INSURANCE PRODUCT

SUMMARY AND FACT SHEET

Summary of Coverages included with your

American Express Cobalt® Card

TABLE OF CONTENTS

Royal & Sun Alliance Insurance Company of Canada

Travel Insurance Summary .................................................................................................................................... 2

Travel Insurance Fact Sheet................................................................................................................................... 8

Purchase Insurance Summary .............................................................................................................................. 9

Purchase Insurance Fact Sheet............................................................................................................................15

Chubb Life Insurance Company of Canada

Travel Accident Insurance ..................................................................................................................................... 16

Fact Sheet ............................................................................................................................................................. 20

1

This document contains both information and form fields. To read information, use the Down Arrow from a form field.

American Express Cobalt

®

Card

Product Summaries & Fact Sheets

Travel insurance summary

Travel insurance for American Express (Amex) Cards is provided by Royal & Sun Alliance Insurance Company of Canada

(RSA). This summary provides important information about travel insurance included with the American Express Cobalt

®

Card and is intended to help you determine if this insurance meets your needs.

This summary is an explanatory document and is NOT your Certificate of Insurance nor is it an insurance

contract. For all coverage details, including benefits, eligibility, limitations and exclusions, consult the Certificate of Insurance.

Insurer contact information

Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

Toll-free: 1 800 243-0198

Collect: 905 475-4822

rsagroup.ca

Client number delivered by the Autorité

des marchés financiers: 2001291200

Website of the Authority: lautorite.qc.ca

Distributor contact information

Amex Bank of Canada

2225 Sheppard Avenue East, Suite 100

Toronto, Ontario M2J 5C2

General Enquiries only:

Toll-free at 1 800 869-3016

americanexpress.com

2

•

Important information about travel insurance included with your Card

1. What coverages are included?

The following is an overview of available coverages:

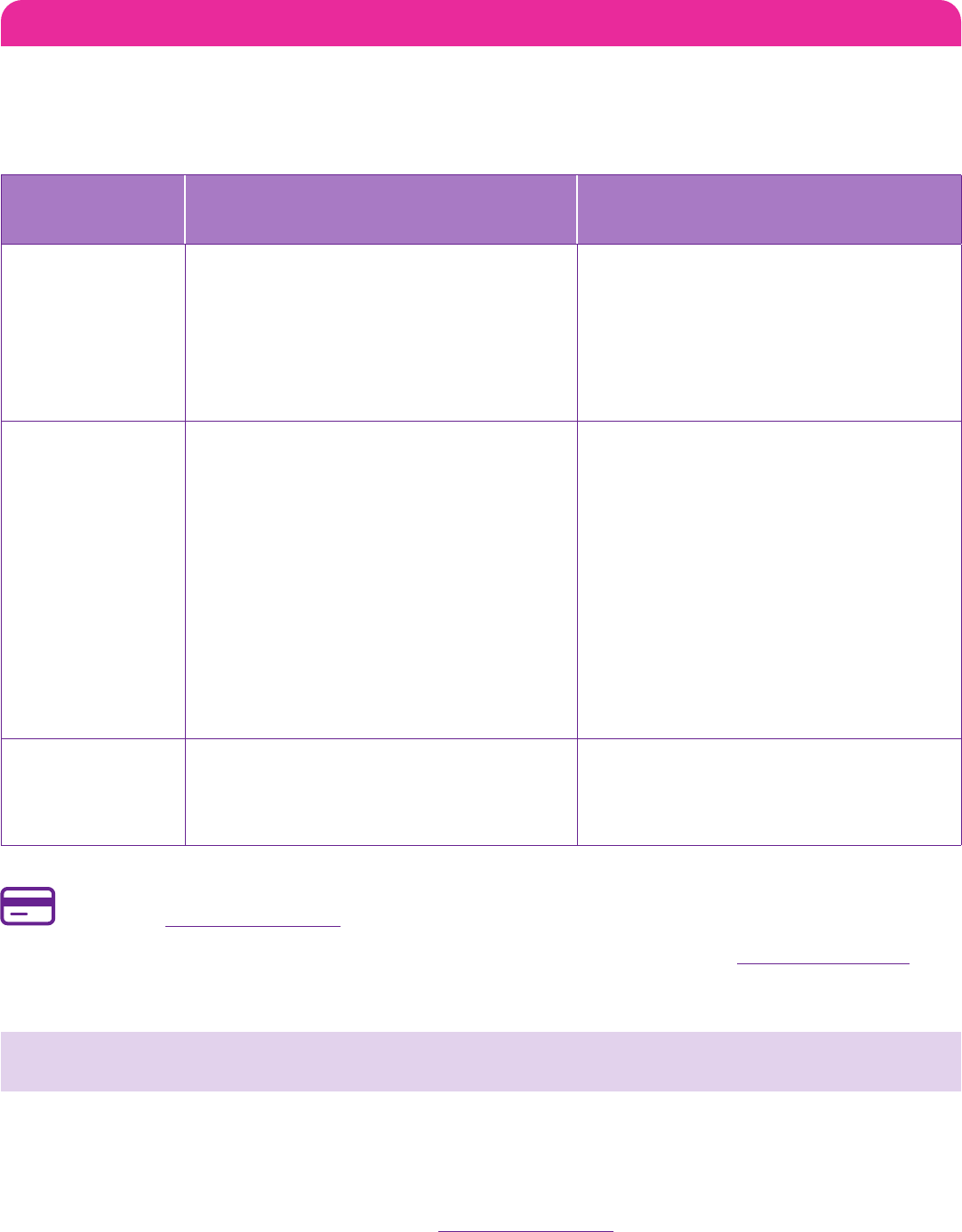

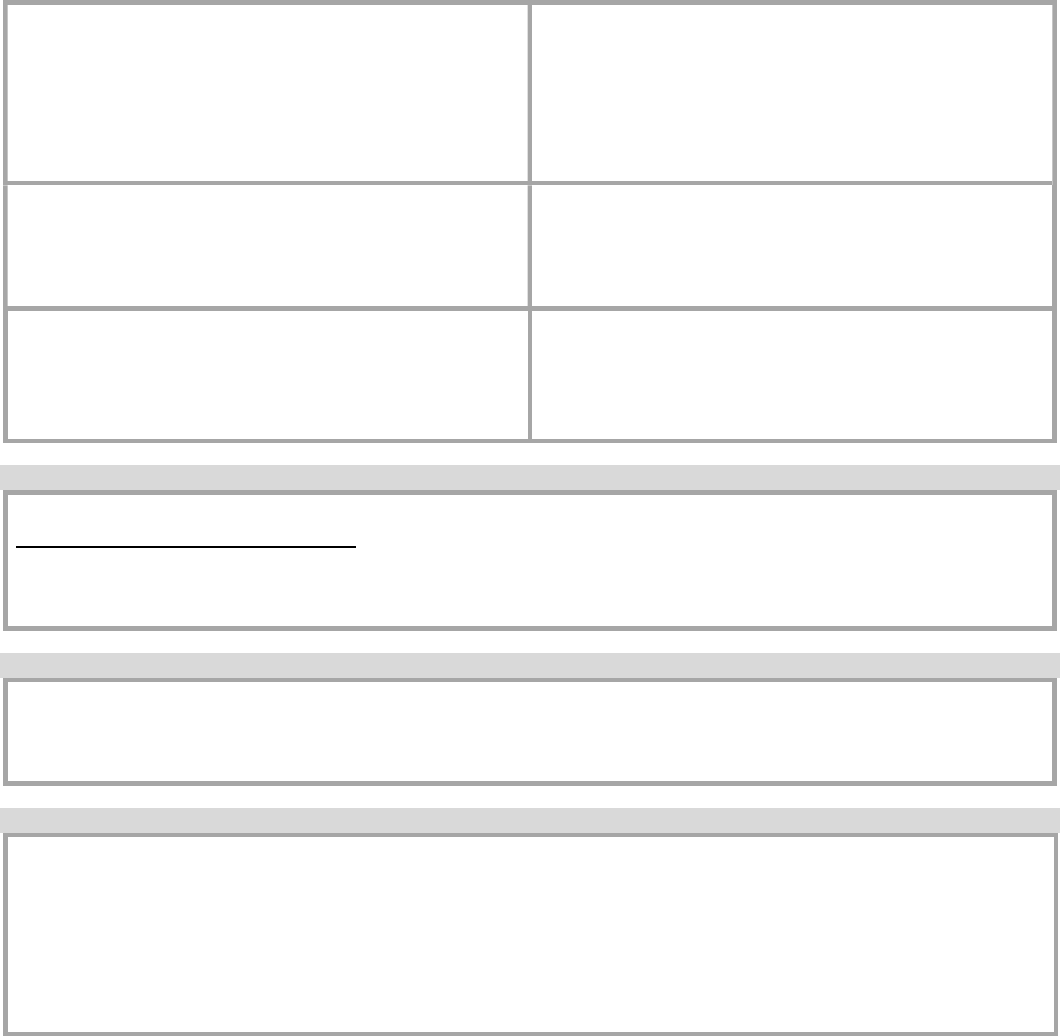

Coverage Description Coverage Maximums

Emergency

Medical

Covers certain expenses incurred for

emergency medical care while travelling

outside your province or territory.

15-day coverage period including the day

you leave and the day you return, if insured

person is under the age of 65

$5,000,000 per insured person, per trip

Flight &

Baggage Delay

and

Hotel Burglary

Flight Delay:

Covers reasonable living expenses such as

meals and accommodation when a flight is

delayed 4 hours or more

Baggage Delay:

Covers certain expenses in the event of

baggage delayed 6 hours or more

Hotel Burglary:

Offers compensation for loss or damage to

personal items if your accommodation is

broken into while you are registered as a guest

Flight & Baggage Delay:

Maximum $500 per occurrence for all

insured persons combined

Hotel Burglary:

Maximum $500 per occurrence for all

insured persons combined

Lost or Stolen

Baggage

Covers certain expenses in the event of lost,

damaged or stolen checked or carry-on

baggage

Maximum $500 per occurrence for all

insured persons combined

Certain fees or expenses must be charged to the Card account, in full or at least in part, to be covered.

Refer to the Certificate of Insurance for each coverage for full details.

You can find all information concerning what types of care, situations and costs are covered in the Certificate of Insurance for

each coverage under the section titled “What are the Benefits?” or “What is Covered and What are the Benefits?”, as applicable.

Travel insurance offers medical and general assistance services at all times

in the event of sudden and unforeseen circumstances.

2. What’s not covered?

We may deny your claim because of exclusions, limitations and reductions. This is not a complete list. Consult the

Exclusions and Conditions sections, as applicable, in the Certificate of Insurance for each coverage to see a complete list of

exclusions, limitations and reductions.

3

•

•

•

Exclusions

No benefits are payable in the following circumstances:

Concerning travel insurance in general:

- If the insurance is not in effect at the time the event occurs.

- If you do not submit the insurance claim form or supporting documents that we ask of you and that are required to

process your request, within the applicable time limit.

- If you do not get our approval before incurring certain travel medical expenses related to your benefit request.

Limitation

Benefits payable by us will be reduced by any amount reimbursed by another entity or insurer.

Pre-Existing Health Conditions:

Emergency

Medical

Pre-existing health conditions not covered

Expenses associated with any injuries or health problems you may have that were not stable

in the 90 days before leaving on your trip.

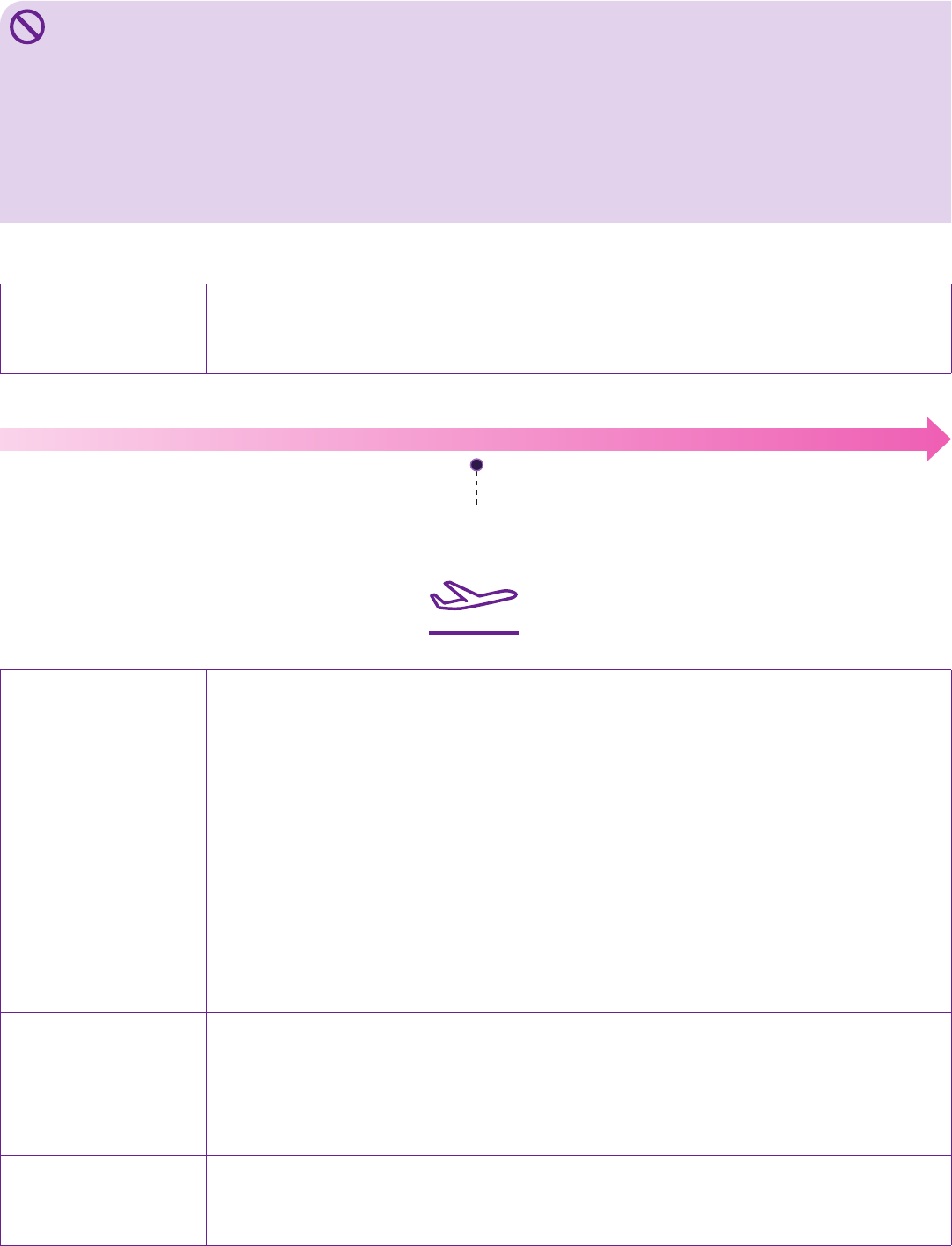

Illustration of application of pre-existing health conditions’ exclusion (Emergency medical coverage)

Before the date of departure,

you consulted your doctor for chest pain

and have been scheduled for a

diagnostic stress test.

