Return to Work

Return to Work

A. Responsibilities: Claimant and Employing Agency

B. OPM Retention Rights

C. Offers of Employment

D. Preliminary Assessment

E. Advising the Claimant

F. Claimant’s Response

G. Refusal of Job Offer

H. Acceptable Reasons for Refusal

Return to Work

I. Unacceptable reasons for refusal

J. Further Action

K. Abandonment of Job

L. Acceptable Reasons for Abandonment

M. Unacceptable Reasons for Abandonment

N. Relocation Expenses

O. Case Study

Return to Work = Goal

• The primary goal of the Office of Workers’

Compensation Programs (OWCP) is to return injured

workers to suitable employment (RTW) either with

their original employing agency (EA) or with a

company in the private sector.

• OWCP is not a disability retirement program.

Injured Worker’s Responsibilities

• To seek or accept suitable employment.

• To resume federal employment if capable.

• To provide physician with information on any

available light duty.

• To participate fully in the vocational rehabilitation

effort (providing information, attending meetings and

testing, etc.)

Employer’s Responsibilities

When the claim is filed:

• Maintain contact with injured worker (IW).

• Monitor IW’s duty status and prospective date

of RTW.

• If alternative positions are available for a

partially disabled employee, advise IW in writing

of specific duties and physical demands.

• Where no alternative position is available with

current restrictions, continue to monitor the

medical condition and advise IW of any

accommodation(s) EA can make.

