PROMOTIONAL PLAY

PRESENTATION

MASSACHUSETTS GAMING COMMISSION

DECEMBER 12, 2022

1 | MASSACHUSETTS GAMING COMMISSION

What is promotional play or free play?

Promotional Play or Free Play –

Is a way a casino or online operator can invite a

known player to return or a new player to sign-up

or create an account. It takes one of many forms of

credits toward playing a slot machine, table game,

or sports wager. In order to use it a player must

wager it and if won it turns into real money from

cashing out or it is placed into their account.

2 | MASSACHUSETTS GAMING COMMISSION

Why is it used by operators?

An operator uses promotions to ensure customers are aware

of the operator's existence in a competitive market place as

well as to achieve the following:

-Increase brand awareness

-Provide appropriate information

-Increase Customer Traffic

-Build sales and profits

Promotions also help operators to introduce products easily

in the ever-so-competitive market.

3 | MASSACHUSETTS GAMING

COMMISSION

Recent offers found in the Sports Wagering realm

Use promo code

WIN aNd receIve a

$1,000 deposIt

boNUs.

Bet $5 get $200

$1,500

bonus for

World Cup

4 | MASSACHUSETTS GAMING COMMISSION

A&K Legal Presentation

5 | MASSACHUSETTS GAMING COMMISSION

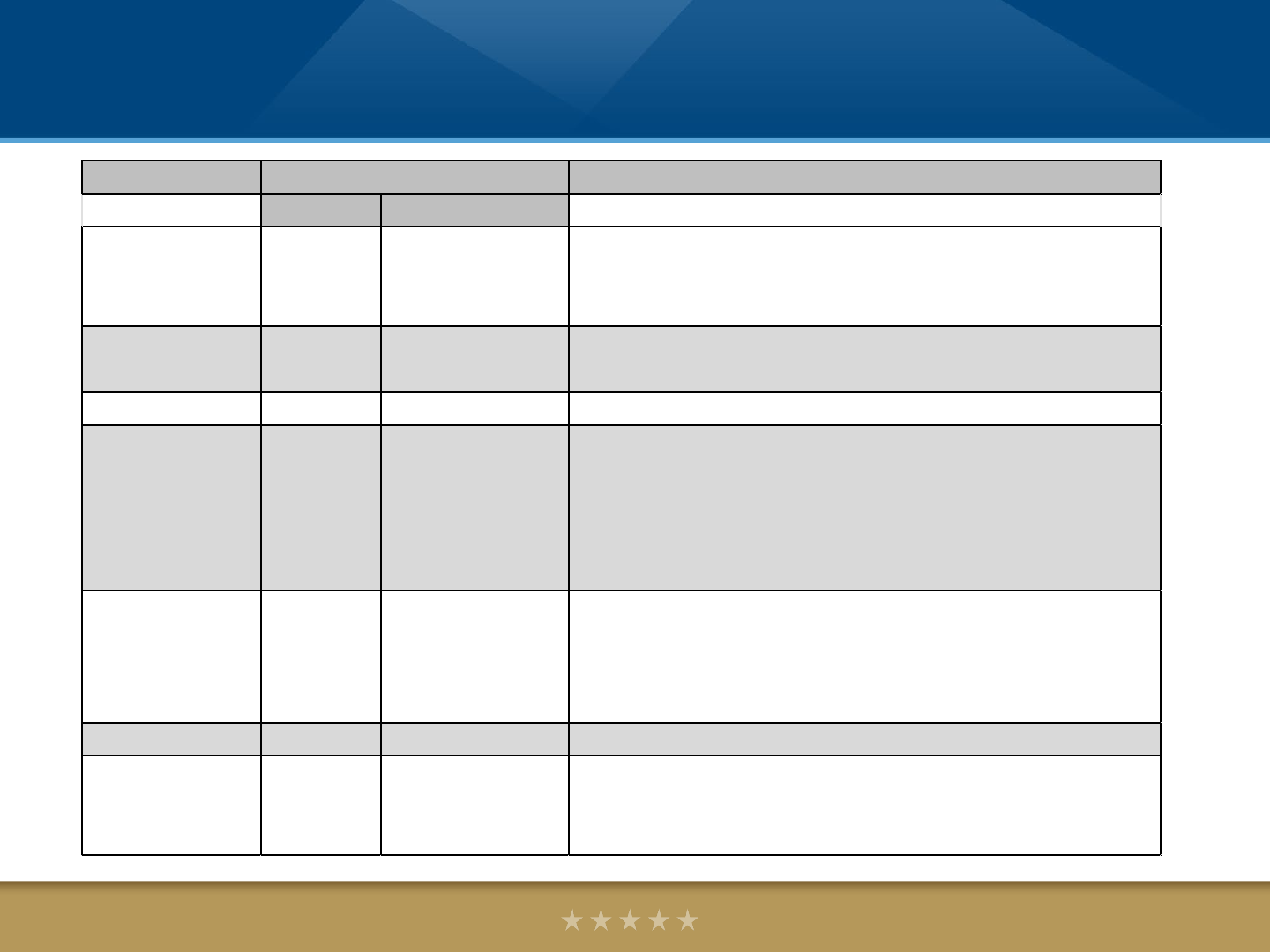

July 2021 - Colorado, Pennsylvania, Michigan, and Virginia stood

out as the few that allowed licensees to adjust their revenue by

deducting unlimited free play and promotional bets from their

taxable base. This has since changed in Colorado and Virginia.

States that allow and don’t allow promotional bets to be deducted from the taxable win.

MONTH AND

YEAR

NUMBER OF STATES

WITH COMMERCIAL

SPORTS BETTING

NUMBER OF STATES THAT

ALLOW UNTAXED

PROMOTIONAL CREDITS

GAMING GROSS REVENUE (GGR)

ADJUSTED GROSS REVENUE

(AGR)

DIFFERENCE IN

DOLLARS (GGR-AGR)

Feb-22 26 9 $387,507,164 $262,989,268 $124,517,896

Dec-21 26 8 $375,176,988 $259,156,688 $116,020,300

Oct-21 24 8 $446,890,754 $334,338,789 $112,551,965

34.6%

6 | MASSACHUSETTS GAMING COMMISSION

State

Allow Promo deduction or %

Retail Online

Arizona

8.0%

10.0%

Are allowed to deduct up to 20% of their revenue for

promotions such as "free bets" in the first two years they

are open.

Colorado

10.0% 10.0%

At first allow total deduction. Now they are tiering it

down to eventually 1.75% of their monthly handle

Michigan

8.4% 8.4% Can deduct all

New Jersey

8.5% 13.0%

A4002 specifies that promotional credits for land-based

sportsbooks can only be deducted for betting credits in

excess of $8 million each year. For online books, the tax

