1

1 March 2023

Aston Martin Lagonda Global Holdings plc

Preliminary results for the 12 months to 31 December 2022

- FY 2022 results in-line with prior outlook, with strong Q4 performance

- FY 2022 revenue growth of 26%, driven by record total ASP of more than £200k

- Strong demand across the portfolio; c.80% of current range GT/Sports sold out for 2023 ahead of

upcoming launches; DBX order book into Q3 2023

- Strong underlying year-on-year core gross margin progression, aligned with ultra-luxury strategy

- Cash balance of £583m; net debt of £766m, despite £156m negative FX impact

- 2023 Outlook: Wholesale volume growth to c.7,000, and up to c.20% adjusted EBITDA margin

- On track to achieve 2024/25 financial targets

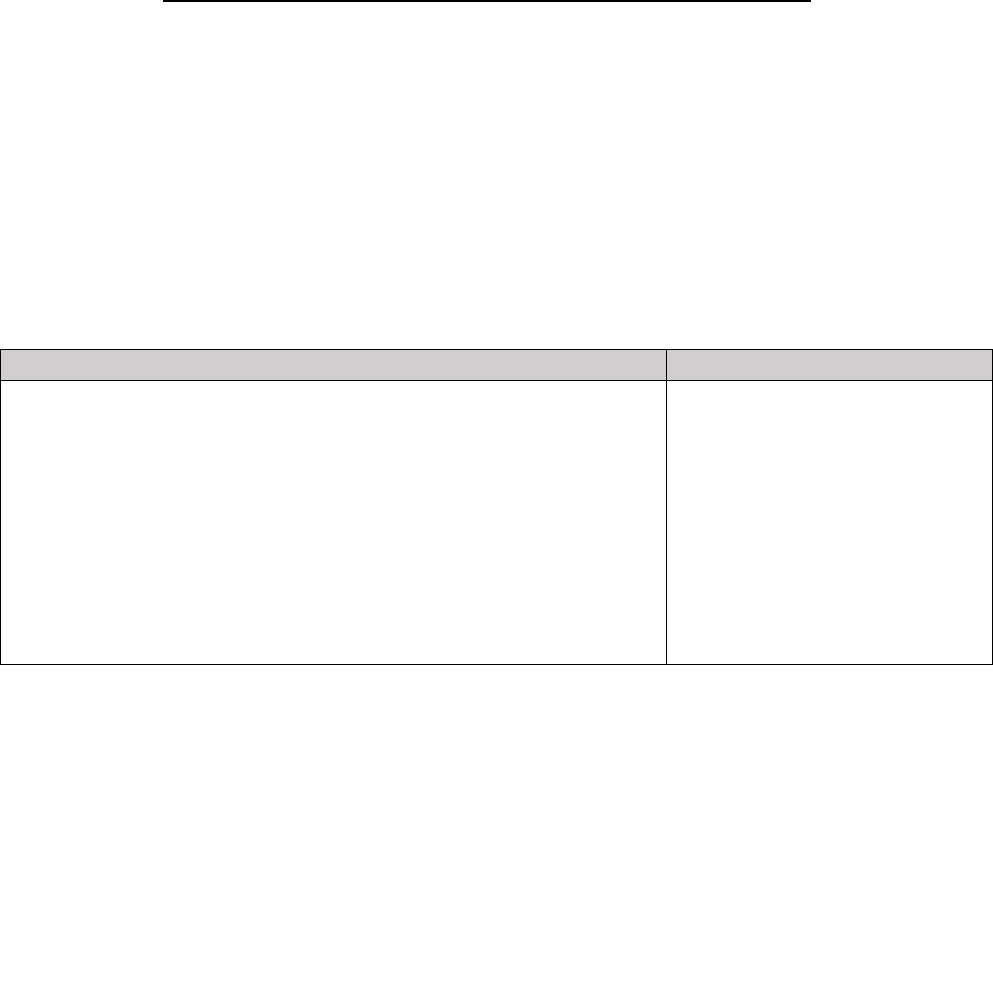

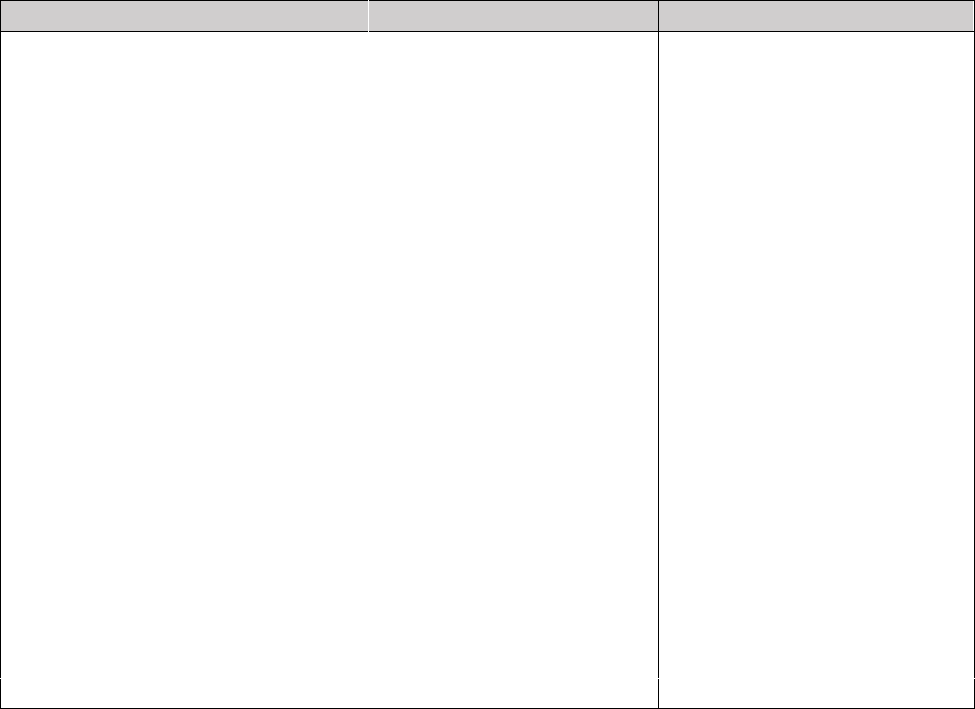

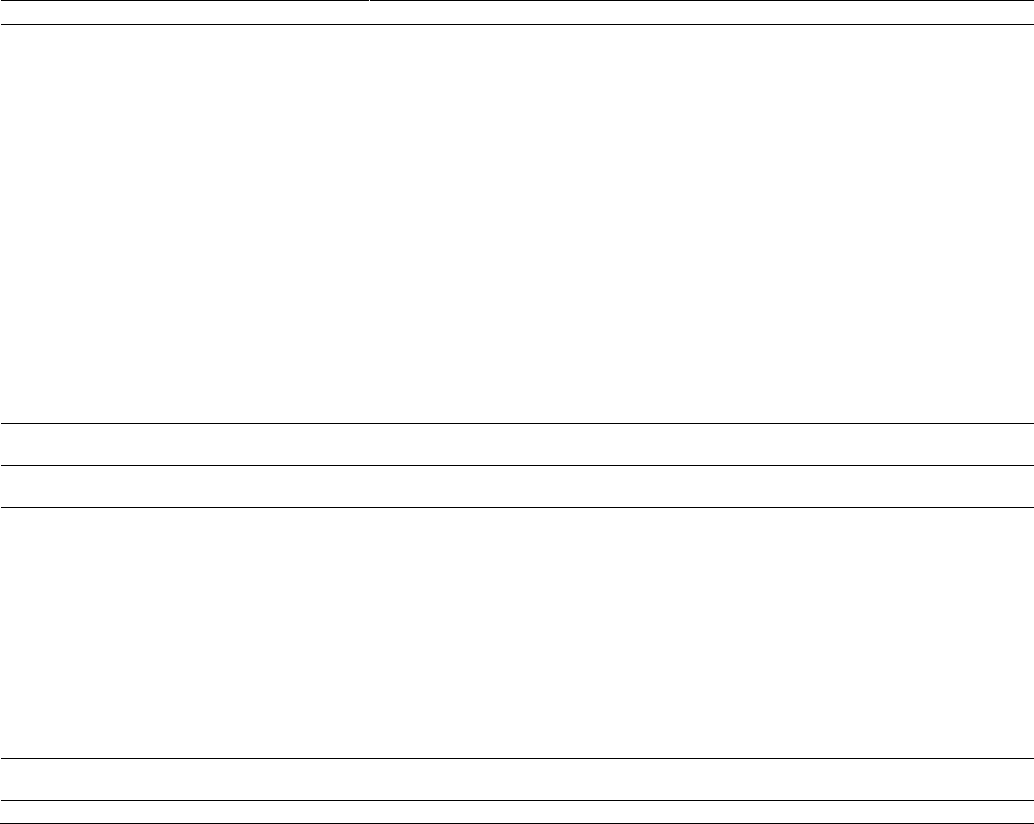

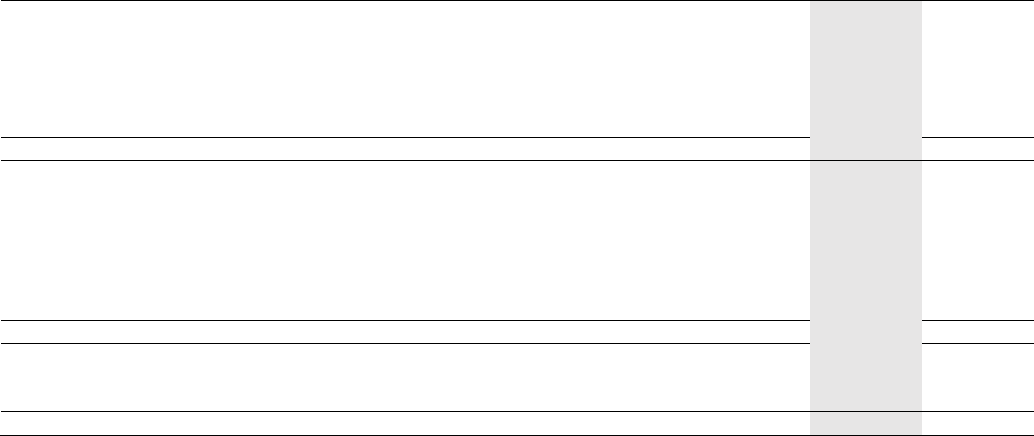

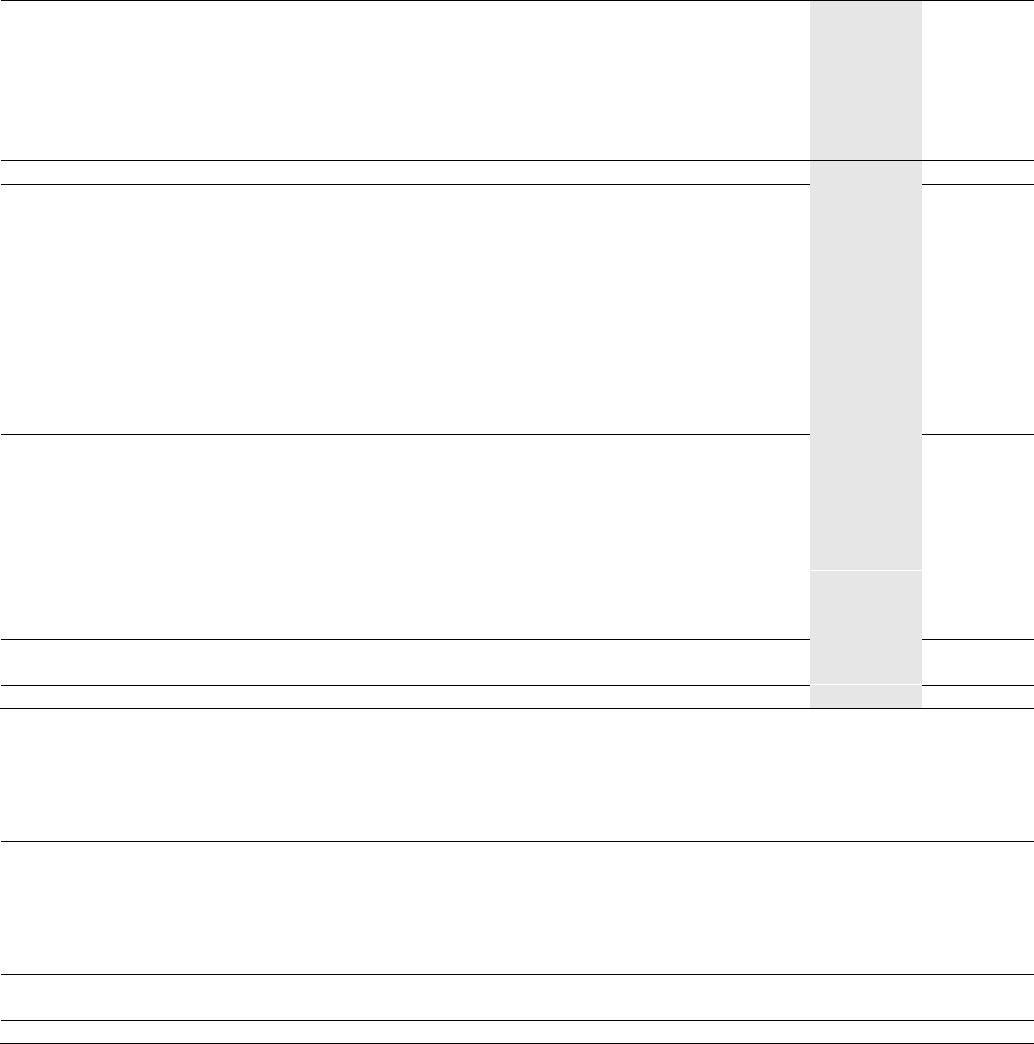

£m

31-Dec-22

31-Dec-21

% change

Q4-22

Q4-21

% change

Total wholesales

1

6,412

6,178

4%

2,352

1,928

22%

Revenue

1,381.5

1,095.3

26%

524.3

358.9

46%

Gross Profit

450.7

343.7

31%

164.5

121.8

35%

Adjusted EBITDA

2

190.2

137.9

38%

110.4

65.6

68%

Adjusted operating (loss)/profit

2

(117.9)

(74.3)

(59%)

10.3

(9.2)

n.m.

Operating (loss)/ profit

(141.8)

(76.5)

(85%)

6.6

(8.3)

n.m.

(Loss)/ Profit before tax

(495.0)

(213.8)

(132%)

16.3

(25.2)

n.m.

Net debt

2

(765.5)

(891.6)

14%

(765.5)

(891.6)

14%

1. Number of vehicles including Specials; 2. For definition of alternative performance measures please see Appendix

Financial Highlights

• Continued strong demand across all product lines with c.80% of current range of GT/Sports cars sold

out for 2023 ahead of upcoming launches and DBX order book into Q3 2023

• Despite the impact of supply chain and logistics disruptions, most notably in Q2 and Q3, wholesale

volumes in 2022 grew in line with revised range:

- Wholesale volumes increased by 4% year-on-year to 6,412 (2021: 6,178)

▪ Volumes included more than 3,200 DBXs, driven by launch of the DBX707 which

represented more than 50% of overall DBX volumes

- Q4 wholesale volumes of 2,352 increased by 22% year-on-year (Q4 2021: 1,928)

• Revenue increased by 26% year-on-year to £1.4bn and Q4 revenue increased by 46% year-on-year to

£524m driven by:

- Strong pricing dynamics and favourable mix in the core portfolio:

▪ FY 2022 core ASP of £177k, up 18% from £150k in FY 2021

▪ Q4 2022 core ASP of £184k, up 21% from £152k in Q4 2021

- 80 Aston Martin Valkyrie programme deliveries during 2022, including 36 in Q4

- Foreign exchange tailwinds for ASPs due to GBP weakness versus major currencies

• Gross profit increased by 31% year-on-year to £451m (2021: £344m) and gross margin increased to

33% (2021: 31%), reflecting improved pricing and gross margin for core models, partially offset by the

impact of lower year-on-year gross margin within Specials. In addition, year-on-year gross margin

performance was impacted by approximately £20 million of supply chain recovery costs incurred in the

second half of the year

• Adjusted EBITDA increased by 38% year-on-year to £190m, primarily driven by higher revenue and

gross profit, partially offset by higher operating expenses including reinvestments into brand,

marketing and new product launch activities, as well as inflationary impacts on general costs

• Operating loss of £142m included a £96m year-on-year increase in depreciation and amortisation,

primarily driven by higher year-on-year Aston Martin Valkyrie programme deliveries and, to a lesser

extent, by accelerated amortisation of capitalised development costs ahead of the next generation of

sports car launches

• Loss before tax of £495m was materially impacted by a £156m negative non-cash FX revaluation of US

dollar-denominated debt as the GBP weakened significantly against the US dollar during the year

• Net cash inflow from operating activities of £127m. Free cash outflow

1

of £299m included:

- Capital expenditure of £287m, primarily related to new model development including the next

generation of sports cars

- Net cash interest payments of £139m

• Positive free cash flow in Q4 of £37m, driven by strong profitability and cash inflows from working

capital following the impact of supply chain and logistics disruptions, earlier in the year

