Dispute Management

Guidelines for

Visa Merchants

Contents

Introduction ..................................................................1

1. Getting Down to Basics ..........................................................4

Disputes Overview .............................................................5

2. Disputes .......................................................................7

Why Disputes Occur ...........................................................8

Responding to Disputes ........................................................9

Minimizing Disputes ..........................................................10

Visa Rules for Returns, Exchanges and Cancellations ..............................14

Dispute Monitoring ...........................................................16

When Dispute Rights Do Not Apply..............................................17

3. Dispute Conditions.............................................................18

Condition 10.1 EMV Liability Shift Counterfeit Fraud ..............................20

Condition 11.3 No Authorization/Late Presentment Effective for Transactions

completed on or after 13 April 2024.............................................28

Condition 12.1Late Presentment Effective through 12 April 2024....................29

Condition 10.2 EMV Liability Shift Non-Counterfeit

Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Condition 10.3 Other Fraud – Card-Present Environment ..........................22

Condition 10.4 Other Fraud – Card-Absent Environment ...........................23

Condition 10.5 Visa Fraud Monitoring Program ...................................25

Condition 11.1 Card Recovery Bulletin ...........................................26

Condition 11.2 Declined Authorization...........................................27

Condition 12.2 Incorrect Transaction Code .......................................30

Condition 12.3 Incorrect Currency ..............................................31

Condition 12.4 Incorrect Account Number .......................................32

Condition 12.5 Incorrect Amount ...............................................33

Condition 12.6 Duplicate Processing ............................................34

Condition 12.6 Paid by Other Means ............................................35

Condition 12.7 Invalid Data ....................................................36

Condition 13.1 Merchandise/Services Not Received ...............................37

Condition 13.2 Cancelled Recurring Transaction ..................................39

Condition 13.3 Not as Described or Defective Merchandise/Services.................40

Condition 13.4 Counterfeit Merchandise .........................................42

Condition 13.5 Misrepresentation...............................................43

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

i

Condition 13.6 Credit Not Processed ............................................45

Condition 13.7 Cancelled Merchandise/Services ..................................46

Condition 13.8 Original Credit Transaction Not Accepted........................... 48

Condition 13.9 Non-Receipt of Cash at an ATM ...................................49

4. Providing Compelling Evidence ..................................................50

Compelling Evidence and Merchant Rights ....................................... 51

Issuer Compelling Evidence Requirements ....................................... 56

Glossary ........................................................................57

Appendix: Training Your Staff .....................................................63

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

ii

Introduction

Purpose

Dispute Management Guidelines for Visa Merchants is a comprehensive manual for all businesses

that accept Visa transactions. The purpose of this guide is to provide merchants and their back-

oce sales sta with accurate, up-to-date information to help merchants minimizing the risk of

loss from fraud and disputes. This document covers dispute requirements and best practices

for processing transactions that are charged back to the merchant by their acquirer.

Audience

This book is targeted at both card-present and card-absent merchants and their employees.

Contents

The Dispute Management Guidelines for Visa Merchants contains detailed information on disputes

merchants receive and what can be done to respond to them or prevent them. It is organized

to help users nd the information they need quickly and easily. The table of contents serves as

an index of the topics and material covered.

Topics covered include:

– Section 1: Getting Down to Basics – Provides an overview of how Visa transactions are

processed, from point of transaction to clearing and settlement. A list of key Visa policies

for merchants is also included to help ensure the security of condential cardholder

information.

– Section 2: Disputes – Highlights strategies for dispute prevention, as well as information on

how and when to resubmit a disputed transaction back to your acquirer. A brief compliance

process overview is also included.

– Section 3: Dispute Conditions – Contains detailed information on the conditions for

disputes that merchants receive. For each condition, a denition is provided along

with the merchant’s actions—or failure to act—that may have caused the dispute, and

recommendations are given for resubmitting the transaction and preventing similar disputes

in the future.

– Section 4: Providing Compelling Evidence – Discusses dispute response processing

requirements related to merchant compelling evidence.

– Glossary – A list of terms used in the guide.

– Appendix: Training Your Staff – A reference to Visa.com which oers resources that

merchants can use for training their employees on card acceptance and fraud prevention

procedures.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

1

i

Important Note About Country Differences

Most of the information and best practices contained in this document pertain to all regions;

however, in some countries, there are specic products, services, and regulatory dierences

that must be noted. In these instances, country or region-specic details have been identied

with an icon for the country under discussion.

The country icons are as follows:

United States (US)

Canada

Europe

Latin America and Caribbean (LAC)

Asia Pacic (AP)

Central Europe, Middle East, and Africa (CEMEA)

Guide Navigation

Dispute Management Guidelines for Visa Merchants provides icons that highlight additional

resources or information:

Additional insights related to the topic that is being covered.

A brief explanation of the Visa service or program pertinent to the topic at hand.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

2

Introduction

Disclaimer

This guide contains information based on the current Visa Core Rules and Visa Product and

Service Rules. If there are any dierences between the Visa Core Rules and Visa Product and

Service Rules and this guide, the Visa Core Rules and Visa Product and Service Rules will prevail in

every instance. Your merchant agreement and the Visa Core Rules and Visa Product and Service

Rules take precedence over this guide or any updates to its information. To access a copy of the

Visa Core Rules and Visa Product and Service Rules, visit Visa.com and click on Operations and

Procedures.

All rules discussed in this guide may not apply to all countries. Local laws and rules may exist

and it is your responsibility to ensure your business complies with all applicable laws and

regulations.

The information, recommendations or “best practices” contained in this guide are provided

“AS IS” and intended for informational purposes only and should not be relied upon for

operational, marketing, legal, technical, tax, nancial or other advice. This guide does not

provide legal advice, analysis or opinion. Your institution should consult its own legal counsel to

ensure that any action taken based on the information in this guide is in full compliance with all

applicable laws, regulations and other legal requirements.

Visa is not responsible for your use of the information contained in this guide (including errors,

omissions, inaccuracy or non-timeliness of any kind) or any assumptions or conclusions you

might draw from its use. Visa makes no warranty, express or implied, and explicitly disclaims

the warranties of merchantability and tness for a particular purpose, any warranty of non-

infringement of any third party’s intellectual property rights, any warranty that the information

will meet your requirements, or any warranty that the information is updated and will be error

free.

For further information about the rules or practices covered in this guide, please contact your

acquirer.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

3

1

Getting Down

to Basics

What’s Covered

– Dispute Overview

– The Dispute Life Cycle

By accepting Visa cards at your point-of-sale, you become an integral part of the

Visa payment system. That’s why it’s important that you start with a clear picture of

the Visa card transaction process; what it is, how it works, and who’s involved. The

basic knowledge in this section provides you with a conceptual framework for the

policies and procedures that you must follow as a Visa merchant. It will also help

you to understand the major components of payment processing and how they

aect the way you do business.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

4

1

Getting Down to Basics

Disputes Overview

What is a Dispute?

A dispute provides an issuer with a way to return a contested transaction. When a cardholder

disputes a transaction, the issuer may request a detailed explanation of the problem from the

cardholder. Once the issuer receives this information, the rst step is to determine whether a

dispute situation exists. There are many reasons for disputes—those reasons that may be of

assistance in an investigation include the following:

– Merchant failed to get an authorization

– Merchant failed to obtain card imprint (electronic or manual)

– Merchant processed the transaction incorrectly

When a dispute right applies, the issuer sends the transaction back to the acquirer and

disputes the dollar amount of the disputed sale. The acquirer then researches the transaction.

If the dispute is valid, the acquirer deducts the amount of the dispute from the merchant

account and informs the merchant.

Under certain circumstances, a merchant may respond to a dispute to its acquirer. If the

merchant cannot remedy the dispute, it is the merchant’s loss. If there are no funds in the

merchant’s account to cover the disputed amount, the acquirer must cover the loss.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

5

1

Getting Down to Basics

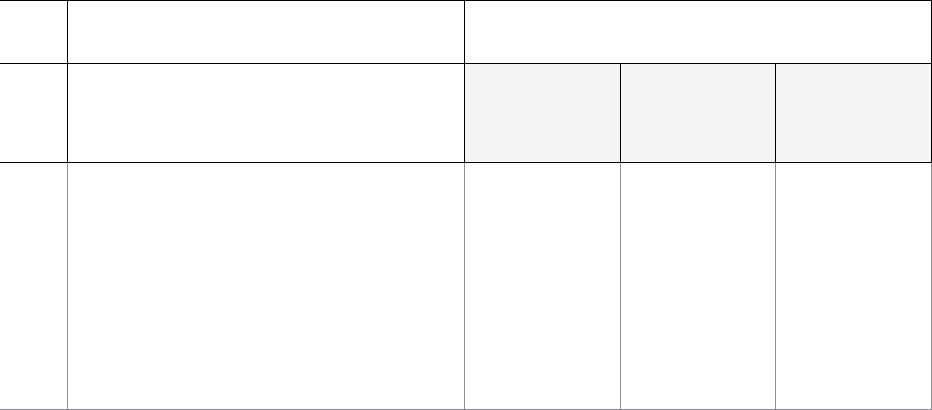

The Dispute Life Cycle

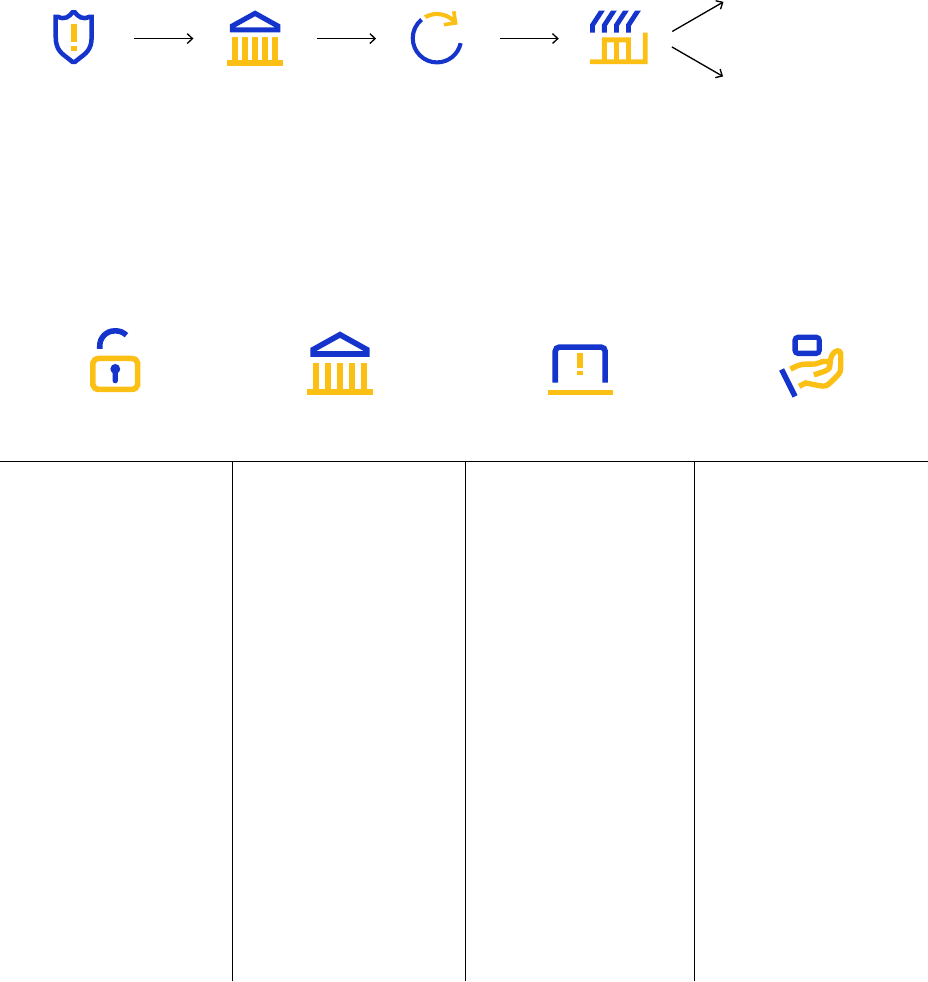

The diagram below illustrates and explains the Visa dispute resolution.

ACCEPT

Merchant pays

dispute amount

Cardholder files

transaction dispute

with their bank

Cardholder bank

sends dispute to

merchant card

processor

Merchant card

processor forwards

dispute to merchant

Merchant

accepts or

rejects dispute

For your convenience, we have organized the content into four Visa dispute categories: Fraud,

Authorization, Processing Errors, and Consumer Disputes. Each category includes a set of

numbered dispute conditions as shown below.

REJECT

Merchant prepares

supporting documentation

in response to dispute and

submits it to merchant

card processor

10. Fraud 11. Authorization 12. Processing Errors 13. Consumer Disputes

10.1 – EMV Liability Shift

Counterfeit Fraud

11.1 – Card Recovery

Bulletin

12.1 – Late Presentment

(Effective through 12 April

2024)

13.1 – Merchandise/

Services Not Received

10.2 – EMV Liability Shift

Non-Counterfeit Fraud

11.2 – Declined

Authorization

13.2 – Cancelled Recurring

Transaction

12.2 – Incorrect

Transaction Code

10.3 – Other Fraud –

Card-Present Environment

11.3 – No Authorization/

Late Presentment

(Effective for Transactions

completed on or after

13 April 2024)

13.3 – Not as Described or

Defective Merchandise/

Services

12.3 – Incorrect Currency

10.4 – Other Fraud –

Card-Absent Environment

10.5 – Visa Fraud

Monitoring Program

12.4 – Incorrect Account

Number

12.5 – Incorrect Amount

13.4 – Counterfeit

Merchandise

12.6 – Duplicate

Processing/ Paid by Other

Means

13.6 – Credit Not

Processed

12.7 – Invalid Data

13.5 - Misrepresentation

13.7 – Cancelled

Merchandise/Services

13.8 – Original Credit

Transaction Not Accepted

13.9 – Non-Receipt of

Cash at an ATM

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

6

2

Disputes

What’s Covered

– Why Disputes Occur

– Responding to Disputes

– Minimizing Disputes

– Dispute Monitoring

– When Dispute Conditions Do Not Apply

For merchants, disputes can be costly. You can lose both the dollar amount of the

transaction being disputed and the related merchandise. You can also incur your

own internal costs for processing a dispute response. Since you control how your

employees handle transactions, you can prevent many unnecessary disputes by

simply training your sta to pay attention to a few details.

In this section, you will nd a set of strategies for dispute prevention, as well as

information on how and when to resubmit a disputed transaction to your acquirer.

A brief compliance process overview is also included.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

7

2

Disputes

i

Why Disputes Occur

Visa has four dispute categories:

– Fraud

– Authorization

– Processing Errors

– Consumer Disputes

Although you probably cannot avoid disputes completely, you can take steps to reduce or

prevent them. Many disputes result from avoidable mistakes, so the more you know about

proper transaction-processing procedures, the less likely you will be to inadvertently do, or fail

to do, something that might result in a dispute. (See Minimizing Disputes in this section.)

Of course, disputes are not always the result of something merchants did or did not do. Errors

are also made by acquirers, card issuers, and cardholders.

From the administrative point of view, the main interaction in a dispute is between a card issuer

and an acquirer. The card issuer sends the dispute to the acquirer, which may or may not need

to involve the merchant who submitted the original transaction. This processing cycle does not

relieve merchants of the responsibility of taking action to remedy and prevent disputes. In most

cases, the full extent of your financial and administrative liability for disputes is spelled out in

your merchant agreement.

If a cardholder with a valid dispute contacts you directly, act promptly to resolve the situation.

Issue a credit, as appropriate, and send a note or e-mail message to let the cardholder know he

or she will be receiving a credit.

For more information on dispute conditions merchants receive, see Section 3: Dispute Conditions.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

8

2

Disputes

Responding to Disputes

Even when you do receive a dispute, you may be able to resolve it without losing the sale.

Simply provide your acquirer with additional information about the transaction or the actions

you have taken related to it.

For example, you might receive a dispute because the cardholder is claiming that credit has

not been given for returned merchandise. You may be able to resolve the dispute by providing

evidence showing the amount and the date the credit has been submitted/processed.

To help support validity of the transaction, it is essential to promptly supply all available details

including relevant documentation at the initial dispute notification. Evidence must be legible

(good scan copy) and in English or accompanied by an English translation,

With appropriate information, your acquirer may be able to respond back to the card issuer

and address the dispute. Timeliness is also crucial when attempting to remedy a dispute.

Each step in the dispute cycle has a dened time limit during which action can be taken. If you

or your acquirer do not respond during the time specied on the request—which may vary

depending on your acquirer, it may potentially lead to unfavorable outcome of the case.

Although many disputes are resolved without the merchant losing the sale, some cannot be

remedied. In such cases, accepting the dispute may save you the time and expense of needlessly

contesting it.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

9

2

Disputes

Minimizing Disputes

Most disputes can be attributed to improper transaction-processing procedures and can be

prevented with appropriate training and attention to detail. The following best practices will

help you minimize disputes.

Card-Present Merchants

– Authorization. Do not complete a transaction without obtaining an authorization.

– Declined Authorization. Do not complete a transaction if the authorization request was

declined.

– Expired Card. Do not accept a card after its “Good Thru” or “Valid Thru” date.

A chip card and the chip-reading device work together to determine the appropriate cardholder

verification method for a transaction (either signature, PIN or Consumer Device Cardholder

Verification Method (CDCVM). If the transaction has been PIN verified, there is no need for

signature.

– Card Imprint for Key-Entered Card-Present Transactions. If, for any reason, you must key-

enter a transaction to complete a card-present sale, make an imprint of the front of the card

on the transaction receipt, using a manual imprinter. Do not capture an impression of the card

using a pencil, crayon, or other writing instrument. This process does not constitute a valid

imprint. Even if the transaction is authorized and the receipt is signed, the transaction may be

disputed back to you if fraud occurs, and the receipt does not have an imprint of the payment

credential and expiration date.

This applies to all card-present transactions, including key-entry situations where the card

presented is chip and the terminal is chip-enabled. When a merchant key-enters a transaction,

an imprint is required regardless of the type of card and terminal capability.

– Legibility. Ensure that the transaction information on the transaction receipt is complete,

accurate and legible before completing the sale. An illegible receipt, or a receipt which

produces an illegible copy, may be returned because it cannot be processed properly. The

growing use of electronic scanning devices for the electronic transmission of copies of

transaction receipts make it imperative that the item being scanned is more legible.

– Fraudulent Card-Present Transaction. If the cardholder is present and has the payment

credential but not the card, do not accept the transaction. Even with an authorization

approval, the transaction can be disputed and sent back to you if it turns out to be fraudulent.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

10

2

Disputes

You submitted a CVV2 verication request during authorization and received a “U” response

with a presence indicator of 1, 2, or 9 from a card issuer. This response means the card

issuer does not support CVV2.

You submitted a CVV2 verication request on a Mail/Phone Order Transaction or an

Electronic Commerce Transaction during authorization and received an “N” response with a

presence indicator of 1 from the card issuer. The issuer approved the transaction with the

no match response.

Card-Absent Merchants

Address Verification Service (AVS) and Card Verification Value 2 (CVV2)

1

Dispute Protection.

Be familiar with the dispute response rights associated with the use of AVS and CVV2.

Specifically, your acquirer can provide a response for a disputed transaction for:

AVS:

– You received an AVS positive match “Y” response in the authorization message and

if the billing and shipping addresses are the same. You will need to submit proof of

the shipping address and signed proof of delivery.

– You submitted an AVS query during authorization and received a “U” response

from a card issuer. This response means the card issuer is unavailable or does not

support AVS.

CVV2:

–

–

Visa Secure Dispute Protection. Visa Secure provides merchants with cardholder

authentication on eCommerce transactions. Visa Secure helps reduce eCommerce fraud

by helping to ensure that the transaction is being initiated by the rightful owner of the Visa

account. This gives merchants greater protection on eCommerce transactions.

Visa Secure participating merchants are protected by their acquirer from receiving certain

fraud-related disputes, provided the transaction is processed correctly.

If: Then:

The cardholder is successfully

authenticated

The merchant is protected from fraud-related disputes, and can

proceed with authorization using Electronic Commerce Indicator (ECI)

2

of ‘5’.

The card issuer or cardholder is not

participating in Visa Secure

The merchant is protected from fraud-related disputes, and can

2

proceed with authorization using ECI of ‘6’.

Merchant does not participate or

doesn’t attempt to authenticate

The merchant is not protected from fraud-related disputes, but can

still proceed with authorization using ECI of ‘7’.

Liability shift rules for Visa Secure transactions may vary by region. Please check with your

acquirer for further information.

1

In certain markets, CVV2 is required to be present for all card-absent transactions.

2 A Visa Secure merchant identified by the Visa Fraud Monitoring Program may be subject to disputes Condition 10.5: Visa

Fraud Monitoring Program.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

11

2

Disputes

Make Sure Customers Can Recognize Your Name on Their Bills

Cardholders must be able to look at their bank statements and recognize transactions

that occurred at your establishment. Check with your acquirer to be sure it has the correct

information on your “Doing Business As” (DBA) name, city, and state/region/province. You can

check this information yourself by purchasing an item on your Visa card at each of your outlets

and looking at the merchant name and location on your monthly Visa statement. Is your name

recognizable? Can your customers identify the transactions made at your establishment?

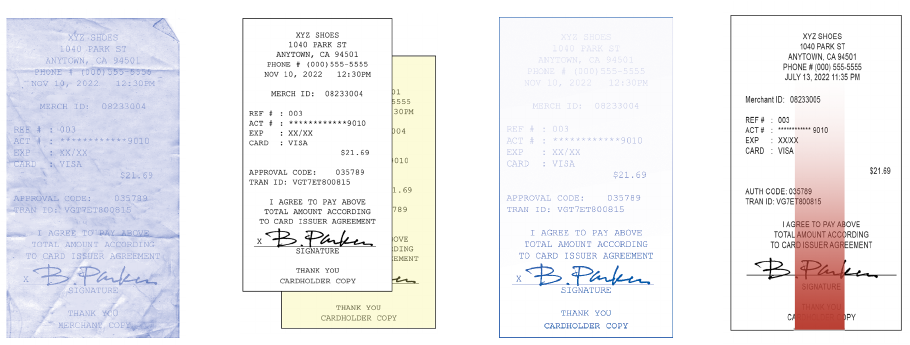

Make Sure Your Business Name Is Legible on Receipts

Make sure your company’s name is accurately and legibly printed on transaction receipts. The

location, size, or color of this information should not interfere with the transaction details.

Similarly, you should make sure that any company logos or marketing messages on receipts

are positioned away from transaction information.

Handle carbonless

paper and carbon/

silver-backed paper

carefully.

if you use a two-color

receipt, keep the white

copy and give your

customers the color

copy.

Change point-of-sale

printer cartridge

routinely.

Change point-of-sale

printer paper when

the color streak first

appears.

Sales-Receipt Processing

– One Entry for Each Transaction. Ensure that transactions are entered into point-of-sale

terminals only once and are deposited only once. You may get a dispute for duplicate

transactions if you:

– Enter the same transaction into a terminal more than once.

– Deposit both the merchant copy and bank copy of a transaction receipt with your

acquirer.

– Deposit the same transaction with more than one acquirer.

– Proper Handling of Transaction Receipts. Ensure that incorrect or duplicate transaction

receipts are voided and that transactions are processed only once.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

12

2

Disputes

– Depositing Transaction Receipts. Deposit transaction receipts with your acquirer as quickly

as possible, preferably within one to ve days of the transaction date; do not hold on to

them.

– Timely Deposit of Credit Transactions. Deposit credit receipts with your acquirer as quickly

as possible, preferably the same day the credit transaction is generated.

Customer Service

– Prepayment. If the merchandise or service to be provided to the cardholder will be delayed,

advise the cardholder in writing of the delay and the new expected delivery or service date.

– Item Out of Stock. If the cardholder has ordered merchandise that is out of stock or no

longer available, advise the cardholder in writing. If the merchandise is out of stock, let the

cardholder know when it will be delivered. If the item is no longer available, oer the option

of either purchasing a similar item or cancelling the transaction. Do not substitute another

item unless the customer agrees to accept it.

– Ship Merchandise Before Depositing Transaction. For card-absent transactions, do

not deposit transaction receipts with your acquirer until you have shipped the related

merchandise. If customers see a transaction on their monthly Visa statement before they

receive the merchandise, they may contact their card issuer to dispute the billing. Similarly, if

delivery is delayed on a card-present transaction, do not deposit the transaction receipt until

the merchandise has been shipped.

– Requests for Cancellation of Recurring Transactions. If a customer requests cancellation

of a transaction that is billed periodically (monthly, quarterly, or annually), cancel the

transaction immediately or as specied by the customer. As a service to your customers,

advise the customer in writing that the service, subscription, or membership has been

cancelled and state the eective date of the cancellation.

When customer withdrew permission to charge the account for a recurring transaction or,

in the Europe Region, an installment transaction, you are prohibited from billing the Visa

account after a cancellation request has been received and must ask for another form of

payment from the cardholder if balance payment is due.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

13

2

Disputes

Visa Rules for Returns, Exchanges and Cancellations

As a merchant, you are responsible for establishing your merchandise return and refund or

cancellation policies. Clear disclosure of these policies can help you avoid misunderstandings

and potential cardholder disputes. For face-to-face or eCommerce environment, the cardholder

must receive the disclosure at the time of purchase. For guaranteed reservations made by

telephone, the merchant may send the disclosure after by mail, email or text message.

If you are unsure how to disclose your return, refund and cancellation policies, contact your

acquirer for further guidance.

Disclosure for Card-Present Merchants

For card-present transactions, Visa will accept that proper disclosure has occurred before

a transaction is completed if the following (or similar) disclosure statements are legibly

printed on the face of the transaction receipt near the cardholder signature area or in an

area easily seen by the cardholder. If the disclosure is on the back of the transaction receipt

or in a separate contract, it must be accompanied by a space for the cardholder’s signature

or initials. Your policies should be pre-printed on your transaction receipts; if not, write or

stamp your return or refund policy information on the transaction receipt near the customer

signature line before the customer signs (be sure the information is clearly legible on all copies

of the transaction receipt). Failure to disclose your return or refund policies at the time of a

transaction could result in a dispute should the customer return the merchandise.

Common Disclosure

Statement

What It Means

No Refunds or Returns

or Exchanges

Your establishment does not issue refunds and does not accept returned

merchandise or merchandise exchanges.

Exchange Only

Your establishment is willing to exchange returned merchandise for similar

merchandise that is equal in price to the amount of the original transaction.

In-Store Credit Only

Your establishment takes returned merchandise and gives the cardholder an in-

store credit for the value of the returned merchandise.

Special Circumstances

You and the cardholder have agreed to special terms (such as late delivery

charges or restocking fees). The agreed-upon terms must be written on the

transaction receipt or a related document (e.g., an invoice). The cardholder’s

signature on the receipt or invoice indicates acceptance of the agreed-upon

terms.

Timeshare

You must provide a full credit when a transaction receipt has been processed

and the cardholder has cancelled the transaction within 14 calendar days of the

contract date or the date the contract or related documents were received.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

14

2

Disputes

Disclosure for Card-Absent Merchants

Phone Order

For proper disclosure, your refund and credit policies may be mailed, emailed, or texted

to the cardholder. As a reminder, the merchant must prove the cardholder received and

acknowledged the policy in order for the disclosure to be proper.

Internet or Application

Your website must communicate its refund policy to the cardholder in either of the following

locations:

– In the

sequence of pages before nal checkout, with a “click to accept” or other

acknowledgement button, checkbox, or location for an electronic signature, or

– On the checkout screen, near the “submit” or click to accept button

The disclosure may

be a link to a separate page if that link forms part of the “click to accept”

acknowledgement and refers to the return, refund, or cancellation policy.

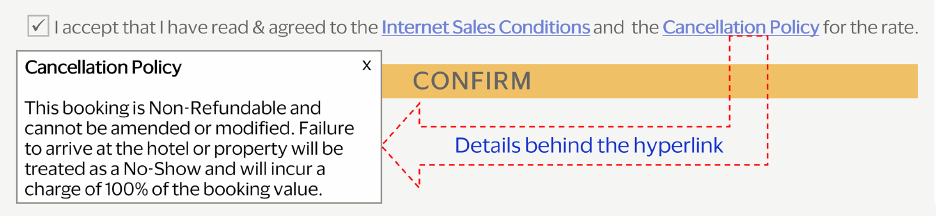

The image below is an example of valid proper disclosure. It illustrates the details or text

behind the cancellation policy hyperlink, which is part of the “click to accept” acknowledgement:

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

15

2

Disputes

Dispute Monitoring

Monitoring dispute rates can help merchants pinpoint problem areas in their businesses and

improve prevention eorts. Card-absent merchants may experience higher disputes than card-

present merchants as the card is not electronic read, which increases liability for disputes.

General recommendations for dispute monitoring include:

– Track disputes and dispute responses by conditions. Each condition is associated with

unique business issues and requires specic remedies and reduction strategies.

– Track dispute activity as a proportion of sales activity.

– Include initial dispute amounts and net disputes after dispute response.

– If your business combines traditional retail with card-absent transactions, track the card-

present and card-absent disputes separately. Similarly, if your business combines mail

order telephone order (MOTO) and Internet sales, these disputes should also be monitored

separately.

Visa Dispute Monitoring Programs

Visa monitors all merchant dispute activity on a monthly basis and noties acquirers when any

of their merchants have excessive disputes.

Once notied of a merchant with excessive disputes, acquirers are expected to take

appropriate steps to reduce the merchant’s dispute activity. Remedial action will depend

on the dispute condition, merchant’s line of business, business practices, fraud controls,

and operating environment, sales volume, geographic location, and other factors. In some

cases, merchants may need to provide sales sta with additional training on card acceptance

procedures. Merchants should work with their acquirer to develop a detailed dispute-reduction

plan which identies the root cause of the dispute issue and an appropriate remediation

action(s).

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

16

2

Disputes

When Dispute Rights Do Not Apply

Compliance—Another Option

Sometimes, a problem between clients is not covered under Visa’s dispute conditions. To help

resolve these kinds of rule violations, Visa has established the compliance process, which oers

clients another dispute resolution option. The Visa compliance process can be used when all of

the following conditions are met:

– A violation of the Visa Core Rules occurred.

– The client has no Dispute, Dispute Response, or pre-Arbitration right.

– The client incurred or will incur a nancial loss as a direct result of the violation.

– The client would not have incurred the nancial loss had the violation not occurred.

Typical Compliance Violations

There are many dierent violations that can be classied as a compliance issue. Here are some

of the compliance violations most commonly cited:

– The merchant bills the cardholder for a delayed or amended charge without cardholder’s

consent.

– The cardholder was reimbursed twice for the same transaction as a result of a credit or

reversal processed on or before a dispute that was processed through Rapid Dispute

Resolution. For this violation it is the acquirer who initiates compliance against the issuer.

– The merchant processed a credit transaction without completing a previous retail

transaction with the same cardholder and subsequently reversed the credit transaction after

the funds have been depleted.

– A merchant key-entered multiple card-present transactions that occurred at the same

merchant outlet and on the same date but the cardholder only acknowledges participation

in at least one transaction.

Compliance Resolution

During compliance, the ling client must give the opposing party an opportunity to resolve

the issue. This is referred to as pre-compliance. If the dispute remains unresolved, Visa will

review the information presented and determine which client has nal responsibility for the

transaction.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

17

3

Dispute

Conditions

What’s Covered

The dispute conditions are listed in numerical order.

Condition 10.1 EMV Liability Shift Counterfeit Fraud

Condition 10.2 EMV Liability Shift Non-Counterfeit Fraud

Condition 10.3 Other Fraud – Card-Present Environment

Condition 10.4 Other Fraud – Card-Absent Environment

Condition 10.5 Visa Fraud Monitoring Program

Condition 11.1 Card Recovery Bulletin

Condition 11.2 Declined Authorization

Condition 11.3 No Authorization/Late Presentment Eective for Transactions

completed on or after 13 April 2024

Condition 12.1 Late Presentment Eective through 12 April 2024

Condition 12.2 Incorrect Transaction Code

Condition 12.3 Incorrect Currency

Condition 12.4 Incorrect Account Number

Condition 12.5 Incorrect Amount

Condition 12.6 Duplicate Processing/Paid by Other Means

Condition 12.7 Invalid Data

Condition 13.1 Merchandise/Services Not Received

Condition 13.2 Cancelled Recurring Transaction

Condition 13.3 Not as Described or Defective Merchandise/Services

Condition 13.4 Counterfeit Merchandise

Condition 13.5 Misrepresentation

Condition 13.6 Credit Not Processed

Condition 13.7 Cancelled Merchandise/Services

Condition 13.8 Original Credit Transaction Not Accepted

Condition 13.9 Non-Receipt of Cash at an ATM

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

18

3

Dispute Conditions

i

How to Use This Information

In this section, each dispute condition includes the following information:

Why did I get this notification?

This section will help you understand what happened from the card issuer’s perspective; that

is, what conditions or circumstances existed that caused the card issuer to issue a dispute on

the item.

What caused the dispute?

This section looks at the dispute from the merchant’s perspective; that is, what may or may not

have been done that ultimately resulted in the item being disputed. The “Causes” sections are

short and may be helpful to you as quick references and/or for training purposes.

How should I respond?

This section outlines specic steps that merchants can take to help their acquirers respond to

the dispute and under what circumstances—that is, circumstances where there is no remedy

available—you should accept nancial liability for the disputed item.

How to avoid this dispute in the future?

This section will help you prevent or minimize future recurrence of the particular dispute

condition, and address customer service and back-oce issues.

An overview of the dispute life cycle can be found in Section 1: Getting Down to Basics.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

19

3

Dispute Conditions

Condition 10.1

EMV Liability Shift Counterfeit Fraud

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 10.1, EMV Liability Shift Counterfeit Fraud.

Why did I get this notification?

A cardholder is claiming that they did not authorize or participate in a transaction that you

processed on a counterfeit card.

The cardholder’s bank determined all of the following has occurred:

– The transaction was completed in a card-present environment with a card that was reported

as counterfeit,

– The transaction qualies for the EMV liability shift,

– The card is a chip card, and

– Either of these things occurred:

– The transaction did not take place at a chip-reading device (terminal entry capability

code was not 5).

– The transaction was chip-initiated and, the transaction was authorized online, however,

the card processor did not transmit the full chip data to Visa in the authorization

request.

What caused the dispute?

The cardholder has a chip card, but the transaction did not take place at a chip terminal or was

not chip read.

How should I respond?

– The transaction took place at a chip terminal.

Provide documentation to support that the transaction was chip read and evidence that the

full chip data was transmitted.

– The transaction did not take place at a chip terminal.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder stating that they no longer dispute the

transaction.

How to avoid this dispute in the future

– Make sure your terminal is EMV-compliant and the correct Cardholder Verication Method

(CVM) was obtained. For example: signature, PIN, etc.

– Chip cards are properly processed.

– Train your sta on the proper procedures for handling terminal issues.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

20

3

Dispute Conditions

Condition 10.2

EMV Liability Shift Non-Counterfeit Fraud

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 10.2, EMV Liability Shift Non-Counterfeit Fraud.

Why did I get this notification?

A cardholder is claiming that they did not authorize or participate in a transaction that you

processed on a lost or stolen card, or on a card not received as issued (NRI).

The cardholder’s bank determined all of the following has occurred:

– The transaction was completed in a card-present environment with a card that was reported

lost, stolen, or card not received as issued (NRI)

– The transaction qualies for the EMV liability shift,

– The card is a PIN-preferring chip card, and

– One of these actions transpired:

– The transaction did not take place at a chip-reading device.

– A chip-initiated transaction took place at a chip-reading device that was not EMV

PIN-compliant.

– The online authorized transaction was chip-initiated without an online PIN and the card

processor did not transmit the full chip data to Visa in the authorization request.

What caused the dispute?

The most common cause of this dispute is that a PIN-preferring chip card was used either at a

non-EMV terminal or a chip transaction was initiated without full chip data.

How should I respond?

– The transaction took place at an EMV PIN compliant terminal.

Provide documentation to support that the transaction took place at an EMV PIN compliant

terminal.

– The transaction was not completed at an EMV PIN-compliant terminal.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Make sure your terminal is EMV PIN-compliant and the correct Cardholder Verication

Method (CVM) was obtained. For example: signature, PIN, etc.

– Chip cards are properly processed.

– Train your sta on the proper procedures for handling terminal issues.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

21

3

Dispute Conditions

Condition 10.3

Other Fraud – Card-Present Environment

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 10.3, Other Fraud – Card-Present Environment.

Why did I get this notification?

A cardholder is claiming that they did not authorize or participate in a key-entered transaction

conducted in a card-present environment.

What caused the dispute?

The most common causes of this type of dispute are that you:

– Did not ensure that the card was either swiped or that the chip was read.

– Did not make a manual imprint of the card account information on the transaction receipt

for a key-entered transaction.

– Completed a card-absent transaction but the transaction was not properly identied as an

internet or mail order/ phone order.

How should I respond?

– The card was swiped or chip-read and the transaction was authorized at the point of sale.

Provide a copy of the authorization record as proof that the card’s magnetic stripe or chip

was read.

– A manual imprint was obtained at the point of sale. (Does not apply to the Europe region)

Provide a copy of the manual imprint.

– The transaction was not swiped, chip-read, or manually imprinted.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Make sure all card-present transactions are either magnetic stripe-read or chip-read.

– If you are unable to swipe or read the chip, make a manual imprint of the card.

– Train your sta on the proper procedures for handling terminal issues.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

22

3

Dispute Conditions

Condition 10.4

Other Fraud – Card-Absent Environment

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 10.4, Other Fraud – Card-Absent Environment.

Why did I get this notification?

The cardholder is claiming that they did not authorize or participate in a transaction conducted

in a card-absent environment (i.e., internet, mail-order, phone-order, etc.).

What caused the dispute?

The most common causes of this type of dispute are:

– You processed a card-absent transaction from a person who was fraudulently using a

payment credential.

– The cardholder had their payment credential taken by fraudulent means.

– Due to an unclear or confusing merchant name the cardholder believes the transaction to

be fraudulent

How should I respond?

– The transaction was authenticated with Visa Secure.

Advise your card processor that the transaction was Visa Secure-authenticated at time of

authorization.

– The cardholder has two or more completed transactions (settled 120 calendar days prior

to the dispute) which the issuer did not report as Fraud Activity to Visa, with at least two

data elements (device ID, device ngerprint, or the IP address) the same as the disputed

transaction.

Provide the following details of the two previous transactions (settled between 120–365

calendar days prior to the dispute processing date) and the disputed transaction:

– Detailed description of merchandise or services purchased for the disputed

Transactions and the 2 previous Transactions

– Effective for Disputes Processed through 18 October 2024 Date/time the merchandise

or services were provided

– Effective for Disputes Processed on or after 19 October 2024 Date the merchandise or

services were provided

– The same device ID, device fingerprint or the IP address and an additional one or more

data elements (Customer account/login ID, Full delivery address, device ID, device

fingerprint, or the IP address) used in previous transactions and disputed transactions.

– Documentation meeting the Compelling Evidence criteria is available.

For further details, refer to the Compelling Evidence Chart in Section 4: Providing Compelling

Evidence.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

23

3

Dispute Conditions

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future.

– For card-absent transactions, consider using all available Visa tools such as Visa Secure,

CVV2 and the Address Verication Service (AVS) to help reduce fraud. Contact your card

processor for more information on these important risk-management tools.

– Always request authorization for mail order, telephone order, internet, and recurring

transactions, regardless of the dollar amount.

– Always make sure to properly identify card present and card absent transactions.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

24

3

Dispute Conditions

Condition 10.5

Visa Fraud Monitoring Program

Your card processor has notied you that the Visa Fraud Monitoring Program (VFMP) has

identied a transaction that you processed. The dispute falls under Condition 10.5, Visa Fraud

Monitoring Program.

Why did I get this notification?

Visa notied the cardholder’s bank that the Visa Fraud Monitoring Program (VFMP) identied

the transaction and the cardholder’s bank has not successfully disputed the transaction under

another dispute condition.

What caused the dispute?

Your business has been identied with excessive fraud levels and the issuer was permitted to

dispute the fraudulent transaction identied by VFMP.

How should I respond?

– Issuer has initiated a prior dispute for the same transaction which you have already

accepted.

Provide details of the previously accepted dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

25

3

Dispute Conditions

Condition 11.1

Card Recovery Bulletin

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 11.1, Card Recovery Bulletin.

Why did I get this notification?

The cardholder’s bank determined that both of these occurred:

– There was no authorization obtained on the transaction date, and

– The payment credential was listed in the Card Recovery Bulletin for the Visa region in which

you are located.

What caused the dispute?