break kicks in after $12 million in gaming credits are

issued.

New York

Falls under

casino's

tax rate

51%

No deduction allowed

Pennsylvania

36% 36% Can deduct all promotional play and bonuses

Virginia

15% 15%

Started with full deduction of promo. Passed law in July

2022 to stop all deductions from the tax responsibilities.

Tax Rate

7 | MASSACHUSETTS GAMING COMMISSION

Colorado collected just $6.6 million in its first full year of legal

sports betting, equivalent to a 4% net tax rate. (From the previous

slide Colorado’s tax rate is 10%)

For comparison, New York generated more than $216

million in tax revenue from sports betting in just four months.

An operator said this equals a more than 100% net tax rate.

https://www.legalsportsreport.com/70580/no-

more-tax-breaks-colorado-sports-betting-

promos/#:~:text=Per%20the%20bill%2C%20tax%20

write,be%20deducted%20as%20free%20bets.

A Change for Colorado

8 | MASSACHUSETTS GAMING COMMISSION

Per the bill, tax write-offs for promo spend will be phased out gradually:

•From January 1, 2023 through June 30 2024, up to 2.5% of an

operator’s monthly sports betting handle can be deducted as free bets.

•Declines to 2.25% from July 1, 2024 through June 30, 2025.

•Declines to 2% from July 1, 2025 through June 30, 2026.

•Finally, from July 1, 2026 onward, 1.75% of an operator’s monthly

handle can be deducted as free bets.

The new policy licensees in Colorado must follow

9 | MASSACHUSETTS GAMING COMMISSION

Options for Regulating Promotional Play

Included in Gross Sports Wagering Receipts and Not Deducted for Taxation:

• Maximizes Tax Revenue

• Minimizes Profit of Operators

• Not Consistent with Treatment of Promotional Play with Other Tax

Applications

Excluded from the Gross Sports Wagering Receipts, and Deduction for

Taxation:

• Maximizes Operator Profits

• Potential to Create a Perverse Incentive to Minimize Taxes

• Closer Treatment to Corporate Tax Structure

Partial Exclusion From the Gross Sports Wagering Receipts and Partially

Deducted for Taxation:

• A Tool Other Jurisdictions are Utilizing

• Attempts to Balance Operator Profits with Tax Receipts

• Eliminates any Potential Perverse Incentive to Minimize Taxes

10 | MASSACHUSETTS GAMING COMMISSION

c. 23N Statutorily Defined Terms

Adjusted Gross Fantasy Wagering Receipts:

The total gross receipts from fantasy contests as defined in section 11M1/2 of

chapter 12, less only the total of all cash prizes paid to participants in the fantasy

contests; provided, however, that the total of all cash prizes paid to participants

shall not include the cash equivalent of any merchandise or thing of value

awarded as a prize.