• Successfully completed $200m debt tender in October 2022

• Year-end cash of £583m (2021: £419m); Net debt of £766m (2021: £892m), including a negative

£156m impact of non-cash FX revaluation of US dollar-denominated debt as the GBP weakened

significantly against the US dollar during the year

FY 2022 Operational Highlights

• Product development and launches continue at pace, with breath-taking new products focused on

ultra-luxury, high performance and driving intensity:

- The critically-acclaimed DBX707, the most powerful luxury SUV on the market, unveiled in

February 2022. DBX707 represented more than 50% of total DBX deliveries in 2022

- The V12 Vantage Coupe, an iconic finale and the only time a turbocharged V12 engine has ever

been fitted in a Vantage. All 333 units were sold before the car’s reveal in March, and deliveries

started in Q2 2022

- The V12 Vantage Roadster, fusing ultimate performance with open-air thrills. All 249 units

sold-out following unveil at Pebble Beach, and deliveries started in Q4 2022

- The stunning, two-seater, coach-built DBR22, an ultra-exclusive concept limited to 22 units.

Crowned Best of Show at the influential Chantilly Arts et Élégance Richard Mille, all examples

are sold, with deliveries expected to start in 2023

- Development upgrades to hybrid supercar Valhalla showcased to customer acclaim at Pebble

Beach; more than 50% of the 999 vehicles already sold

1

For definition of alternative performance measures please see Appendix

New brand positioning and go-to-market strategy realising our iconic brand’s potential by elevating profile,

increasing desire, driving awareness, and raising customer demand

- Impactful new creative identity and Intensity. Driven. brand positioning, supporting a >10%

increase in sales leads, 10% increase in web and configurator sessions, as well as heightened

brand desirability

- More than 60% of customers placing orders in 2022 were new to the Aston Martin brand

- Bold campaigns & optimised content strategy, including the introduction to new platforms

such as TikTok, delivering a >70% increase in social media views and improved engagement

- New model launches, enhanced data management and customer targeting tools driving a

c.60% increase in dealership test drives

- Increasing brand salience and optimised digital user experience supporting >60% increase in

sales leads generated by award-winning online configurator

- Aston Martin Aramco Cognizant Formula One

TM

Team continues to connect the brand with

engaged audience and raising consideration in key markets, with Aston Martin’s Formula One®

global fanbase surpassing 150 million in 2022. Research shows that >95% of US customers feel

Aston Martin’s presence in F1 made them more likely to consider the brand

- More than 70% of Vantage F1 Edition owners are new to the Aston Martin brand, further

demonstrating the positive impact that Aston Martin’s global presence in the sport is having on

its brand image and appeal to new customers

• New leadership appointments and operational improvements to support future growth:

- New executive appointments and internal promotions, including senior leaders in engineering,

commercial, procurement, human resources and operational teams

- Changes to the organisational structure, including new operational improvements, tailored to

enhance future product launches and support long-term growth with a focus on enhancing

quality and driving overall efficiencies

- Cross-functional structure established for the engineering organisation, to enhance

development of the next generation of high-performance and electrified vehicles covering

areas such as e-Powertrain, Software & Electronics Technology, Infotainment, as well as

Product & Component Development

- Re-shaped and enhanced supply chain strategy, focused on building long-term partnerships,

to improve resilience and performance

• Deepening the integration of sustainability into our business and improving our sustainability

performance through our Racing. Green. strategy

- Working towards net-zero manufacturing facilities and a 30% reduction in supply chain

emissions by 2030 compared with 2020 levels

- In 2022 new targets were set to drive year-on-year improvements in our sustainability

performance including reducing CO

2

emissions and energy intensity per car each year by 2.5%.

