NY State of Health

Small Business Marketplace

(SBM)

Certification Training for Navigators

Objectives

2

• Outline the SBM Employer and Employee Registration and

Enrollment process.

• Describe the benefits for employers who enroll in the Small

Business Marketplace

• Explain the rules of enrollment timing in the Small Business

Marketplace

• Provide an Overview of the Small Business Marketplace

(SBM) rules and regulations.

Small Business Marketplace

Overview

3

Who is Eligible?

4

A Small Business Employer is eligible to purchase a health

plan through the Small Business Marketplace (SBM) if the

business:

• Is based in NYS or has employees with a physical location in NYS.

• Has 100 or fewer Full-Time Equivalent (FTE) employees.

o At least one common law employee must enroll.

Overview

Who is Eligible?

Small Business Employers who elect to offer coverage through

the SBM, must offer health insurance coverage through the

Small Business Marketplace to all eligible employees:

• Eligible employees must include those working 30 or more hours per

week.

• Employers may also offer coverage to part-time employees who work,

on average, 20 hours per week or more. However, it is not required.

o Employees who work less than 20 hours per week are not eligible.

nystateofhealth.ny.gov 5

Overview

What Employers Should Know

6

Overview

• Small employers are not required to offer health coverage or pay for coverage for

their employees.

• Employers employing a least 50 full-time employees (or a combination of full-time and

part-time employees that is equivalent to 50 full-time employees) may be subject to

the Employer Shared Responsibility provisions under section 4980H of the Internal

Revenue Code (added to the Code by the Affordable Care Act).

o The employer may be subject to an Employer Shared Responsibility payment if at least one of its full-

time employees receives a premium tax credit for purchasing individual coverage in the Marketplace.

o Beginning in January 2016 (for 2015 plan years), the federal government will require applicable large

employers and insurers to report annually to employees and the IRS on the health care coverage they

provided.

7nystateofhealth.ny.gov

Businesses can:

• Buy insurance through the NY State of Health

Marketplace, Small Business Marketplace (SBM), or

• Choose to provide insurance through their current

options.

Overview

8

Choice

• Employers can choose whether to offer all, some or a single QHP to their employees.

• Employees can choose from the health plan options made available by their employer

.

Contribution Options

• The Marketplace gives business owners the flexibility to define the coverage tier of the health

plan(s) which will be offered to employees and the amount they would like to contribute

toward the premiums for the employee.

• Employers may pay a percentage of premiums, pay a fixed amount, or pay nothing at all.

Minimum Participation Required

• NY State only requires a minimum of one (1) enrolled common law employee in order to be

eligible as a small business with the NY State of Health SBM.

Administrative Simplicity

• The Marketplace provides monthly billing to employers along with other administrative

simplifications.

