Income – Other Income

15-1

Introduction

This lesson will help you determine other forms of income and how to report other sources of income. Part

of the lesson is for all course levels and part is only for the International level.

The International part of this lesson will help you report income earned from worldwide sources. To do this,

you need to be able to identify the type of income and, if reportable, convert it to the equivalent U.S. dollar

value of the foreign currency.

This lesson will cover the foreign earned income exclusion reported on

Form 2555, Foreign Earned Income.

Income – Other Income

Objectives

At the end of this lesson, using your resource materials, you will be able

to determine:

• Other types of income and how to report other sources of income

• Determine the requirements for the cancellation of debt on

nonbusiness credit card debt when preparing tax returns

• Determine when canceled credit card debt is included in gross income

on Form 1040

• How to properly report income earned from worldwide sources

• Who is eligible for the foreign income exclusion and how to calculate

the excludable amount using Form 2555, Foreign Earned Income

What is other income?

Income that does not have its own line on Form 1040 is generally reported on the Form 1040, Schedule 1.

Here are some examples:

• Prizes and awards

• Gambling winnings, including lotteries and raes

• Jury duty pay

• Alaska Permanent Fund dividends

• Recovery of a deduction claimed in a prior year

• Nonbusiness credit card debt cancellation

Even if the taxpayer does not receive an income document from the payer, the taxpayer is required to report

the income.

The Economic Impact Payment is not taxable and not includible in gross income. Also, a payment will not

aect income for purposes of determining eligibility for federal government assistance or benet programs.

What do I need?

□ Form 13614-C

□ Publication 4012

□ Publication 17

□ Publication 54

□ Form 1040 Instructions

□ Form 1099-NEC

□ Form 2555

Optional:

□ Publication 525

□ Publication 970

□ Form W-2G

□ Form 1099-MISC

□ Form 1099-Q

Income – Other Income

15-2

If you are unsure about sources of other income, consult the Volunteer Resource Guide, Tab D, Income,

and Publication 17, Other Income, or discuss the income item with your Site Coordinator.

Use the interview techniques and tools discussed in earlier lessons to ensure that all taxable income has

been included.

Health Savings Accounts (HSA)

HSA distributions not used to pay or reimburse the taxpayer for qualied medical expenses are generally

reported as additional income on Form 1040, Schedule 1. This topic is not covered in this lesson, it is

covered in the Adjustments lesson.

What are some examples of other income?

Gambling Winnings

The taxpayer may receive one or more Forms W-2G reporting gambling winnings. Total gambling winnings

must be reported as other income. If the taxpayer also had gambling losses, the losses can only be

deducted on Schedule A. See the Itemized Deductions lesson for more details.

Tax Software Hint: To review information related to reporting gambling income, go to the Volunteer

Resource Guide, Tab D, Income, Income Quick Reference Guide.

Cash for Keys Program

Cash for Keys Program income, which is taxable, is income from a nancial institution, oered to taxpayers to

expedite the foreclosure process. The taxpayers should receive Form 1099-MISC with the income in Box 3.

Penal Income

Amounts received for work performed while an inmate in a penal institution aren’t earned income for the

earned income credit. This includes amounts received for work performed while in a work release program

or while in a halfway house. Any amount received for work done while an inmate in a penal institution is

included in wages. See the Volunteer Resource Guide, Tab D, Income, for instructions on entering penal

income in the software.

Under the PATH Act, a wrongfully incarcerated individual does not include in income any civil damages,

restitution, or other monetary award received that relates to his or her incarceration.

Qualied Medicaid Waiver Payments

Qualied Medicaid waiver payments may be excluded from gross income. To be qualied Medicaid waiver

payments, the care provider and the care recipient must reside in the same home. When the care provider

and the care recipient do not live together in the same home, the Medicaid waiver payments are fully

taxable.

A taxpayer may choose to include qualied Medicaid waiver payments in the calculation of earned income

for the earned income credit (EIC) and the additional child tax credit (ACTC). The taxpayer may include

qualied Medicaid waiver payments in earned income even if the taxpayer chooses to exclude those

payments from gross income.

• A taxpayer may not choose to include or exclude only a portion of qualied Medicaid waiver payments.

Either include all or none of the qualied Medicaid waiver payments for the taxable year in earned

income.

• If the taxpayer chooses to include qualied Medicaid waiver payments in earned income, that amount

will be included in the calculation for both the EIC and the ACTC.

Income – Other Income

15-3

Refer to the Volunteer Resource Guide, Tab D, Income, Entering Medicaid Waiver Payments.

Are distributions from ABLE accounts taxable?

A qualied ABLE program is a program established and maintained by a state agency under which a

person may make cash contributions to an ABLE account to pay for the qualied disability expenses of an

eligible individual (the designated beneciary). Qualied beneciaries can have only one ABLE account.

Contributions are made in after-tax dollars and can be made by any person. Contributions must be made in

cash and are not deductible for federal income tax purposes.

Distributions from an ABLE account that do not exceed the qualied disability expenses of the beneciary

during the taxable year are excluded from gross income. A distribution from an ABLE account that exceeds

the qualied disability expenses of the beneciary is included in the beneciary’s gross income and is

subject to an additional tax of 10% imposed on the amount not used for qualied disability expenses.

Taxable distributions from ABLE accounts are out of scope for the VITA/TCE programs.

Qualied disability expenses include: education, housing, transportation, employment training and support,

assistive technology and personal support services, health, prevention and wellness, nancial management

and administrative services, legal fees, expenses for oversight and monitoring, funeral and burial expenses.

Form 1099-QA, Distributions from ABLE Accounts, is used to report distributions from an ABLE Account.

Are distributions from an Educational Savings Account (ESA), such as a Coverdell ESA

and a 529 plan, taxable?

Distributions from Coverdell ESAs and Qualied Tuition Plans (QTPs) are reported on Form 1099-Q,

Payments From Qualied Education Programs (Under Sections 529 and 530). Coverdell ESA distributions

can be used to pay for qualied elementary, secondary, and postsecondary expenses. QTP distributions

may also be used for qualied educational expenses for elementary and secondary public, private,

and religious schools of up to $10,000 per year for each qualied beneciary, certain expenses of an

apprenticeship program, and the principal or interest on a qualied education loan up to a lifetime limit of

$10,000 per beneciary.

A portion of the distributions is generally taxable to the beneciary if the total distributions are more than

the beneciary’s adjusted qualied education expenses for the year. Qualied education expenses are

discussed in more detail in the Education Credits lesson.

The taxable portion is the amount of the excess distribution that represents earnings that have accumulated

tax free in the account. The taxable amount must be reported as other income on the tax return. Taxable

distributions from ESAs and QTPs are out of scope.

For additional information about educational savings accounts, distributions, and qualied education

expenses, refer taxpayers to Publication 970, Tax Benets for Education.

An American opportunity credit or lifetime learning credit can be claimed in the same year the beneciary

takes a tax-free distribution from a QTP or Coverdell ESA, as long as the same expenses are not used for both

benets. See Publication 970, Tax Benets for Education, for more details.

Is a recovery taxable?

Reimbursement in a later year for medical or other expenses deducted in an earlier year must be reported

as income up to the amount previously deducted as medical or under another provision. However, do not

report as income the amount of reimbursement received up to the amount of the prior year deductions that

did not reduce the tax for the earlier year.

Income – Other Income

15-4

example

John made a deal with his credit card company to pay $2,000 on his $7,000 balance, and the company

agreed to take it as payment in full. In January of the current year, John received a Form 1099-C from

his credit card company reporting $5,000 (the amount of debt canceled). John was solvent immediately

before the debt was canceled. John must include the entire $5,000 as other income on his tax return.

Cancellation of Debt – Nonbusiness Credit Card Debt

Cancellation of Debt – Basics

A debt includes any indebtedness for which a taxpayer is liable or which attaches to the taxpayer’s property,

such as auto loans, credit card debt, medical care, professional services, mortgages, and home equity

loans. Generally, if a debt for which a taxpayer is personally liable is canceled or forgiven, the taxpayer

must include the canceled amount in income. There is no income from canceled debt if the cancellation or

forgiveness of debt is a gift or bequest.

Use Form 13614-C, Intake/Interview & Quality Review Sheet, to determine if the taxpayer received one or

both of Forms 1099-C, Cancellation of Debt, or 1099-A, Acquisition or Abandonment of Secured Property.

Refer to the Legislative Extenders section for possible exclusion of cancellation of debt income on a main

home.

Taxability of Canceled Debt

Taxpayers often question the taxability of canceled debt because they did not receive money in hand.

In situations where property is surrendered, such as a foreclosure, taxpayers feel that by giving up the

property they are relieved from any further obligation. Explain that the benet to the taxpayer is the

relief from personal liability to pay the debt. Information in Publication 17, Your Federal Income Tax for

Individuals, can assist with the explanation. Refer to Publication 4681, Canceled Debts, Foreclosures,

Repossessions, and Abandonments.

Generally, when debt is canceled, the lender will issue Form 1099-C, Cancellation of Debt, which is then

reported as income by the recipients on their tax return. There are exceptions and exclusions to the general

rule that determines whether a canceled debt is included as income. This is covered in greater detail in the

Legislative Extenders lesson and later in this lesson.

Form 1099-C

Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent (assets

greater than liabilities) immediately before the debt was canceled, all the canceled debt will be included on

the tax return as other income.

Sometimes, Form 1099-C will show an interest amount in Box 3. Because only nonbusiness credit card

debt income is in scope, any interest on the account would not have been deductible. The amount shown in

Box 3 is included in Box 2; therefore, the full amount shown in Box 2 should be reported as other income.

Lenders and creditors are required to issue Form 1099-C if they cancel a debt of $600 or more. If the debt

canceled is less than $600, some lenders or creditors may send a letter or some other form of notication to

the taxpayer. Generally, taxpayers must include all canceled amounts (even if less than $600) in income.

The discharge of certain student loan debt in 2021 through 2025 is excluded from gross income. If excludible,

the lender will not issue Form 1099-C.

Income – Other Income

15-5

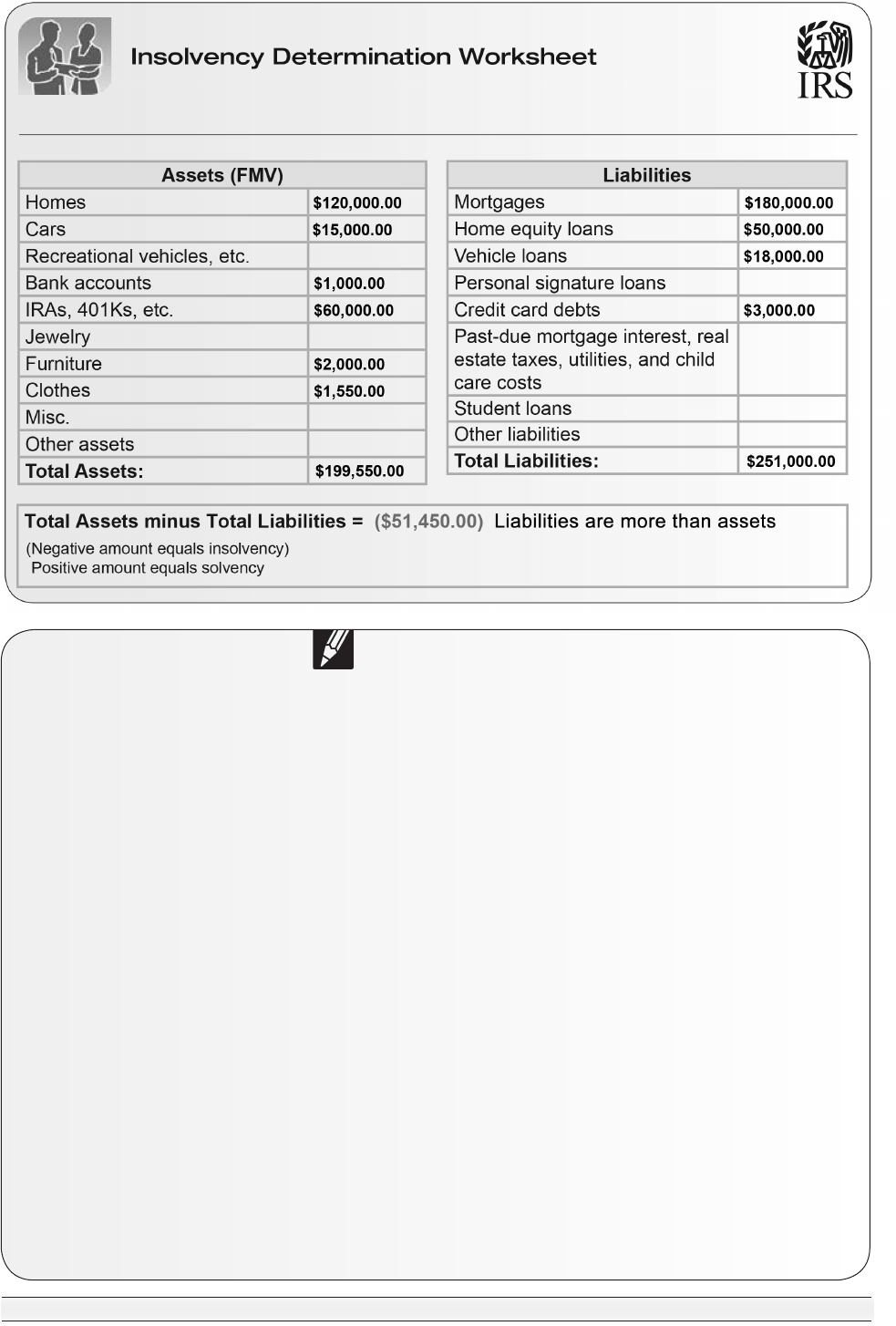

Insolvency (Out of Scope for VITA/TCE)

Insolvency is a condition in which the fair market value (FMV) of all assets is less than one’s liabilities. The

amount or level of insolvency is expressed as a negative net worth.

For purposes of determining insolvency, assets include the value of everything owned (including assets that

serve as collateral for debt and exempt assets which are beyond the reach of creditors under the law, such

as an interest in a pension plan and the value of a retirement account).

Liabilities are amounts owed and include:

• The entire amount of recourse debts

• The amount of nonrecourse debt that is not in excess of the FMV of the property and is security for the debt

Refer to the Insolvency Determination Worksheet in the Volunteer Resource Guide, Tab D, Income, as a

resource. Taxpayers must determine if they are considered insolvent.

If the taxpayer had nonbusiness credit card debt canceled, all or part of the debt may be excluded if the

cancellation occurred in bankruptcy, or if the taxpayer was insolvent immediately before the cancellation. These

situations are beyond the scope of VITA/TCE. If any of these situations apply, refer the taxpayer to a professional tax

preparer. See IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments, for more

information.

