Authors

Structured Finance ABS/RMBS

Sandra Fronteau

Paris

sandra.fronteau@spglobal.com

F

lorent Stiel

Paris

florent.stiel@spglobal.com

Sustainability Research

Terry Ellis

London

terry.ellis@spglobal.com

Contributors

Structured Finance ABS/RMBS

Matthew Mitchell

Paris

matthew.mit[email protected]

Sustainability Insights | Research

Building Energy Regulations

And The Potential Impact On

European RMBS

Sept. 6, 2023

Climate transition risks related to changes in building energy efficiency regulations are not

currently a material driver of European RMBS' credit quality.

This research report does not comment on current or future credit ratings or credit rating methodologies. It is part of the Toward

Net Zero report series and reflects research conducted by and contributions from S&P Global Ratings’ structured finance and

sustainability research teams.

This report does not constitute a rating action.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

2

Several countries in Europe have committed to cutting their greenhouse gas emissions by 2050,

and energy efficiency of homes is a primary focus of policymakers. This research aims to explore

the potential effects of the resulting initiatives in S&P Global Ratings' analysis of loan pools

backing residential mortgage-backed securities (RMBS) in the region.

To do so, we conducted a scenario analysis of properties in the U.K. (focusing on England and

Wales), Ireland, France, and the Netherlands, where energy performance certificates (EPCs)

indicate low energy efficiency (for example classes F and G). Our scenario analysis assumes

energy efficiency regulations would lower property values if owners do not carry out any

renovations to improve energy efficiency. This research entailed a review of energy efficiency

regulations for residential buildings and a comparison of EPC data reporting by country.

Our scenario analysis shows a valuation discount has a low impact on RMBS loss severity

pp(s)--Percentage point(s). Source: S&P Global Ratings.

Key Takeaways

• Climate transition risks linked to changes in energy-efficiency performance regulations

currently have a limited impact on European RMBS. This is due to uncertainties on the

timing and extent of sale or rental restrictions, financing available for renovations, supply

and demand in housing markets, and structural protections in RMBS transactions.

• Nevertheless, EPCs may influence property values. Studies show there is a valuation

discount for properties with low EPC classes. If this discount increases as EPC classes

gain importance or is not fully reflected in property valuations, it may eventually affect

how we calculate the foreclosure frequency and loss severity of RMBS loan pools.

• Our scenario analysis shows a low potential impact on our modelled loss severity

assumptions. This is even though energy-intensive properties could face higher losses.

Our weighted-average loss severity increases 2.5% at the 'AAA' rating level and 2.8% at

the 'B' rating level, albeit we acknowledge that our assumptions are very conservative.

• Foreclosure frequencies may increase over time due to higher leverage. Property

owners may incur higher debt to carry out renovations if countries start requiring

improvement in energy efficiency, especially if subsidies are insufficient to cover the cost.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

3

Regulation And Its Impact On The Housing Market

Targets and regulations differ by country in the EU and U.K.

The European Climate Law, which took effect in July 2021, wrote into law the European Green

Deal's goal of achieving climate neutrality (net zero greenhouse gas emissions) by 2050. As part

of this, EU member states are obliged to cut their greenhouse gas emissions by 55% by 2030,

compared to 1990. Fit for 55, a set of legislative proposals, describes concrete actions for the EU

to achieve this target.

Improving the energy performance of housing will likely be key to reaching this target, since the

residential building sector was responsible for 27.4% of the EU's energy consumption in 2020,

according to Eurostat, and 12% of its emissions in 2021, according to the European Environment

Agency.

As part of Fit for 55, the European Commission has proposed changes to the Energy

Performance of Buildings Directive (EPBD) to improve the energy efficiency of residential

buildings. EPCs are a keystone of the EU taxonomy to determine whether a building is energy

efficient (see box). In the U.K., the Climate Change Act requires the reduction of greenhouse

gases by 100% by 2050. The U.K. has also committed to cutting emissions by 68% by 2030 under

the Paris Agreement.

EU Taxonomy: Definition of energy-efficient property

Many RMBS issuers want collateral in the mortgage loan pool to show greater energy efficiency and, for some,

alignment with the EU taxonomy. The EU taxonomy is primarily a classification system that clarifies which

economic activities are considered environmentally sustainable, based on four overarching conditions. The

activity must:

• Make a substantial contribution to at least one of the six environmental objectives (see footnote);

• Do no significant harm to any of the other five environmental objectives;

• Comply with minimum safeguards; and

• Comply with the technical screening criteria (see below) set out in the Taxonomy's Delegated Acts.

EU taxonomy technical screening criteria

Category of building Technical screening criteria

7.7 Acquisition and

ownership of existing

buildings (built before

2021)

The building has an EPC of at least class A. Alternatively, the building is within the

top 15% of the national or regional building stock.

7.2 Renovation of existing

buildings

The renovation complies with the applicable national or regional requirements for

renovations. Alternatively, it leads to a reduction of primary energy demand (PED)

of at least 30%.

7.1 Construction of new

buildings (built in 2021 or

later)

PED, which defines the energy performance of the building resulting from the

construction, is at least 10% lower than the threshold set for the nearly zero-

energy building requirements for that country.

The Taxonomy's six environmental objectives are

climate change mitigation, climate change adaptation, sustainable use and protection of water

and marine resources, transition to a circular economy, pollution prevention and control, and protection and resto

ration of biodiversity and

ecosystems

. Nearly zero-energy building (NZEB).

According to the European Commission, an NZEB is a building with very high energy performance,

while the nearly zero or very low amount of energy required is covered to a very significant extent by energy from renewable

sources, including

energy from renewable sources produced on

-site or nearby. Source: EU Taxonomy.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

4

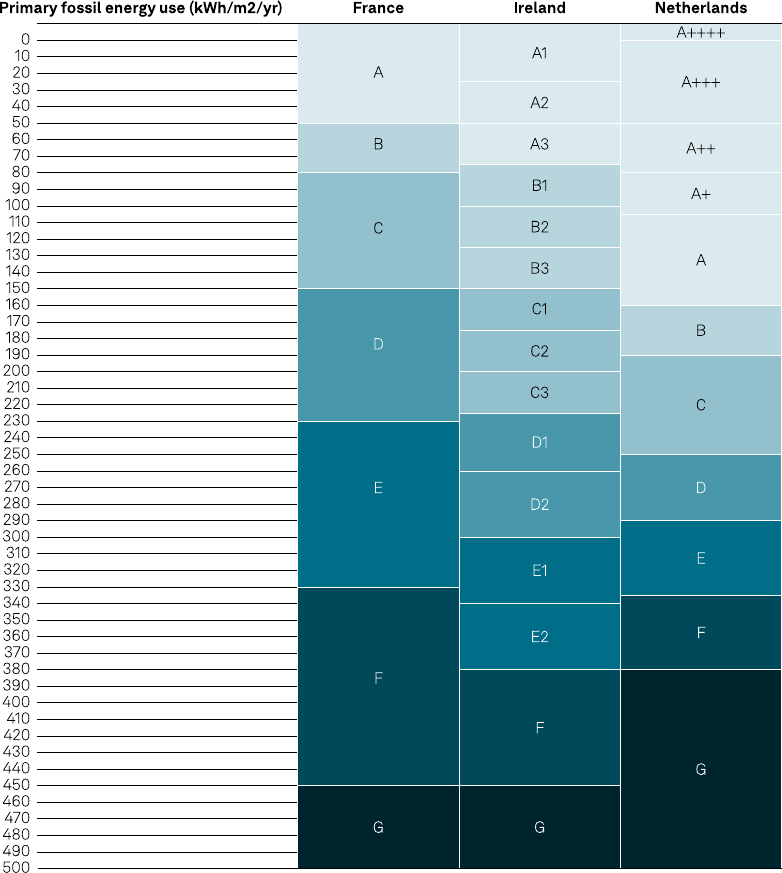

EPC assessments vary by country but provide a measure of the energy performance of a home

and recommendations to improve efficiency. An EPC is compulsory when selling or renting a

property in all EU countries and in the U.K. The EPBD sets general guidelines, and each EU

member state implements them in its own way. The U.K. (England and Wales) also has its own

definition of the EPC. As a result, there is a variety of EPC definitions and, historically, it has been

difficult to compare EPCs across European jurisdictions. EPC labels typically include a class,

based on a ranking system (see graphic 1), from class A (most energy efficient) to class G (least

energy efficient). The classes indicate the expected level of energy use and carbon dioxide the

property emits in the number of kilowatt hours per meters squared per year (m

2

/year).

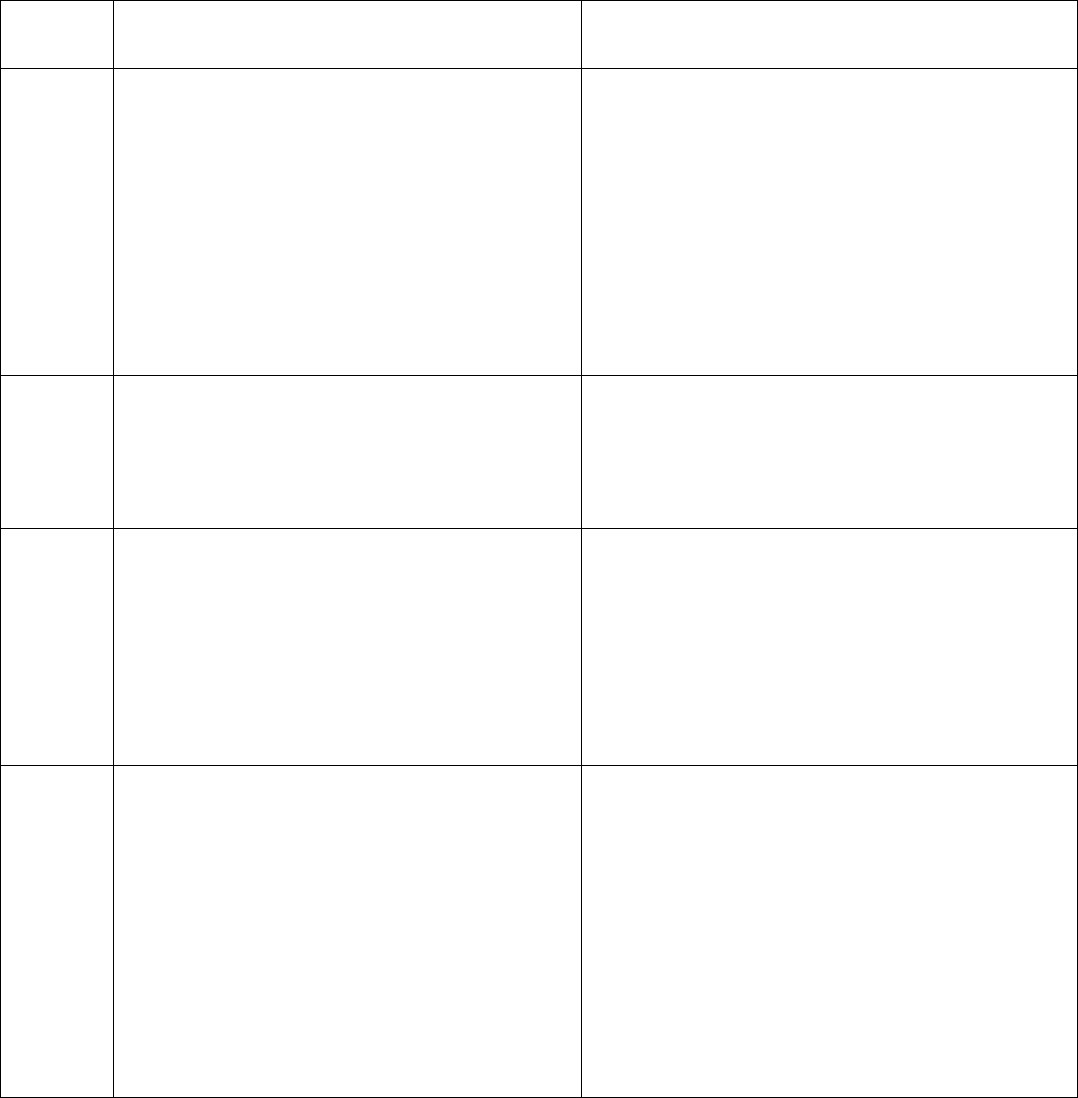

Graphic 1

EPC class definitions vary widely among France, Ireland, and the Netherlands

kWh/m2/yr--Kilowatt hours per square meter per year. We did not add the U.K. to the table because the EPC definition in England and

Wales is based on a composite indicator, which is not directly comparable with EPC definitions in Ireland, France, or the Netherlands.

This composite indicator is derived from a property’s Standard Assessment Procedure score of 1-100 that is determined by an

accredited assessor based on the home's characteristics in terms of heating system, insulation, lighting, ventilation, carbon dioxide

emissions, and energy consumption, etc. Sources: France: Ministère de la Transition écologique et de la Cohésion des territoires,

Ministère de la Transition énergétique; Ireland: Sustainable Energy Authority of Ireland, Netherlands: Netherlands: Rijksdienst voor

Ondernemend Nederland – RVO (Netherlands Enterprise Agency); and S&P Global Ratings.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

5

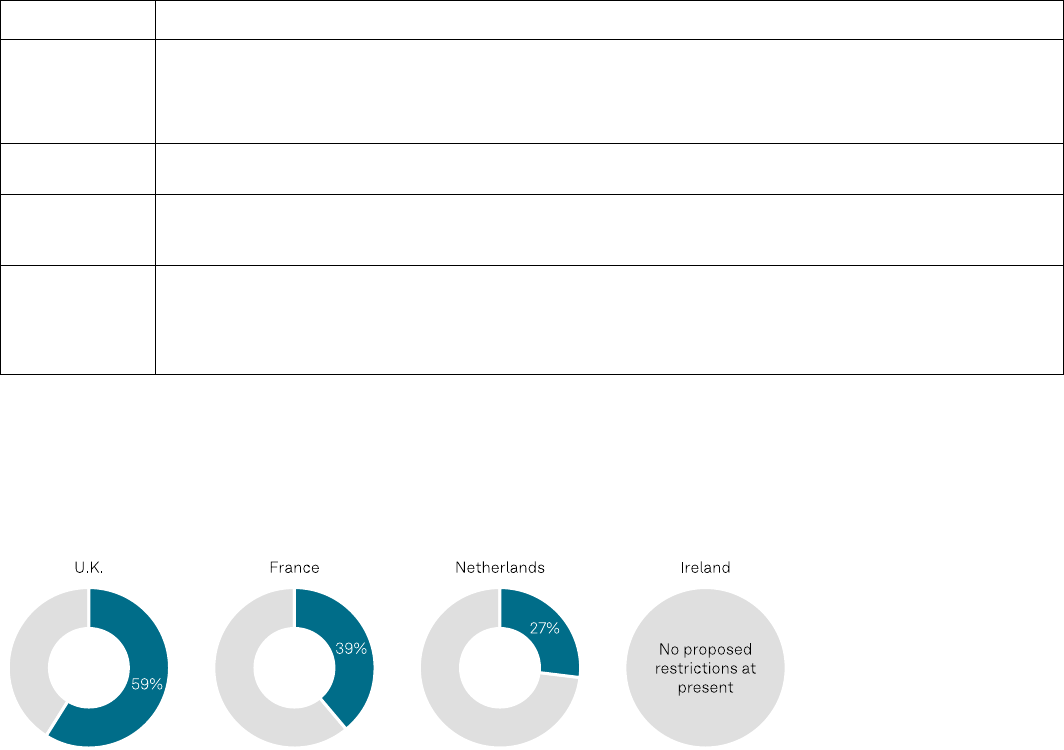

Countries have differing approaches to defining minimum EPC classes for residential property

rentals. France and the U.K. have already put in place regulations that set a minimum EPC class

for rental properties (see table 1). In the case of the U.K., these prevent properties from being

rented unless they meet the minimum EPC class. In France, rents are frozen until the minimum

EPC class is met and, in the future, landlords will be prevented from renting properties with low

EPC labels; the Netherlands has also put in place policy that will apply in the future. So far,

Ireland has not announced any rent restrictions related to energy efficiency (see graphic 2).

Table 1

Sample of building energy efficiency regulations for property rentals by country

Jurisdiction Energy efficiency regulation

France The French government has implemented bans on renting properties with low EPC classes. Since August 2022, rents of

properties labelled as class G and class F have been frozen. Since January 2023, properties with energy consumption

exceeding 450 kWh/m2/year cannot be rented. Starting in 2025, all properties labelled class G will be banned from the

rental market, followed by class F in 2028, and class E in 2034.

Ireland In Ireland, EPCs are called Building Energy Rating (BER) certificates. The government has not implemented any

restrictions on the rental market with respect to BERs at this time.

Netherlands In the Netherlands, properties labelled class E, F, and G will be banned from public and private rental markets starting

January 2030. From 2026, when a heating installation needs to be replaced, the switch must be to a "greener" system,

notably hybrid heat pumps.

U.K. (England and

Wales)

Since April 2018, all rented properties must have a minimum EPC label of class E. More recently, the U.K. government has

proposed to ban all properties with EPC labels lower than class C from being rented from 2028. This policy is still in

development and has not been legally implemented yet. In our view, the main risk is a property value decline for low

energy-efficient homes if landlords decide not to renovate and, instead, sell their properties. If a landlord does not

renovate and continues to rent out the property, they can be fined.

Sources: France: Loi Climate et Résilience (Law of Climate and Resilience; 2021); Netherlands: Beleidsprogramma versnelling

verduurzaming gebouwde omgeving (Policy program to accelerate the sustainability of the built environment; 2022); U.K.

(England and Wales) - UK Minimum Energy Efficiency Standards (MEES) regulations (2018); and S&P Global Ratings.

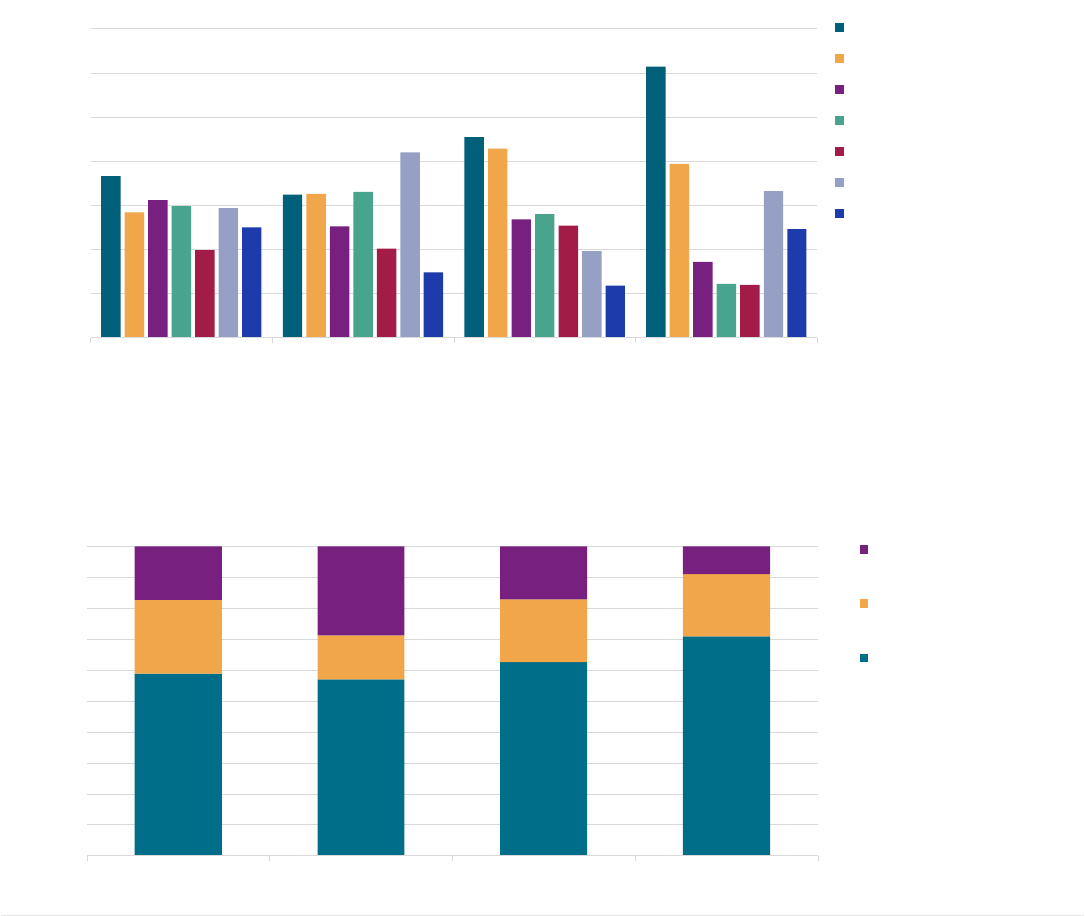

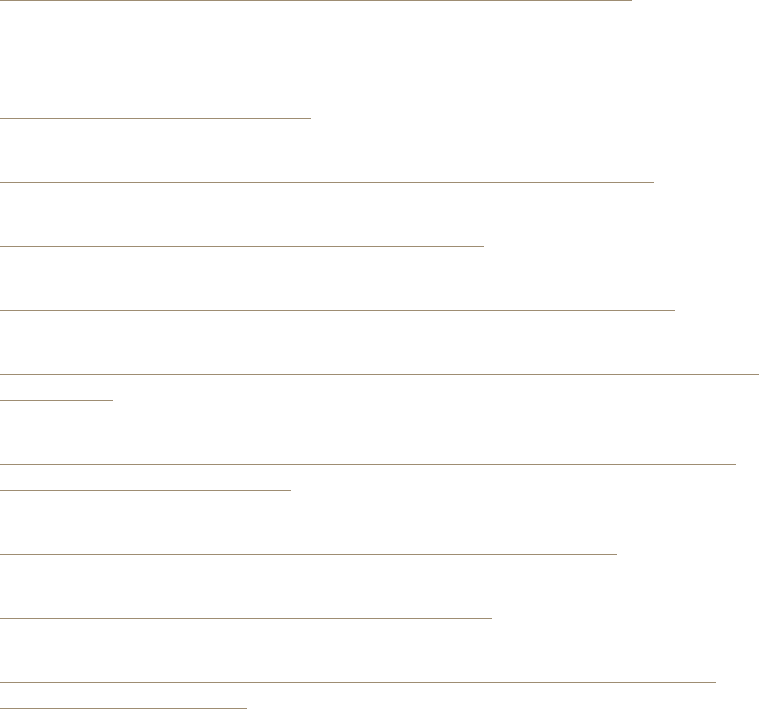

Graphic 2

Share of housing stock subject to potential rental bans over time, based on the EPC class

EPC--Energy performance certificate. Sources: U.K. (England and Wales): U.K. government; France: fidéli, SDES data; The

Netherlands: CFP Green Buildings; and S&P Global Ratings.

The proposed EPBD aims to introduce a unified definition of the EPC across EU member states

and set a binding timeline for renovations and EPC upgrades. The draft EPBD would require all

existing residential buildings to have a minimum EPC label of class F by 2030 and class E by 2033,

and all new buildings to generate net zero emissions by 2030. The U.K. implemented the 2018

EPBD (the most recent revision) after the referendum in which the U.K. voted to leave the EU, and

it has been in effect since 2020. However, the U.K. does not participate in the new EPBD

discussions.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

6

Old houses may require more renovation to improve energy efficiency

Research from the European Commission and the EU Building Stock Observatory finds that the

U.K. has one of the oldest housing stocks in Europe, with half of its dwellings built before 1970

(see graphic 3). Although 44% of residences in the Netherlands were built before 1970, the

country has one of the highest shares of energy-efficient properties in Europe, based on the

reported distribution of EPC classes. However, EPC definitions are not directly comparable

across countries at present. In each of the four countries, about 40% of residential homes are

rented (see graphic 4) and could be affected by potential regulations banning the rental of

properties with low EPC classes.

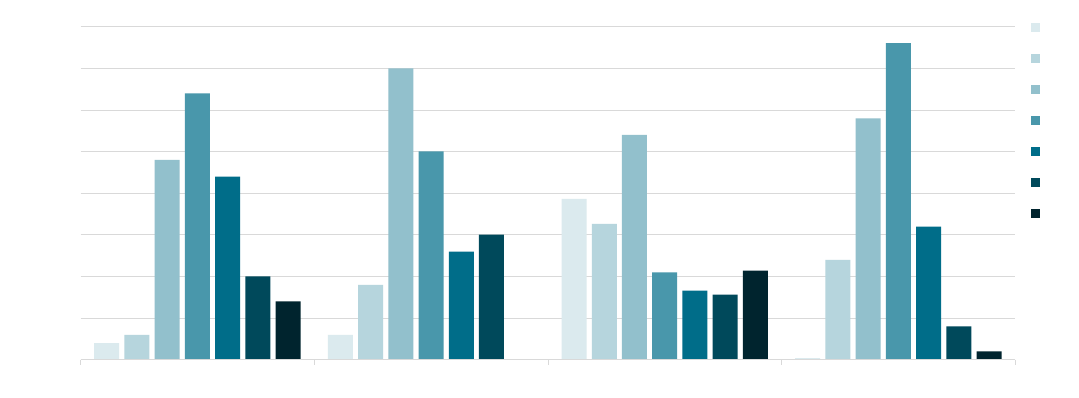

Graphic 3

The age profile of residential housing varies across Europe

Sources: European Commission, EU Building Stock Observatory, 2017 data; and S&P Global Ratings.

Graphic 4

Distribution of homes by residential ownership type

Sources: France: INSEE, 2022 (share of residential primary homes), Ireland: Central Statistics Office, 2016 (share of

households), Netherlands: CBS 2021, Kadaster 2021 (share of residential housing units), U.K. (England and Wales): U.K.

Government, 2021 (share of households); and S&P Global Ratings.

0%

5%

10%

15%

20%

25%

30%

35%

France Ireland Netherlands U.K.

Percentage of housing stock

<1945

1945-1969

1970-1979

1980-1989

1990-1999

2000-2010

>2010

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

France Ireland Netherlands U.K.

Public renters or housing

associations

Private renters

Owner occupied

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

7

EPC data reporting is inconsistent among jurisdictions

The distribution of residential buildings by EPC varies greatly across countries, due to the specific

features of housing, processes for assigning EPC classes, and the variety of EPC class definitions

(see graphic 5). National databases are publicly available in France, the Netherlands, the U.K.,

and Ireland. By looking at the distribution of EPCs across countries, we cannot conclude that a

certain country has more energy efficient buildings than another because the EPC definitions are

not directly comparable. For instance, a property with 155 kilowatt hours per m2/year of primary

fossil energy use could have an EPC label with class D in France and class A in the Netherlands.

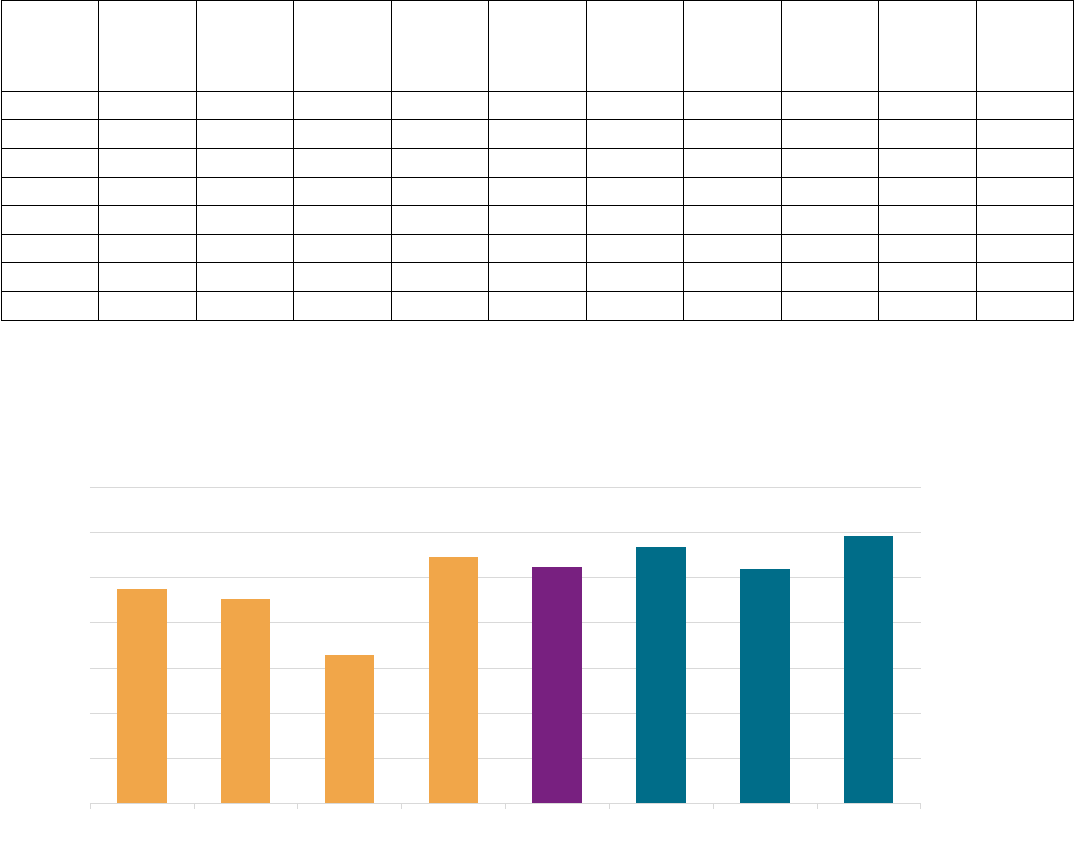

Graphic 5

EPC classes vary widely across countries

Note: The EPC distributions across countries are not directly comparable given the differences in EPC class definitions

presented in graphic 1. Sources: England and Wales: U.K. government; France: fidéli, SDES data; Ireland: Central Statistics

Office; the Netherlands: CFP Green Buildings. Ireland data combines EPC classes F and G. Data as of 2019 (Ireland), 2020,

Netherlands, 2022 (England and Wales, France), and S&P Global Ratings.

As part of a new European Banking Authority regulation, banks will be required to disclose

information on the climate exposure of their real estate portfolios from December 2023. As a

result, many banks have started to capture EPCs during the loan origination process, and some

of them map existing properties to the national database when available. However, most banks

are at an early stage of development in this area, and it will take time to collect enough data to

create a meaningful sample. As more EPC data is provided over time by securitization issuers, it

should help to enhance the understanding and monitoring of the potential relevance of EPC-

related valuation and collateral risks.

Lower EPC classes could affect property values

Many of the studies we consulted (see the External Research list at the end of this report) that

were conducted across Europe show that a discount exists for properties with the lowest EPC

classes (F and G), both in the owner-occupied and buy-to-let (or BTL) markets. The magnitude of

the discount varies, depending on the type of property, price segment, location, market

tightness, and market sentiment. A number of studies argue that energy performance of a home

is highly correlated with its date of construction.

0%

5%

10%

15%

20%

25%

30%

35%

40%

France Ireland Netherlands U.K.

Percentage of housing stock

A

B

C

D

E

F

G

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

8

Nevertheless, some studies have rejected the date of construction as an indicator and instead

demonstrated that lower EPC classes themselves constrain property valuations. Some of them

show that the discount has increased in the last few years and is likely to rise further in the

coming years as public awareness of climate risks for the housing sector increases. Some

academic studies also report a premium for energy-efficient properties, in several markets.

Lower EPC classes can be associated with higher energy and renovation costs. They can also

reflect lower comfort, both in winter and during summer heat waves, notably if the property is

badly insulated. In the buy-to-let market, low EPCs can cause higher vacancy rates, lower rents,

and eventually a lower valuation; however, this depends on the market's location and conditions.

Financing Will Likely Be Needed For Renovations

The cost of renovation varies widely

Generally, renovation costs depend on the type of property, the EPC class targeted, and the

types of work. Light renovation refers to conducting only one or two types of works that might

raise the EPC label by one class, such as replacing an oil boiler with an electric boiler. A deep

renovation encompasses several types of works, such as replacing a boiler, and the insulation in

walls and the roof, to raise the label to class A or B. The types of retrofit necessary to improve

energy performance generally include walls and attic insulation, as well as replacement of

heating systems, controls, or ventilation.

Although most countries included in our scenario analysis offer grants to retrofit homes (see

table 2), we find the amount, conditions, and processes for receiving such a grant vary greatly

across countries. In most cases, grants are conditional upon a household's income and the type

of work. Governments can also provide incentives to owners through subsidized loans, tax

credits, or reduced value-added tax.

When grants are not sufficient or available, owners may finance works out of their own pocket

or from further borrowing (secured or unsecured). Financing solutions vary across countries.

However, when purchasing a property, it is common to finance renovation through the mortgage

loan, with the cost of renovation reflected in the loan's current balance once the amount

dedicated to the works is released by the lender (most of the time upon presentation of invoices).

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

9

Barriers to energy-performance improvements remain

Government grants do not generally provide a sufficient incentive for owners to renovate their

homes. This is because such grants typically do not cover the whole cost of renovation and the

amount and types of grants vary widely across countries. In addition, the costs of renovation

often exceed the benefits of increasing the property's valuation and reducing energy bills, unless,

for the latter, the owner intends to keep the property for a long time. There is also the possibility

that EPC regulations could evolve in the coming years. Therefore, owners are often uncertain

whether renovations will be sufficient to achieve the minimum EPC class for rental when

standards are constantly raised.

For homeowner associations, it might be difficult to pursue works that have to be approved by

all owners. This is particularly the case for landlords when owner occupiers make up the majority

of homeowners in the building. Also, deep renovations cannot be done if the property is not

vacant.

Sometimes, unwillingness to renovate stems from a lack of information, for example about the

costs, types of works needed to improve energy performance, and how to find a contractor. In

several countries, renovation grants are conditional upon the works being conducted by a

certified contractor. However, there may not be sufficient certified contractors to do all the

renovations required to meet the EPC target. In some cases, renovations are not doable because

of the property's features, such as lack of a cavity for insulation or the building's classification as

a historical monument. Raw material shortages and cost inflation can also hinder completion of

renovations.

How EPCs Might Influence Our Credit Analysis

Renovation costs could be credit negative, absent mitigating factors

A homeowner or landlord may seek additional financing upon buying a property with a low EPC

class to complete energy-efficiency upgrades. If that homeowner or landlord decides to finance

the renovation through a mortgage loan, the cost would be reflected in the mortgage loan

balance once the lender releases the amount dedicated to the works. This could impair several

ratios we consider in our loan foreclosure frequency analysis, including the loan to value (LTV),

loan to income (LTI), debt to income (DTI; relevant for French RMBS transactions) and debt

service coverage (DSC; relevant for buy-to-let transactions in the U.K. and Ireland).

However, in our view, several factors could mitigate the impact:

• Whether the loan is new or seasoned, the lender will consider the additional financing

subject to the maximum LTV, LTI, DTI, and interest coverage ratio limits, as per its

underwriting criteria, which cannot be exceeded. In a seasoned loan, the borrower can

benefit from the loan’s amortization since origination (unless it is an interest-only loan)

and from any increase in primary income. The borrower could also benefit from a

potential increase in house prices since origination.

• In addition, if the EPC class improves due to renovation, the property value will likely also

improve. The renovation cost's potential weight on the LTV--and therefore on our

foreclosure frequency assumption--would be at least partly mitigated by the increase in

property value. However, it is hard to assess the magnitude of the rise in value after

renovation because this depends on many factors, such as the types of renovation,

market location, and market sentiment.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

10

• For buy-to-let properties, another mitigant is that the rental income could increase after

the property is renovated, especially if the EPC class improves from a low-efficiency

class. A higher EPC class (the A classes are the highest) is typically associated with lower

energy costs and potentially higher rent.

Effect of property valuation haircut on the WAFF and WALS

To simulate the hypothetical impact on the weighted average foreclosure frequency (WAFF) and

weighted average loss severity (WALS), we applied an average 15% haircut to the valuation of low-

energy-efficient properties backing a mortgage loan pool. Climate transition risk may materialize

through potential property valuation discounts for such properties if the owners do not

undertake any renovations.

We use EPC class distributions to indicate this risk in our scenario analysis. We assume the main

effect would be lower property sale proceeds after a repossession in case of a borrower default,

and therefore a higher WALS. This risk could also affect our stressed WAFF assumptions by

reducing the current LTV ratio, therefore influencing the effective LTV ratio we use to determine

our LTV adjustment. This is because 80% of the effective LTV represents the original LTV and

20% the current LTV. However, this aspect is less significant to our scenario analysis than the

potential increase in WALS.

Components Of The Scenario Analysis

Assumptions

Valuation haircut of 15% for the average cost of renovation. A valuation haircut equals the

estimated cost of renovation. In other words, the property's market value fully discounts the

estimated costs to improve its energy efficiency. Research papers mention costs of renovation

ranging from approximately 8% of the property value, for a light renovation, to 25% for a deep

renovation. With the variety of renovations possibly required, we assumed an average cost of

renovation of 15% in all markets and for all properties.

A larger haircut (20%) for buy-to-let (BTL) properties than for owner-occupied properties

(15%). We distinguish between BTL and owner-occupied properties in our scenario because the

energy-efficiency requirements announced by some countries to date apply only to rental

properties. As a result, we believe there could be a relatively higher valuation discount on rental

properties with a low EPC class, since some landlords may choose to sell rather than carry out

improvements, and there could be less demand for those properties on the BTL market.

In France and the Netherlands, properties with EPC classes F or G are assumed the first affected

by the ban on renting properties with low energy efficiency. In the U.K., currently all properties to

be rented should have an EPC class of at least E. In addition, properties with low energy

efficiency on the rental market might be subject to higher vacancy rates and potentially lower

rental prices, since tenants avoid properties with high energy costs; this may then be reflected

through a lower property value.

However, the magnitude of discount would depend on a variety of factors, such as market

location, type of property, price range, and market sentiment. For instance, in markets where the

supply of BTL properties is low, the discount is generally lower. The discount for BTL properties

would also be mitigated by demand for owner-occupied property to a certain extent. When a

landlord sells a low-energy-efficient BTL property, a first-time or low-income buyer that can

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

11

afford the property, because of the discount, may purchase it without being obligated to

renovate, since they plan to occupy the property rather than rent it out.

30% of the mortgage loan pool comprises low-energy-efficient properties. EPC data is not

required when submitting individual mortgage loans to securitization repositories, and we

typically do not receive the EPCs of properties backing rated RMBS transactions. Many

originators now request EPCs during the loan underwriting process, so data availability may

improve over time. But for seasoned loans, EPC data is not widely reported; therefore, we use a

proxy.

To determine the percentage of a collateral pool comprising low-energy-efficient properties, we

considered the new definition of the G class under the proposed EPBD. The G class will reflect

the bottom 15% of all residential properties in the EU in terms of energy efficiency. This means

some properties currently labelled class F will be considered class G, and some labelled class E

will be considered class F. For our scenario analysis, we assumed that both class F and class G

properties will account for a maximum 30% of residential property in the future.

For simplicity, we applied the same assumption for the U.K., although the current distribution of

classes F and G in the housing stock is currently very low, and we are uncertain how the EPC

framework might evolve compared to that in the EU. However, with a potential new U.K. law

targeting rental properties with EPC classes lower than C, a higher share of loan pools might be

affected than the 30% we assume for our scenario analysis.

Calculating the total haircut applied at pool level

To do this, we take the sum of:

• 15% of the assumed property value discount for owner-occupied properties, multiplied

by the share of owner-occupied properties in the pool, multiplied by 30%, which is the

assumed share of properties with EPC classes F and G; and

• 20% of the assumed property value discount for BTL (buy-to-let) properties, multiplied

by the share of BTL properties in the pool, multiplied by 30%, which is the assumed

share of properties with EPC classes F and G.

For example, if a pool contains 40% owner-occupied properties and 60% BTL properties, we

would apply a haircut of 5.4% at pool level.

We applied the valuation haircut to the current indexed valuation and on top of any valuation

haircut already applied under our rating criteria

Sample RMBS transactions

We used a representative sample of eight transactions, including prime, nonconforming, and BTL

assets in the U.K., Ireland, France, and the Netherlands to assess how our scenarios affect the

WAFF and WALS. The ratings on these transactions range from 'AAA (sf)' to 'B (sf)'.

Some limitations and caveats to our scenario analysis

• The stresses we selected are hypothetical, are not meant to be predictive, and may not be a

precise representation of reality.

• We apply declines in house prices immediately, which we believe is a conservative

assumption because the timing and final form of any energy efficiency regulations that could

influence property valuations remains highly uncertain. In our view, any future decline in

property values for low-energy-efficient properties is likely to occur gradually and--in the

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

12

meantime--borrowers with amortizing loans would continue to reduce their outstanding

balances, which may mitigate any deterioration in the LTVs at that time.

• In addition, an appreciation of overall property market prices in the long term would

contribute to lower LTVs and reduce the impact of declines versus that in our scenario

analysis.

Results of the scenario analysis

Table 2

Haircuts and the impact on the WAFF and WALS

Country

Type of

transaction

Share of

owner

-

occupied

properties (%)

Share of buy-

to-

let

properties (%)

Valuation

haircut applied

for sensitivity*

(%)

Increase o

f

WAFF at 'AAA

'

rating level

§

Increase o

f

WALS at 'AAA

'

rating level

§

Increase of

credit

coverage at

'AAA'

rating

level§

Increase of

WAFF at 'B'

rating level§

Increase o

f

WALS at 'B

'

rating level

§

Increase o

f

credit

coverage at 'B

'

rating level

§

France

Prime

65.1

34.9

5.00

0.14

2.37

0.41

0.02

0.79

0.02

Ireland

Prime

100.0

0.0

4.50

0.79

2.26

0.74

0.10

2.10

0.08

Ireland

BTL

0.0

100.0

6.00

2.14

2.84

2.26

0.30

3.70

0.37

Netherlands

Prime

100.0

0.0

4.5

0.14

1.64

0.16

0.02

0.96

0.01

Netherlands

BTL

0.0

100.0

6.00

0.28

2.59

0.62

0.04

4.25

0.12

U.K.

Prime

100.0

0.0

4.50

0.78

2.72

0.96

0.12

2.66

0.11

U.K.

BTL

0.0

100.0

6.00

1.17

2.96

1.40

0.17

4.70

0.21

U.K.

Nonconforming

65.4

34.6

5.00

0.94

2.62

1.19

0.15

3.06

0.19

*On top of existing valuation haircut applied under our RMBS methodology, if any. §In percentage points. BTL--Buy to let.

Source: S&P Global Ratings.

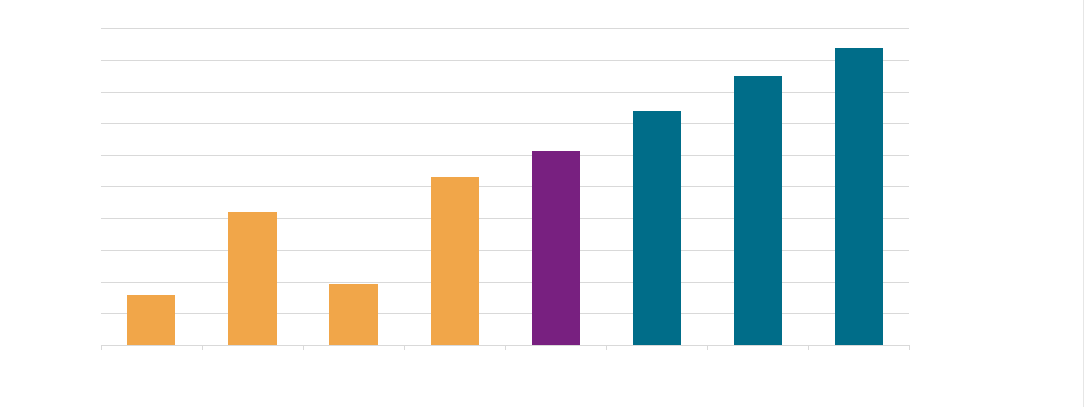

Graphic 6

Effect on WALS: Additional percentage points at the 'AAA' rating level

WALS--Weighted average loss severity. Source: S&P Global Ratings.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

France

prime

Ireland

prime

Netherlands

prime

U.K.

prime

U.K.

nonconforming

Ireland

buy to let

Netherlands

buy to let

U.K.

buy to let

Percentage point increase in WALS

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

13

Graphic 7

Effect on WALS: Additional percentage points at the 'B' rating level

WALS --Weighted average loss severit y. Source: S&P Global Ratings.

Main findings: Overall influence on loss severity is relatively low

After applying the value discount in our scenario, we saw an increase of only 2.5% in the WALS

for RMBS at the 'AAA' rating level and 2.8% in the WALS for RMBS at the 'B' rating level, on

average. This is before considering any mitigating factors such as a gradual rather than an

instant decline in property values for low EPC classes, continued deleveraging, or price

appreciation of properties over time. This does not reflect any offsetting benefit from higher

valuations of properties with high EPC classes in mortgage collateral pools, which may benefit

from climate transition policies.

Unsurprisingly, a high share of BTL properties in a mortgage pool correlates with a higher

influence on the WALS in our scenario analysis. The impact on the WAFF is limited, with an

increase of only 0.8 percentage points overall at the 'AAA' rating level, and 0.12 percentage points

at the 'B' rating level.

The effect on credit coverage is low, with an average increase of 0.97 percentage points only

at 'AAA' and 0.14 percentage points at 'B'. This shows that the higher loss severity as a result of

a property value discount for low energy efficiency would have only a limited effect on our cash

flow analysis, especially when the WAFF is low.

Structural features in RMBS transactions could mitigate the risk of reduced property

valuations for low-energy-efficient homes. First, at an individual loan level, borrowers generally

repay principal over time, which reduces the potential loss severity if they default. Additionally,

although we do not give credit for future house price appreciation in our RMBS analysis, house

price increases can reduce LTVs over time. RMBS structures differ from transaction to

transaction. Generally, however, RMBS structures often have generic structural features that

provide stability to our RMBS ratings. Structural mitigants often include some or all or the

following:

• Sequential amortization of rated notes, meaning that higher-rated notes are repaid before

lower-rated notes and credit enhancement often increases over time for all notes.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

France

prime

Ireland

prime

Netherlands

prime

U.K.

prime

U.K.

nonconforming

Ireland

buy to let

Netherlands

buy to let

U.K.

buy to let

Percentage point increase in WALS

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

14

• Hard credit enhancement. This refers to tangible forms of credit enhancement, such as

reserve funds, overcollateralization, or unrated subordinated notes. Generally, hard credit

enhancement would cover any losses on the sale of underlying mortgage collateral before it

is allocated to the rated RMBS.

• Soft credit enhancement. This generally takes the form of excess spread and, if available,

can be used to cover any losses on the sale of property underlying the RMBS.

Looking Ahead

Our scenario analysis enables a better understanding of the range of possible exposures that

issuers of RMBS face and may enhance our dialogue with issuers and market participants

regarding future climate transition risks and any related mitigants.

The scenarios in this research illustrate how EPC-related variables could in the future influence

RMBS credit-rating analytics. However, they are not considered in our current assumptions for

securitized mortgage loans because of uncertainty regarding the timing and extent of any legal

obligation to renovate properties to reach some mandated minimum level of energy efficiency.

Furthermore, there is limited visibility on the required amount of financing for renovations and

any resulting effect on property valuations.

The valuation discount of homes with the lowest energy efficiency could be significant if owners

do not do the renovations. Moreover, in countries that already have or may implement rental

market bans based on EPCs, BTL properties with low energy efficiency might be subject to higher

vacancy rates and lower rents, and therefore even lower valuations. Therefore, in our view,

mortgage loan pools with a high share of BTL properties may present a higher credit risk in the

future. In RMBS transactions backed by nonperforming loans, the main risk would be lower sale

proceeds if property is repossessed, due to the discounted value of low-energy-efficient

properties.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

15

Appendix

Table 3

Sample of government and private lender support for building renovations by country

Jurisdiction Government and regulatory support for renovation Banks/lenders energy-efficiency financing solutions

France --The French government offers grants for homeowners and

landlords to finance energy performance improvements. The

amount is up to €11,000 and depends on household income

and energy improvement. A specific scheme for low-income

borrowers offers grants up to €17,500.

--The government has introduced subsidized interest-free

loans (Eco-PTZ) up to €50,000, available for all owners, for

energy performance renovation, in partnership with main

banks. The maximum term is 20 years. Low-income

households can benefit from a specific renovation mortgage

loan and the state guarantees up to 75% of the amount.

--There are many local grants available, and the value-added

tax for energy performance works is reduced to 5.5% instead

of 20%.

--In France, light renovations are often financed through a

consumer loan and deep renovations through a residential loan.

--All main banks offer interest-free loans (Eco-PTZ) in

partnership with the government.

--Some banks have set tighter underwriting criteria to purchase

BTL properties with an EPC class of G or F, requiring borrowers

to commit to renovate the property (evidence via quotations or

invoices is required). If the borrower does not commit to

renovate, then the rental income is excluded from the debt-to-

income ratio calculation.

Ireland --Government grants are available for all homeowners and

private landlords and managed by the Sustainable Energy

Authority of Ireland. The grants, of up to €6,000, are for a

variety of works including attic and wall insulation, heating

upgrades, solar panels, and heat pumps. A specific, fully-

funded grant scheme is also available for qualifying

homeowners that already get welfare benefits.

--The cost of renovation can generally be financed through a

mortgage loan.

--Some originators have launched green mortgage loans, with

lower rates, for borrowers purchasing a property with a high

energy performance assessment or conducting home

improvement works to increase the energy performance

assessment.

Netherlands --The government offers subsidies to homeowners and

renters for home energy efficiency renovation. Installation

must be completed to apply for the subsidy, based on

quotations, invoices, and photos. The amount of subsidy

depends on the number and types of works, and equipment

used.

--Local subsidies are also available.

--The National Heat Fund, funded by the Dutch government

and banks, provides homeowners and landlords with cheap

consumer loans for home renovation. Interest-free mortgage

loans exist for low-income households.

--Renovation is typically decided when a property is purchased,

and often financed through a construction deposit released to

the borrower after the renovation has been completed.

--Home energy performance has become a marketing strategy

for Dutch lenders to distinguish themselves. Some propose

discounted interest rates for loans backed by properties with

strong EPCs, or when the borrower commits to renovate the

property and improve the EPC class. Lenders also offer tools to

help borrowers get information on energy performance

renovation.

U.K.

(England

and Wales)

--The Energy Company Obligation (ECO4) and ECO+ schemes

are funded by the main energy suppliers. ECO4 targets low-

income homeowners or tenants in energy inefficient

properties and can finance insulation, boiler replacements,

electric heating, draught proofing, heat pumps, and solar

panels. ECO+ targets both low-income and middle-income

households with grants of up to £15,000 to finance mostly

insulation. About 80% of the scheme is dedicated to homes

with an EPC class of D or lower.

--The Home Upgrade Grant is funded by the government’s

Local Authority Delivery scheme. It targets both homeowners

and private renters to finance various measures, including

insulation and low-carbon technologies.

--The Boiler Upgrade Scheme, funded by the government,

offers grants of up to £6,000 to finance heat pumps and

biomass boilers.

--The cost of renovation can generally be financed through a

mortgage loan. Some homeowners and landlords benefit from

increased property values and amortization since their initial

loan, which can help finance the costs through their existing

mortgage loan.

--There are some initiatives from lenders to create specific

offers related to energy efficiency. Some originators have

decreased the interest rate on their green additional borrowing

product to 0%. However, only a limited number of mortgage

holders could benefit from this green product.

Sources: France: Ministère de l'Économie des Finances et de la Souveraineté Industrielle et Numérique (Ministry of the

Economy, Finance and Industrial and Digital Sovereignty; Ireland - Sustainable Energy Authority of Ireland: Netherlands:

Rijksdienst voor Ondernemend Nederland – RVO (Netherlands Enterprise Agency); UK (England and Wales) - Ofgem,

Department for Energy Security and Net Zero; and S&P Global Ratings.

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

16

Related Research

• Carbon Pricing, In Various Forms, Is Likely To Spread In The Move To Net Zero, Aug. 9, 2022

External Research

• La valeur verte des logements en 2021 (The green value of housing in 2021), Nov. 14, 2022

(Etudes statistiques immobilières, Notaires de France)

• De waarde van het energielabel - investeren in duurzaamheid loont steeds meer (The value

of the energy label - investing in sustainability increasingly pays off), July 12, 2022 (Brainbay)

• Rood energielabel doet steeds meer pijn bij woningverkoop (Red energy label increasingly

hurts home sales), Nov. 14, 2021 (Tilburg and Maastricht Universities)

• Energy performance certificates and house prices: A quantile regression approach, Aug. 31,

2020 (M. McCord, M. Haran, PT. Davis, J. McCord, Journal of European Real Estate Research)

• What will you pay for an ‘A’? – a review of the impact of building energy efficiency labelling on

building value, June 3, 2017 (F. Brocklehurst, Ballarat Consulting, European Council For An

Energy Efficient Economy)

• The Impact of Energy Performance Certificates on property values and nearly zero-energy

buildings - Report for policy makers, July 2016 (J. Santos, A. Rajkiewicz, I. De Graaf, R.

Bointner, Zebra 2020 project)

• The Price Effect of Building Energy Ratings in the Dublin Residential Market, Oct. 2, 2015 (R.

Lyons, S. Lyons, S. Stanley, Energy Efficiency)

• An investigation of the effect of EPC ratings on house prices, June 17, 2013 (U.K. Department

Of Energy & Climate Change)

• Energy performance certificates in buildings and their impact on transaction prices and

rents in selected EU countries, April 19, 2013 (Directorate-General for Energy, European

Union Commission)

Sustainability Insights | Research: Building Energy Regulations And The Potential Impact On European RMBS

spglobal.com/ratings

Sept. 6, 2023

17

Editor

Bernadette Stroeder, Elora Karim, Kelliann Delegro

Digital Designer

Joe Carrick-Varty, Tim Hellyer

Copyright 2023 © by Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR

PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR

THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for

any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses

(including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the

Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&Ps opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-

related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P

Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any

damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P

reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.spglobal.com/ratings (free of charge) and www.ratingsdirect.com (subscription) and may be distributed through other means, including via S&P

publications and third-party redistributors. Additional information about our ratings fees is available at www.spglobal.com/ratings/usratingsfees.

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor’s Financial Services LLC.