originators if originating USDA loans;

2)

Have and maintain a retail mortgage origination office physically located in North

Carolina that has originated residential mortgages for at least one (1) year. If less than

one full year of physical presence, you may apply after six months of having a physical

location opened and located in North Carolina originating loans along with a Letter of

Recommendation from another state housing finance agency indicating good standing.;

3)

Originate, process, underwrite, close and fund the loan in their own name;

4)

In compliance with applicable minimum capital requirements imposed by federal

banking laws and regulations;

5)

Not under supervisory control of, or subject to, enforcement proceedings by federal

banking regulators with respect to any violations or alleged violations of federal

banking laws or regulations;

6)

Have a net company asset worth of $1,000,000 (subject to change);

7)

Be approved by NCHFA and the Master Servicer and execute a Mortgage Origination

Agreement with both; and

8)

Have the in-house capability and legal authority to provide interim servicing of closed

loans prior to purchase by Master Servicer, and

9)

Complete in-person lender training (or approved webinar training) with NCHFA staff.

18 | P a g e R e v 4 / 2 0 2 2

Any lender who does not close a minimum of ten (10) loans with NCHFA in a calendar

year may be removed from the program at the Agency’s discretion. A lender may be

removed from participation from Agency programs at any time for fraud or program

violations, without recourse.

By becoming an approved lender and participating in the Program, the lender understands

and agrees that the Agency reserves the right to suspend the lender’s ability to make new

locks under the Program if the lender has outstanding fees, late documents, excessive

withdrawal of locks, or for any other reason as determined by the Agency in its sole

discretion. Any loan not re-purchased by lender as requested under the Agreement by

Master Servicer will result in lender being terminated from program.

Loan officers must reside in North Carolina (or a county that touches the NC border) and

are required to attend in-person training (or approved webinar training) before offering

NCHFA loan products. When possible, Operations Staff are encouraged to attend in-person

training, however attendance at NCHFA conducted webinars, required as indicated, will

satisfy the training requirement for Ops staff only. Loan officers must maintain at least five

(5) closed loan products with NCHFA in a rolling 12-month period to remain eligible to

originate NCHFA products. Loan Officers who fall below that threshold must repeat

training.

All staff who originate, process, underwrite, close, or have access to NCHFA’s On Line

Lender Services system (OLS) must remain current on NCHFA program guidelines and

requirements. All staff with access to the OLS must receive training before being issued a

User ID by the Lender’s System Administrator. After issuing a User ID, the system

administrator must notify NCHFA of the new user, including the user’s contact information

and most recent training date. Loan officers must complete in-person training annually or

remain current on NCHFA programs by closing at least 5 loans in a rolling 12-month year.

Training Policy

Operations Staff:

All processors and underwriters must attend a series of three webinars; the NC Home

Advantage Mortgage™, the NC 1st Home Advantage Mortgage Down Payment ($8,000),

and the NC Home Advantage Tax Credit (MCC).

These webinars are normally offered monthly and may be taken in any order. Processors

and underwriters are not authorized to work on NCHFA products until they have completed

all three webinars and passed the required quiz with a score of 80% or higher. The quiz is

sent after each webinar and is comprehensive, but it only has to be passed once. After

passing the quiz, the Operation’s staff member should take a screen shot of their passing

grade to give to their supervisor. They should save the screen shot as evidence of their

passing score.

19 | P a g e R e v 4 / 2 0 2 2

Closers, post-closers, and lock desk staff may elect to attend the webinars as well, however

PowerPoints are posted on the Forms and Resources page for their review. These

PowerPoints must be reviewed prior to working with NCHFA products. Post-closers must

also review the ServiSolutions power point. The lender is responsible for determining that

staff members have reviewed the power points and understand NCHFA and ServiSolutions

policies and requirements. Failure to follow both NCHFA and ServiSolutions guidelines

may result in a non-purchasable loan or non-issuance of the Mortgage Credit Certificate.

All members of the Lender’s team must complete required training, even if they have

worked with NC Housing Finance Agency products at their previous employer.

Loan Officers:

Prior to originating any NCHFA product Loan Officers must attend the three-hour Let’s

Make Home Happen (LMHH) class, in-person when available (on-line as a synchronous

class until further notice). This class is normally offered monthly. After completing the

class, Loan Officers must also pass a quiz with a score of 80% or higher. After completing

both the class and the quiz, the Loan Officer should forward their class date and a

screenshot of their passing quiz score to their supervisor and the Training Coordinator at

NCHFA. At that time, Loan Officers are eligible to originate NCHFA products.

3.2

Annual Recertification Requirements

On an annual basis, each lender will be required to electronically recertify that it is still in

compliance with NCHFA mortgage origination guidelines and reconfirm lender locations

and loan officer additions/subtractions. Official audited financials are required. The

designated corporate contact for each participating lender will receive an e-mail from

NCHFA that contains a single-purpose weblink and user ID for performing the

recertification process.

There is a $375 fee payable by ACH at the end of the recertification. Failure to recertify

may prohibit future participation in NCHFA programs.

In addition, the Master Servicer may require an annual recertification that is separate from

the annual NCHFA recertification.

3.3

Online Lender Services System (OLS)

To reserve an NC 1

st

Home Advantage Mortgage™ loan, the lender must access the Online

Lender Services System (OLS) at http://www.nchfa.org/ols/login.aspx. OLS access is

granted by the Lender’s System Administrator. Access is restricted to Loan Officers and

Operations Staff who have met NCHFA training requirements.

20 | P a g e R e v 4 / 2 0 2 2

3.4

Record Retention

NCHFA, it’s Master Servicer, or authorized Quality Control firm may perform random

reviews of lender records pertaining to NCHFA’s NC 1

st

Home Advantage Down Payment

Mortgage™ program. Therefore, the originating lender is required to maintain for a period

of 36 months a copy of the entire loan file, appraisal and credit package, including closing

package.

3.5

Master Servicer Contact Information

ServiSolutions is the Master Servicer for the NC 1

st

Home Advantage Down Payment

Mortgage™ loans. Each participating lender must be approved by NCHFA and the Master

Servicer through execution of a Mortgage Origination Agreement.

The following contact information for ServiSolutions information may be subject to

change:

Master Servicer:

Alabama Housing Finance Authority, doing business as ServiSolutions

Contact e-mail:

-

Closed Loan Delivery Questions/Pended conditions - [email protected]m

-

Purchase Advice Questions - purc[email protected]

-

ServiSolutions Policy Questions, Lisa Treece - [email protected]

-

Lender Online issues, Brian Hunt - [email protected]

Instructions for creating a new NC 1

st

Home Advantage Down Payment™ lock

1.

Click the NC Home Advantage Mortgage™ reservation link on OLS home page, left menu.

2.

OLS will guide you through a multi-step process for creation and submission of the lock.

Use the [Continue>>] button to navigate through these steps.

3.

At the Final Review step, review your input and click the [Submit!] button. This action

will generate a confirmation e-mail and lock your rate, starting the clock on the closing

and delivery timelines required under the program.

4.

Make a note of the NCHFA Loan Number displayed on the confirmation page. Please

use this loan number when corresponding with NCHFA concerning the loan.

Note: You must have all the requested loan information available to you at the time you are

locking the NC Home Advantage Mortgage™ loan as partially completed data cannot be saved

in OLS. If at any time during the lock process you choose to cancel, all previously entered

information will be lost.

21 | P a g e R e v 4 / 2 0 2 2

-

Loan Collateral & Final Docs Original Notes /Recorded MTGS or DOTs /Final

Title Policy, Renee Dotson - [email protected]

Address:

ServiSolutions - Final Documents

7460 Halcyon Pointe Drive, Suite 200

Montgomery, AL 36117

(334)-244-9200

ServiSolutions provides answers to frequently answered questions on its website at

http://servsol.com/lenders/lender_faqs.aspx. Any questions concerning their guidelines

should be directed to ServiSolutions at (334) 244-9200 or [email protected].