Under age 65: 0 – 90 days before date of departure

Day 0

Date of

departure

During your trip, you have a heart

attack and have been hospitalized for

emergency medical care. We will not

pay any benefits for this condition as

you were waiting for a diagnostic stress

test before you left on your trip.

Emergency

Medical

Circumstances not covered

routine prenatal care, pregnancy or the birth and delivery of a child in the 9 weeks before

or after the expected delivery date

Note: A child born during a trip is not covered

•

an accident or illness while travelling in a region or country that the Canadian Government

has issued an advisory of “Avoid non-essential travel” or “Avoid all travel” before your trip

begins. If the travel advisory is issued after you leave on your trip, coverage is limited to

10 days from the time the travel advisory was issued. This only applies to conditions or

losses that are directly or indirectly related to the reason the travel advisory was issued.

•

participation in certain sports, activities or risky behaviour

•

committing or attempting to commit an illegal or criminal act

•

alcohol or drug abuse or an accident while driving under the influence of drugs or alcohol

or having an alcohol concentration that exceeds the legal limit

•

taking a trip to receive medical care or services or travelling against medical advice

Flight & Baggage

Delay and

Hotel Burglary

Circumstances not covered for Flight & Baggage Delay

•

alternate travel arrangements such as taxi, limo, bus or purchase of an airline ticket

•

baggage delay when a flight is returning to your place of residence

Circumstances not covered for Hotel Burglary

any illegal activity, fraud, committed by or attempted by you

Lost or

Stolen Baggage

Items not covered

cash, traveller’s cheques, tickets, important documents, china, glass, fragile items, household

effects or furnishings

4

•

•

•

3. Who can be covered?

To be eligible for the following coverages, you must be a resident of Canada, and:

Emergency

Medical

Flight & Baggage

Delay and Hotel

Burglary

Lost or Stolen

Baggage

the primary Cardmember or an authorized

user* of the account

✓ ✓ ✓

the spouse** of the primary Cardmember

or an authorized user* of the account

✓ ✓ ✓

a dependent child*** of:

- the primary Cardmember or their

spouse**; or

- an authorized user* of the account or

their spouse**

✓ ✓ ✓

* A person who is a Supplementary Cardmember.

** A person who is legally married to an individual or with whom the individual resides and has been in a common-law

relationship for at least one year.

*** A child is considered a dependent child in the following cases:

- the child is between 15 days and 20 years old and is financially dependent on you

- the child is between the ages of 21 and 24, is financially dependent on you, and attends an educational institution

(secondary school, CEGEP or university) on a full-time basis

- the child has a permanent physical or mental disability and is financially dependent on you

4. When does the insurance start and end?

Start

The insurance becomes available when you activate your Card.

End

The insurance ends on the earlier of:

- the date the Card account is cancelled or closed by Amex

- the date the Card account is closed at the request of the primary Cardmember

- the date the Card account is no longer in good standing

- the date the insurance is cancelled or suspended by Amex

For all details concerning the duration of insurance, consult the section titled “When Does Coverage Begin and End?”

of the Certificate of Insurance for each coverage.

5. How much does the insurance cost?

This insurance is included with your Card. There are no separate fees, premiums or expenses.

6. What if I provide inaccurate information?

You must always provide accurate information we consider necessary. We may refuse your claim if we obtain, as part of a

claim or at any other time during the duration of the insurance, any information that differs from the information you previously

provided. We may also cancel your insurance retroactively to its start date.

5

7. What if I want to cancel?

You have the right to rescind this insurance product within 10 days of activating your Card. Please note that this insurance

product is embedded and any cancellation of insurance may require the cancellation of your Card. Contact Amex (the

Distributor) for assistance and refer to the “Notice of rescission of an insurance contract” at the end of this summary.

8. How do I file a claim and what are the applicable timeframes?

Here’s how to file an insurance claim:

As soon as the event occurs, call 1 800 243-0198 or 905 475-4822 (collect calls accepted).

You will be given instructions on how to file a claim.

Global Excel Management Inc., the authorized assistance and claims provider for RSA, provides claims and assistance for all

travel insurance coverages outlined in this summary.

Timeframe to submit claim forms and supporting documents

Fill out the claim form that you will receive and return it as instructed, along with all the necessary documents, within

90 days of the event that led to the claim.

We will notify you of our decision following review of your application and, if applicable, we will pay the benefit within

60 days of receiving all the requested documents.

What if I disagree with a decision made regarding my claim?

You must contact us:

RSA Complaint Liaison Office

137 Venture Run, Suite 300

Dartmouth, Nova Scotia B3B 0L9

1 888 877-1710

Fax: 905 403-2331

Email: [email protected]

Website: https://www.rsagroup.ca/complaint-procedures

It is our goal to resolve your complaint within 30 business days. If this is not possible, we will let you know within the 30

business days that it will take longer and explain the reason for the delay.

Please include your full name, address, and telephone number. In addition to providing the details of your concern, please

make sure you have your policy or claim number ready so we can begin our review as quickly as possible.

RSA will work very diligently at resolving the problem to your satisfaction.

If you are not satisfied with the outcome and you wish to escalate it further, you can:

- request a review of your file,

- consult your legal counsel,

- contact one of the following organizations:

Autorité des marchés financiers (AMF)

Place de la Cité, tour Cominar

2640, boulevard Laurier, bureau 400

Québec (Québec) G1V 5C1

Québec: 418 525-0337

Montréal: 514 395-0337

Toll-free: 1 877 525-0337

Fax: 1 877 285-4378

Website: lautorite.qc.ca

General Insurance OmbudService (GIO)

4711 Yonge Street, 10

th

Floor

Toronto, Ontario M2N 6K8

Toll Free: 1 877 225-0446

Fax: 416 299-4261

Website: giocanada.org

You must comply with the time limits imposed by law if you wish to bring a proceeding or any other action against the insurer.

We’re here to help you. For any questions, call 1 800 243-0198 or 905 475-4822.

6

Date:

I hereby rescind insurance contract no.:

Entered into on:

In:

NOTICE OF RESCISSION OF AN INSURANCE CONTRACT

Notice given by a distributor

Section 440 of the Act respecting the distribution of financial products and services (chapter D-9.2)

The Act respecting the distribution of financial products and services gives you important rights.

The Act allows you to rescind an insurance contract, without penalty, within 10 days of the date on which it is signed.

However, the insurer may grant you a longer period.

To rescind the contract, you must give the insurer notice, within that time, by registered mail or any other means that allows

you to obtain an acknowledgement of receipt.

Despite the rescission of the insurance contract, the first contract entered into will remain in force. Caution, it is possible

that you may lose advantageous conditions as a result of this insurance contract; contact your distributor or consult

your contract.

After the expiry of the applicable time, you may rescind the insurance contract at any time; however, penalties may apply.

For further information, contact the Autorité des marchés financiers at 1 877 525-0337 or visit lautorite.qc.ca.

