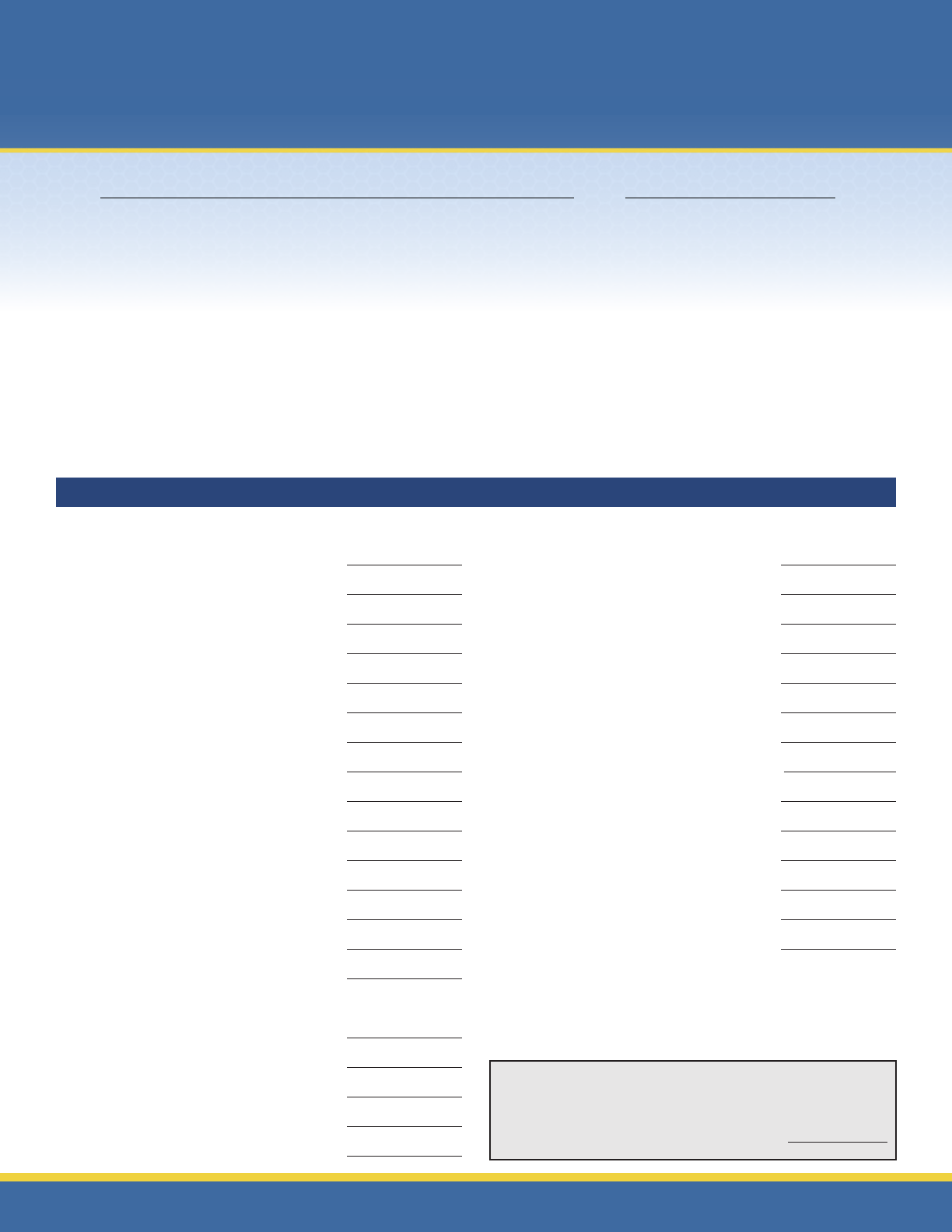

Financial Planning Worksheet

for Career Transition

STATEMENT OF NET WORTH

ASSETS (Total Value)

Cash on hand $

Checking Accounts $

Savings Accounts $

Certicates of Deposit $

Cash Value of Life Insurance $

U.S. Savings Bonds $

Mutual Funds/Money Market $

Stocks/Bonds $

College Funds $

401(k)/403(b)/TSP $

Other (IRAs, etc.) $

Real Estate (Market Value) $

Home $

Rental Property $

Other (Vac Home/Trailer/Time Share) $

Personal Property

Vehicles/Motorcycles/Boats $

Furniture $

Jewelry $

Other (Collectibles, etc.) $

TOTAL ASSETS $

LIABILITIES (Total Balance Due)