Publication 4731, Screening Sheet for Volunteers Assisting Taxpayers with Form 1099-C, located in the

Volunteer Resource Guide, Tab D, Income, provides step-by-step guidance for the volunteer tax return preparer to

determine if the cancellation of credit card debt is within scope.

Taxpayer Interview and Tax Law Application

Here is how a volunteer advised Michelle regarding her canceled credit card debt.

SAMPLE INTERVIEW

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

VOLUNTEER SAYS… MICHELLE RESPONDS…

I notice you received a 1099-C from a credit card company. Yes, I negotiated with them to cancel

$3,000 of my debt.

Yes, Form 1099-C shows the amount of debt discharged. I could only aord to pay them $1,000,

so it really helped me.

Do you think your debts at the time exceeded your assets? I’m not sure, but it’s certainly possible.

Let’s ll out the Insolvency Determination Worksheet to help us

determine whether you were insolvent.

OK.

According to the worksheet, you are insolvent. I am afraid I am

not able to help you. VITA/TCE volunteers are not trained to

compute the nontaxable portion of canceled credit card debt.

Oh, I understand.

I suggest you seek assistance from a professional tax preparer. I will, thank you.

Income – Other Income

15-6

EXERCISES

Question 1: Greg was released from his obligation to pay $5,000 of personal credit card debt. The

credit card company sent Form 1099-C showing canceled debt of $5,000. Greg is fairly certain he has

more debt than he has assets.

Can the VITA/TCE site provide tax return preparation assistance to Greg?

A. Yes, since the entire $5,000 in canceled debt is considered income and reported on Form 1040.

B. No, because it appears Greg is insolvent, which might mean some of the canceled credit card debt

would be nontaxable and beyond the scope of the VITA/TCE programs.

Question 2: Kay was released from her obligation to pay personal credit card debt. She owed $10,000

to her credit card company, which agreed to accept $2,500 as payment in full. Before paying the

credit card company, it was determined Kay was solvent (assets greater than liabilities) and not in

bankruptcy. The credit card company issued Kay a Form 1099-C, reporting $7,500 as the amount of

debt discharged.

Based on the information above, can Kay be assisted at her local VITA/TCE site? ¨ Yes ¨ No

Question 3: Review the information in Question 2 about Kay’s canceled debt. If the VITA/TCE site is

able to assist Kay, what amount would be reported on Kay’s Form 1040?

A. $0

B. $10,000

C. $2,500

D. $7,500

Income – Other Income

15-7

example

In the current year, Alfredo Kendall earned $40,000 while working in Dallas, Texas, for Dade

Corporation. In September of this year, he transferred to their oce in Stuttgart, Germany. While in

Germany, he earned $30,000 (U.S. dollars). All of Alfredo’s wages, including the income he earned in

Germany, is included in his gross income. His Form 1040 will show $70,000 in wages.

What is worldwide income?

U.S. citizens and U.S. resident aliens are required to report worldwide income on a U.S. tax return

regardless of where they live and even if the income is taxed by the country in which it was earned. Filing

requirements are the same as for U.S. citizens and U.S. resident aliens and apply whether income is from

within or outside the U.S.

U.S. citizens and U.S. resident aliens living abroad may be able to claim tax benets such as the foreign

earned income exclusion or the foreign tax credit. This part of the lesson covers the foreign earned income

exclusion. The foreign tax credit will be covered in another lesson.

Income is treated the same on the return regardless of the country from which it is derived. Similar income

earned inside or outside the U.S. is generally taxed in the same way on the return. Likewise, income earned

in the U.S. and not taxed will be treated in the same way if earned outside the U.S. The lines on which

income is reported on Form 1040 are the same whether the U.S. citizen or U.S. resident alien is living within

or outside U.S. boundaries.

Foreign income might be reported to taxpayers on forms or in ways that are not used in the United States.

Question taxpayers closely to ensure that they are reporting all worldwide income. Review the income records to

ensure that includible amounts are accurate and complete.

Taxpayers with foreign income, bank accounts, or assets may have additional ling responsibilities, which are

out of scope. See Schedule B and Form 8938 for additional information.

Tax Software Hint: To review information related to income from a foreign employer, go to the

Volunteer Resource Guide, Tab D, Income.

Income – Other Income

15-8

example

Ryan received 3,000 Euros (€3000) on a day that the exchange rate was 0.74855 Euros to one U.S.

dollar. Based on this exchange rate, the value of Ryan’s €3000 is: €3000 ÷ 0.74855 = $4,007.75

EXERCISES (continued)

Answers are listed following the lesson summary.

Question 4: Marta Bremer, a U.S. citizen, lives in Mussbach, Germany. Her income included $22,000

in wages earned in Germany. She earned $300 in interest from her U.S. bank. What is Marta’s total

income?

A. $0

B. $22,300

C. $300

D. $22,000

Question 5: Mary Carleton, a U.S. citizen, lives in Belgium. Her income included $10,000 in wages

from her Belgian employer, $200 in interest from her U.S. bank, $8,000 in gambling winnings, and

$7,000 in child support payments from her ex-spouse. What is Mary’s gross income?

A. $8,000

B. $10,200

C. $18,200

D. $25,200

How do I convert foreign income to U.S. dollars?

Exchange rates

All amounts on the U.S. tax return must be stated in U.S. dollars. Convert income that taxpayers received

in foreign currency into U.S. dollars using the appropriate exchange rate. U.S. exchange rates are stated in

two ways:

• Units of foreign currency to one U.S. dollar: 0.74855 Euro = 1 U.S. dollar

• U.S. dollars to one unit of the foreign currency: 1.33592 U.S. dollar = 1 Euro

Exchange rates shown here are for example only. Use the exchange rates in eect when the income was

received.

To convert a sum of money into U.S. dollars, divide the amount of foreign currency by the exchange rate for

the foreign currency to one U.S. dollar.

Income – Other Income

15-9

example

Edward Hall worked in Dallas for Lubbock Incorporated from January until September. On September

29, he was transferred to Lubbock’s Mexico City oce, where he will be working for three more years.

In Mexico, he is paid in Mexican pesos. Because he did not receive his salary in Mexican pesos evenly

throughout the year, he cannot use the annual average exchange rate for Mexico source income. If he

does not know the exchange rate at the time he received the funds, he can use the monthly average

exchange rate for October, November, and December.

EXERCISES (continued)

Question 6: Caryn received 200 Euros on a day that the exchange rate was .75514 Euros to one U.S.

dollar. In U.S. dollars, she would have ____.

A. $264.85

B. $377.57

C. $115.03

D. $11.50

Question 7: Given an exchange rate of .7000, how much is 36,000 Euros worth in U.S. dollars?

A. $252.00

B. $25,200.00

C. $51,428.57

D. $61,614.00

In other words:

Amount of foreign currency

= Amount in U.S. dollars

Exchange rate of foreign currency to one U.S. dollar

3,000 Euros

= $4,007.75

0.74855

Which exchange rate should I use?

The exchange rate for a particular currency is likely to change every day. Use the exchange rate prevailing

when the taxpayer receives the pay or accrues the item. The exchange rate is determined by the date

of transaction, which is either the date on the check or the date the money is credited to the taxpayer’s

account. If there is more than one exchange rate, use the one that most properly reects the income.

However, the taxpayer can use the average annual exchange rate if:

• Foreign income was received evenly throughout the year, and

• The foreign exchange rate was relatively stable during the year

Taxpayers may use the monthly average exchange rates if they earned foreign income evenly for one or

more months, but less than twelve months.

Income – Other Income

15-10

Where to obtain exchange rates

In mid-January, the IRS distributes exchange rates for various currencies to its worldwide oces, including

the prior year’s average annual exchange rate information.

Exchange rates can be found at irs.gov by typing “foreign currency rates” in the search box. You may also

contact banks that provide international currency exchange services.

Because taxpayers should use the rate that most closely reects the value of the foreign currency at the

time they receive the income, taxpayers may use an exchange rate that is dierent from the rates posted in

IRS worldwide oces if they nd it to be a true representation.

What is the foreign earned income exclusion?

Use Form 2555 to claim the foreign earned income exclusion. Certain taxpayers can exclude income

earned in, and while living in, foreign countries. The maximum amount of the foreign earned income

exclusion is indexed to ination annually. For the current year amount go to irs.gov or Publication 17. The

foreign earned income exclusion does not apply to wages and salaries of U.S. military members and

civilian employees of the U.S. government.

If the taxpayer qualies to exclude foreign earned income, the excludable amount will be reported as a

negative amount on the other income line of Form 1040, Schedule 1. Since the foreign earned income would

have been reported on Form 1040 as taxable wages or as self-employment income, the exclusion (negative

amount) will reduce the total income calculated. The method of calculating the tax when the taxpayer elects

the foreign earned income exclusion is based on the Foreign Earned Income Tax Worksheet. The tax

software will do this calculation automatically.

If a taxpayer elects to exclude foreign earned income, he or she cannot claim the earned income credit and

the refundable portion of the child tax credit. The child and dependent care credit does not include excluded foreign

income as earned income when computing the credit.

Tax Software Hint: To review information related to the software for the foreign earned income

exclusion, go to the Volunteer Resource Guide, Tab D, Income.

When do I choose the exclusion?

The foreign earned income exclusion is voluntary. It is not always an advantage to claim the exclusion. If

taxpayers wish to claim the exclusion, they must le Form 2555 with a timely return (including extensions).

If the taxpayer is not eligible for the foreign earned income exclusion, any taxes paid on this income to a

foreign government may be eligible for the foreign tax credit. See the lesson Foreign Tax Credit for more

information.

Once the taxpayer chooses to exclude foreign earned income, that choice remains in eect for that year

and all later years until revoked. The taxpayer may revoke the exclusion for any tax year by attaching a

statement to the return. When the exclusion is revoked, the taxpayer may not claim the exclusion again for

the next ve tax years without the approval of the IRS.

What are the eligibility requirements?

To claim the foreign earned income exclusion, taxpayers must:

• Demonstrate that their tax home is in a foreign country

• Meet either the bona de residence test or the physical presence test

• Have income that qualies as foreign earned income

Income – Other Income

15-11

example

John and Mary are both in the Armed Forces and have been permanently stationed in Germany since

August 2007. Their tax home for the current year is Germany.

EXERCISES (continued)

Question 9: Alan has lived and worked in China since August 16, 2005. China is his tax home.

¨ True ¨ False

EXERCISES (continued)

Question 8: Miranda has lived in Puerto Rico since 2003. Is she eligible for the foreign earned income

exclusion? ¨ Yes ¨ No

The requirements are applied separately to each individual. If a married couple is working overseas, each

spouse must meet all requirements to qualify for the exclusion. If they do qualify, each is entitled to an

exclusion of up to the maximum amount for the current year.

The terms foreign, abroad, and overseas do not include Puerto Rico, U.S. Virgin Islands, American Samoa,

Guam, the Commonwealth of the Northern Marianas, Wake Island, the Midway Islands, and Johnston Island.

How do I determine the tax home?

To claim the foreign earned income exclusion, the taxpayer’s tax home must be in a foreign country. The tax

home is dened as the country in which the taxpayer is permanently or indenitely engaged to work as an

employee or a self-employed individual, regardless of where the family home is maintained.

For taxpayers who work abroad but do not have a regular place of business because of the nature of the

work, their tax home is the place where they regularly live. The tax home for members of the U.S. Armed

Forces is the permanent duty station, either land-based or on a ship.

What is a regular place of abode?

For purposes of the foreign earned income exclusion, if taxpayers work overseas for an indenite period of

time, and their regular place of abode is the U.S., the taxpayers cannot designate the foreign country as the

tax home.

“Regular place of abode” is dened as one’s home, habitation, domicile, or place of dwelling. It does not

necessarily include one’s principal place of business.

If the taxpayer maintains a place of business, or is assigned to overseas employment in a foreign country

for an indenite period, and does not maintain a regular place of abode in the U.S., the tax home is

overseas and the taxpayer may be eligible for the foreign earned income exclusion.

Income – Other Income

15-12

How do I determine whether the U.S. is the taxpayer’s regular place of abode?

Ask three questions to determine whether a U.S. home is the taxpayer’s regular place of abode:

1. Did you use your home in the U.S. as a residence while you worked at your job in the U.S. just before

going abroad to your new job, and did you continue to maintain work (e.g., contacts, job seeking, leave

of absence, ongoing business) in that area in the U.S. during the time you worked abroad?

2. Are your living expenses duplicated at your U.S. and foreign homes because your work requires you to

be away from your U.S. home?

3. Do you have a family member or members living at your U.S. home, or did you frequently use your U.S.

home for lodging during the period you worked abroad?

If the answer to two of the questions is “no,” the taxpayer is considered to be indenitely assigned to the

new location abroad and is eligible for the foreign earned income exclusion.

If the answer to all three questions is “yes” and the job duration is for less than one year with the taxpayer

returning to the U.S. home, the taxpayer is considered “temporarily away” from home. In this case, the

taxpayer does not qualify for the foreign earned income exclusion, but may qualify to deduct away-from-

home expenses.

If the answer to two of the three questions is “yes,” with the same expectation of job duration and return to

the U.S. home, the location of the tax home depends on the facts and circumstances.

example

Henry is a member of the Armed Forces. He was assigned to a post in Japan last year. This assignment

was for an indenite period that exceeds one year. Margaret, his wife, accompanied him to Japan and

has foreign earned income. They have not used their home in the U.S. as a place of residence for over a

year. Therefore, their tax home for this year is Japan.

EXERCISES (continued)

Question 10: Stan is employed on an oshore oil rig in the territorial waters of a foreign country and

works a 28-day on/28-day o schedule. He returns to his family residence in the U.S. during his o

periods. Does Stan’s employment satisfy the tax home test? ¨ Yes ¨ No

What is the period of stay requirement?

The period of stay is the amount of time the taxpayer stays in the foreign country. To meet the period of stay

requirement, the taxpayer must be either:

• A U.S. citizen or U.S. resident alien from a tax treaty country who is a bona de resident of a foreign

country (or countries) for an uninterrupted period that includes an entire tax year, or

• A U.S. citizen or U.S. resident alien who is physically present in a foreign country or countries for at

least 330 full days during any period of 12 consecutive months

Income – Other Income

15-13

What is the bona de residence test?

To meet the bona de residence test, taxpayers must show that they have set up permanent quarters

in a foreign country for an entire, uninterrupted tax year (even though they intend to eventually return to

the U.S.). Simply going to another country to work for a year or more is not enough to meet the bona de

residence test. A taxpayer must establish a residence in the foreign country.

A brief trip to the U.S. will not prevent the taxpayer from being a bona de resident, as long as the intention

to return to the foreign country is clear.

example

Charles is a military spouse who has lived and worked in England since 2006. His mother still lives in

the U.S. Charles came to the U.S. for two weeks this year to be with his mother after she had surgery.

Charles’ trip to the U.S. does not aect his status as a bona de resident of a foreign country.

EXERCISES (continued)

Question 11: Zach, a U.S. citizen, has homes in the U.S. and in Spain, where he has worked for the

last two years. Zach’s spouse, who is also a U.S. citizen, lives with him in Spain. Zach visits the U.S.

occasionally. Does Zach meet the bona de residence test in Spain? ¨ Yes ¨ No

What is the physical presence test?

If the taxpayers do not meet the bona de residence test, then they may qualify under the physical

presence test rules. To qualify, the taxpayers must be physically present in a foreign country 330 full days

during a period of twelve consecutive months.

In order for a day to count for the test, it must be a full day in a foreign country. When arriving from the U.S.,

or returning to the U.S., any day in which part of the time is spent in the U.S. or over international waters

does not count as a qualifying day in a foreign country.

The taxpayer may move about from one place to another in a foreign country or to another foreign country

without losing full days. If any part of the taxpayer’s travel is not in any foreign country and takes less

than 24 hours, you are considered to be in a foreign country during that part of travel. See Publication

54, Tax Guide for U.S. Citizens and Resident Aliens Abroad physical presence test section for additional

information.

example

If a taxpayer left England by ship at 10:00 p.m. on July 6 and arrived in Lisbon at 6:00 a.m. on July 8,

the taxpayer would lose July 6, 7, and 8 as full days because the trip took more than 24 hours. In this

example, if the taxpayer remained in Lisbon, the rst full day would be July 9.

Figuring the 12-Month Period

Any 12-month period may be used if the 330 full days in a foreign country fall within that period. If

necessary, more than one period may be used, including periods that overlap. See Publication 54 for

clarication on the physical presence rules.

Income – Other Income

15-14

What is qualifying income?

To qualify for the exclusion, income must be earned income.

How does earned income qualify for the exclusion?

To qualify for the exclusion, the earned income must be for services performed in a foreign country.

Amounts paid by the United States or its agencies to its employees do not qualify for the exclusion. This

includes military pay and payment for such activities as post exchanges, commissaries, and ocers clubs.

Earned income does not include:

• Dividends

• Interest

• Capital gains

• Alimony

• Social Security benets

• Pensions

• Annuities

example

Alisa, a U.S. resident, is a member of the Armed Forces and has lived in Japan since 2010. Her military

pay is not eligible for the foreign earned income exclusion. In her spare time, she is a self-employed DJ

in Tokyo. The income from her self-employment may qualify for the exclusion.

What are sources of earned income?

To qualify for the exclusion, services must be performed in a foreign country. Where the payments come

from or where they are deposited is not a factor in determining the source of the income.

If a taxpayer works predominantly in a foreign country, but does some work in the U.S., an adjustment must

be made to the total foreign earned income.

example

Earl works and lives in the Bahamas. During the tax year, he worked 49 weeks in the Bahamas. He

attended a business meeting in Florida for one week, and was on vacation for two weeks. One-ftieth or

2% of his wages are not foreign earned income because of the week spent working in Florida.

example

Ron and his wife Amy, both U.S. citizens, have lived in England for two years. Ron is in the military and

Amy works in a pastry shop in a nearby town. Ron’s military income does not qualify for the foreign

earned income exclusion but Amy’s wages from the company in England does qualify. The source of

Amy’s income is England.

EXERCISES (continued)

Question 12: Juanita lives in Scotland. She is retired and her income consists of U.S. Social Security, a

pension, and several stock dividends. Does she qualify for the foreign earned income exclusion?

¨ Yes ¨ No

Income – Other Income

15-15

How do I complete Form 2555?

Use the following guidelines when completing Form 2555.

• Part I is completed by all taxpayers

• Part II is completed by taxpayers who qualify under the bona de residence test

• Part III is completed by all taxpayers who qualify under the physical presence test

• Part IV is completed by all taxpayers – list all foreign earned income

• Part V is completed by all taxpayers

• Part VI is completed by taxpayers claiming the housing exclusion and/or housing deduction

• Part VII is completed by taxpayers claiming the foreign earned income exclusion

• Part VIII is completed by taxpayers claiming the foreign income exclusion, the foreign housing

exclusion, or both.

• Part IX is completed by taxpayers claiming the housing deduction if line 33 is more than line 36, and

line 27 is more than line 43

Tax Software Hint: To review information related to the software, go to the Volunteer Resource

Guide, Tab D, Income, Form 2555.

Taxpayer Interview and Tax Law Application

Look at the following sample interview for taxpayers Hudson and Hope Howard.

SAMPLE INTERVIEW

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

VOLUNTEER SAYS… HOPE RESPONDS…

Will we be able to exclude any of my

income on our tax return? I worked for

Bavaria Advertising in Munich this past

year and made $24,000 in U.S. dollars. I

heard that you don’t have to pay taxes on

income earned in a foreign country and

I’ve never done this before.

That is possible. First, we will have to determine if you meet

the requirements. Were you working as a military or civilian

employee of the U.S. government?

No, Bavaria Advertising is a foreign

company owned by a family right there in

Munich.

Great. That would qualify, but Hudson’s military pay won’t.

Let’s see. You are a U.S. citizen. You earned wages in a

foreign country and the total was less than the maximum

amount. You have no self-employment income or business/

moving expenses and since you lived on base, you won’t

have a foreign housing exclusion.

Yeah, that all sounds right.

Now we have to determine if you meet the bona de

residence or physical presence test and if your tax home is

in a foreign country.

It sounds complicated to me.

Don’t worry, I just need to ask you a few questions. How

long did you say you were in Germany?

We moved on base in Germany on

March 3, 2011 and just returned to the

states on January 10 this year.

Income – Other Income

15-16

SAMPLE INTERVIEW

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .

VOLUNTEER SAYS… HOPE RESPONDS…

No problem then. You were living in Germany for the entire

year so you are considered a bona de resident this tax

year. Since your home and place of employment were both

in Germany, you meet the tax home test. Now, what was

your address while you were living in Germany?

1567 Albion Street, Munich.

What did you do for Bavaria Advertising? I was a copywriter.

Do you have Bavaria Advertising’s address? I sure do; it is right here on this

statement.

Were you present in the U.S. during this tax year? I have to

enter the dates on this form.

Not this year. But we did come home

for the holidays last year.

Summary

Total income from all sources is entered on Form 1040.

Taxpayers are sometimes alarmed at how high their total income is. If this happens, reassure the taxpayer

that the return is not nished yet! It is very likely that adjustments, deductions, and credits will considerably

reduce the total tax owed.

Other income includes any taxable income for which there is not a specic line identied on Form 1040.

This income is reported on the other income line of Form 1040, Schedule 1.

If a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the

debt was canceled, all the canceled debt will be included on the tax return as other income.

U.S. citizens and resident aliens are taxed on worldwide income. They must le a U.S. tax return even if all

the income is from foreign sources, and even if they pay taxes to another country.

When taxpayers living abroad receive income in foreign currency, the amounts reported on the return

must be converted into U.S. dollars. Use the exchange rate prevailing when the taxpayer receives the pay

or accrues the item. If there is more than one exchange rate, use the one that most properly reects the

income.

If the taxpayers are eligible to exclude some or all of their foreign earned income, then Form 2555 must be

completed. The excludable amount will be entered as a negative number on Schedule 1 to oset income

reported as wages or self-employment income.

What situations are out of scope for the VITA/TCE programs?

The following are out of scope for this lesson. While this list may not be all inclusive, it is provided for your

awareness only.

• Distributions from an ABLE account in which the funds were not fully used for qualied disability

expenses

• Distributions from Educational Savings Accounts in which the:

○ Funds were not used for qualied education expenses, or

○ Distribution was more than the amount of the qualied expenses

• Taxpayers who are insolvent and had debt canceled

Income – Other Income

15-17

EXERCISE ANSWERS

Answer 1: B. Greg is fairly certain that he has more debt than he has assets, which means he is

insolvent. This situation is beyond the scope of the VITA/TCE programs.

Answer 2: Yes. Kay was solvent and not in bankruptcy, and the credit card company issued her a

Form 1099-C.

Answer 3: D. Kay would report $7,500 on her Form 1040.

Answer 4: B. Marta’s gross income includes her wages and interest, both of which should be reported

on her tax return.

Answer 5: C. Mary’s gross income includes her wages, interest, and gambling winnings, all of which

should be reported on her tax return. Her child support payments are her only nontaxable income.

Answer 6: A. Dividing 200 Euros by the .75514 exchange rate comes to $264.85.

Answer 7: C. Dividing 36,000 Euros by the .7000 exchange rate comes to $51,428.57.

Answer 8: No. Miranda is not eligible for the foreign earned income exclusion because Puerto Rico is

not a foreign country.

Answer 9: True. Generally, the tax home is the country in which taxpayers maintain their place of

business. Because Alan works in China, it is considered to be his tax home. For taxpayers who do not

have a regular place of business because of the nature of the work, their tax home is the place where

they regularly live.

Answer 10: No. Stan is considered to have a residence in the United States and does not satisfy the

tax home test in the foreign country. He is not eligible for the foreign earned income exclusion.

Answer 11: Yes. Since Zach went to Spain to work and has established a permanent residence there

with his spouse, he meets the bona de residence test.

Answer 12: No. Social Security benets, pension, and dividends do not qualify as earned income;

therefore, Juanita does not qualify for the foreign earned income exclusion.

TAX LAW APPLICATION

To gain a better understanding of the tax law, complete the practice return(s) for your course of study

using the Practice Lab on L<.

Income – Other Income

15-18

Notes