In 2022 we reduced Scope 1 CO

2

emissions by 3.9% per car compared to 2021

- In our manufacturing facilities in Gaydon and St Athan we continued our commitments to only

use renewable electricity. By 2025 we aim to achieve zero single-use plastic packaging from

our manufacturing facilities and to reduce our water consumption by 15% compared with 2019

levels

- In 2022 we also enhanced our gender diversity goals with a target of 25% women in leadership

positions by 2025, rising to 30% by 2030

- In January 2023 we announced that we are increasing employment at our Gaydon

headquarters with the creation of more than 100 new skilled jobs in our manufacturing factory

to support the launch of our next generation of sports cars

Lawrence Stroll, Aston Martin Lagonda Executive Chairman commented:

“2022 saw Aston Martin continue to build on the strong foundations that have been established during my three

years as Executive Chairman. While the last 12 months presented industry-wide challenges, we look to the

future with renewed confidence in our ability to deliver on our vision, and the targets we have set.

“Despite the operating environment, we ended the year with significantly improved growth, margin

enhancement and positive free cash flow in Q4, exiting 2022 with the strongest order book in many years.

“2022 marked the start of a thrilling new product line-up, starting with the critically acclaimed DBX707 – the

most powerful luxury SUV in the world - combining ultra-luxury with high performance and, crucially, with

increased profitability. The DBX707 was followed by V12 Vantage, the ultra-luxury DBR22 and, in early January

of this year, the DBS 770 Ultimate - all fully sold out.

“The year saw us continue to strengthen our teams, led by Amedeo, with a focus on innovation, execution and

efficiency to support our longer-term growth. Furthermore, we completed a significant £654 million equity

capital raise, which also saw the Public Investment Fund become a new anchor shareholder. This enabled us to

take action to deleverage our balance sheet and our target remains to become sustainably free cash flow

positive from 2024.

“We have made the biggest investment in our iconic brand through the launch of a bold new creative strategy

and brand position that aligns Aston Martin to our future ambitions. Our high-performance DNA has been

further amplified by our partnership with the Aston Martin Aramco Cognizant Formula One

TM

team, driving

growing demand from a new generation of customers, with more than 60% new to the brand.

“As I have said before, I knew it would take multiple years to build Aston Martin into the world’s most desirable

ultra-luxury British performance brand. With the heavy lifting behind us, we are now poised to see the results

of this transformation, starting in 2023. In addition to celebrating our 110

th

anniversary and our exciting line up

of Specials, it will also see the start of our next generation of front-engine sports cars which will truly reposition

Aston Martin for the future.

“Over the last three years, I have consistently referenced our target to deliver around £2bn of revenue and

£500m of adjusted EBITDA by 2024/25. I am extremely proud that given the strong progress we have made to

transform Aston Martin into a truly ultra-luxury business, demonstrated by the trajectory of our ASP and gross

margin, we are on track to meet these financial targets, but with significantly lower volumes than I originally

envisaged. In addition, I remain highly confident that we will achieve our target to deliver 10,000 wholesales

over the coming years, and with it, significantly enhanced financial performance.”

Amedeo Felisa, Aston Martin Lagonda Chief Executive Officer commented:

“Having navigated a challenging operating environment throughout 2022, I am pleased with how we ended the

year. We delivered in line with expectations, took actions to address the short-term impacts of supply chain

issues, and continued to make progress in a number of key areas that will support our ability to meet strong

customer demand and deliver our growth ambitions.

“A top priority has been to improve our execution capabilities, leveraging my experience and the exceptional

talent we have to implement changes throughout the organisation. This has included measures to address

short-term issues, such as the supply chain disruption on DBX707 deliveries, as well as more structural changes

to support future product launches, focused on innovation, quality and overall efficiencies.

“We enter our 110

th

anniversary year ready to write a new chapter in our proud history. Building on the strong

product momentum we created in 2022, this year will see us begin the transformation to our game-changing,

next generation of front-engine sports cars. This transition is also expected to deliver significant improvements

in profitability in the second half of the year, with all new models continuing to target a 40%+ gross margin.

“I also want to thank our people for what we have achieved. They continue to demonstrate an unwavering

commitment and passion for our iconic company. At the start of 2023, we introduced a new set of company

values, grounded by the powerful principle that ‘No one builds an Aston Martin on their own’. Combined with

our iconic brand, the market opportunity, and our focus on consistently executing our ultra-luxury strategy, I

have great confidence in Aston Martin delivering on our shared ambitions.”

Outlook

We remain on our way to achieving our target of c.10,000 wholesales, aligned with our ultra-luxury strategy. In

addition, we are well on track to deliver our medium-term financial targets of c.£2bn revenue and c.£500m

adjusted EBITDA in 2024/25.

For 2023 we expect to deliver significant growth in profitability compared to 2022, primarily driven by an

increase in volumes and higher gross margin in both Core and Special vehicles. More specifically, we expect

significant year-on-year growth and positive free cash flow in the second half of the year.

For the first half of 2023, we expect our adjusted EBITDA and free cash flow performance to be similar to the

first half of 2022. This is driven by expectations of strong year-on-year growth in DBX volumes, commencing

the transition of sports cars sales ahead of new launches later in the year, as well as investments to support our

future growth.

Within the first half of 2023, we expect broadly similar free cash flow outcomes between Q1 2023 and Q2 2023

driven by the expected phasing of deliveries, capital expenditure and working capital dynamics in Q1 2023, and

the timing of cash interest payments related to our Senior Secured Notes in Q2 2023.

The second half of 2023 is expected to see delivery of a number of new products across the Core and Specials

ranges, all with improved profitability. In addition to the ramp up of the already sold-out DBS 770 Ultimate, we

expect deliveries of the first of our next generation of sports cars to commence in Q3.

Within Specials, we plan to commence deliveries of the sold-out Aston Martin Valkyrie Spider and the ultra-

luxury DBR22 in the second half of the year. Finally, and in conjunction with our historic 110

th

anniversary, we

plan to launch a new, strictly limited, exclusive Aston Martin model, with deliveries commencing in Q4.

We expect to increase investment in brand and new product launch activities during the year. This will also allow

us to continue to elevate our ultra-luxury performance brand positioning and to support the acceleration of our

longer-term growth.

Although the operating environment remains volatile, including ongoing inflationary pressures and pockets of

supply chain disruptions, our teams continue to work in partnership with our suppliers to mitigate any impact

on our performance in 2023.

Capital expenditure is expected to increase year-on-year, primarily driven by:

- a rephasing of deferred spend from 2022,

- the impact of significantly higher year-on-year inflation,

- incremental investments related to the new, strictly limited, exclusive Aston Martin model referenced

above, which will accelerate our growth in Q4 and into 2024

- increasing investments in our electrified portfolio, alongside the final year of significant expenditure

associated with our Internal Combustion Engine (ICE) portfolio

We expect 2023 to be the peak year of capital expenditure, with capital expenditure readjusting from next year

to support both the development and the delivery of our future product range, as well as our target of

becoming sustainably free cash flow positive from 2024.

2023 guidance:

• Wholesales: year-on-year growth to c.7,000 units

• Adjusted EBITDA margin: year-on-year expansion, up to c.20% adjusted EBITDA margin

• Capex and R&D: c.£370m

• Depreciation and amortisation: c.£350m-£370m

• Interest costs: c.£120m (cash) assuming current exchange rates prevail for 2023

Enquiries

Investors and Analysts

Sherief Bakr

Director of Investor Relations

+44 (0)7789 177547

Holly Grainger

Deputy Head of Investor Relations

+44 (0)7442 989551

Media

Kevin Watters

Director of Communications

+44 (0)7764 386683

Paul Garbett

Head of Corporate and Brand

Communications

+44 (0)7501 380799

Grace Barnie

Corporate Communications Manager

+44 (0)7880 903490

Tulchan Communications

Harry Cameron and Simon Pilkington

+44 (0)20 73534200

• Recorded presentations accompanying this release from Lawrence Stroll, Amedeo Felisa and Doug Lafferty

are available on the corporate website from 07.00am GMT today; there will be a live Q&A for investors and

analysts at 08:30am GMT

• Presentations and the Q&A can be accessed here: www.astonmartinlagonda.com/investors/calendar

• A replay facility will be available on the website later in the day

No representations or warranties, express or implied, are made as to, and no reliance should be placed on, the accuracy,

fairness or completeness of the information presented or contained in this release. This release contains certain forward-

looking statements, which are based on current assumptions and estimates by the management of Aston Martin Lagonda

Global Holdings plc (“Aston Martin Lagonda”). Past performance cannot be relied upon as a guide to future performance

and should not be taken as a representation that trends or activities underlying past performance will continue in the future.

Such statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from any

expected future results in forward-looking statements. These risks may include, for example, changes in the global economic

situation, and changes affecting individual markets and exchange rates.

Aston Martin Lagonda provides no guarantee that future development and future results achieved will correspond to the

forward-looking statements included here and accepts no liability if they should fail to do so. Aston Martin Lagonda

undertakes no obligation to update these forward-looking statements and will not publicly release any revisions that may

be made to these forward-looking statements, which may result from events or circumstances arising after the date of this

release.

This release is for informational purposes only and does not constitute or form part of any invitation or inducement to

engage in investment activity, nor does it constitute an offer or invitation to buy any securities, in any jurisdiction including

the United States, or a recommendation in respect of buying, holding or selling any securities.

