1

1 of 37

Questions about this ALRD? Email? eeworkforcep[email protected]ov.

Problems with PAGE? Email page-hotline@ee.doe.gov or call the PAGE hotline at 866-492-4546.

Include ALRD name and number in subject line.

U.S. Department of Energy

State and Community Energy Programs

Golden Field Office

State and Community Energy Programs (SCEP)

Inflation Reduction Act (IRA) of 2022

State-Based Home Energy Efficiency Contractor Training Grant Program

CFDA Number: 81.041

ADMINISTRATIVE AND LEGAL REQUIREMENTS DOCUMENT (ALRD)

ALRD Issue Date: July 17, 2023

Overview of Key Information

Agency: U.S. Department of Energy (DOE)

Program Overview: The State-Based Home Energy Efficiency Contractor Training Grants (CTG)

program will provide States the ability to develop and implement a state workforce energy program

that prepares workers to deliver energy efficiency, electrification, and clean energy improvements,

including those covered under the Home Energy Performance-Based, Whole House Rebate Program

(HOMES) and the Home Electrification and Appliance Rebate Program (HEAR). This program was

established by Section 50123 of the Inflation Reduction Act (IRA).

1

The goals of the program are to:

1. Reduce the cost of training contractor employees by providing workforce development

tools for contractors, their employees, and individuals including, but not limited to,

subsidizing available training, testing and certifications.

2. Provide testing and certifications of contractors trained and educated to install home

energy efficiency and electrification technologies and deliver residential energy efficiency and

electrification improvements.

3. Partner with nonprofit organizations to develop and implement a State sponsored

workforce program that attracts and trains a diverse set of local workers to deliver the influx

of new federally-funded energy efficiency and electrification programs—including but not

limited to the IRA-funded Home Energy Rebate programs (IRA Sections 50121 and 50122).

2

Eligible Applicants: In accordance with the IRA Section 50123, funding is only available to States,

the District of Columbia, and a United States Insular Area (as that Term is defined in section 50211 of

the IRA)

3

. These eligible entities are referred to throughout this ALRD as “States”. No other entity

types may be considered for this funding. In accordance with 2 CFR Part 910.126 and DOE Program

Rule 10 CFR Part 420, eligibility for these awards is restricted to State Energy Offices.

Funding Overview: $150 million in formula funding is available in this ALRD. Please see Appendix

1

42 U.S.C. 18795b.

2

42 U.S.C. 18795b(b)(1)-(3).

3

As referenced in IRA section 50111, section 50211 defines a United States Insular Area to mean American

Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the Commonwealth of Puerto Rico, and the

United States Virgin Islands.

2

2 of 37

Questions about this ALRD? Email? eeworkforcep[email protected]ov.

Problems with PAGE? Email page-hotline@ee.doe.gov or call the PAGE hotline at 866-492-4546.

Include ALRD name and number in subject line.

C for funding allocations. These allocations are based on the formula set forth in 10 CFR Part 420.11

for the State Energy Program effective as of January 1, 2022. Grantees should develop their

applications using the allocations shown in Appendix C.

IRA Section 50123 provides $200 million to CTG, to remain available through September 30,

2031. Of the amount appropriated by the IRA, DOE will allocate funds to States as follows:

• $150 million for formula grants

• Up to $40 million for competitive grants

4

Cost Matching: Cost match is not required for these awards. States should consider how they could

leverage philanthropic and private sector funding to advance their goals and amplify the impact of the

IRA funding. If cost match is proposed, it must be included in the budget and budget narrative. All

sources of cost match are considered part of total project costs, and the cost match dollars will be

scrutinized under the same Federal regulations as Federal dollars. Further information on cost match is

detailed in section 5.2 in the Application Instructions and at 2 CFR 200.306.

Program Income: States may earn income in connection with CTG activities to defray program

costs. If the State Project Plan includes such activities, States should include an estimated amount of

earned income in the budget portion of the Grant Application. Program income is defined in Federal

Regulations as gross income earned by the recipient that is directly generated by a supported activities

or earned because of the award. Program income includes but is not limited to:

• Income from fees for services performed.

• The use or rental of real or personal property acquired with grant funds.

• The sale of commodities or items fabricated under a grant agreement.

• License fees and royalties on patents and copyrights.

• Payments of principal and interest on loans made with grant funds.

Program income does not include interest on grant funds except as otherwise provided in this subpart,

program regulations, or the terms and conditions of the award. Nor does it include rebates, credits,

discounts, refunds, etc., or interest earned on any of them.

If the Recipient earns program income during the project period as a result of this Award, the

Recipient must add the program income to the funds committed to the Award and used to further

eligible project objectives. (See 2 CFR Part 200.80 and 2 CFR Part 200.307 for further information.)

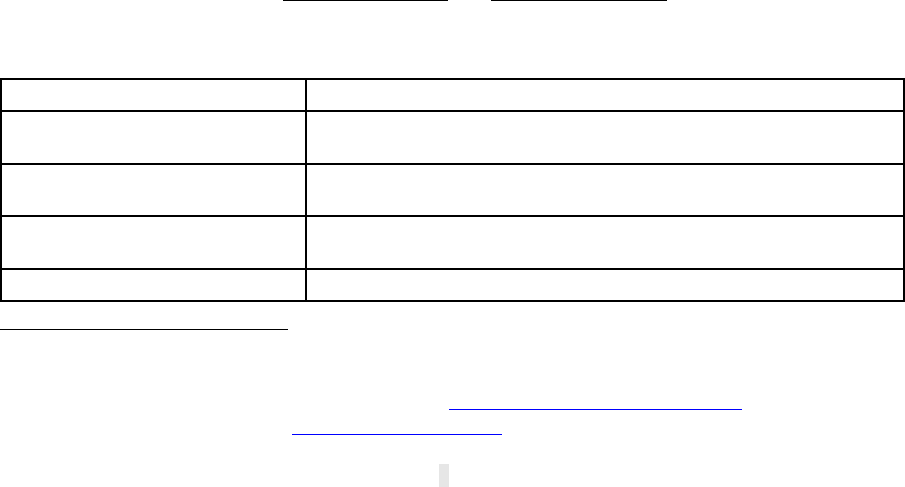

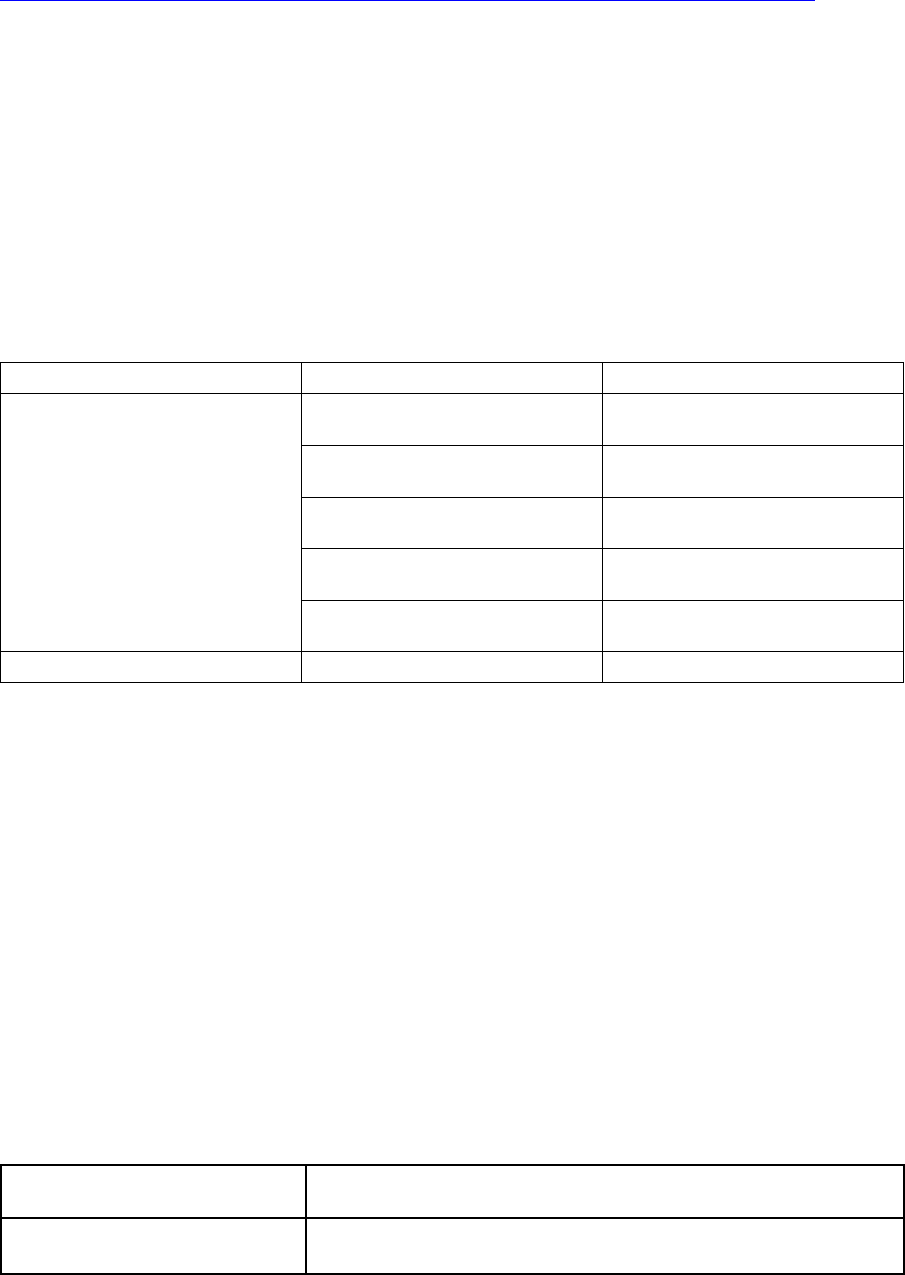

Timeline:

Initial Application Deadline

September 30, 2023

Negotiations

(on a rolling basis)

October 1, 2023 – October 31, 2023

Awards

(on a rolling basis)

November 1, 2023 – February 1, 2024

First Funding Installment

(50% of total award)

Executed Assistance Agreement

Second Funding Installment

State submits:

4

DOE will provide additional details on plans for these competitive funds in a future notice.

3

3 of 37

Questions about this ALRD? Email? eeworkforcep[email protected]ov.

Problems with PAGE? Email page-hotline@ee.doe.gov or call the PAGE hotline at 866-492-4546.

Include ALRD name and number in subject line.

(50% of total award)

• Results from the program evaluation (see Section 6.4.e)

• Plans for incorporating the evaluation results into

improving the current State program

Period of Performance: The expected period of performance is 48 months and includes all necessary

implementation and start-up activities. DOE will consider applications that contain justification for a

period of performances longer or shorter than 48 months.

Application Components: The State Application consists of the following:

1. Project Narrative (section 6.4)

o Performance Metrics (section 6.4.a)

o Community Benefits Plan (section 6.4.b)

o State Workforce Development Plan (section 6.4.c)

o Description of State Workforce Advisory Group (section 6.4.d)

o Program Evaluation Plans (section 6.4.e)

2. Standard Form-424 (Application for Federal Assistance) (section 6.5)

3. Standard Form-424A (Budget Summary) (section 6.6)

4. Budget Narrative (section 6.7)

5. Other Forms, as applicable (section 6.9)

o Negotiated Indirect Rate Agreement or Rate Proposal

o A document containing a link to the state’s latest single or program-specific audit as

required by 2 CFR 200 Subpart F

o A document providing the name, phone number and email address of the Authorized

Representative and Business Officer

o Certifications regarding Lobbying (SF-LLL Disclosure Form to report lobbying)

o Various certifications: The list of certifications and assurances found here. Please

verify compliance with Intergovernmental Review through your State’s single point

of contact, as applicable.

o A National Environmental Policy Act (NEPA) Statement of Work(section 4.4.c)

Questions/Agency Contacts:

• Questions relating to the registration process, system requirements, how an application form

works, or the submittal process must be directed to the PAGE hotline at 866-492-4546, or

[email protected]e.gov.

• States should reach out to the SCEP Workforce Development Team with any ALRD-specific

questions: eeworkforceprogram[email protected].