It is the lender’s responsibility to understand all ServiSolutions requirements for delivery

of loans and requirements for purchase of closed loans under the Program.

Lenders should refer to the ServiSolutions closing package checklist at www.servsol.com.

3.6

Lender Compensation

The lender shall be paid a fixed amount as a servicing release premium (SRP) for all

eligible loans under the NC Home Advantage Mortgage™ program that also meet the

guidelines of FHA, VA, USDA or Fannie Mae. The SRP amount is 2.5% for FHA, VA and

USDA. The SRP amount for conventional loans is 1.75%. The SRP is paid on the net

balance of the first mortgage when purchased by the Master Servicer. SRPs may be

changed with 30 days’ notice by NCHFA to lender.

Please note extension and penalty fees for late and non-delivery in Section 9.

3.7

Fraud / Lender Violations / Lender Self-Reporting

The lender and its personnel are required to report to NCHFA any false statements,

program abuses or violations of state and federal laws and regulations within 30 days of

occurrence. Any reports or notifications in this regard made to Fannie Mae, Freddie Mac,

FHA, VA or USDA must also be reported to NCHFA in a timely manner.

Any instances of fraud concerning a NCHFA loan, before, during or after origination, must

be reported to NCHFA.

22 | P a g e R e v 4 / 2 0 2 2

Section 4: Loan Eligibility Guidelines

The following section details the various loan options available to participating lenders and their

eligible borrowers.

The NC 1

st

Home Advantage Mortgage Down Payment is funded through tax-exempt mortgage

revenue bond (MRBs) financing. Certain income and sales price limits apply. Eligible borrowers

including anyone who will become the mortgagor must be first-time homebuyers or meet certain

exceptions. The use of funds under this program is subject to IRS Recapture Tax rules. Borrowers

may be eligible for reimbursement of any potential recapture tax paid to the IRS. Recapture Tax

Reimbursement program details can be reviewed at www.nchfa.com. The DPA is a subordinate

lien and subject to repayment under the terms specified below.

Qualified borrowers who utilize the $8,000 DPA cannot combine these funds with the NC Home

Advantage 3% or 5% down payment assistance program or Mortgage Credit Certificate program

(MCC).

4.1

NC 1

st

Home Advantage Down Payment™ Loan Program Overview

The NC Home Advantage Mortgage™ program offers all eligible borrowers affordable

mortgage financing. NCHFA does not make the loan(s) directly to the borrower; instead,

the designated Master Servicer purchases eligible loans from its participating lenders.

To be eligible, all borrowers must:

1)

meet FHA, VA, USDA, or Conventional industry guidelines. For example, follow

standard industry guidelines for seller contribution, student loans, bankruptcy,

foreclosure, etc.;

2)

have incomes within the established limits, which vary by county and household size;

3)

have a maximum debt-to-income (DTI) ratio of 45.0%;

4)

be a first-time home buyer, certain military veterans may qualify or targeted census

tract

5)

have at least two (2) credit scores per borrower, with the mid or low score at 640 or

better, and receive an AUS approval; and

6)

occupy and maintain the property as a principal residence.

23 | P a g e R e v 4 / 2 0 2 2

4.2

Down Payment Assistance (DPA) – $8,000 Overview

Down payment assistance (DPA) is available to first-time homebuyers and certain other

borrowers who qualify for an NC 1

st

Home Advantage Mortgage™ loan from participating

lenders. Income limits vary by household size and county of subject property. In addition,

minimum FICO credit scores and DTI limits apply.

Eligible borrowers must use the full $8,000.

The DPA is provided as a 15-year deferred/forgiven subordinate lien. The DPA is deferred

for the first 10 years and forgiven by 20% each year at the end of years 11 through 15.

After 15 years, the loan is fully forgiven. Repayment of the DPA (any portion not yet

forgiven) is due and payable when the house is sold, no longer owner occupied or

refinanced before year 15 or there is a breach of the Promissory Note.

a)

Key NC 1

st

Home Advantage Down Payment ™ $8,000 DPA Highlights:

• 15 year deferred/subordinate lien

• Forgiven at 20% per year at end of years 11-15

• 0% interest rate on DPA

• Repayment in full is required when home is sold or refinanced before year 15, or

borrower breaches the Promissory Note

• Total, gross family income of all mortgagors (and those expected to live in the home

and hold an ownership interest, including a spouse)

• Restricted to first-time home buyers, certain military veterans, and targeted census

tracts

4.3

Eligible Loan Types

NCHFA accepts 30-year fixed-rate FHA, VA, USDA and conventional loan types under

its NC 1

st

Home Advantage Down Payment Mortgage™ program. FHA loan types include

FHA 203(b) loans and condominium 234(c) loans.

All loans financed under the NC 1

st

Home Advantage Down Payment™ program must be

purchase transactions. First-time homebuyers and certain military veterans are eligible for

the $8,000 down payment option. Targeted census tracts are also eligible. Borrowers may

only have one outstanding NCHFA loan or home or NCHFA product at a time.

An AUS finding of “Refer” or “Ineligible” is not eligible for the NC 1

st

Home Advantage

Down Payment Program™. Manually underwritten loans are not eligible.

1)

FHA Loan Program: NCHFA offers 30-year fixed-rate loans insured by the Federal

Housing Administration. These loans are underwritten to FHA and program guidelines.

24 | P a g e R e v 4 / 2 0 2 2

The lender must submit FHA loans through an automated underwriting system

approved by FHA and NCHFA. FHA/VA loans may use either LPA or DU.

Note: The FHA Award Letter must be signed by the borrower(s) at or before closing if

2nd mortgage, subordinate lien is attached. The Obligation Letter is a HUD

requirement and does not guarantee the reimbursement of the DPA funds for loans not

eligible or purchased by the Master Servicer under the rules of the Agreement.

2)

VA Loan Program: NCHFA offers 30-year fixed-rate loans guaranteed by the Veterans

Administration. These loans are underwritten to VA and program guidelines. The

lender must submit VA loans through an automated underwriting system approved by

VA and NCHFA.

3)

USDA Loan Program: NCHFA offers 30-year fixed-rate loans guaranteed by the US

Department of Agriculture. Lenders must use USDA’s Guaranteed Underwriting

System (GUS). All loans must receive a GUS credit recommendation of “Accept.”

4)

Conventional Loan Program: NCHFA offers 30-year fixed-rate loans under the HFA

Preferred program from Fannie Mae or Freddie Mac HFA Advantage program. These

loans are underwritten to Fannie Mac or Freddie Mac program guidelines under

FNMA’s “HFA Preferred” or Freddie Mac’s “HFA Advantage” program.

Note: Conventional loans must be run through Fannie Mae’s Desktop Underwriter

(DU) or Loan Prospector Advisor (LPA). HFA Preferred is available through DU using

the "Additional Data" screen by selecting "HFA Preferred." Reserves and asset

requirements are determined by DU Findings. Special Feature Code (SFC) 782 should

be used to identify all HFA Preferred loans and other SFCs as applicable.

If using the Freddie Mac HFA Advantage program, the AUS Findings must show

Offering Identifier HFA Advantage. Eligible loans limited to 80% AMI.

Note: All loans must receive an AUS Approve/Eligible or Loan Prospector Accept

credit recommendation. If the information reflected on the final application (Form 1003)

differs from the data submitted to the automated underwriting system (AUS), NCHFA may

ask the lender to re-run the submission. Lender must be careful to submit eligible Fannie

Mae or Freddie Mac loan types that are specific to Fannie Mae or Freddie Mac. AUS

Findings are not interchangeable between GSEs.

The post-closing package must contain the final approved 1003 and AUS findings.

