Chargeback Management

Guidelines for Visa Merchants

Chargeback Management

Guidelines for Visa Merchants

Table of Contents

Chargeback Management Guidelines for Visa Merchants i

© 2015 Visa. All Rights Reserved.

Table of Contents

Introduction .........................................................................1

SECTION 1: Getting Down to Basics.................................................4

Cardholder Disputes and Chargebacks

...............................................5

Visa Rules for Returns, Exchanges and Cancellations

..................................7

SECTION 2: Copy Requests .........................................................9

Transaction Receipt Requirements—Card-Present Merchants

.......................10

Substitute Transaction Receipt Requirements—Card-Absent Merchants.............11

Responding to Copy Requests ......................................................12

How to Minimize Copy Requests....................................................14

SECTION 3: Chargebacks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Why Chargebacks Occur

............................................................17

Customer Dispute Chargebacks.....................................................18

Invalid Chargebacks

.................................................................19

Remedying Chargeback Issues ......................................................20

Minimizing Chargebacks

............................................................21

Chargeback Monitoring.............................................................25

When Chargeback Rights Do Not Apply.............................................27

SECTION 4: Chargeback Reason Codes

........................................... 29

Reason Code 30: Services Not Provided or Merchandise Not Received

...............30

Reason Code 41: Cancelled Recurring Transaction...................................33

Reason Code 53: Not as Described or Defective Merchandise .......................36

Reason Code 57: Fraudulent Multiple Transactions ..................................39

Reason Code 62: Counterfeit Transaction............................................40

Reason Code 71: Declined Authorization............................................41

Reason Code 72: No Authorization ..................................................43

Reason Code 73: Expired Card ......................................................46

Reason Code 74: Late Presentment .................................................47

Reason Code 75: Transaction Not Recognized .......................................49

Reason Code 76: Incorrect Currency or Transaction Code or Domestic Transaction

Processing Violation

..............................................................50

Reason Code 77: Non-Matching Account Number ..................................52

Table of Contents

ii Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Reason Code 80: Incorrect Transaction Amount or Account Number . . . . . . . . . . . . . . . . 54

Reason Code 81: Fraud—Card-Present Environment ................................56

Reason Code 82: Duplicate Processing ..............................................59

Reason Code 83: Fraud—Card-Absent Environment.................................61

Reason Code 85: Credit Not Processed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Reason Code 86: Paid by Other Means ..............................................70

SECTION 5: Providing Compelling Evidence....................................... 71

Compelling Evidence and Merchant Representment Rights

.........................72

Issuer Compelling Evidence Requirements ..........................................77

Glossary .........................................................................78

Appendix 1: Training Your Staff ................................................... 87

Appendix 2: Visa Europe Territory.................................................88

Introduction

Chargeback Management Guidelines for Visa Merchants 1

© 2015 Visa. All Rights Reserved.

Introduction

Purpose

Chargeback Management Guidelines for Visa Merchants is a comprehensive manual for all businesses that

accept Visa transactions. The purpose of this guide is to provide merchants and their back-oce sales

sta with accurate, up-to-date information to help merchants minimizing the risk of loss from fraud

and chargebacks. This document covers chargeback requirements and best practices for processing

transactions that are charged back to the merchant by their acquirer.

Audience

This book is targeted at both card-present and card-absent merchants and their employees outside of the

jurisdiction of Visa Europe, which may have dierent practices and requirements.

Contents

The Chargeback Management Guidelines for Visa Merchants contains detailed information on the most

common types of chargebacks merchants receive and what can be done to remedy or prevent them. It is

organized to help users nd the information they need quickly and easily. The table of contents serves as

an index of the topics and material covered.

Topics covered include:

• Section1:GettingDowntoBasics—Provides an overview of how Visa transactions are processed,

from point of transaction to clearing and settlement. A list of key Visa policies for merchants is also

included. st comply, to help ensure the security of condential cardholder information.

• Section2:CopyRequests—Includes requirements and best practices for responding to a request for a

copy of a transaction receipt to resolve a cardholder dispute. Information on minimizing copy requests,

ensuring legible receipts, and meeting sales draft requirements are also covered.

• Section3:Chargebacks—Highlights strategies for chargeback prevention, as well as information on

how and when to resubmit a charged back transaction to your acquirer. A brief compliance process

overview is also included.

• Section4:ChargebackReasonCodes—Contains detailed information on the reason codes for the

most common types of chargebacks that merchants receive. For each reason code, a denition is

provided along with the merchant’s actions—or failure to act—that may have caused the chargeback,

and recommendations are given for resubmitting the transaction and preventing similar chargebacks

in the future.

• Section5:ProvidingCompellingEvidence—Discusses updated representment processing

requirements related to merchant compelling evidence.

Introduction

2 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

• Glossary—A list of terms used in the guide.

• Appendix1:TrainingYourStaff—A reference to Visa.com which oers resources that merchants can

use for training their employees on card acceptance and fraud prevention procedures.

• Appendix2:VisaEuropeTerritory—A list of Visa European Territories.

Important Note About Country Differences

Most of the information and best practices contained in this document pertain to all regions; however in

some countries, there are specic products, services, and regulatory dierences that must be noted. In

these instances, country or region-specic details have been identied with an icon for the country under

discussion.

The country icons are as follows:

US

United States

Can

Canada

LAC

Latin America and Caribbean (LAC)

AP

Asia Pacic (AP)

CEMEA

Central Europe, Middle East, and Africa (CEMEA)

It is important to note that the Visa payment system is operated in the European economic area by Visa

Europe, a separate company operating under license from Visa Inc.

Participation in the Visa payment system in such countries is governed by the Visa Europe Operating

Regulations, rather than the Visa Core Rules and Visa Product and Service Rules. While the Visa Europe

Operating Regulations share many core requirements to ensure interoperability, such rules and best

practices may vary from the guidelines set forth in this document. Please see Appendix 2: Visa Europe

Territory for a list of countries within Visa Europe.

Guide Navigation

Chargeback Management Guidelines for Visa Merchants provides icons that highlight additional resources or

information:

Additional insights related to the topic that is being covered.

A brief explanation of the Visa service or program pertinent to the topic at

hand.

Introduction

Chargeback Management Guidelines for Visa Merchants 3

© 2015 Visa. All Rights Reserved.

Disclaimer

The information in this guide is current as of the date of printing. However, card acceptance and

processing procedures are subject to change. This guide contains information based on the current Visa

Core Rules and Visa Product and Service Rules. If there are any dierences between the Visa Core Rules and

Visa Product and Service Rules and this guide, the Visa Core Rules and Visa Product and Service Rules will prevail

in every instance. Your merchant agreement and the Visa Core Rules and Visa Product and Service Rules take

precedence over this guide or any updates to its information. To access a copy of the Visa Core Rules and

Visa Product and Service Rules, visit www.visa.com and click on Operations and Procedures.

All rules discussed in this guide may not apply to all countries. Local laws and rules may exist and it is your

responsibility to ensure your business complies with all applicable laws and regulations.

The information, recommendations or “best practices” contained in this guide are provided “AS IS” and

intended for informational purposes only and should not be relied upon for operational, marketing, legal,

technical, tax, nancial or other advice. This guide does not provide legal advice, analysis or opinion. Your

institution should consult its own legal counsel to ensure that any action taken based on the information

in this guide is in full compliance with all applicable laws, regulations and other legal requirements.

Visa is not responsible for your use of the information contained in this guide (including errors, omissions,

inaccuracy or non-timeliness of any kind) or any assumptions or conclusions you might draw from its

use. Visa makes no warranty, express or implied, and explicitly disclaims the warranties of merchantability

and tness for a particular purpose, any warranty of non-infringement of any third party’s intellectual

property rights, any warranty that the information will meet your requirements, or any warranty that the

information is updated and will be error free.

For further information about the rules or practices covered in this guide, please contact your acquirer.

4 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

SECTION 1

Getting Down to Basics

What’s Covered

• Cardholder Disputes and Chargebacks

• Visa Rules for Returns, Exchanges and Cancellations

By accepting Visa cards at your point-of-sale, you become an integral part of the

Visa payment system. That’s why it’s important that you start with a clear picture

of the Visa card transaction process; what it is, how it works, and who’s involved.

The basic knowledge in this section provides you with a conceptual framework

for the policies and procedures that you must follow as a Visa merchant. It will

also help you to understand the major components of payment processing and

how they aect the way you do business.

Section 1: Getting Down to Basics

Chargeback Management Guidelines for Visa Merchants 5

© 2015 Visa. All Rights Reserved.

Cardholder Disputes and Chargebacks

What is a Chargeback?

A “chargeback” provides an issuer with a way to return a disputed transaction. When a cardholder disputes

a transaction, the issuer may request a written explanation of the problem from the cardholder and can

also request a copy of the related sales transaction receipt from the acquirer, if needed. Once the issuer

receives this documentation, the rst step is to determine whether a chargeback situation exists. There are

many reasons for chargebacks—those reasons that may be of assistance in an investigation include the

following:

• Merchant failed to get an authorization

• Merchant failed to obtain card imprint (electronic or manual)

• Merchant accepted an expired card

When a chargeback right applies, the issuer sends the transaction back to the acquirer and charges back

the dollar amount of the disputed sale. The acquirer then researches the transaction. If the chargeback is

valid, the acquirer deducts the amount of the chargeback from the merchant account and informs the

merchant.

Under certain circumstances, a merchant may re-present the chargeback to its acquirer. If the merchant

cannot remedy the chargeback, it is the merchant’s loss. If there are no funds in the merchant’s account to

cover the chargeback amount, the acquirer must cover the loss.

