U350MN (02-18) Page 1 of 4

GEICO GOOD DRIVER PLAN

EFFECTIVE: July 26, 2018

HOW THE PLAN WORKS

The Company uses a point system under which drivers with accidents and traffic convictions pay higher rates, while

drivers with no accidents and convictions are charged the lowest premiums. Points are assigned when you, or a driver

currently residing in your household and operating your automobiles, are involved in negligent accidents while driving

private passenger automobiles, or convicted of moving traffic violations that were received while driving any type of

vehicle.

EXPERIENCE PERIOD

Accidents and convictions result in points only if they occurred during the "Experience Period." The experience period

shall be: For New Business - the three years immediately preceding the policy effective date; For Renewals - the

thirty-four months ending sixty days prior to the policy effective date.

The points for all drivers assigned to the same vehicle are totaled to develop the premium surcharge on that vehicle.

Points for a driver who is rated as a principal operator are assigned to the vehicle which he or she principally

operates. If the driver is the principal operator of more than one vehicle, the points are assigned to the vehicle

he or she operates most often. For occasional operators, points are assigned to the vehicle he or she most

often uses. If there is more than one occasional youthful operator, the points are assigned to the vehicle on

which the driver is rated.

I. ACCIDENTS

A. Initial Rating (First Time Rated Under the Plan)

1. One point is assigned for the first accident involving you or any resident operator and two points are

assigned for the second and each subsequent accident by the same operator, if the accident resulted in

damage to your property or that of another in excess of $750. A point for an accident is to be assigned

in addition to any points which may be assigned for a conviction as a result of the same occurrence.

2. One point is assigned for every second accident which resulted in property damage and was not

surchargeable under paragraph 1. above only because of the $750 threshold.

EXCEPTIONS:

No point shall be assigned for an accident above if the insured demonstrates that the accident

occurred under the following circumstances:

1. Automobile Lawfully Parked: An automobile rolling from a parked position, however, shall not be considered

as lawfully parked, but as the operation of the last operator.

2. Reimbursement: An accident for which you are reimbursed by or on behalf of the person responsible for the

accident or have judgment against the person.

3. Struck In Rear: An accident in which your vehicle is struck in the rear by another and you, or other operator

of your vehicle, are not convicted of a violation in connection with the accident.

4. Other Party Charged: An accident in which the operator of the other vehicle is convicted of a moving

violation and you, or other operator of your vehicle, are not.

5. Hit and Run: An automobile operated by you or a driver on your policy is damaged by a hit and run driver,

provided you report the accident to proper authorities within 24 hours.

6. Animals or Fowl: An accident involving damage by contact with animals or fowl.

7. Flying Gravel, Falling Objects: An accident involving physical damage, limited to and caused by flying

gravel, missiles or falling objects.

8. Emergency Use: Accidents involving the operation of a vehicle in response to an emergency if the operator

at the time of the accident was responding to the call to duty as a paid or volunteer member of any Police or

Fire Department, First Aid Squad, or any law enforcement agency, or was performing any other

governmental function in a public emergency. This exception does not include an accident occurring after

the emergency situation ceases or after the automobile ceases to be used in response to the emergency.

9. Accidents which result in an amount being paid under Personal Injury Protection or Additional Personal Injury

Protection and no payment is made under the Liability or Collision coverage. This exception does not apply

to single vehicle accidents in which property damage occurs.

Policy No.:

U350MN (02-18) Page 2 of 4

B. Subsequent Rating Under the Plan

1. One point is assigned for the first accident during the experience period for which any of the GEICO companies

has paid under Property Damage and/or Collision (for single car accidents only) coverages of the policy as a

result of any one occurrence, provided that the loss payment(s) made exceeds $750. In determining the sum of

such payments, claim adjustment expense, bail bond expense, and medical first aid expense shall be excluded.

2. Two points are assigned for the second and each subsequent accident by the same operator categorized in

paragraph 1. above.

3. One point is assigned for every second accident which resulted in property damage and was not surchargeable

under paragraph 1. above only because of the $750 threshold.

Only claim payments attributable to accidents incurred by regular operators currently on the policy will be considered.