Adjusted Gross Sports Wagering Receipts:

The total gross receipts from sports wagering less the sum of: (i) the total of all

winnings paid to participants; and (ii) all excise taxes paid pursuant to federal

law; provided, however, that the total of all winnings paid to participants shall not

include the cash equivalent of any merchandise or thing of value awarded as a

prize.

Promotional Gaming Credit:

A sports wagering credit or other item issued by an operator to a patron to enable

the placement of a sports wager.

11 | MASSACHUSETTS GAMING COMMISSION

Taxation Formulas of Options for Promotional Play

Adjusted Gross Sports Wagering Receipts:

(Gross Sports Wagering Receipts) – (Payouts to Players) – (Federal Excise Tax)

Included in Gross Sports Wagering Receipts and Not Deducted for Taxation:

• Gross Sports Wagering Receipts = (Player Funded Bets) + (Promotional Funded Bets)

• AGSWR = ((Player Funded Bets) + (Promotional Funded Bets)) – (Payouts to Players) –

(Federal Excise Tax)

Excluded from the Gross Sports Wagering Receipts, and Deduction for Taxation:

• Gross Sports Wagering Receipts = (Player Funded Bets) + (Promotional Funded Bets) –

(Promotional Funded Bets)

• AGSWR= ((Player Funded Bets) + (Promotional Funded Bets) – (Promotional Funded Bets)) -

(Payouts to Players) – (Federal Excise Tax)

Partial Exclusion From the Gross Sports Wagering Receipts and Partially Deducted for

Taxation:

• Gross Sports Wagering Receipts = (Player Funded Bets) + (Promotional Funded Bets) – (%

of Handle)

• AGSWR= ((Player Funded Bets) + (Promotional Funded Bets) – (% of Handle)) - (Payouts to

Players) – (Federal Excise Tax)

