FINANCIAL CONDITION REPORT ON EXAMINATION

OF THE

GREAT – WEST LIFE & ANNUITY INSURANCE

COMPANY OF NEW YORK

AS OF DECEMBER 31, 2020

EXAMINER: ERIC C. DERCHER, CFE

DATE OF REPORT: JUNE 29, 2022

TABLE OF CONTENTS

ITEM

PAGE NO.

1.

Executive summary

2

2.

Scope of examination

3

3.

Description of Company

5

A. History

5

B. Holding company

6

C. Organizational chart

7

D. Service agreements

8

E. Management

9

4.

Territory and plan of operations

12

A. Statutory and special deposits

12

B. Direct operations

12

C. Reinsurance

13

5.

Financial statements

14

A. Independent accountants

14

B. Net admitted assets

15

C. Liabilities, capital and surplus

16

D. Condensed summary of operations

17

E. Capital and surplus account

18

6.

Subsequent events

19

June 29, 2022

Honorable Adrienne A. Harris

Superintendent of Financial Services

New York, New York 10004

Dear Adrienne A. Harris:

In accordance with instructions contained in Appointment No. 32311, dated October 1, 2021, and

annexed hereto, an examination has been made into the condition and affairs of

Great-West Life & Annuity Insurance Company of New York, hereinafter referred to as “the

Company”. The Company’s home office is located at 370 Lexington Avenue, Suite 703, New

York, NY 10017. Due to the COVID-19 pandemic, the examination was conducted remotely.

Wherever “Department” appears in this report, it refers to the New York State Department of

Financial Services.

The report indicating the results of this examination is respectfully submitted.

2

1. EXECUTIVE SUMMARY

The material comments contained in this report are summarized below.

• Effective June 1, 2019, the Company completed the sale, via indemnity reinsurance, of

substantially all of its life insurance and annuity business to Protective Life and Annuity

Insurance Company (“Protective”). (See item 3 of this report.)

• On December 31, 2020, the Company completed the acquisition, via indemnity

reinsurance, of the retirement services business of Massachusetts Mutual Life Insurance

Company (“MassMutual”). (See item 3 of this report.)

• Effective January 19, 2021, the Company received its foreign insurance license to write

life insurance business in the state of Colorado. Also, on October 5, 2021, the Company

received its accredited reinsurance status in New Jersey. (See item 6 of this report.)

3

2. SCOPE OF EXAMINATION

The examination of the Company was a full-scope examination as defined in the National

Association of Insurance Commissioner’s (“NAIC’s”) Financial Condition Examiner’s

Handbook, 2021 Edition (the “Handbook”). The examination covers the five-year period from

January 1, 2016, to December 31, 2020. The examination was conducted observing the guidelines

and procedures in the Handbook and, where deemed appropriate by the examiner, transactions

occurring subsequent to December 31, 2020, but prior to the date of this report (i.e., the completion

date of the examination) were also reviewed.

The examination was conducted on a risk-focused basis in accordance with the provisions

of the Handbook published by the NAIC. The Handbook guidance provides for the establishment

of an examination plan based on the examiner’s assessment of risk in the insurer’s operations and

utilizing that evaluation in formulating the nature and extent of the examination. The examiner

planned and performed the examination to evaluate the current financial condition as well as

identify prospective risks that may threaten the future solvency of the insurer. The examiner

identified key processes, assessed the risks within those processes and evaluated the internal

control systems and procedures used to mitigate those risks. The examination also included

assessing the principles used and significant estimates made by management, evaluating the

overall financial statement presentation, and determining management’s compliance with New

York statutes and Department guidelines, Statutory Accounting Principles as adopted by the

Department, and annual statement instructions.

The examination was called by the Colorado Department of Regulatory Agencies

(“Colorado”) in accordance with the Handbook guidelines, through the NAIC’s Financial

Examination Electronic Tracking System. The examination was conducted in conjunction with

the examination of the Company’s parent, Great-West Life and Annuity Insurance Company

(“GWLA”), a Colorado domestic insurance company. Colorado served as the lead state with

participation from the states of New York, Pennsylvania, Michigan, and South Carolina. Since

the lead and participating states are all accredited by the NAIC, all states deemed it appropriate to

rely on each other’s work.

Information about the Company’s organizational structure, business approach and control

environment were utilized to develop the examination approach. The Company’s risks and

4

management activities were evaluated incorporating the NAIC’s nine branded risk categories.