Section 1: Getting Down to Basics

6 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

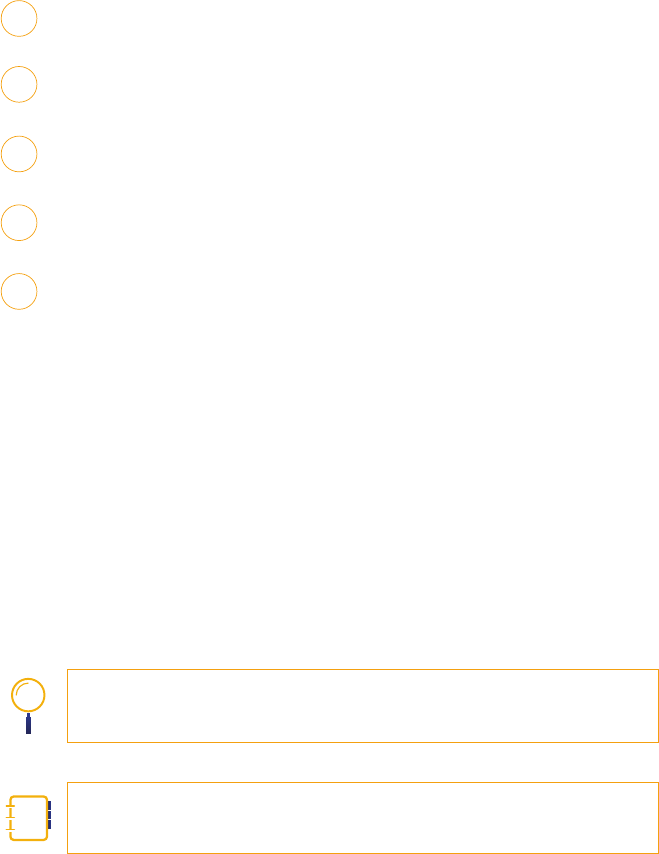

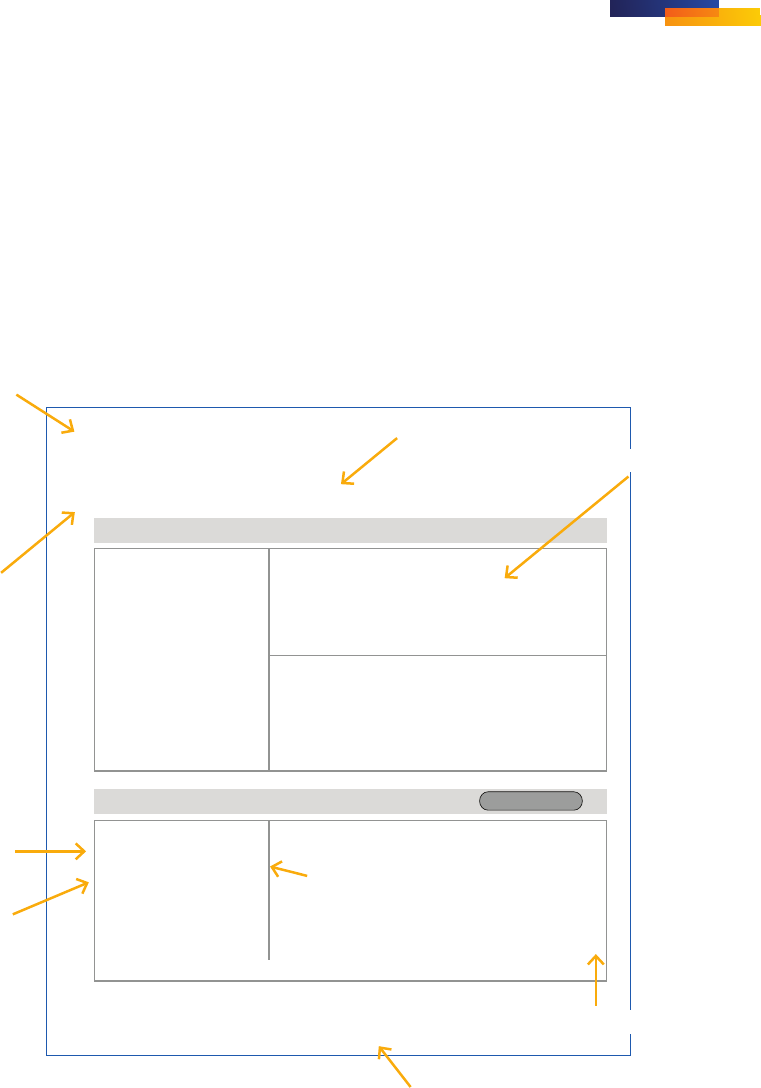

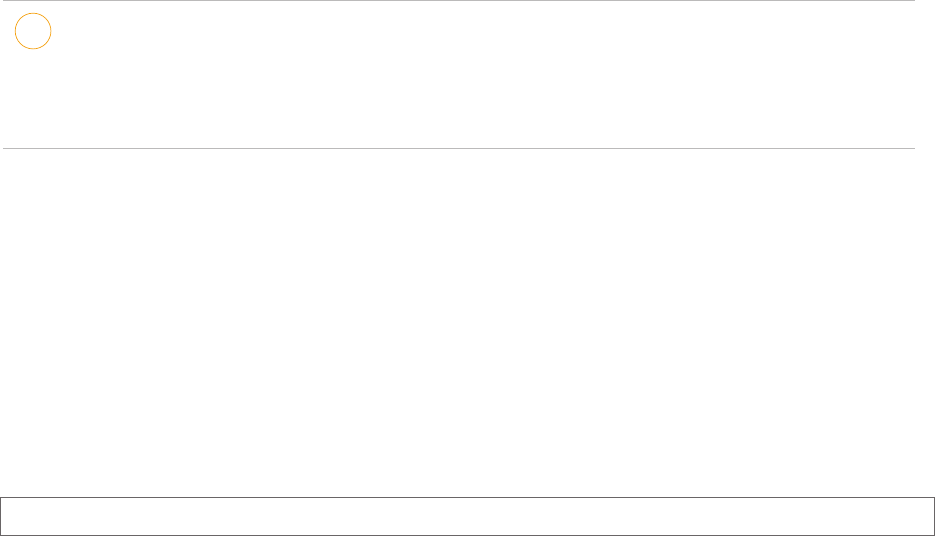

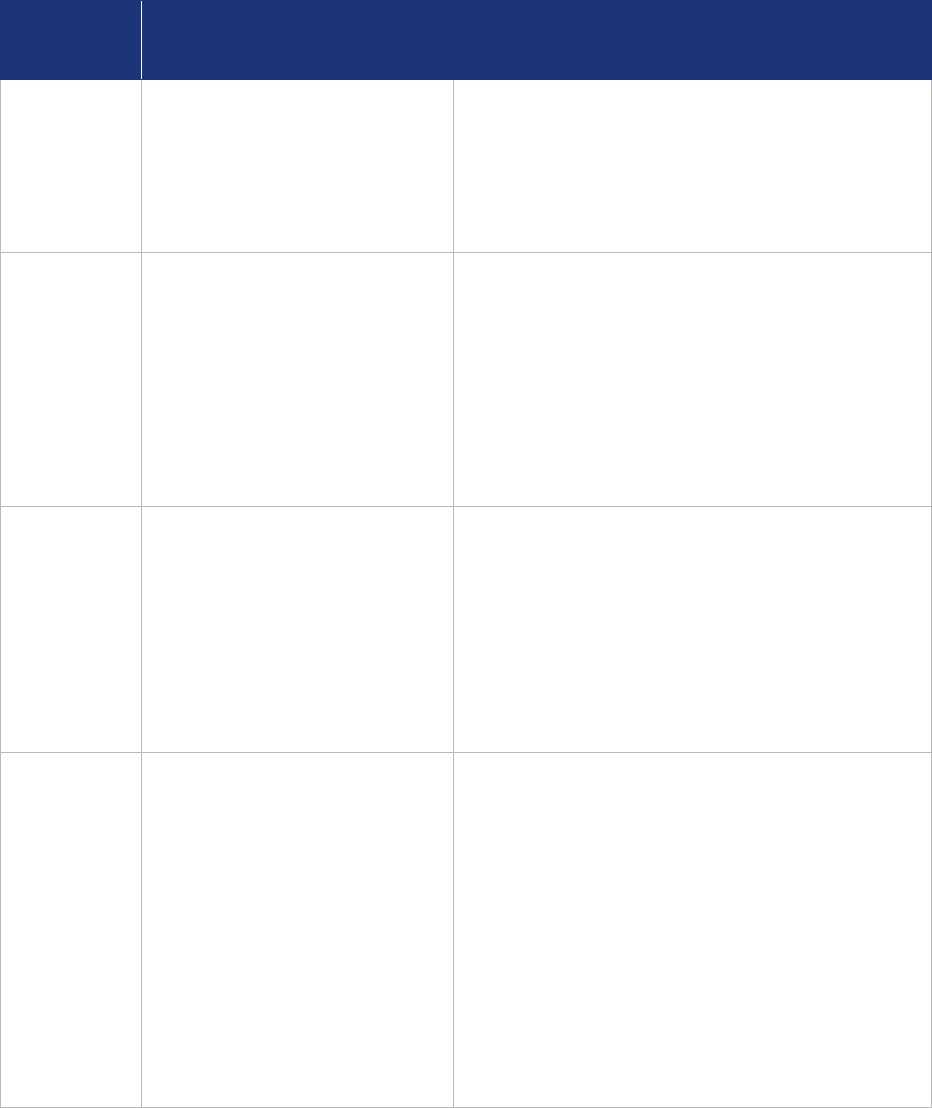

The Chargeback Life Cycle

The diagram below illustrates and explains the Visa dispute resolution process in detail.

1 2 3

7 6

4

5

Upon receipt of the

representment issuers may

submit an arbitration case for a

nancial liability decision. There

may be instances, however, that

require a prearbitration attempt.

An example is if compelling

evidence is provided with the

representment the issuer must

submit a prearbitration to the

acquirer prior to ling a case

with Visa.

Pre-Arbitration

Acquirer receives the pre-

arbitration and has the option

of accepting it, or if applicable

forwarding it to the merchant.

If the dispute cannot be resolved

through pre-arbitration the

issuer may submit the dispute to

Visa for arbitration for a nancial

liability decision.

Compliance

Visa issuers and acquirers may

submit a compliance case to

Visa for review if they incur a

loss and a valid chargeback or

representment is unavailable.

Cardholder

disputes

transaction.

Upon receipt of the

representment issuers may

accept the representment and

re-post the transactionto the

cardholder’s account.

Acquirer receives the

chargeback and has the

option of resolving the

issue or forwarding it to

the merchant.

Merchant either accepts

the chargeback item or

addresses the chargeback

issue and resubmits the item

to the merchant bank.

Acquirer reviews the information

received from the merchant.

If the acquirer agrees that

merchant information addresses

the chargeback, the acquirer

represents the chargeback

electronically via VisaNet to the

issuer.

Arbitration

If the card issuer disputes

a representment or pre-

arbitration response from the

acquirer, the card issuer may

le for arbitration with Visa.

In arbitration, Visa decides

which party is responsible for

the disputed transaction. In

most cases, Visa’s decision is

nal and must be accepted by

both the card issuer and the

acquirer. During arbitration,

Visa reviews all information/

documentation submitted

by both parties to determine

who has nal liability for the

transaction.

Issuer asks the cardholder for

an explanation of the problem,

then sends the transaction back

electronically via VisaNet to the

acquirer.

Section 1: Getting Down to Basics

Chargeback Management Guidelines for Visa Merchants 7

© 2015 Visa. All Rights Reserved.

Visa Rules for Returns, Exchanges and Cancellations

As a merchant, you are responsible for establishing your merchandise return and refund or cancellation

policies. Clear disclosure of these policies can help you avoid misunderstandings and potential cardholder

disputes. Visa will support your policies, provided they are clearly disclosed to cardholders. For face-to-

face or eCommerce environment, the cardholder must receive the disclosure at the time of purchase. For

guaranteed reservations made by telephone, the merchant may send the disclosure after by mail, email or

text message.

If you are unsure how to disclose your return, adjustment and cancellation policies, contact your acquirer

for further guidance.

Disclosure for Card-Present Merchants

For card-present transactions, Visa will accept that proper disclosure has occurred before a transaction

is completed if the following (or similar) disclosure statements are legibly printed on the face of the

transaction receipt near the cardholder signature area or in an area easily seen by the cardholder. If the

disclosure is on the back of the transaction receipt or in a separate contract, it must be accompanied by a

space for the cardholder’s signature or initials.

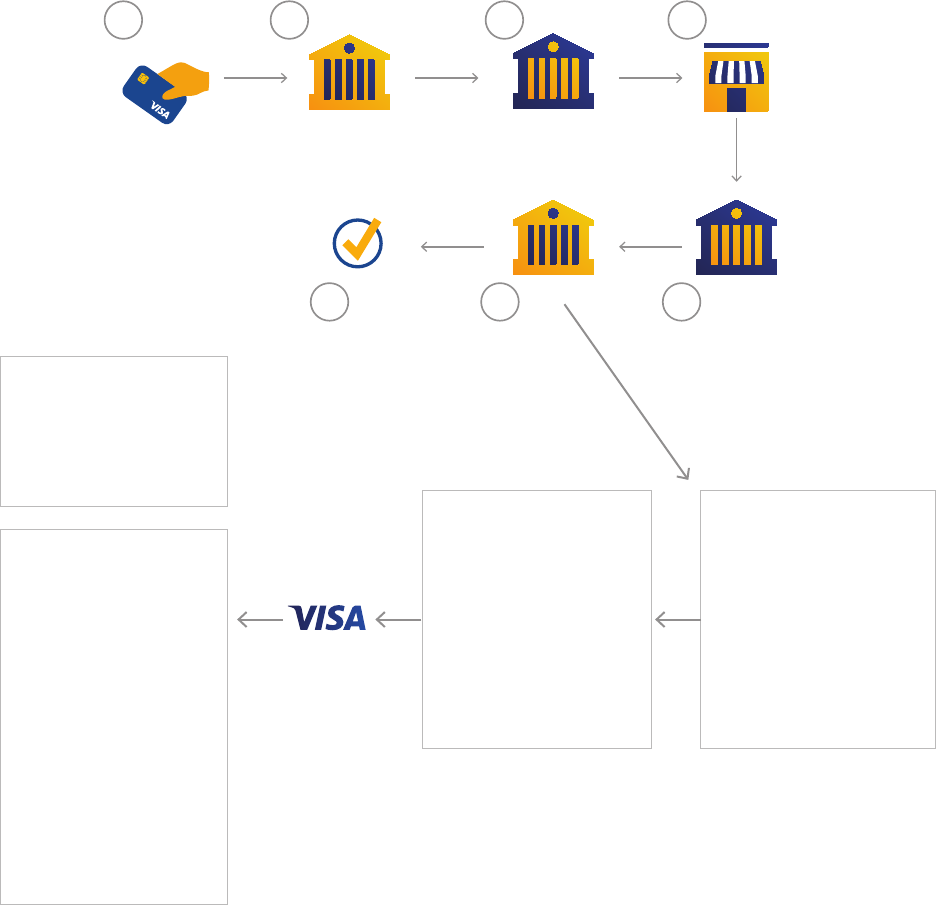

Disclosure Statement What It Means

No Refunds or

Returns or Exchanges

Your establishment does not issue refunds and does not accept returned merchandise or

merchandise exchanges.

Exchange Only Your establishment is willing to exchange returned merchandise for similar merchandise

that is equal in price to the amount of the original transaction.

In-Store Credit Only Your establishment takes returned merchandise and gives the cardholder an in-store credit

for the value of the returned merchandise.

Special Circumstances You and the cardholder have agreed to special terms (such as late delivery charges or

restocking fees). The agreed-upon terms must be written on the transaction receipt or a

related document (e.g., an invoice). The cardholder’s signature on the receipt or invoice

indicates acceptance of the agreed-upon terms.

Timeshare You must provide a full credit when a transaction receipt has been processed and the

cardholder has cancelled the transaction within 14 calendar days of the transaction date.

Disclosure for Card-Absent Merchants

Phone Order

For proper disclosure, your refund and credit policies may be mailed, emailed, or texted to the

cardholder. As a reminder, the merchant must prove the cardholder received or acknowledged the policy

in order for the disclosure to be proper.

Section 1: Getting Down to Basics

8 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Internet or Application

Your website must communicate its refund policy to the cardholder in either of the following locations:

· In the sequence of pages before nal checkout, with a “click to accept” or other acknowledgement

button, checkbox, or location for an electronic signature, or

· On the checkout screen, near the “submit” or click to accept button

The disclosure must not be solely on a link to a separate web page.

Chargeback Management Guidelines for Visa Merchants 9

© 2015 Visa. All Rights Reserved.

SECTION 2

Copy Requests

What’s Covered

• Transaction Receipt Requirements—Card-Present Merchants

• Transaction Receipt Requirements—Card-Absent Merchants

• Responding to Copy Requests

• How to Minimize Copy Requests

When cardholders do not recognize transactions on their Visa statements, they

typically ask their card issuer for a copy of the related transaction receipt to

determine whether the transaction is theirs. In this kind of situation, the card

issuer rst tries to answer the cardholder’s questions. If this cannot be done, the

card issuer electronically sends a “request for copy” (also known as a “retrieval

request”) to the acquirer associated with the transaction.

If your acquirer stores your transaction receipts, the acquirer will fulll the

copy request. However, if you store your own transaction receipts, the acquirer

forwards the request to you. You must then send a legible copy of the transaction

receipt to the acquirer. The acquirer will send it on to the card issuer.

This section highlights merchant requirements and best practices for responding

to a request for a copy of a transaction receipt.

Section 2: Copy Requests

10 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

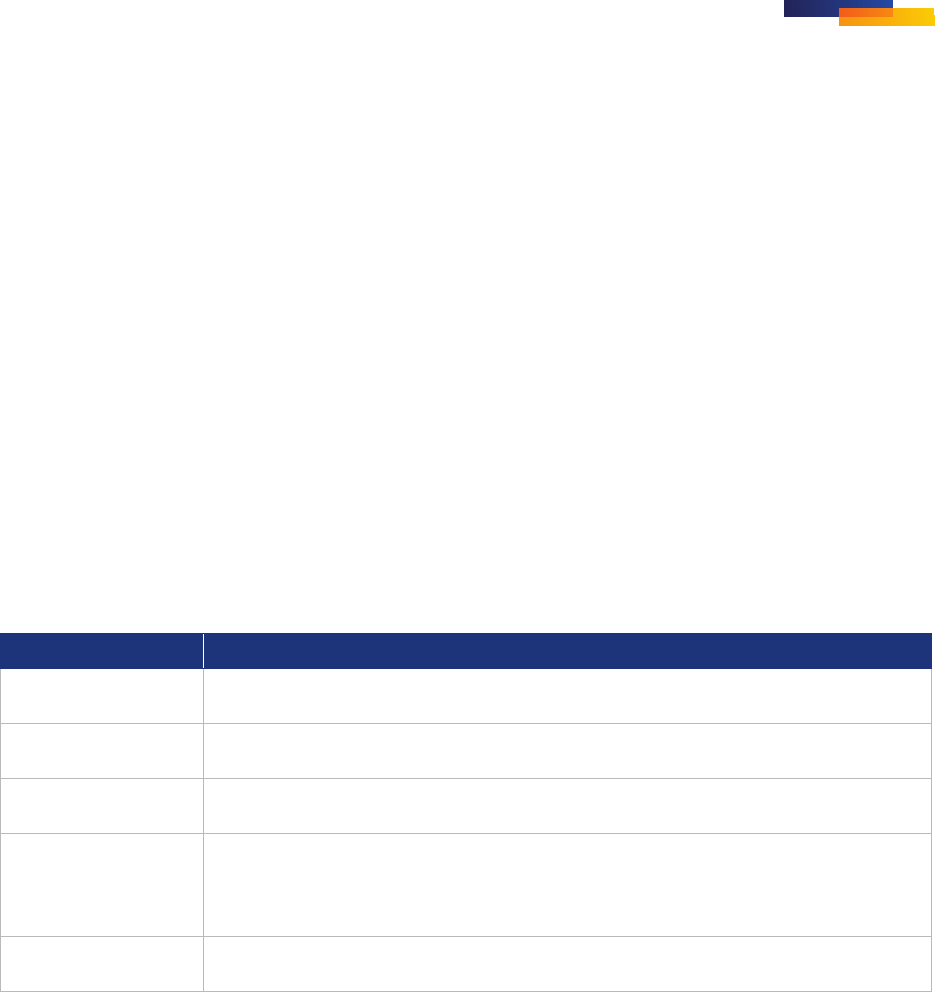

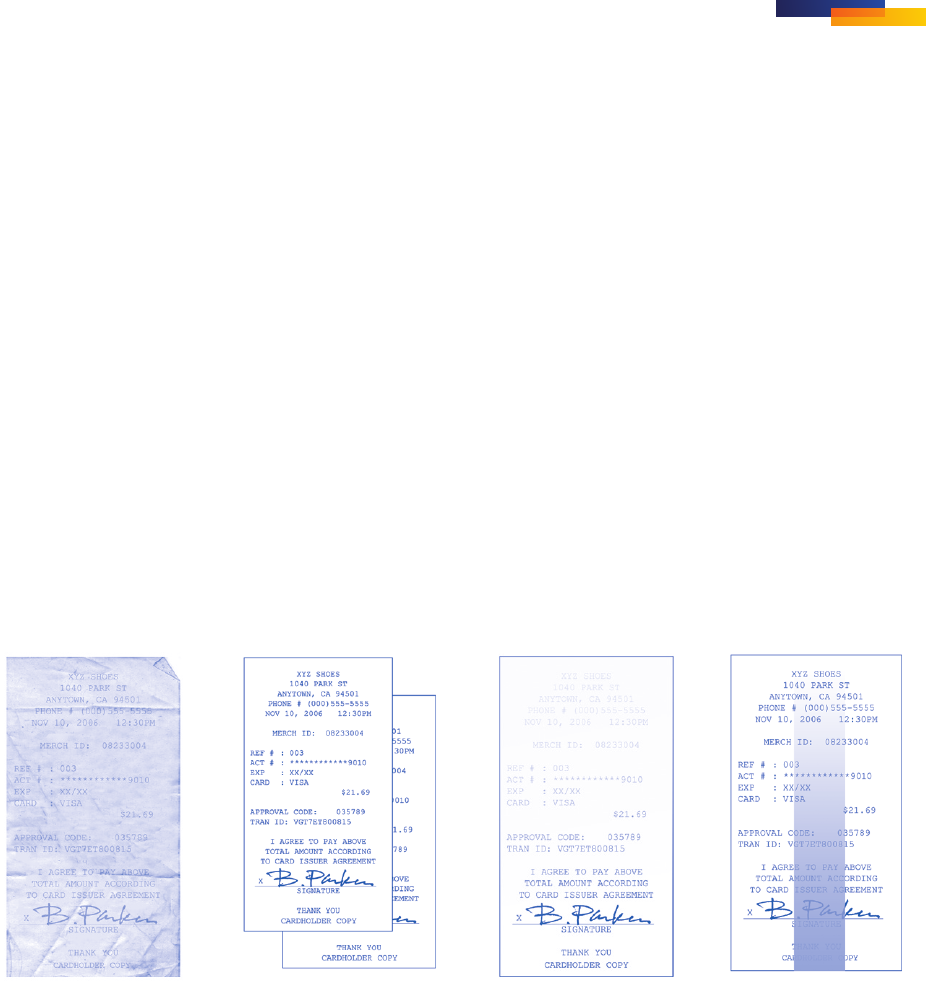

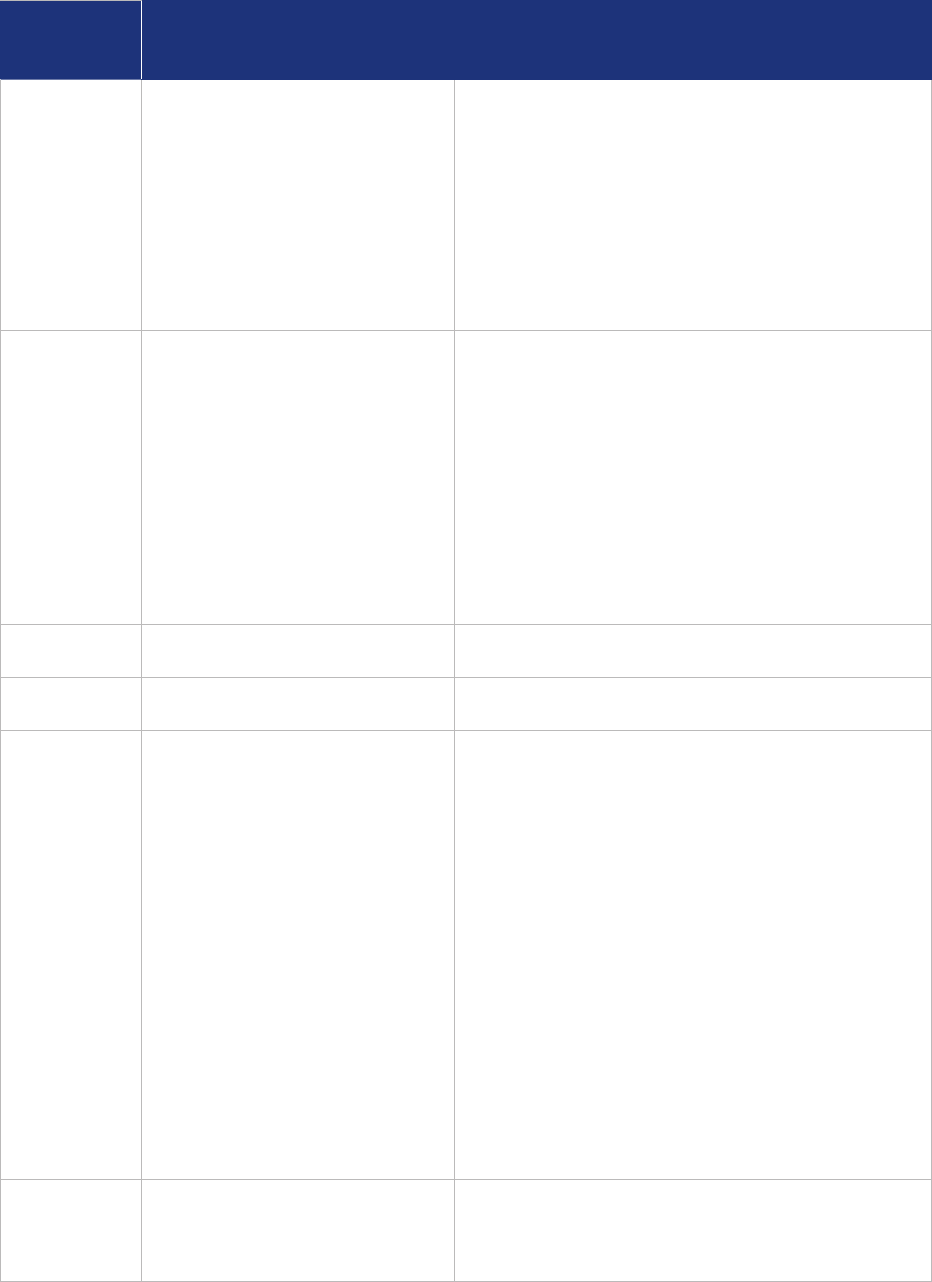

Transaction Receipt Requirements—Card-Present

Merchants

The following are the Visa requirements for all transaction receipts generated from electronic point-of-sale

terminals (including cardholder-activated terminals). It is recommended that merchants provide itemized

receipts when possible.

Electronic Point-of-Sale Terminal Receipts

XYZ SHOES

1040 PARK ST

ANYTOWN, CA 94501

PHONE # (000) 555-5555

OCT 10, 2016 12:35 PM

Merchant ID: 0000223

Description: Goods

REF # : 003

CT # : XXXXXXXXXXXX5220

EXP : XX/XX

CARD : VISA

32445 WMN SANDAL $100.00

SUBTOTAL $100.00

SALES TAX $9.23

Total $109.23

AUTH CODE: 035789

TRAN ID: VG7ET800815

x ______________________________________________

SIGNATURE

No refunds after 30 days.

THANK YOU

Suppressed Account Number

or Token Visa recommends that

all but the last four digits of the

account number or token on the

cardholder copy of the transaction

receipt be suppressed.

In addition, the Expiration Date

should not appear at all. To ensure

your point-of-sale terminals

are properly set up for account

number suppression, contact your

acquirer.

The payment brand used to

complete the transaction

must be identified on the

cardholder’s copy of the

transaction receipt.

Merchant

Location Code

Transaction Date

Transaction Amount and

transaction currency symbol

Authorization Code, if

applicable, except for Visa Easy

Payment Service (VEPS).

Space for Cardholder

Signature, except for:

• Transactions in which the

PIN is an acceptable

substitute for cardholder

signature

• Limited-Amount Terminal

Transactions

• Self-Service Terminal

Transactions

• VEPS

Merchant or member name and location, or the

city and state of the Automated Dispensing Machine

or Self-Service Terminal

Refund/Return Policy (optional)

Description of Goods or

Services: This does not

apply to VEPS or Cash

Disbursements

Section 2: Copy Requests

Chargeback Management Guidelines for Visa Merchants 11

© 2015 Visa. All Rights Reserved.

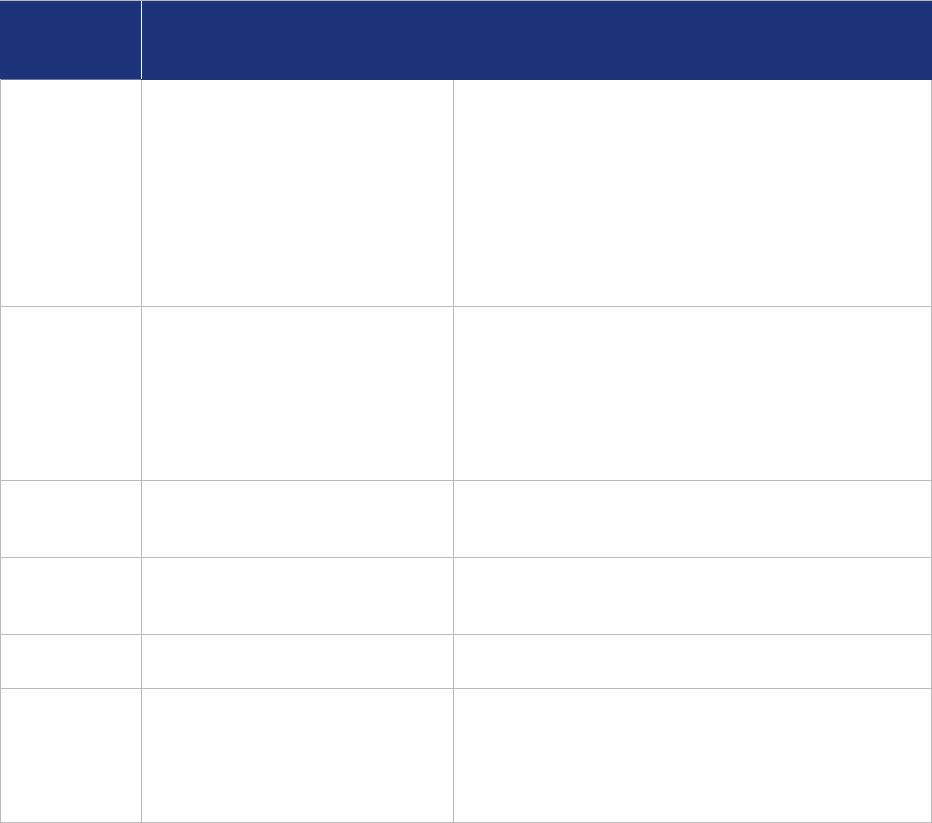

Substitute Transaction Receipt Requirements—

Card-Absent Merchants

The following are the Visa requirements for all manually printed transaction receipts in the card-

absent environment.

Substitute Transaction Receipts

Shipping Address:

John Bennett

2423 Sweet Dr.

San Francisco, CA 94111

USA

Shipping:

Standard

Payment Method:

Visa: xxxxxxxxxxxx0123

Authorization Code: XXXXXX

Transaction Type: Purchase

Billing Address:

John Bennett

2423 Sweet Dr.

San Francisco, CA 94111

USA

ORDER #: 103-62567-3299874

Items Ordered Price

1 How to Raise a Puppy

(Hardcover) $16.95

by Jane Russo

- 1 item(s) Gift options: None

Item(s) Subtotal: $16.95

Shipping & Handling: $3.99

- - - -

Subtotal: $20.64

- - - -

Total for this Shipment: $20.64

Item(s) Subtotal: $16.95

Shipping & Handling: $3.99

- - - -

Total Before Tax: $20.64

Estimated Tax: $0.00

- - - -

Grand Toal: $20.64

Books Are Us

1111 Something Ave.

City, State 98102

Order placed: January 14, 2016

www.booksareus.com

No refunds after 30 days. See our Return Policy.

Questions? Call Customer Service at 1-800-111-1111

PAYMENT INFORMATION

Printable version

Merchant Name and Location

Transaction Date

Payment Method Used

and Suppressed Account

Number or Token

Merchant

Online Address

Authorization

Code

Transaction Type:

Purchase or Credit

Refund/Return Policy (optional)

Description of Goods or Services

Transaction Amount

Section 2: Copy Requests

12 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Responding to Copy Requests

When a card issuer sends a copy request to an acquirer, the bank has 30 days from the date it receives the

request to send a copy of the transaction receipt back to the card issuer. If the acquirer sends the request

to you, it will tell you the number of days you have to respond. You must follow the acquirer’s time frame.

Once you receive a copy request, retrieve the appropriate transaction receipt, make a legible copy of it,

and fax or mail it to your acquirer within the specied time frame. Your acquirer will then forward the

copy to the card issuer, which will, in turn, send it to the requesting cardholder. The question or issue the

cardholder had with the transaction is usually resolved at this point.

Note: When you send the copy to the acquirer, use a delivery method that provides proof of delivery. If

you mail the copy, send it by registered or certied mail. If you send the copy electronically, be sure to

keep a written record of the transmittal.

If you store your own transaction receipts, you should retain your merchant copies—or copies of them, for

example, on CD-ROM—for 13 months from the date of the original transaction to ensure your ability to fulfill copy

requests

Copy Requests by Phone

To assist their cardholders, card issuers may call you directly to request a copy of a transaction receipt. You

are not obligated to fulll a verbal copy request from a card issuer. However, if you do decide to provide a

copy of the transaction receipt, be sure to keep a copy for your own records. You may nd you need it for

dispute-related or accounting purposes.

It Pays to Respond to Copy Requests

Responding to copy requests saves you time and money. As a merchant, you should always:

• Fulll any copy requests you receive, except for chip card, EMV PIN (except in the case of cash and

quasi-cash transactions), and VEPS transactions where the merchant is not required to provide copy.

• Fulll requests in a timely manner.

• Ensure that the receipt copy you send is legible.

• Provide transaction details that may assist the cardholder in recognizing the transaction.

– Cardholder signature (if available)

– Suppressed Visa account number*

– Cardholder name

* Visa requires that all new and existing eletronic POS terminals provide suppressed account numbers on sales transaction receipts.

Section 2: Copy Requests

Chargeback Management Guidelines for Visa Merchants 13

© 2015 Visa. All Rights Reserved.

– Guest name (If different than the cardholder name)

– Dates of entire stay

– Transaction amount

– Authorization code, if available

– Your business name and address

– All itemized charges

Issuers are no longer required to request a copy of a transaction receipt, but can do so in an effort to resolve a

question or prevent a dispute. Acquirers must continue to respond and properly fulfill request for copy in a timely

manner to avoid further dispute or compliance action.

Section 2: Copy Requests

14 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

How to Minimize Copy Requests

Best practices for reducing copy requests include the following:

Make Sure Customers Can Recognize Your Name on Their Bills

Cardholders must be able to look at their bank statements and recognize transactions that occurred at

your establishment. Check with your acquirer to be sure it has the correct information on your “Doing

Business As” (DBA) name, city, and state/region/province. You can check this information yourself by

purchasing an item on your Visa card at each of your outlets and looking at the merchant name and

location on your monthly Visa statement. Is your name recognizable? Can your customers identify the

transactions made at your establishment?

Make Sure Your Business Name Is Legible on Receipts

Make sure your company’s name is accurately and legibly printed on transaction receipts. The location,

size, or color of this information should not interfere with transaction detail. Similarly, you should make

sure that any company logos or marketing messages on receipts are positioned away from transaction

information.

Change point-of-sale

printer paper when

colored streak first

appears

Change point-of-sale

printer cartridge

routinely

Keep white copy of

sales draft receipt—

give customers

colored copy

Handle carbonless

paper and carbon/

silver-backed paper

carefully

Section 2: Copy Requests

Chargeback Management Guidelines for Visa Merchants 15

© 2015 Visa. All Rights Reserved.

Train Sales Staff

With proper transaction processing, many copy requests can be prevented at the point of sale. Instruct

your sales sta to:

• Follow proper point-of-sale card acceptance procedures.

• Review each transaction receipt for accuracy and completeness.

• Ensure the transaction receipt is readable.

• Give the cardholder the customer copy of the transaction receipt, and keep the original, signed copy.

Sales associates should also understand that merchant liability encompasses the merchandise, as well as the dollar

amount printed on the receipt; that is, in the event of a dispute, the merchant could lose both.

Avoid Illegible Transaction Receipts

Ensuring the legibility of transaction receipts is key to minimizing copy requests. When responding to a

copy request, you will usually photocopy or scan the transaction receipt before mailing or electronically

sending it to your acquirer. If the receipt is not legible to begin with, the copy that the acquirer receives

and then sends to the card issuer may not be useful in resolving the cardholder’s question.

The following best practices are recommended to help avoid illegible transaction receipts.

• Change point-of-sale printer cartridge routinely.

Faded, barely visible ink on transaction receipts is the leading cause of illegible receipt copies. Check

readability on all printers daily and make sure the printing is clear and dark on every sales draft.

• Change point-of-sale printer paper when the colored streak first appears.

The colored streak down the center or on the edges of printer paper indicates the end of the paper

roll. It also diminishes the legibility of transaction information.

• Keep the white copy of the transaction receipt.

If your transaction receipts include a white original and a colored copy, always give customers the

colored copy of the receipt. Since colored paper does not photocopy as clearly as white paper, it often

results in illegible copies.

• Handle carbon-backed or carbonless paper carefully.

Any pressure on carbon-backed or carbonless paper during handling and storage causes black

blotches, making copies illegible.

Copy Request Monitoring

Visa recommends that merchants monitor the number of copy requests they receive. If the ratio of copy

requests to your total Visa sales (less returns and adjustments) is more than 0.5 percent, you should review

your procedures to see if improvements can be made.

16 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

SECTION 3

Chargebacks

What’s Covered

• Why Chargebacks Occur

• Customer Dispute Chargebacks

• Invalid Chargebacks

• Remedying Chargeback Issues

• Minimizing Chargebacks

• Chargeback Monitoring

• When Chargeback Rights Do Not Apply

For merchants, chargebacks can be costly. You can lose both the dollar amount

of the transaction being charged back and the related merchandise. You can also

incur your own internal costs for processing the chargeback. Since you control

how your employees handle transactions, you can prevent many unnecessary

chargebacks by simply training your sta to pay attention to a few details.

In this section, you will nd a set of strategies for chargeback prevention, as well

as information on how and when to resubmit a charged back transaction to your

acquirer. A brief compliance process overview is also included.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 17

© 2015 Visa. All Rights Reserved.

Why Chargebacks Occur

Four Common Reasons

The most common reasons for chargebacks include:

• Customer disputes

• Fraud

• Processing errors

• Authorization issues

Although you probably cannot avoid chargebacks completely, you can take steps to reduce or prevent

them. Many chargebacks result from avoidable mistakes, so the more you know about proper transaction-

processing procedures, the less likely you will be to inadvertently do, or fail to do, something that might

result in a chargeback. (See Minimizing Chargebacks in this section.)

Of course, chargebacks are not always the result of something merchants did or did not do. Errors are also

made by acquirers, card issuers, and cardholders.

From the administrative point of view, the main interaction in a chargeback is between a card issuer and an

acquirer. The card issuer sends the chargeback to the acquirer, which may or may not need to involve the merchant

who submitted the original transaction. This processing cycle does not relieve merchants of the responsibility of

taking action to remedy and prevent chargebacks. In most cases, the full extent of your financial and administrative

liability for chargebacks is spelled out in your merchant agreement.

For more information on the most common types of chargebacks merchant receive, see Section 4, Chargeback

Reason Codes.

Section 3: Chargebacks

18 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Customer Dispute Chargebacks

Customer disputes are one of the most common reasons for chargebacks. A customer may dispute a

transaction because:

• A credit has not been processed when the customer expected it would be.

• Merchandise ordered was never received.

• A service was not performed as expected.

• The customer did not make the purchase; it was fraudulent.

Because these chargebacks may indicate customer dissatisfaction—and the potential for lost sales in the

future—addressing their underlying causes should be an integral part of your customer service policies.

If a cardholder with a valid dispute contacts you directly, act promptly to resolve the situation. Issue a credit, as

appropriate, and send a note or e-mail message to let the cardholder know he or she will be receiving a credit.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 19

© 2015 Visa. All Rights Reserved.

Invalid Chargebacks

Responding to the needs of card issuers, acquirers, and merchants, Visa has implemented sophisticated

systems that signicantly reduce chargebacks and vastly improve the chargeback process.

When Visa systems detect an invalid chargeback, it is automatically returned to the card issuer that

originated it, and the merchant and acquirer never see it. Many acquirers also have systems that routinely

review exception items, allowing them to resolve issues before a chargeback is necessary. Together, these

systems ensure that chargebacks you receive are either those that only you can respond to or those that

cannot be remedied in any other way.

Section 3: Chargebacks

20 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Remedying Chargeback Issues

Even when you do receive a chargeback, you may be able to resolve it without losing the sale. Simply

provide your acquirer with additional information about the transaction or the actions you have taken

related to it.

For example, you might receive a chargeback because the cardholder is claiming that credit has not

been given for returned merchandise. You may be able to resolve the issue by providing proof that you

submitted the credit on a specic date. In this example and similar situations, always send your acquirer

as much information as possible to help it remedy the chargeback. With appropriate information, your

acquirer may be able to resubmit, or “re-present,” the item to the card issuer for payment. Timeliness

is also essential when attempting to remedy a chargeback. Each step in the chargeback cycle has a

dened time limit during which action can be taken. If you or your acquirer do not respond during the

time specied on the request—which may vary depending on your acquirer—you will not be able to

remedy the chargeback.

Although many chargebacks are resolved without the merchant losing the sale, some cannot be remedied. In such

cases, accepting the chargeback may save you the time and expense of needlessly contesting it.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 21

© 2015 Visa. All Rights Reserved.

Minimizing Chargebacks

Most chargebacks can be attributed to improper transaction-processing procedures and can be

prevented with appropriate training and attention to detail. The following best practices will help you

minimize chargebacks.

Card-Present Merchants

• Declined Authorization. Do not complete a transaction if the authorization request was declined. Do

not repeat the authorization request after receiving a decline. Instead, ask for another form of payment.

• Transaction Amount. Do not estimate transaction amounts. For example, restaurant merchants should

authorize transactions only for the known amount on the check; they should not add on a tip.

• Referrals. If you receive a “Call” message in response to an authorization request, do not accept the

transaction until you have called your authorization center. In such instances, be prepared to answer

questions. The operator may ask to speak with the cardholder. If the transaction is approved, write the

authorization code on the transaction receipt. If declined, ask the cardholder for another Visa card.

Failure to respond to a referral request may result in a lost sale if a cardholder does not have an

alternate means to pay.

• Expired Card. Do not accept a card after its “Good Thru” or “Valid Thru” date.

• Missing or Questionable Cardholder Signature. In the card-present environment, the cardholder’s

signature is required for all magnetic-stripe and some chip transactions. For example, a card and

signature is required if Card Verication Method (CVM) is signature preferring, except for qualied Visa

Easy Payment Service (VEPS) transactions. Failure to obtain the cardholder’s signature could result in a

chargeback if the cardholder denies authorizing or participating in the transaction. When checking the

signature, always compare the rst letter and spelling of the surname on the transaction receipt with

the signature on the card. If they are not the same, ask for additional identication.

A chip card and the chip-reading device work together to determine the appropriate cardholder or verification

method for transaction (either signature, PIN or CDCVM). If the transaction has been PIN verified, there is no need

for signature.

• Card Imprint for Key-Entered Card-Present Transactions. If, for any reason, you must key-enter a

transaction to complete a card-present sale, make an imprint of the front of the card on the transaction

receipt, using a manual imprinter. Do not capture an impression of the card using a pencil, crayon, or

other writing instrument. This process does not constitute a valid imprint. Even if the transaction is

authorized and the receipt is signed, the transaction may be charged back to you if fraud occurs and

the receipt does not have an imprint of the account number and expiration date.

This applies to all card-present transactions, including key-entry situations where the card presented

is chip and the terminal is chip-enabled. When a merchant key-enters a transaction, an imprint is

required regardless of the type of card and terminal capability.

Section 3: Chargebacks

22 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

• Legibility. Ensure that the transaction information on the transaction receipt is complete, accurate, and

legible before completing the sale. An illegible receipt, or a receipt which produces an illegible copy,

may be returned because it cannot be processed properly. The growing use of electronic scanning

devices for the electronic transmission of copies of transaction receipts makes it imperative that the

item being scanned be very legible.

• Digitized Cardholder Signature. Some Visa cards have a digitized cardholder signature on the front of

the card in addition to the hand-written signature on the signature panel on the back. Checking the

digitized signature is not sucient for completing a transaction. Sales sta must always compare the

customer’s signature on the transaction receipt with the hand-written signature in the signature panel.

• Fraudulent Card-Present Transaction. If the cardholder is present and has the account number but

not the card, do not accept the transaction. Even with an authorization approval, the transaction can

be charged back to you if it turns out to be fraudulent.

Independent entrepreneurs have been selling sales-receipt stock bearing a statement near the signature area that

the cardholder waives the right to charge the transaction back to the merchant. These receipts are being marketed

to merchants with the claim that they can protect businesses against chargebacks; in fact, they do not. “No

chargeback” transaction receipts undermine the integrity of the Visa payment system and are prohibited

Card-Absent Merchants

Address Verification Service (AVS) and Card Verification Value 2 (CVV2)* Chargeback Protection. Be

familiar with the chargeback representment rights associated with the use of AVS and CVV2 and the

option to provide compelling information. Specifically, your acquirer can represent a charged back

transaction for:

US

Can

AVS:

• You received an AVS positive match “Y” response in the authorization message and if the

billing and shipping addresses are the same. You will need to submit proof of the shipping

address and signed proof of delivery.

• You submitted an AVS query during authorization and received a “U” response from a card

issuer. This response means the card issuer is unavailable or does not support AVS.

CVV2:

• You submitted a CVV2 verication request during authorization and received a “U” response with a

presence indicator of 1, 2, or 9 from a card issuer. This response means the card issuer does not support

CVV2.

• You can provide documentation that you:

– Spoke to the cardholder and he or she now acknowledges the validity of the transaction, or

– Received a letter or e-mail from the cardholder that he or she now

acknowledges the validity of the transaction.

If you believe you have AVS, CVV2, or compelling information representment rights on a charged back transaction,

work with your acquirer to ensure that all supporting evidence for the representment is submitted.

* In certain markets, CVV2 is required to be present for all card-absent transactions.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 23

© 2015 Visa. All Rights Reserved.

Verified by Visa Chargeback Protection. Veried by Visa provides merchants with cardholder

authentication on eCommerce transactions. Veried by Visa helps reduce eCommerce fraud by helping

to ensure that the transaction is being initiated by the rightful owner of the Visa account. This gives

merchants greater protection on eCommerce transactions.

Veried by Visa participating merchants are protected by their acquirer from receiving certain fraud-related

chargebacks, provided the transaction is processed correctly.

If: Then:

The cardholder is successfully

authenticated

The merchant is protected from fraud-related chargebacks, and can

proceed with authorization using Electronic Commerce Indicator (ECI)

of ‘5’.*

The card issuer or cardholder is not

participating in Verified by Visa

The merchant is protected from fraud-related chargebacks, and can

proceed with authorization using ECI of ‘6’.**

Merchant doesn’t attempt to

authenticate

The merchant is not protected from fraud-related chargebacks, but can still

proceed with authorization using ECI of ‘7’.

Liability shift rules for Verified by Visa transactions may vary by region. Please check with your acquirer for further

information.

Sales-Receipt Processing

• One Entry for Each Transaction. Ensure that transactions are entered into point-of-sale terminals only

once and are deposited only once. You may get a chargeback for duplicate transactions if you:

– Enter the same transaction into a terminal more than once.

– Deposit both the merchant copy and bank copy of a transaction receipt with your acquirer.

– Deposit the same transaction with more than one acquirer.

• Proper Handling of Transaction Receipts. Ensure that incorrect or duplicate transaction receipts are

voided and that transactions are processed only once.

• Depositing Transaction Receipts. Deposit transaction receipts with your acquirer as quickly as

possible, preferably within one to ve days of the transaction date; do not hold on to them.

• Timely Deposit of Credit Transactions. Deposit credit receipts with your acquirer as quickly as

possible, preferably the same day the credit transaction is generated.

Customer Service

• Prepayment. If the merchandise or service to be provided to the cardholder will be delayed, advise the

cardholder in writing of the delay and the new expected delivery or service date.

• Item Out of Stock. If the cardholder has ordered merchandise that is out of stock or no longer

available, advise the cardholder in writing. If the merchandise is out of stock, let the cardholder know

when it will be delivered. If the item is no longer available, oer the option of either purchasing a

similar item or cancelling the transaction. Do not substitute another item unless the customer agrees

to accept it.

* In certain markets, CVV2 is required to be present for all card-absent transactions.

** A Verified by Visa merchant identified by the Merchant Fraud Performance (MFP) program may be subject to chargeback Reason Code 93: Merchant

Fraud Performance Program, which does not apply in the U.S.

Section 3: Chargebacks

24 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

• Disclosing Refund, Return, or Service Cancellation Policies. If your business has policies regarding

merchandise returns, refunds, or service cancellation, you must disclose these policies to the

cardholder at the time of the transaction. Your policies should be pre-printed on your transaction

receipts; if not, write or stamp your refund or return policy information on the transaction receipt near

the customer signature line before the customer signs (be sure the information is clearly legible on all

copies of the transaction receipt). Failure to disclose your refund and return policies at the time of a

transaction could result in a dispute should the customer return the merchandise.

• Return, refund, and cancellation policy for Internet merchants. Make sure this policy is clearly posted

to inform cardholders of their rights and responsibilities (e.g., if the merchant has a limited or no refund

policy, this must be clearly disclosed on your website before the purchase decision is made to prevent

misunderstandings and disputes). The website must communicate its refund policy and require the

cardholder to select a “click to accept” or other armative button to acknowledge the policy, or appear

on the checkout screen, near the “submit” or “click to accept” button. The terms and conditions of the

purchase must be displayed on the same screen view as the checkout screen used to present the

total purchase amount or within the sequence of website pages the cardholder accesses during the

checkout process. This policy page cannot be bypassed.

• Ship Merchandise Before Depositing Transaction. For card-absent transactions, do not deposit

transaction receipts with your acquirer until you have shipped the related merchandise. If customers

see a transaction on their monthly Visa statement before they receive the merchandise, they may

contact their card issuer to dispute the billing. Similarly, if delivery is delayed on a card-present

transaction, do not deposit the transaction receipt until the merchandise has been shipped.

• Requests for Cancellation of Recurring Transactions. If a customer requests cancellation of

a transaction that is billed periodically (monthly, quarterly, or annually), cancel the transaction

immediately or as specied by the customer. As a service to your customers, advise the customer in

writing that the service, subscription, or membership has been cancelled and state the eective date

of the cancellation.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 25

© 2015 Visa. All Rights Reserved.

Chargeback Monitoring

Monitoring chargeback rates can help merchants pinpoint problem areas in their businesses and improve

prevention eorts. Card-absent merchants may experience higher chargebacks than card-present

merchants as the card is not electronic read, which increases liability for chargebacks.

General recommendations for chargeback monitoring include:

• Track chargebacks and representments by reason code. Each reason code is associated with unique

business issues and requires specic remedy and reduction strategies.

• Track chargeback activity as a proportion of sales activity.

• Include initial chargeback amounts and net chargebacks after representment.

• Track card-present and card-absent chargebacks separately. If your business combines traditional retail

with card-absent transactions, track the card-present and card-absent chargebacks separately. Similarly,

if your business combines mail order/telephone order (MO/TO) and Internet sales, these chargebacks

should also be monitored separately.

Visa Chargeback Monitoring Programs

Visa monitors all merchant chargeback activity on a monthly basis and noties acquirers when any of their

merchants has excessive chargebacks.

Once notied of a merchant with excessive chargebacks, acquirers are expected to take appropriate steps

to reduce the merchant’s chargeback activity. Remedial action will depend on the chargeback reason

code, merchant’s line of business, business practices, fraud controls, and operating environment, sales

volume, geographic location, and other factors. In some cases, merchants may need to provide sales sta

with additional training on cardacceptance procedures. Merchants should work with their acquirer to

develop a detailed chargeback-reduction plan which identies the root cause of the chargeback issue and

an appropriate remediation action(s).

Visa has three chargeback monitoring programs:

US

Visa Merchant Fraud Program

The Visa Merchant Fraud Program monitors chargeback activity for all U.S. acquirers and

merchants on a monthly basis. If a merchant meets or exceeds specied chargeback thresholds,

its acquirer is notied in writing.

First notication of excessive chargebacks for a specic merchant is considered a warning.

If actions are not taken within an appropriate period of time to return chargeback rates to

acceptable levels, Visa may impose nancial penalties on acquirers that fail to reduce excessive

merchant- chargeback rates.

Section 3: Chargebacks

26 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

High Brand Risk Chargeback Monitoring Program (HBRCMP)

The High Brand Risk Chargeback Monitoring Program (HBRCMP) is specically targeted at

reducing excessive chargebacks activity from high-risk merchants. The Visa Core Rules and Visa

Product and Service Rules (VIOR) contains the current list of high risk merchant category codes as

dened by Visa. High-risk merchants include direct marketers, adult content, online pharmacies,

gambling merchants, outbound telemarketers, travel services, online pharmacies and others.

HBRCMP applies to all high-risk merchants that meet or exceed specied chargeback thresholds.

Under HBRCMP, there is no notication or workout period. Acquirers are immediately fee eligible

in the HBRCMP for their high risk merchant identications.

In addition, Visa has the ability to “accelerate” merchants from the MCMP to the HBRCMP. Visa

would notify the acquirer of the change from MCMP to HBRCMP, as well as the resulting fee

liability.

US

Global Merchant Chargeback Monitoring Program (GMCMP)

The Global Merchant Chargeback Monitoring Program (GMCMP) is operated by Visa Inc. on

a monthly basis. The GMCMP is intended to encourage merchants globally to reduce their

incidence of chargebacks by using sound best practices. In the U.S., The program augments the

U.S. Merchant Chargeback Monitoring Program (MCMP) in eect today.

The GMCMP applies when a merchant meets or exceeds specied International chargeback

thresholds. Visa noties the acquirer of the program violation in writing. Initial notication of

excessive chargebacks for a specic merchant is considered a warning. If the acquirer is unable

to reduce the excessive chargeback activity of their merchant to acceptable levels, Visa may

impose nancial penalties on the acquirer.

Section 3: Chargebacks

Chargeback Management Guidelines for Visa Merchants 27

© 2015 Visa. All Rights Reserved.

When Chargeback Rights Do Not Apply

Compliance—AnotherOption

Sometimes, a problem between members is not covered under Visa’s chargeback rights. To help resolve

these kinds of rule violations, Visa has established the compliance process, which oers members another

dispute resolution option. The Visa compliance process can be used when all of the following conditions

are met:

• A violation of the Visa Core Rules and Visa Product and Service Rules has occurred.

• The violation is not covered by a specic chargeback right.

• The member incurred a nancial loss as a direct result of the violation.

• The member would not have incurred the nancial loss if the regulation had been followed.

Typical Compliance Violations

There are many dierent violations that can be classied as a compliance issue. The list below oers a

quick peek at some of the compliance violations most commonly cited.

• The merchant bills the cardholder for a delinquent account, or for the collection of a dishonored check.

• The merchant re-posts a charge after the card issuer initiated a chargeback.

• The merchant insists that the cardholder sign a blank sales draft before the nal dollar amount is

known.

• A merchant does not hold a Visa account through an acquirer, but processes a transaction through

another Visa merchant.

Compliance Resolution

During compliance, the ling member must give the opposing member an opportunity to resolve

the issue. This is referred to as pre-compliance. If the dispute remains unresolved, Visa will review the

information presented and determine which member has nal responsibility for the transaction.

28 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

SECTION 4

Chargeback Reason Codes

What’s Covered

The chargebacks discussed in this section are listed in numerical order.

• Reason Code 30: Services Not Provided or Merchandise Not Received

• Reason Code 41: Cancelled Recurring Transaction

• Reason Code 53: Not as Described or Defective Merchandise

• Reason Code 57: Fraudulent Multiple Transactions

• Reason Code 62: Counterfeit Transaction

• Reason Code 71: Declined Authorization

• Reason Code 72: No Authorization

• Reason Code 73: Expired Card

• Reason Code 74: Late Presentment

• Reason Code 75: Transaction Not Recognized

• Reason Code 76: Incorrect Currency or Transaction Code or Domestic

Transaction Processing Violation

• Reason Code 77: Non-Matching Account Number

• Reason Code 80: Incorrect Transaction Amount or Account Number

• Reason Code 81: Fraud—Card-Present Environment

• Reason Code 82: Duplicate Processing

• Reason Code 83: Fraud—Card-Absent Environment

• Reason Code 85: Credit Not Processed

• Reason Code 86: Paid by Other Means

Section 4: Chargeback Reason Codes

Chargeback Management Guidelines for Visa Merchants 29

© 2015 Visa. All Rights Reserved.

How to Use This Information

In this section, each chargeback reason code includes the following information:

• Definition. Each chargeback is dened. The denition will help you understand what happened from

the card issuer’s perspective; that is, what conditions or circumstances existed that caused the card

issuer to issue a chargeback on the item.

• Most Common Causes. This section looks at the chargeback from the merchant’s perspective; that is,

what may or may not have been done that ultimately resulted in the item being charged back. The

“Causes” sections are short and may be helpful to you as quick references and/or for training purposes.

• Merchant Actions. This section outlines specic steps that merchants can take to help their acquirers

remedy the chargeback, prevent future recurrence, and address customer service issues. You will also

be advised under what circumstances—that is, circumstances where there is no remedy available—

you should accept nancial liability for the charged back item. Merchant actions are further classied

by the sta functions within your establishment most likely to be responsible for taking the actions.

– Back-Office Staff. The employees responsible for your general operations, administration, and

processing of chargebacks and copy requests.

– Point-of-Sale Staff. The employees responsible for accepting payment from customers for goods

and services at the point of sale. For card-absent environments, point-of-sale staff refers to order

desk staff who receive and process orders.

– Owner/Manager. The employee(s) responsible for the policies, procedures, and general

management of your establishment. Owners and managers may also be responsible for training.

The suggestions and recommendations for merchant actions are further classied by action type.

• (PR) Possible Remedy. Steps you could take to help your acquirer re-present (resubmit) a chargeback

item.

• (NR) No Remedy. You must accept the chargeback.

• (PM) Preventive Measures. Possible steps you could take to minimize future recurrence of the

particular type of chargeback being discussed.

