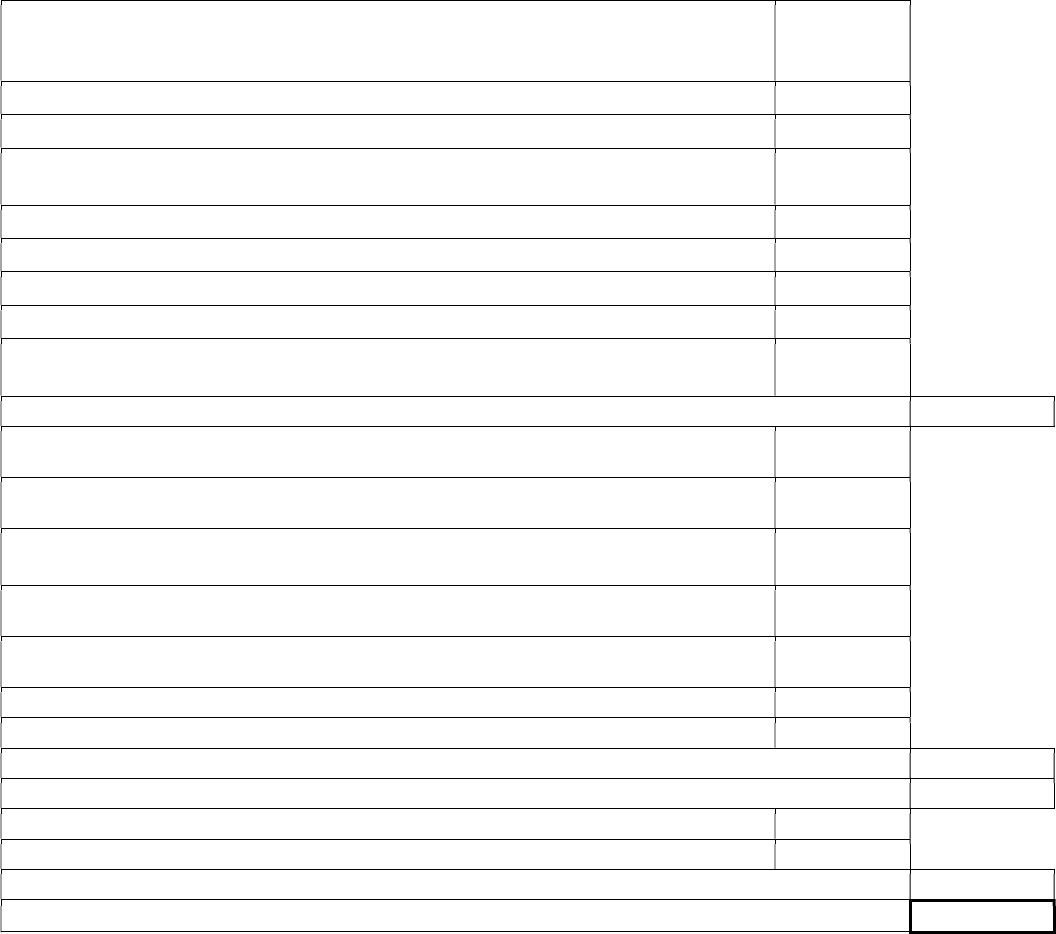

SAN FRANCISCO GROSS RECEIPTS WORKSHEET (EDITED 6/12/2023)

BUSINESS ACCOUNT NUMBER: _ _ _ _ _ _ _ BUSINESS ACTIVITY: _______________________

Page 1 of 3

City and County of San Francisco Office of the Treasurer & Tax Collector

EDITED 6/12/2023)

WORKSHEET ONLY – DO NOT FILE

Use this worksheet to calculate your San Francisco gross receipts if you have business activities both inside and outside of San

Francisco. If your business activities are wholly within San Francisco, you are not eligible to allocate or apportion gross receipts.

If you are engaged in multiple business activities complete a worksheet for each business activity to calculate your San Francisco gross

receipts. Note that San Francisco Payroll and Total Payroll in lines A20 and A21 are for all business activities combined, not broken out

by business activity. Sum the results of all worksheets to determine your San Francisco gross receipts.

Part A –Gross Receipts within and outside San Francisco – Enter your gross receipts from within and outside San Francisco for

this business activity. If you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending

on the election you made that governs your California Franchise Tax Board filing for this tax year. Enter amounts only once, even if they

qualify in more than one line.

A1. Sales, including but not limited to revenues received from services provided, from the

lease or rental of equipment, and from dealings in property, if such amount has not been

accounted for in lines A2 through A8.

A1.

A2. Rent received from real property

A2.

A3. Royalties received

A3.

A4. Interest, dividends, and other amounts received from the ownership or sale of financial

instruments

A4.