Notice of rescission of an insurance contract

Send to: Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

Pursuant to section 441 of the Act respecting the distribution of financial products and services,

These insurance products are underwritten by Royal & Sun Alliance Insurance Company of Canada.

© 2023 Royal & Sun Alliance Insurance Company of Canada. All rights reserved.

®

RSA, RSA & Design and related words and logos are trademarks and the property of RSA Insurance Group Limited, licensed

for use by Royal & Sun Alliance Insurance Company of Canada.

®

Used by Amex Bank of Canada under license from American Express.

®

“Global Excel” and the Global Excel logo are registered trademarks of Global Excel Management Inc.

__________________________________________________________________________________________(date of sending of notice)

___________________________________________________ (number of contract, if indicated)

___________________________________________________________________________ (date of signature of contract)

_______________________________________________________________________________________________(place of signature of contract)

_________________________________________________________________________________________________________(name of client)

______________________________________________________________________________________________________ (signature of client)

7

$

Travel insurance fact sheet

The purpose of this fact sheet is to inform you of your rights.

It does not relieve the insurer or the distributor of their obligations to you.

LET’S TALK INSURANCE!

Name of distributor:

Amex Bank of Canada

Name of insurer:

Royal & Sun Alliance Insurance Company of Canada

Name of insurance product:

Travel Insurance

IT’S YOUR CHOICE

You are never required to purchase insurance:

• that is offered by your distributor;

• from a person who is assigned to you; or

• to obtain a better interest rate or any other benet.

Even if you are required to be insured, you do not have to purchase the insurance that

is being offered. You can choose your insurance product and your insurer.

HOW TO CHOOSE

To choose the insurance product that’s right for you, we recommend that you read the summary

that describes the insurance product and that must be provided to you.

DISTRIBUTOR REMUNERATION

A portion of the amount you pay for the insurance will be paid to the distributor as remuneration.

The distributor must tell you when the remuneration exceeds 30% of that amount.

RIGHT TO CANCEL

The Act allows you to rescind an insurance contract, at no cost, within 10 days after the purchase of your

insurance. However, the insurer may grant you a longer period of time. After that time, fees may apply if

you cancel the insurance. Ask your distributor about the period of time granted to cancel it at no cost.

If the cost of the insurance is added to the nancing amount and you cancel the insurance, your monthly

nancing payments might not change. Instead, the refund could be used to shorten the nancing

period. Ask your distributor for details.

The Autorité des marchés nanciers can provide you with unbiased, objective information.

Visit www.lautorite.qc.ca or call the AMF at 1-877-525-0337.

Reserved for use by the insurer:

Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

AMF Register - Insurer's client no.: 2001291200

This fact sheet cannot be modified

8

Purchase insurance summary

Purchase insurance for American Express (Amex) Cards is provided by Royal & Sun Alliance Insurance Company of Canada

(RSA). This summary provides important information about purchase insurance included with the American Express

Cobalt

®

Card and is intended to help you determine if this insurance meets your needs.

This summary is an explanatory document and is NOT your Certificate of Insurance nor is it an insurance contract.

For all coverage details, including benefits, eligibility, limitations and exclusions, consult the Certificate of Insurance.

Insurer contact information

Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

Toll-free: 1 800 243-0198

Collect: 905 475-4822

rsagroup.ca

Client number delivered by the Autorité

des marchés financiers: 2001291200

Website of the Authority: lautorite.qc.ca

Distributor contact information

Amex Bank of Canada

2225 Sheppard Avenue East, Suite 100

Toronto, Ontario M2J 5C2

General Enquiries only:

Toll-free at 1 800 869-3016

americanexpress.com

9

•

•

Important information about purchase insurance included with your Card

1. What coverages are included?

The following is an overview of available coverages:

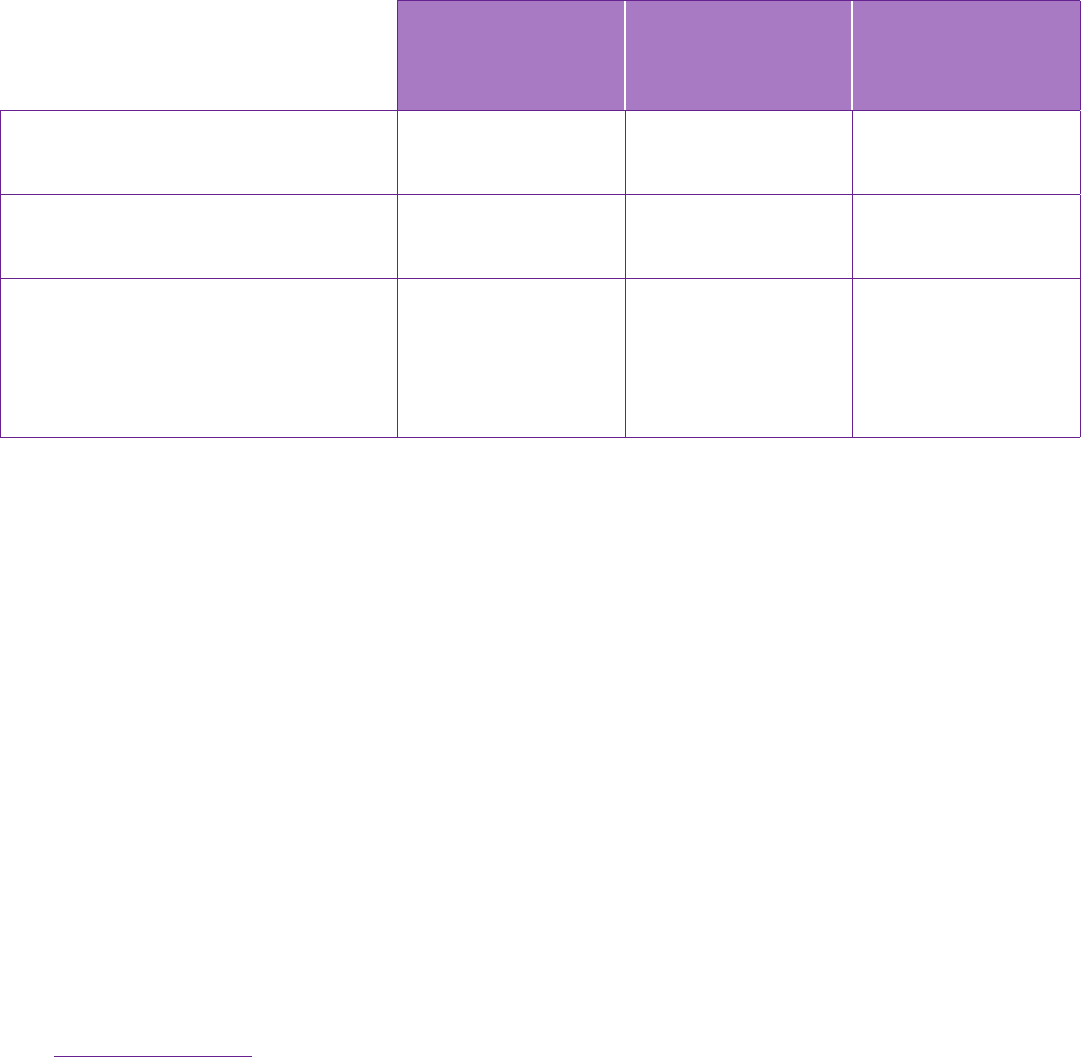

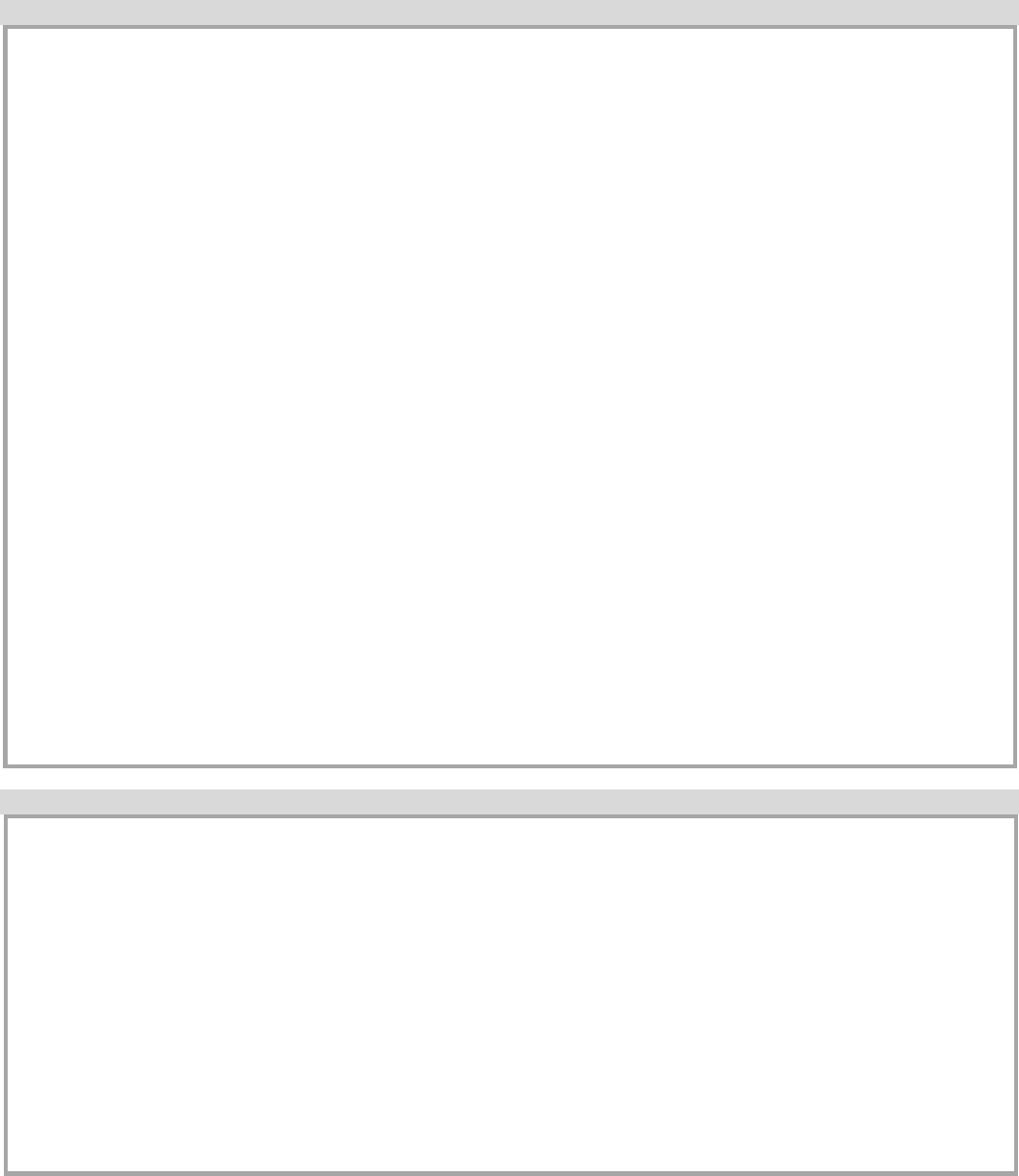

Coverage Description Coverage Maximums

Car Rental Theft

and Damage

Covers theft, loss, or damage to a rental

car

Up to $85,000 Manufacturer’s Suggested

Retail Price per rental (maximum duration

of 48 consecutive days)

Buyer’s

Assurance

®

Protection Plan

For most new personal items:

doubles the manufacturer’s warranty

duration up to a maximum of one

additional year

Maximum $10,000 per item not to exceed

$25,000 per Cardmember per policy year

for all occurrences and items combined

Purchase

Protection

®

Plan

For most new personal items:

covers theft or damage occurring within

90 days following the date of purchase

Maximum $1,000 per Cardmember per

occurrence

Mobile Device Offers compensation in case of loss, theft

or accidental damage to devices such as a

cell phone, smartphone or tablet

Up to $1,000 per occurrence, per insured

person

Certain fees or expenses must be charged to the Card account, in full or at least in part, to be covered.

Refer to the Certificate of Insurance for each coverage for full details.

You can find all information concerning what types of situations, items and costs are covered in the Certificate of Insurance for

each coverage under the section titled “Description of Coverage”.

2. What’s not covered?

We may deny your claim because of exclusions, limitations and reductions. Below is a summary of some circumstances and

items that are not covered. This is not a complete list. Consult the Limitations and Exclusions sections, as applicable, in

the Certificate of Insurance for each coverage to see a complete list of exclusions, limitations and reductions.

Exclusions

No benefits are payable in the following circumstances:

Concerning purchase insurance in general:

- If the insurance is not in effect at the time the event occurs.

- If you do not submit the insurance claim form or supporting documents that we ask of you and that are required to

process your request, within the applicable time limit.

- If you do not get expenses related to repair services or replacement of purchased items approved in advance by us.

Limitation

Benefits payable by us will be reduced by any amount reimbursed by another entity or insurer.

10

•

•

•

Car Rental Theft

and Damage

Vehicles not covered

trucks, pick-up trucks, off-road vehicles, motorcycles, mopeds, motor bikes,

recreational vehicles, buses, vans, cargo vans or mini cargo vans (other than mini-vans)

Circumstances not covered

•

driving while impaired by alcohol or drugs

•

normal wear and tear or mechanical or electrical breakdown or loss, damage or

misplacement of keys or remote-control devices

•

operation of the vehicle in violation of the terms of the rental contract

•

transport of contraband, use of vehicle for illegal trade

•

participation in any race or speed contest

•

personal injury, damage to property or third-party liability

Buyer’s Assurance

®

Protection Plan

Items not covered

•

all motorized vehicles and their parts and accessories

•

used and pre-owned items

•

items purchased by or for use by a business

Circumstances not covered

•

improper alteration or installation

•

fraud, confiscation by authorities, war, negligence, misuse and abuse, illegal activity or acts

•

inherent product defect

Purchase Protection

®

Plan

Items not covered

•

animals, living plants or perishable products and consumables

•

traveller’s cheques, any type of currency, cash, tickets

•

jewellery stolen from baggage not hand carried

•

all motorized vehicles

•

items purchased by or for use by a business

Circumstances not covered

•

normal wear and tear

•

fraud, confiscation by authorities, war, misuse and abuse, illegal activity or acts

•

inherent product defect

•

flood, earthquake or mysterious disappearance

Mobile Device Items not covered

•

accessories, laptops and batteries

•

devices purchased for resale or by, or for, a business

•

used, previously owned, or refurbished (except by the manufacturer) devices

•

devices that have been modified from their original state

•

devices being shipped or devices stolen from baggage

Circumstances not covered

•

normal wear and tear or cosmetic damage that does not affect functionality

•

inherent product defects or catastrophic damage beyond repair

•

power surges, artificially generated electrical currents or electrical irregularities

