Welcome to the Office of State Uniform Payroll's presentation on the Affordable Care

Act, Employer Shared Responsibility Provisions for LaGov HCM Paid Agencies.

Beginning February 2015, members of the Office of State Uniform Payroll, Office of

Technology Services, Office of Group Benefits, and various Human Resource

professionals began working on a plan of action to comply with the provisions and

reporting requirements of the Affordable Care Act (ACA). As with most employers,

the data required to be reported to the Internal Revenue Service is not housed in one

(1) system. One of the first tasks for the project team was to review the

requirements, determine where the data resides, and what data is missing. In order

to prepare for agency training, the project team met approximately two to three (2-3)

times per week.

The following panel and project team members were instrumental in making the

decisions and determining system requirements: Amy Landry – Project Leader,

Lawanna Green – OSUP Lead, Dawn Harris – DOA/OHR, Marilyn Joseph – CRT, Ashley

Gautreaux – SOS, Shelley Johnson – DCFS, Tanisha Matthews – DOC, Susan Pellegrin

– DOTD, Suzette Meiske – LCTCS, Stacy Campbell – OTS Lead, plus many additional

staff members from these agencies and from OGB.

Today we will go over the following items:

ACA requirements at a glance

Employer Responsibilities

• Classifying employees

• Determining health coverage eligibility

• Understanding ACA measurement periods

• Counting ACA hours

• Offering health coverage and documentation

• LaGov HCM entry requirements

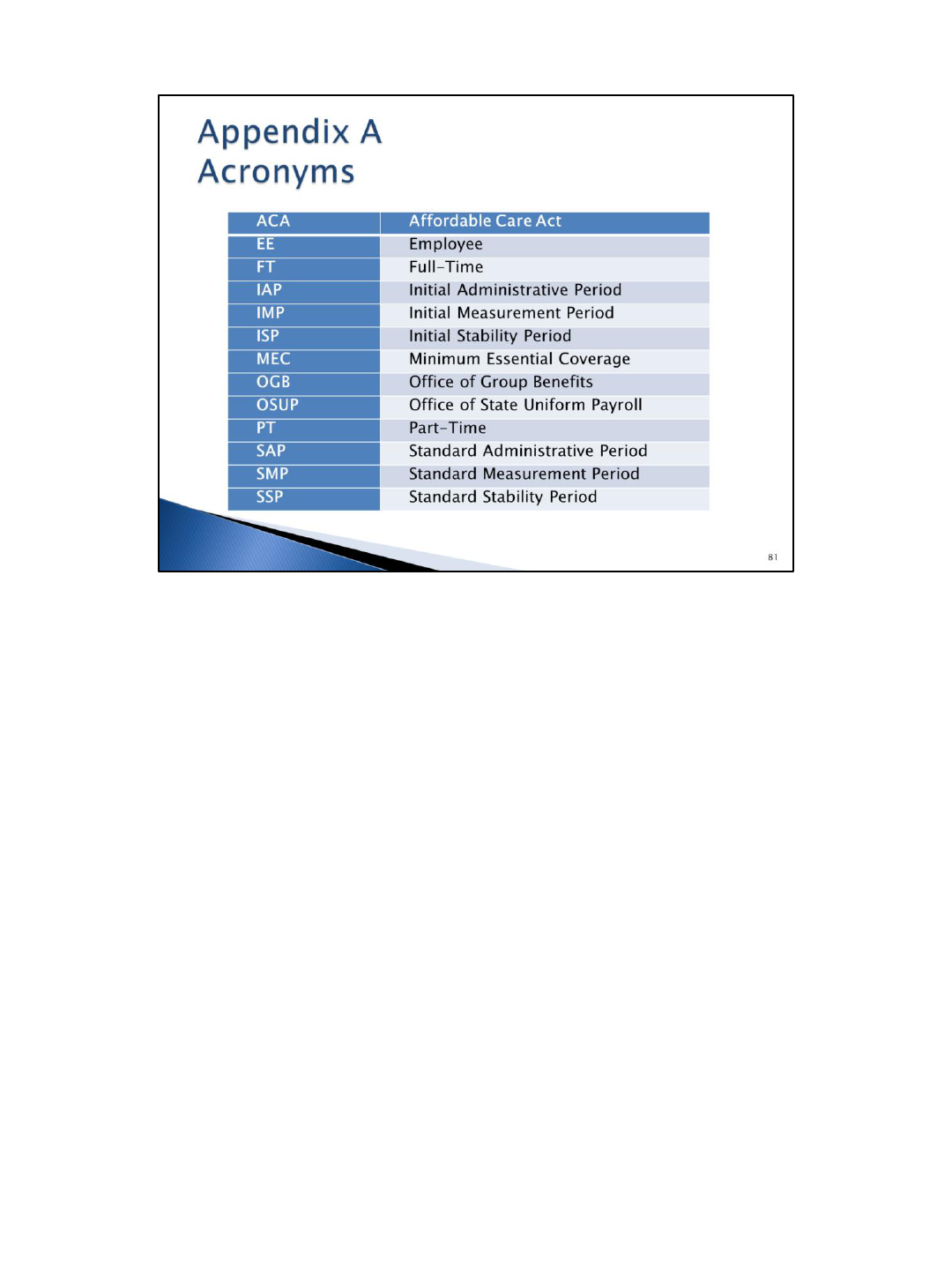

We will be using a lot of acronyms. We have provided an acronym list on the last

page of the presentation guide that you can use.

Effective January 1, 2015, the Employer Shared Responsibility Provisions (commonly

referred to as the employer mandate) went into effect. The employer mandate

requires all applicable large employers to offer health coverage to all full-time

employees and their dependents. This is generally anyone who works an average of

30 or more hours per week. Employers are also required to report health coverage

information to employees and the Internal Revenue Service (IRS). Based on advice

from legal counsel, for the purposes of the Affordable Care Act, the Office of State

Uniform Payroll (OSUP) is “the employer” for all LaGov HCM paid agencies according

to the IRS. Each agency will be required to offer health coverage to eligible

employees, review the data to be reported for accuracy, and maintain documentation

of the offers of coverage.

*LaGov HCM Paid Agencies, collectively, are considered as one employer for ACA

purposes, and data will be reported under OSUP’s tax ID.

The employer mandate requires employers to provide health coverage to all eligible

FT employees and their dependent children beginning January 2015. In order to be

compliant with this requirement in 2015 only, employers must have made health

coverage available to at least 70% of all ACA full-time employees. At the end of

November 2014, the Office of Group Benefits (OGB) requested information to

determine compliance with this provision. The Office of State Uniform Payroll (OSUP)

provided information to OGB for our control group (LaGov HCM paid agencies are

registered under one tax identification number assigned to OSUP). OSUP performed

the look-back exercise and it was determined that, as a control group, the LaGov

HCM paid agencies met the 2015 required threshold of 70%. There was a low

percentage of part-time employees compared to full-time employees. The required

threshold increases to 95% for 2016. It is important that we assure that agencies are

offering coverage to the applicable employees and maintain records of that

information. Non-compliance with this provision will result in employer penalty taxes

under Internal Revenue Code (IRC) §4980H, which your agency will be responsible to

pay. The Internal Revenue Service can audit information for the prior six (6) years;

documentation must be kept at least six (6) years or according to your agency’s

retention schedule, if longer.

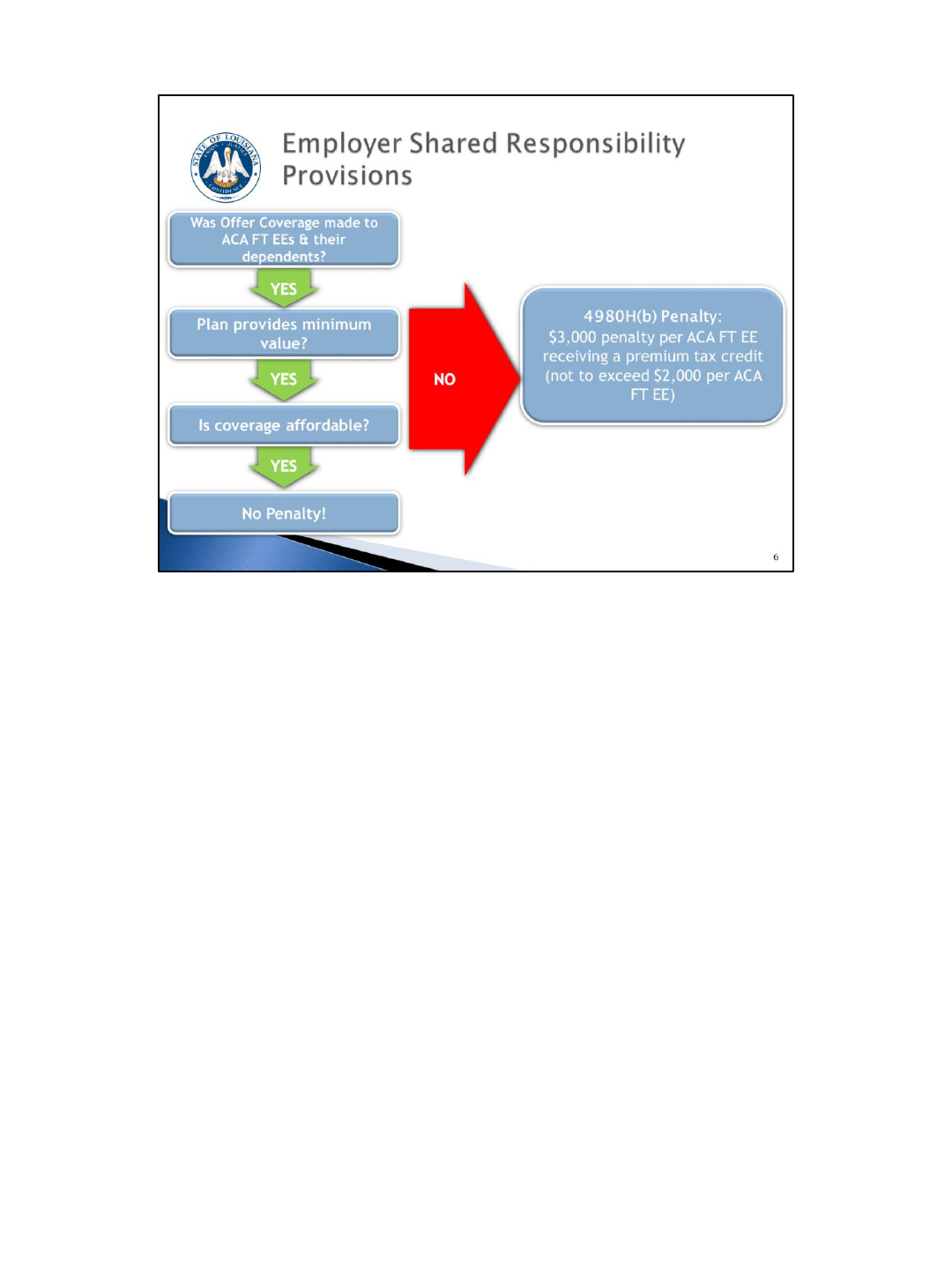

There are two (2) penalties which can be assessed by the Internal Revenue Service (IRS). The

first penalty is the 4980H(a) penalty. Generally, a $2,000 annual penalty (adjusted annually

for inflation) will be assessed if we do not offer health coverage to at least 95% of ACA full-

time employees (and their dependents) and at least one (1) ACA full-time employee receives

the premium tax credit. This penalty is not based on affordability; it’s based on offers of

health coverage that provide minimum essential coverage and provide minimum value. The

penalty will be assessed on the entire full-time “employer” population. There are

approximately 40,000 full-time employees in LaGov HCM; so we are facing a possible 80

million dollar ($80,000,000) penalty for failure to comply. The penalty will be assessed

monthly, and all agencies will be assessed a portion of the penalty proportionately. We need

to take the proper steps to ensure this does not happen. THIS CANNOT HAPPEN.

~~~~~~~~~~

Affordable: employee’s share of lowest cost self-only coverage does not exceed 9.5% of

household income (this percentage is subject to annual inflation adjustments); there are

three (3) safe harbors provided by the IRS because employers will not know an employee’s

household income (federal poverty line, rate of pay, and Form W-2 wages).

Minimum essential coverage: employer-sponsored plans, government-sponsored plans, and

marketplace plans are considered to provide minimum essential coverage

Minimum value: the plan covers at least 60% of the total cost of benefits and covers

substantial in-patient hospital and physician services

Premium tax credit: an advanceable, refundable tax credit designed to help eligible

individuals and families with low or moderate income afford health insurance purchased

through the Exchange; the credit can be paid to the insurance company in advance (which

will reduce the premium amount) or the credit can be claimed when filing income tax return

The second penalty is the 4980H(b) penalty. Generally, this penalty will be assessed if

we do offer health coverage to at least 95% of ACA full-time employees and their

dependents, but at least one (1) full-time employee receives the premium tax credit

and, for that employee, coverage was not offered, was not affordable, or the

coverage did not provide minimum value. This is a $3,000 annual penalty (also

assessed monthly and adjusted annually for inflation). If an ACA full-time employee

receives a premium tax credit, we will receive a notice from the IRS. We will have to

prove that the employee and their dependents were offered coverage, the health

coverage was affordable, and that the coverage provided minimum value. Employers

will have an opportunity to respond to the notice prior to the penalty being assessed.

If we are assessed this penalty, the appropriate/affected agency will be responsible

for paying this penalty.

Another aspect of the employer mandate is the reporting. The Internal Revenue

Service requires employers to file an information return to report health coverage

information. This information will be used (1) to administer the Employer Shared

Responsibility Provisions and (2) to determine an employee’s eligibility for the

premium tax credit. The Office of State Uniform Payroll (OSUP) will submit data on

ACA full-time employees and covered individuals on these forms on behalf of the

LaGov HCM paid agencies. As with Form W-2 reporting, OSUP will provide the Form

1095-C to the employee/covered individual by January 31. The data will be

transmitted to the IRS no later than March 31. The IRS is the enforcement agency

and can audit multiple years. It is recommended to keep records for the last six (6)

years or according to your record retention schedule if longer.

Data elements required to be reported on Form 1095-C include the name of the

employee/plan member, employee/plan member social security number,

employee/plan member address, employer information, the months during the year

that minimum essential coverage was offered that provided minimum value,

employee share of lowest cost monthly premium for self-only coverage available to

the employee (not necessarily the actual premium paid by the employee), employer

safe harbor and transition relief codes, a listing of all covered individuals and the

months they were covered.

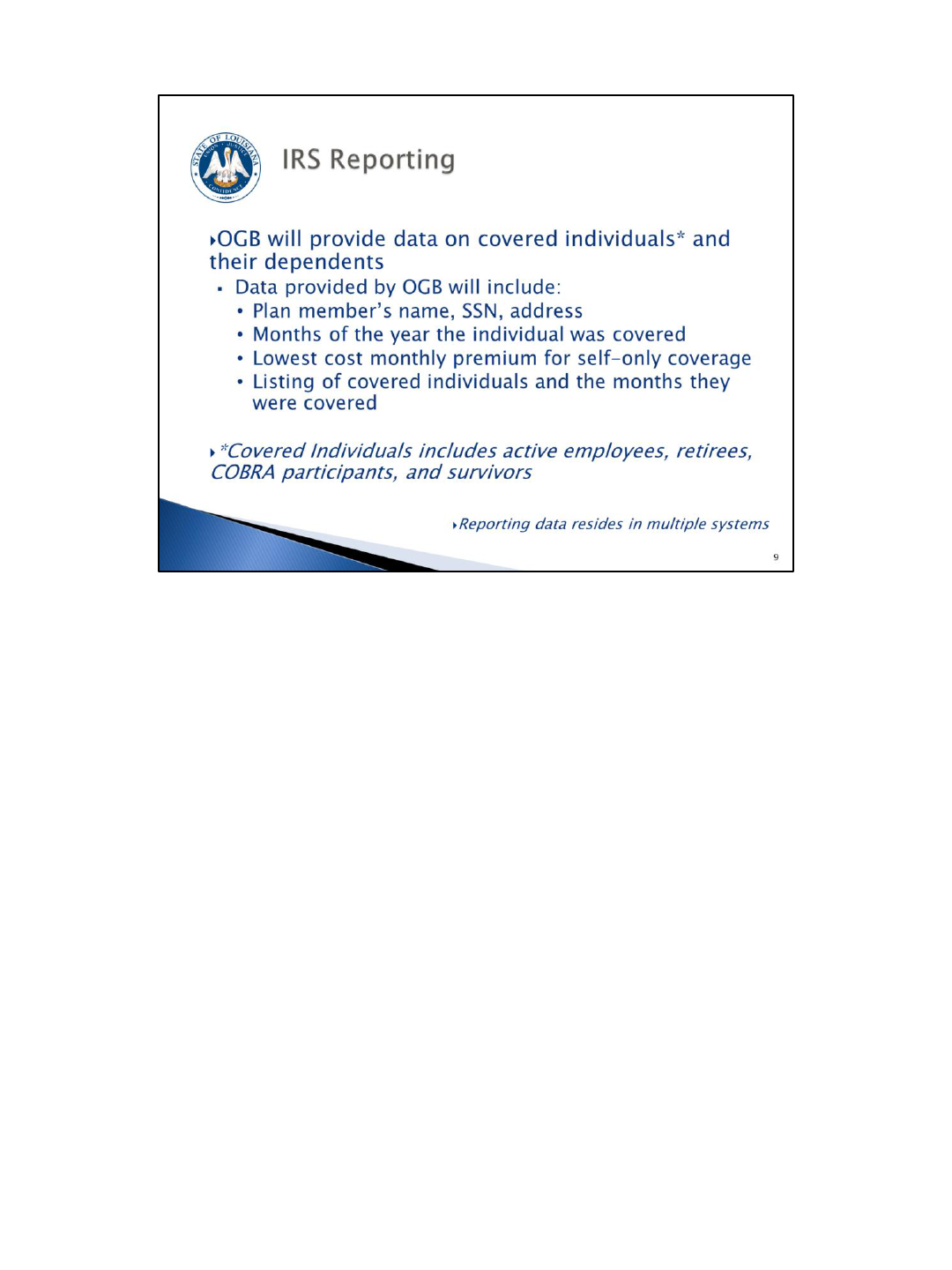

Since not all data resides in one (1) system, we will rely on the Office of Group

Benefits to provide some of the information. OGB will provide a data file on covered

individuals and their dependents. Covered individuals include employees, retirees,

COBRA participants and survivors. The data file will include:

• Plan member’s name, address, social security number.

• The months of the year the plan member was covered.

• The lowest cost monthly premium for self-only coverage (not necessarily the

actual premium paid by the employee).

• A listing of covered individuals (e.g. spouse, dependents) and the months they

were covered.

This will be a daily file, so any updates made in eEnrollment will not appear in LaGov

HCM until the next day. It is important for you to follow the OGB instructions

regarding the collection of missing social security numbers on covered individuals and

updating eEnrollment/LaGov HCM.

While the Office of Group Benefits will provide the data that resides in their

system(s), some of the required data exists in LaGov HCM. There were some data

elements that didn’t exist in either system, so LaGov HCM has been enhanced to

capture these data elements:

• ACA reportability indicator

• Offer code

• Coverage code

• Initial measurement period (IMP)

• Initial stability period (ISP)

• Plan option

• Waiver

More details regarding these will be provided later in the training material.

It is the responsibility of the Human Resources (HR) office to obtain and enter this

data.

Although this is referred to as the employer mandate, it will take a collaborative

effort between several entities to collect and report the data accurately. The Office

of Group Benefits will provide a data file on all covered individuals and their

dependents. The Office of State Uniform Payroll worked with the Office of

Technology Services to design LaGov HCM reports, including the OGB data file. OSUP

will also print and mail forms to ACA full-time employees and covered individuals in

addition to transmitting the data to the IRS. Individual agency HR offices are

responsible for reviewing the data for accuracy and completeness (including

collection of missing social security numbers), entering missing data in LaGov HCM,

and maintaining offer of coverage documentation.

In a nutshell…it is very important for you to manage your liabilities: monitor hours

worked of part-time staff, offer health coverage when required, and document the

offers. This may require a new approach to how you handle hours for part-time

employees (students, WAEs); where you didn’t have to offer them coverage before,

you will have to offer it now if they meet the ACA definition of a full-time employee.

For dual employees you must consider the total hours worked at all LaGov HCM Paid

agencies in determining eligibility. On-call hours are used in the calculation of hours

worked and could cause a part-time employee to become eligible for health

coverage.

Next we will begin going over all the details of the employer responsibilities.

As we discuss the HR responsibilities keep in mind that we will be providing

information based on whether employees are considered ACA FT versus non-FT and

whether they are ongoing employees versus newly hired employees.

We will start with classifying employees appropriately under ACA.

Agencies will need to determine the appropriate ACA employee classification based on facts

and circumstances at the time of hire. Newly hired employees should be classified as full-

time, part-time, variable, or seasonal.

Full-time employees, according to ACA, are those employees hired to work at least 30 hours

on average per week. Per OGB requirements, coverage must be offered and enrollment

decision must be made within 30 days of the hire date for these employees and annually

during the Annual Enrollment period. Most of the State's workforce falls into this category.

Part-time employees are hired to work less than 30 hours on average per week. These

employees are not eligible for health coverage. Although you don’t anticipate that these

employees will work 30 hours or more per week, you will still need to monitor them over a

period of time to count their hours to determine their eligibility for health coverage. An

example of a part-time employee would be your student workers.

Variable hour employees are those employees that you cannot reasonably determine their

average hours at the time of hire. These employees will also need to be monitored over a

period of time to count their hours to determine their eligibility for health coverage. For

example: shelter workers, food stamp application assistants.

Seasonal employees, per the IRS, are employees who work for a period of time not to exceed

six months, and are generally hired at the same time each year (e.g. winter, summer). These

employees are not eligible for health coverage as long as they do not work more than six

months. For example: life guards and summer camp counselors at CRT, Revenue Tax Analysts

at Department of Revenue. (The six (6) months can be divided up during the year, as long as

the employee is truly seasonal. So, they could work, for example, three (3) months in the fall

and three (3) months in the spring, but no more than six (6) months total.)

Next let's review how to determine if an employee is eligible for health coverage.

Was this employee hired as a full-time employee? If the answer is yes, then this

employee would be eligible for health coverage. As was stated before, an ACA full-

time employee is someone who is expected to work an average of 30 hours or more

per week. Prior to ACA, agencies determined what was considered FT for OGB

eligibility purposes. You will now determine FT in accordance with the ACA rules.

Some factors to consider when determining an employee's classification are:

• Is the employee replacing a full-time employee?

• Was the job advertised as full-time (30 or more hours)?

• Was the employee advised the job/position requires working more than 30

hours per week?

• What are the working hours for the same or other comparable positions?

Answering yes to any of these questions would lead to the determination that the

employee is a full-time employee. These employees must be offered health coverage

immediately and will have 30 days to enroll in coverage or provide documentation of

waiver of coverage.

Next we will look at non full-time employees.

Was this employee hired as a full-time employee? If the answer is no, then the

employee would not be offered health coverage at the time of hire but would need to

have their hours counted to determine eligibility for health coverage after 24 pay

periods of employment.

OSUP has developed an Offer of Coverage Worksheet that agencies may use to assist

in determining the expectation of an employee's working hours. This form is

available on the OSUP website. When using this tool, agencies will just walk through

the questions on the worksheet.

Agencies must count hours for these non full-time employees to determine whether

or not they are eligible for health coverage. We will be using the look-back method

to determine which employees qualify as ACA full-time so that coverage may be

offered to them at the appropriate time. Documentation must be maintained for

each look-back exercise.

You must have documentation to prove the employee is not full-time to dispute

penalties when the employee gets a premium tax credit at the Exchange.

Documentation should include the average hours worked for that particular

measurement period as well as the offer coverage/waiver, if applicable.

So let's review how to perform the look-back method. These measurement periods will be very

important for you to understand.

Remember that this look-back exercise will be performed by agencies for non full-time employees only

since all full-time employees are offered coverage immediately.

In order to perform the look-back exercise you will need to determine the employee's Measurement

Period, Administrative Period and Stability Period. So let's define what each of these periods

represent.

The Measurement Period is the period in which the employee is earning their hours of service. These

are the hours that you will “look back” on and “count” to determine ACA FT status and thus eligibility

for health coverage. For on-going employees the Measurement Period is 26 pay periods. For newly

hired employees the Measurement Period is 24 pay periods.

The Administrative Period is the time period for agencies to determine eligibility and complete all

necessary administrative tasks to document the offer of coverage. During this period, agencies will

perform the look-back exercise, determine if the employee is eligible for health coverage, make the

offer if the employee is eligible, collect a signed GB-01 form with an election or waiver within 30 days

of eligibility and enter the coverage in LaGov HCM and/or eEnrollment, if elected.

Per ACA regulations, the Administrative Period must not exceed 90 days. Per OGB requirements,

coverage must be offered and employee decision must be made within 30 days of eligibility. We will

discuss the exact time period for the Administrative Period later in the presentation.

The Stability Period immediately follows the Administrative Period. Newly eligible employees must

maintain coverage, if elected, during this period regardless of their working hours during this time.

LaGov HCM Paid agencies will use a 12-month Stability Period. For on-going employees, the Stability

Period will always be January 1 through December 31 of each year which coincides with the OGB Plan

Year. For newly hired employees, the Stability Period will vary based on their Measurement Period

and Administrative Period dates (based on their hire date).

Let's discuss the Standard Measurement Period, the Standard Administrative Period and the

Standard Stability Period for non full-time on-going employees.

An on-going employee is an employee who has been employed for a complete Standard

Measurement Period. This would be anyone hired prior to pay period 22 of the previous

year.

All LaGov HCM Paid agencies must use the 26 pay period Standard Measurement Period that

is required by OSUP. This Standard Measurement Period will always be pay period 22

through pay period 21. An on-going employee will be offered coverage, if eligible, during

Annual Enrollment after the end of the Standard Measurement Period.

The Standard Administrative Period for on-going employees is pay period 22 of each year

through December 31 of the same year. This is the period in which an on-going employee,

determined to be eligible for health coverage, will be offered coverage and be required to

make an election during annual enrollment. It’s also the period in which agencies complete

all administrative tasks related to the measurement period, offer of coverage, and

enrollment.

The Standard Stability Period for on-going employees is January 1 through December 31 of

each year. This is the time period in which the employee must maintain health coverage, if

elected.

OGB’s annual enrollment will now be October 1

st

– November 15

th

to allow time to identify

the newly ACA eligible employees, notify them of their eligibility, offer them coverage, and

allow them adequate time to make a decision.

Now we will review the Initial Measurement Period, the Initial Administrative Period and the Initial Stability

Period for new non full-time employees.

All non full-time employees hired on/after the first day of the Standard Measurement Period will need to be

evaluated after 24 pay periods to determine their eligibility based on their hours of service.

The Initial Measurement Period begins on the first day of the first full pay period after the hire date and extends

24 pay periods. This means that everyone hired during the same pay period will have the same Initial

Measurement Period. This will standardize the Initial Measurement Period and limit the number of exercises you

will have to do to 26 possible Initial Measurement Periods.

The Initial Administrative Period begins the day after the Initial Measurement Period ends and expires the day

before health coverage becomes effective. Per ACA regulations, the Administrative Period must not exceed 90

days. Per OGB requirements, coverage must be offered and employee decision must be made within 30 days of

eligibility. We are basically backing into the administrative period.

The Initial Stability Period is 12 months from coverage effective date. This is the time period in which the

employee must maintain coverage regardless of working hours.

There is a report in LaGov HCM to assist agencies in performing the look-back exercises to count hours for the

Initial Measurement Period (ZP136). We’ll take a look at this report later.

Let’s look at an example for a New Non-FT Employee: Use the information in the slide to determine all of the

appropriate dates.

Becky is hired June 1, 2015. Because her hire date falls in pay period 12 2015, we will begin counting her hours on

06/08/15 (the first day of pay period 13 2015). Now counting forward 24 pay periods brings us to pay period 10

2016 (end date 05/08/16), the end of her initial measurement period. Becky’s date of eligibility determination is

05/09/16. If we “look back” and count her hours of service during her initial measurement period and determine

that she has worked on average more than 30 hours per week then she is eligible for health coverage. Not only is

05/09/16 Becky’s date of eligibility, but it is also the start of her initial administrative period. Per OGB rules,

Becky has 30 days from her date of eligibility (05/09/16) to make a decision on accepting health coverage

(deadline = 06/07/16). If she chooses to accept health coverage, it will become effective 07/01/16 (beginning of

her initial stability period) and continues for 12 months (ending 06/30/17). Becky’s initial administrative period

(05/09/16 – 06/30/16) is the timeframe for HR to determine her eligibility, make the offer of health coverage (if

eligible), make necessary system entries for enrollment, and document the offer of health coverage.

Counting hours are different for “ongoing employees” vs. “new employees”. To count

hours means to add up the total number of hours of service during a measurement

period. For ongoing employees, this will be done at the end of the standard

measurement period. For new employees, this will be done at the end of the initial

measurement period.

In the previous section, determining eligibility, we defined an ACA full-time employee

as someone who is expected to work an average of 30 or more hours per week. You

see on this slide the IRS definition of an “hour of service” (each hour for which an

employee is paid, or entitled to payment, for the performance of duties for the

employer, and each hour for which an employee is paid, or entitled to payment by the

employer for a period of time during which no duties are performed due to vacation,

holiday, illness, incapacity (including disability), layoff, jury duty, military duty or leave

of absence.”) and what hours are included in this definition for LaGov HCM paid

agencies. Note that On-call pay is bolded. Per the IRS, for every hour an employee is

on-call, the employee should be credited for an hour of service. Particular attention

should be given to any non full-time employee receiving on-call pay. The combined

actual hours worked in addition to on-call hours worked could cause the employee to

become eligible for health coverage. Again, there is a report in LaGov HCM (ZP136)

that is available to assist you with counting hours and will be covered later in this

presentation. The hours of service listed here are already programmed into the

report.

When it comes to counting hours, there are two (2) groups of employees. The first

group are the ongoing employees. Again, this is someone who was hired on or

before the beginning of the standard measurement period (SMP) and has been

working for at least one complete standard measurement period. The standard

measurement period for LaGov HCM is pay period 22 through pay period 21. For the

upcoming look-back exercise, you will count hours for any non full-time employee

hired prior to October 13, 2014 (ongoing employees). These employees will have

their hours counted on an annual basis as long as they remain a non full-time

employee. It is recommended that you monitor and manage the work hours for non

full-time employees to ensure the employee does not become eligible for health

coverage.

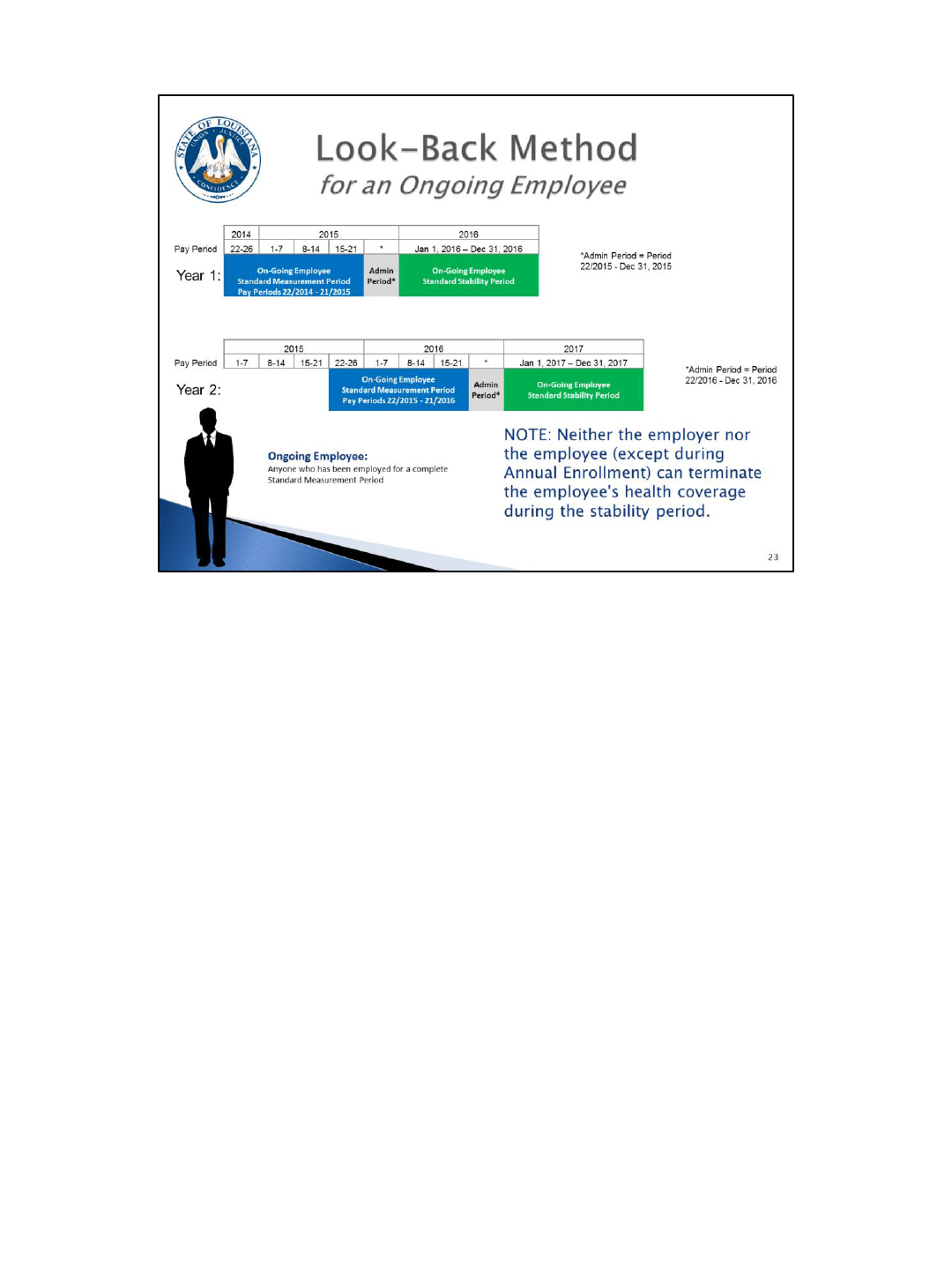

Here is a graphical presentation of the information previously covered on slide 22

regarding measurement, administrative, and stability periods for ongoing employees.

You will see depicted on this slide that there is some overlap between a non full-time

employee’s stability period and subsequent measurement period. It is important to

remember that once a non full-time employee enters a stability period (January 1 –

December 31), their eligibility remains unchanged. This means that an employee

who is eligible for health coverage and accepts coverage must maintain the health

coverage for the stability period, regardless of the number of hours worked during

the stability period. The health coverage cannot be dropped until annual enrollment

and their hours will not be counted again until the end of next standard

measurement period. (There is an exception for regular OGB Flexible Benefit Plan

qualifying event changes e.g. marriage, divorce).

We just covered counting hours for ongoing employees. Now we will cover counting hours

for new hires. Just to recap…

The initial measurement period for newly hired non full-time employees begins the first day

of the first full pay period following date of hire and extends for 24 pay periods.

The initial administrative period for newly hired non full-time employees begins on the first

day after the initial measurement period ends and expires the day before the health

coverage effective date. This period includes 30 days for the employee to make a decision on

health coverage (per OGB).

The initial stability period for newly hired non full-time employees begins after the initial

administrative period ends (health coverage effective date) and extends 12 calendar months.

~~~~~~~~~~

Reminder…a non full-time employee can be…

• Part-time: at time of hire you reasonably expect the employee to work less than an

average of 30 hours per week.

• Variable Hour: at time of hire you cannot reasonably determine if employee will average

at least 30 hours per week.

• Seasonal: period of employment is during the same part of the year each year; annual

employment of 6 months or less.

Let’s walk through an example of a new non full-time employee. Use your OSUP pay period tables and

payroll calendars for 2015 and 2016 as a guide. Becky is hired June 1, 2015. Because her hire date

falls in pay period 12 2015, we will begin counting her hours on 06/08/15 (the first day of pay period

13 2015). Now counting forward 24 pay periods brings us to pay period 10 2016 (end date 05/08/16),

the end of her initial measurement period. Becky’s date of eligibility determination is 05/09/16. We

have counted Becky’s hours of service during her initial measurement period and we determine that

she has worked on average more than 30 hours per week making her eligible for health coverage. At

the point she is deemed eligible for health coverage, HR must make the offer of health coverage and

begin documenting. Not only is 05/09/16 Becky’s date of eligibility, but it is also the start of her initial

administrative period. Per OGB rules, Becky has 30 days from her date of eligibility (05/09/16) to

make a decision on accepting health coverage (deadline = 06/07/16). Becky must indicate her decision

using the GB-01 and return it to you by 06/07/16. If Becky chooses to accept health coverage, it will

become effective 07/01/16 (beginning of her initial stability period) and continues for 12 months

(ending 06/30/17). Becky’s initial administrative period (05/09/16 – 06/30/16) is the timeframe for

HR to determine her eligibility, make the offer of health coverage (if eligible), make necessary system

entries for enrollment, and document the offer of health coverage. The GB-01 is your documentation

and has been revised to capture the Qualified Event Date (date of eligibility).

If she chooses not to elect health coverage, you must get her to sign a GB-01 waiving coverage. She

will remain “waived” throughout the stability period. This is an irrevocable decision.

If Becky is deemed ineligible for coverage after the measurement period (non-FT), she will remain

ineligible during the stability period.

One of the LaGov HCM enhancements, which will be discussed later, is the ability to create a date

reminder. The system will generate an email to the ACA Contact on ZP200 30 days before the end of

an employee’s initial measurement and initial stability periods reminding you of the upcoming

deadline so you can start preparations.

We will now allow you an opportunity to determine a new employee’s periods on your own.

Calculate the dates for the two (2) exercised on slide 26.

ANSWERS - Exercise 1: Employee hired 03/12/15

Initial Measurement Period: 07/2015 – 04/2016 (pay periods)

03/16/15 – 02/14/16 (calendar dates)

Date of Eligibility Determination: 02/15/16; Employee Decision Deadline: 03/15/16; Health

Coverage Effective Date: 04/01/16; Initial Administrative Period: 02/15/16 – 03/31/16;

Initial Stability Period: 04/01/16 – 03/31/17

ANSWERS - Exercise 2: Employee hired 09/01/15

Initial Measurement Period: 20/2015 – 17/2016 (pay periods)

09/14/15 – 08/14/16 (calendar dates)

Date of Eligibility Determination: 08/15/16; Employee Decision Deadline: 09/13/16; Health

Coverage Effective Date: 10/01/16; Initial Administrative Period: 08/15/16 – 09/30/16;

Initial Stability Period: 10/01/16 – 09/30/17

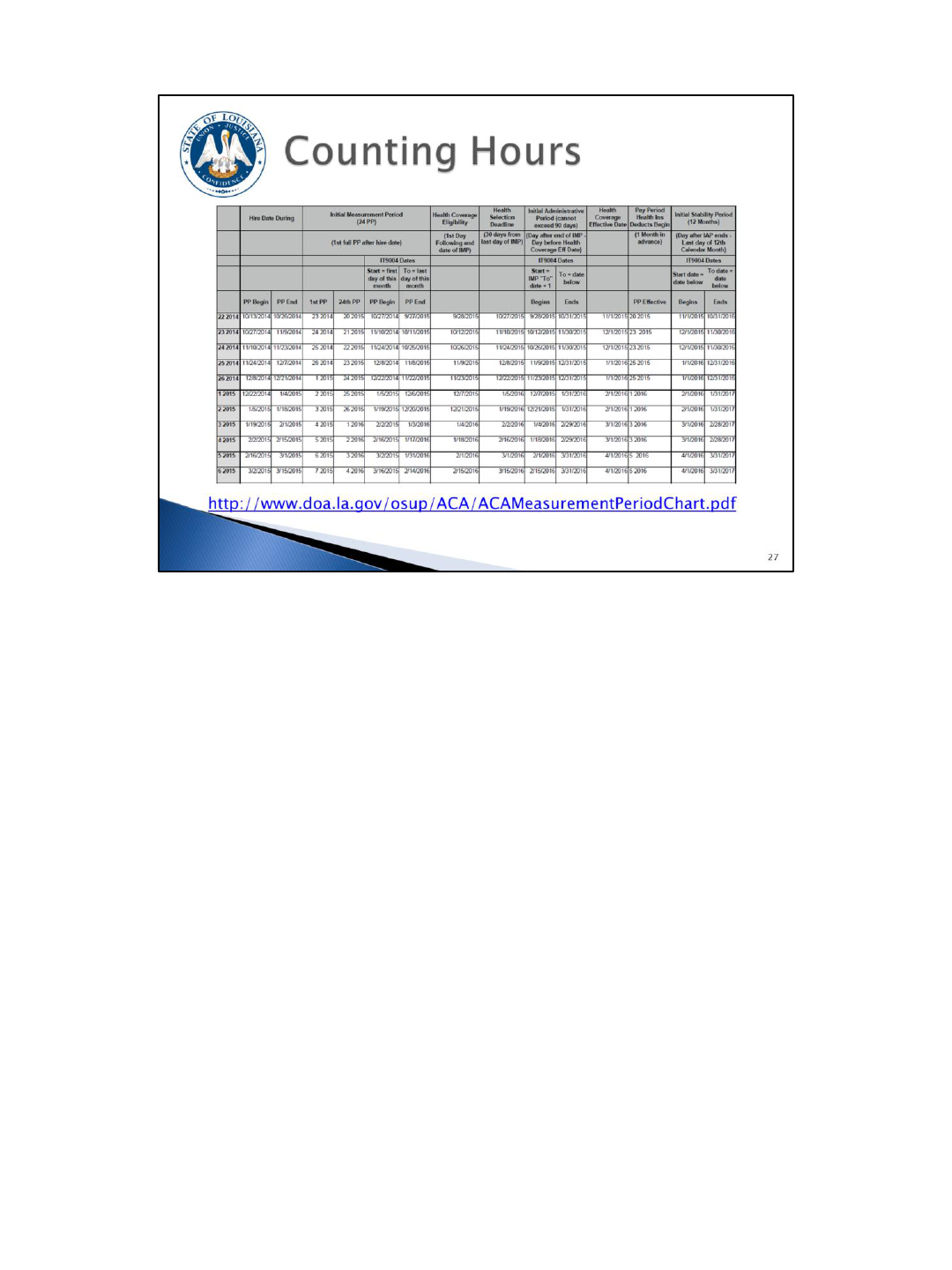

There are now two (2) tools [chart (see next slide) and system utility (ZP250)] available to

assist you with determining these dates, but it is very important for you to understand how

to calculate these dates because you will need to enter this information in LaGov HCM.

Here is a snapshot of the ACA Measurement Period Chart located on OSUP’s ACA

webpage. The full chart can be found on the web address located on the slide.

How do you handle an employee who transfers from one paid agency to another paid

agency? The answer depends on the type of employee (full-time or non full-time).

The gaining agency is responsible for collecting the appropriate documentation.

If the employee is full-time in both agencies, the employee must complete a GB-01

or, if agency policy allows, print the Transferred Employee Deductions Authorization

Report (ZP165) for employee signature. Please note that LSU First Health Plan

enrollment will not appear on this report. Revisions to ZP165 to add LSU First Health

Plan are on hold; agencies can use ZP255 (Plan Participation Report) until the

revisions are completed.

If the transferring employee is non full-time...the gaining agency must determine if

the employee is in an initial measurement/stability period or the standard

measurement/stability period. It is very important to know if the employee is in an

initial measurement/stability period because this impacts when you count their hours

(initial measurement) or how long they can retain their health coverage (initial

stability). Use OSUP/F100 to document this information. Because LaGov HCM Paid

agencies are considered one employer for reporting, the employee MUST continue

the existing measurement/stability period from the previous agency. You CANNOT

start a new measurement/stability period because they are new to your agency.

The gaining agency must include the hours worked in the losing agency when

counting hours after the measurement period ends (this is because all LaGov HCM

paid agencies are considered one (1) employer for ACA purposes).

For employees transferring non-paid to paid, the gaining agency is responsible for

collecting the appropriate documentation. If the employee is full-time, the employee

must complete a GB-01. If the employee is non full-time, you will treat the employee

as a newly hired non full-time employee (meaning they will have an initial

measurement period and initial stability period). Measurement/stability periods and

hours of service at non-paid agencies are not taken into consideration at your paid

agency. Agencies are encouraged to use the OSUP/F100 to document your

reasonable expectations for the employee’s working hours.

Remember that this is IRS driven – based on the employer identification number (tax

ID).

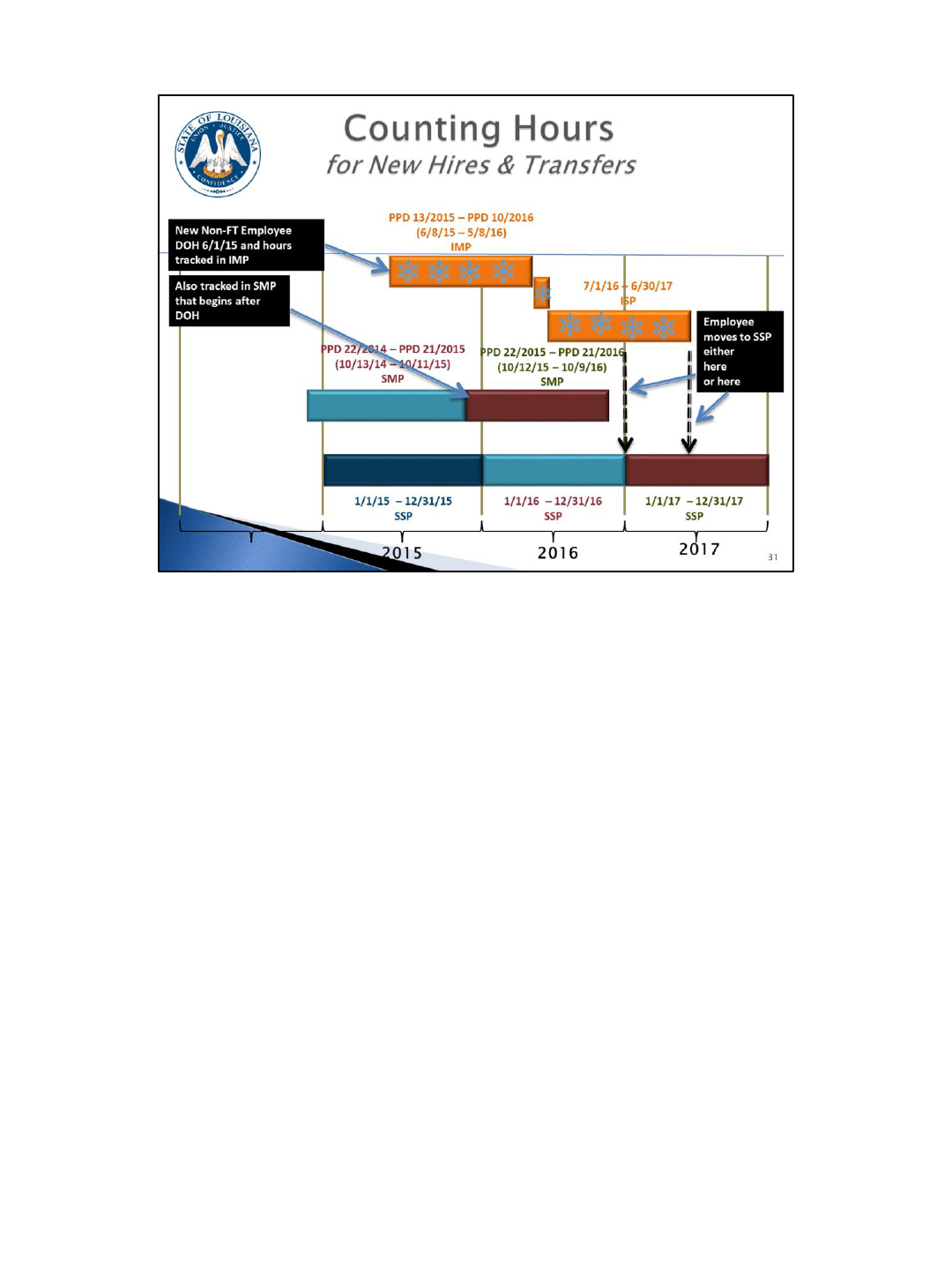

At what point does a new hired non full-time employee move to the standard

measurement period? Transitioning to the standard measurement period is by far

the most complicated topic in counting hours. You probably won’t get it

immediately. You will have to take it back to your office, study, and think on it some

more. Remember, though, that you will only have to use this for non-FT employees.

The new non full-time employee will have their hours of service counted during their

initial measurement period to determine eligibility during their initial stability period.

They will also be included in the fi rst standard measurement period that begins

after their hire date. This will most likely result in overlapping of initial stability

period and the standard measurement period.

Let’s look at an example.

Date of Hire: 6/1/15

IMP: PPD 13/2015 – PPD 10/2016 (6/8/15-5/8/16) (track hours here)

ISP: 7/1/16-6/30/17

SMP: PPD 22/2015 – PPD 21/2016 (10/12/15 – 10/9/16) (this is the SMP that starts after the

date of hire, so track hours here as well)

During the employee’s ISP, we will need to determine if the employee is eligible for coverage

in the next SSP.

Assuming the employee is currently covered in their ISP, if they are deemed to be

ineligible for coverage based on SMP, then they will stay in their ISP until it expires on

6/30/17 and their health coverage ends. They will be evaluated again after PPD 21/2017

(the end of the next SMP).

If they are deemed eligible for coverage during the SMP ending 10/9/16, then they end

their ISP on 12/31/16 and move into SSP on 1/1/17.

(Do not evaluate their hours in the ISP.)

Employee moves to SSP either 01/01/17or 07/01/17 (whichever is advantageous to the

employee)

First dotted arrow—SMP status is favorable, so ISP ends early and EE shifts to SSP early

(01/01/17)

Second dotted arrow—IMP status is favorable, so ISP does not end early and EE shifts to SSP

when it expires (07/01/17)

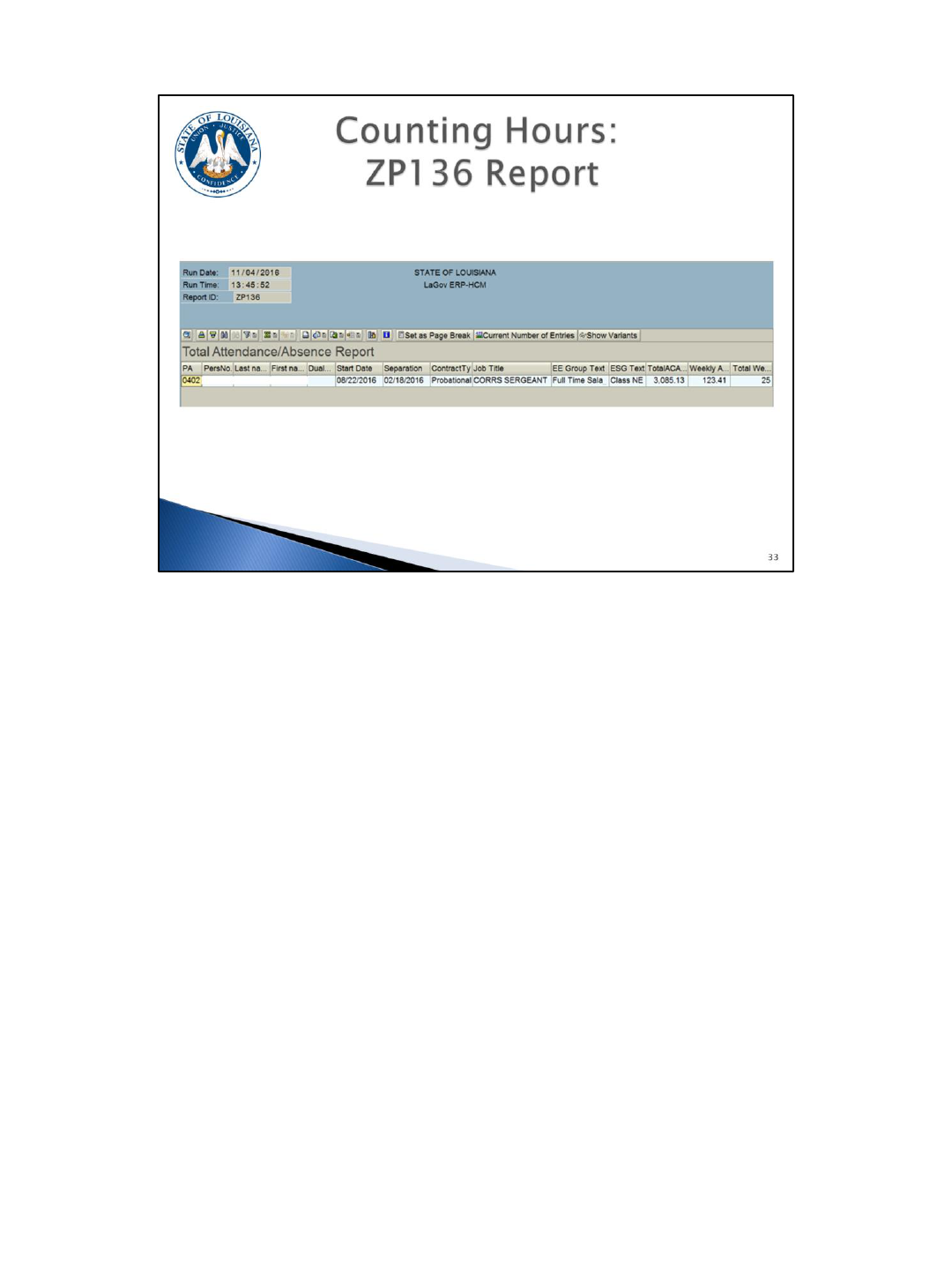

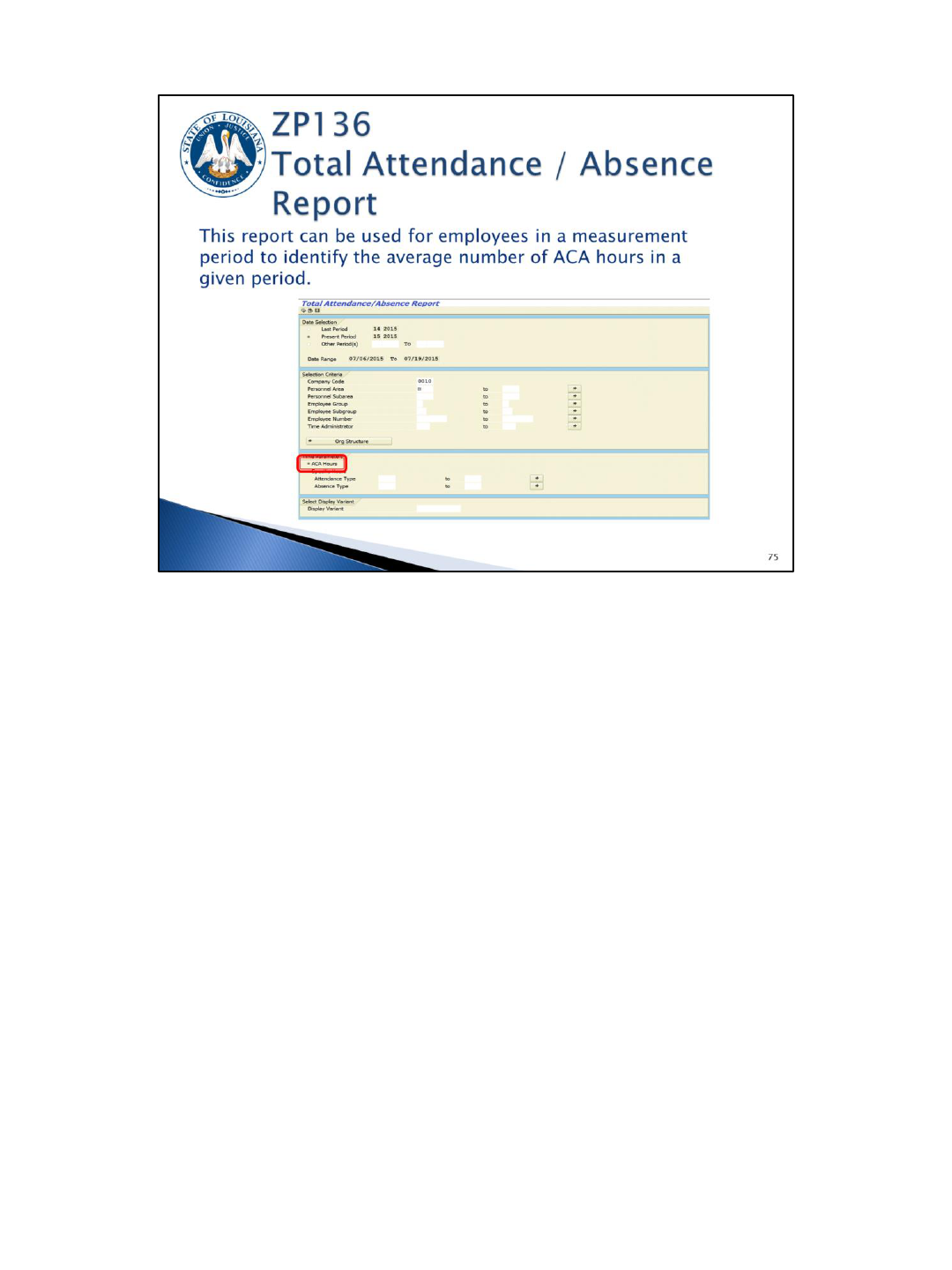

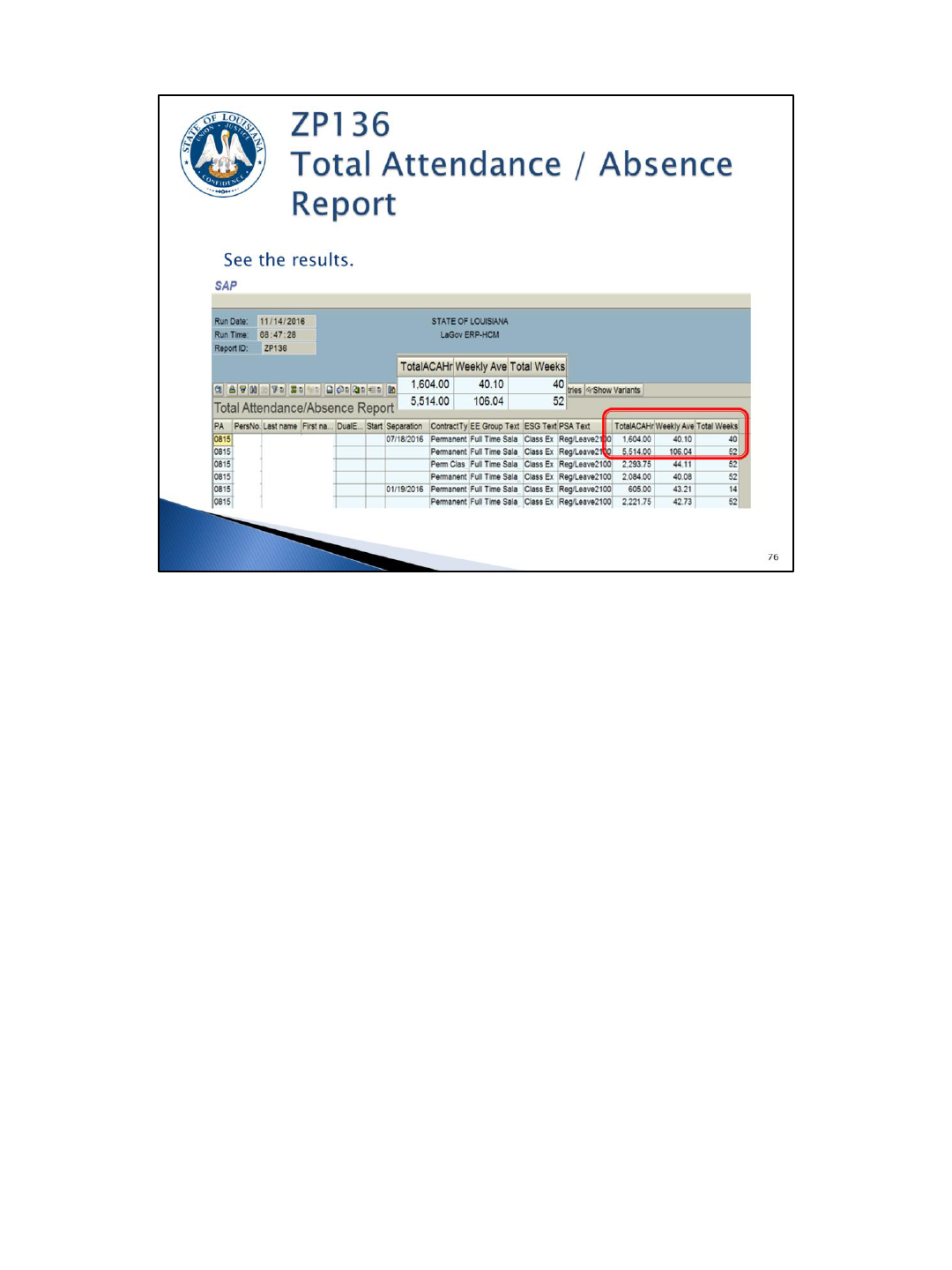

The ZP136 Total Attendance/Absence Report has been enhanced to include an option (via a radio button) that

allows you to look at the number of ACA hours worked for a given period. We have included the number of hours

that we are required to use per the ACA regulations. These hours were covered previously on the “Hours of

Service” slide. To recap, it includes regular, overtime/k-time, on-call, all paid leave types, FMLA LWOP, and

military LWOP.

You will use this report to look at the number of total ACA hours for non-FT employees. To get the hours of

service for an individual, run the ZP136 report to get the hours worked for specified pay periods. Typically, you

will use the pay periods for the Initial Measurement Period or the Standard Measurement Period.

The report gives you the weekly average hours worked. It will also output the total number of weeks that the

employee was active during the look-back period and will do an average based on that number of weeks. So, for

example, if you are doing a 26 pay period look-back, and the employee only worked 14 weeks of those 26 pay

periods, the report will output 14 in the Weekly Ave column and compute the average hours worked based on 14

weeks rather than 26 pay periods.

A separation date will appear on the report, if at the time you run the report the employee is active and at any

point during the period being reviewed the employee had a separation action. If there was more than one

separation date, the most recent separation date will be displayed. This is so that you can see that the employee

was not active at some point during the period.

The same will be reported if the employee has a hire date during the period being reviewed.

The report also outputs the Contract type, so this should be helpful to you.

Since you will have to offer coverage immediately after the Initial Measurement Period ends, it will be important

to begin running the report as you are nearing the end of an IMP to determine which employees appear to be

averaging 30 or more hours per week. DO NOT WAIT UNTIL THE MEASUREMENT PERIOD IS OVER TO BEGIN

ANALYZING THE HOURS.

There is a tool in the system that gives you the ability to create a date reminder that will generate an e-mail to the

ACA contact on ZP200 30 days prior to the end of the measurement and stability periods. This will remind you of

the upcoming deadlines. This is not driven from ZP136. It is driven from a new ACA infotype (IT9004) which will

be covered later.

This is a quick glance at what the ZP136 report output looks like. This will be covered

in detail later.

We’ve explained that ACA requires employers to offer health coverage to eligible

employees and their dependents. So you might be asking what type of

documentation you should keep in an employee’s file to demonstrate that you did

offer coverage.

For newly hired ACA full-time employees, because you have to offer them coverage

immediately, the completed GB-01 is your documentation along with the OSUP/F100

Offer of Coverage Worksheet, if you choose to use it.

For newly hired non full-time employees, your documentation will include the

OSUP/F100 (if used), the hours of service calculation which shows if the employee is

eligible or not at the end of the initial measurement period (this is the ZP136 report),

and the GB-01 for the coverage chosen if the employee is eligible or if they waived

coverage.

Ongoing employees evaluated after the standard measurement period ends will have

the hours of service calculation (ZP136) which shows if the employee is eligible or

not, and the GB-01 for the coverage chosen if the employee is determined to be

eligible or if they waived coverage.

This documentation will be needed if there is an IRS audit or if we are assessed a

penalty. You should retain all documentation for at least 6 years.

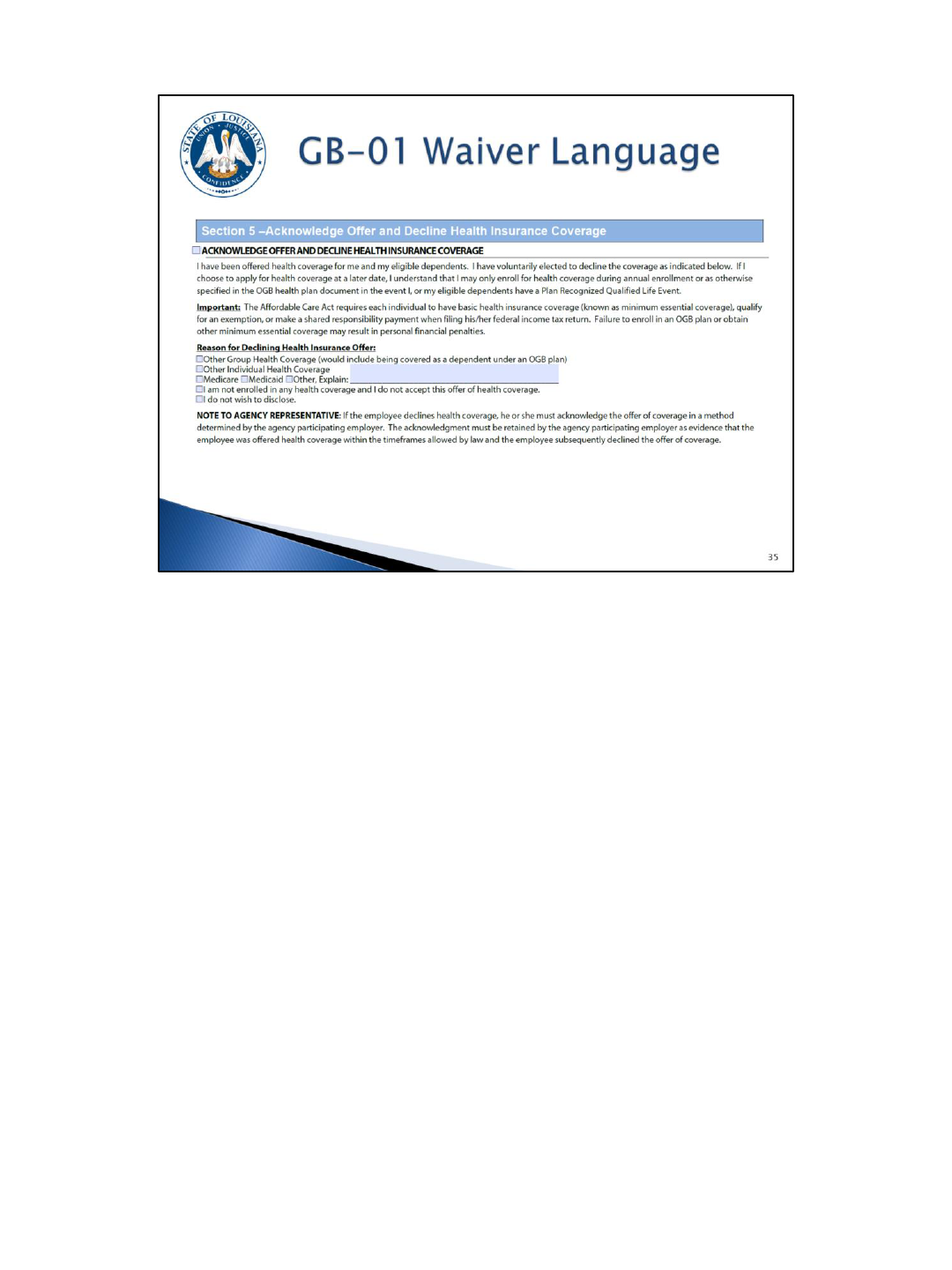

The GB-01 has been revised for ACA and other purposes. It includes new waiver

language.

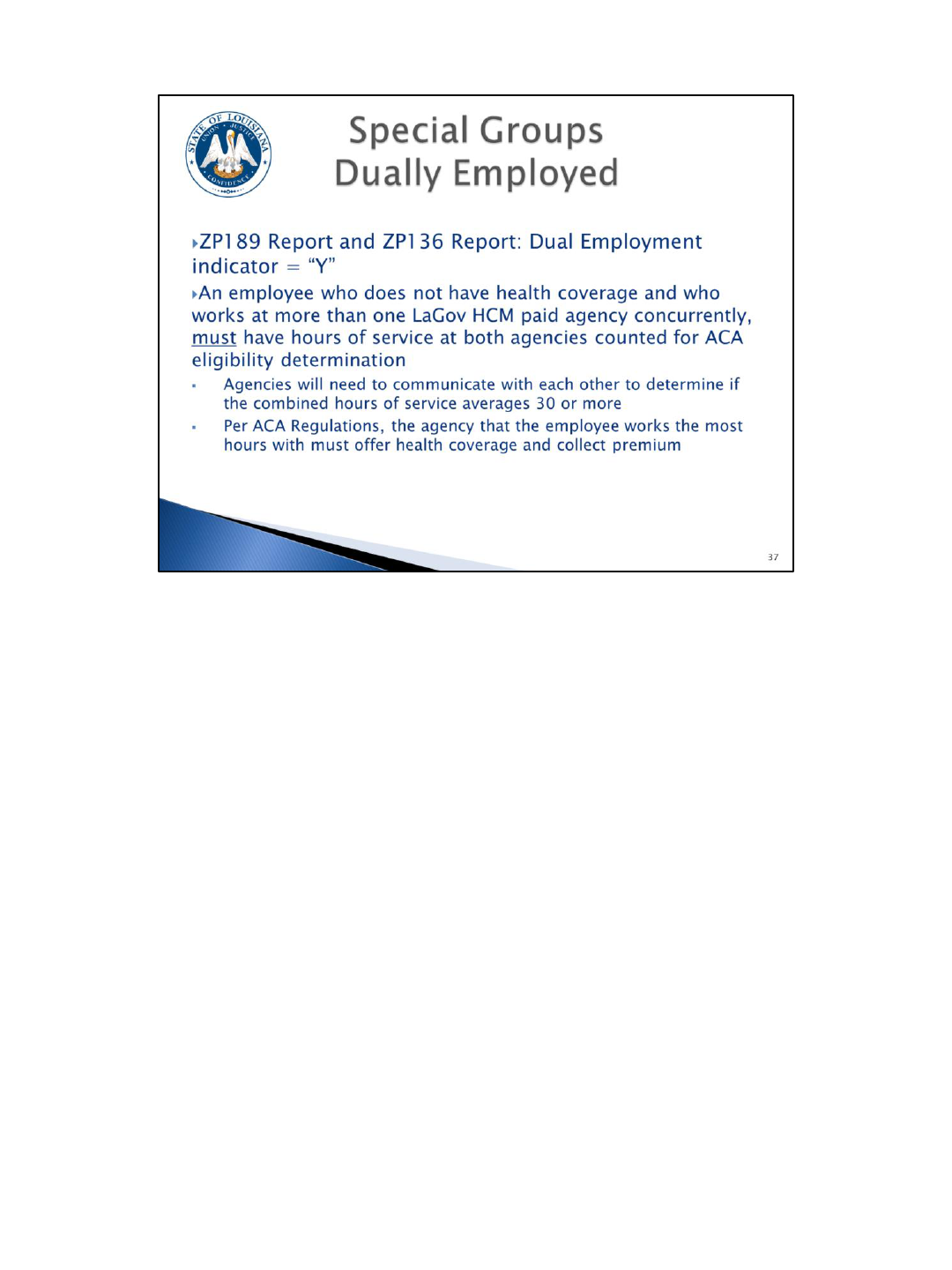

There are some special situations that you will have to pay close attention to when

you are counting hours and determining an employee’s eligibility for health care

coverage.

One of these situations is employees who are dually employed.

These are employees who work for more than one LaGov HCM paid agency during a given year (more

than one personnel number). This isn’t as much of an issue if they are full time at one agency and

have been offered health coverage. It does become an issue if they are non-FT at two different

agencies (for example student workers who work part time for two agencies). You will have to

consider the hours worked for both positions to determine eligibility. So a student could potentially

qualify as ACA FT even if you never intended for them to be FT at your agency.

The ZP136 Total Attendance/Absence Report and the ZP189 ACA Audit Report will have a dual

employment indicator to show that these employees have two different personnel numbers.

However, this does not necessarily mean that the employee worked for two agencies at the same time

during the year being evaluated so you will need to look at these employees closely to determine if

they were in fact employed by two agencies at the same time.

The dual employment indicator shows “Y” for anyone that previously worked in another paid or non-

paid agency (with multiple personnel numbers). So, they may not truly be a dual employee / working

at 2 agencies at the same time.

If you find that the employee did work for two agencies at the same time for the period you are

evaluating, you must count the hours for both personnel numbers to determine eligibility.

Per ACA Regulations, the agency that the employee works the most hours with must offer health

coverage and collect the premium. However, it may be necessary for both affected agencies to work

together to determine the plan of action regarding counting hours, LaGov HCM entry, and offering

coverage.

One thing that you will need to do when you hire an employee is find out if they are working for

another paid agency and if they are in a measurement or stability period. If so, you will have to

consider both jobs for the measurement and stability periods.

Rehired retirees also require special attention. What is required by ACA regulations may be very different than how you

currently handle rehired retirees.

Per ACA, rehired retirees are considered active employees and as an ac tive employee you, as the employer, are required to

offer health coverage to all active employees, if they are eligible.

If they are rehired as ACA FT, they may choose to continue having their premium deducted from their retirement check, but you

are still required to offer them coverage and have them complete a GB-01 “waiving coverage” if they choose to continue having

their premiums withheld from their retirement check (rather than through payroll).

The GB-01 has been revised and now has a section on the form to “waive” coverage. One of the reasons for waiving coverage is

that the employee already has Group health coverage. The GB-01 with coverage “waived” should not be sent to OGB. It is

documentation for you, as the employer, to show that you did in fact make an offer of health coverage.

If they choose coverage in their rehired retiree position, you must deduct the premium through payroll. They will pay the same

rate they paid as a retiree, so if they are subject to a vesting schedule of 19%, they will still pay that same rate if it is deducted

through payroll.

Also, if, for example, the rehired retiree chooses to have health coverage come out of their pay check, your agency will pay the

employer share. However, once the rehired retiree separates from service, they will revert back to the OGB invoice of the

agency they retired from.

If the rehired retiree is considered to be non-FT, you will have to go through the process of placing them in a measurement

period, and evaluating their hours worked at the end of the measurement period, and offering coverage if applicable. You will

also have to complete the LaGov HCM entries for these employees.

Further, if the rehired retiree does not have OGB health coverage as a retiree, they are still considered active for ACA purposes

and you must go through the same exercise as for other employees to determine their eligibility. So even if they didn't elect

coverage as a retiree, as an active employee, they may be eligible for health coverage.

Some other groups we have identified who may need special consideration are board members, clients at developmental

centers, district attorneys, and 9/10 month employees at educational institutions. If your agency has any of these types of

employees, OSUP will work with you individually to determine the requirements and the best plan of action. If you have any

employees who you feel fall into a “special group” not listed here, contact OSUP.

Per ACA regulations, if an employee terminates and is rehired within 13 weeks, the employee

is treated as a continuing employee. So if they were separated for less than 13 weeks they

are not a new hire. If the employee was in a measurement period or a stability period prior

to the separation, you will continue using that same period.

If they were in a measurement period, the employee is credited with zero hours of service

during the time period which he was not employed by the agency.

If he was in a stability period before termination of employment and he had health coverage,

you must offer health coverage, and if elected, coverage must be reinstated by the first of

the month after rehire.

FOR EXAMPLE: If an employee terms June 15

th

and is rehired July 30

th

, this is 6 weeks of

separation so you must treat them as a continuing employee since the separation is less

than 13 weeks. If they were in a measurement period or stability period, they would

continue in that same measurement period or stability period.

This is an example of where the average functionality on the ZP136 report will not work for

you. You will use the report to get the total number of ACA hours, but you will have to do a

manual calculation to determine the average hours worked during the measurement period.

The report will not include the inactive periods in the average calculation and you must

include this time period as if the employee was still active.

If there were 13 or more weeks between the point of separation and rehire, you would

follow the same guidelines as for any new hire. If you expect that they will work full time,

you offer them coverage, have them complete a GB-01 which will document their choice, and

update LaGov HCM accordingly. If they are a non-FT employee, you will begin a new initial

measurement period and follow the guidelines we have covered.

An employee that is separated for less than 13 weeks is not a new employee.

Unless:

Their separation is at least 4 weeks but less than 13 weeks and they were separated

longer than their employment.

The “rule of parity” says an employee may be treated as a new employee if the

period of non-employment of less than 13 weeks (for an employee of an educational

organization employer, a period that is shorter than 26 weeks) is at least four (4)

weeks long and is longer than the employee’s period of employment immediately

preceding the period of non-employment.

FOR EXAMPLE: An employee was hired by Corrections on May 1

st

and then termed

on June 15

th

. Then on August 30

th

they are rehired by LDH. So they wor ked for 6

weeks and then they were separated for 10 weeks. So their separation was longer

than their employment and at least 4 weeks but less than 13 weeks so they are

treated like a new employee.

Just remember that this situation does exist, although probably rarely, and it is

something you will have to think about if you are rehiring someone. Also, since we

are considered one employer for ACA purposes, this same rule applies for someone

who is transferring from one paid agency to another paid agency.

As covered previously, we are required to provide an IRS Form 1095-C to every ACA

FT employee who was eligible for health coverage during the calendar year (whether

they had coverage or not), and every employee who actually had coverage, along

with their dependents.

The form will report, by month, whether the employee was offered coverage and

whether they actually had coverage.

We also have to report on retirees, COBRA participants, and survivors who are

enrolled in the OGB self-insured plans which are the Blue Cross and LSU Health plans.

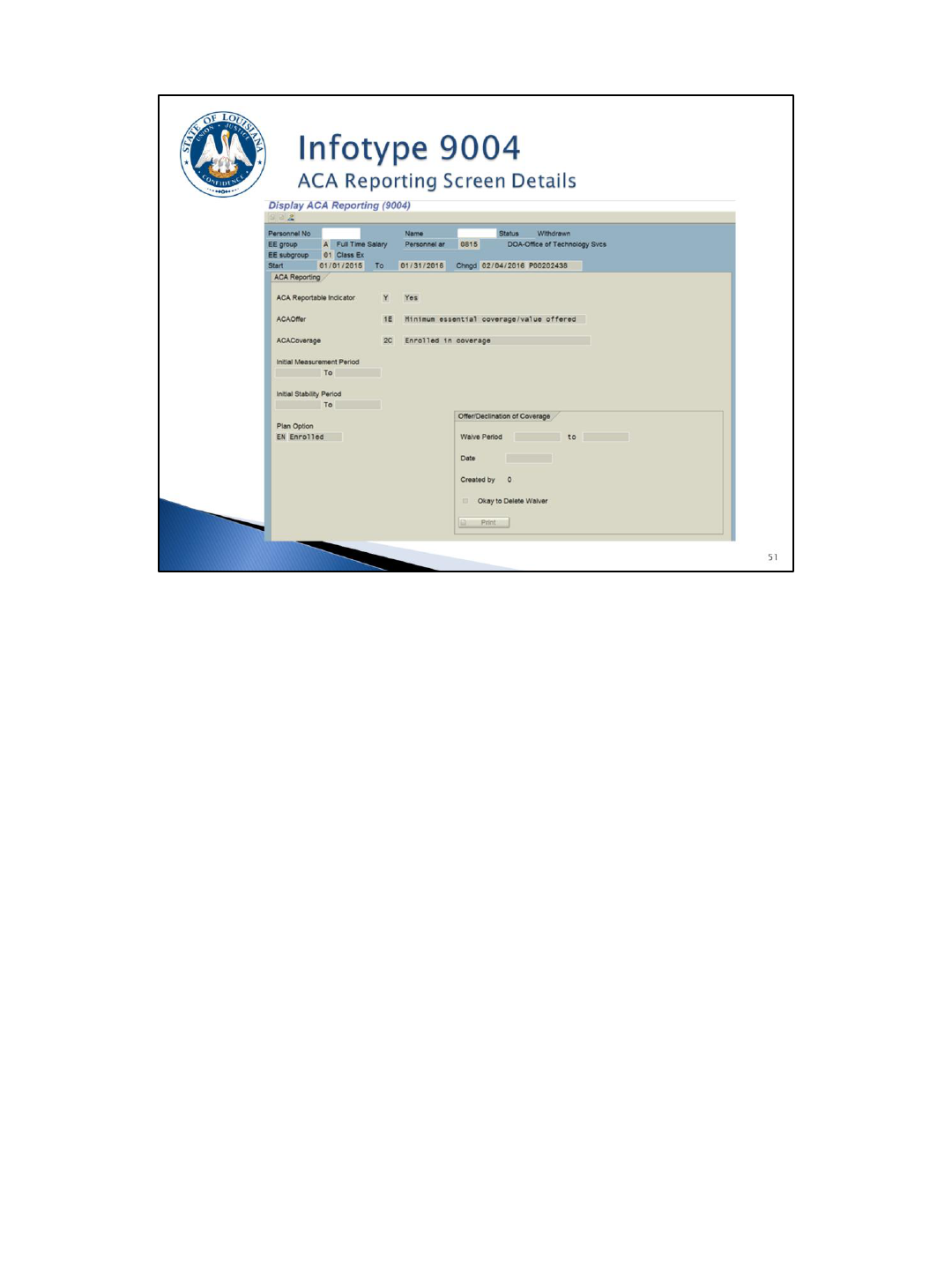

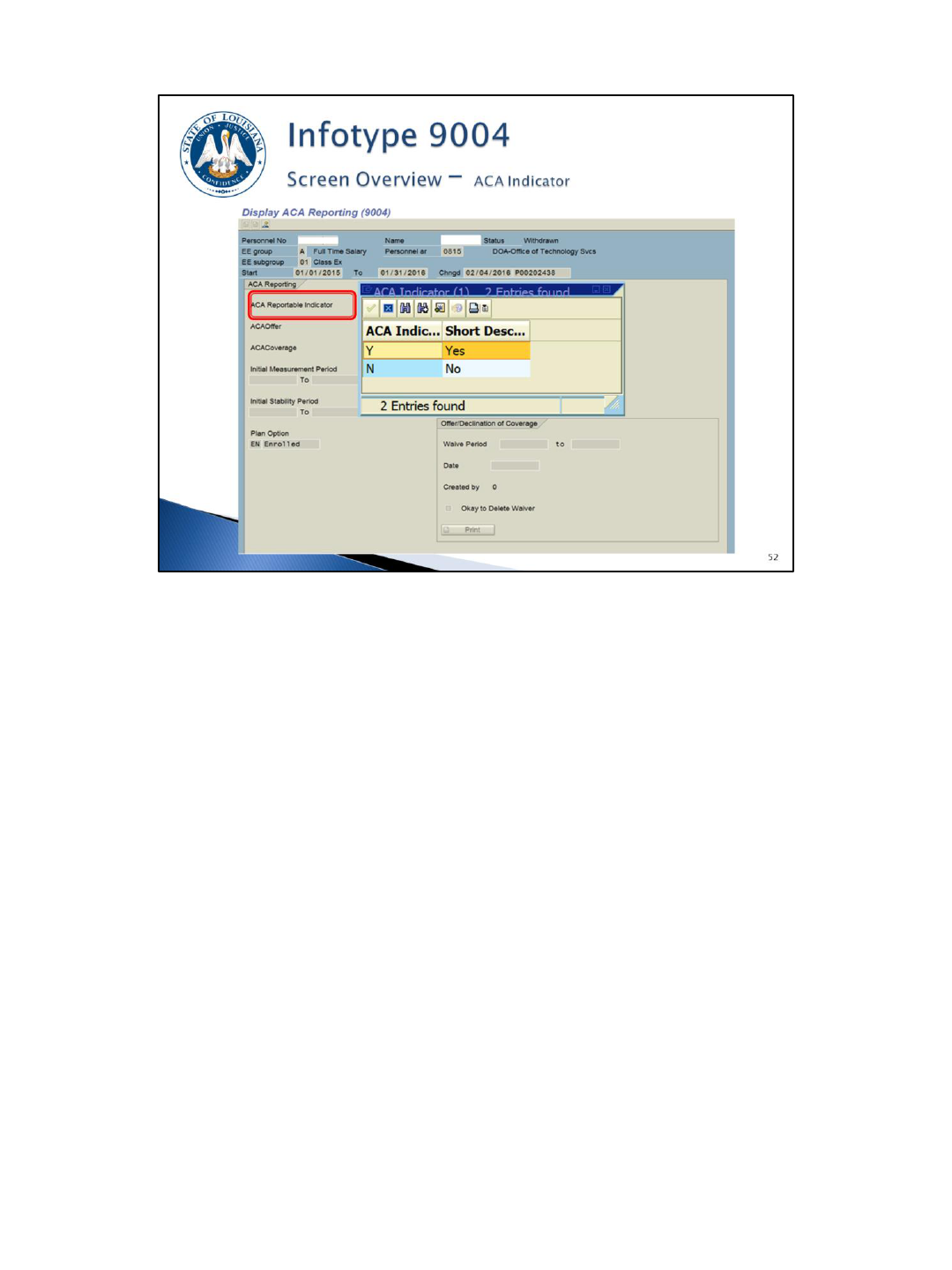

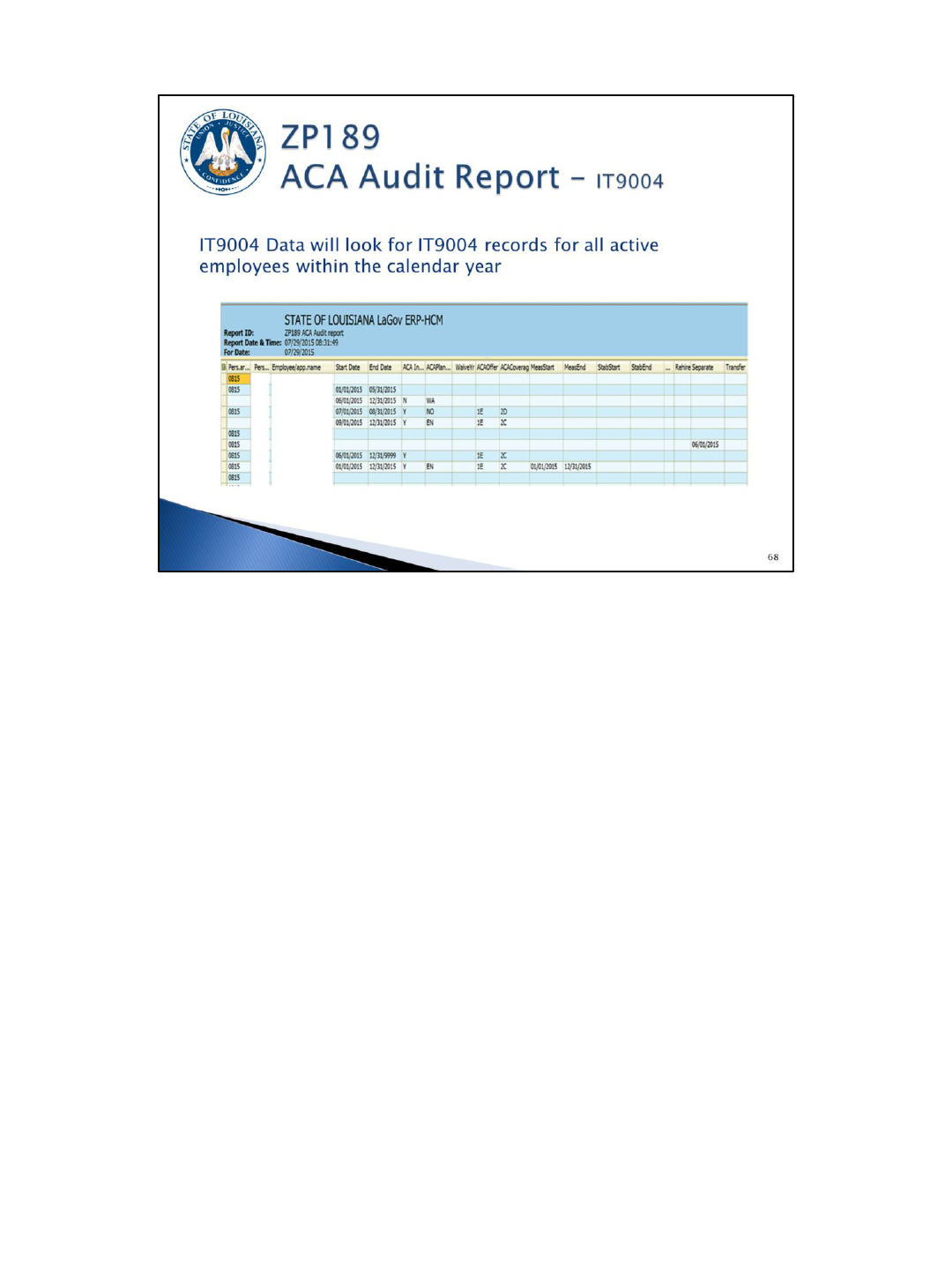

In order for us to do the reporting, a new infotype (IT9004) was created in LaGov HCM to capture the needed ACA data. The information on this

infotype will be used to determine whether or not an IRS Form 1095-C is created for an employee. We will know this based on the ACA

reportable indictor on the infotype where you will select Yes or No.

Agencies are required to create this infotype for every employee who is active any month during the calendar year regardless of whether they are

now separated. You will only need to create it for the months when the employee was active.

A new infotype will have to be created each year for non-FT employees and FT employees who waive coverage.

For FT employees who have coverage, the infotype can be created with an infinity end date (12/31/9999) so you won't have to create a new one

each year.

This infotype has been added to certain hire/transfer actions, so you will either create, display, or edit the infotype when you are hiring an

employee in LaGov HCM, depending on the type of action. You should make this process a part of your new hire checklist.

Again, you will only create the IT9004 for the period the employee was active – not necessarily for the full year.

In addition, newly hired ACA FT employees will require 2 IT9004 records. One for the admin period, which is the date of hire thru the eligibility

date and then another for the eligibility period. For example, if a FT employee is hired June 5

th

and enrolls in coverage, you will create an IT9004

record for June 1-July 31 to represent the admin period and then copy the record for August 1 through 12/31/9999 to represent the coverage

period. (NOTE: The begin date should always be the first day of a month and the end date should always be the last day of a month.)

You will have the ability to mass create this infotype for groups of employees using transaction ZP38.

You will also need to copy the IT9004 record anytime any part of the record needs to be changed, so an employee can have multiple IT9004

records during a given year.

You will be required to populate the following fields on IT9004: the ACA Reportable Indicator, Offer Code, the Coverage Code, the Initial

Measurement Period Start and End Dates, when applicable, the Initial Stability Period Start and End Dates, when applicable, and the Plan Option.

You will populate IMP and ISP dates for new, non-FT employees.

IT9004 records must be created for all employees (employed at any point during the year) beginning with calendar year 2015. For eligible

employees who were offered coverage, but waived coverage, a GB-01 should be obtained with the “Acknowledge Offer and Decline Health

Insurance Coverage” section completed.

While doing your entry, keep in mind that even though we have met the IRS threshold for 2015, we still have to capture the data to report it in

2016 and subsequent years, and the only way we know whether to create a form is based on you completing this Infotype.

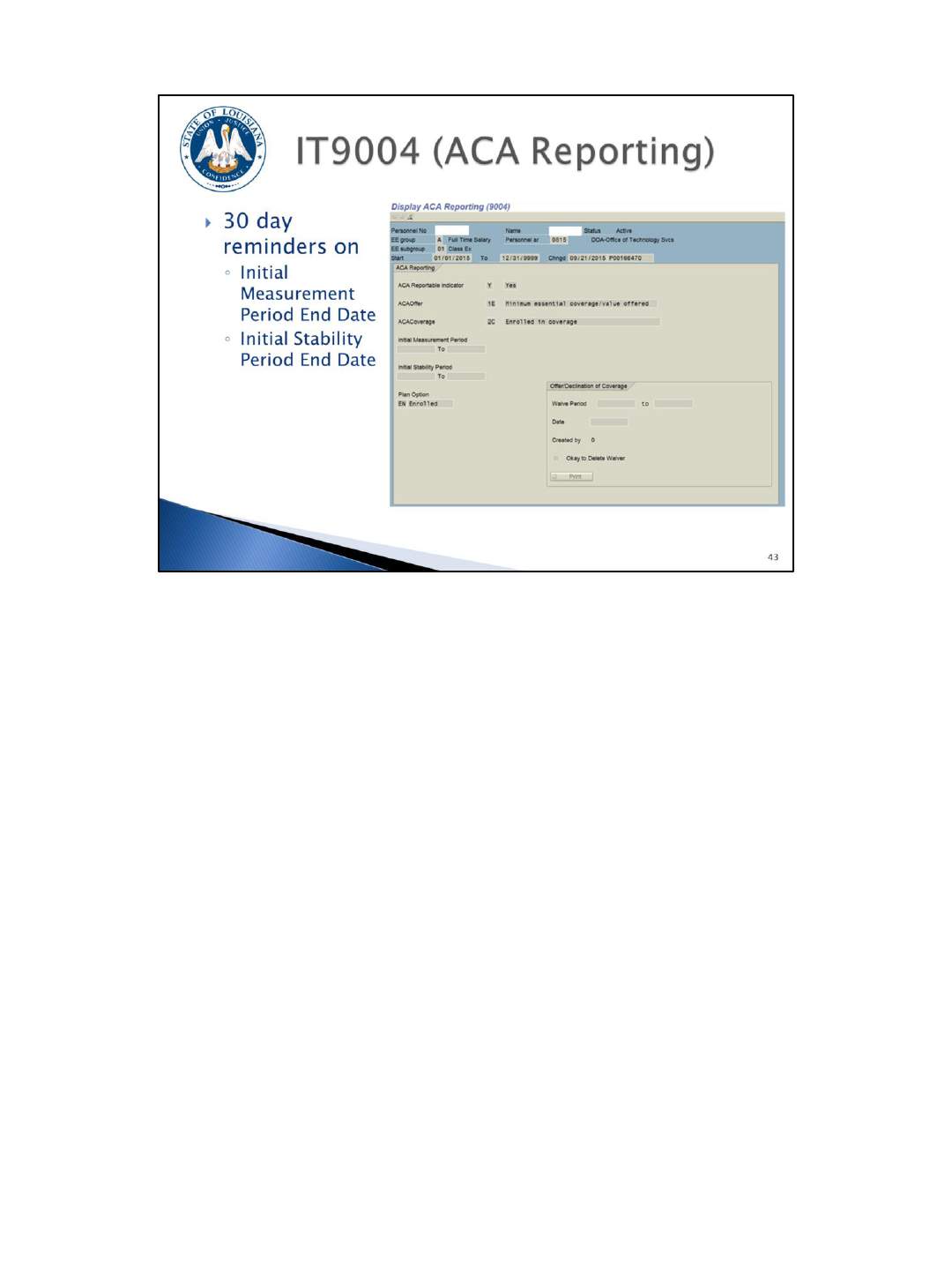

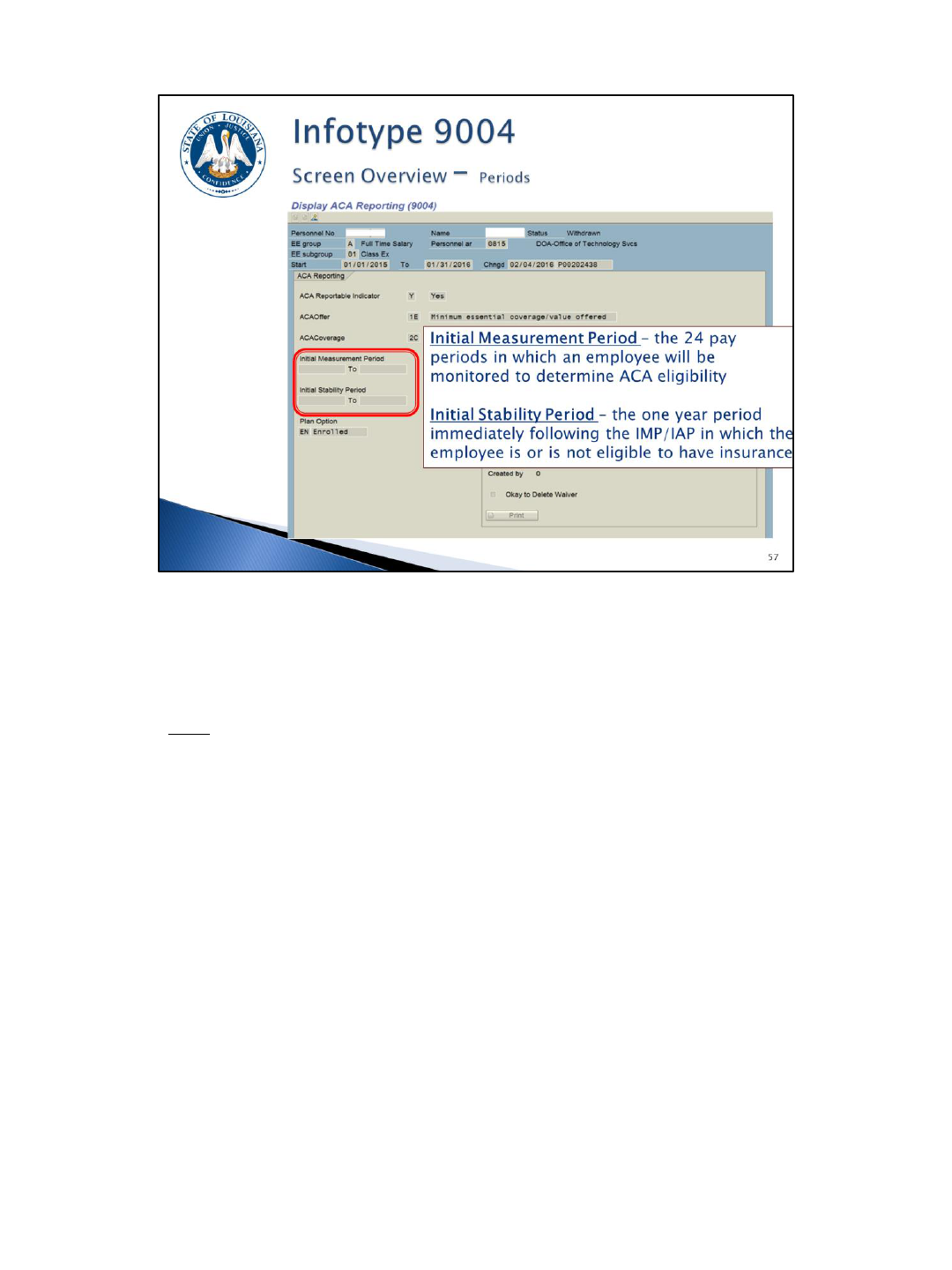

This is a quick glance of the IT9004 screen. One thing to note is when an Initial

Measurement Period or Initial Stability Period is entered here, a date reminder will be

created that will send you an e-mail 30 days prior to the end of the period. At that

time you should begin “counting” the employee’s hours using ZP136 to determine

their eligibility.

The reminder e-mail will be sent to the ACA contact(s) on ZP200, so you should

review your contacts and update them if necessary. The reminder will also be

included on the date reminder report (ZP08).

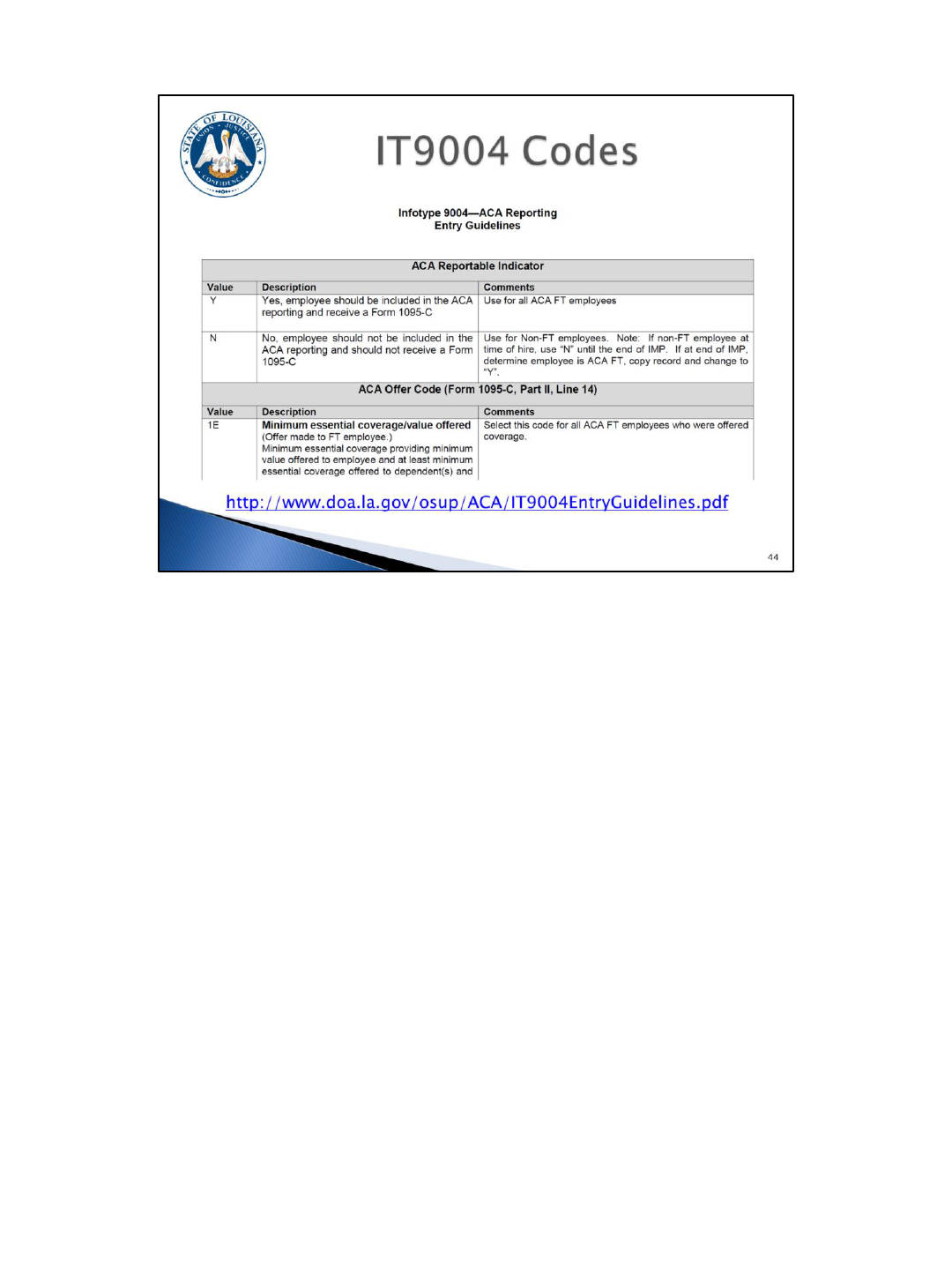

We’ve created an entry guidelines chart for you to use to create your IT9004 records.

Here is a snapshot of the IT9004 ACA Reporting Entry Guidelines chart. The entire chart can

be found on the web page listed on the slide.

This document will list the fields that you will see on IT9004 and their possible entries.

You will use this chart and the employee scenario document (to be covered on the next slide)

to create the IT9004 records for all of your employees.

The codes that are available for the IT9004 record are the IRS codes that will be used on

Form 1095-C.

The “ACA Reportable Indicator” field will determine who should be included in the ACA

reporting and receive a Form 1095-C.

The “ACA Offer Code” field shows whether an offer was made to the employee.

The “ACA Coverage Code” field shows if the employee had coverage or explains why they

didn’t have coverage.

There will be some codes that you will see on the ZP189 ACA Audit Report that you will not

have access to on IT9004: 2A and 2G. We have included them on this chart so you will know

why they were used for a particular employee.

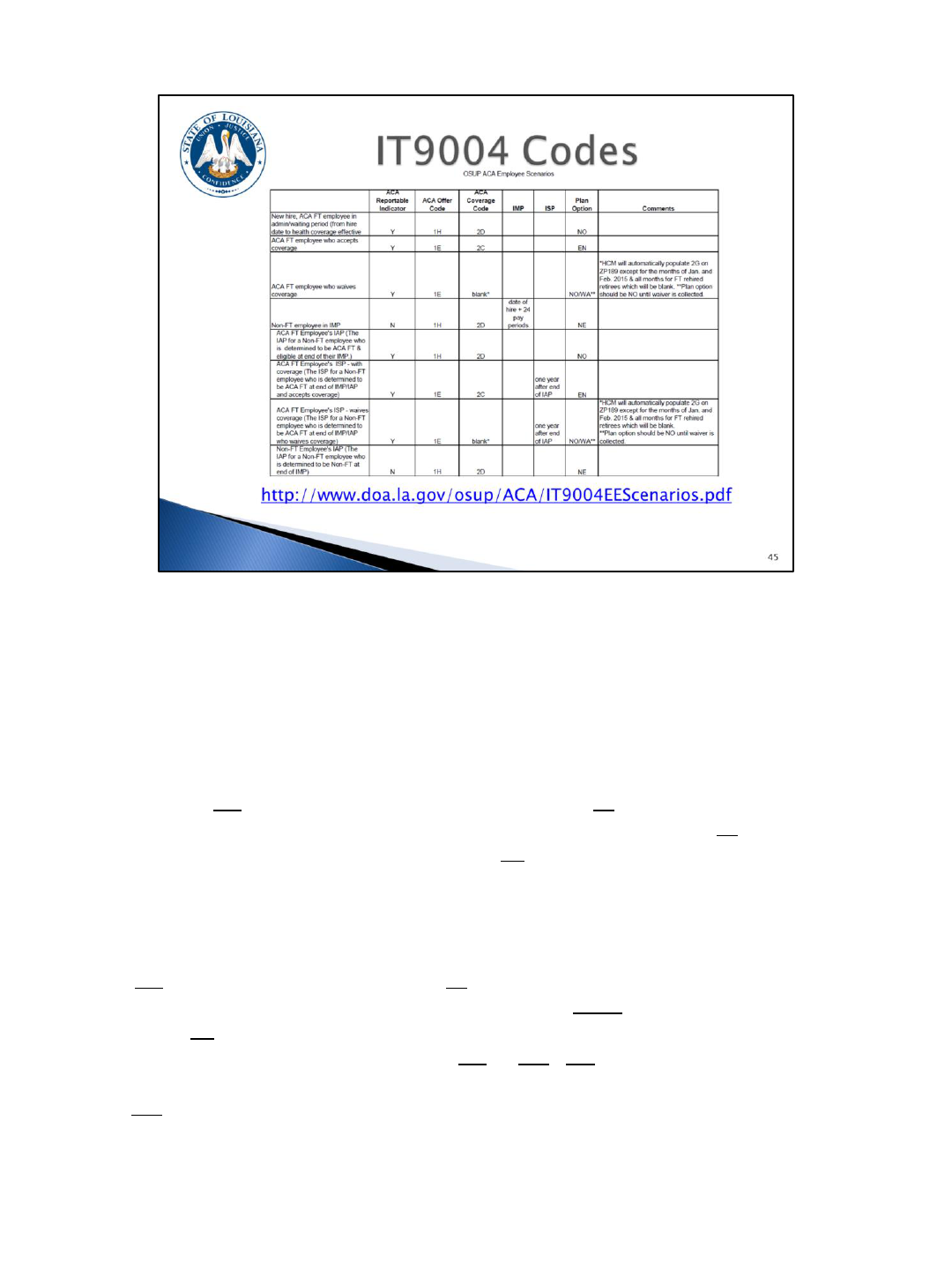

Here is a snapshot of the OSUP ACA Employee Scenarios chart. The entire chart can

be found on the web page listed on the slide.

Let’s go through a couple of scenarios. If we look at the second and third scenarios,

these will cover most of your employees.

We have an ACA FT employee who elected coverage. Their ACA Reportable Indicator

would be Yes; their ACA Offer Code would be 1E for Minimum Essential

Coverage/Minimum Value offered; their ACA Coverage Code would be 2 C for Enrolled

in Coverage; and their Plan Option would be EN for Enrolled. Since this is not a new

employee, you wouldn’t complete the Initial Measurement Period or Initial Stability

Period date fields.

For an ACA FT employee who waives coverage their ACA Reportable Indicator would

be Yes; their ACA Offer Code would be 1E for Minimum Essential Coverage/Minimum

Value offered; their ACA Coverage Code would be Blank, HCM will automatically

populate 2G on Form 1095-C for Section 4980H affordability federal poverty line safe

harbor; and their Plan Option would be NO or WA. NO is used until the GB-01 with

the waiver information completed is collected and then you change the Plan Option

to WA for waived. You must remember to complete this final step to ensure that the

Form 1095-C is completed correctly.

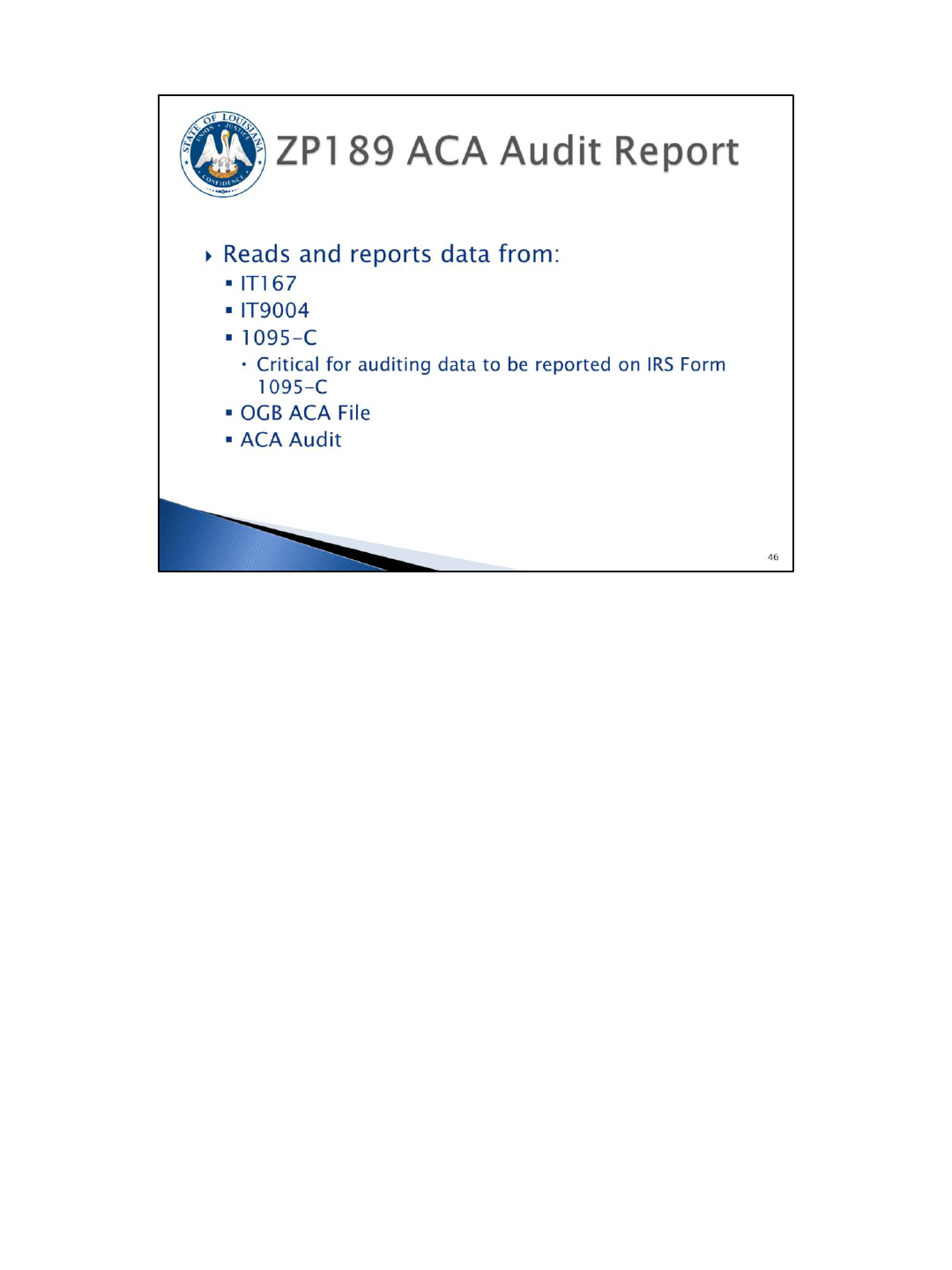

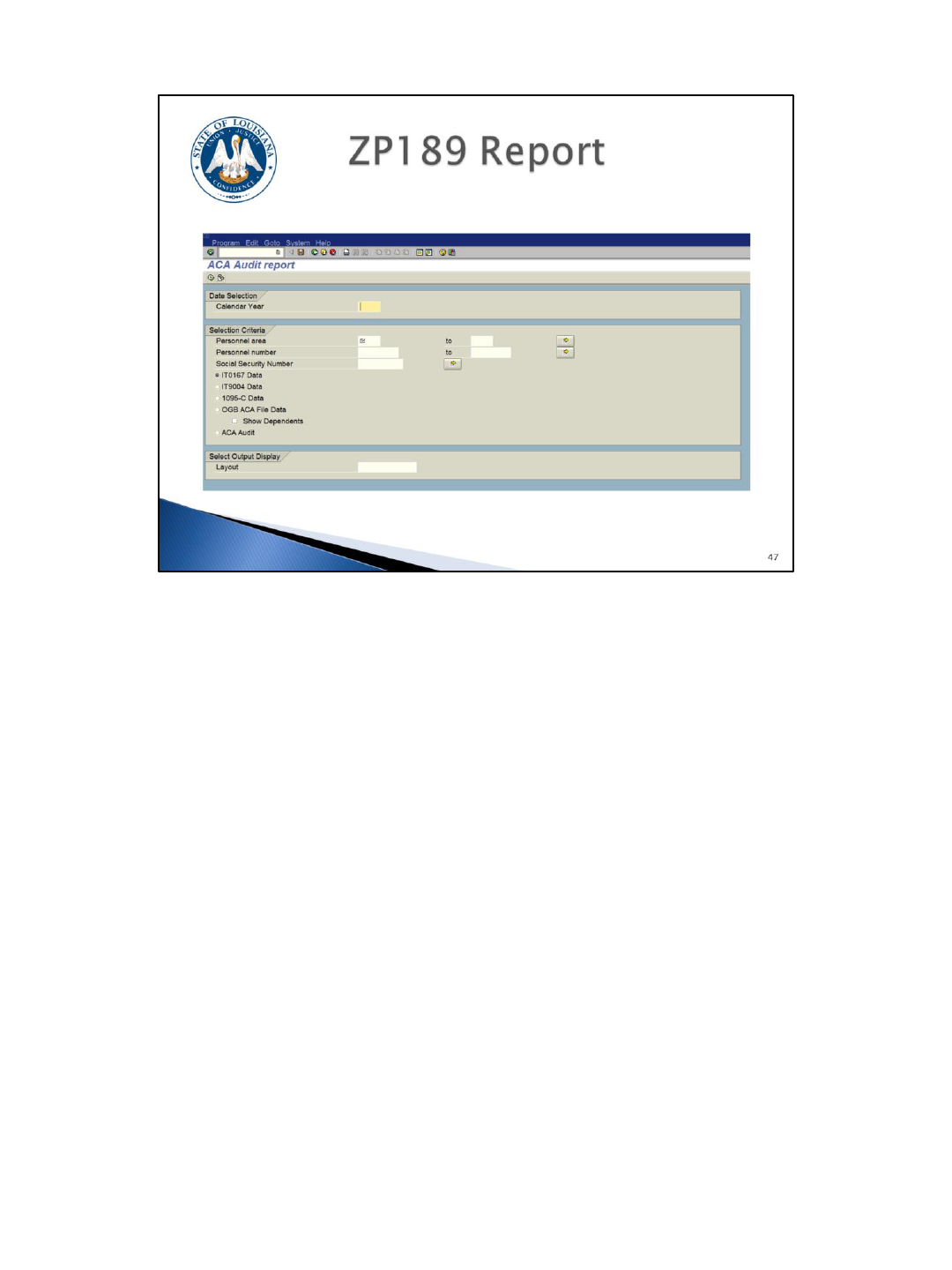

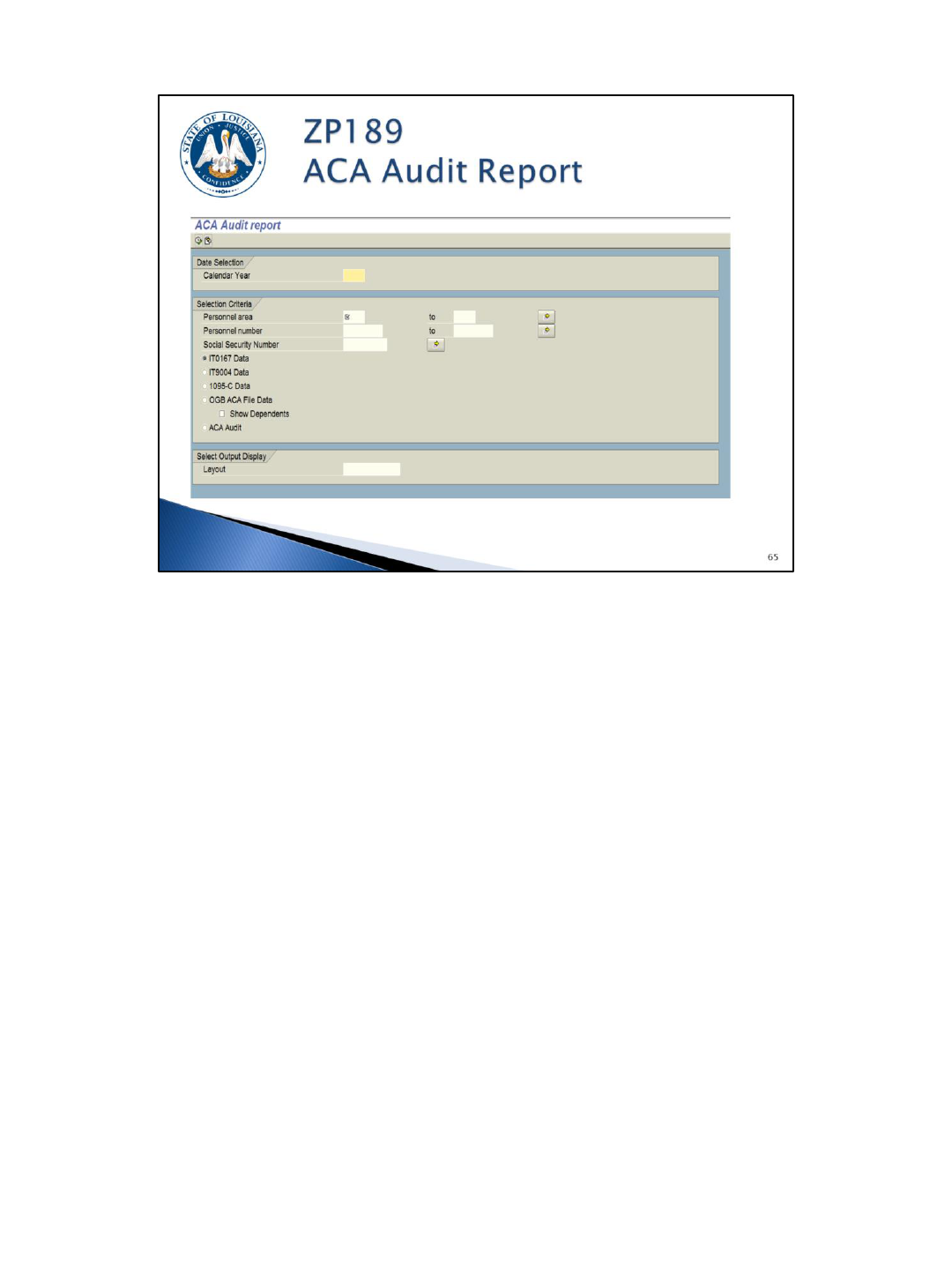

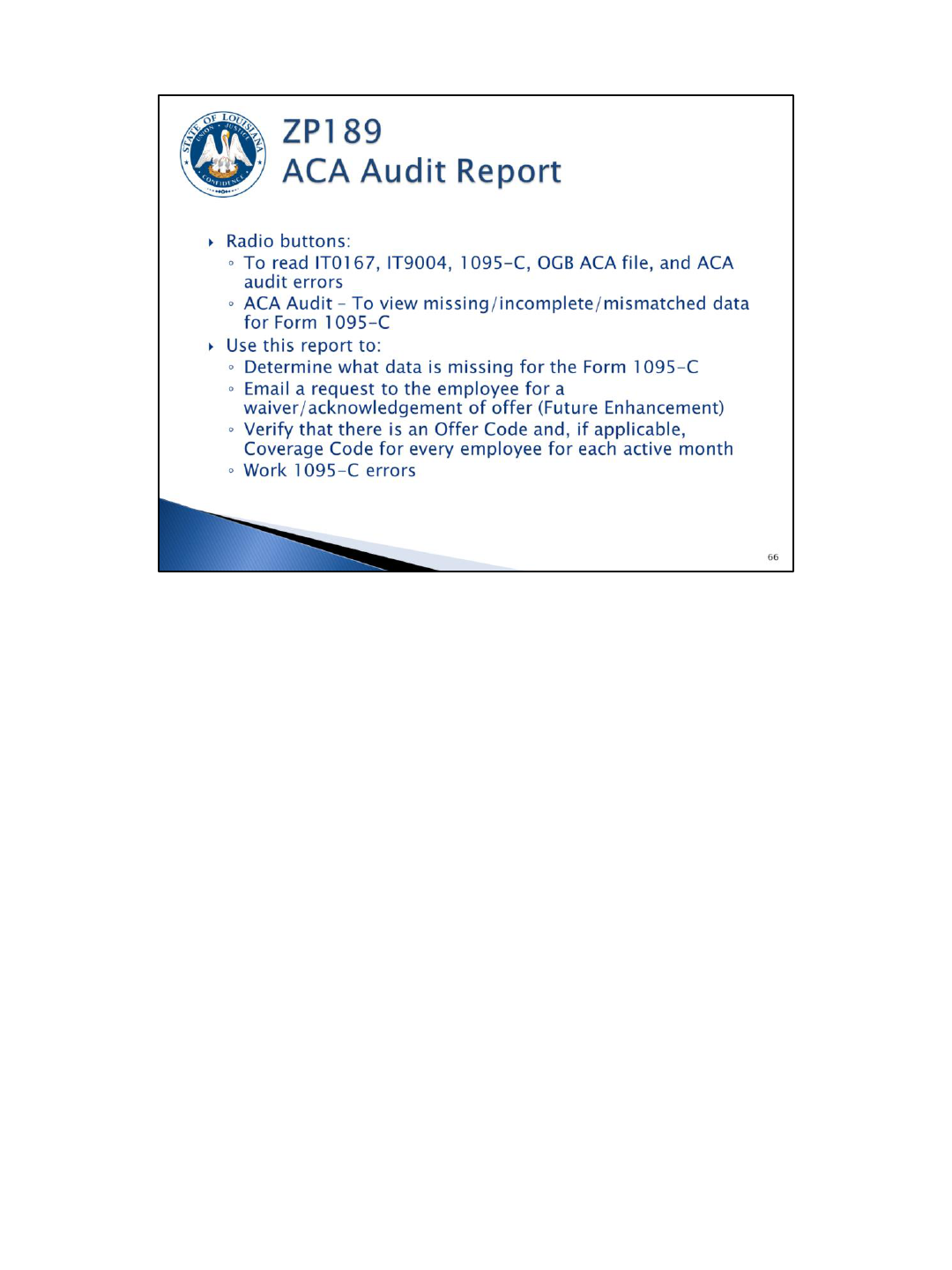

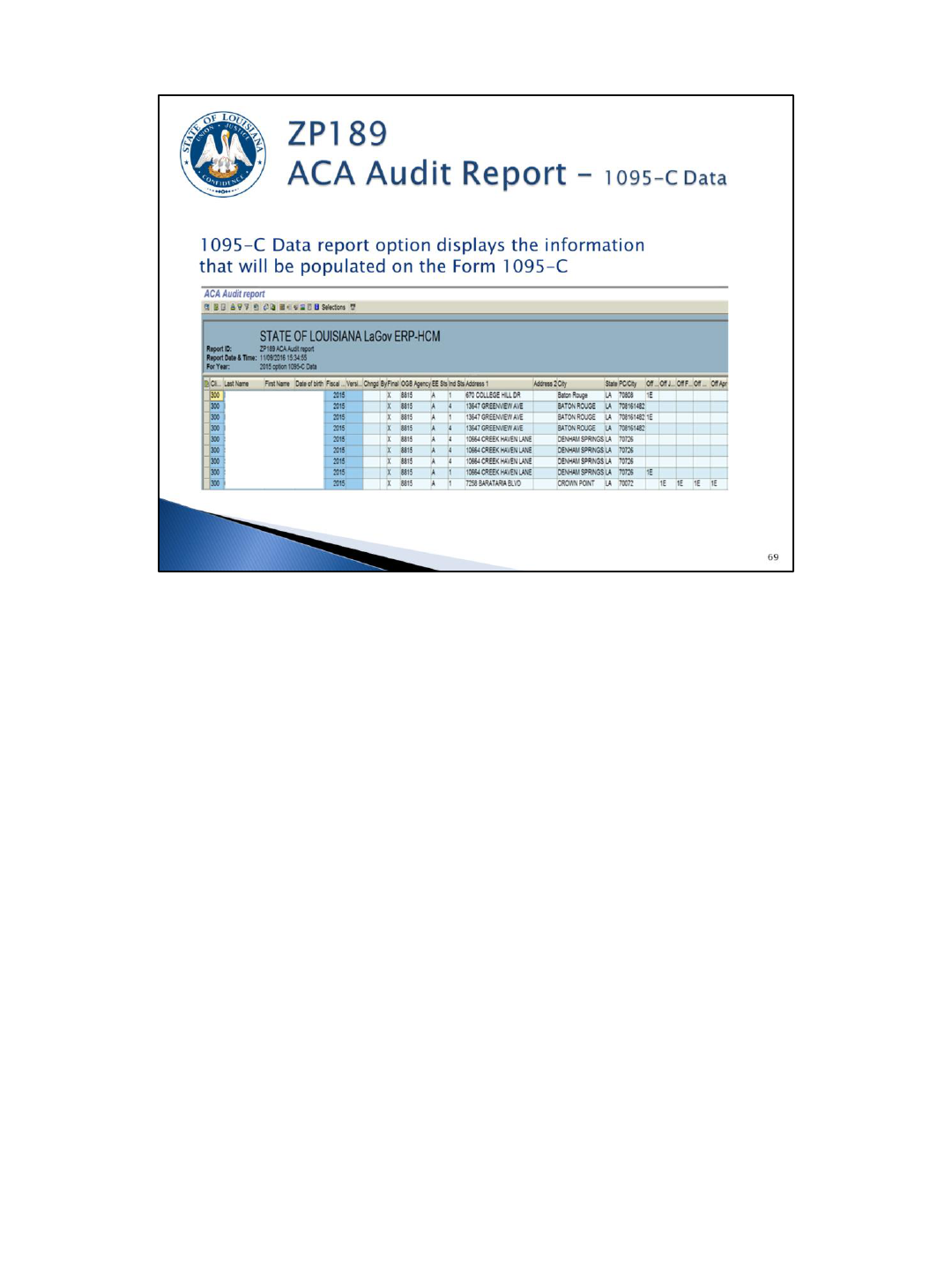

The ZP189 ACA Audit Report will be used to audit the information that will be

reported on the IRS Form 1095-C.

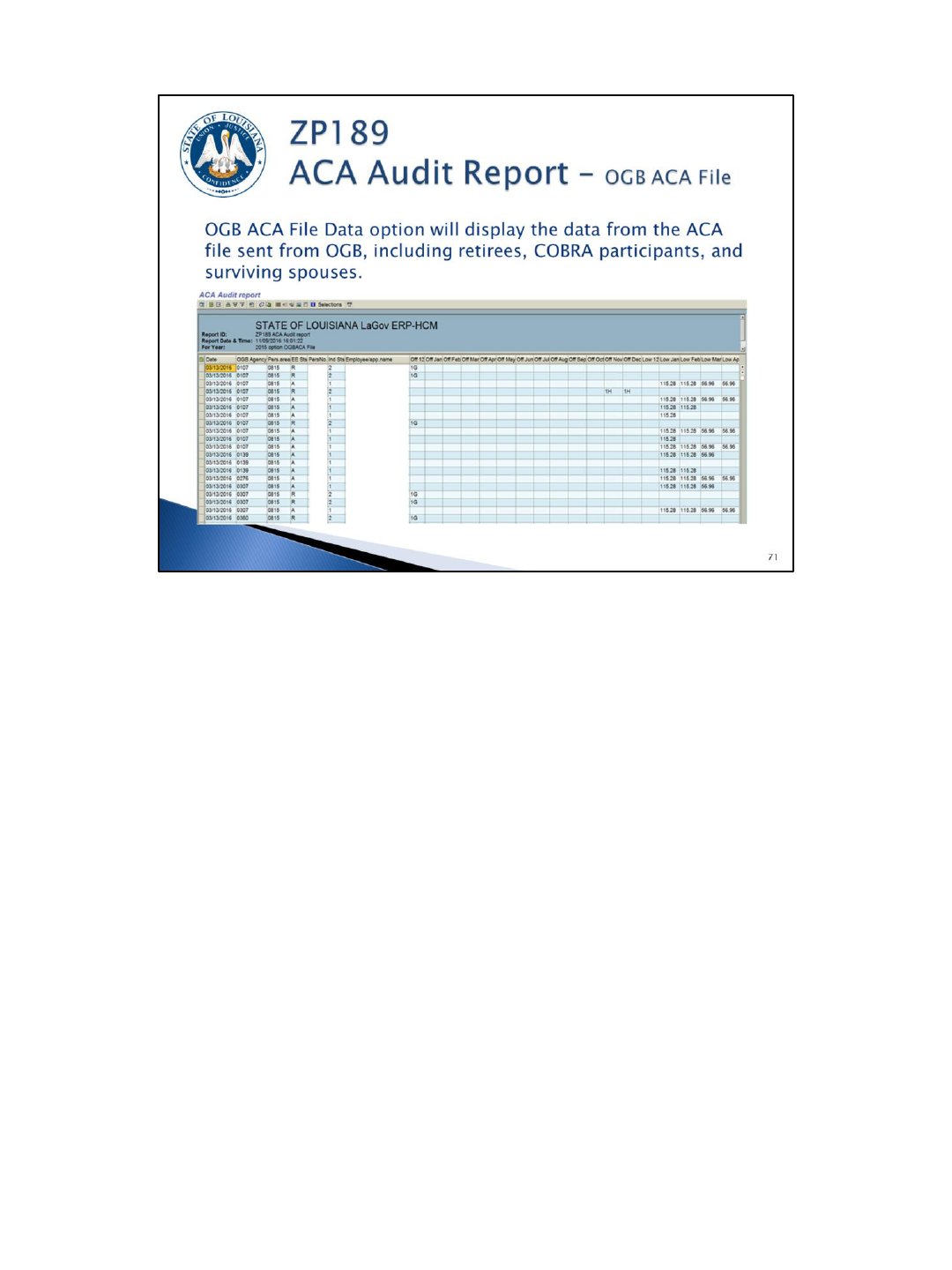

There are five (5) report options:

1) The IT0167 Data radio button: Reads health plan data from IT0167, the Health

Plans infotype. This option also includes a hire, rehire, separation, transfer to NP,

and/or transfer from NP date if in the calendar year.

2) The IT9004 Data radio button: Reads data from the IT9004 records that you will

be creating.

3) The 1095-C Data radio button: Displays what information will be used to populate

the IRS Form 1095-C.

4) The OGB ACA File Data option: Reads the file that we are receiving directly from

OGB. It includes coverage information for employees, retirees, COBRA, survivors,

and their dependents. OGB is providing a full file daily. If a change is made in

eEnrollment, the HCM system will be updated the next business day.

5) The ACA Audit option: Displays various messages identified by OSUP and/or OTS.

This is a quick glance of the ZP189 report selection screen. The report options will be

covered in greater detail later in the training material.

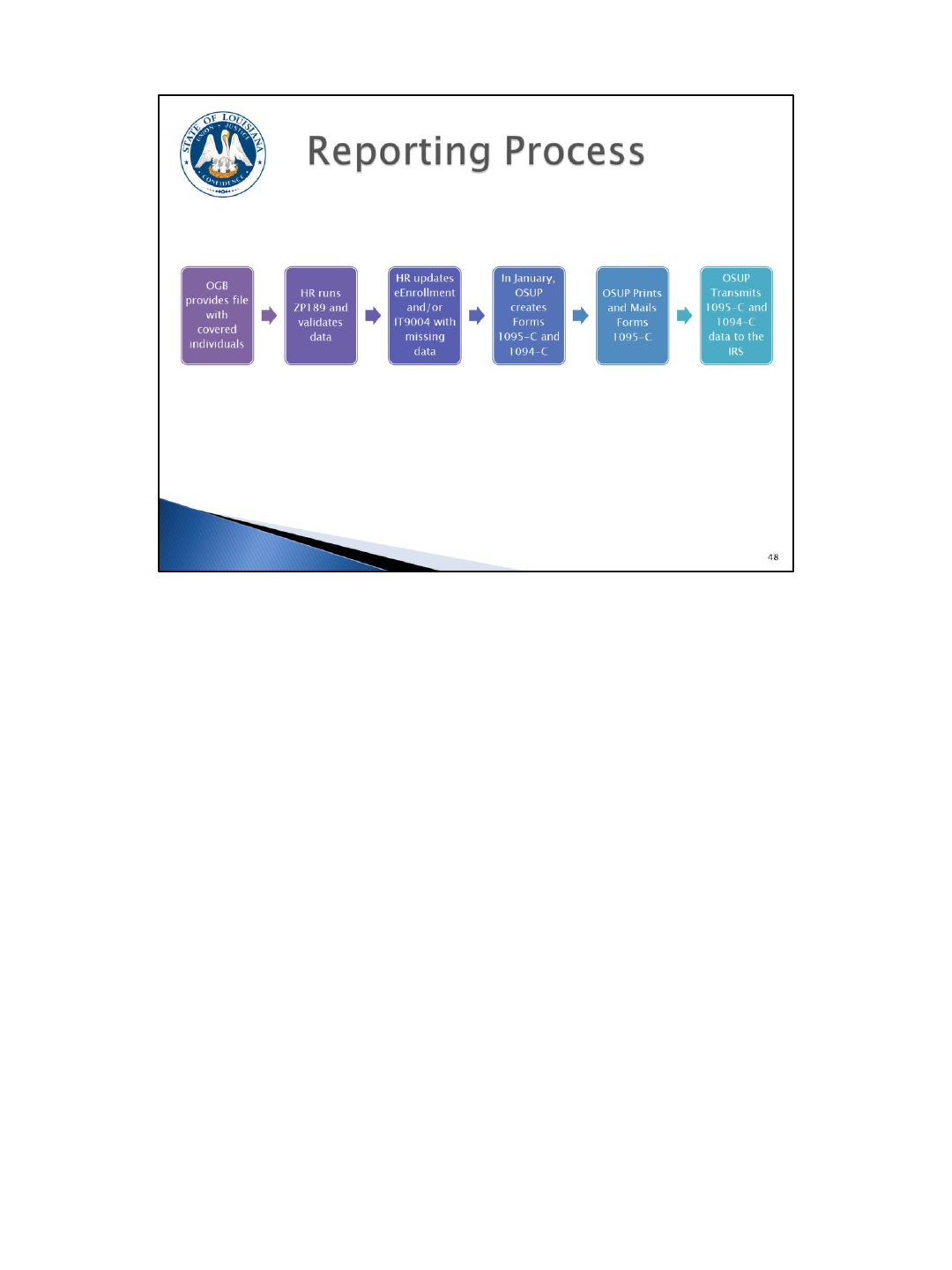

This graphic recaps the reporting process.

First, we will be receiving a daily file from OGB which will report information for

covered individuals.

Agencies should review the data on ZP189 to validate the data. Any inconsistencies

identified from ZP189 should be corrected via IT9004, LaGov HCM, and/or

eEnrollment.

In January, OSUP/OTS will use the data to create the IRS forms. It is most important

that the data is accurate so that we can produce correct forms. We are required to

provide a form to any person who was eligible for health coverage, regardless of

whether they had coverage or not.

In January, OSUP/OTS will print and mail the forms to employees. Forms will also be

provided to retirees, survivors, and COBRA participants who are enrolled in any self

insured plan (Blue Cross Plans, and LSU Health).

Finally, OSUP/OTS will transmit the data file to the IRS.

Agencies need to identify the person(s) at their agency designated as the ACA

contact.

Agencies can run ZP200 and search for Contact Type 025 to determine if an ACA

contact exists.

ACA contacts can be added or changed using ZP200.

Refer to the “Agency Contacts” in LaGov Online Help for instructions.

Multiple ACA contacts may be added. We recommend having at least 2 ACA contacts,

but 3 would be preferred. These contacts will be used to send out reminder

notifications that we will discuss later.

This infotype will be used to store important information needed for ACA reporting.

An employee’s record can be created directly from the infotype screen through PA30 or it can be

created for multiple employees at the same time using ZP38. IT9004 will also be part of the hire,

rehire, and transfer in from non-paid agency actions.

This infotype is used to store offer codes, coverage codes, and other ACA data.

All employees active at any point within the calendar year should have an IT9004 record covering all

active months. Action dates are provided on the ZP189 IT9004 Data report option to make auditing

easier.

Reminder: HR must create IT9004 records for 2015 for everyone and annual records will be required

for all non FT employees or employees who waive coverage. Waiver forms must be obtained for each

year an employee waives coverage.

For on-going employees with coverage, the end date should be 12/31/9999. It is not necessary to

create new IT9004 records every year unless the employee’s coverage option changes or their

employment status changes.

Agencies should use the Infotype 9004—ACA Reporting Entry Guidelines chart

(http://www.doa.la.gov/osup/ACA/IT9004EntryGuidelines.pdf) and OSUP ACA Scenarios document

(http://www.doa.la.gov/osup/ACA/IT9004EEScenarios.pdf) to determine the correct codes to use and

refer to while viewing the following slides.

The begin date of this record can only be the first day of a month. So if my employee is hired 6/5, the

begin date of the IT9004 will be 6/1. Likewise, the end date must be the last day of a month.

This infotype will require a reportable indicator, an offer code, a coverage code (if coverage is not

waived), and a plan option.

A “WA” plan option is only allowed if the Offer/Declination of Coverage section is completed.

The ACA Reportable Indicator (required field)

Yes – Employee should receive Form 1095-C

No – Employee should not receive Form 1095-C

If the employee is not reportable and becomes reportable within the same calendar

year, the existing IT9004 record needs to be copied and changed to reflect the new

information and effective dates.

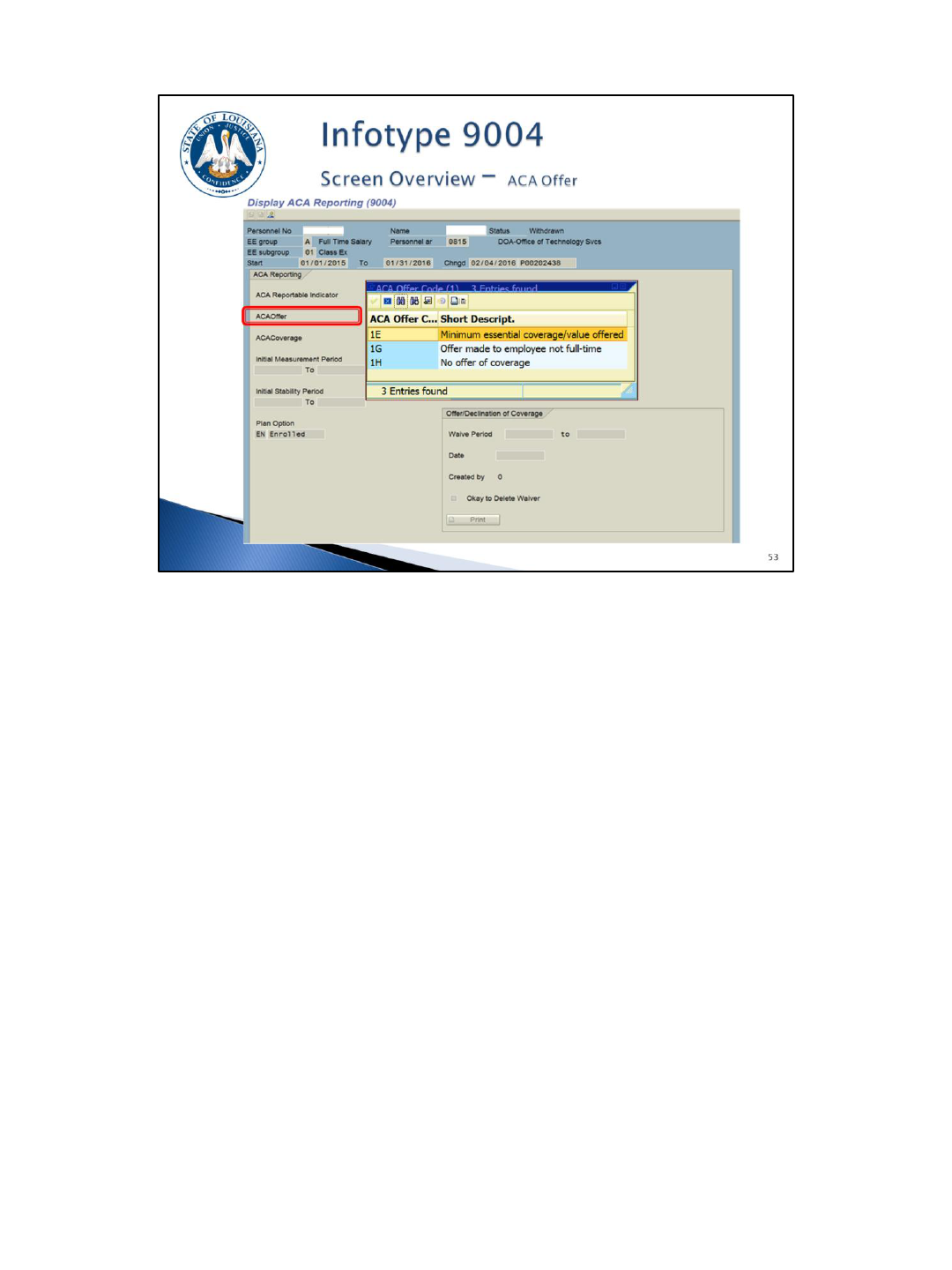

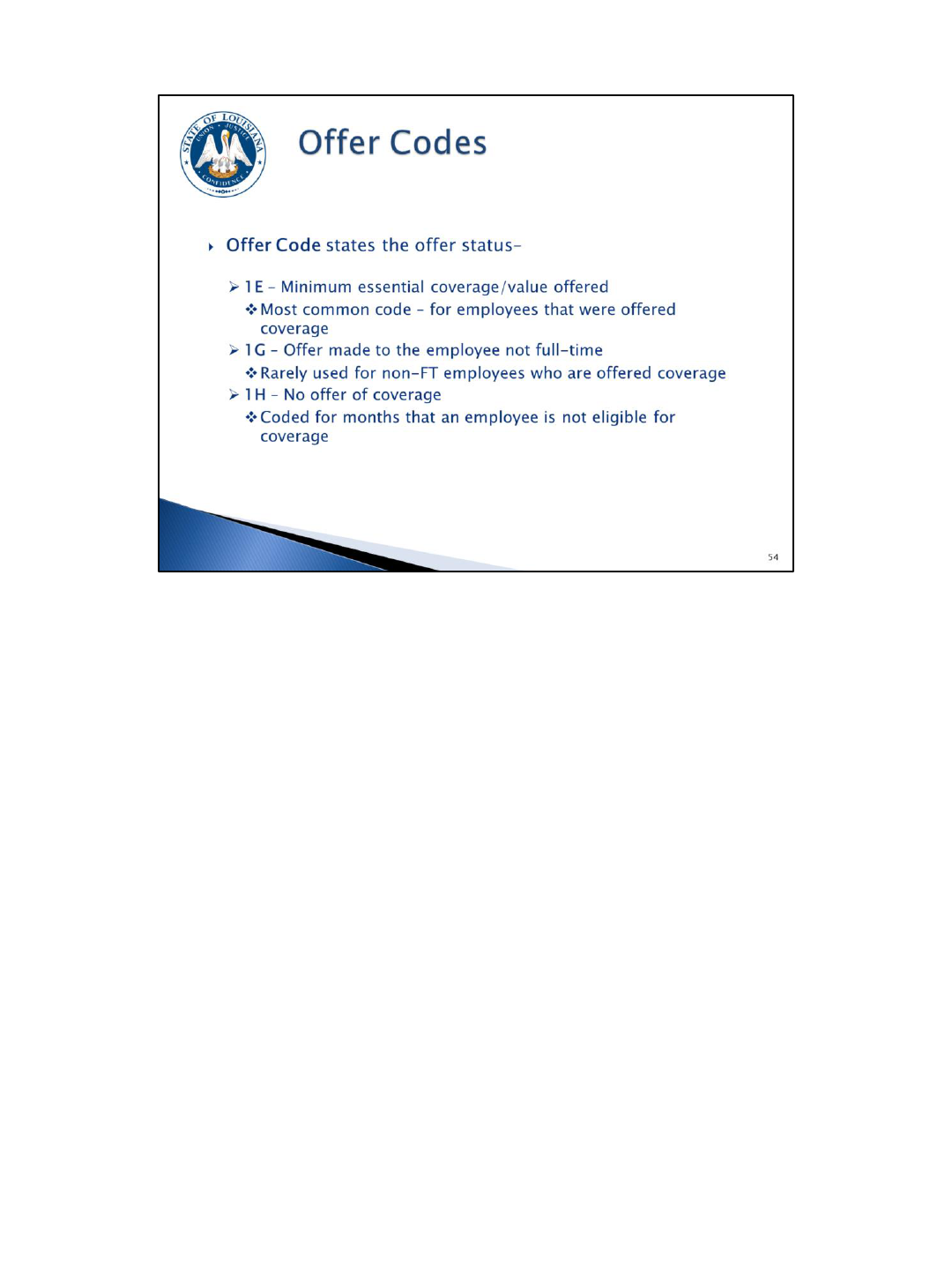

The ACA Offer Code (required field)

1E – Minimum essential coverage/value offered

1G – Offer made to employee not full-time

1H – No offer of coverage

The Offer Code field provides the offer status:

1E – Minimum essential coverage/value offered. This is the most common code and

should be used for ACA full-time employees who were offered coverage.

1G – Offer made to a non full-time employee. Use this code for non-FT employees

who are offered coverage and enrolled (rarely used). If an offer is made to a non full-

time employee and the coverage is waived, use offer code 1H instead of 1G

(reportable indicator would be “N”).

1H – No offer of coverage. Coded for months that an employee is not eligible for

coverage. It is also used during measurement and administrative periods.

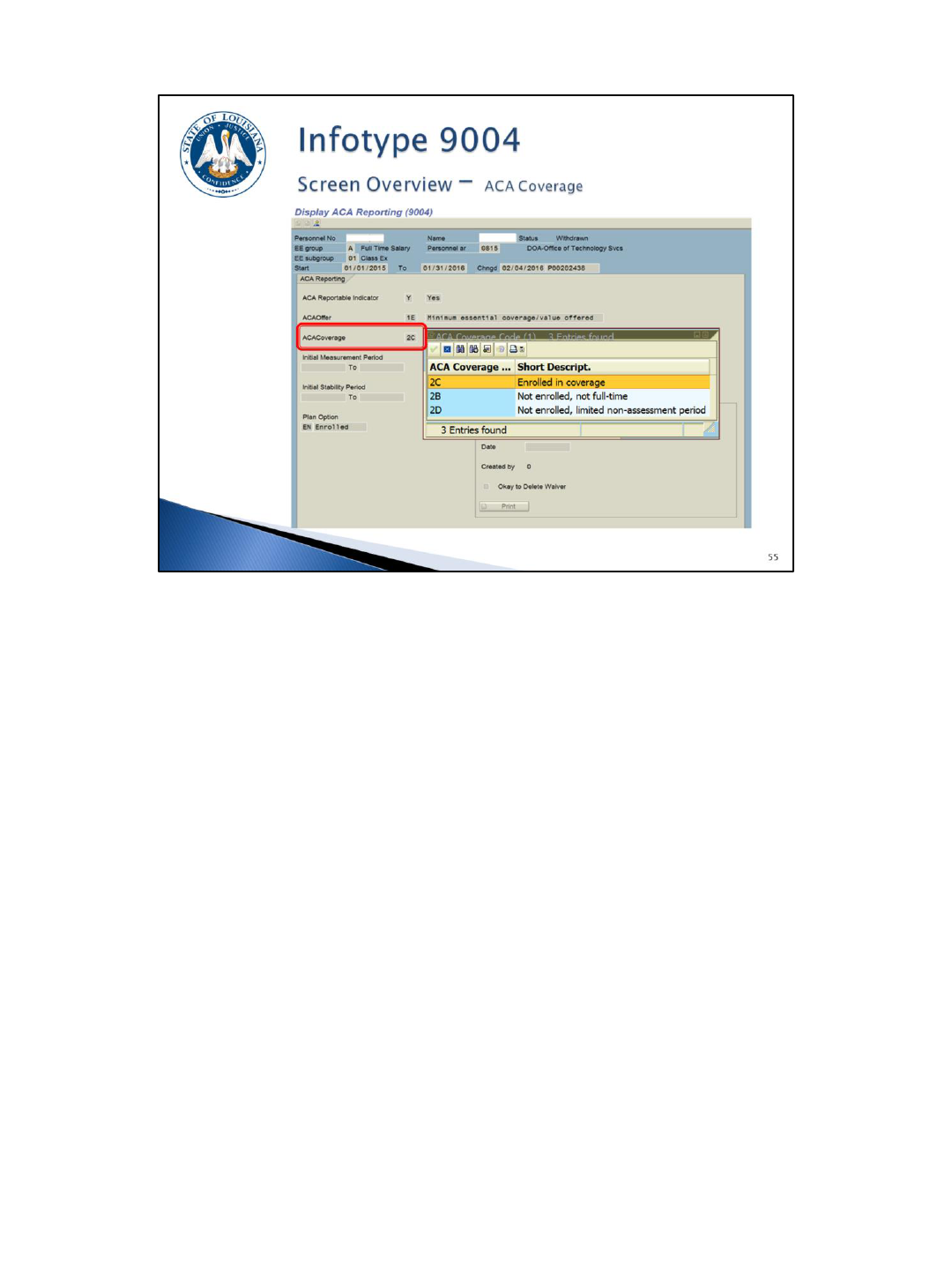

The ACA Coverage Code (only allowed to be blank if plan option is WA)

2C – Enrolled in coverage

2B – Not enrolled, not full-time

2D – Not enrolled, limited non-assessment period

Coverage Code – designates coverage status

2C – Enrolled in coverage. This is the most common code – for employees who elect

coverage.

2B – Not enrolled, not full-time. This code is used for non-FT employees who are not

ACA eligible including the non-FT employee’s ISP.

2D – Not enrolled, limited non-assessment period. This code is used for non-FT

employees during their IMP/IAP and for ACA FT employees in an

administrative/waiting period.

The coverage code must be blank for an eligible (ACA FT) employee who waives

coverage. The system will automatically populate code 2G for the Form 1095-C.

The Initial Periods

Initial Measurement Period (IMP): the 24 pay periods in which a non-FT employee

will be monitored to determine ACA eligibility; begins the first day of the first full pay

period after hire date and extends 24 pay periods.

Initial Stability Period (ISP): the one year period immediately following the IMP/IAP in

which the employee is or is not eligible to have insurance; begins the day after the

Initial Administrative Period expires and extends 12 months.

When either of these fields are completed, a Monitoring of Tasks (IT0019) record will

be created. The Initial Measurement subtype is 89 and the Initial Stability subtype is

90. Emails will be sent to the agency’s ACA contact when the reminder date is

reached. The reminder date defaults 30 days out but can be changed.

The email will contain the employee’s name, personnel number, and will tell you the

date that the initial period will end.

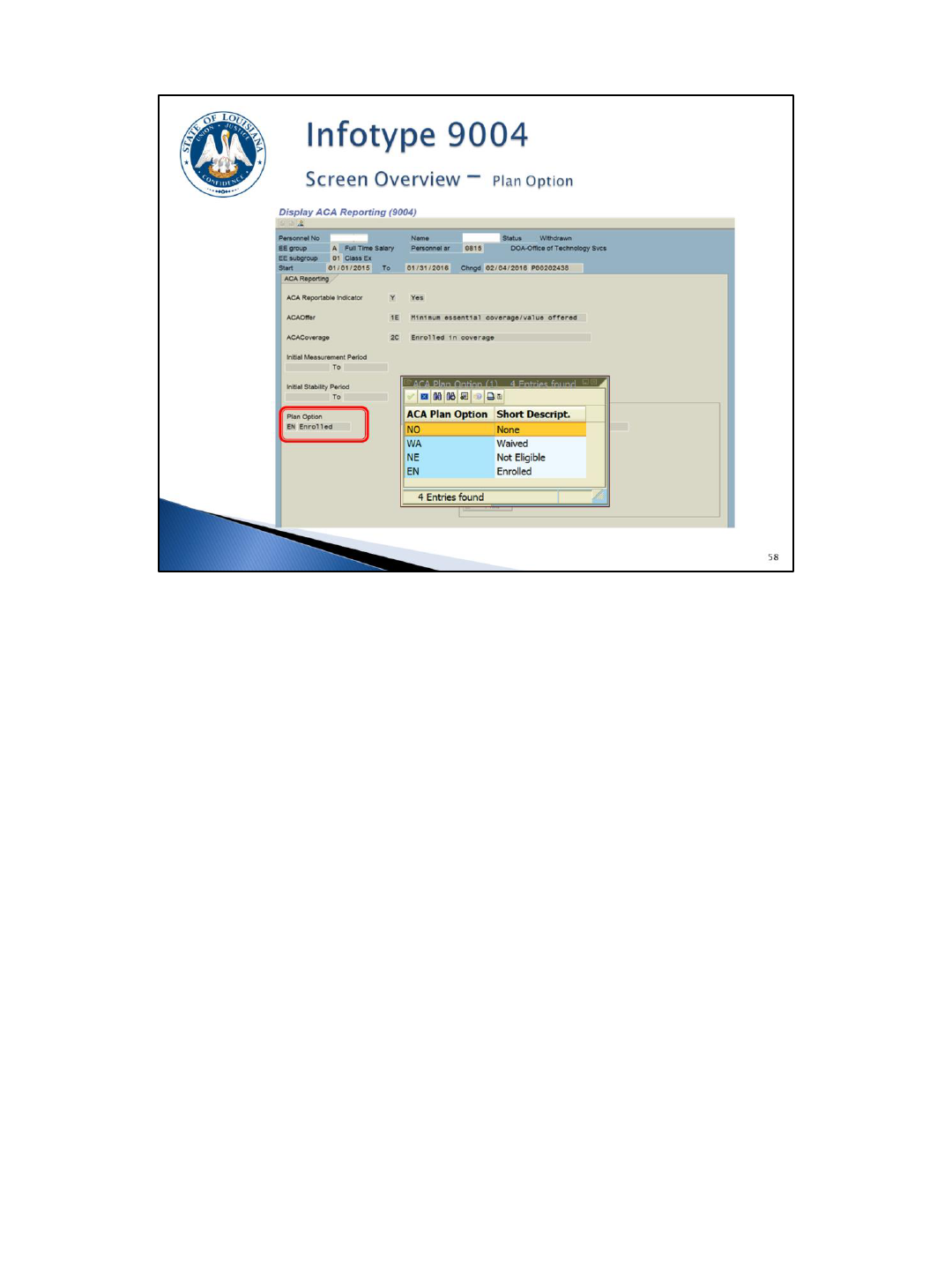

The Plan Option (required field)

NO – None

WA – Waived

NE – Not Eligible

EN - Enrolled

Plan Option – designates the plan status

NO – None. This code is used during the administrative period for ACA full-time

employees who have not yet elected coverage or waived coverage. Once the

employee submits the GB-01 form indicating election or waiver of coverage, the plan

option should be changed to EN or WA.

WA – Waived. The ACA full-time employee was offered coverage, but waived

(declined) the offer. The ACA Reportable Indicator will be “Y” for Yes. The Offer Code

will be 1E and the Coverage Code will be blank. Reminder: new calendar year

records are required for IT9004 records with a coverage indicator of WA.

Plan Option (continued) – designates the plan status

NE – Not Eligible. This code is used for employees who are not eligible for coverage.

The ACA Reportable Indicator will be “N” for No, the Offer Code will be 1H, and the

Coverage Code will be 2B or 2D.

EN – Enrolled. This code is used when an employee is offered coverage and accepts.

The ACA Reportable Indicator will be “Y” for Yes, the Offer Code will be 1E, and the

Coverage Code will be 2C. Note: for a non-FT employee with coverage, the offer

code will be 1G and the coverage code will be 2C. This is rare and should not be used

without first consulting with the OSUP BFA unit.

NOTE: There may be some instances where the Louisiana Revised Statute requires

you to offer health coverage to a non-FT employee. If the non-FT employee enrolls in

coverage, the ACA reportable indicator will be Y, the offer code will be 1G, the

coverage code will be 2C, and the plan option will be EN. If the non-FT employee

waives coverage, the ACA reportable indicator will be N, the offer code will be 1H, the

coverage code will be 2B, and the plan option will be NE.

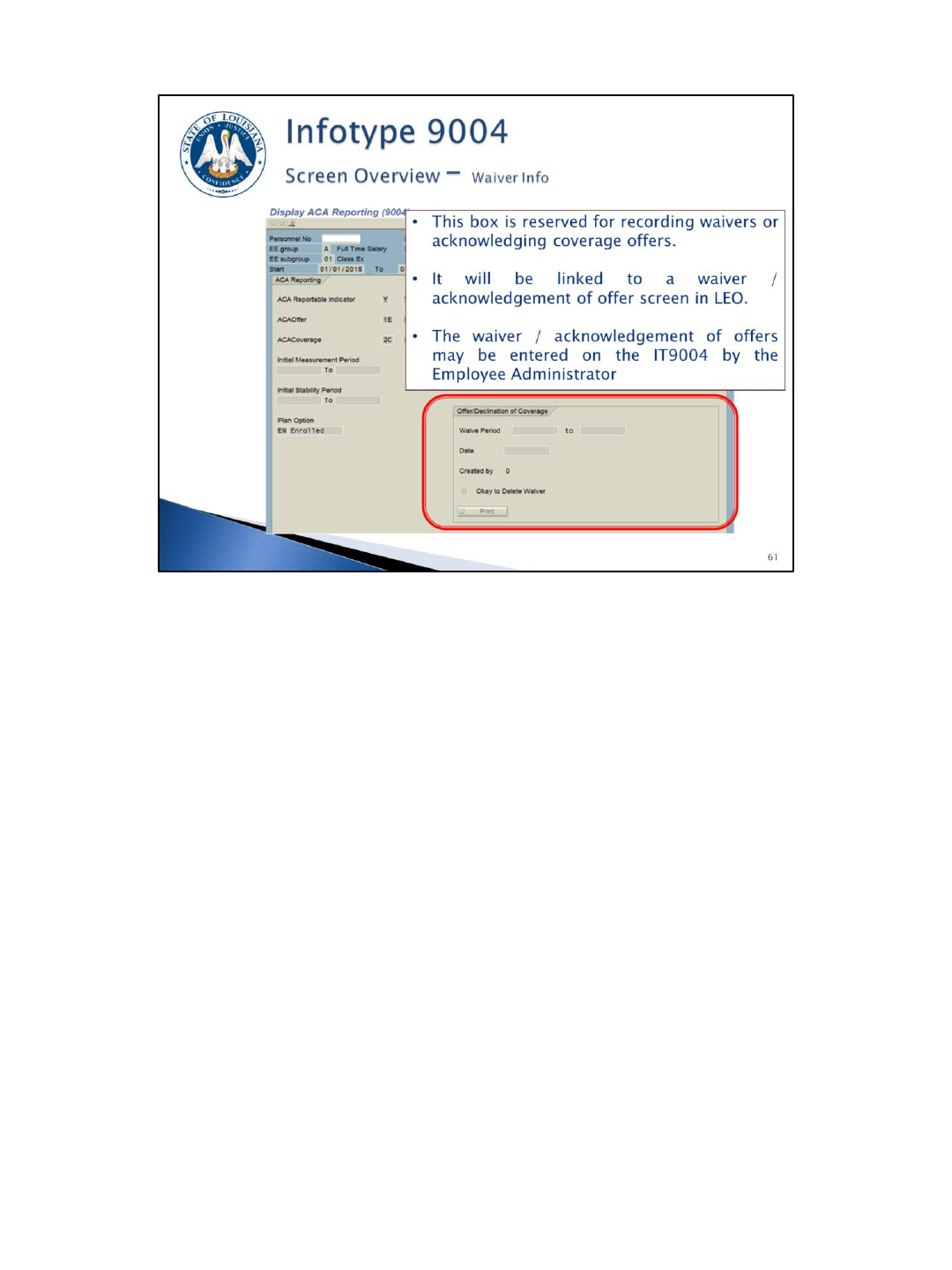

The Offer/Declination of Coverage Information

This box is used for recording Offers/Declinations of Coverage (waivers).

A future LaGov HCM enhancement will link to an Offer/Declination of coverage

screen in LEO. When the employee completes this screen, it will update an existing

infotype with the information and update the plan option with WA.

This information may also be entered on the IT9004 by the Employee Administrator.

Completion of this box requires the plan option to be WA.

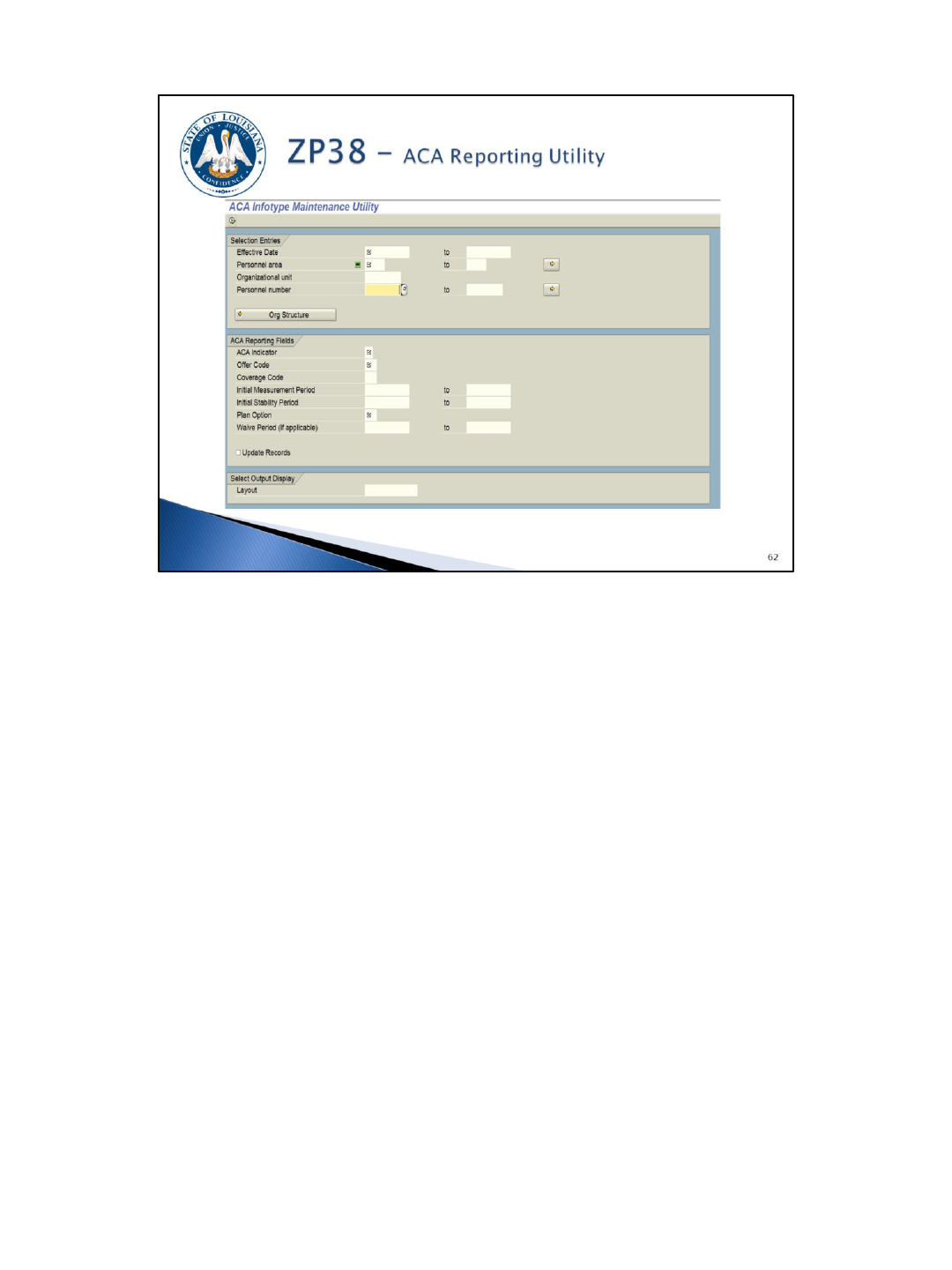

This utility is used to populate the fields on the IT9004 record as discussed earlier for

large numbers of employees at one time. So for example (refer to IT9004 scenario

document), if you identify all FT active employees with coverage for the entire year,

they can all be created with 1/1/2015 – 12/31/9999 effective dates, an ACA Indicator

of Y, an Offer code of 1E, a coverage code of 2C, and a plan option of EN.

The utility can create a record for an entire Personnel Area(s), Organizational Unit(s),

or a list of Personnel Number(s) all at one time.

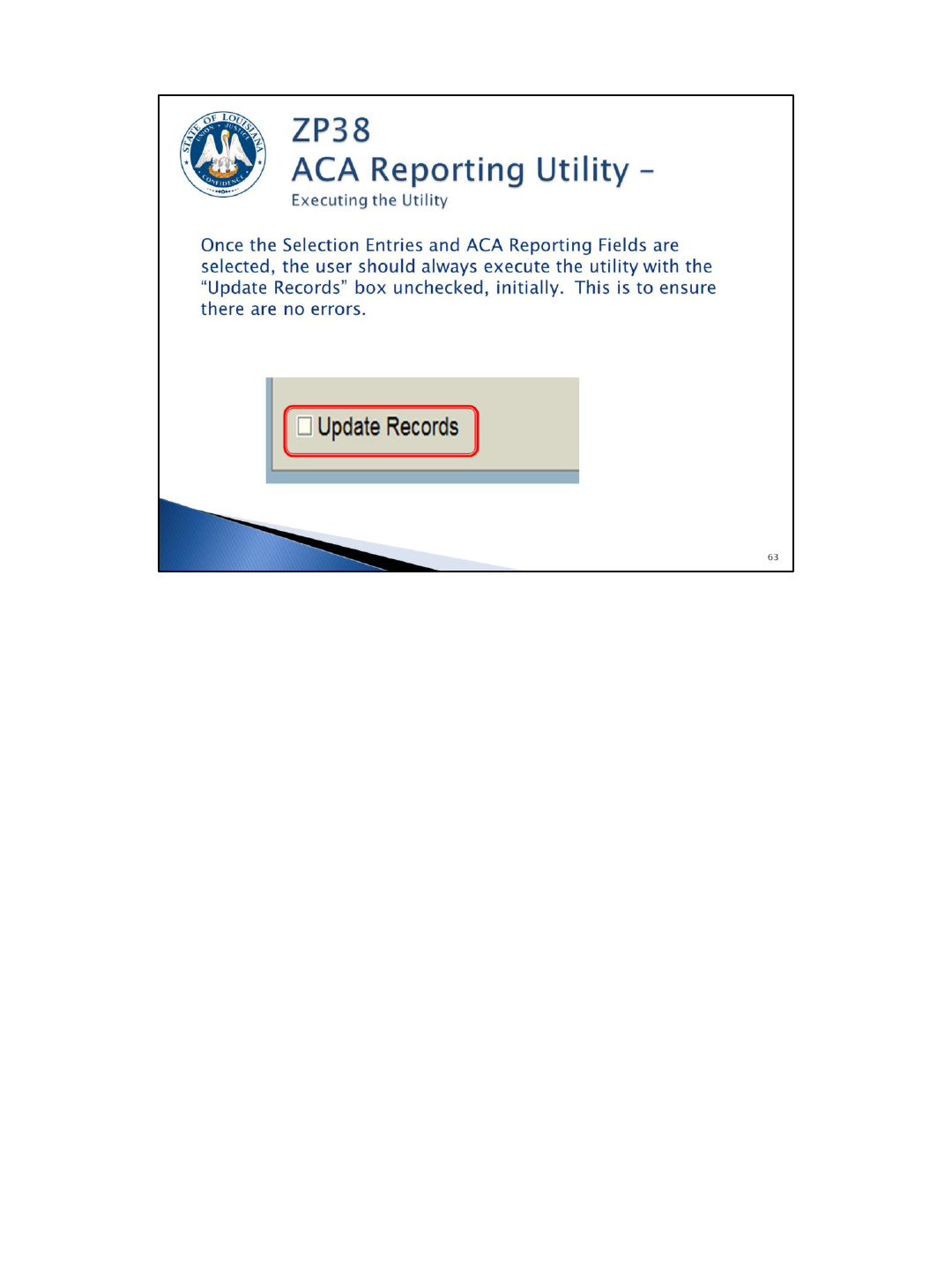

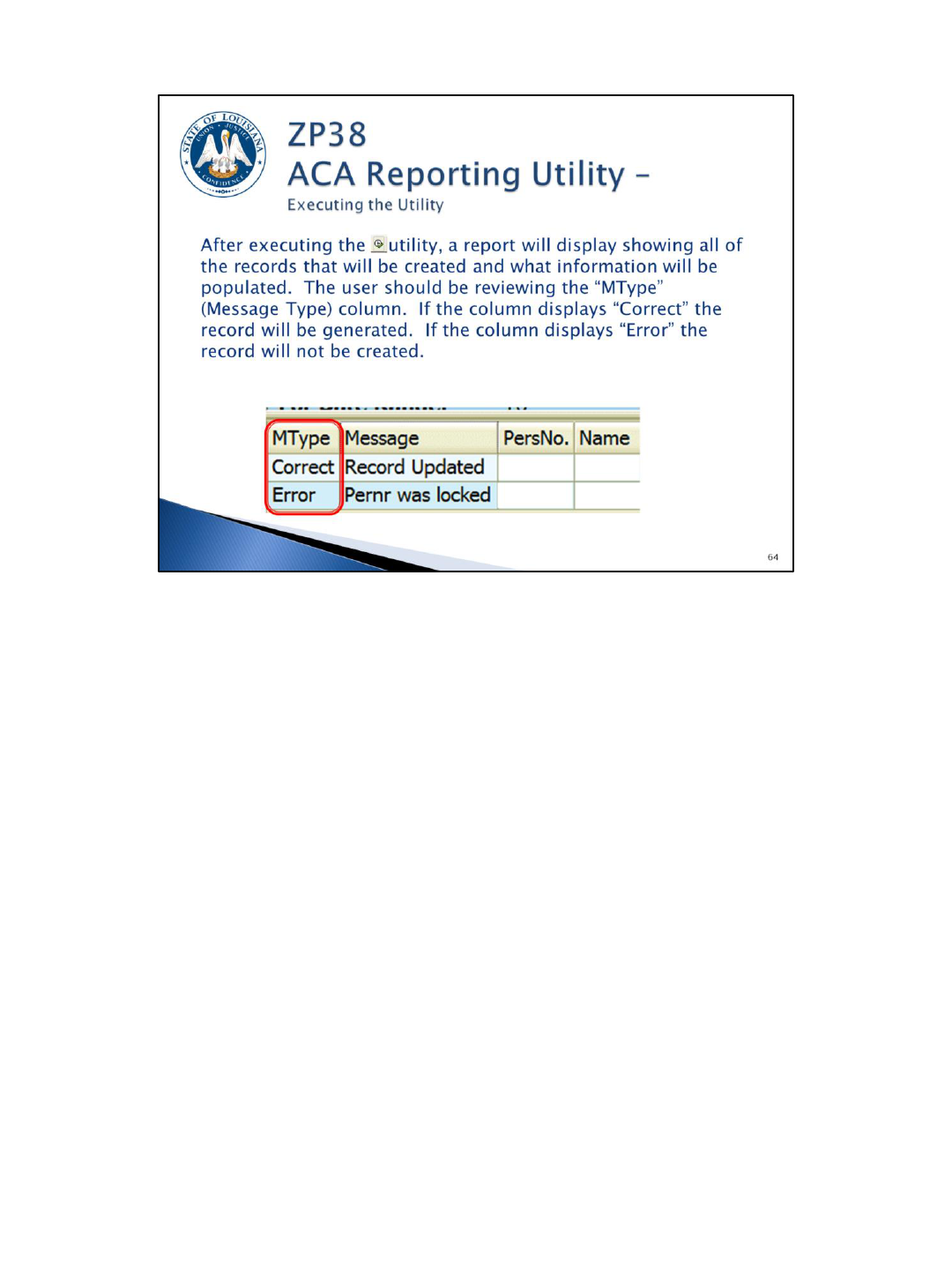

This utility is designed to first be run in “test mode” which is the default. Once run in

test mode, the agency can see which employee records the system will be creating

based on the selection information. There is no “un-do” option.

Once the agency is satisfied with the employee list, the “Update Records” check box

should be selected to create the IT9004s.

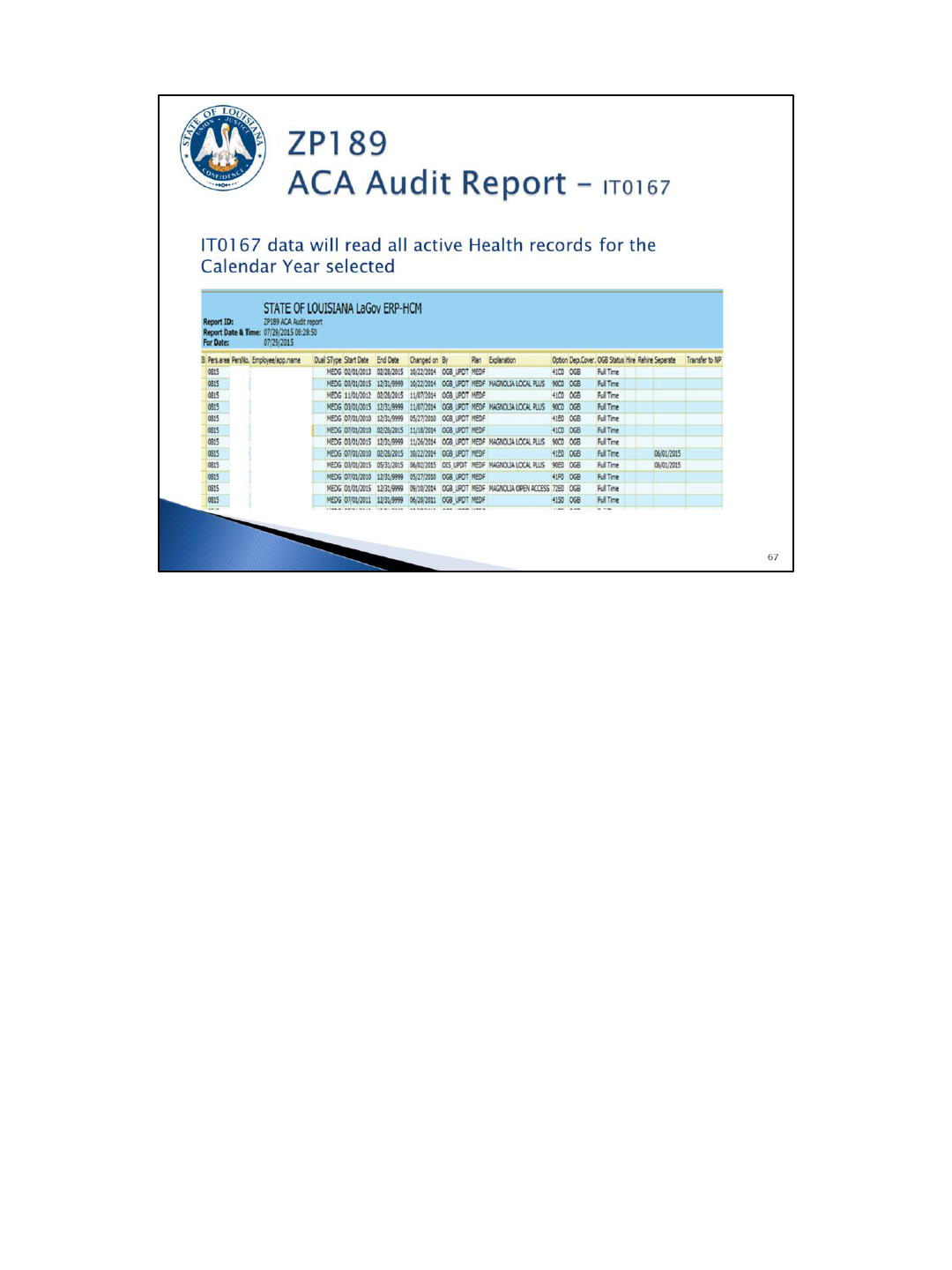

This report should be run to review, analyze, and correct ACA reporting data.

The report can be run to display:

• all records on IT0167 – Health Plans,

• all active employees who have or do not have an IT9004 – ACA Reporting record,

• information from IT9004 and the OGB ACA file combined to populate the IRS Form

1095-C,

• all data from OGB’s ACA file including dependents, COBRA participants, retirees,

and surviving spouses,

• and error messages pertaining to IT9004, IT0167, and the OGB ACA data file.

The 1095-C Data option contains all of the fields needed to complete the employee’s

1095-C for ACA reporting. This should make it easy to identify which fields are

missing.

The ACA Audit option will identify errors that must be researched and corrected, if

necessary.

How can this report option help me?

The IT9004 records that you build for covered employees should align with the

IT0167 records.

As the bulk of your employees will be full time, active for the entire calendar year,

and have coverage – this report can be sorted and filtered to extract this list of

personnel numbers. This list can then be loaded into ZP38 to create the bulk of your

IT9004 records.

Once you run ZP189 with the IT0167 option and you create the bulk of your IT9004

records, you can run the IT9004 Data report option to see which employees still need

a record.

Employees with no IT9004 record will have a blank line. Double-clicking on the blank

line will bring up the ZP38 screen if you want to create an IT9004 record for that

employee.

Employees with multiple IT9004 records will be listed on multiple lines.

This report can also be used to identify those employees with a “NO” in the plan

option field. These should be employees that still need to turn in a GB-01.

This report option will eventually have a feature that will allow you to email

employees requesting the completion of a GB-01 accepting or declining coverage and

also provide them with a link to the LEO screen where they could decline coverage.

Start and end dates on this report should coincide with action dates provided on this

report option.

At a glance, the agency can see the information that will be populated on each

employee’s 1095-C form. All employees with an IT9004 reportable indicator of Y at

any point during the calendar year will be listed here.

This option also includes the dependent information. This can be used to determine

where dependent social security numbers are missing. Agencies should make

multiple attempts to collect this data, update LaGov HCM, and report it to the Office

of Group Benefits.

NOTE: The columns containing the social security numbers (employee and individual)

are hidden on this screenshot.

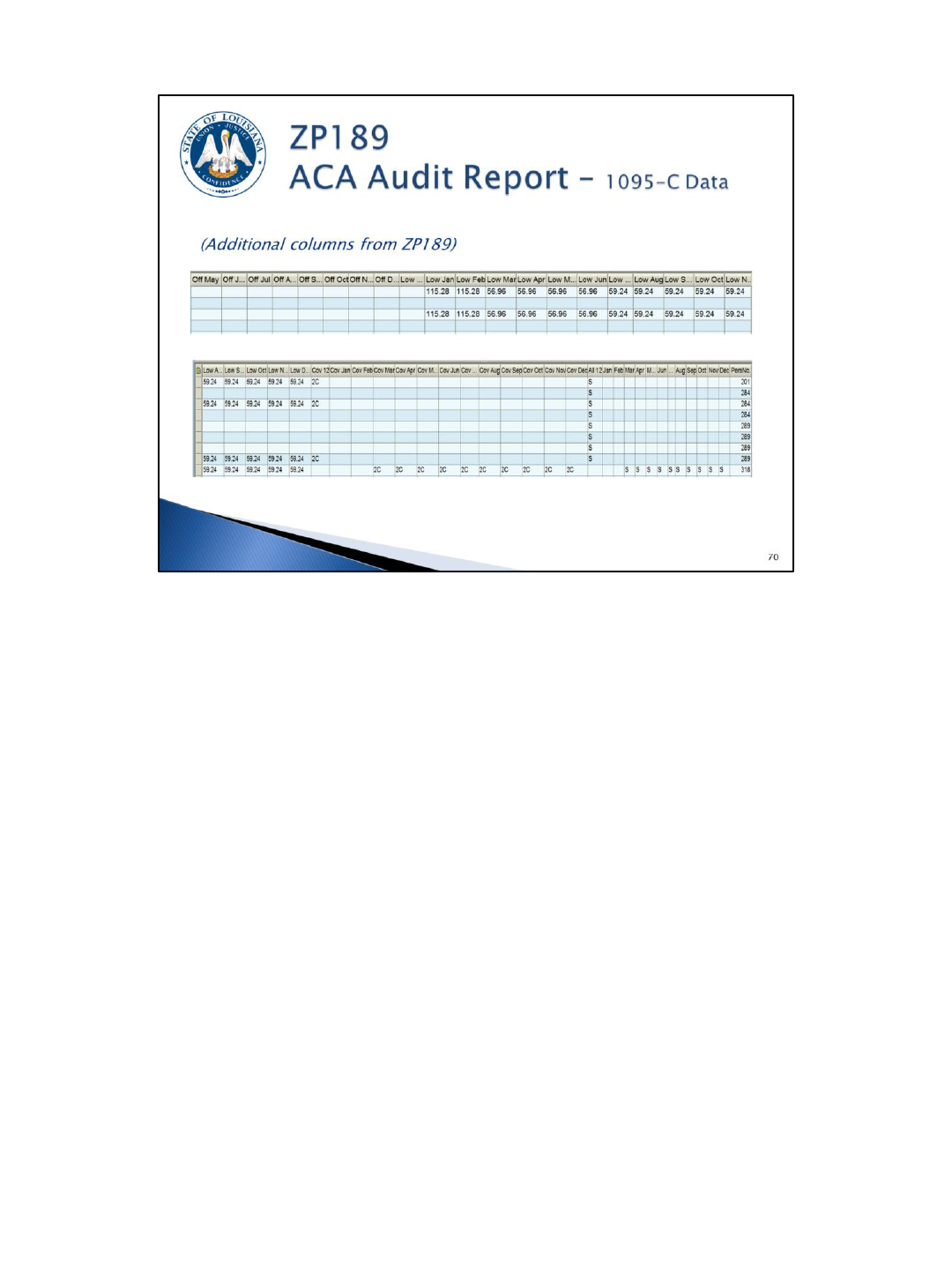

These are the remaining columns in the ZP189 1095-C Data option report output.

(Note: the lowest cost self-only premiums, the coverage codes, months of coverage,

and dependent data from OGB are included here.)

In certain scenarios, this report will default codes, regardless of what might be on the

OGB ACA file or the IT9004 record. Therefore, you may see codes that are not listed

as options on IT9004.

Because all 12 months must be reported for each employee, we will also be using a

1H offer code and a 2A coverage code for each of the inactive months.

To see dependents, the “Show Dependents” box must be checked on the selection screen. Dependent

information will be displayed with the employee’s personnel number. So sorting this information by

personnel number will paint a better picture of which dependents will appear on which employee’s

1095-C.

Date – the OGB ACA file is run at night once a day. Corrections you make today in eEnrollment will

show up on the next day’s file.

OGB agency number vs. LaGov HCM personnel area – retired employees (R2) will appear in OGB’s file

with the agency number of the agency paying the premiums. The LaGov HCM agency number for

these employees will be different if the employee is rehired (A2) and working at a different agency.

The LaGov HCM personnel area may be blank if the covered individual is a non-employee

(COBRA/Survivor), Other, or an employee who retired prior to LaGov HCM.

EE status – this status will tell you if the individual is Active (A), Retired (R), COBRA (C), Survivor (S), or

Other (O). Rehired retirees will be active (A).

Ind Status – this status will tell you if the individual is the employee (1), retiree (2), non-employee

(COBRA/SV) (3), a dependent (4) or other (blank).

For example: A1 would be actives, A2 would be rehired retiree, R2 would be retiree, A4 would be a

dependent of an active employee.

The following offer codes are being sent by OGB:

• 1E - you may see an offer code of 1E on this report option (individual status = blank); this is for

employees who were offered COBRA due to a reduction in hours (full-time to part-time);

• 1G for someone who was not a full-time employee for any month of the current reporting year

(retirees who retired in a prior year, COBRA offers for prior year termination), Survivors, and

Others;

• 1H for someone who retired during the current reporting year and has coverage as a retiree (for

the retired months) and COBRA.

The lowest premiums are included on the OGB file for inclusion on the 1095-C.

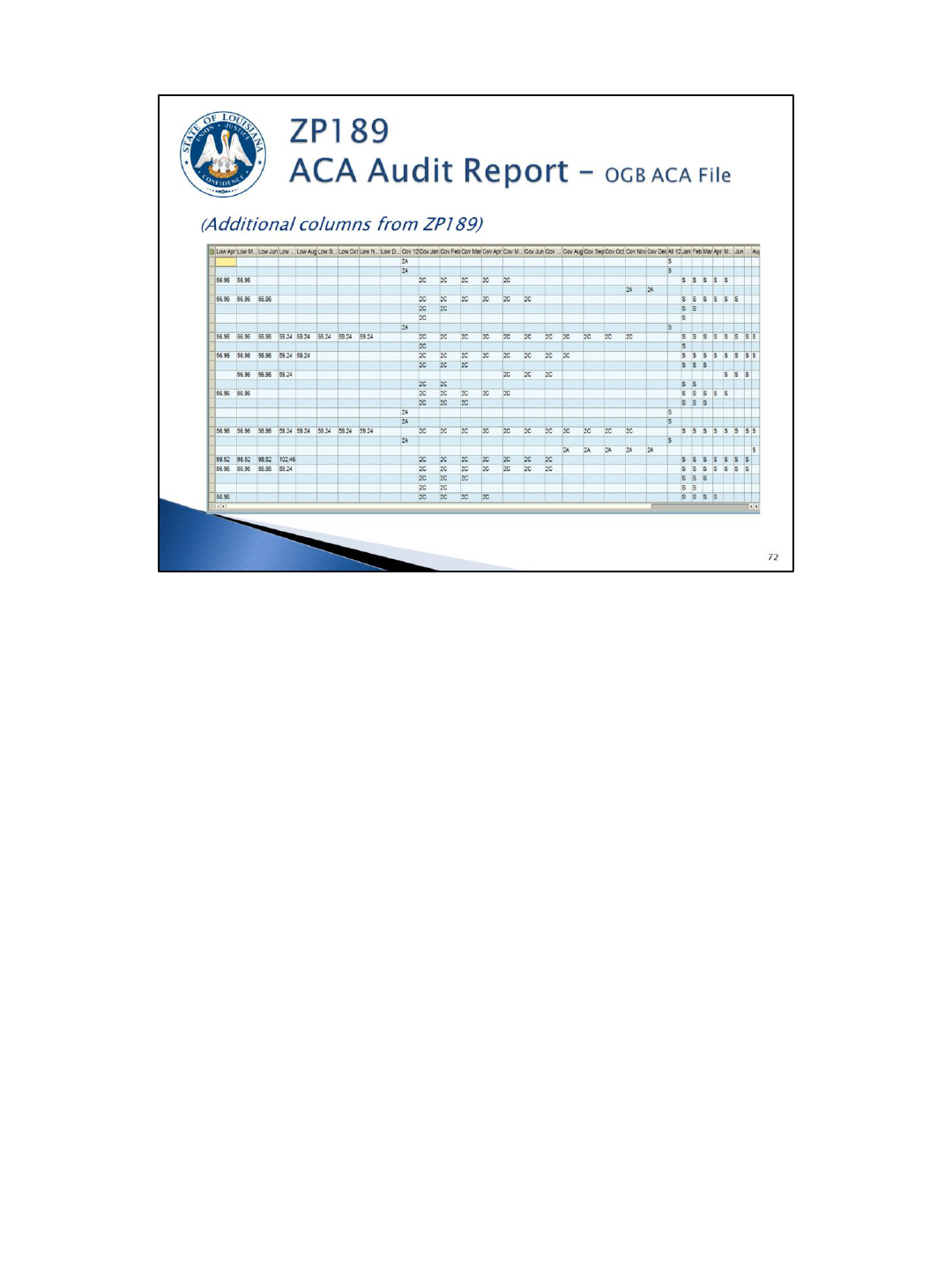

These are the additional columns on the OGB ACA File Data report option.

The following coverage codes are being sent by OGB:

• 2A for employees who terminated in the current reporting year with COBRA

coverage;

• 2A for employees who retire in the current or prior year with retiree coverage;

• 2A for survivors (S) and others (O);

• 2B for employees enrolled in COBRA coverage due to a reduction in hours (full-

time to part-time);

• 2C for employees with coverage (including rehired retirees if OGB has been

notified by the agency that the employee is a rehired retiree).

Again, to see the dependents, the “Show Dependents” box must be checked.

Employee and dependent covered months will be listed with S for self-insured plans

and F for fully insured plans.

EE SSN – this is the employee’s Social Security number.

Ind SSN – this is the dependent’s Social Security number. It is important to review

this information to determine when data is missing (i.e. field is blank or all zeroes).

Date of Birth – the employee or dependent’s date of birth. This information is

provided to the IRS when a dependent’s Social Security number is missing.

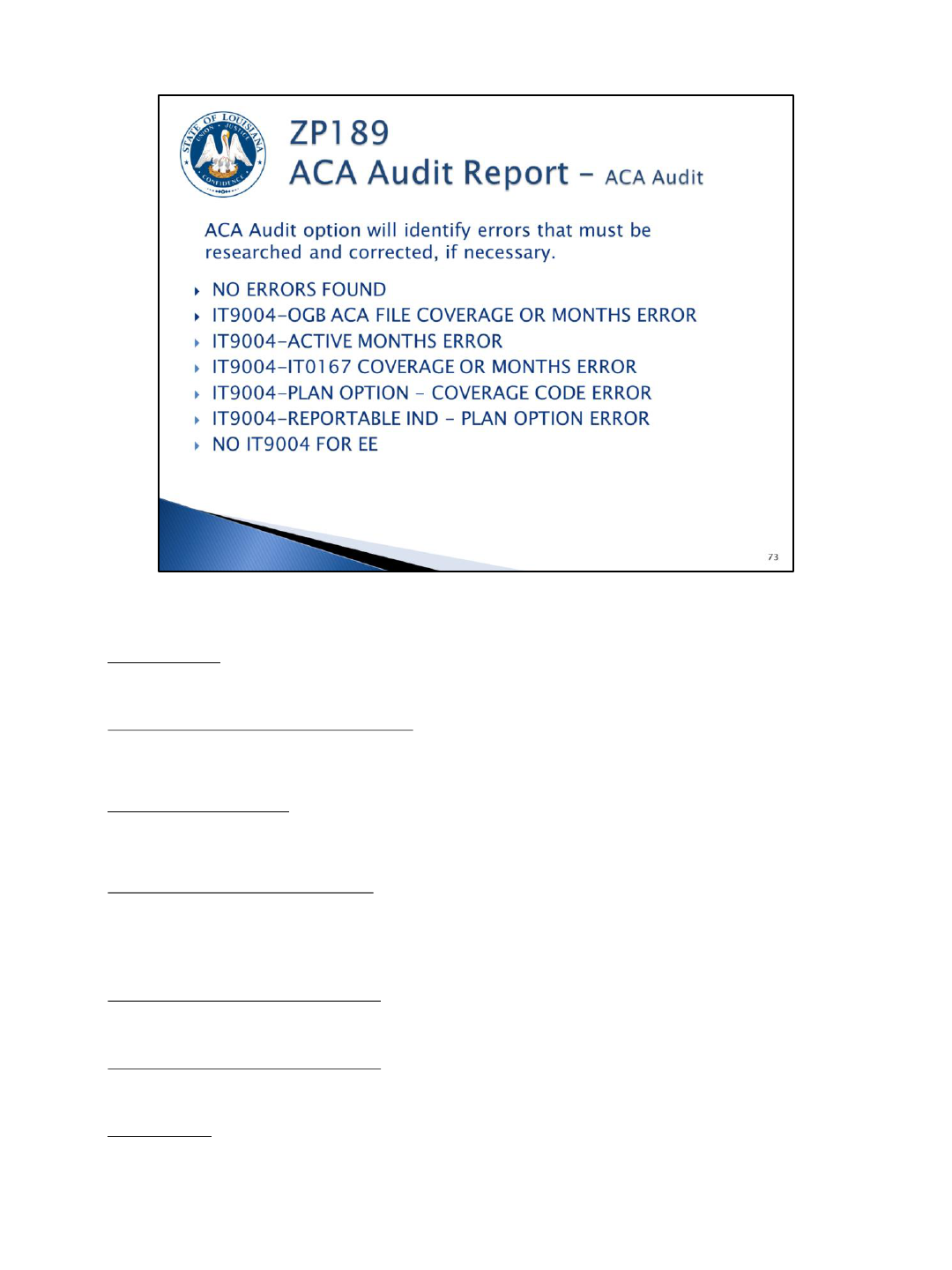

The ACA Audit option will display various messages based on criteria identified by OSUP and/or OTS. Below are the possible

messages:

NO ERRORS FOUND

OCCURS: Employees with no errors will appear with this message. The report output can be filtered to exclude this message to

obtain a listing of employees with errors.

CORRECTIVE ACTION: None.

IT9004-OGB ACA FILE COVERAGE OR MONTHS ERROR

OCCURS: when an IT9004 with plan option enrolled (EN) does not match coverage months on the OGB ACA file or employee is

not on the OGB file.

CORRECTIVE ACTION: Review the IT9004 to ensure plan option and time period is correct; review OGB to ensure employee is

correctly enrolled in health coverage. Correct as appropriate.

IT9004-ACTIVE MONTHS ERROR

OCCURS: when IT9004 records do not match employee’s active months; partial months and months with no health coverage still

require an IT9004 record.

CORRECTIVE ACTION: Review employee action to ensure IT9004 record(s) exist for all months of active employment and update

IT9004 begin/end dates accordingly.

IT9004-IT0167 COVERAGE OR MONTHS ERROR

OCCURS: when an IT9004 with an ACA coverage code of 2C or a plan option of waived (WA) does not match IT0167 months.

NOTE: employees with LSU First coverage stored on IT14/IT15 from January 2015 to August 2015 will display as an error; after

data is verified, this error may be ignored for these employees. Beginning January 2016, this will be a valid error that requires

review.

CORRECTIVE ACTION: If IT9004 is correct, review IT0167 to ensure employee is correctly enrolled/not enrolled in health

coverage. This may require an update to OCB and/or LaGov HCM records

IT9004-PLAN OPTION - COVERAGE CODE ERROR

OCCURS: when an IT9004 ACA coverage code is 2D or 2B but the plan option is enrolled.

CORRECTIVE ACTION: Coverage code should be changed to 2C if employee is enrolled in health coverage; plan option should be

changed to NE or NO, as applicable, if coverage code is correct.

IT9004-REPORTABLE IND - PLAN OPTION ERROR

OCCURS: when an IT9004 reportable indicator is no (N) but the plan option is enrolled (EN).

CORRECTIVE ACTION: Change reportable indicator to yes (Y); all employees enrolled in coverage, regardless of status, should

receive a Form 1095-C. Or change the plan option in incorrect.

NO IT9004 FOR EE

OCCURS: when an IT9004 has not been created.

CORRECTIVE ACTION: Create an IT9004 for all active months of employment.

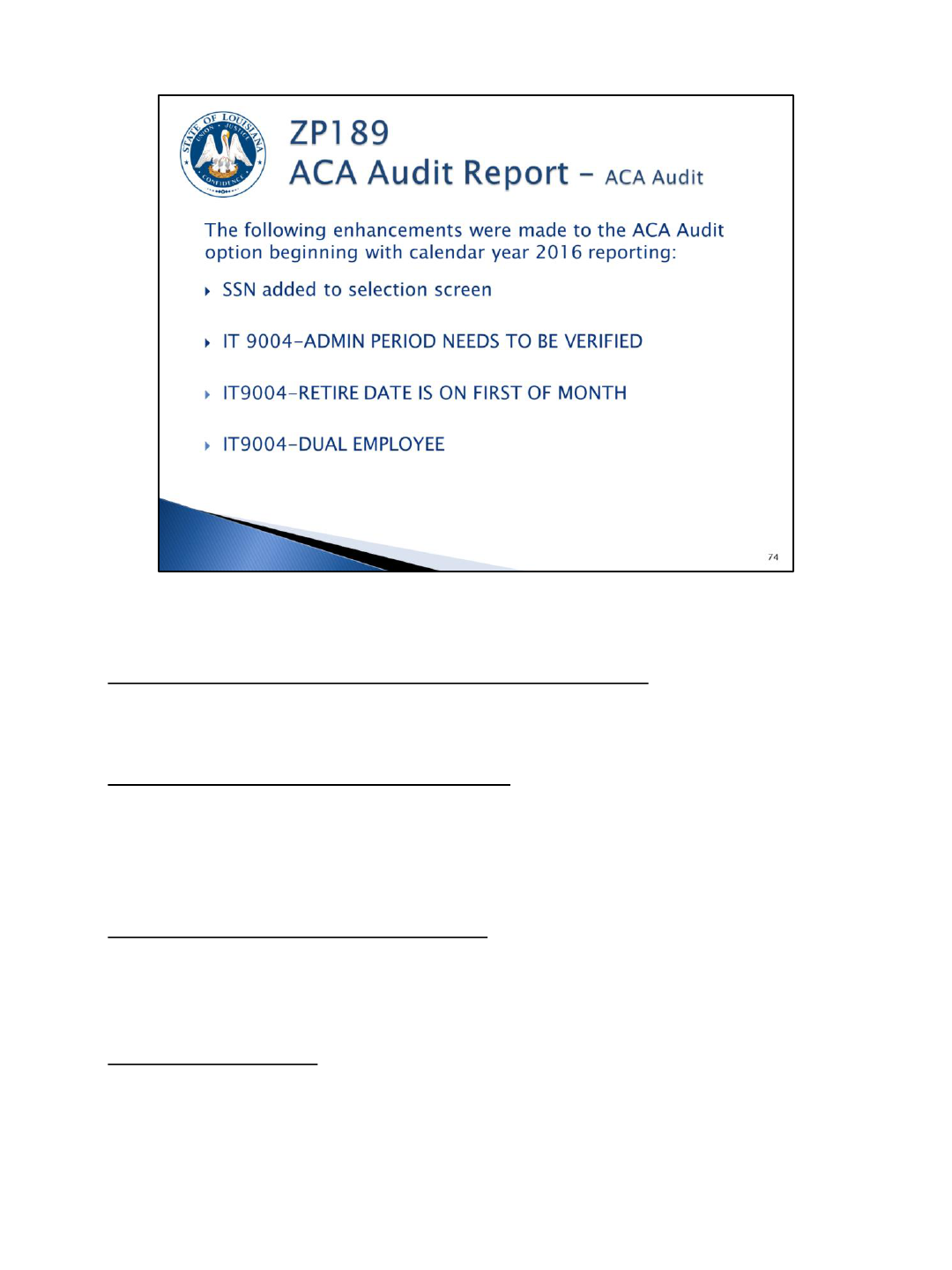

ZP189 – ACA Audit Report option was enhanced in 2016 with the below changes.

Social Security Number has been added to the selection screen

You may only search for SSN or personnel number, not both. This selection is n ot

available for the IT0167 and IT9004 Data options.

IT 9004-ADMIN PERIOD NEEDS TO BE VERIFIED

OCCURS: when an admin period IT9004 record (Y, 1H, 2D, NO) is valid for more than

one (1) or two (2) months.

CORRECTIVE ACTION: Review the employee’s IT9004 for accuracy and make

corrections if necessary.

IT9004-RETIRE DATE IS ON FIRST OF MONTH

OCCURS: when an employee has a separation action with an action reason of

retirement on the first of the month.

CORRECTIVE ACTION: For OSUP use only; no agency action is needed.

IT9004-DUAL EMPLOYEE

OCCURS: when an employee is active in more than one (1) personnel number for the

reporting year being reviewed.

CORRECTIVE ACTION: This is an indication that all information for the employee (all

personnel numbers) needs to be reviewed.

Select ACA Hours in the Time Parameters section.

The report will use the number of pay periods entered on the selection screen to

perform the calculation in the output. If the employee was not active for the full

range of periods, the report will determine the number of active periods and use this

value instead.

The report output shows weekly average and the total ACA hours based on the date

selection. Refer to the ZP136 report descriptor for additional information on the ACA

Hours report option.