Tax Credits

• The Marketplace is the exclusive place to access small business tax credits

Overview

Employer Benefits of Enrolling in the SBM

9

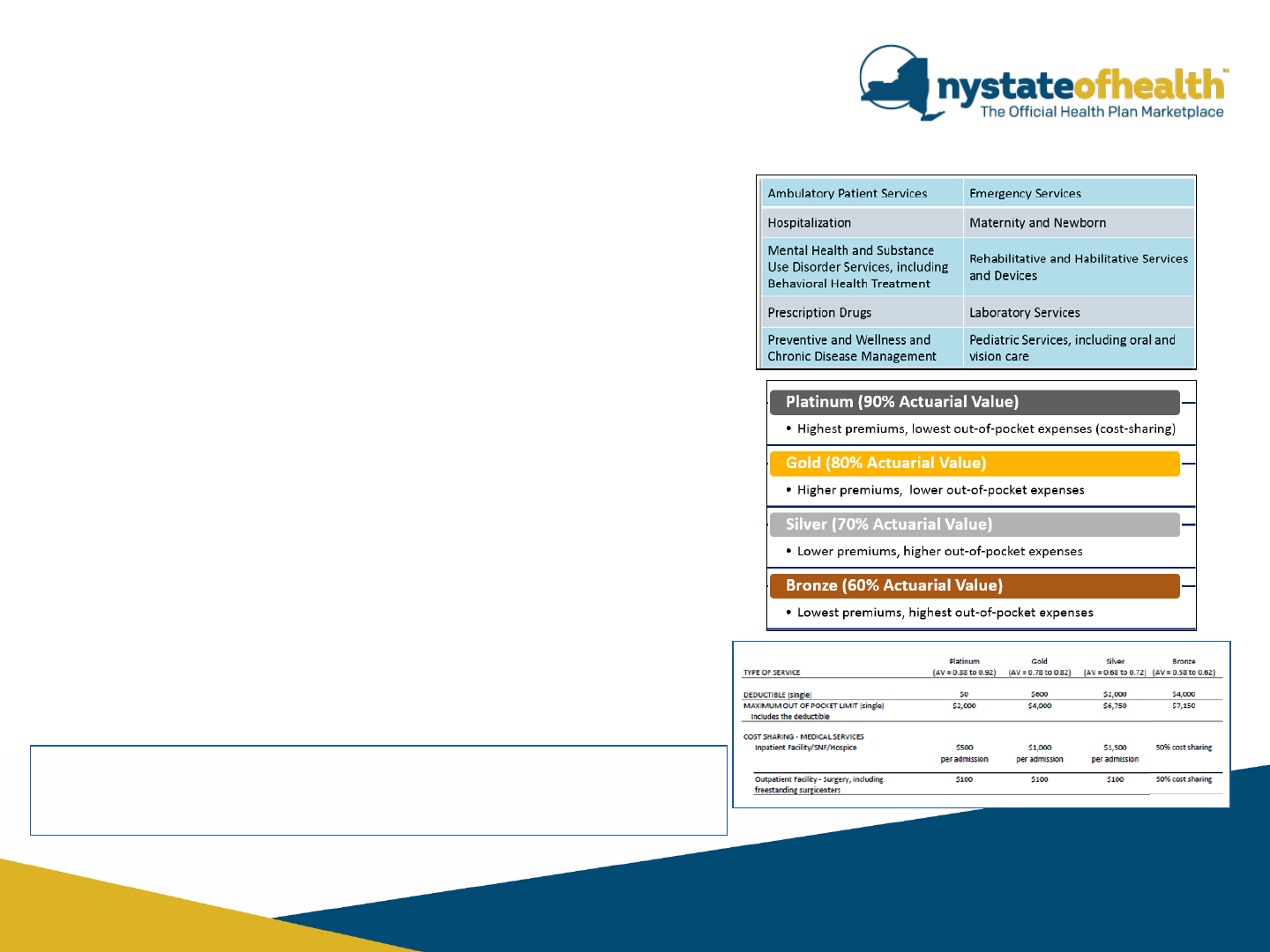

What Do Plans Cover?

1. All QHPs must cover the Essential Health Benefits

• Preventive services will be offered at no cost to the consumer

• Each plan must have an adequate network

• All state consumer and provider protections are in place

2. QHP offered within each Metal Level provide standard

plans which offer the same benefit packages.

• The Metal tier of the plan determines the amount of cost sharing

for services.

• Attachment B outlines the Out-Of-Pocket costs for SBM Standard

QHPs in the same way that is does for the Individual Marketplace.

3. Non-Standard QHPs are also available for selection in

the SBM.

Navigators are familiar with these concepts as they

are the same as in the Individual Marketplace.

Employer Choice

Employer Choice

Same

elements as in

the Individual

Marketplace

Specific to

SBM only

QHP

Naming

Format

Field Name Values Meaning

Product Name To be assigned by Insurer

Metal Tier Bronze, Silver, Gold,

Platinum, Child Only

Identifies Metal Level and whether

Child Only Product

Standard/Non-standard ST, ST3PCP or NS Identifies Standard (ST), Standard with

3 PCP Visits, or Non-Standard (NS)

Product

Network Coverage INN or OON Identifies in-network coverage (INN)

or out-of-network coverage (OON)

Dental Coverage Pediatric Dental,

Adult/Family Dental

Identifies type of dental coverage

included, if any, in QHP

Dependent Age

Coverage

Dep25, Dep29 Identifies the maximum age of

covered dependents

Non-Standard Details Adult Vision, Family

Dental,

Family Vision, Wellness,

Other

Identifies additional covered benefits

Domestic Partner DP Identifies that domestic partners are

covered

Family Planning FP Identifies that family planning

benefits are covered

Employer Choice

Qualified Religious Organization Exemption:

• An employer who is determined to be a qualified religious organization

will be able to claim an exemption from the requirement to provide,

without cost-sharing, coverage of certain contraceptive services for

employees.

o Employers who qualify and want to claim this exemption should be helped to

understand that in claiming this exemption, they are restricting family planning services

from their plan’s coverage.

Coverage Options for Employers to choose from to be made

available to their employees through the SBM

1) Select among QHPs offered by a specific carrier

2) Select specific QHPs offered by multiple carriers

3) Select metal levels and carriers

4) Select coverage tier options (i.e employee only

coverage, employee plus spouse, employee plus child,

or employee plus family coverage)

5) Allow employees to select any Marketplace QHP

12

Employer Premium Contribution Options

1)No Contribution

2)Uncapped percentage

(e.g., employer pays 55% of premium)

3)Capped percentage

(e.g., employer pays 55% of premium, up to $300)

4)Defined dollar amount

(e.g., employer pays $300/month)

13

Small Business Marketplace (SBM)

Administrative Simplicity

14

Administrative Simplicity

• The Marketplace provides employers with a single monthly bill.

– Monthly bill will include breakdown of employer/employee contribution

due to each QHP (employers remain responsible for collecting premiums

from employees).

• The Marketplace collects monthly payment from the employer

and remits payment to insurers.

• SBM will provide record maintenance for ten (10) years.

15

Billing and Payments

• NY State of Health will maintain books, records and documents as

well as other evidence of accounting procedures and practices of the

premium aggregation program for each benefit year for at least 10

years.

• Invoicing timeline: Employers of participating small businesses will be

billed a month in advance for all plan policies on the 1

st

of each month,

beginning at the start of their selected plan year.

Note: Navigators do not collect premiums.

Administrative Simplicity

Accounting Procedures

16

Administrative Simplicity

SBM Dependents who have aged out:

• Dependents who are turning either 26 or 30 years old (depending

on the rider options selected) will have aged out.

• The SBM tracks each enrolled dependents’ age and will send

disenrollment notices 45 days prior to plan termination.

Field Name Values Meaning

Dependent Age

Coverage

Dep25, Dep29 Identifies the maximum age of

covered dependents

17

Small Business Marketplace (SBM)

Small Business Tax Credit

18

As of January 1, 2014, the Small Business Health Care Tax Credit is only available

through the NY State of Health, Small Business Marketplace (SBM).

• The credit is available to eligible employers for two consecutive taxable

years.

• There is currently no end date to claim the tax credit for groups that have

not yet received it.

• For tax-exempt employer, if there is no taxable income, the employer may

be eligible to receive the credit as a refund.

• The credit is calculated on a sliding scale for up to 50% of premiums paid for

small business employers and 35% of premiums paid for small business

employers that are tax-exempt.

Small Business Tax Credit

19

To be eligible, the small business employer must:

• Purchase health care coverage through the Small Business Marketplace (SBM).

• Have fewer than 25 full-time equivalent employees (FTEs).

• Have average employee wages of less than $50,000 a year. This excludes the

owner and their immediate family.

• Contribute at least 50% of the employee-only premium cost (not family or

dependent).

Employer contributions to health savings accounts, health reimbursement

arrangements, and flexible spending accounts are not counted as insurance

premium payments when determining the credit amount.