Unapproved changes may result in a loan that is ineligible for purchase.

Upon the effective date per CFPB, all loans must meet new General Qualified Mortgage

(QM) rules for APOR. Lender is solely responsible for verifying that the underlying loans

(both 1

st

or subordinate mortgages) meet the points, price, and other criteria of QM before

or after closing. In no case can a loan exceed 45% DTI regardless of the QM rule.

25 | P a g e R e v 4 / 2 0 2 2

4.4

Ineligible Loans / Loan Types

The following loans and loan types are not eligible for financing under the NC 1

st

Home

Advantage Down Payment™ program:

• Refinances (purchase transactions only)

• Vacation homes or “second homes”

• USDA Direct 502

• HUD 184 loans

• FHA 203k Renovation loans

• High-Cost Loans

• Income producing properties (renting, AirBnB, etc.)

High priced mortgage loans (HPML) are acceptable if all federal guidelines and Master

Servicer guidelines are met. High cost mortgage loans (HCML) are not accepted.

4.5

Mortgage Insurance Coverage Requirements

Mortgage insurance coverage factors are based on area median income (AMI) and LTV. Only

Fannie Mae loans are eligible for AMIs over 80%. Freddie Mac loans are capped at 80% AMI

or lower. The MI coverage factors are as follows:

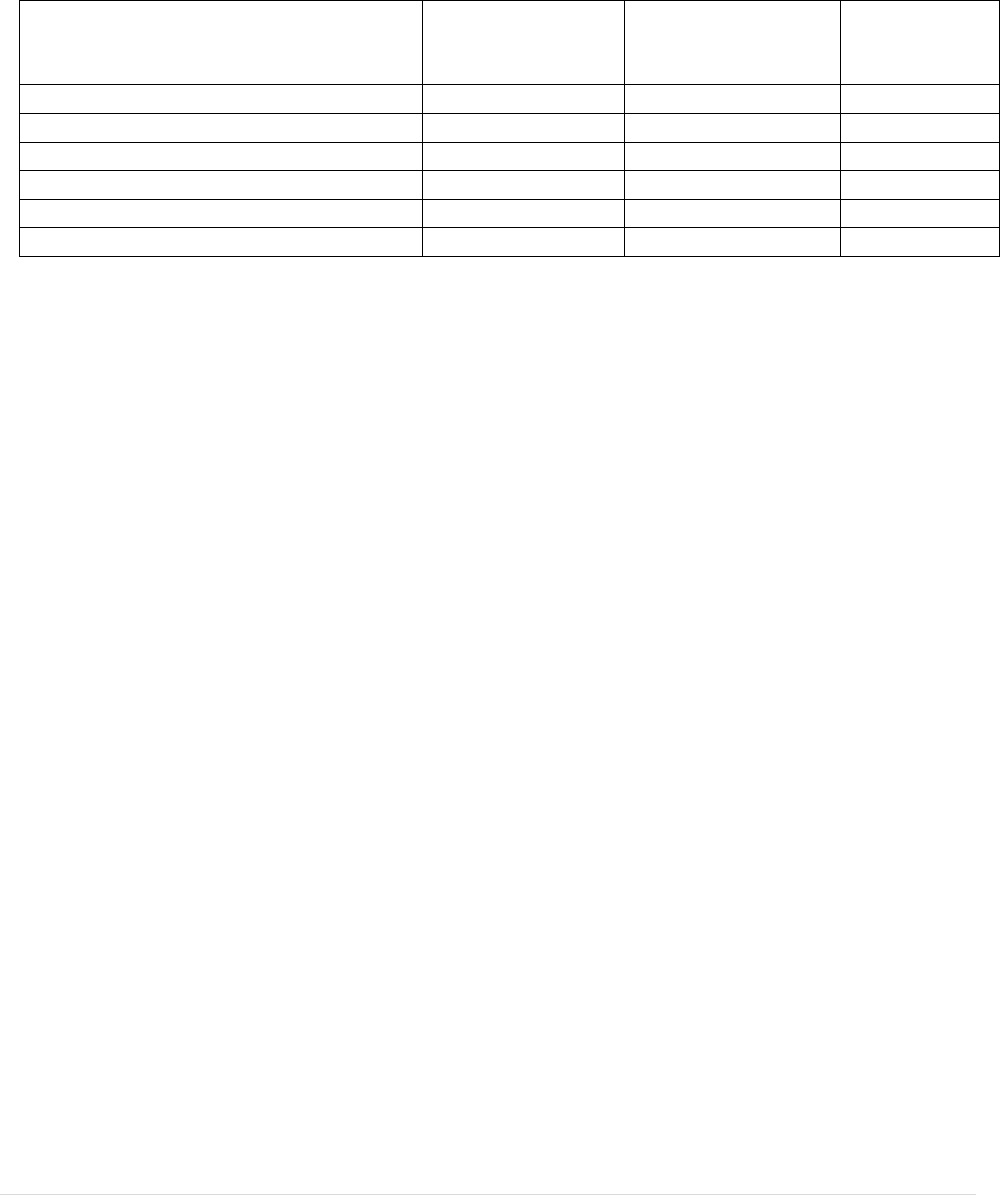

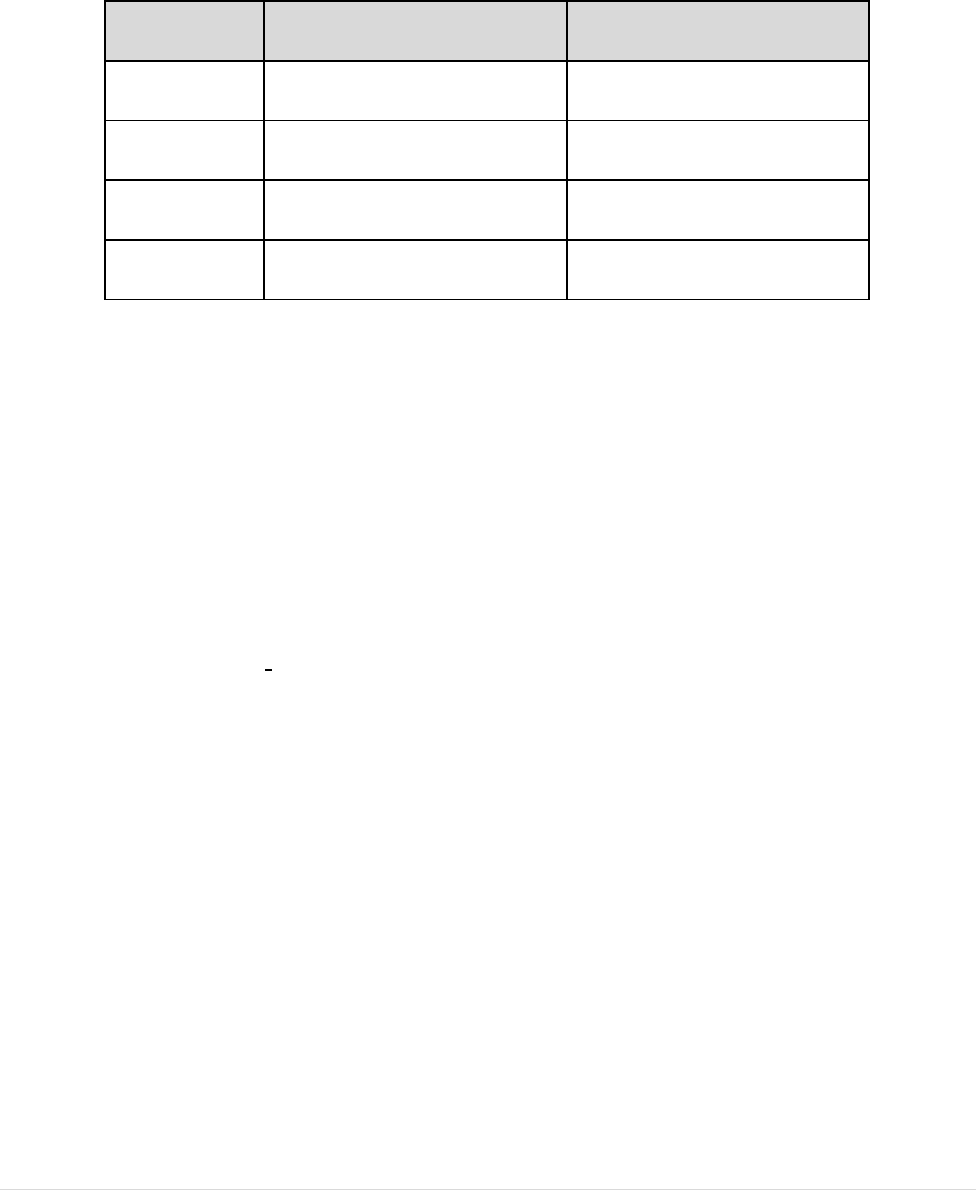

Loan to Value

MI Factor

(AMI Over 80%)