4 of 37

1.0 PURPOSE ...................................................................................................................................................... 6

2.0 SCOPE............................................................................................................................................................ 6

2.1 Legal Authority.............................................................................................................................. 6

2.2 Eligible Applicants ........................................................................................................................ 6

2.3 IIJA Formula Allocations .............................................................................................................. 6

2.4 Cost Match ..................................................................................................................................... 6

2.5 Program Income ............................................................................................................................ 6

3.0 PROGRAM OVERVIEW & GOALS ............................................................................................................ 7

3.1 Diversity, Equity, Inclusion, and Accessibility ............................................................................. 8

3.2 Justice40 Initiative ......................................................................................................................... 9

3.3 Job Growth and Quality ............................................................................................................... 12

3.4 Community and Labor Engagement ............................................................................................ 12

3.5 Technical Assistance ................................................................................................................... 13

4.0 AWARD ADMINISTRATION INFORMATION ....................................................................................... 14

4.1 Award Notices ............................................................................................................................. 14

4.2 Funding Restrictions .................................................................................................................... 14

4.3 Reporting and Monitoring ........................................................................................................... 14

4.4 Administrative and National Policy Requirements ..................................................................... 18

4.5 Intergovernmental Review .......................................................................................................... 19

4.6 Government Right to Reject or Negotiate ................................................................................... 19

4.7 Commitment of Public Funds ...................................................................................................... 19

4.8 Lobbying Restrictions .................................................................................................................. 19

4.9 Expenditure Restrictions .............................................................................................................. 19

4.10 Modifications ............................................................................................................................. 19

4.11 Proprietary Application Information ......................................................................................... 19

4.12 Protected Personally Identifiable Information ........................................................................... 20

5.0 APPLICATION and SUBMISSION INFORMATION ............................................................................... 21

5.1 Application Package .................................................................................................................... 21

5.2 Application Submission ............................................................................................................... 22

6.0 APPLICATION INSTRUCTIONS FOR CTG FORMULA GRANTS ....................................................... 23

6.1 Overview ..................................................................................................................................... 23

6.2 IRA Awards ................................................................................................................................. 23

6.3 State Application ......................................................................................................................... 23

6.4. Project Narrative ......................................................................................................................... 24

6.4.a Performance Metrics ................................................................................................................. 26

6.4.b. Community Benefits Plan ........................................................................................................ 28

6.4.c. State Workforce Development Plan ......................................................................................... 29

6.4.d. Workforce Advisory Group ..................................................................................................... 31

6.4.e. Program Evaluation Plans ........................................................................................................ 32

5 of 37

6.5 Standard Form 424 (Application) ................................................................................................ 32

6.6 Standard Form 424A (Budget) .................................................................................................... 32

6.7 Budget Narrative .......................................................................................................................... 32

6.8 Expenditure Prohibitions and Limitations ................................................................................... 34

6.9 Other Forms ................................................................................................................................. 35

6.10 National Environmental Policy Act Information ....................... Error! Bookmark not defined.

REFERENCE MATERIAL ................................................................................................................................ 35

Appendix A. State Formula Award Allocations ................................................................................................. 36

6 of 37

SUBJECT: INFLATION REDUCTION ACT OF 2022 STATE-BASED HOME ENERGY

EFFICIENCY CONTRACTOR TRAINING GRANTS FORMULA GRANT APPLICATION

INSTRUCTIONS

1.0 PURPOSE

The purpose of these application instructions is to provide guidance to States regarding the

preparation of State-Based Home Energy Efficiency Contractor Training Grant Program Formula

Grant applications under Section 50123 of the Inflation Reduction Act (IRA). In these application

instructions we also refer to this program as Contractor Training Grants (CTG).

2.0 SCOPE

2.1 Legal Authority

CTG is authorized under section 50123 of the IRA.

5

2.2 Eligible Applicants

In accordance with the IRA Section 50123, funding is only available to States, the District of

Columbia, and a United States Insular Area (as that term is defined in section 50211 of the IRA).

These entities are referred to throughout these application instructions as “States”. No other entity

types may be considered for this funding.

In accordance with 2 CFR Part 910.126 and DOE Program Rule 10 CFR Part 420, eligibility for these

awards is restricted to State Energy Offices.

2.3 IIJA Formula Allocations

Individual State IRA section 50123 allocations are included in Appendix A. These allocations are

based on the formula set forth in 10 CFR Part 420.11.

2.4 Cost Match

The IRA does not subject CTG funds to cost matching requirements. Accordingly, cost match is not

required.

DOE encourages States to consider (1) how they may leverage philanthropic and private sector

funding to advance their goals and amplify the impact of the IRA funding; and (2) what strategies they

can use to secure leveraged funding, to the extent practicable, in the plans they are submitting for IRA

section 50123 funding.

2.5 Program Income

States could earn income in connection with CTG activities to defray program costs. If the State

Project Plan includes such activities, States should include an estimated amount of earned income in

the budget portion of the Application. Program income is defined in federal regulations as gross

5

42 U.S.C. 18795b.

7 of 37

income earned by the recipient that is directly generated by a supported activity or earned because of

the award. Program income includes but is not limited to:

• Income from fees for services performed.

• The use or rental of real or personal property acquired with grant funds.

• The sale of commodities or items fabricated under a grant agreement.

• License fees and royalties on patents and copyrights.

• Payments of principal and interest on loans made with grant funds.

Program income does not include interest on grant funds except as otherwise provided in this subpart,

program regulations, or the terms and conditions of the award. Nor does it include rebates, credits,

discounts, refunds, etc., or interest earned on any of them.

If the Recipient earns program income during the project period as a result of this Award, the

Recipient must add the program income to the funds committed to the Award and used to further

eligible project objectives.

(See 2 CFR Part 200.80 and 2 CFR Part 200.307 for further information.)

3.0 PROGRAM OVERVIEW & GOALS

State programs awarded under this ALRD will use funding appropriated by the IRA to: (1) reduce the

cost of training contractor employees; (2) provide access to workforce development tools for

contractors including, but not limited to, testing and certification; and (3) partner with community

organizations to develop and implement an equitable state program.

6

The IRA is a $370 billion investment that will lower energy costs for families and small businesses,

accelerate private investment in clean energy solutions in every sector of the economy and every

corner of the country, strengthen supply chains for everything from critical minerals to efficient

electric appliances, and create good-paying jobs and new economic opportunities for workers.

7

The IRA establishes a State-Based Home Energy Efficiency Contractor Training Program

8

and

through this funding action, the IRA will invest appropriations of $150,000,000 for the four (4) year

period encompassing fiscal years (FYs) 2022 through 2027 to be distributed to States for the

development and implementation of contractor training programs. DOE will allocate formula awards

under this program to eligible units of state government in accordance with the formula for the State

Energy Program effective as of January 1, 2022. CTG funds can be used to attract, train, certify, place,

and retain a diverse set of local workers to deliver the influx of new federally-funded energy

efficiency and electrification programs—including but not limited to the IRA-funded Home Energy

Rebate programs (IRA Sections 50121 and 50122) covered under the Home Energy Performance-

Based, Whole House Rebate Program (HOMES) and the Home Electrification and Appliance Rebate

Program (HEAR).

9

CTG provides grants that reduce States’ cost of training contractor employees; provides testing and

certification of contractors trained and educated under state programs; and supports partnerships to

6

42 U.S.C. 18795b(b)(1)-(3).

7

White House Inflation Reduction Act Guidebook, “Inflation Reduction Act Guidebook, Jan. 2023.

8

42 U.S.C. 18785b.

9

42 U.S.C. 18795 and 18795a.

8 of 37

develop and implement a state workforce energy program. Below are examples of general activities

and goals that States may choose to pursue:

• Equip contractors with the hard and soft skills necessary to electrify homes and make them

more energy-efficient;

• Stimulate higher quality contracting across the residential sector by providing testing and

certification of contractors;

• Prepare workers and businesses in every U.S. state and territory to deliver the energy

efficiency and electrification measures funded through the IRA-funded HOMES and HEAR

programs (IRA Sections 50121 and 50122);

• Provide training and other support to encourage entrepreneurship among contractor firms,

including resources for new or aspiring business owners such as introductions to business

professionals (e.g., attorneys, accountants, HR support, insurance companies, etc.) to which

small contractors can outsource essential business services; inform minority- and women-

owned businesses (MWDBEs) of state diverse business enterprise certifications; or assist

MWDBEs to become trade allies/qualified contractors to deliver utility-run energy efficiency

programs, etc.

• Develop programs to upskill incumbent workers and support professional growth;

• Implement workforce readiness strategies, including on-the-job training, mentorship,

apprenticeship, and job placement efforts;

• Provide resources to develop and support relevant pre-apprenticeship and registered

apprenticeship training programs;

• Establish, or strengthen, career awareness programs to increase interest in relevant energy

workforce careers;

• Engage with community and labor organizations, including labor unions, to support the

development of high-quality jobs; and

• Promote diversity, equity, inclusion, and accessibility by designing programs for delivery in

underserved communities.

3.1 Diversity, Equity, Inclusion, and Accessibility

It is the policy of the Administration that:

“[T]he Federal Government should pursue a comprehensive approach to advancing

equity

10

for all, including people of color and others who have been historically

underserved, marginalized, and adversely affected by persistent poverty and

inequality. Affirmatively advancing equity, civil rights, racial justice, and equal

opportunity is the responsibility of the whole of our government. Because advancing

equity requires a systematic approach to embedding fairness in decision-making

processes, executive departments and agencies must recognize and work to redress

inequities in their policies and programs that serve as barriers to equal opportunity.

10

The term “equity” means the consistent and systematic fair, just, and impartial treatment of all individuals,

including individuals who belong to underserved communities that have been denied such treatment, such as

Black, Latino, and Indigenous and Native American persons, Asian Americans and Pacific Islanders and other

persons of color; members of religious minorities; lesbian, gay, bisexual, transgender, and queer (LGBTQ+)

persons; persons with disabilities; persons who live in rural areas; and persons otherwise adversely affected by

persistent poverty or inequality. See E.O. 13985, Advancing Racial Equity and Support for Underserved

Communities Through the Federal Government.

9 of 37

By advancing equity across the Federal Government, we can create opportunities for

the improvement of communities that have been historically underserved, which

benefits everyone.”

11

As part of this whole of government approach, this funding action seeks to encourage States to include

the participation of underserved communities

12

and underrepresented groups in the activities States

undertake with these funds. States are highly encouraged to include contractors and sub-contractors

from groups historically underrepresented

13

,

14

in their project scoping. Further, Minority Serving

Institutions

15

, Minority Business Enterprises, Minority Owned Businesses, Woman Owned

Businesses, Veteran Owned Businesses, or entities located in an underserved community that meet the

eligibility requirements are encouraged to be considered as sub-recipients for proposed CTG-funded

projects.

States should describe their efforts related to Diversity, Equity, Inclusion, and Access and associated

community benefits in their project narrative, as described in section 6.

3.2 Justice40 Initiative

16

Consistent with Executive Order 14008,

17

this funding action is designed to help meet the goal that

40% of the overall benefits of the Administration’s investments in clean energy and climate solutions

flow to disadvantaged communities, as defined by the Department pursuant to the Executive Order, to

drive the creation of good-paying jobs with the free and fair chance for workers to join a union; and to

foster economic revitalization and investment in coal, oil and gas, and power plant communities.

11

E.O. 13985, “Advancing Racial Equity and Support for Underserved Communities Through the Federal

Government,” Jan. 20, 2021.

12

The Executive Office of the President Memorandum for the Heads of Executive Departments and Agencies

defines a disadvantaged community as either: (1) a group of individuals living in geographic proximity, or (2) a

geographically dispersed set of individuals (such as migrant workers or Native Americans), where either type of

group experiences common conditions. This memo also directs federal agencies to use the Climate and

Economic Justice Screening Tool (CEJST) to identify disadvantaged communities,

13

According to the National Science Foundation’s 2019 report titled, “Women, Minorities and Persons with

Disabilities in Science and Engineering”, women, persons with disabilities, and underrepresented minority

groups—blacks or African Americans, Hispanics or Latinos, and American Indians or Alaska Natives—are

vastly underrepresented in the STEM (science, technology, engineering and math) fields that drive the energy

sector. For example, in the U.S., Hispanics, African Americans and American Indians or Alaska Natives make

up 24 percent of the overall workforce, yet only account for 9 percent of the country’s science and engineering

workforce. DOE seeks to inspire underrepresented Americans to pursue careers in energy and support their

advancement into leadership positions. Source: https://www.energy.gov/articles/introducing-minorities-energy-

initiative.