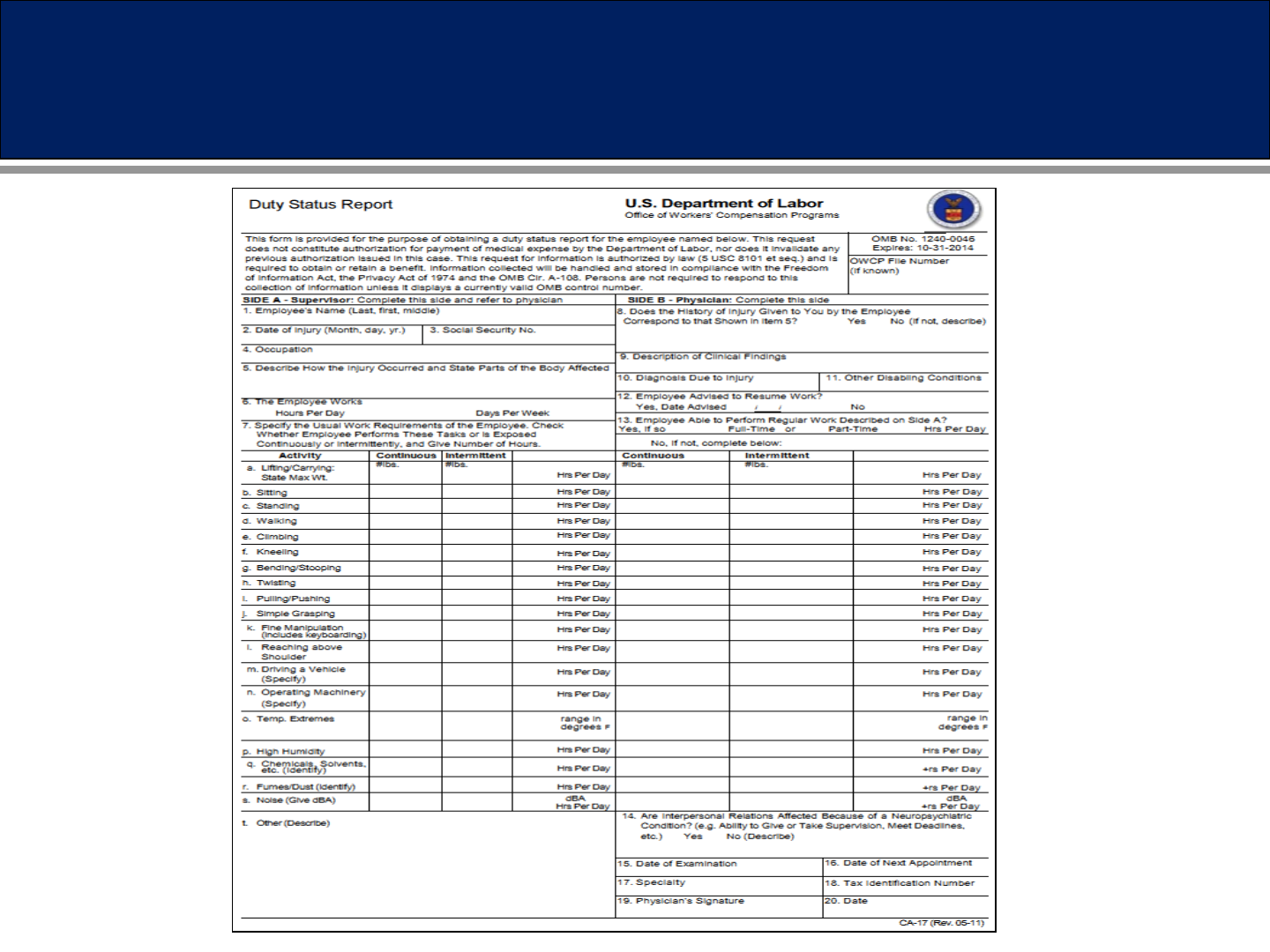

Form CA-17

• Form CA-17 - Duty Status Report: This form is provided for

purpose of obtaining a medical duty status report for IW. It

may be issued initially with Form CA-16.

• Supervisor/Employing Agency completes agency portion by

describing physical requirements of IW’s job and noting

availability of light or limited duty.

• EA can send to physician at any time during life of claim (at

reasonable intervals).

Form CA-17

Retention Rights

• Under 5 U.S.C. 8151, an employee who recovers within one year

of starting compensation has mandatory rights to his/her old

position or its equivalent, regardless of whether he/she is still on

EA rolls. If full recovery occurs after one year, or IW is considered

partially recovered, he/she is entitled to priority consideration as

long as application is made within 30 days of date compensation

ceases.

• Such employees incur no loss of benefits which they would have

received but for the injury or disease. Regulations on retention

rights are contained in 5 CFR 353, 302, & 330. These regulations,

as well as 5 U.S.C. 8151 are administered by the Office of

Personnel Management (OPM), not OWCP.

Retention Rights

• Any period of time during which an employee receives

compensation from OWCP is credited to employee for the

purposes of determining rights and benefits based upon length of

service, including eligibility for retirement.

• An employee who has applied for and been approved for federal

retirement benefits is no longer considered an employee, and any

reemployment is covered by OPM rules and regulations for

reemployed annuitants. This is true even if employee never

actually received a federal retirement annuity.

Return to Work – Job Offers

• EA must consider physical or emotional restrictions

placed on an employee due to a work related injury, as

well as any concurrent, non-injury related ailments

(whole person).

• EA personnel can request work restrictions directly from

physician, from an OWCP nurse, or OWCP Claims

Examiner (CE).

• If work restrictions differ, OWCP will determine which

are appropriate.

Developing a Job Offer

• 20 CFR 10.506 allows an EA to monitor IW’s medical care.

• EA may contact the physician in writing only and at

reasonable intervals.

• EA may contact IW at reasonable intervals for updated

medical information.

• If OWCP obtains medical evidence that indicates IW is able

to RTW, a job offer may be solicited by Rehabilitation

Specialist (RS), Rehabilitation Counselor (RC), Staff Nurse

(SN), or CE.

Types of Job Offers

1. Limited Duty Assignments: Most often occur during IW’s initial recovery

period. IW cannot perform his/her date of injury job, but is capable of

performing some type of work.

• The assignment is not intended to represent permanent job

placement and, as such,

• a formal suitability ruling cannot be made on these types of

temporary assignments.

2. Permanent Rehabilitation Job Offer: OWCP has determined that IW

requires permanent medical restrictions due to work injury, and EA offers

IW a permanent position within those medical restrictions.

Required Elements of a Job Offer

Job offer must be in writing and include following

information:

• Description of specific job duties to be

performed

• Specific physical requirements of position, and

any special demands or unusual working

conditions

• Schedule

• Organizational and geographical location

• Date job is first available

• Date by which a response to job offer is required

• Provide pay information including grade, step

and salary

Job Offer: Do’s and Don’ts

Do

• Base job offer on restrictions of record

• Send a copy of job offer to OWCP

• Send a copy of IW’s response to job offer to OWCP

Don’t

• Do not include any information in job offer regarding

election of OPM benefits, since obtaining an election is

solely responsibility of OWCP.

Preliminary Assessment of Job

Once OWCP receives a copy of a written job offer, a preliminary

assessment will be made on whether job is suitable, including:

• Must involve four hours of work per day if IW is capable of working

four hours or more.