These categories are as follows:

• Pricing/Underwriting

• Reserving

• Operational

• Strategic

• Credit

• Market

• Liquidity

• Legal

• Reputational

The Company was audited annually, for the years 2016 through 2020, by the accounting

firm of Deloitte & Touche LLP (“Deloitte”). The Company received an unqualified opinion in all

years.

Certain audit workpapers of the accounting firm were reviewed and relied upon in

conjunction with this examination. The Company shares an internal audit department with its

parent which was given the task of assessing the internal control structure and compliance with

the Sarbanes Oxley Act of 2002 (“SOX”). Where applicable, SOX workpapers and reports were

reviewed and relied upon for this examination.

Certain audit workpapers of the accounting firm were reviewed and relied upon in

conjunction with this examination.

The examiner reviewed the prior report on examination which did not contain any

violations, recommendations, or comments.

This report on examination is confined to financial statements and comments on those

matters which involve departure from laws, regulations, or rules, or which require explanation or

description.

5

3. DESCRIPTION OF COMPANY

A. History

The Company, under the name of Canada Life Insurance Company of New York

(“CLINY”), was incorporated as a stock life insurance company under the laws of New York on

June 7, 1971, was licensed on December 14, 1971, and commenced business on January 1, 1972.

Initial resources of $3,000,000, consisting of common capital stock of $1,000,000 and paid in and

contributed surplus of $2,000,000, were provided through the sale of 100,000 shares of common

stock (with a par value of $10 each) for $30 per share by Canada Life Assurance Company

(“CLACO”), a Canadian mutual insurance company.

In 1999, Canada Life Financial Corporation (“CLFC”) acquired control of CLACO and its

subsidiaries. CLFC was established to convert CLACO from a mutual life insurance company to

a stock life insurance company. On July 10, 2003, Great-West Lifeco Inc. (“Lifeco”), a Canadian

holding company, completed its acquisition of CLFC and then transferred all of the common shares

of CLFC to its Canadian subsidiary, The Great-West Life Assurance Company (“GWL”). On

December 31, 2003, all of the outstanding common shares of CLINY were transferred to GWLA.

Effective December 31, 2005, CLINY merged with First Great-West Life & Annuity

Insurance Company (“FGWLA”). Prior to the merger both insurers were wholly-owned U.S.

subsidiaries of GWLA. Upon completion of the merger, CLINY, the surviving company, adopted

the First Great-West Life & Annuity Insurance Company name. On August 12, 2012, the

Company’s name was changed to Great-West Life & Annuity Insurance Company of New York.

Effective June 1, 2019, the Company completed the sale, via indemnity reinsurance, of

substantially all of its life insurance and annuity business to Protective. The business transferred

included bank-owned and corporate-owned life insurance, single premium life insurance,

individual annuities as well as closed block life insurance and annuities. The Company retained a

block of participating life insurance policies, which are now administered by Protective.

On December 31, 2020, the Company completed the acquisition, via indemnity

reinsurance, of the retirement services business of MassMutual in line with its shift in focus to the

defined contribution retirement and asset management markets.

6

As of December 31, 2020, the Company had capital stock in the amount of $2,500,000,

which consisted of 2,500 shares of common stock with a par value of $1,000 each and paid in and

contributed surplus amounted to $32,450,000.

B. Holding Company

The Company is a wholly owned subsidiary of GWLA, a Colorado stock life insurer.

GWLA is a wholly owned subsidiary of GWL&A Financial Inc., a Delaware holding company,

which in turn is an indirect wholly owned subsidiary of Lifeco, a Canadian holding company.

Lifeco is a member of the Power Financial Corporation group of companies, a diversified

management and holding company based in Montreal, Canada, which currently holds 67.4% of

Lifeco. The ultimate controlling company is Power Corporation of Canada.