You failed to check the Card Recovery Bulletin (CRB) when required and completed the

transaction without authorization request.

How should I respond?

– The transaction was not authorized and the CRB was not checked.

Accept the dispute.

– Transaction qualies for the EMV liability shift and had taken place at an EMV compliant

terminal or contactless only acceptance device.

Provide documentation to support that the transaction took place at an EMV compliant

terminal.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

How to avoid this dispute in the future

– Make sure required authorization was obtained in accordance with the Visa Rules before

completing any transaction.

– Always review the CRB when the transaction is below your oor limit.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

26

3

Dispute Conditions

Condition 11.2

Declined Authorization

Your card processor has notied you that an issuer is disputing a transaction that you

processed. The dispute falls under Condition 11.2, Declined Authorization.

Why did I get this notification?

A transaction was processed after receiving a Decline or Pickup response.

What caused the dispute?

The most common cause for this type of dispute is processing a transaction after a decline or

card pickup response, and you sent the transaction in your capture le without attempting

another authorization request (commonly referred to as forced posting).

How should I respond?

– The transaction was authorized.

Have your card processor provide evidence that the transaction was authorized online or

oine via the chip.

– The transaction was not authorized.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

How to avoid this dispute in the future

– Make sure required authorization is obtained in accordance with the Visa Rules before

completing any transaction.

– Train your sta on the proper procedures for handling terminal issues.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

27

3

Dispute Conditions

Condition 11.3

No Authorization/Late Presentment Effective for

Transactions completed on or after 13 April 2024

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 11.3, No Authorization/Late Presentment

Why did I get this notification?

A transaction was processed without obtaining the required authorization, or the transaction

was not processed within the required transaction processing time limit.

What caused the dispute?

There are four common causes for this type of dispute:

– An authorization was required but was not obtained.

– An authorization was obtained, but the transaction was processed for a higher amount.

– An authorization was obtained, but the transaction was not processed in time.

– An authorization was not required, and the transaction was not processed in time.

How should I respond?

– The transaction was authorized:

Have your card processor provide evidence that the transaction was authorized online or

oine via the chip, or

Document to show that the transaction date initially used to process the transaction was

incorrect and that the transaction was properly authorized.

– The transaction was completed within the time limit.

Provide a copy of the receipt or other evidence to disprove late presentment.

– The transaction was not authorized, or the transaction was completed later than the

specied transaction processing time limit.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

How to avoid this dispute in the future

– Make sure required authorization is obtained in accordance with the Visa Rules before

completing any transaction.

– Train your sta on the proper procedures for handling terminal issues.

– Send completed transactions to your card processor as soon as possible, preferably on the

day of the sale or within the timeframe specied in your merchant agreement.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

28

3

Dispute Conditions

Condition 12.1

Late Presentment Effective through 12 April 2024

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.1, Late Presentment.

Why did I get this notification?

The transaction was completed past the required transaction processing time limits.

What caused the dispute?

The transaction was not sent to Visa within the timeframe required.

How should I respond?

– The transaction was completed within the time limit.

Provide a copy of the receipt to support the transaction date.

– The transaction was completed later than the specied transaction processing time limit.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Send completed transactions to your card processor as soon as possible, preferably on the

day of the sale or within the timeframe specied in your merchant agreement.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

29

3

Dispute Conditions

Condition 12.2

Incorrect Transaction Code

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.2, Incorrect Transaction Code.

Why did I get this notification?

The transaction was completed with an incorrect transaction code (i.e., you meant to send a

credit, but you actually sent a sale, and vice versa or a credit refund was processed instead of a

reversal or an adjustment).

What caused the dispute?

You processed a debit when you should have processed a credit (vice versa), or a credit was

processed when you should have processed a reversal to correct a transaction that was

processed in error.

How should I respond?

– The transaction was settled with the correct details.

Provide documentation that shows the transaction was processed correctly as a credit or

debit to the cardholder’s account or an explanation or documentation to support that the

credit was not a result of a processing error on the original transaction.

– The transaction was processed incorrectly.

Accept the dispute.

– For a credit processed as a debit or a debit processed as a credit, a credit or reversal has

already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed. (Does not apply when credit was processed instead of a reversal.)

How to avoid this dispute in the future

– Train your sales sta on the proper procedures for processing credits, debits and reversals.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

30

3

Dispute Conditions

Condition 12.3

Incorrect Currency

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.3, Incorrect Currency.

Why did I get this notification?

The transaction was processed with an incorrect currency code (i.e., the transaction currency is

dierent from the currency transmitted through Visa; or the cardholder was not advised or did

not agree that Dynamic Currency Conversion (DCC) would occur).

What caused the dispute?

There are two common causes for this type of dispute:

– The transaction currency is dierent from the currency transmitted through Visa.

– The cardholder claims that you failed to oer them a choice of paying in your local currency

or that they declined paying in their local currency.

How should I respond?

– Correct transaction currency was used to complete the transaction.

Provide your card processor with documentation such as:

– Evidence that the cardholder actively chose DCC

– A copy of the transaction receipt

– The transaction was processed incorrectly.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Train your sta on the proper procedures for using dierent currency.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

31

3

Dispute Conditions

Condition 12.4

Incorrect Account Number

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.4, Incorrect Account Number.

Why did I get this notification?

The transaction was processed using an incorrect payment credential.

What caused the dispute?

The incorrect payment credential was used to complete the transaction.

How should I respond?

– The payment credential on the dispute matches the payment credential on your copy of the

receipt.

Provide a copy of the receipt and if the dispute relates to a transaction processed on a

payment credential not on the issuer’s master le, provide a copy of the authorization log.

– The payment credential on the dispute does not match the payment credential on your copy

of the receipt.

Accept the dispute.

– Transaction was not authorized.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

Train your sales sta on the proper procedures for processing transactions, including the

recommendation that all transactions be swiped, or chip read.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

32

3

Dispute Conditions

Condition 12.5

Incorrect Amount

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.5, Incorrect Amount.

Why did I get this notification?

The cardholder submitted a claim to their bank that says one of the following things happened:

– The transaction amount is incorrect.

– An addition or transposition error was made when calculating the transaction amount.

– You altered the transaction amount after the transaction was completed without the

consent of the cardholder.

What caused the dispute?

An incorrect amount was keyed in to complete the transaction or the handwritten amount

diers from printed amount.

How should I respond?

– Transaction amount is correct.

Provide supporting documentation (i.e., copy of the transaction receipt).

– The transaction amount used to settle the transaction was dierent from the actual

amount due.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Train your sales sta on the proper procedures for processing transactions ensuring

correct details are keyed in the terminal before submitting the transaction, including the

recommendation that all transactions be swiped, or chip read.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

33

3

Dispute Conditions

Condition 12.6

Duplicate Processing

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.6.1, Duplicate Processing.

Why did I get this notification?

The cardholder claims that a single transaction was processed more than once using the same

Payment Credential on the same Transaction date, and for the same Transaction amount.

What caused the dispute?