• Permanent seasonal employment is not suitable unless IW was a

career seasonal or temporary employee when injured.

• Temporary job will be considered unsuitable unless IW was a temporary

employee when injured.

• If medical reports in file document a condition which has arisen since

compensable injury, and this condition disables IW from offered job, job

will be considered unsuitable (even if subsequently-acquired condition

is not work related).

Accepted Job Offer – Employee

Responsibilities

IW should take following actions:

• Sign offer and notify EA of acceptance;

• Contact EA for a start date and time; and

• Notify OWCP of RTW in order to avoid overpayment

Accepted Job Offer – OWCP Responsibilities

• If IW accepts offered job, there is no need to request a

job suitability determination.

• Generally, if IW has performed a job for 60 days or more

and is working number of hours he/she is capable of

working, this establishes that job fairly and reasonably

represents his/her wage earning capacity. It is not

necessary for OWCP to make a determination

concerning validity or suitability of offered job in these

situations.

Refusal of Job Offer – OWCP Responsibilities

• If IW refuses offered job, OWCP should be notified immediately and

provided a copy of refusal.

• At that time OWCP will make a determination if job offer contained

necessary elements and if the offer is “suitable”:

– Compare duties and physical requirements of job offer to medical

limitations on file

– Determine whether IW is vocationally capable of performing job

– Determine whether kind of appointment (i.e. part time or

temporary) is at least equivalent to that of job held on date of injury

Suitability Determination – Not Suitable Offer

• If job offer is determined to be not suitable, OWCP will

notify EA and request that EA modifies offer.

• IW will continue on compensation while a suitable offer is

pursued; vocational rehabilitation services are initiated or

continued; or any necessary medical development is

undertaken

.

Suitability Determination – Suitable Offer

• After assessing position and determining job is suitable,

OWCP will telephone EA to confirm that job remains

open to IW, and then will advise IW in writing:

– Job is considered suitable.

– Job remains open for IW.

– IW will be paid compensation for difference (if any) between pay of

offered job and pay of IW's date of injury job.

– IW can still accept job with no penalty.

– IW has 30 days from date of CE's letter to either accept job or provide a

written explanation of reason (s) for refusing it.

Injured Worker’s Response to Suitability Finding

• If IW submits evidence and/or reason(s) for refusing

offered position, OWCP will evaluate IW response.

• OWCP will then determine whether reason(s) for

refusing job are valid.

Acceptable Reasons for Refusing a Job Offer

• Reasons which may be considered acceptable for refusing

offered job include (but are not limited to):

– Offered position was withdrawn.

– IW found other work which fairly and reasonably

represents his/her earning capacity.

– Medical evidence establishes that IW’s condition has

worsened since beginning of reemployment effort, and

IW is now disabled for job in question.

Acceptable Reasons for Refusing a Job Offer

– IW provides evidence that his/her decision was based

on attending physician's advice, and that such advice

included medical reasoning in support of opinion.

– Medical evidence establishes that IW is unable to travel

to job because of residuals of injury. (However,

expenditures of an IW who is able to travel, but requires

special arrangements to do so may be reimbursed as a

vocational rehabilitation expense.)

Acceptable Reasons for Refusing a Job Offer

• An IW may be on both EA's rolls as a matter of employment status, and OWCP's

rolls for purposes of compensation payment, at same time. For IWs no longer on

EA’s rolls--that is, who have been separated by formal personnel action--the

following are also considered acceptable reasons for refusing offered job:

– IW will lose health insurance coverage by accepting job. (If offered job is not

classified at same grade level as date of injury job, EA should be asked to

offer job at a pay rate lower than date of injury job, so that compensation will

be payable and OWCP can retain IW's health insurance enrollment.)

– IW is already working, and job fairly and reasonably represents his/her Wage

Earning Capacity (WEC), whether or not a formal rating is in place.

– IW has moved, and a medical condition (either pre-existing or subsequent to

the injury) of IW or a family member contraindicates return to area of

residence at time of injury.

Unacceptable Reasons for Refusing a Job Offer

• Reasons which may not be considered acceptable for refusing

offered job include (but are not limited to):

– IW's preference for area in which he/she currently resides

– Personal dislike of position offered or work hours scheduled

– Lack of potential for promotion

– Lack of job security

– Retirement

– Previously-issued rating for loss of WEC based on a

constructed position where IW is not already working at a

job which fairly and reasonably represents his/her WEC.

Advising Injured Worker

• If OWCP determines response is not sufficient to justify refusal,

IW is so advised, and afforded 15 days to accept job.

• IW who unreasonably refuses an offer of suitable employment is

not entitled to any further compensation benefits.

• If IW continues to decline offer after 15 days elapses, a

compensation order will be issued denying entitlement to further

compensation benefits (5 USC 8106 (c )(2)). This applies to wage

loss and schedule award only, not medical benefits.

Assessing Reasons for Refusal

• If IW worker provides a justified reason for refusal, OWCP will:

– notify both IW and EA of finding, and

– IW will be continued on temporary total disability (TTD) while CE contacts

EA concerning further attempts at placement.

• If EA is unable to make any further job offers, IW will be referred

to a rehab specialist for consideration of further vocational

rehabilitation services.

Assessing Reasons for Refusal

• If IW does not provide a justified reason for refusal, OWCP will do the

following:

– IW will be notified by letter that his/her reason(s) for refusal are not

justified and he/she will be afforded an additional 15 days to accept job

offer.

• If IW continues to refuse job offer, a formal decision shall be prepared

which provides full findings of facts as to why IW’s reason(s) for refusing

job are deemed unacceptable.

• Entitlement to all compensation benefits, including a schedule award, is

terminated; however, medical benefits continue.

Compensation Benefits and RTW

20 CFR §10.500 provides the basic rules governing continuing receipt of compensation

benefits and return to work.

Benefits are available only while the effects of a work-related condition continue.

Compensation for wage loss due to disability is available only for any periods during which

an employee’s work-related medical condition prevents him or her from earning the wages

earned before the work-related injury.

For example, an employee is not entitled to compensation for any wage loss claimed on

a CA-7 to the extent that evidence contemporaneous with the period claimed on a CA-7

establishes that an employee had medically required work restrictions in place; that

light duty within those work restrictions was available; and that the employee was

previously notified in writing that such duty was available.

Similarly, an employee receiving continuing periodic payments for disability was not

prevented from earning the wages earned before the work-related injury if the

evidence establishes that the employer had provided, in accordance with OWCP

procedures, a temporary light duty assignment within the employee’s work restrictions.

Compensation Benefits and RTW

20 CFR §10.500 continued:

Each disabled employee is obligated to perform such work as he or she can.

OWCP's goal is to return each disabled employee to work as soon as he or she is

medically able.

When an offer of employment is made, and the position is not temporary, the job

offer can be evaluated under the auspices of 5 U.S.C. §8106(c) which is a sanction

decision that affects ongoing compensation and schedule award entitlements.

When a job offer is temporary

but is not accepted or performed, compensation

for wage loss for a specific time frame would be evaluated under the criteria of 20

C.F.R. § 10.500.

However, if either decision is made, medical benefits remain payable.

Temporary Assignments

Basic Criteria for Applicability

– The temporary LD assignment may be for either a specified or indefinite period of

time.

– The LD assignment must take into account the claimant’s work-related condition(s),

as well as any pre-existing medical condition(s) and any condition(s) which have

arisen since the compensable injury.

– If the agency is only able to provide a temporary LD assignment when the claimant

has permanent work restrictions, the agency must provide written verification that

it is unable to provide a permanent job offer.

– In certain circumstances, a temporary assignment for fewer than the number of

hours upon which the claimant is released may be considered

– The LD assignment should be in the location where the claimant currently resides.

If this is not practical, the agency may provide LD at the claimant’s former duty

station if that station is within the claimant’s commuting area.

– Reemployment at any other location may only be considered where the distance

between the location of the LD assignment and the location where the claimant

currently resides is no greater than 50 miles.

Abandonment of a Job

• When an IW stops work after reemployment, it may require further action,

depending on whether rating has been completed at time work stoppage

occurs.

• If no claim for recurrence is filed, and a retroactive loss of WEC is not

appropriate, CE should consider applying penalty provision of 5 U.S.C.

8106(c)(2). This may be invoked if an IW is shown to have abandoned a

suitable job without good reason and subsequently, claims benefits. Reasons

for abandoning employment must be explored before penalty provision is

applied.

• CE must make a finding of suitability, advise IW that job is suitable and that

refusal of it may result in application of penalty provision of 5 U.S.C. 8106(c)(2),

and allow IW 30 days to submit his/her reasons for abandoning job. If IW

submits evidence and/or reason(s) for abandoning job, CE must carefully

evaluate IW's response and determine whether IW's reasons for doing so are

valid.

Job Abandonment – Injured Worker’s Response

• If IW returns to work, a formal decision determining loss of WEC

should be made after 60 days of reemployment.

• If no reply is received from IW, CE should prepare a formal decision

which terminates any further compensation for wage loss (effective

as of end of roll period), as well as compensation for permanent

partial impairment to a schedule member, under 5 U.S.C. 8106(c)(2).

IW's entitlement to payment of medical expenses for treatment of

accepted condition(s) is not terminated.

• If IW provides reasons for ceasing employment which do not

constitute a claim for recurrence, CE must evaluate reasons given.

Acceptable Reasons for Abandonment

• Reasons which CE may accept include (but are not

limited to):

– IW found other work which fairly and reasonably represents

his/her earning capacity (in which case compensation would

be adjusted or terminated based on actual earnings).

– A subsequent medical condition prevents IW from continuing

to perform job.

Unacceptable Reasons for Abandonment

• Reasons which CE should not accept include (but are

not limited to):

– personal dislike of position or work hours

– lack of potential for promotion

– lack of job security

Relocation Expenses

• OWCP's regulations (20 CFR 10.123(f)) provide that an IW

who relocates to accept a suitable job offer after

termination from EA’s rolls may receive payment or

reimbursement of moving expenses from compensation

fund.

• OWCP's regulations (20 CFR 10.123(f)) further provide that

federal travel regulations (addressing permanent change

of duty station (PCS) moves) will be used to determine

whether expenses claimed are reasonable and necessary.

Relocation Expenses – Criteria for Payment

• Relocation expenses are payable only to an IW who is no longer

on EA’s rolls. They are payable whether IW still resides in locale

where he/she last worked and is offered employment in another

area, or whether IW has moved away from locale where he/she

was employed and is offered employment in either original area

or a different one.

• Expenses may be paid for relocation to a temporary job as long as

it is expected to lead to a permanent assignment, but may not be

paid for relocation to a temporary job which is not expected to

lead to a permanent assignment. The distance between the two

locations must be at least 50 miles, but IW is not required to

demonstrate financial need for relocation expenses to be paid.

Relocation Expenses – Responsibilities

• District Office staff will adjudicate all requests for relocation. (EA, however,

has an advisory role with respect to amounts payable.) Where relocation is

approved, district office will pay or reimburse authorized expenses to IW

or EA.

• National Office staff will handle all requests for advance payment from

compensation fund in cases where EA cannot provide money for move

from its own accounts, and IW has not already expended funds.

• EA will be asked to make all arrangements for move (e.g., have a moving

company transport IW's household goods to new duty station). It will also

be asked to ensure that types of expenses and actual amounts are

allowable according to GSA travel regulations and according to what EA

would authorize for any other employee making a PCS move. [CEs are not

expected to determine kinds of expenses and amounts payable.]

Relocation Expenses – Advising the Parties

• IW may inquire whether relocation expenses will be paid if

he/she accepts a job offer. IW should be advised that expenses

will be paid as long as offered job is found suitable and criteria

previously listed are met.

• If EA wants a description of claimant's entitlement to relocation

expenses included in job offer, a copy of the job description

should be sent to the district office before making job offer so

that suitability of job and entitlement to payment of relocation

expenses can be determined.

• OWCP will notify an IW (with a suitable job offer who meets the

criteria for payment of relocation expenses) of OWCP's

regulations (20 CFR 10.123(f)).

Relocation Expenses – Adjudication of Request

If offered job is found suitable, medically and otherwise, CE may proceed to consider

whether relocation expenses may be paid.

• Using criteria previously noted, OWCP will evaluate request for payment of relocation

expenses and make a recommendation to a Supervisory Claims Examiner (SCE)

concerning payment. Even though SCE will advise parties of this determination, CE still

notifies IW directly that job has been found suitable.

• Supervisory Claims Examiner reviews CE’s recommendation and advises EA and IW of

decision. If decision is favorable, letter to IW will note that GSA regulations require

employees whose moving expenses are paid by the Federal government to remain in

federal employment for one year after the move. Should IW cease working for a reason

unacceptable to OWCP, the relocation expenses will be declared an overpayment and

handled according to usual procedures.

