The Pennsylvania Insurance Department is here to

help you understand automobile insurance. In the

next few pages you will learn about auto insurance,

types of coverage available, and some tips on how to

shop and what to do if you are in an accident.

There is no such thing as a “full coverage” auto

insurance policy. Insurance coverages and policies can

vary. The information in this guide is intended to help

you understand auto insurance. The information is

general and not specific to your insurance policy. If

you have specific questions about your coverage, you

should consult your agent or insurance company.

What Is Automobile Insurance?

Automobile insurance is a

contract between you and

your insurance company. It

protects you against financial

loss if you are in an auto

accident. Auto policies

contain a variety of required

and optional coverages. You

agree to pay a fee, called the premium,

and in return, the insurance company

agrees to pay for certain losses as

defined in your policy. Having the

right insurance coverage may prevent

you from suffering a large financial loss

in the event of an automobile accident.

Is Auto Insurance Mandatory in

the Commonwealth?

Drivers must purchase and maintain auto insurance

to legally drive in Pennsylvania. This is called

maintaining “financial responsibility” on your

vehicles. A lapse in insurance coverage may result in

the suspension of your vehicle registration. Operating

a vehicle without the required insurance

may result in a fine, the suspension of

your driver’s license, and the forfeiture

of your license plate and registration

sticker. Restoration fees and proof of

insurance must be provided prior to

having either registration or driving

privileges returned. Insurers are

required to report policy terminations

to PennDOT. Drivers are responsible for

providing proof of continuous coverage.

What Are the Required

Coverages in Pennsylvania?

When you purchase auto insurance, there are certain

coverages that are required and others that are

optional. The required coverages are:

Required coverages in Pennsylvania:

« Medical Benefits

« Bodily Injury Liability

«

Property Damage Liability

Required coverages in Pennsylvania:

« Medical Benefits

« Bodily Injury Liability

«

Property Damage Liability

Medical Benefits

This coverage pays the medical bills for you and

others who are covered by your policy, regardless of

fault, if there are injuries resulting from an accident.

The minimum limit is $5,000. Higher limits are

also available.

Bodily Injury Liability

If you injure someone in an auto accident,

this coverage pays damages for which |

you are liable, such as medical and

rehabilitation expenses. The minimum

limit is $15,000/$30,000. The $15,000

pays for injuries to one person, while

the $30,000 represents the total available for

one accident. Higher limits are also available.

Property Damage Liability

If you damage someone’s property (such as his or her

car) in an accident and you are at fault, this coverage

pays for repairs to that property. The minimum

limit is $5,000. Higher limits are also available.

Some companies offer a combined single limit of

$35,000 which meets the bodily injury liability and

property damage liability minimum requirements.

2

What Do Policy Limits Mean?

The coverage limits are the most your insurance

company will pay for injuries to any one person,

all persons injured in an accident, and for property

damage. If you do not have enough liability

Please refer to the Glossary found on page 11 for definitions of the terms in bold face.

3

coverage, and you are found at fault for an accident,

you may be responsible to pay for anything your

insurance does not cover.

What Are the Optional

Coverages in Pennsylvania?

Auto insurance policies also offer a variety of

additional optional coverages that can be purchased.

These include:

Uninsured Motorist (UM)

This coverage applies to you, relatives residing in

your household, and your passengers if injured by an

at-fault uninsured motorist or hit and run driver.

This does not cover damage to property.

Underinsured Motorist (UIM)

This coverage applies to you, relatives residing in

your household, and your passengers if injured by

an at-fault motorist who does not have enough

insurance to pay your claim. This does not cover

damage to property.

Stacking of UM or UIM

When you stack your UM and/or UIM

coverages, your limit of coverage for each

covered vehicle on your policy is multiplied by

the number of vehicles on the policy. You can also

stack your UM and/or UIM coverages to receive

uninsured or underinsured motorist

coverage from more than one policy under

which you are insured. By law, stacked

coverage applies unless you reject it. You

will pay less in premiums if you reject

stacked coverage.

Funeral Benefit

Funeral Benefits pay, up to the limit specified in

the policy, for funeral expenses if you or a family

member dies as a result of an auto accident, regardless

of who was at fault in the accident.

Income Loss

This pays a portion of your lost wages when injuries

sustained in an auto accident keep you from working.

Collision

Collision coverage pays to repair damage to your

car as a result of an accident. Most banks or lenders

require you to buy this coverage to receive a car loan.

Under Pennsylvania law, the insurance company

applies a $500 deductible unless you request a

lower amount. Generally speaking, the higher your

deductible, the lower your premium.

Comprehensive

Comprehensive coverage pays for theft or

damage to your car from hazards such as fire, flood,

vandalism, and striking an animal. Most banks or

lenders require you to buy this coverage to receive a

car loan. There are various levels of deductible that

may be purchased.

Extraordinary Medical Benefits

This pays for medical and rehabilitation expenses that

exceed $100,000, up to a maximum limit of $1.1

million.

4

Accidental Death Benefit

Accidental Death Benefit pays a specified dollar benefit

to the personal representative of a person who dies as

a result of injuries sustained in an auto accident.

Rental Reimbursement Coverage

Rental Reimbursement Coverage pays—up to the

limit on your policy, your expenses to rent a vehicle

if the vehicle on your policy sustains a covered

comprehensive or collision loss.

Towing Coverage

This reimburses you, up to the limit of

your policy, for towing and labor costs

for your covered vehicle. This coverage is

usually only available if comprehensive

and collision is carried on your vehicle.

GAP Coverage

Guaranteed Asset Protection (GAP) will

pay the difference between an insurance company’s

payment for a totaled vehicle and the balance of a

vehicle loan. This coverage is traditionally purchased

when an individual is buying a new vehicle.

These policies do not pay for deductibles, missed

payments, or late fees and many times have a limit

to the amount they will pay. Check your policy

carefully when choosing to add GAP coverage.

How Are Rates Determined?

When you are ready to purchase insurance, the

insurance company or producer (agent) will

ask you a series of questions and, based on your

answers, will decide whether or not they will accept

you as a policyholder. This practice is known as

underwriting. By law, insurance companies may

not unfairly discriminate by using underwriting

standards based on things such as race, religion,

nationality, ethnic group, age, gender, family size,

occupation, place of residence, and marital status.

Certain items will be taken into consideration when

figuring your premium, such as the type and age

By law, insurance companies are

prohibited from charging different

rates based on an applicant’s race,

religion, national origin, and gender.

By law, insurance companies are

prohibited from charging different

rates based on an applicant’s race,

religion, national origin, and gender.

What Should I Know Before I

Start to Shop?

You need to know what coverages you want, as well

as the limits and deductibles you desire. Also, you

should have the following basic information available

on all drivers in your household:

«

All drivers’ names, ages, and marital statuses;

«

Driving record (accidents and moving violations);

«

Estimated annual mileage driven;

«

Full vehicle identification number;

«

Year of vehicle;

«

Cost of vehicle; and

«

Special equipment, such as anti-theft devices,

airbags, etc.

of the vehicle, its safety features, where the vehicle

is garaged, the average number of miles driven in a

year, the coverages and limits chosen for the policy,

and the driving history of the drivers, to name a few.

Some companies may use your credit history when

determining your premium. Companies cannot use

it to increase your rate when you renew. By law,

insurance companies are prohibited from charging

different rates based on an applicant’s race, religion,

national origin, and gender.

5

What Questions Should I Ask?

The insurer will ask you questions and use the

answers to decide whether to insure you and how

much your premium should be. You should also ask

questions to be sure you are getting the coverage you

want and from an agent and insurer you trust.

Here are some questions you should ask your agent

or company representative when you

shop for auto insurance:

«

What coverages

am I required to

have in this state?

«

What is the

minimum amount

of liability insurance

coverage this state

requires me to carry?

«

Are these liability limits high

enough to cover me if I have an

accident and I am at fault?

«

How much would it cost me to buy more than

the minimum amount of liability insurance

coverage?

«

Do I need collision and comprehensive

(sometimes called “other than collision”)

coverage?

«

What deductible should I have for collision

coverage? For comprehensive (sometimes called

“other than collision”) coverage?

«

Will this policy cover me if I let someone else drive

my car?

«

Will this policy cover me if I have an accident in a

rental car while on vacation?

«

Will this policy cover me if I have an accident

while traveling for work?