Signature Loans $

Auto Loans or Leases $

Consolidation Loans $

Student Loans $

Military Exchange Credit Cards $

Department Store Credit Cards $

Other Credit Cards $

Aid Organization Loans (NMCRS ACS, AFAS, etc.) $

Other (Friends, Relatives, etc.) $

Advance/Over Payments $

Mortgage (Home) $

Home Equity Line of Credit (HELOC) $

Mortgage (Rental Property) $

TOTAL LIABILITIES $

NET WORTH

Total Assets – Total Liabilities $

Name: Date:

You’ll need the following items to fully prepare this worksheet:

P Current LES (http://mypay.dfas.mil)

P Other paycheck stubs or a listing of other sources of income

P Current Credit Report (www.annualcreditreport.com)

P Listing of current living expenses (mortgage or rent amount, food,

childcare, entertainment, personal care, subscriptions, etc.)

P Current bank and mortgage statements

P Investment and retirement account statements

P Pencil and Calculator

P Current Bills (Monthly Amount and Total Balances Due)

O Utility Bills

O Phone Bills (Home/Cell)

O Cable/Satellite

O Internet

O Credit cards

O Car loans

O Insurance payments

O Personal loans

O Student loans

O Other debts

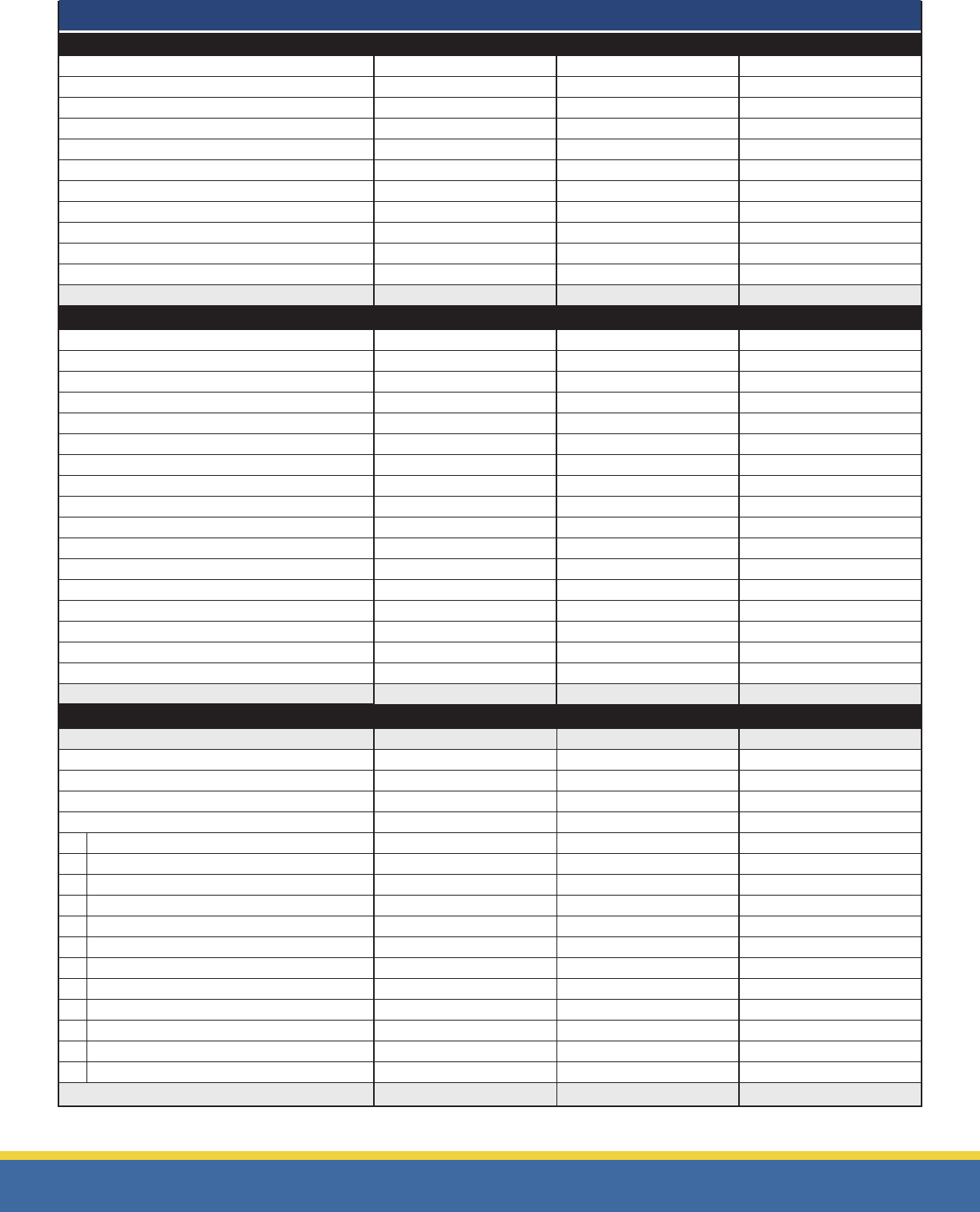

*Note: Pay Entitlements are taxable. Allowance Entitlements are non-taxable.

