1

Please read this Product Disclosure Sheet before You decide to take up the General

Accident Package Insurance Policy. Please be sure to also read the general terms

and conditions.

1. What is this product about?

This Policy provides You with a comprehensive insurance protection against

various general accident risks to Your business and property. The coverage

sections available under this packaged product are All Risks, Burglary, Money,

Plate Glass, Public Liability, Employer’s Liability, and Fidelity Guarantee.

This Policy can be a Consumer and a Non-Consumer Policy. Consumer Insurance

Policy means a contract of insurance entered into, varied or renewed by an

individual for his/her own purposes unrelated to the individual’s trade, business

or profession.

2. What are the covers / benets provided?

This Policy provides coverage under the following respective sections:

All Risks

Covering any accidental physical loss or damage to the property insured (for

example equipment, plant, and machinery) as described in the Schedule,

provided it is not excluded under the Policy.

Burglary

Protects Your goods and all properties properly locked and secured in Your

insured Premises against Burglary or robbery (with forcible entry).

Money

Covers Your cash, bank and currency notes, cheques and money orders against

Burglary or robbery whilst in transit to and from the bank, contract sites and in

Your insured Premises during and after business hours.

Plate Glass

Covers Your Signage and Glass panels against accidental breakage.

Public Liability

Protection is provided for You against third party claims resulting from Bodily

Injury or Property Damage which took place at Your Premises.

Employer’s Liability

Covers You against liabilities in the event of Bodily Injury sustained by employees

due to work related accidents or disease.

Fidelity Guarantee

Insures You against loss of money and/or property due to fraud or act of

dishonesty of Your employee.

The duration of cover is for one (1) year. You will need to renew Your insurance

Policy annually.

Note: The description on the available cover is only a brief summary for quick and

easy reference. Please refer to the Policy contract for the full details of covers/

benets under this Policy.

Product Disclosure Sheet -

General Accident Package Insurance

© 2024 Chubb. Not all coverages available in all jurisdictions. Chubb®, its

respective logos and Chubb.Insured.

SM

are protected trademarks of Chubb.

2

© 2024 Chubb. Not all coverages available in all jurisdictions. Chubb®, its respective logos and Chubb.Insured.

SM

are

protected trademarks of Chubb.