Employers must use Form 8941 and Form 990T for tax-exempt organizations.

Small Business Tax Credit

20

21

Maximum Small Business Tax Credit

• Available to eligible employers for two (2) consecutive taxable years.

o If an employer does not owe taxes during the year, they may be eligible to carry the credit back

or forward per applicable IRS guidelines.

• Up to 50% of a taxable small business’s premium costs.

o Traditional businesses may receive a tax credit, but are ineligible to receive this in the form of a

refund.

• Up to 35% of a tax-exempt small business’s premium costs

o Tax exempt small businesses can receive their tax credit in the form of a refundable credit. If

they take the credit in the form of a refund, then the amount of the refund cannot exceed the

total of the employer’s income tax withholding from employee wages plus the employer’s share

of the Medicare tax withholdings

Credit is reduced on a sliding scale(The smaller the business or charity, the bigger the credit)

• As average wages increase from beyond $25,000 up to $50,000

• As FTEs increase beyond 10 up to 25 employees

Small Business Tax Credit

22

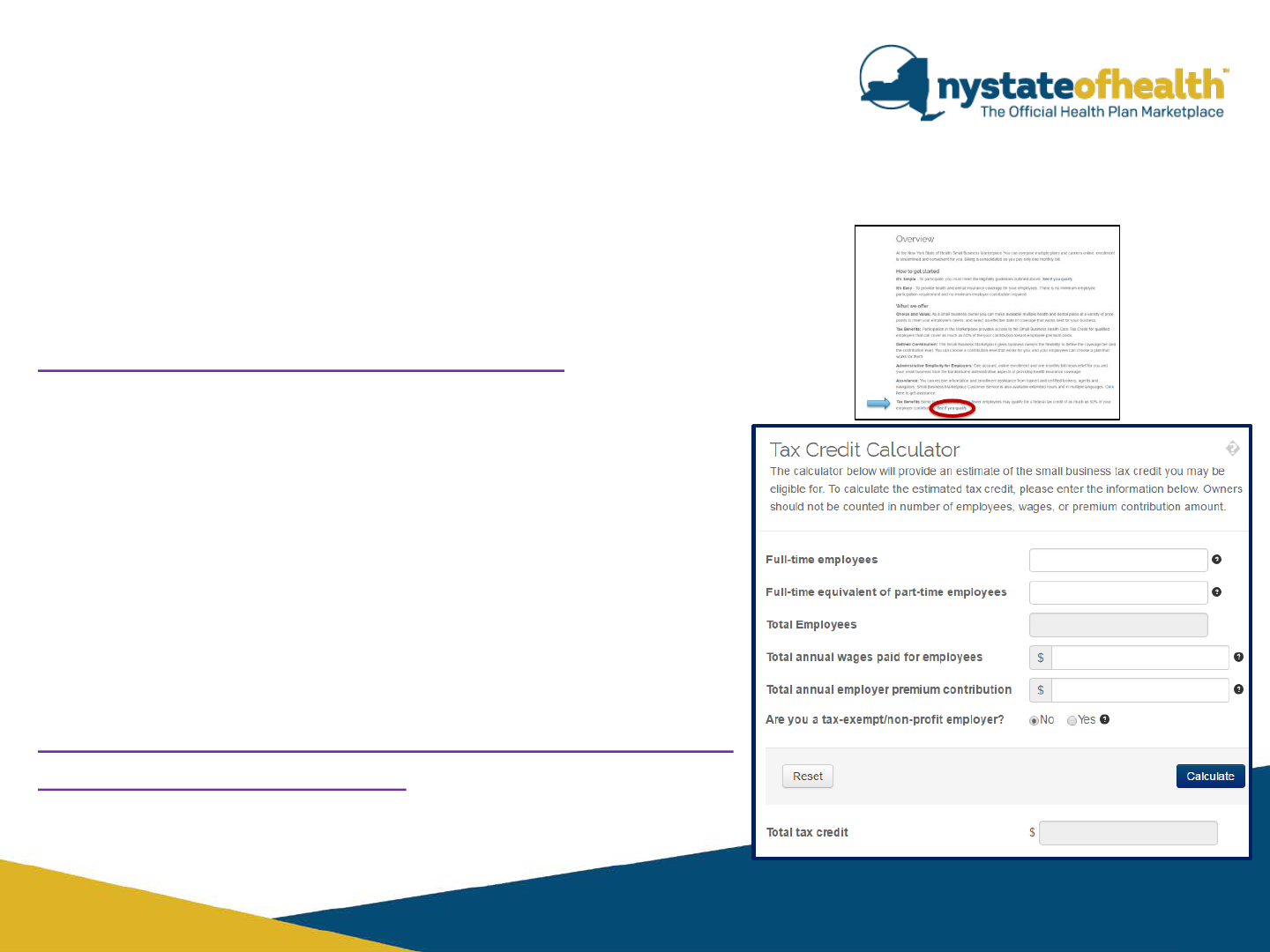

Small Business Tax Credit

Marketplace is the only place to access the tax credit beginning in 2014.

There are a few exceptions to this rule.

NY State of Health Tax Credit Calculator:

https://nystateofhealth.ny.gov/employer

• Scroll to the bottom of the page to the “Overview”

section.

• Under “Tax Benefits” click on “See if you qualify”

IRS Tax Credit Estimator:

http://www.taxpayeradvocate.irs.gov/estimator/small

business2014/estimator.htm

23

Firm Size (FTEs) = Total Full Time Employees + (Total Annual Part

Time Hours/2080)

• Owners are excluded from FTE count and employers cannot

receive a tax credit for owner’s insurance.

• All employee hours are counted and based on a 40-hour work

week.

Wages = Total Wages Paid/ FTEs

• Owners and family member wages are excluded from total wages.

Small Business Tax Credit

How is Full Time Equivalent (FTE) Calculated?

