1

TD Insurance

TD Trip Cancellation and Trip Interruption Insurance

Certificate of Insurance

Issued by: TD Life Insurance Company (“TD Life”) under Group Policy Number TI004 and TD Home and Auto

Insurance Company ("TD Home & Auto") under Group Policy Number TGV007 (the “Group Policy” or "Group Policies")

to The Toronto-Dominion Bank (the “Policyholder”). Global Excel Management Inc. ("Global Excel") provides claims

and assistance services and CanAm Insurance Services (2018) Ltd. ("CanAm"), a subsidiary of Global Excel, provides

sales and policy administration under the Group Policy.

IMPORTANT NOTICE - READ CAREFULLY BEFORE YOU TRAVEL

You have purchased travel insurance coverage – what’s next? We want You to understand (and it is in Your best

interests to know) what Your coverage includes, what it excludes, and what is limited (payable but with limits).

Please take time to read through Your Certificate before You travel. Italicized and capitalized terms are defined

in Your Certificate.

• Travel insurance covers claims arising from sudden and unexpected situations (e.g. accidents and emergencies).

• To qualify for this insurance, You must meet all the eligibility requirements.

• This insurance contains limitations and exclusions (e.g. Medical Conditions that are not Stable, pregnancy, child

born on trip, excessive use of alcohol, high risk activities, etc.).

• This insurance may not cover claims related to Pre-Existing Medical Conditions whether disclosed or not at time

of purchase.

• Contact Global Excel at 1-800-359-6704 +1-416-977-5040 (collect) before You need to cancel or interrupt Your

Covered Trip or Your benefits may be limited or denied.

• In the event of a claim Your prior medical history may be reviewed.

• If any of Your information is not accurate or complete, Your insurance plan will be voidable.

IT IS YOUR RESPONSIBILITY TO UNDERSTAND YOUR COVERAGE. Please read Your Certificate for

specific coverage, details, limitations and exclusions.

IF YOU HAVE QUESTIONS, CALL 1-800-775-1669, or visit www.td.com/safetravels

24-hour Emergency Assistance

In a Medical Emergency, You must call Global Excel immediately, or as soon as reasonably possible. If not, benefits

will be limited as described in Section 6, under “Medical Emergency Insurance Limitations and Exclusions.” Some

expenses will only be covered if Global Excel approves them in advance.

You can get help 24 hours a day, seven days a week by calling:

• from Canada or the U.S., toll-free, 1-800-359-6704; or

• from other countries, +1-416-977-5040, collect.

Claims Support

To request a claim form or to receive claim-related support, call Global Excel from 8 a.m. to 8 p.m. ET, Monday to

Friday, toll-free at 1-800-359-6704 or collect +1-416-977-5040

Changes to Your Coverage

To cancel Your insurance or to make changes to Your coverage, call CanAm from 8 a.m. to 9 p.m. ET, Monday to

Friday, and 9 a.m. to 5 p.m. ET on Saturday, toll-free at 1-800-775-1669

Table of Contents

Section 1: Introduction ............................................................................................................................... 3

Section 2: Eligibility .................................................................................................................................... 3

Section 3: Summary of Trip Cancellation and Trip Interruption Benefits ............................................. 4

Section 4: Definitions ................................................................................................................................. 4

Section 5: Description of Insurance Coverage ........................................................................................ 4

Trip Cancellation Coverage (before Departure Date) ............................................................................... 4

What to do if You need to cancel Your Covered Trip ................................................................................ 4

Trip Interruption Coverage (after Departure Date) .................................................................................... 4

What to do if You need to interrupt Your Covered Trip ............................................................................. 4

Trip Cancellation and Trip Interruption Insurance Benefits ....................................................................... 5

Section 6: Limitations and Exclusions That Apply to All Benefits ...................................................... 11

Section 7: How to Become Insured, Extend or Increase Coverage ..................................................... 14

How to Become Insured .......................................................................................................................... 14

Trip Cancellation and Trip Interruption Coverage Period ....................................................................... 15

Trip Cancellation Coverage Period ..................................................................................................... 15

Trip Interruption Coverage Period ....................................................................................................... 15

Automatic Extension of Coverage ....................................................................................................... 15

When Your Certificate Terminates .......................................................................................................... 15

How to Extend Your Coverage Period if the Covered Trip is Extended .................................................. 15

Section 8: Insurance Premium ................................................................................................................ 15

About Your Premium ............................................................................................................................... 15

Premium Refund ..................................................................................................................................... 16

Section 9: Contract or Coverage Termination or Void by Insurer ....................................................... 16

Section 10 – How to Submit a Claim ....................................................................................................... 16

Who to Contact to Submit a Claim .......................................................................................................... 16

Complete the Required Form .................................................................................................................. 16

Provide the Information requested .......................................................................................................... 17

If You Report the Claim Immediately ...................................................................................................... 17

If You Do Not Report the Claim Immediately .......................................................................................... 17

What Claimant Can Expect from Insurer................................................................................................. 17

Section 11 – How to Contact Our Administrator.................................................................................... 18

Section 12 – General Conditions ............................................................................................................. 18

Access to Medical Care .......................................................................................................................... 18

Benefit Payments .................................................................................................................................... 18

Coordination of Benefits with other insurance ........................................................................................ 18

Currency .................................................................................................................................................. 19

Group Policy ............................................................................................................................................ 19

Legal Action Limitation Period ................................................................................................................. 19

Relationship between Us and the Group Policyholder............................................................................ 19

Review and Medical Examination ........................................................................................................... 19

Right of Subrogation ............................................................................................................................... 19

Recovery ................................................................................................................................................. 19

Other Sources of Payment ...................................................................................................................... 19

Definitions .................................................................................................................................................. 19

Complaint-Handling Process for TD Life Insurance Company ............................................................ 24

3

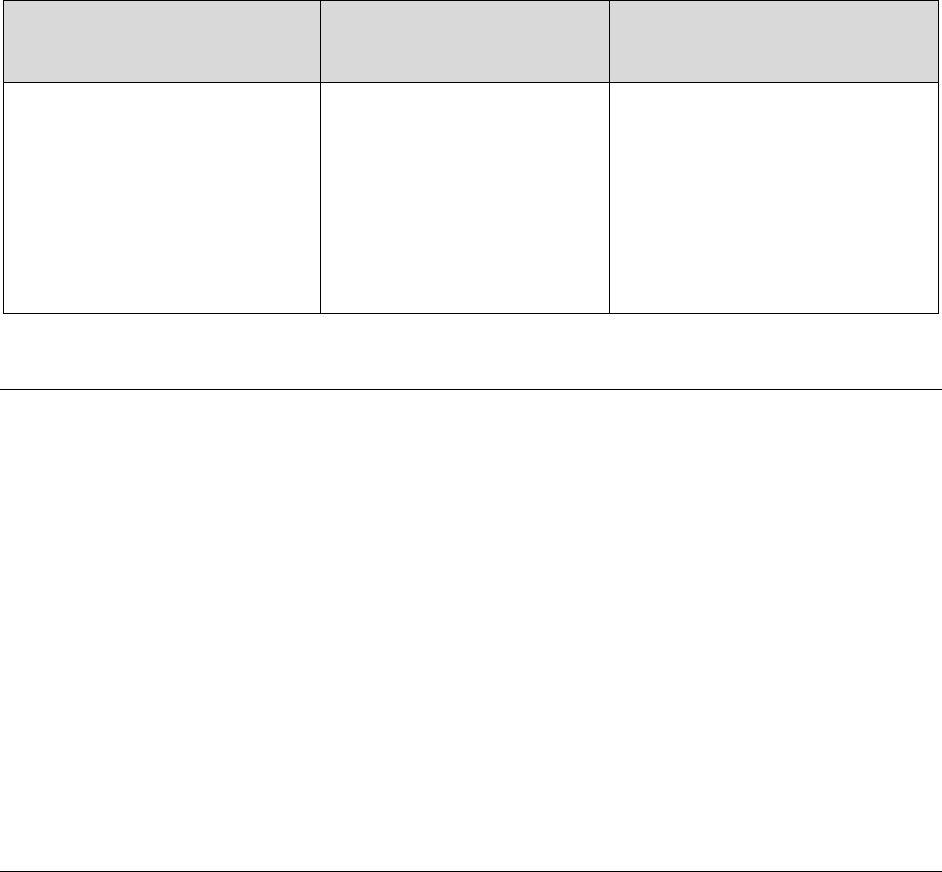

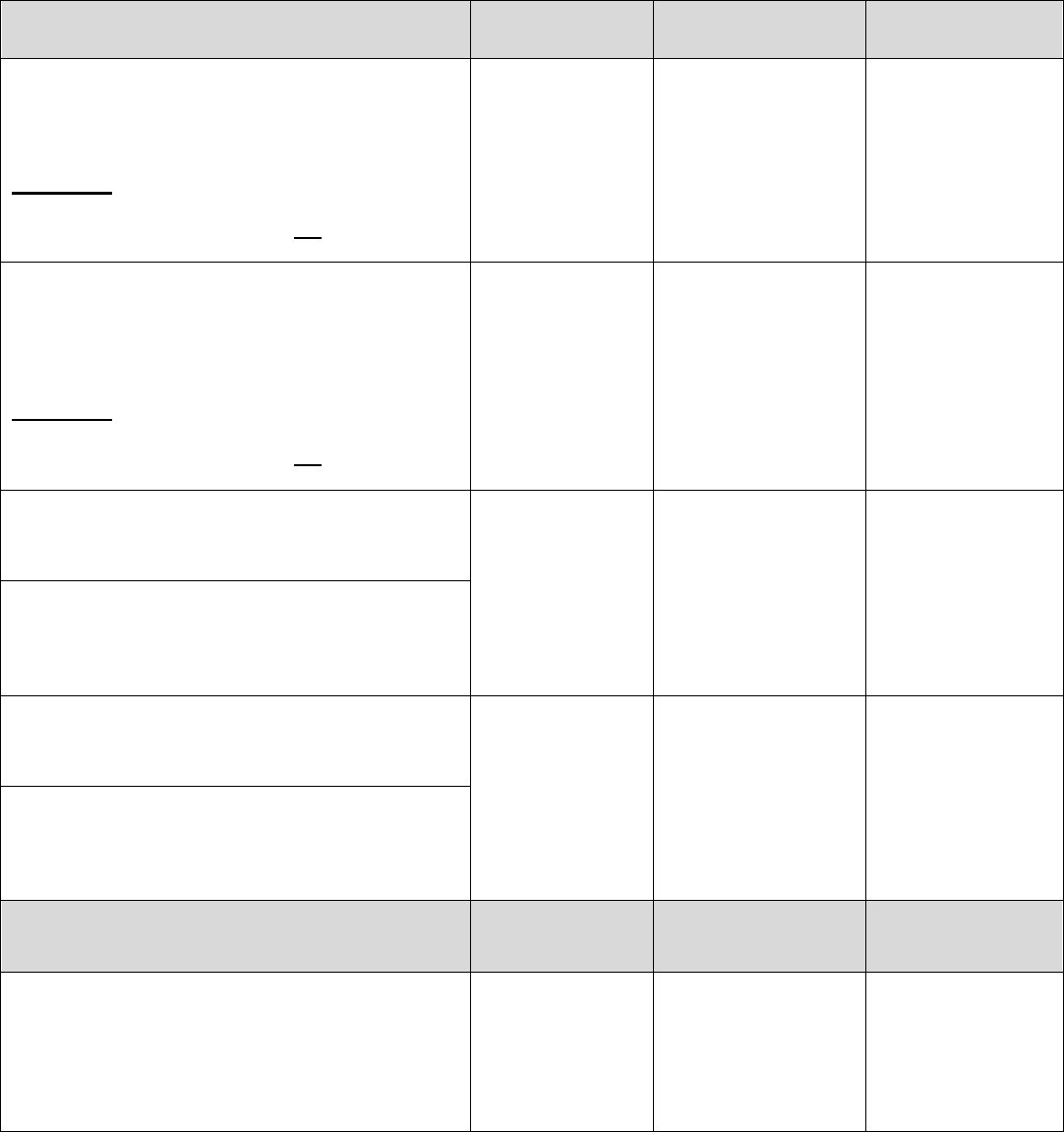

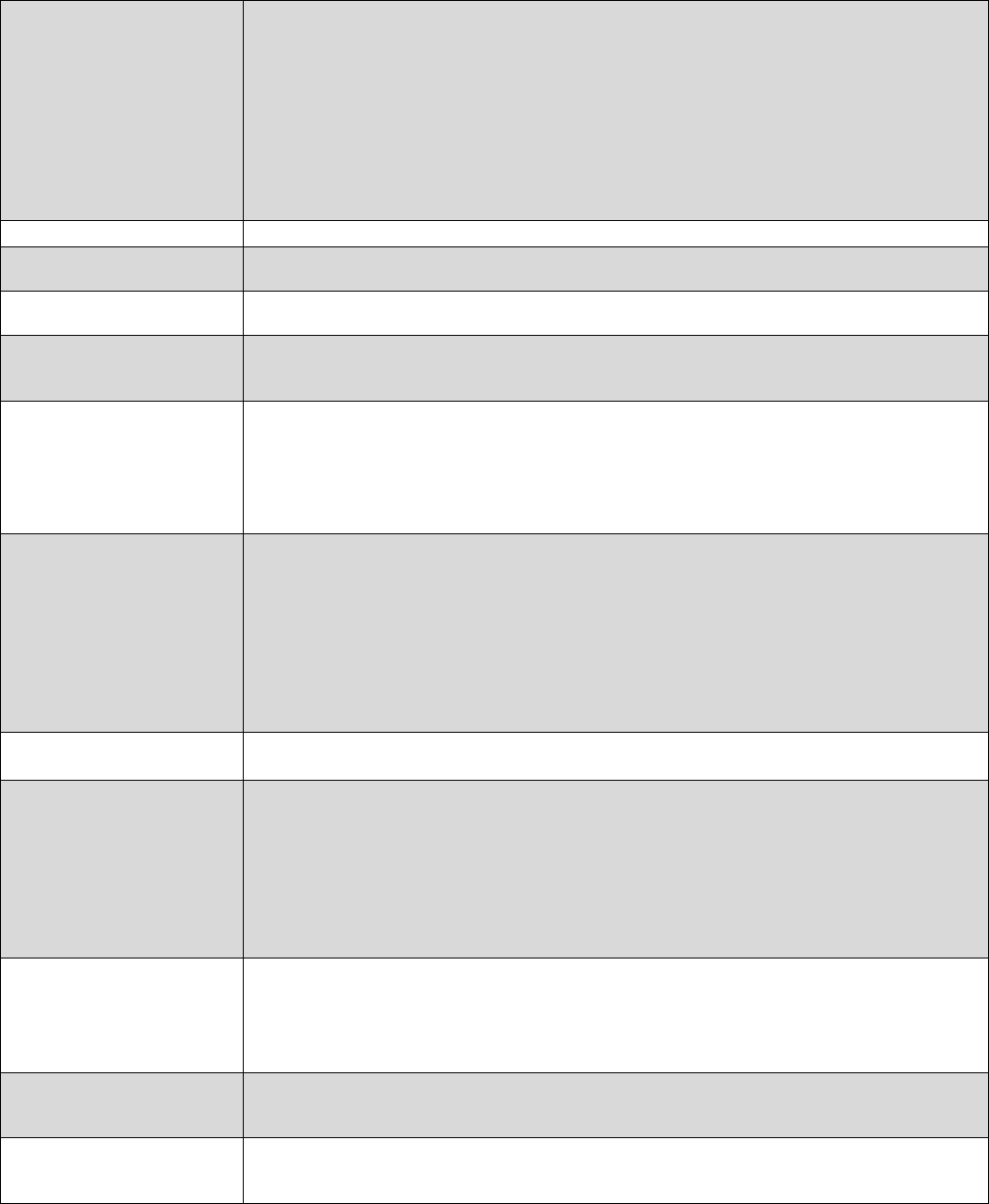

Coverage under this

Certificate is provided by:

Claims administration and

adjudication services are

provided by:

Sales and policy

administration services are

provided by:

TD Life Insurance Company

(Insurer)

P.O. Box 1 TD Centre

Toronto, Ontario M5K 1A2

TD Home and Auto

Insurance Company

(Insurer)

320 Front St West, 3rd Floor

Toronto, Ontario M5V 3B6

Global Excel Management

Inc. (Administrator)

73 Queen Street

Sherbrooke, Quebec J1M

0C9

Phone: 1-800-359-6704 or

+1-416-977-5040

CanAm Insurance Services

(2018) Ltd. (Administrator)

73 Queen Street

Sherbrooke, Quebec J1M 0C9

Phone: 1-800-775-1669

Section 1: Introduction

Certificate of Insurance

Your Certificate of Insurance is part of Your contract and indicates the coverages and insurance to the

contract. You have the coverage(s) only if it was purchased.

How to contact Us

• Prior to travel:

o Call CanAm from 8 a.m. to 9 p.m. ET, Monday to Friday, and 9 a.m. to 5 p.m. ET on

Saturday, toll-free at 1-800-775-1669

• When travelling and You require emergency assistance:

o From Canada or the U.S., toll-free, 1-800-359-6704; or from other countries, collect, +1-

416-977-5040.

o 24-hour Emergency Assistance:

In a Medical Emergency, You must call Global Excel immediately, or as soon as

reasonably possible. If not, benefits will be limited as described in Section 6: Limitations

and Exclusions That Apply to All Benefits, under “Trip Cancellation and Trip Interruption

Insurance Limitations.” Some expenses will only be covered if Global Excel approves

them in advance.

Section 2: Eligibility

Eligibility Requirements

You may apply for coverage if You are:

• at least 18 years old on the Effective Date of Your Trip Cancellation and Trip Interruption

Insurance;

o If You are under 18 years old, a parent or guardian can provide authorization.

• a Resident of Canada; and

• a TD Bank Group customer, or the Spouse or Dependent Child of a TD Bank Group customer;

and

• in Canada when You buy the coverage; and

• purchasing coverage for the full duration of Your Trip up to a maximum of 365 days from the

Departure Date as indicated on Your insurance application or most recent Declaration of

Coverage.

If You fail to meet any of the conditions outlined above, Your insurance is void and Our liability is limited

to a refund of the premium paid.

