1

Aston Martin Lagonda Global Holdings plc

(“Aston Martin”, or “AML”, or the “Company”; or the “Group”)

Preliminary results for the twelve months ended 31 December 2023

Revenue growth of 18%; driven by robust volumes and record ASPs

Gross margin improved 650bps to 39.1%; driven by ongoing portfolio transformation

Adjusted EBITDA increased 61%; margin improved 490 basis points to 18.7%

Strong Q4 performance delivered record gross margin and adjusted EBITDA in the quarter

Disciplined strategic delivery supported ongoing deleveraging; net leverage ratio at 2.7x

Near- and medium-term guidance maintained

1

Number of vehicles including Specials;

2

For definition of alternative performance measures please see Appendix

Lawrence Stroll, Aston Martin Executive Chairman commented:

“In 2023, Aston Martin delivered significant strategic milestones and further financial progress, driven by

continued strong demand for our ultra-luxury, high-performance products. The rich mix of sales, driven

by our ongoing commitment to product innovation, supported growth in average selling prices to record

levels. This, combined with our ongoing portfolio transformation, resulted in a significantly enhanced

gross margin, remaining on track to achieve our longstanding target of around 40% gross margin in 2024.

“Aligned to our vision of creating the most comprehensive product portfolio in our segment, we

launched the highly acclaimed DB12 in 2023. We have seen a clear demonstration of DB12 and our other

ultra-luxury vehicles addressing the growing demand for unique personalised products driving

increased options revenue while also attracting new customers to the brand.

“Critical to the long-term success of Aston Martin is the strength of our iconic global brand and loyal, as

well as evolving, customer base. Continued investment in both the brand and our go-to-market strategy

are imperative to our success. I was extremely proud of our achievements in 2023 which included our

fantastic partnership with the Aston Martin F1® Team, the global celebration of our historic 110

th

anniversary, and continued implementation of our renewed corporate identity across our network

including the opening of our first ultra-luxury flagship location, Q New York.

“Looking ahead to 2024, I’m excited by the future development of our product portfolio with the

completion of our line-up of next generation, front-engine sports cars, including the recently unveiled

Vantage, and the continuation of our Specials programmes. These and other advancements will support

the delivery of the Company’s near- and medium-term financial targets, including positive FCF

generation in H2’24, as we unleash the power of our brand and continue our growth trajectory.”

Aston Martin’s management team will host a video webcast presentation at 8am (GMT) today. Details

can be found on page 6 of this announcement and online at www.astonmartinlagonda.com/investors

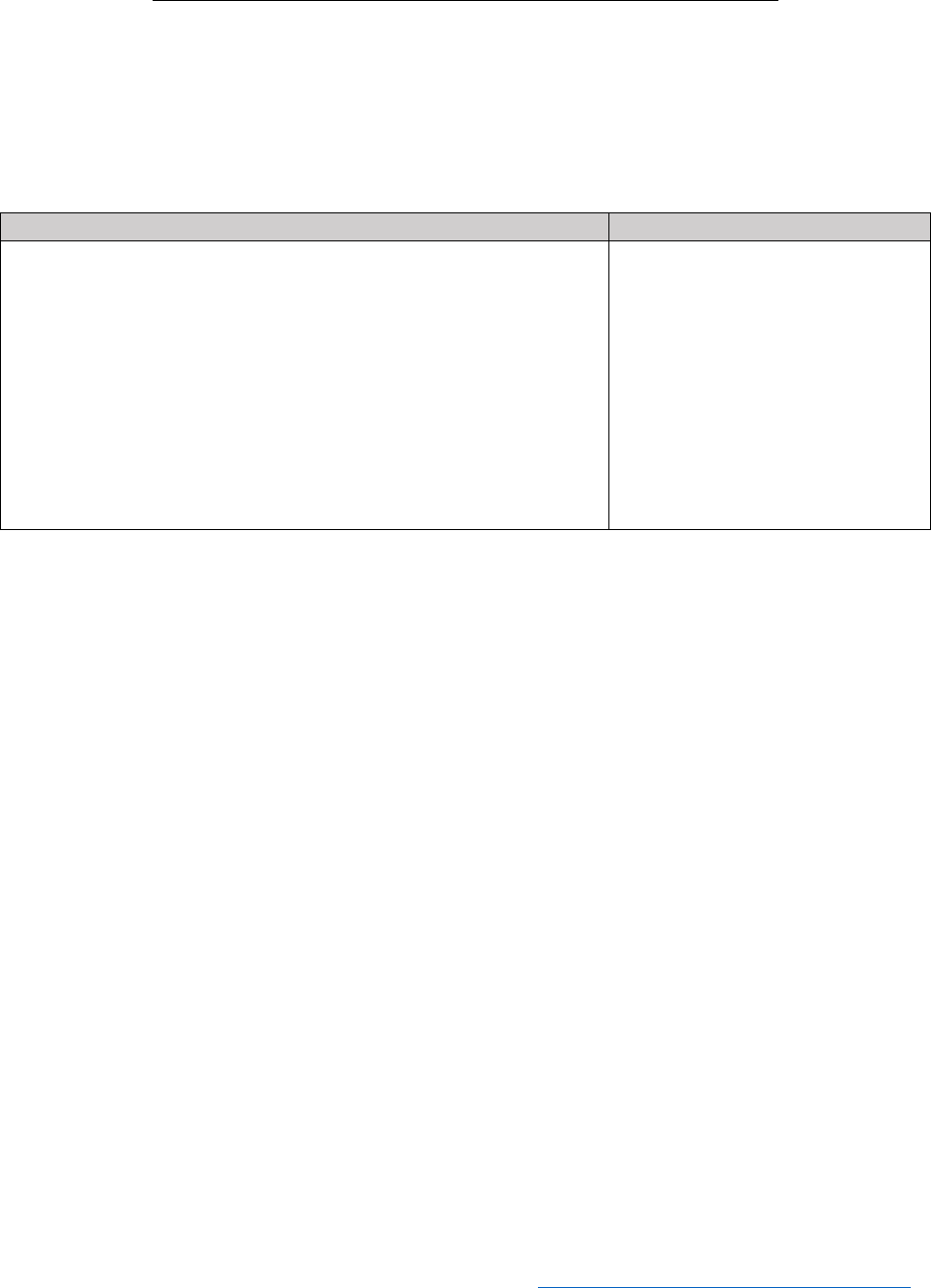

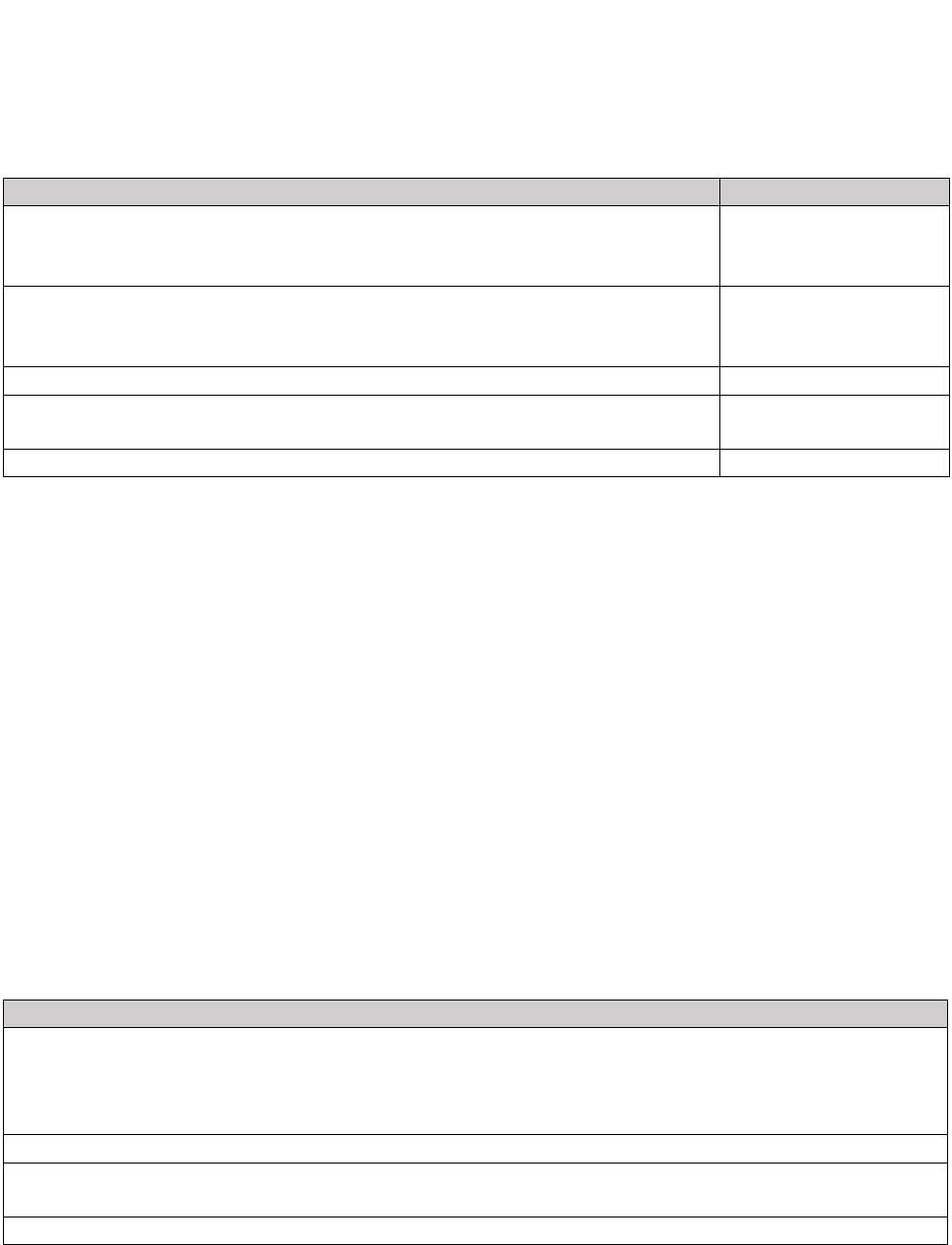

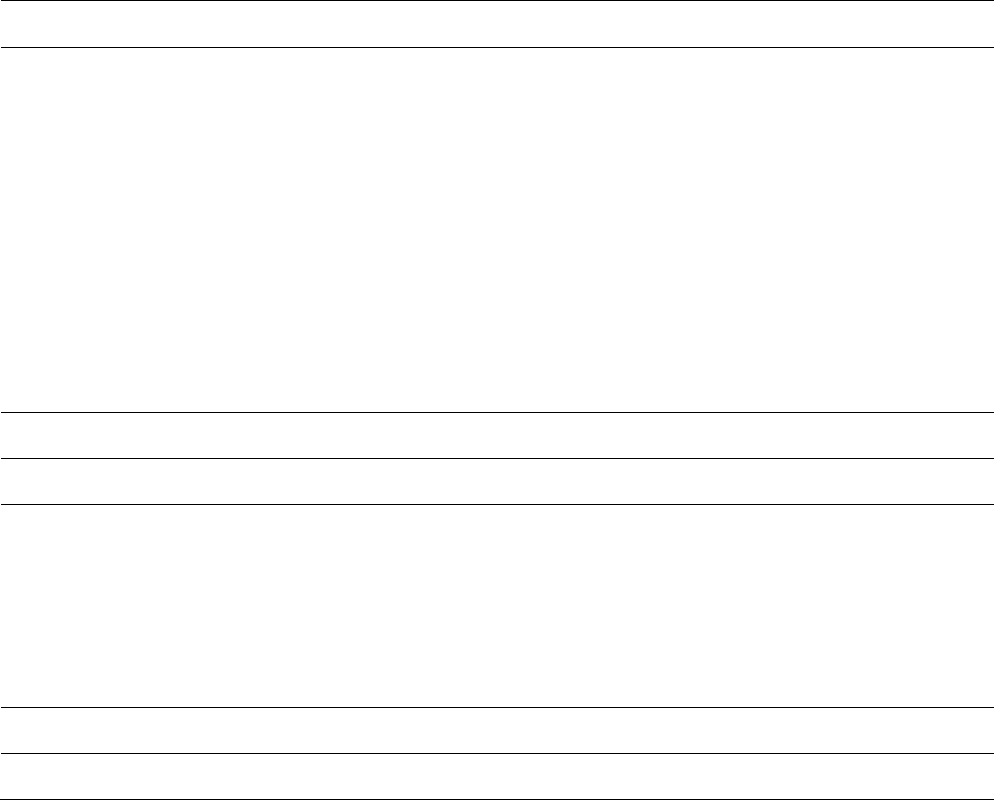

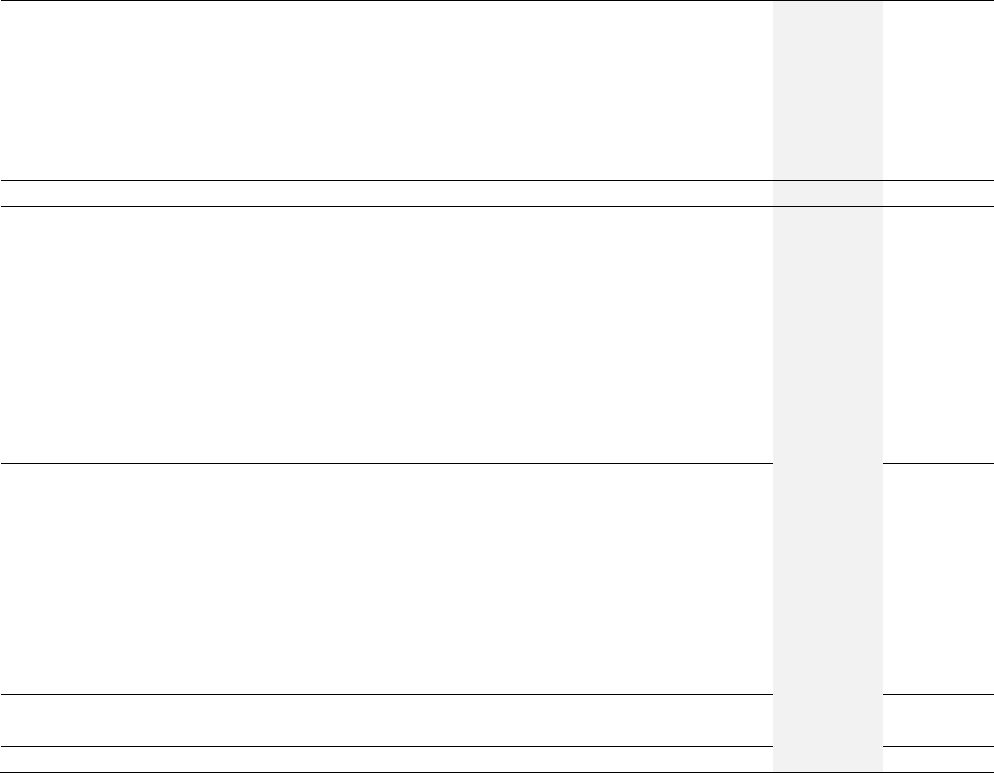

£m

FY 2023

FY 2022

% change

Q4 2023

Q4 2022

% change

Total wholesale volumes

1

6,620

6,412

3%

2,222

2,352

(6)%

Revenue

1,632.8

1,381.5

18%

593.3

524.3

13%

Gross Profit

639.2

450.7

42%

268.4

164.5

63%

Gross Margin (%)

39.1%

32.6%

650 bps

45.2%

31.4%

1380 bps

Adjusted EBITDA

2

305.9

190.2

61%

174.8

110.4

58%

Adjusted EBIT

2

(79.7)

(117.9)

32%

55.4

10.3

438%

Operating (loss)/profit

(111.2)

(141.8)

22%

34.1

6.6

417%

(Loss)/profit before tax

(239.8)

(495.0)

52%

20.0

16.3

23%

Net debt

2

(814.3)

(765.5)

(6)%

(814.3)

(765.5)

(6)%

2

2023 Full year financial summary

• Delivered robust wholesale volumes during a period of ongoing product portfolio

transformation:

- FY 2023 wholesale volumes increased 3% to 6,620 (FY 2022: 6,412); driven by 14%

Sport/GT growth, reflecting growth in DB12 and DBS 770 Ultimate volumes in H2’23,

despite slight delays to the initial production ramp up of DB12

- As expected, Q4 2023 wholesale volumes increased 54% sequentially compared with Q3

2023; decreased 6% to 2,222 compared to prior year period (Q4 2022: 2,352) due to

elevated Q4 2022 wholesales

• FY 2023 revenue increased 18% to £1,633m reflecting continued execution of our growth

strategy; enhanced positioning of our ultra-luxury brand and enriched product portfolio driving

growth in volumes and record average selling prices (ASPs):

- Strong pricing dynamics in the core portfolio and favourable mix from DBS 770 Ultimate,

DBX707, V12 Vantage Roadster and new DB12:

▪ FY 2023 core ASP of £188k, up 6% (FY 2022: £177k)

▪ Q4 2023 core ASP of £196k, up 7% (Q4 2022: £184k)

- Higher year-on-year Specials volumes with consistent delivery of Aston Martin Valkyrie

(87 compared to 80 in FY 2022) including deliveries of the first Aston Martin Valkyrie

Spiders, DBR22 and Valour limited edition models:

▪ FY 2023 total ASP of £231k, up 15% (FY 2022: £201k)

▪ Q4 2023 total ASP of £255k, up 20% (Q4 2022: £213k); reflecting richer mix

• Significant increase in gross profit and margin progressing towards longstanding c. 40% target in

FY 2024/25; reflecting benefits from the ongoing portfolio transformation, driving favourable

pricing dynamics, product mix and volumes:

- FY 2023 gross profit increased by 42% to £639m (FY 2022: £451m); gross margin at 39%

(FY 2022: 33%)

- Q4 2023 gross profit increased by 63% to £268m (Q4 2022: £165m); gross margin at 45%

(Q4 2022: 31%)

• FY 2023 adjusted EBITDA increased 61% to £306m (FY 2022: £190m) translating to an adjusted

EBITDA margin increase of 490 basis points to 18.7%; primarily driven by higher gross profit,

partially offset by 26% increase in adjusted operating expenses, including reinvestments into

brand and marketing activities and inflationary impacts on the cost base, while recognising £11m

relating to upward revaluation of investment in AMR GP Holdings Limited

• FY 2023 operating loss decreased by 22% to £111m (FY 2022: £142m loss), including £78m year-

on-year increase in depreciation and amortisation; Q4 2023 operating profit increased to £34m

(Q4 2022: £7m)

• Net cash inflow from operating activities of £146m (FY 2022: £127m); Free cash outflow

3

of

£360m (FY 2022: £299m outflow) reflecting:

- Q4 free cash outflow of £63m (Q4 2022: £37m inflow) impacted by timing of DB12 and

Valour deliveries in December 2023 with related receivables unwinding in January 2024

- Higher year-on-year capital expenditure of £397m (FY 2022: £287m), primarily related

to new models and next generation sports car developments, as well as development of

the Company's electrification programme including the initial $33m (£27m) payment to

Lucid Group, Inc. (Lucid) relating to the new strategic supply agreement

3

For definition of alternative performance measures please see Appendix

3

- Net cash interest payments of £109m (FY 2022: £139m)

- Working capital outflow of £86m (FY 2022: £15m outflow) reflecting timing of

December deliveries and the unwinding of customer deposits on delivery of Special

wholesales, partially offset by a reduction in inventory and payables

• Year-end cash of £392m (2022: £583m), following the redemption of 50% of the outstanding

second lien notes in November 2023

• Net debt of £814m (2022: £766m), including a positive £61m impact of non-cash FX revaluation

of US dollar-denominated debt as sterling strengthened against the US dollar during 2023;

disciplined strategic delivery supported ongoing deleveraging with net leverage ratio improving

to 2.7x (2022: 4.0x)

Operational Overview: Accelerating.Forward.

Amedeo Felisa, Aston Martin Chief Executive Officer, commented:

“2023 was a landmark year for Aston Martin’s portfolio transformation as we delivered stunning new

products to market including the DBS 770 Ultimate and DB12, the first of our next generation sports cars,

celebrating a new era of ultra-luxury design and high-performance. The demand for our 110

th

anniversary special edition Valour also demonstrated our brand’s unique ability to operate at the very

pinnacle of the ultra-luxury segment, something also exemplified by further Specials such as the DBR22

and Aston Martin Valkyrie. The momentum and experience our teams have amassed in 2023 to develop

and deliver our ambitious plans is carried into 2024, which along with further investment in people and

facilities, and a relentless focus on quality and continuous improvement, will support successful future

model launches and our growth ambitions.”

Heightened focus on ultra-luxury and high-performance

The success of the Company’s ultra-luxury high-performance product portfolio this year is

demonstrated by record total and core ASPs, and strong revenue and margin growth. In 2023, the

Company completed a year-long celebration of Aston Martin’s 110

th

anniversary, with a series of unique

global events bringing its community of customers even closer to the brand, culminating in the launch

of the ultra-exclusive Special, Valour. The Company also completed first deliveries of its highly

acclaimed next generation sports car, DB12. The model was recently awarded “Car of the Year” for 2024

by Robb Report and confirmed by Autocar magazine as a true “Super GT”, driving reappraisal of Aston

Martin amongst new audiences, whilst engaging loyal customers.

The DBS 770 Ultimate, the most powerful production Aston Martin ever, was unveiled in January 2023,

with all examples sold out before production commenced in 2023. The world’s most powerful ultra-

luxury SUV, DBX707, continued to win awards, named ‘Best Exclusive & Luxury Car’ at the prestigious

Auto vum Joer awards in Luxembourg, and was announced as the new Official FIA Medical Car of F1 in

conjunction with the start of the 2023 World Championship season. The transformational demand for

Aston Martin’s high-performance DBX707 since its launch in 2022, underpins the next phase of the

model’s evolution, now the sole SUV model marketed.

In June 2023, the Company proudly opened the doors to Q New York, its first ultra-luxury flagship on

450 Park Avenue. The new location brings the highest levels of the iconic British brand’s bespoke service,

Q by Aston Martin, to North America for the very first time, providing the most sophisticated luxury

specification experience available anywhere in the world.

The Company celebrated the success of the Aston Martin F1® Team with the release of an exclusive

AMR23 Edition DBX707. Named after the brand’s 2023 F1® challenger, the AMR23 Edition creates a

DBX707 that shares a racing identity with both the AMR23 F1® car and the Official Medical Car of F1®.

The Aston Martin F1® Team continued to drive brand visibility and heightened product consideration,

with a 7% increase in website traffic versus non-race weekends in 2023 and 20% uplift in traffic to Aston

4

Martin’s award-winning configurator. Market research indicates that 60% of luxury car buyers strongly

agree they are more likely to buy an Aston Martin because of its association with F1 .

Further strengthening its high-performance DNA, in October 2023, Aston Martin announced it is set to

enter the 2025 24 Hours of Le Mans Hypercar class with a racing prototype version of the ultimate

Hypercar, the Aston Martin Valkyrie.

Looking to the year ahead, 2024 sees Aston Martin begin to complete its vision for a world-class product

portfolio, with an incredible line-up of new, front-engine sports cars, joining the best performance SUV

in the luxury segment. Unveiling the new Vantage in February 2024, the fastest and most driver focused

in the famous nameplate’s 74-year history, is testament to Aston Martin’s commitment to delivering a

thrilling driving experience and integrating the very best in motorsport technologies. This was

exemplified by the car’s launch on the same day as the 2024 Aston Martin Formula One challenger and

Vantage GT3 racer. Complementing the portfolio, the Company has an incredible, mid-engine supercar

in Valhalla on the horizon, with prototype testing already taking place and currently on course to enter

production before the end of this year.

Aligning the organisation for accelerated growth

In 2023, the Company delivered the majority of its vehicles in line with production plans, including the

DBS 770 Ultimate, DBX707 and Special models. During Q3, despite initial production ramp up delays due

to supplier readiness and EE platform integration issues, deliveries of DB12 commenced. This model

included Aston Martin’s first-ever in-house, bespoke infotainment system, where teams across the

Company collaborated with suppliers to deliver this significant step forward for the product. Aligned

with the Company’s commitment to providing customers with the highest quality products and best user

experience possible, these and other continual improvement processes will be carried forward into 2024

to support the successful launch of further new models.

In June 2023, the Company moved further forward in its ambition to create the world’s most thrilling and

highly desirable electric performance cars, with the formation of a landmark new supply agreement with

world-leading electric vehicle technologies company, Lucid Group. This long-term relationship will help

propel Aston Martin’s high-performance electrification strategy, as the Company develops alternatives

to the Internal Combustion Engine with a blended drivetrain approach between 2025 and 2030, including

PHEV and BEV, with a clear plan to have a line-up of electric sports cars and SUVs. With Aston Martin’s

technical partnerships now in place, the Company’s first battery electric vehicle (BEV) is now targeted

for launch in 2026, benefitting from the very best high-performance technologies available.

In October 2023, a consortium working on the Company’s high-performance electrification strategy was

awarded £9 million of government funding through the Advanced Propulsion Centre UK, further

supplementing the research and development of Aston Martin’s innovative modular BEV platform, which

will be propelled by world-leading electric vehicle technologies from Lucid.

Continued investment in people, skills and facilities

At the core of the Group’s value is one single guiding tenet: No one builds an Aston Martin on their own.