MONTHLY INCOME

ENTITLEMENTS ACTUAL PROJECTED 1 PROJECTED 2

*

Base Pay

Basic Allowance for Housing

Overseas Housing Allowance

Basic Allowance for Subsistence (BAS)

Family Separation Allowance (FSA)

*

Special Pay

*

Special Pay

*

Special Pay

*

Special Pay

*Other Taxable Pay

Other Non-taxable Pay (allowance)

TOTAL MILITARY COMPENSATION (

A)

DEDUCTIONS ACTUAL PROJECTED 1 PROJECTED 2

ALLOTMENT

ALLOTMENT

ALLOTMENT

ALLOTMENT

ALLOTMENT

Family SGLI (For Spouses)

Servicemembers’ Group Life Insurance (SGLI)

Uniform Services TSP

MGIB

FITW Filing Status Actual

FICA (Social Security)

FICA (Medicare)

State Income Tax

AFRH (Armed Forces Retirement Home)

TRICARE Dental Plan (TDP)

Advance Payments

Overpayments

TOTAL DEDUCTIONS (B) $ $

CALCULATE NET INCOME ACTUAL PROJECTED 2 PROJECTED 2

Service Member’s Take Home Pay (A-B) $ $

Service Member’s Other Earnings (less taxes)

Spouse’s Earnings (less taxes)

Child Support/Alimony (Received/Income)

Other Income (e.g., SSI, Rental Income)

ALLOTMENT

ALLOTMENT

ALLOTMENT

ALLOTMENT

ALLOTMENT

Family SGLI (For Spouses)

Servicemembers' Group Life Insurance (SGLI)

Uniform Services TSP

MGIB

TRICARE Dental Plan (TDP)

