Development And Integration

Of Renewable Energy:

Lessons Learned From Germany

Hans Poser

Jerey Altman

Felix ab Egg

Andreas Granata

Ross Board

July 2014

DEVELOPMENT AND INTEGRATION

OF RENEWABLE ENERGY: LESSONS

LEARNED FROM GERMANY

July 2014

Hans Poser

Jeffrey Altman

Felix ab Egg

Andreas Granata

Ross Board

© 2014 by FAA Financial Advisory AG (Finadvice).

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or

transmitted in any form or by any means, electronic, mechanical, photocopying, recording or any

information storage or retrieval system or method, now known or hereinafter invented or adopted, without

the express prior written permission of the FAA Financial Advisory AG.

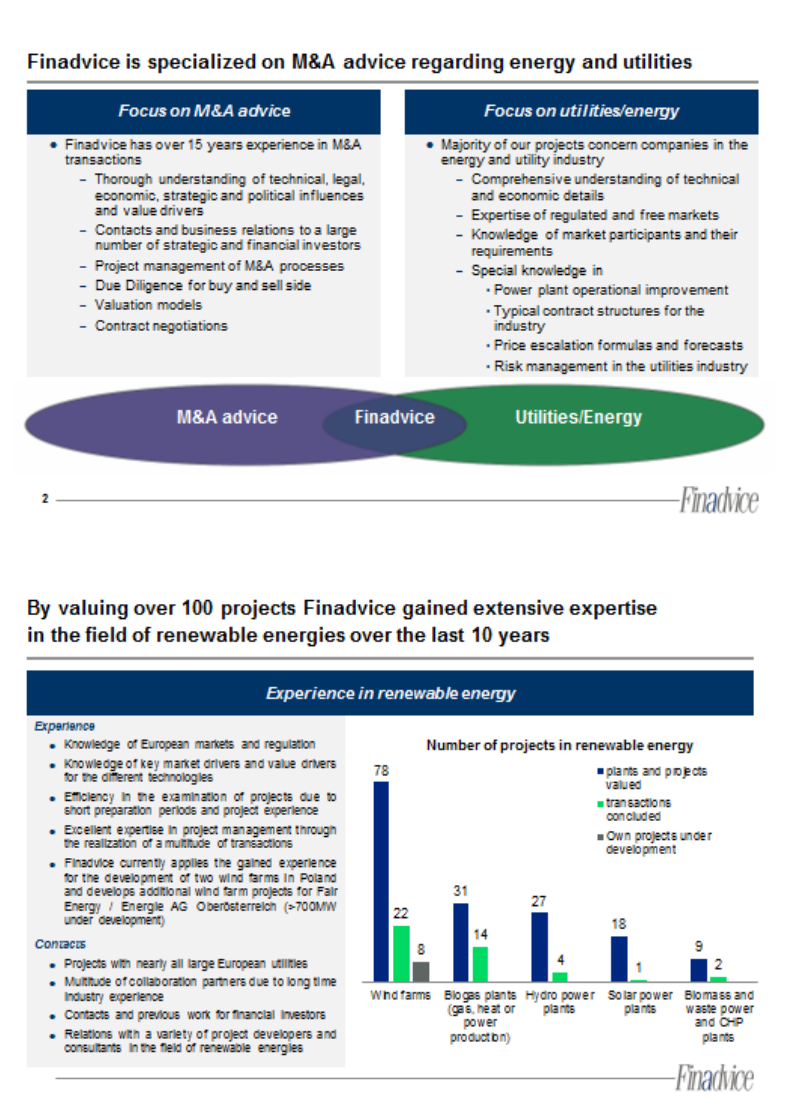

This work was prepared by FAA Financial Advisory AG (Finadvice) for the Edison Electric Institute

(EEI) and Finadvice’s European clients. When used as a reference, attribution to Finadvice is

requested. Although every reasonable effort has been made to ensure the accuracy of this

publication, Finadvice and any person acting on its behalf (a) does not make any warranty, express or

implied, with respect to the accuracy, completeness or usefulness of the information, advice or

recommendations contained in this work, and (b) does not assume and expressly disclaims any liability

with respect to the use of, or for loss and/or damages resulting from the use of any information, advice or

recommendations contained in this work.

The views and opinions expressed in this work do not necessarily reflect those of Finadvice or any

person(s) acting on behalf of Finadvice. This material and its production, reproduction and distribution by

Finadvice does not imply endorsement of the material.

Published by:

Finadvice

FAA Financial Advisory AG

Soodstrasse 55

CH-8134 Adliswil

Switzerland

Office: +41 43 377 1000

Fax: +41 43 377 1005

Website: www.finadvice.ch

Contents

1. EXECUTIVE SUMMARY ......................................................................................................... 1

2. INTRODUCTION .................................................................................................................... 8

2.1. Why Germany? ............................................................................................................ 8

2.2. Germany’s renewable policies and support mechanisms ........................................... 10

3. GERMANY’S RENEWABLE “SUCCESS” STORY ..................................................................... 16

3.1. Renewable energy deployment and diversification of the power portfolio ............... 16

3.2. Emission reductions ................................................................................................... 18

3.3. Energy independence ................................................................................................. 20

3.4. Lower wholesale prices .............................................................................................. 20

3.5. Job creation and expansion of Germany’s manufacturing industry ........................... 21

4. UNINTENDED CONSEQUENCES OF GERMANY’S RENEWABLE POLICIES ............................... 26

4.1. Enormous governmental subsidies for renewables .................................................... 26

4.2. Ever increasing power prices to residential customers .............................................. 30

4.3. Impact on national competitiveness ........................................................................... 34

4.4. Financial impact to thermal generators and reliability ............................................... 36

4.5. Impact of renewables’ variability on market operations and thermal plants ............. 42

4.6. Expansion and additional investment in the power grid ............................................ 47

4.7. Repeated redesigns and boom and bust cycles ........................................................... 50

5. CONCLUSION: TAKEAWAYS OF THE GERMAN AND EUROPEAN EXPERIENCE WITH

RENEWABLES ............................................................................................................................. 58

APPENDIX A: INFLUENCE OF HIGHLY FLEXIBLE GRID DEMANDS ON AGING AND LONG TERM

RELIABILITY OF LARGE TURBINE GENERATOR: AN INSIGHT FROM SIEMENS ............................. 60

APPENDIX B: A PERSPECTIVE FROM THE INSURANCE INDUSTRY ON CHANGES TO THE POWER

INDUSTRY: INSIGHT FROM MARSH ............................................................................................ 65

APPENDIX C: REGULATORY INTERVENTIONS ON VARIOUS SUBSIDIES SCHEMES ACROSS

SEVERAL EUROPEAN COUNTRIES ............................................................................................... 69

BIBLIOGRAPHY .......................................................................................................................... 72

References to the Finadvice and the Authors ........................................................................... 78

1

1. EXECUTIVE SUMMARY

Over the last decade, well-intentioned policymakers in Germany and other European countries

created renewable energy policies with generous subsidies that have slowly revealed themselves

to be unsustainable, resulting in profound, unintended consequences for all industry stakeholders.

While these policies have created an impressive roll-out of renewable energy resources, they

have also clearly generated disequilibrium in the power markets, resulting in significant

increases in energy prices to most users, as well as value destruction for all stakeholders:

consumers, renewable companies, electric utilities, financial institutions, and investors.

Accordingly, the United States and other countries should carefully assess the lessons learned in

Germany, with respect to generous subsidy programs and relatively rapid, large-scale

deployment and integration of renewable energy into the power system. This white paper is

meant to provide further insight into the German market, present an objective analysis of its

renewable policies, and identify lessons learned from Germany, and to a lesser degree, other

European countries.

1

The rapid growth of renewable energy in Germany and other European countries during the

2000’s was due to proactive European and national policies aimed at directly increasing the share

of renewable production in their energy mixes through a variety of generous subsidy programs.

Two main types of subsidy programs for renewable power developed in Europe include feed-in

tariffs (FITs), which very quickly became the policy of choice for Germany and many other

European countries, and quota obligation systems.

FITs are incentives to increase production of renewable energy. This type of subsidy guarantees

long-term (usually for 20 years) fixed tariffs per unit of renewable power produced. These fixed

tariffs normally are independent of market prices and are usually set by the government, but can

be structured to be reduced periodically to account for technology cost decreases. The level of

1

The authors of this white paper would like to state that they fully support renewables as a part of the overall power

portfolio. All the authors have worked with both electric utilities and purely renewable companies. Some of them

have 20+ years of experience in the power sector, and a couple have direct equity interests in renewable projects.

2

the tariffs normally depends on the technology used and the size of the production facility.

Because of their generosity, FITs proved capable of quickly increasing the share of renewable

power, but since the FITs are set administratively, it is difficult to meet renewable energy goals

in the most cost-effective way possible.

The quota system is the European equivalent to the Renewable Portfolio Standard used in the

United States. Whereas FIT programs set the price for the resources and let the market achieve

whatever level it can at that price, the quota system is a market based system that sets the desired

amount of renewable resources and lets the market determine its price. Under the quota system,

compliance is proven through renewable certificates that can usually be traded.

Germany used FITs to help finance its energy policy, “Energiewende” (the energy

transformation), that calls for a nuclear-free and carbon-reduced economy through a vast

deployment of renewable technologies.

Because FITs levels were administratively driven and slow to adapt to the evolution of the solar

market, the incentive became excessively generous, which initiated an uncontrolled development

of renewables, which, in turn, created unsustainable growth with a myriad of unintended

consequences and lessons learned. Accordingly, this analysis will focus on Germany, whose FIT

policies allowed it to realize the highest production of non-hydro renewable electricity (wind and

solar) in Europe.

The most important lessons learned include:

1. Policymakers underestimated the cost of renewable subsidies and the strain they

would have on national economies. As an example, Germany’s FIT program has cost

more than $412 billion to date (including granted and guaranteed, but not yet paid FIT).

Former German Minister of the Environment Peter Altmaier recently estimated that the

program costs would reach $884 billion (€680 billion

2

) by 2022. He added that this figure

could increase further if the market price of electricity fell, or if the rules and subsidy

2

Amounts in dollars are translated from euros at 1:1.3 exchange rate.

3

levels were not changed.

3

Moreover, it is estimated that Germany will pay $31.1 billion in

subsidies for 2014 alone.

4

A recent analysis

5

found that from 2008 to 2013, Germany

incurred $67.6 billion (€52 billion) in net export losses because of its high energy costs,

compared to its five leading trade partners. Losses in energy intensive industries

accounted for 60 percent of the total losses. This was further highlighted by a recent

International Energy Agency report, which stated that the European Union (EU) is

expected to lose one-third of its global market share of energy intensive exports over the

next two decades due to high energy prices,

6

expensive energy imports of gas and oil, as

well as costly domestic subsidies for renewable energy.

2. Retail prices to many electricity consumers have increased significantly, as subsidies

in Germany and the rest of Europe are generally paid by the end users through a cost-

sharing procedure. Household electricity prices in Germany have more than doubled,

increasing from €0.14/kilowatt hour (kWh) ($0.18) in 2000 to more than €0.29/kWh

($0.38) in 2013. In Spain, prices also doubled from €0.09/kWh in 2004 to €0.18/kWh in

2013 ($0.12 to $0.23) while Greece’s prices climbed from €0.06/kWh in 2004 to

€0.12/kWh in 2013 ($0.08 to $0.16)

7

. Comparatively, household electricity prices in the

United States average $0.13/kWh, and have remained relatively stable over the last

decade.

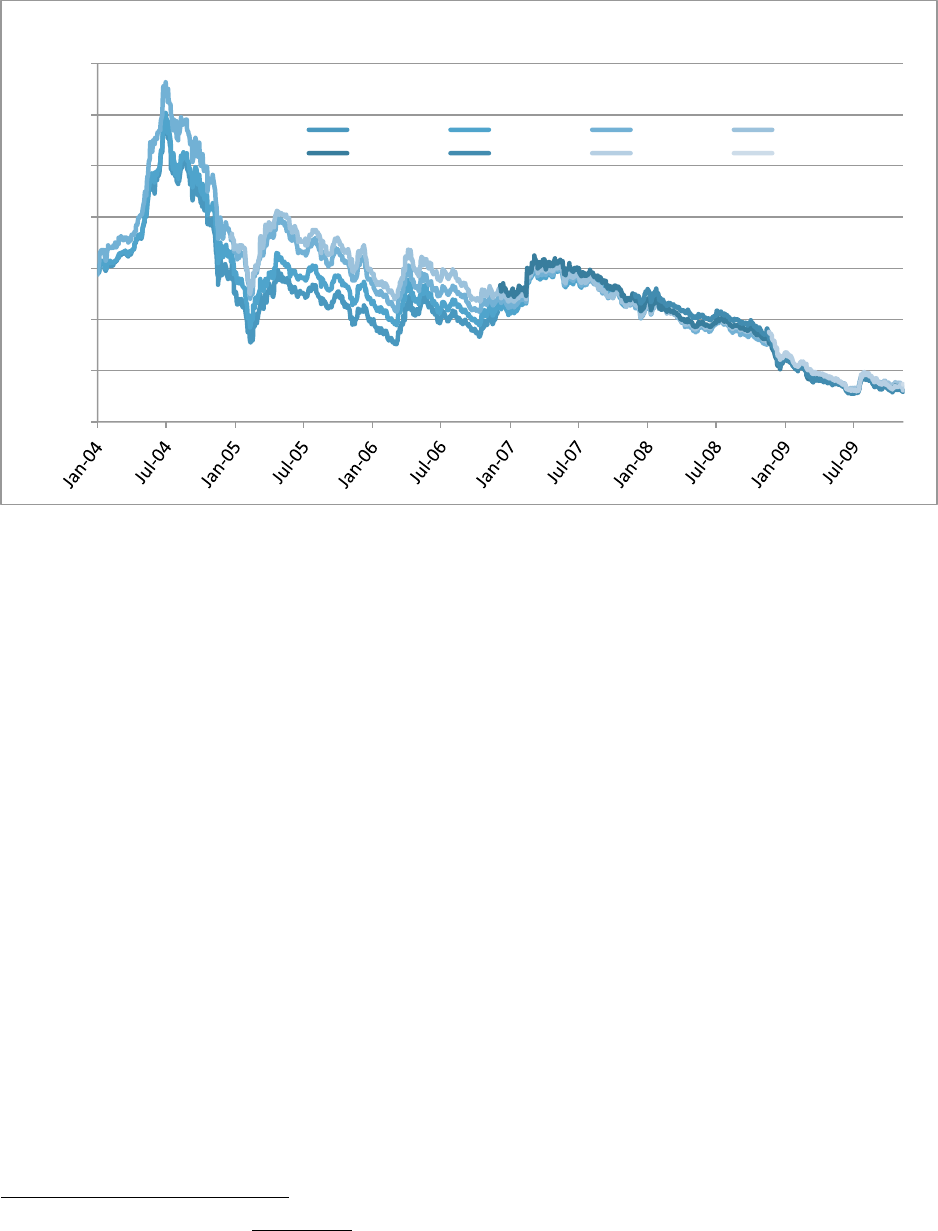

3. The rapid growth of renewable energy has reduced wholesale prices in Germany,

with adverse consequences on markets and companies. Large subsidies and guaranteed

interconnection to the grid for renewable energy led to unexpected growth over the last 10

years in Germany and elsewhere. The merit order in Germany’s wholesale markets

switched as renewables, with a zero variable cost of production, take precedence over

3

Frankfurter Allgemeine, Energiewende könnte bis zu einer Billion Euro kosten, 19th February 2013;

http://www.faz.net/aktuell/politik/energiepolitik/umweltminister-altmaier-energiewende-koennte-bis-zu-einer-

billion-euro-kosten-12086525.htm

4

German Federal Ministry for the Environment, “Nature Conservation, Building and Nuclear Safety: Development

of renewable energy sources in Germany in 2012”

5

Financial Times, “Germans told of billions lost to trade due to energy policy”, 26

th

February 2014,

http://on.ft.com/1cRFiKb

6

Financial Times, “Energy price gap with the US to hurt Europe for ‘at least 20 years’”; 29

th

January 2014;

http://www.ft.com/cms/s/0/80950dfe-8901-11e3-9f48-00144feab7de.html#axzz2thyHzZc8

7

European Commission, Eurostat,

http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&plugin=1&language=en&pcode=ten00115

4

thermal plants. As a result, wholesale prices in Germany for base load have fallen

dramatically from €90-95/megawatt hour (MWh) in 2008 to €37/MWh in 2013. This has

created a large amount of load and margin destruction for utilities that built and financed

thermal plants. Many new gas-fired power plants have been rendered uneconomical,

leaving owners to shore up their balance sheets by undertaking large divestitures of some

of their holdings, as well as by reducing their operational costs. The impact to utilities’

shareholder value has been dramatic and has come on top of the impact of the global

financial crises, and, in the case of Germany, the decommissioning of nuclear power. The

German utilities have seen their stock plunge by nearly 45 percent since 2010. Some

power plant operators in Germany and other countries, like the United Kingdom, are now

calling for capacity payments to ensure that reliability is maintained and not threatened by

the shutdown of various thermal power stations.

4. The wholesale pricing model has changed as a result of the large renewable energy

penetration. In the past, wholesale prices followed the demand curve, but in Europe they

now react to the weather; going down when the sun shines and the wind blows, and up

when—at times of high demand—the sun does not shine and the wind does not blow.

Price forecasts and power trading require more skill sets and different know-how,

including weather forecasting.

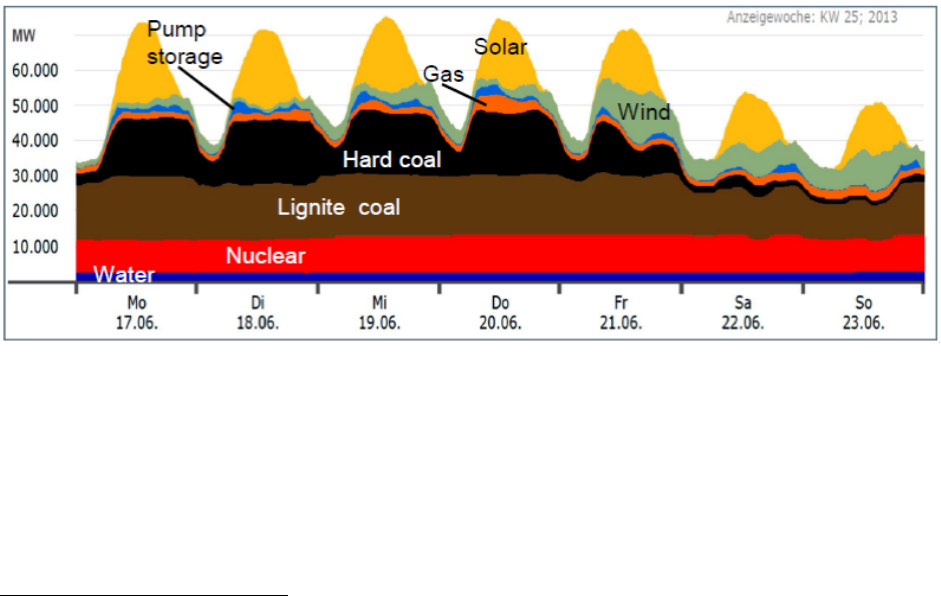

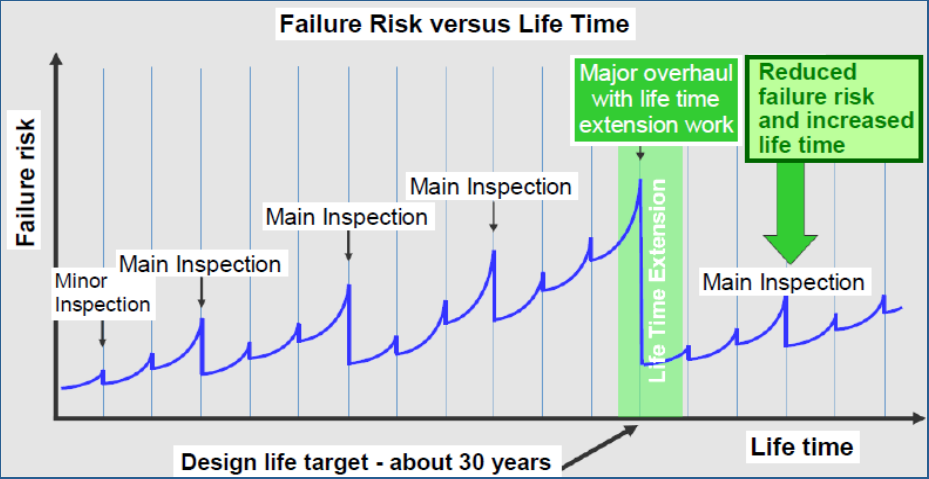

5. Fossil and nuclear plants are now facing stresses to their operational systems as these

plants are now operating under less stable conditions and are required to cycle more often

to help balance renewables’ variability. Investments in retrofits will be required for these

plants in order to allow them to run to these new operational requirements. Moreover,

renewable resources are dramatically changing thermal plants’ resource planning and

margins. As a result, many of these plants are now being retired or are required to receive

capacity payments in order to economically be kept online.

6. Large scale deployment of renewable capacity does not translate into a substantial

displacement of thermal capacity. Because of the variability of wind and solar, there are

many hours in the year during which most generation comes from thermal power plants,

which are required to provide almost complete redundant capacity to ensure the reliability

5

of the system. In turn, grid interventions have increased significantly as operators have to

intervene and switch off or start plants that are not programmed to run following market-

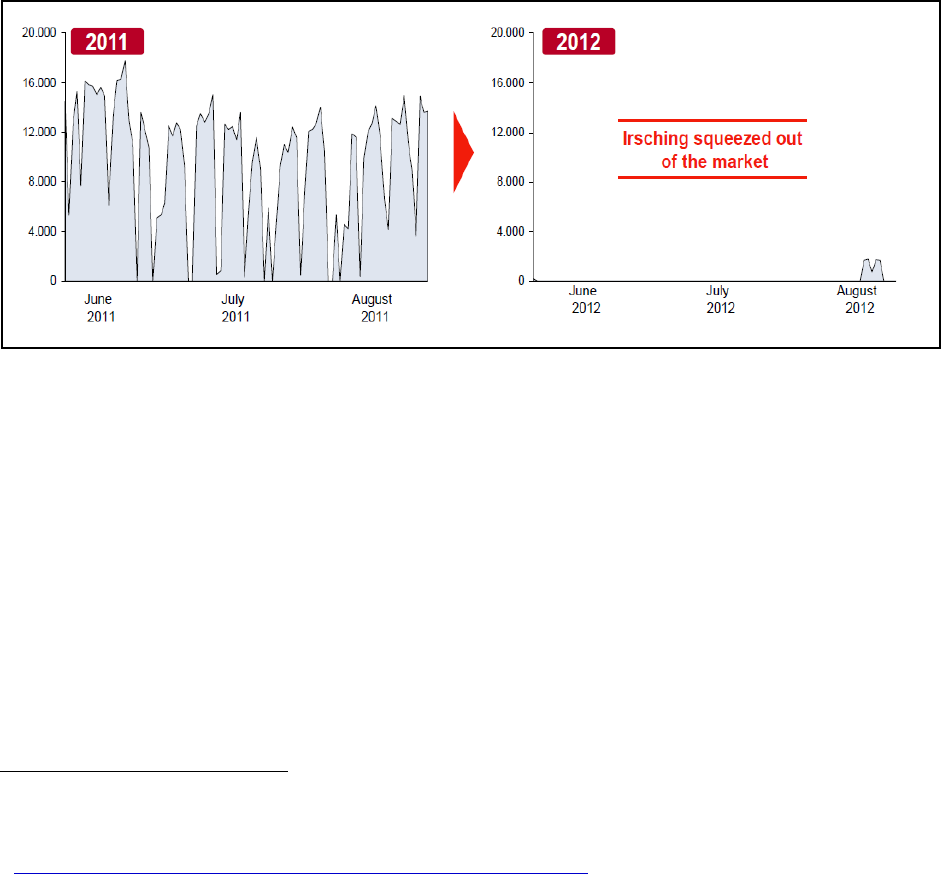

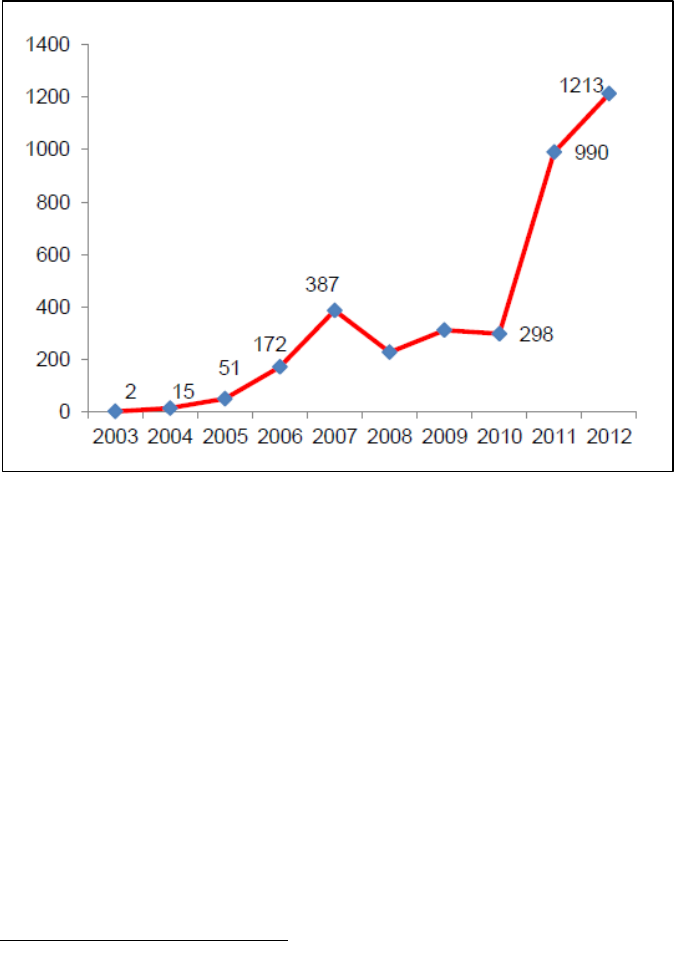

based dispatching. For instance, one German transmission operator saw interventions

grow from two in 2002 to 1,213 in 2013. It is higher amounts of renewables with low full

load hours relative to the total portfolio of power production that creates greater variability

and strains on the grid. In the case of Germany, it is the large-scale deployment of both

wind and solar that has impacted the entire system.

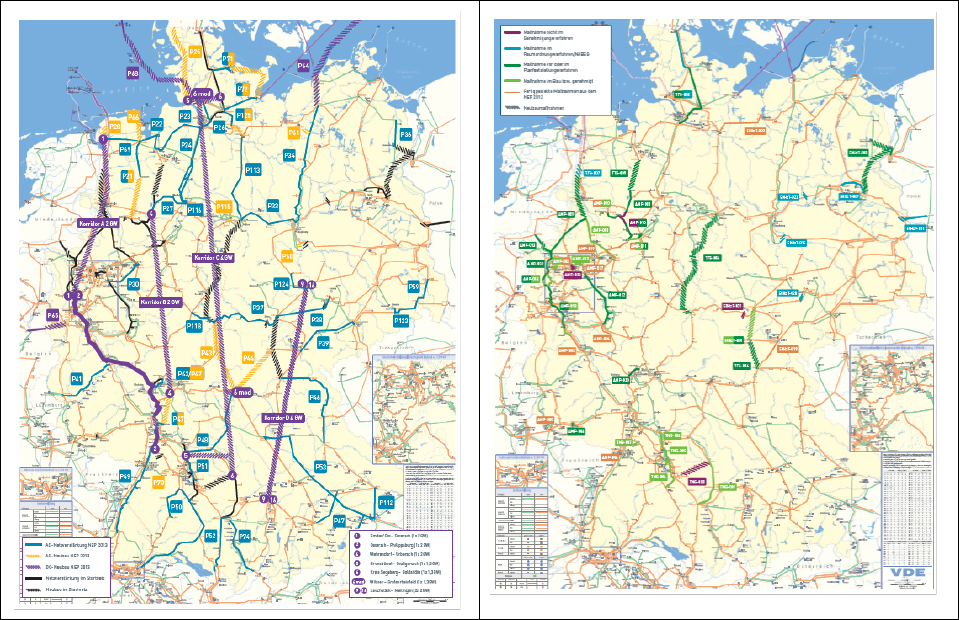

7. Large-scale investments in the grid are being required to expand transmission grids so

they can connect offshore and onshore wind projects in the north of Germany to

consumers in the south of the country. The total investment cost for the build-out of

German onshore and offshore transmission systems is estimated to be around $52 billion

(€40 billion) over the next 10 years. Moreover, the grids are now being challenged to meet

the dynamic flows of variable renewables and require significant additional investment to

accommodate increased penetration of renewables. All of these costs will ultimately be

passed on to electricity consumers. This has not gone unnoticed in Germany or in the EU.

A report was released in late February 2014 by an independent expert commission

mandated by the German government, which concluded that Germany’s current program

of incenting renewables is an uneconomic and inefficient means to reduce emissions and

therefore should be stopped

8

. Moreover, the European Commission released new

guidelines on April 9, 2014, with effect starting in 2017 that will correct market

distortions. It will essentially ban all FIT subsidies and introduce technology agnostic

auctions as the only incentives for renewables.

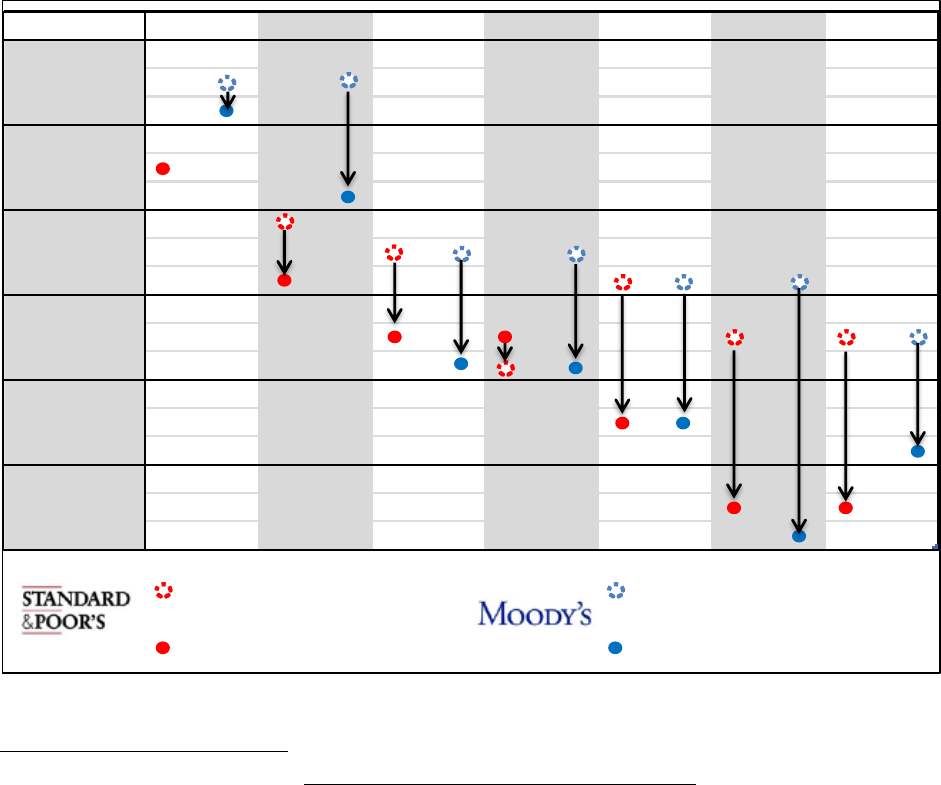

8. Overgenerous and unsustainable subsidy programs resulted in numerous redesigns

of the renewable support schemes, which increased regulatory uncertainty and

financial risk for all stakeholders in the renewable energy industry. As the lessons

above show, some European renewable energy regulatory regimes were inappropriately

structured, gamed by market players, or made obsolete by market conditions. As a result,

governments and regulators corrected unsustainable regulatory regimes by reducing the

8

Frankfurter Allgemeine. http://www.faz.net/aktuell/wirtschaft/wirtschaftspolitik/oekostrom-regierungsberater-

wollen-eeg-abschaffen-12820227.html

6

level of subsidies, sometimes retroactively, and modifying the rules of the programs.

These changes often resulted in significant value destruction to various renewable players

and their respective investors. This continued regulatory uncertainty across Europe is

increasing the cost of capital to European renewable companies, which the rating agency

Fitch just recently highlighted as the most likely sector in the European energy market to

receive a downgrade in 2014.

These lessons learned are important and provide factual analyses to assist other countries’

electric industry stakeholders’ in creating more technically-efficient, cost-effective and

sustainable ways to integrate renewable energy.

U.S. stakeholders should take into consideration the lessons learned from Germany and Europe:

Utilities should incorporate those lessons into their strategic planning, load forecasting, financial

planning, trading, and regulatory affairs organizations. Decisions about current and future

investments should then be made with this new analysis in mind.

Renewable companies should calculate appropriately the true costs of grid enhancements,

capacity, and other important measures when submitting their plans to commissioners, investors,

and other stakeholders.

Legislators and regulators should use the lessons learned from large scale integration of

renewables in Germany and elsewhere in Europe to ensure a stable transition of renewables as

part of the overall power portfolio while ensuring high reliability of power, stability of pricing to

all users, as well as minimal value destruction to both utilities and renewable companies.

Finally, consumers must be made aware of the tradeoffs to a large portfolio of renewables and

the necessary requirement for a smooth transition as part of the overall power portfolio.

In conclusion, the lessons learned in Europe prove that the large-scale integration of renewable

power does not provide net savings to consumers, but rather a net increase in costs to consumers

and other stakeholders. Moreover, when not properly assessed in advance, the rapid, large scale

integration of renewables into the power system will ultimately lead to disequilibrium in power

markets, as well as value destruction to renewable companies, utilities, and their respective

7

investors. The U.S. has the opportunity to incorporate these lessons learned to ensure the

sustainable growth of renewable energy over the long-term, for the benefit of all customers.

8

2. INTRODUCTION

Over the last decade, well-intentioned policymakers in Germany and other European countries

have created renewable energy policies that have slowly revealed themselves to be

unsustainable, resulting in profound, unintended consequences for all industry stakeholders.

While these policies have created an impressive roll-out of renewable energy resources, they

have also clearly generated disequilibrium in the power markets, resulting in significant

increases in energy prices to most users, as well as value destruction for all stakeholders:

consumers, renewable companies, electric utilities, financial institutions, and investors.

Accordingly, the United States and other countries should carefully assess the lessons learned in

Germany, with respect to generous subsidy programs and relatively rapid, large-scale

deployment and integration of renewable energy into the power system. This white paper is

meant to provide further insight into the German market, present an objective analysis of its

renewable support policies, and identify lessons learned from Germany, and to a lesser degree,

other European countries.

9

2.1. Why Germany?

More than any other region in the world, Europe has taken a proactive stance on an extensive

roll-out of renewable forms of energy. Further, Germany has been one of the most aggressive

supporters of renewable power in the world, and, accordingly provides an appropriate case study

of the law of unintended consequences.

As a result of aggressive policies during the last decade, the European Union (EU or Europe) has

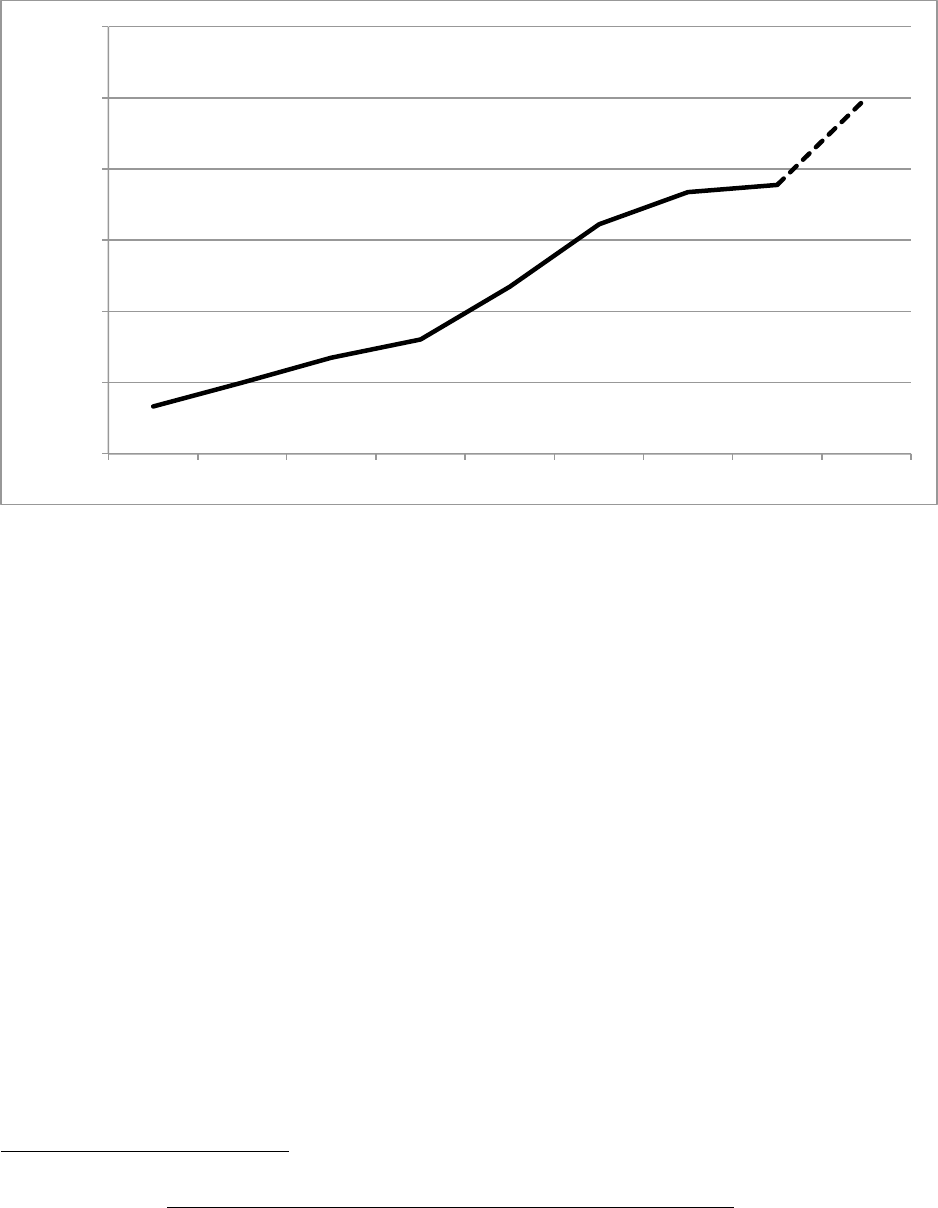

increased its gross renewable electricity generation by 50 percent, climbing from 13.6 percent in

2000 to 23.5 percent in 2012. As of 2011, the EU was the world’s second largest renewable

generator (following China with 18.6 percent of total production), providing 16.5 percent of the

world’s total renewable electricity generation (including hydropower). More interestingly, in

2010, the EU produced 70 percent of the world’s electricity net generation from solar

9

The authors of this white paper would like to state that they fully support renewables as a part of the overall power

portfolio. All the authors have worked with both electric utilities and purely renewable companies. Some of them

have 20+ years of experience in the power sector, and a couple have a direct equity interests in renewable projects.

9

photovoltaics (PV) and 44 percent of the world’s wind generation.

10

However, it must be noted,

this market share is decreasing as the United States and China expand both their wind and solar

PV portfolios.

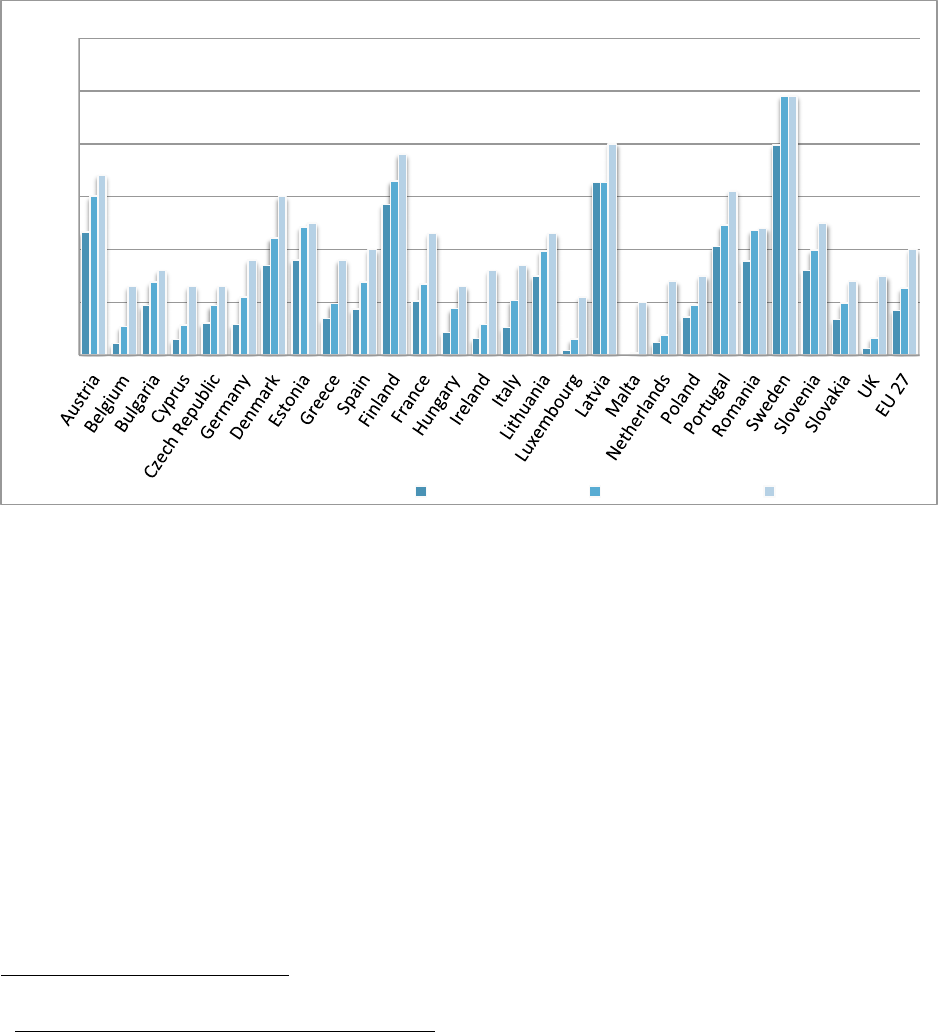

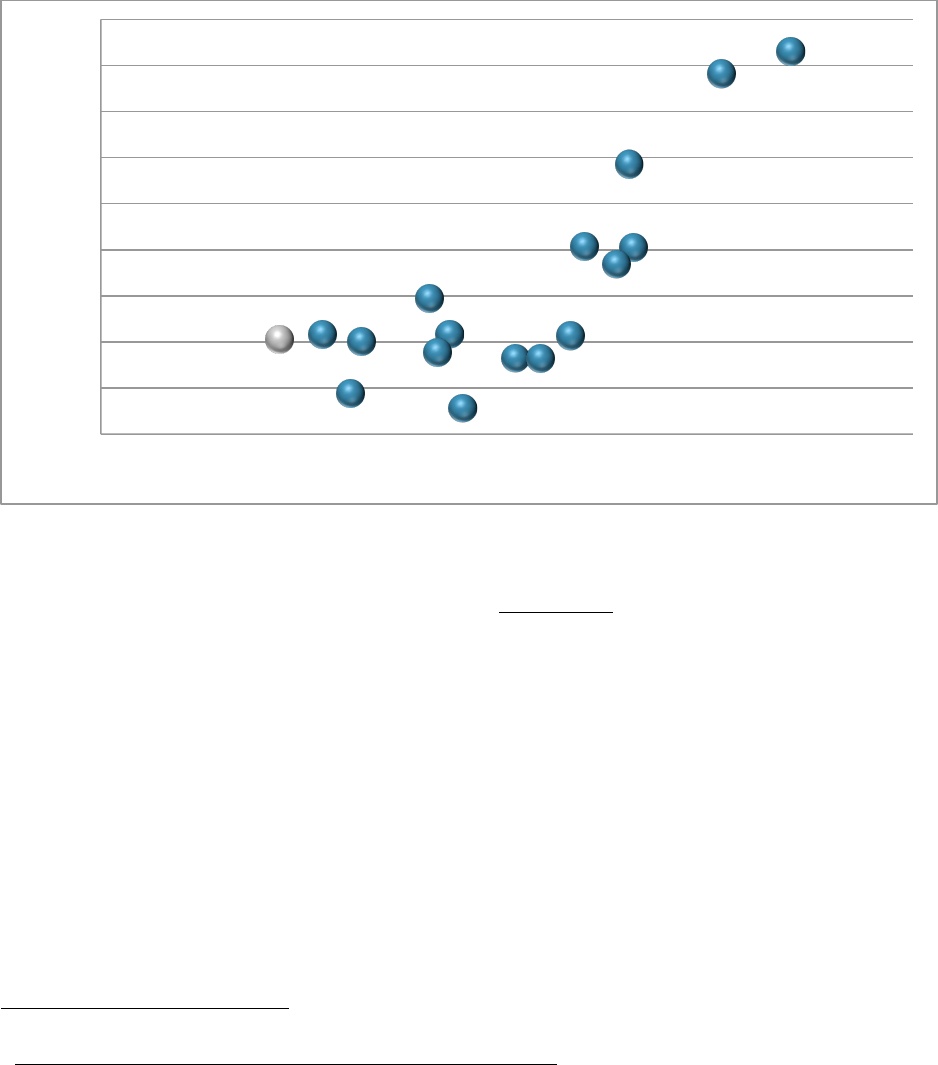

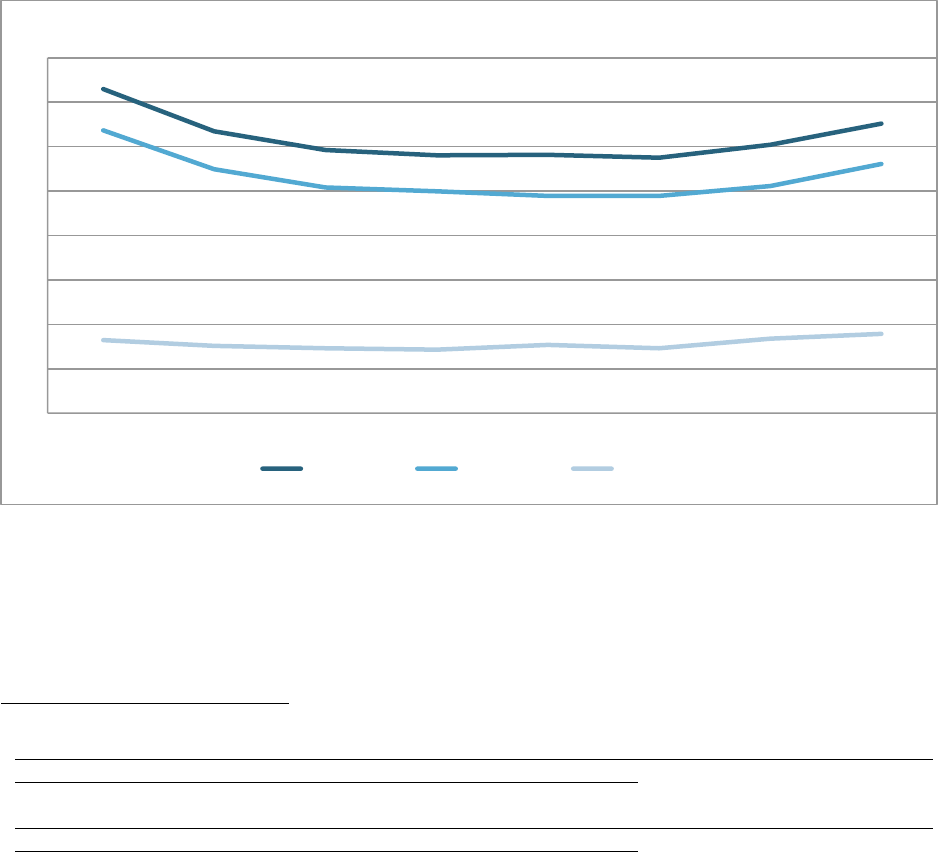

Figure 1. EU 27 Member States: Trends in the share of renewable generation in gross final

energy consumption (EC, 2010)

11

Although Germany is not the European country with the highest renewable energy penetration, it

has become the most widely cited case study because of its status as the largest European

producer of non-hydro renewable electricity, its economic importance in Europe, and its much-

observed and replicated support mechanism for renewables, the feed-in tariff (FIT) program.

After decades of experience with policies promoting renewable energy, Germany has become the

focus of global attention with respect to its aggressive renewable policies and their unintended

consequences.

Germany is Europe’s largest economy, the fourth largest country in the world based on GDP,

and the third largest exporting country in the world. Additionally, Germany also has the single

10

EU Commission Staff Working Document, “Energy Economic Developments in Europe”, Brussels 22.1.2014.

http://ec.europa.eu/energy/renewables/index_en.htm

11

Eurostat European Commission

!"#

$!"#

%!"#

&!"#

'!"#

(!"#

)!"#

%!!(#*+,#,-./0#

%!$!#*+,#,-./0#

%!%!#*+,#1./203#

10

largest energy market in Europe, with a total net installed generation capacity of 168 gigawatts

(GW) in 2011 and, with its interconnection to nine surrounding countries through a large

interconnection network, Germany is the second largest European exporter of energy after

France.

2.2. Germany’s renewable policies and support mechanisms

The rapid growth of renewable energy in Germany and other European countries is due to

proactive European and national policies aimed at directly increasing the share of renewable

production in their energy mixes through a variety of generous subsidy programs.

2.2.1. Government support for renewable energy

The European Commission (EC) has historically concluded that more renewable energy will

enable the EU to cut greenhouse gas (GHG) emissions and reduce its dependency on energy

imports. It also has created mechanisms to ensure that a strong renewables industry will

encourage technological innovation and job creation.

12

To achieve those goals, the EC developed

the first European Directive on renewable energy in 2001, which was amended by a second

directive in 2009 that established the Europe-wide goal of obtaining 20 percent of its total energy

consumption, including all sectors, from renewable sources by 2020.

13

The directive also set

differentiated goals for each country, but left it up to them to decide how to achieve their national

target. The EC asked each member state to develop a National Renewable Energy Action Plan

(NREAP) outlining the country’s overall strategy and to submit periodic progress reports.

In 2014, the EU extended climate and energy targets to 2030, requiring an aggregate 27 percent

renewable energy within total energy consumption, and a 40 percent reduction of GHG

emissions (from 1990 levels). This package is not prescriptive and does not require NREAPs.

Instead, it offers states the opportunity to determine policy at a national level.

12

European Commission's Directorate-General for Energy, Online Information platform about strategies for

renewable energy

13

European Commission, Directive 2009/28/EC, 23 April 2009; http://eur-

lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32009L0028:EN:NOT

11

According to the differentiated goals set by the renewables directive, Germany’s share of energy

from renewable sources in gross final consumption of energy by 2020 was set at 18 percent. In

its NREAP from 2010,

14

the country estimated that renewable energy would account for 19.6

percent of final energy consumption by 2020, with 38.6 percent of renewables in the electricity

sector, 15.5 percent in the heating/cooling sector, and 13.2 percent in the transportation sector.

At the end of 2012, Germany’s total renewable generation, including hydropower, represented

23.5 percent of total electric output.

15

In addition to European goals, Germany has, for many years, had its own energy policy

promoting renewable energy. The so-called “Energiewende,” or the energy transformation, calls

for a nuclear-free and carbon-reduced economy through a vast deployment of renewable

technologies. Germany’s goal is to reduce carbon dioxide (CO

2

) emissions by 90 percent from

1990 levels and to provide 80 percent of its electricity generation with renewables by 2050. The

government has also planned the complete phase out of nuclear power by 2022.

2.2.2. Different subsidy schemes around Europe

16

As a result of the European renewable directives, all European countries chose their preferred

policies and support mechanisms and later implemented NREAPs to deploy renewable energy.

Two main types of subsidy programs for renewable power developed in Europe include FITs,

which very quickly became the policy of choice, and quota obligation systems.

FITs

FITs are incentives to increase production of renewable energy. This type of subsidy guarantees

long-term (usually for 20 years) fixed tariffs per unit of renewable power produced. These fixed

tariffs normally are independent of market prices and are usually set by the government. The

level of the tariffs normally depends on the technology used and the size of the production

14

European Commission, Action Plans and Forecasts; http://ec.europa.eu/energy/renewables/action_plan_en.htm

15

German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety: Development

of renewable energy sources in Germany

16

Sources: IZES (Instituts für ZunkunftsEnergieSysteme); “Das Erneuerbare-Energien-Gesetz –Erfahrungen und

Ausblick“ Institut der deutschen Wirtschaft Köln, 2012 - Frankfurter Allgemeine Zeitung 21.10.2013 Wirtschaft.

http://blog.insm.de/4770-quotenmodell-versus-einspeisevergutung-aus-der-praxis-lernen/;

http://www.greenpeace.de/themen/energie/nachrichten/artikel/warum_das_eeg_besser_ist_als_ein_quotenmodell/

12

facility. Additionally, in some cases, the tariff is scheduled to be lowered periodically by a

defined percentage to account for the assumed technology cost decrease.

The advantage (and also disadvantage) of FITs is that it is independent of the market price. This

mechanism allows fostering a technology that has not yet reached commercial viability, but is

considered an important addition to the production portfolio. In 2004, the FIT for PV power was

€457/megawatt hour (MWh), but in 2014, it was only €94.7/MWh.

17

This reduction followed a

decrease in the cost of technologies, as well as program redesigns that lowered the subsidy rate.

Because of their generosity, FITs proved capable of quickly increasing the share of renewable

power. Since FITs set the price for resources and not volume, it is difficult to set the height of the

FIT such that the renewable goals are reached as economically as possible. A large FIT target

results in uncontrollable development of qualifying projects, irrespective of the demand for this

power. FITs remove the price risk from project developers and gives policymakers the ability to

decide on the optimal allocation of resources (as opposed to the market). This ultimately leaves

consumers paying for the outcome, and causes value destruction to investors in renewables and

utilities who made investment decisions based upon representations of stable regulatory regimes

as well as the interaction of dynamic market forces.

Like many other European countries, Germany chose FITs as the main support mechanism to

support the renewables goals of the EU, and later developed a more comprehensive plan for the

reduction of carbon emissions known as the Energiewende. Germany introduced the first FIT

law in 1990, aimed at fostering the development of renewable energy and designed to promote

rural economic development and domestic manufacturing. This law was later revised several

times, including in 2000, when the German Renewable Energy Act (Erneuerbare Energien

Gesetz or EEG) created the FIT program that became famous throughout the world and that still

remains today. The German legislation guarantees renewable developers interconnection to the

grid, priority scheduling and dispatch, and a technology differentiated FIT for 20 years. The FITs

applicable to new projects decrease each year by a legal percentage (or by law amendments).

17

Erneuerbare-Energien-Gesetz (EEG) am 1. August 2004 in Kraft getreten §11,

http://www.bgbl.de/banzxaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&bk=Bundesanzeiger_BGBl&start=//

*%255B@attr_id=%2527bgbl104s1918.pdf%2527%255D#__bgbl__%2F%2F*[%40attr_id%3D%27bgbl104s191

8.pdf%27]__1400074679965

13

This was meant to ensure price certainty while encouraging technology innovation and cost-

efficiency. This subsidy is socialized and financed mainly by residential consumers, since many

exporting industrial customers are exempt from paying any costs associated with the subsidy in

an effort to maintain global industrial competitiveness. It was the starting block for rapid

increases in renewable energy.

German Renewable Energy Act – Erneuerbare Energien Gesetz (EEG)

The German Renewable Energy Act (Erneuerbare-Energien-Gesetz, EEG) is a law that came into

force in 2000 and introduced FITs as the main mechanism to incent and finance renewable energy

projects. The EEG can be seen as the starting point of a tremendous boost of renewable energy in

Germany. The purpose of the EEG is to promote electricity generated from renewables

(hydropower, landfill gas, mine gas, sewage gas, biomass, geothermal, wind, and solar). Due to

changes in market conditions as well as the state of renewable energy in Germany, this law was

reformed several times (EEG 2004, 2009, and 2012) and ongoing modifications are needed to keep

the development of renewable energy up to date and improve the efficiency of its impact.

The main four provisions of the EEG are:

1. Investment protection through guaranteed feed-in tariffs (FITs). Owners of new plants

receive a fixed rate, the FIT, for every kWh of renewable energy they generate. The FIT

depends on the specific year a plant goes online, its size and technology, and is guaranteed

for 20 years.

2. Guaranteed interconnection to the grid for renewable energy resources. Every new plant

which generates renewable energy gets a preferential treatment over conventional sources

by the network operator for feeding “green” electricity into the grid.

3. Decreasing FITs/degressive rates: Every year, the FIT rate decreases for new plants by a

fixed percentage (degression rate). Initially, the degression intended to give renewable

owners an incentive to lower the costs.

4. Socialized and financed by customers, not the government. The FIT is not paid with

governmental funding, but instead is completely financed by markets and consumers.

Renewable generation is sold into wholesale markets and receives the market price. The

difference between the market price and the government set, predetermined FIT, is paid for

by consumers as part of their electricity bills. This portion is called the EEG levy or

renewable energy levy (or surcharge). The levy is not applied equally to all consumer

types. Industrial consumers pay only a fraction or, in the case of energy intensive

industries, are completely exempted.

14

Quota obligation

The quota system is the European equivalent to the Renewable Portfolio Standard used in the

United States. All players, such as energy producers, retailers, and end-use consumers, have to

produce and/or consume a specific amount of renewable power, which is set by the government.

The price paid for the renewables is set by the market and the actual production or usage of

renewable energy is proven through certificates, which are given out once power is produced

from renewable energy. Since these certificates are tradable, at least within the specific country,

it is possible either to produce renewable energy on one’s own or to buy certificates from other

producers. There are government sanctions in place in case market participants don’t fulfill the

quota. The quota system is used by various European countries, such as Sweden, Belgium, the

UK, and the Netherlands, but the regulations and details (number of certificates per kilowatt hour

(kWh), limit of quotas, etc.) vary among the nations.

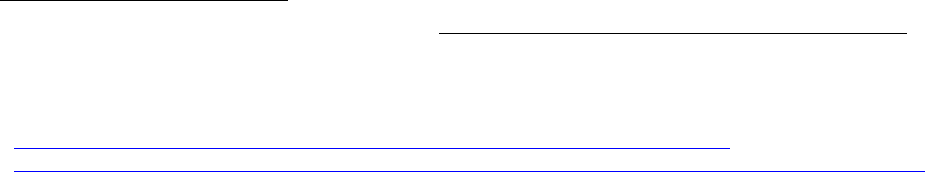

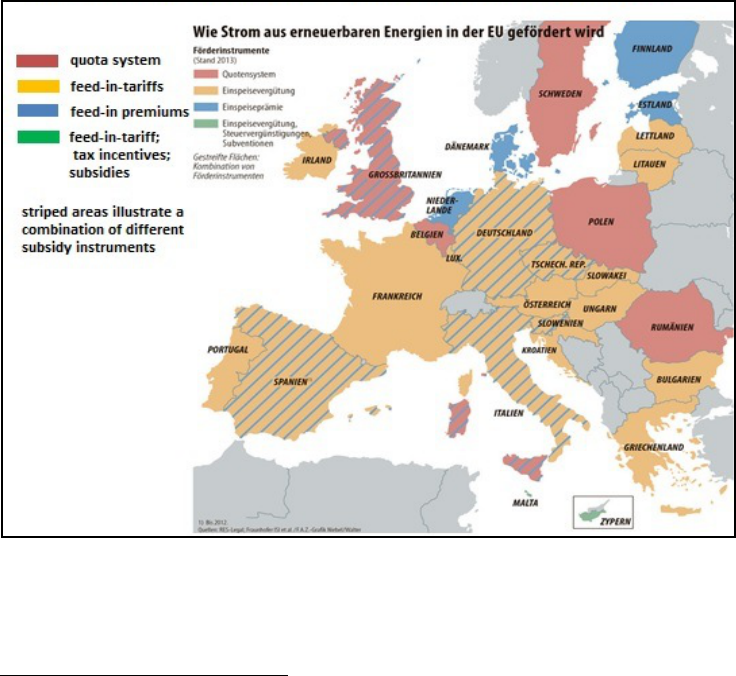

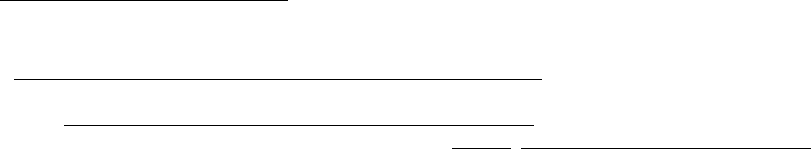

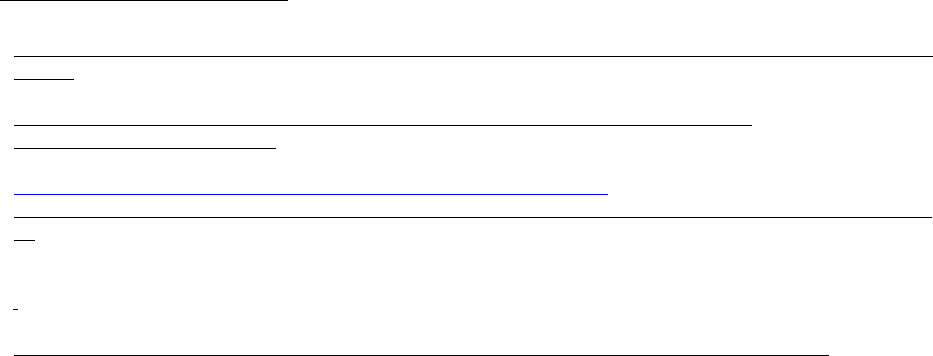

Figure 2. Incentive schemes in Europe

18

The quota system is a market-based system. It aims at lowering costs during the roll-out of

renewable energy. It exploits the cheapest possibilities of renewable energy production available

18

Frankfurter Allgemeine Zeitung 21.10.2013

15

given a certain demand. This system displays much price competition between different

renewable energy technologies. Sometimes, it is argued, quotas do not give sufficient investment

security to producers of renewable power, which in turn increases the need for a subsidy.

Yet another subsidy mechanism is feed-in premiums, which offer a premium for the ecological

value added in addition to the market price of electricity. As they are not very common in Europe

they are not explained in detail in this document.

16

3. GERMANY’S RENEWABLE “SUCCESS” STORY

Germany’s experience with renewables has often been portrayed as a success story. It

undoubtedly met one of the objectives set by the EEG: the promotion of renewable generation. It

remains unclear, however, how successful Germany has been in meeting the other stated goals of

its renewable energy policy: mainly climate change mitigation, energy independence, reduction

of fuel costs, conservation of fossil fuels, local economic development, and expansion of the

domestic manufacturing base.

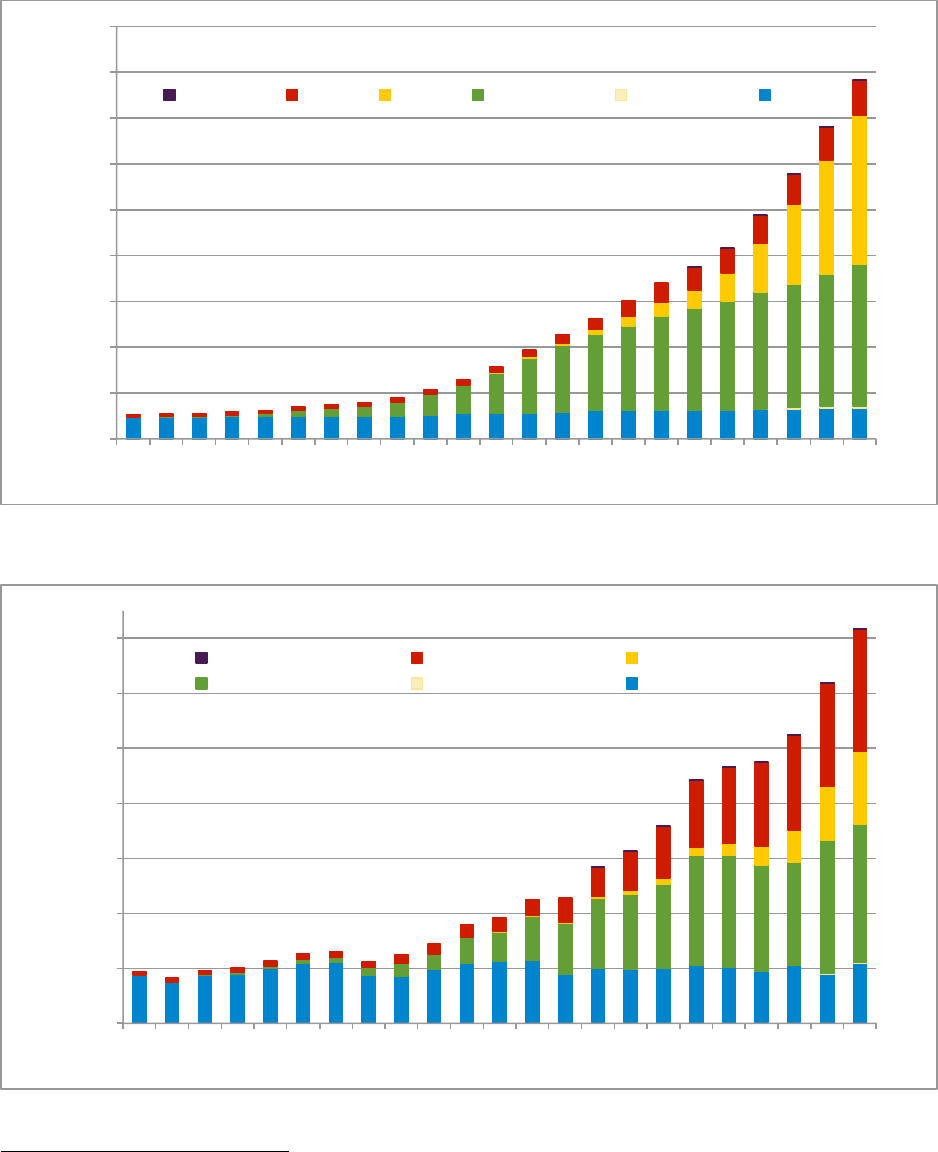

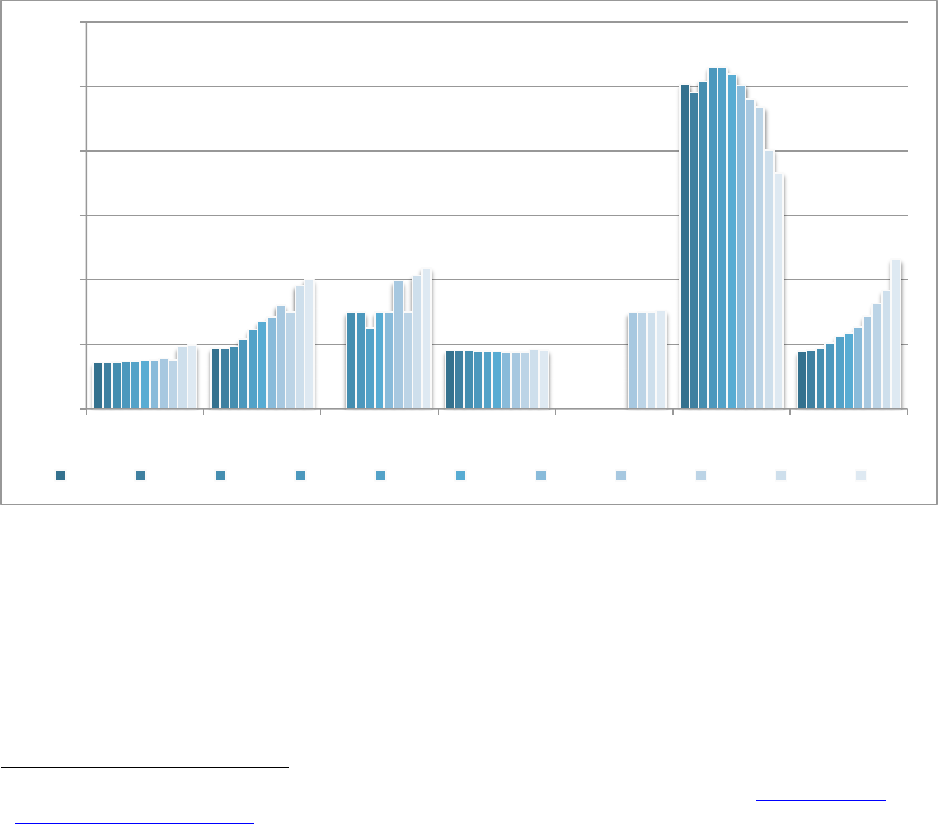

3.1. Renewable energy deployment and diversification of the power portfolio

Germany experienced rapid growth of renewable energy. In 2012, renewable energy generation,

including hydropower, accounted for 23.5 percent of total power consumption in Germany, up

from 11 percent in 2005.

19

Renewable generation grew from 4.3 percent (19.000 GWh) of total

power consumption in 1990 to 23.5 percent (140’000 GWh) in 2012. As the potential for

additional hydropower is limited due to topographic preconditions, Germany had to resort to

wind and solar, as well as biomass. All of these resources showed impressive growth rates in the

last decade.

It is worth noting the difference between resources with high capacity factors, like biomass and

hydropower, and those with lower capacity factors, like solar PV. Electricity from biomass, for

example, has grown proportionately more than its installed capacity, whereas solar PV has

required a lot more investment for a much lesser impact on the electricity mix.

19

German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety: Development

of renewable energy sources in Germany. http://www.erneuerbare-energien.de/die-themen/datenservice/zeitreihen-

entwicklung-ab-1990

17

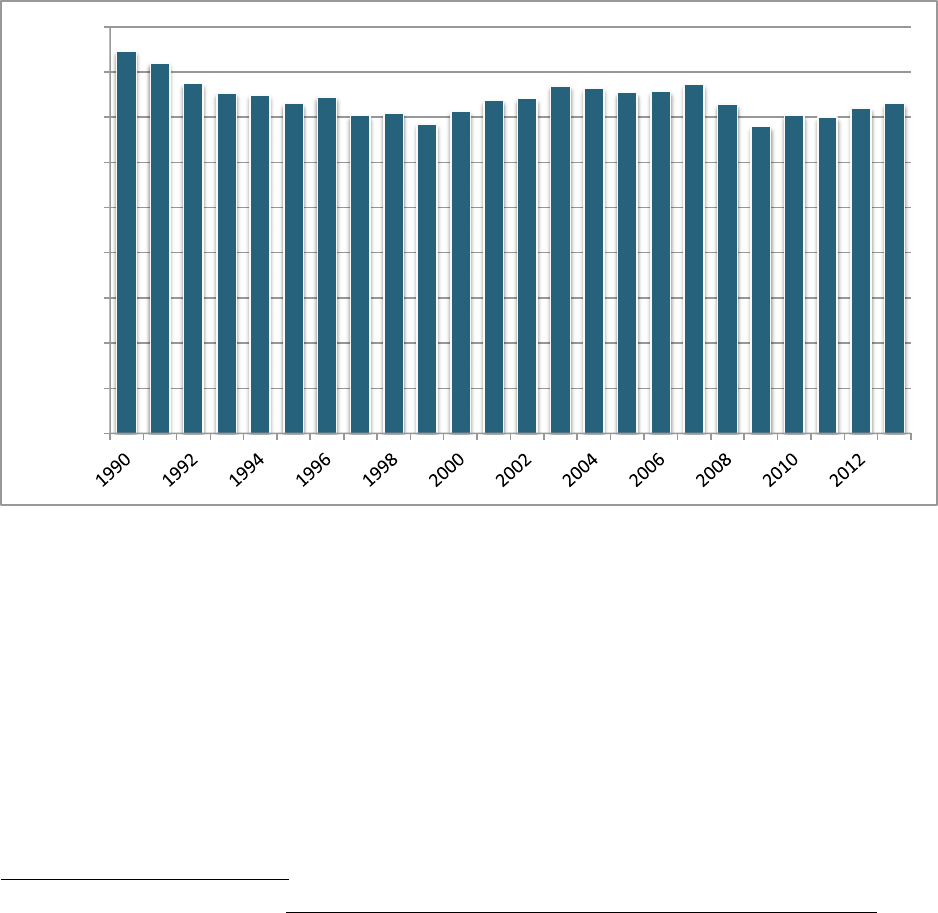

Figure 3. Germany - Installed renewable energy capacity (MW), 1990-2012

Figure 4. German renewable energy generation

20

20

German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety: Development

of renewable energy sources in Germany. http://www.erneuerbare-energien.de/die-themen/datenservice/zeitreihen-

entwicklung-ab-1990/

!#

$!4!!!#

%!4!!!#

&!4!!!#

'!4!!!#

(!4!!!#

)!4!!!#

5!4!!!#

6!4!!!#

7!4!!!#

$77!#

$77$#

$77%#

$77&#

$77'#

$77(#

$77)#

$775#

$776#

$777#

%!!!#

%!!$#

%!!%#

%!!&#

%!!'#

%!!(#

%!!)#

%!!5#

%!!6#

%!!7#

%!$!#

%!$$#

%!$%#

MW#

8093-0/:.;# <=9:.>># ,9;./#?@# AB>-9/0#C=BD# AE>-9/0#C=BD# FGD/9#

!#

%!4!!!#

'!4!!!#

)!4!!!#

6!4!!!#

$!!4!!!#

$%!4!!!#

$'!4!!!#

$77!#

$77$#

$77%#

$77&#

$77'#

$77(#

$77)#

$775#

$776#

$777#

%!!!#

%!!$#

%!!%#

%!!&#

%!!'#

%!!(#

%!!)#

%!!5#

%!!6#

%!!7#

%!$!#

%!$$#

%!$%#

GWh#

8093-0/:.;# <=9:.>># ,9;./#?@#

AB>-9/0#C=BD# AE>-9/0#C=BD# FGD/9#

18

3.2. Emission reductions

According to the European Renewable Energy Council, in 2009 alone, through the use of

renewable energy sources in the EU, carbon dioxide (CO

2

) emissions were reduced by about 340

million metric tons, or 7 percent, against 1990 levels (calculations are based on the GEMIS-

model [Global Emission Model for Integrated Systems]). Given a carbon price of about €15/t in

2009, this emission reduction benefit equals around €51 billion.”

21

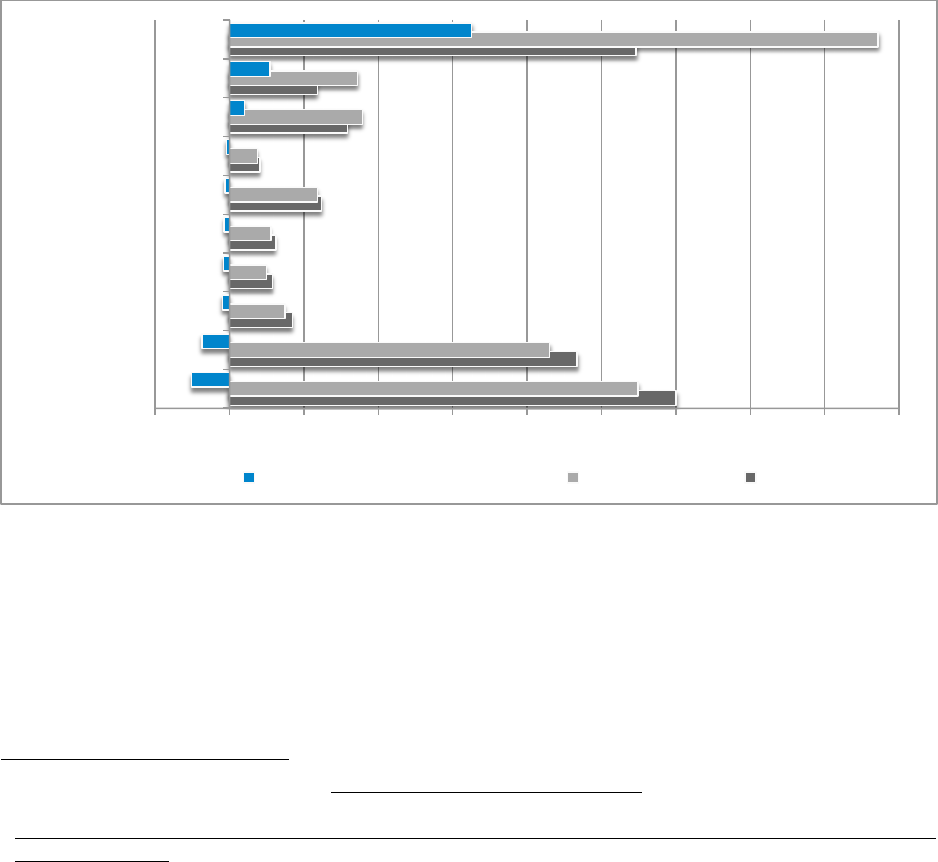

Figure 5. CO

2

emissions worldwide (million metric tons)

22

Without a doubt, renewables have helped achieve the CO

2

goals, thereby taking some of the

burden from other emission sources and keeping the CO

2

certificate prices lower than they would

have otherwise been. From 2005 to 2011, Germany’s CO

2

emissions declined by 99 million

metric tons, or 12 percent.

21

European Renewable Energy Council. http://www.erec.org/statistics/co2.html

22

US Department of Energy, Energy Information Administration, “International Energy Statistics”,

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=90&pid=44&aid=8&cid=regions,&syid=2005&eyid=20

11&unit=MMTCD

H$4!!!# !# $4!!!# %4!!!# &4!!!# '4!!!# (4!!!# )4!!!# 54!!!# 64!!!# 74!!!#

IB=30D#,3.30>#

+J/9K0#

80/:.BG#

IB=30D#L=B2D9:#

M.B.D.#

N.K.B#

O/.BP0#

*J>>=.#

QBD=.#

M-=B.#

R03#M-.B20#%!!(H%!$$# %!$$# %!!(#

19

Yet, since 2009, a number of factors have led to an increase in German emissions: low prices for

CO

2

certificates, low coal prices in comparison to natural gas prices, larger power generation

needs due to the increase in electricity consumption in response to the economic recovery, the

decommissioning of nuclear plants, and the increase in power exports. It is interesting to note

that the United States is the country that has achieved the greatest reductions in CO

2

emissions,

helped by significant fuel switching to natural gas.

Figure 6. CO

2

emissions from the power sector’s generation in Germany

23

While in most circumstances renewable energy contributes to reducing GHG emissions, there

have been voices that have contested the suitability of FITs as a tool to reduce emissions. A 2009

report

24

estimated that while carbon allowances were at the time trading at around $20/metric ton

CO

2

e, PV had an estimated abatement cost of $1,050 per metric ton CO

2

e, and wind had an

abatement cost of around $80 per metric ton CO

2

e. These results suggest that FITs have

produced unnecessarily expensive outcomes.

23

Eionet, Central Data Repository; http://cdr.eionet.europa.eu/de/eu/ghgmm/envutt6ka/index_html?&page=2

24

RWI (2009) “Economic impacts from the promotion of renewable energies: The German experience”, Essen,

Germany.

!#

(!#

$!!#

$(!#

%!!#

%(!#

&!!#

&(!#

'!!#

'(!#

S=;;=9B#39B>#

20

3.3. Energy independence

Energy independence is desirable for every country, and certainly for Europe. Unlike the United

States, which has a long-term estimated supply of 2,400 trillion cubic feet of recoverable natural

gas reserves,

25

and 29 billion barrels of oil reserves,

26

the EU is the world’s largest energy

importer. Fifty five percent of the EU’s total energy supply comes from imports. In 2012, the

region imported 84 percent of its oil consumption and 64 percent of its natural gas consumption.

The EU is keenly aware of its dependence on fuel sources, as was exemplified in January 2009,

when 18 European countries suffered major disruptions of natural gas supplies, or in some cases,

complete cutoff, during the dispute between Russia's Gazprom and Ukraine's Naftohaz Ukrayiny

over prior debts, gas supplies, and prices. European countries that import gas from Russia

received severe drops in pressure in their pipelines that affected countries as far as the United

Kingdom. Needless to say, at the time of this writing, the EU is acutely aware of these issues,

given the disputes between Russia and Ukraine with respect to Crimea, whereby the EU is

considering sanctions against Russia, with the expectation that supply of natural gas from Russia

may be possibly withheld.

As will be discussed later, competitiveness and energy independence are intimately related. A

recent International Energy Agency report released on January 29, 2014, stated that the EU is

expected to lose one-third of its global market share of energy intensive exports during the next

two decades due to high energy prices, the majority of which is due to the high cost of energy

imports, such as gas and oil.

27

Renewables help reduce the dependency on imported fossil fuels,

thereby reducing the risk of possible price shocks.

3.4. Lower wholesale prices

European wholesale power prices have declined in recent years. The reasons for this include

increased participation of renewables in the market (especially PV during the day, reducing high

25

Speech of Gregg Kantor Chairman of American Gas Association, NARUC Winter Committee Meetings, February

11, 2014

26

The Wall Street Journal, “U.S. Oil Reserves Continue to Bulge”, August 1, 2013.

http://online.wsj.com/news/articles/SB10001424127887323681904578641871449942246

27

Financial Times, “Energy price gap with the US to hurt Europe for ‘at least 20 years”, 29

th

January 2014.

http://www.ft.com/cms/s/0/80950dfe-8901-11e3-9f48-00144feab7de.html#axzz2thyHzZc8

21

mid-day prices), abundant and cheaper coal from the United States as a result of the impact of

increased development of shale gas resources on American fuel markets that make exporting

coal more economical, and the global financial crisis. While lower wholesale prices are

problematic for power producers who struggle to obtain adequate compensation in the market for

their costs, reduced wholesale prices have helped to keep retail market prices from rising as

much as they otherwise would have by providing some savings that help to offset a portion of the

cost of the renewable subsidy. Given the ever-increasing large amount of subsidies, retail rates

would have increased even more if wholesale prices had not declined. However, as will be

explained later, sharp decreases in wholesale prices are unsustainable, as owners of generating

units will be unable to keep uneconomical plants in service. In turn, many of these plants will

ultimately be required to receive capacity payments in order to be online to provide back-up

power for periods of power variability.

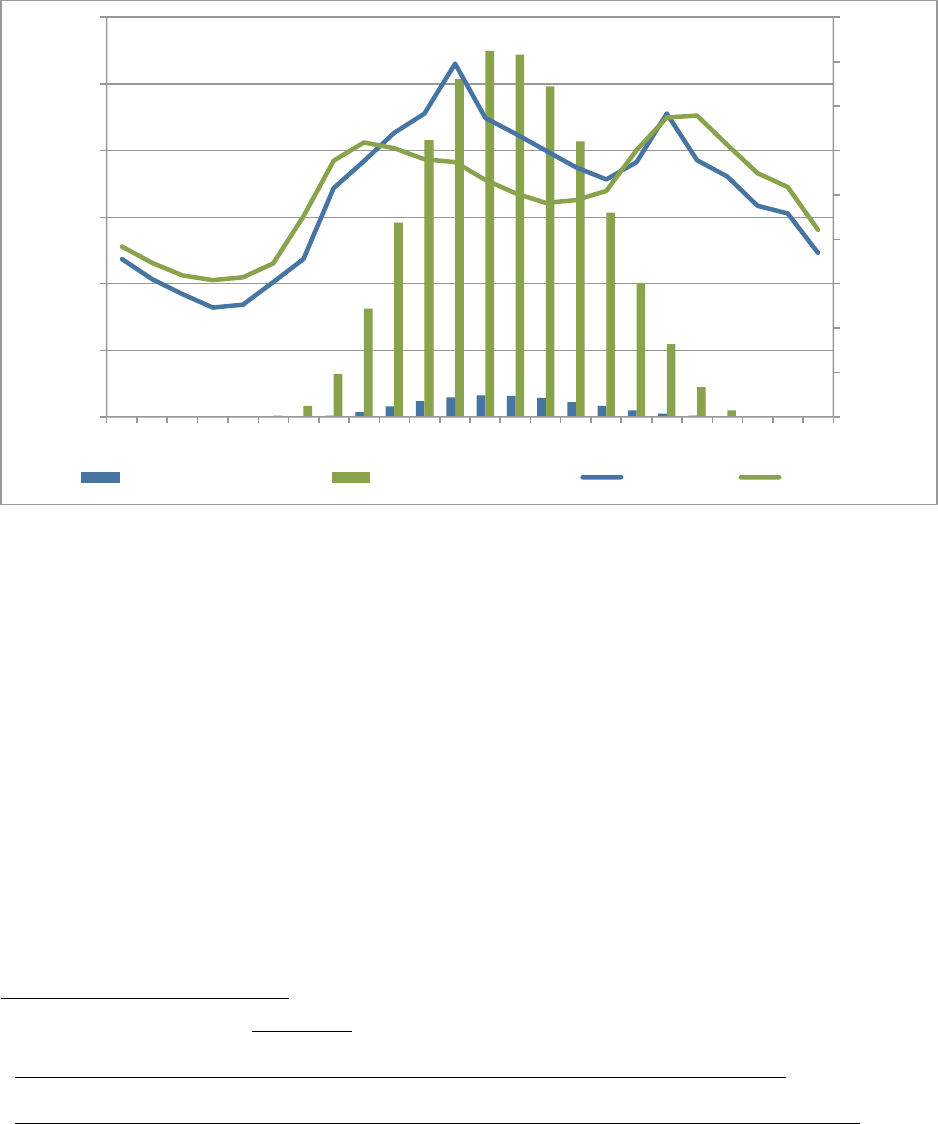

3.5. Job creation and expansion of Germany’s manufacturing industry

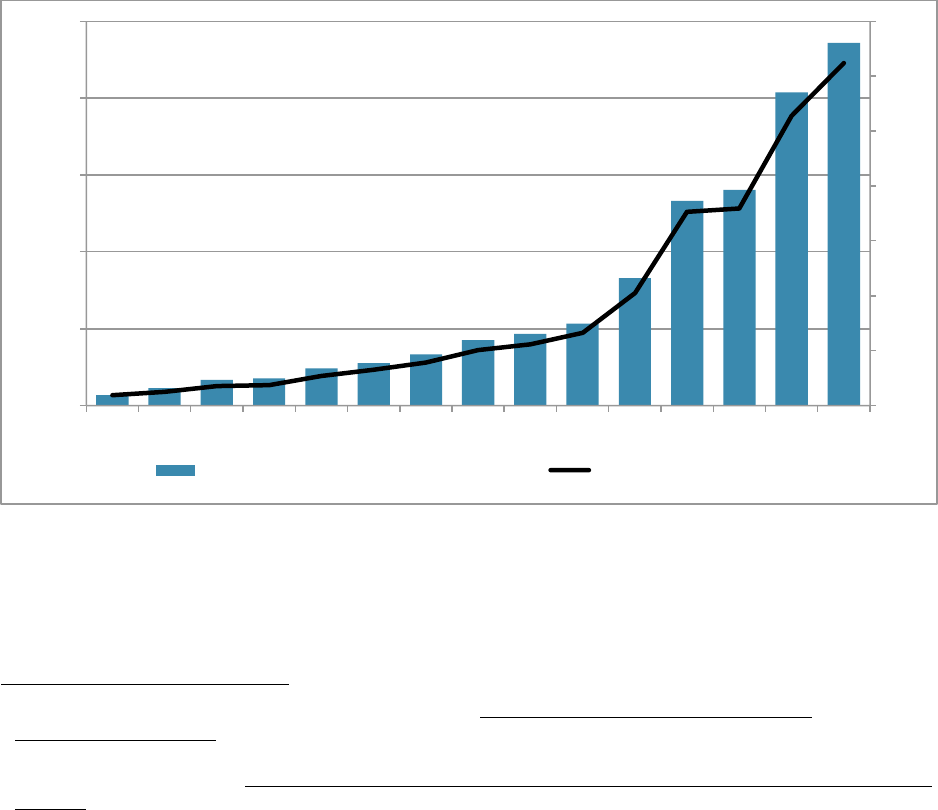

The rapid growth of renewable energy created new jobs in the industry. In 2012, the German

renewables industry employed 378,000 people,

28

which accounted for four times the amount of

jobs in 2000. During the time of greatest growth, 2004-2010, renewable energy jobs grew around

129 percent. Although biomass is the sector that has traditionally employed the most Germans,

most of the growth occurred in the solar energy sector, which went from about 25,000 jobs in

2004 to nearly 120,000 in 2010. During this timeframe, the other technologies remained

relatively stable. Wind energy jobs, however, increased to 100,000 in 2009, but decreased

slightly in 2010 and beyond.

28

Agentur für Erneuerbare Energie - Agency of Renewable Energy Data and Figures about employment in

renewable energy. http://www.unendlich-viel-energie.de/themen/wirtschaft/arbeitsplaetze/artikel367

22

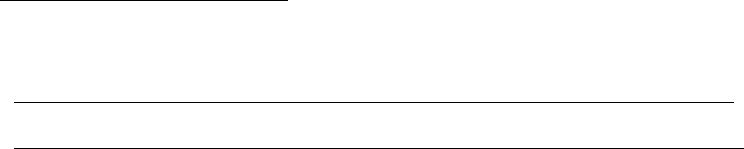

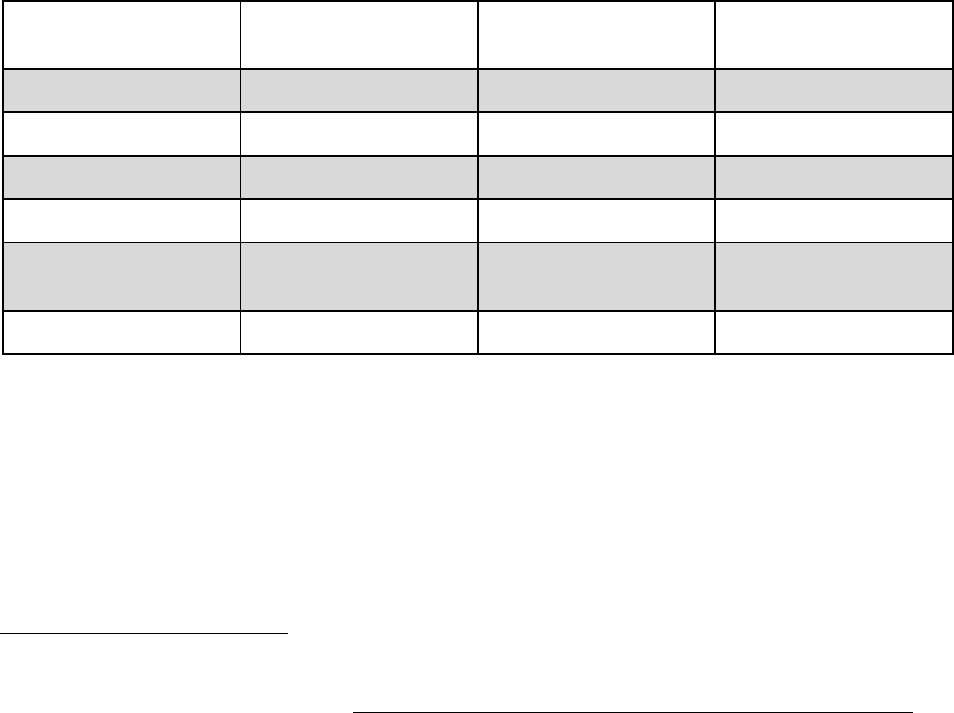

Figure 7. Jobs attributable to renewable energy in Germany: 2004-2010

29

After rapid growth, 2012 saw a slight decrease in the number of renewable jobs, due, for the

most part, to a reduction of employment in the solar industry. German officials, however, expect

that growth in the wind and biomass industries will continue to grow strongly.

30

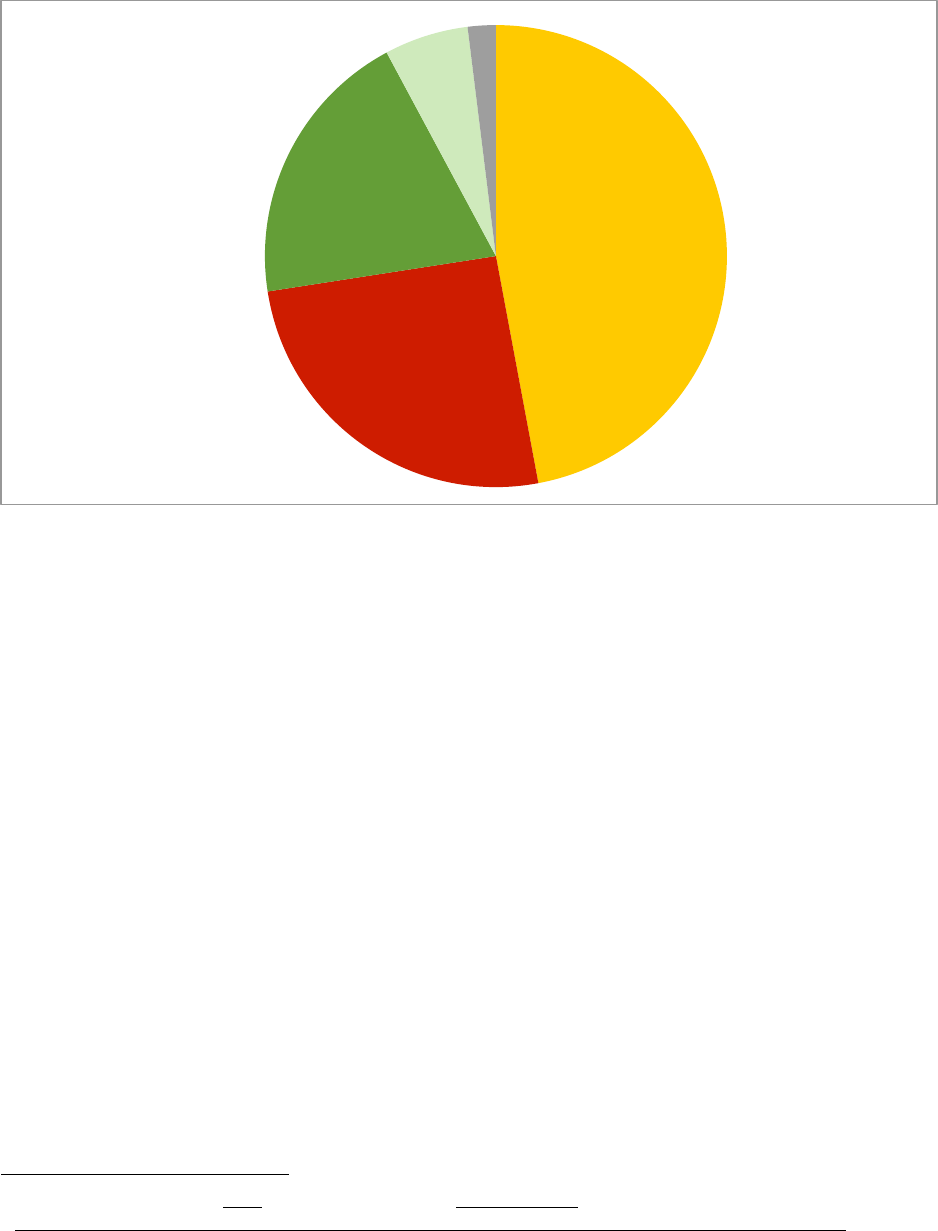

In 2012, biomass, wind, and solar shared almost equal parts of renewable energy jobs. Biomass

accounted for 34 percent of the total, followed by wind (31 percent) and solar (27 percent).

Geothermal, hydro, and other renewables rounded out the total. These figures are converse with

respect to the overall deployment of renewables themselves, which is likely due to the capital

intensity, stage of development of technologies, and economies of scale and scope.

29

O’Sullivan, et al, 2011

30

Agentur für Erneuerbare Energie - Agency of Renewable Energy Data and Figures about employment in

renewable energy. http://www.unendlich-viel-energie.de/themen/wirtschaft/arbeitsplaetze/artikel367

!#

%!4!!!#

'!4!!!#

)!4!!!#

6!4!!!#

$!!4!!!#

$%!4!!!#

$'!4!!!#

C=BD#+B0/2G# <=9:.>># ,9;./#+B0/2G# FGD/9K9T0/# 8093-0/:.;#

%!!'# %!!5# %!!7# %!$!#

23

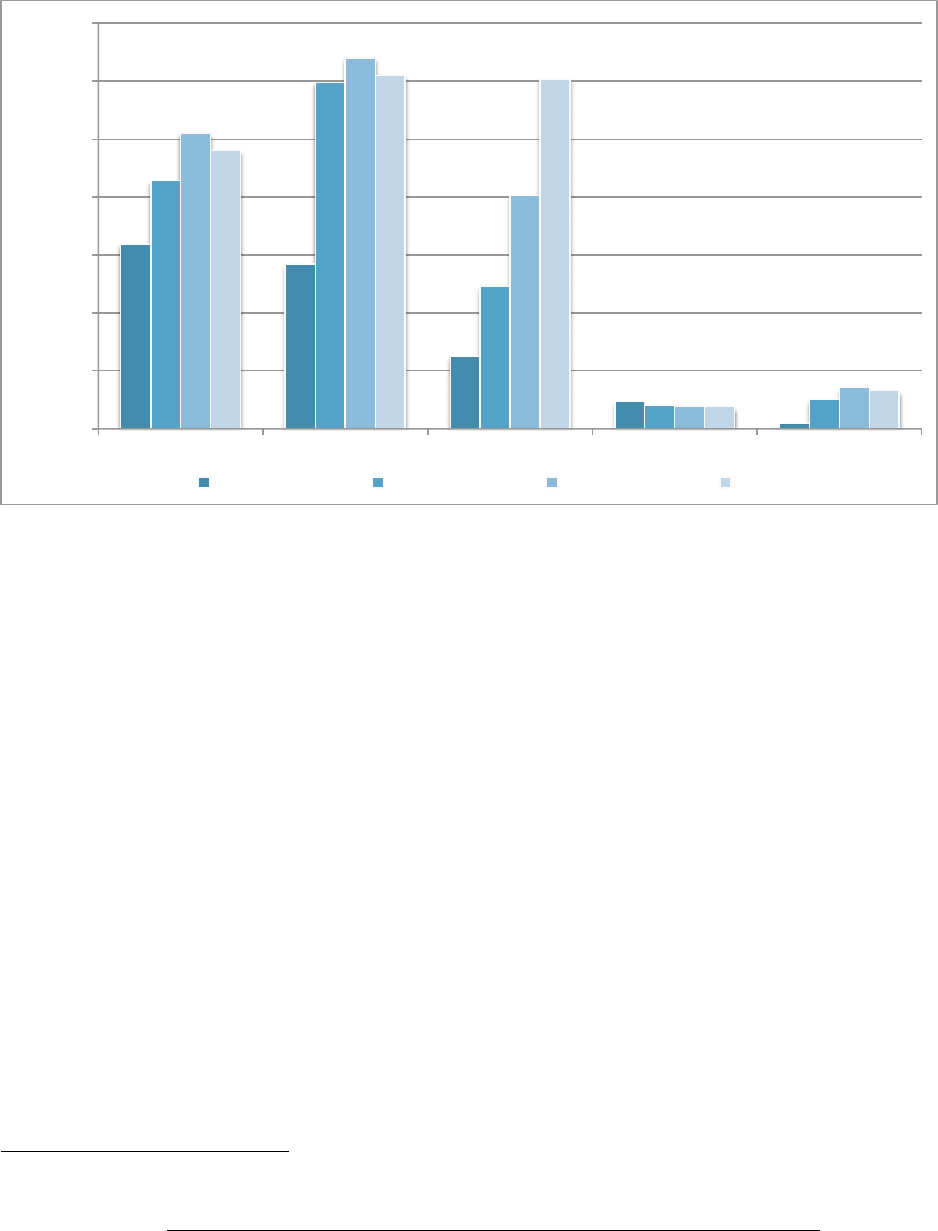

Figure 8. Renewable energy employment in 2012

31

The development of renewable energy in Germany and other countries fostered growth in the

German manufacturing industry. Germany is Europe’s leading PV manufacturer and is the

largest manufacturer of inverters in the world.

32

The growth of renewable energy throughout the

world has allowed Germany to expand its wind and solar manufacturing base. However, other

countries have also expanded their capabilities, thereby hurting German domestic manufacturers,

which have tended to be more costly than their foreign counterparts. Historically, a considerable

share of PV modules installed in Germany has come from China and Japan. In 2006 and 2007,

for instance, about half of PV module demand was covered by imports. Also, the boom and bust

cycle that FITs created in the solar market has left some German manufacturers in a precarious

situation, while Asian manufacturers have been the greatest beneficiaries of German and other

European countries’ programs.

Despite recent difficulties in the solar market, it is expected that new renewable energy jobs will

reach 500,000 in 2020.

31

Agentur für Erneuerbare Energie - Agency of Renewable Energy Data and Figures about employment in

renewable energy. http://www.unendlich-viel-energie.de/themen/wirtschaft/arbeitsplaetze

32

Id.

,9;./4#%5"#

C=BD4#&$"#

<=9:.>>4#&'"#

8093-0/:.;4#'"#

FGD/94#%"#

A3-0/4#%"#

24

Figure 9. Job creation in renewable energy in Germany

33

Yet, there is some controversy around this issue.

34

While there is no doubt that the growth of the

renewable market led to new jobs, like in the case of emissions reductions, it is less clear if it

happened in an efficient way. For example, if 380,000 jobs were created in 2012, and €14 billion

were disbursed in payments to renewables that same year (total amount of EEG levy per year.),

then it can be calculated that each job received a €35,000 subsidy per year.

Moreover, the total net employment is called into question when assessing the total macro-

economic impact. A recently published study by the Institute on the Future of Labor states that

the increasing trend of electricity prices affects jobs in other sectors. This study calculates that

the increase of the EEG levy from 5.28 eurocents/kWh in 2013 to 6.24 eurocents/kWh in 2014,

will lead to the loss of around 86,000 jobs, or 1.4 percent.

33

Agentur für Erneuerbare Energie - Agency of Renewable Energy Data and Figures about employment in

renewable energy. http://www.unendlich-viel-energie.de/themen/wirtschaft/arbeitsplaetze

34

EEG- Jobm otor oder Job killer? www.energie-fak ten.de/pdf/eeg -job-motor.pdf

#H####

#$!!4!!!##

#%!!4!!!##

#&!!4!!!##

#'!!4!!!##

#(!!4!!!##

#)!!4!!!##

$776# %!!!# %!!%# %!!'# %!!)# %!!6# %!$!# %!$%# %!%!#

25

On the other hand, as Germany’s industrial sector is exempt from EEG’s surcharge, a reversal of

this support and its direct impact to industrial jobs could translate into a significant loss of jobs.

35

With respect to the renewable manufacturing sector, the PV industry provides a good example of

what could happen to other industries when Germany reduces the subsidy. There have been

several recent bankruptcies of various solar and wind manufacturers, as well as service

providers. For example, in the last two years, the total number of solar cell and module

production employees has fallen from 10,196 to 5,973.

36

The same trend applies to conventional

power plants. Due to the transition to renewable energy and the need of conventional plants only

as backup, many of these plants have been turned down or closed definitely. It is estimated that

these actions will impact around 200,000 thermal power plant employees.

37

In sum, several industries in Germany have benefited from the development of renewable energy

sources and, as a result, a large number of additional jobs have been created. Nevertheless, it has

to be pointed out that generous subsidies are having adverse macroeconomic effects in other

areas of the economy. Also, due to an increasing level of global competition in the solar market,

especially due to the extraordinary cost efficiency of Chinese companies, German manufacturing

companies are suffering and, as a consequence, job creation is struggling.

35

Die Welt: Ende der EEG-Privilegien gefährdet eine Million Jobs 07

th

November 2013; Handelsblatt Online:

Altmaier reist mit radikalem Ökostrom-Plan zur EU 07

th

November 2013

36

Die Welt: Deutschlands Solarbranche löst sich auf 20

th

April 2013.

http://www.welt.de/wirtschaft/energie/article121621919/Ende-der-EEG-Privilegien-gefaehrdet-eine-Million-

Jobs.html; http://www.handelsblatt.com/politik/international/foerderung-metallindustrie-eine-million-jobs-

bedroht/9039578-2.htm

37

Wirtschaftswoche: Reservekraftwerke werden Milliarden verschlingen 05th February 2014

26

4. UNINTENDED CONSEQUENCES OF GERMANY’S RENEWABLE

POLICIES

While there have been some positive impacts from increased development of renewables in

Germany, with respect to emissions reductions, diversification of the power portfolio, and energy

independence, there have also been challenges and problems associated with this evolution.

Large subsidies brought about rapid deployment of renewable energy that resulted in increased

costs for most types of consumers, additional investment needs for transmission lines and other

integration capabilities, disequilibrium in wholesale markets with the potential of seriously

affecting reliability, and unsustainable costs to the economy, resulting in repeated redesigns and

realignments of renewable policies and support schemes that led to boom and bust cycles

detrimental to the renewables and power industries.

4.1. Enormous governmental subsidies for renewables

Germany’s FIT program has cost more than $412 billion to date (including granted and

guaranteed, but not yet paid FIT). Former German Minister of the Environment Peter Altmaier

recently estimated that the program costs could reach $884 billion (€680 billion) by 2022. He

added that this figure could increase further if the market price of electricity falls, or if the rules

and subsidy levels are not changed.

38

It is estimated that Germany will pay $31.1 billion in

subsidies in 2014 alone.

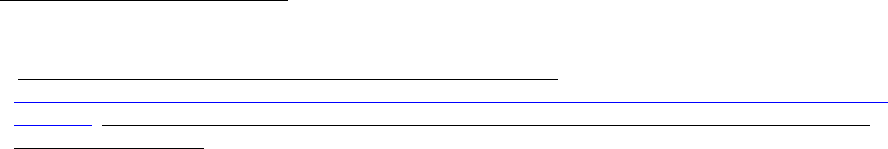

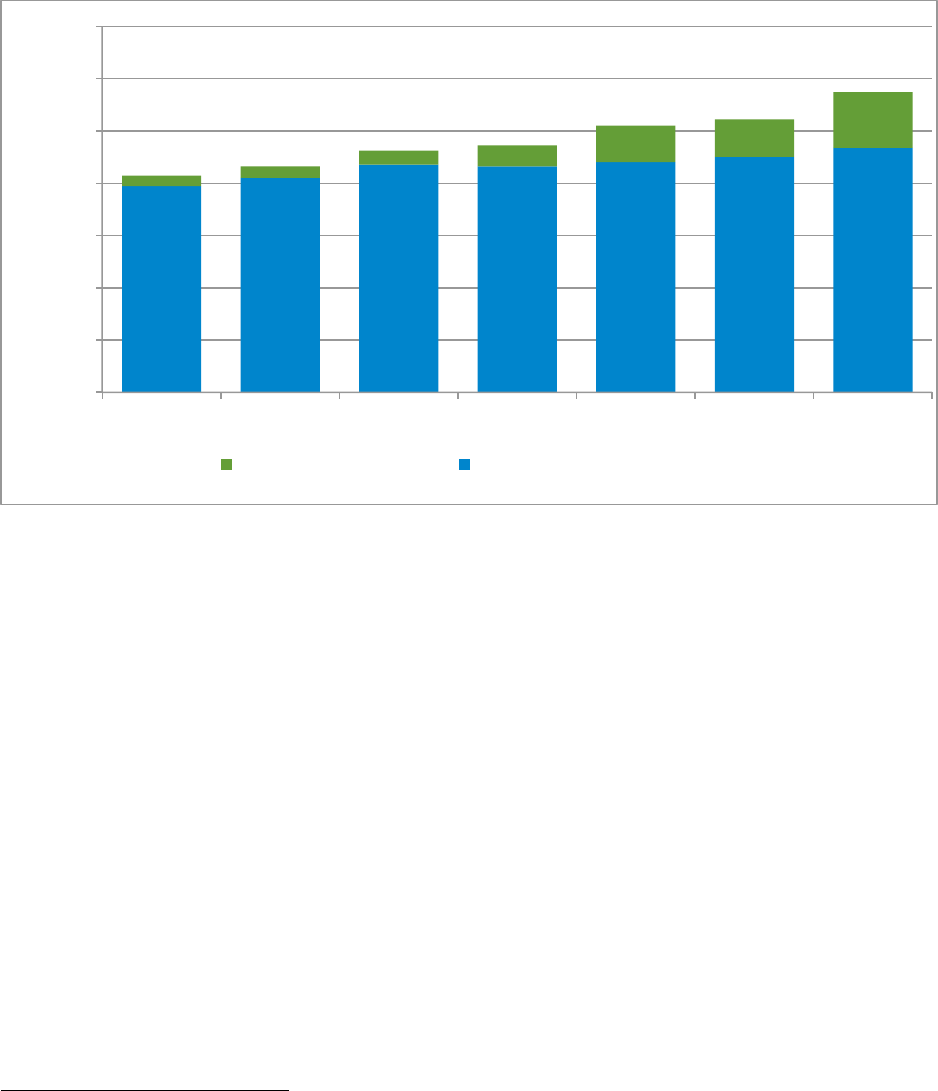

Enormous, guaranteed FITs for PV led to very rapid, unexpected growth of PV installations

during the last few years in Germany. As technology improved, costs decreased and generous

subsidies made installing PV a lucrative business. While the installation of wind turbines was

relatively stable at around 2 GW since 1999, the growth of PV exploded in 2009. Between 2010

and 2012, Germany built 21 GW of PV, around 7 GW a year.

38

Frankfurter Allgemeine Zeitung: „Energiewende könnte bis zu einer Billion Euro kosten“ 19

th

February 2013.

http://www.faz.net/aktuell/politik/energiepolitik/umweltminister-altmaier-energiewende-koennte-bis-zu-einer-

billion-euro-kosten-12086525.html

27

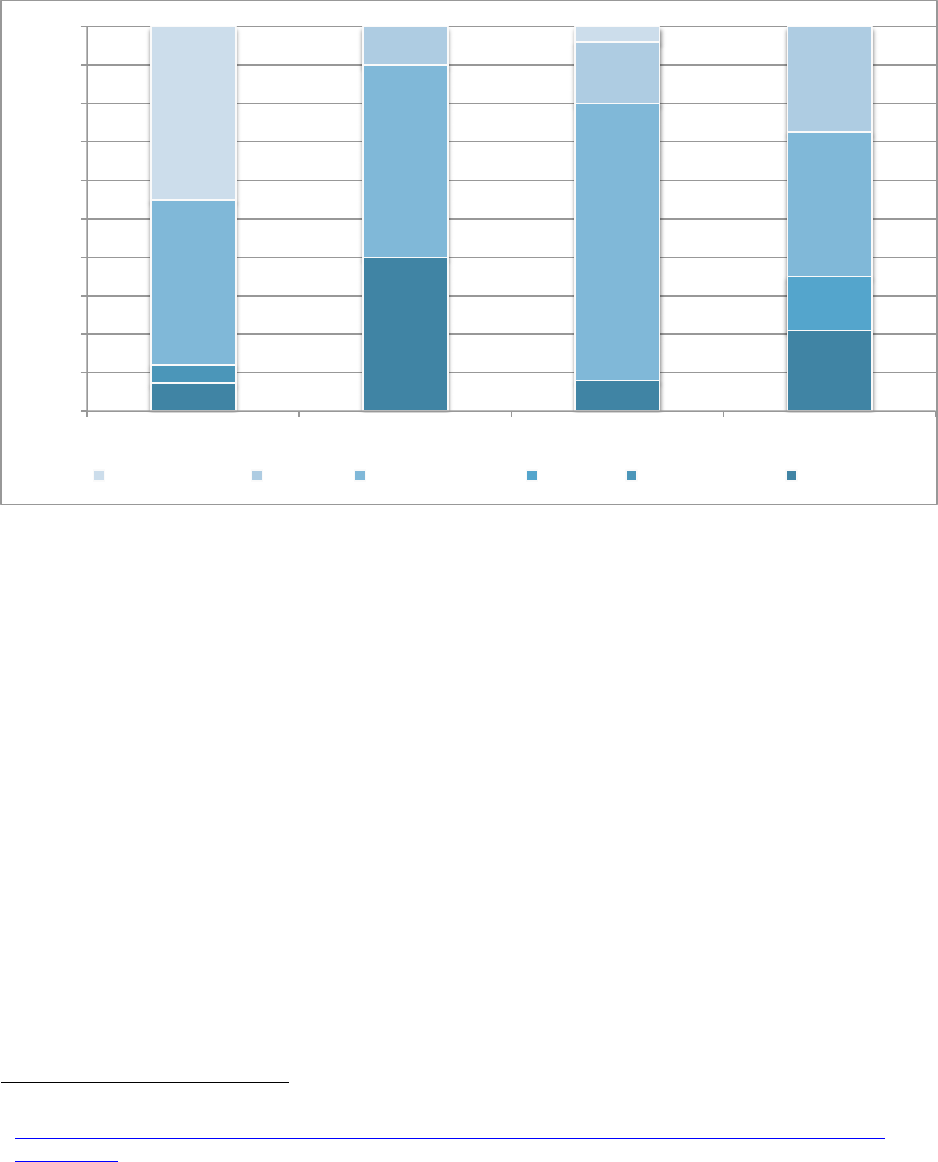

Figure 10. Annual renewable energy capacity additions in Germany, 1990-2021

Given the long planning and construction periods of traditional power plants, (for example, the

new nuclear plant in Olkiluoto, Finland, with 1.7 GW, is in the tenth year of construction) this

rapid deployment of renewables can only be described as a macroeconomic shock. The

development of 21 GW of PV in only three years blindsided the energy market. The speed of

capacity additions made it impossible for the market and the generation fleet to adjust

appropriately.

The fast growth in PV was unexpected. The system and respective market players were unable to

plan the amount of capacity that was coming online. In 2012, Peter Terium, CEO of RWE,

Germany’s largest power generator, said that the prices for PV modules had decreased to an

extent that RWE did not consider possible. The impact has been material to RWE and other

German energy companies. As an example, RWE recently reported a net loss in 2013 accounts

for €2.8 billion accompanied from write-downs of approximately €4.8 billion which was

attributed to the huge increase in solar and wind capacity. This is RWE’s first full year loss since

the foundation of the Federal Republic of Germany in 1949.

39

Moreover, it was not just the

39

RWE, “RWE posts first net loss in 60 years“. http://www.rwe.com/web/cms/en/113648/rwe/press-news/press-

release/?pmid=4010679

!#

$4!!!#

%4!!!#

&4!!!#

'4!!!#

(4!!!#

)4!!!#

54!!!#

64!!!#

SC#

C=BD#

,9;./#?@#

<=9:.>>#

28

utilities, but also research institutions that underestimated the growth of the renewables. For an

industry that has long-term technical and investment lifetimes, this created system disruptions

that led to value destruction.

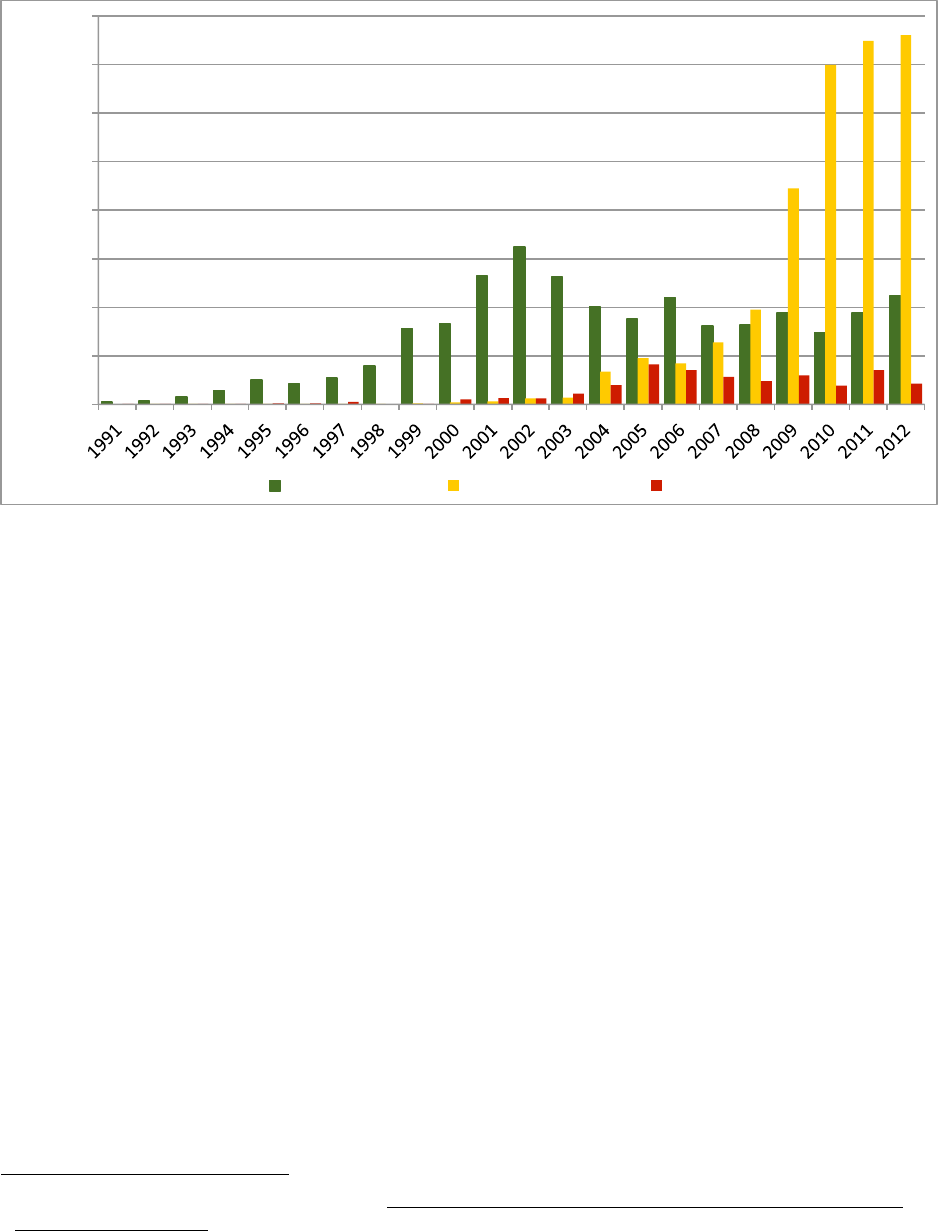

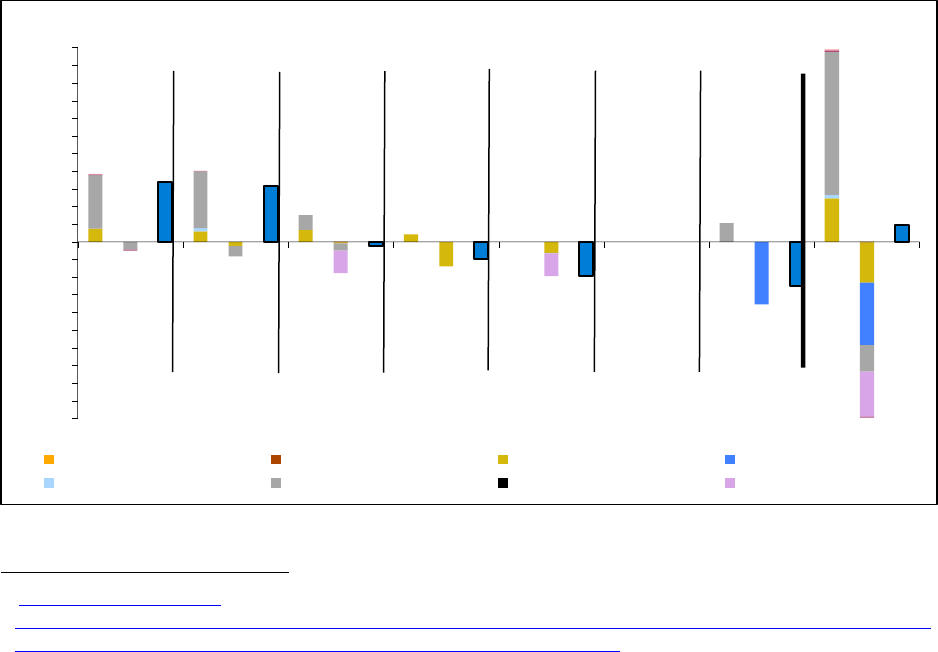

Because of the large amount of renewable plants coming online, the EEG levy increased steadily

from 0.19 eurocents/kWh in 2000 to 6.24 eurocents/kWh in 2014. Future development is unclear

and experts expect a value between 5.8 and 6.8 eurocents/kWh

40

for 2015. The main drivers of

the increase in the EEG levy over the years have been the rapid increase in renewable energy

(especially in expensive PV), the levy exemptions for industry, and the decreasing price of

renewable energy in the wholesale market.

Figure 11. Development of EEG subsidy and EEG levy

41

In absolute terms, the EEG subsidy for renewable energy has increased dramatically. While in

the years between 2000 and 2003 the total amount of the levy for renewable energy was around

40

Netztransparenz: German transmission system operators. http://www.netztransparenz.de/de/Jahres-

Mittelfristprognosen.htm

41

Federal Ministry for the Environment, Nature Conservation and Nuclear Safety: Development of renewable

energy sources in Germany. http://www.erneuerbare-energien.de/die-themen/datenservice/zeitreihen-entwicklung-

ab-1990/ (updated 15.10.2013)

%#U#

%#U#

%#U# &#U#

&#U#

'#U#

(#U#

(#U#

6#U#

$&#U#

$'#U#

%!#U#

%'#U#

!V$7#

!V)(#

%V!(#

(V%6#

)V%'#

!#

$#

%#

&#

'#

(#

)#

5#

!#

(#

$!#

$(#

%!#

%(#

%!!!# %!!$# %!!%# %!!&# %!!'# %!!(# %!!)# %!!5# %!!6# %!!7# %!$!# %!$$# %!$%# %!$&# %!$'#

++8#;0WG##X+J/9P3YZC-[#

++8#M9>3#K0/#G0./#X\=;;=9B#U[#

++8#P9>3#K0/#G0./#X<=;;=9B#U[#

++8#;0WG#X+J/9P3YZC-[#

29

€1 billion per year, it surpassed the €20 billion mark in 2013, and is estimated to approach €25

billion in 2014.

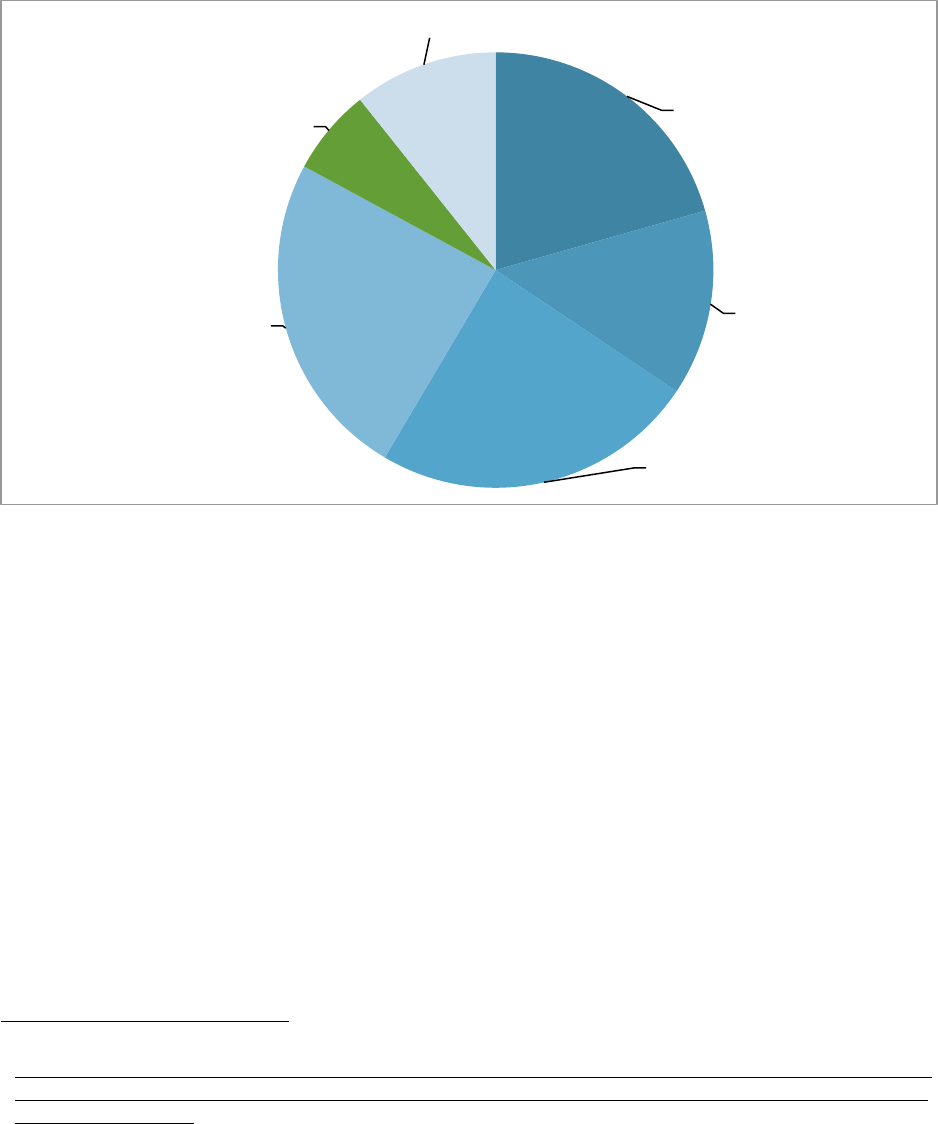

Taking a closer look at the EEG and the distribution of average FITs for existing renewable

projects among the different technologies, figure 12 illustrates the huge differences that persist

between technology types, both in the rate and its trend over the last years. The highest support is

dedicated to PV, although the numbers in 2012 are only two-thirds of what they were in 2006. In

total, the average FIT to plants without direct marketing increased from €89/MWh to

approximately €230/MWh, as the share of high, albeit decreasing, PV FITs increased.

Figure 12. Development of average FIT rates paid out to all existing EEG plants divided

per technology in Germany (€/MWh)

42

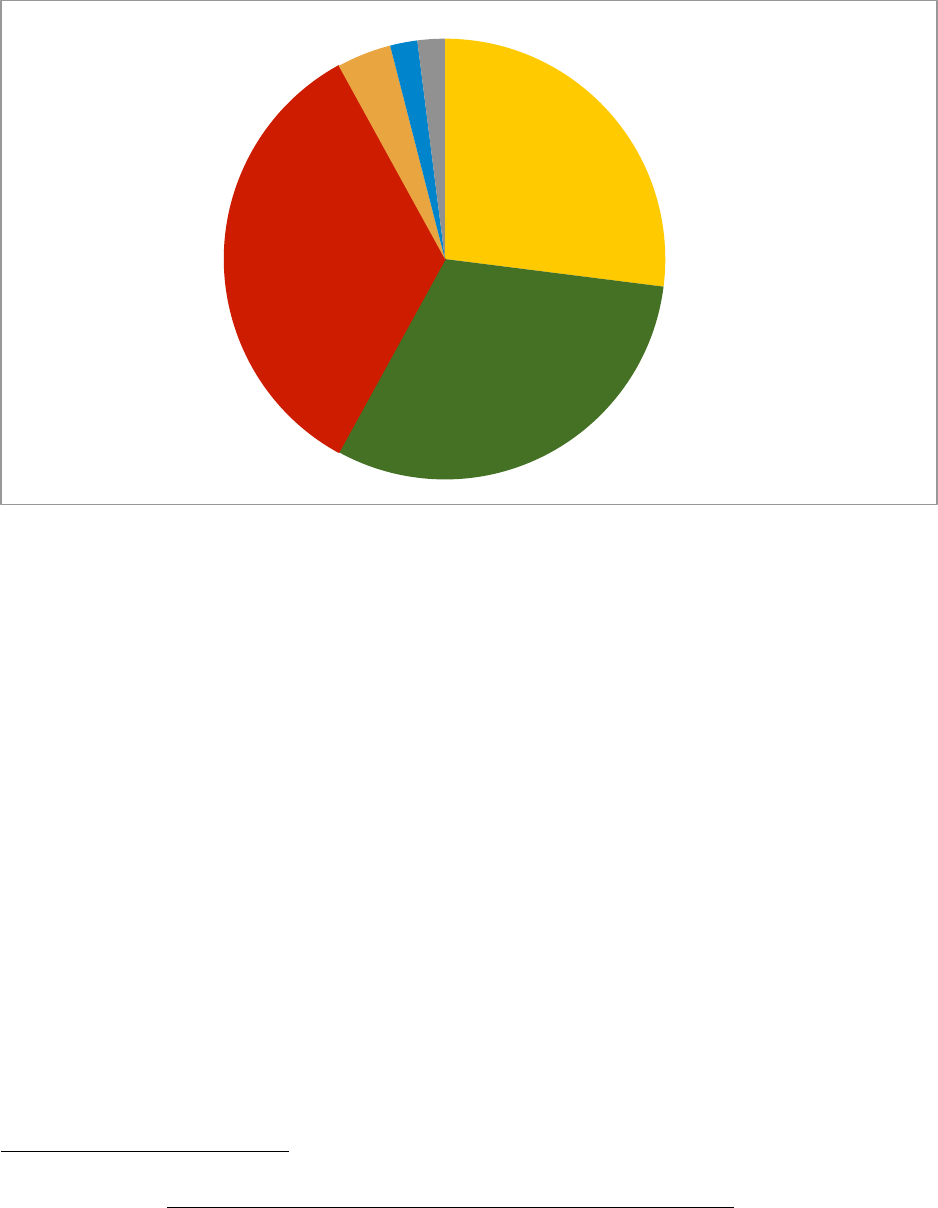

In 2014, payments to solar PV will account for almost half of the total EEG levy, followed by

biomass and onshore wind.

42

Netztransparenz: Information platform run by the 4 German transmission system operators. http://www.eeg-

kwk.net/de/EEG-Umlage.htm

!#

$!!#

%!!#

&!!#

'!!#

(!!#

)!!#

FGD/9K9T0/# <=9:.>># 8093-0/:.;# C=BD#9B>-9/0#C=BD#9E>-9/0# ?@# ]W0/.20#

€/MWh#

%!!%# %!!&# %!!'# %!!(# %!!)# %!!5# %!!6# %!!7# %!$!# %!$$# %!$%#

30

Figure 13. Share of renewable technologies to the EEG levy, 2014

43

4.2. Ever increasing power prices to residential customers

Retail electricity prices have increased in Germany due in part to the generous subsidies for

renewable energy. The two figures below show an increase in household electricity prices from

€0.14/kWh in 2000 to €0.21 /kWh in 2007 to €0.29 /kWh in 2013. There are diverse reasons

behind the increase in retail electricity rates, including the considerable growth of taxes and

charges. While taxes and charges accounted for 25 percent of the total price in 1998, they were

responsible for around 40 percent of the total price in 2012. Also, the price of electricity

(including procurement, transmission, and distribution) has increased slightly, as a result, in part,

of additional grid costs and balancing needs associated with increased renewable penetration.

Finally, while the EEG levy only contributed slightly to the price of electricity in the first years

of its introduction (1.4 percent in 2000), it is now one of the main factors contributing to the rise

of retail electricity rates (18 percent in 2013). The EEG levy grew from €0.013/kWh in 2009 to

43

PV Magazine, Germany: EEG levy increases in 2014, http://www.pv-

magazine.com/news/details/beitrag/germany--eeg-levy-increases-in-2014_100013038/#axzz2vf5eJZkV

PV!

47%!

Biomass!

25%!

Onshore wind!

20%!

Offshore wind!

6%!

Other!

2%!

31

€0.053/kWh in 2013, or €240 per year per citizen, and is expected to grow to €0.062/kWh in

2014.

Figure 14. Evolution of residential power prices

44

Electricity price increases went mostly uncontested in Germany because of two main factors.

First, electricity expenses are only a small part, about 2.5 percent, of the overall expenditures of a

regular German household. Second, there was initial strong support for the Energiewende and

the readiness to bear additional costs. However, there are signs indicating that further unchecked

price increases risk diminishing the popular support for the Energiewende, which is the main

reason why Germany is currently working on a complete change of the existing EEG system.

Other European countries have had similar experiences with rapidly rising electricity prices. In

the EU-28 area, the household electricity price rose by 11.7 percent between 2011 and 2013,

while the industrial price rose by 9 percent. It is worth noting that the countries with the highest

electricity prices, Denmark (€0.30/ kWh) and Germany (€0.29/kWh), also have significant levels

of renewable energy; whereas the countries with the lowest prices, Bulgaria (€0.09/kWh),

44

Agentur für Erneuerbare Energie – Agency of Renewable Energy

!#

(#

$!#

$(#

%!#

%(#

&!#

&(#

%!!5# %!!6# %!!7# %!$!# %!$$# %!$%# %!$&#

0J/9P3YZC-#

++8#;0WG# ?9T0/#P9>3>4#3.^0>#.BD#93-0/#P-./20>#

32

Romania (€0.13/ kWh), and Estonia (€0.14/kWh), have more traditional electric-generating

resources.

Figure 15. Breakdown of household prices in Germany, 2013

45

A further analysis confirms that a correlation exists between the amount of variable renewable

energy capacity that a country has (PV and wind) and its household electricity prices including

taxes, levies, and value added tax. The figure below measures the capacity of PV and wind plants

in watts (W) per capita. A trend can be detected which shows that higher W per capita will result

in higher electricity prices. While the majority of European countries have a low/medium level

of capacity, with a level under 300 W per capita, other countries show a higher level of capacity

and, accordingly, increased electricity prices. Leading countries in this analysis are Denmark and

Germany, followed by Spain, Italy, and Belgium.

45

Bundesnetzagentur:

Federal Network Agency.

http://www.bundesnetzagentur.de/SharedDocs/Downloads/DE/Sachgebiete/Energie/Verbraucher/PreiseUndRechn

ungen/WieSetztSichDerStrompreisZusammen.pdf;jsessionid=0B318530B0B7F0F3325CB5CA631C83F7?__blob

=publicationFile&v=2

8/=D#P-./20>4#%!V)!"#

M9BP0>>=9B#;0WG4#

$&V6!"#

+B0/2G#P9>3>4#%'V$!"#

1.^0>4#%'V'!"#

++8#;0WG4#)V'!"#

_=>3/=\J`9B#P9>3>4#

$!V5!"#

33

Figure 16. Comparison of the amount of wind and solar capacity and electricity prices,

selected countries, 2012

46

The rise in electricity prices has spurred a new debate in Europe about a new energy poverty. A

recent front cover of the popular German magazine Der Spiegel titled “Luxury Electricity: Why

energy will always be more expensive and what politicians have to do against it” and showing

gold-plated and diamond-encrusted power cables, succinctly summarized the mood of the

German public toward high energy prices. The article discussed “Germany's aggressive and

reckless expansion of wind and solar power (that) has come with a hefty price tag for consumers

and the costs often fall disproportionately on the poor.”

47

According to the EU Fuel Poverty Network,

48

a portal established with the aim of bringing

together energy researchers and practitioners from across the EU, energy poverty occurs “when a

household is unable to afford the most basic levels of energy for adequate heating, cooking,

46

Wikipedia, ”Solar energy in the European Union”,

http://en.wikipedia.org/wiki/Solar_energy_in_the_European_Union; US Department of Energy, Energy

Information Administration

47

Germany’s Energy Poverty: How Electricity Became a Luxury Good, Der Spiegel, 4 Sept. 2013

48

The EU Fuel Poverty Network has become the leading online portal for information about EU fuel poverty and

aims to bring together researchers and practitioners from across the European Union who are working in the field

of fuel poverty in order to facilitate discussion, further the dialogue on across the EU and provide a platform for

researchers and practitioners

#_0B:./Z#

80/:.BG#

#,K.=B#

#,T0D0B#

#Q3.;G#

#<0;2=J:#

#<J;2./=.#

#8/00P0#

#Ma0P-#*0KJ\;=P#

#]J>3/=.#

#+>39B=.#

#O/.BP0#

IL#

#R03-0/;.BD>#

#*9:.B=.#

#O=B;.BD#

I,#

!#

$!!#

%!!#

&!!#

'!!#

(!!#

)!!#

5!!#

6!!#

7!!#

!# (# $!# $(# %!# %(# &!# &(#

?@bT=BD#P.K.P=3G#=B#C.c>#K0/#P.K=3.#

+;0P3/=P=3G#K/=P0#X0J/9P3YZC-[#

34

lighting, and use of appliances in the home.” While this phenomenon was initially only British

49

,

it is now expanding to the whole EU as electricity and natural gas prices increase throughout the

continent.

In November 2013, after many years of promoting FITs as an effective mechanism to support

renewable energy development, the EC hinted at the need to reform or end renewable subsidies,

and the need to support fossil generation that backs up renewables. The EC stated that “(i)n some

cases, state intervention in energy markets may be necessary in order to ensure security of supply

and to achieve climate objectives” and that “ (a)s technologies mature, renewables should

gradually be exposed to market prices and eventually support must be fully removed.”

50

As will

be described later, the EC will ultimately remove all FIT schemes starting in 2017.

4.3. Impact on national competitiveness

Concerns about the impact of high energy prices on national competitiveness are growing. In

January 2014, the EC released a communication on a policy framework for climate and energy

51

that warned of the particularly high risk for “industries that have high share of energy costs and

which are exposed to international competition” (p.10). At the World Economic Forum Annual

Meeting in early 2014, energy prices and competitiveness was one of the biggest themes.

Participants observed the growing competitiveness gap between Europe and the United States,

contrasting the United States’ “shale revolution” and abundant domestic natural gas supplies

with Europe, where industrial electricity prices are much higher than in other parts of the world

because of “a pell-mell push toward high-cost renewable electricity (wind and solar), which is

imposing heavy costs on consumers and generating large fiscal burdens for governments.”

52

The rise in German power prices does not only apply to residential consumers, but also to

industry consumers. In this case the main factors contributing to the end price are represented by

the procurement costs. For medium-sized enterprises, the additional part is denoted by taxes and

49

Fuel Poverty: a Framework for Future Action, Department of Energy and Climate Change, July 2013

50

EC Communication, Guidance to Member States on state intervention in electricity markets; November 2013;

http://ec.europa.eu/energy/gas_electricity/internal_market_en.htm

51

EC Communication, A policy framework for climate and energy in the period from 2020 to 2030, 22

nd

January

2014. http://ec.europa.eu/energy/doc/2030/com_2014_15_en.pdf

52

Daniel Yergin, US vs. Europe: Energy battle heats up, CNBC, http://www.cnbc.com/id/101365772

35

charges, which has gained a higher portion over the last few years, reaching about one-third of

the final price in 2012.

For energy-intensive industrial consumers, such as paper, aluminum (non-iron metals), steel, and

cement, electricity prices are a critical factor in economic competitiveness. These consumers

represent an important part of the German economy and are therefore exempt from paying the

EEG levy.

53

The aforementioned industries account for around 40 percent of the power

consumption, although they represent only a small portion of the total number of privileged

companies (10 percent).

As the next table shows, a huge number of companies benefit from privileged treatment

regarding power prices, and that number is steadily increasing.

Figure 17. Exempted companies and power consumption in power-intensive industries

(2012/2013)

54

Exempted companies

Consumption (GWh)

Ratio consumption/

companies (GWh)

Paper

107

14,062

132

Aluminum

40

10,699

267

Steel

37

11,945

323

Cement

25

3,738

150

Total: power intensive

industries

209

40,464

194

Total: ALL industries

2,057

107,477

52

The share of total production costs attributable to electricity expenses varies between 7 percent in

the paper industry and 40 percent in the aluminum industry, meaning electricity price increases

have a great impact on total production costs.

53

Forum Ökologisch-soziale Marktwirtschaft by order of Greenpeace e.V.: Strom- und Energiekosten der Industrie

54

German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety: Development

of renewable energy sources in Germany. www.erneuerbare-energien.de/.../ee.../hintergrundpapier_besar_bf.pdf

36

Figure 18. Share of total production costs for power-intensive industries

55

For power-intensive industry companies, this special treatment is without a doubt an important

benefit and enables them to stay competitive. Current calculations state that the exemptions

given to German industrial companies will account for a total of €5 billion in 2014.

56

Because of the advantage that this exemption brings to large German exporting industries, these

exemptions are now being challenged by the EC, which is planning to examine the special

treatment that the above mentioned German companies are enjoying, and determine whether this

situation violates the principle of fair competition.

4.4. Financial impact to thermal generators and reliability

Large penetration of renewable energy has not only translated into higher costs for the economy,

it is also having profound effects on wholesale electricity markets that could ultimately result in

a deterioration of the country’s reliability. Subsidized renewables have dispatch priority over

55

Forum Ökologisch-soziale Marktwirtschaft by order of Greenpeace e.V.: Strom- und Energiekosten der Industrie.

http://www.greenpeace.de/fileadmin/gpd/user_upload/themen/energie/2012-FOES-IZES-Verguenstigungen-

Industrie.pdf

56

Frankfurter Allgemeine Zeitung: EEG-Umlage: Welche Firmen müssen künftig zahlen? 19

th

February 2014.

http://www.faz.net/aktuell/wirtschaft/wirtschaftspolitik/oekostrom-eeg-umlage-welche-firmen-muessen-kuenftig-

zahlen-12808022.html

!"#

$!"#

%!"#

&!"#

'!"#

(!"#

)!"#

5!"#

6!"#

7!"#

$!!"#

?.K0/# ];J:=BJ:# ,300;# M0:0B3#

A3-0/#P9>3># ,3.E# *.T#:.30/=.;# OJ0;# R.3J/.;#8.># +;0P3/=P=3G#

37

thermal generators and come first in the market’s merit order, thus depressing wholesale prices

to levels that are making thermal plants uneconomical. At the same time, increasing amounts of

renewables require increasing amounts of back-up and balancing power that only thermal plants

can provide. The implications of these developments for reliability are evident.

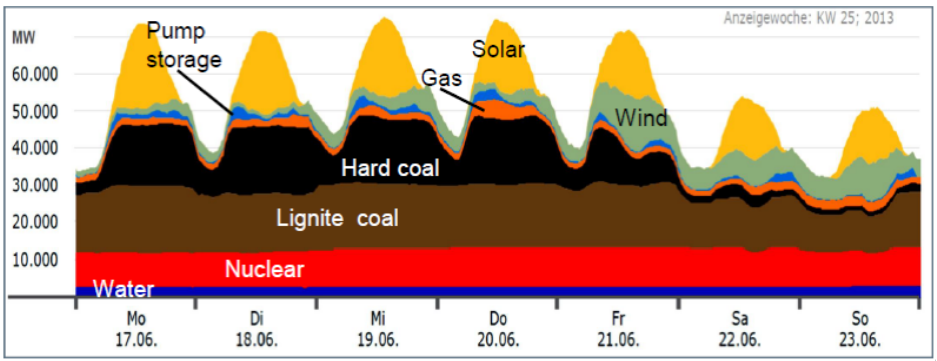

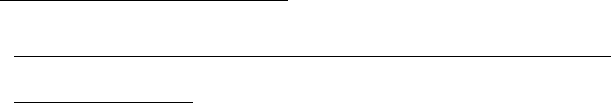

4.4.1. Impact on wholesale markets: Subsidized renewables first in merit order and low

wholesale prices

While it is the total costs that determine investment decisions for power plants, it is the variable

costs that determine if an existing power plant runs at any given time. Therefore the offer curve

of a power market is determined by the marginal costs in ascending order of the available power

sources. This is the so-called merit order. If there is an increase in demand, then plants are turned

on, starting with the cheapest, until the demand is satisfied. The last plant that is turned on

determines the market price for all market participants. Focusing on the difference between the

long-term investment decisions and the short-term merit order is key to understanding power

markets.

Renewable energy resources, like wind and solar, have very low marginal costs because they

have no fuel costs. Accordingly, renewable resources are bid into the market at very low prices,

thereby becoming first in the merit order. In an undistorted market, generators may offer their

power at prices below their total costs. As long as the market is in equilibrium, the use of power

plants with higher marginal costs ensures that other plants cover their total costs. However, the

power markets today are distorted by subsidies. Renewable generation will continue to be built

since it depends only on subsidies and does not react to the markets’ excess power signals.