There are four common causes for this type of dispute:

– The same transaction details were entered into the terminal more than once.

– The same transaction capture batch was electronically sent to your card processor more

than once.

– Both the merchant copy and the acquirer copy of the transaction receipt were submitted/

deposited.

– Two transaction receipts were created for the same purchase.

How should I respond?

– The charges represent two separate transactions/purchases.

Provide information and documentation to show the two transactions are separate.

– Cardholder made only one transaction conrmed by your records, but it was settled

more than once.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that shows they no longer dispute the

transaction.

How to avoid this dispute in the future

– Avoid entering/processing a transaction more than once. If you do enter a transaction twice,

reverse the duplicate transaction.

– Train your sales sta on the proper procedures for processing transactions, including how to

reverse duplicate transactions.

– Review transaction receipts before you deposit them.

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

34

3

Dispute Conditions

Condition 12.6

Paid by Other Means

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.6.2, Paid by Other Means.

Why did I get this notification?

The cardholder claims that they paid for the merchandise or service by other means (i.e., cash,

check, other card, the same card with discrepancies on the date and/or amount, etc.).

What caused the dispute?

The cardholder initially gave you a Visa card as payment, but then decided to use cash, check,

or another card after you completed the transaction.

How should I respond?

– Visa card was the only form of payment used.

Provide the sales records or other documentation that shows no other form of payment

was used.

– The Visa card and other form of payment were for dierent merchandise or services.

Provide the sales records or other documentation to show that both payments were for

dierent merchandises or services

– The charges represent two separate transactions/purchases.

Provide documentation to show the two transactions represent the purchase of separate

merchandise or services.

– The transaction was paid using another form of payment.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– If a customer asks to use another form of payment after you have processed the Visa card

transaction, reverse the Visa card transaction.

– Train your sales sta on the proper procedures for handling reversals.

Dispute Management Guidelines for Visa Merchants | June 2024 35

© 2024 Visa. All Rights Reserved.

3

Dispute Conditions

Dispute Management Guidelines for Visa Merchants | June 2024

© 2024 Visa. All Rights Reserved.

36

Condition 12.7

Invalid Data

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 12.7, Invalid Data.

Why did I get this notification?

An authorization was obtained using invalid or incorrect data.

What caused the dispute?

The common causes for this type of dispute:

– An authorization request contained an incorrect transaction date, MCC, merchant or

transaction type indicator, Country or State Code, Special Condition Indicator, or other

required eld.

How should I respond?

– The authorization request submitted with the correct/valid data.

Provide the sales records or other documentation to support that the transaction was

authorized with valid data.

– The authorization was obtained using invalid data.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– Ensure that all transactions are processed with the correct data and your account is correctly

set up with the proper information.

3

Dispute Conditions

Condition 13.1

Merchandise/Services Not Received

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 13.1, Merchandise/Services Not Received.

Why did I get this notification?

The cardholder claims that merchandise or services that they ordered were not received by

the expected date (or merchandise was unavailable for pick-up).

What caused the dispute?

There are several common causes for this type of dispute:

– The merchandise was not delivered and received by the agreed-upon delivery date, time or

to the agreed upon location.

– The merchandise was not available for pick-up at the agreed location or by agreed date.

– The services were not available and/or not provided to the customer.

How should I respond?

– The merchandise has been delivered /picked up by the agreed-upon date or agreed

upon location.

Provide documentation to prove that the cardholder or authorized person received the

merchandise or services as agreed.

– Specied delivery date has not yet passed.

Provide documentation to support the expected delivery date.

– Cardholder cancelled prior to expected date.

Provide documentation to support you were able to provide merchandise or service and

that the cardholder cancelled prior to the delivery date.

– Transaction represents a partial payment with balance due.

Provide documentation to support additional payments due.

– Airline transaction when the Cardholder is disputing the ight did not take place.

Provide documentation to prove that the ight departed.

– Transaction represents future services.

Provide documentation to show that merchant did not cancel and services were available.

– Effective for Dispute Response on or after 19 October 2024, For Transactions involving

the acquisition of non-at currency or non-fungible token(s), the non-at currency or

nonfungible tokens (NFT) was successfully delivered to the destination wallet address

supplied by the cardholder at the time of the transaction.

Provide documentation to show one or more of the following:

• Destination wallet address

• Blockchain Transaction hash, which

must be searchable/traceable on an open-source

website

• Prior approved similar transactions using the same Cardholder Account Number

Dispute Management Guidelines for Visa Merchants | June 2024 37

© 2024 Visa. All Rights Reserved.

3

Dispute Conditions

– The merchandise or service was not delivered/provided to the customer.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder that states they no longer dispute the

transaction.

How to avoid this dispute in the future

– If merchandise is going to be delayed, notify the customer in writing of the delay and

expected delivery date. Allow the customer to cancel if they choose to.

– If you are shipping merchandise without requesting proof of delivery, consider the costs and

benets of doing so compared to the value of the merchandise you ship. Proof of delivery or

pick-up, such as certied mail or a carrier’s certication that the merchandise was delivered

to the correct address or picked up and signed for by the cardholder, will allow you to return

the dispute if the customer claims the merchandise was not received.

– You may consider purchasing shipping insurance as additional protection for possible lost,

stolen and/or damaged in transit.

Dispute Management Guidelines for Visa Merchants | June 2024 38

© 2024 Visa. All Rights Reserved.

3

Dispute Conditions

Condition 13.2

Cancelled Recurring Transaction

Your card processor has notied you that a cardholder is disputing a transaction that you

processed. The dispute falls under Condition 13.2, Cancelled Recurring Transaction.

Why did I get this notification?

The Cardholder withdrew permission to charge the account for a recurring transaction or you

or your card processor received notication that, before the Transaction was processed, that

the cardholder’s account was closed.

4

3

What caused the dispute?

There are several common causes for this type of dispute such as follows:

– The cardholder withdrew permission to charge the account.

– The cardholder cancelled the card account.

– The cardholder’s bank cancelled the card account.

– The transaction was processed after you received notice that the cardholder’s account was

closed.

How should I respond?

– Transaction was cancelled, but services were used.

Effective for Disputes processed on or after 19 October 2024, provide proof the cardholder

used services after the withdrawal of permission to bill date and prior to the Dispute

Processing Date.

– The cardholder withdrew their permission to charge the account for a recurring transaction

and you have not issued a credit.

Accept the dispute.

– Credit or reversal has already been processed for the transaction.

Provide documentation of the credit or reversal that includes the amount and the date it

was processed.

– The cardholder no longer disputes the transaction.

Provide a letter or email from the cardholder stating that they no longer dispute the

transaction.

How to avoid this dispute in the future

– Train your sales and customer service sta on the proper procedures for processing

recurring transactions, as these transactions are particularly susceptible to cardholder

disputes.

– Always respond in a timely manner to customer requests relating to the renewal or

cancellation of recurring transactions. Check customer logs daily for cancellation or non-

renewal requests; take appropriate action to comply with them in a timely manner.