Accidents which were assigned points under Initial Rating continue to be assigned points under Subsequent Rating if

the date of occurrence is still within the experience period.

C. Accident Forgiveness Program

We will waive the surcharge for an accident if:

1. The policyholder has been insured with the Company for five or more years;

2. The surchargeable accident occurred after your coverage has been in effect for five years;

3. The driver, at the time of the loss, was age 21 or older; and

4. During the five year period ending 60 days prior to the renewal effective date, there was no other accident by a

driver age 21 or older for which the surcharge was applied or waived under this rule.

II. TRAFFIC CONVICTIONS

A. Conviction Points

Points are assigned for motor vehicle violations for which you or any resident operator have been convicted during

the experience period.

1. Three points are assigned for the following:

a) Operating a motor vehicle while in an intoxicated condition or while disabled by reason of the use of drugs;

b) Leaving the scene of an accident without stopping to report;

c) Felony involving a motor vehicle;

d) Reckless driving which results in injury to a person.

2. Two points are assigned for:

a) Driving a motor vehicle at an excessive rate of speed where injury to a person or damage to property

results;

b) Careless driving;

c) Refusing to take a sobriety test;

d) Open bottle conviction and allow open bottle conviction;

e) Reckless driving which does not result in injury to a person;

f) Participating in a race or speed contest.

3. One point is assigned for speeding in excess of 20 MPH of the posted limit.

4. One point is assigned for the second, and each subsequent conviction incurred by the same operator

for moving traffic violations not specified above.

Note: Points are not assigned for both a qualifying accident and associated conviction described under 4.;

the surcharge is to be made only in the category resulting in the higher point assignment.

Non-moving violations such as defective equipment and failure to have driver’s license in possession are

not subject to points.

III. INEXPERIENCED OPERATOR

One point is assigned when the principal operator of the automobile has not been licensed for at least three

years in the United States, its territories or possessions, or Canada.

Exception: This point is not assigned to male drivers age 29 or less, or female drivers age 24 or less, who

are single principal operators.

Policy No.:

U350MN (02-18) Page 3 of 4

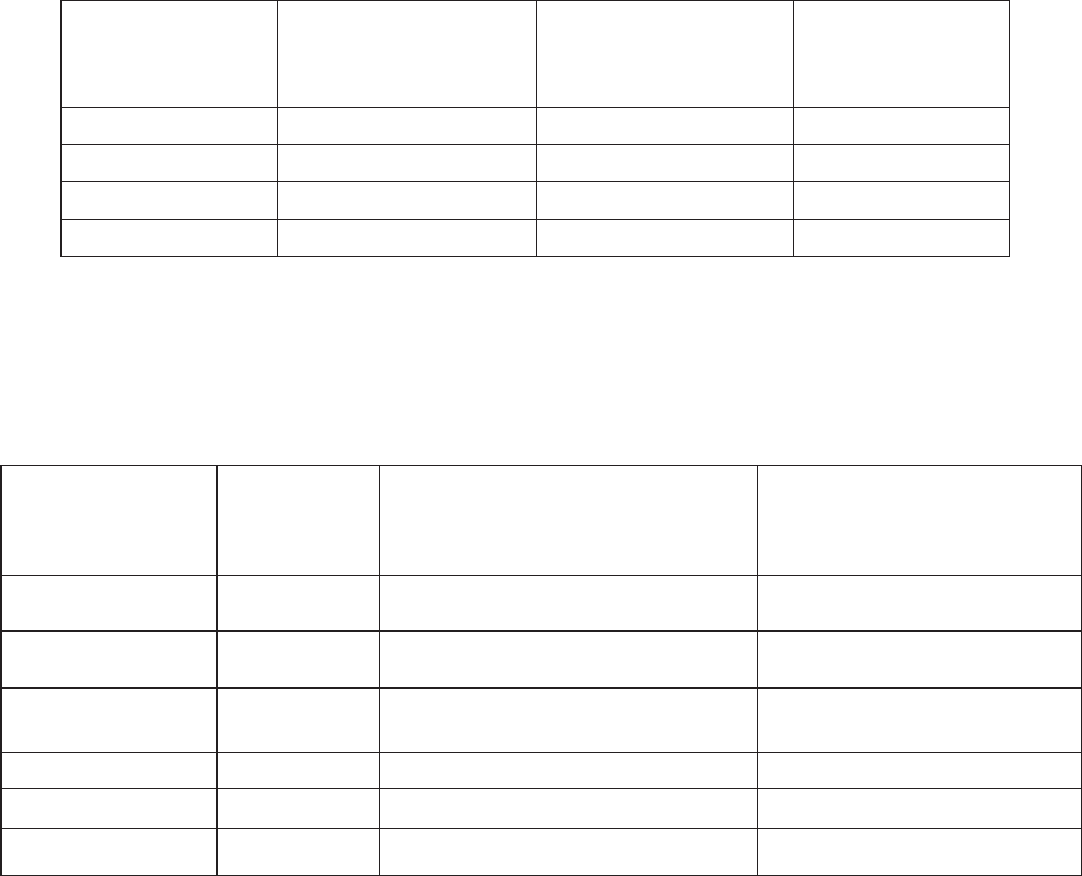

V. POINTS AND SURCHARGE CALCULATION

The number of points assigned determines the surcharge. The following examples show some of the possible

surcharges as an approximate percent of the premium for a single car policy.

VI. EXAMPLES OF SURCHARGE PLAN

The following are examples of our surcharge plan, they do not reflect your actual premium but are intended to show

how the surcharge plan works.

Example A shows a one-vehicle policy. Example B shows how the surcharge would apply to a two-vehicle policy.

A. ONE VEHICLE INSURED

IV. FIVE YEAR GOOD DRIVER DISCOUNT

A Five Year Good Driver Discount applies to all eligible vehicles insured under the policy if:

1. No points are currently assignable to the vehicle;

2. One of the principal operators under the policy has at least five years of driving experience; and

3. During the five year period immediately preceding the date of application for new business, or ending 60 days

prior to the effective date of the policy for renewals, no operator assigned to the vehicle on the policy has been

involved in an accident which would have resulted in a point being assigned under the Good Driver Plan.

Note: If you are involved in an accident or convicted of a motor vehicle violation, we may apply a surcharge

in addition to removing the discount.

IF THE

NUMBER OF

DRIVING RECORD

POINTS IS:

YOUR SURCHARGE FOR

BODILY INJURY AND

PROPERTY DAMAGE

COVERAGES WILL BE:

YOUR SURCHARGE FOR

PERSONAL INJURY

PROTECTION

COVERAGE WILL BE:

YOUR SURCHARGE

FOR COLLISION

COVERAGE WILL

BE:

1 45% 45% 45%

2 95% 95% 95%

3 155% 155% 155%

4 225% 225% 225%

* Surcharge is not applicable to Uninsured Motorist Coverage.

COVERAGE

PREMIUM

WITH NO

ACCIDENTS

PREMIUM INCLUDING SURCHARGE

FOR ONE CHARGEABLE ACCIDENT

PREMIUM INCLUDING

SURCHARGE FOR TWO

CHARGEABLE ACCIDENTS

BODILY INJURY/

PROPERTY DAMAGE $80.00 $116.00 $204.00

UNINSURED

MOTORIST $5.00 $5.00 $5.00

PERSONAL INJURY

PROTECTION $40.00 $58.00 $102.00

COMPREHENSIVE $25.00 $36.25 $63.75

COLLISION $50.00 $72.50 $127.50

TOTAL PREMIUM $200.00 $287.75 $502.25

Policy No.:

U350MN (02-18) Page 4 of 4

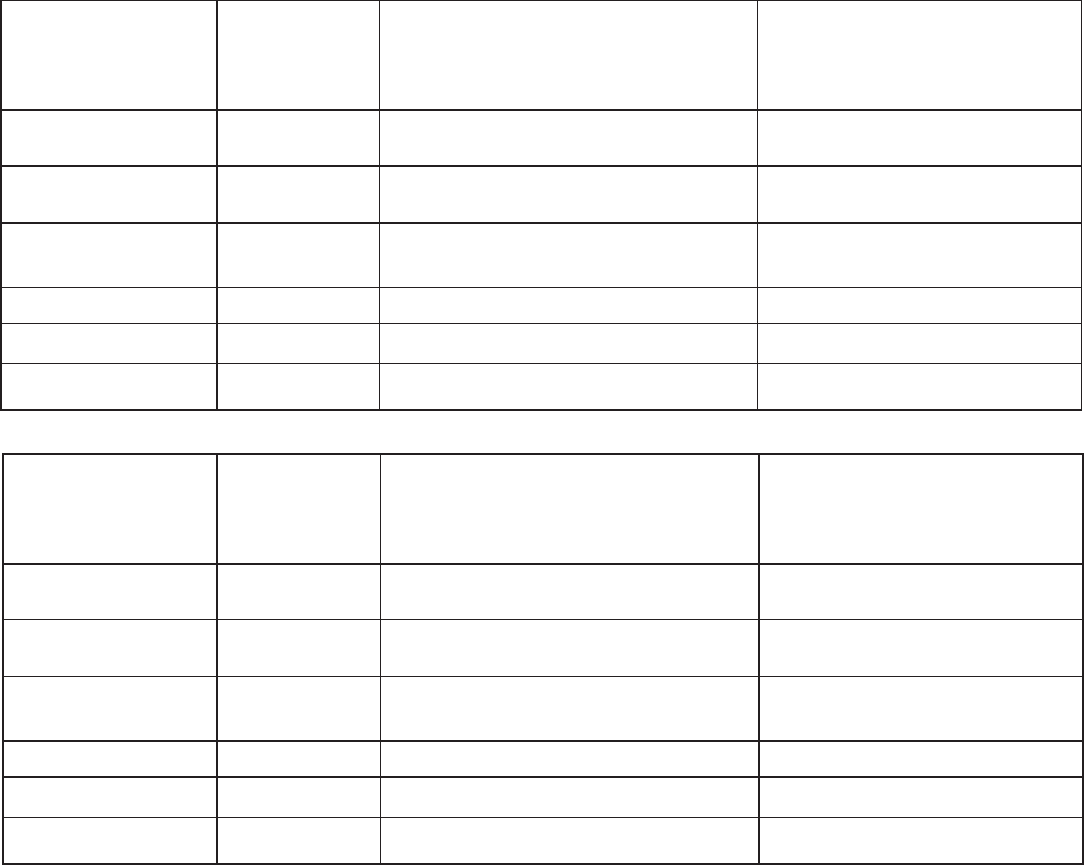

B. TWO VEHICLES INSURED

Accidents chargeable to the principal operator of vehicle number one, while operating vehicle number one.

(1) Vehicle number one:

COVERAGE

PREMIUM

WITH NO

ACCIDENTS

PREMIUM INCLUDING SURCHARGE

FOR ONE CHARGEABLE ACCIDENT

PREMIUM INCLUDING

SURCHARGE FOR TWO

CHARGEABLE ACCIDENTS

BODILY INJURY/

PROPERTY DAMAGE $80.00 $100.00 $188.00

UNINSURED

MOTORIST $5.00 $5.00 $5.00

PERSONAL INJURY

PROTECTION $40.00 $50.00 $94.00

COMPREHENSIVE $25.00 $31.30 $58.80

COLLISION $50.00 $62.50 $117.50

TOTAL PREMIUM $200.00 $248.80 $463.30

(2) Vehicle number two:

COVERAGE

PREMIUM

WITH NO

ACCIDENTS

PREMIUM INCLUDING SURCHARGE

FOR ONE CHARGEABLE ACCIDENT

PREMIUM INCLUDING

SURCHARGE FOR TWO

CHARGEABLE ACCIDENTS

BODILY INJURY/

PROPERTY DAMAGE $120.00 $120.00 $120.00

UNINSURED

MOTORIST $5.00 $5.00 $5.00

PERSONAL INJURY

PROTECTION $60.00 $60.00 $60.00

COMPREHENSIVE $40.00 $40.00 $40.00

COLLISION $75.00 $75.00 $75.00

TOTAL PREMIUM $300.00 $300.00 $300.00

Policy No.: