2023 BIRT Summary Page 07-10-2023

Page 1

YOU MUST COMPLETE WORKSHEET "S" and SCHEDULE "C-1"

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Check Box If Applies:

A

ddress Change

A

mended Return

Final Return:

(add Cease Date)

--

MIFirst Name Last Name

Apt / SuiteStreet Address

Zip / Postal CodeStateCity

Business Name

Individual/ Sole

Proprietor

Partnership Estate Trust

Entity Classification (MUST select one):

Corporation

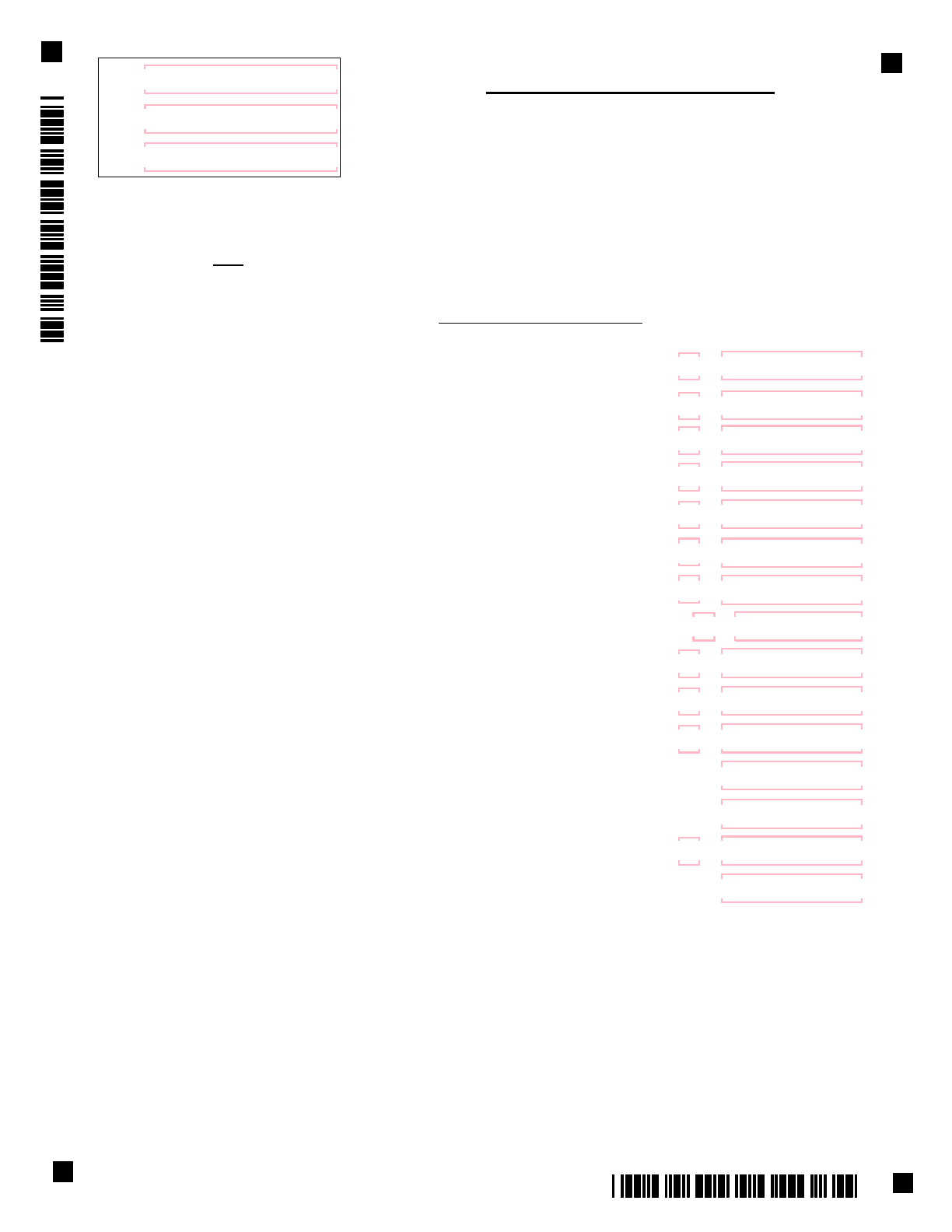

2023 City of Philadelphia BUSINESS INCOME & RECEIPTS TAX

FOR BUSINESS CONDUCTED IN AND OUT OF PHILADELPHIA

PHTIN

EIN

SSN

2023 BIRT

DUE DATE: APRIL 15, 2024

Taxpayer E-mail Address

1. NET INCOME PORTION OF TAX (from Schedule B, Line 13 or Schedule A, Line 15.

If there is no tax due, enter "0")................................................................................................

1.

COMPUTATION OF TAX DUE OR OVERPAYMENT

2. GROSS RECEIPTS PORTION OF TAX (from Schedule D, Line 15).

If there is no tax due, enter "0".................................................................................................

2.

3. Tax Due for the 2023 Business Income & Receipts Tax (Line 1 plus Line 2).......................... 3.

4. Credit from Special Credit Schedule (SC). (Cannot exceed amount on Line 3)...................... 4.

5.5. Tax Due 2023. (Line 3 minus Line 4)......................................................................................

6.

MANDATORY 2024 BIRT Estimated Payment (See Instructions)......................................

6.

7. Total Due by 4/15/2024 (Line 5 plus Line 6)...........................................................................

7.

ESTIMATED PAYMENTS AND OTHER CREDITS

8. Include any estimated and/or extension payments of 2023 BIRT previously made,

and any credit from overpayment of the 2022 BIRT and/or 2023 NPT return...................

8.

9. Net Tax Due (Line 7 less Line 8).

If Line 8 is greater than Line 7, enter "0".................................................................................

9.

10. Interest and Penalty

Refer to web site for current percentage........................................................................ .........

10.

11. TOTAL DUE including Interest and Penalty (Line 9 plus Line 10).

Use payment coupon. Make check payable to: "City of Philadelphia"...........................

11.

OVERPAYMENT OPTIONS If Line 8 is greater than Line 7, enter the amount to be:

12a. Refunded. Do not file a separate Refund Petition............................................................

12a.

12b. Applied to the 2023 Net Profits Tax Return.......................................................................... 12b.

12c.12c. Applied to the 2024 Business Income & Receipts Tax.........................................................

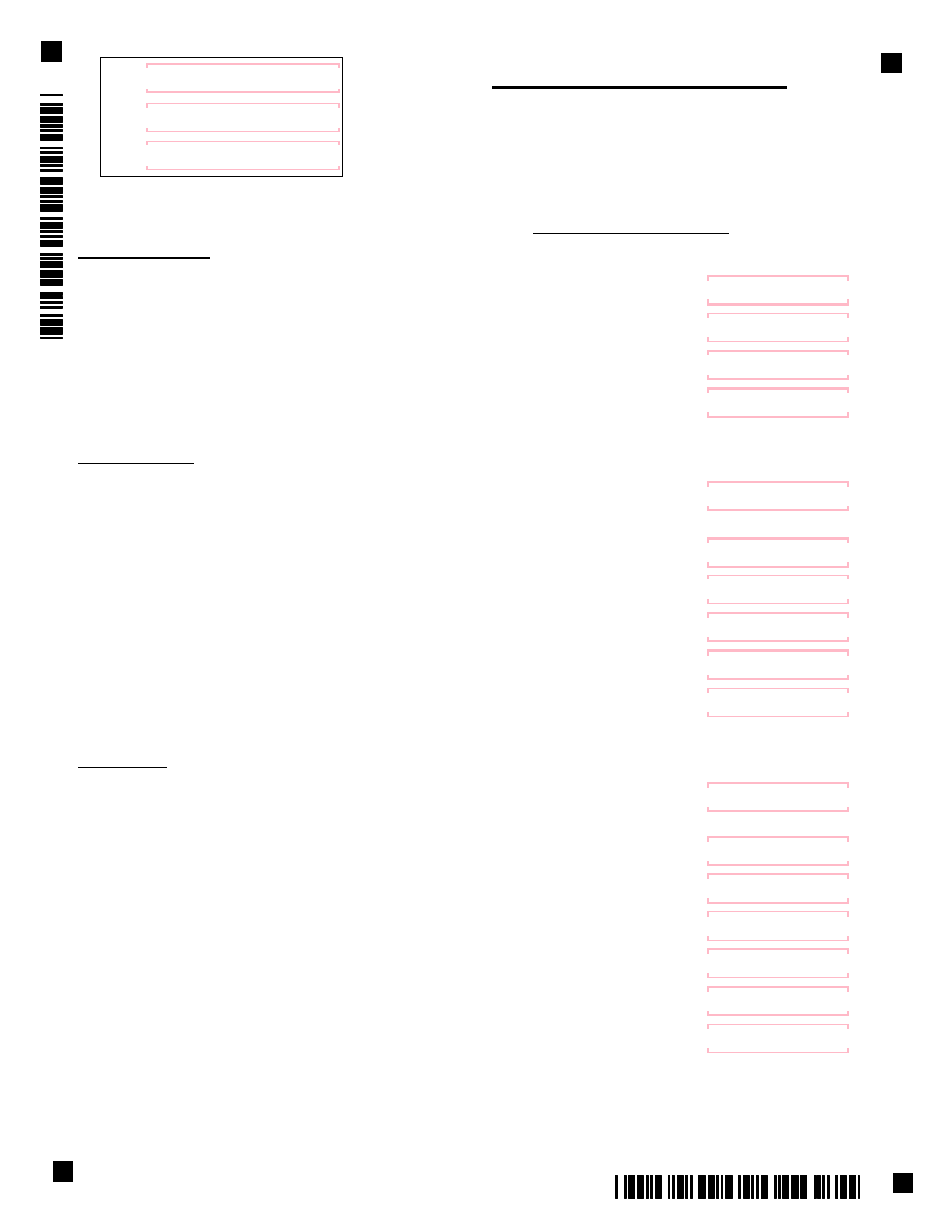

(e) Receipts by corporations of dividends, interest and royalties received from other

corporations in the same affiliated group and/or from other corporations of which

the receiving corporation owns at least 20% of the stock and/or

BIRT Regulation §404 (B)(5) adjustments (Reg. 302 (O))..............................................

(f) Line 1 minus Lines 2a through 2e..................................................................................

(g) All other receipts from other corporations of the same affiliated group.

(Reg. 302 (N))..............................................................................................................

(h) Gross Receipts per BIRT Regulation §404(B)(5)(e).....................................................

(i) Divide Line g by Line h and enter the result here............................................................

(j) Multiply Line f by Line i and enter the result here...........................................................

3. ADJUSTED NET INCOME (LOSS) (Line 2f minus Line 2j)................................................

4. Total

Nonbusiness Income (Loss).......................................................................................

5. Income (Loss) to be apportioned (Line 3 minus Line 4)......................................................

6. Appo

rtionment Percentage from Schedule C-1, Line 3........................................................

7. Inco

me (Loss) apportioned to Philadelphia (Line 5 times Line 6)........................................

8. Nonbusiness Income (Loss) allocated to Philadelphia........................................................

9. Current year Income (Loss) (Line 7 plus Line 8).................................................................

ENTER HERE AND ON PAGE 1, LINE 1 OF THIS RETURN.

1. Net Income (Loss) as properly reported to the Federal Government...................................

2. ADJUSTMENTS (Per BIRT Reg. 404 and Public Law 86-272)

(a) Income net of interest expense attributable to direct obligations of the Federal

Government, Pennsylvania or the political subdivisions of Pennsylvania.

(If less than zero, enter zero on this line).......................................................................