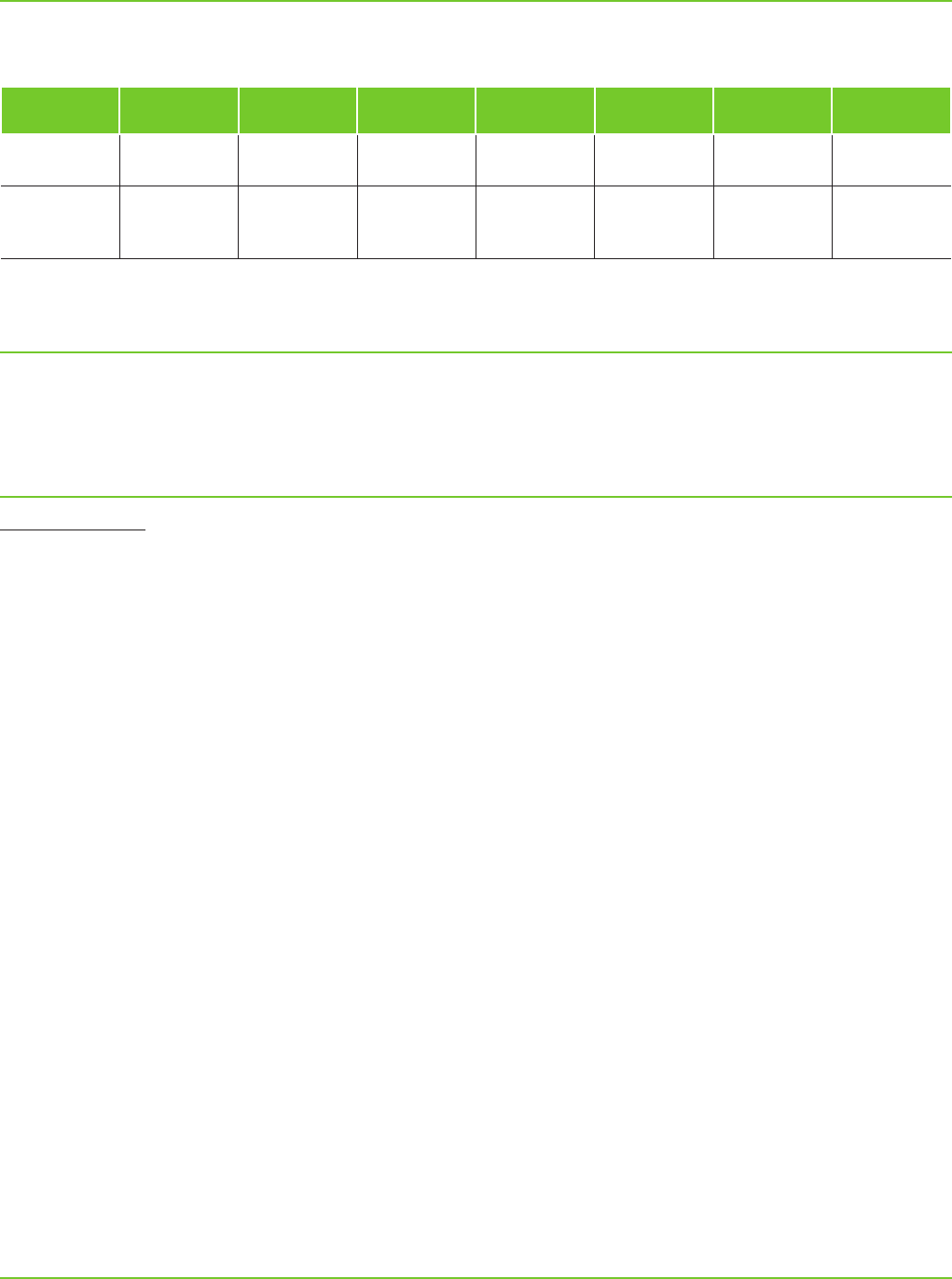

3. How much premium do I have to pay?

The total annual premium that You must pay may vary depending on the risk exposure, Our underwriting requirement,

type of coverage required, and sum insured/limit required under each section.

Section /

Coverage

All Risks Burglary Money Plate Glass Public

Liability

Employer’s

Liability

Fidelity

Guarantee

Sum Insured

/ Limit (RM)

Estimated

Premium

(RM):

The Policy is subject to minimum premium of RM75.00.

4. What are the fees and charges I have to pay?

• Stamp duty – RM10

• Service Tax (ST) (where applicable) – The applicable ST rate imposed by the Government.

• Commission paid, if any, to the insurance intermediary (included in the premium) – maximum of 25% on the premium.

5. What are some of the key terms and conditions that I should be aware of?

Your duties to Us

1. Duty for Consumer Insurance Policy

1.1. If this Policy is a Consumer Insurance Policy, then You must take reasonable care:

(a) not to make a misrepresentation to Us when answering any questions, We ask in the proposal form, or any other

disclosures made.

(b) when renewing this Policy, not to make a misrepresentation to Us in answering any questions, or conrming or

amending any matter previously disclosed to Us in relation to this Policy; and

(c) to disclose to Us any matter, other than what We have asked in (a) and (b) above, that You know to be relevant to

Our decision on whether to accept the risk or not and the rates and terms to be applied.

2. Duty for non-Consumer Insurance Policy

2.1. If this Policy is not a Consumer Insurance Policy, then You have a duty to disclose to Us any matter that:

(a) You know to be relevant to Our decision on whether to accept the risk or not and the rates and terms to be applied;

or

(b) a reasonable person in the circumstances could be expected to know to be relevant.

• For All Risks section, You must ensure that Your property or interest insured is covered at the appropriate amount taking

into account the renovations or improvements made to Your property. You may insure Your property on market value

(less wear, tear & depreciation) or reinstatement value (full cost of repairing without any deduction being made for

wear, tear & depreciation) basis. The sum insured must be monitored and reviewed regularly representing the full value in

order to avoid under insurance. Otherwise, claims settlement will be on Average basis.

• For other sections (Burglary, Money, Plate Glass, Public Liability, Employer’s Liability and Fidelity Guarantee), cover is

based on the limit required.

• The Excess is the amount You have to bear before We indemnify You.

• You must inform Your insurance intermediary or Us in writing on any material changes during the Policy Period so that

the necessary amendments are endorsed to Your Policy.

• Premium is due within sixty (60) days from the inception date of the Policy / endorsement / renewal. If this condition is

not complied with, the Policy shall be automatically cancelled, and We shall be entitled to the pro-rated premium for

period covered.

• If there are other Policies covering the same or part of the same loss, damage, or liability, We will only pay a share of the

loss, damage, or liability proportionately.

• In the event of claim, You must notify Us within 14 days on any loss or damage and deliver the claim in writing with

detailed particulars and proof(s) within thirty (30) days after the loss and damage incident and/or notify Us of the loss

or damage in accordance with the requirements of each of the sections insured under the Policy.

6. What are the major exclusions under this Policy?

This Policy does not cover certain loss or damage, such as:

3

• Loss / damage due to radioactive and nuclear energy risks.

• Loss / damage caused by or arising from war, invasion, act of foreign enemy, hostilities, or warlike operations (whether

war be declared or not) or civil war.

• Loss / damage caused by or arising from mutiny, civil commotion assuming the proportions of or amounting to a popular

rising, military rising, insurrection, rebellion, revolution, military, or usurped power.

• Loss / damage caused by or arising from any Act of Terrorism.

• Conscation and destruction by order of any government or public authority.

• Loss / damage due to a Communicable Disease.

• Loss / damage due to Cyber Loss.

• Loss / damage due to inability of any computer to recognize any true date on the calendar.

Note: This list is non-exhaustive. Please refer to the Policy contract for the full list of exclusions under the Policy. Each section

of cover is subject to its own list of exclusions.

7. Can I cancel my Policy?

You may cancel Your Policy at any time by giving written notice to Your insurance intermediary or Us. Upon cancellation, You

may be entitled to a refund of the premium based on the short period rates for the unexpired period of insurance subject to

the minimum premium to be retained by Us and subject to any claim that may have been made.

8. What do I need to do if there are changes to my contact / personal details?

It is important that You inform Your insurance intermediary or Us of any change in Your contact details to ensure that all

correspondences reach You in a timely manner.

9. Where can I get further information?

Should You require additional information about Our General Accident Package Insurance, You can contact Your insurance

intermediary, or Us at Our branches nationwide, or

If You have any queries, please contact Us at :

Chubb Insurance Malaysia Berhad

Registration Number: 197001000564 (9827A)

Wisma Chubb

38 Jalan Sultan Ismail

50250 Kuala Lumpur

O +6 03 2058 3000

F +6 03 2058 3333

E Inquiries.MY@chubb.com

W www.chubb.com/my

10. Other types of similar insurance cover available?

Individual Policy such as All Risks, Burglary, Money, Plate Glass, Public Liability, Employer’s Liability and Fidelity Guarantee

are available as well.

IMPORTANT NOTE:

YOU MUST ENSURE THAT YOUR PROPERTY IS INSURED AT THE APPROPRIATE AMOUNT. YOU SHOULD SATISFY YOURSELF

THAT THIS INSURANCE POLICY WILL BEST SERVE YOUR NEEDS AND THAT THE PREMIUM PAYABLE UNDER THIS POLICY IS

AN AMOUNT YOU CAN AFFORD. YOU SHOULD READ AND UNDERSTAND THIS INSURANCE POLICY AND DISCUSS WITH THE

INSURANCE INTERMEDIARY OR CONTACT CHUBB INSURANCE MALAYSIA BERHAD DIRECTLY FOR MORE INFORMATION.

Please be reminded that:

- You have a duty to take reasonable care to provide Us or Our intermediary with all relevant information in order for Us to

provide You with the most suitable nancial products and by withholding any information which We or Our intermediary

request for, or providing inaccurate information, We may not be able to recommend You a suitable nancial product to cater

to Your needs;

- You should read and understand the contract terms and discuss further with Us or Our intermediary if there are any terms

that You do not understand, before accepting the Policy contract.

By accepting the Policy contract, You would acknowledge that Our intermediary or Chubb personnel had explained to You

© 2024 Chubb. Not all coverages available in all jurisdictions. Chubb®, its respective logos and Chubb.Insured.

SM

are

protected trademarks of Chubb.

4

clearly on the Policy coverage and key contract terms, and that the Policy contract oered is suitable for Your insurance

needs.

The information provided in this Disclosure Sheet is valid as at April 2024.

The information provided in this Disclosure Sheet is a brief summary for quick and easy reference. The exact terms and

conditions that apply are stated in the Policy contract.

In the event of any inconsistencies between the Bahasa Malaysia version and the English version of this Policy, the English

wordings shall prevail.

CHUBB INSURANCE MALAYSIA BERHAD is licensed under the Financial Services Act 2013 and regulated by Bank Negara

Malaysia.

The benet(s) payable under eligible certicate/policy/product is(are) protected by PIDM up to limits. Please refer to PIDM’s

TIPS brochure or contact Chubb Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my)

© 2024 Chubb. Not all coverages available in all jurisdictions. Chubb®, its respective logos and Chubb.Insured.

SM

are

protected trademarks of Chubb.

Published 04/2024/V1