BUSINESS REVIEW

2022 saw Aston Martin continue to execute in a number of key areas on its journey to become the world’s most

desirable ultra-luxury British performance brand. This included the introduction of a new line of breath-taking

products with strong consumer desirability and enhanced profitability, establishing a bold new creative identity

for the Company’s iconic brand, significantly enhancing its in-house engineering and operational expertise, as

well as completing a strategic equity capital raise.

In addition, the Company continued to strengthen its leadership team with new executive appointments across

the organisation and, in conjunction with the 110

th

anniversary of Aston Martin in 2023, introduced new

Company values grounded on the principle that ‘No one builds an Aston Martin on their own’.

Despite a challenging operating environment throughout the year, including supply chain and logistics

disruptions which limited the Company’s ability to meet strong customer demand, as well as inflationary

pressures, it ended 2022 well positioned to deliver on its medium-term financial targets.

Delivering thrilling new products

Building on the strong momentum from its new introductions in 2021, the Company accelerated the

transformation of its portfolio during 2022, combining ultra-luxury with high performance and improved

profitability.

In Q1 the DBX707, the most powerful luxury SUV on the market, was unveiled. Building on the success of the

DBX, Aston Martin’s first SUV, the DBX707 elevated the Company’s positioning and attractiveness to the

pinnacle of the SUV segment. Deliveries of the DBX707 commenced in Q2 to extensive media acclaim and

strong customer demand, and the DBX707 represented more than 50% of overall DBX volumes in 2022.

This was quickly followed with the introduction of the new V12 Vantage Coupe in March, the final edition of an

iconic bloodline, which enjoyed unprecedented demand with all 333 units sold ahead of its release.

At the Pebble Beach Concours d’Elegance, the Company introduced two new models – the V12 Vantage

Roadster and the ultra-exclusive DBR22 – and shared the latest development updates to its hybrid supercar,

Valhalla. All 249 units of the V12 Vantage Roadster, which combines the thrilling performance of the most

powerful Aston Martin Vantage ever made with the freedom and sensory stimulation of roof-down driving,

were sold out ahead of its unveiling. The DBR22, a spectacular V12-engined two-seater coach-built design

concept, was declared Best of Show at the influential Chantilly Arts et Élégance Richard Mille. Priced at £1.75m

and with the orderbook closed, deliveries are expected to start in 2023.

2023, Aston Martin’s 110

th

anniversary, promises to be a monumental year, as the Company prepares to unleash

the start of its highly anticipated next generation sports cars, which will further enhance Aston Martin’s focus

on ultra-luxury, high-performance and driving intensity. Ahead of this, and with production of the current

generation DBS nearing its end, the Company introduced its most powerful production Aston Martin ever. The

limited-edition DBS 770 Ultimate launched in January 2023 in both Coupe and Volante form. All 499 examples

are sold out, with deliveries scheduled to begin in Q3 2023.

Brand repositioning and new iconic wings logo

In July 2022, the Company launched a bold new creative brand strategy and global marketing campaign to

further accelerate its growth amongst new audiences.

Celebrating the Company’s position as makers of the most exquisitely addictive performance cars and centred

on the brand idea Intensity. Driven. the creative identity builds on Aston Martin’s strong, established reputation

for combining luxurious craftsmanship and sophisticated design with high-octane emotion and intense driving

pleasure, as defined by breath-taking new models such as DBX707, V12 Vantage and the uncompromising

Aston Martin Valkyrie.

The strategic repositioning is the largest investment in Aston Martin’s brand for more than a decade and

strengthens its position at the pinnacle of the performance ultra-luxury segment. It builds on Aston Martin’s

growing appeal to a wider, affluent global audience strategically targeted by the brand, whilst underpinning its

core values.

In addition to the new visual and verbal expression, the radical redesign includes a contemporary update to the

iconic wings, created by the manufacturer’s world-renowned design function in collaboration with acclaimed

British art director and graphic designer Peter Saville.

• 48.8 million online impressions generated for new Intensity. Driven. brand campaign

• More than 1.1million website sessions throughout August 2022 – the busiest month of traffic since the

brand’s return to Formula One® in March 2021

Enhancing innovation and operational capabilities to support future growth

The Company continued to add key talent across the organisation, with new executive management

appointments as well as new senior leaders in its engineering, commercial, procurement, human resources and

operational teams. In addition to the appointments of Amedeo Felisa as the new Chief Executive Officer and

Doug Lafferty as the new Chief Financial Officer, the Company announced the additions of Simon Smith as the

new Chief People Officer and Roberto Fedeli as the new Group Chief Technology Officer.

Aligned with the Company’s plans to globalise its brand and increase its share of key strategic markets, regional

leadership has also been reinforced with the appointment of new, experienced regional presidents in the

Americas, Asia and Europe.

A former CEO of Ferrari, Amedeo is one of the most highly regarded leaders and engineering professionals in

the high-performance luxury sports car sector. In conjunction with Amedeo’s appointment in May, the

Company implemented a number of changes to its organisational structure, including new ways of working, to

enhance its operational capabilities – all aligned to support future growth.

This included a new cross-functional structure for its engineering organisation to enhance the development of

its next generation of high-performance vehicles, and expanding its in-house engineering capabilities covering

areas such as e-Powertrain, Software and Electronics Technology, Infotainment, as well as Product and

Component Development.

Consistent with the Company’s ongoing focus on operational excellence, new initiatives and processes were

implemented with key functional capabilities strengthened. For example, a new supplier strategy, focused on

building long-term partnerships, was developed over the course of the year to improve supply chain resilience

and performance. In addition, new processes were implemented to support future product launches, with a

focus on improving quality and driving overall efficiencies.

Investing in people and their career development will continue to shape Aston Martin’s future. This includes

supporting and developing the next generation of British talent and skills. Over the course of the year, the

Company renewed its commitment to making Aston Martin a great place to work, with a focus on fostering a

spirit of collaboration. At the start of 2023, the Company introduced a new set of values, grounded by the

principle that ‘No one builds an Aston Martin on their own’.

Equity capital raise, new anchor shareholder and Board appointments

In July, the Company announced a £654m equity capital raise to strengthen its financial position and enhance

its pathway for significant shareholder value creation. The equity capital raise, successfully completed in

September, has allowed the Company to de-lever its balance sheet, and supports its target to become

sustainably free cash flow positive from 2024. In October, the Company successfully completed a tender offer

for a total consideration of $200m relating to its outstanding Senior Secured Notes.

In conjunction with the equity capital raise, the Public Investment Fund (PIF) became a new anchor investor and

the Company’s second largest shareholder. A Relationship Agreement was entered into between the Company

and PIF, whereby Ahmed Al-Subaey and Scott Robertson were appointed to the Board as PIF’s representative

Non-executive Directors with effect from 1 November 2023. The Company also appointed Sir Nigel Boardman

as an Independent Non-executive Director with effect from 1 October 2022.

Making sustainability central to everything we do

In 2022 the Company accelerated progress towards the goals in its sustainability strategy Racing. Green’ and

its updated targets now include:

• Carbon Neutral manufacturing facilities

• 100% use of renewable electricity in its manufacturing facilities

• A new goal to achieve a 2.5% year-on-year reduction in CO

2

emissions from its manufacturing facilities*

• A new goal to reduce CO

2

emissions intensity and energy consumption per car by 2.5% year on year*

• Enhancing its gender diversity aspiration with a new target of women in 25% of leadership positions by

2025 and in 30% of leadership positions by 2030

• A new target to improve biodiversity at its manufacturing facilities

*Scope 1 CO

2

emissions

Reducing CO

2

emissions from the Company’s products, manufacturing processes and wider supply chain

remains a top priority. Our first PHEV, the Valhalla, commences delivery in 2024, followed by the first BEV

which is targeted for launch in 2025 and a fully electrified GT/Sport and SUV portfolio by 2030. Aston Martin’s

company-wide EV Transformation Programme is equipping its people, changing its processes, and reshaping

the organisation for a new electrified, lower carbon future. Sustainability is also increasingly embedded

throughout the vehicle design process, and the Company is intensifying its focus on optimising the materials

used, as well as increasing its focus on the use of materials which are low carbon, sustainably sourced and

recycled.

The Company continues to implement projects which will help make its manufacturing facilities net-zero by

2030 and work on reducing CO

2

emissions from the supply chain is gaining momentum as the Company aims

for net-zero across its supply chain by 2039. Successfully reducing emissions across the entire supply chain will

require strong collaboration, with all supply chain partners playing their part.

With a focus going beyond climate change, the Company is working collaboratively with suppliers to achieve

the target of zero single-use plastic packaging waste by 2025. Investment in water saving technologies in 2022

will save 1 million litres of water annually from staff facilities, as the Company strives to reduce total water

consumption by 15% by 2025, compared with 2019 levels.

No one builds an Aston Martin on their own. People are at the heart of the success of the business and over the

last year, the Company has invested in a commitment to make Aston Martin a great and inclusive place to work.

This includes a new safety training programme and further improvements to safety management systems as

the Company continues to strive for zero injuries and zero harm. The last year has also seen further emphasis

on increasing diversity and championing inclusivity at Aston Martin. This includes an enhanced target for

women to be in 25% of leadership positions by 2025 and 30% by 2030, compared with 15% currently. During

2022 the Company welcomed new apprentices and graduate trainees, strengthening the talent it continues to

develop at every level of the business.

All of the Company’s work on sustainability is guided by its support for the Ten Principles of the United Nations

Global Compact in the areas of Human Rights, Labour, Environment and Anti-Corruption. It is also underpinned

by a broad commitment to delivering the highest standards, with strategic oversight provided by the Board

Sustainability Committee. Throughout 2022, the Company maintained this commitment by continuing to focus

on compliance with its legal and regulatory obligations as well as embracing sustainability best practices. Aston

Martin’s sustainability strategy is helping to shape its transformation as it takes action to turn aspirations into

reality, making sustainability central to everything it does. In some areas more will need to be done to accelerate

progress, but by continuing to intensify the focus on delivery, the Company will achieve its ambition: to become

a world-leading sustainable ultra-luxury automotive business.