(b) Net Income (Loss) from certain port related activities. (Reg. 302 (T))..........................

(c) Net Income (Loss) from specific PUC and ICC business activities.

(Reg. 101 (D)(3))...........................................................................................................

(d) Net Income (Loss) from Public Law 86-272 activities...................................................

2023 Scedule B 07-10-2023

1.

2a.

2b.

2c.

2d.

2e.

2f.

2g.

2h.

2i.

2j.

3.

4.

5.

6.

7.

8.

9.

Place "X" in box to indicate a loss.

11. Loss Carry Forward, if any..................................................................................................

12. Taxable Income (Loss). (Line 9 minus Line 10 minus Line 11)..........................................

13.

TAX DUE (Line 12 times .0581) If Line 12 is a loss, enter zero.......................................

11.

12.

13.

10. Statutory Net Income Deduction from Worksheet S, Line S5.

(Must complete Schedule C-1.)........................................................................

10.

.

.

BIRT - Sch. B

PHTIN

EIN

SSN

Reminder - You must use the same method (METHOD I or METHOD II) that you

elected on the first Business Income & Receipts Tax return filed. If you are

using Schedule B, do not complete or file Schedule A.

CITY OF PHILADLELPHIA - DEPARTMENT OF REVENUE

2023 BIRT SCHEDULE B

COMPUTATION OF TAX ON NET INCOME (METHOD II)

2023 Schedule C-1 12-18-2023

ENTER THE PHILADELPHIA RECEIPTS FACTOR APPORTIONMENT PERCENTAGE ON SCHEDULE A, LINE 8 OR SCHEDULE B, LINE 6.

DO NOT FILE THIS RETURN if Line 3 is equal to 100%. Use the BIRT-EZ return which is available at

www.phila.gov/revenue.

Do not submit Schedule C-1 with the BIRT-EZ return.

1. Philadelphia Sales/Receipts (From Schedule D line 8)...................................................

2.

Gross Sales/Receipts Everywhere (From Schedule D line 6).........................................

3. Single Sales/Receipts Factor Apportionment Percentage (Line 1 divided by 2)..............

1.

2.

3.

COMPUTATION OF APPORTIONMENT FACTOR TO BE APPLIED TO APPORTIONABLE NET INCOME. YOU

MUST COMPLETE SCHEDULE C-1 IF YOU ARE APPORTIONING YOUR INCOME. FAILURE TO INCLUDE THIS SCHEDULE WITH YOUR

RETURN MAY RESULT IN THE DISALLOWANCE OF YOUR APPORTIONMENT AND YOU MAY BE BILLED.

.

This schedule must be completed in order to receive the deduction from Worksheet S.

The Department has adopted a Single Sales/Receipts Factor Apportionment methodology for BIRT.

The Property and Payroll Factors are no longer used

in the calculation of the Philadelphia Apportionment

percentage. The Single Sales/Receipts Factor Apportionment percentage is the ratio of Philadelphia

Sales/Receipts to Total Sales/Receipts everywhere.

The sourcing

of sales/receipts is the same as it has been in prior years. Receipts and Taxable Receipts

are defined at Philadelphia Code § 19-2601 and explained in Article III of the BIRT Regulations.

www.phila.gov/revenue/birt-regs

Market-Based Sourcing of Service/Sales for Software Companies

A Software Company (as defined by BIRT Regulations Section 101DD) is to source sales/receipts (for

both the Receipts and Net Income bases) in accordance with Market-based sourcing. That is, the sale

of products and the performance of services will be deemed to be the location where the recipient receives

the benefit of the products and services.

BIRT - Sch. C-1

PHTIN

EIN

SSN

For business conducted in and out of Philadelphia

CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE

2023 BIRT SCHEDULE C-1

8. Net Taxable Receipts before Statutory Exclusion (Line 6 minus Lines 7a through 7d)........

1. Gross Receipts from sales and/or rentals of tangible personal property, dividends,

interest, royalties, and gains on sale of stocks, bonds and business capital assets............

2. Gross Receipts from services.............................................................................................

3. Gross Receipts from rentals of real property.......................................................................

4. Total of Lines 1 through 3...................................................................................................

7. Less exclusions from:

7a. Sales delivered outside of Philadelphia......................................................................

7b. Services performed outside of Philadelphia................................................................

7c. Rentals of real property outside of Philadelphia..........................................................

7d. Other (specify)_______________________...............................................................

These industries should file BIRT-HJ Return, available on our website at www.phila.gov/revenue.

Do not report negative numbers on this schedule.

11. Receipts on which tax is to be computed by the Alternate Method.

(Enter here and on Schedule E, Line 1, 5 or 10.)..................................................................

12.

Receipts subject to tax at the regular rate (Line 10 minus Line 11).......................................

13.

TAX DUE at the regular rate. (Line 12 times .001415)........................................................

14. TAX DUE using the Alternate Method from Schedule E, Line 15, if applicable....................

15.

9. Statutory Exclusion (Lower of Line 8 or $100,000.00).......................................

2023 Schedule D 07-10-2023

10. Net Taxable Receipts after Statutory Exclusion (Line 8 minus Line 9)................................

BIRT - Sch. D

PHTIN

EIN

SSN

Worksheet S - Use to calculate Statutory Net Income Deduction

S1. Enter the lower of Line 8 above or $100,000...................................................................

S2. Enter Current Year Income from Line 11 of Schedule A or Line 9 of Schedule B.

If loss, enter zero.............................................................................................................

S3. Enter Net Taxable Receipts from Line 8 above................................................................

S4. Divide Line S2 by Line S3. (Cannot be greater than 1.0000)...........................................

S5. Statutory Net Income Deduction (Line S1 times Line S4. Cannot exceed $100,000)......

Enter here and on Line 12 of Schedule A or Line 10 of Schedule B.

.00

S1.

.00

.00

.00

S2.

S3.

S4.

S5.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

14.

13.

12.

11.

10.

9.

8.

7d.

7c.

7b.

7a.

6.

5c.

5b.

5a.

4.

3.

2.

1.

CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE

2023 BIRT SCHEDULE D

COMPUTATION OF TAX ON GROSS RECEIPTS

The following taxpayers should not file Schedule D.

· Taxpayers registered under the Pennsylvania Securities Act of 1972;

· Persons subject to a tax imposed pursuant to Article VII, VIII, IX or XV

of the Tax Reform Code of 1971 (Banks, Title Insurance Companies,

Trust Companies, Insurance Companies and Mutual Thrift Institutions)

·

Other Financial Businesses

Enter here and on Page 1, Line 2 of this return.

15.

TOTAL TAX DUE (Line 13 plus Line 14)...........................................................................

5. Adjustments to Total Gross Receipts (Gross Receipts which do not meet the definition

of "Business") (BIRT Reg. 101 (D)):

6. Gross Sales/Receipts Everywhere (Line 4 minus Lines 5a through 5c)................................

5c. Other (specify)_______________________...............................................................

5b. Gross Receipts from specific PUC and ICC business activities..................................

5a. Gross Receipts from certain port related activities.....................................................

1. Net Income (Loss) per accounting system used plus income taxes deducted

in arriving at Net Income.................................................................................................

2.

Net Income (Loss) from certain port related activities. (Reg. 302 (T))...............................

3.

Net Income (Loss) from specific PUC and ICC business activities. (Reg. 101 (D)(3)).....

4.

N

et Income (Loss) from Public Law 86-272 activities....................................................

5.

Adjusted Net Income (Loss) (Line 1 minus Lines 2, 3 and 4)............................................

5.

4.

3.

2.

1.

Place "X" in box to indicate a loss.