12 | MASSACHUSETTS GAMING COMMISSION

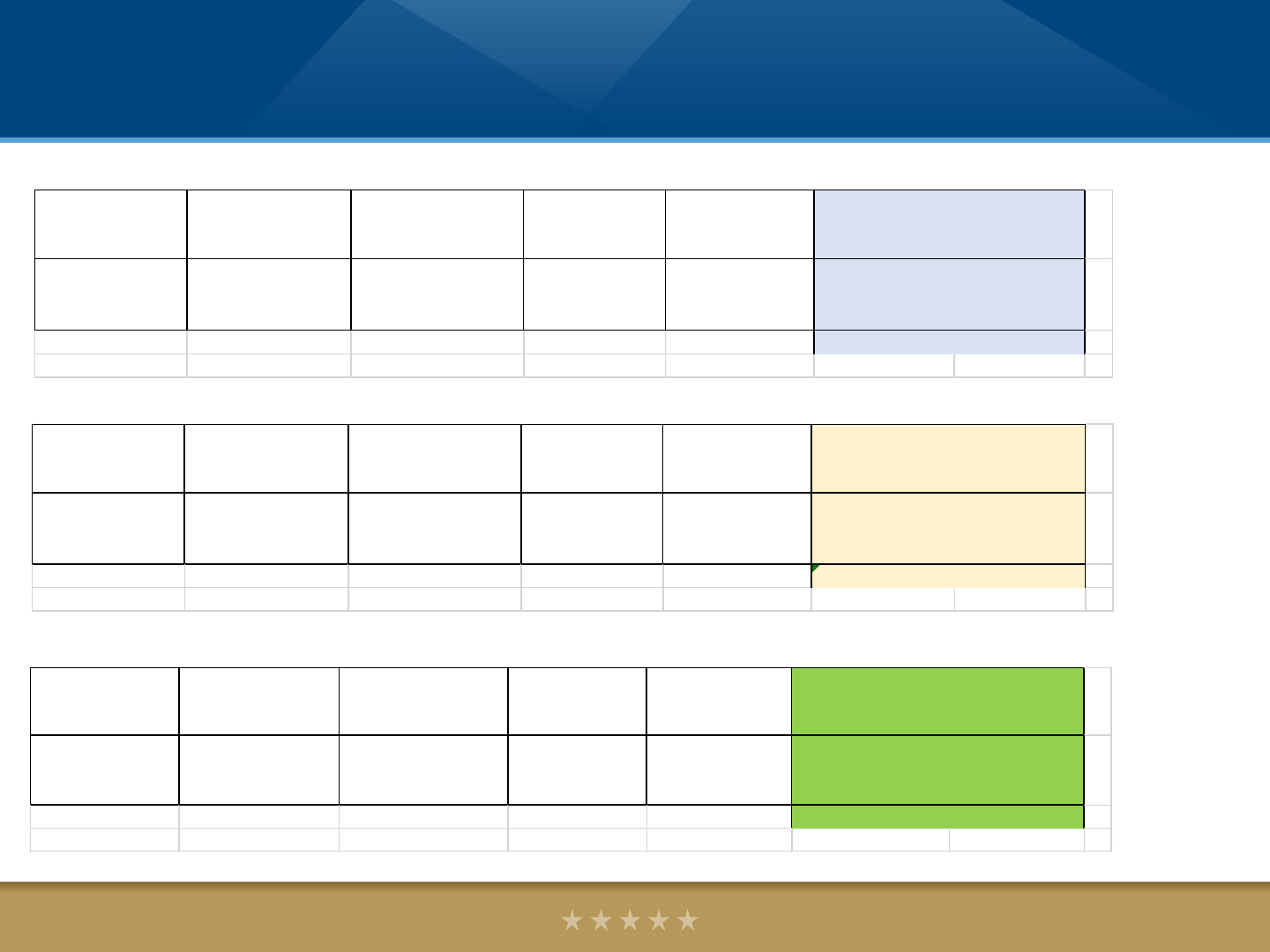

Promotional Play Scenarios (For Discussion Only)

Assumptions for Scenarios of How Treatment of Promotional Play Impacts

Taxes

• Handle = $1,000,000,000

• Player Bets = $960,000,000

• Promotional Bets = $40,000,000 (4% of Handle)

• Hold = $60,000,000 (6% of Handle)

• Partial Deduction for Promotional Play for Taxation Scenario is up to

2.5% of Handle

• Tax Rate of 20% (equal to mobile and digital operators)

13 | MASSACHUSETTS GAMING COMMISSION

Revenue

Coupons/

Promotional

Handle (player +

promo)

Payouts Hold

Player Bet Promo Bet Total Bet Player Win Hold

Taxable Base Taxes

960,000,000.00 40,000,000.00 1,000,000,000.00 940,000,000.00 60,000,000.00 20,000,000.00

4,000,000.00

96.000% 4.000% 94.000% 6.000%

With Promotional Play Deducted

(Total Bet-Promo-Player Win)

Revenue

Coupons/

Promotional

Handle (player +

promo)

Payouts Hold

Player Bet Promo Bet Total Bet Player Win Hold Taxable Base Taxes

960,000,000.00 40,000,000.00 1,000,000,000.00 940,000,000.00 60,000,000.00 35,000,000.00 7,000,000.00

96.000% 4.000% 94.000% 6.000%

With Partial Promotional Play

Deducted

(Total Bet-2.5% of Handle-Player Win)

Revenue

Coupons/

Promotional

Handle (player +

promo)

Payouts

Hold

Player Bet Promo Bet Total Bet

Player Win Hold

Taxable Base Taxes

960,000,000.00 40,000,000.00 1,000,000,000.00 940,000,000.00 60,000,000.00

60,000,000.00 12,000,000.00

96.000% 4.000%

94.000% 6.000%

Without Promotional Play

Deducted

(Total Bet-Player Win)

Scenario 1: Promo Not Deducted

Scenario 2: Promo Fully Deducted

Scenario 3: Promo Deducted up to 2.5% of Handle

Promotional Play Scenarios (For Discussion Only)

14 | MASSACHUSETTS GAMING COMMISSION

Interactive Promotional Play Demonstration

• Demonstrate the Discussion Around Promotional Play

Minimizing or Eliminating Taxes.

• Demonstrate the Impact of a Theoretical Multiplier for Use of

Promotional Play to the Tax Base.

15 | MASSACHUSETTS GAMING COMMISSION

Carry Forward of Negative AGSWR

c. 23N Section 14b (4) allows an operator to carry negative amounts of

Adjusted Gross Sports Wagering Receipts to subsequent months for purposes

of calculating taxes:

(4) When an operator’s adjusted gross sports wagering receipts for a

month is a negative number because the winnings paid to wagerers and

excise taxes paid pursuant to federal law exceed the operator’s total gross

receipts from sports wagering, the commission shall allow the operator to

carry over the negative amount to returns filed for subsequent months. The

negative amount of adjusted gross sports wagering receipts shall not be

carried back to an earlier month and taxes previously received by the

commission shall not be refunded unless the operator surrenders its license

and the operator’s last return reported negative adjusted gross sports

wagering receipts.