In line with this and Aston Martin’s growth ambitions, the Company continued to invest in its world-class

team, including the appointment of Chief Industrial Officer, Chief Procurement Officer, and BEV Chief

Engineer. The Company also welcomed a breadth of new talent to complement its skilled and passionate

team, increasing employment at its Gaydon headquarters to support the launch of its next generation of

sports cars, as well as an enhanced early careers intake and senior appointments, notably in the area of

electrification.

In 2023, Aston Martin launched new company values of Unity, Openness, Trust, Ownership and Courage

through an internal and external campaign; these values are at the heart of the Company’s commitment

to make Aston Martin a great place to work. To solidify its community of people, the Company expanded

its employee engagement programme with new internal initiatives and events, including a family

weekend, which saw more than 10,000 employees and their friends and family attend. Aligned with the

5

Company’s diversity and inclusion aspirations, progress was made this year towards the target of having

women in 25% of leadership positions by 2025 and in 30% of leadership positions by 2030.

The Company also announced further progress in its Racing.Green. sustainability strategy, using CO₂

emission offsets to establish carbon neutral status for its Gaydon and St Athan plants. This follows an

acceleration towards the goals established in the strategy announced in 2022, with targets relating to

Carbon Neutral manufacturing facilities, CO₂ emissions and energy consumption, and biodiversity

improvement updated in 2023.

Continued financial progress is reflected in our unchanged outlook

We remain on track to substantially achieve our 2024/25 financial targets in FY 2024. This is driven by

continued strong demand for our products underpinned by the exciting new next generation launches in

2024 of Vantage and our final front-engine sports car later in the year. While recognising the ongoing

geopolitical and macro economic volatility and associated inflationary and supply chain uncertainties,

our world-class teams continue to collaborate with our partners, seeking to minimise potential impacts

on our operations.

2024 is expected to deliver another year of significant strategic and financial progress as we continue the

ongoing product portfolio transformation. Enhanced profitability and EBITDA will be driven by high

single-digit percentage wholesale volume growth, gross margin further improving to achieve our

longstanding target of c. 40% and EBITDA margin expansion continuing into the low 20s%.

Given the launch timings of our exciting two next generation sports cars in 2024, wholesale volumes will

be heavily weighted to the second half of the year, resulting in significant H2’24 growth in gross profit

and EBITDA compared with the prior year period.

Continued capital investment in new product developments to support our growth strategy is expected

to total c. £350m in 2024, broadly flat across the first and second half of the year. FCF is expected to

materially improve in 2024 compared with the prior year, achieving our targeted inflection point for

positive FCF generation in H2’24, primarily driven by the timing of wholesale volumes.

Through disciplined strategic delivery, we expect to continue deleveraging, towards our net leverage

ratio target of c. 1.5x in 2024/25. As previously announced, we expect to refinance our outstanding debt

in the first half of 2024. We are in the advanced stages of preparation and look forward to launching this

process in due course.

Additional 2024 guidance:

• Depreciation and amortisation: c. £400m

• Net cash interest: c. £110m, assuming current exchange rates prevail for 2024

The Group’s medium-term outlook for 2027/28, remains unchanged:

• Revenue: c. £2.5 billion

• Gross margin: mid-40s%

• Adjusted EBITDA: c. £800 million

• Adjusted EBITDA margin: c. 30%

• Free cash flow: to be sustainably positive

• Net leverage ratio: below 1.0x

• Expect to invest: c. £2bn over FY 2023-2027 in long-term growth and transition to

electrification

6

All metrics and commentary in this announcement exclude adjusting items unless stated otherwise and

certain financial data within this announcement have been rounded.

Appointment of Corporate Broker

Aston Martin also announces the appointment of Goldman Sachs International (“Goldman Sachs”) as its

joint Corporate Broker, alongside Barclays Bank PLC (“Barclays”), with immediate effect.

Enquiries

Investors and Analysts

James Arnold Head of Investor Relations +44 (0) 7385 222347

james.arnold@astonmartin.com

Ella South Investor Relations Analyst +44 (0) 7776 545420

ella.south@astonmartin.com

Media

Kevin Watters Director of Communications +44 (0) 7764 386683

kevin.watters@astonmartin.com

Paul Garbett Head of Corporate & Brand Communications +44 (0) 7501 380799

paul.garbett@astonmartin.com

Teneo

Harry Cameron +44 (0) 20 7353 4200

Results Presentation

• There will be a video presentation and Q&A for today at 08.00am GMT:

https://app.webinar.net/50XL9z5nrwb

• The presentation and Q&A can be accessed live via the corporate website:

https://www.astonmartinlagonda.com/investors/results-and-presentations

• A replay facility will be available on the website later in the day

No representations or warranties, express or implied, are made as to, and no reliance should be placed

on, the accuracy, fairness or completeness of the information presented or contained in this release. This

release contains certain forward-looking statements, which are based on current assumptions and

estimates by the management of Aston Martin Lagonda Global Holdings plc (“Aston Martin Lagonda”).

Past performance cannot be relied upon as a guide to future performance and should not be taken as a

representation that trends or activities underlying past performance will continue in the future. Such

statements are subject to numerous risks and uncertainties that could cause actual results to differ

materially from any expected future results in forward-looking statements. These risks may include, for

example, changes in the global economic situation, and changes affecting individual markets and

exchange rates.

Aston Martin Lagonda provides no guarantee that future development and future results achieved will

correspond to the forward-looking statements included here and accepts no liability if they should fail

to do so. Aston Martin Lagonda undertakes no obligation to update these forward-looking statements

and will not publicly release any revisions that may be made to these forward-looking statements, which

may result from events or circumstances arising after the date of this release.

This release is for informational purposes only and does not constitute or form part of any invitation or

inducement to engage in investment activity, nor does it constitute an offer or invitation to buy any

securities, in any jurisdiction including the United States, or a recommendation in respect of buying,

holding or selling any securities.

7

FINANCIAL REVIEW

Wholesale and revenue analysis

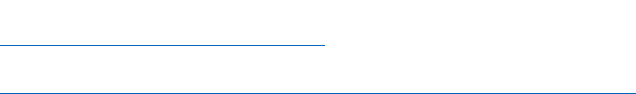

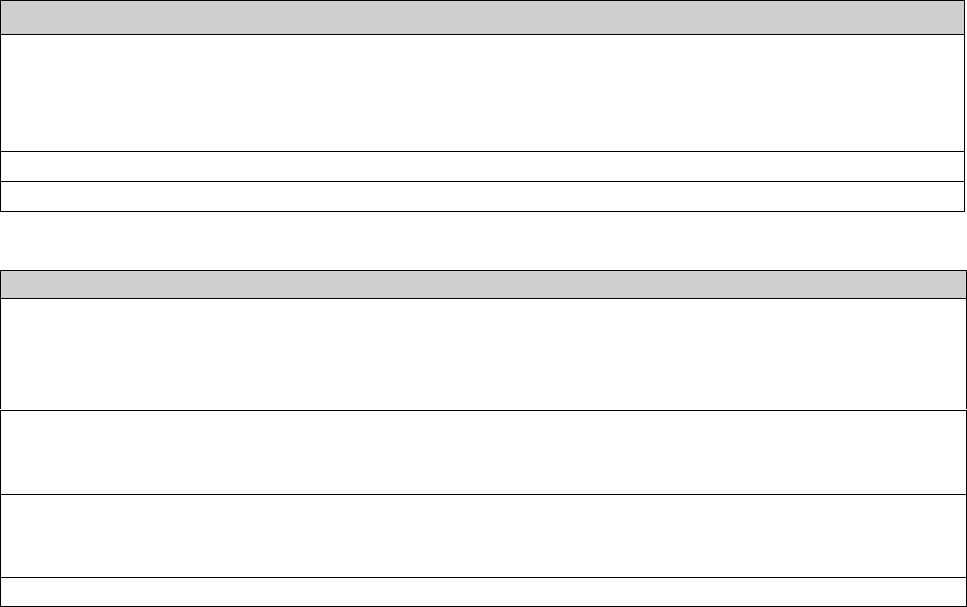

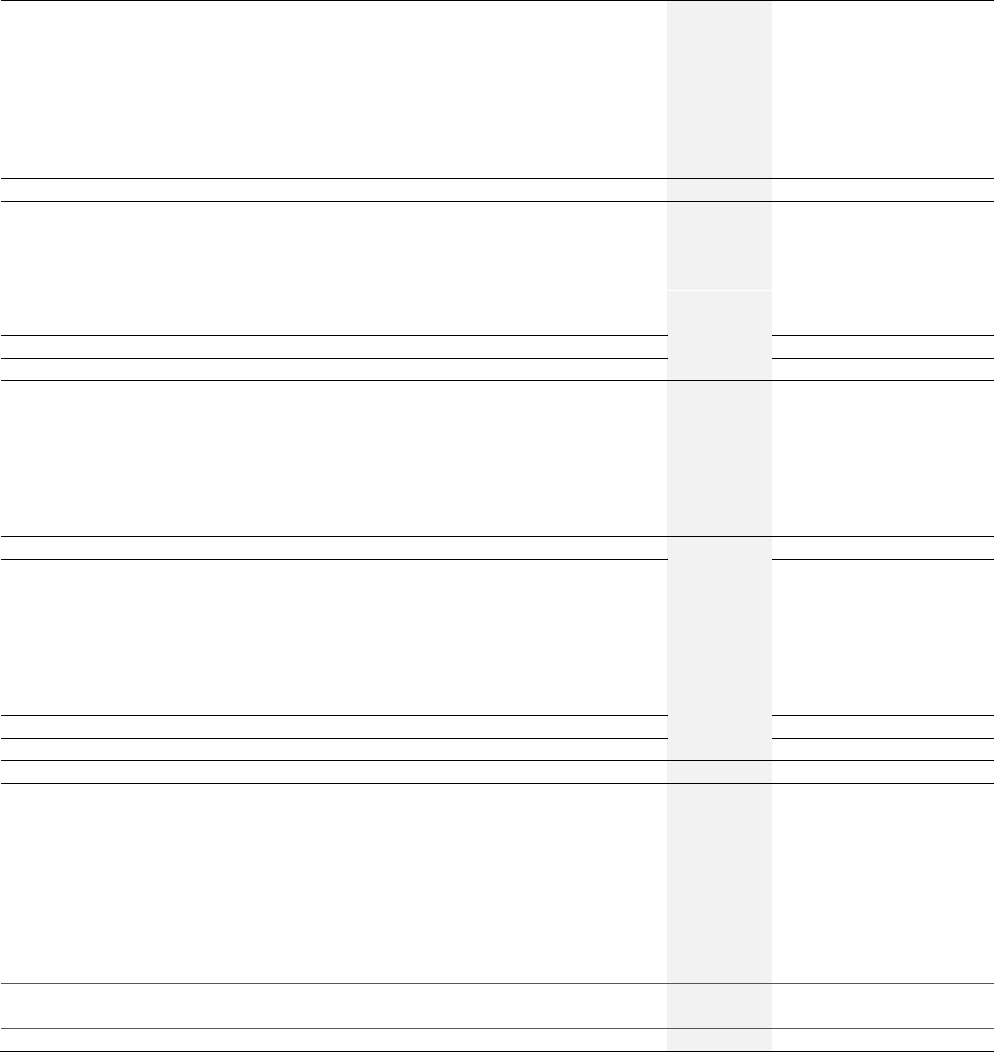

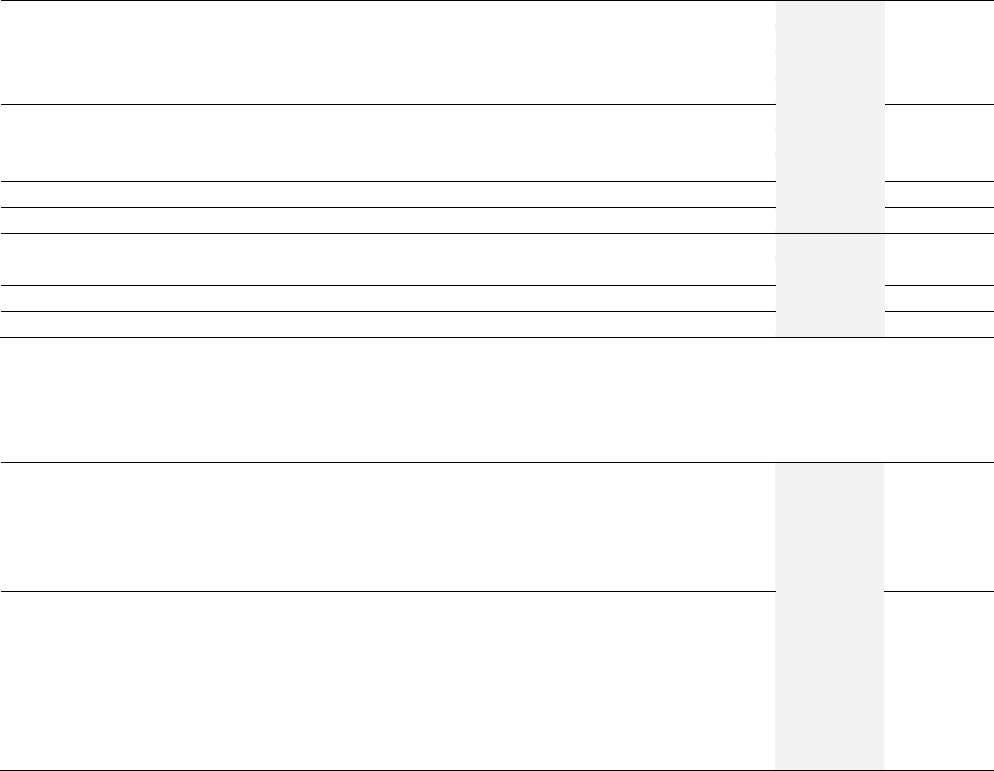

Number of vehicles

FY 2023

FY 2022

Change

Q4 2023

Q4 2022

Change

Total wholesale

6,620

6,412

3%

2,222

2,352

(6%)