• (CS) Customer Service. Suggestions that may help you provide enhanced service to your customers.

Disclaimer

The chargeback information in this section is current as of the date of printing. However, chargeback procedures are

frequently updated and changed. Your merchant agreement and Visa Core Rules and Visa Product and Service Rules take

precedence over this manual or any updates to its information. For a copy of the Visa Core Rules and Visa Product and Service

Rules visit www.visa.com.

An overview of the chargeback life cycle and merchant responsibilities for representment and prevention

can be found in Section 1: Getting Down to Basics.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

30 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Reason Code 30: Services Not Provided or

Merchandise Not Received

Definition

The card issuer received a claim from a cardholder that merchandise or services ordered were not received

or that the cardholder cancelled the order as the result of not receiving the merchandise or services by the

expected delivery date (or merchandise was unavailable for pick-up).

Most Common Causes

The merchant:

• Did not provide the services.

• Did not send the merchandise.

• Billed for the transaction before shipping the merchandise.

• Did not send the merchandise by the agreed-upon delivery date.

• Did not make merchandise available for pick-up.

Merchant Actions

Back-Office Staff

Merchandise Was Delivered

(PR) If the merchandise was delivered by the agreed-upon delivery date, contact your acquirer with

details of the delivery or send your acquirer evidence of the delivery, such as a delivery receipt

signed by the cardholder or a carrier’s conrmation that the merchandise was delivered to the

correct address. If the merchandise was software that was downloaded via the Internet, provide

evidence to your acquirer that the software was downloaded to or received by the cardholder. For

further details, refer to the Compelling Evidence Chart in Section 5: Providing Compelling Evidence.

Less Than 15 Days Since Transaction and No Delivery Date Set

(PR) If no delivery date has been specied, and the card issuer charged back the transaction less than 15

days from the transaction date, send a copy of the transaction receipt to your acquirer pointing out

that 15 days have not yet elapsed. You should also state the expected delivery date.

Specified Delivery Date Has Not Yet Passed

(PR) If the specied delivery date has not yet passed, return the chargeback to your acquirer with a copy

of the documentation showing the expected delivery date. In general, you should not deposit

transaction receipts until merchandise has been shipped. For custom-made merchandise, you may

deposit the entire transaction amount before shipping, provided you notify the cardholder at the

time of the transaction.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

Chargeback Management Guidelines for Visa Merchants 31

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Specified Delivery Date Has Not Yet Passed

(PR) If the specied delivery date has not yet passed, return the chargeback to your acquirer with a copy

of the documentation showing the expected delivery date. In general, you should not deposit

transaction receipts until merchandise has been shipped. For custom-made merchandise, you may

deposit the entire transaction amount before shipping, provided you notify the cardholder at the

time of the transaction.

Merchandise Shipped After Specified Delivery Date

(PR) If the merchandise was shipped after the specied delivery date, provide your acquirer with the

shipment date and expected arrival date, or proof of delivery and acceptance by the cardholder.

For further details, refer to the Compelling Evidence Chart in Section 5: Providing Compelling Evidence.

Services Were Rendered

(PR) If the contracted services were rendered, provide your acquirer with the date the services were

completed and any evidence indicating that the customer acknowledged receipt.

For further details, refer to the Compelling Evidence Chart in Section 5: Providing Compelling Evidence.

Merchandise Was Available for Pick-Up

(PR) If you received a chargeback for merchandise that was to be picked up by the cardholder, consider

the following and provide this information to your acquirer:

1. The merchandise was available for the cardholder to pick up,

2. The chargeback was processed less than 15 days from the transaction date and no pick-up

date was specied, and

3. The specied pick-up date had not yet passed as noted on any internal documentation (e.g.,

invoice, bill of sale).

Point-of-Sale Staff

Delayed Delivery

(PM) If delivery of merchandise is to be delayed, notify the customer in writing of the delay and the

(CS) expected delivery date. As a service to your customer, give the customer the option of

proceeding with the transaction or cancelling it.

Expected Delivery

(PM) For any transaction where delivery occurs after the sale, the expected delivery date should be

clearly indicated on the transaction receipt or invoice.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

32 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Owner/Manager

Proof of Delivery/Proof of Pick-Up

(PM) If you are shipping merchandise without requesting proof of delivery, consider the costs and

benets of doing so compared to the value of the merchandise you ship. Proof of delivery or pick-

up, such as certied mail or a carrier’s certication that the merchandise was delivered to the correct

address or picked up and signed for by the cardholder, will allow you to return the chargeback if the

customer claims the merchandise was not received.

For further details, refer to the Compelling Evidence Chart in Section 5: Providing Compelling Evidence.

Software Downloaded via Internet

(PM) If you sell software that can be downloaded via the Internet, Visa suggests that you design your

website to enable you to provide evidence to your acquirer that the software was successfully

downloaded and received by the cardholder.

For further details, refer to the Compelling Evidence Chart in Section 5: Providing Compelling Evidence.

Airline Transaction

(PR) If you are supplying proof that services for an airline transaction were used, you should provide a

ight manifest that includes the passenger’s name, ight details, seat information and conrmation

that the ight departed. Merchants must also ensure that the passenger name matches the

purchased itinerary. In addition, due to the large number of airlines in the market and dierences

in ight manifests, merchants must provide an explanation or key to the data elds in the ight

manifest provided.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

Chargeback Management Guidelines for Visa Merchants 33

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Reason Code 41: Cancelled Recurring Transaction

Definition

• The card issuer received a claim by a cardholder that:

• The merchant was notied to cancel the recurring transaction or that the cardholder’s

account was closed but has since billed the customer.

US

• The transaction amount exceeds the pre-authorized dollar amount range, or the merchant

was supposed to notify the cardholder prior to processing each recurring transaction, but

has not done so.

Most Common Causes

The cardholder:

• Withdrew permission to charge the account.

• Cancelled payment of a membership fee.

• Cancelled the card account.

The card issuer:

• Cancelled the card account.

The merchant:

• Received notice before the transaction was processed that the cardholder’s account was

closed.

US

• Exceeded the pre-authorized dollar amount range and did not notify the cardholder in

writing within ten days prior to the transaction date.

Notied the cardholder in writing within ten days of processing the recurring transaction,

but cardholder did not consent to the charge.

Merchant Actions

Back-Office Staff

Transaction Cancelled and Credit Issued

(PR) If the cardholder claimed to have cancelled the recurring transaction, inform your acquirer of the

date that the credit was issued.

Transaction Cancelled and Credit Not Yet Processed

(NR) If a credit has not yet been processed to correct the error, accept the chargeback. Do not process a

credit; the chargeback has already performed this function.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

34 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Transaction Not Cancelled

(NR) If you do not have a record showing that the cardholder did not cancel the transaction, accept the

chargeback. The cardholder does not have to supply evidence that you received the cancellation

notice.

TransactionCancelled—ServicesUsed

(PR) If the customer claimed they were billed for the service after they cancelled, you may need to

supply proof to your acquirer that the bill in question covered services used by the customer

between the date of the customer’s prior billing statement and the date the customer requested

cancellation.

Cardholder Expressly Renews

(PR) If the customer expressly renewed their contract for services, inform your acquirer.

Final Billing

(CS) If the customer has cancelled the recurring payment transaction and there is a nal payment

(PM) still to be charged, contact the cardholder directly for payment.

Customer Cancellation Requests

(CS) Always respond in a timely manner to customer requests relating to renewal or cancellation

(PM) of recurring transactions. Check customer logs daily for cancellation or non renewal requests;

take appropriate action to comply with them in a timely manner. Send notication to the

customer that his or her recurring payment account has been closed. If any amount is owed for

services up to the date of cancellation, seek another form of payment if necessary.

(CS) Credit Cardholder Account

(PM) Ensure credits are processed promptly. When cancellation requests are received too late to

prevent the most recent recurring charge from posting to the customer’s account, process

the credit and notify the cardholder.

US

Transaction Exceeds Pre-authorized Amount Ranges

(PM) (PR) Flag transactions that exceed pre-authorized amount ranges; notify customers of

this amount at least ten days in advance of submitting the recurring transaction billing. If

the customer disputes the amount after the billing, send evidence of the notication to your

acquirer.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

Chargeback Management Guidelines for Visa Merchants 35

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Owner/Manager

Train Staff on Proper Procedures

(PM) Train your sales and customer service sta on the proper procedures for processing recurring

transactions as these transactions are particularly susceptible to cardholder disputes.