MI Factor

(AMI Under 80%)

95.01-97%

35%

18%

90.01-95%

30%

16%

85.01-90%

25%

12%

80.01-85%

12%

6%

The applicable MI rates for the coverage factor listed above must be used. Rates may vary by

PMI provider. Borrower-paid single premium, split premium and monthly MI are all

acceptable. In all cases using MI, the max LTV cannot exceed 97% and the CLTV 105%.

Financed MI and Lender Paid MI is not allowed.

The lender is responsible for verifying the correct and accurate MI rates based on loan criteria.

Any errors not corrected before closing will result in loan not being eligible for

reimbursement/purchase by the Servicer.

26 | P a g e R e v 4 / 2 0 2 2

4.6

Escrow Holdbacks and Repairs

Loans requiring repair escrows are acceptable. However, the lender must follow ServiSolutions

guidelines before proceeding. Approved repairs typically include paint (interior and exterior),

carpet, appliances, roofing and minor exterior repairs such as facia boards, eaves, gutters and

window replacements. No structural repairs allowed.

ServiSolutions

®

does not require prior approval of escrow hold backs. The lender must

maintain a copy of the escrow agreement and copies of work bid estimates. The escrow

agreement usually provides the list of repairs, cost of repairs, total price of the holdback (150%

of repair unless it is a HUD repo, then it is 110%) and who will hold/disburse the funds. Escrow

repairs must be completed prior to submittal of closed loan file to Master Servicer for purchase.

The Final Inspection report verifying repairs have been completed is required. More details are

available at: www.servsol.com.

The lender is responsible for ensuring that the borrower, property, and other aspects of the loan

meet the particular insurer and servicing guidelines of the loan type chosen.

4.7

Repurchase Conditions

The lender must repurchase from NCHFA or Master Servicer any NC 1

st

Home Advantage

Down Payment loan or NC Home Advantage loan upon the occurrence of any of the following

events:

1)

the loan closes before formal NCHFA written approval;

2)

the lender breaches any covenant, warranty or representation in the Mortgage

Origination Agreement or this Program Guide;

3)

the DPA is defective arising from the origination, closing or delivery of the DPA to the

Master Servicer;

4)

the DPA documents are not delivered in a timely manner or in the form described in the

Program Guide;

5)

the DPA does not conform to the terms of its commitment or approval as per the

Program Guide;

6)

any request by the Master Servicer to repurchase the related first mortgage loan; or

7)

the lender makes any warranty or representation under the Mortgage Origination

Agreement which, in the sole discretion of NCHFA or the Master Servicer, is

determined to be false at the time when made by the Lender. Such representations or

warranties include any fraud, material misrepresentation, or material act of omission

regarding information submitted for the DPA or related first mortgage, regardless of

whether the lender had knowledge thereof.

The repurchase of any DPA will be equal to the unpaid balance of the Note plus any interest,

attorney’s fees, legal expenses, court costs or other expenses that have been incurred by

NCHFA or the Master Servicer regarding the DPA.

27 | P a g e R e v 4 / 2 0 2 2

Loans that are not purchased by Master Servicer will not be reimbursed by NCHFA

under any circumstances, for the 1

st

or 2

nd

mortgage. This includes FHA loans.

4.8

Minimum Borrower Investment / Cash Back Limits

No minimum investment is required from the borrower. The AUS findings and industry

guidelines for loan type should be followed. Funds for down payment and closing may come

from the borrower’s funds, a gift, seller contribution to closing expenses, down payment

assistance or grant. The borrower(s) cannot receive funds back at closing that exceed

verified borrower-paid POCs and cannot exceed $2,500 regardless of amount

contributed, from any source. All DPA funds must be used for Down Payment or Closing

Expenses.

4.9

Assets

There is no maximum asset limitation for the borrower.

Per Fannie Mae, for the proceeds from a bitcoin or other digital currency exchange to be

considered as an eligible asset, it must be converted to US currency and deposited into an

eligible asset account. All Assets must be verified in accordance with B3-4.2-01, Verification

of Deposits and Assets.

4.10

Gift Funds

Gift funds are allowed and must meet the loan type (i.e., FHA, USDA, VA or conventional)

Agency guidelines. Conventional loans must also comply with any requirements of the private

mortgage insurance (PMI) company used. The maximum cash back regardless of investment

by borrower(s) is $2,500.

4.11

Lien Position Policy

At time of closing, NCHFA will NOT take a lower lien position on down payment assistance

loans against any other non-NCHFA subordinate loans from any source. The NCHFA DPA

must be in 2

nd

lien position. This includes loans with CPLP, which must also be in 2

nd

position.

IRS tax liens are not allowed.

All subordinate financing must meet all investor, GSE, and federal regulatory requirements.

4.12

Principal Reduction Policy

Master servicer does not allow recasting of loan amounts after closing. Excess funds or

investment from borrower after all closing costs are paid should be used to reduce the 1

st

mortgage loan amount before closing.

Maximum cash back at closing cannot exceed $2,500 and must be from verified POCs paid

onto the transaction by the borrower(s). Excess Borrower funds resulting from gift funds, or

verified Borrower POCs, EMD, or Due Diligence fee, may be applied as a principal reduction.

28 | P a g e R e v 4 / 2 0 2 2

To make the necessary changes at closing:

a. Do NOT change the Promissory Note

b. Amend the Closing Disclosure to reflect the amount of the Principal Reduction

c. Post Closing, after ServiSolutions has purchased the loan, send the amount of the

Principal Reduction to ServiSolutions at:

ServiSolutions

Data Validation

7460 Halcyon Pointe Dr, Ste 200 or PO Box 242967

Montgomery, AL 36227

4.13

Eligibility with Other DPA Options

The NC 1st Home Advantage Mortgage Down Payment is a special $8,000 DPA for first- time

home buyers or qualifying military veterans who meet all the guidelines established for IRS

bond funded mortgages as well as NC 1

st

Home Advantage guidelines. Targeted census tracts

are also eligible. The NC 1

st

Home Advantage Mortgage Down Payment $8,000 cannot be

combined with the MCC program or the 3% or 5% DPA options from NCHFA.

4.14

Down Payment Assistance (DPA) – General Guidelines

1)

NCHFA does not offer stand-alone subordinate liens. The DPA is not assumable.

2)

The DPA must be in compliance with all federal and state statutes, rules and regulations, as

amended from time to time including, but not limited to, RESPA and mortgage loan servicing

regulations, and secured by a residential second-lien mortgage against the borrower’s principal

residence located within the State.

3)

A separate Loan Estimate (LE) is required for the subordinate mortgage.

No attorney fees may be charged on the second mortgage (DPA).

Allowable fees on the 2

nd

mortgage are limited to:

a)

A Housing Counseling fee, if applicable

b)

A recording fee (cost to record at the register of deed’s office)

c)

Application fee, if applicable (subject to max fees cap)

There is no prescribed allowable amount for these fees per the CFPB under the Partial

Exemption rule, but they must be reasonable, normal and customary.

4)

DPA cannot be used to pay negative equity (meaning the property appraises for less than

the sales price), nor to pay extension fees, or to pay off debts, collections or judgements.

5)

The borrower may obtain subordinate financing from other sources that also meet FHA, VA,

USDA and conventional guidelines.

29 | P a g e R e v 4 / 2 0 2 2

6)

Gift funds are eligible as long as the loan type (i.e., FHA, USDA, VA or conventional)

allows them. Conventional loans must also comply with any requirements of the PMI company

used.

7)

DPA used on USDA or VA loans must meet VA or USDA’s program requirements. The

lender is responsible for verifying that rates and program meet VA/USDA guidelines

8)

DPA funds cannot be used for repairs or repair escrows.

9)

Lender is responsible for 2

nd

mortgage (DPA) until purchased by Master Servicer.

10)

Box 4b on the new URLA 1003 should list “NCHFA” as the Creditor.

4.15

Funding of the DPA by Participating Lender

The lender must fund the subordinate DPA mortgage at closing, except for CPLP subordinate

mortgages.

The subordinate DPA mortgage must be closed in NCHFA’s name and utilize NCHFA’s Deed

of Trust (Form 405) and Promissory Note (Form 406), available at www.nchfa.com.

The Master Servicer will purchase the first mortgage and NCHFA DPA from the lender after

the approval of the closed loan by the Master Servicer, with the exception of CPLP

subordinates which will be funded by NCHFA at closing. The Lender must use the

ServiSolutions checklist(s) for delivery.

Failure by Master Servicer to purchase a loan will result in lender retaining both the 1

st

and 2

nd

(if applicable) mortgage, with no recourse.

ServiSolutions requires a copy of the NCHFA Commitment to be included as part of the closing

package.

For FHA loans, at the time the lender obtains the Commitment Letter, the document will also

contain a Down Payment Assistance (DPA) Award Letter and a Legally Enforceable

Obligation Letter pursuant to HUD Mortgagee Letter 2013-14 and HUD Handbook 4000.1

II.A.4.d.ii.(C).

The lender must provide a copy of the Down Payment Assistance (DPA) Award Letter and the

Legally enforceable Obligation Letter executed by the borrower(s) in the FHA case binder as

well as the closed loan file electronically delivered to ServiSolutions.

4.16

Loan Terms and Fees

The first mortgage associated with the NC 1

st

Home Mortgage Down Payment must be locked

at the mortgage interest rate set daily Monday through Friday on the NCHFA

30 | P a g e R e v 4 / 2 0 2 2

website. Rates are subject to change daily.

The $8,000 DPA funds may be used toward eligible down payment, mortgage insurance and

closing expenses. The maximum allowed cash back cannot exceed $2,500 and must be from

verified POCs paid into transaction by borrower(s). The DPA cannot cover negative equity.

The $8,000 DPA has a fifteen-year term with a 0% interest rate. It is a non-recourse, deferred

loan, forgiven at 20% per year at the end of years 11-15. At the end of the fifteen years, the

note will be considered satisfied and NCHFA will release the lien securing the note. Please

note that the forgiveness schedule is annual, not monthly. Non-arm’s-length transactions must

follow industry guidelines.

The maximum Origination Fee is capped at 1% of the loan amount. Fees not directly paid

to a 3

rd

party are capped at $1,300. The 1% cap and $1,300 are shown in Section A of Loan

Estimate (LE). Example fees under the $1,300 cap in Section A of the LE are underwriting fee,

application fee, commitment fee, etc. These are capped at $1,300 max and must meet state or

federal high-cost guidelines. Total fees are 1% + $1,300 as appropriate.

All or a portion of the unforgiven loan funds are due and payable to NCHFA if the home is

sold, refinanced or no longer owner-occupied (unless otherwise prohibited under applicable

federal law). Loans are repayable from proceeds to borrower from a sale or refinance.

No subordinations are allowed on any NC Home Advantage down payment loans during

the first seven (7) years.

4.17

Subordination Policy for Refinances (DPA)

To be eligible for subordination on the down payment assistance (DPA) after year seven (7):

1)

The age of the NCHFA second mortgage must be at least 7 years old from the date of

closing (84 months).

2)

The refinance of the first mortgage must not allow any cash back to the borrower(s) except

for a refund of Paid Outside Closing (POC) items paid during the processing of the new

mortgage, such as an appraisal fee.

3)

The new first mortgage Principal and Interest (P&I) payment must be lower than the current

first mortgage P&I payment. Exception: Reduction in loan term from 30 years to 25 or

fewer years.

4)

The new first mortgage must be a fixed rate loan. (Credit union ARM loans may be

permitted).

5)

The subordination, if approved, will retain NCHFA’s lien position. If the current NCHFA

subordinate lien position is second, then the subordinated lien retains the second lien

position.

6)

Closing costs may be financed into the new loan if allowed by the new loan product. The

request for subordination will be denied if the sum of any Loan Origination Fee(s) and/or

Commitment fees exceeds 1% of the new first mortgage loan amount.

31 | P a g e R e v 4 / 2 0 2 2

7)

Subordinations will be allowed if the new first mortgage is a reverse mortgage.

8)

A non-refundable processing fee must be submitted with the subordination request

documents. The check must be payable to North Carolina Housing Finance Agency. No

personal checks allowed. Any changes made after NCHFA’s subordination approval will

require an additional non-refundable processing fee. (Note: No fee(s) will be charged if the

source of funding for the subordinate loan is HOME funds.)

9)

Requests should be emailed to: subordinations@nchfa.com

4.18

Special High-Needs Rural Closing Cost Assistance Options (Fannie Mae loans only)

1. For borrower(s) and properties that meet specific eligibility requirements, $2,000 in closing

cost assistance is available. Funds are provided by lender at closing as a LLPA credit and

will be reimbursed upon purchase of a valid, closed loan by our Master Servicer.

2. Funds can only be applied to eligible closing costs, not down payment. No monies can be

given as cash back at closing.

3. Purchases only; principal residence.

4. Cash back cannot exceed $2,500 and no portion of the LLPA Credit ($2,000) can be

reimbursed to borrower(s) at closing. Cash back cannot exceed cash contributed by

borrower, of their own funds

5. The program is time limited.

6. Only applies to Fannie Mae loans under 80% AMI and properties meeting the High-Needs

Rural census tract property eligibility.

7. The mortgaged property must be located in a rural census tract in a High-Needs Region as defined

by Fannie Mae under their High-Needs County and Rural Tracts designation.

8. Fannie Mae may request that Loans originated under this program be subject to additional

review under Fannie Mae’s or Master Servicer’s QC process.

9. Full program rules and details are provided under a separate Term Sheet. Email

[email protected] for complete details.

32 | P a g e R e v 4 / 2 0 2 2

Section 5: Borrower Eligibility Guidelines

___________________________________________________________________________________________________________________________________________________________

Lenders must review the borrower requirements in this section to assess the eligibility of mortgages to

be purchased in the program. Eligibility for the NC 1st Home Advantage Mortgage Down Payment

($8,000) may be different than other down payment programs offered by NCHFA.

The lender is responsible for ensuring the borrower's compliance with various program requirements,

including the income limit requirement.

5.1

Borrower Requirements

1)

Borrower(s) shall occupy the property as a principal residence within sixty (60) days

after loan closing

2)

Mortgagors, a spouse, and titleholders residing in the property must be first-time

homebuyers, certain military veterans, or purchasing subject property in targeted census

tracts.

