1 WE-SUMM-EN_04/24

Table of Contents

ROGERS RED WORLD ELITE MASTERCARD PRODUCT SUMMARY for Out-of-Province/Out-of-Country

Emergency Medical Coverage, Trip Cancellation and Trip Interruption and Trip Delay ............................ 2

INTRODUCTION ................................................................................................................................ 2

COVERAGE

SUMMARY ........................................................................................................................ 2

OUT-OF-PROVINCE/OUT-OF-COUNTRY

MEDICAL

COVERAGE

.................................................................. 3

TRIP CANCELLATION AND TRIP INTERRUPTION AND TRIP DELAY COVERAGE ....................................... 4

GENERAL

PROVISIONS

....................................................................................................................... 4

ADDITIONAL

INFORMATION .............................................................................................................. 5

HOW TO FILE A COMPLAINT .............................................................................................................. 5

ROGERS RED WORLD ELITE MASTERCARD PRODUCT SUMMARY for Rental Car Collision/Damage

Insurance, Purchase Protection and Extended Warranty Insurance ....................................................... 7

INTRODUCTION ................................................................................................................................ 7

COVERAGE

SUMMARY ........................................................................................................................ 7

RENTAL

CAR

COLLISION/DAMAGE

INSURANCE

.................................................................................... 8

PURCHASE

PROTECTION

AND

EXTENDED

WARRANTY

COVERAGE

........................................................ 8

GENERAL

PROVISIONS

..................................................................................................................... 10

ADDITIONAL

INFORMATION ............................................................................................................ 10

HOW TO FILE A COMPLAINT ............................................................................................................ 10

Rogers Red World Elite

®

Mastercard

®

Insurance Product Summary

2 WE-SUMM-EN_04/24

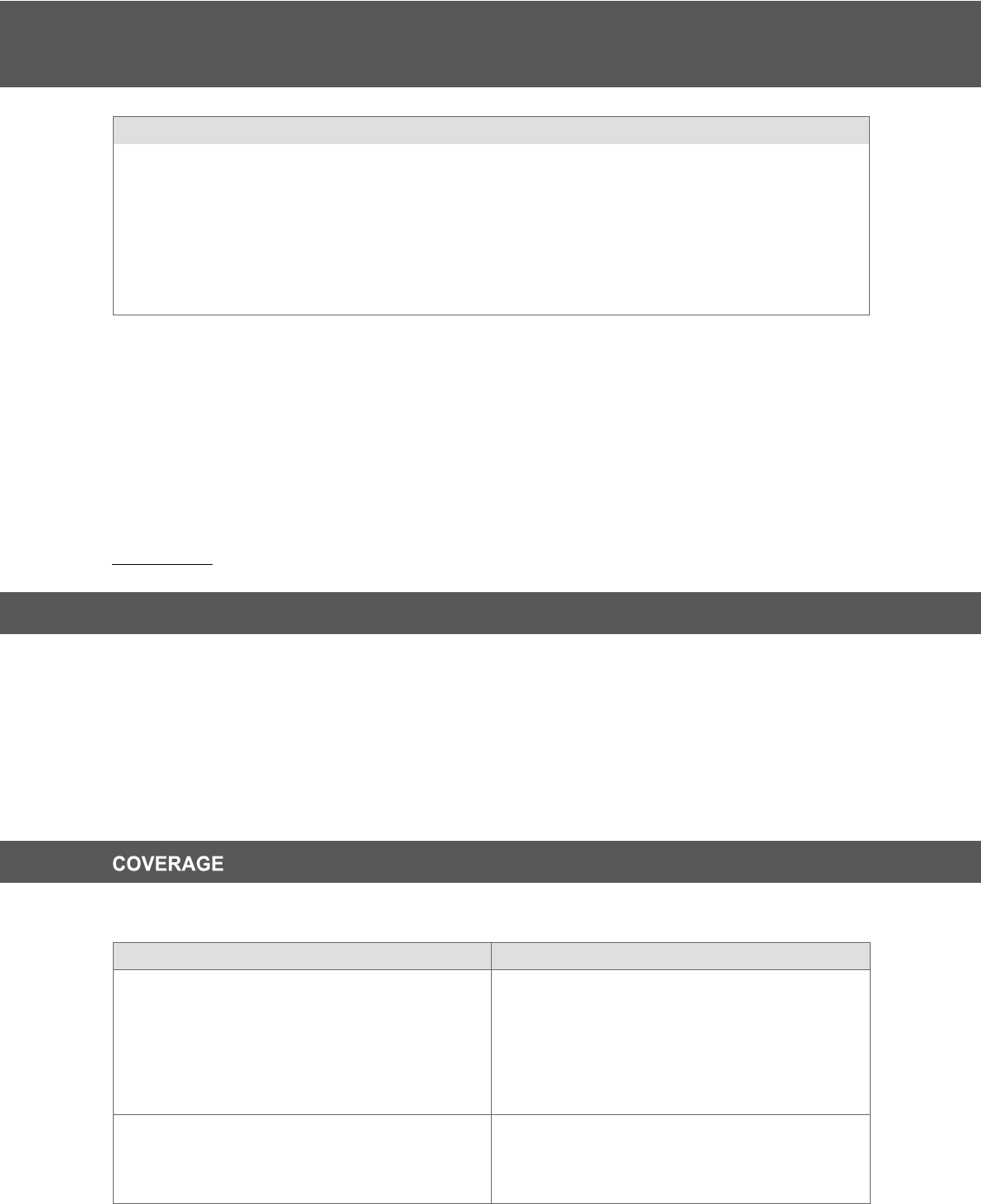

INSURER

ADMINISTRATOR

DISTRIBUTOR

CUMIS

General

Insurance

Allianz

Global

Assistance

Rogers Bank

Company

700

Jamieson

Parkway

1 Mt. Pleasant Road, 5

th

Floor

151 North Service Road

Cambridge, ON N3C 4N6

Toronto, ON, M4Y 2Y5

Burlington, ON L7R 4C2

1-800-670-4426

1-855-775-2265

1-800-263-9120

Registered with the Autorité

des

marchés

financiers

under

client number 2000383675.

QUEBEC

RESIDENTS

The Autorité des marchés financiers can provide information about your rights and the duties of the

insurer, administrator and distributor.

Autorité des marchés financiers

Place de la Cité, Tour Cominar

2640, boulevard Laurier, 4e étage

Québec, QC G1V 5C1

1-877-525-0337

lautorite.qc.ca

This Product Summary will provide an overview of the insurance benefits included with your Rogers

Red World Elite Mastercard. It will help you determine if this insurance meets your needs. This

document highlights some of the key benefits, exclusions, limitations and restrictions that apply to this

coverage. Refer to the certificate of insurance for the complete terms and conditions. If you have

questions about this coverage, contact Allianz Global Assistance.

The certificate of insurance can be found at:

https://www.cumis.com/en/information/Pages/quebec-guides-and-summaries.aspx

Coverage

is

effective

during

the

Coverage

Period

described

in

the

certificate

of

insurance.

COVERAGE

LIMITS

Out-of-Province/Out-of-Country Emergency

Medical Coverage

Trip

Duration

•

Age 0-64:

Up to 10 consecutive days per trip

•

Age 65-75:

Up to 3 consecutive days per trip

Coverage Maximum:

Up to $1,000,000 per

person per trip.

Trip Cancellation and Trip Interruption and Trip

Delay Coverage

Cancellation:

$1,000 per insured person ($5,000

per account, per trip)

Interruption and Delay:

$1,000 per insured

person ($5,000 per account, per trip)

INTRODUCTION

SUMMARY

ROGERS RED WORLD ELITE MASTERCARD PRODUCT SUMMARY for Out-of-

Province/Out-of-Country Emergency Medical Coverage, Trip Cancellation and Trip Interruption

and Trip Delay

3 WE-SUMM-EN_04/24

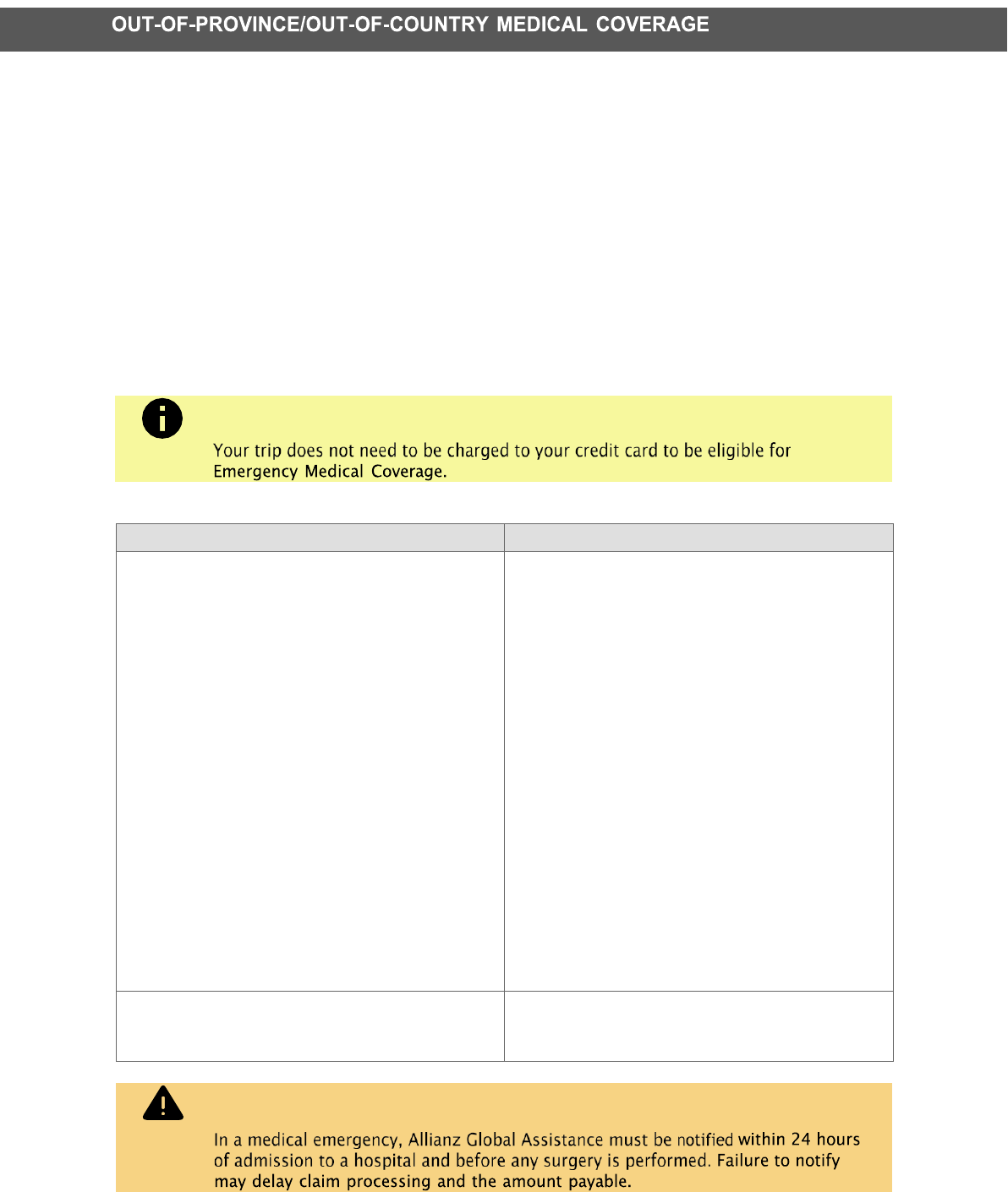

Emergency Medical covers you up to $1 million for any unexpected emergency sickness or injury that

happens during your trip outside of your province or territory of residence.

To

be

eligible,

you

must:

•

be

a

Canadian

resident

listed

on

a

Rogers Red World Elite Mastercard

account,

•

be age 75 or younger, and

•

be

covered

by

a

government

health

insurance

plan

during

the

entire

trip.

Important:

Your

account

must

be

in

good

standing

If you are age 0-64, you have coverage for trips up to 10 consecutive days (including your departure date).

If you are age 65-75 you have coverage for trips up to 3 consecutive days (including your departure date).

BENEFITS

EXCLUSIONS

If you experience a medical emergency while

travelling, this insurance provides coverage for

the following:

•

Emergency Hospital, Ambulance & Medical

Expenses

•

Emergency

Air

Transportation

or

Evacuation

•

Attendant/Return

of

Travel

Companion

•

Transportation

to

Bedside

•

Return

of

Deceased

(Repatriation)

•

Additional Hotel and Meal Expenses

•

Return

of

Vehicle

You will not be paid for expenses that arise

from, or relate to the following:

•

Pre-existing Conditions:

A sickness, injury, or

medical condition that is not stable during the

stability period listed in the certificate of

insurance.

•

Travelling against the advice of a physician

•

Some matters relating to mental or emotional

disorders

•

Abuse of alcohol or drugs including misuse of

medication

•

Travelling

to

seek

medical

treatment

•

Some

matters

related

to

pregnancy

•

Participation in dangerous activities or illegal

acts

•

Travel to regions for which the Canadian

government has issued a travel advisory

•

Acts of war and terrorism or any nuclear

occurrence

Refer to the

Benefits

of the Emergency Medical

Coverage section in the

certificate

of insurance for

details.

Refer to the Exclusions of the Emergency Medical

Coverage section in the

certificate

of insurance for

details.

NOTICE

WARNING

4 WE-SUMM-EN_04/24

You will receive payment for non-refundable, non-transferable, prepaid travel expenses if you need to

cancel, interrupt or delay your trip as a result of a covered reason.

•

Trip Cancellation Insurance: Up to $1,000 per person per trip (maximum $5,000 per account). Trip

Cancellation Insurance occurs before you leave.

•

Trip Interruption/Trip Delay Insurance: Up to $1,000 per person per trip (maximum $5,000 per

account). Trip Interruption/Trip Delay Insurance occurs while you are on trip and cannot continue as

planned.

To

be

eligible,

you

must:

•

be

a

Canadian

resident

listed

on

a

Rogers Red World Elite Mastercard

account,

and

•

charge

the

full

trip

cost

to

the

account

prior

to

departure.

COVERED

REASONS

EXCLUSIONS

Covered Reasons include but are not limited to

the following:

Work

•

Job

transfer

•

Involuntary

termination

Health

•

Sickness

or

injury

•

Death

Legal

•

Jury

duty

Other

•

Extreme

weather

•

Canadian government issues a travel advisory

after the effective date

You will not be paid for expenses that arise

from, or relate to the following:

•

Pre-existing Conditions:

A sickness, injury, or

medical condition that is not stable during the

stability period listed in the certificate of

insurance.

•

Known reasons that require you to cancel

your trip or return during the trip

•

Visiting an ailing person whose sickness or

death causes cancellation or interruption

•

Certain matters related to mental and

emotional disorders

•

Abuse of alcohol or drugs including misuse of

medication

•

Certain

matters

related

to

pregnancy

•

Acts or war and terrorism, any nuclear

occurrence, or participation of any criminal

offence

•

Losses

recovered

from

any

other

source

Refer to the Trip Cancellation Insurance and Trip Interruption and Trip Delay Coverage section of the

certificate

of

insurance.

Additional Insurance

- This insurance only pays amounts that are beyond amounts payable from your

government health insurance plan (if applicable), any other insurance plan or source.

Currency - All amounts in the certificate are in Canadian currency and reimbursements will be provided in

Canadian currency.

Waiver - no provision of this insurance shall be considered to be waived, either in whole or in part, unless

clearly stated in writing and signed by the insurer.

TRIP CANCELLATION AND TRIP INTERRUPTION AND TRIP DELAY

COVERAGE

WARNING

5 WE-SUMM-EN_04/24

Legal Action

- Legal action against the insurer must begin within the timeline determined by the Insurance

Act or Limitations Act of your home province or territory of residence. For Quebec residents this is in the

Quebec Civil Code.

Third Party Liability

- If you incur expenses due to a third party, the insurer may take legal action against

the third party at the insurer's expense. You will support the insurer by co-operating with them and

supplying any documentation they may need. You agree to do nothing to interfere with the insurer's right

to recover funds.

Refer

to

the

General

Provisions

section

of

the

certificate

of

insurance

for

details.

The

Operations

Center

has

the

following

services

available

to

you

24/7:

•

Pre-trip

assistance

such

as

passport

and

visa

information.

•

Medical emergency assistance

such as case monitoring and arranging emergency transportation

arrangements.

•

Non-medical

emergency

assistance

such

as

emergency

cash transfer

and

emergency

message

services.

Coverage automatically extends during hospitalization and for an additional 5 days after discharge from

the hospital. If medical evidence shows you are medically unfit to travel due to a covered sickness,

coverage automatically extends for up to 5 days.

If you are delayed due to a vehicle, airline, bus, train, or government-operated ferry system, coverage

automatically extends for up to 72 hours.

Refer

to

Automatic

Extension

of

Coverage

in

the

Emergency

Medical

section

of

the

certificate

for

details.

If you make a claim knowing it to be untrue in any respect, you will not have coverage and your claims will

not be paid.

If

you

decide

to

extend

your

trip

please

call

Allianz

Global

Assistance.

If you submit a claim and are not satisfied with the outcome, you have the right to file a complaint by

following the process below.

1.

Contact

Allianz

Global

Assistance

Appeals must be submitted in writing describing why the outcome of your claim is incorrect along

with any new supporting documentation.

Allianz

Global

Assistance

Appeals Department

P.O. Box 277

Waterloo, ON N2J 4A4

appeals@allianz-assistance.ca

2.

Contact

the

Ombudsman

If your complaint remains unresolved after following the appeals process above, you may request

additional consideration from the Ombudsman Office.

HOW TO FILE A COMPLAINT

INFORMATION

6 WE-SUMM-EN_04/24

The

Co-operators

Group

Limited

Ombudsperson

130 Macdonell Street

Guelph ON, N1H 6P8

Phone: 1-877-720-6733

Email:

Ombuds@cooperators.ca

3.

External

Recourse

If after submitting an appeal and contacting the insurer's ombudsman you are still unable to resolve

your concerns you may contact the General Insurance OmbudService (GIO).

General

Insurance

OmbudService

(GIO)

Phone:

1-877-225-0446

Website:

www.giocanada.org

QUEBEC

RESIDENTS

You may request in writing that a copy of your file be sent to Autorité des marchés financiers

(AMF) within 3 years of your claim being denied.

Autorité

des

marchés

financiers

(AMF)

Phone:

1-877-525-0337

Email:

renseignement-consommateur@lautorite.qc.ca

4.

The

Financial

Consumer

Agency

of

Canada

(FCAC)

The Financial Consumer Agency of Canada provides consumers with information about Financial

Products and your rights and responsibilities. They ensure compliance with federal consumer

protection laws that apply to banks and insurance companies.

Website:

https://www.canada.ca/en/financial-consumer-agency.html

7 WE-SUMM-EN_04/24

INSURER

ADMINISTRATOR

DISTRIBUTOR

CUMIS

General

Insurance

Allianz

Global

Assistance

Rogers Bank

Company

700

Jamieson

Parkway

1 Mt. Pleasant Road, 5th Floor

151 North Service Road

Cambridge, ON N3C 4N6

Toronto, ON M4Y 2Y5

Burlington, ON L7R 4C2

1-800-670-4426

1-855-775-2265

1-800-263-9120

Registered with the Autorité

des

marchés

financiers

under

client number 2000383675.

QUEBEC

RESIDENTS

The Autorité des marchés financiers can provide information about your rights and the duties of the

insurer, administrator and distributor.

Autorité des marchés financiers

Place de la Cité, Tour Cominar

2640, boulevard Laurier, 4e étage

Québec, QC G1V 5C1

1-877-525-0337

lautorite.qc.ca

This Product Summary will provide an overview of the insurance benefits included with your Rogers

Red World Elite Mastercard. It will help you determine if this insurance meets your needs. This

document highlights some of the key benefits, exclusions, limitations and restrictions that apply to this

coverage. Refer to the certificate of insurance for the complete terms and conditions. If you have

questions about this coverage, contact Allianz Global Assistance.

The certificate of insurance can be found at:

https://www.cumis.com/en/information/Pages/quebec-guides-and-summaries.aspx

Coverage

is

effective

during

the

Coverage

Period

described

in

the

certificate

of

insurance.

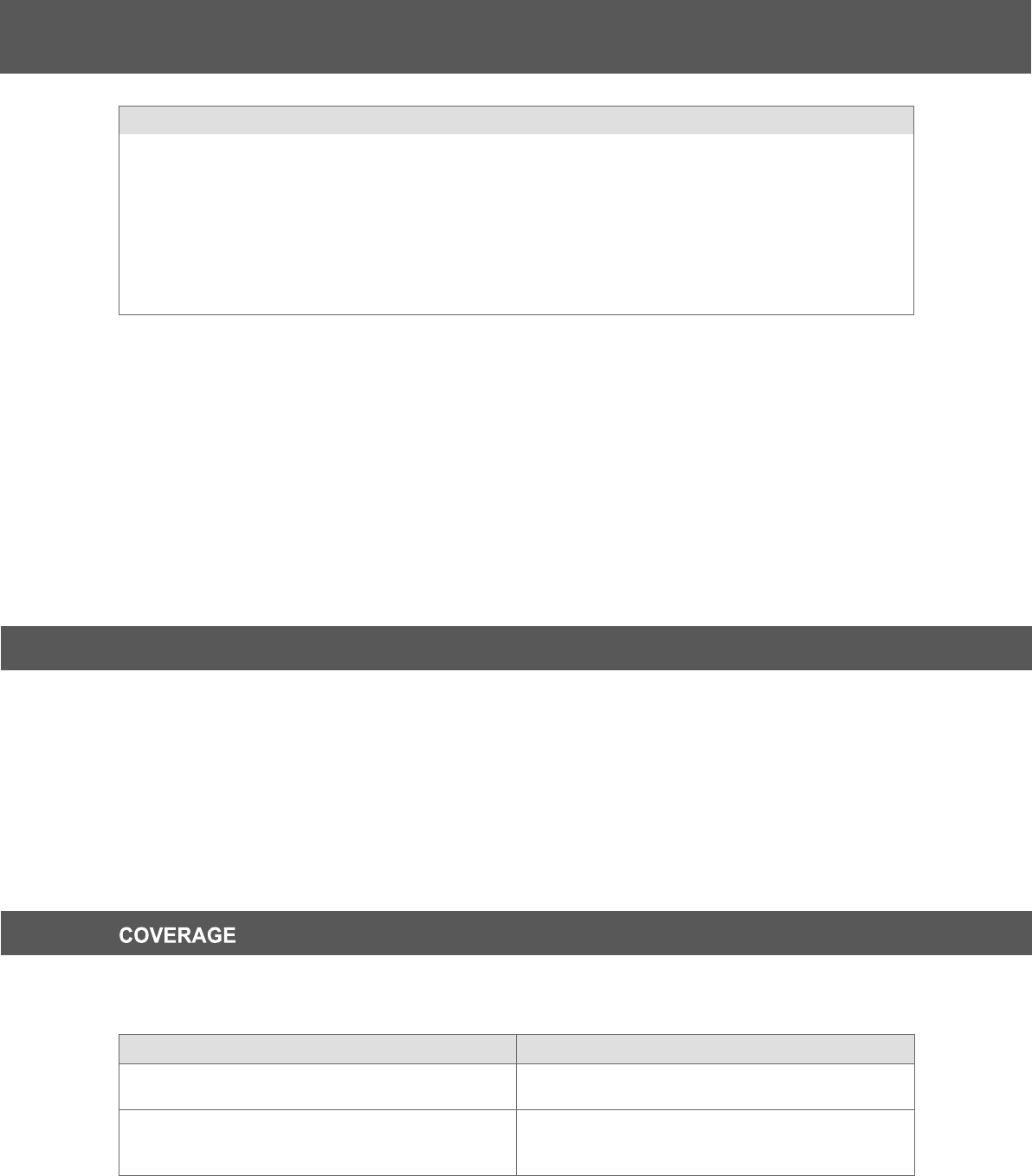

COVERAGE

LIMITS

Rental

Car

Collision/Damage

Insurance

Rental

Period:

31

consecutive

days

Manufacturer's

Suggested

Retail

Price:

$65,000

Purchase Protection and Extended Warranty

Insurance

Purchase Protection:

90 days from purchase

Extended Warranty:

doubles original up to a 1

year

extension

ROGERS RED WORLD ELITE MASTERCARD PRODUCT SUMMARY for Rental Car

Collision/Damage Insurance, Purchase Protection and Extended Warranty Insurance

INTRODUCTION

SUMMARY

8 WE-SUMM-EN_04/24

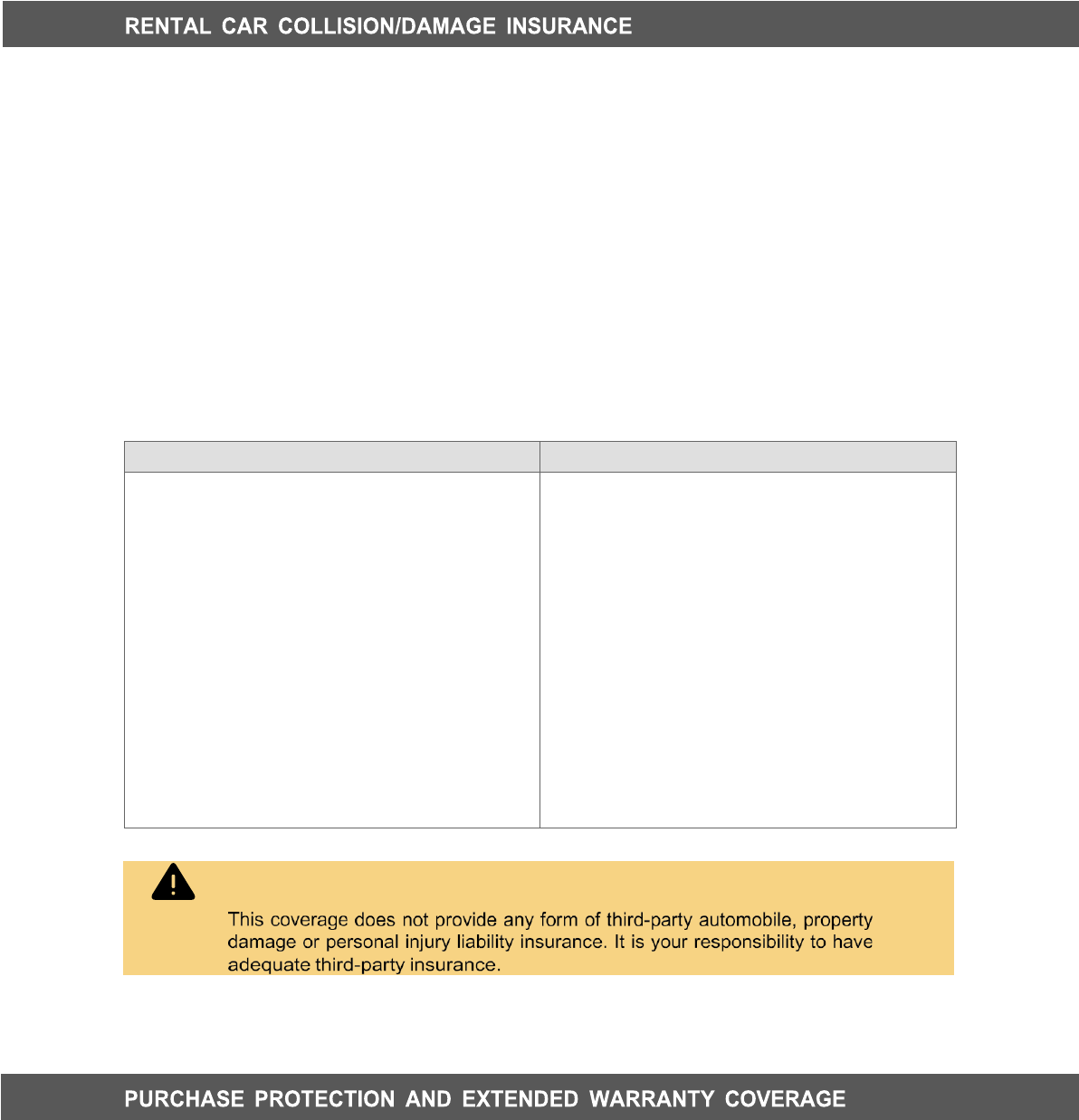

Do

You

Qualify

For

This

Insurance?

(Eligibility)

To

be

eligible:

•

the rental car agreement

must be non-renewable

and

for

a maximum of 31 days,

•

you

must

be

a

Canadian

resident

listed

on

a

Rogers Red World Elite Mastercard

account,

•

you must rent the rental car,

•

the rental car must be rented from a

commercial agency,

•

the incident

must

be in the

coverage period,

•

the full cost

of the

rental

must

be

charged

to your

credit

card,

•

only

one

vehicle can

be rented during a

rental period,

•

you

must

decline

Collision

Damage

Waiver

benefits

from

the

rental

agency,

and

•

the rental car must be operated by a person on the rental agreement.

Coverage Details

BENEFITS

EXCLUSIONS

When the rental period does not exceed 31

consecutive days, Car Rental - Collision/Loss

Damage Insurance provides coverage for the

rental car up to a maximum Manufacturer's

suggested retail price of $65,000 for:

•

damages.

•

theft, including

parts and accessories.

•

loss-of-use charges.

•

towing.

You will not be paid for expenses or damage that

arise from the following:

•

insurance costs from the agency.

•

rental cars to transport property or

passengers.

•

Specific excluded vehicles such as trucks,

trailers, off-road vehicles, motorcycles, or

antiques.

•

Wear

and

tear

and

gradual

deterioration.

•

Violation

of

the

rental

car

agreement.

•

Off-road

operation

or

speed

contests.

•

Intoxication.

•

Travel to a location for which the Canadian

government issued a travel advisory.

Refer

to

the

Car

Rental

Collision/Loss

section

of

the

certificate

of

insurance.

Purchase Protection Coverage

Do

You

Qualify

For

This

Insurance?

(Eligibility)

To be eligible, you must

•

be

a

Canadian

resident

listed

on

a

Rogers Red World Elite Mastercard

account,

and

WARNING

9 WE-SUMM-EN_04/24

•

charge the

full price of the item to the

account.

BENEFITS

EXCLUSIONS

•

Purchase Protection provides coverage

against theft or damage to covered items for

90 days from the purchase date.

•

You will receive payment for the purchase

price, repair or replacement.

•

There is a lifetime maximum for Purchase

Protection and Extended Warranty combined

of $60,000.

You will not be paid for expenses or damage that

arise from the following:

•

Specific items including money, animals,

plants, consumables, cell phones, and jewelry.

•

Used

and

refurbished

items.

•

Items

intended

for

commercial

use.

•

Motorized vehicles and their parts and

accessories

•

Misuse and wear and tear.

•

Theft from a vehicle or residence when there

are no signs of a forced entrance.

Refer

to

the

Purchase

Protection

section

in

the

certificate

of

insurance

Extended Warranty Coverage

Do

You

Qualify

For

This

Insurance?

(Eligibility)

To

be

eligible:

•

you

must

be

a

Canadian

resident

listed

on

a

Rogers Red World Elite Mastercard

account,

•

you must charge the

full price of the item to the account,

•

the

original

manufacturer's

warranty

must

be

valid

in

Canada,

and

•

if the original warranty exceeds five years, you must register the item with Allianz Global Assistance

within one year of purchase.

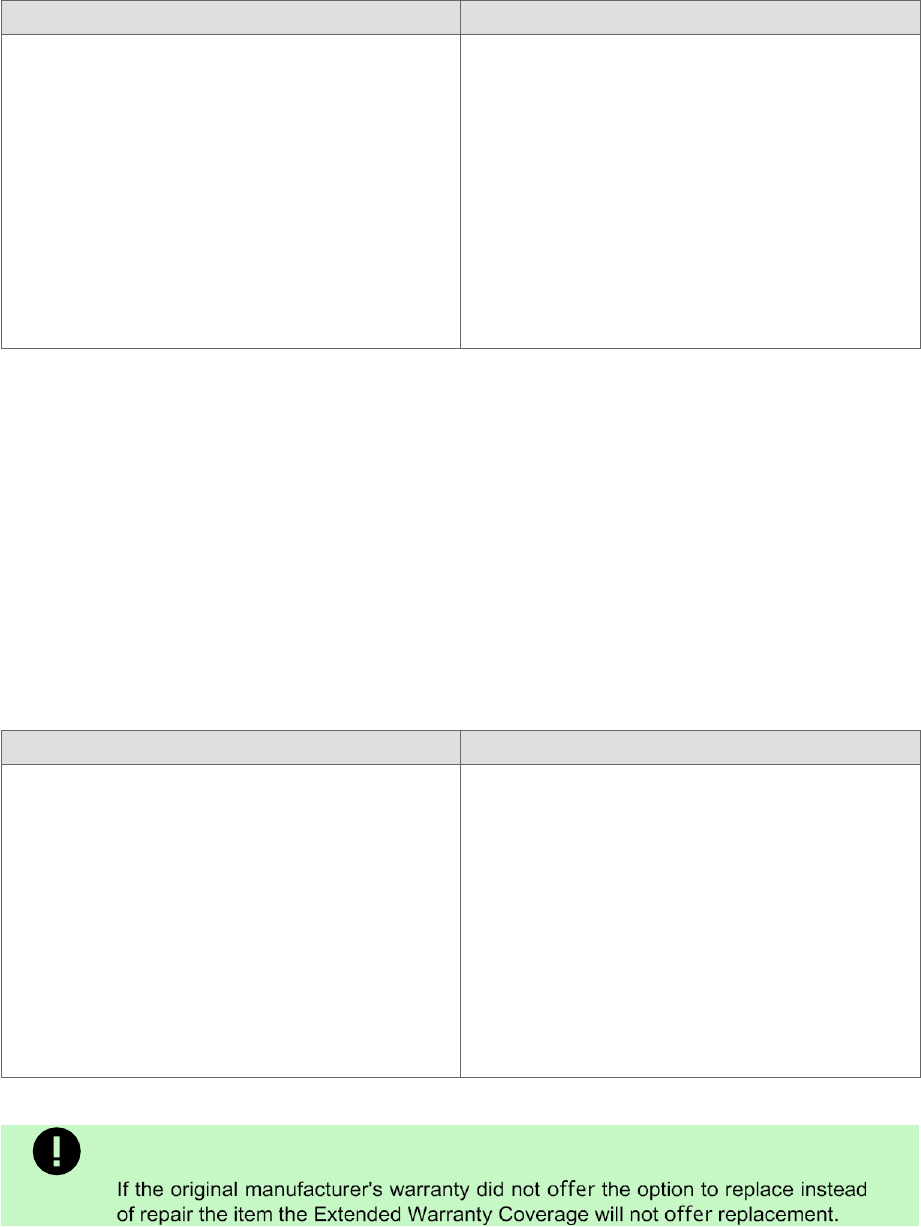

BENEFITS

EXCLUSIONS

•

Extended Warranty coverage extends the

original manufacturer's warranty to a

maximum extension of 1 year.

•

This coverage follows the terms and

conditions of the original manufacturer's

warranty.

•

You will receive payment for the lesser cost of

repair or replacement.

•

There is a lifetime maximum for Purchase

Protection and Extended Warranty combined

of $60,000.

You will not be paid for expenses or damages

that arise from the following:

•

The original manufacturer stops business for

any reason.

•

Used

and

refurbished

items.

•

Motorized vehicles and their parts and

accessories.

•

Items with a

lifetime warranty.

•

Misuse

and

wear

and

tear

•

Theft from a vehicle or residence when there

are no signs of a forced entrance.

Refer

to

the

Extended

Warranty

section

in

the

certificate

of

insurance

IMPORTANT

10 WE-SUMM-EN_04/24

Additional Insurance

- This insurance only pays amounts that are beyond amounts payable from your

government health insurance plan (if applicable), any other insurance plan or source.

Currency - All amounts in the certificate are in Canadian currency and reimbursements will be provided in

Canadian currency.

Waiver - no provision of this insurance shall be considered to be waived, either in whole or in part, unless

clearly stated in writing and signed by the insurer.

Legal Action

- Legal action against the insurer must begin within the timeline determined by the Insurance

Act or Limitations Act of your home province or territory of residence. For Quebec residents this is in the

Quebec Civil Code.

Third Party Liability

- If you incur expenses due to a third party, the insurer may take legal action against

the third party at the insurer's expense. You will support the insurer by co-operating with them and

supplying any documentation they may need. You agree to do nothing to interfere with the insurer's right

to recover funds.

Refer

to

the

General

Provisions

section

of

the

certificate

of

insurance

for

details.

Travel

Assistance

The

Operations

Center

has

the

following

services

available

to

you

24/7:

•

Pre-trip

assistance

such

as

passport

and

visa

information.

•

Medical emergency assistance

such as case monitoring and arranging emergency transportation

arrangements.

•

Non-medical

emergency

assistance

such

as

emergency

cash transfer

and

emergency

message

services.

Misrepresentation And Nondisclosure

If you make a claim knowing it to be untrue in any respect, you will not have coverage and your claims will

not be paid.

Extending

Your

Trip

If

you

decide

to

extend

your

trip

please

call

Allianz

Global

Assistance.

If you submit a claim and are not satisfied with the outcome, you have the right to file a complaint by

following the process below.

1.

Contact

Allianz

Global

Assistance

Appeals must be submitted in writing describing why the outcome of your claim is incorrect along

with any new supporting documentation.

Allianz

Global

Assistance

Appeals Department

P.O. Box 277

Waterloo, ON N2J 4A4

appeals@allianz-assistance.ca

INFORMATION

HOW TO FILE A COMPLAINT

11 WE-SUMM-EN_04/24

2.

Contact

the

Ombudsman

If your complaint remains unresolved after following the appeals process above, you may request

additional consideration from the Ombudsman Office.

The

Co-operators

Group

Limited

Ombudsperson

130 Macdonell Street

Guelph ON, N1H 6P8

Phone: 1-877-720-6733

Email:

Ombuds@cooperators.ca

3.

External

Recourse

If after submitting an appeal and contacting the insurer's ombudsman you are still unable to resolve

your concerns you may contact the General Insurance OmbudService (GIO).

General

Insurance

OmbudService

(GIO)

Phone:

1-877-225-0446

Website:

www.giocanada.org

QUEBEC

RESIDENTS

You may request in writing that a copy of your file be sent to Autorité des marchés financiers (AMF)

within 3 years of your claim being denied.

Autorité

des

marchés

financiers

(AMF)

Phone:

1-877-525-0337

Email:

renseignement-consommateur@lautorite.qc.ca

4.

The

Financial

Consumer

Agency

of

Canada

(FCAC)

The Financial Consumer Agency of Canada provides consumers with information about Financial

Products and your rights and responsibilities. They ensure compliance with federal consumer

protection laws that apply to banks and insurance companies.

Website:

https://www.canada.ca/en/financial-consumer-agency.html