FINANCIAL REVIEW

Sales and revenue analysis

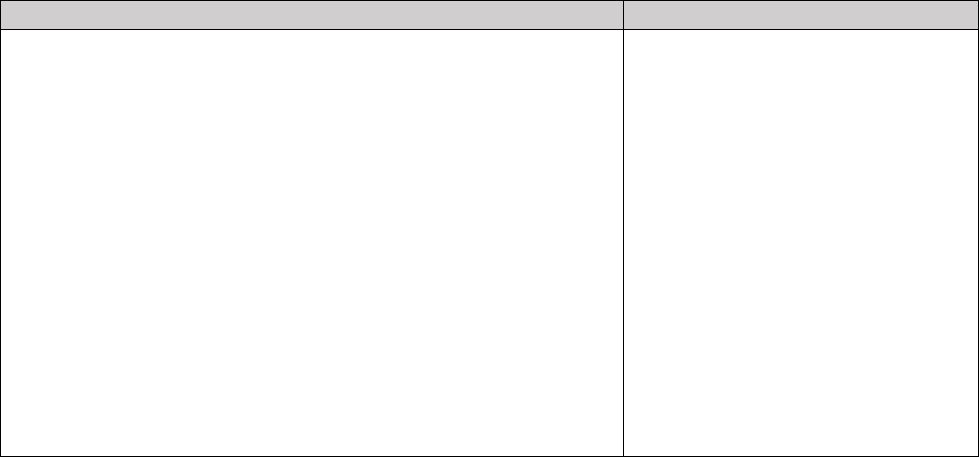

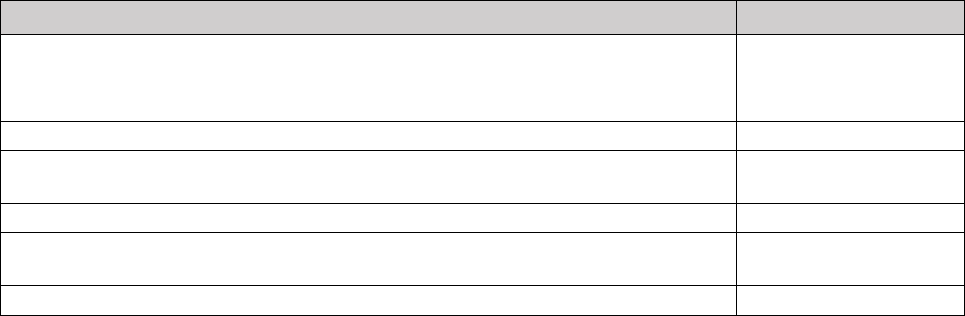

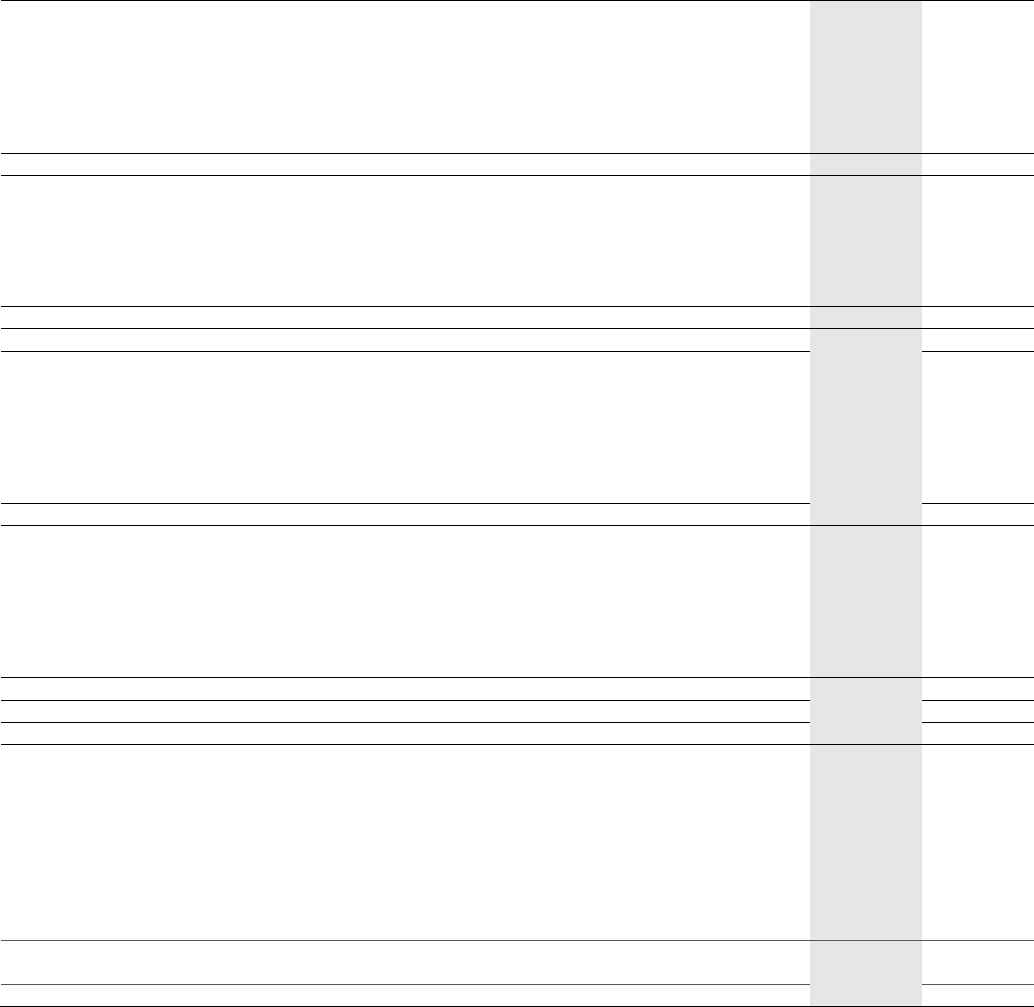

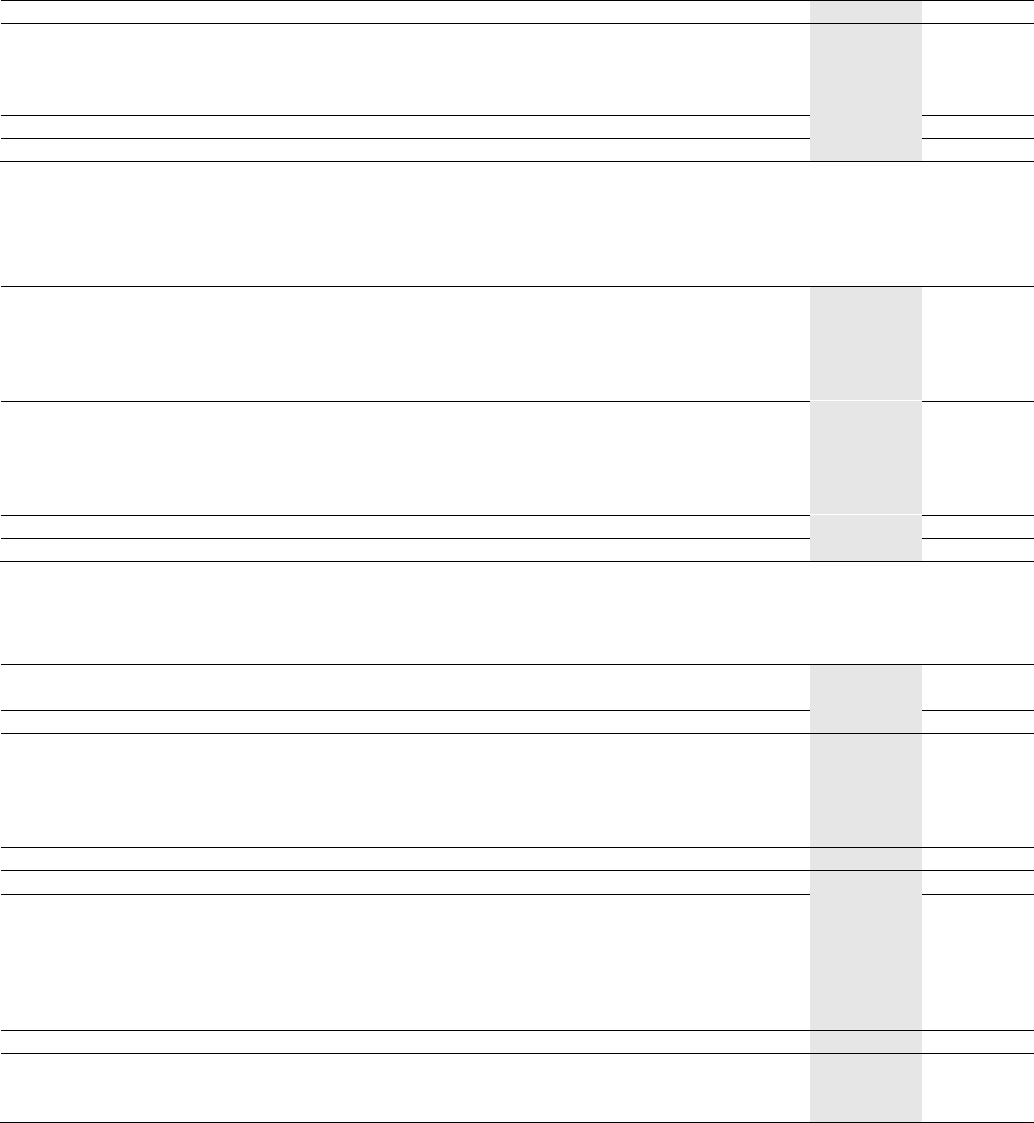

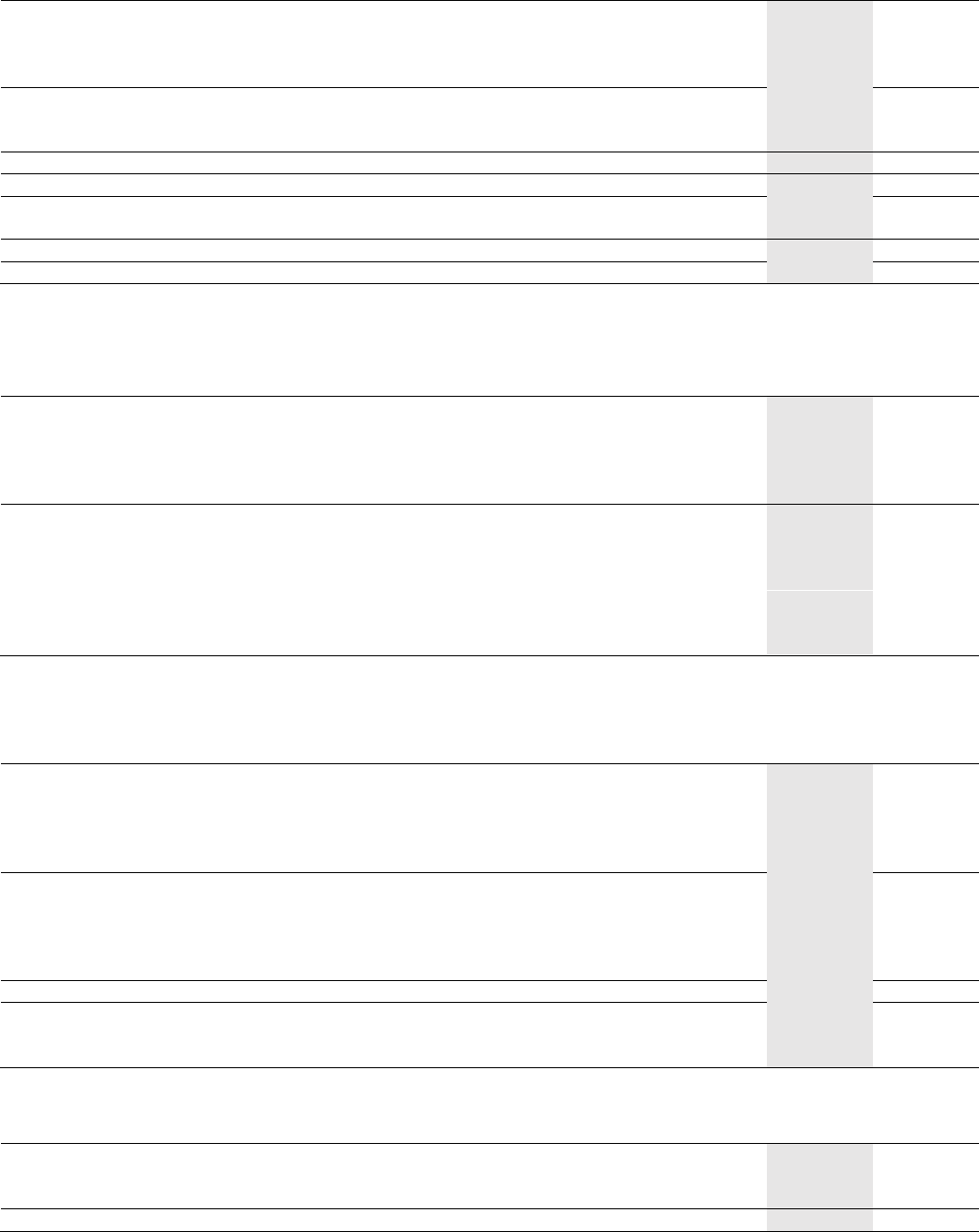

Number of vehicles

FY-22

FY-21

% change

Q4-22

Q4-21

% change

Wholesale

6,412

6,178

4%

2,352

1,928

22%

Core (excluding Specials)

6,323

6,080

4%

2,313

1,886

23%

By region:

UK

1,110

1,109

0%

416

381

9%

Americas

1,980

1,984

0%

828

546

52%

EMEA (ex. UK)

1,508

1,270

19%

723

372

94%

APAC

1,814

1,815

0%

385

629

(39%)

By model:

Sports

1,833

1,479

24%

614

520

18%

GT

1,271

1,589

(20%)

306

546

(44%)

SUV

3,219

3,001

7%

1,393

815

71%

Other

0

11

n.m.

0

5

n.m.

Specials

89

98

(9%)

39

42

(7%)

Note: Sports includes Vantage, GT includes DB11 and DBS, SUV includes DBX and Other includes prior generation models

Despite a challenging and uncertain operating environment, characterised by the war in Ukraine, supply chain

and logistics disruptions, inflationary pressures, as well as intermittent COVID-19 lockdowns in China, total

wholesales increased by 4% year-on-year, driven by strong demand across the portfolio.

Total wholesales of 6,412 units included 89 Specials in 2022, comprised of 80 Aston Martin Valkyrie programme

vehicles and 9 other vehicles. This compared to 6,178 total wholesales, which included 98 Specials, in 2021.

Given significant supply chain and logistics disruptions, most notably in Q2 and Q3, which delayed the

Company’s ability to meet customer demand, the fourth quarter represented the peak of volumes for the year,

as expected.

Total wholesales of 2,352 units in Q4 increased by 70% compared to Q3 and by 22% year-on-year. The year-

on-year growth in Q4 wholesales was primarily driven by significantly higher DBX volumes, supported by

strong customer demand and strong operational execution, as the Company actively managed the supply chain

and logistics disruptions which had restricted its ability to meet demand earlier in the year. This was partially

offset by lower year-on-year wholesales in China, following the strong growth achieved in Q4 2021 and, to a

lesser extent, by the COVID-19 lockdowns during the quarter.

Aligned with its ultra-luxury strategy, the Company continues to operate a demand-led operating model.

However, given the timing of deliveries towards the end of Q4, total wholesale volumes were temporarily

ahead of retail volumes at the end of 2022. Many of those vehicles were retailed in early Q1, and the Company

expects to see retails outpace wholesales in 2023.

Geographically, wholesale volumes remained well balanced across all regions, reflecting the broad customer

appeal of the Company’s product portfolio. In addition, supply chain disruptions throughout the year, most

notably in Q2 and Q3, impacted our geographic and product mix, as well as our ability to meet strong customer

demand.

The Americas and APAC were the largest regions, collectively representing approximately 60% of total

volumes. Despite geopolitical challenges, EMEA wholesales increased by 19% year-on-year, driven by strong

customer demand for the DBX707 and higher year-on-year Sports volumes.

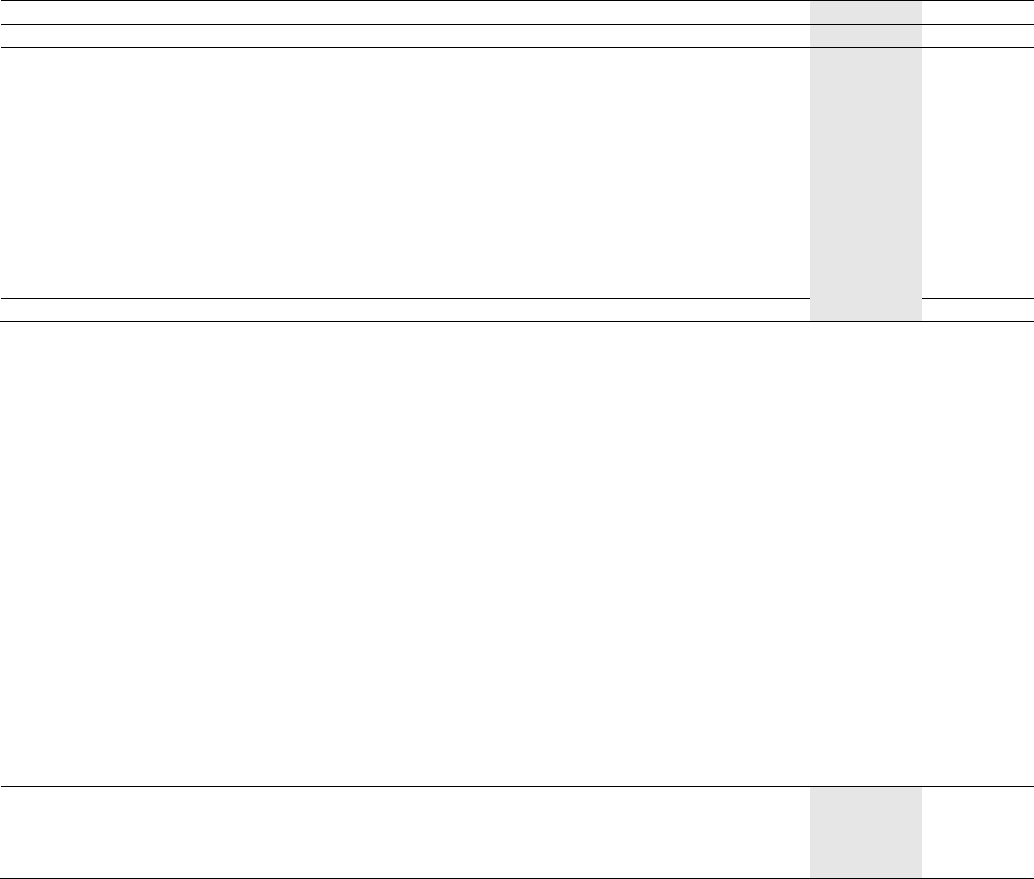

Revenue by Category

£m

FY-22

FY-21

% change

Sale of vehicles

1,291.5

1,005.4

28%

Sale of parts

70.8

65.5

8%

Servicing of vehicles

9.3

10.6

(12%)

Brand and motorsport

9.9

13.8

(28%)

Total

1,381.5

1,095.3

26%

Revenues increased by 26% year-on-year to £1.4bn (2021: £1.1bn), primarily due to strong wholesale average

selling price (ASP) growth and, to a lesser extent, due to higher wholesale volumes. Total ASP of £201k (2021:

£162k) – a record level for Aston Martin – increased by 24% year-on-year, reflecting higher Aston Martin

Valkyrie deliveries (80 in 2022, compared to 10 in 2021) and higher core ASPs. Core ASP of £177k (2021: £150k)

increased by 18% year-on-year driven by strong pricing and mix dynamics, as well as foreign exchange

tailwinds.

Q4 revenues increased by 46% year-on-year to £524m (Q4 2021: £359m), driven by strong ASP growth and

higher wholesale volumes, most notably DBX. Total Q4 ASP of £213k (Q4 2021: £175k) increased by 22% year-

on-year, reflecting higher Aston Martin Valkyrie deliveries (36 in Q4 2022, compared to 10 in Q4 2021) and

higher core ASPs. Core Q4 ASP of £184k (Q4 2021: £152k) increased by 21% year-on-year driven by strong

pricing and mix dynamics, as well as foreign exchange tailwinds.

Pricing dynamics were strong throughout 2022, aligned with the Company’s ultra-luxury strategy. This included

price increases implemented across the range during late 2021 and in the first half of 2022, reflecting the strong

pricing power of the Aston Martin brand. ASPs also benefitted from favourable mix, as well as lower incentive

support.

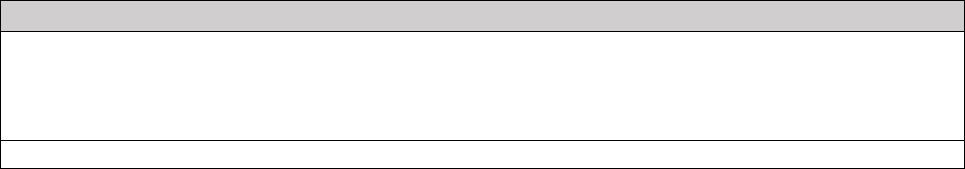

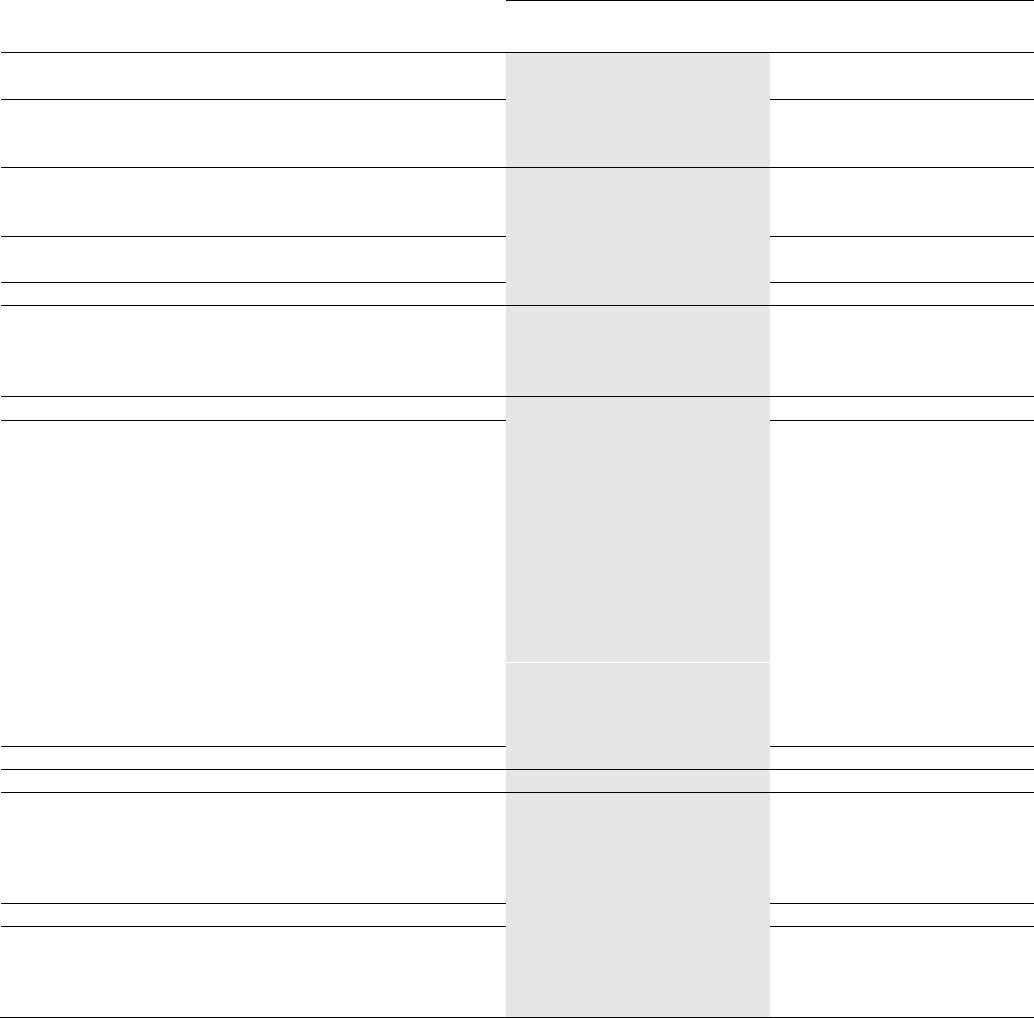

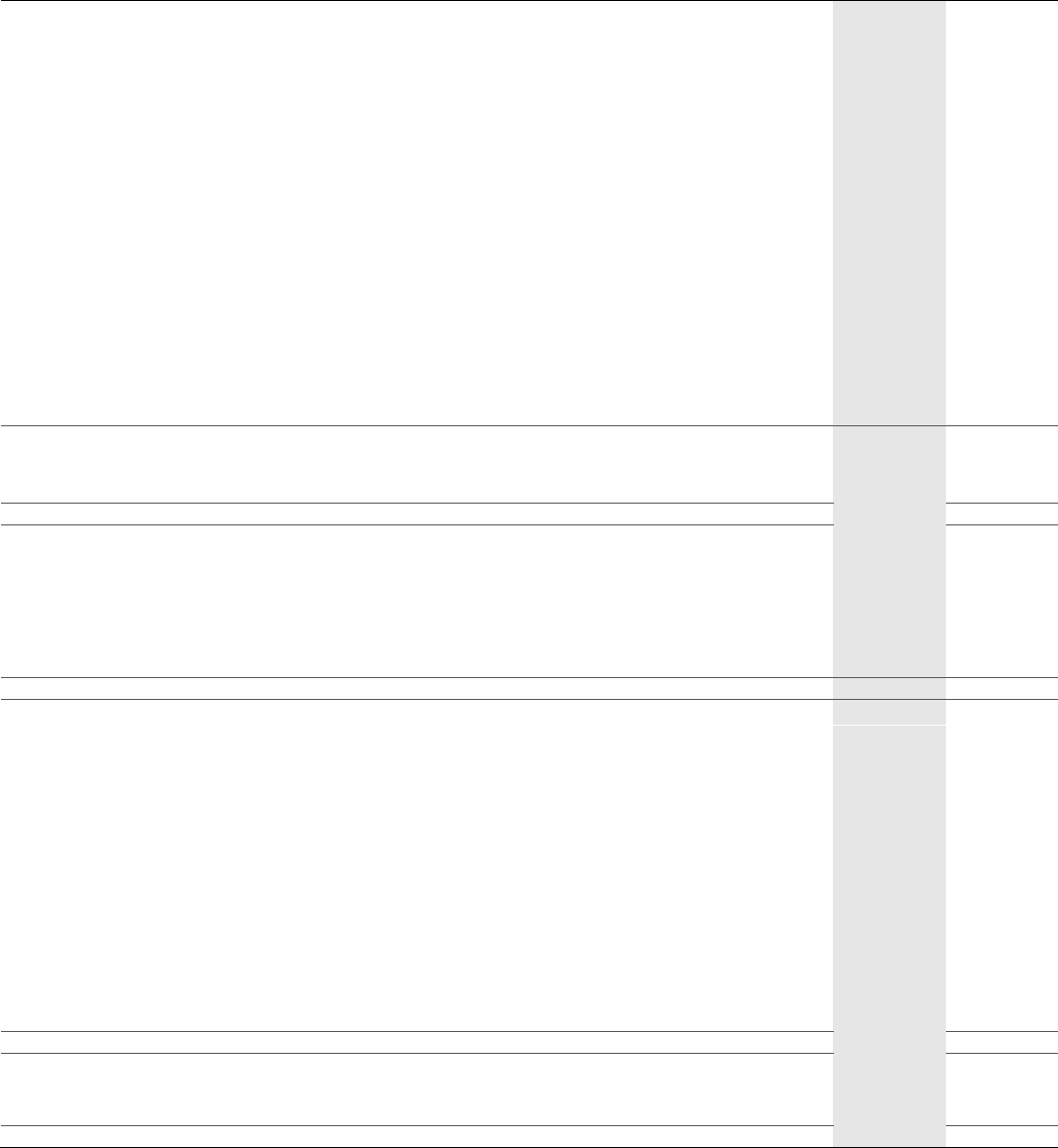

Summary income statement and analysis

£m

FY-22

FY-21

Q4-22

Q4-21

Revenue

1,381.5

1,095.3

524.3

358.9

Cost of sales

(930.8)

(751.6)

(359.8)

(237.1)

Gross profit

450.7

343.7

164.5

121.8

Gross margin %

32.6%

31.4%

31.4%

33.9%

Operating expenses

1

(568.6)

(418.0)

(154.2)

(131.0)

of which depreciation & amortisation

308.1

212.2

100.1

74.8

Adjusted operating (loss)/ profit

2

(117.9)

(74.3)

10.3

(9.2)

Adjusting operating items

(23.9)

(2.2)

(3.7)

0.9

Operating (loss)/ profit

(141.8)

(76.5)

6.6

(8.3)

Net financing (expense)/income

(353.2)

(137.3)

9.7

(16.9)

of which adjusting financing items

(20.1)

34.1

(39.1)

21.2

(Loss)/profit before tax

(495.0)

(213.8)

16.3

(25.2)

Taxation

(32.7)

24.5

(26.0)

(7.5)

(Loss)/profit for the period

(527.7)

(189.3)

(9.7)

(32.7)

Adjusted EBITDA

1,2

190.2

137.9

110.4

65.6

Adjusted EBITDA margin

13.8%

12.6%

21.1%

18.3%

Adjusted (loss)/profit before tax

1

(451.0)

(245.7)

59.1

(47.3)

EPS (pence)

(124.5)

(58.6)

Adjusted EPS (pence)

2

(114.1)

(70.9)

1. Excludes adjusting items; 2. For definition of alternative performance measures please see Appendix

In 2022, gross profit of £451m increased by £107m, or 31%, year-on-year. This translated to a gross margin of

33%, a year-on-year expansion of approximately 120 basis points. The gross margin expansion was primarily

due to higher year-on-year gross margin within the core range of vehicles, supported by the introduction of

new products – most notably the V12 Vantage and DBX707 – as well as foreign exchange tailwinds.