4

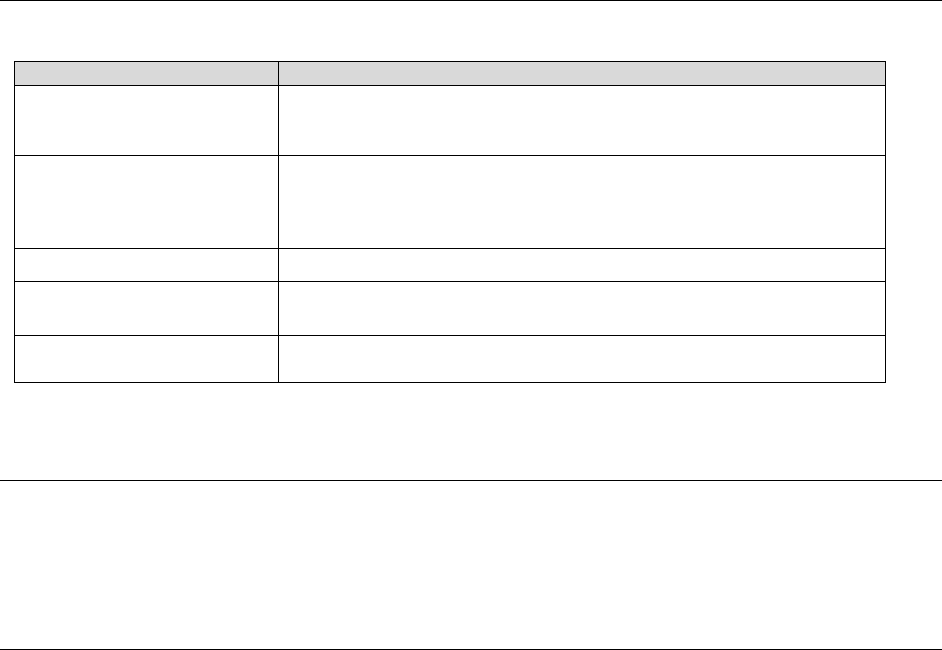

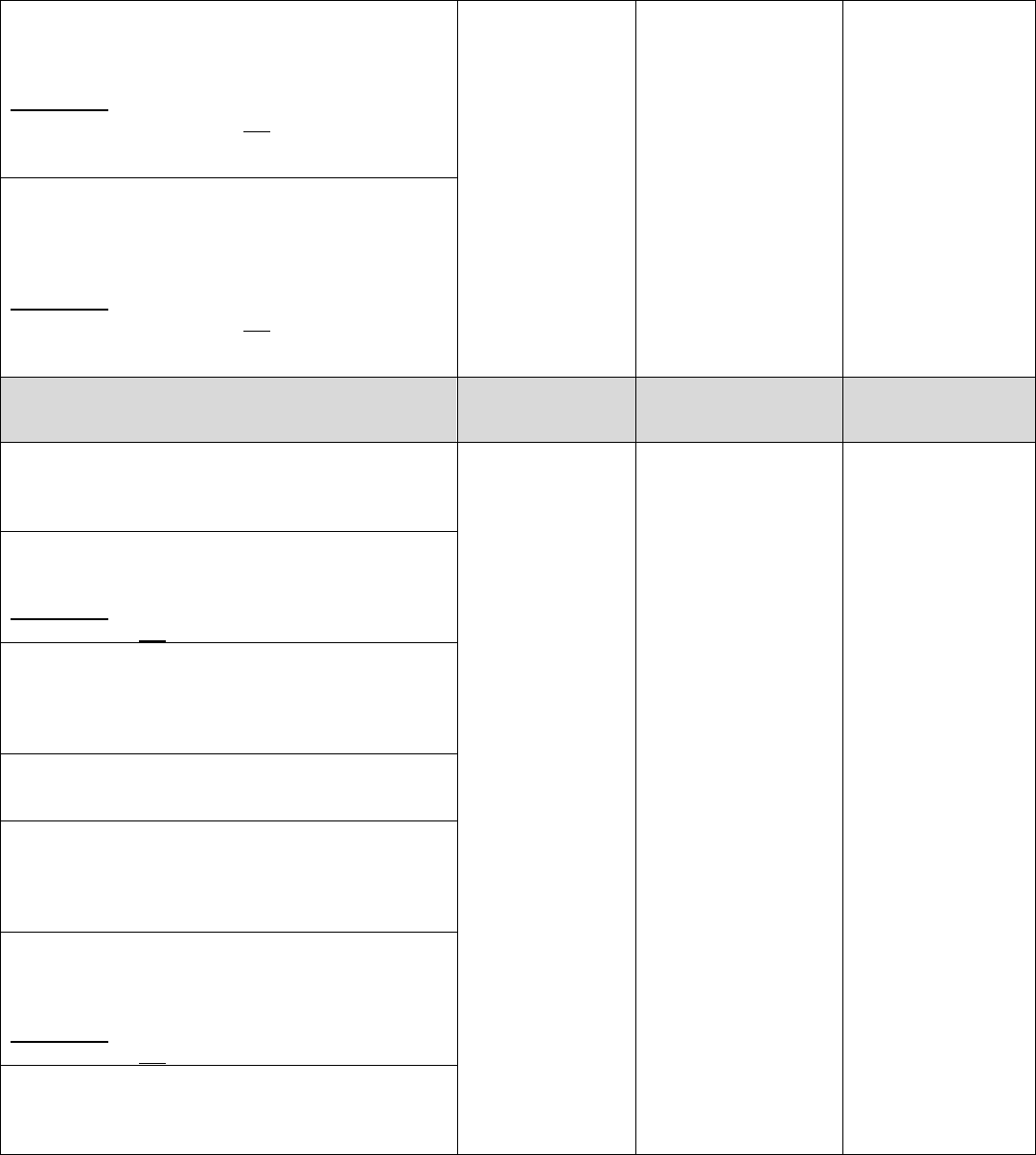

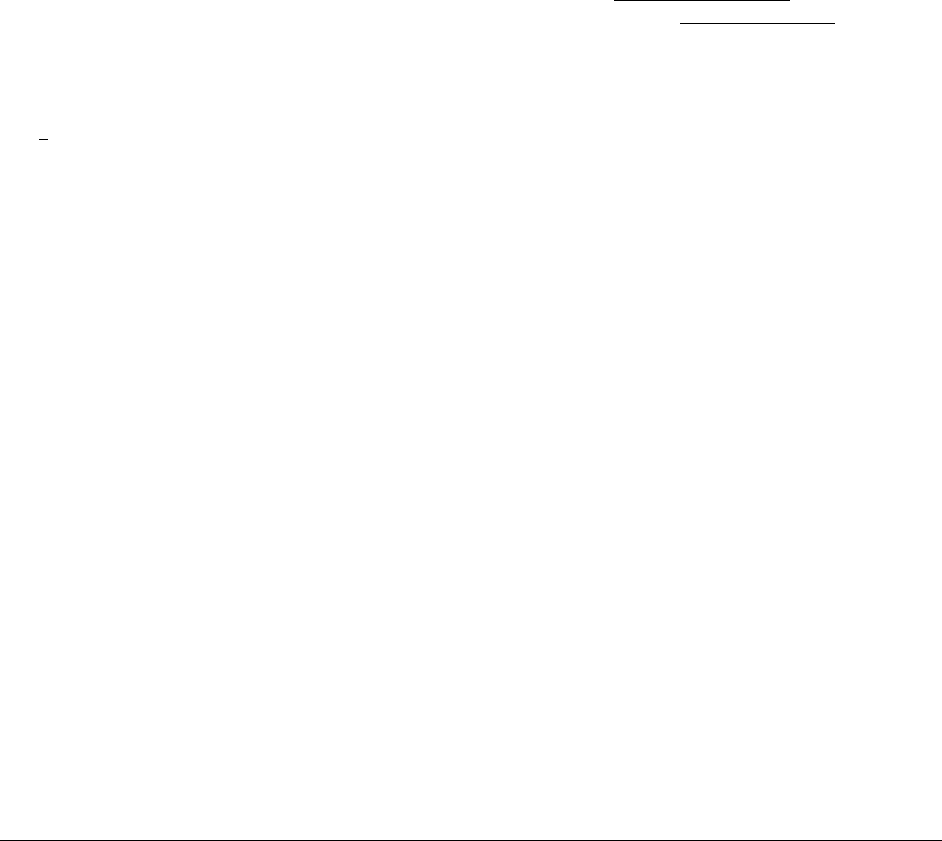

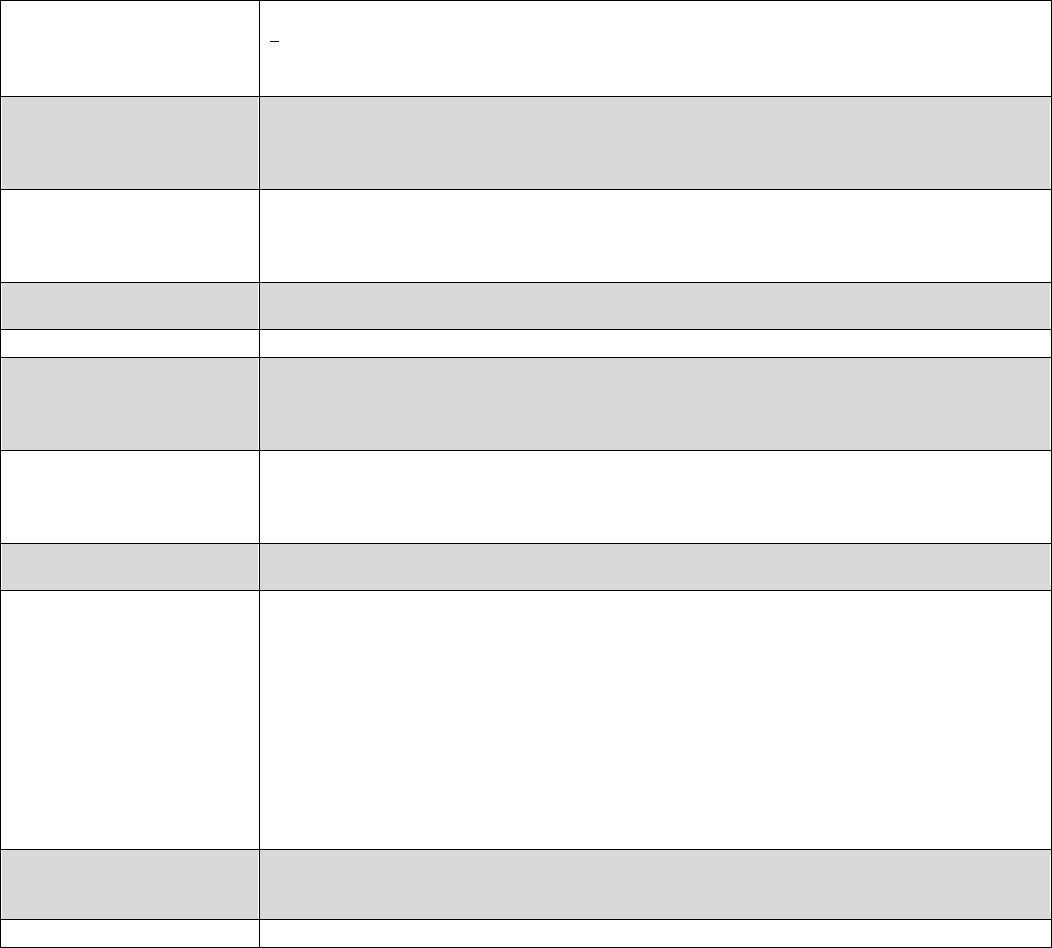

Section 3: Summary of Trip Cancellation and Trip

Interruption Benefits

For complete details of benefits, please refer to the applicable sections within this Certificate.

Benefit

Maximum Benefit Payable

Trip Cancellation

Insurance (Before

Departure Date)

Up to the Amount of Coverage purchased, to a maximum

insurable amount of $20,000 per Insured Person, per Covered

Trip.

Trip Interruption Insurance

(After Departure Date):

Unused portion of pre-paid travel arrangements, up to the Amount

of Coverage purchased prior to departure, to a maximum

insurable amount of $20,000 per Insured Person, per Covered

Trip.

Transportation

One-way economy class ticket.

Meals and accommodation

Up to $350 per day, per Insured Person, up to a maximum of

$700 per Insured Person, per Covered Trip.

Return of deceased

Up to $10,000 towards transportation or burial in the event of the

death of an Insured Person.

Section 4: Definitions

Italicized and capitalized terms are defined. As You read through the Certificate, please refer to

Definitions on page 19 to ensure You have a full understanding of Your coverage, limitations and

exclusions.

Section 5: Description of Insurance Coverage

Trip Cancellation Coverage (before Departure Date)

Trip Cancellation coverage offers financial protection if unexpected events occur before departure and

cause cancellation of travel plans.

What to do if You need to cancel Your Covered Trip

After the Insured Person has cancelled their travel arrangements with the travel supplier, the Insured

Person will need to follow the instructions under Section 10, "How to Submit a Claim" to submit a claim.

It is important to call Global Excel immediately or within 24 hours at the emergency assistance number

found in Section 11, "How to Contact Our Administrator". Some expenses are only covered if they’re

approved in advance by Global Excel. All transportation expenses must be pre-approved.

The amount payable under Trip Cancellation Insurance coverage is limited to the cancellation penalties in

effect on the date the covered cause for cancellation occurs, so it’s important to cancel the Insured

Person’s plans immediately but no later than within 24 hours of cancellation with Your travel agent or

travel supplier.

Trip Interruption Coverage (after Departure Date)

Trip Interruption coverage offers financial protection if unexpected events interrupt travel plans on or after

departure date.

What to do if You need to interrupt Your Covered Trip

After the Insured Person has interrupted their travel arrangements with the travel supplier, the Insured

Person will need to follow the instructions under Section 10, "How to Submit a Claim" to submit a claim.

5

The Insured Person must call Global Excel immediately at the 24 Hour Emergency Assistance number

found in Section 11, "How to Contact Our Administrator". Some expenses are only covered if they’re

approved in advance by Global Excel. All transportation expenses must be pre-approved.

Only the expenses that are non-refundable on the day the covered cause for interruption occurs are

eligible for reimbursement, so contact Global Excel immediately but no later than within 24 hours to

discuss alternate travel arrangements.

When does Your Trip Cancellation and Trip Interruption Insurance Coverage Start and End

Refer to Section 7, "Trip Cancellation and Trip Interruption Coverage Period" and "When Your Certificate

Terminates," for details on when Your coverage starts and ends.

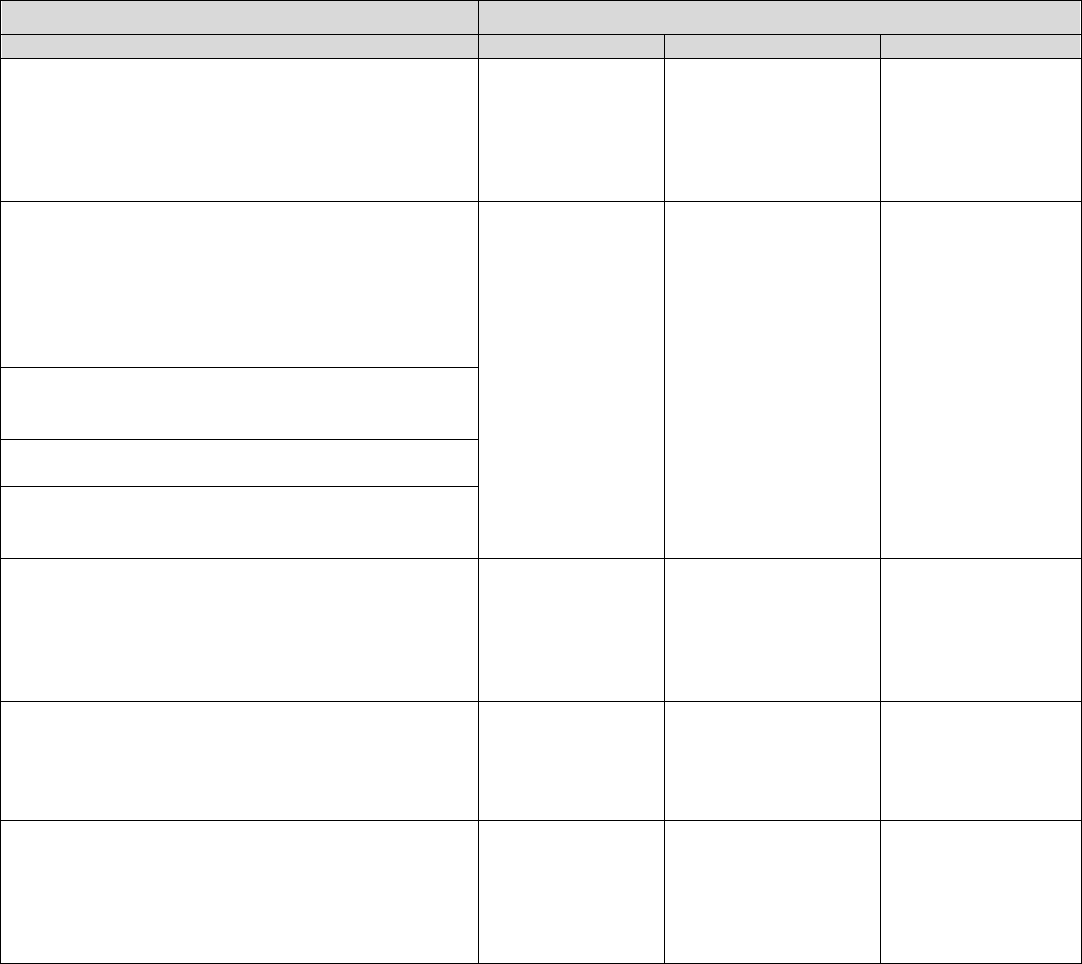

Trip Cancellation and Trip Interruption Insurance Benefits

Trip Cancellation and Trip Interruption Insurance provides coverage for the following causes for

Cancellation and Interruption. Below is a summary of what benefits are available to You.