•

fraud, confiscation by authorities, illegal activities, theft or intentional criminal acts by the

Cardmember or a family member

•

flood, earthquake or mysterious disappearance

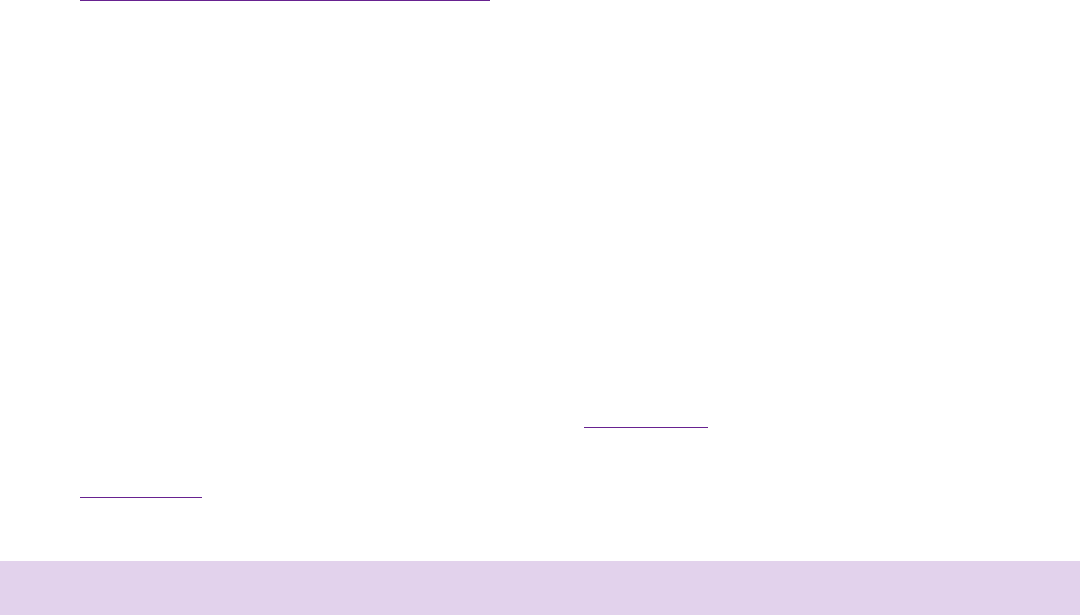

3. Who can be covered?

To be eligible for the following coverages, you must be a resident of Canada, and:

Car Rental Theft

and Damage

Buyer’s Assurance

®

Protection Plan

Purchase

Protection

®

Plan

Mobile

Device

the primary Cardmember, an

authorized user* of the account,

or a secondary driver

✓

the primary Cardmember or an

authorized user* of the account

✓ ✓ ✓

* A person who is a Supplementary Cardmember.

11

4. When does the insurance start and end?

Start

The insurance becomes available when you activate your Card.

End

The insurance ends on the earlier of:

- the date the Card account is cancelled or closed by Amex

- the date the Card account is closed at the request of the primary Cardmember

- the date the Card account is no longer in good standing

- the date the insurance is cancelled or suspended by Amex

For all details concerning the duration of insurance, consult the section titled “Term of Coverage” of the Certificate of Insurance

for each coverage.

5. How much does the insurance cost?

This insurance is included with your Card. There are no separate fees, premiums or expenses.

6. What if I provide inaccurate information?

You must always provide accurate information we deem necessary. We may refuse your claim if we obtain, as part of a claim

or at any other time during the duration of the insurance, any information that differs from the information you previously

provided. We may also cancel your insurance retroactively to its start date.

7. What if I want to cancel?

You have the right to rescind this insurance product within 10 days of activating your Card. Please note that this insurance

product is embedded and any cancellation of insurance may require the cancellation of your Card. Contact Amex (the

Distributor) for assistance and refer to the “Notice of rescission of an insurance contract” at the end of this summary.

8. How do I file a claim and what are the applicable timeframes?

Here’s how to file an insurance claim:

As soon as the event occurs, call 1 800 243-0198 or 905 475-4822 (collect calls accepted).

You will be given instructions on how to file a claim.

Timeframe to submit claim forms and supporting documents

Fill out the claim form that you will receive and return it as instructed, along with all the necessary documents, within 90days

of the event that led to the claim.

We will notify you of our decision following review of your application and, if applicable, we will pay the benefit within 60days

of receiving all the requested documents.

What if I disagree with a decision made regarding my claim?

You must contact us:

RSA Complaint Liaison Office

137 Venture Run, Suite 300

Dartmouth, Nova Scotia B3B 0L9

1 888 877-1710

Fax: 905 403-2331

Email: [email protected]

Website: https://www.rsagroup.ca/complaint-procedures

12

It is our goal to resolve your complaint within 30 business days. If this is not possible, we will let you know within the

30 business days that it will take longer and explain the reason for the delay.

Please include your full name, address, and telephone number. In addition to providing the details of your concern, please

make sure you have your policy or claim number ready so we can begin our review as quickly as possible.

RSA will work very diligently at resolving the problem to your satisfaction.

If you are not satisfied with the outcome and you wish to escalate it further, you can:

- request a review of your file,

- consult your legal counsel,

- contact one of the following organizations:

Autorité des marchés financiers (AMF)

Place de la Cité, tour Cominar

2640, boulevard Laurier, bureau 400

Québec (Québec) G1V 5C1

Québec: 418 525-0337

Montréal: 514 395-0337

Toll-free: 1 877 525-0337

Fax: 1 877 285-4378

Website: lautorite.qc.ca

General Insurance OmbudService (GIO)

4711 Yonge Street, 10

th

Floor

Toronto, Ontario M2N 6K8

Toll Free: 1 877 225-0446

Fax: 416 299-4261

Website: giocanada.org

You must comply with the time limits imposed by law if you wish to bring a proceeding or any other action against the insurer.

We’re here to help you. For any questions, call 1 800 243-0198 or 905 475-4822.

13

__________________________________________________________________________________________(date of sending of notice)

___________________________________________________ (number of contract, if indicated)

___________________________________________________________________________ (date of signature of contract)

_______________________________________________________________________________________________(place of signature of contract)

_________________________________________________________________________________________________________(name of client)

______________________________________________________________________________________________________ (signature of client)

Date:

I hereby rescind insurance contract no.:

Entered into on:

In:

NOTICE OF RESCISSION OF AN INSURANCE CONTRACT

Notice given by a distributor

Section 440 of the Act respecting the distribution of financial products and services (chapter D-9.2)

The Act respecting the distribution of financial products and services gives you important rights.

The Act allows you to rescind an insurance contract, without penalty, within 10 days of the date on which it is signed.

However, the insurer may grant you a longer period.

To rescind the contract, you must give the insurer notice, within that time, by registered mail or any other means that allows

you to obtain an acknowledgement of receipt.

Despite the rescission of the insurance contract, the first contract entered into will remain in force. Caution, it is possible that you

may lose advantageous conditions as a result of this insurance contract; contact your distributor or consult your contract.

After the expiry of the applicable time, you may rescind the insurance contract at any time; however, penalties may apply.

For further information, contact the Autorité des marchés financiers at 1 877 525-0337 or visit lautorite.qc.ca.

Notice of rescission of an insurance contract

Send to: Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

Pursuant to section 441 of the Act respecting the distribution of financial products and services,

These insurance products are underwritten by Royal & Sun Alliance Insurance Company of Canada.

© 2023 Royal & Sun Alliance Insurance Company of Canada. All rights reserved.

®

RSA, RSA & Design and related words and logos are trademarks and the property of RSA Insurance Group Limited, licensed

for use by Royal & Sun Alliance Insurance Company of Canada.

®

Used by Amex Bank of Canada under license from American Express.

14

$

Purchase insurance fact sheet

The purpose of this fact sheet is to inform you of your rights.

It does not relieve the insurer or the distributor of their obligations to you.

LET’S TALK INSURANCE!

Name of distributor:

Amex Bank of Canada

Name of insurer:

Royal & Sun Alliance Insurance Company of Canada

Name of insurance product:

Purchase Insurance

IT’S YOUR CHOICE

You are never required to purchase insurance:

• that is offered by your distributor;

• from a person who is assigned to you; or

• to obtain a better interest rate or any other benet.

Even if you are required to be insured, you do not have to purchase the insurance that

is being offered. You can choose your insurance product and your insurer.

HOW TO CHOOSE

To choose the insurance product that’s right for you, we recommend that you read the summary

that describes the insurance product and that must be provided to you.

DISTRIBUTOR REMUNERATION

A portion of the amount you pay for the insurance will be paid to the distributor as remuneration.

The distributor must tell you when the remuneration exceeds 30% of that amount.

RIGHT TO CANCEL

The Act allows you to rescind an insurance contract, at no cost, within 10 days after the purchase of your

insurance. However, the insurer may grant you a longer period of time. After that time, fees may apply if

you cancel the insurance. Ask your distributor about the period of time granted to cancel it at no cost.

If the cost of the insurance is added to the nancing amount and you cancel the insurance, your monthly

nancing payments might not change. Instead, the refund could be used to shorten the nancing

period. Ask your distributor for details.

The Autorité des marchés nanciers can provide you with unbiased, objective information.

Visit www.lautorite.qc.ca or call the AMF at 1-877-525-0337.

Reserved for use by the insurer:

Royal & Sun Alliance Insurance Company of Canada

700 University Avenue, Suite 1500A

Toronto, Ontario M5G 0A1

AMF Register - Insurer's client no.: 2001291200

This fact sheet cannot be modified

15

INSURANCE PRODUCT SUMMARY

$250,000 Travel Accident Insurance

Master Group Policy – TMH600135

Summary of coverage included with your AMERICAN EXPRESS

®

COBALT

®

CARD

Insurer:

Chubb Life Insurance Company of Canada

199 Bay Street, Suite 2500, P.O. Box 139

Commerce Court West Postal Station

Toronto, ON M5L 1E2

AMF Register – Insurer’s Number.: 2000461714

INSURER CUSTOMER SERVICE HELPLINE

1-877-777-1544

Distributor:

Amex Bank of Canada

2225 Sheppard Ave E,

North York, ON M2J 5C2

CUSTOMER SERVICE HELPLINE

1-800-869-3016

General Inquiries only

Autorité des marchés financiers:

Place de la Cité, tour Cominar

2640 boulevard Laurier, 4e étage

Québec (Québec) G1V 5C1

Québec City: 418-525-0337

Montreal: 514-395-0337

Toll Free: 1-877-525-0337

Fax: 418-525-9512

Website: www.lautorite.qc.ca

What is the purpose of this document?

This Summary has been provided to help you decide if the insurance included with your AMEX card meets your needs.

This is not your Certificate of Insurance. The information contained in this Summary is not exhaustive. For complete

details, please refer to your Certificate of Insurance by clicking on the following link:

https://www.chubb.com/content/dam/chubb-sites/chubb-com/ca-en/business-insurance/distribution-

guides/documents/pdf/American_Express_Colbalt_Card-Certificate_of_Insurance.pdf

What is this insurance for?

Common Carrier Accident Insurance provides coverage for an accidental death or dismemberment resulting from riding as a

passenger on a common carrier (land, air or water vehicle). Alternate Transportation Insurance provides coverage for an injury

resulting from an accident during a trip while riding as a passenger in or being struck by any conveyance providing alternate

transportation for a scheduled flight. Many conditions apply.

Who is eligible for insurance?

Warning: Words or phrases in bold type in this Summary are defined in the Certificate of Insurance. You should be familiar with

these definitions. Refer to the Certificate of Insurance (page 25) to see how the definitions apply to you.

To be eligible for this insurance coverage:

A. you must be the Basic or Supplementary Cardmember who has an American Express Card issued by Amex Bank of Canada

(“American Express”) in his or her name, or

B. you must be the Spouse or dependent child under age 23 of such person; and

C. the American Express Card account must be billed in Canada.

16

Summary of key conditions

Who can be insured?

A. you, provided you meet all the eligibility requirements described above; and

B. your Spouse or dependent child under age 23 provided you meet all the eligibility requirements described above.

TRAVEL INSURANCE COVERAGE

The Insurer will pay the applicable benefit amount if you suffer a Loss from an Injury while coverage is in force under the Policy,

but only if such Loss occurs within 100 days after the date of the accident which caused the Injury. In no event will the Insurer

pay for more than one Loss sustained as a result of any one accident. The benefit amount paid will be for the greatest Loss.

Common Carrier Benefit:

A benefit is payable under the Policy if you sustain an Injury as a result of an accident which occurs while riding solely as a

passenger in or boarding or alighting from a Common Carrier Conveyance or being struck by such Common Carrier Conveyance

on a Covered Trip.

Alternate Transportation Benefit:

A benefit is payable under the Policy if you sustain an Injury as a result of:

1. an accident which occurs on a Covered Trip while riding as a passenger in or boarding or alighting from any conveyance

providing alternate transportation for a Scheduled Airline flight which was delayed or rerouted, requiring the carrier which

would have operated the flight to arrange for such alternate transportation; or

2. being struck by a conveyance providing alternate transportation for a Scheduled Airline flight.

EXPOSURE AND DISAPPEARANCE

If you are unavoidably exposed to the elements because of an accident on a Covered Trip which results in the disappearance,

sinking or wrecking of a Common Carrier Conveyance, and if as a result of such exposure you suffer a Loss for which benefits

are otherwise payable under the Policy, such Loss will be covered under the Policy.

If you disappear because of an accident on a Covered Trip which results in the disappearance, sinking or wrecking of a Common

Carrier Conveyance, and if your body has not been found within 52 weeks after the date of such accident, it will be presumed,

provided there is no evidence to the contrary, that you suffered Loss of life as a result of Injury covered by the Policy.

MAXIMUM INDEMNITY

If you have multiple American Express Cards, the Insurer under the Policy will only pay the highest amount payable under one

American Express Card, as stated in “Benefit Amounts”, for any one Loss sustained by you as a result of any one accident.

What’s not covered?

EXCLUSIONS

For a detailed list of all exclusions, refer to page 27 of the Certificate of Insurance.

This insurance does not cover any Loss caused or contributed to by:

1. suicide or intentionally self-inflicted Injury by the Covered Person, or any attempt thereat;

2. war or any act of war, whether declared or undeclared; however, any act committed by an agent of any government, party or

faction engaged in war, hostilities or other warlike operations provided such agent is acting secretly and not in connection

with any operation of armed forces (whether military, naval or air forces) in the country where the Injury occurs shall not be

deemed an act of war;

3. the commission or aiding and abetting in the commission of an offense under the Criminal Code of Canada or the laws of

another country, or any attempt thereat, by or on behalf of the Covered Person or his or her beneficiaries;

4. Injury sustained while serving as an operator or crew member of any conveyance;

5. Injury received while driving, riding as a passenger in, boarding or alighting from a rental vehicle;

6. the Covered Person taking any alcohol, drug, medication, gas or poison unless taken as prescribed by a physician;

7. directly or indirectly, the actual, alleged or threatened discharge, dispersal, seepage, migration, escape, release of or

exposure to any hazardous biological, chemical, nuclear or radioactive material, gas, matter or contamination.

17

When does coverage apply?

During a trip taken by you between the point of departure and the final destination as shown on your ticket or verification issued

by the Common Carrier Conveyance provided your fare for such trip has been charged to an American Express Card prior to any

Injury.

When does coverage end?

The insurance of any Covered Person will terminate:

1. on the date the Policy terminates; or

2. on the date the person ceases to be a Covered Person under the Policy.

To file a claim

• You must call us as soon as possible after the incident.

• We will provide you with instructions needed to file a

claim.

• You must submit your claim to us within 30 days of the

incident.

FILING A CLAIM

If a Loss occurs, You should contact the Insurer and file a claim.

The procedure for filing a claim is detailed on page 27 of the

Certificate of Insurance.

A. Submission of a Claim

All claims must be reported in writing to the Insurer within 30

days of the covered Loss. The Insurer will send you forms for

giving proof of loss within 15 days of the notice of loss.

To file a claim, complete the claim form and return it, with

supporting documents listed on the form to:

Chubb Life Insurance Company of Canada

199 Bay Street - Suite 2500

P.O. Box 139, Commerce Court Postal Station

Toronto, Ontario M5L 1E2

B. Deadline to Submit a Claim

The claim form and the required documents must be

completed as requested and returned to the Insurer as soon

as possible within 30 days after the loss or, if you are a

Quebec resident, within the year of the loss if you prove your

impossibility to act within 30 days after the loss. Your

insurance must not have been terminated at the time of loss.

C. Insurer’s Reply

If your claim is approved, the benefit is paid within 15 days of

receipt of all documents necessary for the Claims Agent to

process your claim. If your claim is denied or the Insurer pays

only a portion of the benefit, you will receive a letter explaining

the reasons for the Insurer’s decision within 15 days of

receiving the documents required to process the claim.

D. Appeal of an Insurer’s Decision and Recourses

You may appeal from the Insurer’s decision if you disagree

with the outcome. You have 31 days from the date of the

Insurer’s decline of your claim to appeal from decision. Your

appeal to the Claims Agent must be in writing. The Insurer will

send you a response within 30 days of receipt of your request

to review. You may also contact the Autorité des marchés

financiers or your own lawyer.

HELPLINE

Canada and the United States

1-877-772-7797 (toll free)

18

What are the consequences of misrepresentation or failure to disclose?

Any misrepresentation, inaccurate representation or failure to disclose could lead to the Policy being cancelled, coverage being

denied, or benefits being refused or reduced. Should you have any questions, please contact the Insurer.

What if I change my mind after applying for an American Express card?

Coverage can be cancelled by cancelling Your American Express Card without penalty at any time. The insurance is non-

refundable, as there is no insurance premium nor additional fee. To cancel Your insurance coverage, You must send notice of

cancellation of the card to the Distributor that provided You with Your card.

Privacy

You may consult the Insurer’s Privacy policy to understand how they collect and use your personal information. You may

request to review Your personal information in your file or request to make a correction by writing to: The Privacy Officer; Chubb

Life Insurance Company of Canada, 199 Bay Street, Suite 2500, Toronto, Ontario, M5L 1E2. For more information on privacy at

Chubb Life, visit: https://www.chubb.com/ca-en/privacy-policy.aspx

Other conditions and exclusions may apply

Additional conditions and exclusions are described in detail in the Certificate of Insurance. You can view the Certificate of

Insurance by following the link on the first page of this Summary. Please read it carefully.

How much does it cost?

The insurance is included with your AMEX card. No separate fees, premiums or expenses will be charged.

What happens in the event of a dispute?

• We’re here to help you, please contact us for support.

• You must comply with the time limits imposed by law if you wish to bring a proceeding or any other action against the

insurer.

COMPLAINT TO THE INSURER AND COMPLAINT RESOLUTION PROCESS

To make a complaint and access the Insurer's policy on handling complaints, please click on the following link:

https://www.chubb.com/ca-en/complaint-resolution-process.aspx

Have a question?

Insurer Customer Service: 1-877-777-1544 AMEX Customer Service: 1-800-869-3016

General Inquiries only

This insurance product is underwritten by Chubb Life Insurance Company of Canada.

®, TM

Used by Amex Bank of Canada under license from American Express.

19

Fact Sheet

LET’S TALK INSURANCE!

IT’S YOUR CHOICE

You are never required to purchase insurance:

that is offered by your distributor;

from a person who is assigned to you; or

Even if you are required to be insured, you do not have to purchase the insurance that

You can choose

HOW TO CHOOSE

DISTRIBUTOR REMUNERATION

The distributor must

RIGHT TO CANCEL

The Act allows you to rescind an insurance contract, at no cost, within 10 days after the purchase of your

Ask your distributor about the period of time granted to cancel it at no cost

period. Ask your distributor for details

The can provide you with unbiased, objective information.

Visit

$

This fact sheet cannot be modified

Name of distributor:

Name of insurer:

Name of insurance product:

Reserved for use by the insurer:

Fact Sheet

Amex Bank of Canada

Chubb Life Insurance Company of Canada

Travel Accident Insurance

The purpose of this fact sheet

is

to inform you of your rights

It

does not relieve

the

insurer or

the

distributor of their obligations

to

you

LET'S

TALK

INSURANCE!

Name of distributor

Name of insurer

Name of insurance product

IT'S

YOUR

CHOICE

You

are

never required

to

purchase insurance

• that is offered by your distributor;

• from a person who

is

assigned

to

you;

or

•

to

obtain a better interest rate or any other benefit

Even if you are required

to

be insured, you

do

not have

to

purchase

the

insurance that

is

being offered

You

can choose your insurance product and your insurer.

HOW

TO

CHOOSE

0

To choose the insurance product that's right for

you,

we recommend that you read

the

summary

that describes the insurance product and that must be provided

to

you

DISTRIBUTOR

REMUNERATION

E)

A portion of the amount you pay for the insurance will be paid

to

the distributor as remuneration.

The

distributor must tell you when

the

remuneration exceeds

30%

of

that amount

RIGHT

TO

CANCEL

The

Act allows you to rescind an insurance contract,

at

no

cost, within 10 days after the purchase of your

insurance. However,

the

insurer may grant you a longer period of time. After that time, fees may apply if

you cancel the insurance.

Ask your distributor about

the

period of time granted

to

cancel it

at

no

cost.

If

the cost of the insurance

is

added

to

the

financing amount and you cancel the insurance, your monthly

financing payments might not change Instead, the refund could

be

used to shorten the financing

period.

Ask

your distributor

for

details.

The Autorite des marches financiers can provide you with unbiased, objective information.

Visit

www

lautorite

qc

ca or call the AMF at 1-877-525-0337

Reserved

for

use

by

the

insurer.

This

fact

sheet

cannot

be

modified

20