Regional Investment Plan

Baltic Sea

TYNDP 2022

Final Version · May 2023

Regional Investment Plan 2022 – Baltic Sea

1

1. EXECUTIVE SUMMARY – Key messages of the region

The electricity system in the Baltic Sea region is undergoing significant changes as the

electricity generation structure is rapidly decarbonising and production is becoming more variable

due to weather conditions. The development of renewable energy in the region has been accelerated

by rapid technological advances and national subsidies. The energy transition is producing more

renewables and lessening the region’s reliance on thermal power plants. These developments have

reduced carbon dioxide emissions but also increased the risk of brownouts or blackouts in parts of

the region, as identified in the ERAA 2021. Simultaneously, society’s dependency on electricity is

increasing. As a result, the power systems of the future will be expected to provide even greater

reliability to safeguard the vital functioning of society.

Large quantities of new renewable

energy generation are still being planned

across the region, and these must be

integrated successfully, while also maintaining

the security of supply and facilitating an

efficient and secure European energy market.

The integration of renewables will further

replace production from thermal power plants.

The grid needs to facilitate flows to cover the

deficit at load centres caused by the closure of

power plants and the growing flows between

synchronous areas. To solve the challenges of

load balancing and power generation – in all

parts of the region – further grid development

is necessary, and the prospects for such

development are favourable. As the future

generation mix is expected to be far more

weather dependent, this increases the need to

strengthen the grid.

The main driver for the energy system

in the region is the green energy transition, followed by climate and decarbonisation goals. From a

grid development perspective, the most important drivers within the Baltic Sea region are as follows:

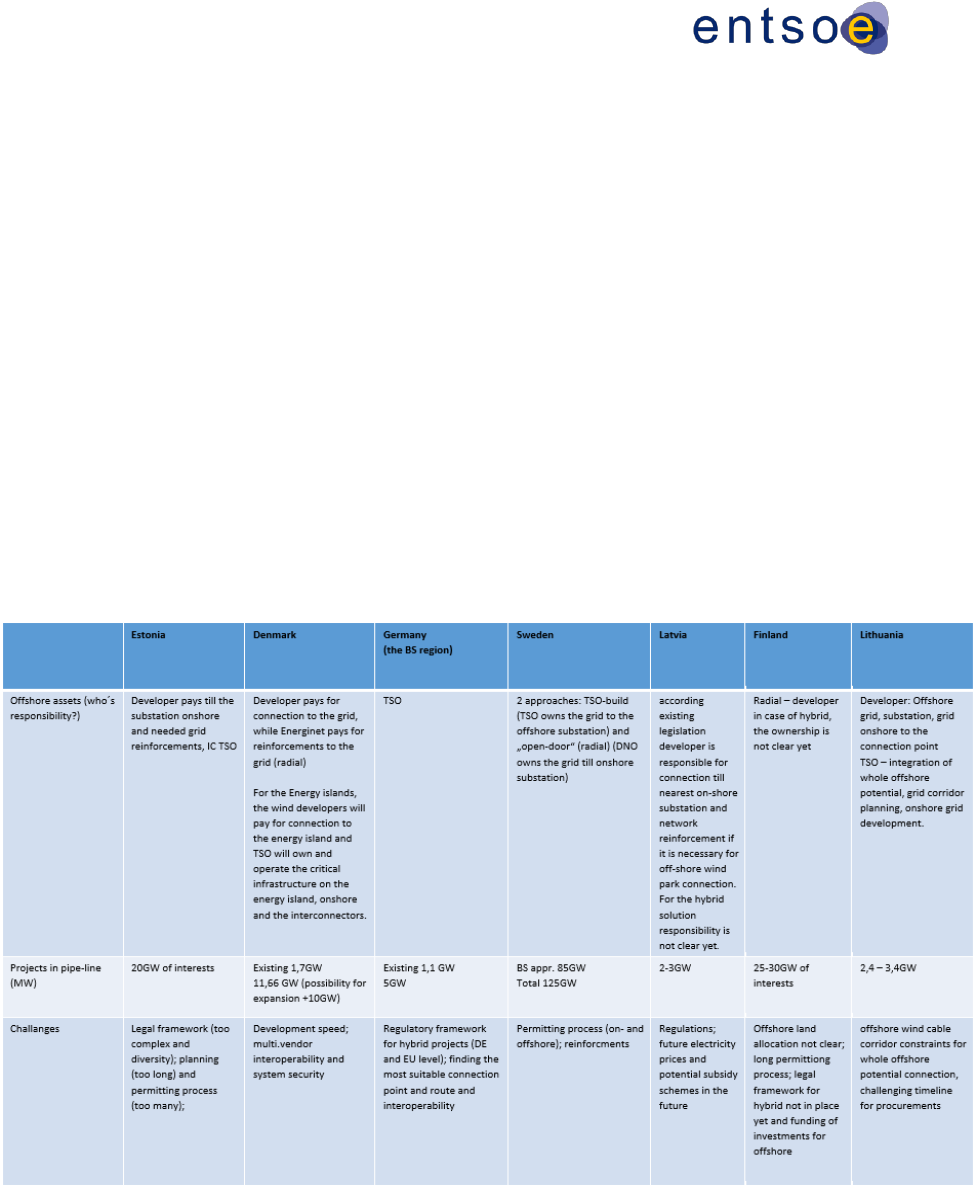

Driver 0: Rapid expansion of offshore wind → Offshore infrastructure needed

The Baltic Sea area has great potential for offshore wind development due to shallow waters

and good wind conditions. The political goals of the European Union (300 GW by 2050), combined

with these good offshore wind prospects, have resulted in huge ambitions for most of the countries

around the Baltic Sea. However, the potential for energy generation may be greater than the

consumption needs. Hence a planned and coordinated offshore wind development might be wise.

Good coordination between the countries around the Baltic Sea in the development of the offshore

infrastructure would probably be very valuable. The rapid expansion of offshore and onshore

infrastructure is required to integrate this energy source into the system and deliver the energy to

the main demand centres. Both Member States and TSOs of the Baltic Sea region have started

Figure 1-1: Key drivers of the Baltic Sea region

Regional Investment Plan 2022 – Baltic Sea

2

forming the first cooperation platforms. This also meets the requirements of the new TEN-E

regulation, which asks ENTSO-E to publish offshore grid development plans for 5 sea basins,

including the Baltic Sea area, at the beginning of 2024.

Driver 1: Need for flexibility → Further integration between synchronous areas

The transformation of the European power system is leading to a less flexible generation mix.

However, the Nordic system will continue to be relatively flexible due to its hydro-dominated

generation mix. In addition, the Nordic system is likely to increase its annual energy surplus, though

some nuclear power plants have been decommissioned. Both the need for flexibility and the

expected price differences between the systems will be drivers for the further integration of

synchronous systems. In continental low wind situations, energy might be exported from the Nordic

system, whereas in continental high wind situations power might be imported and stored in the hydro-

dominated Nordic system. Hybrid solutions may also integrate offshore wind energy.

Driver 2: Integration of onshore renewables → Increased North-South flows

Based on the political goals of reduced CO2 emissions and the cost development of wind

and solar generation units, further integration of onshore renewables is expected within the Nordic

countries. In Germany, large amounts of solar energy are already being produced and further

increases are expected. In Germany, Denmark and Sweden, large amounts of onshore wind energy

are already integrated. New interconnectors to the continent/Baltic States, in combination with

substantial amounts of new renewable generation capacity, are increasing the need to strengthen

north-south transmission capacities in Germany, Sweden, Norway, Finland and Denmark. In

addition, plans for the decommission of nuclear and/or thermal plants in southern Germany, Sweden,

Denmark and Finland will further increase capacity need in the north-south direction. One exception

might be the greenification of the north Swedish steel industry, which might decrease the need for

north-south transport through Sweden in the long run. In the Baltic States, plans for the development

of onshore wind generation are increasing dramatically. In the last couple of years, TSOs has issued

the technical requirements for onshore wind connection up to 10 GW of installed capacity.

Driver 3: Electrification/new consumption → Reinforcing the grid

To meet the EU climate goals, the European energy system must become much more

efficient. This will demand the more efficient use of energy in industry, transport and households, as

well as solutions for lowering energy consumption. As a result, the total energy demand for Europe

should decrease. Electrification of all kinds of consumption will play a major role in this transformation

to a much more efficient and decarbonised system. In addition, new types of consumption, such as

data storage, will increase electricity consumption. Over the coming decades, energy consumption

is expected to decrease, while electricity consumption is expected to increase. This increased

electricity consumption and electrification will therefore mean huge reinforcements of the grid might

be necessary.

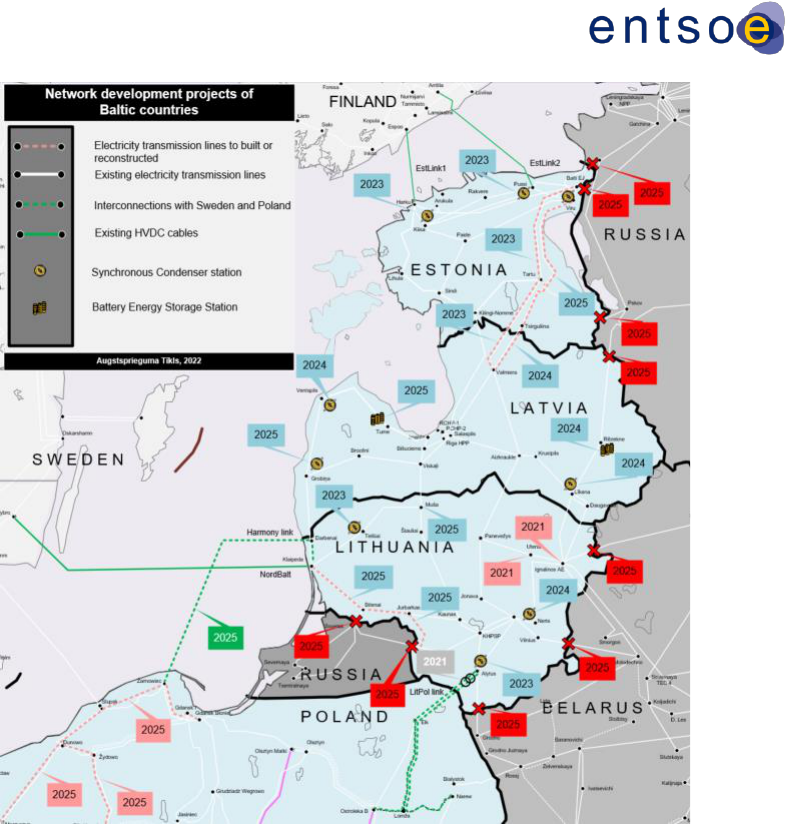

Driver 4: Baltic integration - Improved security of supply for the Baltic system

For historical reasons, the electricity systems of the Baltic States currently operate

synchronously with the Russian and Belarussian electricity systems (the IPS/UPS system). In recent

years, great progress has been made in integrating the Baltic countries with the European energy

Regional Investment Plan 2022 – Baltic Sea

3

markets. The Baltic countries are now connected to Finland, Sweden and Poland via HVDC

connections.

The three Baltic TSOs are now preparing to de-synchronise from IPS/UPS and instead

synchronise with the Continental European Network (CEN) through the existing interconnection

between Lithuania and Poland. In addition, a new subsea HVDC (the Harmony Link) is planned

between Lithuania and Poland, aimed at improving the security of supply. Synchronising the Baltic

countries with the CEN will ensure energy security by their connection to a grid that is operated using

joint European rules. As a result of the Ukrainian conflict, work on the project is accelerating, which

means that the Baltic system can decouple from Russia and Belarus at any time.

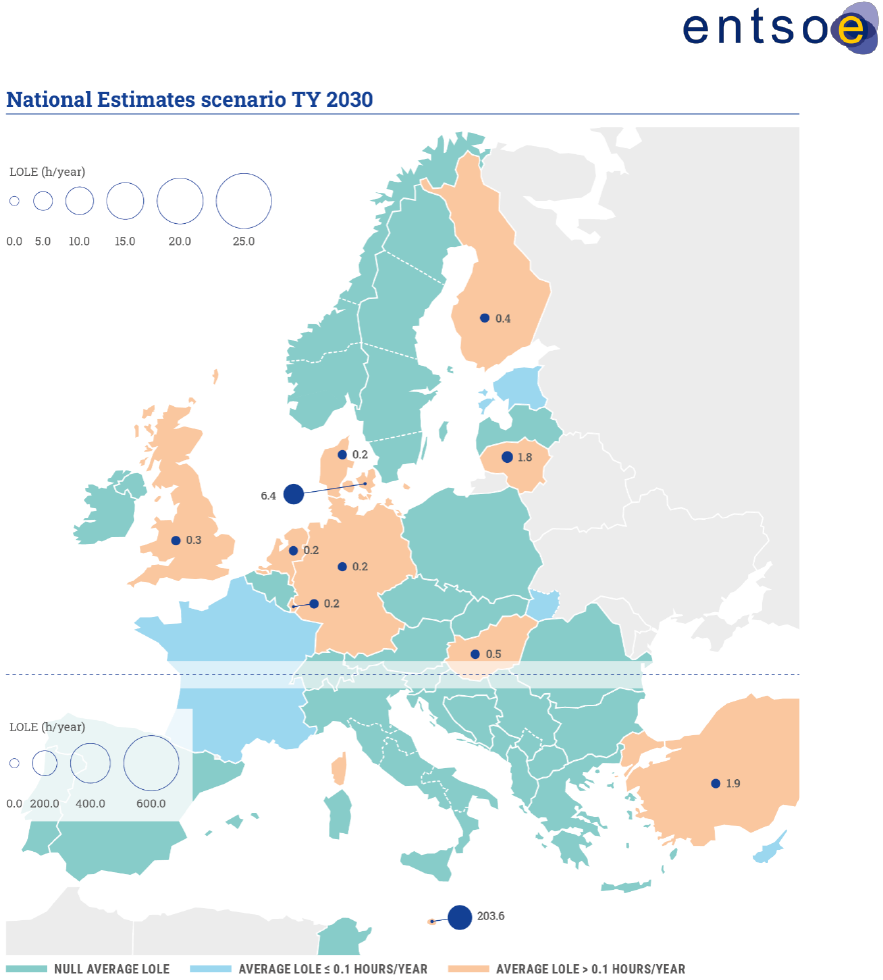

Driver 5: Nuclear and thermal decommissioning → Security of supply challenges

All of the nuclear power plants in Germany, a substantial proportion of the thermal/nuclear

power plants in Sweden and a substantial proportion of the thermal power plants in Germany,

Denmark and Finland are expected to be decommissioned by 2030. Furthermore, the

decommissioning of thermal power plants, particularly in Poland, is needed to achieve the EU’s

climate targets. Decommissioning of both the nuclear and thermal power plants will system risk,

challenging the security of supply. Nuclear and thermal power are important in today’s system, and

a phaseout will require new generation capacity, grid development, and further development of

system services.

Driver 6: Smart sector integration and flexible loads → Optimising decarbonisation

Sector integration, demand response and flexible loads are core instruments for cutting

emissions cost-effectively. Smart Sector Integration (SSI) seeks the optimal solution for the whole

energy system, supporting a fast and cost-optimised path to zero emissions by 2050. Electricity

would be used directly in sectors such as transportation and industry and for heating buildings or

used indirectly to produce green hydrogen. The hydrogen can in turn be used directly for

transportation, heating, and even power generation – for example, during hours of scarcity – or to

produce methane, fuel, ammonia or more. The benefits of SSI arise from the variable character and

falling costs of wind and solar power. In addition to cutting emissions cost-effectively, SSI provides

offers the flexibility to employ various energy systems. This again increases supply security. Flexible

loads and demand response will help in the optimisation of the dimensioning and operation of the

power system. Flexibility markets may be used in the future to solve bottlenecks in the system.

Driver 7: Current geopolitical developments accelerate the transition

At this writing, Europe, like the rest of the world, is experiencing an energy crisis. Energy

carriers were already paying high prices before Russia invaded Ukraine. The Baltic Sea region is

more dependent on Russia than most other regions of Europe. The long-term effects of the current

situation are not yet known, but geopolitics and energy independence are likely to be important

themes in decision-making. Improving the security of supply in the region, accelerating the transition

to renewables, speeding the synchronisation process and diversifying power production are now

topics of discussion. To counter the current energy crisis, the European Commission has proposed

the ‘REPowerEU’ plan, which aims to reduce the usage of fossil gas by 155 billion cubic metres

(BCM) by 2030.

Regional Investment Plan 2022 – Baltic Sea

4

1.2 Future capacity needs

The drivers described above are the basis for further grid development. Short-term grid

development needs can be studied by analysing the current measurements, trends, generation plans

and expected consumption changes. Grid infrastructure is a long-term investment with a lifetime of

decades. Building a new line, for example, can take ten years or longer, particularly when factoring

in planning and permitting. Therefore, it is important to consider the benefits of new infrastructure in

the long term. It is not meaningful to try to forecast the future as ‘one truth’ because small changes,

such as in policies or fuel prices, can have major impacts.

In addition to the main drivers described above, the list below describes the key future capacity

needs for the region and the positive effects of transmission grid expansion up to 2050:

• The green energy transition, along with climate goals and decarbonisation, will lead to

fundamental changes in generation and energy demand, which will trigger changes in power

flows across the region. The dominant power flow direction will be north to south.

•

Rapid expansion of both onshore and offshore renewables in the region and the

decommissioning of nuclear power plants in Germany by the end of 2022 and potentially in

Sweden by 2040 will trigger related offshore and onshore infrastructure needs.

•

Flexibility will be challenged. Sector integration and demand response will be part of the

solution, together with hydro resources. In addition, further capacity increase between

different countries and synchronous areas might be necessary.

•

The plans described above require new interconnectors, some of which are already in

preparation, under construction or commissioned. These interconnectors will also help with

internal energy market (IEM), security of supply (SoS) and renewable energy sources (RES)

integration. Continued strong collaboration between actors in the region is needed, and those

actors are responsible for the timely implementation of interconnectors.

•

The Baltic countries will be synchronised with continental Europe by 2025 at the latest, but

the security of supply will need to be further enhanced. The medium-term SoS in the Baltic

States are primarily related to flexibility needs after desynchronisation from IPS/UPS and

synchronisation with the CEN.

All of the scenarios being studied in the Identification of System Needs (IoSN) include a large

increase in renewable generation and a decrease in CO2 emissions; but without additional grid

development, the price spread between market areas in the region would increase rapidly and some

of the climate benefits would not be realised. The benefits of increased capacities in the scenarios

are clear in Chapter 3 of this report, which describes the market results of the IoSN. Increasing

capacities at the borders would have a significant impact on both the electrical system and society.

Regional Investment Plan 2022 – Baltic Sea

5

2. INTRODUCTION AND REGIONAL CONTEXT

2.1 About Regional Investment Plans

2.1.1 Legal requirements and links to the TYNDP package

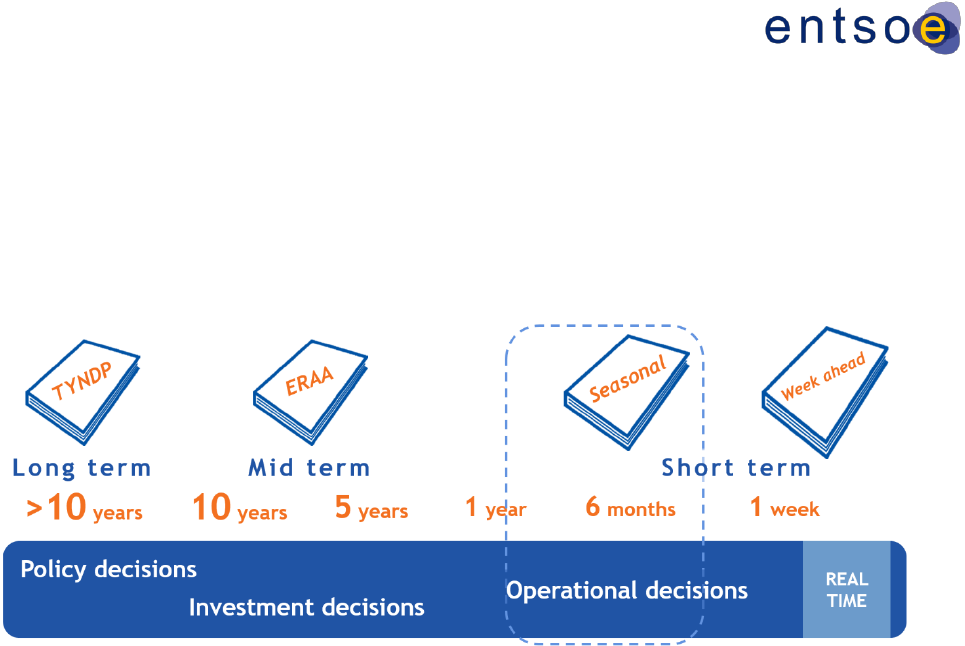

The Regional Investments Plans are part of the Ten-Year Network Development Plan

(TYNDP) package and comply with Regulation (EU) 2019/943 (Article 34 and Article 48) that

requests TSOs to establish regional cooperation within ENTSO-E and publish a Regional Investment

Plan biennially. In addition, TSOs may take investment decisions based on that Plan.

Regional Investment Plans are part of the TYNDP 2022 package, which also includes the Scenario

report and the System needs study. The Scenario report describes possible European energy

futures up to 2050 and is used to test potential electricity and gas infrastructure needs and projects.

The scenarios serve as a basis for the Regional Investment Plans by describing the region’s future

challenges. The System needs study investigates system gaps in the mid- and long-term time

horizons (2030 and 2040) in the National Trends scenario. The present Plan further analyses at

regional and country levels the capacity increases identified in the System needs study.

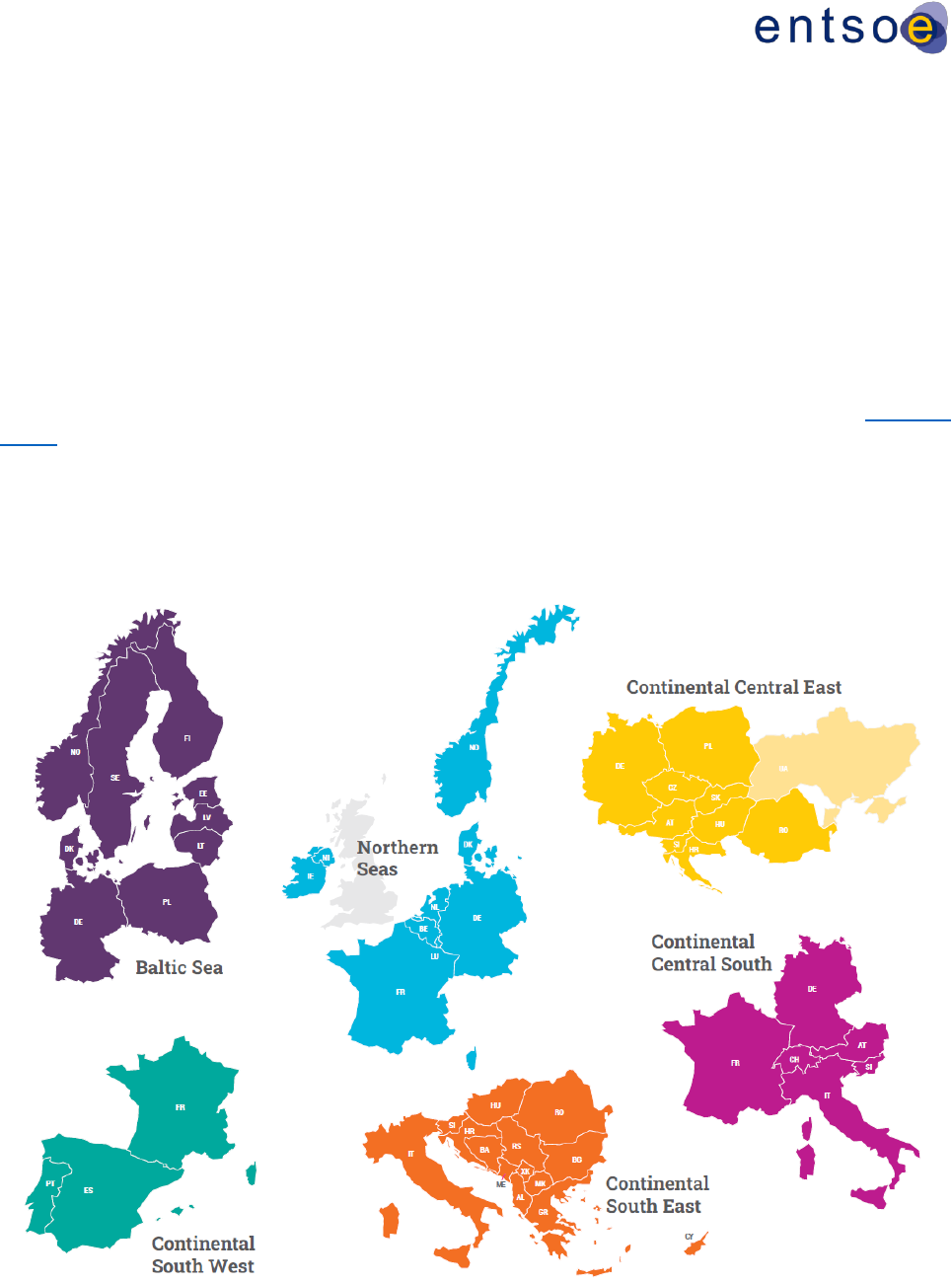

Figure 2-1: ENTSO-E’s System Development regions. Each region is covered by one Regional Investment

Plan.

Regional Investment Plan 2022 – Baltic Sea

6

2.1.2 Scope of the RegIPs 2022

Regional investment plans describe the present situation in each region as well as future

regional challenges, considering 2030 and 2040 time horizons. The Regional Investment Plan 2022

also investigates solutions that could help to mitigate future challenges and offers projections in

terms of internal network reinforcements. In addition, this edition of the Plan includes a study

roadmap for the region, laying out ongoing and future studies that cover the priorities stemming from

the 2040 System needs analysis.

The present document comprises the following chapters:

• Chapter 1 gathers the key messages relating to the Regional Group Baltic Sea.

• Chapter 2 outlines the legal requirements and scope of the Regional Investment Plans. An

overview of the present situation of the regions is also presented.

• Chapter 3 describes the identified regional system needs, which depend on the regional

challenges.

• Chapter 4 is dedicated to additional region-specific analyses.

• Chapter 5 presents the future challenges in the region, the necessary mitigation steps and

projections based on expected internal reinforcements.

• The Appendix includes additional region-specific content and lists of the abbreviations and

terminology used in the report.

Regional Investment Plan 2022 – Baltic Sea

7

2.2 Introduction to the region

The Baltic Sea Regional Group, under the scope of the ENTSO-E System Development

Committee, is among the six regional groups that have been set up to cover short- and long-term

transmission grid planning and system development tasks. The group has been working actively

since 2010 and cooperation among the TSOs has been very good. The countries belonging to the

Baltic Sea Regional Group are shown below.

Figure 2 – 2: ENTSO-E System Development Committee Baltic Sea region

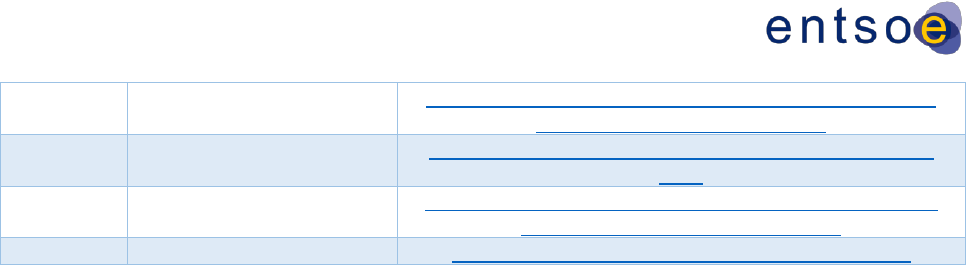

The Baltic Sea Regional Group comprises nine countries, which are listed in Table 2-1 along

with their representative TSOs. Each Member State prepares its own National Development Plan

that contains much more detailed information about the power system and transmission network

developments in that country. The national development plans are harmonised with TYNDP and are

designed in line with European Union regulations and guidelines to meet long-term targets and

strategies. Links to the national development plans of the Baltic Sea Regional Group countries are

provided below.

Country

Company/TSO

Links to the NDP

Denmark

ENERGINET

Energinets Langsigtede Udviklingsplan 2022 | Energinet

Estonia

ELERING

https://elering.ee/sites/default/files/2021-

12/Varustuskindlus%202021%20lk.pdf

Finland

FINGRID

fingrid-main-grid-development-plan-2022-2031.pdf

Germany

50HERTZ GmbH

Grid Development Plan Electricity | Grid Development

Plan (netzentwicklungsplan.de)

Latvia

AS AUGSTSPRIEGUMA

TIKLS

Electricity Transmission System Development Plan

Regional Investment Plan 2022 – Baltic Sea

8

Lithuania

LITGRID AB

Development Plan of the Electric Power System and

Transmission Grid 2021-2030

Norway

STATNETT

National Grid Development Plan and Power System

Plan

Poland

PSE S.A.

Development Plan for meeting the current and future

electricity demand for 2021-2030

Sweden

SVENSKA KRAFTNÄT

System Development Plan 2022–2031 (svk.se)

Table 2-1: ENTSO-E Regional Group Baltic Sea membership and links to the NDPs

2.3 Evolution compared to RegIP 2020

Climate goals

The EU has agreed to a comprehensive update of its energy policy framework to facilitate

the transition from fossil fuels to carbon-neutral energy. The EU has set an ambitious, binding target

of 32% for renewable energy sources in the EU's energy mix by 2030. The development of

renewable sources will also lead to greater energy independence. The National Trends 2030

scenario used in the analyses performed under IoSN 2022 assumes a progressive 25% reduction in

CO2 emissions in the Baltic Sea Regional Group compared to the previous edition, IoSN 2020. This

effect is achieved thanks to a 17% increase in the production of energy from renewable sources and

a 43% reduction in the constraints of power output from them.

Power to gas

The European Commission’s hydrogen strategy presented in July 2020 outlines, amongst

other elements, how to upscale the demand and supply of renewable hydrogen. It has set the

strategic objective of installing at least 40 GW of renewable hydrogen electrolyser capacity within

the EU (producing about 5 Mt of renewable hydrogen), based upon an estimated demand for up to

10 Mt per year of renewable hydrogen in the EU by 2030. The National Trends 2030 scenario used

in the IoSN 2022 analyses predicts a 12-fold increase in the energy used for hydrogen production

by electrolysers in the Baltic Sea Regional Group area, compared to the IoSN 2020 edition.

Flexibility

Currently, 20% of all energy in the European Union comes from renewable sources;

achieving the Fit for 55 goal would mean a doubling of renewable energy sources by 2030. For the

energy sector, achieving this target will entail shifting from conventional to renewable energy sources

at an increased pace. Most renewable energy sources, such as wind and solar, are fluctuating and

non-dispatchable; that is, they cannot be controlled by grid operators or market needs but instead

are weather dependent. This fluctuation in supply can create mismatches between generation and

demand, so equilibrating the power system requires additional flexibility. From the standpoint of the

power grid, the installation of battery energy storage is a very helpful technological solution. It allows

for stabilising the variability of energy production from renewable sources and responding to

changing demand. The National Trends 2030 scenario used in the analyses carried out under IoSN

2022 anticipates a 4-fold increase in the consumption of energy accumulated in battery systems in

the Baltic Sea Regional Group area, compared to the IoSN 2020 edition.

Regional Investment Plan 2022 – Baltic Sea

9

Moreover, acquiring more RES is much quicker than expanding the grid to transport them.

Consequently, this is creating bottlenecks in transmission systems. To solve the related congestion,

conventional power plants are currently used for preventive redispatch. Alternative solutions have to

be implemented as conventional power plants will become less available or even be phased out and

the costs for redispatch will increase tremendously. To help TSOs to solve resolve congestion, two

courses of action may provide solutions. Firstly, the available grid could be more balanced by the

use of controllable devices such as high-voltage direct current (HVDC) or phase shift transformers

(PST) to bypass the congested areas. Secondly, technical solutions for higher utilization of the

existing grid may be implemented. The TSOs have already implemented dynamic line rating (DLR),

which is weather dependent and in certain situations allows for adjusting the rating of the lines for

system-wide congestion management.

Additionally, there are newly planned and implemented controls. For example, the

Gridbooster offers significantly faster reaction times on grid events that would otherwise lead to

congestion. Taking into account these faster reaction times and free thermal short-time capacities in

the assets and lines, curative congestion management may unleash the unused potential of the grid

and permit better coordination of system operations. The potential of these approaches was shown

in the German research project InnoSys 2030. Concepts for curative measures were developed and

a roadmap for implementation was published. A first Gridbooster pilot system in Germany

(Audorf/Süd and Ottenhofen) should commence operations in 2023. It will be used to test these

innovative concepts for higher utilization of the transmission grid.

Influence of Russian – Ukraine conflict on the electricity sector

The outbreak of the war between Russia and Ukraine in 2022 resulted in the imposition of a

series of sanctions on the Russian aggressor by the international community. The sanctions imposed

on Russia resulted in significant increases in the prices of fuels and raw materials, influencing the

pace of transformation of the manufacturing sector towards renewable energy sources. The greatest

threat to this situation was maintaining the continuity of energy supplies, especially because most

gas was imported from Russia, and those supplies were cut off. The impact of rising gas prices on

the generation sector had a large impact on the overall system cost and resulted in a merit order

shift (coal before gas).

3. REGIONAL SYSTEM NEEDS

3.1 Present situation

This chapter describes the present Baltic Sea regional situation regarding the transmission

grid, power generation and consumption and power flow exchanges. In addition, the most significant

grid constraints among the Baltic Sea Regional Group countries have been defined.

3.1.1 The transmission grid in the Baltic Sea region

The Baltic Sea region comprises Sweden, Norway, Finland, Denmark, Estonia, Latvia, Lithuania,

Poland and Germany. Within this region, there are three separate synchronous systems: the Nordic

system, the continental system and the Baltic States power system, which is currently synchronous

with the IPS/UPS system (Russia and Belarus). The synchronous areas are illustrated in Figure 3-

Regional Investment Plan 2022 – Baltic Sea

10

1. Note that Denmark is divided between two synchronous areas: Denmark-East, which is a part of

the Nordic system, and Denmark-West, which is part of the continental system.

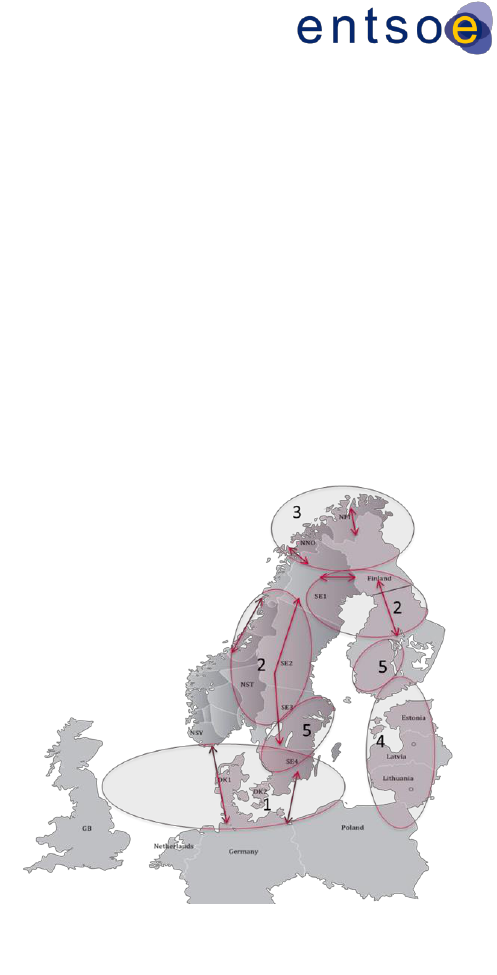

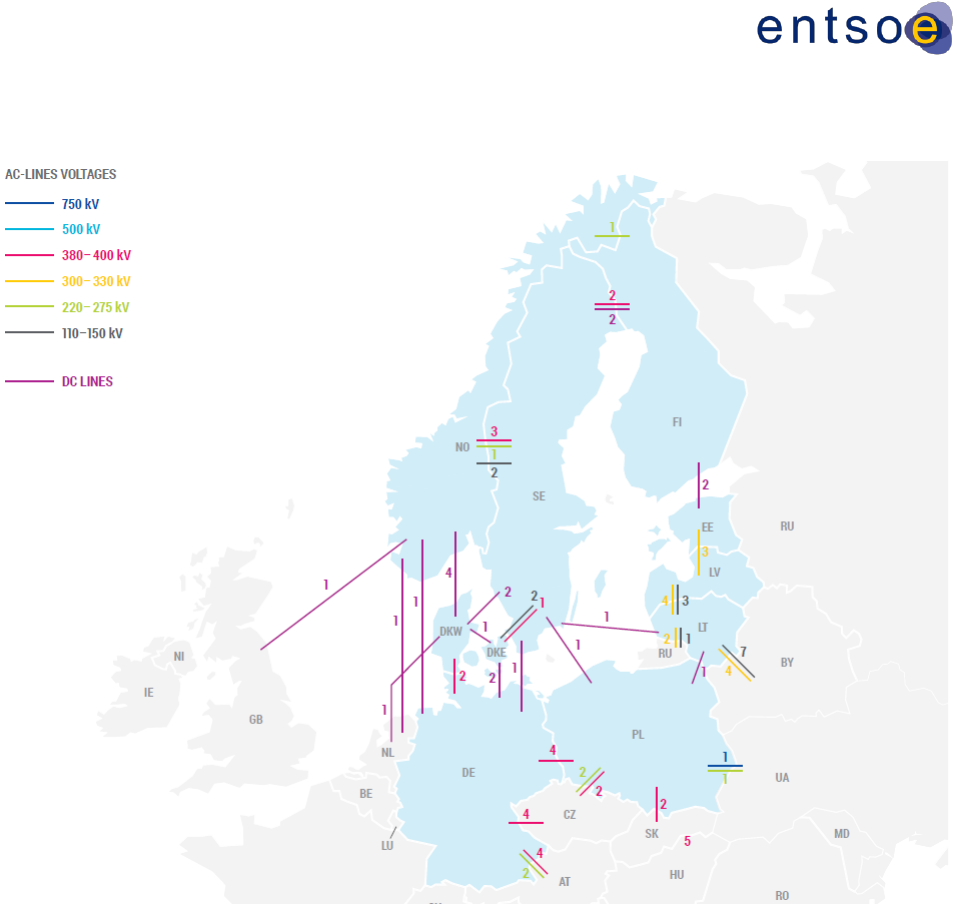

Figure 3-1: Synchronous areas and existing interconnections in the Baltic Sea region

The Baltic States are currently in the same synchronous area as the Russian IPS/UPS power

system and have several AC connections to both Russia and Belarus. However, the Baltic system

has had no market exchange with Belarus since the end of 2021 or with Russia since May of 2022.

The interconnection capacities between the Baltic States are strongly dependent on the operations

of non-ENTSO-E countries; therefore, there is political motivation in the Baltic States to

desynchronise from the IPS/UPS system and synchronise with the European system. The

synchronisation project started on 28 June 2018 when the president of the European Commission,

Jean-Claude Juncker, together with the heads of state or government of Lithuania, Latvia, Estonia

and Poland, agreed on a political roadmap for the synchronisation of the Baltic States' electricity

networks with the continental European network via Poland, with a target date of 2025. In line with

that political roadmap, the BEMIP High-Level Group (senior-official level) on the synchronisation

project agreed on 14 September 2018 on the technical and economic feasibility of the

synchronisation option. It will consist of the existing double-circuit, alternating-current line between

Poland and Lithuania (LitPol Link), complemented by the construction of an offshore high-voltage

Regional Investment Plan 2022 – Baltic Sea

11

direct current link, together with other optimisation measures including synchronous condensers.

The status of the Baltic Synchronization project is described in Chapter 4.1.

Transmission capacity will play a key role in addressing future power system challenges.

Adequate transmission capacity allows for the cost-effective utilisation of power, ensures access to

adequate generation capacity, enables the smooth exchange of system services and is key to a well-

integrated market. A cost-effective transition towards a green power system depends largely on the

strength of the transmission networks. Therefore, transmission network improvements must be

completed in a timely fashion.

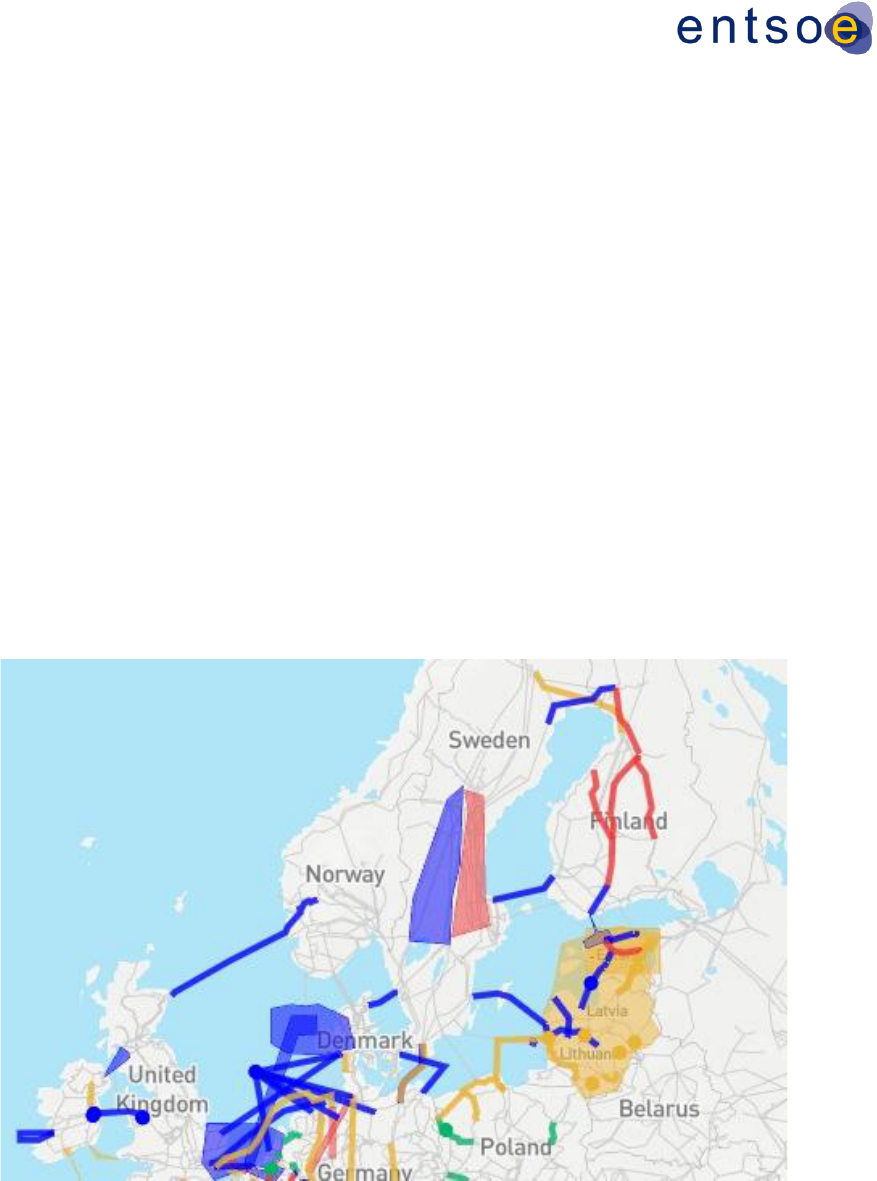

Many new HVDC interconnectors since 2010.

Seven new interconnectors have been commissioned since 2010, which has increased total

capacity by approximately 4450MW. These new interconnectors are Skagerrak 4 (Norway-

Denmark), Fenno-Skan 2 (Sweden-Finland), Estlink 2 (Estonia-Finland), Nordbalt (Sweden-

Lithuania), the LitPol link (Lithuania-Poland), Cobra (Denmark-The Netherlands) and the Kriegers

Flak CGS (Denmark-Germany) project. Two new HVDC connections are to be commissioned in the

region during the next five years: the Harmony Link (Poland-Lithuania) and the Hansa PowerBridge

I (Sweden-Germany). Preparatory work for the construction of the Harmony link – HVDC link

between Poland and Lithuania started in 2019 as a part of the Baltic synchronisation project.

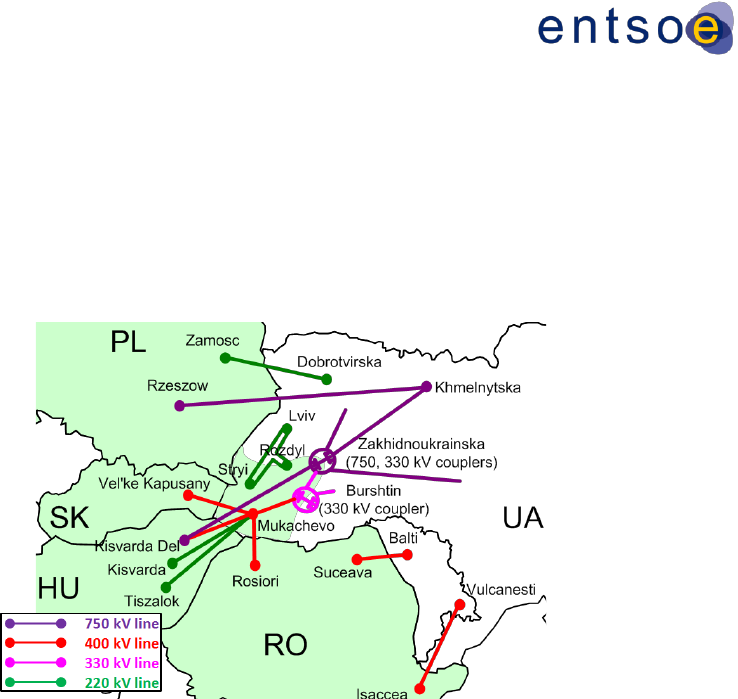

The Interconnected HVAC network in the Baltic Sea region is illustrated in Figure 3-2 and is

also found at https://www.entsoe.eu/map/. The Nordic and continental systems utilise 400kV AC

as the main transmission voltage level and 220/130/110kV AC as sub-transmission voltage levels.

In the Baltic States’ power system, the main transmission voltage level is 330kV. The map in Figure

3-3 shows the diverse level of net transfer capacities (NTC) in the Baltic Sea region. The NTC is the

maximum total exchange capacity in the market between two adjacent price areas.

Figure 3-2: Interconnected network in the Baltic

Sea region

Figure 3-3: NTCs in the Baltic Sea region

Regional Investment Plan 2022 – Baltic Sea

12

3.1.2 Power generation, consumption and exchange in the Baltic Sea region

The total annual power consumption in the Baltic Sea region is approximately 1100 TWh, of

which half is consumed in Germany. The peak load is much higher in winter than in summer due to

colder weather and the high usage of electric heating in the Nordic and Baltic countries. During the

last ten years, the peak load in the region has only shown moderate growth, while renewable

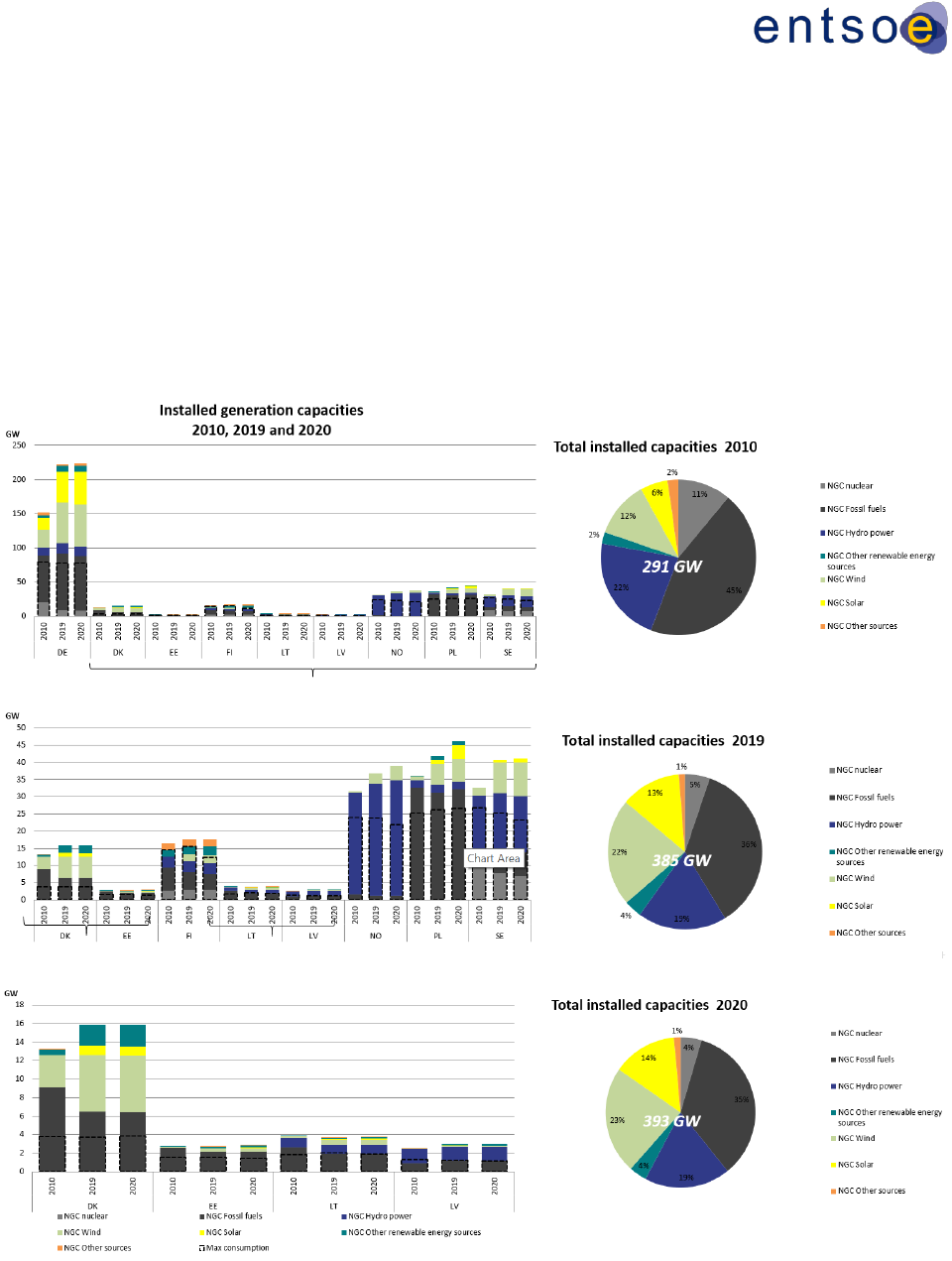

generation capacity has greatly increased, as shown in Figure 3-4. Thermal, fossil fuel-fired

generating capacity has decreased in the Nordic countries, while it has slightly increased in

continental Europe. The German nuclear phaseout is also clearly visible in the figure.

Figure 3-4: Installed generation capacities by fuel type and maximum consumption in the Baltic Sea region in

2010, 2019 and 2020

Regional Investment Plan 2022 – Baltic Sea

13

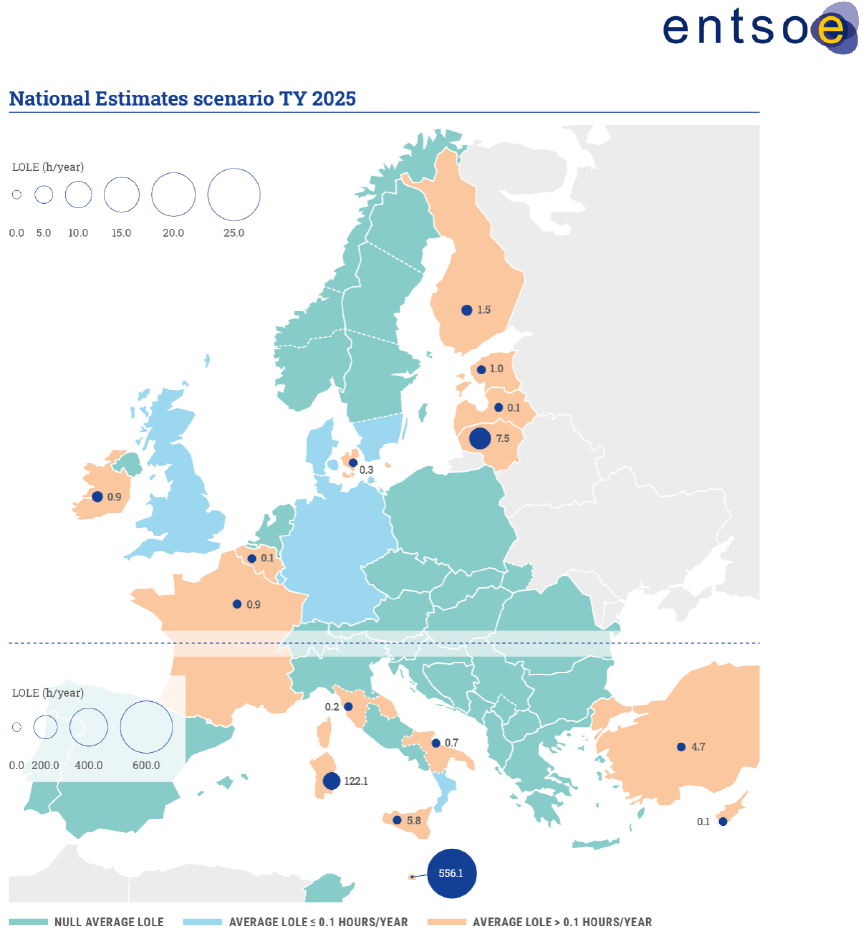

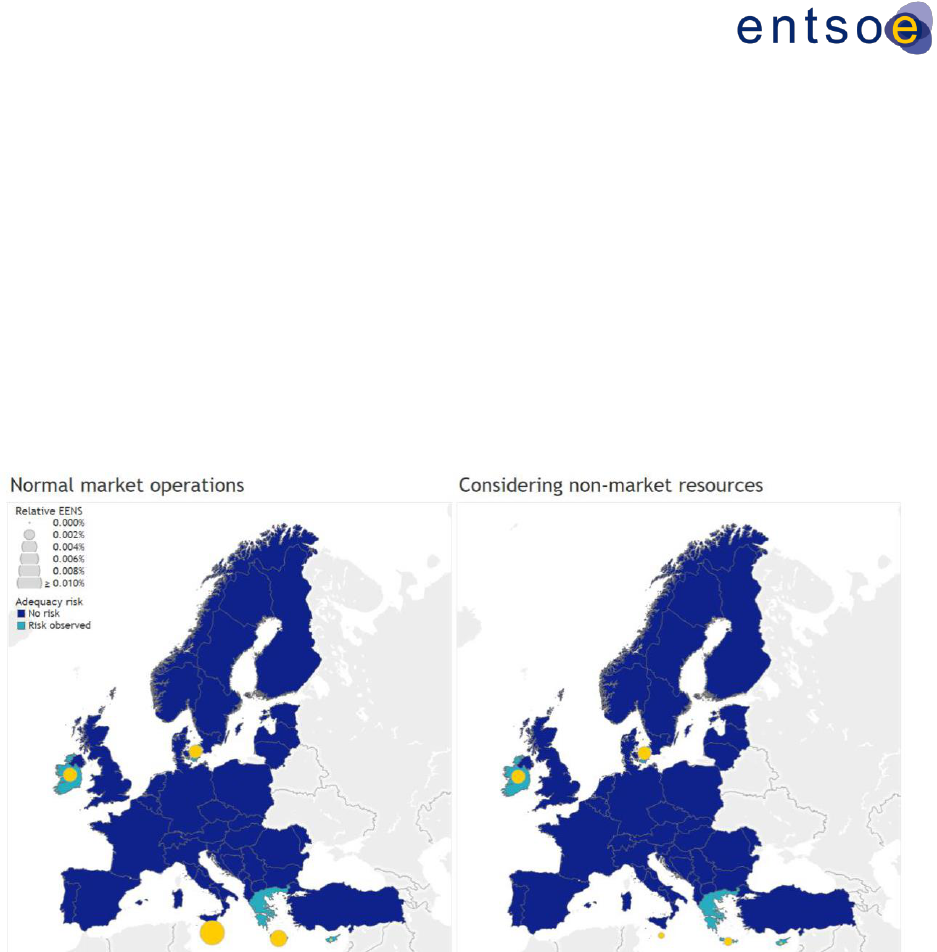

The continental and Nordic markets currently have sufficient thermal production capacity to

cover demand during periods of low production from variable renewable sources or dry years with

low hydro production. Currently, most of the countries have enough reliably available capacity to

cover peak load without having to import from neighbouring countries. However, the trend in many

countries is also towards dependency on imports in peak load situations due to the increase in

renewable generation capacity.

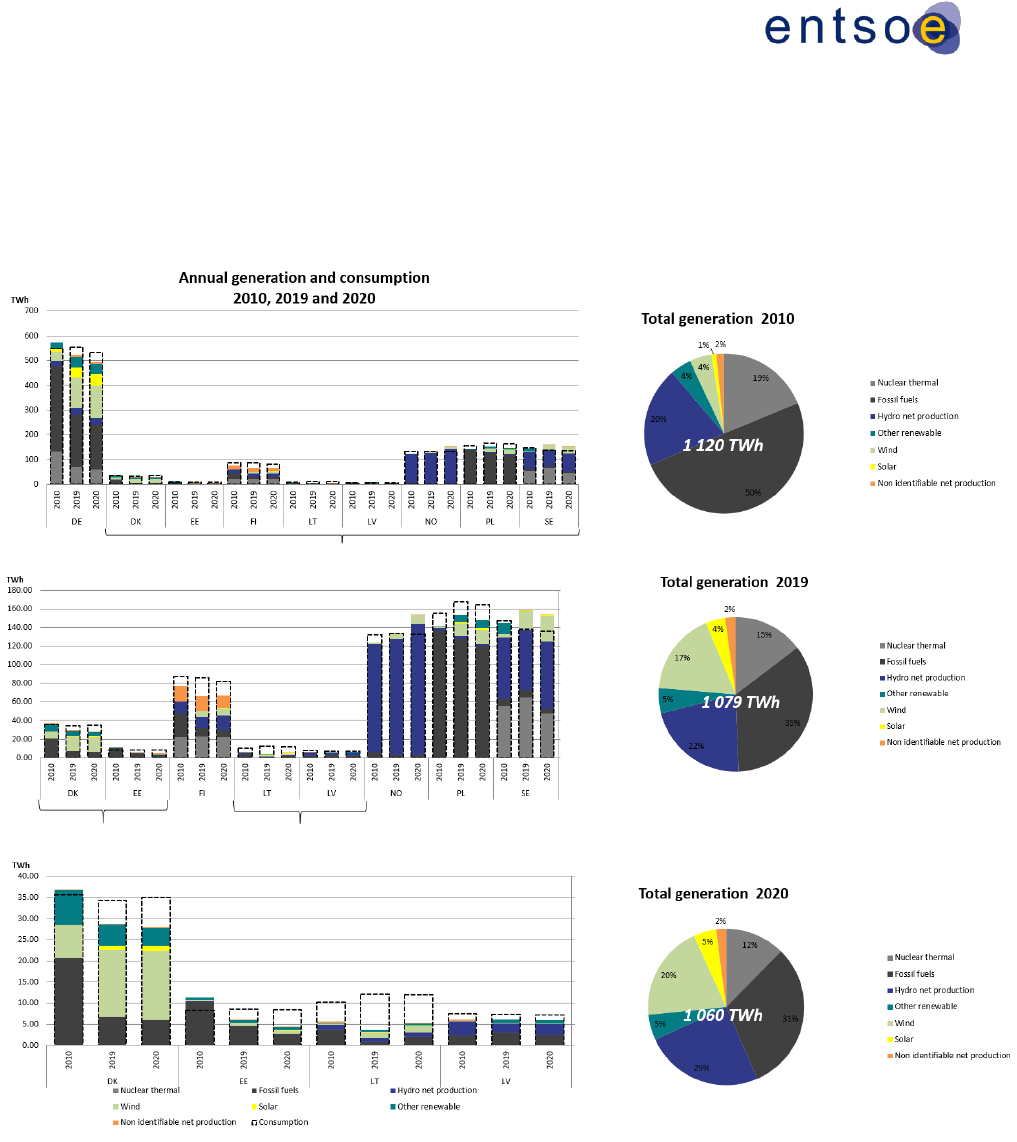

Figure 3-5: Annual generation by fuel type and annual consumption in the Baltic Sea region in 2010, 2019

and 2020

The Nordic power system is dominated by hydropower, followed by nuclear, wind and

combined heat and power (CHP). Most of the hydropower plants are located in Norway and northern

Sweden, and the nuclear power plants are located in southern Sweden and Finland. During a year

with normal inflow, hydropower represents approximately 50 % of annual electricity generation in the

Nordic countries, but variations between wet and dry years are significant. For Norway, the variations

Regional Investment Plan 2022 – Baltic Sea

14

can be almost 60 – 70 TWh between a dry and wet year. Consumption in the Nordic countries is

characterised by a high amount of electrical heating and energy-intensive industries. The power

balance in the region is positive in a normal year but varies significantly between wet/warm and

dry/cold years. Sweden and Norway have energy surpluses, whereas Finland has an energy deficit

and is dependent on imports. The development of generation and demand in the Baltic Sea region

is shown in Figure 3-5.

Power production in the continental part of the Baltic Sea region and the Baltic States area

is dominated by thermal power, except in the Danish power system, which is dominated by wind and

other RES, which account for more than 60 % of consumption in Denmark. Consumption in the area

is less temperature dependent than in the Nordic countries. Denmark, Poland, Estonia and Latvia

have a neutral annual power balance during an average year, whereas Germany has a yearly

surplus. Lithuania, on the other hand, is currently operating with a large energy deficit. The massive

increase in RES generation in Germany has replaced nuclear production but has only slightly

decreased fossil fuel-based generation while significantly increasing exports.

Regional Investment Plan 2022 – Baltic Sea

15

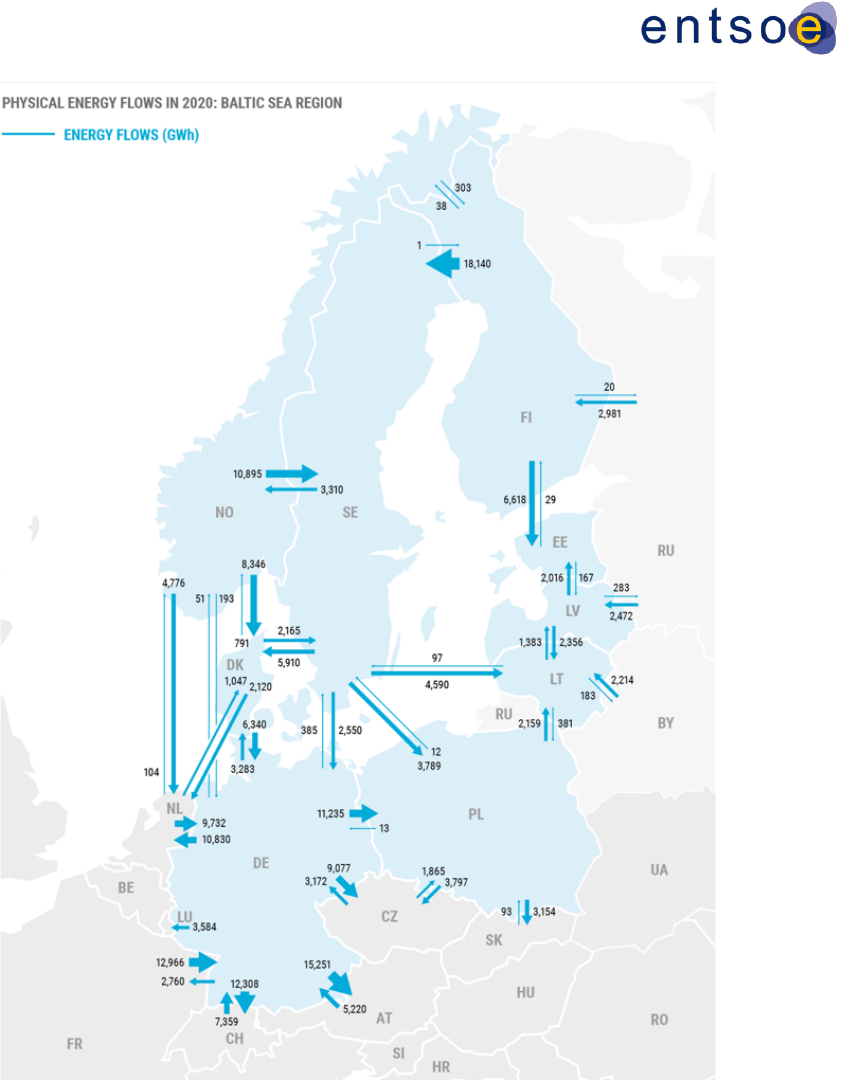

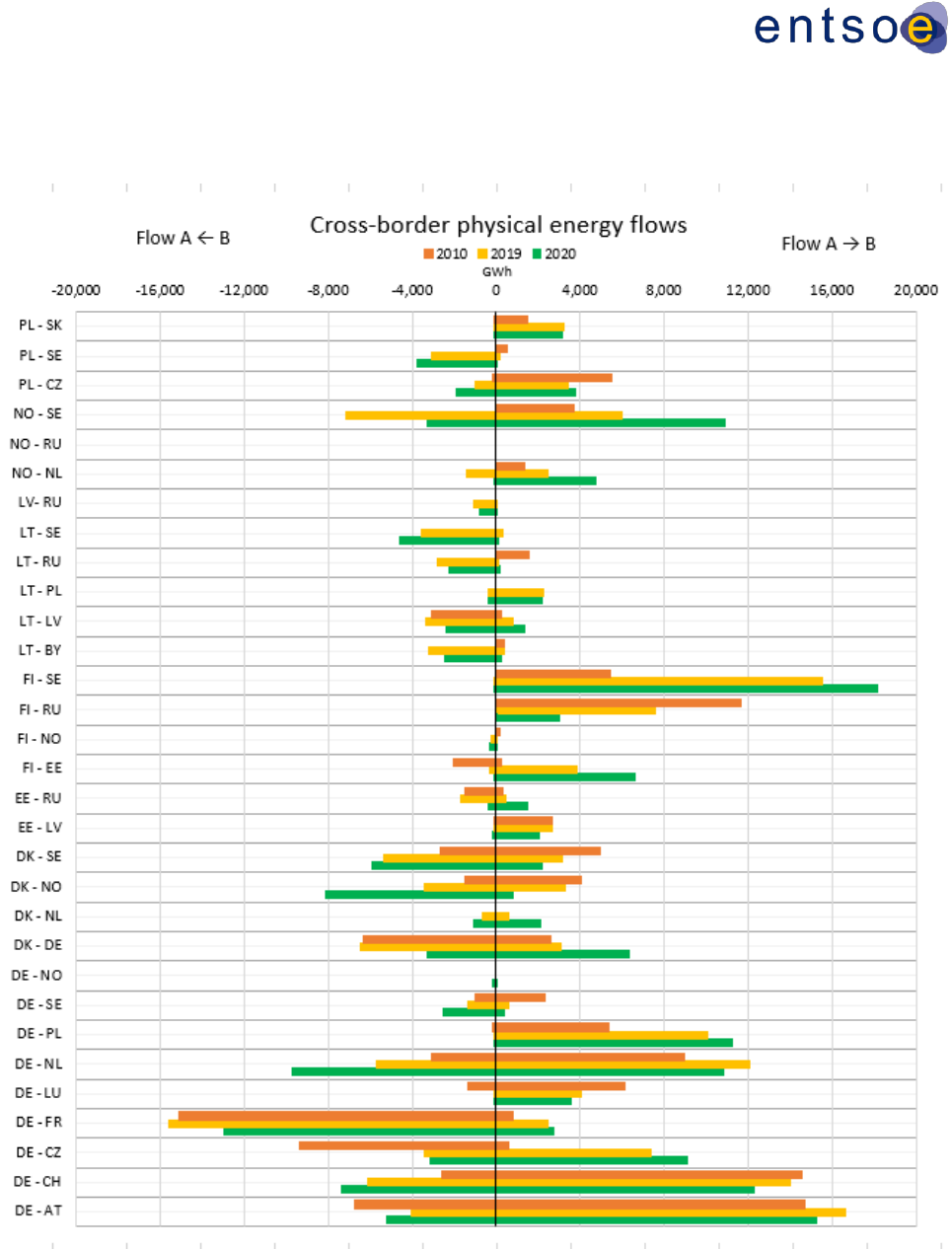

Figure 3-6: Cross-border physical energy flows (GWh) in the Baltic Sea region in 2020

Cross-border flows in 2020 are shown in Figure 3-6, and the development of cross-border

exchanges from 2010 to 2020 is presented in Figure 3-7. The largest exchanges were from Norway,

Sweden and Germany to neighbouring countries, while the largest increases in power flow between

2010 and 2020 were from Sweden to Finland, Norway to Sweden, the Netherlands to Germany and

Germany to the Czech Republic. In the Nordic countries, the flow pattern varies greatly from year to

year as a result of variations in hydrological inflow (for example, 2010 was a dry year). In wet years,

exports from Sweden and Norway are typically much larger than during dry years. In addition, Finnish

imports from Russia have decreased as a result of a new market design in Russia, which has

Regional Investment Plan 2022 – Baltic Sea

16

significantly increased the price of exports during peak hours. In practice, this has limited Finnish

imports to nights and weekends. Furthermore, the electricity trading between Finland and Russia

was suspended in spring 2022 and remains suspended at the time of the writing of this report.

Figure 3-7: Cross-border physical energy flows (GWh) in the Baltic Sea region in 2010, 2019 and

2020

Regional Investment Plan 2022 – Baltic Sea

17

3.2 Description of the scenarios

The scenarios in which the studies in this report have been performed are presented in this

chapter. First, the expected changes in the generation portfolio of the region are explained, followed

by a description of the pan-European TYNDP scenarios.

Building on the previous scenario reports, the cooperative work of gas and electricity planning

experts across Europe and the public consultation, the TYNDP 2022 Scenario Report includes two

COP21-compliant scenarios designed to capture the impact of the fast-moving and fast-paced

energy transition on the electricity and gas infrastructure. The report contains a series of important

highlights for the future of Europe's energy system:

• Net zero can be achieved by 2050 while ensuring the security of the energy supply

• Energy efficiency is key to achieving the EU’s long-term climate and energy objectives

• The ambitious development of renewable energy across Europe

• Integrated energy systems: hydrogen is a game changer for gas and electricity systems

• Innovation is key to achieving a sustainable energy future

3.2.1 Storylines

Storylines aim to ensure that sufficient differences are made between the scenarios by correctly

identifying high-level drivers and quantifying their outcomes. The energy landscape is constantly

evolving and scenarios need to keep pace with the main drivers and trends affecting the energy

system and, in particular, the gas and electricity infrastructures. Based on engagement with the

stakeholders, ENTSOG and ENTSO-E identified four high-level drivers:

• The green transition determines the level of GHG reduction targets and is one of the most

important political drivers of the energy scenarios.

• Beyond climate targets, the European energy system will be increasingly shaped by societal

decisions and initiatives.

• Energy intensity is a result of innovation and consumer behaviour and may have a major

effect on transitions in the energy system.

• Technological progress is a driver of energy system evolution.

3.2.2 Scenarios cover different time horizons

For both 2024 and 2025, ‘best estimate’ scenarios were developed. For the quantification of this

time horizon, ENTSOG and ENTSO-E used data collected from the TSOs. These figures reflect the

national and European regulations in place at the end of 2020. The long-term goals, starting from

2030, are covered by three different scenarios, reflecting increasing uncertainties towards 2050.

The National Trends scenario is in line with national energy and climate policies (NECPs , national

long-term strategies, hydrogen strategies, etc.) derived from the European targets. The electricity

and gas datasets for this scenario are based on figures collected from the TSOs and translate the

latest policy- and market-driven developments discussed at the national level. The National Trends

scenario is quantified using electricity and gas up to 2040.

Regional Investment Plan 2022 – Baltic Sea

18

In addition to the National Trends scenario, ENTSOG and ENTSO-E have developed two

COP21- compliant scenarios. Both scenarios aim at achieving the 1.5 °C target of the Paris

Agreement following the carbon-budget approach. They are developed on a country level until 2040

and on a EU27 level until 2050.

Distributed Energy pictures a pathway achieving EU-27 carbon neutrality by 2050 and at least a

55% emission reduction by 2030. The scenario is driven by a societal willingness to achieve energy

autonomy based on widely available, indigenous, renewable energy sources. It translates into both

a way-of-life evolution and a strong, decentralised drive towards decarbonisation through local

initiatives by citizens, communities and businesses, supported by authorities. This leads to a

maximization of renewable energy production in Europe and a strong decrease in energy imports.

Global Ambition (GA) pictures a pathway to achieving carbon neutrality by 2050 and at least a 55%

emission reduction by 2030, driven by a global move towards the Paris Agreement targets. It

translates into the development of a wide range of renewable and low-carbon technologies (many

being centralised) and the use of global energy trading as a tool to accelerate decarbonization.

Economies of scale lead to significant cost reductions in emerging technologies such as offshore

wind, but imports of decarbonised energy from competitive sources are also considered viable

options.

Please refer to the Scenario Report and visualisation platform for the results of the three scenarios.

This material will provide an insight into the development and outcomes of the scenarios mentioned

in this report.

3.2.3 Key findings of the scenarios for the Baltic Sea region

The main drivers for change in the regional generation portfolio are explained in this chapter as a

basis for the regional scenarios. The challenges expected due to these changes are then elaborated

on in Chapter 3.1.2. The main drivers of change in the Baltic Sea region are related to climate policy,

which is stimulating the development of more RES and a common European framework for the

operation and planning of the electricity market. The main structural changes anticipated in the Baltic

Sea region power system in the future relate to the following:

• Strong increase in RES generation

− An increased share of renewable sources in the power system is shown in all

scenarios

− Additional wind power generation will occur mainly in the northern and middle part of

the region, which is located farther away from the main load centres in the middle and

southern parts of the region

− PV capacity will be mainly increased in the middle and southern part of the region

• Reduction of thermal power capacity

− Decommissioning of old lignite, hard coal and oil-fired power plants

− Full decommissioning of all nuclear power plants in Germany by the end of 2023

− Four nuclear units in Sweden, with a total capacity of 2900MW, were

decommissioned in the period 2015-20. The remaining six units are expected to reach

the end of their technical lifetimes around 2040

• New large generating units

− New nuclear capacity is being built in Finland, with one unit of 1600MW anticipated

to be commissioned in 2022

Regional Investment Plan 2022 – Baltic Sea

19

− Before 2040, new nuclear-generating units will be built in Poland, with a total installed

capacity of 4400 MW

− Large wind power generation units are planned throughout the Baltic States region

• Significantly increased battery storage capacities are to be achieved through technological

advances in all scenarios to serve the flexible RES power generation

• An increased capacity for hydrogen production will receive attention in all scenarios

• Power to gas generation capacities will increase sharply, but mainly in the Distributed Energy

scenario

Variable renewables will account for an increased share of energy generation

Historically, the development of renewable generation has been based on subsidies. Lower

development costs, gradual improvements in solar cell efficiency and increasingly larger wind

turbines with a higher number of full-load hours will reduce the overall costs per MWh for both solar

and wind power. Today, solar power and wind power, if located favourably, can be profitable without

the need for subsidies. This is leading to changes in their geographical distribution as it is more

profitable to develop solar and wind power in the locations with the best conditions and lowest costs.

For example, there is much interest in greater development in the Nordic and Baltic regions, which

have some of the best wind resources in Europe. Development can proceed very rapidly, with some

market participants already planning to build new wind turbines without subsidies.

Nuclear phaseout continues in Sweden, while Finland and Poland build new capacity

Nuclear power in Sweden and Finland plays a key role in the Nordic power system. It represents

25% of overall annual power generation in the Nordic countries. Nuclear power delivers a stable and

predictable baseload near consumption centres, and its contribution during dry years is important.

Moreover, the power plants contribute stability to the Nordic grid, and many are strategically located

in areas where they can fully support the capacity of the power grid.

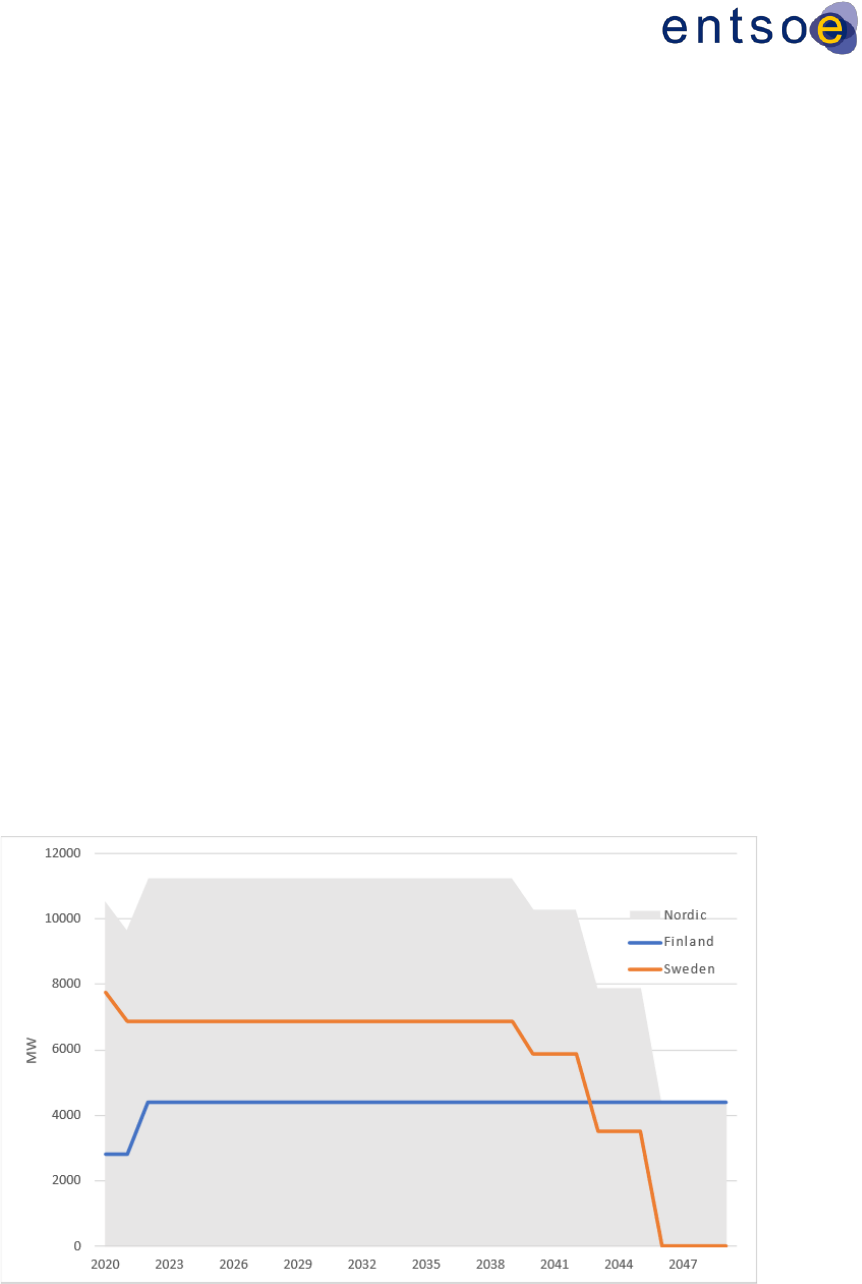

Figure 3-8: Expected developments in Nordic nuclear power capacity from 2020 to 2050 used in the scenario

building, based on an expected lifetime of 50 to 60 years

Regional Investment Plan 2022 – Baltic Sea

20

The further development of nuclear power in Sweden and Finland is a key uncertainty in the

Nordic power system and the market. All of the current active reactors started operating between

1972 and 1985, with a planned lifetime of 50 to 60 years. Swedish nuclear power plants have been

under financial strain in recent years due to low power prices, increased taxes and high capital costs

from earlier investments in maintenance and capacity extension. As a result, four reactors with a

total capacity of 2900MW were decommissioned during the years 2015–2020. This means that

energy generation will decline from 65TWh a year currently to approximately 50TWh. Furthermore,

a Swedish energy policy implemented in the summer of 2016 included the decision to remove the

special tax on output, which had a severe impact on nuclear power (Figure 3.8).

In Finland, there is some political support for further investment in nuclear power. However,

the Hanhikivi 1 NPP project (1200 MW) was recently cancelled due to the Russia-Ukraine war.

Olkiluoto 3 (1600 MW), on the other hand, will be in operation before any older nuclear plants are

decommissioned.

In addition to the massive development of renewable sources, an important element in the

transformation of the energy generation sector in Poland is the development of nuclear power plants.

On 2 October 2020, the Council of Ministers approved the Polish Nuclear Power Program (PPEJ),

which sanctioned the construction of nuclear power plants with a total capacity of approx. 6–9 GW.

According to the provisions of the PPEJ, the first nuclear power unit is to be commissioned in 2033.

The next units are to be put into operation every two years until 2043. In 2040, nuclear power plants

with a total capacity of 4400 MW are expected to be built in Poland.

Reduced utilisation hours for thermal capacity and flexibility needs

The continental and Nordic markets currently have sufficient thermal production capacity to

cover demand during periods of low production from variable renewable sources or dry years with

low hydro production. The increasing share of variable renewables is reducing both the usage and

profitability of thermal plants, and a significant share of thermal capacity will probably be shut down.

This will, in turn, reduce the capacity margin (the difference between the available generation

capacity and consumption) in the day-ahead market and will result in tighter margins. This type of

situation is particularly observed in Poland, where the capacity margin will decrease drastically with

the increase in installed RES in the country's system.

The high percentage of hydro production with reservoirs in the Nordic region provides large

volumes of relatively cheap flexibility, both in the day-ahead market and during operational hours. In

addition to hydropower, flexible coal and gas power plants also provide both long- and short-term

flexibility, though at a higher cost than hydropower. Until now, the flexibility from hydro plants with

reservoirs has been enough to cover most of the flexibility needed in Norway and Sweden, as well

as a significant proportion of the flexibility demand in Denmark, Finland and the Baltic countries. This

has resulted in relatively low price volatility in the day-ahead market and made possible the balancing

of costs. A higher market share of variable renewables will be the main driver of increased demand

for flexibility because the flexibility provided by existing hydro plants is limited and thermal capacity

is declining.

3.2.3 Technical challenges of the power system

Two significant changes in the Baltic Sea region challenge the power system’s further

development needs. The biggest challenge in the region as a whole is how to cope with a significant

increase in RES generation. The majority of the future RES increase will come from solar and

onshore and offshore wind. The current mainland transmission network might not be suitable and

sufficient for offshore wind, and therefore offshore grid developments are inevitable. The increasing

Regional Investment Plan 2022 – Baltic Sea

21

share of RES in the generation portfolio will be connected with the grid as power park modules. This

means that they will be converter coupled and therefore will not provide natural short circuit and

inertia support. This technological change might bring new challenges related to frequency stability

and the minimum short circuit power necessary to operate equipment in normal conditions. The

power park modules and the required capabilities are specifically described in the EU Requirements

for Generators (RfG) code. A power park module (PPM) means a unit or ensemble of units

generating electricity that is either non-synchronously connected to the network or connected

through power electronics and also has a single connection point to a transmission and distribution

system, whether a closed distribution system or HVDC system (Article 2(17) of the Network Code

on Requirements for Grid Connection of Generators).

1

Besides the change in the technical

characteristics of the power system, the change in RES will result also in higher price volatility and

sudden changes in power flow in different parts of the power system depending on the location of

the RES source in given weather conditions. It is also very difficult to plan and predict exact flow

patterns as weather conditions are indefinite. Therefore, the system must develop sufficient

transmission capabilities to cope with high and changing flows and the ability to compensate for the

risks deriving from changes in system characteristics such as inertia and short circuit power.

The second big technical challenge which primarily affects the Baltic States is the Baltics’

power system synchronisation with the continental Europe synchronous area, which will require

several technical and system changes. A more specific technical solution and plan are described in

the separate synchronisation project in Chapter 4.1. Considered separately, the Baltic power system

is rather small, with a peak load of roughly 5GW. Historically, it has operated as part of the Russian

power system IPS/UPS, in which the responsibilities are divided differently than in the EU system.

So, a major challenge will be the change in the way that the system will be operated. In the Russian

system, the frequency is controlled centrally, while in the EU the responsibility is shared

proportionally among the members connected to the same synchronous area.

Due to the technical solution chosen for the future synchronous interconnection between

Lithuania and Poland, there is a small but still significant probability that the Baltics could be

disconnected from the continental synchronous system and placed in island operation mode during

an exceptional contingency which tripped the only double-circuit, high-voltage, 400kV overhead line

that connects the Baltics with the rest of Europe. This situation could, technically, be handled, but it

is a big technical challenge that will require additional technological investment in enabling sufficient

system inertia and limiting the Rate of Change of Frequency (RoCoF) to an acceptable level and

allowing superfast activation of countermeasures to restore the system balance and frequency

stability. Technical challenges presented by increases in RES generation that have been identified

by TSO experts include:

• Frequency stability issues due to reduced inertia, increased deviation range and ramp rate

of generation and larger contingencies;

• Voltage stability issues due to longer transmission paths and reduced voltage control near

load centres; and

• Angular stability issues, due to reduced minimum short circuit current levels.

New interconnections and synchronous condensers with increased inertia are part of the

solution when it comes to providing flexibility, while factors such as energy and electricity storage

and demand response can also help balance energy levels. From a dynamic stability perspective,

the flexibility needed to keep the power system running when the penetration of synchronous

machines is reduced can be provided by RES generation units, the use of flexible AC transmission

1

Source (footnote): https://www.emissions-euets.com/internal-electricity-market-glossary/830-power-park-module-ppm

Regional Investment Plan 2022 – Baltic Sea

22

(FACTS) devices, controlling HVDC links and using solutions such as dynamic line rating and special

system protection schemes. Decreases in inertia, short circuit power and voltage regulation near

load centres are a few of the main issues that must be solved as the generation portfolio becomes

increasingly CO2-free.

Decreased inertia

One of the major challenges identified is the decrease in inertia when synchronous

generation decreases and converter-connected generation increases within the system. Inertia is

the kinetic energy stored in the rotating masses of machines, and the inertia of a power system

resists the change in frequency after a step change in generation or load.

Too little inertia can lead to frequency instability, in which a sudden change in generation and

load balance results in unacceptable frequency deviations and, potentially, cascading tripping in the

system elements and possible blackouts in worst-case scenarios. The low-inertia situation is only

expected in the Nordic synchronous system in the medium term, and in the event of island operation,

also in the Baltic system. The amount of inertia in future Nordic synchronous power systems has

been analysed by the Nordic TSOs.

One of the possibilities for compensating for the decrease in system inertia is to provide a

temporary, fast-response, active power injection from the wind production units, decoupled from the

grid with converter technology. The temporary boost of active power support following a sudden

decrease in frequency could be achieved by utilising the kinetic energy stored in the wind turbine

rotors and generators. Reaction time and control would not be instantaneous but with today’s

advanced power electronics should be fast enough to support the system and prevent sudden

frequency drops. This method of control could cause a slight decrease in power output after the

utilisation of the stored kinetic energy of the rotating turbines as the wind turbine blades would not

be rotating at the optimal speed for achieving maximum production at certain wind speeds. The

maximum output would typically be restored in a very short time (several tens of seconds) after the

use of the synthetic inertia. In case of further RES increases, synthetic system inertia could be

considered as a basic function for rotating RES units decoupled through power electronics.

Decreased voltage regulation near load centres

Much planned wind power production is located far from the load centres where the

conventional units are and have traditionally been located. Therefore, a large extension of reactive

power compensation devices will be necessary because power will have to be transmitted over long

distances and the dynamic voltage support will be less than with the conventional units. For example,

in both Germany and the Nordic countries, wind power from northern areas will need to be

transmitted to load centres in southern areas.

Decreased minimum short circuit power

Directly connected synchronous generators provide short circuit current and voltage support

regulation during faults that are necessary for the normal operation of certain types of converter

technologies to avoid commutation failures. Insufficient short circuit power support might lead to the

tripping of the line-commutated converters (LCC), which are technology-based. Furthermore, when

the penetration level of converter-connected power generators is very high, the form of the fault

current is determined by the controls of the converters and not by the short circuit output of rotating

machines, which can cause issues with the protection devices that are designed to work in a system

based on synchronous machines. When designing future power systems, these technical issues

should be studied in more detail and sufficient countermeasures developed.

Regional Investment Plan 2022 – Baltic Sea

23

3.3 Regional System Needs

This chapter illustrates and explains the results of the regional studies. It is divided into two

sections. Subchapter 3.3.1 describes the future capacity needs that were identified during the IoSN

process. Subchapter 3.4 provides the detailed outcomes of the IoSN that relate to market results.

3.3.1 Future capacity needs

The Baltic Sea region’s energy system is in flux. Over recent years, onshore wind capacity

has been added at an increasing rate. More recently, in parts of the region, offshore wind generation

has been developed in significant quantities. The expansion of renewable generation, alongside

existing hydro generation, is providing the region with increased amounts of ‘clean’ energy. Thermal

generation may be largely phased out. Finally, nuclear generation is undergoing major restructuring.

It will be discontinued in Germany by the end of 2022. In Sweden, some nuclear units have been

decommissioned for economic reasons, but the remaining capacity is expected to be available until

around 2040 when the units’ technical lifetimes are reached. All of the shifts in generation described

above are expected to become more pronounced in the future. In addition, electricity consumption

is changing due to increasing electrification in industry and transportation and the entry of consumers

into the production system as prosumers.

Different scenarios have been developed to analyse future capacity needs. Potential

changes in both generation and consumption are described in the first phase of the TYNDP 2022

process through the construction of new scenarios for 2030 and 2040 and the assessment of system

needs for the long-term 2040 horizon. Cross-border capacity increases are expected to have a

positive impact on the system in most of the development scenarios and various climate years. A

European overview of these increases is presented in the European IoSN developed by ENTSO-E

in parallel with the RegIPs. Figure 3-9 shows all of the projects of the TYNDP 2022 program. LasGo-

Link – the blue interconnector between Sweden (via Gotland) and Latvia – is not part of the national

development plan in Sweden. The Swedish TSO, Svenska kraftnät, earlier this year (February 2022)

rejected a grid connection inquiry from the promotor of the project.

Regional Investment Plan 2022 – Baltic Sea

24

Figure 3-9: TYNDP 2022 project list

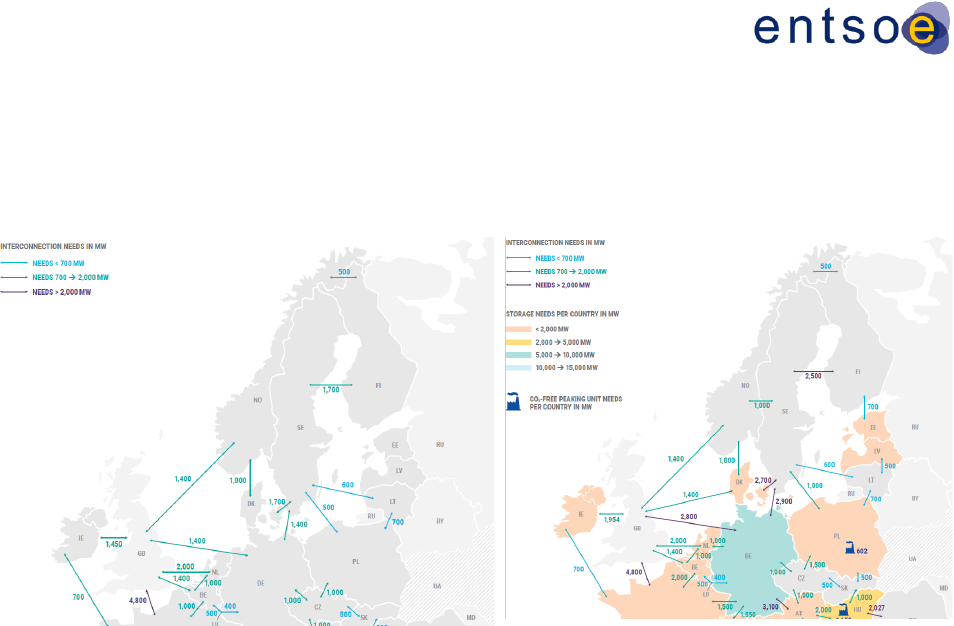

Projects categorised as ‘Under construction and ‘In permitting’ are part of Reference Grid 2025 and

are assumed to have been built by 2025. Figures 3-10 and 3-11 show the identified capacity

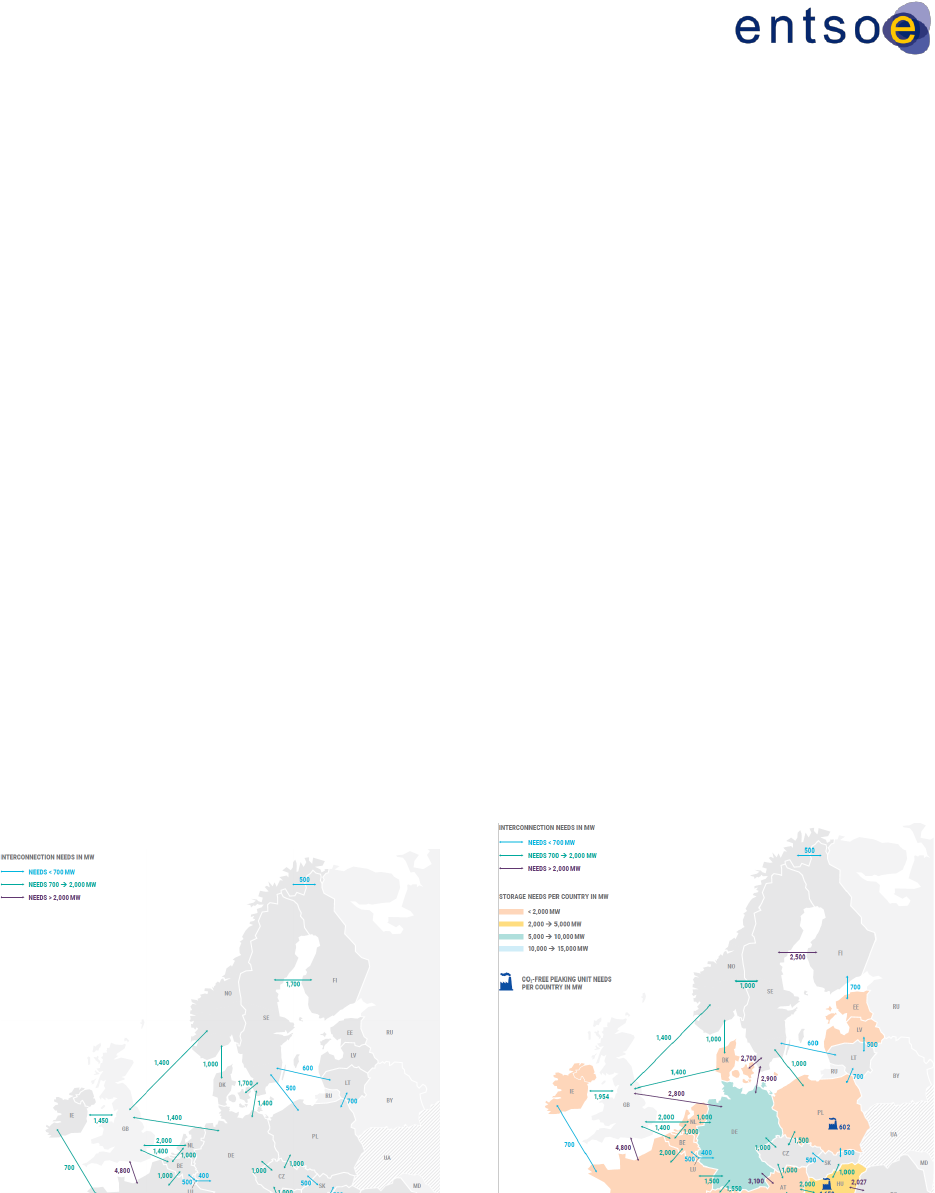

increases between 2030 and 2040 for the Baltic Sea region.

Figure 3-10: Identified capacity needs in 2030

Figure 3-11: Identified capacity needs in 2040

These figures are based on the 2030 and 2040 Pan-European System Needs analyses and

assume that the Reference Grid 2025 is already realised. They also show the effect on those

boundaries when another IoSN grid solution that is not part of the IoSN economic needs solution

would have similar benefits. This so-called upper bound capacity does not represent an alternative

grid solution but rather a different combination of increased boundary capacity, which would lead to

slightly more expensive benefits. Not all ‘upper bound’ capacity increases could be added to the

IoSN economic needs solution at the same time. However, adding one or two provides benefits

similar to those offered by the IoSN economic needs solution. The two figures show that, based on

the TYNDP 2022 projects, the project promoters and TSOs are partly covering the gap between

today's grid and future needs. However, many projects still need to be realised to meet future needs.

To cope with this long-term generation mix, the interconnected European power systems will need

to solve the following problems through cross-border capacity increases:

1. Insufficient integration of renewables into the power systems as high amounts of curtailed

energy occurred in a couple of power systems;

2. Insufficient market integration, including high system costs in certain market areas and high

price differences between the market areas;

3. High CO2 emissions; and

4. Insufficient cross-border capacities.

The ‘future capacity needs’ identified as part of the IoSN process are mainly due to the

change in the overall situation in the power systems in future scenarios such as load-flow pattern

changes. Therefore, the transmission system elements limiting cross-border capacity in the 2022

time horizon could change in 2040 due to the generation mix change – installed capacities and

locations of the power systems – as well as the partial strengthening of the grid infrastructure.

Regional Investment Plan 2022 – Baltic Sea

25

The effects of identified future capacity needs on the cross-border profiles in the Baltic States

region could potentially be covered, fully or partly, by the future transmission projects included in the

TYNDP 2022 process. If they are not, they will have to be met through future grid development. In

addition, the expectations for increased offshore wind might lead to new types of hybrid projects

combining offshore wind and interconnections between countries. This is to be further investigated.

As part of this work, cross-border capacity increases were identified that will have a positive impact

on the system. A European overview of these increases is presented in the European IoSN report

developed by ENTSO-E in parallel with the RegIPs. The system needs for the 2040 horizon are

evaluated with respect to (1) market integration/socio-economic welfare, (2) integration of

renewables, (3) reduction of greenhouse gas emissions and (4) security of supply. For the Baltic

Sea region, the 2040 needs are primarily anticipated to be met by:

• Synchronisation of the Baltic system with the continental system and further internal

integration within the Baltic region to improve the security of supply;

• Offshore wind parks – if these are realised, the energy will have to be transported to the

onshore system;

• Further Sweden-Finland integration to increase market integration and address the negative

Finnish energy balance;

• Further integration between Sweden and Germany due to price differences and for better

optimisation of RES generation (hydro/wind);

• Further integration between Sweden and Denmark due to price differences and for better

optimisation of RES generation (hydro/wind);

• Further integration between Denmark and Norway due to price differences and for better

optimisation of RES generation (hydro/wind);

• Further integration between Sweden and Norway due to price differences;

• Further integration between Sweden and Lithuania due to price differences and for better

optimisation of RES generation;

• Further integration between Sweden and Poland due to price differences;

• Further integration between Poland and Lithuania due to price differences and for better

optimisation of RES generation;

• Further integration between Lithuania and Latvia due to higher market integration for and

optimisation of RES generation;

• Further integration between Estonia and Finland due to price differences and for better

optimisation of RES generation.

The IoSN results are very much dependent on the scenario assumptions. For some of the

results, the trends are not fully aligned with the scenario assumptions made two years ago. The

offshore wind goals and development within each country have become more progressive. Also, the

fact that the IoSN analysis is based on only three climate years makes some of the results less

reliable than through the scenario process. In addition, internal costs are not fully taken into account

for several of the investigated borders – for example, Norway–Finland and Sweden–Finland. These

corridors require further investigation. The potential for increasing transmission capacity on the LT-

PL connection relates to the possibility of unblocking these capacities on the existing LitPol Link

connection. This is linked to increasing the resilience and robustness of the Baltic States’ grid after

synchronisation with continental Europe through this connection and the step-by-step release of

transmission capacity for trade. The needs for the region, detailed in the 2040 pan-European IoSN,

are partly covered by projects already waiting to be assessed in TYNDP 2022. Table 3-1 shows

cross-border capacities, including increases identified during the TYNDP 2022 process. The

columns in the table show the capacities relevant for the cost-benefit analysis (CBA), which will be

carried out on the 2030 and 2040 time horizons.

Regional Investment Plan 2022 – Baltic Sea

26

Border

NTC 2030

NTC 2040

=>

<=

=>

<=

DE-DEkf

400

400

400

400

DE-DKe

600

600

600

600

DE-DKw

3500

3500

3500

3500

DE-NSWPH

0

0

6000

6000

NSWPH-DKw

0

0

2000

2000

DEkf-DKkf

400

400

400

400

DE-Nos

1400

1400

1400

1400

DE-PLE

0

3000

0

3000

DE-PLI

2000

0

2000

0

DE-SE4

1315

1315

2015

2015

DKe-DKkf

400

600

400

600

DKe-DKw

600

590

600

590

DKe-SE4

1700

1300

1700

1300

DKw-NOs

1632

1632

1632

1632

DKw-SE3

715

715

715

715

EE-FI

1016

1016

1716

1716

EE-LV

1100

900

1100

900

FI-SE1

2000

2000

2800

2800

FI-SE3

1200

1200

1600

1600

LT-LV

800

950

800

950

LT-PL

700

700

700

700

LT-SE4

700

700

700

700

NL-Nos

700

700

700

700

NOm-NOn

1300

1300

1300

1300

NOm-NOs

1400

1400

1400

1400

NOm-SE2

600

1000

600

1000

NOn-SE1

700

600

700

600

NOn-SE2

250

300

250

300

NOs-SE3

2145

2095

2145

2095

PL-SE4

600

600

600

600

SE1-SE2

3300

3300

3300

3300

SE2-SE3

8100

8100

8100

8100

SE3-SE4

6200

2800

6200

2800

UK-NOs

2800

2800

2800

2800

DKw-NL

700

700

700

700

NSWPH-NL

0

0

4000

4000

Regional Investment Plan 2022 – Baltic Sea

27

DKw-GB

2800

2800

2800

2800

Table 3-1: Cross-border capacities relevant for the cost-benefit analysis, which will be carried out on the

2030 and 2040 time horizons

3.4 Market results of IoSN 2030 and 2040

The market simulations have been carried out using the Antares pan-European, open-source

market model, with a publicly available expansion module. The market results show that the

identified investments in the 2030 and 2040 grid will significantly decrease the general level of prices,

the amount of curtailed energy and the amount of CO2 emissions, compared to the No grid (after

2025) scenario. The three future grid development scenarios envisioned in the IoSN study have

been analysed in detail and are described and explained in the IoSN main report.

The outcomes of the economic optimization (from here on called the Economic grid) can be

compared with the case in which there is no further extension of the current grid after 2025 (from

here on called No grid) and the case in which only the currently planned grid investments are made

(from here on called the Portfolio grid).

Important observation: The results of the analyses of Norway, Sweden and Finland

present possible inconsistencies. ENTSO-E will further investigate them during the public

consultation period. These potential inconsistencies especially influence generation figures,

net balance and marginal cost.

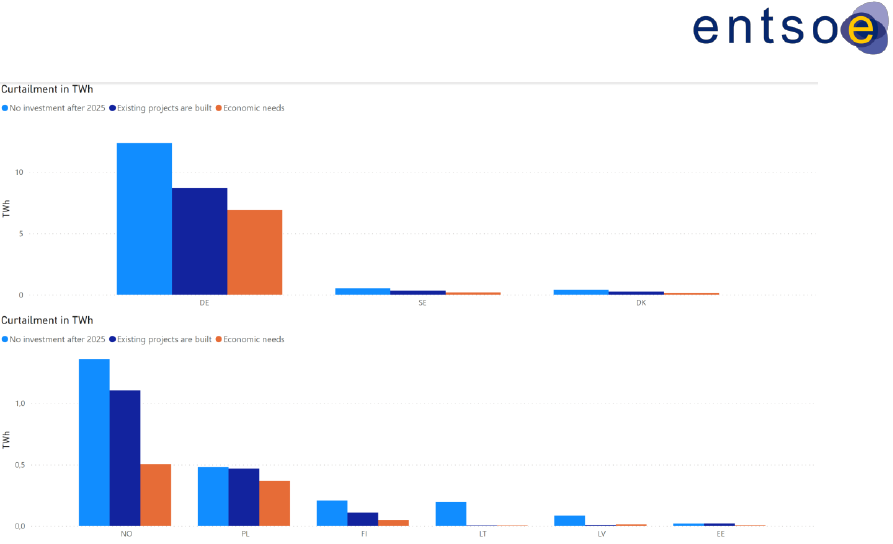

Curtailed energy

The amount of curtailed energy decreases substantially in the IoSN in the Economic grid and

Portfolio grid scenarios, compared to the No grid scenario. Figures 3-12 and 3-13 show the curtailed

amounts of energy for the Baltic Sea region countries during the years 2030 and 2040. Among them,

the most significant energy curtailments have been in Germany, Denmark and Sweden, with

Germany facing the highest curtailments. The new grid capacity up to 2040 helps in situations in

which the RES share is large. In surplus situations in Germany and Denmark, surplus energy could

be exported and mostly stored in hydro reservoirs. In Sweden, curtailed energy decreases since

hydro reservoirs could often be full in a RES surplus situation. Therefore, increasing exports to the

rest of Europe will avoid curtailment issues, reducing the risk of having to spill during periods of high

RES. For the majority of the Baltic Sea region countries, the anticipated amount of curtailed energy

would be insignificant.

Regional Investment Plan 2022 – Baltic Sea

28

Figure 3-12: The amount of curtailed energy in the Baltic Sea region with and without identified capacity

increases in 2030

The results indicate that there would still be relatively large amounts of energy curtailment

with the Portfolio and Economic grid scenarios. However, the results likely exaggerate the absolute

level of curtailment since the modelling of wind power, in particular, does not fully consider the

expected increase in full load hours, meaning that the same amount of energy can be produced by

turbines with lower generation capacity. Even if the results are slightly exaggerated, the message is

clear: grid investments are needed to avoid large amounts of wasted renewable energy in the region,

and even more capacity than the 2040 grid may be needed, particularly with considerable variable

renewable generation. However, in a future power system with a very large amount of variable

generation, some curtailment needs to be accepted as avoiding curtailment completely will be too

expensive.

Regional Investment Plan 2022 – Baltic Sea

29

Figure 3-13: The amount of curtailed energy in the Baltic Sea region with and without identified capacity

increases in 2040

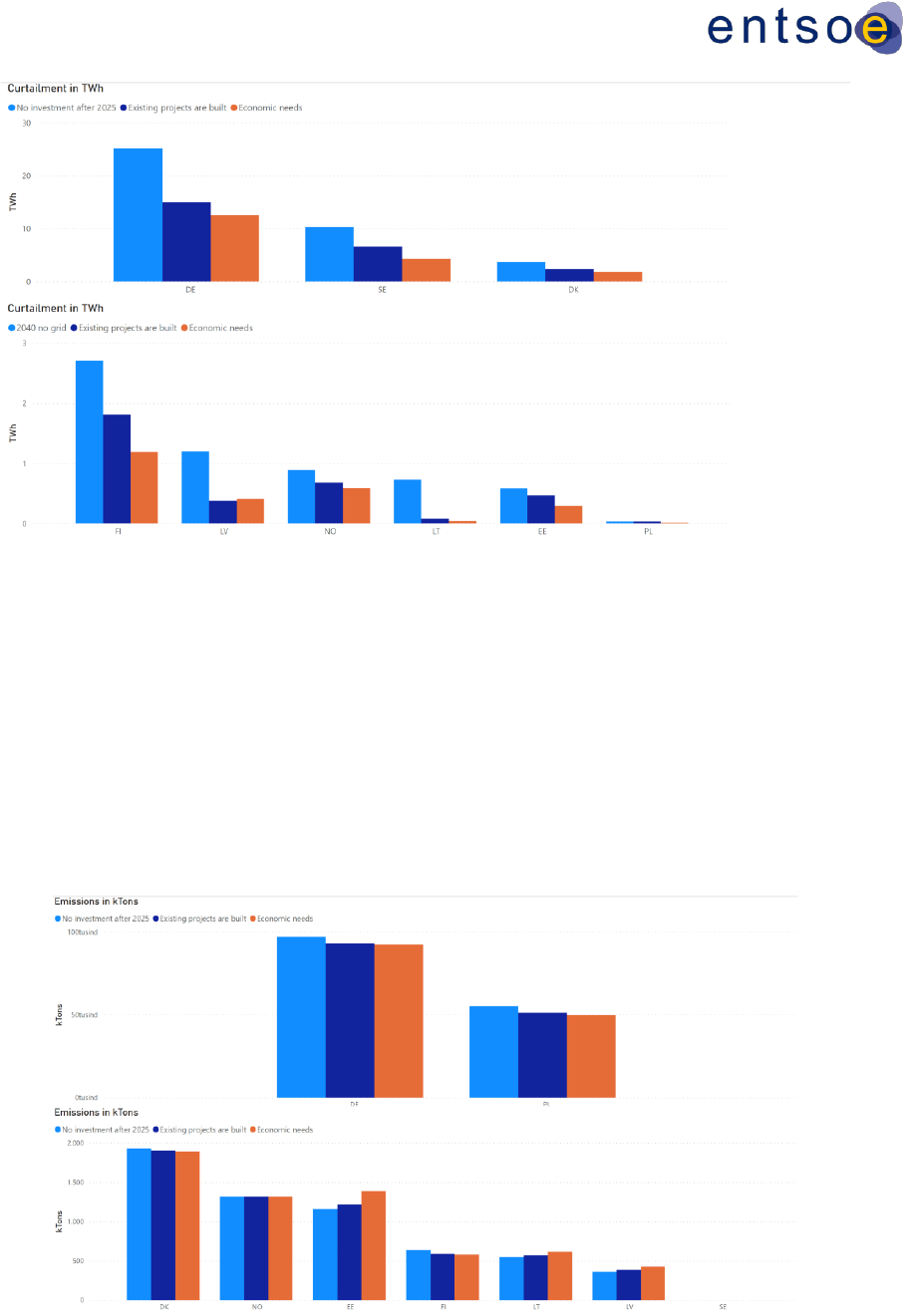

Decreased CO2 emissions

A higher interconnector capacity will also have an impact on CO2 emissions. This is due to

the better integration of zero-emission renewables and the move towards a carbon-neutral Europe,

as well as the increased use of gas in place of coal in thermal generation. There will be some

changes in Germany and Poland, but both countries will still have a significant amount of thermal

capacity in the 2040 scenario. The deployment of renewables has a greater effect on CO2 emissions

than the interconnectors as can be seen in Figures 3-14 and 3-15.

Figure 3-14: CO2 emissions in the Baltic Sea region, based on the IoSN (2030)

Regional Investment Plan 2022 – Baltic Sea

30

Figure 3-15: CO2 emissions in the Baltic Sea region (from the IoSN 2040)

Figure 3-16: CO2 emissions in different European regions (2040)

Regional Investment Plan 2022 – Baltic Sea

31

These figures show that the level of CO2 emissions is neither particularly high nor particularly

significant for the Baltic States and the Nordic countries and that both regions emit very low levels

of CO2 emissions. As CO2 emissions levels move towards zero, both regions are on course to meet

their EU 2050 CO2 emissions reduction targets. In contrast, both Germany and Poland have high

CO2 emissions levels, which will vary widely in the future depending on grid expansion. The reason

for these high CO2 emissions is the production of fossil fuels – lignite, coal and gas. Additional cross-

border capacity increases from Germany to the Nordic countries could reduce these CO2 emissions

levels. Comparing all scenarios for Germany and Poland, CO2 emissions are slightly reduced when

cross-border capacity is increased. However, more significant reductions can be seen if coal, gas

and lignite generation is reduced and replaced with CO2-free generation sources. For the other

countries, additional capacity increases will not significantly reduce the level of CO2 emissions.

Improved market integration and decreased average prices

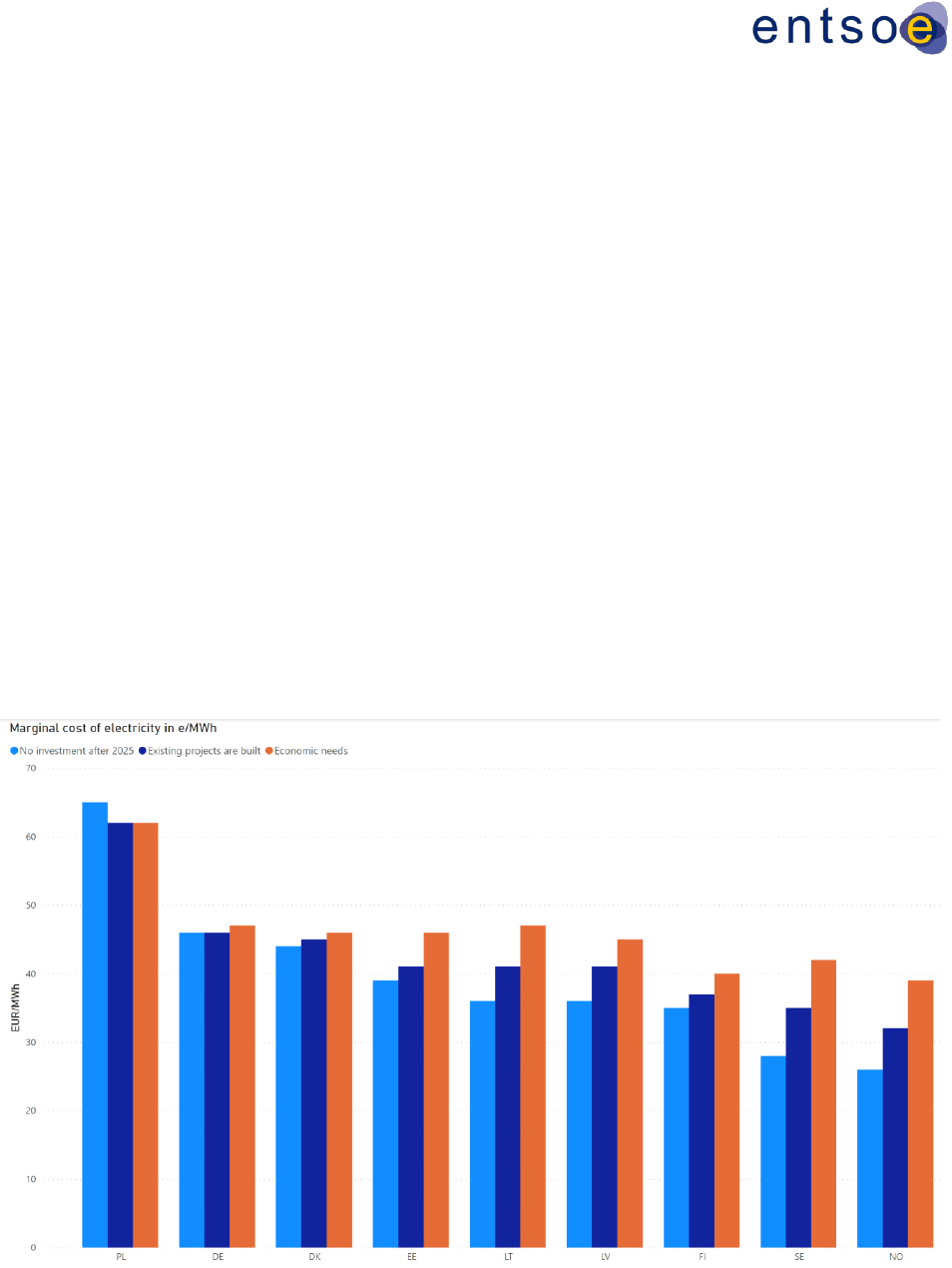

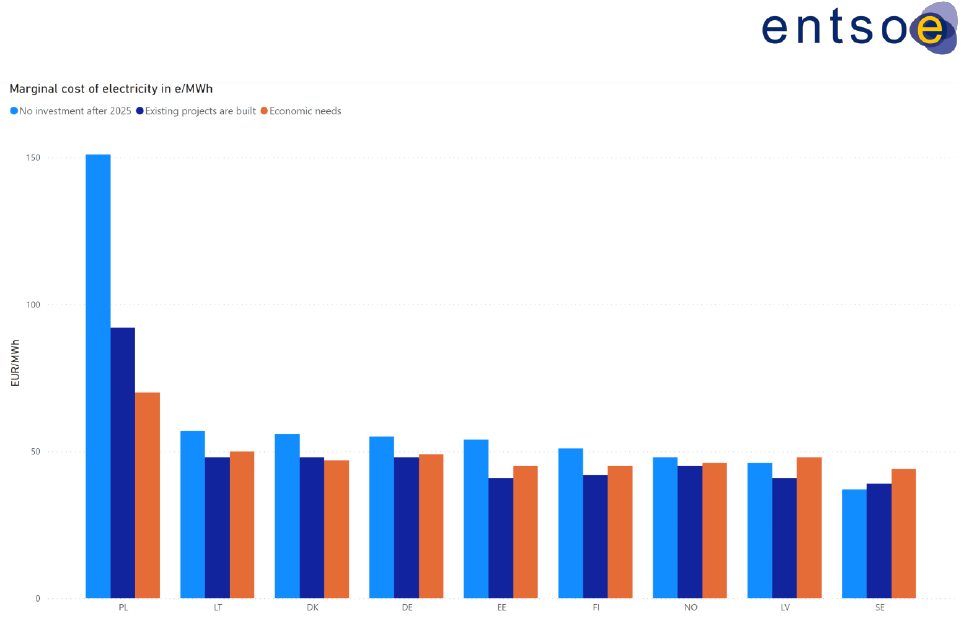

As shown in Figures 3-17 to 3-20, the average price differences decrease when the

transmission network is expanded and new cross-border capacities are introduced. More

interconnector capacity between countries will reduce price differences and help develop a more

effective and integrated market. Therefore, it will be possible to import/export more power within a

shorter period when price differences are high, such as during dry years with higher prices in the

Nordic regions or periods when the variation in renewable production is high. The hydro-based power

market in the Nordics will become more integrated than the more thermal-based market in

continental Europe, and price variations between wetter and drier years will be lower.

Due to the potential errors observed in the hydro-modelling of the Nordics, the results for

some countries (especially Norway and Sweden) are not reliable.

Figure 3-17: Yearly average of marginal cost (€/MWh) identified in the Baltic Sea region (from the 2030

IoSN)

Regional Investment Plan 2022 – Baltic Sea

32

Figure 3-18: Yearly average of marginal cost (€/MWh) identified in the Baltic Sea region (from the 2040

IoSN)

On average, in the 2040 Portfolio grid scenario, marginal cost levels in the Baltic Sea region

countries are relatively close to each other. It should be noted that the results are very sensitive to

assumptions made regarding fuel and CO2 pricing. To integrate electricity markets and harmonise

marginal costs between the country groups within the Baltic Sea region, additional capacity

increases in these groups will be necessary.

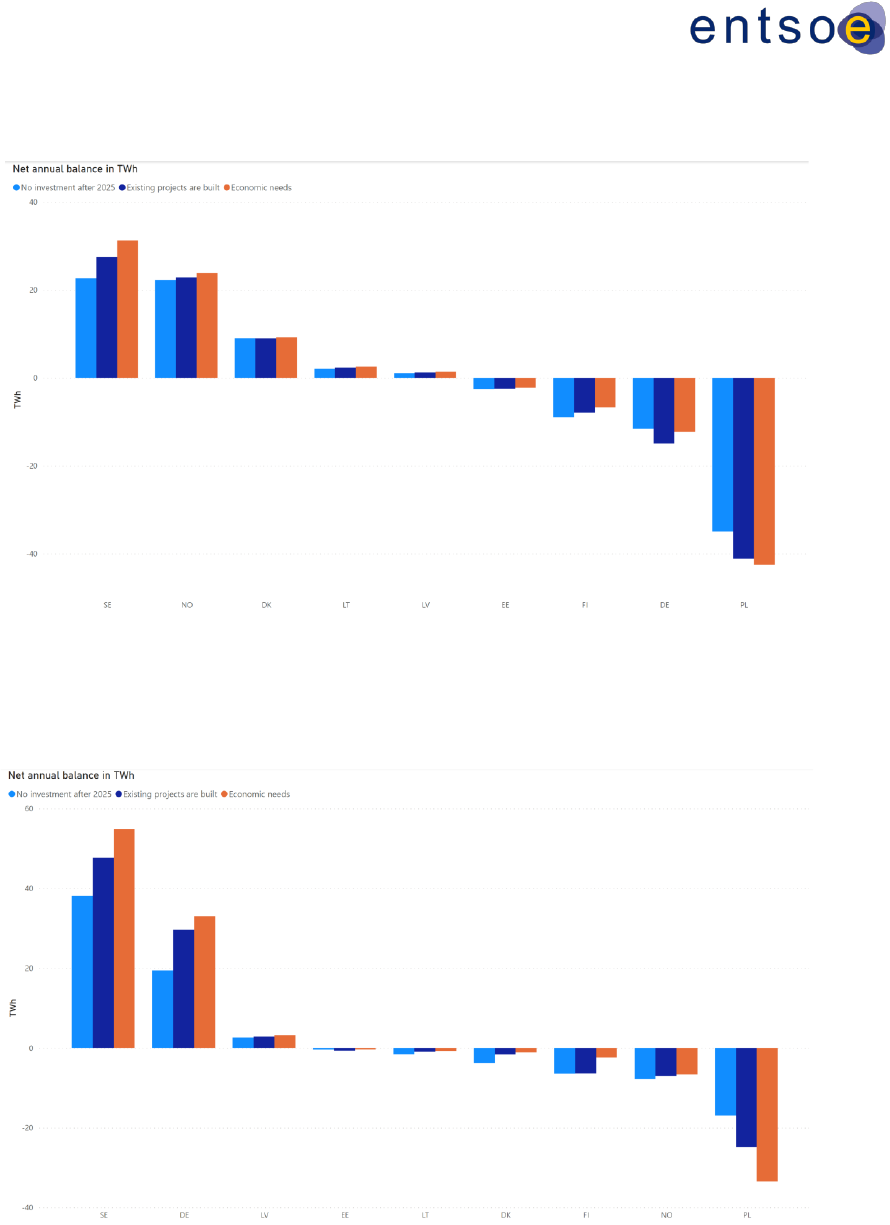

A surplus in the western part of the region and a deficit in the eastern part

The net annual country balance in different investment scenarios shows that the main

electricity producers in the Baltic Sea region are Denmark, Norway and Sweden. Their export

amounts exceed their import amounts, and their energy is transmitted to Poland, Finland and

Germany (Figures 3-19 and 3-20). In the IoSN, the assumptions were slightly different from those

that have been made previously, and the change between climate years wasn’t given as important

a role as it should have been. Sweden will maintain a net annual surplus despite a reduction in

nuclear capacity by 2040. Depending on the scenario, the annual country balance will mostly hover

around zero for Lithuania, Estonia and Latvia. The annual balances for these countries will be very

close to zero because they have relatively small power systems compared with Germany, Norway,

Poland, Finland and Sweden. A significant amount of imported electricity is expected for Poland in

all scenarios. In Poland, domestic coal-fired generation will be partially replaced by imports. In

Finland, the balance will be close to 2015 levels as increases from new wind and nuclear generation

will be offset by growth in demand, as well as the decommissioning of existing nuclear and CHP

generation by 2040.

Regional Investment Plan 2022 – Baltic Sea

33

The potential errors observed in the hydro-modelling of the Nordic countries make the results

reported for them, especially for Norway and Sweden, unreliable.

Figure 3-19: Net annual country balance (export and import in wet climate year) in the IoSN Economic grid

scenario (2030)

Figure 3-20: Net annual country balance (export and import in wet climate year) in the IoSN Economic grid

scenario (2040)

Regional Investment Plan 2022 – Baltic Sea

34

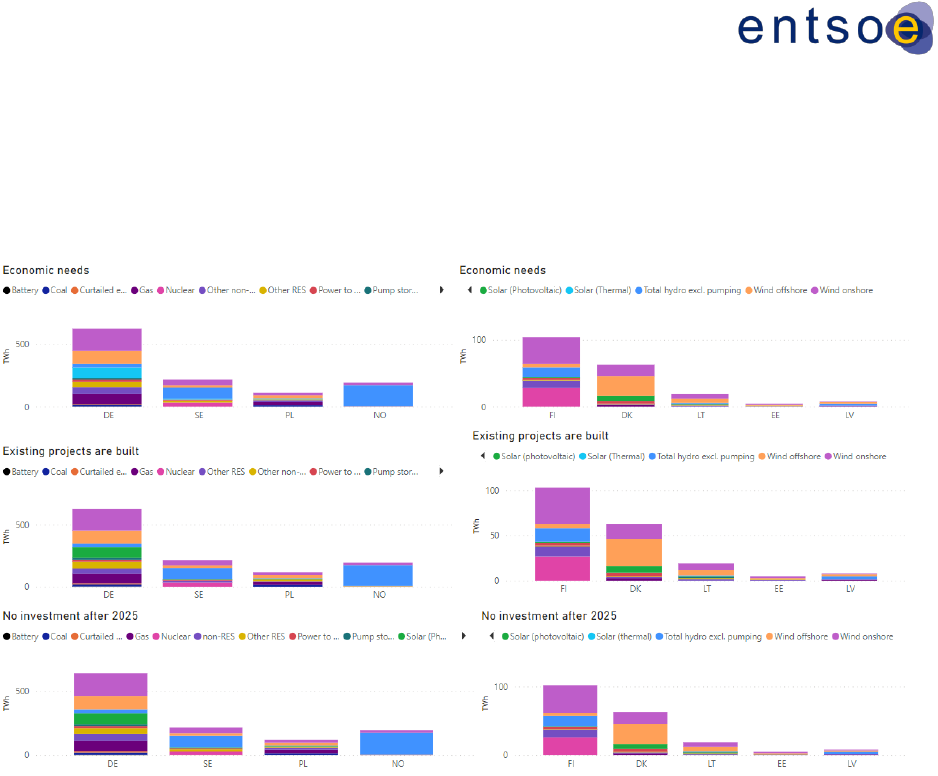

Electricity generation in all these countries will be based on offshore and onshore wind and

solar energy, hydropower and hydro storage, and biomass generation. The anticipated production

mixes from the IoSN 2030 and 2040 Economic grid scenarios are presented in Figures 3-21 and 3-

22. Hydro generation will have a major role in Norway and Sweden. Nuclear generation will continue

up to 2040 in Finland and Poland. The generation mix doesn't change significantly for most of the

Baltic Sea region countries among the scenarios.

Figure 3-21: Generation mix in TWh in the Baltic Sea Regional Group in the IoSN Economic grid scenario

(2030)

Regional Investment Plan 2022 – Baltic Sea

35

Figure 3-22: Generation mix in TWh in the Baltic Sea Regional Group in the IoSN Economic grid scenario

(2040)

Grid extension could reduce system costs

Figures 3-23 and 3-25 display the change and comparative system costs in the different

scenarios for the countries of the Baltic Sea area for the years 2030 and 2040. The system costs will

decrease for several countries with increasing grid development (Germany and Poland and, to a