2023 Schedule A 07-10-2023

9. Income (Loss) apportioned to Philadelphia (Line 7 times Line 8).............................

10. Nonbusiness Income (Loss) allocated to Philadelphia....................................................

11. Current year Income (Loss) (Line 9 plus Line 10)............................................................

ENTER HERE AND ON PAGE 1, LINE 1 OF THIS RETURN.

11.

10.

9.

13. Loss Carry Forward, if any..............................................................................................

14.

Taxable Income (Loss). (Line 11 minus Line 12 minus Line 13).......................................

15.

TAX DUE (Line 14 times .0581) If Line 14 is a loss, enter zero....................................

15.

14.

13.

12. Statutory Net Income Deduction from Worksheet S, Line S5

(Must complete Schedule C-1.).....................................................................

12.

8. Apportionment Percentage from Schedule C-1, Line 3....................................................... 8.

.

6.

7.

6. Total Nonbusiness Income (Loss)....................................................................................

7. Income (Loss) to be apportioned (Line 5 minus Line 6)....................................................

BIRT - Sch. A

PHTIN

EIN

SSN

CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE

2023 BIRT SCHEDULE A

COMPUTATION OF TAX ON NET INCOME (METHOD I)

To be used by taxpayers electing to report net income from the operation of a

business in accordance with their accounting system, after subtracting from

gross receipts the cost of goods sold and all ordinary and necessary expenses

of doing business, rather than as reported to and ascertained by the Federal

Government.

Reminder - You must

use the same method (METHOD I or METHOD II) that you elected on the first Business Income &

Receipts Tax return filed. If you are using Schedule A, do not complete or file Schedule B.

2023 Schedule E 07-10-2023

B. WHOLESALERS

5. Receipts on which tax is to be computed by the Alternate Method (from Schedule D, Line 11)..........

6. Applicable Cost of Goods for the receipts reported on Line 5:

(a) Cost of material.......................................................................................................

(b) Cost of Labor..........................................................................................................

7.

TOTAL APPLICABLE COST OF GOODS (Line 6a plus 6b).............................................................

8. TAX BASE (Line 5 minus Line 7)......................................................................................................

9. TAX DUE (Line 8 times .0329). If Line 8 is a loss, enter zero...........................................................

A. MANUFACTURERS

1. Receipts on which tax is to be computed by the Alternate Method (from Schedule D, Line 11)..........

2. Cost of goods sold for the receipts reported on Line 1.....................................................................

3.

TAX BASE (Line 1 minus Line 2)......................................................................................................

4. TAX DUE (Line 3 times .0234). If Line 3 is a loss, enter zero..........................................................

C. RETAILERS

Enter the amount from Line 15 on Schedule D, Line 14.

15.

14.

13.

12.

11b.

11a.

10.

1.

2.

3.

4.

5.

6a.

6b.

7.

8.

9.

10.

Receipts on which tax is to be computed by the Alternate Method (from Schedule D, Line 11)..........

11. Applicable Cost of Goods for the receipts reported on Line 10:

(a) Cost of material........................................................................................................

(b) Cost of Labor............................................................................................................

12. TOTAL APPLICABLE COST OF GOODS (Line 11a plus 11b).........................................................

13. TAX BASE (Line 10 minus Line 12)..................................................................................................

14. TAX DUE (Line 13 times .0078). If Line 13 is a loss, enter zero......................................................

15. TOTAL TAX DUE (Total of Lines 4, 9 and 14)..................................................................................

BIRT - Sch. E

PHTIN

EIN

SSN

CITY OF PHILADELPHIA - DEPARTMENT OF REVENUE

2023 BIRT SCHEDULE E

COMPUTATION OF TAX ON GROSS RECEIPTS

ALTERNATE METHOD OF COMPUTING TAX ON GROSS RECEIPTS,

MUST COMPLETE SCHEDULE D.

(To be used by Manufacturers, Wholesalers and Retailers electing to use

the Alternate Method of computation.)

SEE BUSINESS INCOME AND RECEIPTS TAX REGULATIONS

(SECTION 305) AT WWW.PHILA.GOV/REVENUE.