• If decision is favorable, EA will include in job offer a statement that job has been found

suitable and that relocation expenses are payable under OWCP's regulations (20 CFR

10.123(f)).

• OWCP is responsible for resolving any dispute between IW and EA as to allowable costs

in accordance with GSA regulations. Any denial will be accompanied by appeal rights.

Relocation Expenses – Payment & Reimbursement

• EA which can advance funds to IW may be authorized to do so on a transaction-by-

transaction basis. For example, amount required for temporary lodging should be

forwarded first, followed by a separate advance for transportation of household

goods.

• If IW or EA requests reimbursement, SCE will approve relocation expenses and

advise parties of procedures to obtain reimbursement.

Once move is completed, EA should examine expenditures and certify that they are

in accordance with GSA travel regulations. If so, EA will send copies of bills and

travel vouchers to district office for payment.

• An IW who has paid for relocation expenses from his/her own funds will be

directed to submit copies of bills and travel vouchers to EA for examination to

ensure that amounts claimed are in accordance with GSA travel regulations. The

bills and vouchers should then be forwarded to OWCP for reimbursement to IW.

Relocation Expenses – Payment & Reimbursement

• When EA cannot pay costs of relocation from its own funds, and IW has not

already paid for move, CE (or RS) will forward to National Office a copy of job

offer and IW’s acceptance.

• National Office staff will contact EA to determine best method of transferring

funds, and will send a letter outlining procedures to be followed to EA, with a

copy to district office. Letter will ask EA to sign a written agreement to abide

by GSA regulations in approving expenditures.

• EA will be authorized to withdraw from compensation fund amount of

estimated or actual expenses. EA will be required to submit copies of bills and

travel vouchers to support its payments and withdrawals from compensation

fund. Any difference between amount of advance and actual expenses will be

recovered by EA from IW and refunded to OWCP.

Return to Work

Case Study

Case Study - Mr. Sample

Following an injury, Mr. Sample’s doctor released him

to work with the following restrictions:

• No lifting over 10 pounds

• No standing more than 2 hours per day

• No walking more than 1 hour per day

Case Study - Mr. Sample

Review the following job offer - is it valid?

Remember, to be valid, a job offer must:

Be in writing

Describe duties to be performed

Describe physical requirements of job

State location of job

State date job is available

State date that IW must respond to offer

Case Study - Mr. Sample

Is the offer valid? What is missing?

RECOVERING EMPLOYEE’S LIGHT DUTY ASSIGNMENT

Date:12/15/05 Employee: Mr. Sample SSN: 123456789________

Light Duty Begins:

Office Name: Any Government Agency

Report to: Room 5, 10001 Any St, Any Town

Salary: $24.50 (Base Pay) per hour

Premium Pay: None

Medical documentation from your physician indicates that you will be

unable to perform your regular duties due to residual effects of your on-

the-job injury. The following is a description of duties offered to you to

perform while you are assigned to light duty. If you do not wish to accept

light duty offered to you, it may affect your OWCP benefits. You are

required to work within your medical restrictions, and perform all of your

duties in a safe manner at all times.

Case Study- Mr. Sample

The assignment was not valid. It did not include:

Name of person to whom Mr. Sample should report

Location

Effective Date

Tour of duty

Premium pay

Correct physical requirements

Description of duties

Correct Light Duty Assignment, Page One: Mr. Sample

RECOVERING EMPLOYEE’S LIGHT DUTY ASSIGNMENT

Date:12/15/05 Employee: Mr. Sample SSN: 123456789________

Light Duty Begins: 12/20/2005 (Review w/next appt)

• Hours of Work: 6:30 am -3:00 pm Scheduled Days off: Saturday and Sunday

• Office Name: Any Government Agency

• Location: Room: 4, 10001 Any St, Any Town,

• Report to: Ms. New Supervisor at Room 5, 10001 Any St, Any Town

• Salary: $24.50 (Base Pay) per hour

• Premium Pay: None

• Medical documentation from your physician indicates that you will be unable to perform your

regular duties due to residual effects of your on-the-job injury. The following is a description

of duties offered to you to perform while you are assigned to light duty. If you do not wish to

accept light duty offered to you, it may affect your OWCP benefits. You are required to work

within your medical restrictions, and perform all of your duties in a safe manner at all times.

—New Light Duty Assignment is required with every change in Medical Status—

Description of job duties offered: Answer telephones, greet customers entering the office,

file, enter data into computer

Physical

requirements of the job listed above are:

Sit-not more than seven hours per day

Stand-not more than two hours per day

Walk-not more than one hour per day

Lift/Carry (up to 10 Ibs)

Twist/Bend-intermittently up to two hours per day

Squat/Kneel-none

Use Steps/Stairs-none

Grasp/ Fine Manipulation - eight hours per day

Drive a Vehicle-none

Reach Over Shoulder –intermittently up to three hours per day

Supervisor Signature: ___________________Date:_____________________

This Limited Duty Assignment is being offered in good faith, and will remain available.

Correct Light Duty Assignment, Page Two: Mr. Sample

Questions

One primary goal of the Office of Workers’ Compensation Programs is:

a) To return injured workers to suitable employment

b) To provide injured workers with a disability retirement program

Questions

After an employee is injured, the agency has many responsibilities. When a claim

is filed, the employing agency should:

a) Maintain contact with the injured worker.

b) Monitor the injured worker’s duty status and prospective date of return to

work.

c) Advise partially disabled injured workers in writing of specific duties and

physical demands of any available alternative positions.

d) All of the above

Questions

Form CA-17 (Duty Status Report) is provided for the purpose of obtaining medical

restrictions from the injured worker’s treating physician. The employing agency

fills out the left side of the form which describes the restrictions of the job. The

employing agency can request the physician complete the right side by:

a) Calling the physician’s office and asking them to tell you the restrictions.

b) Visiting the physician’s office and waiting for them to fill it out.

c) Sending it to the physician’s office at reasonable intervals.

d) All of the above

Questions

An employee who recovers within one year of starting compensation has

mandatory rights to his/her old position or its equivalent, regardless of whether

he/she is still on the employing agency rolls.

a) True

b) False

Questions

All of the following are required elements of a job offer except:

a) Description of specific job duties to be performed

b) Specific physical requirements of position

c) Schedule

d) Date job is first available

e) Supervisor’s name

f) Pay information including grade, step and salary

Questions

If an injured employee refuses a job offer, who determines whether or not that

offer is suitable?

a) The employing agency that made the offer

b) The Office of Workers’ Compensation Programs

c) The injured employee

Questions

If OWCP deems a permanent job offer suitable after an injured worker has refused

it, the injured worker will be provided due process to explain why the job is not

suitable. If at the end of due process they have not established an acceptable

reason for refusing the job offer, then:

a) Their entitlement to wage-loss compensation benefits will be terminated.

b) Their entitlement to schedule award benefits will be terminated.

c) Their medical benefits will continue.

d) All of the above

Questions

If an injured worker relocates to accept a suitable job offer after termination from

the employing agency rolls, they will not receive payment or reimbursement of

moving expenses from the compensation fund.

a) True

b) False

Take Away Tips

1) The primary goal of OWCP is to return injured workers to suitable

employment either with their original employing agency or with a company in

the private sector.

2) Form CA-17 (Duty Status Report) is provided for purpose of obtaining a

medical duty status report for the injured worker. The Supervisor/Employing

Agency completes agency portion by describing physical requirements of the

injured workers job and noting availability of light or limited duty.

3) An employee who recovers within one year of starting compensation has

mandatory rights to his/her old position or its equivalent, regardless of

whether he/she is still on the employing agency rolls.

Take Away Tips

4) When making a job offer, the employing agency must consider physical or

emotional restrictions placed on an employee due to a work related injury, as

well as any concurrent, non-injury related ailments.

5) When making a job offer, the employing agency will base job offer on

restrictions of record, send a copy of job offer to OWCP, and send a copy of

the injured worker’s response to job offer to OWCP.

6) If the injured worker refuses an offered job, OWCP should be notified

immediately and provided a copy of refusal. At that time OWCP will make a

determination if the job offer contained necessary elements and if the offer

is suitable.

Take Away Tips

7) If an injured worker refuses suitable permanent employment then their

entitlement to all compensation benefits, including a schedule award, is

terminated; however, medical benefits continue.

8) If the agency is only able to provide a temporary limited duty assignment

when the claimant has permanent work restrictions, the agency must provide

written verification that it is unable to provide a permanent job offer. In

certain circumstances, a temporary assignment for fewer than the number of

hours upon which the claimant is released may be considered.

9) OWCP's regulations (20 CFR 10.123(f)) provide that an injured worker who

relocates to accept a suitable job offer after termination from employing

agency rolls may receive payment or reimbursement of moving expenses

from the compensation fund.