Advance Payments

Overpayments

MONTHLY NET INCOME

$ $ $

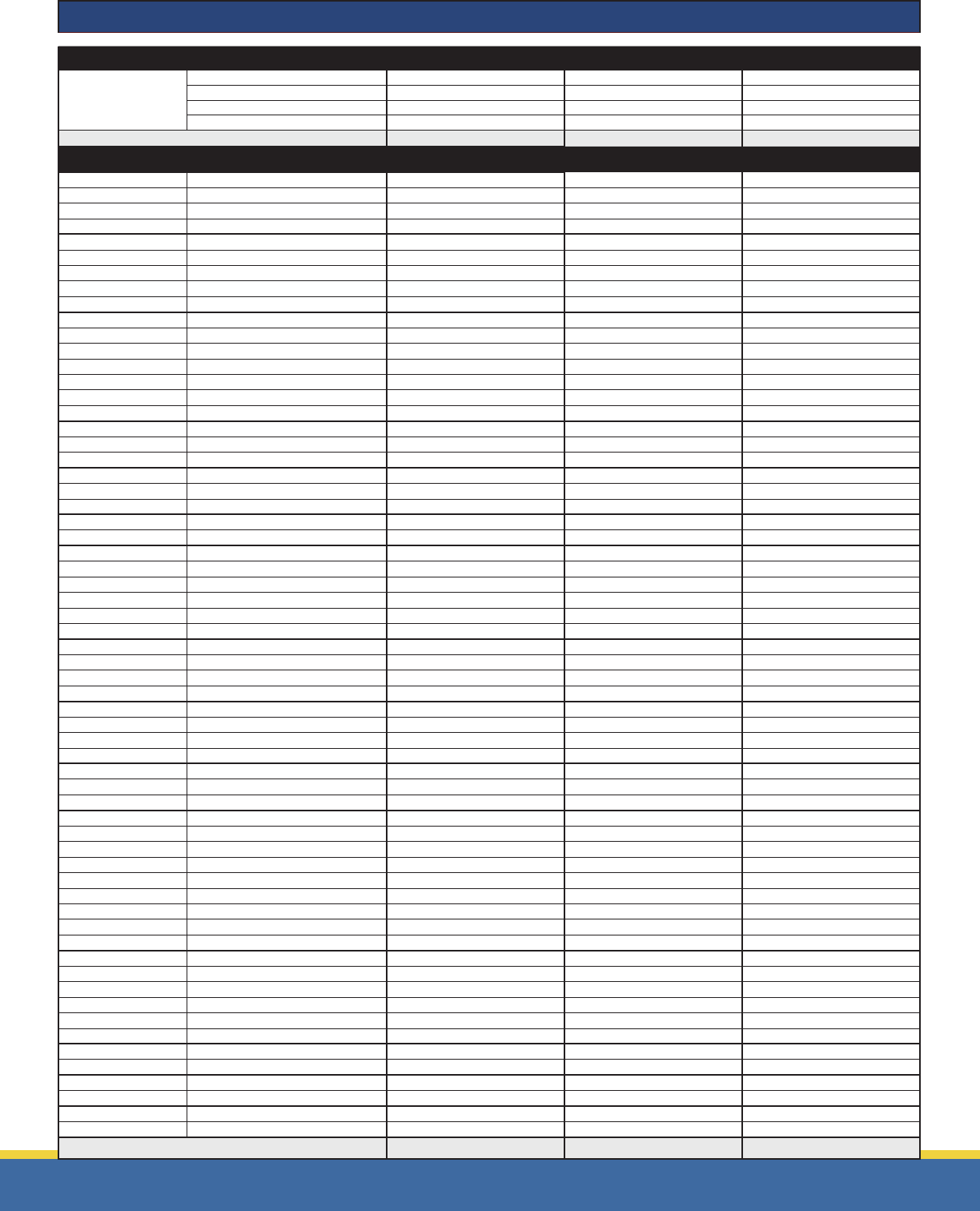

MONTHLY SAVINGS AND LIVING EXPENSES

SAVINGS ACTUAL PROJECTED 1 PROJECTED 2

Emergency Fund (1-3 months)

Reserve Fund

"Goal-Getter" Fund

Investments/IRAs/TSP/etc.

TOTAL SAVINGS AND INVESTMENTS

$ $

LIVING EXPENSES ACTUAL PROJECTED 1 PROJECTED 2

HOUSING

Furnishings

Maintenance/Repairs

Mortgage/Rent

Taxes/Fees

FOOD

Dining Out

Groceries

Lunches

Vending Machines

Meal Deductions from military pay

UTILITIES

Cable/Satellite TV

Cellular/Pagers/Phone Cards

Electricity

Internet Service

Natural Gas/Propane

Telephone

Water/Garbage/Sewage

CHILD CARE

Allowances

Daycare

Child Support/Other Dependent Care

AUTOMOBILE

Gasoline

Maintenance/Repairs

Other

CLOTHING

Laundry/Dry Cleaning

Purchases ($50 monthly per person)

INSURANCE

Automobile

Health

Life

Homeowners/Renters

SGLI/FSGLI

Dental Insurance

HEALTHCARE

Dental Expenses

Eye Care

Hospital/Physician

Prescriptions

EDUCATION

Books

Fees (Other/Room & Board)

Tuition

MGIB

CONTRIBUTIONS

Charities

Club Dues/Association Fees

Religious

LEISURE

Athletic Events/Sporting Goods

Books/Magazines

Computer Products (Software/Hardware)

DVD/VHS & Video Games Rentals

DVD’s & CD’s

Entertainment

Lessons

Toys & Games

Travel/Lodging

PERSONAL

Beauty Shop/Nails

Barber Shop

Cigarettes/Other Tobacco

Vending Machines

Liquor/Beer/Wine

Other (Toiletries, Supplements, etc.)

GIFTS

Holidays

Birthdays/Anniversaries

PET CARE

Food/Supplies

Veterinarian/Service (Boarding/Grooming)

MISCELLANEOUS

ATM Fees/Stamps/etc.

Other

TOTAL MONTHLY LIVING EXPENSES

$ $ $

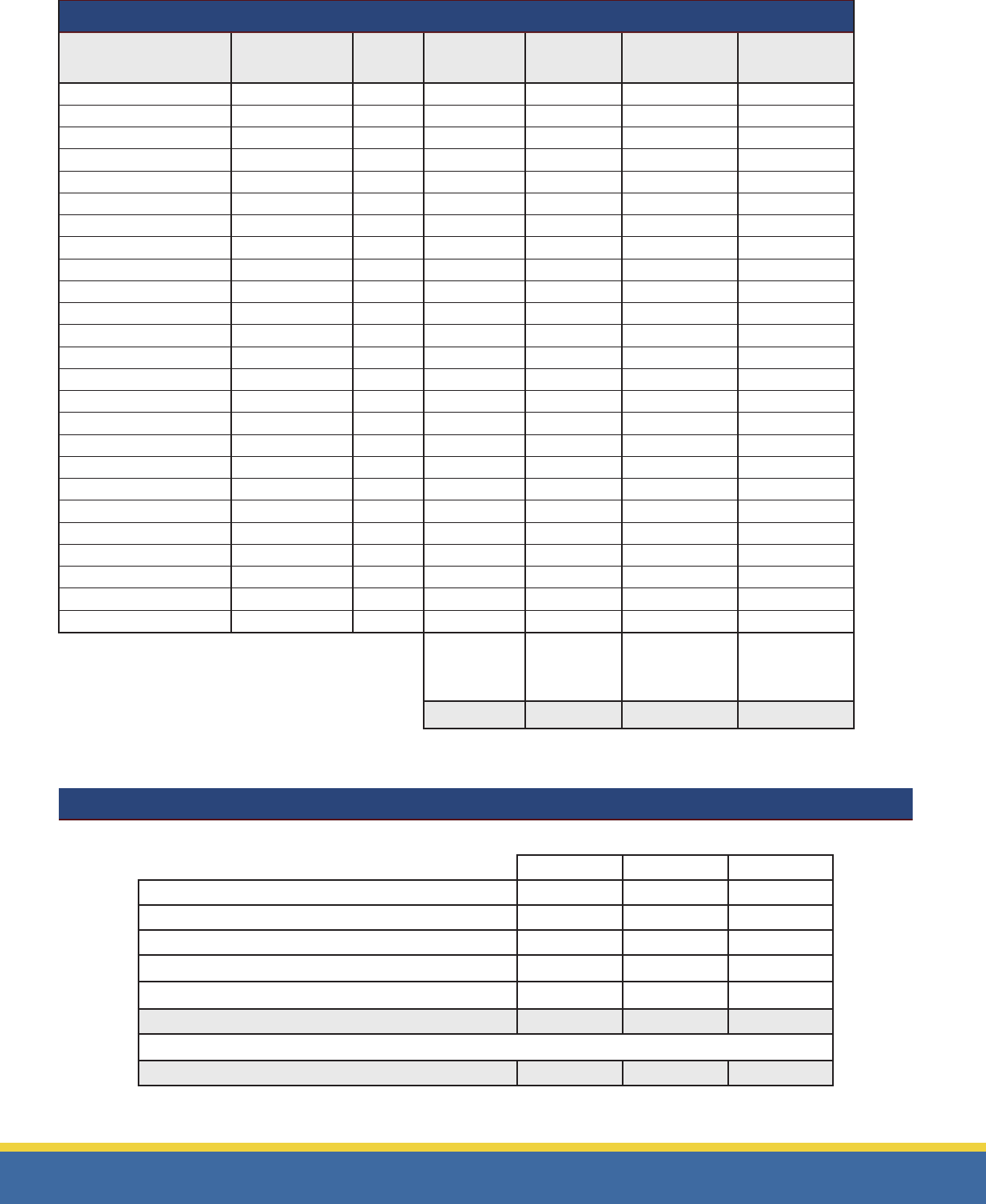

SUMMARY

ACTUAL PROJECTED 1 PROJECTED 2

NET INCOME (Bottom of Page 2)

SAVINGS & INVESTMENTS (Page 3)

–

LIVING EXPENSES (Page 3)

–

AMOUNT LEFT TO PAY DEBTS

=

TOTAL MONTHLY DEBT PAYMENTS (Page 4)

–

SURPLUS OR DEFICIT

=

DEBT-TO-INCOME RATIO

(Total Monthly Debt Payments ÷ Net Income x 100 = Debt-to-Income Ratio)

INDEBTEDNESS

CREDITOR

PURPOSE APR %

BALANCE

(From Page

One)

CURRENT

MONTHLY

PAYMENT

PROJECTED 1 PROJECTED 2

1. US Govt. Advance Pay

2. US Govt. Over Payments

3.

4.

5.

6.

7.

8.

8.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

TOTAL

ACTION PLAN

INCREASE INCOME

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

DECREASE LIVING EXPENSES

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

DECREASE INDEBTEDNESS

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

ADDITIONAL INFORMATION NEEDED

1. �����������������������������������������������������������������������

2. �����������������������������������������������������������������������

3. �����������������������������������������������������������������������

4. �����������������������������������������������������������������������

TRANSITION GOALS

GOAL COST DATE WANTED MONTHLY SAVINGS TO REACH GOAL

1.

2.

3.

4.

5.

6.