14

Note that Congress recognized in section 305 of the American Innovation and Competitiveness Act of 2017,

Public Law 114-329: “[I]t is critical to our Nation’s economic leadership and global competitiveness that the

United States educate, train, and retain more scientists, engineers, and computer scientists; (2) there is currently

a disconnect between the availability of and growing demand for STEM-skilled workers; (3) historically,

underrepresented populations are the largest untapped STEM talent pools in the United States; and (4) given the

shifting demographic landscape, the United States should encourage full participation of individuals from

underrepresented populations in STEM fields.”

15

Minority Serving Institutions (MSIs), including Historically Black Colleges and Universities/Other Minority

Institutions as educational entities recognized by the Office of Civil Rights (OCR), U.S. Department of

Education, and identified on the OCR's Department of Education U.S. accredited postsecondary minorities’

institution list: https://www2.ed.gov/about/offices/list/ocr/edlite-minorityinst-list-tab.html.

16

Department of Energy Justice40 Initiative: https://www.energy.gov/diversity/justice40-initiative.

17

E.O. 14008, “Tackling the Climate Crisis at Home and Abroad,” Jan. 27, 2021.

10 of 37

States should maximize these benefits and describe how applicable project benefits will flow to

disadvantaged communities to the greatest extent practicable.

DOE’s General Guidance on Justice40 Implementation

18

was designed to help States and other

interested parties incorporate Justice40 Initiative goals into DOE-funded projects.

Identifying Disadvantaged Communities

The Justice40 Initiative directs that 40% of benefits realized from Covered Programs flow to

“disadvantaged communities.” OMB’s Interim Implementation Guidance defines a community as

either: (1) a group of individuals living in geographic proximity (such as census tract), or (2) a

geographically dispersed set of individuals (such as migrant workers or Native Americans), where

either type of group experiences common conditions. M-21-28 (whitehouse.gov).

Pursuant to the Interim Implementation Guidance and OMB guidance M-23-09

19

DOE recognizes

disadvantaged communities as defined and identified by the White House Council on Environmental

Quality’s Climate and Economic Justice Screening Tool (CEJST), which can be located at

https://screeningtool.geoplatform.gov/.

Nationwide, approximately 27,251 communities were identified as disadvantaged by the CJEST tool.

Communities are considered disadvantaged if they are in a census tract that meets the threshold for at

least one of the tool’s categories of burden and corresponding economic indicator. Additionally,

federally recognized Tribal lands are categorized as disadvantaged communities in accordance with

OMB’s Interim Implementation Guidance “common conditions” definition of community.

Justice40 Initiative Implications

As a best practice, DOE’s Office of Economic Impact and Diversity recommends that recipients

develop and sustain procedures and systems that can easily track what benefits are flowing to specific

communities or locations (e.g., connecting benefits accrued with zip codes, and/or census tracts).

Tracking benefits will allow funding recipients to measure progress and ensure programs are meeting

intended goals. Further analysis of this data can also be used to empower program designers and

lawmakers with information that is often needed to update or create new programs that better assist

communities most in need.

Identifying Benefits

Benefits from these programs include, but are not limited to, measurable direct or indirect investments

or positive project outcomes that achieve or contribute to the following in disadvantaged

communities:

18

Final DOE Justice40 General Guidance 072522.pdf (energy.gov). On January 9, 2023, DOE issued

a Request for Information (RFI) to solicit feedback from States and nonprofits, as well as partner

stakeholders such as labor unions, employers and contractors, workforce investment boards, energy

efficiency training providers, researchers, community partners, manufacturers, community-based

organizations, and others on issues related to the development and implementation of relevant

programs. This included specific requests for feedback on the ways in which CTG can be designed to

reach underserved communities.

19

“Addendum to the Interim Implementation Guidance for the Justice40 Initiative”, M-23-09 (whitehouse.gov).

11 of 37

(1) a decrease in energy burden;

(2) a decrease in environmental exposure and burdens;

(3) an increase in access to low-cost capital;

(4) an increase in access to good jobs with family-sustaining wages and benefits;

(5) an increase in access to job training, education, and credentialling;

(6) an increase in clean energy enterprise creation and contracting (e.g., minority-owned or

disadvantaged business enterprises);

(7) an increase in energy democracy, including community ownership of energy resources;

(8) an increase in parity in clean energy technology access and adoption; and

(9) an increase in energy resilience.

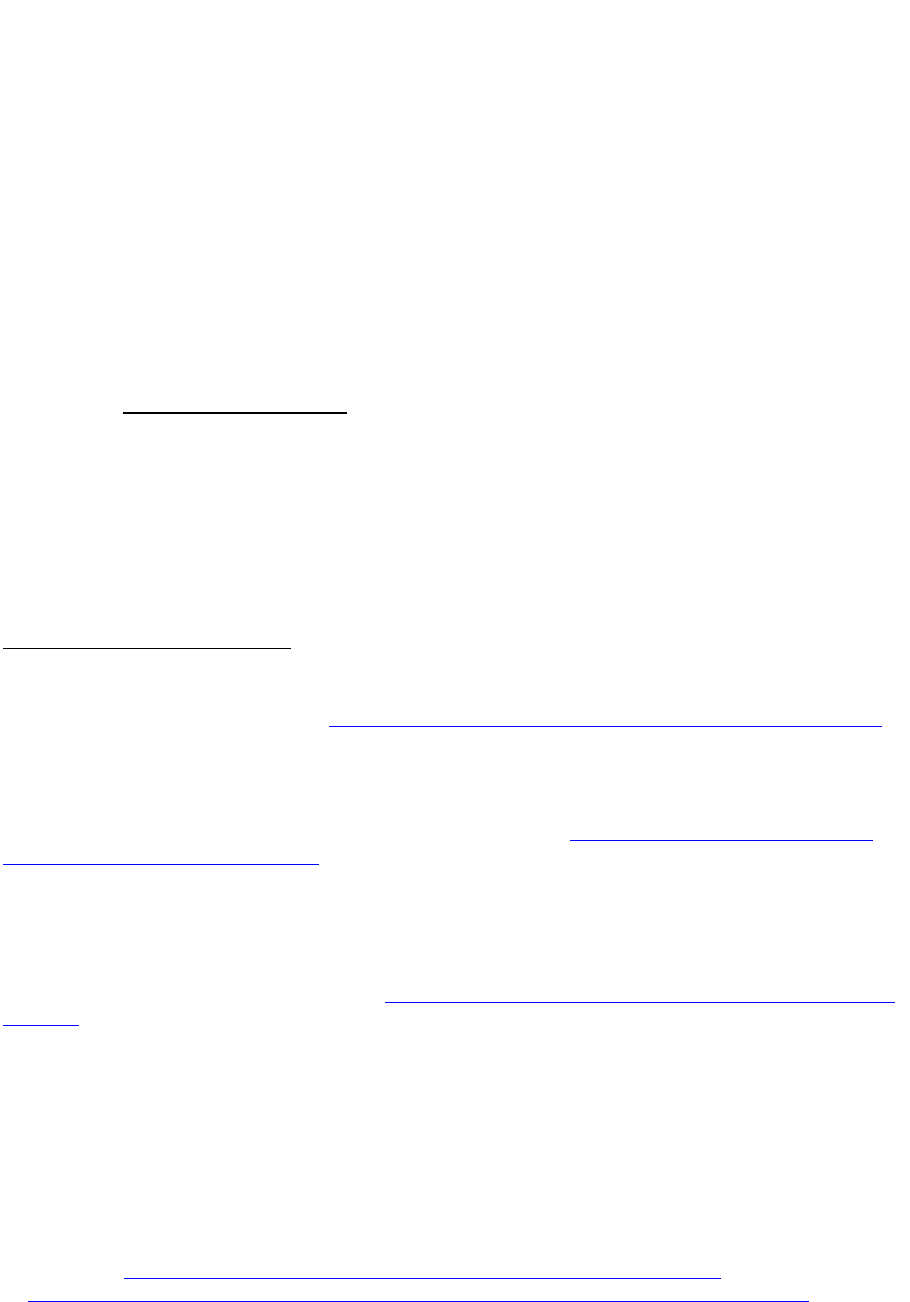

Not all nine policy priorities will be applicable to all DOE programs or funding opportunities. The

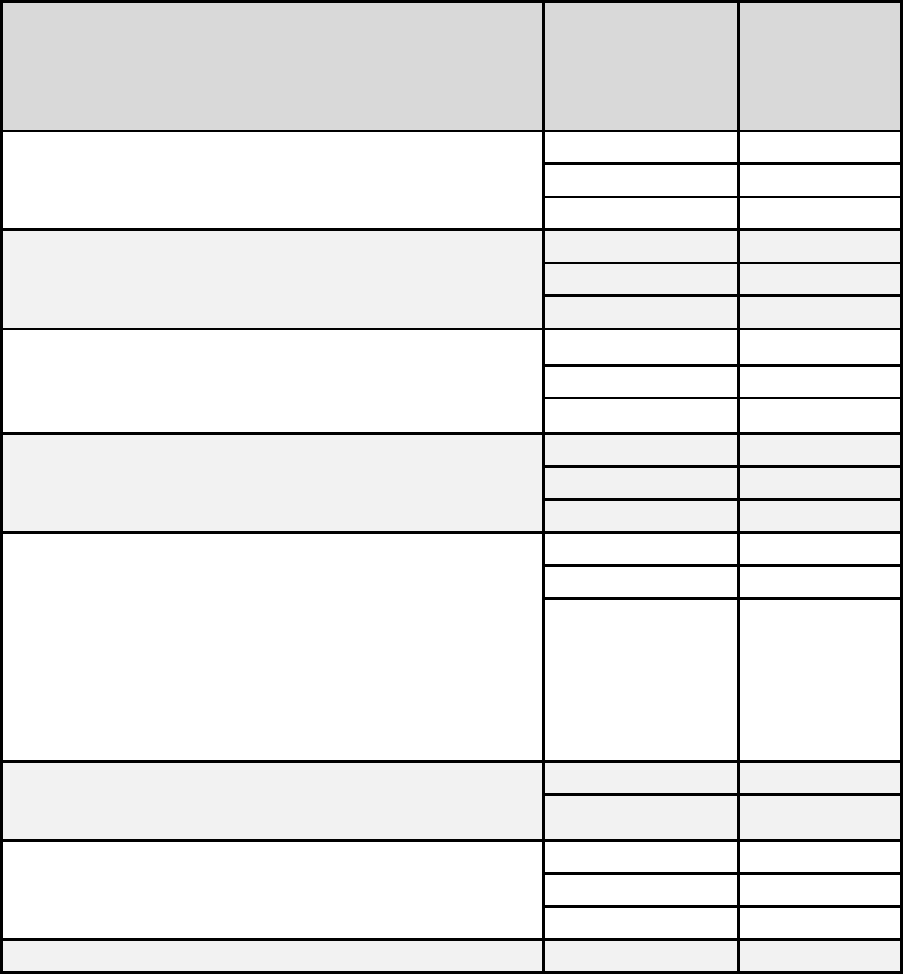

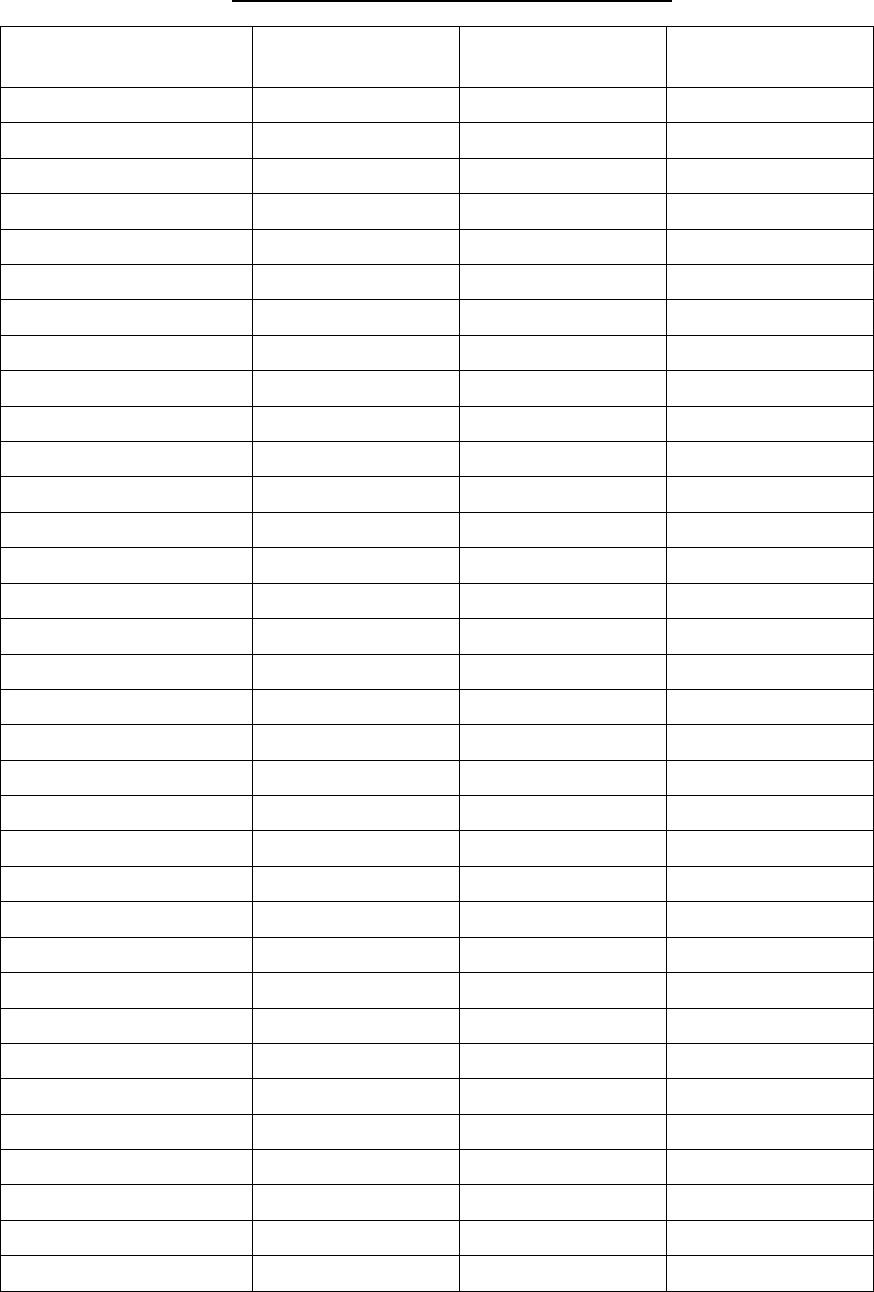

matrix below provides examples of measurable benefits and how they map to the different DOE

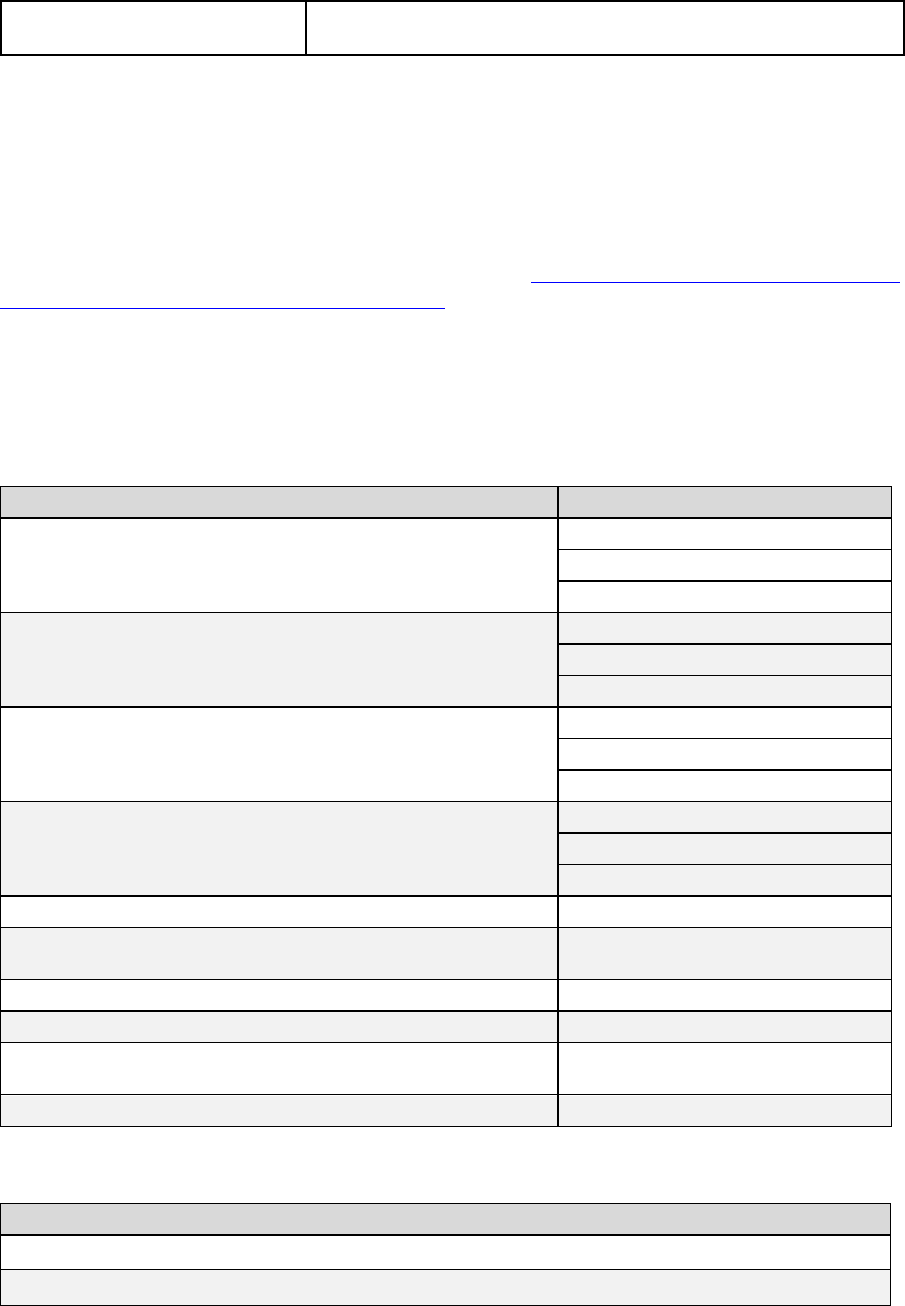

policy priorities mentioned above.

Policy Priorities

Benefit Metric and Units

N/A

Dollars spent [$] by DOE Covered Programs [$] in

disadvantaged communities

Decrease energy burden in disadvantaged

communities

Dollars saved [$] in energy expenditures due to technology

adoption in disadvantaged communities

Energy saved [MMBTU or MWh] or reduction in fuel [GGe]

by disadvantaged communities

Decrease environmental exposure and

burdens for disadvantaged communities

Avoided air pollutants (CO2 equivalents, NOx, SO2, and/or

PM2.5) in disadvantaged communities

Remediation impacts on surface water, groundwater, and soil

in disadvantaged communities

Reduction of legacy contaminated waste in disadvantaged

communities

Increase in access to good jobs with family-

sustaining wages and benefits

Average and range of wages [$/hour] for occupations funded

through program

Number of jobs at or above prevailing wage for a given

occupation

Increase clean energy jobs, job pipeline,

and job training for individuals from

disadvantaged communities

Dollars spent [$] and/or number of participants from

disadvantaged communities in job training programs,

apprenticeship programs, STEM education, tuition,

scholarships, and recruitment.

Number of hires from Disadvantaged communities resulting

from DOE job trainings

Number of jobs created for disadvantaged communities

because of DOE program

Number of and/or dollar value [$] of partnerships, contracts,

or training with minority serving institutions (MSIs)

Increase clean energy enterprise creation

and contracting for minority or

disadvantaged businesses in disadvantaged

communities

Number of contracts and/or dollar value [$] awarded to

businesses that are principally owned by women, minorities,

disabled veterans, and/or LGBT persons

Increase energy democracy in

disadvantaged communities

Number of stakeholder events, participants, and/or dollars

spent to engage with organizations and residents of

disadvantaged communities, including participation and

notification of how input was used

Number of tools, trainings for datasets/tools, people trained

and/or hours dedicated to dataset/tool and technical assistance

12 of 37

and knowledge transfer efforts to disadvantaged communities

Dollars spent [$] or number of hours spent on technical

assistance for disadvantaged communities

Dollar value [$] and number of clean energy assets owned by

disadvantaged community members

Increase access to low-cost capital in

disadvantaged communities

Dollars spent [$] by source and purpose and location

Leverage ratio of private to public dollars [%]

Loan performance impact through dollar value [$] of current

loans and of delinquent loans (30-day or 90-day) and/or

number of loans (30-day delinquent or 90-day default)

Increase parity in clean energy technology

access and adoption in disadvantaged

communities

Clean energy resource [MWh] adopted in disadvantaged

communities

Increase reliability, resilience, and

infrastructure to support reliability and

resilience in disadvantaged communities

Increase in community resilience hubs in disadvantaged

communities

Number and size (MWh) of community resilience

infrastructure deployed in disadvantaged communities (e.g.,

Distributed solar plus storage, utility scale, DERs, microgrids)

3.3 Job Growth and Quality

As an agency whose mission is to help strengthen our country’s energy prosperity, DOE strongly

supports efforts to invest in the American workforce. This includes investments that expand quality

jobs by adopting labor standards; ensure workers have a free and fair chance to join a union; engage

responsible employers; reduce systemic barriers to accessibility of quality jobs; foster safe, healthy,

and inclusive workplaces and communities; and develop a diverse workforce well-qualified to build

and maintain the country’s energy infrastructure and to grow domestic manufacturing.

States efforts should support good-paying jobs with the free and fair choice to join a union and

support labor-management training partnerships, such as registered apprenticeships. In their project

planning, States are highly encouraged to engage with an inclusive collection of local stakeholders

including labor unions and community-based organizations that support or work with disadvantaged

communities. The DOE Justice40 Guidance provides a helpful template strategy for undertaking

strategic stakeholder engagement.

Stakeholder engagement is a relatively small cost that delivers high value. Proactive and meaningful

engagement with stakeholders ensures stakeholders’ perspectives can be incorporated into the project

plan, allows for transparency, and helps reduce or eliminate certain risks associated with the project.

States are encouraged to include information in their application about how they have engaged labor

and community stakeholders in ways that foster the negotiation of new community and workforce

agreements.

3.4 Community and Labor Engagement

13 of 37

As part of the whole-of-government approach to advance equity and encourage worker organizing and

collective bargaining,

20

,

21

,

22

and in alignment with IRA section 50123, this funding action and any

related activities will seek to encourage meaningful engagement and participation of workforce

organizations, including labor unions, as well as underserved communities and underrepresented

groups.

DOE encourages applicants to engage with labor unions and community stakeholders – such as local

governments, Tribal governments, and community-based organizations that support or work with

underserved communities, including Disadvantaged Communities as defined for purposes of the

Justice40 Initiative. By facilitating community input, social buy-in, and accountability, such

engagement can substantially reduce or eliminate stalls or slowdowns, litigation, and other risks

associated with project implementation.

Community and labor engagement should ideally lay the groundwork for the eventual negotiation of

Workforce and Community Agreements, which could take the form of one or more kinds of

negotiated agreements with communities, labor unions, or, ideally, both. Registered apprenticeship

programs, labor-management training partnerships, quality pre-apprenticeship programs, card check

neutrality, and local and targeted hiring goals are all examples of provisions that Workforce and

Community Agreements could cover that would increase the success of a DOE-funded project.

3.5 Technical Assistance

DOE will continue to work with States to implement efficient, equitable, and effective programs.

DOE will explore opportunities to provide technical assistance support to States to help accelerate

their efforts to leverage other IRA funding. DOE encourages States to use the materials provided by

DOE. DOE encourages States to adopt best practices for developing and implementing their

Contractor Training programs.

The following activities—among others identified as valuable to States—may be available through

DOE technical assistance, particularly if groups of States present similar needs:

• Model workforce development plans for different sectors and target audiences.

• Webinars to cover a variety of technical assistance topics, including guidance on preparing

an application or comprehensive workforce development plan and compliance with Federal

regulations and statues as outlined in the Uniform Guidance.

• Peer Learning Groups to facilitate connections between States and organizations to

exchange knowledge and expertise; brainstorm program design and service delivery best

practices; and ask questions about program development and implementation.

• Case Studies on successful programs.

• Research and analyses to detect state-specific workforce skills gaps; synthesize labor market

information and wage data; examine workforce development program metrics and evaluation

best practices; and identify gaps in existing education, training, and credentialing programs.

• Stakeholder mapping to identify existing workforce development organizations.

20

E.O. 13985, “Advancing Racial Equity and Support for Underserved Communities Through the Federal

Government”. Jan. 20, 2021.

21

E.O. 14025, “Worker Organizing and Empowerment,” Apr. 26, 2021.

22

E.O. 14052, “Implementation of the Infrastructure Investment and Jobs Act,” Nov. 18, 2021.

14 of 37

DOE encourages States to consider utilizing early administrative funds available under the IRA Home

Energy Rebate programs to assess and plan for anticipated workforce needs.

23

4.0 AWARD ADMINISTRATION INFORMATION

4.1 Award Notices

An Assistance Agreement issued by the Contracting Officer is the authorizing award document. The

Assistance Agreement normally includes, either as an attachment or by reference: (1) Special Terms

and Conditions; (2) Application as approved by DOE; (3) Federal regulations at 2 CFR Part 200 as

amended by DOE at 2 CFR Part 910; (4) National Policy Assurances to Be Incorporated as Award

Terms; (5) Project Narrative (6) Budget Summary; (7) Intellectual Property Provisions; (8) Federal

Assistance Reporting Checklist, which identifies the Reporting Requirements; and (9) National

Environmental Policy Act (NEPA) Determination. These documents are sent to the recipient via

FedConnect.

4.2 Funding Restrictions

All expenditures must be allowable, allocable, and reasonable in accordance with the applicable

Federal Cost Principles. Determinations of allowable costs will be made in accordance with the Cost

Principles regulations, now found in the Office of Management and Budget’s Uniform Administrative

Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance),

codified at 2 CFR Part 200 and at 2 CFR Part 910 (Uniform Guidance-DOE specific).

States will not be entitled to reimbursement of pre-award costs.

4.3 Reporting and Monitoring

Reporting requirements are identified on the Federal Assistance Reporting Checklist, DOE F 4600.2,

attached to the award agreement.

Awards initiated since 10/1/2010 are subject to the requirement of Reporting Subawards and

Executive Compensation to comply with the Federal Funding and Transparency Act of 2006

(FFATA). Additional information about this requirement can be found in the Special Terms and

Conditions of the State’s award, at https://www.fsrs.gov, and in 2 CFR Part 170.

DOE reserves the right to update the reporting requirements through policy guidance, if needed.

Additional reporting requirement will be directly communicated to the States and posted on this

website: .

Federal regulations require DOE to monitor each grant recipient and grantees for each project,

program, sub-recipient, function, or initiative supported by federal funds to ensure compliance with all

federal regulations. The goal of grant monitoring is to maximize the effectiveness of awards, to

confirm compliance with applicable federal and state regulations and to ensure awards are on schedule

and on budget. Monitoring also provides an opportunity for DOE to communicate with states and

states with sub-recipients to provide assistance to help achieve our mutual energy goals. Monitoring

23

The Home Energy Rebates ALRD for early administrative funds encourages States to consider using a portion

of the administrative funds available to identify existing workforce development programs, engage local trade

groups and retailers, and plan for equity in workforce development programs. For more information, see:

https://www.energy.gov/sites/default/files/2023-03/Home_Energy_Rebates_ALRD.pdf.

15 of 37

procedures will be directly communicated to the States and posted on this website:

https://www.energy.gov/scep/state-based-home-energy-efficiency-contractor-training-grants.

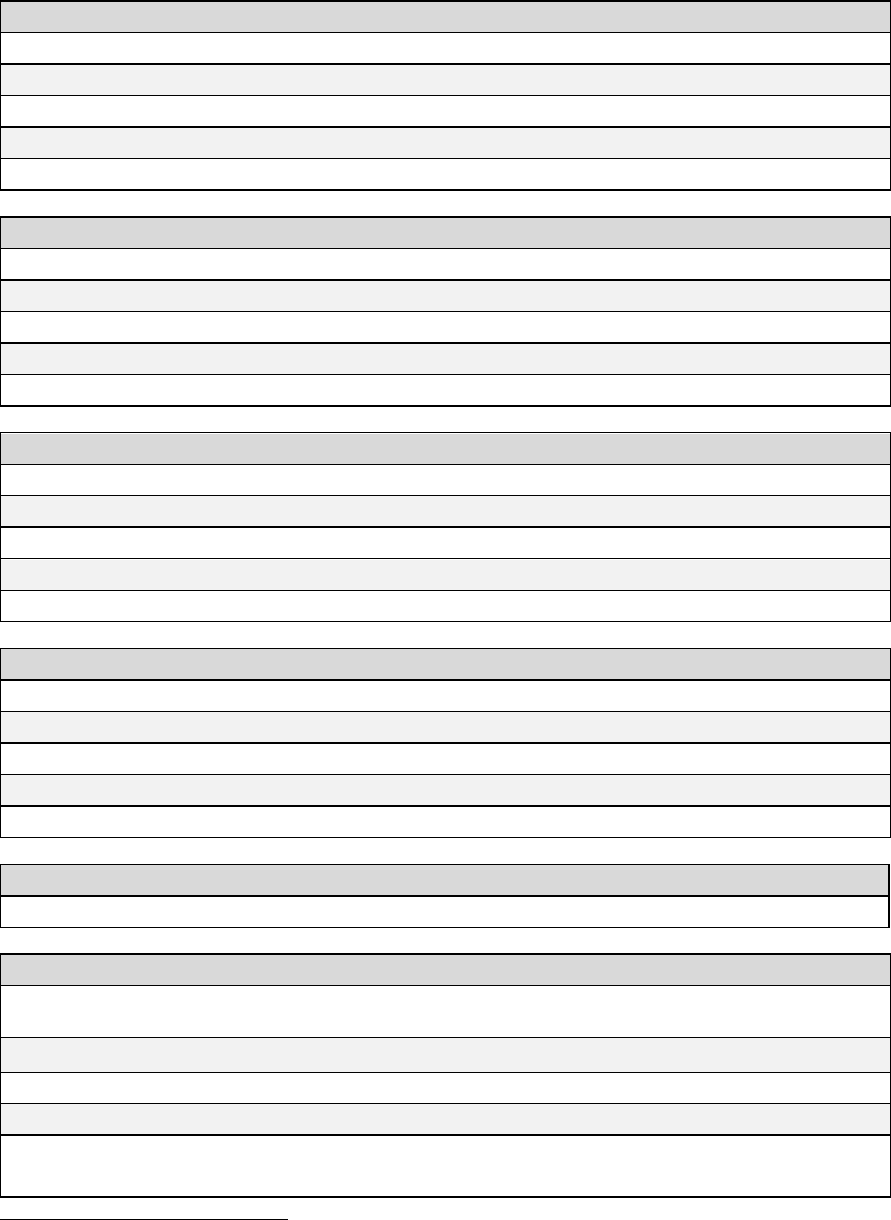

4.3.a Reporting Requirements

Transparency and accountability are central throughout the grant process. DOE will effectively

monitor and report the return on investment of CTG funds.

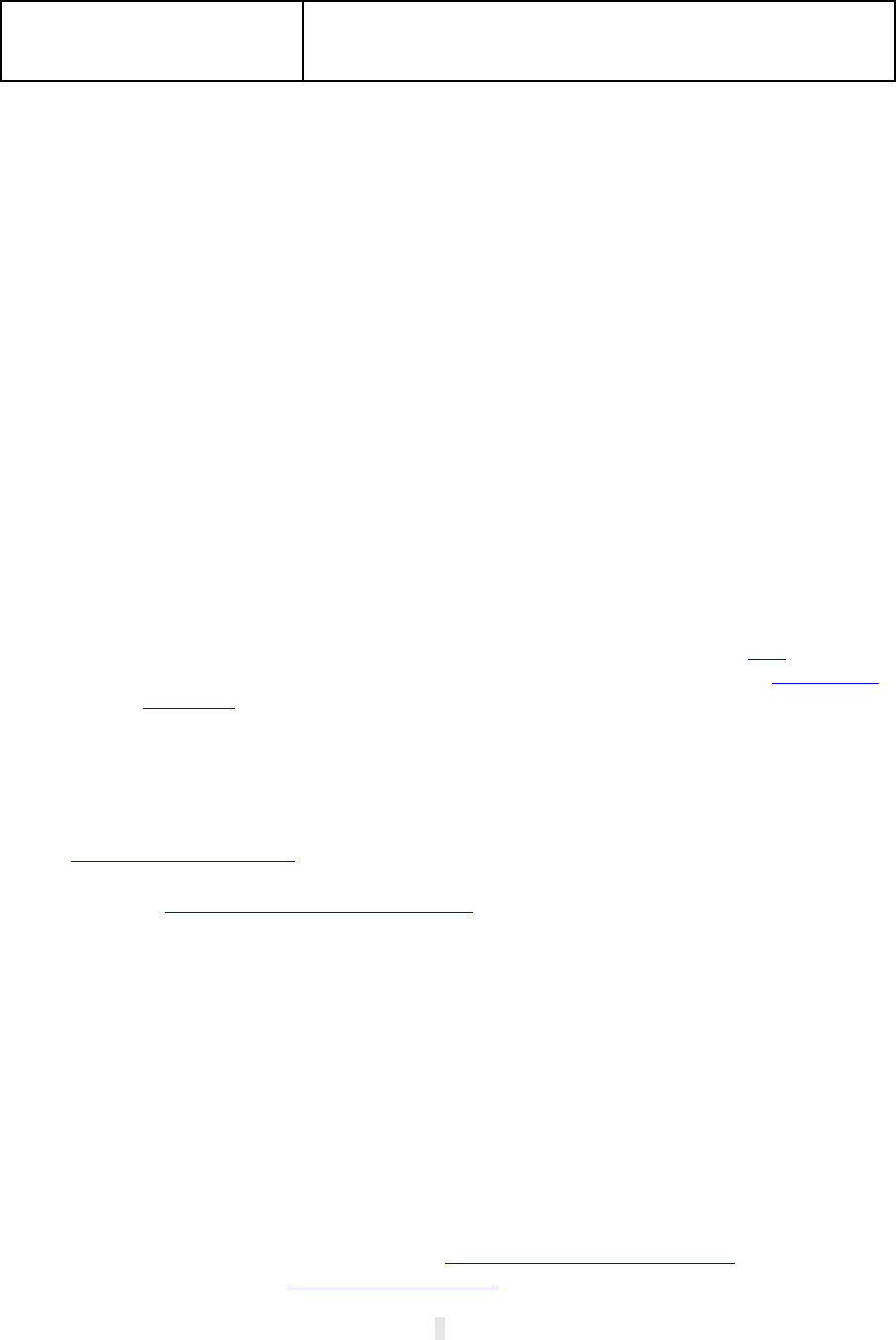

CTG recipients will fulfill most reporting requirements by reporting via the Performance and

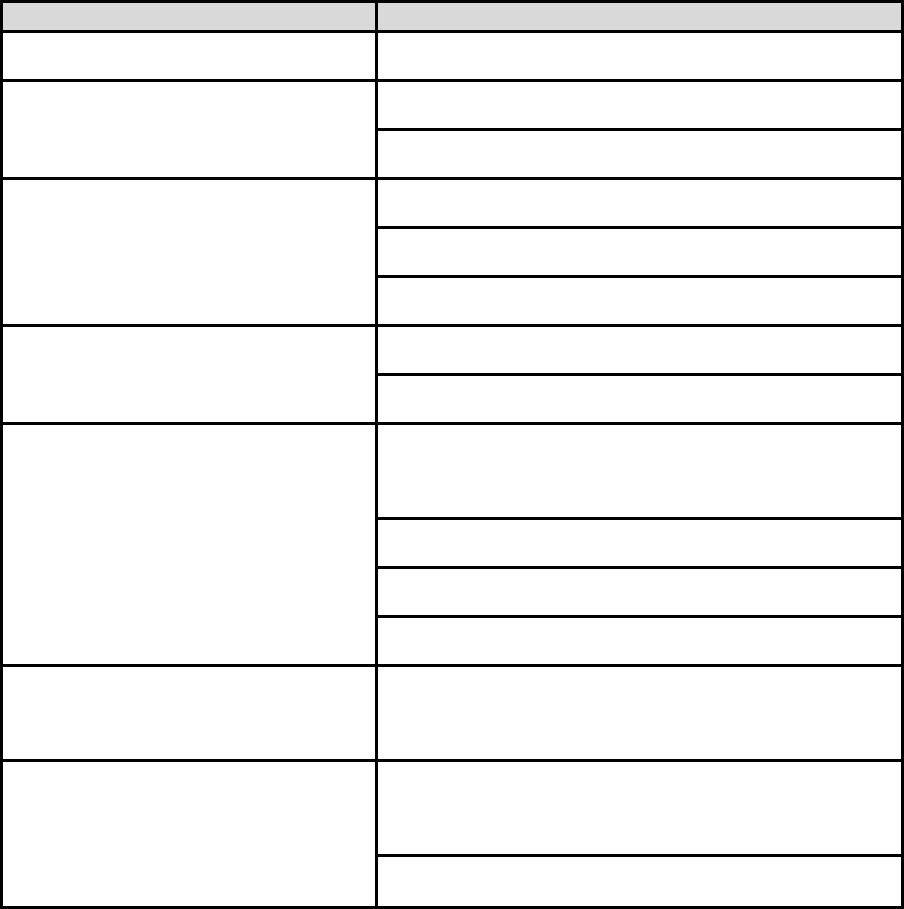

Accountability for Grants in Energy (PAGE) system. The chart below (Figure 1) indicates which

reports are required for CTG. This is not a conclusive list as additional reports may be required.

Figure 1.

Method

Report

Frequency of Report

PAGE

1a. Federal Financial Report

(FFR) (SF-425)

Quarterly

1b. Quarterly Performance

Report (QPR)

Quarterly

1c. Federal Financial Programs

Report (FPR)

Quarterly

1d. Semi Annual Davis Bacon

Report

Semi Annual

1e. Annual Historic

Preservation Report

Annual

Email

Annual Summary

Annual

The quarterly reporting requirements are authorized by an approved Information Collection Request,

OMB Control Number 1910-5126. Financial reporting requirements are identified on the Financial

Assistance Reporting Checklist (FARC), DOE EERE 355, attached to the award agreement.

All quarterly reports are required to be submitted to DOE via PAGE no later than the 30th day of the

month following the end of the reporting period. Note that the QPR and FFR are reviewed and

compared simultaneously, and neither will be approved until they are both submitted.

4.3.b Additional Reporting Requirements after First Funding Installment

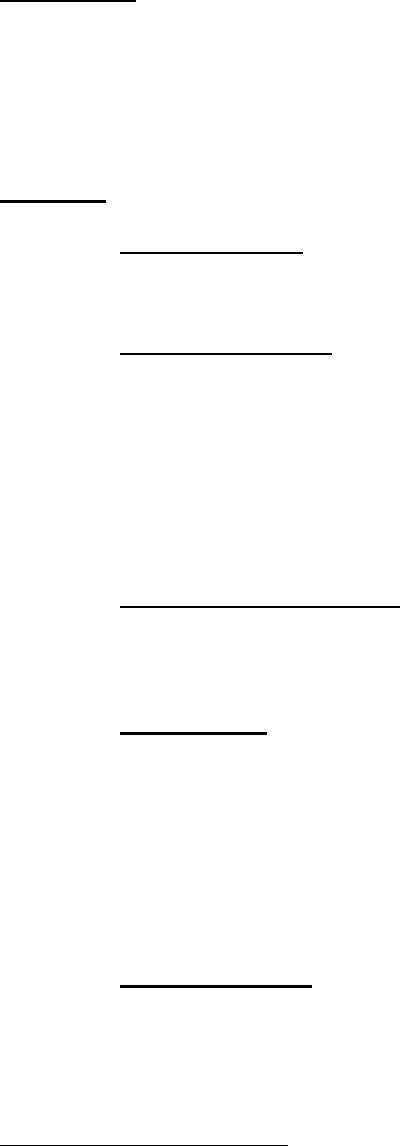

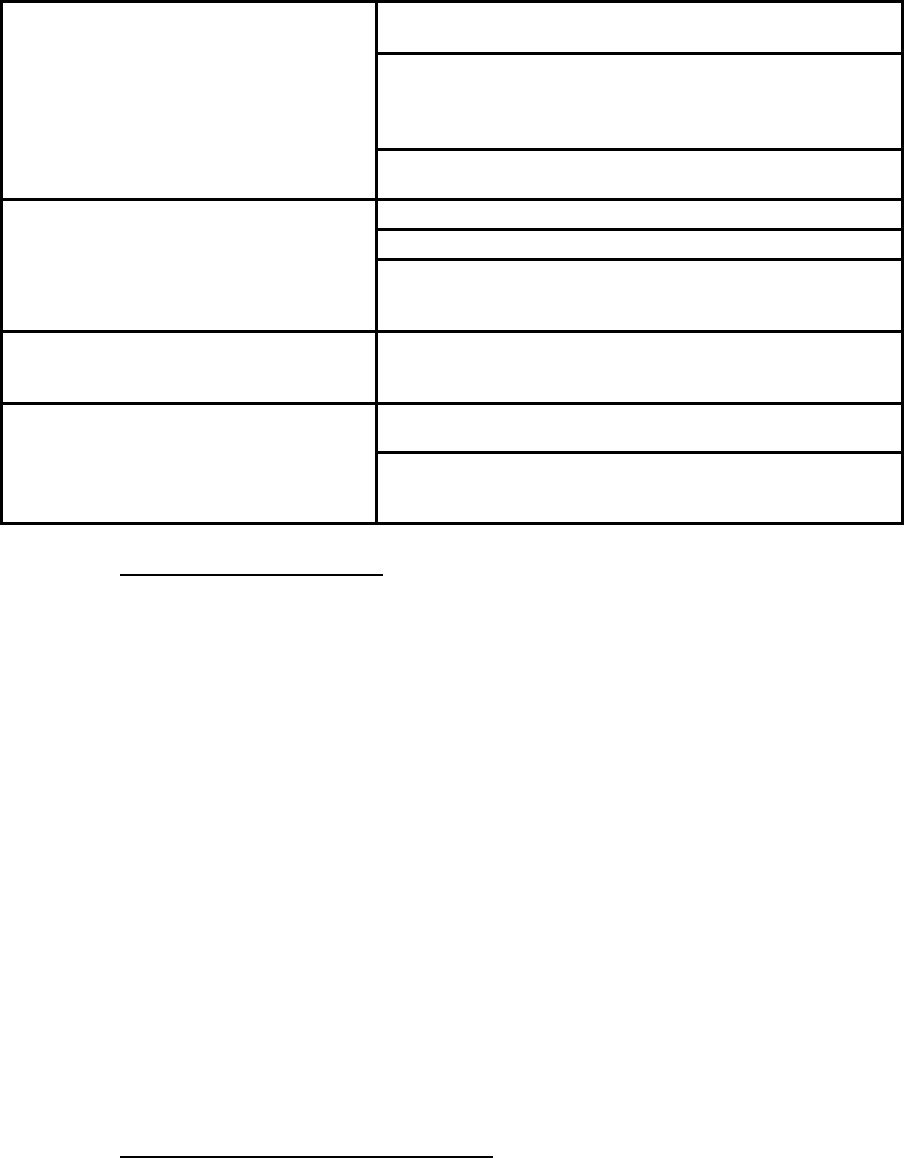

To release state formula allocations (see Figure 2), States must submit the following:

1. Results of the program evaluation (see section 6.4.e: Program Evaluation Plans); and

2. Plans for incorporating the evaluation results into improving the current State program.

Figure 2. DOE allocates formula grants to eligible units of state government as described in the

following table:

First Funding Installment

(50% of total award)

Executed Assistance Agreement

Second Funding Installment

(50% of total award)

State submits:

• Results from the program evaluation (see section 6.4.e)

16 of 37

• Plans for incorporating the evaluation results into

improving the current State program

4.3.c Close-Out Reporting Requirements

States must submit, no later than 120 calendar days after the end date of the period of performance, all

financial, performance, and other reports as required by the terms and conditions of the Federal award

(see 2 CFR 200.344 Closeout.)

The closeout reporting requirements will be detailed in the terms and conditions of the State’s

executed Assistance Agreement and posted on this website: https://www.energy.gov/scep/state-based-

home-energy-efficiency-contractor-training-grants.

In the final report, States must report on the status of each performance metric (section 6.3.a) and the

data and metrics listed, and described, in this section (section 4.3.c) below.

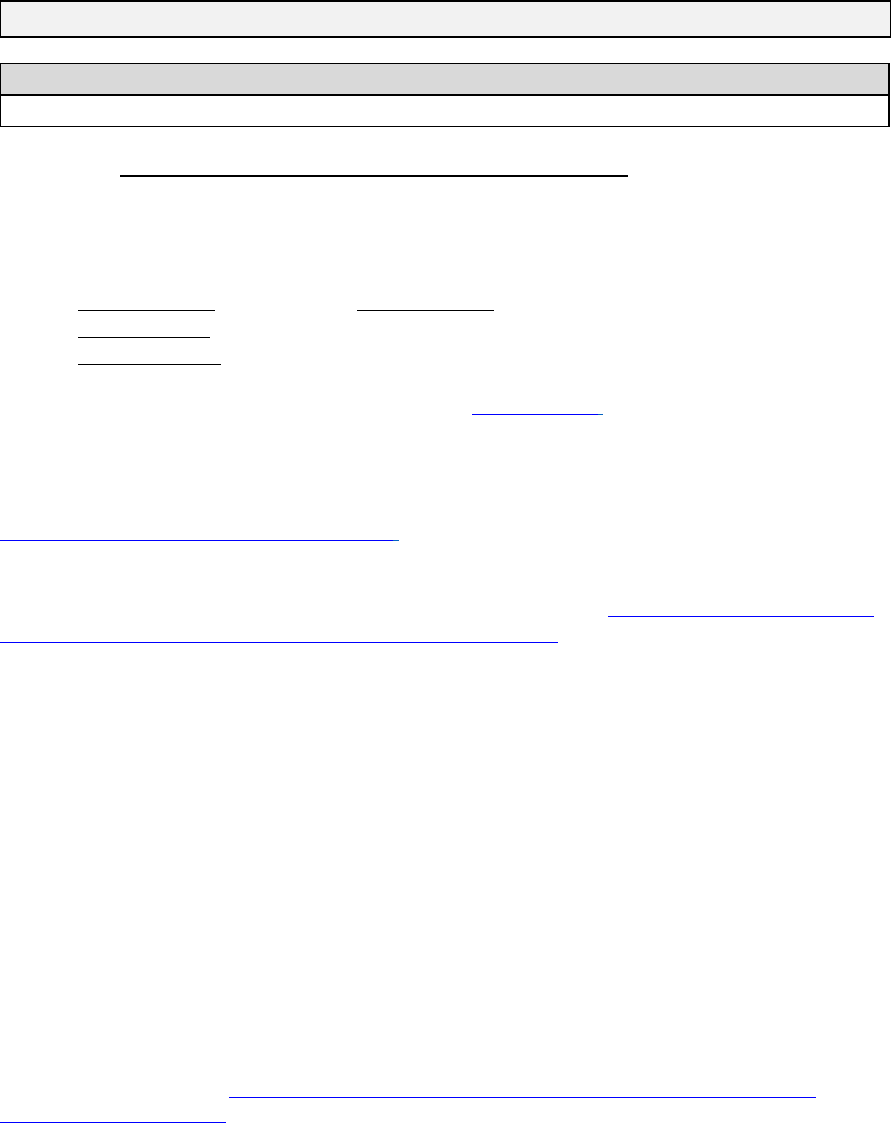

Qualitative Data from Program Participants: States should collect qualitative data and feedback from

program participants that include, but is not limited to, the following:

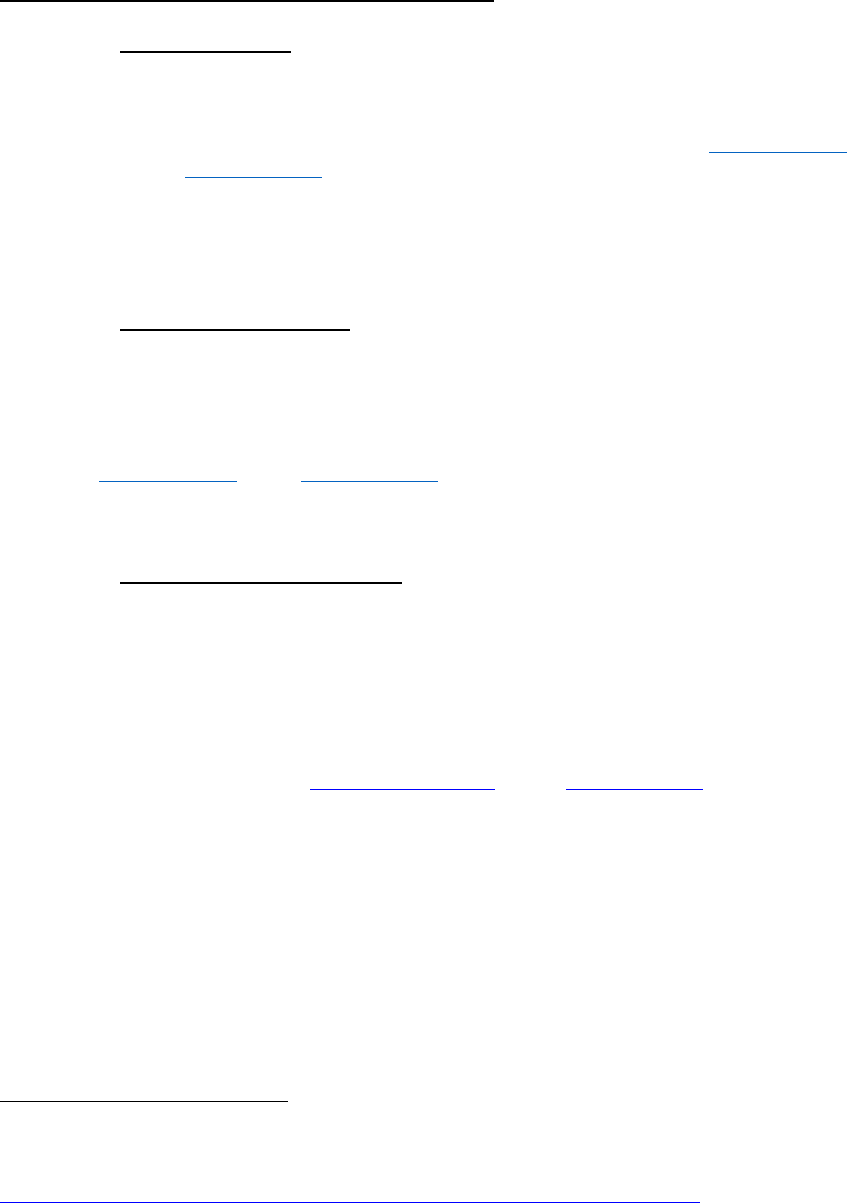

Qualitative Data

By Target Audience

What were the program benefits?

New workers

Existing workers

Contractor firms

What were the most valuable aspects of trainings/program?

New workers

Existing workers

Contractor firms

What opportunity exist to improve the program?

New workers

Existing workers

Contractor firms

Why did the participant pursue the training/program?

New workers

Existing workers

Contractor firms

How did the program assist with employment placement?

New workers

How did the program increase the participant’s access to

apprenticeships/paid internships? Explain.

New workers

How did the program increase career advancement?

Existing workers

How did the program increase access to hire new workers?

Contractor firms

How were the curricula/trainings offered to

workers beneficial?

Contractor firms

How did the program benefit the business?

Contractor firms

Metrics: States should collect metrics that include, but is not limited to, the following:

Labor Engagement Metric

Number of collective bargaining agreements executed.

Number of labor organizations engaged as stakeholders.

17 of 37

Funding and Impacts to Disadvantaged Communities Metric

Percent of funding to each community of interest.

Identification of potential community benefits.

Discussion of potential negative impacts or community harms.

List the realized community benefits.

List the realized and mitigated community harm.

Funding and Impacts to Tribal Communities Metric

Percent of funding to each community of interest.

Identification of potential community benefits.

Discussion of potential negative impacts or community harms.

List the realized community benefits.

List the realized and mitigated community harm.

Funding and Impacts to Rural

24

Communities Metric

Percent of funding to each community of interest.

Identification of potential community benefits.

Discussion of potential negative impacts or community harms.

List the realized community benefits.

List the realized and mitigated community harm.

Funding and Impacts to Energy Communities Metric

Percent of funding to each community of interest.

Identification of potential community benefits.

Discussion of potential negative impacts or community harms.

List the realized community benefits.

List the realized and mitigated community harm.

Funding to Businesses by Ownership & Classification Metric

List the self-identification of ownership of contracting companies that utilized the program.

Community and Stakeholder Engagement Metric

Report how many, and what type, of community engagement events were held? (e.g., virtual/in

person)

Provide the total number of attendees across events.

Provide the total number of attendees from communities of interest.

Describe the level of community engagement in project development and implementation.

Describe activities completed for each level of engagement, including any outcomes such as

community benefits agreements or barriers.

24

For CTG, SCEP is defining “rural communities” as cities, towns, or unincorporated areas with a population

of not more than 10,000 inhabitants. This definition is based on the one used in Bipartisan Infrastructure Law

(BIL) Section 40103(c).

18 of 37

Identify if the project was operated under a negotiated Community Benefits Agreement.

Non-DOE Investment Metrics

Provide the amount and source of matching funds.

4.4 Administrative and National Policy Requirements

4.4.a Administrative Requirements

The administrative requirements for DOE Grants and Cooperative Agreements are contained in:

• 2 CFR Part 200 as amended by 2 CFR Part 910

• 2 CFR Part 25 – Universal Identifier and Central Contractor Registration

• 2 CFR Part 170 – Reporting Subaward and Executive Compensation

The Electronic Code of Federal Regulations found at www.ecfr.gov.

4.4.b National Policy Requirements

The National Policy Assurances to be incorporated as Award Terms are located at

http://www.nsf.gov/awards/managing/rtc.jsp.

Intellectual Property Provisions. The standard DOE financial assistance intellectual property

provisions applicable to the various types of recipients are located at http://energy.gov/gc/standard-

intellectual-property-ip-provisions-financial-assistance-awards.

4.4.c Environmental Review in Accordance with National Environmental Policy

Act

SCEP’s decision whether and how to distribute Federal funds is subject to the National Environmental

Policy Act (42 U.S.C. 4321, et seq.). NEPA requires Federal agencies to integrate environmental

values into their decision-making processes by considering the potential environmental impacts of

their proposed actions.

DOE must comply with NEPA prior to authorizing the use of Federal funds, pursuant to 42 U.S.C.

4321, et seq; consider the effects on historic properties, pursuant to Section 106 of the National

Historic Preservation Act (NHPA); and consider the impacts to floodplains and wetlands, pursuant to

10 CFR Part 1022—Compliance with Floodplain and Wetland Environmental Review Requirements.

To streamline these required reviews, DOE carries out each of these reviews under the umbrella of its

NEPA review.

For an expeditated NEPA review, applicants can access, and use, the NEPA scope of work templates

available on this website: https://www.energy.gov/scep/state-based-home-energy-efficiency-

contractor-training-grants. DOE encourages applicants to submit a NEPA scope of work with their

application.

States should review and follow the NEPA determination in their award documents for the final

restrictions, and the list of activities that have been categorically excluded from further NEPA review.

While NEPA compliance is a federal agency responsibility, and the ultimate decisions remain with the

federal agency, States will be required to assist in the timely and effective completion of the NEPA

19 of 37

process in the manner most pertinent to their proposed project.

For additional background on NEPA, please see DOE’s NEPA website, at

https://www.energy.gov/nepa.

4.5 Intergovernmental Review

This program is subject to Executive Order 12372 (Intergovernmental Review of Federal Programs)

and the Federal regulations at 10 CFR Part 1005.

One of the objectives of the Executive Order is to foster an intergovernmental partnership and a

strengthened federalism. The Executive Order relies on processes developed by state and local

governments for coordination and review of proposed Federal financial assistance.

Applicants should contact the appropriate State Single Point of Contact (SPOC) to find out about, and

to comply with, the State's process under Executive Order 12372. The names and addresses of the

SPOCs are listed on the Web site of the Office of Management and Budget at Intergovernmental

Review (SPOC List) (whitehouse.gov) Intergovernmental Review (SPOC List) (whitehouse.gov) or

at: https://www.whitehouse.gov/wp-content/uploads/2020/04/SPOC-4-13-20.pdf.

4.6 Government Right to Reject or Negotiate

DOE reserves the right, without qualification, to reject any, or all, applications received in response to

this ALRD and to select any application, in whole or in part, as a basis for negotiation and/or award.

4.7 Commitment of Public Funds

The Contracting Officer is the only individual who has the authority to make awards or commit the

Government to the expenditure of public funds. A commitment by other than the Contracting Officer,

either explicit or implied, is invalid.

4.8 Lobbying Restrictions

By accepting funds under this award, you agree that none of the funds obligated on the award shall be

expended, directly or indirectly, to influence congressional action on any legislation or appropriation

matters pending before Congress, other than to communicate to Members of Congress as described in

18 U.S.C. 1913. This restriction is in addition to those prescribed elsewhere in statute and regulation.

4.9 Expenditure Restrictions

By accepting funds under this award, you agree that none of the funds obligated on the award shall be

expended, directly or indirectly, to support or oppose union organizing.

4.10 Modifications

Modifications to this Administrative and Legal Requirements Document will be processed and posted

on this website: https://www.energy.gov/scep/state-based-home-energy-efficiency-contractor-training-

grants.

4.11 Proprietary Application Information

DOE will use data and other information contained in applications strictly for evaluation purposes.

20 of 37

Applicants should not include confidential, proprietary, or privileged information in their applications

unless such information is necessary to convey an understanding of the proposed project.

Applications containing confidential, proprietary, or privileged information must be marked as

described below. Failure to comply with these marking requirements may result in the disclosure of

the unmarked information under the Freedom of Information Act or otherwise. The U.S. Government

is not liable for the disclosure or use of unmarked information and may use or disclose such

information for any purpose.

The cover sheet of the application must be marked as follows, and identify the specific pages

containing confidential, proprietary, or privileged information:

“Please be aware that all information provided to DOE (including confidential proprietary or

confidential commercial information) is subject to public release under the Freedom of

Information Act (FOIA). (5 U.S.C. § 552(a) (3) (A) (2006), amended by OPEN Government

Act of 2007, Pub. L. No. 110175, 121 Stat. 2524). When a FOIA request covers information

submitted to DOE by an applicant, and the cognizant DOE FOIA Officer cannot make an

independent determination regarding the public releasability of this information, the cognizant

DOE FOIA Officer will contact the submitter and ask for comment regarding the redaction of

information under one or more of the nine FOIA exemptions. However, the cognizant DOE

FOIA Officer will make the final decision regarding FOIA redactions. Submitters are given a

minimum of seven (7) days to provide redaction comments and if DOE disagrees with the

submitter’s comment, DOE will notify the submitter of the intended public release no less than

seven (7) days prior to the public disclosure of the information in question.” (10 CFR §

1004.11).

4.12 Protected Personally Identifiable Information

Applicants submitting applications in response to this ALRD must ensure that Protected Personally

Identifiable Information (PII), as defined at 2 CFR 200.1 and by OMB, is safeguarded and all data

exchanges conducted through, or during, the performance of this grant will be conducted in a manner

consistent with applicable federal law.

By submitting an application, applicants agree to take all necessary steps to protect such

confidentiality by complying with the following provisions that are applicable in governing their

handling of confidential information:

1. You must ensure that PII and sensitive data developed, obtained, or otherwise associated

with DOE/ETA funded grants is securely transmitted.

2. To ensure that such PII is not transmitted to unauthorized users, all PII and other sensitive

data transmitted via e-mail or stored on CDs, DVDs, thumb drives, etc., must be encrypted using a

Federal Information Processing Standards (FIPS) 140-2 compliant and National Institute of Standards

and Technology (NIST) validated cryptographic module. You must not e-mail unencrypted sensitive

PII to any entity, including ETA or contractors.

3. You must take the steps necessary to ensure the privacy of all PII obtained from

participants and/or other individuals and to protect such information from unauthorized disclosure.

4. You must ensure that any PII used during the performance of your grant has been obtained

in conformity with applicable Federal and state laws governing the confidentiality of information.

5. You further acknowledge that all PII data obtained through your DOE grant must be stored

in an area that is always physically safe from access by unauthorized persons and the data will be

processed using recipient-issued equipment, managed information technology (IT) services, and

designated locations approved by DOE. Accessing, processing, and storing of DOE grant PII data on

21 of 37

personally owned equipment, at off-site locations, (e.g., employee’s home), and non-recipient

managed IT services, (e.g., Yahoo mail), is strictly prohibited unless approved by DOE.

6. Your employees and other personnel who will have access to

sensitive/confidential/proprietary/private data must be advised of the confidential nature of the

information, the safeguards required to protect the information, and that there are civil and criminal 55

sanctions for noncompliance with such safeguards that are contained in Federal and state laws.

7. You must have policies and procedures in place under which your employees and other

personnel, before being granted access to PII, acknowledge their understanding of the confidential

nature of the data and the safeguards with which they must comply in their handling of such data, as

well as the fact that they may be liable to civil and criminal sanctions for improper disclosure.

8. You must not extract information from data supplied by DOE for any purpose not stated in

the grant agreement.

9. Access to any PII created by the DOE grant must be restricted to only those employees of

the grant recipient who need it in their official capacity to perform duties in connection with the scope

of work in the grant agreement.

10. All PII data must be processed in a manner that will protect the confidentiality of the

records/documents and is designed to prevent unauthorized persons from retrieving such records by

computer, remote terminal or any other means. Data may be downloaded to, or maintained on, mobile

or portable devices only if the data are encrypted using NIST validated software products based on

FIPS 140-2 encryption. In addition, wage data may only be accessed from secure locations.

11. PII data obtained by the recipient through a request from DOE must not be disclosed to

anyone but the individual requestor, except as permitted by the Grant Officer or by court order.

12. You must permit DOE to make onsite inspections during regular business hours for the

purpose of conducting audits and/or conducting other investigations to assure that you are complying

with the confidentiality requirements described above. In accordance with this responsibility, you

must make records applicable to this Agreement available to authorized persons for the purpose of

inspection, review, and/or audit.

13. You must retain data received from DOE only for the period of time required to use it for

assessment and other purposes, or to satisfy applicable Federal records retention requirements, if any.

Thereafter, you agree that all data will be destroyed, including the degaussing of magnetic tape files

and deletion of electronic data.

5.0 APPLICATION and SUBMISSION INFORMATION

5.1 Application Package

All submissions must conform to the form and content requirements described below, including

maximum page lengths. Submissions must follow the following requirements:

1. Each must be submitted in Adobe PDF format unless stated otherwise.

2. Each must be written in English.

3. All pages must be formatted to fit on 8.5- by 11-inch paper with margins not less than one

inch on every side. Use Calibri typeface, a black font color, and a font size of 12 point or

larger (except in figures or tables, which may be 10-point font). References must be included

as footnotes or endnotes in a font size of 10 or larger. Footnotes and endnotes are counted

toward the maximum page requirement.

4. Page numbers must be included in the footer of every page.

a. Each submission must not exceed the specified maximum page limit, including cover

page, charts, graphs, maps, and photographs when printed using the formatting

requirements set forth above and single spaced.

22 of 37

5.2 Application Submission

There are several one-time actions required to submit an application in response to this ALRD. It is

recommended that you allow at least 21 days to complete the registrations. These requirements are as

follows:

5.2.a PAGE

Create and maintain a login for the Performance and Accountability for Grants in Energy System at

https://www.page.energy.gov/default.aspx in order to submit your application.

Required State Applications materials, such as the Project Narrative, Community Benefits Plan, State

Workforce Development Plan, Program Evaluation Plan, Budget and all other forms , must be

submitted via the PAGE online system at https://www.page.energy.gov/default.aspx.

The PAGE Help System has detailed instructions for creating and submitting an application. The Help

instructions can be found in PAGE by selecting ‘help’ from the blue horizontal menu bar, and under

the Contents in the left panel selecting ‘CTG’ and the subtopic for ‘New Grant Application’.

From the Home screen, select ‘Create New Application’ then select the ‘Add New Application

Package’. Once the application has been completed, be sure to validate and submit the application.

DOE reserves the right to request additional or clarifying information.

For questions regarding PAGE, refer to the Help Menu in PAGE or contact the PAGE hotline at

PAGE-H[email protected] or 1-866-492-4546.

5.2.b Unique Entity Identifier and System for Award Management

Each applicant (unless the applicant is excepted from those requirements under 2 CFR 25.110) is

required to: (1) be registered in the System for Award Management (SAM) at https://www.sam.gov

before submitting its Application; (2) provide a valid unique entity identifier (UEI) number in its

Application; and (3) continue to maintain an active SAM registration with current information at all

times during which it has an active federal award or an application or plan under consideration by a

federal awarding agency.

DOE may not make a federal award to an applicant until the applicant has complied with all

applicable UEI and SAM requirements. Prime awardees must update their SAM registration annually.

Please note, there are new requirements for registering in SAM. Entities registering in SAM must

submit a notarized letter appointing their authorized Entity Administrator. Please see SAM website for

updates, alerts, and FAQs. For questions, call 866-606-8220 or 334-206-7828.

Designating an Electronic Business Point of Contact and obtaining a special password called a

Marketing Partner ID Number (MPIN) are important steps in SAM registration.

NOTE: Entities should start the UEI and SAM registration process as soon as possible. If entities

have technical difficulties with the UEI validation or SAM registration process, they should utilize the

Help feature on SAM.gov. Additional entity validation resources can be found here: GSAFSD Tier 0

Knowledge Base - Validating your Entity.

23 of 37

5.2.c FedConnect

Register in FedConnect at https://www.fedconnect.net. To create an organization account, your

organization’s SAM MPIN is required. For more information about the SAM MPIN or other

registration requirements, review the FedConnect Ready, Set, Go! Guide at:

https://www.fedconnect.net/FedConnect/Marketing/Documents/FedConnect_Ready_Set_Go.pdf. For

additional questions, email support@fedconnect.net or call 1-800-899-6665.

5.2.d Electronic Authorization of Applications and Award Documents

Submission of an application and acknowledgement of award documents by the Grantee’s authorized

representative through electronic systems used by the Department of Energy, including FedConnect,

constitutes the State’s acceptance of the terms and conditions of the award. Acknowledgement via

FedConnect by the State’s authorized representative constitutes the State's electronic signature.

IMPORTANT: The electronically signed Assistance Agreement with attached award documents

distributed via FedConnect is the formal authorization and approval from the Contracting Officer.

Grantees may not rely on PAGE as the formal authorization and approval. Award documents in the

initial award, and any modifications to the award, must be reviewed and acknowledged by the Grantee

in FedConnect.

6.0 APPLICATION INSTRUCTIONS FOR CTG FORMULA GRANTS

6.1 Overview

The following instructions provide all the information needed to complete the Application. Carefully

read and consider each section and include all required information in your Application. Application

due dates are identified on the cover page of the ALRD.

As a reminder, application documents, forms, and data submitted to DOE may be made available to

the public at DOE’s discretion following all applicable laws and regulations that protect confidential

or proprietary information.

6.2 IRA Awards

The IRA section 50123 awards will consist of a 48-month period of performance. DOE expects States

to expend the entire funding allocation within the period of performance, unless justified in the State

Application and approved in the Assistance Agreement.

6.3 State Application

The State Application consists of the following:

1. Project Narrative (section 6.4)

o Performance Metrics (section 6.4.a)

o Community Benefits Plan (section 6.4.b)

o State Workforce Development Plan (section 6.4.c)

o Description of State Workforce Advisory Group (section 6.4.d)

o Program Evaluation Plans (section 6.4.e)

2. Standard Form 424 (Application form) (section 6.5)

3. Standard Form 424A (Budget summary) (section 6.6)

4. Budget Narrative (section 6.7)

24 of 37

5. Other Forms, as applicable (section 6.9)

o Negotiated Indirect Rate Agreement or Rate Proposal

o A document containing a link to the state’s latest single or program-specific audit as

required by 2 CFR 200 Subpart F

o A document providing the name, phone number and email address of the Authorized

Representative and Business Officer

o Certifications regarding Lobbying (SF-LLL Disclosure Form to report lobbying)

o Various certifications (The list of certifications and assurances found here. Please verify

compliance with Intergovernmental Review through your State’s single point of contact,

as applicable.)

6. A National Environmental Policy Act (NEPA) Statement of Work (section 4.4.c)

6.4. Project Narrative

The Project Narrative must demonstrate the State’s ability to implement the grant project in

accordance with the provisions of the ALRD. The Project Narrative must provide a comprehensive

framework and description of all aspects of the proposed project. States may choose to apply these

funds to supplement existing workforce development programs; create new workforce programs; or a

combination of these approaches to (1) reduce the cost of training contractor employees; (2) provide

testing and certification of contractors training and educated under a State program; and (3) partner

with nonprofit organizations to develop and implement a State program pursuant to item 1 in this

paragraph.

25

The Project Narrative must be succinct, self-explanatory, and well-organized so that reviewers can

understand the proposed project.

DOE has provided the following information for States to consider:

Non-Exclusive Resources: States could review and build upon existing resources from DOE and

national laboratories that may be relevant to their program needs. Such resources include:

• Skill needs and standards resources:

o Building Science Education Solution Center Training Modules by Occupation –

currently available for HVAC technicians

o Building Science Education Solution Center Training Modules by Technology Area

o Building America Solution Center Home Improvement Expert

• Responsible contracting and community benefits plans resources:

o Community Benefits Plans Frequently Asked Questions

o Apprentices “Earn While They Learn” to Build A Clean Energy Future

o Apprenticeship | U.S. Department of Labor (dol.gov)

• Clean energy job data:

o U.S. Energy Employment Report

o State-Level Employment Projections for Four Clean Energy Technologies in 2025

and 2030

Non-Exclusive Certifications: Certification programs and professional certifications can be useful to

provide the baseline education, training, and professional upskilling to implement, support, and

maintain the Bipartisan Infrastructure Law (BIL) and IRA investments. CTG is an opportunity for

States to prepare the workforce to deliver energy efficiency, electrification, and clean energy

25

42 U.S.C. 18795b(b)(1)-(3).

25 of 37

improvements. Applicants can propose certifications that support the purpose of this funding and lead

to good-quality jobs. For the purposes of this ALRD, good-quality jobs are jobs that pay sustaining

wages with wage progression, benefits, access to paid leave, opportunities for career advancement

through training and education, adequate staffing, safety and health protections, nondiscriminatory

and harassment-free workplaces that promote Diversity, Equity, Inclusion, and Accessibility (DEIA)

and, to the strongest extent possible, a platform for worker voice that supports all workers and ensures

fair pay and safe working conditions.

Considering these priorities, CTG applicants must demonstrate that their proposed certifications align

with the skills and needs of their service area(s), meet energy workforce demands, and prepare that

workforce to deliver energy efficiency, electrification, and clean energy improvements.

For the in-demand professions, the following includes a non-exclusive list of example certification

programs:

Energy Auditors (SOC/O*NET 47-4011.01

26

)

For energy auditors, below are a few sample certifications:

• ASHRAE (formerly the American Society of Heating and Air-Conditioning Engineers)

Building Energy Assessment Professional certification*

• Association of Energy Engineers (AEE) Certified Energy Auditor certification*

• Building Performance Institute Home Energy Professional Energy Auditor certification*

• Building Performance Institute Building Analyst certification

• Residential Energy Services Network Home Energy Rater certification*

• SMART Energy Auditor certifications: Total Building Energy Audit Technician and Indoor

Air Quality (IAQ) Technician, Supervisor, and Contractor certifications

• Home Energy Score Assessor certification

• Other approved certifications (reviewed by DOE, National Laboratory or another designee)

submitted at https://bsesc.energy.gov/submit-recognition

*Listed in the BIL section 40503

27

HVAC Contractors (SOC 49-9021.00)

In many states, HVAC contractors are required to have a specialty license under the umbrella of an

electrician. In addition to this licensure (when required by the state), the following professional

certification bodies are in the CareerOneStop database, and have undergone a DOE review of their

curriculum related to heat pump design and installations, especially related to cold climates

5

: