Understanding Property

Taxes in Ohio

DAVID A. GRAHAM

GREENE COUNTY AUDITOR

DGRAHAM@CO.GREENE.OH.US

Items to Discuss

General Comments

Terminology

Types of Levies

Why are we always seeing new levies

Exceptions to the rules

Myths

General Comments

Property taxes are not fair:

◦ Based on value of what you own not what you can afford to pay

◦ You cannot control always control you property value

Property taxes produce a stable source of income that does not fluctuate as

dramatically with the economy as sales and income taxes

Property taxes are confusing it’s not just: value * rate = tax

Basic Terminology

Appraised/Market Value – What the property is expected to sell for at a given point in time

Assessed/Taxable Value – 35% of the appraised/market value for real property

Full/Voted Tax Rate – rate established by law or by voters

Effective Tax Rate – the rate actually paid by the tax payer

Rollbacks/Credits – portion of property tax paid by state on behalf of property owners

Millage – term used to express tax rate (equals $1 per $1000 of assessed value)

So a one mill levy would cost the owner of a home appraised for $100,000, $35 per year

($100,000 * 35% * 1 mill / $1000)

Types of Ballot Issues

Additional – new levy generates additional revenue

Replacement – replaces an existing levy so that the effective rate of the levy reverts back to the

voted rate

Renewal – continues an existing levy at its current effective tax rate

Note: Any additional levy passed or replaced after August 2013 does not qualify for the Non-

business or Owner Occupancy Credit

Types of Levies

Inside

Fixed Sum

Fixed Rate

Substitute

Types of Levies – Inside Millage

Unvoted

Maximum of 10 mills within a taxing district

Can only be adjusted by the Budget Commission or the Courts

Makes up a relatively small portion of the total millage in a taxing district

As value changes, regardless of why, revenue changes by an equal percentage

The rate is constant; the revenue and value are variable

Types of Levies – Fixed Sum Levies

Levy voted to generate a specific amount of revenue

Limited to Bond and Emergency levies

Rate set each year by the Budget Commission to generate required revenue

A change in value, regardless of the reason, has an inverse effect on the rate

If values increase 10% the rate will decrease so the levy generates the same revenue

The revenue is constant; the value and rate are variable

Types of Levies – Fixed Rate Levies

Most popular type of levy

Why value changes determines the impact on revenue and the tax rate:

Reappraisal value changes – revaluing something that previously existed

◦ Rate is adjusted to generate the same amount of revenue as the prior year

◦ Revenue remains constant; value and rate are variable

Non-Reappraisal changes – valuing something that has changed (new construction)

◦ As new construction occurs additional revenue is received

◦ Rate remains constant; value and revenue are variable

Theory

Just because the value of something increased does not mean it costs more to provide services

New construction generally results in increased demand for services and thus generate more revenue

Types of Levies – Substitute/Incremental

Levies

Only applicable to school district

Like a Fixed Sum Levy

- guaranteed to generate at least the amount of money it did in the

previous year regardless of value change

Like a Fixed Rate Levy - allows for additional revenue to be realized

Incremental Levy – incremental increases are established in ballot language to provide

guaranteed growth

Substitute Levy – allows revenue growth for non-reappraisal changes (new construction)

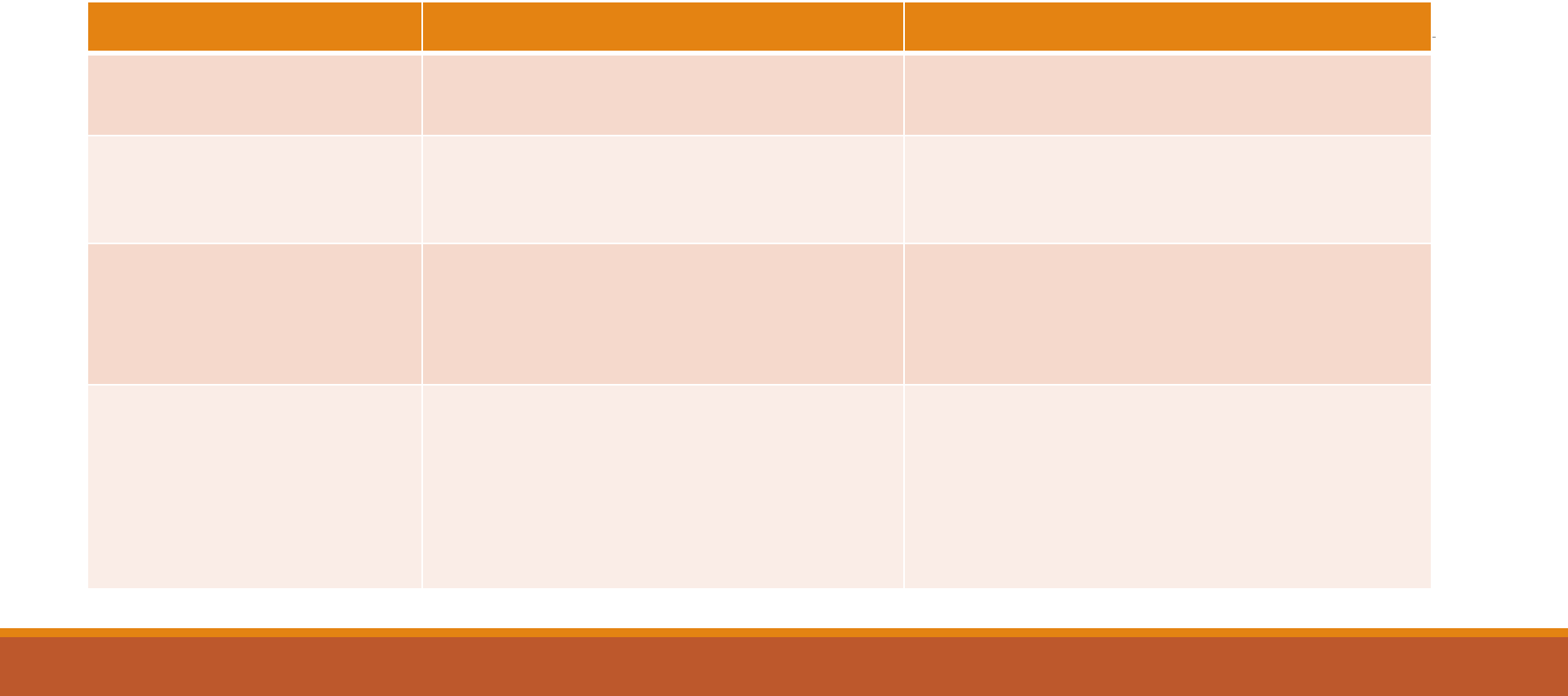

Summary of Types of Tax Levies

Levy Type Description Impact of Value Change

Inside – Unvoted • 10 mill limit

• shared among political subdivisions

• Moves in direct proportion to value change

• Value up 10% taxes up 10%

Voted Fixed Sum Levies –

Voted

• Bond & Emergency levies

• Rate set to produce a specific dollar

amount

• As values increase rate decreases resulting

in no tax impact

Fixed Rate Levies – Voted • Specific rate approved by the voters

• Rate is adjusted for reappraisal changes

• As value increases due to reappraisal; rate is

reduced resulting in no tax impact

• Value increases due to new construction

taxes increase

Substitute Levies • Combination of Fixed Rate & Fixed Sum

Levies

• Guaranteed the amount received in the

prior year

• As value increases due to reappraisal; rate is

reduced resulting in no tax impact

• Value increases due to new construction

taxes increase

11

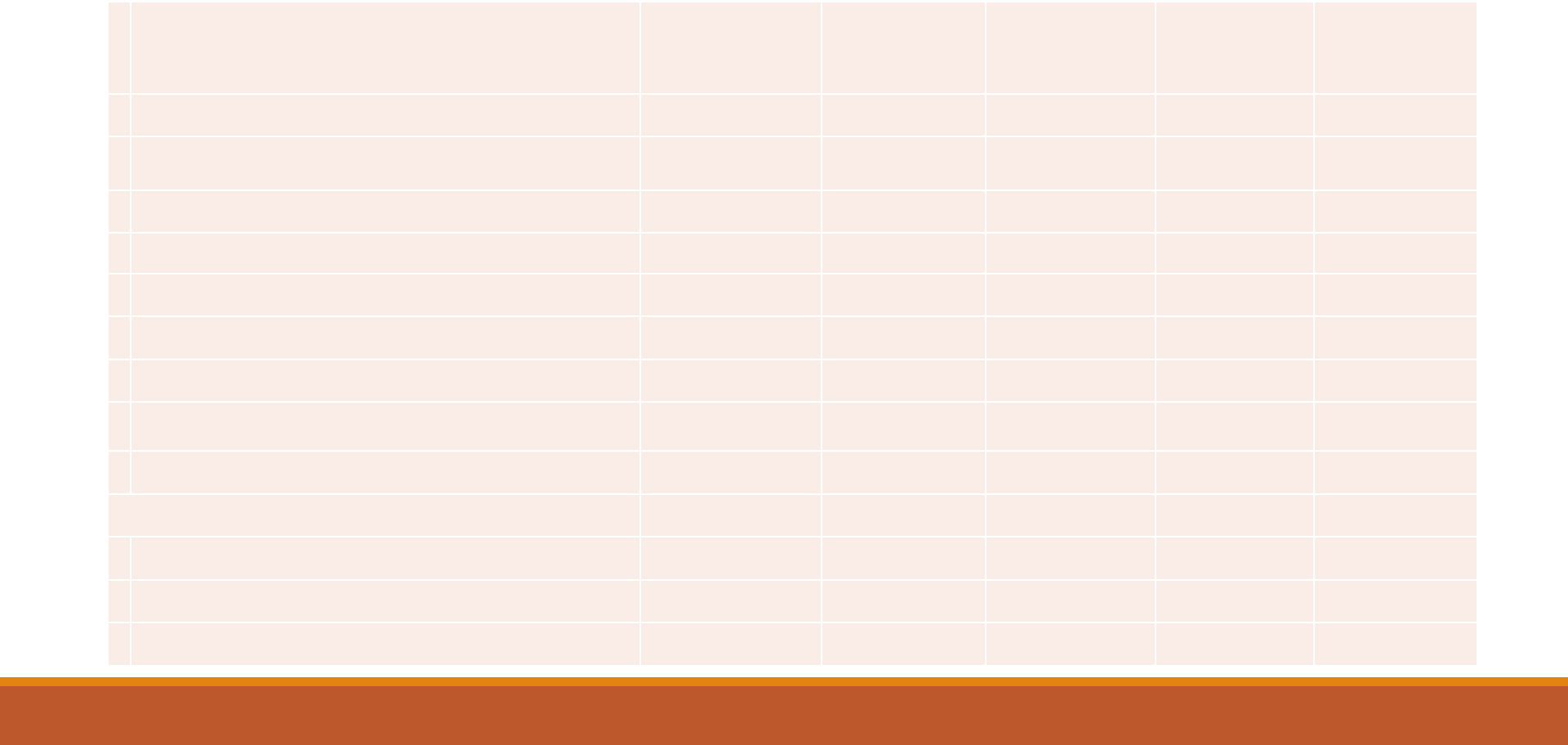

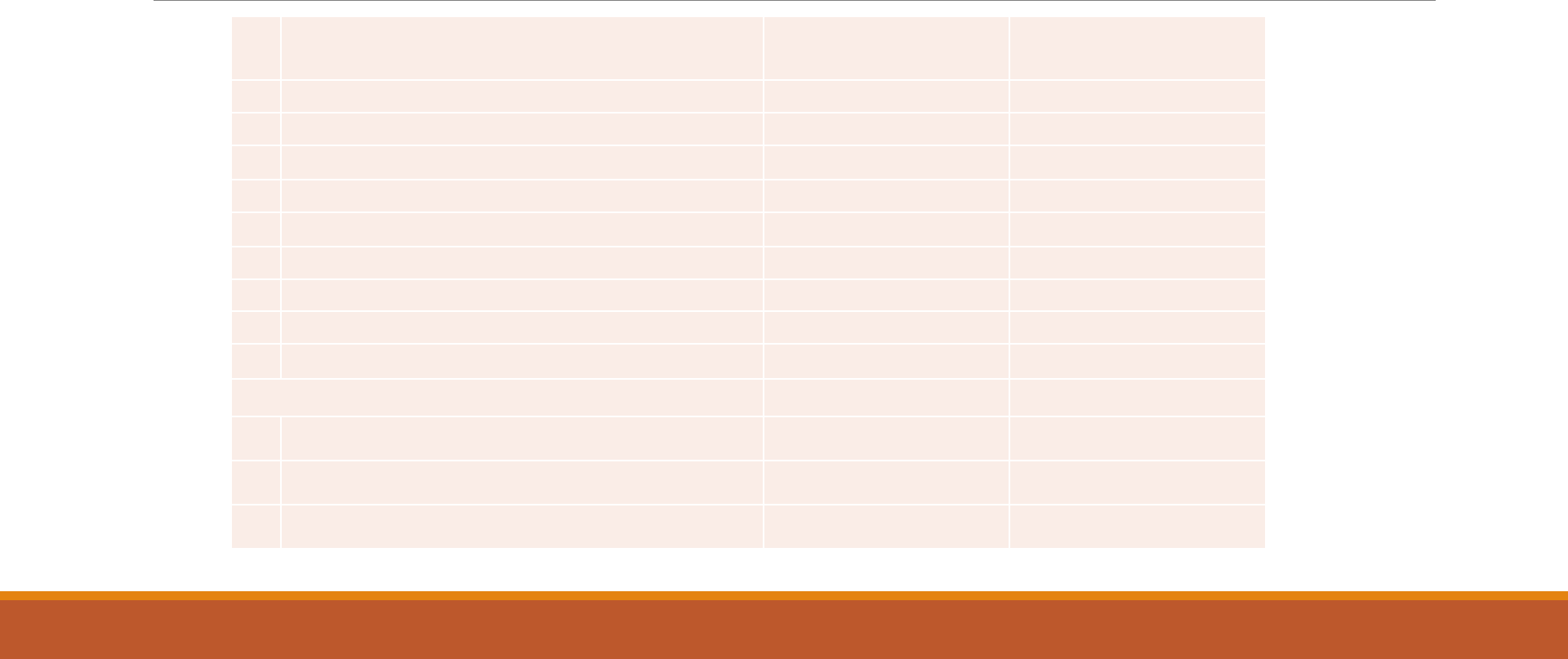

Example With Value Increases

Inside

Levies

Fixed Sum

Levies

Substitute

Levies

Fixed Rate

Levies Total

Assessed Value

$ 100,000 $ 100,000 $ 100,000 $ 100,000 $ 100,000

Effective Tax Rate

10.00 8.00 4.00 50.00 72.00

Tax Revenue

$ 1,000 $ 800 $ 400 $ 5,000 $ 7,200

Reappraisal Change (10%)

$ 10,000 $ 10,000 $ 10,000 $ 10,000 $ 10,000

New Construction (2%)

$ 2,000 $ 2,000 $ 2,000 $ 2,000 $ 2,000

New Value (12% Higher)