• The employer has 9 FTE employees

• The average wage of the employees is $23,000

per employee

• The employer pays $72,000 in premiums for his

employees

Tax Credit for Non-Tax Exempt Employer

The employers credit is calculated as follows:

• 50% x $72,000 =$36,000*

*This is an estimate only. Employers are advised to work with a tax professional to determine eligibility for

and to claim this credit.

The tax credit amounts are as follows:

Up to a maximum potential tax credit 50% of employer contribution for businesses.

Small Business Tax Credit

24

Tax Credit for Tax Exempt Employer

Employer has 10 FTE employees with an average wage

of $25,000 per employee. The employer pays $69,000

in health insurance premiums for those employees.

Please note: For tax exempt employers, the amount of

refund cannot exceed the total of the employer’s income

tax withholding from employee wages + the employer’s

share of the Medicare tax withholdings (equals $29,500 in

this scenario).

Tax credit is calculated as follows:

1) The initial amount before any reduction: (35% x $69,000)= $24,150

2) The employer’s withholdings and Medicare taxes are: $29,500

3) The total tax credit is $24,150

*This is an estimate only. Employers are advised to work with a tax professional to determine eligibility for and

to claim this credit.

The tax credit amounts are as follows:

Up to a maximum potential tax credit 35% of employer contribution for a tax-exempt business.

Small Business Tax Credit

25

Tax Credit for Tax Exempt Employer

Employer has 10 FTE employees with an average wage

of $25,000 per employee. The employer pays $69,000

in health insurance premiums for those employees.

Please note: For tax exempt employers, the amount of

refund cannot exceed the total of the employer’s income

tax withholding from employee wages + the employer’s

share of the Medicare tax withholdings (equals $29,500 in

this scenario).

Tax credit is calculated as follows:

1) The initial amount before any reduction: (35% x $69,00 )= $24,150

2) The employer’s withholdings and Medicare taxes are: $29,500

3) The total tax credit is

*This is an estimate only. Employers are advised to work with a tax professional to determine eligibility for and

to claim this credit.

The tax credit amounts are as follows:

Up to a maximum potential tax credit 35% of employer contribution for a tax-exempt business.

Small Business Tax Credit

$100,000

$100,000 $35,000

$29,500

26

Small Business Marketplace (SBM)

Employer Enrollment Offering for

Employees

27

nystateofhealth.ny.gov 28

Employer Registration Process

1. Employers will register and enroll through the SBM.

2. Employers will be asked to create an account. In order to do this, employers will go

through the Identity Proofing process to validate their own identity. They will be asked to

answer some personal questions and provide some of their personal information:

• Personal Address

• Personal Phone Number

• Gender

• Date of Birth

• Social Security Number

3. Employers will then be asked specific identifying and contact information about their

company.

• Employer Identification Number (EIN) or Tax Identification Number (TIN).

4. Employers will be asked to check attestations that they meet the requirements of the

Small Business Marketplace and that they have the authority to enter into agreements for

insurance coverage on behalf of the business.

5. Employers must also agree to the Terms, Rights, and Responsibilities, and the Privacy

Attestation.

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 29

Employer Registration Process

Employers will be required to provide data on:

• Number of full time employees

• FTEs (Full Time Equivalents)

• Average annual wage

• Employee roster data:

o Name

o Email

o Address

o DOB

o SSN

o Hire Date

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 30

Employer Registration Process

Employers will be able to:

• Find and authorize a Navigator/Broker

• Compare health plans

Employers must:

• Select health plans and coverage tiers

o The Marketplace contains a full list of available QHPs.

o Navigators should know how to compare the SBM QHP options to guide employers

through the process.

o Navigators should serve customers by remaining neutral and helping the employer find

suitable health plans.

• Determine employer premium contributions

Employees must:

• Use the same Navigator that the employer offers

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 31

Employer Registration Process

Employers may also:

• Set up “classes” of their employees complete with defined new hire waiting

periods, premium contribution amounts, and plan offerings.

• Each class is to be set up for similarly situated employees. Examples of a class

might include:

o Managers

o Full-Time Employees

o Part-Time Employees

o Retiree Beneficiary

o COBRA Beneficiary

If it is the employers initial open enrollment period in the SBM and the employer has existing COBRA

participants to whom the employer would like to offer an SBM enrollment opportunity, the

employer must create a “COBRA” class and assign the COBRA participants to this class.

If employees were enrolled in COBRA during a previous SBM plan year, those individuals will

automatically be assigned to the “COBRA_Internal” class.

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 32

Employer Registration Process

• An employer that offers coverage through the Small Business Marketplace will

decide whether they will offer coverage to the employee only or to additional

family members as well.

• Employees can then choose from the options their employer provides.

• Qualified Health Plans are available in four standard tiers of coverage:

o Employee only

o Employee and spouse

o Employee and child/ren

o Employee and family

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 33

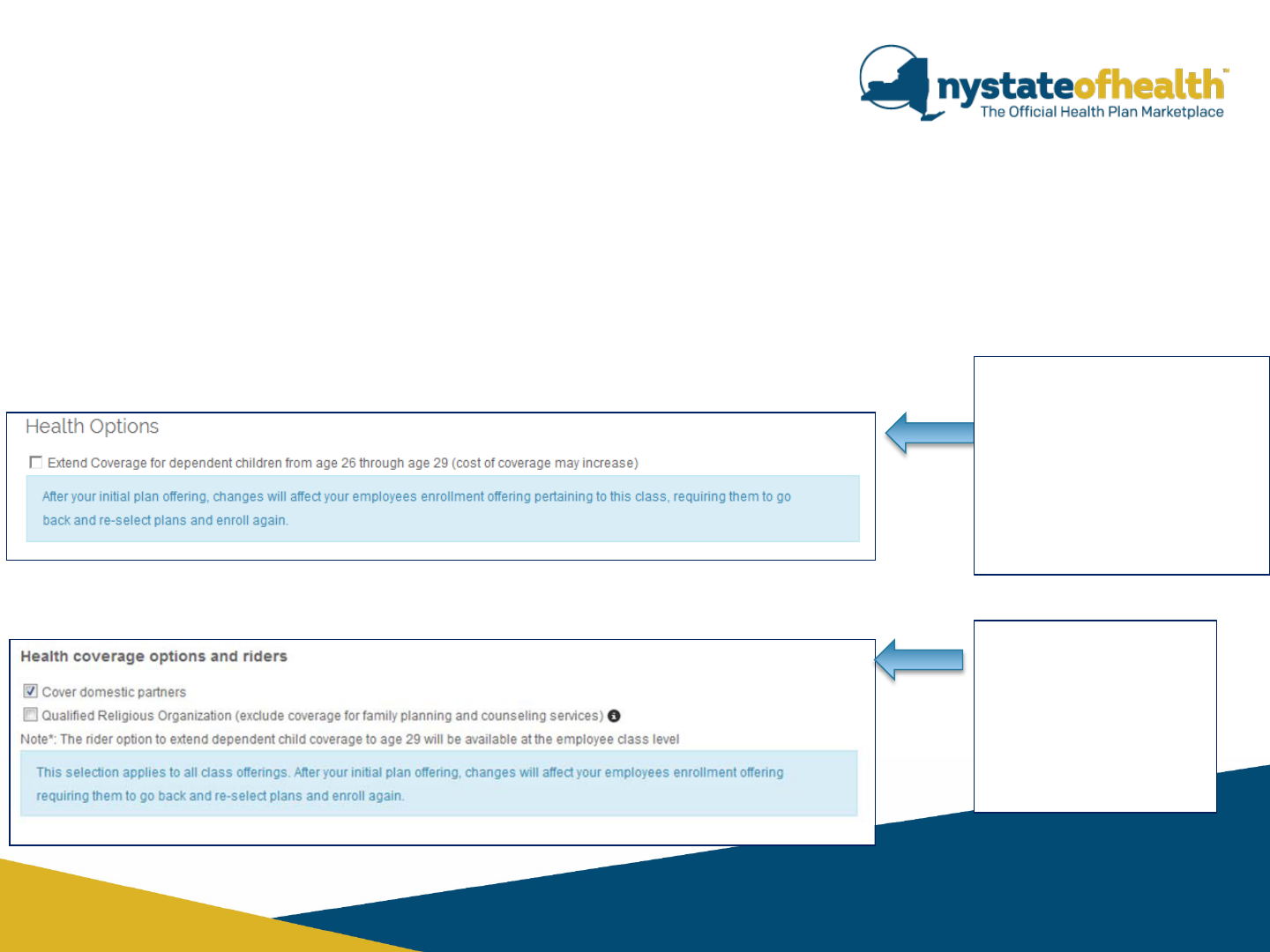

Employer Registration Process

Employers have the option to select one or all of the following health option riders:

• Dependent Coverage through age 29 Option

• Domestic Partner Coverage Option

• Qualified Religious Organization Option

The option to cover

Domestic Partners or

claim a Qualified

Religious exemption is at

the “group” level and will

apply to all employee

offerings.

When creating class offerings,

employers may decide to add a

rider for dependents through

age 29 at the class level; i.e.,

they could choose to offer this

benefit for their executive staff

but not their management staff

if they choose to do so.

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 34

Employer Registration Process

Dental enrollment is linked to enrollment into a QHP; employers cannot offer

dental without also offering QHP coverage.

• Dental Plans are available in five tiers of coverage:

o Employee only

o Employee and spouse

o Employee and child/ren

o Employee and family

o Pediatric only dental

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 35

Employer Registration Process

Pediatric dental cannot be offered unless a coverage tier that includes children is

offered.

For tiers of coverage that include children, pediatric dental is either embedded in the

QHP or made available as a stand-alone product:

• When creating an offer for a class, if the employer chooses to offer

dental, the employer will be presented with the equivalent dental plan

tiers and Pediatric Only dental.

o For the employee to select Pediatric Only dental, the child dependent must be

included in the QHP enrollment.

• The Pediatric Dental premium that displays during plan selection is per

child and will be multiplied by the number of children covered, capped

at three children (one-child x 3 rate).

Employer Enrollment Offering for Employees

nystateofhealth.ny.gov 36

Employee Registration and Enrollment Process

Completing the Application

• To be able to participate in the SBM, an employee must receive an offer of coverage from

a qualified employer.

• After the employer adds the employee to the company roster and adds the employee to

a class offering, the employee will receive an automated email from the SBM with an

invitation to participate and an employer participation code.

nystateofhealth.ny.gov 37

Employee Registration and Enrollment Process

Completing the Application

• Must use the employer participation code which will be sent to the employee’s email

address.

• Create username, password, choose personal email

• Employee enrollment – (similar to enrollment on the Individual Marketplace)

o Add employee’s identifying information

o Add family details (if applicable)

o Compare plans offered by employer

o Select plan, tier of coverage, and metal level

nystateofhealth.ny.gov 38

Employee Registration and Enrollment Process

Completing the Application

• Navigators should serve consumers by remaining neutral and

helping employees select a suitable health plan from the options

their employer is offering through the SBM.

nystateofhealth.ny.gov 39

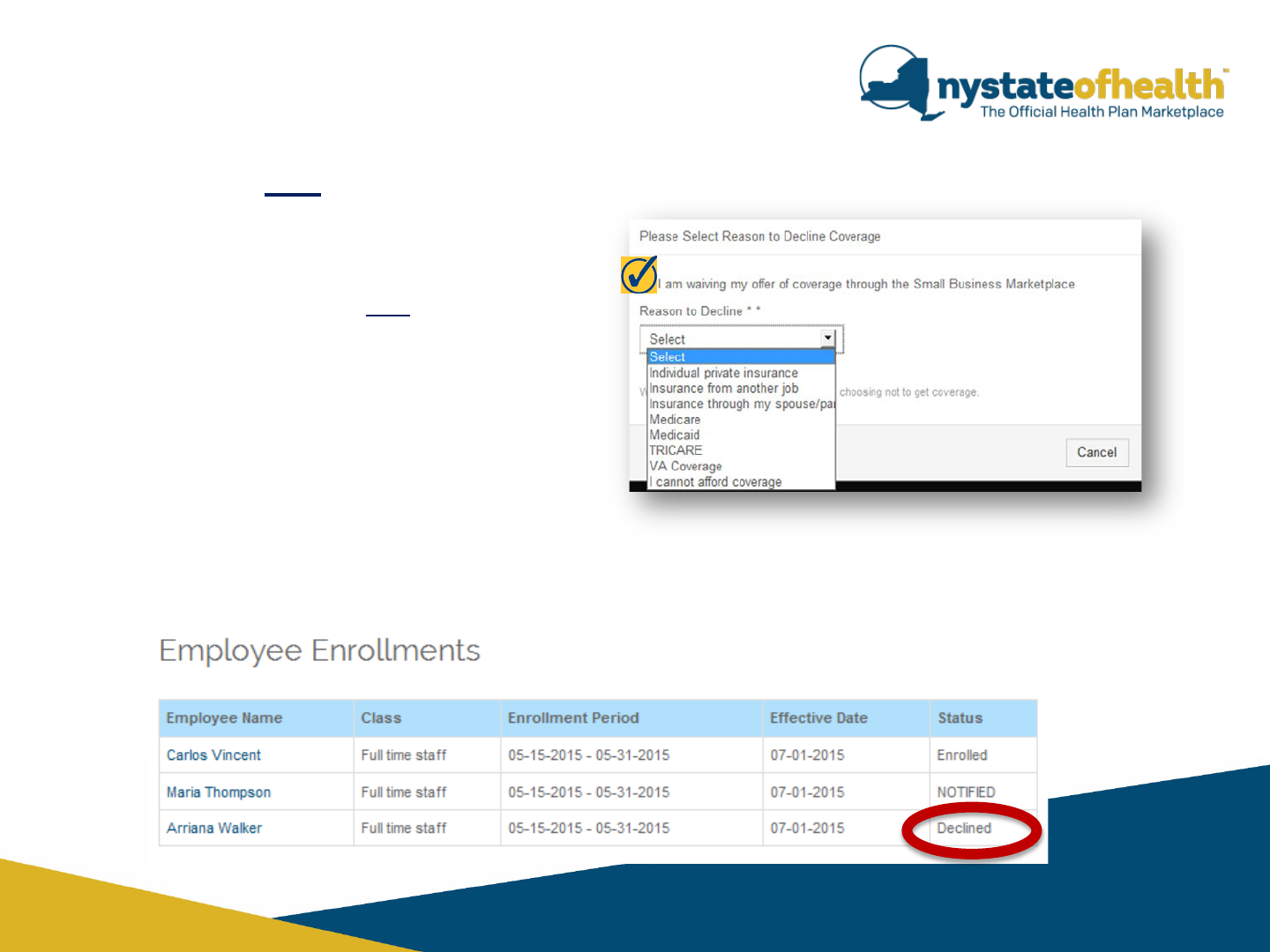

Employee Registration and Enrollment Process

Completing the Application

• If the employee does not want to

enroll, they may choose to decline

the coverage and select a reason

from the dropdown.

When the employee clicks the checkbox to waive the offer, the status of the

employee is marked as “Declined” in the employer’s “My Enrollments” tab.

nystateofhealth.ny.gov 40

Employee Registration and Enrollment Process

Completing the Application

• SBM Certified Navigators are positioned to assist in both the Small

Business Marketplace and in the Individual Marketplace.

• If an employee presents to a Navigator for assistance, and has

employee-only coverage, and that employee also has uninsured

family members:

o Navigators should encourage the employee to have his/her

family explore coverage options through the Individual

Marketplace, if needed.

nystateofhealth.ny.gov 41

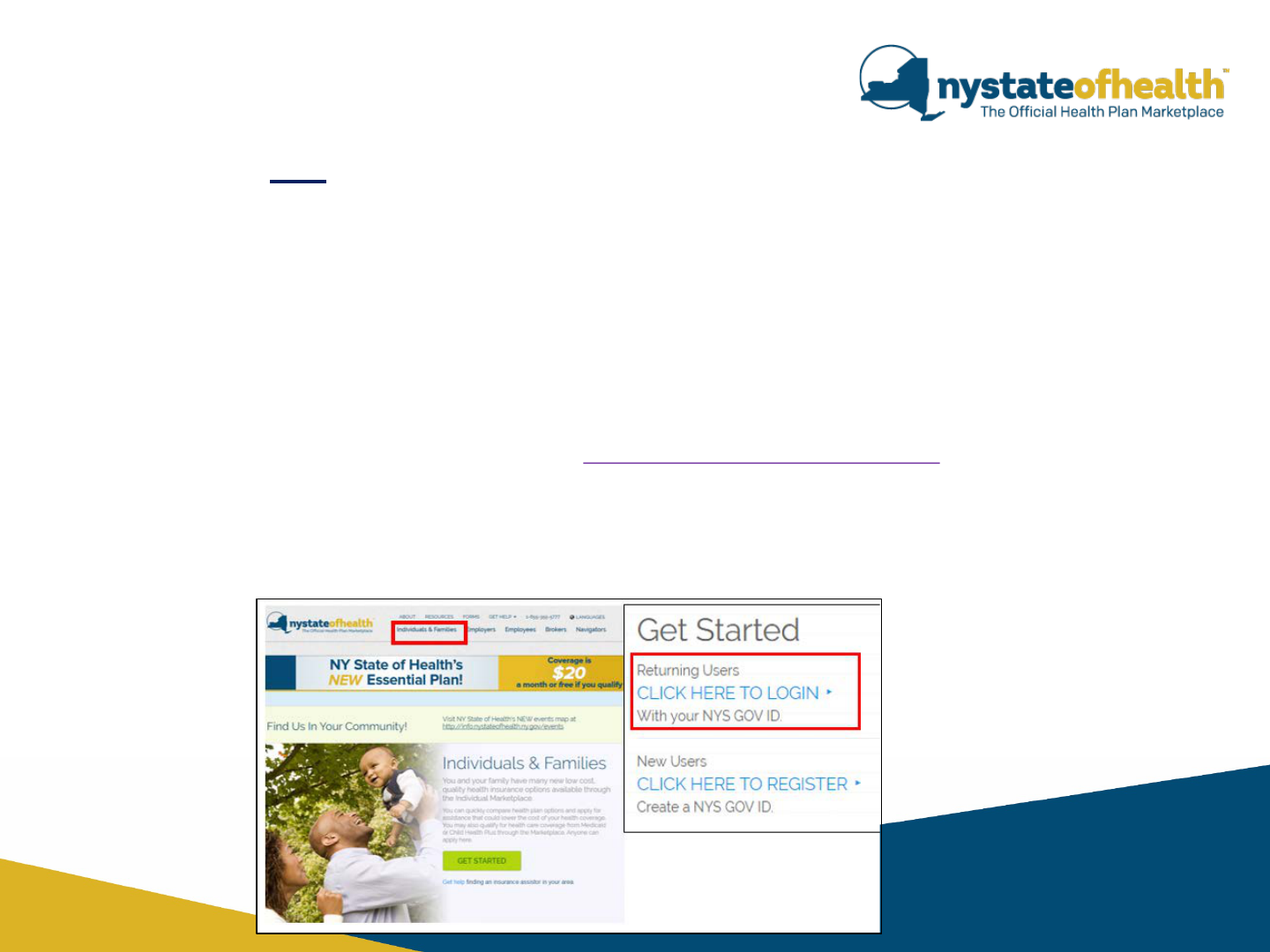

Employee Registration and Enrollment Process

Completing the Application

• Individuals who have Employee accounts which were created

through their Employer, will automatically have an account set up

for them in the Individual Marketplace.

Navigators can assist employees in accessing their Individual account, if they need

to enroll a dependent, by going to

www.nystateofhealth.ny.gov and clicking on

“Individuals and Families”

Then click on “Returning User” and sign into the Individual account using the same

NY.gov Username and Password which is used to access the Employee Account.

Small Business Marketplace (SBM)

Enrollment Timing

42

An eligible business may enroll in the SBM at any time during the calendar

year. Once a group effective date is selected– the first of any month of the

calendar year – it becomes the start date for that group’s plan year.

• Effective date is always the first of the month. The employer can elect one

group plan effective date to enroll their employer group at the first of any

month throughout the year.

• The Small Business Marketplace allows qualified individuals a special

enrollment period if they experience a change in circumstances that is

deemed a “qualifying event”.

SBM Enrollment Timing

43

44

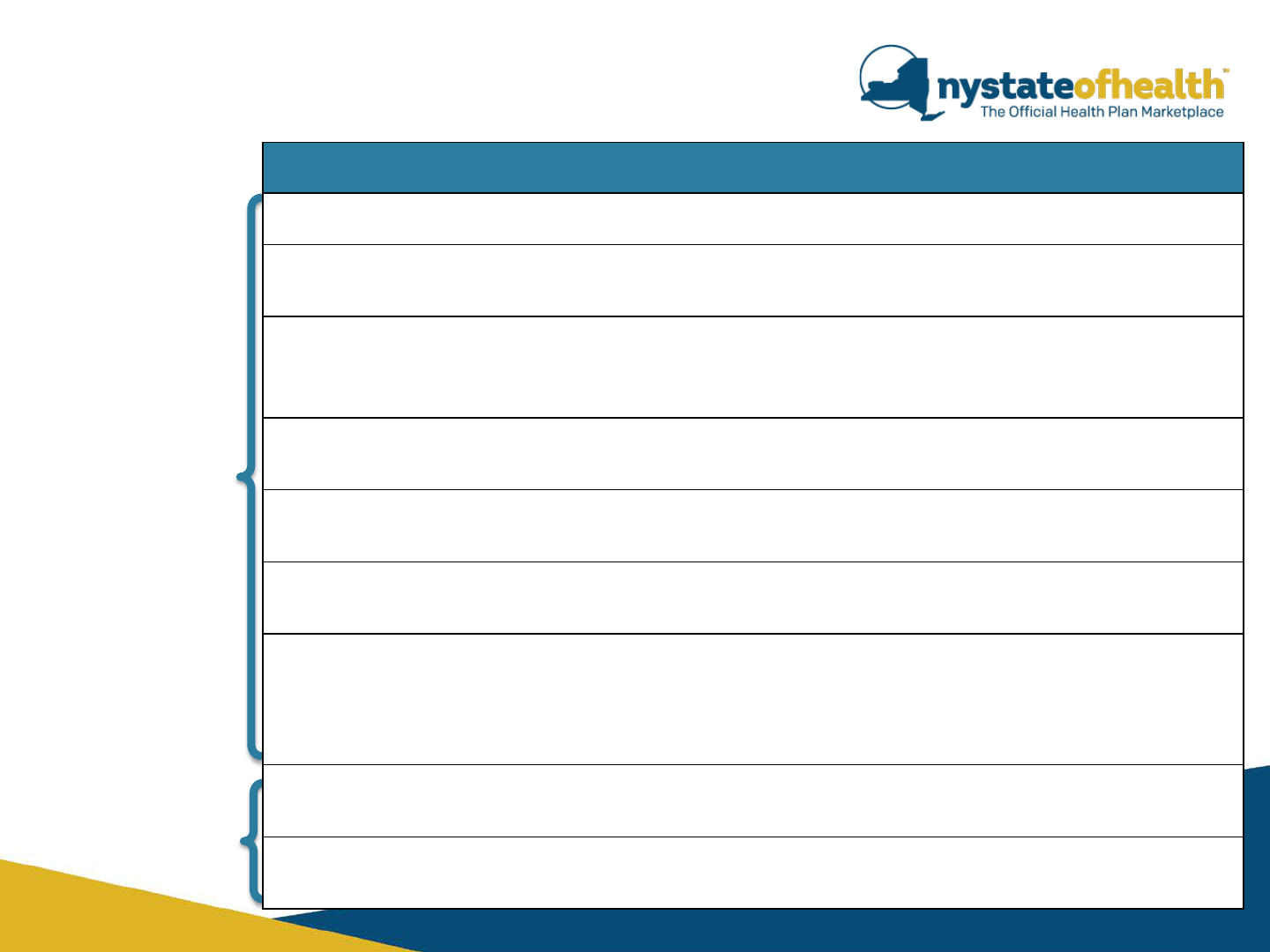

SBM Open Enrollment End Dates for Employer

Group Effective Dates

Open Enrollment End Dates

Group Effective Dates

December 15 January 1

January 15 February 1

February 15 March 1

March 15 April 1

April 15 May 1

May 15 June 1

June 15 July 1

July 15 August 1

August 15 September 1

September 15 October 1

October 15 November 1

November 15 December 1

SBM Provides Year-Round, Online Open Enrollment

SBM Enrollment Timing

45

Annual Open Enrollment for Subsequent Years of Coverage

Annual Open Enrollment for Employers:

• Annual Open Enrollment begins 90 days prior to the renewal effective date.

• For subsequent years of coverage, employers can only change coverage

options during the annual open enrollment period.

• The annual open enrollment period each year for an employee must be no

less than 30 days after the employer’s annual open enrollment period.

• If an employee remains eligible for coverage through SBM, they will remain

in the same QHP unless they choose another QHP, if such option exists, or

the QHP is no longer available to the employee.

SBM Enrollment Timing

During the Open Enrollment Period the employer can make the following

edits:

• The group effective coverage date can be changed during the initial open

enrollment period only.

o Cannot be changed when renewing coverage

• Health option riders, QHP metal level, carriers, and dental options

• Premium Contributions

• Coverage Tiers

• Add or delete Dental offering

• Edit the employees’ information

• Add or remove employees from the Roster

*If during the Open Enrollment period, the employer makes a change to a plan offering that an employee has

already enrolled in, making that plan no longer available to that employee, then the employee may receive a

new enrollment offering and may have to re-enroll.

SBM Enrollment Timing

46

47

Special Enrollment Periods (SEPs)

Qualifying life events will allow the employee to enroll outside of the

business’s annual open enrollment period.

• Most changes must be reported within 30 days from the date of the

Qualifying Event.

After reporting a Qualifying Event, the effective date will depend on the type of event being

reported. The effective date could be:

• The date of the Qualifying Event

• The day after the Qualifying Event

• The first of the following month after the Qualifying Event

SBM Enrollment Timing

The Small Business Marketplace allows qualified individuals a Special Enrollment

Period (SEP) if they have one of the following changes of circumstances:

Marriage

Divorce/Legal Separation

Birth/Adoption

Relocation

American Indian/Alaskan Native

Legal Orders

Death

Remove Enrolled Dependents

Loss of Medicaid/Child Health Plus Coverage

Loss of Health Insurance for a Qualified Dependent

SBM Enrollment Timing

48

How to enter a qualifying event in the application:

• If the employee has access to their account, they are able to report

most Qualifying Events (QE) by clicking on the “Report Change in

Circumstance” tab.

• The Employer or Navigator can report a QE on behalf of the

Employee. From the Employer Roster, the Employer clicks the

“Manage” button for the Employee with the QE; a Navigator can

access the employee’s account from the Navigator Dashboard.

• Some QEs must be reported through the NY State of Health Call

Center (855-355-5777).

• Changes in Circumstances which involve American Indians/Alaskan Natives or

Legal Orders must be reported by calling the Call Center.

SBM Enrollment Timing

49

Can an employer terminate SBM participation?

An employer can choose to terminate Small Business Marketplace

participation at any time.

• Coverage terminates at the end of the month in which the termination request was

received.

• When an employer terminates Small Business Marketplace participation, the

system will automatically disenroll all enrolled employees (and employer, if

applicable) and send notices to both employee(s) and employer(s) that coverage

has been terminated.

• This notice will also contain information about potential tax implications for the

employer.

• An Employer Group can be terminated for non-payment of premiums – termination

is initiated by the Small Business Marketplace.

o Termination for non-payment occurs on the last day of the month for which payment was

received

SBM Enrollment Timing

50

SBM Training Resource

51

All SBM Certified Navigators will receive resources accompanying this training.

You will receive:

• How to Enroll an Employee

• Simple instructions accompanying each screenshot for your reference.

• How to Create an NY.gov ID for all types of Marketplace

applicants.

NY State of Health Resources available at

info.nystateofhealth.ny.gov/resources

52

• Producer Tools and Resources: https://info.nystateofhealth.ny.gov/ProducerToolkit

o Includes an administrative guide for Producers

o Details on Eligibility and Enrollment Policies

o Step-by-step User Guides

o Videos on account set-up and enrollment

o Benefit and Rate Details

o So much more…..

• Small Business Premiums “Quick Quote”

https://nystateofhealth.ny.gov/employer

• Small Business Marketplace marketing materials (available in

English + 7 additional languages – order online)

https://info.nystateofhealth.ny.gov/sites/default/files/Overview%20for%20Small%20Business%20Owners_1.pdf

http://info.nystateofhealth.ny.gov/sites/default/files/Poster-Small%20Businesses%208.5%20x%2011.pdf