7

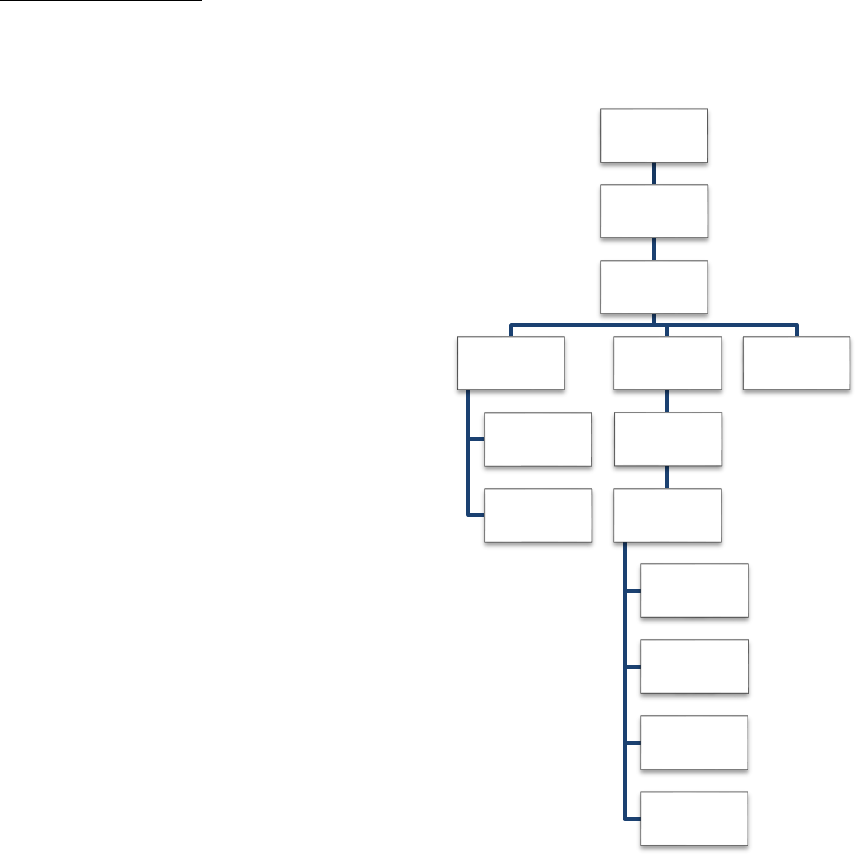

C. Organizational Chart

An organization chart reflecting the relationship between the Company and significant entities in its holding company system as

of December 31, 2020, follows:

Power Corporation of

Canada

Power Financial

Corporation

Great-West Lifeco

Inc.

Canada Life

Assurance Company

Canada Life

Assurance Company-

U.S. Branch (MI)

Canada Life

Reinsurance

Company (PA)

Great-West Lifeco

U.S. Inc.

GWL&A Financial Inc.

Great-West Life &

Annuity Insurance

Company

Great-West Life &

Annuity Insurance

Company of New

York

Great-West Life &

Annuity Insurance

Company of South

Carolina

Empower

Retirement, LLC

Advised Assets

Group, LLC

Putnam Investments,

LLC

8

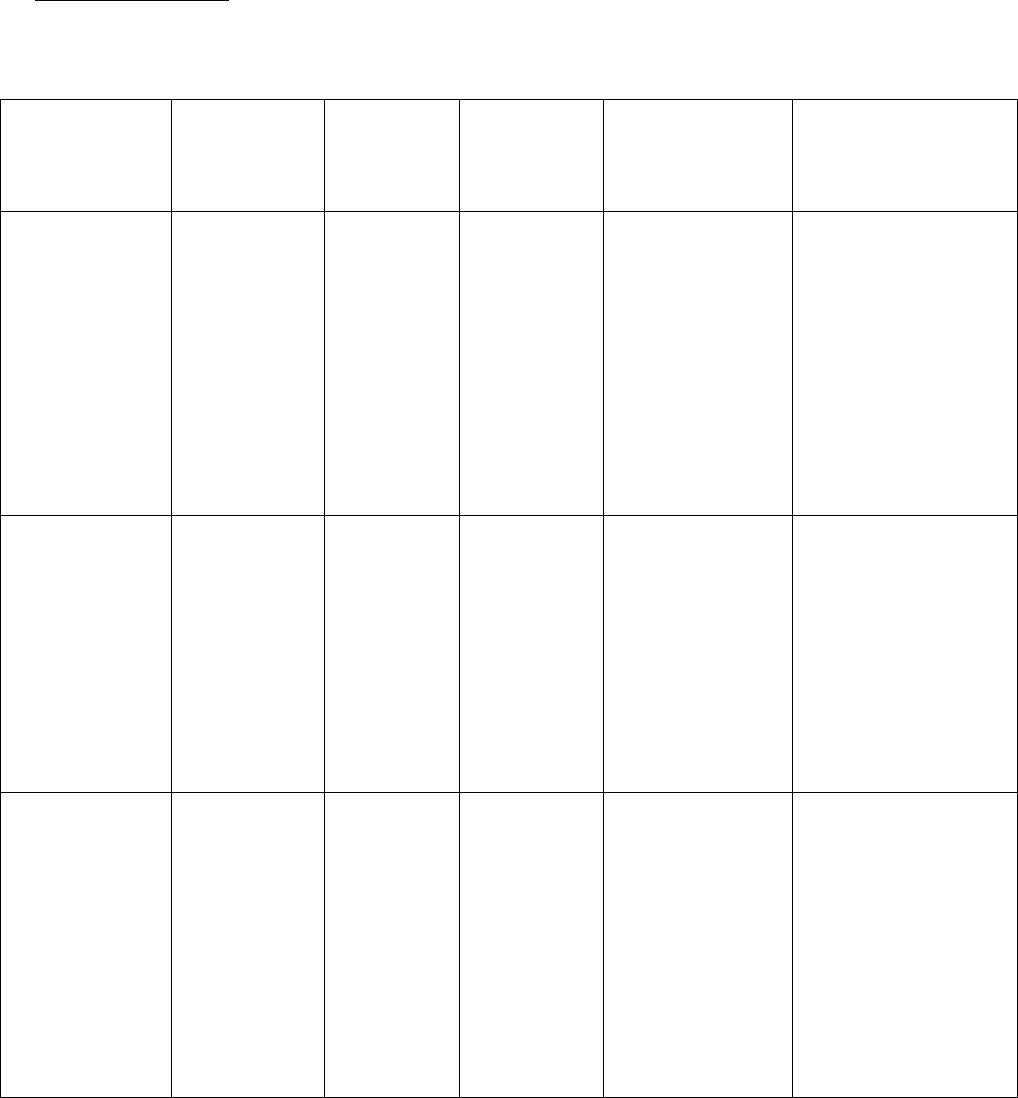

D. Service Agreements

The Company had five service agreements in effect with affiliates during the examination

period.

Type of

Agreement and

Department

File Number

Effective

Date

Provider(s)

of

Service(s)

Recipient(s)

of

Service(s)

Specific

Service(s)

Covered

Income/

(Expense)* For Each

Year of the

Examination

Administrative

Services

Agreement

File No. 30772

08/01/2003

(Amended

10/05/2005)

GWLA

(and

certain

affiliates)

The

Company

Underwriting,

policy owner

services, claims,

marketing,

accounting,

corporate

support,

functional

support, and

investment

services.

2016 $(13,648,279)

2017 $ (9,918,269)

2018 $(12,957,145)

2019 $(16,349,113)

2020 $(29,525,729)

Administrative

and Recording

Keeping

agreement

File No. 47399

10/01/2013

The

Company

GWLA

Recording

keeping and

other

administrative

services,

including plan

participant

recording

keeping and

client services.

2016 $2,096,059

2017 $2,422,539

2018 $2,550,616

2019 $2,327,620

2020 $1,201,426

Service

Agreement

File No. 48128

01/01/2014

Advised

Assets

Group,

LLC

The

Company

Marketing,

preparation of

investment

option data,

recommendation

of investment

options, and

delivery of

investment

performance

reports.

2016 $0**

2017 $0

2018 $0

2019 $0

2020 $0

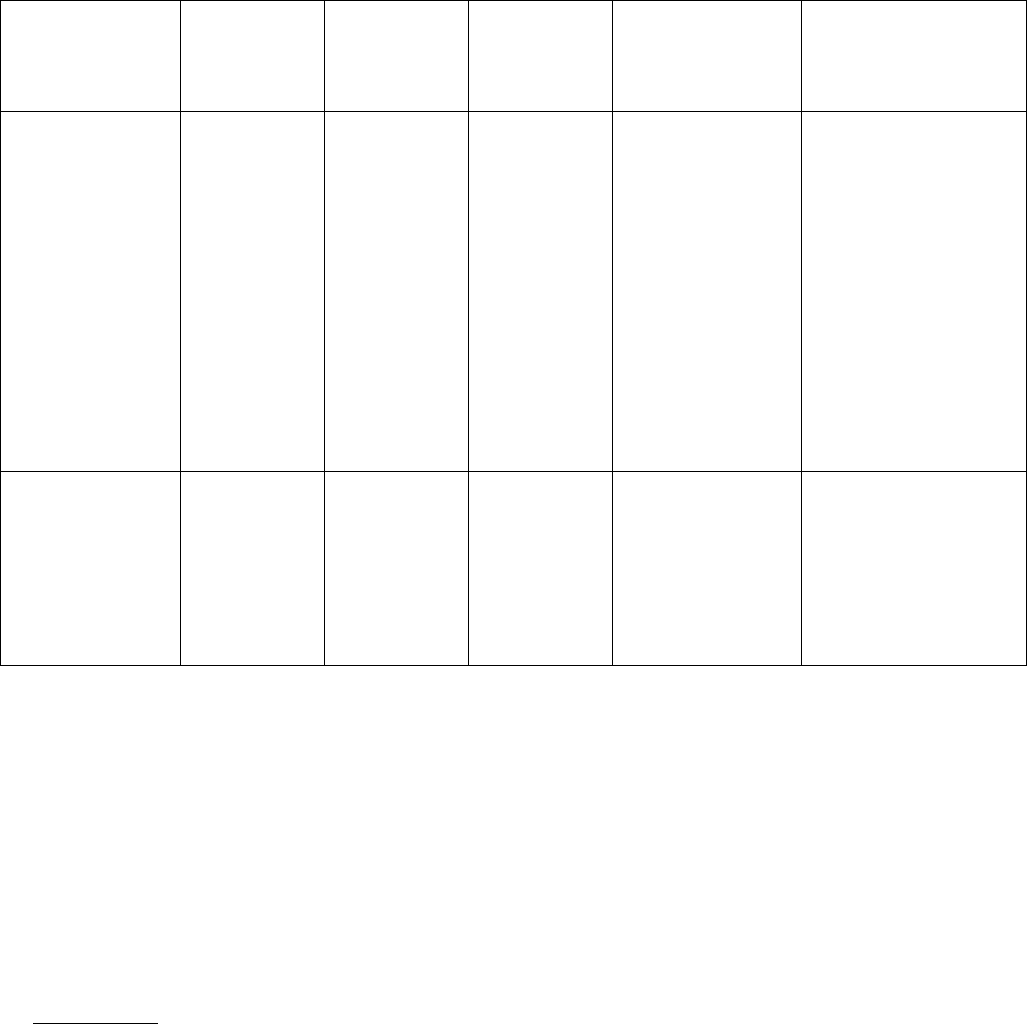

9

Type of

Agreement and

Department File

Number

Effective

Date

Provider(s)

of

Service(s)

Recipient(s)

of

Service(s)

Specific

Service(s)

Covered

Income/

(Expense)* For Each

Year of the

Examination

Administration

Services

Agreement

File No. 48129

04/01/2016

Empower

Retirement,

LLC

(formerly

named

FASCore,

LLC)

The

Company

Administrative

services agent

for certain

products,

including

collection

processing,

accounting,

auditing, records,

disbursements,

claims,

compliance, and

reports.

2016 $ (6,042,783)

2017 $ (1,487,231)

2018 $(11,069,414)

2019 $(12,917,994)

2020 $ (7,870,358)

Administrative

Services

File No. 27974

09/06/2000

Canada Life

Assurance

Company

The

Company

Agency

marketing and

support services,

claims services,

and

policy/contract

owner services.

2016 $ 0***

2017 $(66,376)

2018 $(47,780)

2019 $(10,331)

2020 $ 0***

* Amount of Income or (Expense) Incurred by the Company

** The Company generated no volume under the investment options covered by the agreement

during the examination period.

*** The agreement was dormant prior to 2017 and was no longer active after the sale of the

Company’s life and annuity business to Protective in 2019. The Company is conducting a review

to confirm that there is no further or potential business purpose for the agreement before a decision

is made regarding termination.

The Company participates in a federal tax allocation agreement with its parent and

affiliates.

E. Management

The Company’s by-laws provide that the board of directors shall be comprised of not less

than 7 and not more than 21 directors. Directors are elected for a period of one year at the annual

meeting of the stockholders held in June of each year. As of December 31, 2020, the board of

directors consisted of nine members. Meetings of the board are held quarterly.

10

The nine board members and their principal business, as of December 31, 2020, were as

follows:

Name and Residence

Principal Business Affiliation

Year First

Elected

Marcia D. Alazraki, Esq. *

New York, New York

Attorney

Manatt, Phelps & Philips, LLP

2009

John L. Bernbach *

Miami, Florida

President and Founder

Not Traditional Media, Inc.