Core (excluding Specials)

6,469

6,323

2%

2,139

2,313

(8%)

By region:

UK

1,141

1,110

3%

367

416

(12%)

Americas

2,037

1,980

3%

620

828

(25%)

EMEA ex. UK

3

1,994

1,508

32%

727

628

16%

APAC

3

1,448

1,814

(20%)

508

480

6%

By model:

Sport/GT

3,530

3,104

14%

1,440

920

57%

SUV

2,939

3,219

(9%)

699

1,393

(50%)

Specials

151

89

70%

83

39

113%

Note: Sport/GT includes Vantage, DB11, DB12, and DBS; 3 2022 numbers restated

Total wholesales of 6,620 increased by 3% year-on-year (FY 2022: 6,412), driven by high demand for

DBS 770 Ultimate and DB12, despite expected impacts of the ongoing product portfolio transition. This

included 151 Specials in FY 2023 (FY 2022: 89), comprised of a mature cadence of 87 Aston Martin

Valkyries (FY 2022: 80), as well as DBR22 and initial Valour deliveries, demonstrating the Company’s

unique ability to operate at the very highest levels of the luxury automotive segment and attract new

customers and collectors to the brand.

As expected, total wholesales of 2,222 units in Q4 2023 increased by 54% compared to Q3 2023, though

decreased by 6% year-on-year, due to elevated Q4 2022 SUV wholesales following the resolution of

supply chain and logistics disruptions in Q2 and Q3 2022.

SUV wholesales remained robust in FY 2023, with ASPs benefiting from the planned change in mix to

DBX707 in line with the Company’s ultra-luxury high-performance strategy. The DBX707 is now clearly

established as the benchmark in the ultra-luxury SUV segment and represented 71% of SUV wholesales

in FY 2023 (FY 2022: 52%), with volumes increasing 25% in 2023 compared with the prior year. SUV

wholesales decreased both on a FY 2023 and Q4 2023 year-on-year basis (9% and 50% decreases,

respectively), reflecting portfolio transition and the previously mentioned elevated Q4 2022 wholesales

following disruptions earlier in 2022.

Q4 2023 Sport/GT wholesales of 1,440 units increased by 57% (Q4 2022: 920), reflecting considerable

contribution from DB12. The temporary peak in DB12 wholesales reflected partial delays in Q3 2023

deliveries due to supplier readiness and EE platform integration issues.

Aston Martin continues to operate a demand-led approach, aligned with its ultra-luxury high

performance strategy. Prior to the initial production ramp up delays of DB12, retail volumes (retails)

were ahead of wholesale volumes (wholesales) for the year. However, similar to the profile experienced

at the end of 2022, and as a direct result of the timing of DB12 deliveries in December 2023, wholesales

were temporarily ahead of retails at the end of the year. Following the unwinding of this position, the

Company expects to see retails outpace wholesales in FY 2024 as it continues the transition to its next

generation of sports cars.

Geographically, wholesale volumes remained well balanced across all regions. The Americas and EMEA

excluding UK were the largest regions in FY 2023, collectively representing 61% of total wholesales,

driven by strong demand for DBX707, DBS 770 Ultimate and DB12. In our home market, the UK,

8

wholesales grew 3% year-on-year, driven by DBS 770 Ultimate and DB12 deliveries. Finally, FY 2023

wholesale volumes in APAC were impacted by lower sales in China, which decreased by 47% compared

to 2022, which more than offset growth in wholesale volumes including DBX707 and DBS 770 Ultimate

outside of China. China continues to be a market where we see significant opportunity for long-term

growth. Wholesale volumes in APAC excluding China were up 12% year-on-year (FY 2022: 10%).

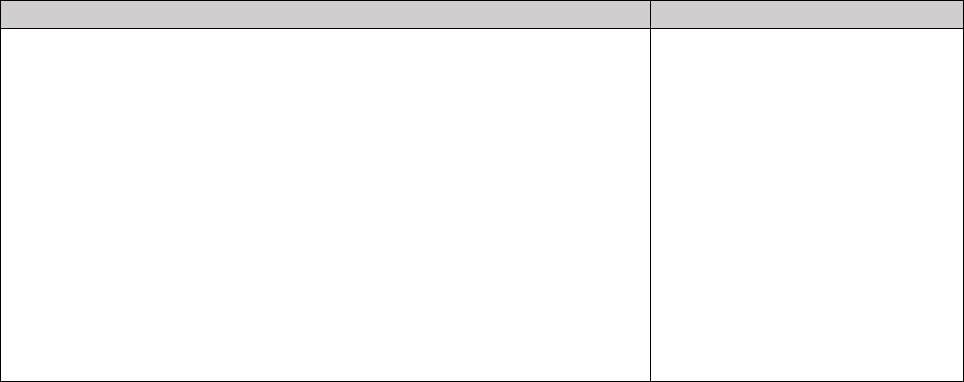

Revenue by category

£m

FY 2023

FY 2022

% Change

Sale of vehicles

1,531.9

1,291.5

19%

Sale of parts

80.0

70.8

13%

Servicing of vehicles

9.8

9.3

5%

Brand and motorsport

11.1

9.9

12%

Total

1,632.8

1,381.5

18%

FY 2023 revenue increased by 18% to £1.6bn (FY 2022: £1.4bn), primarily due to strong wholesale ASP

growth, with both core and total ASP reaching record levels and, to a lesser extent, due to higher

wholesale volumes. Total ASP of £231k (FY 2022: £201k) increased by 15% year-on-year, reflecting

richer mix including deliveries of the full range of Aston Martin Valkyrie models and the 110

th

anniversary

Special, Valour, and DBR22, as well as higher core ASPs. Core ASP of £188k (FY 2022: £177k) increased

by 6% year-on-year driven by strong pricing and favourable mix dynamics, despite some foreign

exchange headwinds.

Q4 2023 revenue increased by 13% to £593m (Q4 2022: £524m), driven by strong ASP growth. Total Q4

2023 ASP of £255k (Q4 2022: £213k) increased by 20%, reflecting 113% increase in Special edition

wholesale volumes. Q4 2023 core ASP of £196k (Q4 2022: £184k) increased by 7%, driven by strong

pricing and favourable mix dynamics from new DB12 and exclusive DBS 770 Ultimate, and despite

foreign exchange headwinds in Q4 2023.