A5. Amounts distributed from business entities

A5.

A6. Licensing and related fees received

A6.

A7. Commissions

A7.

A8. All taxes and government imposed fees received

A8.

A9. Other amounts that constitute gross income for federal income tax purposes, if not

included above

A9.

A10. Sum of A1 through A9

A10.

A11. Any amount(s) included in lines A1 through A8 that that were received from related

entities, if applicable

A11.

A12. Interest, dividends, and other amounts received from the ownership or sale of financial

instruments that are exclusively derived from the investment of capital

A12.

A13. Allocations of income, gain, and distributions (including returns on capital) received from

a pass-through entity solely because of an investment in that entity

A13.

A14. Distributed share of the gross receipts of a pass-through entity that is also subject to the

San Francisco Gross Receipts Tax

A14.

A15. Receipts from the sale of real property for which the Real Property Transfer Tax was

paid

A15.

A16. Excludable taxes

A16.

A17. Other amounts excludable by law, if part of A10, and if not included in A11 to A16

A17.

A18. Sum of A11 through A17

A18.

A19. Business wide Gross Receipts (Subtract A18 from A10)

A19.

A20. San Francisco Payroll

A20.

A21. Total Payroll

A21.

A22. Payroll Apportionment Percentage (SF Payroll over Total Payroll)

A22.

A23. Multiply line A19 by line A22.

A23.

(Worksheet Continues on Next Page)

$ 0.00

$ 0.00

0.00000000%

$ 0.00

$ 0.00

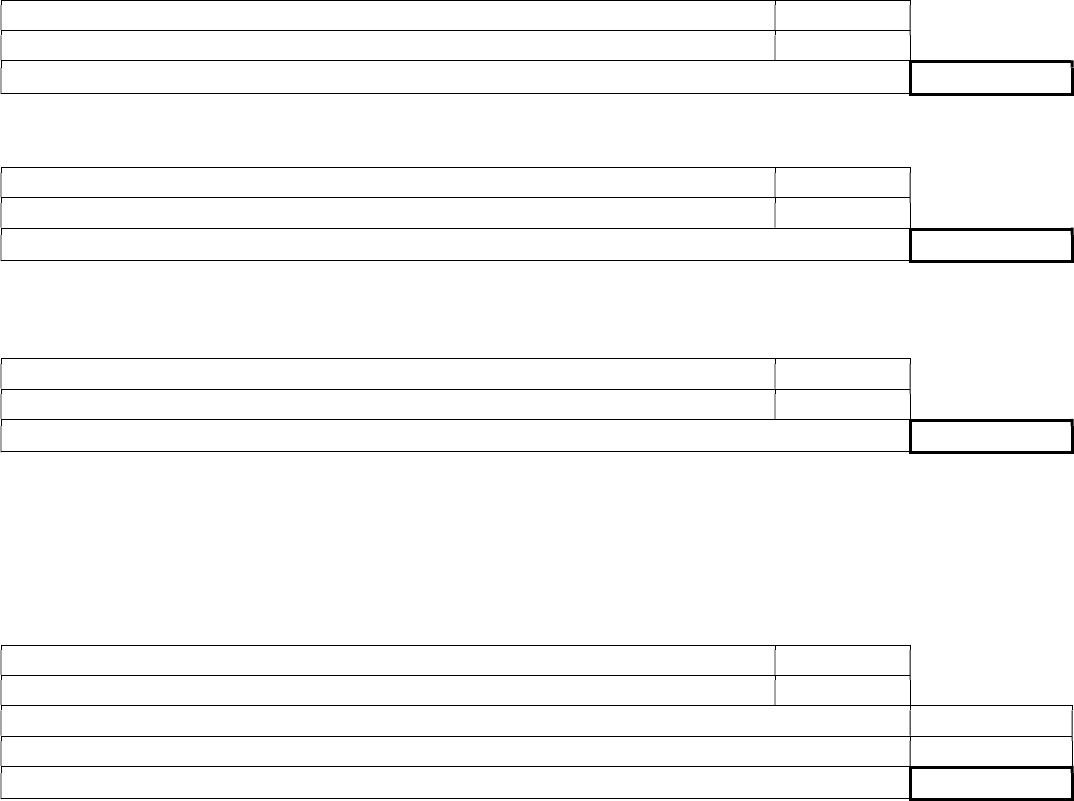

Retail Trade

SAN FRANCISCO GROSS RECEIPTS WORKSHEET (EDITED 6/12/2023)

BUSINESS ACCOUNT NUMBER: _ _ _ _ _ _ _ BUSINESS ACTIVITY: _______________________

Page 2 of 3

City and County of San Francisco Office of the Treasurer & Tax Collector

EDITED 6/12/2023

WORKSHEET ONLY – DO NOT FILE

Part B – Gross Receipts Within San Francisco – Enter your gross receipts allocated to San Francisco from your business activity. If

you have foreign business activities, provide this information on a water’s edge or worldwide basis, depending on the election you made

that governs your California Franchise Tax Board filing for this tax year. Enter amounts only once, even if they qualify in more than one

line.

B1. Sales, including but not limited to revenues received from services provided, from the

lease or rental of equipment, and from dealings in property, if such amount has not been

accounted for in lines 2 through 9

B1.

B2. Rent received from real property

B2.

B3. Royalties received

B3.

B4. Interest, dividends, and other amounts received from the ownership or sale of financial

instruments

B4.

B5. Amounts distributed from business entities

B5.

B6. Licensing and related fees received

B6.

B7. Commissions

B7.

B8. All taxes and government imposed fees received

B8.

B9. Other amounts that constitute gross income for federal income tax purposes, if not

included above

B9.

B10. Sum of B1 through B9

B10.

B11. Any amount(s) included in lines B1 through B8 that that were received from related

entities, if applicable

B11.

B12. Interest, dividends, and other amounts received from the ownership or sale of financial

instruments that are exclusively derived from the investment of capital

B12.

B13. Allocations of income, gain, and distributions (including returns on capital) received from

a pass-through entity solely because of an investment in that entity

B13.

B14. Distributed share of the gross receipts of a pass-through entity that is also subject to the

San Francisco Gross Receipts Tax

B14.

B15. Receipts from the sale of real property for which the Real Property Transfer Tax was

paid

B15.

B16. Excludable taxes

B16.

B17. Other amounts excludable by law, if part of B10, and if not included in B11 to B16

B17.

B18. Sum of B11 through B17

B18.

B19. San Francisco Allocated Gross Receipts (Subtract B18 from B10)

B19.

(Worksheet Continues on Next Page)

$ 0.00

$ 0.00

$ 0.00

Retail Trade

SAN FRANCISCO GROSS RECEIPTS WORKSHEET (EDITED 6/12/2023))

BUSINESS ACCOUNT NUMBER: _ _ _ _ _ _ _ BUSINESS ACTIVITY: _______________________

Page 3 of 3

City and County of San Francisco Office of the Treasurer & Tax Collector

EDITED 6/12/2023

WORKSHEET ONLY – DO NOT FILE

Part C. Allocation and Apportionment

If your business activity is Retail Trade, Wholesale Trade, Manufacturing, Transportation and Warehousing, Information, Biotechnology,

Clean Technology, Food Services, or Utilities, your allocated and apportioned San Francisco gross receipts are one half the amount

determined under Code section 956.1 (allocation) plus one half of the amount determined under Code section 956.2 (apportionment.)

C1. Multiply line A23 by 50%

C1.

C2. Multiply line B19 by 50%

C2.

C3. Sum line C1 and line C2 – These are your San Francisco gross receipts for this business activity

C3.

If you are in the business activity of Accommodations or Real Estate, Rental and Leasing Services, your San Francisco gross receipts

are wholly determined under Code section 956.1(allocation.)

C1. Multiply line A23 by 0%

C1.

C2. Multiply line B19 by 100%

C2.

C3. Sum line C1 and line C2 - These are your San Francisco gross receipts for this business activity

C3.

If your business activity is: Certain Services, Arts, Entertainment and Recreation, Private Education and Health Services, Administrative

and Support Services, Activity Not Listed, Financial Services, Insurance, Professional, Scientific and Technical Services, your San

Francisco gross receipts are wholly determined under Code section 956.2 (apportionment.)

C1. Multiply line A23 by 100%

C1.

C2. Multiply line B19 by 0%

C2.

C3. Sum line C1 and line C2 - These are your San Francisco gross receipts for this business activity

C3.

The amount of gross receipts from construction subject to the gross receipts tax shall be one-half of the amount determined under

Section 956.1 plus one-half of the amount determined under Section 956.2. The amount of gross receipts so determined shall then be

reduced by any amounts which were included in a person's gross receipts within the City pursuant to Section 956.1, and which that

person paid to a subcontractor possessing a valid business registration certificate with the City during the tax year. There shall be no

reduction for any other costs, including without limitation costs for materials, fees, equipment, or other services. In order to claim such a

reduction, a person must maintain an itemized schedule of payments to subcontractors and information sufficient to enable the Tax

Collector to verify that the subcontractor possessed a valid business registration certificate with the City.

C1. Multiply line A23 by 50%

C1.

C2. Multiply line B19 by 50%

C2.

C3. Sum line C1 and line C2

C3.

C4. Amounts included in C2 paid to subcontractors.

C4.

C5. Line C3 less line C4.

C5.

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

Retail Trade