$ 112,000 $ 112,000 $ 112,000 $ 112,000 $ 112,000

New Effective Tax Rate

10.00 7.14 3.64 45.45 66.23

New Taxes

$ 1,120 $ 800 $ 407 $ 5,091 $ 7,418

Analysis of Changes

% Change in Value

12% 12% 12% 12%

12%

% Change in Taxes

12% 0% 2% 2%

3%

% Change in Tax Rate

0% -11% -9% -9% -

8%

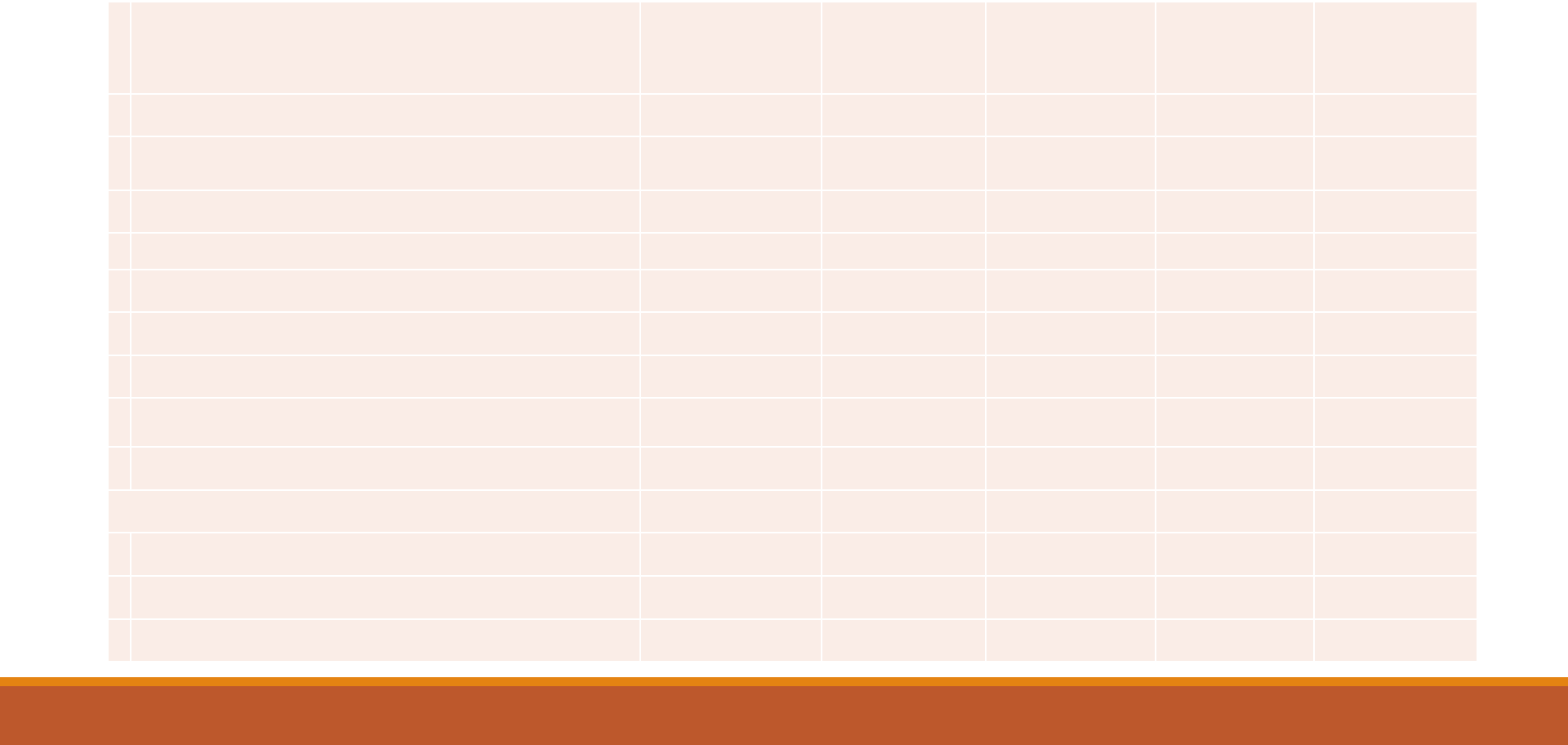

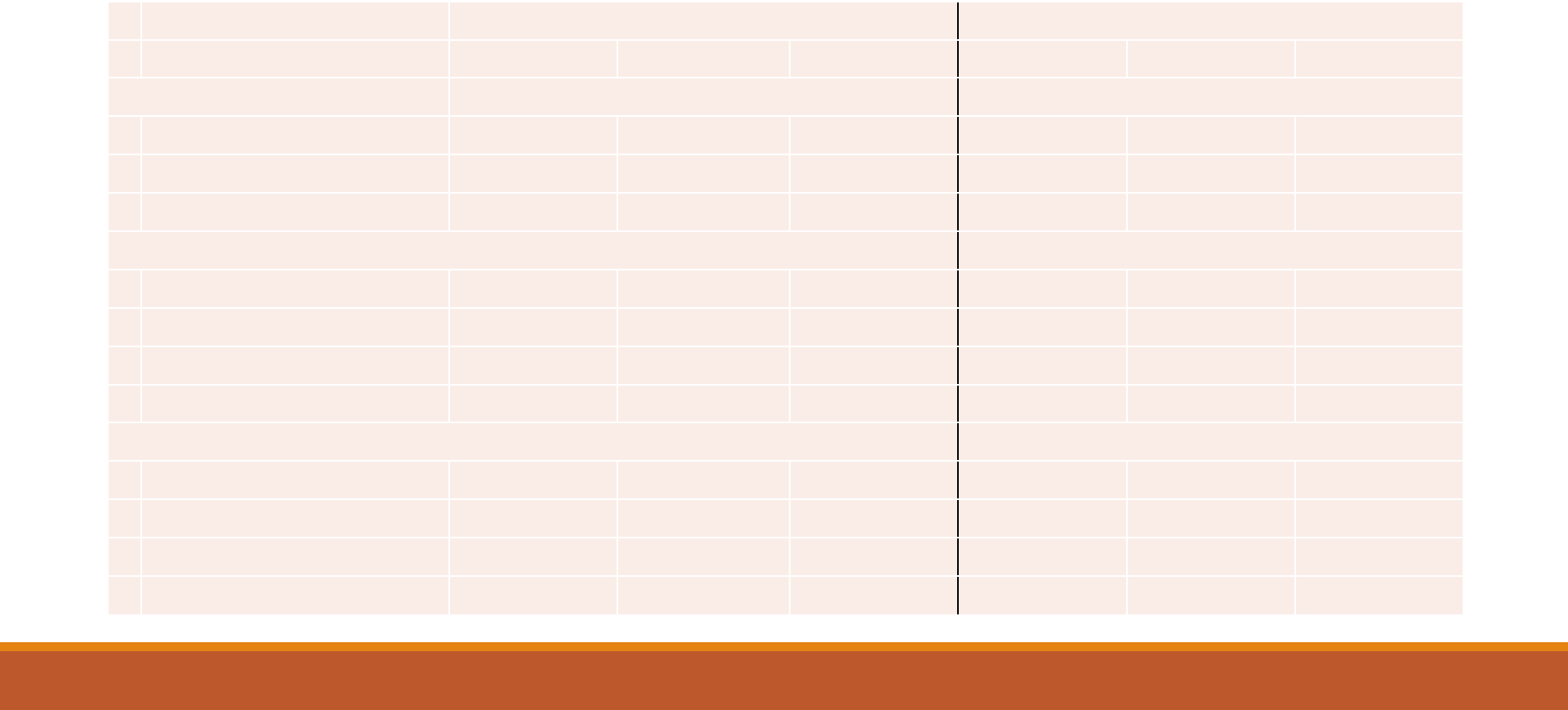

Example With Value Decreases

Inside

Levies

Fixed Sum

Levies

Substitute

Levies

Fixed Rate

Levies Total

Assessed Value

$100,000

$100,000

$100,000

$100,000

$100,000

Effective Tax Rate

10.00

8.00

4.00

50.00

72.00

Tax Revenue

$1,000

$800

$400

$5,000

$7,200

Reappraisal Change (

-10%) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000)

Demolition (

-2%) ($2,000)

($2,000)

($2,000)

($2,000)

($2,000)

New Value (8% Lower)

$88,000

$88,000

$88,000

$88,000

$88,000

New Effective Tax Rate

10.00

9.1 4.55 55.68 79.33

New Taxes

$880

$800

$400

$4,900

$6,981

Analysis of Changes

% Change in Value

-12% -12% -12% -12% -

12%

% Change in Taxes

-12% 0% 0% -2% -

3%

% Change in Tax Rate

0% 14% 14% 11%

10%

Why are we constantly seeing additional

levies?

The largest portion of valuation changes are reappraisal changes

Property valuations are only updated every three years

Reappraisal occur once every six years

Triennial updates at the mid point of the reappraisal cycle

Most levies supporting government operations do not allow for revenue growth from

reappraisal changes

Revenue growth occurring due to new construction generally result in an increase in demand for

services

Value Changes from our 2020

Reappraisal

Prior Year Value 561,845,680

Reappraisal Change 59,519,570 10%

Non-Reappraisal Changes 14,729,260 3%

New Value 636,094,510 13%

Watch what occurs to the rates and revenue

Levy Type

PY

Rate

CY

Rate Change

%

Change

PY Revenue CY Revenue $ Change % Change

Inside 4.5 4.5 0 0% 2,622,837 2,957,432 334,595 13%

Fixed Rate 31.05 27.99 (3.06) (10%) 18,829,641 19,258,563 428,922 2%

Total 35.55 32.49 (3.06) (9%) 21,452,478 22,215,995 763,517 4%

Analyzing These Changes

Overall revenues up 4%

◦ Values up 13%

◦ Inside Millage only makes up 13% of their operating levies

This was an update year which only occurs once every three years

◦ Based on these numbers, if there were no reappraisal change revenue would have increased 2-3%

◦ Would this keep up with inflation

New construction generally results in an increased demand for services

◦ Does the revenue produced from new construction keep up with the cost for the additional services

Exceptions to the Fixed Rate Levy Rules -

When Voted Rate Equals the Effective Rate

The effective tax rate cannot exceed the voted rate for a fixed rate levy

If a levy has an effective tax rate equal to the voted rate the effective rate cannot increase which

results in a loss of revenue

Example – Exceptions for Fixed Rate Levies -

Effective Rate Equals Voted Rate

Previous

Example

When Voted Rate =

Effective Rate

Assessed Value

$100,000

$100,000

Voted/Effective Rate 50

50

Tax Revenue

$5,000

$5,000

Reappraisal Change (-10%) ($10,000)

($10,000)

Demolition (-2%) ($2,000)

($2,000)

New Value

$88,000

$88,000

New Effective Tax Rate 55.68

50

New Taxes

$4,900

$4,400

Analysis of Changes

% Change in Value -12%

-

12%

% Change in Taxes -2% -

14%

% Change in Tax Rate 11%

0%

Exceptions to the Fixed Rate Levy Rules -

The 20/2 Mill Floor

• Applies to School Districts (20 mill floor) and JVS (2 mill floor)

• If you have general fund levies in excess of the floor the effective rate of the general fund

levies cannot go below the floor

• Excludes Emergency, Incremental, Substitute, Bond, Permanent Improvement and Class

Room Facilities Levies

• If reappraisal changes would cause your rate to decrease below the floor the rate is adjusted

upwards to reach the floor so you receive additional revenue from reappraisal changes

• The floor adjustment is annual and not cumulative

◦ Value increases from reappraisal changes increase the base revenue that the voted fixed rate

levies will produce

◦ If values decrease in the future due to reappraisal changes the base revenue will not decrease,

instead the effective tax rate will increase to produce that base revenue

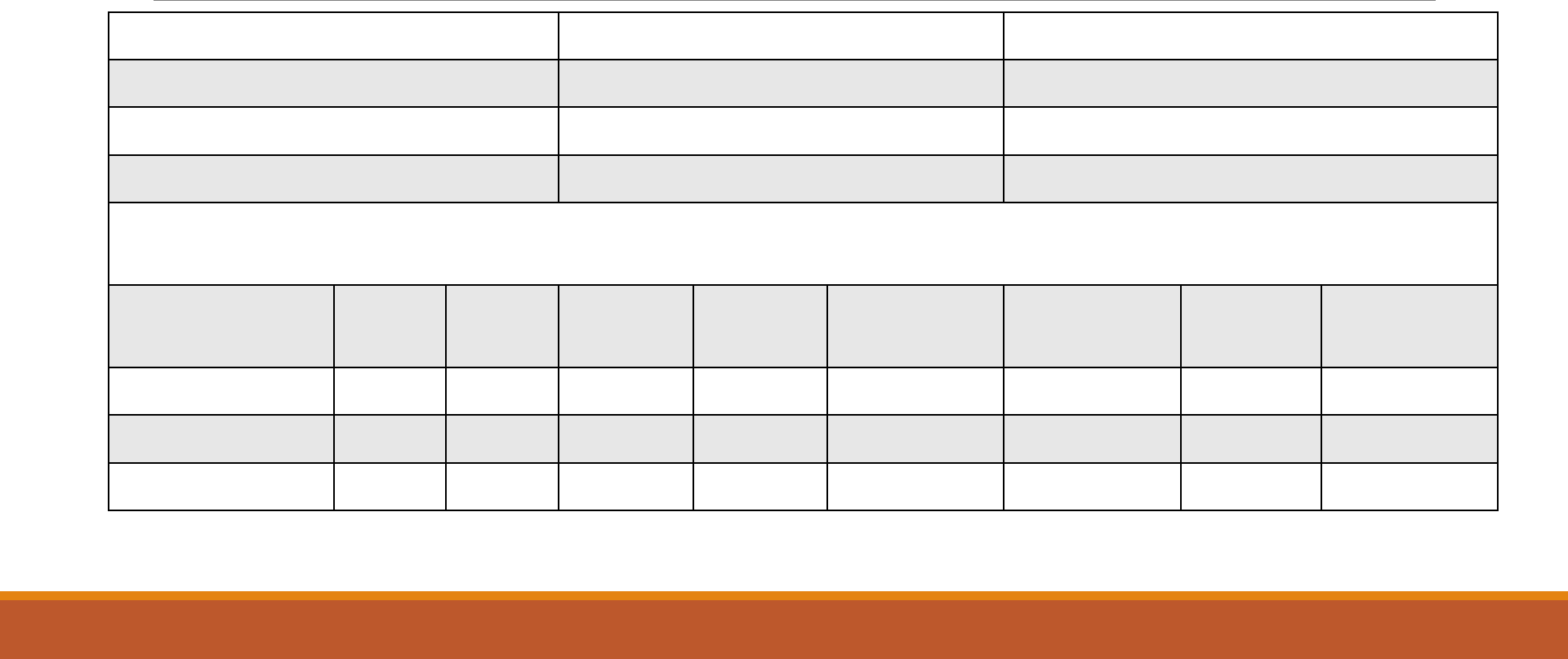

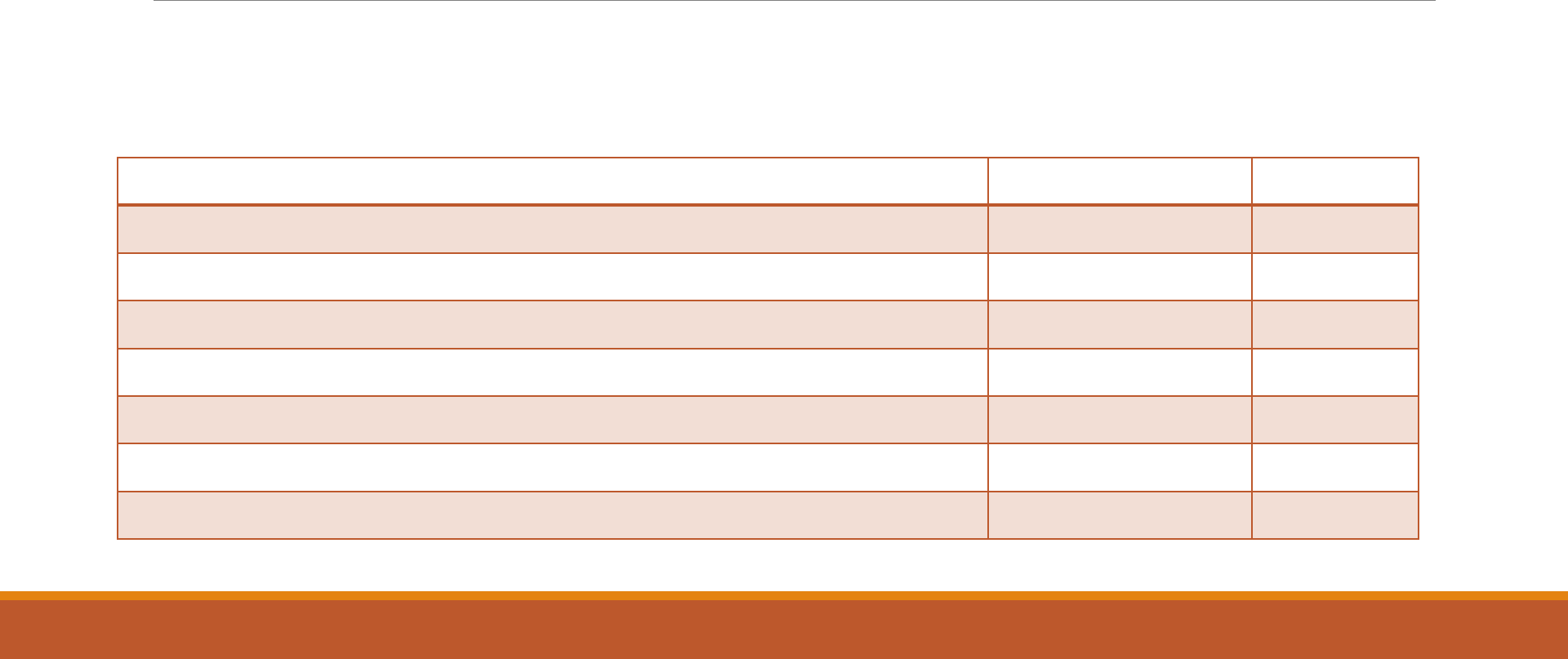

20 Mill Floor Example

With Floor Without Floor

Inside Fixed Rate Total Inside Fixed Rate Total

Year 1 - Base Year

Effective Rate

4.00

16.00

20.00

4.00

16.00

20.00

Assessed Value

$ 100,000

$ 100,000

$ 100,000

$ 100,000

$ 100,000

$ 100,000

Revenue

$ 400

$ 1,600

$ 2,000

$ 400

$ 1,600

$ 2,000

Year 2 - 10% Reappraisal Increase

Reappraisal Change

$ 10,000

$ 10,000

$ 10,000

$ 10,000

$ 10,000

$ 10,000

New Value

$ 110,000

$ 110,000

$ 110,000

$ 110,000

$ 110,000

$ 110,000

Effective Tax Rate

4.00

16.00

20.00

4.00

14.55

18.55

New Revenue

$ 440

$ 1,760

$ 2,200

$ 440

$ 1,600

$ 2,040

Year 3 - $10,000 Reappraisal Decrease

Reappraisal Change $ (10,000) $ (10,000) $ (10,000) $ (10,000) $ (10,000) $ (10,000)

New Value

$ 100,000

$ 100,000

$ 100,000

$ 100,000

$ 100,000

$ 100,000

Effective Tax Rate

4.00

17.60

21.60

4.00

16.00

20.00

New Revenue

$ 400

$ 1,760

$ 2,160

$ 400

$ 1,600

$ 2,000

Impact of the Floor on Revenue

Remember we said only inside millage moves directly with property value, but if

a school district is at the 20 mill floor the floor acts like inside millage resulting in

additional millage being subject to a direct correlation with property values.

Millage %

Inside Millage 10.000000 18%

Fixed Rate Levies Act Like Inside Millage

Xenia School District 15.700000 28%

Greene County Career Center 2.000000 3%

Total Millage Acts Like Inside Millage 27.700000 49%

Voted Millage Not Directly Correlated to Property Valuation Change 34.239644 51%

Total Effective Millage 56.906576

Why is the Floor Important