What are the Covered Causes? What benefits are You eligible for?

Medical Emergency/Death

Trip Cancellation

Trip Interruption

Delayed Return

The Medical Emergency of You or Your Travelling

Companion.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

The admission to a Hospital following a Medical

Emergency of a member of Your Immediate Family

(who is not at Your destination), Your business

partner, Key Employee or Caregiver.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

A member of Your Immediate Family, Your

business partner, Key Employee or Caregiver

suffers a Medical Emergency or dies.

Your host at destination is admitted to a Hospital or

dies following a Medical Emergency.

Your Travelling Companion's Immediate Family

Member, business partner, Key Employee or

Caregiver suffers a Medical Emergency or dies.

The Medical Emergency or death of Your

Immediate Family Member who is at Your

destination.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

Your death.

•

Unused portion of

pre-paid travel

arrangements

• Return of

deceased

• Return of

deceased

The death of Your Travelling Companion.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

6

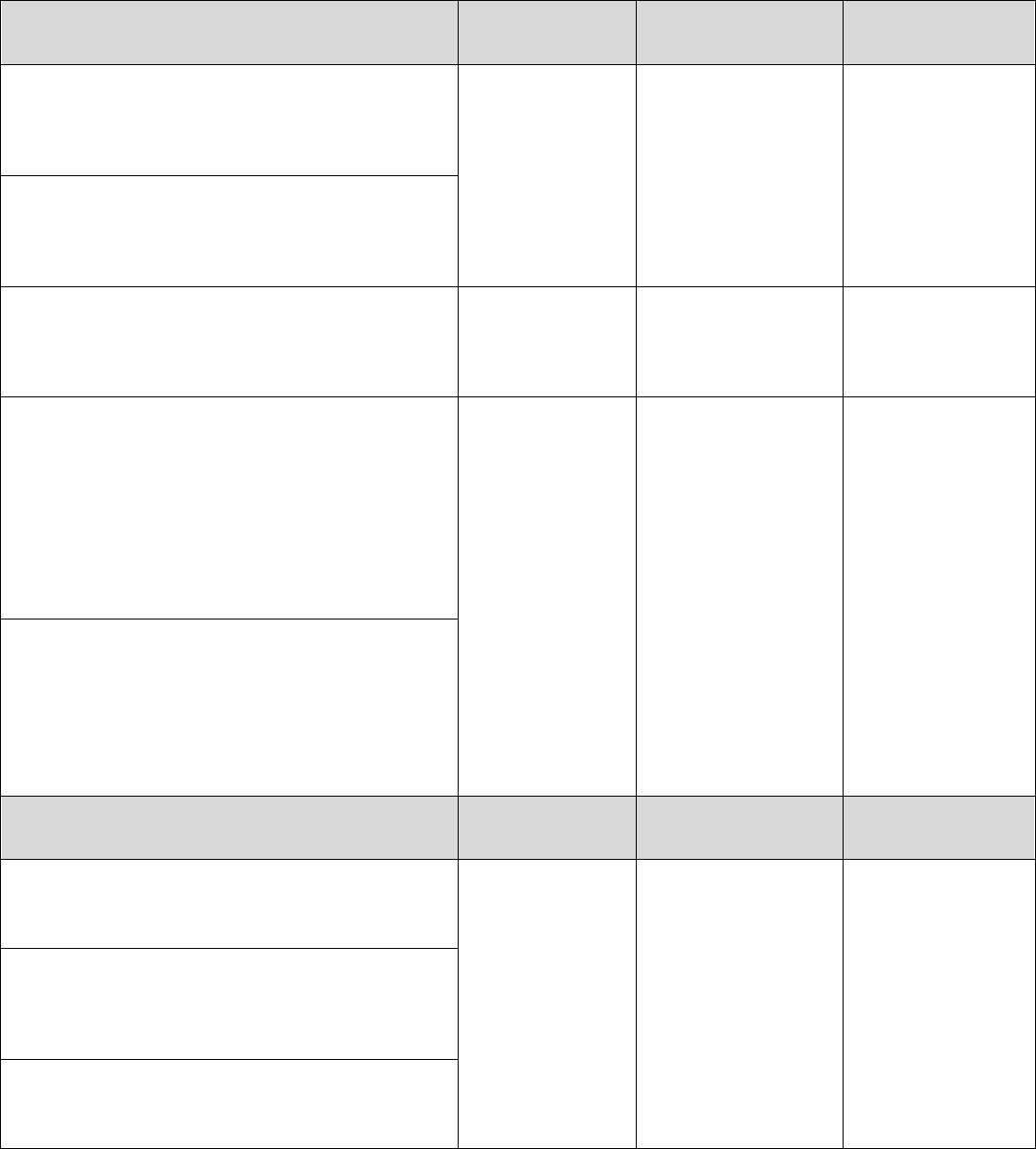

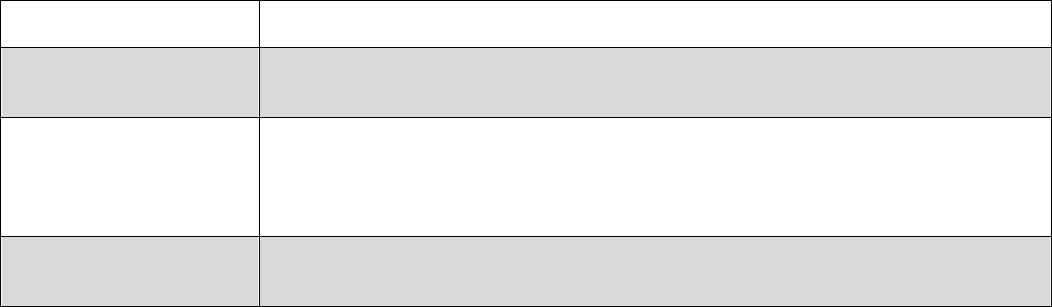

Pregnancy and Adoption Trip Cancellation Trip Interruption

Delayed Return

Complications of a pregnancy when they occur in

the first 31 weeks of a pregnancy involving You,

Your Spouse, or a member of Your Immediate

Family.

Limitation: The confirmation of a multiple

pregnancy or the confirmation of a pregnancy as a

result of fertility treatment(s) are not considered

complications of pregnancy.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

Complications of a pregnancy when they occur in

the first 31 weeks of pregnancy involving Your

Travelling Companion, or a member of the

Immediate Family of Your Travelling Companion or

Travelling Companion’s Spouse.

Limitation: The confirmation of a multiple

pregnancy or the confirmation of a pregnancy as a

result of fertility treatment(s) are not considered

complications of pregnancy.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

Your or Your Spouse's pregnancy being confirmed

after Your Effective Date if Your departure from

Your Home falls within 9 weeks before or after the

expected delivery date.

× ×

Your Travelling Companion’s or Your Travelling

Companion’s Spouse’s pregnancy being confirmed

after Your Effective Date if Your departure from

Your Home falls within 9 weeks before or after the

expected delivery date.

Your legal adoption of a child, when the actual date

of that adoption is scheduled to take place after

Your Effective Date of Insurance and before or

after Your Departure Date.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

Your Travelling Companion's legal adoption of a

child , when the actual date of that adoption is

scheduled to take place after Your Effective Date

of Insurance and before or after Your Departure

Date.

Travel Visas and Government Advisories Trip Cancellation Trip Interruption

Delayed Return

Department of Foreign Affairs, Trade and

Development Canada (DFATD) issues a written

formal Travel Warning during Your Trip, or, after

You purchase Your insurance but before Your

Departure Date, advising Canadians to avoid all or

non-essential travel to a destination included in

Your Covered Trip.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

7

Your travel visa is not issued or Your travel visa

application is rejected for reasons beyond Your

control.

Limitation: The non-issuance of an Immigration

and/or Employment Visa is not covered. The non-

issuance of a travel visa due to late visa application

is not covered.

× ×

Your Travelling Companion’s travel visa is not

issued or travel visa application is rejected for

reasons beyond Your Travelling Companion’s

control.

Limitation: The non-issuance of an Immigration

and/or Employment Visa is not covered. The non-

issuance of a travel visa due to late visa application

is not covered.

Causes relating to Employment Trip Cancellation Trip Interruption

Delayed Return

You or Your Spouse is transferred by the employer

with whom You or Your Spouse is employed on

Your Effective Date, which requires the relocation

of Your principal residence.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

You or Your Spouse lose(s) a permanent job due

to lay-off or dismissal without just cause.

Limitation: Loss of contract employment or self-

employment is not covered.

Cancellation of Your or Your Travelling

Companion’s Business Meeting beyond Your or

Your employer’s control or Your Travelling

Companion’s or Your Travelling Companion’s

employer’s control.

Your being summoned to service in the case of

reservists, active military, police, essential medical

personnel and fire personnel.

A transfer by the employer with whom Your

Travelling Companion or Your Travelling

Companion's Spouse is employed on Your

Effective Date, which requires the relocation of

their principal residence.

Your Travelling Companion or Your Travelling

Companion's Spouse loses a permanent job due to

lay-off or dismissal without just cause.

Limitation: Loss of contract employment or self-

employment is not covered.

Your Travelling Companion being summoned to

service in the case of reservists, active military,

police, essential medical personnel and fire

personnel.

8

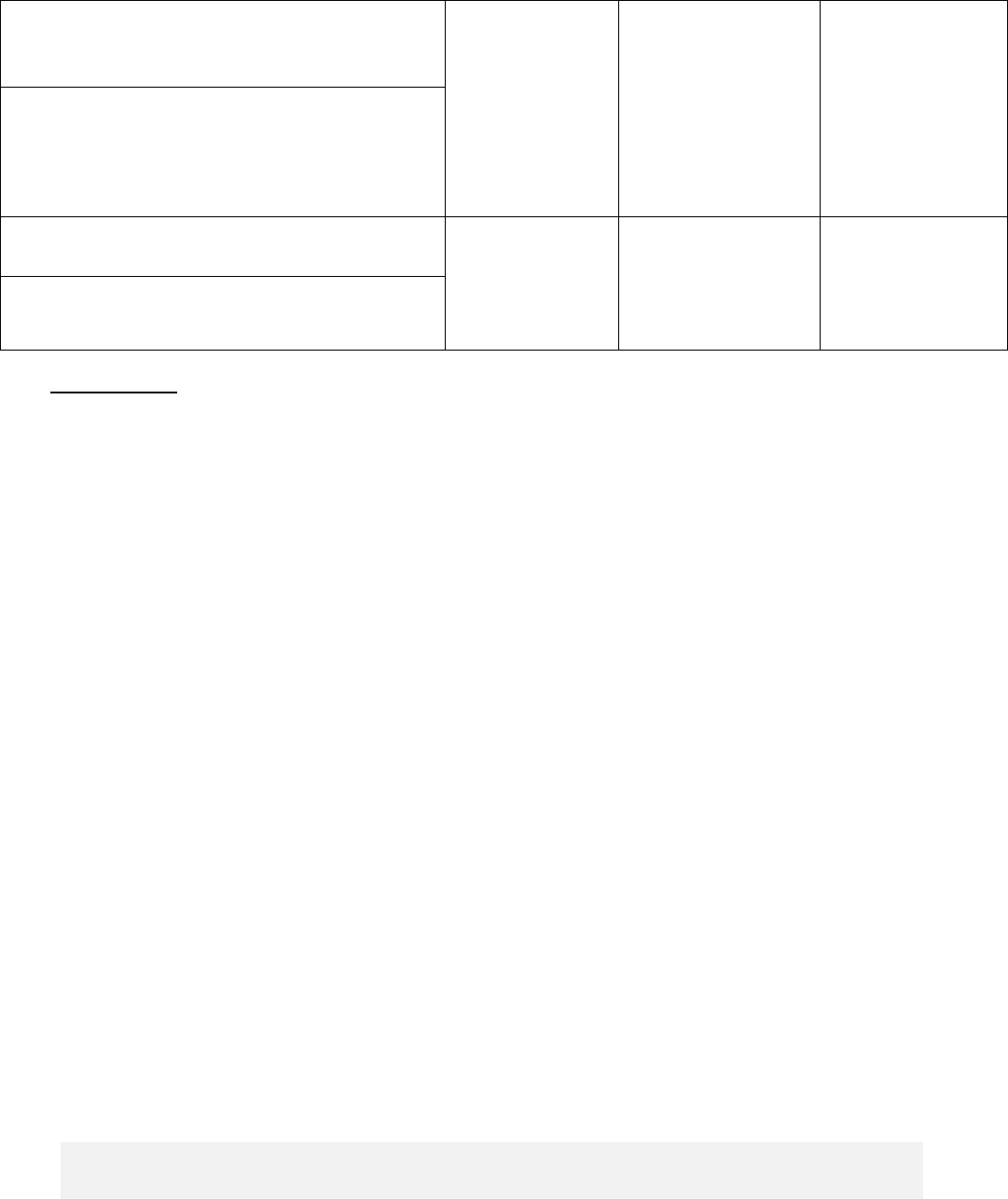

Travel Delays Trip Cancellation Trip Interruption

Delayed Return

Delay of Your scheduled carrier, due to weather

conditions, earthquakes or volcanic eruptions, for a

period of at least 30% of the Covered Trip, when

You choose not to continue with Your travel

arrangements.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

Delay of Your Travelling Companion’s scheduled

carrier, due to weather conditions, earthquakes or

volcanic eruptions, for a period of at least 30% of

the Covered Trip, when You choose not to

continue with Your travel arrangements.

Delay of Your Travelling Companion’s scheduled

carrier, due to weather conditions, earthquakes or

volcanic eruptions, for a period of at least 30% of

the Covered Trip, when You choose to continue

with Your travel arrangements

• Cost of the next

occupancy charge

×

Delay of a private automobile resulting from the

mechanical failure of that automobile, weather

conditions, earthquakes, volcanic eruptions, a

traffic accident, or an emergency police-directed

road closure, causing You to miss a connection or

resulting in the interruption of Your travel

arrangements, provided the automobile was

scheduled to arrive at the point of departure at

least 2 hours before the scheduled time of

departure.

×

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

Delay of Your connecting Common Carrier,

resulting from the mechanical failure of that carrier,

a traffic accident, an emergency police-directed

road closure, weather conditions, earthquakes,

volcanic eruptions, loss or theft of Your passports,

travel documents; causing You to miss a

connection or resulting in the interruption of Your

travel arrangements.

Other Risks Trip Cancellation Trip Interruption

Delayed Return

An event completely independent of any intentional

or negligent act that renders Your principal

residence uninhabitable or the business that You

own inoperative.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

You, Your Spouse or Your Dependent Child being:

a) Called for jury duty;

b) Subpoenaed as a witness; or

c) Required to appear as a party in a judicial

proceeding, during Your Covered Trip.

Your commercial accommodation at Your Trip

destination is rendered uninhabitable due to a

disaster or event independent of any intentional act

of negligence.

9

An event completely independent of any intentional

or negligent act that renders Your Travelling

Companion’s principal residence uninhabitable or

the business that he/she owns inoperative.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

×

Your Travelling Companion, Your Travelling

Companion's Spouse or Dependent Child being:

a) Called for jury duty;

b) Subpoenaed as a witness; or

c) Required to appear as a party in a judicial

proceeding, during Your Covered Trip.

The quarantine or hijacking of You, Your Spouse or

Your Dependent Child.

• Unused portion of

pre-paid travel

arrangements

• Transportation

• Meals and

Accommodation

• Transportation

• Meals and

Accommodation

The quarantine or hijacking of Your Travelling

Companion or Your Travelling Companion’s

Spouse or Dependent Child.

Chart Legend:

:

Eligible for benefit

× :

Ineligible for benefit

The Benefits Listed Above Include the Following:

Trip Cancellation Insurance (before Departure Date):

If one of the covered causes listed above occurs after You purchase Your insurance, and before You

leave Home and You are unable to travel:

• We will pay up to the Amount of Coverage for the prepaid, unused, and non-refundable travel

arrangements that are non-transferrable to another travel date; or

• We will cover the cost of the next occupancy charge up to the Amount of Coverage (only

applicable if Your Travelling Companion must cancel their Covered Trip due to a covered cause

applicable to them).

Trip Interruption Insurance (after Departure Date):

If one of the covered causes listed above occurs after You leave Home on Your Covered Trip, We will

pay, subject to pre-approval by Global Excel:

• Up to the Amount of Coverage for the non-refundable, unused portion of Your prepaid travel

arrangements, excluding the cost of prepaid transportation back to Your Home.

• Transportation:

o The extra cost of Your one-way economy class transportation, subject to pre-approval by

Global Excel:

to rejoin a tour or group;

to Your next destination as stated in Your trip itinerary; or

to Your Home.

• Fly to bedside or funeral:

o If You are required to interrupt Your Covered Trip to attend a funeral, or travel to the

bedside of a Hospitalized Immediate Family Member, business partner, Key Employee or

Caregiver, You have the option to purchase a ticket to the destination where the death or

Hospitalization has occurred. You will be reimbursed for the cost of the ticket, up to the

maximum amount of what it would have cost for one-way economy class transportation

via the most cost-effective route back to Your Home.

Note: Only available for use once during Your Coverage Period as indicated on Your most recent

Declaration of Coverage.

10

Exclusion: The "Fly to bedside or funeral" benefit replaces the option to obtain a return ticket to Your

Home. Additionally, the "Meals and Accommodation" benefit below does not apply under this fly to

bedside or funeral benefit.

Note: It is a condition of any transportation benefit under this Certificate that travel must be

undertaken on the earliest of:

• The date when Your travel is medically possible; or

• Within 10 days following Your originally scheduled Return Date if Your delay is not the

result of Hospitalization.

• Meals and Accommodation:

o Up to $350 per day to a maximum of $700 per Insured Person, per Covered Trip, for

Your:

Commercial accommodations and meals;

Essential telephone calls and internet usage fees;

Taxi fares (or rental car in lieu of taxi fares).

• In the Event of a Delay of Connecting Common Carrier:

o Up to $350 per day to a maximum of $700 per Insured Person, per Covered Trip, for

Your:

Overnight commercial accommodations (if delayed for 6 hours or more and the

delay occurs overnight);

Essential telephone calls and internet usage fees;

Taxi fares (or rental car in lieu of taxi fares).

Exclusion: This benefit can only be claimed if no other compensation was provided or offered by the

delayed connecting Common Carrier.

Note: It is a condition of any "Meals and Accommodation" benefit under this Certificate that travel

must be undertaken on the earliest of:

• The date when Your travel is medically possible; or

• Within 10 days following Your originally scheduled Return Date if Your delay is not the

result of Hospitalization.

Return of Deceased:

• In the event of Your death during the Trip Interruption Coverage Period, We will pay, subject to

pre-approval by Global Excel, up to a maximum of $10,000 towards:

o The cost for preparation and transportation of Your remains from the place of death to

Your Canadian city of residence.

OR;

o The burial or the cremation of Your remains where Your death occurred and one

roundtrip economy class Common Carrier ticket if:

An Immediate Family Member is required to identify or obtain release of the

deceased; and

Global Excel approves this transportation in advance

Exclusion: The cost of a burial casket or urn is not covered. The cost of funeral expenses at home

province or territory is also not covered.

11

Section 6: Limitations and Exclusions That Apply to All

Benefits

Trip Cancellation and Trip Interruption Insurance Limitations

1. Pre-approval

It is important to cancel or interrupt Your Covered Trip immediately, but no later than 24 hours

following the covered cause for cancellation or interruption, as the amount payable under this

Certificate may be limited to any penalties imposed by Your travel provider(s) which are in effect

on the date the covered cause for cancellation or interruption occurs.

You must call Global Excel immediately, so that We may:

• confirm coverage

• provide assistance and pre-approval, where required

If it is not possible for You to call, We ask that You have someone call on Your behalf as soon as

possible. Otherwise, if You do not call Global Excel before You cancel or interrupt Your Covered

Trip, Your maximum benefit payable may be impacted.

2. Other Limitations

Trip Cancellation Insurance (before Departure Date):

The covered cause must occur after You purchase Your insurance, and before You leave Home

and You are unable to travel.

Trip Interruption Insurance (after Departure Date):

The covered causes must occur after You leave Home on Your Covered Trip, benefits are subject

to pre-approval by Global Excel.

Note: To be eligible for cancellation and interruption benefits for medical reasons under

this Certificate, a Pre-Existing Medical Condition must be Stable for a specified period of time

before Your Effective Date.

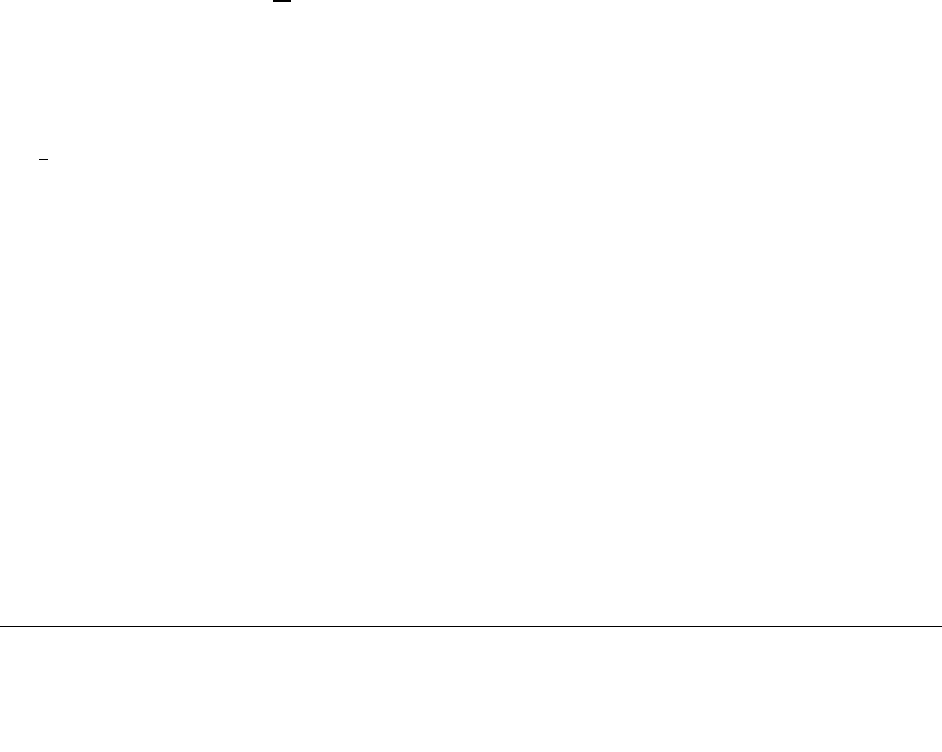

Pre-Existing Medical Condition Exclusions

Your Pre-Existing Medical Condition exclusion is determined by Your age, when You completed Your

Application for insurance. To be eligible for cancellation and interruption benefits for medical reasons

under this Certificate, a Pre-Existing Medical Condition must be Stable for a specified period of time

before Your Effective Date. The following table explains which Pre-Existing Medical Condition exclusion

and stability period applies to You.

Your Age

Pre-Existing Medical Condition exclusion that applies to You:

• Age 64 and under

We will not pay for any expenses or benefits incurred directly or

indirectly as a result of Your Medical Condition or related condition

(whether or not the diagnosis has been determined), if at any time

in the 90 days before Your Effective Date, Your Medical Condition

or related condition has not been Stable, other than a Minor

Ailment.

• Age 65 and older

We will not pay for any expenses or benefits incurred directly or

indirectly as a result of Your Medical Condition or related condition

(whether or not the diagnosis has been determined), if at any time

in the 180 days before Your Effective Date, Your Medical

Condition or related condition has not been Stable, other than a

Minor Ailment.

12

Trip Cancellation and Trip Interruption Insurance Exclusions

In addition to the exclusion outlined above, under "Pre-Existing Medical Condition Exclusion," this

Certificate does not cover any services or expenses of any kind caused directly or indirectly as a result of

the following:

1. General misrepresentation

You must be accurate and complete in Your dealings with Us at all times.

a. Misrepresentation of Your health/medical information

• This Certificate is issued on the basis of information in Your application or provided in

connection with Your application. When completing the application, Your answers must

be complete and accurate. In the event of a claim, We may review Your medical history.

If any of Your answers are found to be incomplete or inaccurate:

– Your coverage will be void which means Your claim will not be paid, and

– We will refund Your premium

• Misrepresentation regarding any Medical Condition for which You or an Insured Person

gave Us or Global Excel, or CanAm false or inaccurate information about diagnosis,

Hospitalizations, Treatment, prescriptions or medications.

b. Misrepresentation of material facts other than Your health/medical information, e.g. departure

date

• We will not pay a claim if You, any person insured under this Certificate or anyone acting

on Your behalf attempt to deceive or mislead Us, or makes a fraudulent, false or

exaggerated statement or claim.

This exclusion applies to You, Your Spouse, Your Dependent Children and Your Travelling Companion,

their Spouse and Dependent Children, whether or not they are travelling with You. It also applies to Your

parents and Your siblings and those of Your Travelling Companion, who live in the same home, whether

or not they are travelling with You.

2. a. Benefits in connection with a Medical Condition which is not Stable:

• no benefit will be paid for any Medical Condition which is not Stable for a specified period of

time (as noted in the table in "Pre-Existing Medical Condition Exclusion" in the beginning of

Section 6, above) before Your Effective Date.

b. Travelling for the purpose of obtaining Treatment:

• no benefit will be paid for a trip made for the purpose of obtaining a diagnosis, medical

Treatment, surgery, investigation, palliative care, or any alternative therapy, as well as any

directly or indirectly-related complication.

c. Travelling when Treatment could be expected

• no benefit will be paid for any Medical Condition or symptoms for which it is reasonable to

believe or expect that Treatment or Hospitalization will be required during Your trip.

• no benefit will be paid for any evident symptoms that would be reasonable to expect You to

investigate in the three (3) months prior to Your departure on a Covered Trip.

3. Illegal act

Situation where Your claim will not be paid:

• claim that results from or is related to Your involvement in the commission or attempted

commission of a criminal offence or illegal act in the jurisdiction where the claim was incurred,

including driving while impaired or over the legal limit.

4. Abuse of alcohol, drug, or intoxicants

Situations where Your claim will not be paid:

• any Medical Condition, including symptoms of withdrawal, arising from, or in any way related to,

Your chronic use of alcohol, drugs or other intoxicants whether prior to or during Your Covered Trip;

or

• any Medical Condition arising during Your Covered Trip from, or in any way related to, the abuse of

alcohol, drugs or other intoxicants.

13

5. Non-compliance with prescribed Treatment

Situation where Your claim will not be paid:

• any Medical Condition that is the result of You not following medical Treatment as prescribed to

You, including prescribed or over-the-counter medication.

6. Claims related to expectant mother’s complications of pregnancy, or delivery

Situations where Your claim will not be paid:

• claim related to routine pre-natal or post-natal care; or

• claim related to pregnancy, delivery or complications of either, arising nine (9) weeks before the

expected date of delivery or any time after delivery.

7. Child born during the Covered Trip

Situation where Your claim will not be paid:

• claim related to Your child born during the Covered Trip.

8. War or civil unrest

Situation where Your claim will not be paid:

• an act of war, whether declared or undeclared; or

• hostile or warlike action in time of peace or war; or

• willing participation in a riot or civil unrest; or

• rebellion; or

• revolution; or

• insurrection; or

• any service in the armed forces while on duty.

9. Travel advisory

Situation where Your claim will not be paid or payment will be limited:

• where an official travel advisory was issued by the Canadian government stating "Avoid all non-

essential travel" or "Avoid all travel" regarding the country, region or city of Your destination, before

Your Effective Date.

To view the travel advisories, visit the Government of Canada Travel site.

This exclusion does not apply to claims for a Medical Emergency or a Medical Condition unrelated to

the travel advisory.

10. Travel against medical advice

Situation where Your claim will not be paid:

• any claim incurred after a Physician advised You not to travel.

11. Other – Sports and High-Risk Activities

Situations where Your claim will not be paid:

• accident that occurs while You are participating in:

o any sporting activity for which you are paid;

o any sporting event for which the winners are awarded cash prizes;

o any extreme sport or activity involving a high level of risk, such as those indicated below,

but not limited to:

parasailing, hang-gliding and paragliding;

parachuting and sky diving;

bungee jumping;

Mountaineering;

cave exploration

scuba diving, outside the limits of Your certification;

any airborne activity in any aircraft other than a passenger aircraft that holds a

valid certificate of airworthiness

any competition, speed event or other high-risk activity involving the use of a

motor vehicle on land, water or air, including training activities, whether on

approved tracks or elsewhere;

14

12. Inaccurate evidence of insurability

Situations where Your claim will not be paid:

• with respect to Your failure to provide accurate and complete evidence of insurability as described

under Section 9: Contract or Coverage Termination or Void by Insurer.

13. Intentional self-inflicted injury

Situation where Your claim will not be paid:

• intentional self-inflicted injury, suicide or attempted suicide (whether or not the Insured Person is

aware of the result of their actions), regardless of the Insured Person's state of mind.

14. Reasons for Cancellation or Interruption occurring outside the Coverage Period

Situation where Your claim will not be paid:

• an incident that occurs outside the Coverage Period.

For example, no benefit will be paid with respect to an incident Medical Emergency that occurs after

11:59 p.m. ET on the last day of the Coverage Period, if You have not purchased top-up extended

Your Coverage Period.

NOTE: The day of departure counts as a full day for this purpose.

15. Non-emergency services

Situation where Your claim will not be paid:

• non-emergency, experimental or elective Treatment (e.g. cosmetic surgery, chronic care,

rehabilitation including any expenses for directly or indirectly related complications).

16. Payment of benefit prohibited by Canadian law

Situation where Your claim will not be paid:

• where the payment of the benefit is prohibited by Canadian law or where Canada has signed a

treaty or agreed to a sanction prohibiting such payment.

17. Reasonably Foreseeable Circumstances

• Any anticipated event, occurrence, circumstance, or Medical Condition, which You had

knowledge of, on or before Your Effective Date, and which You knew might cause the

cancellation, interruption or delay of Your Covered Trip.

• A Covered Trip the purpose of which is to visit or attend an ailing person, when the Medical

Condition or death of that person is the cause of the claim.

• The scheduled change of a medical test or surgery that was originally scheduled before Your

Coverage Period.

18. Non-Payment of Premium

• Pre-paid travel arrangements for which an insurance premium was not paid (e.g. not forming part

of the Amount of Coverage under this Certificate).

19. Travel Documents and Border Issues

• The non-issuance of a travel visa due to late visa application.

• Your refused entry at customs, border crossing, or security checkpoint for any reason.

20. Coverage and/or payment benefit prohibited by law

• This coverage shall be null and void and no benefit will be payable where the coverage and/or

payment of the benefit is prohibited by Canadian law or by any other applicable national

economic or trade sanctions law or regulation.

Section 7: How to Become Insured, Extend or Increase

Coverage

How to Become Insured

You are insured if You have proof of insurance. Your proof of insurance is in the form of the Declaration

of Coverage document that is provided to You when You complete Your Application for coverage. If You

do not receive Your proof of insurance before You depart on Your Covered Trip, You must contact

CanAm immediately.

You will have coverage once You complete all the following steps:

15

• applicants meet the Eligibility Requirements for insurance under Section 2: Eligibility; and

• apply for insurance; and

• pay the required premium.

Once this is complete, You will receive Proof of Insurance.

Trip Cancellation and Trip Interruption Coverage Period

Trip Cancellation Coverage Period

• The Trip Cancellation Insurance Coverage Period begins on the Effective Date indicated on Your

most recent Declaration of Coverage.

• The Trip Cancellation Insurance Coverage Period ends on the Departure Date stated on Your

most recent Declaration of Coverage.

Trip Interruption Coverage Period

• The Trip Interruption Coverage Period begins once You have departed from Your Home as

indicated on Your travel invoice or ticket, provided that the Covered Trip is reserved or purchased

with a travel supplier prior to Your Departure Date.

• The Trip Interruption Coverage Period ends on the earlier of:

o The date You return to Your Home; or

o 11:59 PM ET of Your Return Date, as stated on Your most recent Declaration of

Coverage.

Automatic Extension of Coverage

The delay of a Common Carrier will result in an automatic extension of coverage up to a

maximum of 72 hours or until You return to Your Home, whichever is earlier.

When Your Certificate Terminates

Your Trip Cancellation and Trip Interruption Insurance will automatically terminate on the earliest of:

• The date the covered cause of cancellation occurred, if Your Covered Trip is cancelled before

Your departure from Your Home;

• The date You return to Your Home;

• 11:59 PM ET of Your Return Date.

How to Extend Your Coverage Period if the Covered Trip is Extended

If You already have TD Trip Cancellation and Trip Interruption Insurance coverage, You can apply to

extend the Coverage Period, by contacting CanAm by telephone, if each Insured Person qualifies for

coverage as described under Eligibility Requirements, except that:

• You do not have to be in Canada when You apply to extend coverage; and

• You can apply either before or after You depart on Your trip as long as:

- no Insured Person has suffered a Medical Emergency before You apply for this extension of

coverage; and

- You apply before 11:59 p.m. ET on the date on which the original coverage terminates;

Any extension is subject to approval by CanAm.

The terms, conditions and exclusions of Our Certificate issued as extended coverage apply to You and

may be different than Your existing coverage.

The terms, conditions and exclusions of the Certificate apply to You during the Extension Period.

Section 8: Insurance Premium

About Your Premium

Premiums will be based on:

• the number of travellers to be insured as of the Effective Date of Your Certificate; and

• the total cost of the trip for all travellers (including taxes); and

• Our pricing that is in effect at the time of Your Application;

16

If You cancel Your insurance, some or all of Your premiums may be refunded, as described below.

NOTE: Please note that premium rates can be changed without notice.

Premium Refund

You may be eligible for a refund of Your Trip Cancellation and Trip Interruption Insurance premium if:

• Your Covered Trip is cancelled before You depart on Your Trip and:

o The supplier (e.g. tour operator, airline, etc.) cancels Your Covered Trip

and all penalties

are waived; or

o The supplier (e.g. tour operator, airline, etc.) changes the travel dates and You are

unable to travel on these dates and all penalties are waived; or

o You cancel Your Covered Trip before any cancellation penalties are in effect.

• No refund of premium will be made in the event that a claim has been paid, incurred or reported

or if You have already departed on Your Covered Trip.

All requests for cancellation must be made to CanAm, in writing or by phone (see "How to Contact Our

Administrator" in Section 11).

• by phone – cancellation will be effective on the date of Your call; or

• by written, mailed request – cancellation will be effective on the post-marked date of Your request.

Section 9: Contract or Coverage Termination or Void by

Insurer

When Can the Insurer Void Coverage

Failure to disclose impacts Your benefits

This Certificate and all coverage hereunder is voidable by Us:

• if the failure to disclose or misrepresent relates only to the amount of premium that should have

been paid; or

• even if any failure to disclose or misrepresent does not relate to the cause of any claim.

Premium

May or may not be fully or partially refunded.

Section 10 – How to Submit a Claim

IMPORTANT NOTE: You must report Your claim and provide completed claim form with required

supporting documentation to Global Excel as soon as possible, but no later than one (1) year after the

date it occurred.

Who to Contact to Submit a Claim

Once the Insured Person has cancelled his or her Covered Trip with the travel supplier, call Global Excel:

• from Canada or the U.S., toll-free, 1-800-359-6704; or

• from other countries, collect, +1-416-977-5040

Complete the Required Form

a) Request the Form

To request a claim form call Global Excel from 8 a.m. to 8 p.m. ET, Monday to Friday, toll-free at 1-

800-359-6704

b) Time limit from date of event

If You are making a claim, You must send Global Excel the appropriate claim forms, together with

written proof of loss (e.g. original invoices and tickets, medical and/or death certificates) as soon as

possible. In every case, You must report Your claim and submit Your completed claim form with

17

required documentation within one (1) year from the date of the accident or the date the claim arises.

Failure to provide the applicable documentation may invalidate Your claim.

Provide the Information requested

To make a Trip Cancellation or Trip Interruption claim, as part of the requirements above, under "Time

limit from date of event," We will need documentation to substantiate the claim, including but not limited to

the following:

• completed claim form;

• a medical document, fully completed by the legally qualified Physician in active personal

attendance and in the locality where the Medical Emergency occurred, stating the reason why

travel was not recommended, the diagnosis and all dates of Treatment;

• written evidence of the covered cause of cancellation, interruption or delay;

• travel supplier or tour operator terms and conditions detailing any cancellation penalties or

reimbursement for unused travel arrangements;

• complete original unused transportation tickets and vouchers;

• reports from the police or local authorities documenting the cause of the missed connection;

• all receipts for the prepaid land arrangements as detailed in Your travel documents or itinerary

prior to departure;

• all receipts for subsistence allowance expenses as approved by Global Excel;

• original passenger receipts for new tickets;

• detailed invoices and/or receipts from the service provider(s);

• any receipts for or proof of refund already obtained from travel suppliers or tour operators;

• the Insured Person will also be required to provide evidence of his or her actual or planned

Departure Date from his or her province or territory of residence;

• where the claim relates to a Medical Condition, a signed “Release of Medical Information”

authorization to allow Us to obtain any further information required to complete the claim review.

NOTE: If Global Excel makes an advance payment for expenses that are later discovered to be ineligible

under this Certificate, the Insured Person must reimburse Us.

If You Report the Claim Immediately

If Global Excel guarantees or pays eligible expenses on behalf of an Insured Person, then You and, if

applicable, the Insured Person must sign an authorization form allowing Global Excel to recover those

expenses:

• from any health plan or other insurance; and

• through rights You may have against other insurers or other parties (see Section 12: General

Conditions, under “Right of Subrogation”).

If Global Excel pays eligible expenses that are covered under other insurance or another plan, You and

the Insured Person (if applicable) must help Global Excel to seek reimbursement as required.

The Insured Person must also provide evidence of the actual departure date from his or her province or

territory of residence. If requested, an Insured Person must confirm any return dates to his or her

province or territory of residence, including any return dates related to an interruption in a Covered Trip.

NOTE: If Global Excel makes an advance payment for expenses that are later discovered to be ineligible

under this Certificate, the Insured Person must reimburse Us.

If You Do Not Report the Claim Immediately

It is important to cancel or interrupt Your Covered Trip immediately, but no later than 24 hours following

the covered cause for cancellation or interruption because the amount payable under this Certificate may

be limited to any penalties imposed by Your travel provider(s) which are in effect on the date the covered

cause for cancellation or interruption occurs.

If not, benefits will be limited as described under “Trip Interruption and Trip Interruption Insurance

Limitations” in Section 6. Refer to Section 11 under "How to Contact Our Administrator" for information

on how to get a claim form.

What Claimant Can Expect from Insurer

18

Once We have approved the claim, We will notify You and payment will be made within 60 days after

receipt of the required claim forms, documentation and written proof of loss. If the claim has been denied,

We will inform You of the claim denial reasons within 60 days after receipt of the required claim forms and

written proof of loss.

Section 11 – How to Contact Our Administrator

How to Contact Our Administrator

1. 24-hour Emergency Assistance Number

To enquire about these benefits, or to make arrangements with respect to Trip Cancellation and Trip

Interruption Insurance, call Global Excel 24 hours a day, seven days a week:

• from the U.S. or Canada, 1-800-359-6704;

• from elsewhere, call collect, +1-416-977-5040.

2. Customer Service

To cancel Your insurance or to make changes to your coverage, call CanAm from 8 a.m. to 9 p.m.

ET, Monday to Friday, and 9 a.m. to 5 p.m. ET on Saturday, toll-free at 1-800-775-1669 or mail Your

request to:

Re: TD Travel Insurance

c/o CanAm Insurance Services

73 Queen Street

Sherbrooke, Quebec J1M 0C9

To request a claim form or for claims support, call Global Excel from 8 a.m. to 8 p.m. ET, Monday to

Friday, toll-free at 1-800-359-6704.

Section 12 – General Conditions

Unless this Certificate or the Group Policy states otherwise, the following conditions apply to Your

coverage.

Access to Medical Care

We and/or Global Excel will assist You to access care whenever possible, however will not be

responsible for the availability, quality or results of any medical Treatment, care or transport, or for the

failure of any Insured Person to obtain Treatment.

Benefit Payments

This Certificate contains provisions removing or restricting the right of the Insured Person to

designate persons to whom or for whose benefit money is to be payable. This means that under the

Group Policy, neither You nor any Insured Person has the right to choose a beneficiary who will receive

any benefits payable under this Certificate. Benefits are payable to You or, on Your behalf, to Your

medical service provider.

Coordination of Benefits with other insurance

All of Our coverages are excess insurance, meaning that any other sources of recovery You have will pay

first, and this insurance coverage will be the last to pay. The total benefits payable under all Your

insurance, including this Certificate, cannot be more than the actual expenses for a claim. If an Insured

Person is also insured under any other insurance certificate or policy, We will coordinate payment of

benefits with the other insurer.

19

Currency

All amounts shown are in Canadian currency.

Group Policy

All benefits under this Certificate are subject in every respect to the Group Policy, which alone constitutes

the agreement under which benefits will be provided. The principal provisions of the Group Policy

affecting Insured Persons are summarized in this Certificate. The Group Policy is on file at the office of

the Policyholder and upon request, You are entitled to receive and examine a copy of the Group Policy.

Legal Action Limitation Period

Every action or proceeding against an insurer for the recovery of insurance money payable under the

contract is absolutely barred unless commenced within the time set out in the Insurance Act (for actions

or proceedings governed by the laws of Alberta and British Columbia), The Insurance Act (for actions or

proceedings governed by the laws of Manitoba), the Limitations Act, 2002 (for actions or proceedings

governed by the laws of Ontario), or other applicable legislation. For those actions or proceedings

governed by the laws of Quebec, the prescriptive period is set out in the Civil Code of Quebec.

Relationship between Us and the Group Policyholder

TD Life Insurance Company and TD Home and Auto Insurance Company is affiliated with The Toronto-

Dominion Bank (“TD Bank”).

Review and Medical Examination

When a claim is being processed, We will have the right and the opportunity, at Our own expense, to

review all medical records related to the claim and to examine the Insured Person medically when and as

often as may be reasonably required.

Right of Subrogation

There may be circumstances where another person or entity should have paid You for a loss but instead

We paid You for the loss. If this occurs, You agree to co-operate with Us so We may demand payment

from the person or entity who should have paid You for the loss. This may include:

• transferring to Us the debt or obligation owing to You from the other person or entity; or

• permitting Us to bring a lawsuit in Your name; or

• if You receive funds from the other person or entity, You will hold it in trust for Us; or

• acting so as not to prejudice any of Our rights to collect payment from the other person or entity.

We will pay the costs for the actions We take.

Recovery

In the event that You are found to be ineligible for coverage, or that a claim is found to be invalid, or

benefits are reduced in accordance with any policy exclusion or term or condition, We have the right to

collect from You any amount which We have paid on Your behalf to service providers or other parties.

Other Sources of Payment

The benefits payable, as described in this Certificate, are in excess of all other potential sources of

recovery, including alternative or replacement travel options offered by airlines, tour operators, cruise

lines and other travel suppliers and other insurance coverage (even where such other coverage is

described as excess) and will only become available after all other sources are exhausted.

Definitions

In this Certificate, the following words and phrases shown in italics and capitalized have the meanings

shown below. As You read through the Certificate, please refer to this section to ensure You have a full

understanding of Your coverage, limitations and exclusions.

Application

Means the series of questions that form Your application and are submitted:

20

• on Your behalf when You apply by telephone; or

• when You apply online.

The Application, which is used to determine Your eligibility, forms part of Your

insurance contract and is used to process Your request for insurance.

Amount of Coverage

Means the insurable amount of Trip Cancellation and Trip Interruption Insurance that

You purchase under this Certificate. This is the maximum amount of money that You

may be eligible to receive in the event of an approved claim for Trip Cancellation or

Trip Interruption of a Covered Trip.

Business Meeting

Means a meeting, tradeshow, training course, or convention scheduled before Your

Effective Date between companies with unrelated ownership, pertaining to Your full-

time occupation or profession and that is the sole purpose of Your Trip. Legal

proceedings are not considered to be a Business Meeting.

Caregiver

Means the permanent, full-time person entrusted with the well-being of Your

Dependent Child or Children and whose absence cannot reasonably be replaced.

Certificate

Means this Certificate of Insurance.

Change in Medication

Means the medication dosage or frequency has been reduced, increased, stopped

and/or new medication(s) has/have been prescribed.

Exceptions: A change from a brand name medication to a generic brand medication

of the same dosage does not constitute a Change in Medication.

Common Carrier

Means any land, air or water conveyance (e.g. passenger plane, ferry, cruise ship,

bus, limousine, taxi or train) which is licensed to carry passengers without

discrimination and for hire, excluding courtesy transportation provided without a

specific charge.

Coverage Period

Means the time between the Effective Date of Your Certificate and the return date

indicated in Your Application or most recent Declaration of Coverage.

Covered Trip

Means a trip:

• made by an Insured Person outside the Insured Person’s province or territory

of residence; and

• that begins on the Departure Date of Your Certificate and ends on the return

date shown in the Application or, Your most recent Declaration of Coverage;

and

• That does not extend to or past:

o The date the Insured Person no longer meets the eligibility

requirements set out in Section 2;

o The date coverage terminates as described in Section 7.

• That was booked or reserved prior to Departure Date from Your Home.

Declaration of Coverage

Means the document You receive when You apply for new or additional coverage

under the Group Policy, which includes Your Certificate number and confirms the

coverage You have purchased.

Departure Date

Means the date You leave Home, as shown on Your Covered Trip itinerary.

21

Dependent Child(ren)

Means Your natural, adopted, or step-children who are:

• unmarried; and

• dependent on You for financial maintenance and support; and

o under 22 years of age; or

o under 26 years of age and attending an institution of higher learning,

full-time, in Canada; or

o mentally or physically disabled.

NOTE: A Dependent Child does not include a child born while the child’s

mother is outside her province or territory of residence during the Covered

Trip, and as such, the child will not be insured with respect to that trip.

Dollars and $

Mean Canadian dollars.

Effective Date

Means the date and time the required premium is paid and the Certificate takes effect

as shown on Your insurance Application or most recent Declaration of Coverage.

Extension Period

Means the additional period of coverage which You purchase by contacting Our

Administrator as described in Section 7.

Group Policy or Group

Policies

Means TD Life Insurance Company (“TD Life”) under Group Policy Number TI004 and

TD Home and Auto Insurance Company ("TD Home & Auto") under Group Policy

Number TGV007.

Home

Means:

• Your Canadian province or territory of residence, if You requested coverage to

start when You depart on Your Covered Trip; or

• The place You leave from on the first day of coverage and are scheduled or

ticketed to return to on the last day of coverage, in the case of Trip

Interruption.

Hospital

Means:

• An institution that is licensed as an accredited hospital that is staffed and

operated for the care and treatment of in-patients and out-patients. Treatment

must be supervised by Physicians and there must be registered nurses on duty

24 hours a day. Diagnostic and surgical capabilities must also exist on the

premises or in facilities controlled by the establishment.

• A Hospital is not an establishment used mainly as a clinic, extended or

palliative care facility, rehabilitation facility, addiction treatment centre,

convalescent, rest or nursing home, home for the aged or health spa.

Hospitalized, or

Hospitalization

Means to be an inpatient in a Hospital.

Immediate Family

Member

Means an Insured Person's:

• Spouse, parents, step-parent, grandparents, natural or adopted children, step-

children or legal ward, grandchildren, brothers, sisters, step-brothers, step-

sisters, aunts, uncles, nieces, nephews; and

• mother-in-law, father-in-law, brothers-in-law, sisters-in-law, sons-in-law,

daughters-in-law; and

• the Insured Person’s Spouse’s grandparents, brothers-in-law and sisters-in-

law.

Insured Person(s)

Means a person:

• who is eligible to be insured under this Certificate; and

• who was named in the Application; and

• for whom the required premium has been paid; and

• on whom insurance has been issued under the Certificate.

Key Employee

Means a business partner, or an employee who is critical to the ongoing affairs of Your

business during the trip.

Exceptions: This applies exclusively to self-employed individuals.

Medical Condition

Means any disease, illness, or injury (including symptoms of undiagnosed conditions

complication of pregnancy within the first thirty-one (31) weeks of pregnancy; a mental

or emotional disorder, including acute psychosis that requires admission to a Hospital.

22

Medical Emergency

Means a sudden and unforeseen Medical Condition that requires immediate

Treatment. A Medical Emergency no longer exists when the evidence reviewed by

Global Excel indicates that no further Treatment is required at destination or You are

able to return to Your province/territory of residence for further Treatment.

Minor Ailment

Means any sickness or injury which does not require:

• the use of medication for a period greater than fifteen (15) days; or

• more than one (1) follow up visit to a Physician, Hospitalization, surgical intervention,

or referral to a specialist; or

• which ends at least fourteen (14) consecutive days prior to the Departure Date of the

Covered Trip.

NOTE: A chronic condition or complications of a chronic condition are not considered a

Minor Ailment.

Mountaineering

Means the ascent or descent of a mountain requiring the use of specialized equipment,

including crampons, pick-axes, anchors, bolts, carabineers and lead-rope or top-rope

anchoring equipment.

Physician

Means a person who is not You or Your Immediate Family Member or Your Travelling

Companion, licensed in the jurisdiction where the services are provided, to prescribe

and administer medical treatment.

Pre-Existing Medical

Condition

Means any Medical Condition that exists prior to Your Effective Date

.

Resident of Canada

and/or Canadian

Resident

Is any person who:

• has lived in Canada for a total of 183 days within the last year (the 183 days do not

have to be consecutive); or

• is a member of the Canadian Armed Forces.

Return Date

The date on which You are scheduled to return to Your Home. This date is shown on

Your insurance application or most recent Declaration of Coverage.

Spouse

Means:

• the person who the Insured Person is legally married to; or

• the person the Insured Person has lived with for at least one (1) year and publicly

refers to as his or her domestic partner.

Stable

Means a Medical Condition, other than a Minor Ailment, is considered Stable when all

of the following statements are true:

1. there has not been any new Treatment prescribed or recommended, or change(s)

to existing Treatment (including a stoppage in Treatment); and

2. there has not been any change to any existing prescribed drug (including an

increase, decrease, or stoppage to prescribed dosage), or any recommendation or

starting of a new Prescription Drug; and

3. the Medical Condition has not become worse; and

4. there has not been any new, more frequent or more severe symptoms; and

5. there has been no Hospitalization or referral to a specialist; and

6. there have not been any tests, investigation or Treatment recommended, but not

yet complete, nor any outstanding test results; and

7. there is no planned or pending Treatment.

All of the above conditions must be met for a Medical Condition to be considered

Stable.

Note: The following exceptions are considered Stable:

• the routine adjustment of Coumadin, warfarin or insulin (as long

as they are not newly prescribed or stopped) and there has been

no change in Your Medical Condition; or

• A change from a brand name medication to a generic brand

medication of the same dosage.

Travelling Companion

Means any person who travels with You during the Covered Trip and who is sharing

transportation and/or accommodation with You.

23

Exceptions: No more than three (3) individuals (including You) will be considered

travel companions on any one trip.

Treated or Treatment

Means a procedure prescribed, performed or recommended by a Physician for a

Medical Condition. This includes but is not limited to prescribed medication,

investigative testing and surgery.

We, Us and Our

Mean:

• TD Life with respect to the medically covered causes for Trip Cancellation and

Trip Interruption Insurance; and

• TD Home & Auto with respect to the non-medically covered causes for Trip

Cancellation and Trip Interruption Insurance.

You, Your and Yours

Means the person(s) named as the Insured Person(s) on Your most recent Declaration

of Coverage, for which insurance coverage was applied and the appropriate premium

has been received by Us.

This is the end of Your Certificate of Insurance.

24

Complaint-Handling Process for TD Life Insurance

Company

At TD Insurance we're committed to providing the best customer experience. Your confidence and trust

are extremely important to us. If you have a problem or concern, you can contact us in the way most

convenient for you. To do so, follow the complaint-handling process on our website at tdinsurance.com.

Step 1: Contact Our Administrator

If you are not satisfied with the outcome of your claim, you may appeal the decision by contacting our

administrator by phone, mail, or email using the contact information provided below:

Global Excel

Attention: Appeals Department

73 Queen Street

Sherbrooke, Quebec J1M 0C9

Phone: 1-800-359-6704

Email: TDI.Claims@globalexcel.com

Step 2: Contact TD Insurance Customer Care

If you are not satisfied with the solution offered in Step 1, the problem will be escalated to the TD

Insurance Customer Care Department. At this level a TD Insurance Customer Care Manager will work

with you to understand the problem. The TD Insurance Customer Care Manager will provide you with the

decision on the matter. You may contact the TD Insurance Customer Care Department directly by phone,

mail or email using the contact information provided below:

TD Insurance Customer Care Department

PO Box 1

TD Centre

Toronto, Ontario M5K 1A2

Phone: 1-877-734-1288

Email: tdinsc[email protected]m

Please be sure to include your full name, address, telephone number, Certificate and/or claim number in

all inquiries.

Step 3 – Contact the Senior Customer Complaints Office

If your problem or concern remains unresolved after you have followed Steps 1 and 2, you may contact

the Senior Customer Complaints Office (SCCO). The SCCO is dedicated to resolving disputes fairly and

professionally. If the SCCO determines that your concern has not been addressed by a Customer Care

Manager as outlined in Step 2, the SCCO may direct your problem to the appropriate business area for

investigation and response. Within five days of receiving your enquiry, the SCCO will write or call to

advise you if and where your problem has been redirected, whether it has been resolved, or in more

complex cases, what further steps are being taken and when you can expect a resolution. You may

contact the SCCO by:

Senior Customer Complaints Office

P.O. Box 1

TD Centre

Toronto, Ontario M5K 1A2

Phone: 416-982-4884 or 1-888-361-0319 (toll free)

Fax: 416-983-3460 or 1-866-891-2410 (toll free)

Email: td.scco@td.com

Please be sure to include your full name, address, telephone number, Certificate and/or claim number in

all inquiries.

25

Step 4 – If your problem or concern remains unsatisfied after you have received the SCCO's final position

letter you may contact the appropriate OmbudService:

Contact for home and auto complaints:

General Insurance OmbudService (GIO)

4711 Yonge Street, 10

th

Floor

Toronto, Ontario M2N 6K8

Phone: 1-877-225-0446 (toll free)

Fax: 416-299-4261

Website: www.giocanada.org

Contact for life and health complaints:

OmbudService for Life & Health Insurance (OLHI)

20 Adelaide Street East, Suite 802

P.O. Box 29

Toronto, Ontario M5C 2T6

Phone: 416-777-9002 or 1-888-295-8112 (toll free)

Fax: 416-777-9750

Website: www.olhi.ca

Financial Consumer Agency of Canada

The Financial Consumer Agency of Canada (FCAC) supervises federally regulated financial institutions to

ensure that they comply with federal consumer protection laws.

The FCAC also helps educate consumers, and monitors industry codes of conduct and public

commitments designed to protect the interests of consumers. At TD Insurance, we comply with consumer

laws that protect you in various ways. For example, we will provide you with information about our

complaint-handling procedures. We also comply with the CBA Code of Conduct for Authorized Insurance

Activities.

If you have a complaint regarding a potential violation of a consumer protection law, a public commitment,

or an industry code of conduct, you can contact the FCAC in writing at:

Financial Consumer Agency of Canada

Enterprise Building, 6th Floor

427 Laurier Avenue West

Ottawa, Ontario

K1R 1B9

The FCAC can also be contacted by telephone at 1-866-461-3222 (en français 1-866-461-2232).

For more information about the FCAC, please visit www.fcac-acfc.gc.ca Please note: The FCAC does not

become involved in matters of redress or compensation – all requests for redress from TD Insurance

must follow the problem resolution process available in this site.

26

535106 (0523)

Consent to TD Insurance Handling of Your Personal Information and Privacy

Policy

You consent to Our Privacy Policy. You agree that TD Insurance which includes the Toronto Dominion

Bank and affiliated companies (collectively "TD") may handle your personal information as we set out in

our Privacy Policy. You can find our Privacy Policy online at td.com/privacy.

You have choices. The Privacy Policy outlines your options, where available, to refuse or withdraw your

consent.

Here is a summary of our Privacy Policy.

We collect, use, share and retain your information to:

• Identify you

• Process your application and assess your

eligibility

• Underwrite insurance

• Provide you ongoing service

• Communicate with you

• Personalize our relationship with you

• Determine the right product, premium or

coverage

• Improve TD products and services

• Protect against fraud, financial abuse and

error

• Manage and assess our risks

• Meet legal and regulatory obligations

We collect information (for the purposes set out above) from you and others including:

• Fraud prevention agencies and registries • From your interactions with us, including on

your mobile device or the Internet, cameras

at our property and records of your use of

our products and services