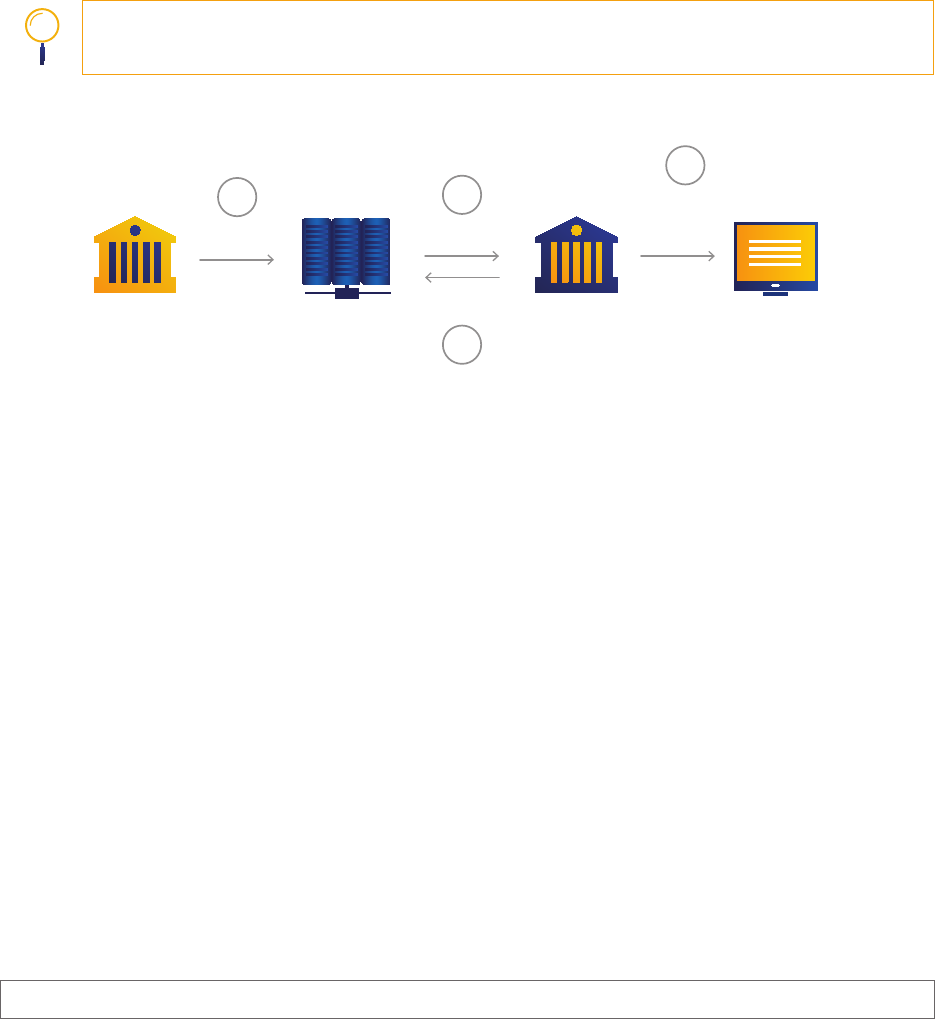

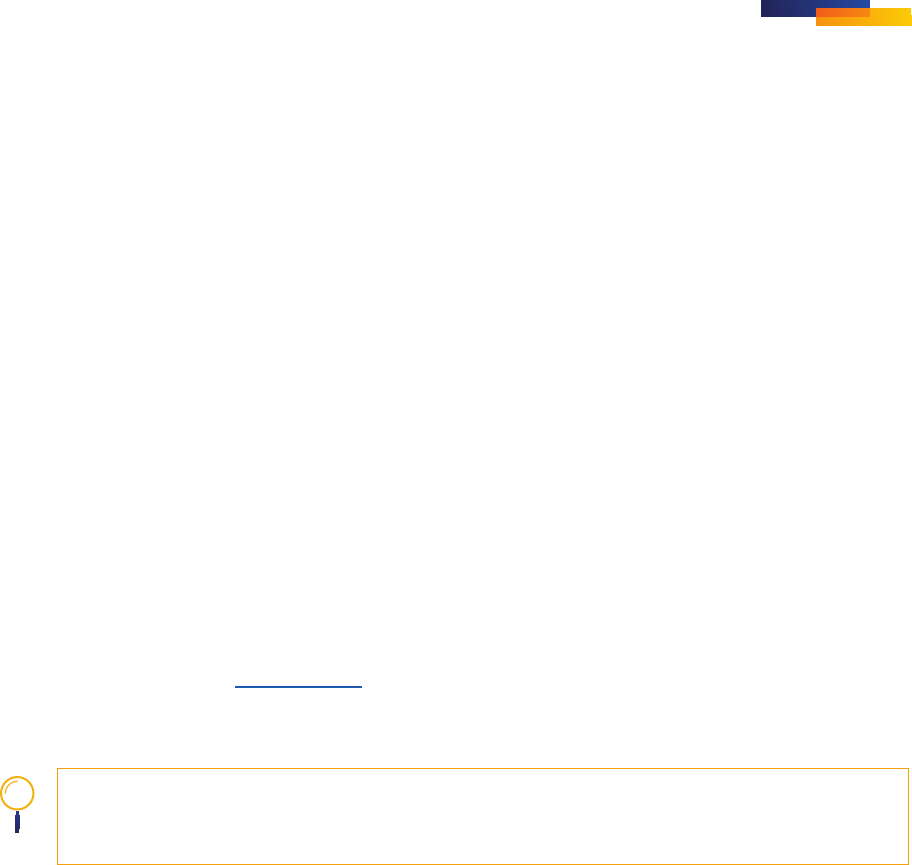

(PM) To minimize the risk associated with all recurring transactions, merchants should participate in Visa

Account Updater (VAU) to verify that on le information, including account number and expiration

date, is correct. VAU is a Visa service that allows merchants, acquirers, and card issuers to exchange

electronic updates of cardholder account information.

The VAU service ensures that merchant on-file information (cardholder account number, expiration date, status,

etc.) is current. VAU allows Visa merchants, acquirers, and card issuers to electronically exchange the most current

cardholder account information, without transaction or service interruption.

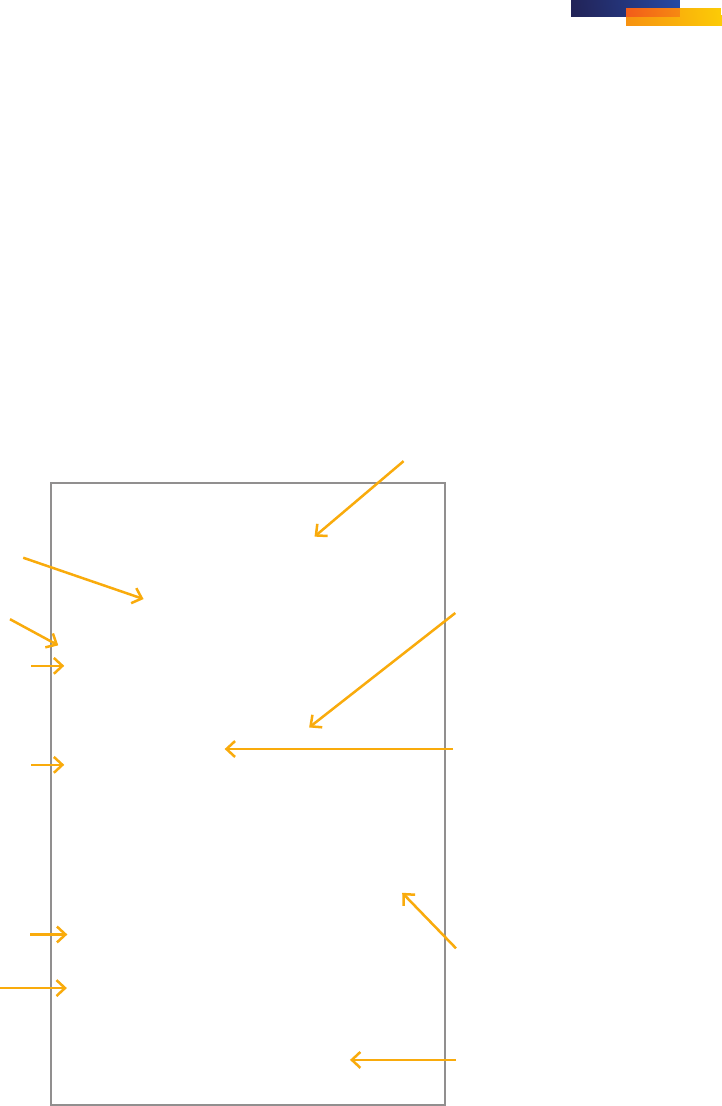

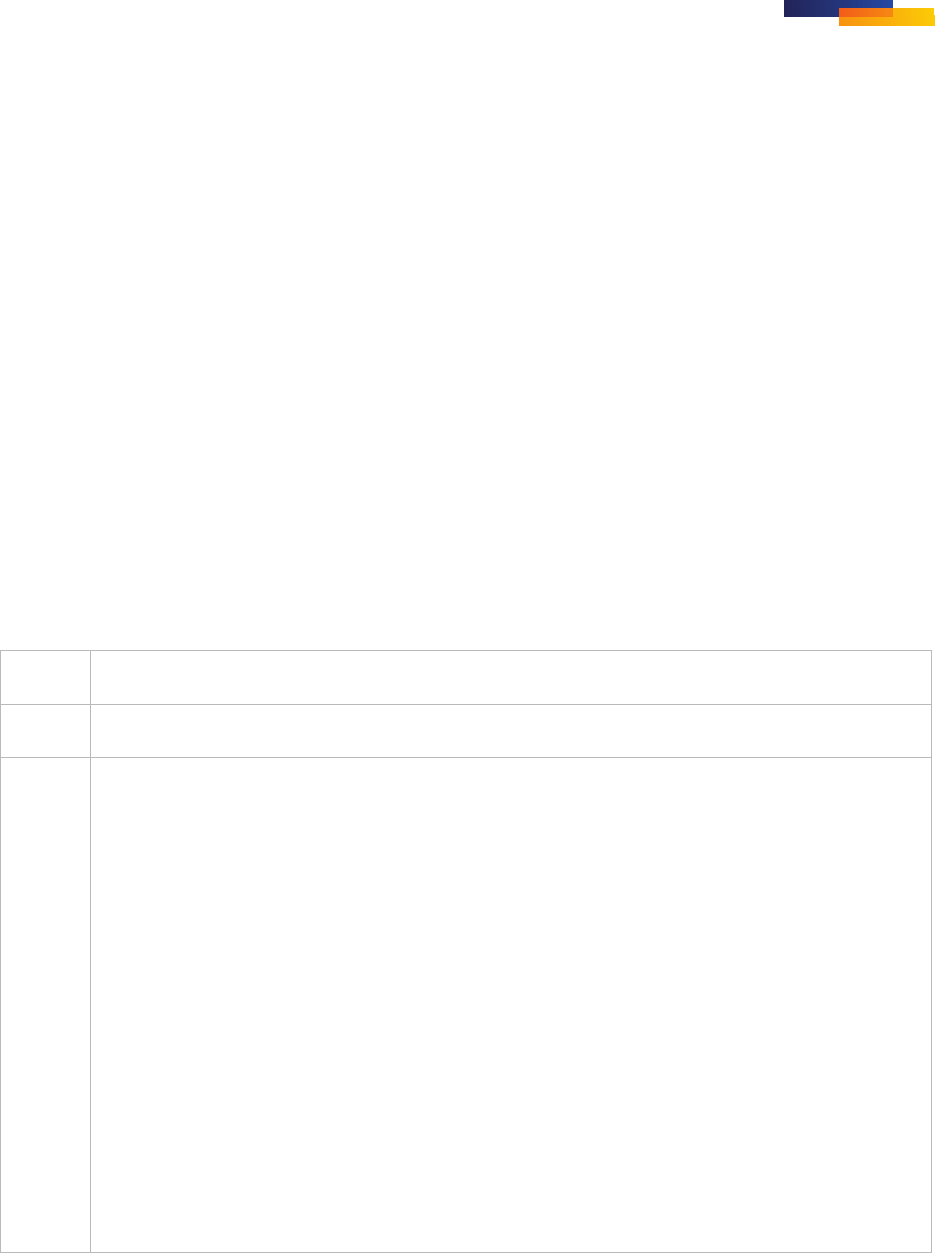

How the Visa Account Updater (VAU) Service Works

Acquirer

Merchant

On-le

Information

Issuer

Updates Inquiries

Updates

Visa Account

Updater

1

2

3

4

2. The acquirer sends

inquiries to Visa Account

Updater for cardholder

accounts that their

enrolled merchants have

on le.

1. The card issuer

sends

information to the Visa

Account Updater that

includes account number,

card expiration date

changes, and account

closures.

4. The merchant

updates the billing

information for the

customer.

3. Visa Account Updater

sends a response to the

acquirer for each inquiry,

including updated

information.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

36 Chargeback Management Guidelines for Visa Merchants

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Reason Code 53: Not as Described or Defective

Merchandise

Denition

The card issuer received a notice from the cardholder stating that the goods or services were:

• Merchandise or services did not match what was described on the transaction receipt or other

documentation presented at the time of purchase

• Not the same as the merchant’s verbal description (for a telephone transaction)

• The merchandise was received damaged or defective

• The cardholder disputes the quality of the merchandise or services

• The merchandise was identied as counterfeit by the owner of the intellectual property or authorized

representative, a custom’s agency, law enforcement agency, other governmental agency or neutral

bona de expert

• The cardholder claims that the terms of the sale were misrepresented by the merchant

For this reason code, the cardholder must have made a valid attempt to resolve the dispute or return the

merchandise. An example of a valid attempt to return may be to request that the merchant retrieve the

goods at the merchant’s own expense.

Most Common Causes

The merchant:

• Sent the wrong merchandise to the cardholder.

• Sent the merchandise, but it was damaged during shipment.

• Inaccurately described the merchandise or services.

• Did not perform the services as described.

• Did not accept the returned merchandise.

• Accepted the returned merchandise, but did not credit the cardholder’s account.

• Terms of Sale Misrepresented

• Counterfeit Merchandise

Merchants should keep in mind that their return policy has no bearing on disputes that fall under Reason Code

53: Not as Described or Defective Merchandise.

MERCHANT ACTIONS LEGEND: (PR) Possible Remedy (PM) Preventive Measure (NR) No Remedy (CS) Customer Service Suggestion

Chargeback Management Guidelines for Visa Merchants 37

© 2015 Visa. All Rights Reserved.

Section 4: Chargeback Reason Codes

Merchant Actions

Back-Office Staff

Credit Was Processed

(PR) If merchandise was returned or services were cancelled and a credit was processed to the

cardholder’s account, provide your acquirer with information or evidence of the credit.

Returned Merchandise Not Received/Services Not Cancelled

(PR) If you have not received the returned merchandise (double check your incoming shipment records

to verify) or the cardholder has not cancelled the service, advise your acquirer. (For U.S. and Canada