School District Floor Statistics

◦ 38% of school district are currently at the floor

◦ 23% of school district are within 5% of the floor

New levies may become increasingly more difficult to pass as more schools reach the floor

resulting in greater tax increases every three years

Common Myths #1

My 1984 fire levy still produces the same amount of money it did in

1984.

Most likely false. New construction generates additional revenue. If

your subdivision has not seen any new construction since 1984 it

could be true.

Common Myths #2

When new construction occurs there is only a one year increase in

the revenue.

◦ Not true. New construction comes on at the current effective tax

rate and continues to bring in additional money through the life of

the levy. This additional value increases the base revenue that the

levy generates.

◦ The converse is also true non-reappraisal decreases in value result

in a permanent loss in revenue.

Common Myth #3

If a levy is replaced it will continue to receive the rollback money

based on the old effective tax rate.

◦ Not true. Any replacement or additional levy approved after

August 2013 is not eligible for the owner occupancy or non-

business credit. This applies to the entire levy not just the

additional effective tax rate.

◦ Renewal of an existing levy that qualified for tax credits will

continue to qualify

◦ Homestead applies to all levies regardless of when they were

passed

Common Myth #4

When new construction is picked up it is taxed at the voted or full

rate.

False. New construction is picked up at the effective rate in place for

the tax year the new value was picked up. One effective rate applies

to all property in a given property class regardless of when the new

construction occurred.