2007

André R. Desmarais

President and Co-Chief Executive Officer

2009

Westmount, Québec, Canada

Power Corporation of Canada

Paul G. Desmarais, Jr

Chairman and Co-Chief Executive Officer

2009

Westmount, Québec, Canada

Power Corporation of Canada

Stuart Z. Katz, Esq. *

New York, New York

Attorney

Fried, Frank, Harris, Shriver & Jacobson LLP

2009

Robert J. Orr

President and Chief Executive Officer

2008

Montreal, Québec, Canada

Power Financial Corporation

Thomas T. Ryan, Jr. *

Bal Harbour, Florida

President and Chief Executive Officer

Securities Industry & Financial Markets

Association

2014

Jerome J. Selitto *

Philadelphia, Pennsylvania

Former President and Chief Executive Officer

PHH Corporation

2012

Brian E. Walsh *

Managing Partner

2009

Stamford, Connecticut

Titan Advisors, LLC

* Not affiliated with the Company or any other company in the holding company system

The examiner’s review of the minutes of the meetings of the board of directors and its

committees indicated that meetings were well attended, and that each director attended a majority

of meetings.

11

The following is a listing of the principal officers of the Company as of December 31,

2020:

Name

Title

Andra S. Bolotin

President and Chief Executive Officer

Terry G. Homenuik

Vice President and Corporate Actuary

Kara Roe

Chief Financial Officer

Richard G. Schultz

General Counsel, Chief Legal Officer and Secretary

Ken Schindler *

Chief Compliance Officer

*Designated consumer services officer per Section 216.4(c) of 11 NYCRR 216 (Insurance

Regulation 64)

12

4. TERRITORY AND PLAN OF OPERATIONS

The Company is authorized to write life insurance, annuities and accident and health

insurance as defined in paragraphs 1, 2 and 3 of Section 1113(a) of the New York Insurance Law.

The Company is licensed to transact business in New York. Effective August 23, 2019,

the Company received its foreign insurance license to write life insurance business in the state

Illinois. Also, on December 16, 2020, the Company received its accredited reinsurance status in

Massachusetts. In 2020, 93.1% of life premiums and 92.1% of annuity considerations were

received from New York. Policies are written on a non-participating basis.

A. Statutory and Special Deposits

As of December 31, 2020, the Company had $1,500,000 (par value) of United States

Treasury Bonds on deposit with the state of New York, its domiciliary state, for the benefit of all

policyholders, claimants, and creditors of the Company.

B. Direct Operations

The Company’s principal lines of business during the examination period were group

variable annuity, individual variable annuity, variable universal life, universal life and term life

insurance. Currently, the Company does not sell group accident and health insurance, although it

has a closed block of business with fewer than 10 dental insurance policies and fewer than 10 long

term disability insurance policies in force. There is also a small block of medical conversion

policies. Excess loss policies are sold to employers who sponsor self-funded accident and health

plans. The Company’s agency operations are conducted on a general agency basis. The group

variable annuity products are sold through broker-dealers and registered brokers. The individual

annuity products are sold through The Charles Schwab Corporation (“Charles Schwab”), a bank

and a brokerage firm. The individual term life products are sold by agents through branch offices.

The Company’s agency operations are conducted on a general agency basis.

The group variable annuity products are sold through broker-dealers and registered

brokers. The individual annuity products are sold through Charles Schwab. The individual term

life products are sold by agents through branch offices.

13

C. Reinsurance

As of December 31, 2020, the Company had reinsurance treaties in effect with ten

companies, of which nine were authorized, accredited, or certified. The Company’s life, accident

and health business is reinsured on a coinsurance, modified-coinsurance, and yearly renewable

term basis. Reinsurance is provided on an automatic and facultative basis.

The maximum retention limit for individual life contracts is $250,000. The total face

amount of life insurance ceded was $3,249,493,772, which represents 94% of the total face amount

of life insurance in force, and of which $2,510,728,723, or 77%, was ceded to Protective. Total

reserve credits taken were $700,811,566, of which $684,788,900, or 98%, was ceded to Protective.

Total reserve credits taken for reinsurance ceded to unauthorized companies was $517,740.

As of December 31, 2020, the Company assumed reserves amounting to $1,662,615,929

and premiums amounting to $1,336,028,795 as a result of the MassMutual transaction.

14

5. FINANCIAL STATEMENTS

The following statements show the assets, liabilities, capital and surplus as of December

31, 2020, as contained in the Company’s 2020 filed annual statement, a condensed summary of

operations and a reconciliation of the capital and surplus account for each of the years under

review. The examiner’s review of a sample of transactions did not reveal any differences which

materially affected the Company’s financial condition as presented in its financial statements

contained in the December 31, 2020, filed annual statement.

A. Independent Accountants

Deloitte was retained by the Company to audit the Company’s combined statutory basis

statements of financial position of the Company as of December 31

st

of each year in the

examination period, and the related statutory-basis statements of operations, capital and surplus,

and cash flows for the year then ended.

Deloitte concluded that the statutory financial statements presented fairly, in all material

respects, the financial position of the Company at the respective audit dates. Balances reported in

these audited financial statements were reconciled to the corresponding years’ annual statements

with no discrepancies noted.

15

B. Net Admitted Assets

Bonds

$1,864,853,504

Stocks:

Preferred stocks

842,000

Mortgage loans on real estate:

First liens

238,563,691

Cash, cash equivalents and short-term investments

516,224,450

Contract loans

16,033,537

Derivatives

248,446

Other invested assets

14,382,367

Receivable for securities

5,038,828

Securities lending reinvested collateral assets

3,794,363

Investment income due and accrued

14,215,093

Premiums and considerations:

Uncollected premiums and agents’ balances in the course of collection

79,529

Deferred premiums, agents’ balances and installments booked but

deferred and not yet due

304,583

Reinsurance:

Funds held by or deposited with reinsured companies

256,738,547

Current federal and foreign income tax recoverable and interest thereon

472,997

Net deferred tax asset

3,691,331

Guaranty funds receivable or on deposit

533

Receivables from parent, subsidiaries and affiliates

11,908

Other assets

6,837,063

Premium tax refund

1,526,886

From separate accounts, segregated accounts and protected cell accounts

$ 674,708,085

Total admitted assets

$3,618,567,741

16

C. Liabilities, Capital and Surplus

Aggregate reserve for life policies and contracts

$2,163,677,784

Liability for deposit-type contracts

447,107,269

Contract claims:

Life

1,359,824

Provision for policyholders’ dividends and coupons payable in

following calendar year – estimated amounts

Dividends apportioned for payment

1,800,000

Contract liabilities not included elsewhere:

Other amounts payable on reinsurance

27,845,624

Interest maintenance reserve

94,771,342

Commissions to agents due or accrued

915,139

General expenses due or accrued

1,239,609

Transfers to separate accounts due or accrued

(15,148)

Taxes, licenses and fees due or accrued, excluding federal income taxes

882,739

Amounts withheld or retained by company as agent or trustee

7,183

Remittances and items not allocated

96,503

Miscellaneous liabilities:

Asset valuation reserve

8,238,364

Payable to parent, subsidiaries and affiliates

1,743,054

Derivatives

357,329

Payable for Securities Lending

3,794,363

Accrued interest on outstanding claims

32,979

Miscellaneous liabilities:

389,360

Annuity surrenders in process

439,022

From Separate Accounts statement

674,554,248

Total liabilities

$3,429,236,587

Common capital stock

2,500,000

Gross paid in and contributed surplus

253,014,513

Unassigned funds (surplus)

(66,183,359)

Surplus

$ 186,831,154

Total capital and surplus

$ 189,331,154

Total liabilities, capital and surplus

$3,618,567,741

17

D. Condensed Summary of Operations

2016

2017

2018

2019

2020

Premiums and considerations

$371,134,167

$328,538,723

$267,966,606

$(395,941,868)

$1,653,527,318

Investment income

43,445,850

49,221,730

51,543,068

40,565,123

36,250,454

Commissions and reserve

adjustments on reinsurance ceded

108,658

104,979

101,336

4,783,400

7,282,437

Miscellaneous income

13,014,061

13,195,994

14,981,792

13,151,589

7,150,687

Total income

$427,702,736

$391,061,426

$334,592,802

$(337,441,756)

$1,704,210,896

Benefit payments

$170,099,894

$216,315,098

$243,823,338

$ 290,716,568

$ 249,223,839

Increase in reserves

204,746,392

134,473,572

72,545,074

(577,235,789)