«

If my car is totalled, how is the value of my

vehicle set?

«

Can I choose any body shop or glass shop to

repair my car? Does the policy pay for original

manufacturer’s parts or aftermarket parts?

«

If my car is disabled, will this policy pay for a

rental car while it is being repaired? Is there any

cap or limit?

«

If my car is disabled, will this policy

pay to have it towed to a garage or body

shop?

«

How much can I save with

a higher deductible?

«

What discounts are

available?

«

What other types

of property do you

insure? Can I qualify

for a discount if I buy

both policies from your

company?

«

What are my payment options? Can I

pay monthly or quarterly? If I do, is there

an extra charge?

«

How do I report a claim?

«

What coverage is available if I drive for a TNC like

Uber or Lyft?

Teen Drivers

Insuring a teen driver is often a significant additional

cost for parents. Some companies require that a

teenager be added to the policy upon obtaining his/

her learner’s permit. Check with your insurance

company to determine their requirements. Many

companies consider younger drivers to be a higher

risk, and this often translates into higher premiums.

Your child may be eligible for discounts. Ask your

insurance company if discounts are offered for good

grades or completed driver education courses.

6

Mature Drivers

Taking a driver safety training course is an excellent

way to keep your driving skills sharp, and it can

also earn you a reduced rate on your car insurance

if your carrier offers such a discount. Pennsylvania

law requires insurance companies to provide at least a

five percent premium discount for each vehicle on an

auto policy under which all named insureds are 55

years of age or older and have successfully completed

a driver improvement course that meets the standards

of PennDOT.

Individuals must take an approved course every

three years to continue to be eligible for the discount.

They may be disqualified if, within three years

of completing the course, they are involved in a

chargeable accident, convicted of a moving violation,

or are convicted—or have Accelerated Rehabilitative

Disposition (ARD)—for driving under the influence of

alcohol or a controlled substance.

Insurance companies recognize that mature drivers

face unique challenges as they get older, and they will

reward those mature drivers who take the initiative to

minimize risk by enrolling in approved driver training

courses.

Know How to Save

Discounts

Most insurance companies offer discounts for

safer drivers, safer cars, drivers with multiple

types of policies, good students, and more.

There are also a variety of discounts that are

required by law, like the mature drivers

discount mentioned above. Ask your insurance

company today and you could start to save.

Limited or Full Tort

If you are in an automobile accident, you are able

to recover out-of-pocket medical and certain other

expenses. Limited tort offers you significant

savings on your premium but you are not able

to recover certain damages—such as payments for

pain and suffering—unless the injuries meet one of

the exceptions in the law. With full tort, you have

unrestricted rights. If you fail to specially elect limited

tort, you will be deemed to have elected full tort.

Deductibles

By choosing higher deductibles on comprehensive

and collision coverage, you may be able to lower

your policy cost. Just remember that the deductible

you choose is what you are responsible for paying

out of your pocket in the event you file a claim.

Where to Buy Insurance

Now that you know all about what to look for when

choosing your auto insurance, let’s talk about where

to buy a policy.

Agents

Agents are individuals

available locally to

address your car

insurance needs. Local

agents can be independent

or captive. If your agent is

independent and not exclusive

to one insurance company, he or

she can compare policies and sell you the one that best

meets your needs from among the

multiple insurance companies he

or she represents. If your local agent

is a captive agent, he or she

exclusively represents one

insurance company.

Direct

Some insurance companies sell

their policies directly over

the phone or Internet

without using agents. In

some cases, you can

choose to interact with a

direct company exclusively

over the Internet.

7

Many companies have payment plans that allow you

to pay the premium over a period of time, sometimes

for an extra fee. If you decide to buy a policy on a

payment plan, find out the applicable installment fees.

If you use a premium finance company to pay for

your insurance, the monthly payments may be easier,

but the total of payments could be larger. Finance

A good rule of thumb is to get quotes from at least

three different insurance companies. Make sure your

quotes are for the exact same coverages and limits.

Cost can vary significantly among companies. Ask

for copies of the insurance policies. It is important to

read the policies to understand the differences in

coverage from policy to policy and especially

what is excluded. No two policies are exactly

the same.

Things to Keep in Mind

Make sure you know the length

of the policy term. The most

common policy terms are six

months (semi-annual) and

one year (annual). While

policies sold for a term of

less than one year may

require less money up front,

they will be re-priced at the

end of the policy term. Keep

in mind that an insurance

company can only non-

renew you on the annual

anniversary of when your

policy was initially written,

even if the policy term is less than 12 months.

Remember, you are ultimately

responsible for the accuracy

and completeness of the

information on your application.

Remember, you are ultimately

responsible for the accuracy

and completeness of the

information on your application.

agreements are separate contracts that often include

a limited power of attorney that gives the finance

company some authority over the termination of

your

policy. Moreover, if the policy is cancelled, the

insurance

company must remit all return premiums

to the

finance company, which will apply them to your

account.

Personal effects and equipment such as

cellular telephones, compact discs,

CD players,

and custom stereo

speakers and systems

that are not

permanently installed in the vehicle

by the manufacturer generally are not

covered, unless specifically declared and

added to the policy.

Read before you sign. Remember, you are ultimately

responsible for the accuracy and completeness of the

information on your application.

Should You Drop Comprehensive

and/or Collision Coverage on an

Older Car?

It may not be cost-effective to have comprehensive

or collision coverage on cars worth less than $1,000.

What Happens if I Can’t Get

Auto Insurance Because of

My Driving History?

Pennsylvania’s Assigned Risk Plan is a

program that offers car insurance to those

who are unable to get coverage on their own.

All insurance companies writing automobile

insurance in the commonwealth are required

to participate in the plan. Applicants are

assigned to insurance companies in proportion to

the amount of business each company writes in the

commonwealth. To learn more about the Assigned

Risk Plan you can visit www.aipso.com or contact

the plan’s customer service office at (401) 946-2800

or toll-free at (800) 477-6146.

8

After You Purchase Insurance

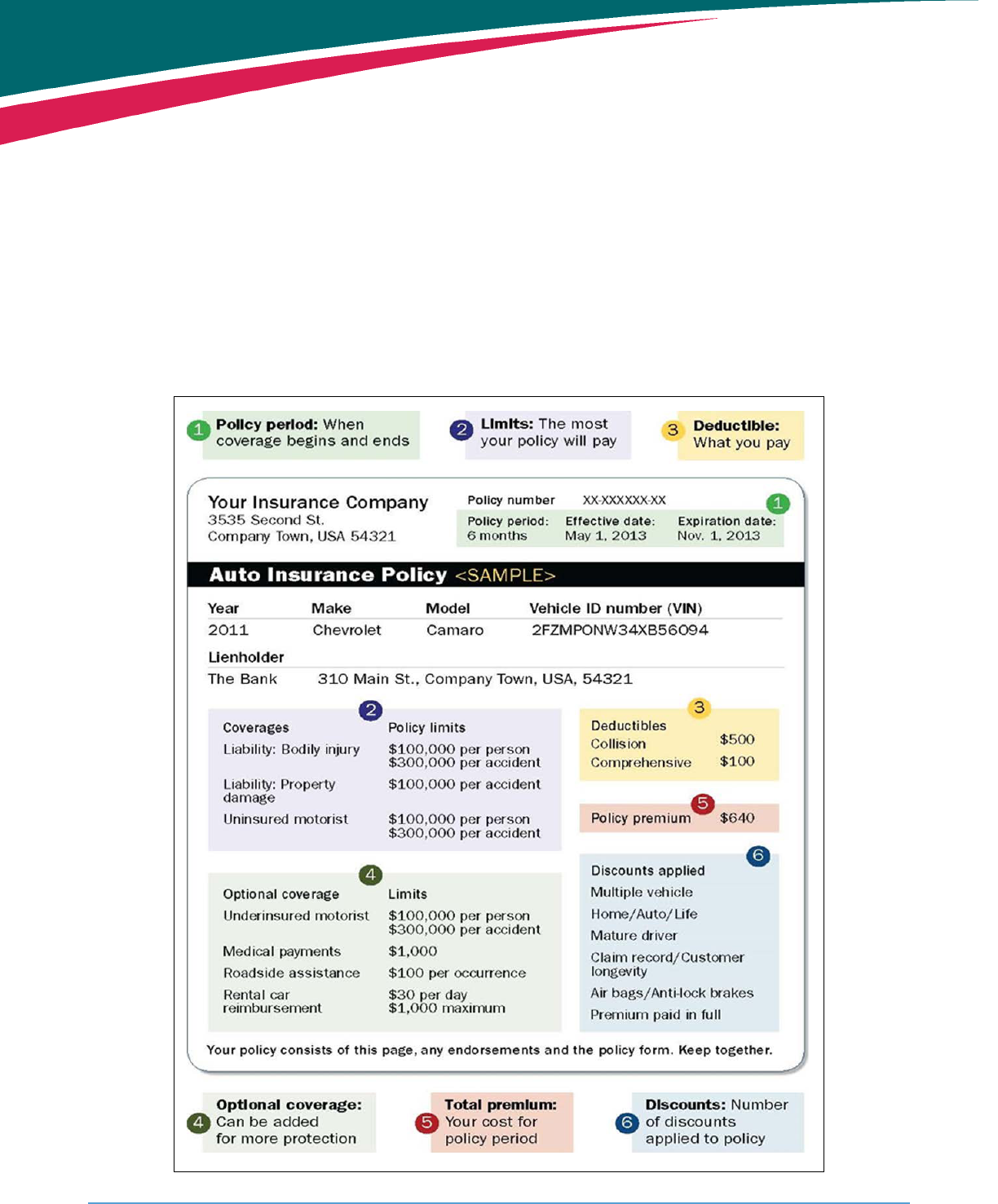

After you purchase automobile insurance you will

receive your policy. Your policy is a contract between

you and your insurance company. You should take

time to read your policy. Every policy includes a

declarations page (below). It lists the insurance

company, your name, the policy number, vehicles,

coverages, deductibles, limits, cost of premium,

and effective and expiration dates. If you have

questions, contact your insurance agent or company.

They are responsible for serving your policy,

including responding to any questions you may have

regarding the terms in your policy. If you purchased

a policy directly from the insurance company, a

company representative should be able to respond

to your questions. If you still have questions, you

may choose to email, write, or call the Pennsylvania

Insurance Department’s Bureau of Consumer

Services. We will be happy to answer your questions.

*Please refer to pages 2 and 3 for the Required Coverages and Optional Coverages in Pennsylvania.

*

*

9

The Pennsylvania

Insurance Department

Whether you have a general question,

or want to file a complaint, you can

get help at Consumer Services online

at www.insurance.pa.gov or contact

us toll-free at 1-877-881-6388.

What Do I Do if I Am in an

Accident?

If you are in an accident you should exchange

information with the other driver. If there are injuries,

call 911. Be sure to obtain the name, insurance

company name, and phone number of each of the

other drivers. If you cannot obtain this

information, write down the license

plate number of each of the other

drivers. Other important information is

as follows:

«

The year, make, and model of each of

the other cars;

If you are in an accident you should

exchange information with the other

driver. If there are injuries, call 911.

If you are in an accident you should

exchange information with the other

driver. If there are injuries, call 911.

Be sure to pay your premium. Pennsylvania law

does not require companies to extend a grace period

for premium payments. If your insurance company

does not receive your premium by the due date, the

company can cancel your policy.

Keep your proof-of-insurance card in your car at all

times.

What if I Drive for a

Transportation Network

Company Like Uber or Lyft?

If you drive for a Transportation Network Company

(TNC) like Uber or Lyft, you want to understand

what coverages, if any, the TNC has in place that

will cover you. While the TNC should have coverage

in place, you may also want to have your own

coverage. Most personal auto policies do not provide

coverage while you are carrying a passenger for hire.

However, there are insurers who do offer to endorse

coverage onto your policy—usually for an additional

premium. It is important not to drive for a TNC

until you are sure that the coverage you need is in

place to protect you.

What Should I Do if I Receive a

Cancellation or Non-Renewal

Notice from My Insurance

Company?

First, contact your insurance producer (agent)

or company for specific details. Pennsylvania law

allows companies to cancel or non-renew policies

for certain reasons. If you still are not satisfied with

your company’s explanation, submit a statement

detailing the reasons you disagree with the action to

the Pennsylvania Insurance Department. To preserve

your appeal rights, the statement must be

received by the Insurance Department within 30

days of the company’s mailing of the notice.

What if I Don’t Understand All

the Terms in My Policy? What

Should I Do?

Discuss with your insurance producer (agent) or

company the terms in your policy. If you purchased

your policy directly from the insurance company, a

company representative should be able to respond to

your questions. If you still have questions, you may

choose to write or call the Pennsylvania Insurance

Department’s Bureau of Consumer Services.

10

you that it has accepted or denied your claim or

provide you with a written explanation of why

more time is needed.

«

An insurance company must complete its

investigation within 30 days of its receipt of notice

of your claim, unless the investigation cannot

reasonably be completed within 30 days. If the

investigation cannot be completed within 30

days, for every 45 days thereafter, the insurance

company must provide you with an explanation

for the delay and state when a decision on

the claim may be expected.

Vehicle Repairs

The choice of where your vehicle is repaired

is up to you. Be sure to do your research

when choosing an auto body repair shop.

Some questions to ask:

«

How long has the shop been in business?

«

What is the shop’s reputation in the

community?

«

Does the shop offer a lifetime warranty?

«

Has the shop worked with your insurance

company in the past?

Ultimately, the insurance company

is responsible for returning

your vehicle back to its pre-

damaged condition.

Ultimately, the insurance company

is responsible for returning

your vehicle back to its pre-

damaged condition.

Filing a Claim

To file a claim, call the phone number on your proof-

of-insurance card as soon as possible. The insurance

company will assign a claims adjuster to investigate

the claim. You should cooperate with the adjuster’s

investigation of your claim. Take notes and keep

track of the dates of conversations you have with

your adjuster.

If you, the insurer, and the claims adjuster disagree,

first try to resolve the differences with your insurer.

Your agent may be helpful. Don’t feel rushed or

pushed to agree to something you aren’t

comfortable with.

Insurance companies, by law, must investigate

your claim fairly and promptly.

«

An insurance company has 10 working days to

acknowledge its receipt of notice of your claim

unless payment is made within these 10 days.

«

If you submitted a claim to your own insurance

company, it has 15 working days after receipt

of properly executed proofs of loss to inform

«

If there are witnesses, their names and contact

information; and

«

If an officer comes to the scene, his or her name,

badge number, police report number, and contact

information.

After the accident, write down the date, time, and

location. If possible, take photos. Write down what

happened. This will assist you when reporting the

claim to your insurance company.

Whether an insurance company recommended the

shop or not, the most important thing is a quality

repair.

If you choose an auto body repair shop that charges

more than the appraised amount to repair the vehicle,

you may be responsible for costs in excess of the

appraised amount.

11

The Pennsylvania

Insurance Department

Whether you have a general question,

or want to file a complaint, you can get

help at Consumer Services online

at www.insurance.pa.gov or contact

us toll-free at 1-877-881-6388.

Pennsylvania law permits the use of non-OEM/

aftermarket parts but “the operational safety of

the vehicle shall be paramount in considering the

specification of new parts.” This consideration is

vitally important for parts involving the drive train,

steering gear, suspension units, brake system, or tires.

Aftermarket parts are usually made by a company

different than the original part manufacturer. Be

sure to consult with your auto body repair shop or

insurance company if you have any safety concerns

or part fit concerns when aftermarket parts are used

to repair your vehicle. If aftermarket crash parts

are included in a vehicle appraisal, it must include a

statement that the appraisal has been prepared based

on the use of aftermarket crash parts, that the

use of these parts voids the existing warranty on the

part being replaced, and the aftermarket crash part

shall have a warranty equal to or better than the

remainder of the existing warranty.

Used parts are original equipment (OE) from your

vehicle’s manufacturer. Be sure to consult with your

auto body repair shop or insurance company if you

have any safety concerns about parts being used to

repair your vehicle.

Ultimately, the insurance company is responsible

for returning your vehicle back to its pre-damaged

condition. If the company uses new parts to replace

parts damaged on an older model vehicle, you may

be responsible for additional costs as the vehicle is in

better condition than before the accident.

What Happens if My Vehicle Is a

Total Loss?

A vehicle is a total loss when the cost to return it

back to the pre-damaged condition is more than the

value of the vehicle or the vehicle is damaged too

severely for repairs. There are different methods that

can be used to calculate the replacement value of your

vehicle. If you have questions regarding the method

used, contact your insurance agent or company.

Many people make monthly payments on their

vehicle. Depending on the agreement between the

lienholder and the owner, the insurance payment

can be made directly to the lienholder, the owner,

or both. If the actual cash value is less than you owe

on the vehicle, you may be responsible to pay the

difference to the lienholder. If you believe your loan

is more than the cash value, there are products that

are available at that time that may eliminate or offset

these costs.

One such product provided by insurance carriers is

Guaranteed Asset Protection (GAP) Coverage, which

will generally pay the difference between an insurance

company’s payment for a totaled vehicle and the

balance of a vehicle loan. This coverage is traditionally

purchased when an individual is buying a vehicle.

GAP coverage does not pay for deductibles, missed

payments, or late fees and many times there is a

limit to the amount it will pay. Check your policy

carefully when choosing to add GAP coverage. If

you have questions about GAP coverage, ask your

insurance agent or company.

Another product that may be purchased in relation

to a vehicle loan is a Debt Cancellation Agreement

(DCA). When this product is sold by the bank issuing

the vehicle loan, it is not considered insurance, but

it functions similar to GAP Coverage. A DCA is an

agreement between the loan issuer and the debtor to

cancel any remaining debt if the debtor experiences

a total loss and the amount of debt on the vehicle

exceeds its actual cash value. Also similar to GAP

Coverage, this product is traditionally purchased at

the time that the vehicle is bought.

Auto Insurance Glossary—a

Supplement to the Automobile

Insurance Guide

These definitions are offered to give you a

general understanding of the terms you may hear

that are associated with automobile insurance. Please

note that your individual company may define

similar terms differently. The definitions page in

your policy

is the final authority regarding

your coverage.

Adjuster

The person who manages the various aspects of

a claim and determines what will be paid out in

accordance with the policy and the facts.

Aftermarket Crash Part

A non-original equipment manufacturer (OEM)

replacement part, either new or used, for any of the

non-mechanical parts that generally constitute the

exterior of the motor vehicle, including inner and

outer panels.

Appraiser

The person who evaluates the damage caused by an

accident or other covered loss and determines the

amount to be paid under the policy terms.

Assigned Risk Plan

A program where drivers can get coverage when

insurance companies are unwilling to sell them a

policy.

Binder

A short-term agreement that provides temporary

insurance coverage until the policy can be issued or

delivered.

Bodily Injury Liability

If you injure someone in a car accident, this

coverage pays damages for which you are liable,

such as medical and rehabilitation expenses.

Cancellation

The termination of a policy at a date other than its

annual anniversary date.

Claim

Notice to an insurance

company that a loss has occurred

which may be covered under the terms and

conditions of the policy.

Collision

Pays to repair damage to your car as a result of an

accident. Most banks or lenders require you to buy

this coverage to receive a car loan.

Commission

A portion of the policy premium that is paid to

an insurance producer (agent) by the insurance

company as compensation for the producer’s work.

Comprehensive Coverage

Pays for theft or damage to your car from hazards

such as fire, flood, vandalism, and striking an

animal. Most banks or lenders require you to buy

this coverage to receive a car loan.

Declarations (DEC) Page

Usually the first page of an insurance policy, it

contains the full legal name of your insurance

company, your name and address, the policy

number, effective and expiration dates, premium

payable, the amount and types of coverage,

deductibles, the vehicle(s) that are covered on the

insurance policy, and the vehicle identification

numbers (VIN).

Deductible

The amount a policyholder is responsible to pay

up front before covered benefits from the insurance

company are payable. This is applicable to

comprehensive or collision coverage only.

12

Endorsement

A written agreement that changes the terms of an

insurance policy by adding or subtracting coverage.

Exclusion

A provision in the policy that explains what is not

covered.

Extraordinary Medical Benefits

Pays for medical and rehabilitation expenses that

exceed $100,000, up to a maximum limit of $1.1

million.

First Party

The named policyholder (insured) in an insurance

contract and any relatives residing in the named

policyholder’s household.

Full Tort

You retain unrestricted rights to bring suit against

the negligent party.

Funeral Benefits

Pays, up to the limit specified in the policy, for

funeral expenses if you or a family member dies as

a result of an auto accident, regardless of who was

at fault in the accident.

Income Loss

Pays a portion of your wages when injuries

sustained in an auto accident keep you from

working.

Insured

The person(s) entitled to covered benefits in case of

an accident or loss.

Insurer

The insurance company who issues the insurance

and agrees to pay for losses and provide covered

benefits.

Lienholder

A person or business, usually a bank or financial

firm, that retains the title of a vehicle while the

purchaser pays off the loan.

Limited Tort

Limited Tort offers you significant savings on your

premiums. You are still able to recover out-of-

pocket medical and certain other expenses; however,

you are not able to recover certain damages—such

as payments for pain and suffering—unless the

injuries meet one of the exceptions in the law.

Limits

The maximum amount of benefits the insurance

company agrees to pay under an insurance policy

in the event of a loss.

Minimum Limit

The state-mandated minimum mandatory amount

of benefits.

Medical Benefits

Pays medical bills for you and others who are

covered by your policy, regardless of fault.

Non-Renewal

The termination of an insurance policy at its annual

anniversary date.

Policy

A contract that states the rights and duties of the

insurance company and the insured.

Premium

The price paid to the insurance company for a

policy.

Premium Finance Company

A lending institution that finances automobile

insurance premiums for a fee.

Producer (agent)

An individual or organization authorized to sell,

solicit, negotiate, and service insurance policies for

an insurance company.

Property Damage Liability

Covers damage to someone’s property (such as his

or her car) resulting from an accident in which you

are at fault.

13

14

Quotation or Quote

An estimate of the cost of insurance based on the

information supplied to the insurance producer

(agent) or company. This amount may change

depending upon findings during the underwriting

process.

Rental Reimbursement Coverage

Pays—up to a defined amount—your expenses

to rent a vehicle if you have a loss covered under

comprehensive or collision benefits. Coverage is sold

based on a daily amount of expense, subject to a

maximum limit.

Single Limit Liability

Some companies offer single limit liability coverage,

which pays—up to the specified limit—damages

for which you are liable under bodily injury and

property damage coverages.

Stacking of UM or UIM

When you stack your UM and/or UIM coverages,

your limit of coverage for each covered vehicle on

your policy is multiplied by the number of vehicles

on the policy. You can also stack your UM and/or

UIM coverages to receive uninsured or underinsured

motorist coverage from more than one policy under

which you are insured. Stacked coverage applies

unless you reject it.

Subrogation

The process of recovering the amount of claims

damages paid out to a policyholder from the legally

liable party. When a company pursues the legally

liable third party, they are required to include the

policyholder’s deductible in the recovery process if

requested by the policyholder. The company must

then share any subrogation recoveries with the

policyholder on a proportionate basis.

Surcharge

An extra charge applied to the premium by an

insurance company, usually applied as a result of

at-fault accidents or moving violations.

Third Party

An individual other than the policyholder or the

insurance company who has suffered a loss and

may be able to collect compensation under the

policy, due to the negligent acts or omissions of the

policyholder.

Total Loss

Damage or destruction to real or personal property

to such extent that it cannot be rebuilt or repaired

to its condition prior to the loss or when it

would be cost-prohibitive to repair or rebuild in

comparison to the value of the property prior to the

loss.

Towing Coverage

An optional coverage of an automobile policy that

pays a specified amount for towing and related

labor costs.

Underinsured Motorist (UIM)

This coverage applies to you, relatives residing in

your household, and your passengers if injured by

an at-fault motorist who does not have enough

insurance to pay your claim. This does not cover

damage to property.

Underwriting

The initial 60-day time frame wherein the company

processes and investigates the information provided

on the application. The results of this process

determine acceptability and the premium.

Uninsured Motorist (UM)

This coverage applies to you, relatives residing in

your household, and your passengers if injured

by an at-fault uninsured motorist or hit and run

driver. This does not cover damage to property.

Questions?

For more information on

auto insurance, visit:

www.insurance.pa.gov

and click “Auto” under

Coverage

or

call the department at

1-877-881-6388

Follow and Like Us!

@PAInsuranceDept

Facebook.com/

PAInsuranceDepartment

Rev. 10/2016 v3