Guide for Employers

Who Hire International

Students

Guide for Employers, 2

TABLE OF CONTENTS

Introduction................................................3

Why Hire International Students?...............................4

Frequently Asked Questions....................................5

Practical Training For F-1 Students..............................7

Stem Opt Extension ..........................................9

J-1 Academic Training........................................12

H-1B Speciality Worker Visas...................................13

J-1 Exchange Visitors.........................................15

TN Status (For Canadian & Mexican Nationals). . . . . . . . . . . . . . . . . . . . .16

E-3 Visas For Austrailian Nationals..............................17

Taxation Issues..............................................18

Resources..................................................19

Note: Much of the content was adapted from a document which was originally published in 2000 with a grant

from NAFSA: Association of International Educators Region XII. Revisions made in 2004, 2010 and 2016.

Editors: Laurie Cox, University of Wisconsin, Madison; 2010 coeditors: Lay Tuan Tan, California State University

Fullerton, Phil Hofer, University of La Verne & Junko Pierry, Stanford University; 2016 co-editors: Junko Pierry,

Stanford University & Laurie Cox, Ball State University

Guide for Employers, 2 Guide for Employers, 3

INTRODUCTION

e purpose of this guide is to inform U.S. employers about F-1 and J-1 international student work authorization

options. It includes a discussion on the new Optional Practical Training (OPT) STEM extension for Science,

Technology, Engineering and Mathematics (STEM) students. It is important for employers to understand the

U.S. immigration process when having discussions with prospective employees about co-op, internships and post-

graduation employment.

is guide is not intended to and does not serve as legal advice; it is for informational purposes only. UC

International Services serves international students directly and does not give immigration advice or respond to

questions from employers. Content is subject to change. Employers are advised to consult an experienced U.S.

immigration attorney with any additional questions.

e mission of UC International Services is to provide quality and condential advice/services to international

visitors engaged in educational/employment activities at the University of Cincinnati (UC), provide quality

services/guidance to University departments who wish to admit or hire international visitors and provide quality

educational programs to international visitors to help integrate them into all aspects of campus and community life.

UC International Services seeks to empower students with the knowledge they need to navigate their visa status,

including seeking and obtaining the authorization to work. While it is the student’s responsibility to seek information

on this authorization, the information in this guide provides a consolidated version of information publicly available

on our website. is information pertains to UC-sponsored students only and may not apply to students at other

institutions.

e Division of Experience-Based Learning and Career Education serves as a fully integrated career preparation hub

within the University of Cincinnati. As the global birthplace of cooperative education, the division is a recognized

leader in “real world” education. Within a thriving culture of collaboration, the division provides students, employers

and partners a single point of contact for experience-based learning opportunities and transition-to-career services.

Co-operative Education was invented at UC in 1906 and today the program is listed among the nation’s best in “US

News & World Report” rankings. Our co-op program is carefully designed and tailed to meet the individual needs of

employers and the educational goals of student participants

UC International Services

Experience-Based Learning and Career Education

Guide for Employers, 4

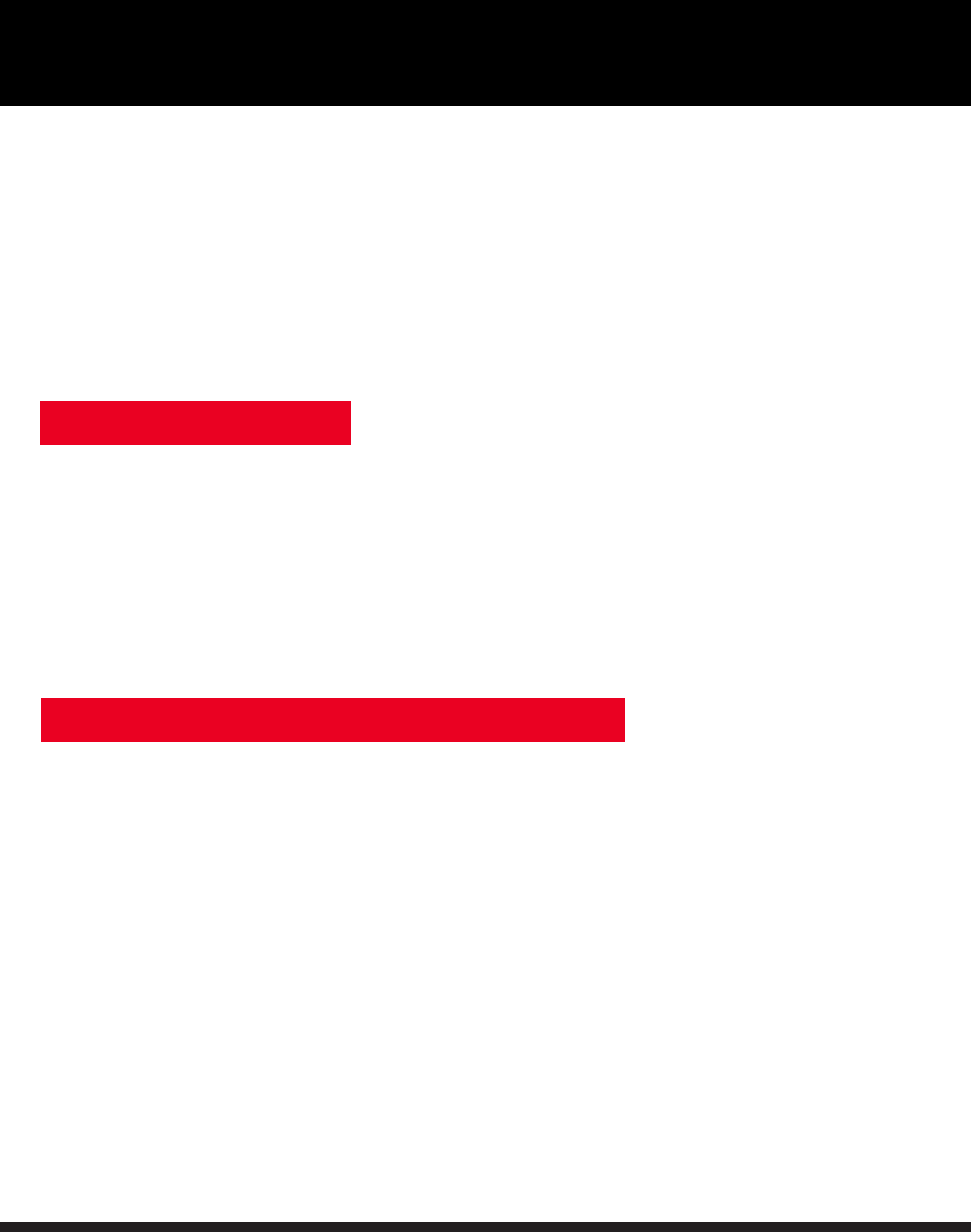

WHY HIRE INTERNATIONAL STUDENTS?

UC international students represent over 100 countries and pursue a diverse array of degrees and career goals. ey possess

qualities that top employers seek:

• Global perspectives with diverse viewpoints and experiences

• Multilingual and cross-cultural communication skills that are vital for companies to compete in a global economy

• Eective leadership and teamwork skills along with the ability to adapt to changes and persevere

Most international students are in F-1 or J-1 immigration status that includes o-campus work authorization benets

during and aer the academic program.e remainder of this guide provides an overview of these work authorization

options along with long-term employment visa options and resources. We hope the information will help to clarify and

streamline the hiring process of international students.

Employers should note that a Social Security Number alone is not sucient proof of work authorization for international

students.It is critical that employers conrm an international student’s work authorization prior to the employment start

date to prevent any liability for the student and the employer in the future.

domestic

international

1/3 from India

1/3 from all

other countries

1/3 from China

2/3 seeking

graduate degrees

Enrollment is set to increase

150%

by 2019.

= 1,000 students

International Population at UC

Important Note

3300

International Students

enrolled at UC last year.

That’s

8%

of all students

(44,000 total).

700

of these students are active on

Optional Practical Training

Guide for Employers, 4 Guide for Employers, 5

FREQUENTLY ASKED QUESTIONS

Isn’t it illegal to hire international students because they do not have a green card?

No. Federal regulations permit the employment of international students on F‐1 and J‐1 visas within certain limits. ese

visas allow students to work in jobs related to their major eld of study. F‐1 students can work on “practical training.” J‐I

students may work on “academic training.”

Even if it’s legal to hire international students, won’t it cost a lot of money and involve a lot of

paperwork?

No. e only cost to the employer hiring international students is the time and eort to interview and select the best

candidate for the job. e international student oce handles the paperwork involved in securing the work authorization

for F‐1 and J‐1 students. In fact, a company may save money by hiring international students because the majority of

them are exempt from Social Security (FICA) and Medicare tax requirements.

How long can international students work in the United States with their student visa?

F‐1 students are eligible for curricular practical training , as well as an additional 12 months of Optional Practical

Training (OPT), either before or following graduation, or a combination of the two.

Students who complete bachelor, master and doctoral degrees in STEM elds may work for 24 additional months of OPT

at an E‐Verify employer. However, if they work full‐time for one year or more on Curricular Practical Training (CPT)

during their program of study, they are not eligible for OPT.

Students with a J‐1 visa are usually eligible to work up to 18 months following graduation, three years for post-doctoral

work. ey may also be eligible to work part‐time during their program of study. e Responsible Ocer (RO) or

Alternate Responsible Ocer (ARO) will evaluate each student’s situation to determine the length of time for which they

are eligible to work.

Don’t international students need work authorization before I can hire them?

No. International students must have the work authorization before they begin actual employment, but not before they

are oered employment. In fact, J‐1 students must have a written job oer in order to apply for the work authorization.

Many F‐1 students will be in the process of obtaining work authorization while they are interviewing for employment.

Students can give employers a reasonable estimate of when they expect to receive work authorization.

What does the work authorization look like?

For OPT, F‐1 students receive from USCIS an Employment Authorization Document (EAD), a small photo identity card

that indicates the dates for which they are permitted to work.

For CPT, F‐1 students receive authorization from the school (NOT from CIS) on page two of the student’s I‐20. “No

Service endorsement is necessary” ‐ per 8CFR 74a.12(b)(6)(iii). J‐1 students receive work authorization on the DS-2019

form. Typically, a letter is also issued by the RO or ARO at their institution.

Guide for Employers, 6

What if I want to continue to employ international students after their work authorization

expires?

With a bit of planning ahead, an employer can hire international students to continue to work for them in the H‐1B visa

category for a total of six years (authorization is granted in two three‐year periods). e H‐1B is a temporary working

visa for workers in a “specialty occupation.” e application procedure to the USCIS is straightforward. e job must

meet two basic requirements:

1) e salary must meet the prevailing wage as dened by the Department of Labor.

2) A bachelor’s degree is a minimum normal requirement for the position.

Doesn’t an employer have to prove that international students are not taking jobs from a

qualied American?

No. American employers are not required to document that a citizen of another country did not take a job from a

qualied American if that person is working under an F‐1, J‐1 or H‐1B visa. Employers must document that they did not

turn down a qualied American applicant for the position only when they wish to hire foreign citizens on a permanent

basis and sponsor them for a permanent resident status (“green card”).

Can I hire international students as volunteer interns?

Normally, if the internship involves no form of compensation and is truly voluntary, the students may volunteer without

having to do any paperwork with the USCIS. If, however, the internship provides a stipend or any compensation,

students must obtain permission for practical training or academic training prior to starting their internship. Students

should check with their employers to ensure that the company is allowed by law to oer unpaid internships.

What is the cost of E‐Verify program, and how can I enroll in E‐Verify program?

ere is no cost to register in E‐Verify program. Information on E‐verify and the enrollment procedure can be found at

the USCIS website at www.uscis.gov/everify.

Many employers are concerned about liability issues related to the employment of international students in the United

States due to changes in federal laws governing non‐citizens. is booklet addresses concerns employers might have

about international students and work.

Getting permission for international students to work in the U.S. is not as dicult as many employers think. Most

international students are in the U.S. on non‐immigrant student visas (F‐1 and J‐1), and these international students are

eligible to accept employment under certain conditions.

FREQUENTLY ASKED QUESTIONS

General Information

Guide for Employers, 6 Guide for Employers, 7

PRACTICAL TRAINING FOR F-1 STUDENTS

Practical training is a legal means by which F‐1 students can obtain employment in areas related to their academic eld of

study. Students, in general, must have completed one academic year (approximately nine months) in F‐1 status and must

maintain their F‐1 status to be eligible for practical training. ere are two types of practical training:

• Optional Practical Training

• Curricular Practical Training

CPT is available during a program of study for F-1 students who have work

requirements/options that are considered an “integral” part of their curriculum

of study. For students in cooperative education programs this will typically

mean that they will begin a program involving a rotation of one semester of full

time study followed by one semester of full time employment for a three year

period, starting in year two of the program of study. Other students may quali-

fy for CPT on a semester by semester basis based on their program of study.

Not all F-1 students are eligible for CPT but those that are will receive an I-20

endorsed for work at the employer with the exact dates of the work authori-

zation indicated on page two of the I-20 form. e employer must see this

endorsement on the I-20 to verify employment eligibility.

OPT must be authorized by the U.S. Citizenship and Immigration Services (USCIS) based on a recommendation from the

designated school ocial (DSO) at the school which issued the I‐20 to the student. Form I‐20 is a government document

which veries the student’s admission to that institution. Student will receive an Employment Authorization Document

(EAD) from the USCIS that establishes their ability to work. Students are eligible for 12 months of OPT for each higher

degree level they obtain. Students who obtain a degree in Science, Technology, Engineering, and Mathematics (STEM) may

be eligible for an additional 24 months of OPT.

OPT can be done prior to completion of study. Students can request to work under the following circumstances:

1) part‐time, a maximum of 20 hours per week, while school is in session

2) full‐time during vacation when school is not in session

3) full‐time/part‐time aer completing all course requirements for the degree

OPT can be authorized for full time aer completion of the course of study. Full-time work means at least 20 hours of em-

ployment per week.

Curricular Practical Training (CPT)

Optional Practical Training (OPT)

Pre-Completion OPT

Post-Completion OPT

Guide for Employers, 8

PRACTICAL TRAINING FOR F-1 STUDENTS

While on OPT, there are limits on how long international students can remain in the U.S. while unemployed. For

students on 12-month OPT, the maximum amount of time they can remain unemployed is 90 days. Students who

qualify for and receive the 24-month OPT extension can be unemployed for an aggregate of 150 days. is particular

part of the rule puts responsibility on students to keep UC International Services up to date with name and address of

their OPT employer. Unless UC International has the SEVIS system updated with the name and address of students’

employers, they will be accumulating unemployment time in SEVIS. Once students have reached the 90 or 150-day

maximum, their F-1 status will be terminated.

Cap-Gap OPT

F-1 students who are the beneciaries of pending or approved H-1B petitions, but whose period of authorized F-1

stay expires before the H-1B employment start date, can extend their status AND work authorization. is rule

applies to all students on OPT, not just STEM students. e extension of duration of status and work authorization

automatically terminates upon the rejection, denial, or revocation of the H-1B petition led on the student’s behalf.

OPT can be extended between 4/1 and through 09/30 of a given year if the student is the beneciary of a timely‐led

H‐1B petition requesting change of status and an employment start date of October 1 of the following H-1B scal

year. e Cap‐Gap OPT is an automatic extension of duration of status and employment authorization to bridge

the gap between the OPT end date and start of H‐1B status. e automatic extension of OPT is terminated upon

the rejection, denial, or revocation of the H‐1B petition. e student must obtain a Cap-Gap I-20 authorizing the

employment from a DSO at the institution they graduated from.

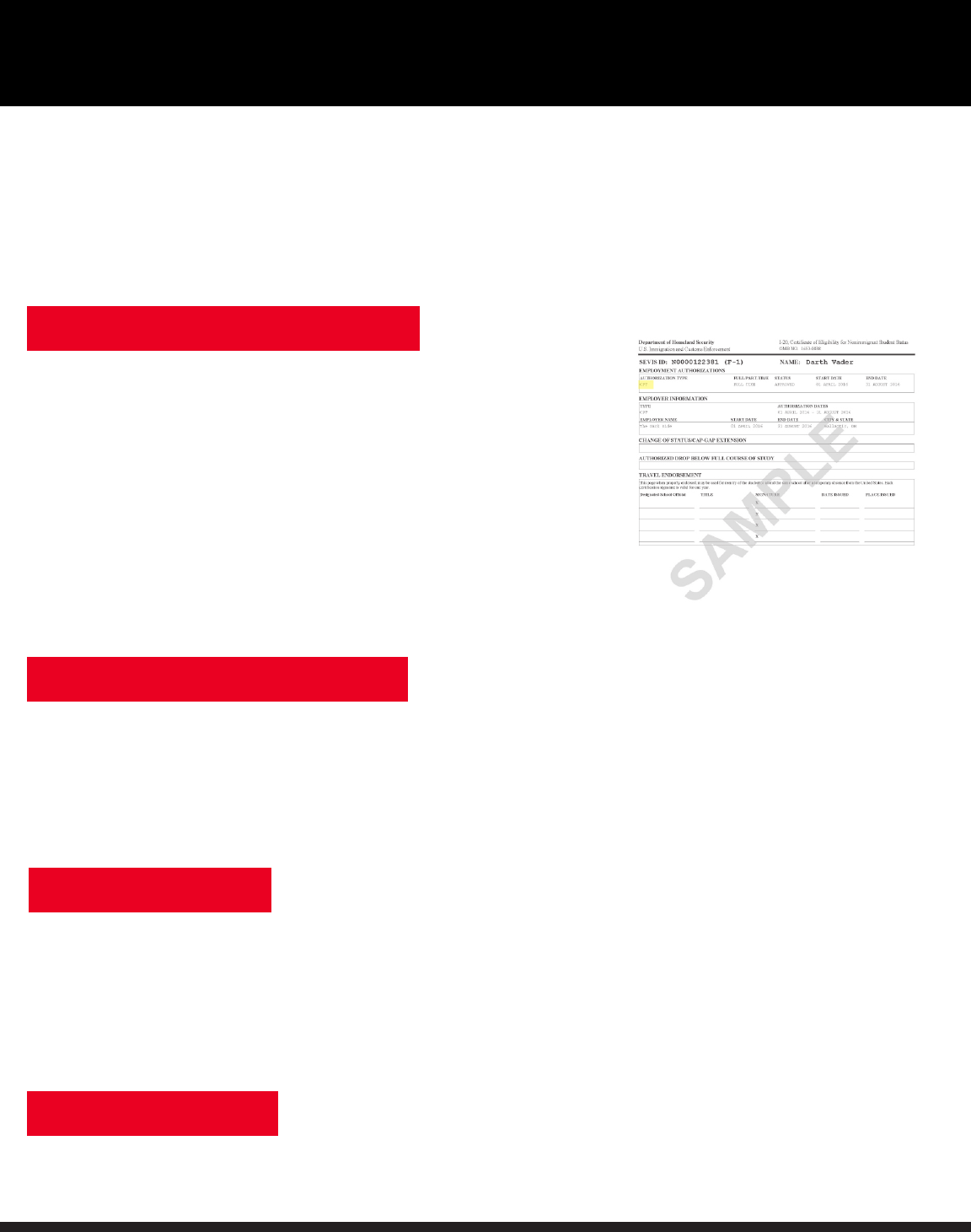

Employment Authorization Document (EAD)

Students who have received OPT work authorization will be issued an EAD by the USCIS. eir name, photo and

valid dates of employment are printed on the EAD. Employers should note that the average processing time for

USCIS to issue the EAD is two or three months, and students may begin employment only aer they receive the

EAD which will indicate the starting and ending dates of employment. Students who have pending STEM extension

application can continue working for up to 180 days while the application is pending.

Unemployment

Guide for Employers, 8 Guide for Employers, 9

24-month STEM OPT Extension

Eective May 10, 2016, the OPT extension for Science, Technology, Engineering and Mathematics (STEM) students increases

from 17 to 24 months. is new rule expands the ability of students in STEM elds to potentially work for an employer for up

to 36 months following completion of their program of study. It is important for employers to understand the requirements

associated with hiring such students, as the new regulation increases the reporting burden on students, employers and

institutions of higher education. It also expands the ability of the Department of Homeland Security to conduct site visits to

employers of STEM OPT students. is guide will explain the requirements associated with hiring STEM OPT students.

Fields of Study

e term “STEM” means a eld included in the Department of Education’s Classication of

Instructional Programs taxonomy within the two-digit series or successor series containing

engineering, biological sciences, mathematics, and physical sciences, or a related eld. A

STEM Designated Degree Program List is published on the Student and Exchange Visitor

Program website:

https://www.ice.gov/sites/default/les/documents/Document/2016/stem-list.pdf

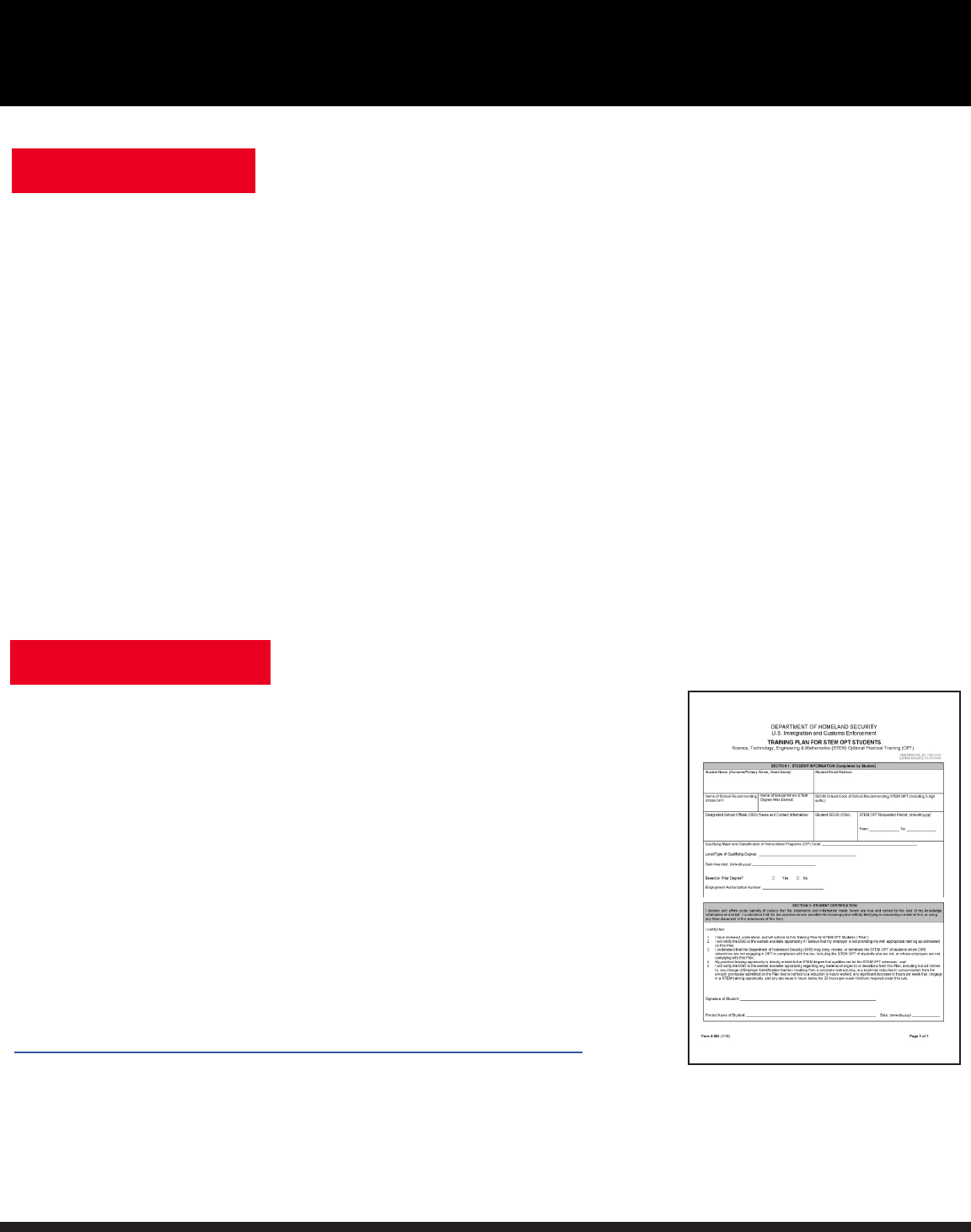

Employer Qualication

In addition to the student completing a program of study in a qualifying eld, the

employer must be enrolled in E-Verify in order for a student to qualify for the STEM

OPT extension. E-Verify is an electronic program through which employers verify the

employment eligibility of their employees aer hire. e program was authorized by the

Illegal Immigration Reform and Immigrant Responsibility Act of 1996 (IIRIRA).

e employer must remain as a participant in good standing with E-Verify for the

duration of the OPT employment. e employer must also provide the company’s

E-Verify number to the student. e number is required when completing the I-765

application for the STEM OPT extension. More information about the E-Verify program

can be found here:

https://www.uscis.gov/e-verify/what-e-verify.

STEM OPT EXTENSION

Guide for Employers, 10

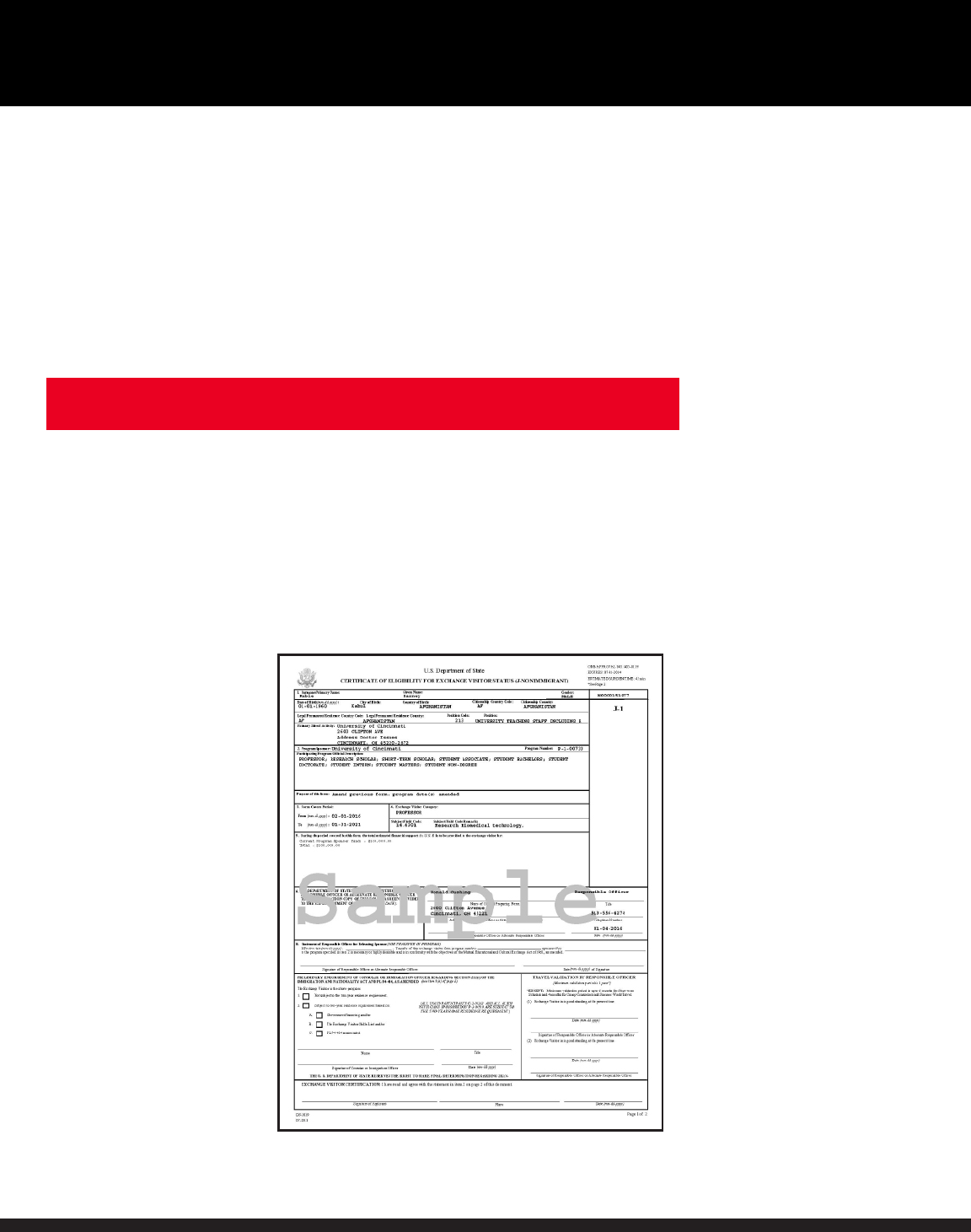

In order for a student to apply for the STEM OPT extension, the employer must sign an I-983 Training Plan for STEM

OPT Students. e I-983 includes a certication of adherence to the training plan and must completed by someone with

signatory authority for the employer. e training plan must do the following:

• Identify goals for the STEM practical training opportunity, including specic knowledge, skills or

techniques that will be imparted to the student, and explain how those goals will be achieved

through the work-based learning opportunity with the employer

• Describe a performance evaluation process

• Dene methods of oversight and supervision

• Explain how the training is directly related to the student’s qualifying STEM degree

As part of completing the Form I-983 Training Plan for STEM OPT Students, an employer must attest to the following:

• It has sucient resources and trained personnel available to provide appropriate training in connection with the

specied opportunity

• e student will not replace a full- or part-time, temporary or permanent U.S. worker

• e opportunity will help the student attain his or her training objectives. e student must present his or her

signed and completed Form I-983 to a DSO at the educational institution of his or her most recent

enrollment as part of the OPT application process

If there are material modications to or deviations from the Training Plan during the

STEM OPT extension period, the student and employer must sign a modied Training

Plan reecting the material changes, and the student must le this modied Training Plan

with the DSO at the earliest available opportunity. Material changes relating to training for

the purposes of the STEM OPT extension include, but are not limited to, the following:

• Change of Employer Identication Number (EIN) resulting from a

corporate restructuring

• Reduction in compensation from the amount previously submitted on

the Training Plan that is not the result of a reduction in hours worked

• Signicant decrease in the hours per week that a student will engage in

the STEM training opportunity, including a decrease below the 20-hour

minimum employment level per week that would violate the requirements

of the STEM OPT extension.

More information about the I-983 can be found here:

https://www.ice.gov/sites/default/les/documents/Document/2016/I-983.pdf

In addition, the employer must report the termination or departure of an OPT student to the DSO at the student’s school,

if the termination or departure is prior to the end of the authorized period of OPT. Such reporting must be made within

ve business days of the termination. Employers must report this information to the DSO. e contact information for the

DSO is on the student’s Form I-20, Certicate of Eligibility for Nonimmigrant (F-1) Student Status (“Form I-20 Certicate

of Eligibility”) and on the student’s Form I-983, Training Plan for STEM OPT Students.

Employer Reporting

Reporting Changes

STEM OPT EXTENSION

Guide for Employers, 10 Guide for Employers, 11

STEM OPT EXTENSION

Annual Evaluation

While on the STEM OPT extension, a student must submit on an annual basis an evaluation of the progress being made on

the training plan. e evaluation is written by the student, but it must be signed by an appropriate individual in the employer’s

company. A mid-point evaluation during the rst 12-month interval and a nal evaluation completed prior to the conclusion

of the STEM OPT extension are required.

Employer Site Visits

e STEM OPT extension rule also provides the DHS with discretion to conduct employer site visits at worksites to verify

whether employers are meeting program requirements, including that they possess and maintain the ability and resources to

provide structured and guided work-based learning experiences. DHS will provide notice to the employer 48 hours before any

site visit unless a complaint or other evidence of noncompliance with the STEM OPT extension regulations triggers the visit,

in which case DHS may conduct the visit without notice.

Unemployment Limitation

e rule revises the number of days an F-1 student may remain unemployed during the practical training period. is rule

retains the 90-day maximum period of unemployment during the initial period of post-completion OPT but allows an addi-

tional 60 days (for a total of 150 days) for a student who obtains a 24-month STEM OPT extension.

Cap-Gap Extensions

e rule continues to allow the DHS to temporarily extend an F-1 student’s duration of status and any current employment

authorization if the student is the beneciary of a timely led H-1B petition and change-of-status request pending with or

approved by USCIS. e Cap-Gap extension extends the OPT period until the beginning of the new scal year (i.e., October

1 of the scal year for which the H-1B status is being requested). e student will obtain an I-20 for a DSO at the school last

attended, authorizing the employment until October 1.

Volunteer Work

e rule eectively prohibits students from using the STEM OPT extension to work in a volunteer capacity. Students must

be paid commensurate with other similarly employed U.S. workers. DHS interprets the compensation element to encompass

wages and other forms of remuneration, including housing, stipends, or other provisions typically provided to employees.

While positions without compensation may not form the basis of a STEM OPT extension, the compensation may include

items beyond wages so long as total compensation is commensurate with that typically provided to U.S. workers whose skills,

experience, and duties would otherwise render them similarly situated.

Contact

Employers with questions about Optional Practical Training and their responsibilities under the STEM OPT regulations can

contact UC International Services at 513-556-4278 or international.st[email protected]u.

Guide for Employers, 12

J-1 ACADEMIC TRAINING

International students on J‐1 visas are eligible for work

authorization called Academic Training. Students in

bachelor’s or master’s programs can obtain 18 months of

Academic Training. Post‐doctoral students may apply

for additional 18 months of Academic Training. Some J‐1

program participants are also allowed to work part‐time

during the academic program. Academic Training is

authorized by the Responsible Ocer (RO) or Alternate

Responsible Ocer (ARO). Students should consult with the

RO or ARO at their institution.

Fortunately, there is little paperwork for an employer who

hires F‐1 or J‐1 students. All paperwork is handled by the

students, the school, and USCIS (for OPT).

Federal regulations require that employment terminate at the conclusion of the authorized practical or academic

training. However, students on an F‐1 visa, or students on a J‐1 visa who are not subject to a two‐year home

residency requirement, may continue to be employed, if they receive approval for a change in visa classication. e

most common immigration statuses that allow for work beyond the student visa include: H-1B Specialty Worker;

J-1 Exchange Visitor; TN Trade NAFTA (for Canadian and Mexican nationals); E-3 (for Australian Nationals); O-1

Extraordinary Ability.

Academic Training for J-1 International Students

Minimal Paperwork for the Employer

Continuing Employment after Practical/Academic Training Period

Guide for Employers, 12 Guide for Employers, 13

H-1B SPECIALITY WORKER VISAS

H-1B specialty workers are international visitors who have skills and experience of a special nature that require at least a

bachelor’s degree or equivalent combination of education and experience. An applicant is not permitted to begin work for an

employer until an H-1B is approved for the employer. ere is an exception for individuals who currently hold H-1B status

for another employer. H-1B employees have a maximum stay of six (6) years in the category no matter how many dierent

employers they have. Employment can be granted for a maximum of three (3) year increments. Extensions beyond the six

year limit are available if an employer has initiated green card eorts prior to the end of the h year of H-1B status.

e initial petition for an individual worker can be approved for up to three years. e validity of an H-1B petition is linked

to the particular employer, employee, job duties, location and wage. If there are material changes in the terms of employ-

ment or the legal identity of the employer during the petition period, the H-1B may be considered automatically invalidated.

If the employee engages in work activities not authorized on the petition, the employee is in violation of U.S. laws and poten-

tially deportable. e employer may request an extension for up to an additional three years. However, most foreign workers

are subject to a six-year limit in H-1B status. Any time spent working under a previous employer’s H-1B petition will count

toward the six year limit in H-1B status.

In some cases, it is possible to get permission to exceed the six-year limit on H-1B status. For example, if the green card pro-

cess is initiated before the end of the employee’s h year of H-1B status, extensions of H-1B status in one year increments

are available until the green card application is decided. ose who are the beneciaries of an approved I-140 are eligible for

additional H-1B time in three year increments if the priority date is not current.

Is there a quota limiting the number of new H-1B workers?

e government’s scal year is from October 1 to September 30. Sixty-ve thousand (65,000) H-1B petitions can be ap-

proved during a scal year. Additionally, twenty thousand (20,000) petitions can be approved for individuals who have

obtained a Master’s degree or higher from a U.S. institution.

Each foreign national (with the three exceptions noted below), who is approved for H-1B classication is counted in this

determination. However, approvals for extensions of stay in H-1B classication, sequential employment, concurrent employ-

ment, and amended petitions are not counted in this determination.

H-1B employees of higher education institutions, nonprot research organizations and government research organizations

are not counted toward the quota. However, if they change employers to a nonexempt employer, they will be counted toward

the quota in the year they changed employers. Furthermore, individuals counted toward the quota in the previous six years

of H-1B status who have been outside the United States for one full year and are again seeking admission pursuant to H-1B

classication will be counted toward the quota.

Not every H-1B applicant is subject to the cap. Visas will still be available for applicants ling for amendments, extensions,

and transfers unless they are transferring from an exempt employer or exempt position and were not counted towards the

cap previously. e cap also does not apply to applicants ling H-1B visas through institutions of higher education, nonprot

research organizations, and government research organizations.

How long does it take to get an H-1B petition approved?

Currently, a reasonable window of expectation is about two to three months. Because each H-1B petition revolves around

facts related to the individual candidate, as well as to the employer and the position, there is some variation in the prepa-

ration and processing time needed for H-1B cases. By paying an extra $1,225 expedited processing fee to U.S. Citizenship

and Immigration Services, an employer can anticipate H-1B petition processing within een (15) calendar days and can be

led no earlier than 4 months prior to start date. If the annual quota for new H-1B workers is reached, processing could be

delayed until October 1st, when the next scal year begins. If the candidate is outside the United States, processing times can

be increased by several weeks or months while the U.S. government completes security clearances and consular visa process-

ing.

Guide for Employers, 14

H-1B SPECIALITY WORKER VISAS

What are the fees involved in ling an H-1B case?

ere are multiple fees involved in ling an H-1B petition. e total amount to be paid depends on whether the peti-

tion is a “new” petition and whether the employer is an institution of higher education or a non-prot governmental or

research organization. ere is a $460.00 application fee that is required of all H-1B petitions (this will increase in No-

vember). A $500.00 fraud prevention and detection fee is required for an employer’s “initial” petition. “Initial” petitions

include any application by an employer for an employee who currently does not hold H-1B status or for an employee

who currently holds H-1B status for another employer.

For employers who are not an institution of higher education or a non-prot governmental or research organization, an

additional training fee is required. e fee is $750 for employers with 25 or fewer full-time equivalent employees and

$1,500 for employers with 26 or more full-time equivalent employees. ere is an optional premium processing fee of

$1,225 that can be paid. e premium processing fee guarantees an answer on the petition within 15 days of receipt at

the USCIS. Finally, if the employee already in the U.S. has dependents who need H-4 dependent status, a fee of $290.00

is required for the I-539 form. Employers that employ more than 50 workers, and more than 50% are H-1B specialty

workers, have to pay a $4,000 training fee.

Who usually pays the legal expenses?

As with the ling fee, a Department of Labor regulation generally requires the employer to pay. e regulation states

that all costs in connection with preparation and ling of the LCA and H-1B petition are considered the employer’s

business expenses and must be paid by the employer, and the employer cannot be reimbursed by the employee.

Department of Labor regulations require that the employer pay the H-1B ling fees (application fee, training fee, fraud

prevention and detection fee). e optional premium processing fee (paid to obtain faster processing) may in some

cases be paid by the employee or a third-party.

Can individuals add/change employers?

Workers in H-1B status are only allowed to work for a petitioning employer. ere is no restriction on changing

employers or working for more than one employer concurrently. So long as the new employer follows proper H-1B

petitioning procedures, an H-1B employee can add/change employers. Employers hiring workers already in H-1B status

under certain circumstances may be allowed to commence the employment upon ling their H-1B petition, rather than

waiting for approval.

What is the portability of H-1B Status?

Individuals who were previously provided H-1B status, who were lawfully admitted and who have not been employed

without authorization in the United States, may accept new employment upon the ling by the prospective employer of

an H-1B petition with the USCIS. If the petition is denied, the authorization to continue the employment ceases. e

H-1B employee should maintain employment with the current H-1B employer until the new employer’s I-129 petition

requesting portability is received by USCIS.

What is Unpaid Benching?

Employers are required to pay H-1B non-immigrants as stated on the LCA, even if the H-1B non-immigrant is not per-

forming work (i.e. benched) unless the non-immigrant is not working for personal reasons unrelated to the job such as

caring for an ill relative, maternity etc.

Guide for Employers, 14 Guide for Employers, 15

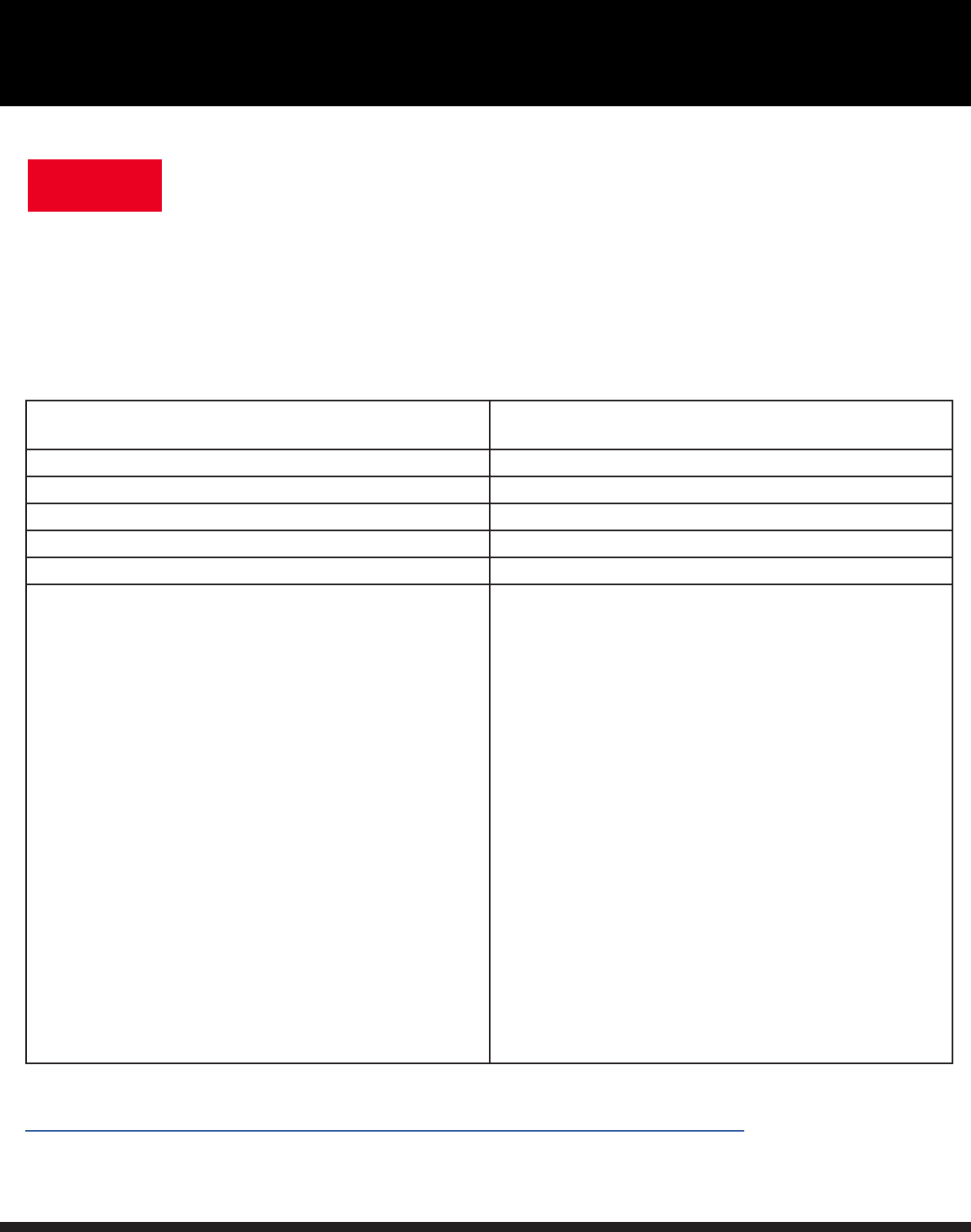

J-1 EXCHANGE VISITORS

J-1 status holders are referred to as Exchange Visitors. Institutions must be designated as an exchange visitor program

in order to issue a DS-2019 for J-1 status. J-1 exchange visitors are limited to work on the premises of the institution

that issued the DS-2019. Under certain circumstances, some exchange visitors may be authorized to do work, give

lectures, or engage in other activities o the premises of the sponsor. Such employment must be specically autho-

rized in writing by the sponsor. J-1 exchange visitors can fall into one of the following categories: Professor, Research

Scholar, Short-Term Scholar, Specialist, Student (degree and non-degree), AuPair, Camp Counselor, Alien Physician,

Trainee, Government Visitors, and Summer Work. Each category has its own time limitations.

e two-year home country physical presence requirement is one of the most important special characteristics of

exchange visitor status and should be thoroughly understood by the employer. An exchange visitor subject to the two

year requirement is not eligible to obtain permanent residency, H temporary worker or trainee, or L intra-company

transferee status in the United States until they have resided and been physically present in their country of national-

ity or last legal permanent residence for a total of at least two years following departure from the United States. ey

are also not permitted to change to another non-immigrant status in the United States.

Two-Year Home Country Physical Presence Requirement

Guide for Employers, 16

TN STATUS (FOR CANADIAN & MEXICAN NATIONALS)

Canadian and Mexican nationals can be admitted for employment under the terms of the North American Free Trade Agree-

ment (NAFTA). e type of employment must be included on the approved list of occupations and can last up to three years

in duration, although the employment can be renewed multiple times. is is a good employment option for Canadians when

the H-1B cap is reached.

Under NAFTA (North American Free Trade Agreement), Canadian and Mexican professionals may apply to enter the U.S.

under the TN visa classication.

Main procedural step

Apply at the U.S./Canadian border (Canadian nationals) or

at the U.S. Consulate/Embassy (Mexican nationals)

Initial duration of status ree year maximum

Total time-limit cap on category No time cap

Processing time Instant approval

Major advantage Quick

Major disadvantage Not all professions qualify

Requirements for TN Status

• Proof of Canadian citizenship (Canadian Landed

Immigrants and non-Canadian citizens must apply for H-1B

status).

• Evidence that the intended U.S. employment and the

applicant quality under Schedule 2 of NAFTA (A list of

professionals who qualify under Chapter 15, Schedule 2, of

NAFTA is provided in the following pages).

• Applicants must intend to engage in employment at a

professional level and the employment must be prearranged

by a U.S. company or institution.

• A letter from the U.S. employer detailing the nature of the

employment. TN status is granted for only one employer at

a time for a specic type of work. For multiple employers,

multiple TN applications must be led (if applying at the

border).

• Form I-129 approved by the USCIS if applying to the

USCIS Service Center instead of the border.

• Self-employed professionals are precluded from obtaining

TN status.

A list of TN professions can be found at:

http://canada.usembassy.gov/visas/doing-business-in-america/professions-covered-by-naa.html

TN Status

Guide for Employers, 16 Guide for Employers, 17

E-3 VISAS FOR AUSTRAILIAN NATIONALS

Australian nationals who have skills and experience of a special nature that require at least a bachelor’s degree or

equivalent combination of education and experience can qualify for an E-3 visa. E-3 employees have a maximum stay

of two years that can be renewed.

e E-3 visa requires the employer to obtain a Labor Condition Application from the Department of Labor. s can

be applied for in country using form I-129 or abroad at the U.S. Consulate/Embassy.

O-1 is an employment category for persons of extraordinary ability. O-1 status is an excellent option for persons sub-

ject to the two year home residency requirement who are not eligible for H-1B specialty worker status. O-1 applicants

must demonstrate that they have made outstanding contributions in their eld, and they have risen to the top of their

eld and enjoy sustained national or international acclaim.

E-3 Visas

O-1 Alien of Extraordinary Ability

Guide for Employers, 18

TAXATION ISSUES

Unless exempted by a tax treaty, F‐1 and J‐1 students earning income under practical training are subject to applicable

federal, state, and local income taxes. Information on tax treaties may be found in Internal Revenue Service Publication

519, U.S. Tax Guide for Aliens and 901, U.S. Tax Treaties.

Generally, F‐1 and J‐1 students are exempted from social security and Medicare tax requirements. However, if F‐1

and J‐1 students are considered “resident aliens” for income tax purpose, social security and Medicare taxes should be

withheld. Chapter 1 of Internal Revenue Service Publication 519, U.S. Tax Guide for Aliens explains how to determine

the residency status of international students. More information on social security and Medicare taxes can be found in

Chapter 8 of Internal Revenue Service Publication 519, U.S. Tax Guide for Aliens and in Section 940 of Social Security

Administration Publication No. 65‐008, Social Security Handbook.

e Code of Federal Regulations (CFR) Title 8 and Title 22 citation numbers for regulations governing practical training

are as follows:

F‐1 students: 8CFR 214.2 (f) (9) &(10)

J‐1 students: 22CFR 62.23 (f)

CFR Title 8 citations governing IRCA requirements are:

F‐1 students: 8CFR 274a.12(b)(6)(iii) and 8CFR 274a.12(c)(3)(i)

J‐1 students: 8CFR 274a.12(b)(11)

What about taxes?

For your reference

Guide for Employers, 18 Guide for Employers, 19

RESOURCES

U.S. Equal Employment Opportunity Commission (EEOC)

http://www.eeoc.gov/laws/index.cfm

U.S. Department of Labor Fact Sheet on Internships

http://www.dol.gov/whd/regs/compliance/whdfs71.pdf

U.S. Citizenship & Immigration Services (USCIS)

http://www.uscis.gov/

U.S. Department of State

http://travel.state.gov/content/visas/english/employment.html

E-Verify

http://www.uscis.gov/e-verify

American Immigration Lawyers Association

http://www.aila.org