(a.) Veterans Exception: The borrower is a veteran who purchases a home using the

proceeds under a one-time exception allowance. The veteran cannot own another

home at time of closing of the mortgage.

A veteran is defined as a person who served 181 consecutive days in active duty of

the United States Armed Forces or Reserves and who was discharged or released

under conditions other than dishonorable. The application for financing must occur

before the 25th anniversary of the last date on which the veteran left active service.

A DD214 showing an honorable discharge is the required documentation for

eligibility.

(b.) Targeted Census Tracts: Borrowers purchasing a home located in a targeted Census

Tract (Tract listed in the MCC section on our website) do not have to be FTHB.

They cannot own any other property at the time of closing.

(c.) Ownership of a mobile or manufactured home (new or existing) not on a permanent

foundation, and titled as personal property does not automatically exclude the

applicant from obtaining the NC 1

st

Home Advantage Mortgage. The lender must

show proof that the previous residence was not on a permanent foundation and was

not classified as real estate.

(d.) Ownership of rental property, or a 2

nd

home, or timeshare, may be allowed if the

borrower has not occupied the property as a primary residence within the last three

years. The borrower may have to furnish a verifiable rental address for the most

recent three-year period.

33 | P a g e R e v 4 / 2 0 2 2

(e.) Retained ownership in a property owned jointly with another person (as in a

separation or divorce) may be allowed as long as the borrower has not occupied the

property as a primary residence within the last three years. The borrower may have

to furnish a verifiable rental address for the most recent 3 year period.

3)

Co-signors or non-occupying borrowers not allowed.

4)

Citizens, permanent legal residents, and non-permanent legal residents of the United

States are eligible for NC Home Advantage Mortgage or NC 1

st

Home Advantage

Mortgage if they meet all residency requirements applicable to their lender and loan

type (i.e., conventional, FHA, VA, USDA). Due diligence for confirming citizenship

and/or residency status and compliance with federal and other requirements for

mortgage loan financing for borrowers is the responsibility of the lender.

5)

Pre-purchase education is required for first-time homebuyers. Certificate is valid for 1-

year. Must meet the underlying loan-type guidelines.

5.2

Pre-Purchase Education Requirement for First-Time Homebuyers

Pre-purchase education is required for first-time homebuyers (only one borrower is required to

take the training; follow GSE requirements by loan type). The lender should upload the pre-

purchase education certificate to NCHFA prior to issuance of NCHFA’s Commitment. FHA,

HUD, or Freddie Mac approved on-line or in-person pre-purchase education programs are

acceptable. Per Fannie Mae Selling Guide Part B2-2-06, conventional loans require the

homeownership education course or counseling meet standards defined by HUD or the

National Industry Standards for Homeownership Education and Counseling.

For homebuyers who complete pre-purchase counseling which is one-on-one completed with

a HUD approved agency prior to the time an Offer to Purchase is signed, the lender must use

SFC 184 and provide Fannie Mae Form 1017 signed by the borrower(s) and the lender at the

time of loan submission to NCHFA. Certificate is valid for 1 year after date of completion.

CPLP loans require in-person training.

5.3

Income Limits

Borrower(s) must meet program income limits, and lenders must calculate income using

the procedures outlined in this section.

The NC 1

st

Home Advantage Down Payment program counts total, gross family income of

all mortgagors and a spouse (and anyone expected to or anticipated to live in the house and

hold an ownership interest).

Income limits vary by county and household size for the NC 1

st

Home Advantage Down

Payment™ product. Income limits are subject to change. See Section 8 for full details on

calculating total, gross family income. Current income limits can be found on the NCHFA

website at www.nchfa.com or via OLS at www.nchfa.org/OLS/login.aspx.

34 | P a g e R e v 4 / 2 0 2 2

The last three years of IRS Tax Transcripts or valid, signed tax returns are required for NC

1

st

Home Advantage Down Payment loan approval. ServiSolutions may require the most

recent year’s transcripts for all borrowers for post-closing audits.

Lender must download the ServiSolutions funding checklist located at www.servsol.com.

In addition to tax documents, a tri-merged credit report is also required on all

mortgagors/spouse.