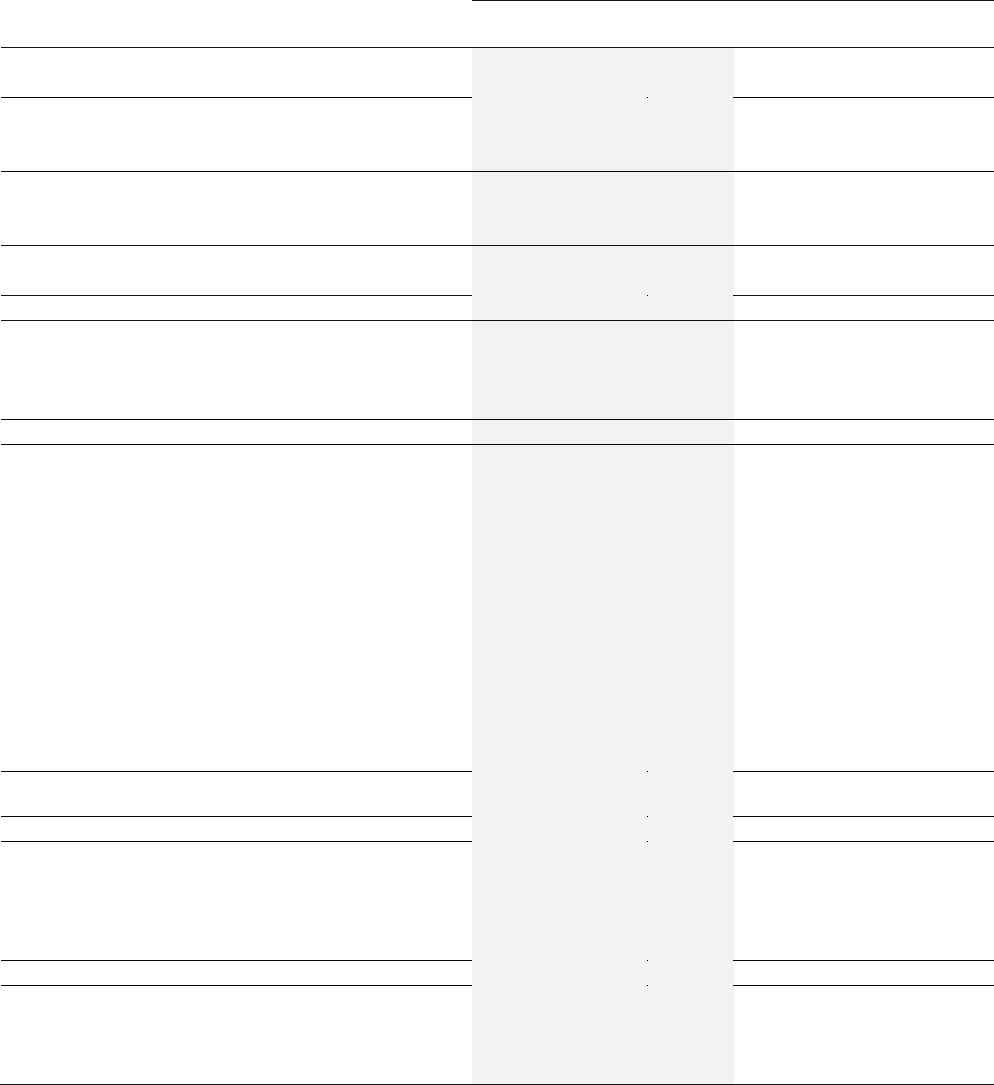

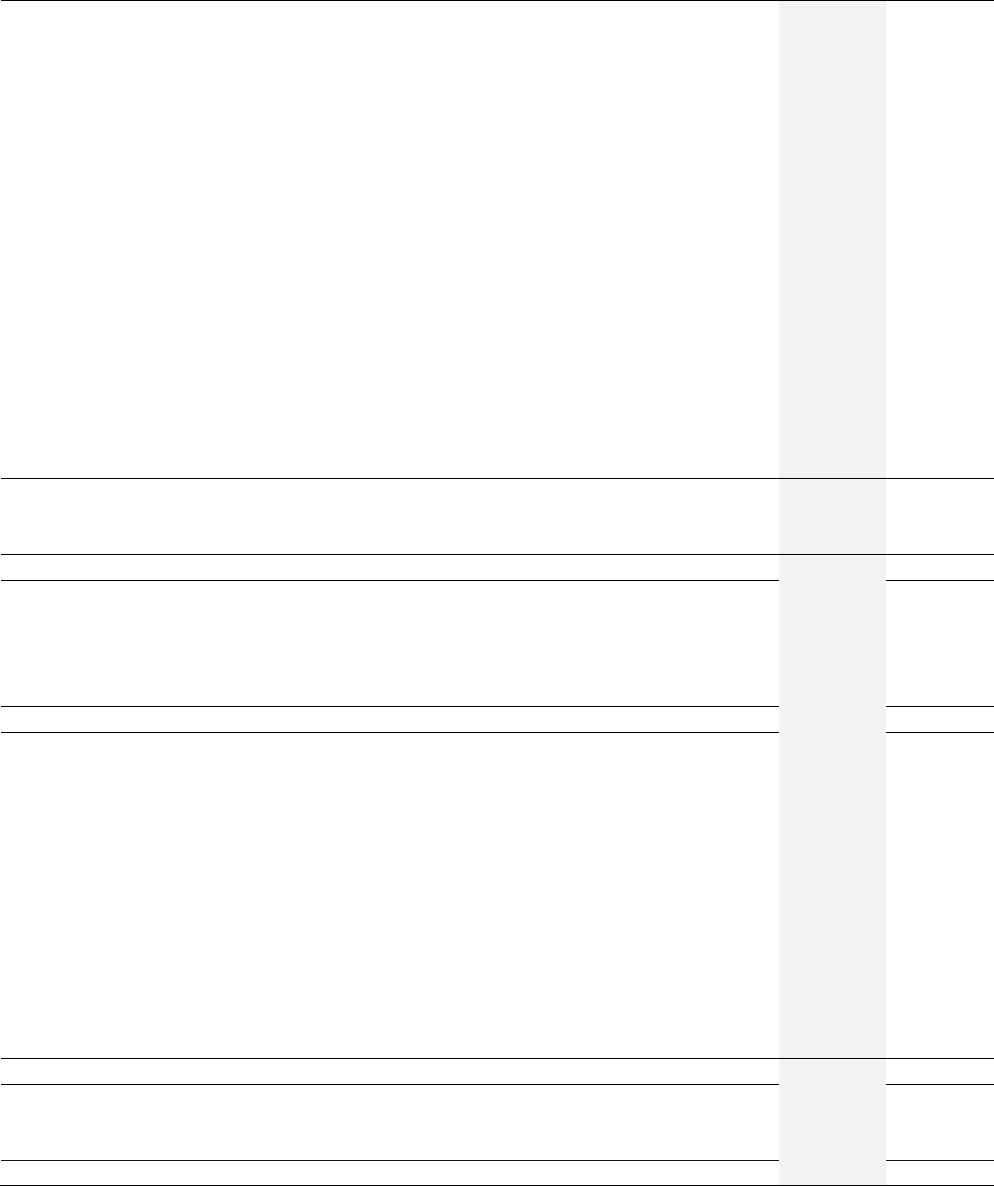

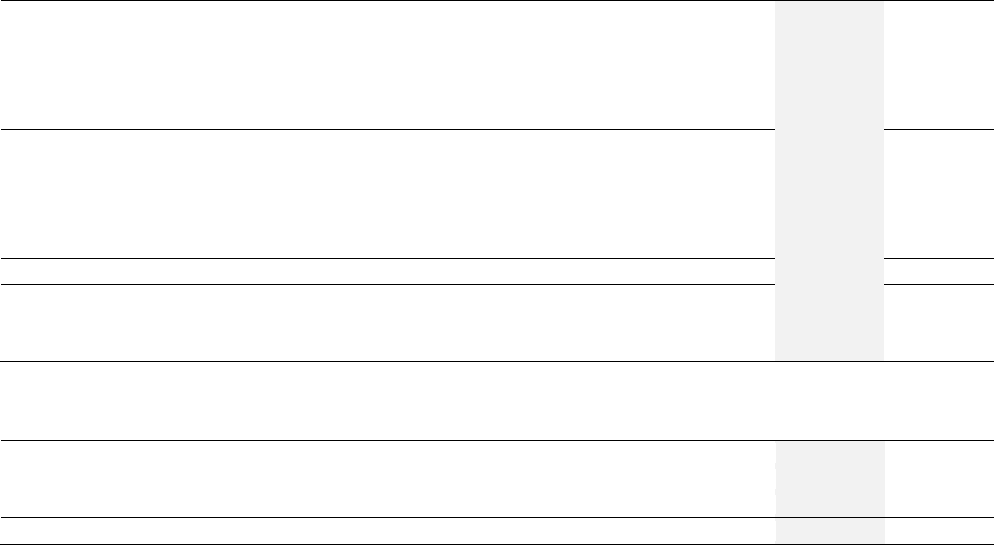

Summary income statement and analysis

£m

FY 2023

FY 2022

Q4 2023

Q4 2022

Revenue

1,632.8

1,381.5

593.3

524.3

Cost of sales

(993.6)

(930.8)

(324.9)

(359.8)

Gross profit

639.2

450.7

268.4

164.5

Gross margin %

39.1%

32.6%

45.2%

31.4%

Adjusted operating expenses

1

(718.9)

(568.6)

(213.0)

(154.2)

of which depreciation & amortisation

385.6

308.1

119.4

100.1

Adjusted EBIT

2

(79.7)

(117.9)

55.4

10.3

Adjusting operating items

(31.5)

(23.9)

(21.3)

(3.7)

Operating (loss)/profit

(111.2)

(141.8)

34.1

6.6

Net financing (expense)/income

(128.6)

(353.2)

(14.1)

9.7

of which adjusting financing

(expense)/ income

(36.5)

(20.1)

(8.2)

(39.1)

(Loss)/profit before tax

(239.8)

(495.0)

20.0

16.3

Tax credit/(charge)

13.0

(32.7)

13.2

(26.0)

(Loss)/profit for the period

(226.8)

(527.7)

33.2

(9.7)

Adjusted EBITDA

1,2

305.9

190.2

174.8

110.4

Adjusted EBITDA margin

18.7%

13.8%

29.5%

21.1%

9

Adjusted (loss)/profit before tax

1

(171.8)

(451.0)

49.5

59.1

EPS (pence)

(30.5)

(124.5)

Adjusted EPS (pence)

(21.4)

(114.1)

1 Excludes adjusting items; 2 Alternative Performance Measures are defined in Appendix

In FY 2023, gross profit of £639m increased by £189m, or 42% (FY 2022: £451m). This translated to a

gross margin of 39%, expanding by 650 basis points compared to the prior year (FY 2022: 33%). The

gross margin performance reflected benefits from the ongoing portfolio transformation strategy,

driving favourable pricing dynamics, product mix and volumes, which was particularly strong in Q4 2023

with a gross margin of 45% (Q4 2022: 31%). Throughout FY 2023 this was partially offset by higher

manufacturing, logistics and other costs, as well as FX headwinds. The Company continues to target over

40% gross margin from future products, aligned with the Company’s ultra-luxury strategy.

Adjusted EBITDA increased by 61% year-on-year to £306m in FY 2023 (FY 2022: £190m), or by £116m.

This translated to an adjusted EBITDA margin of 19% (FY 2022: 14%), a year-on-year expansion of

approximately 490 basis points. The year-on-year increase in adjusted EBITDA was primarily due to

higher year-on-year revenue and gross profit, as described above, partially offset by 26% increase in

adjusted operating expenses including reinvestments into brand and marketing activities and inflationary

impacts on the cost base, while recognising £11m relating to upward revaluation of investment in AMR

GP Holdings Limited.

The operating loss of £111m compared to a £142m loss in the prior year. The 22% decrease year-on-

year was primarily driven by:

– Higher year-on-year gross profit as described above

These factors were partially offset by:

– A £78m year-on-year increase in depreciation and amortisation, primarily related to cadence of

Specials delivery, DBS 770 Ultimate and DB12 launch, as well as full year DBX707 charges

– Increased investment in brand and product launches such as V12 Vantage, DBS 770 Ultimate,

DB12, Valhalla and Valour, and marketing activities at events such as the Goodwood Festival of

Speed, Pebble Beach, and Las Vegas Grand Prix

– Higher general costs, including inflationary pressures

Net financing costs of £129m were down from £353m in 2022, comprising a positive non-cash FX

revaluation impact of £61m, as sterling strengthened against the US dollar (FY 2022: negative £156m).

Adjusting operating items of £32m (FY 2022: £24m) predominantly related to ERP implementation costs

and one-off legal expenses. The £37m net adjusting finance charge (FY 2022: £20m) was due to

movements in fair value of outstanding warrants, and financing expenses associated with the partial

repayment of the second lien notes.

The loss before tax was £240m (FY 2022: £495m loss), an improvement of £255m year-on-year and the

loss for the period was £227m (FY 2022: £528m), an improvement of £301m year-on-year, both

impacted by the significant reduction in net financing costs related to the US dollar-denominated Senior

Secured Notes.

The tax credit on the adjusted loss before tax was £13m, and the total effective tax rate for the period to

31 December 2023 was 5.4% which is predominantly due to recognising deferred tax on accelerated

capital allowances and UK tax losses, as well as movements in deferred tax on the amount of interest the

Group can deduct for tax purposes.

10

The weighted average share count at 31 December 2023 was 748 million, following the placing of new

ordinary shares to Lucid Group, Inc. in November and to Geely International (Hong Kong) Limited in May.

66 million shares in relation to the warrants remain outstanding and are exercisable until 2027, giving an

adjusted EPS of (21.4)p (2022: (114.1)p).

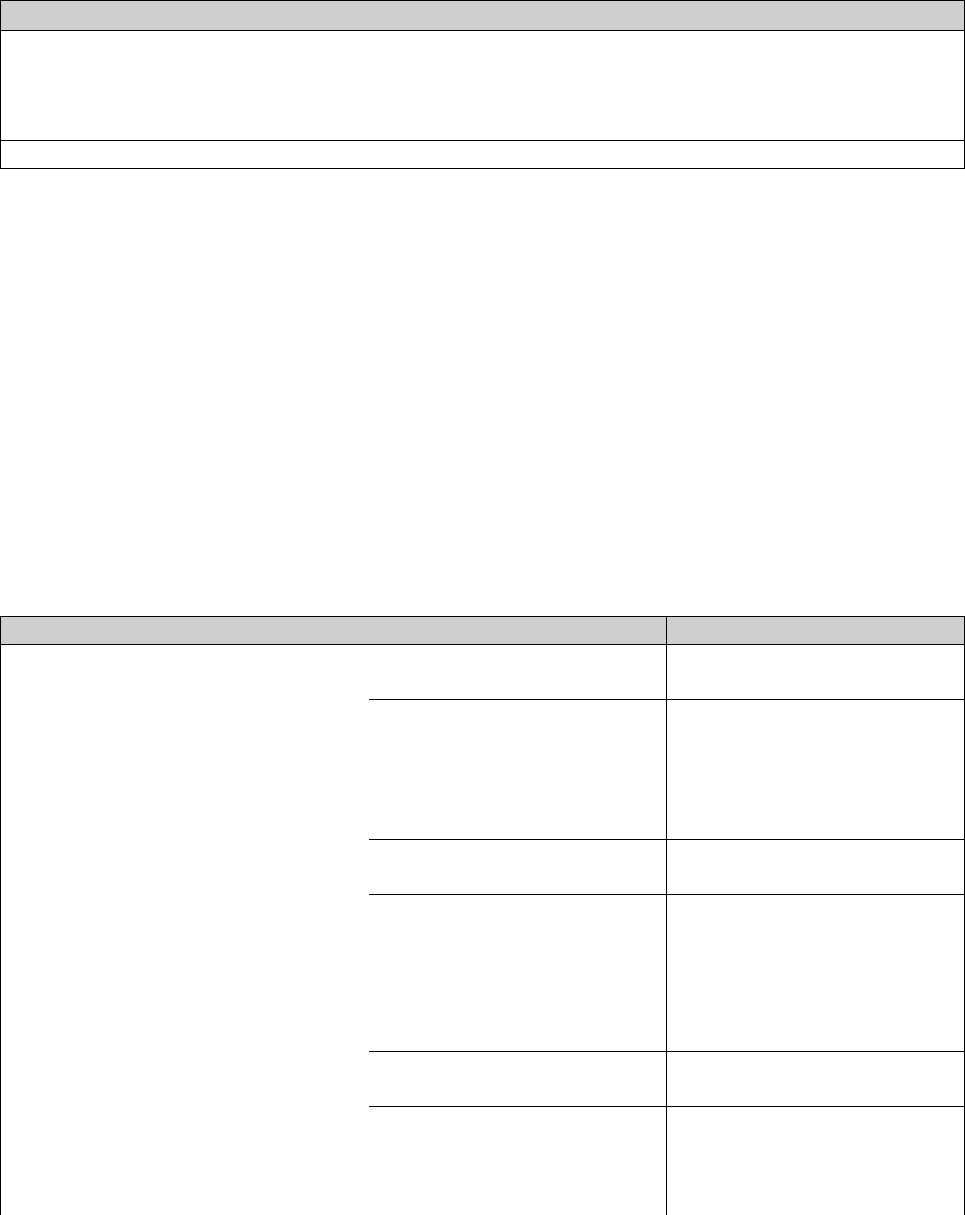

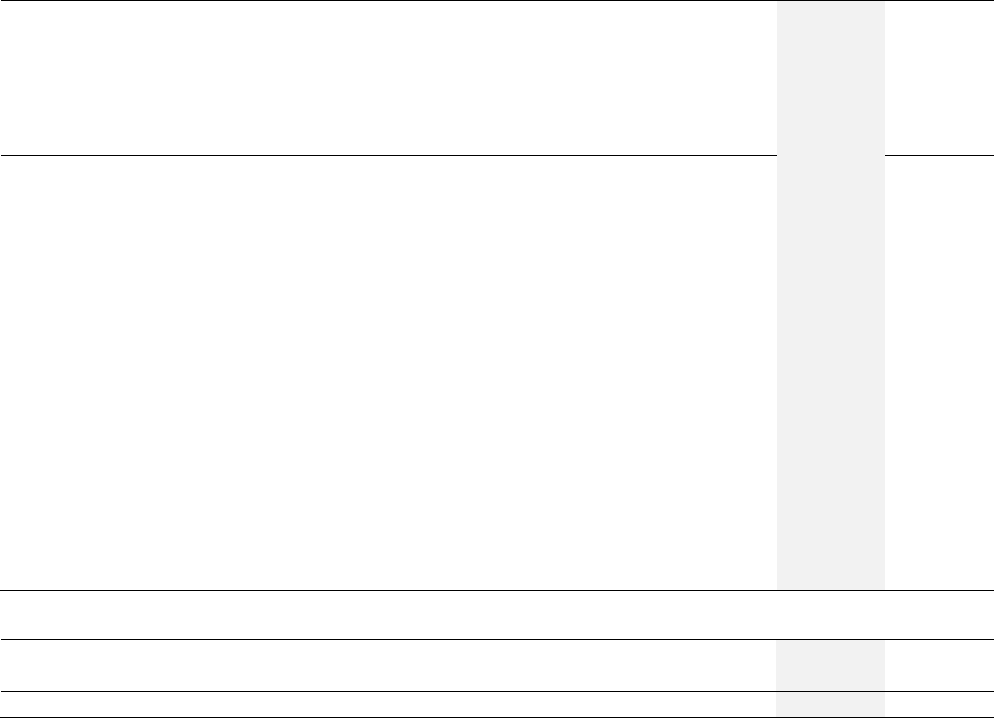

Cash flow and net debt

£m

FY 2023

FY 2022

Q4 2023

Q4 2022

Cash generated from operating activities

145.9

127.1

114.5

184.0

Cash used in investing activities (excl. interest)

(396.9)

(286.9)

(121.9)

(73.5)

Net cash interest paid

(109.0)

(139.0)

(55.8)

(73.7)

Free cash (outflow)/inflow

(360.0)

(298.8)

(63.2)

36.8

Cash inflow/(outflow) from financing activities

(excl. interest)

182.2

456.2

(80.6)

(210.5)

(Decrease)/increase in net cash

(177.8)

157.4

(143.8)

(173.7)

Effect of exchange rates on cash and cash

equivalents

(13.1)

7.0

(7.6)

(14.8)

Cash balance

392.4

583.3

392.4

583.3

Net cash inflow from operating activities was £146m (FY 2022: £127m). The year-on-year change in cash

flow from operating activities was primarily driven by a £116m increase in adjusted EBITDA, as explained

above, and mostly offset by a working capital outflow of £86m (FY 2022: £15m outflow). The largest

driver was an £82m increase in receivables (FY 2022: nil movement), driven by timing on the delivery of

DB12 and Specials, as well as higher volumes in December 2023. This was partially offset by a decrease

in inventories of £12m (FY 2022: £78m increase) due to reduced work-in-progress and finished goods,

and a £51m increase in payables (FY 2022: £82m) due to higher production in December 2023. Due to

the high volume of Specials delivered in Q4 2023, there was a £66m decrease (FY 2022: £18m decrease)

in deposits held, as balances on accounts unwound in the quarter, partially offset by ongoing Valour

deposit collections.

Capital expenditure was £397m in 2023, an increase of £111m year-on-year, with investment focused on

the future product pipeline, particularly the next generation of sports cars, as well as development of the

Company’s electrification programme including a $33m (£27m) payment to Lucid in Q4 2023 relating to

the new strategic supply agreement.

Free cash outflow of £360m in 2023 compared to a £299m outflow in 2022, is due to an increase in capital

expenditure as detailed above, partially offset by the improvement in cash flow from operating activities.

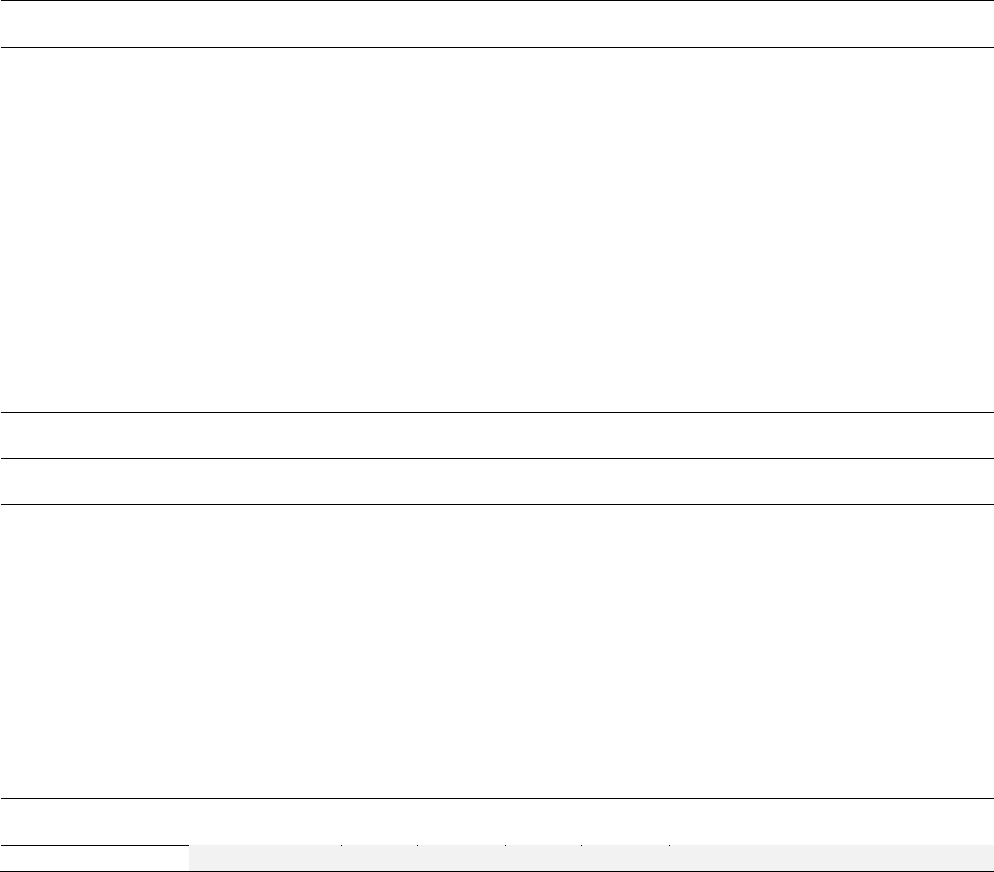

£m

31-Dec-23

31-Dec-22

Loan notes

(980.3)

(1,104.0)

Inventory financing

(39.7)

(38.2)

Bank loans and overdrafts

(89.4)

(107.1)

Lease liabilities (IFRS 16)

(97.3)

(99.8)

Gross debt

(1,206.7)

(1,349.1)

Cash balance

392.4

583.3

Cash not available for short term use

-

0.3

Net debt

(814.3)

(765.5)

Cash as at 31 December 2023 includes the remaining £106m of proceeds from August’s share placing,

following the redemption of a portion of the outstanding second lien notes in November, and £95m

proceeds from the new shares issued to Geely International (Hong Kong) Limited in May.

11

Net debt of £814m (2022: £766m), including a positive £61m impact of non-cash FX revaluation of US

dollar-denominated debt as the sterling strengthened against the US dollar during the year. Disciplined

strategic delivery and EBITDA growth supported ongoing deleveraging with net leverage ratio

improving to 2.7x (2022: 4.0x).

APPENDICES

Dealerships

31 Dec-23

31 Dec-22

UK

20

21

Americas

44

44

EMEA ex. UK

54

52

APAC

45

48

Total

163

165

Number of countries

53

54

Alternative Performance Measure

£m

FY 2023

FY 2022

Loss before tax

(239.8)

(495.0)

Adjusting operating expense

(31.5)

23.9

Adjusting finance expense

(36.5)

(12.5)

Adjusting finance (income)

-

32.6

Adjusted EBT

(171.8)

(451.0)

Adjusted finance (income)

74.3

(3.0)

Adjusted finance expense

(166.4)

336.1

Adjusted EBIT

(79.7)

(117.9)

Reported depreciation

102.2

88.8

Reported amortisation

283.4

219.3

Adjusted EBITDA

305.9

190.2

In the reporting of financial information, the Directors have adopted various Alternative Performance

Measures ("APMs"). APMs should be considered in addition to IFRS measurements. The Directors believe

that these APMs assist in providing useful information on the underlying performance of the Group,

enhance the comparability of information between reporting periods, and are used internally by the

Directors to measure the Group's performance.

– Adjusted EBIT is loss from operating activities before adjusting items

– Adjusted EBITDA removes depreciation, loss/(profit) on sale of fixed assets and amortisation

from adjusted operating loss

– Adjusted operating margin is adjusted EBIT divided by revenue

– Adjusted EBITDA margin is adjusted EBITDA (as defined above) divided by revenue

– Adjusted Earnings Per Share is loss after income tax before adjusting items, divided by the

weighted average number of ordinary shares in issue during the reporting period

– Net Debt is current and non-current borrowings in addition to inventory financing arrangements,

lease liabilities recognised following the adoption of IFRS 16, less cash and cash equivalents and

cash held not available for short-term use

– Free cashflow is represented by cash (outflow)/inflow from operating activities plus the cash

used in investing activities (excluding interest received) plus interest paid in the year less interest

received.

12

Consolidated Statement of Comprehensive Income for the year ended

31 December 2023

2023

2022

Notes

Adjusted

£m

Adjusting

items*

£m

Total

£m

Adjusted

£m

Adjusting

items*

£m

Total

£m

Revenue

3

1,632.8

–

1,632.8

1,381.5

–

1,381.5

Cost of sales

(993.6)

–

(993.6)

(930.8)

–

(930.8)

Gross profit

639.2

–

639.2

450.7

–

450.7

Selling and distribution expenses

(143.8)

–

(143.8)

(113.0)

–

(113.0)

Administrative and other operating expenses

(575.1)

(31.5)

(606.6)

(455.6)

(23.9)

(479.5)

Operating loss

4

(79.7)

(31.5)

(111.2)

(117.9)

(23.9)

(141.8)

Finance income

6

74.3

–

74.3

3.0

12.5

15.5

Finance expense

7

(166.4)

(36.5)

(202.9)

(336.1)

(32.6)

(368.7)

Loss before tax

(171.8)

(68.0)

(239.8)

(451.0)

(44.0)

(495.0)

Income tax credit/(charge)

8

13.0

–

13.0

(32.7)

–

(32.7)

Loss for the year

(158.8)

(68.0)

(226.8)

(483.7)

(44.0)

(527.7)

(Loss)/profit attributable to:

Owners of the Group

(228.1)

(528.6)

Non-controlling interests

1.3

0.9

(226.8)

(527.7)

Other comprehensive income

Items that will never be reclassified to the Income Statement

Remeasurement of Defined Benefit liability

(0.1)

6.8

Taxation on items that will never be reclassified to the

Income Statement

8

–

(1.7)

Items that are or may be reclassified to the

Income Statement

Foreign currency translation differences

(4.0)

3.8

Fair value adjustment – cash flow hedges

0.7

(6.1)

Amounts reclassified to the Income Statement –

cash flow hedges

(5.4)

2.9

Taxation on items that may be reclassified to the

Income Statement

8

1.2

0.8

Other comprehensive (loss)/income for the year, net of income

tax

(7.6)

6.5

Total comprehensive loss for the year

(234.4)

(521.2)

Total comprehensive (loss)/income for the year

attributable to:

Owners of the Group

(235.7)

(522.1)

Non-controlling interests

1.3

0.9

(234.4)

(521.2)

Earnings per ordinary share

Basic loss per share

9

(30.5p)

(124.5p)

Diluted loss per share

9

(30.5p)

(124.5p)

All operations of the Group are continuing.

* Adjusting items are defined in note 2 with further detail shown in note 5.

13

Consolidated Statement of Changes in Equity as at 31 December 2023

Group

Share

capital

£m

Share

premium

£m

Merger

reserve

£m

Capital

redemption

reserve

£m

Capital

reserve

£m

Translation

reserve

£m

Hedge

reserves

£m

Retained

earnings

(restated*)

£m

Non-

controlling

interest

£m

Total

Equity

(restated*)

£m

At 1 January 2023

(restated*)

69.9

1,697.4

143.9

9.3

6.6

6.5

4.3

(1,233.9)

19.5

723.5

Total comprehensive loss

for the year

(Loss)/profit for the year

–

–

–

–

–

–

–

(228.1)

1.3

(226.8)

Other comprehensive

income

Foreign currency translation

differences

–

–

–

–

–

(4.0)

–

–

–

(4.0)

Fair value movement – cash

flow hedges

–

–

–

–

–

–

0.7

–

–

0.7

Amounts reclassified to the

Income Statement – cash flow

hedges

–

–

–

–

–

–

(5.4)

–

–

(5.4)

Remeasurement of Defined

Benefit liability

–

–

–

–

–

–

–

(0.1)

–

(0.1)

Tax on other comprehensive

income (note 8)

–

–

–

–

–

–

1.2

–

–

1.2

Total other comprehensive

income/(loss)

–

–

–

–

–

(4.0)

(3.5)

(0.1)

–

(7.6)

Total comprehensive

income/(loss) for the year

–

–

–

–

–

(4.0)

(3.5)

(228.2)

1.3

(234.4)

Transactions with owners,

recorded directly in equity

Issuance of new shares

(note 11)

11.5

383.0

–

–

–

–

–

–

–

394.5

Issue of shares to Share

Incentive Plan (note 11)

0.1

–

–

–

–

–

–

(0.1)

–

–

Warrant options exercised

(note 11)

0.9

14.1

–

–

–

–

–

18.6

–

33.6

Credit for the year under

equity-settled share-based

payments

–

–

–

–

–

–

–

5.4

–

5.4

Tax on items credited

to equity (note 8)

–

–

–

–

–

–

–

0.5

–

0.5

Total transactions

with owners

12.5

397.1

–

–

–

–

–

24.4

–

434.0

At 31 December 2023

82.4

2,094.5

143.9

9.3

6.6

2.5

0.8

(1,437.7)

20.8

923.1

* Detail on the restatement is disclosed in note 2.

14

Group

Share

capital

£m

Share

premium

£m

Merger

reserve

£m

Capital

redemption

reserve

£m

Capital

reserve

£m

Translation

reserve

£m

Hedge

reserves

£m

Retained

earnings

(restated*)

£m

Non-

controlling

interest

£m

Total

Equity

(restated*)

£m

At 1 January 2022

(restated*)

11.6

1,123.4

143.9

9.3

6.6

2.7

6.7

(711.4)

18.6

611.4

Total comprehensive loss

for the year

(Loss)/profit for the year

–

–

–

–

–

–

–

(528.6)

0.9

(527.7)

Other comprehensive

income

Foreign currency translation

differences

–

–

–

–

–

3.8

–

–

–

3.8

Fair value movement – cash

flow hedges

–

–

–

–

–

–

(6.1)

–

–

(6.1)

Amounts reclassified to the

Income Statement – cash flow

hedges

–

–

–

–

–

–

2.9

–

–

2.9

Remeasurement of Defined

Benefit liability

–

–

–

–

–

–

–

6.8

–

6.8

Tax on other comprehensive

income (note 8)

–

–

–

–

–

–

0.8

(1.7)

–

(0.9)

Total other comprehensive

income/(loss)

–

–

–

–

–

3.8

(2.4)

5.1

–

6.5

Total comprehensive

income/(loss) for the year

–

–

–

–

–

3.8

(2.4)

(523.5)

0.9

(521.2)

Transactions with owners,

recorded directly in equity

Issuance of new shares

(note 11)

58.3

574.0

–

–

–

–

–

–

–

632.3

Credit for the year under

equity-settled share-based

payments

–

–

–

–

–

–

–

1.0

–

1.0

Tax on items credited

to equity

–

–

–

–

–

–

–

–

–

–

Total transactions

with owners

58.3

574.0

-

–

–

–

–

1.0

–

633.3

At 31 December 2022

(restated*)

69.9

1,697.4

143.9

9.3

6.6

6.5

4.3

(1,233.9)

19.5

723.5

* Detail on the restatement is disclosed in note 2.

15

Consolidated Statement of Financial Position at 31 December 2023

Notes

31 December

2023

£m

31 December

2022 (restated*)

£m

1 January

2022 (restated*)

£m

Non-current assets

Intangible assets

1,577.6

1,394.6

1,384.1

Property, plant and equipment

353.7

369.9

355.5

Investments in equity interests

18.2

–

–

Right-of-use lease assets

70.4

74.4

76.0

Trade and other receivables

5.3

6.3

2.1

Other financial assets

–

–

0.5

Deferred tax asset

156.3

133.7

156.4

2,181.5

1,978.9

1,974.6

Current assets

Inventories

272.7

286.2

196.8

Trade and other receivables

322.2

245.7

243.4

Income tax receivable

0.9

1.4

1.5

Other financial assets

3.3

8.8

7.3

Cash and cash equivalents

392.4

583.3

418.9

991.5

1,125.4

867.9

Total assets

3,173.0

3,104.3

2,842.5

Current liabilities

Borrowings

89.4

107.1

114.3

Trade and other payables

840.4

891.2

735.9

Income tax payable

2.1

6.3

5.5

Other financial liabilities

25.2

26.2

34.8

Lease liabilities

8.8

7.4

9.7

Provisions

20.2

18.6

19.9

986.1

1,056.8

920.1

Non-current liabilities

Borrowings

980.3

1,104.0

1,074.9

Trade and other payables

122.3

43.2

43.9

Lease liabilities

88.5

92.4

93.7

Provisions

23.7

22.5

19.0

Employee benefits

49.0

61.2

78.7

Deferred tax liabilities

–

0.7

0.8

1,263.8

1,324.0

1,311.0

Total liabilities

2,249.9

2,380.8

2,231.1

Net assets

923.1

723.5

611.4

Capital and reserves

Share capital

11

82.4

69.9

11.6

Share premium

11

2,094.5

1,697.4

1,123.4

Merger reserve

143.9

143.9

143.9

Capital redemption reserve

9.3

9.3

9.3

Capital reserve

6.6

6.6

6.6

Translation reserve

2.5

6.5

2.7

Hedge reserves

0.8

4.3

6.7

Retained earnings

(1,437.7)

(1,233.9)

(711.4)

Equity attributable to owners of the Group

902.3

704.0

592.8

Non-controlling interests

20.8

19.5

18.6

Total shareholders’ equity

923.1

723.5

611.4

* Detail on the restatement is disclosed in note 2.

The Financial Statements were approved by the Board of Directors on 27 February 2024 and were signed on its behalf by

AME D EO F E LISA DOU G LA FF ER TY

C H I E F E X E C U T I VE O F F I C E R C H I E F FI NA N C I A L O F F I C E R

Company Number: 11488166

16

Consolidated Statement of Cash Flows for the year ended

31 December 2023

Notes

2023

£m

2022

£m

Operating activities

Loss for the year

(226.8)

(527.7)

Adjustments to reconcile loss for the year to net cash inflow from operating activities

Tax charge/(credit) on operations

8

(13.0)

32.7

Net finance costs

128.6

353.2

Depreciation of property, plant and equipment

4

90.3

77.8

Depreciation of right-of-use lease assets

4

9.3

11.0

Amortisation of intangible assets

4

283.4

219.3

Loss on sale/scrap of property, plant and equipment

2.6

–

Difference between pension contributions paid and amounts recognised in Income Statement

(15.0)

(12.1)

Decrease/(increase) in inventories

11.9

(78.4)

(Increase)/decrease in trade and other receivables

(82.3)

0.1

Increase in trade and other payables

50.9

81.5

Decrease in advances and customer deposits

(66.0)

(17.9)

Movement in provisions

3.4

0.7

Other non-cash movements

(0.3)

1.2

Other non-cash movements – Movements in hedging position

(7.2)

(3.2)

Other non-cash movements – Increase in other derivative contracts

(11.2)

(2.3)

Other non-cash movements – Movements in deferred tax relating to RDEC credit

(7.4)

(3.5)

Cash generated from operations

151.2

132.4

Decrease in cash held not available for short-term use

0.3

1.5

Income taxes paid

8

(5.6)

(6.8)

Net cash inflow from operating activities

145.9

127.1

Cash flows from investing activities

Interest received

13.5

2.2

Repayment of loan assets

0.5

–

Payments to acquire property, plant and equipment

(91.1)

(58.6)

Cash outflow on technology and development expenditure

(306.3)

(228.3)

Net cash used in investing activities

(383.4)

(284.7)

Cash flows from financing activities

Interest paid

(122.5)

(141.2)

Proceeds from equity share issue

11

310.9

653.9

Proceeds from issue of warrants

11

15.0

–

Proceeds from financial instrument utilised during refinancing transactions

–

4.1

Principal element of lease payments

(7.9)

(10.0)

Repayment of existing borrowings

(129.7)

(172.7)

Premium paid upon redemption of borrowings

(8.0)

(14.3)

Proceeds from inventory repurchase arrangement

38.0

75.7

Repayment of inventory repurchase arrangement

(40.0)

(60.0)

Proceeds from new borrowings

11.5

–

Transaction fees paid on issuance of shares

(7.6)

(18.6)

Transaction fees paid on financing activities

–

(1.9)

Net cash inflow from financing activities

59.7

315.0

Net (decrease)/increase in cash and cash equivalents

(177.8)

157.4

Cash and cash equivalents at the beginning of the year

583.3

418.9

Effect of exchange rates on cash and cash equivalents

(13.1)

7.0

Cash and cash equivalents at the end of the year

392.4

583.3

17

1 BASIS OF ACCOUNTING

Aston Martin Lagonda Global Holdings plc (the “Company”) is a company incorporated in England and Wales and domiciled in the UK.

The Group Financial Statements consolidate those of the Company and its subsidiaries (together referred to as the “Group”).

The Group Financial Statements have been prepared and approved by the Directors in accordance with UK adopted international

accounting standards.

The Group Financial Statements have been prepared under the historical cost convention except where the measurement of balances at fair

value is required as explained below. The Financial Statements are prepared in millions to one decimal place, and in sterling, which is the

Company’s functional currency.

The financial information set out does not constitute the Company's financial statements for the years ended 31 December 2023 or 2022 but is

derived from those financial statements. Financial statements for 2022 have been delivered to the registrar of companies, and those for 2023 will

be delivered in due course. The auditors have reported on those accounts. Their reports for both years ended 31 December 2023 and 31

December 2022 were not qualified. Their reports did not contain a statement under Section 498(2) or (3) of the Companies Act 2006.

Climate change

In preparing the Consolidated Financial Statements, management have considered the impact of climate change, particularly in the context of the

disclosures included in the Strategic Report this year and the sustainability goals, including the stated net-zero targets. Climate change is not

expected to have a significant impact on the Group’s going concern assessment to June 2025 nor the viability of the Group over the next five

years following consideration of the below points.

- The Group has modelled various scenarios to take account of the risks and opportunities identified with the impact of climate change

to assess the financial impact on its business plan and viability.

- The Group has a Strategic Cooperation Agreement with Mercedes-Benz AG. The agreement provides the Company with access to a

wide range of world-class technologies for the next generation of luxury vehicles which are planned to be launched through to 2027.

- The Group is developing alternatives to the Internal Combustion Engine (‘ICE’) with a blended drivetrain approach between 2025 and

2030, including Plug-in Hybrid Electric Vehicle (‘PHEV’) and Battery Electric Vehicle (‘BEV’), with a clear plan to have a line-up of

electric sports cars and SUVs. This is supported by significant planned capital investment of around £2bn in advanced technologies

over the 5 year period from 2023 to 2027, with investment shifting from ICE to BEV technology.

- The Group has formed a landmark new supply agreement with world-leading electric vehicle technologies company, Lucid Group,

which will help drive the Group’s high-performance electrification strategy and its long-term growth. The agreement will see Lucid, a

world-leader in the design and manufacture of advanced electric powertrains and battery systems, supply industry-leading electric

vehicle technologies. Access to Lucid’s current and future powertrain and battery technology will support the creation of a bespoke,

singular BEV platform, suitable for all product types from hypercar to SUV.

- The Group is leading a six-partner collaborative research and development project, Project ELEVATION, that was awarded £9m of

government funding through the Advanced Propulsion Centre, further supplementing the research and development of its innovative

modular BEV platform.

The Group’s first hybrid supercar, Valhalla, is on course to enter production in 2024, with its first BEV targeted for launch in 2026.

Consistent with the above, management have further considered the impact of climate change on a number of key estimates within the Financial

Statements and has not found climate change to have a material impact on the conclusions reached.

Climate change considerations have been factored into the Directors’ impairment assessments of the carrying value of non-current assets (such

as capitalised development cost intangible assets) through usage of a pre-tax discount rate which reflects the individual nature and specific risks

relating to the business and the market in which the Group operates.

In addition the forecast cash flows used in both the impairment assessments of the carrying value of non-current assets and the assessment of

the recoverability of deferred tax assets reflect the current energy cost headwinds and future costs to achieve net-zero manufacturing facilities by

2030 as well as the forecast volumes for both existing and future car lines given current order books and the assessment of changing customer

preferences.

Going concern

The Group meets its day-to-day working capital requirements and medium term funding requirements through a mixture of $1,143.7m First Lien

notes at 10.5% which mature in November 2025, $121.7m of Second Lien split coupon notes at 15% per annum (8.89 % cash and 6.11%

Payment in Kind) which mature in November 2026, a Revolving Credit Facility (£99.6m) which matures August 2025, facilities to finance

inventory, a bilateral RCF facility and a wholesale vehicle financing facility. As previously announced, the Group expects to refinance the

outstanding debt during the first half of 2024, however, the going concern assessment is not dependent on this occurring. Under the RCF the

Group is required to comply with a leverage covenant tested quarterly. Leverage is calculated as the ratio of adjusted EBITDA to net debt, after

certain accounting adjustments are made. Of these adjustments, the most significant is to account for lease liabilities under “frozen GAAP”, i.e.

under IAS17 rather than IFRS 16. The Group has complied with its covenant requirements for the year ended 31 December 2023 and expects to

do so for the Going Concern period.

The Directors have developed trading and cash flow forecasts for the period from the date of approval of these Financial Statements through

30 June 2025 (the going concern review period). These forecasts show that the Group has sufficient financial resources to meet its obligations

18

as they fall due, including repayment of the current RCF were it needing to be repaid on 30 June 2025 and to comply with covenants for the

going concern review period. The forecasts reflect the Group’s ultra-luxury performance-oriented strategy, balancing supply and demand and the

actions taken to improve cost efficiency and gross margin. The forecasts include the costs of the Group's environmental, social and governance

(“ESG”) commitments and make assumptions in respect of future market conditions and, in particular, wholesale volumes, average selling price,

the launch of new models, and future operating costs. The nature of the Group's business is such that there can be variation in the timing of cash

flows around the development and launch of new models. In addition, the availability of funds provided through the vehicle wholesale finance

facility changes as the availability of credit insurance and sales volumes vary, in total and seasonally. The forecasts take into account these

factors to the extent that the Directors consider them to represent their best estimate of the future based on the information that is available to

them at the time of approval of these Financial Statements.

The Directors have considered a severe but plausible downside scenario that includes considering the impact of a 15% reduction in DBX

volumes and a 10% reduction in sports volumes from forecast levels covering although not exclusively, instances of reduced volume due

to delayed product launches, operating costs higher than the base plan, incremental working capital requirements such as a reduced deposit

inflows or increased deposit outflows and the impact of the strengthening of the sterling dollar exchange rate.

The Group plans to make continued investment for growth in the period and, accordingly, funds generated through operations are expected

to be reinvested in the business mainly through new model development and other capital expenditure. To a certain extent, such expenditure

is discretionary and, in the event of risks occurring which could have a particularly severe effect on the Group, as identified in the severe but

plausible downside scenario, actions such as constraining capital spending, working capital improvements, reduction in marketing expenditure

and the continuation of strict and immediate expense control would be taken to safeguard the Group’s financial position.

In addition, we also considered the circumstances which would be needed to exhaust the Group’s liquidity over the assessment period, a reverse

stress test. This would indicate that vehicle sales would need to reduce by more than 15% from forecast levels without any of the above

mitigations to result in having no liquidity. The likelihood of these circumstances occurring is considered remote both in terms of the magnitude

of the reduction and that over such a long period, management could take substantial mitigating actions, such as reducing capital spending to

preserve liquidity.

Accordingly, after considering the forecasts, appropriate sensitivities, current trading and available facilities, the Directors have a reasonable

expectation that the Group has adequate resources to continue in operational existence for the foreseeable future and to comply with its financial

covenants, therefore, the Directors continue to adopt the going concern basis in preparing the Financial Statements.

2 ACCOUNTING POLICIES

Adjusting items

An adjusting item is disclosed separately in the Consolidated Statement of Comprehensive Income where the quantum, nature or volatility of

such items would otherwise distort the underlying trading performance of the Group, including where they are not expected to repeat in future

periods. The tax effect is also included.

Details in respect of adjusting items recognised in the current and prior year are set out in note 5.

Prior year restatement

The Consolidated Statement of Financial Position as at 1 January 2022 and 31 December 2022 has been restated to reflect a prior period

adjustment in respect of the deferral of tax relief income received under the Research and Development Expenditure Credit (‘RDEC’) regime.

The Group previously recognised the income within Administrative and other operating expenses in the Consolidated Income Statement, in the

period in which the qualifying expenditure giving rise to the RDEC claim was incurred. The Group has reassessed the treatment under IAS 20 in

respect of income from RDEC claims where the qualifying expenditure has been capitalised. For these capitalised expenses, the RDEC income

earned has been deferred to the Consolidated Statement of Financial Position and will be released to the Consolidated Income Statement over

the same period as the amortisation of the costs capitalised to which the RDEC income relates. Where the qualifying expenditure is not

capitalised, the RDEC income will continue to be recognised in the Consolidated Income Statement in the year the expenditure is incurred,

as has previously been the approach.

The impact of this adjustment is that as at 1 January 2022 and 31 December 2022, £49.0m of deferred income has been recognised on the

balance sheet split between current £14.9m and non-current £34.1m Trade and Other Payables with a corresponding adjustment to retained

earnings. There is no adjustment to the Consolidated Income Statement for the year ended 31 December 2022 as the impact of the adjustment

is not material to that individual year. There is no change to the Consolidated Statement of Cash Flows as, whilst the accounting impact of the

claim is deferred, there is no change to the timing of the cash receipt. No change in the corporation tax position is recognised for the year ended

31 December 2022 in either the Consolidated Income Statement or Consolidated Statement of Financial Position, as the recoverability

assessment of the Group’s deferred tax position has not been materially changed by this restatement. As there is no adjustment to the

Consolidated Income Statement and no change in the corporation tax position, there is no impact on earnings per share.

19

Where the notes included in these Consolidated Financial Statements provide additional analysis in respect of amounts impacted by the above

restatement, the comparative values presented have been re-analysed on a consistent basis. The following tables detail the impact on the

Consolidated Statement of Financial Position as at 31 December 2022 and 2021, respectively.

Liabilities

As previously reported

31 December 2022

£m

Adjustment

£m

Restated balance

31 December

2022

£m

Non-current liabilities

Trade and other payables

9.1

34.1

43.2

Current liabilities

Trade and other payables

876.3

14.9

891.2

Capital and reserves

Retained Earnings

(1,184.9)

(49.0)

(1,233.9)

Liabilities

As previously reported

1 January 2022

£m

Adjustment

£m

Restated balance

1 January 2022

£m

Non-current liabilities

Trade and other payables

9.8

34.1

43.9

Current liabilities

Trade and other payables

721.0

14.9

735.9

Capital and reserves

Retained Earnings

(662.4)

(49.0)

(711.4)

3 SEGMENTAL REPORTING

Operating segments are defined as components of the Group about which separate financial information is available and is evaluated regularly

by the chief operating decision-maker in assessing performance. The Group has only one operating segment, the automotive segment, and

therefore no separate segmental report is disclosed. The automotive segment includes all activities relating to design, development, manufacture

and marketing of vehicles, including consulting services; as well as the sale of parts, servicing and automotive brand activities from which the

Group derives its revenues.

Revenue

2023

£m

2022

£m

Analysis by category

Sale of vehicles

1,531.9

1,291.5

Sale of parts

80.0

70.8

Servicing of vehicles

9.8

9.3

Brands and motorsport

11.1

9.9

1,632.8

1,381.5

Revenue

2023

£m

2022

£m

Analysis by geographical location

United Kingdom

309.9

366.0

The Americas

452.8

401.8

Rest of Europe, Middle East and Africa

547.0

260.2

Asia Pacific

323.1

353.5

1,632.8

1,381.5

20

4 OPERATING LOSS

The Group’s operating loss is stated after charging/(crediting):

2023

£m

2022

£m

Depreciation and impairment of property, plant and equipment

91.2

80.7

Depreciation absorbed into inventory under standard costing

(0.9)

(2.9)

Loss on sale/scrap of property, plant and equipment

2.6

–

Depreciation and impairment of right-of-use lease assets

9.3

11.0

Amortisation and impairment of intangible assets

280.4

227.4

Amortisation released from/(absorbed into) inventory under standard costing

3.0

(8.1)

Depreciation, amortisation and impairment charges included in administrative and other operating expenses

385.6

308.1

(Decrease)/increase in trade receivable loss allowance – administrative and other operating expenses

(1.3)

0.6

Research and development expenditure tax credit

(23.8)

(18.4)

Net foreign currency differences

0.3

8.7

Cost of inventories recognised as an expense

844.0

798.0

Write-down of inventories to net realisable value

24.2

8.9

Increase in fair value of other derivative contracts

(11.2)

(2.3)

Lease payments (gross of sub-lease receipts)

Plant, machinery and IT equipment*

0.3

0.7

Sub-lease receipts

Land and buildings

(0.4)

(0.6)

Auditor’s remuneration:

Audit of these Financial Statements

0.3

0.3

Audit of Financial Statements of subsidiaries pursuant to legislation

0.5

0.4

Audit-related assurance

0.1

0.1

Services related to corporate finance transactions

–

0.2

Research and development expenditure recognised as an expense

30.7

14.1

* Election taken by the Group to not recognise right-of-use lease assets and equivalent lease liabilities for short-term and low-value leases.

2023

£m

2022

£m

Total research and development expenditure

299.2

246.1

Capitalised research and development expenditure

(268.5)

(232.0)

Research and development expenditure recognised as an expense

30.7

14.1

21

5 ADJUSTING ITEMS

2023

£m

2022

£m

Adjusting operating expenses:

ERP implementation costs

1

(14.5)

(6.9)

Defined Benefit pension scheme closure costs

2

(1.0)

(13.5)

Director settlement and incentive arrangements

7

–

(3.5)

Legal settlement and costs

3

(16.0)

–

(31.5)

(23.9)

Adjusting finance income:

Foreign exchange gain on financial instrument utilised during refinance transactions

4

–

4.1

Gain on financial instruments recognised at fair value through Income Statement

5

–

8.4

Adjusting finance expenses:

Premium paid on the early redemption of Senior Secured Notes

4

(8.0)

(14.3)

Write-off of capitalised borrowing fees and discount upon early settlement of Senior Secured Notes

4

(9.5)

(16.4)

Professional fees incurred on refinancing expensed directly to the Income Statement

4

–

(1.9)

Loss on financial instruments recognised at fair value through Income Statement

5

(19.0)

–

(36.5)

(20.1)

Total adjusting items before tax

(68.0)

(44.0)

Tax charge on adjusting items

6

–

–

Adjusting items after tax

(68.0)

(44.0)

Summary of 2023 adjusting items

1. In the year ended 31 December 2023, the Group incurred further implementation costs for a cloud-based Enterprise Resource Planning (ERP) system for which the Group will not

own any intellectual property. £14.5m (2022: £6.9m) of costs have been incurred in the period under the service contract and expensed to the Consolidated Income Statement

during the business readiness phase of the project. The project continued to undergo a phased rollout during 2023, which included HR, ordering and dealer management, and

limited aspects of purchasing, following the previous migration of finance in 2022. Due to the infrequent recurrence of such costs and the expected quantum during the

implementation phase, these have been separately presented as adjusting. The cash impact of this item is a working capital outflow at the time of invoice payment.

2. On 31 January 2022, the Group closed its Defined Benefit Pension Scheme to future accrual incurring a past service cost of £2.8m. Under the terms of the closure agreement,

employees were granted cash payments both in the current year and the following two financial years totalling £8.7m. These costs have been fully accrued. In addition, the

affected employees were each granted 185 shares incurring a share-based payment charge of £1.0m during 2022. The terms of the agreement provide the employees with a

minimum guaranteed value for these shares subject to their ongoing employment with the Group. The Group will pay the employees a further cash sum as the share price at 1

February 2024 did not meet this value. The charge associated with this portion was £1.0m in the year ended 31 December 2022 and is being accounted for in accordance with

IFRS2 as a cash settled share-based payment scheme. A cost of £1.0m in the year ended 31 December 2023 relates to the ongoing minimum guaranteed value which will

crystallise in early 2024.

3. During the year ended 31 December 2023, the Group was involved in two High Court cases against entities ultimately owned by a former significant shareholder of the Group.

The first involved AMMENA, Aston Martin’s distributor in the Middle East, North Africa and Turkey region. AMMENA brought a number of claims against the Group, including

claims for debts arising between 2019-2021 when Aston Martin was acting as AMMENA’s agent and several claims that the Group had acted in bad faith when AMMENA

resumed its obligations as distributor. The Group successfully defended all the bad faith claims and AMMENA’s 2021 debt claim was dismissed. Aston Martin, however, was

unsuccessful in its claim to set off its own counter-claim that AMMENA (as the region’s distributor) should indemnify the Group in relation to costs incurred in the termination of a

retail dealer, so is required to pay AMMENA’s debt claims for 2019 and 2020 (totalling £5.3m plus interest of £0.6m). The Group incurred costs of £5.7m in defending AMMENA’s

claims and must pay opposition costs of £1.7m. The cash impact of these costs is a cash outflow in February 2024 as well as working capital movements during the year ended

31 December 2023 for costs already incurred. The second case involves claims against a retail dealership, which is ultimately owned by entities that are shareholders in one of

the Group’s subsidiary entities, including for unpaid debts relating to two agreements from 2015 and 2016. The final judgement has been handed down (and is in AML’s favour on