1,347,799,385

Commissions

14,928,600

15,938,508

14,482,279

12,710,586

191,136,318

General expenses and taxes

16,495,978

15,009,757

16,279,306

13,291,890

14,275,596

Increase in loading on deferred and

uncollected premiums

(56,479)

(20,137)

(28,400)

(17,295)

245

Net transfers to (from) Separate

Accounts

20,510,713

1,434,996

(10,144,511)

(69,379,408)

(49,023,232)

Miscellaneous deductions

0

0

0

(21,652,694)

92,484,769

Total deductions

$426,725,098

$383,151,794

$336,957,086

$(351,566,142)

$1,845,896,920

Net gain (loss)

$ 977,638

$ 7,909,632

$ (2,364,284)

$ 14,124,386

$ (141,686,024)

Dividends

2,646,460

3,065,088

2,131,721

1,938,696

1,497,905

Federal and foreign income taxes

incurred

275,074

1,715,728

952,385

(14,242,727)

1,283,054

Net gain (loss) from operations

before net realized capital gains

$ (1,943,896)

$ 3,128,816

$ (5,448,390)

$ 26,428,417

$ (144,466,983)

Net realized capital gains (losses)

0

0

(175,769)

(596,220)

0

Net income

$ (1,943,896)

$ 3,128,816

$ (5,624,159)

$ 25,832,197

$ (144,466,983)

18

E. Capital and Surplus Account

2016

2017

2018

2019

2020

Capital and surplus, December 31,

prior year

$89,704,164

$86,725,470

$87,513,748

$ 81,441,588

$110,196,546

Net income

$(1,943,896)

$ 3,128,816

$ (5,624,159)

$ 25,832,197

$(144,466,983)

Change in net unrealized capital

gains (losses)

24,251

133,997

0

0

0

Change in net unrealized foreign

exchange capital gain (loss)

0

0

0

0

(86,031)

Change in net deferred income tax

2,472,490

(5,876,396)

2,612,933

(12,707,079)

12,811,670

Change in non-admitted assets and

related items

(1,810,501)

4,476,188

(2,270,712)

7,891,348

(10,372,153)

Change in asset valuation reserve

(806,870)

(1,087,440)

(781,647)

2,699,237

(2,999,814)

Surplus (contributed to), withdrawn

from

Separate Accounts during period

14,753

5,575

0

0

338

Other changes in surplus in Separate

Accounts statement

(10,601)

7,538

(8,575)

15,048

15,189

Surplus adjustments:

Paid in

0

0

0

0

220,564,513

Change in surplus as a result of

reinsurance

0

0

0

5,024,207

3,667,879

Adjustment for prior year

corrections, net of income taxes

(918,320)

0

0

0

0

Net change in capital and surplus for

the year

$(2,978,694)

$ 788,278

$(6,072,160)

$ 28,754,958

$ 79,134,608

Capital and surplus, December 31,

current year

$86,725,470

$87,513,748

$81,441,588

$110,196,546

$189,331,154

19

6. SUBSEQUENT EVENTS

Effective January 19, 2021, the Company received its foreign insurance license to write

life insurance business in the state of Colorado. Also, on October 5, 2021, the Company received

its accredited reinsurance status in New Jersey.

Respectfully submitted,

/s/

Courtney Williams

Principal Insurance Examiner

STATE OF NEW YORK )

) SS:

COUNTY OF NEW YORK )

Courtney Williams, being duly sworn, deposes and says that the foregoing report,

subscribed by him, is true to the best of his knowledge and belief.

/s/

Courtney Williams

Subscribed and sworn to before me

this day of

APPOINTMENT NO. 32311

NEW YORK STATE

DEPARTMENT OF FINANCIAL SERVICES

I, ADRIENNE A. HARRIS, Acting Superintendent of Financial Services of the

State of New York, pursuant to the provisions of the Financial Services Law and the

Insurance Law, do hereby appoint:

ERIC C. DERCHER

(NOBLE CONSULTING SERVICES, INC.)

as a proper person to examine the affairs of the

GREAT-WEST LIFE & ANNUITY INSURANCE COMPANY OF NEW YORK

and to make a report to me in writing of the condition of said

COMPANY

with such other information as he shall deem requisite.

In Witness Whereof, I have hereunto subscribed my name

and affixed the official Seal of the Department

at the City of New York

this 1st day of October, 2021

ADRIENNE A. HARRIS

Acting Superintendent of Financial Services

By:

MARK MCLEOD

DEPUTY CHIEF - LIFE BUREAU