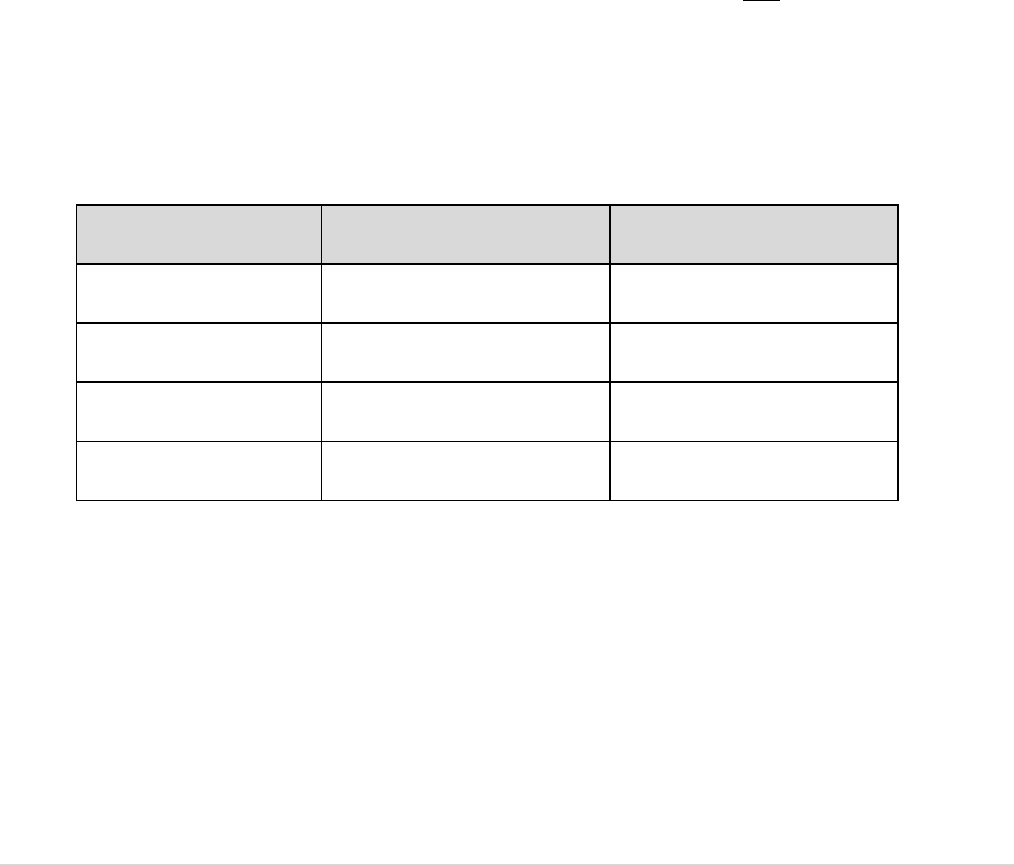

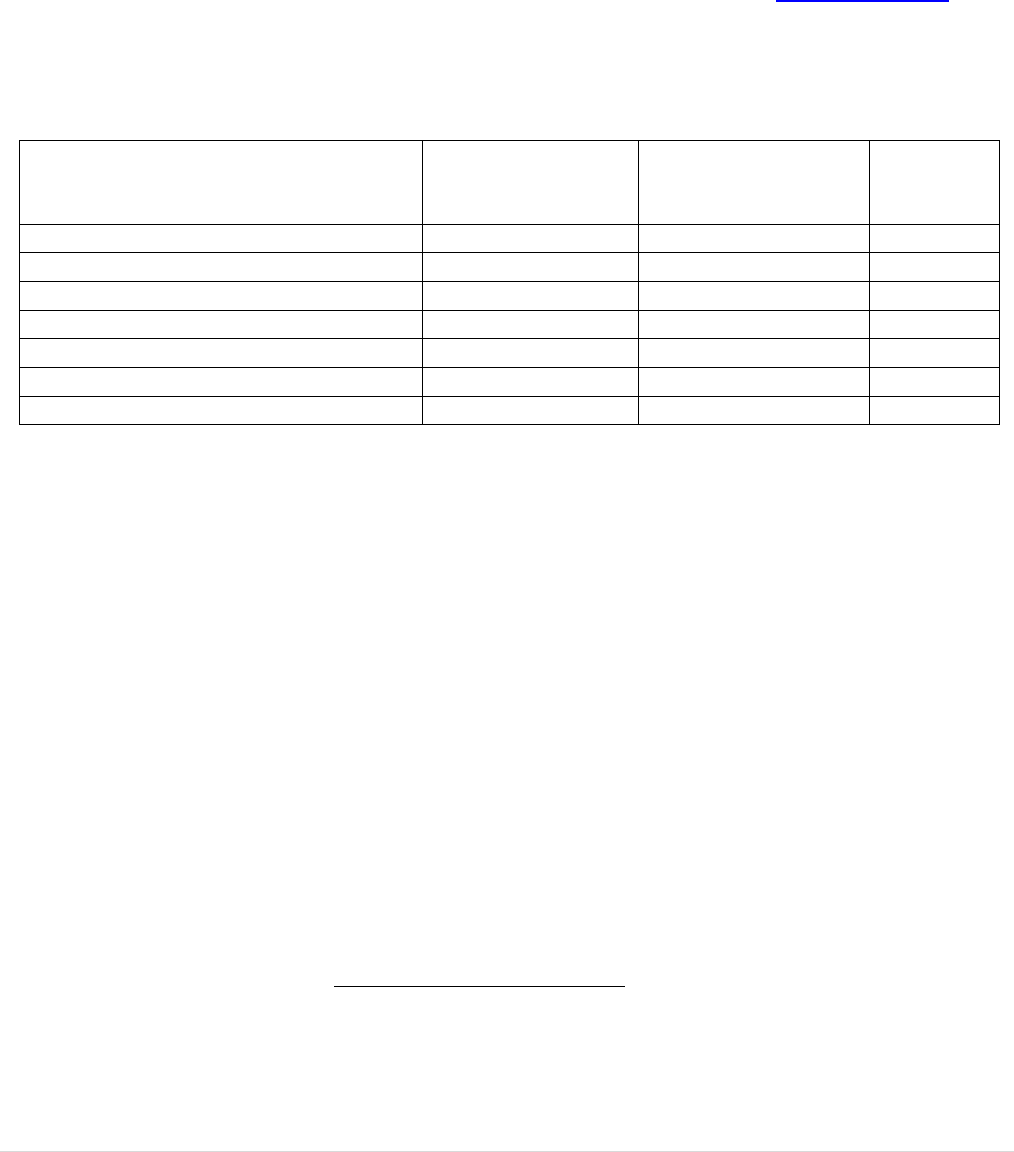

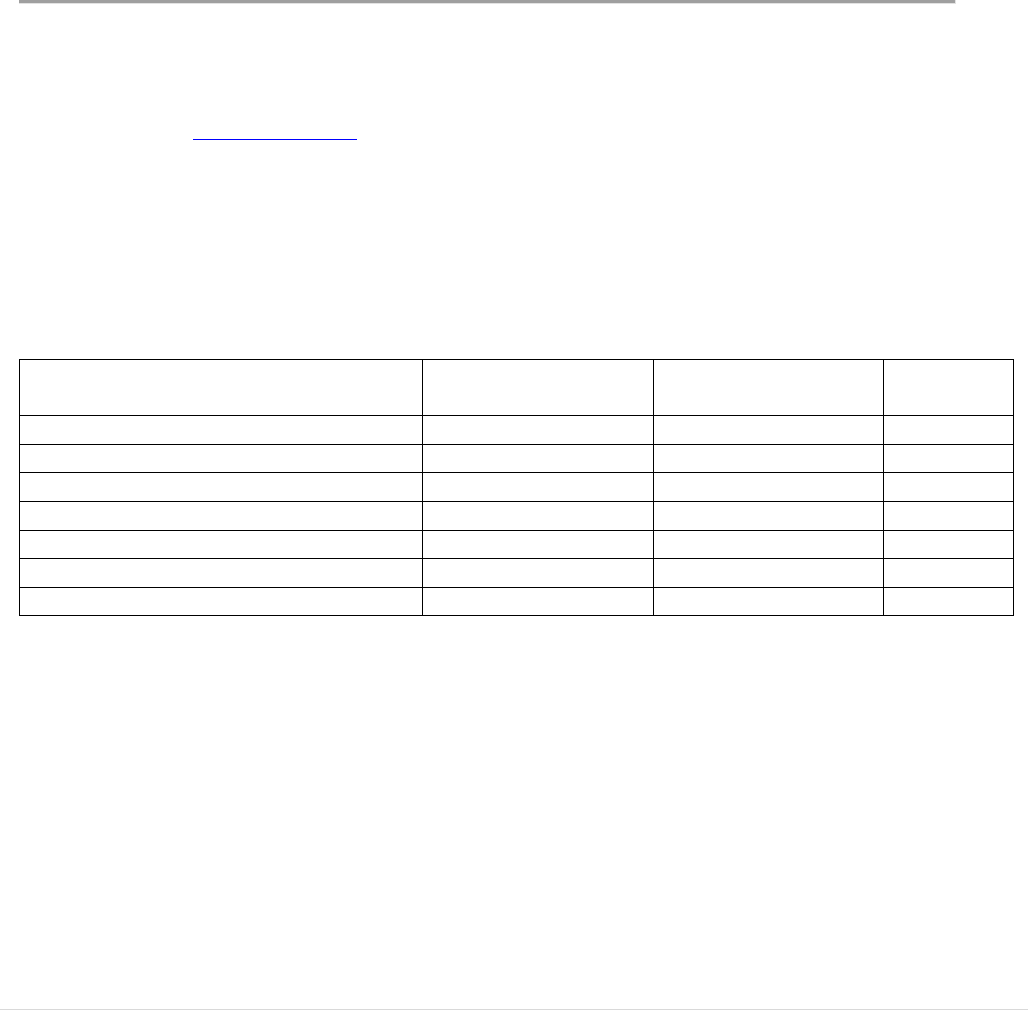

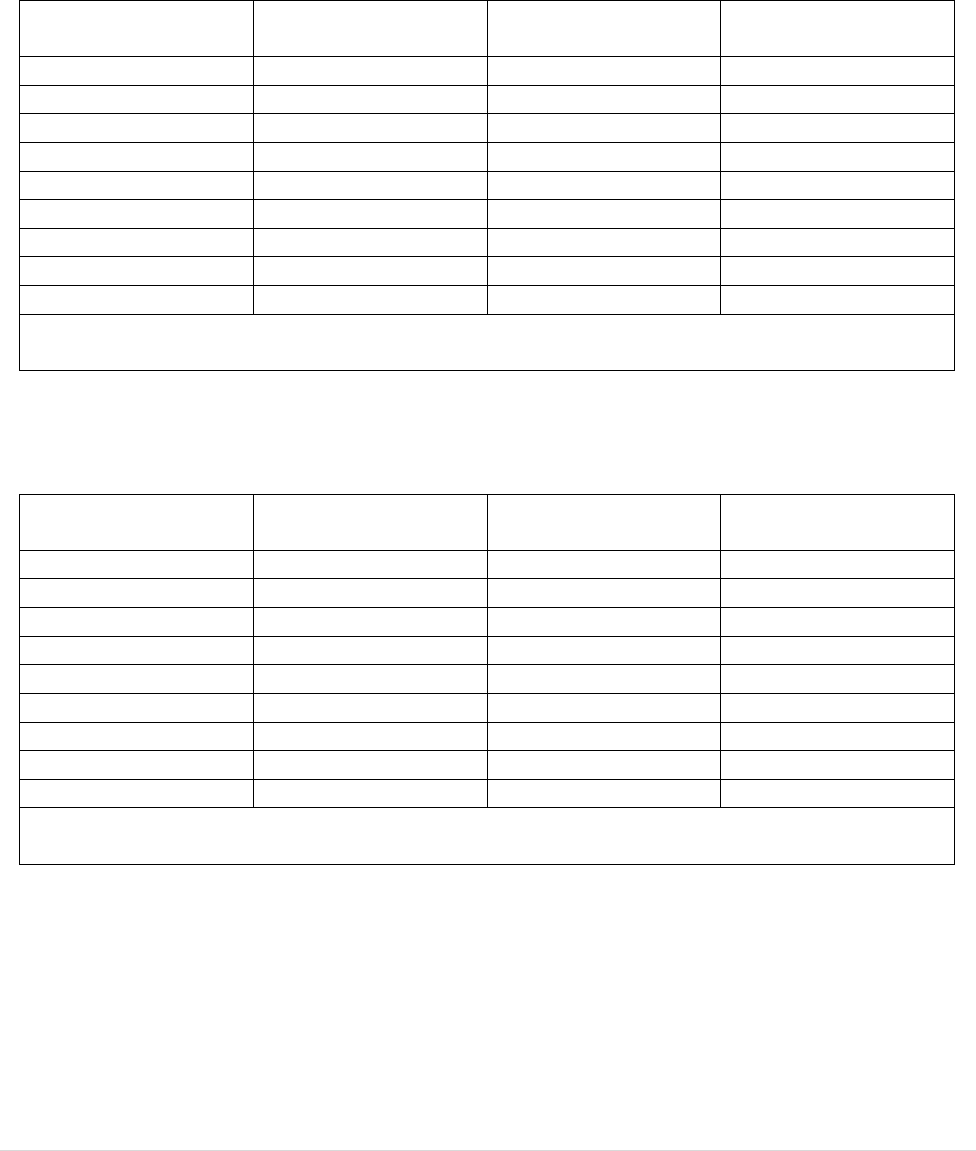

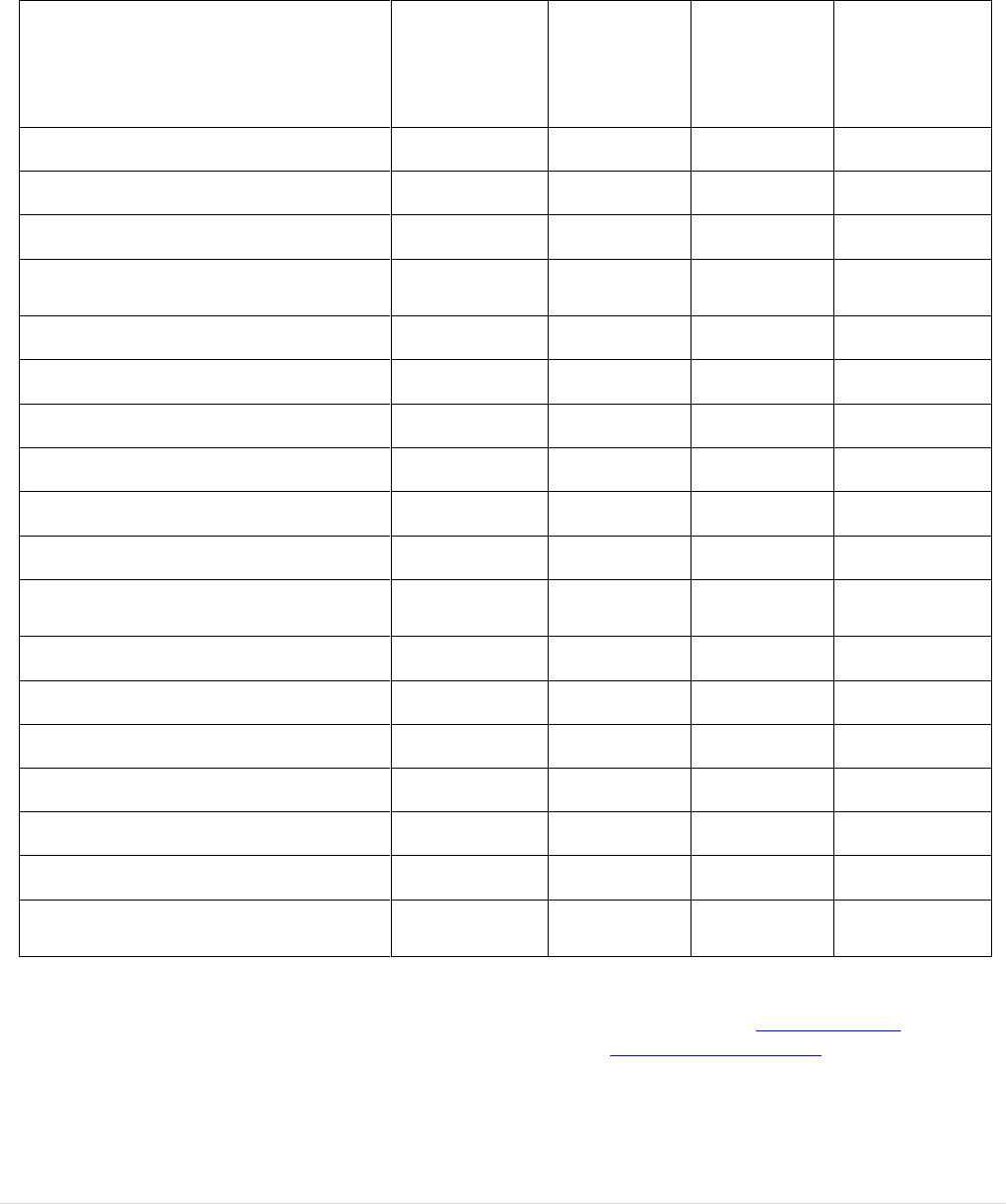

Table 1: Family Income Chart (Whose Income is Counted?)

Category of Borrower/Titleholder

Income Counted?

Income Documents

Required/Tax

Return

FTHB?

Borrower

Yes

Yes

Yes

Co-Borrower

Yes

Yes

Yes

Spouse

Yes

Yes

Yes

Someone Secondarily Liable, Occupant

Yes

Yes

Yes

Titleholder, Occupant

Yes

Yes

Yes

Titleholder, Non-Occupant

No

No

No

Adult Occupant only

No

No

No

5.4

Section 8 Vouchers

When using a Section 8 Voucher, the lender must verify that the underlying income calculation

meets all GSE guidelines. The Servicer will not accept split payments, meaning that the customer

is solely responsible for submitting the full mortgage payment when due. (The non-profit or local

issuer of the voucher cannot send in the partial payment to the Servicer.)

5.5

Ratios

The maximum debt-to-income ratio for all loan types with or without down payment assistance

is 45.0%. These ratio maximums apply to all NC 1

st

Home Advantage Down Payment loans

regardless of the AUS recommendation. There is no front ratio limit at this time, but you must

follow the industry guidelines for the loan type.

5.6

Credit Score Requirements

All loans must receive an AUS Approve/Eligible credit recommendation (DU/GUS/FHA Total

Scorecard. LPA allowed on Freddie Mac conventional, FHA/VA only). In addition, all

borrower(s) must have a minimum of two credit scores, the lowest or mid-score being 640 or

higher (660 if manufactured home type). Both borrower and co-borrower must meet credit score

minimum thresholds, including any GNMA, FNMA or MI company minimum credit scores, if

applicable.