This was partially offset by lower year-on-year gross margin within Specials driven by higher Aston Martin

Valkyrie programme deliveries related to Nebula Project AG during 2022. As disclosed on 22 June 2021, the

Company has filed for civil legal proceedings against Nebula Project AG and criminal proceedings against its

board members, after it became aware that Nebula had taken deposits from its customers and failed to pass

them on to the Company. Aston Martin has continued to work with its affected customers to ensure they

receive their Aston Martin Valkyrie vehicles despite Nebula’s actions.

In addition, year-on-year gross margin was negatively impacted by higher supply chain and logistics costs,

including approximately £20m of incremental supply chain recovery costs in the second half of the year.

Q4 gross profit of £165m increased by £43m, or 35%, year-on-year. This translated to a gross margin of 31%, a

decline of approximately 250 basis points year-on-year, as lower gross margin within Specials and higher

manufacturing and logistics costs were partially offset by higher year-on-year gross margin from the core

range of vehicles and, to a lesser extent, from higher overall core volumes.

The Company continues to target a 40%+ gross margin from its future products.

In 2022, adjusted EBITDA of £190m increased by £52m year-on-year, or by 38%. This translated to an adjusted

EBITDA margin of 14%, an increase of approximately 120 basis points compared to the prior year and within the

revised guidance range of approximately 100-300 basis points of year-on-year margin expansion.

Q4 adjusted EBITDA of £110m increased by £45m year-on-year, or by 68%. This translated to an adjusted

EBITDA margin of 21%, an increase of approximately 280 basis points compared to the prior year period, driven

by strong operating leverage.

The operating loss of £142m compared to a £77m loss in the prior year. The £65m year-on-year change was

primarily driven by:

- A £96m increase in depreciation and amortisation charges, principally related to Aston Martin Valkyrie

deliveries and accelerated depreciation ahead of the next generation of sports cars starting in 2023

- Increased investment in brand and product launches such as the DBX707, V12 Vantage and Valhalla,

marketing initiatives at events such as the Goodwood Festival of Speed and Pebble Beach

- Higher general costs, including inflationary pressures, to support the Company’s future growth

These factors were partially offset by:

- Higher year-on-year gross profit, as described above, which included a £31m benefit to operating

profit from exchange rate movements

Adjusting operating items of £24m (2021: £2m) predominantly related to the closure to future accrual of the

pension scheme disclosed at the Full Year 2021 results, ERP implementation costs, as well as one-time expenses

related to the change of CEO and appointment of other new executives.

Net adjusted financing costs of £333m increased significantly from £171m in the prior year, reflecting the

revaluation of the US dollar-denominated Senior Secured Notes giving a non-cash FX charge of £156m (2021

included a £12m FX charge). The £20m adjusting finance charge related to costs associated with the equity

capital raise and debt tender, partially offset by the fair value movements of outstanding warrants (2021: £34m

adjusting finance credit).

The loss before tax was £495m (2021: £214m loss) and the loss for the period was £528m (2021: £189m loss),

both significantly impacted by the revaluation of the US dollar-denominated Senior Secured Notes.

The tax charge on the adjusted loss before tax was £33m. The effective tax rate at (7.3)% differs from the 19%

standard UK tax rate mainly due to movements in unprovided deferred tax and derecognition of deferred tax

related to losses, accelerated capital allowances and a restriction on the amount of interest that can be

deducted for tax purposes. Tax on adjusting items was nil as a result of the unprovided deferred tax.

The total share count at 31 December 2022 was 699 million following the placing of new ordinary shares to PIF,

as well as the 4-for-1 rights issue completed in September 2022. The weighted average number of shares in

2022 was 425 million. 28.8 million shares in relation to the warrants remain outstanding and are exercisable until

December 2027.

The Company is embedding the first tranche of technology from Mercedes-Benz AG into its product renewal

and expansion pipeline. There are currently no plans to issue additional shares to Mercedes-Benz AG during

2023.

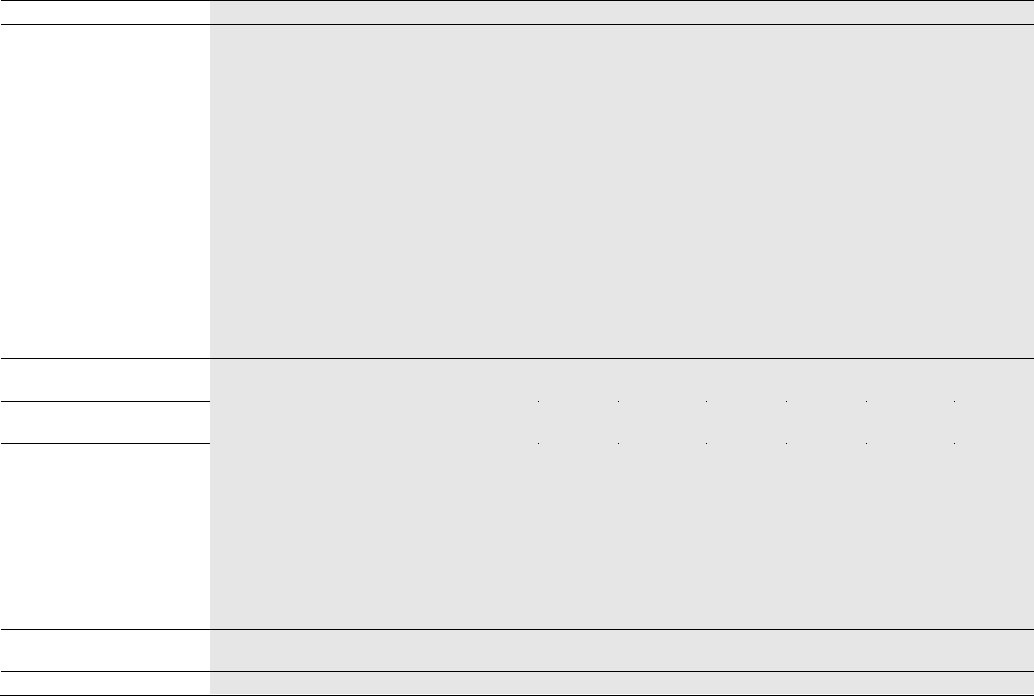

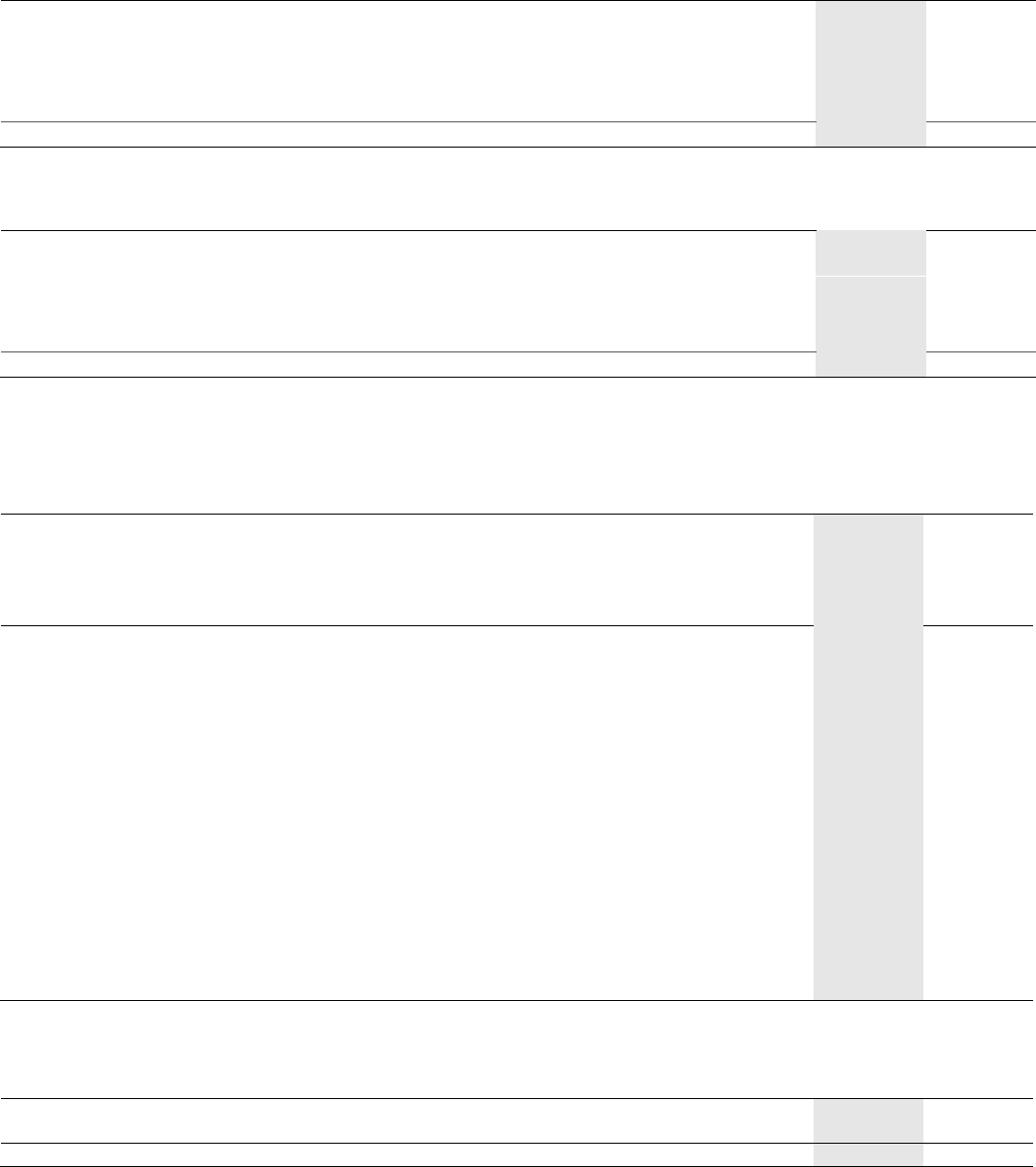

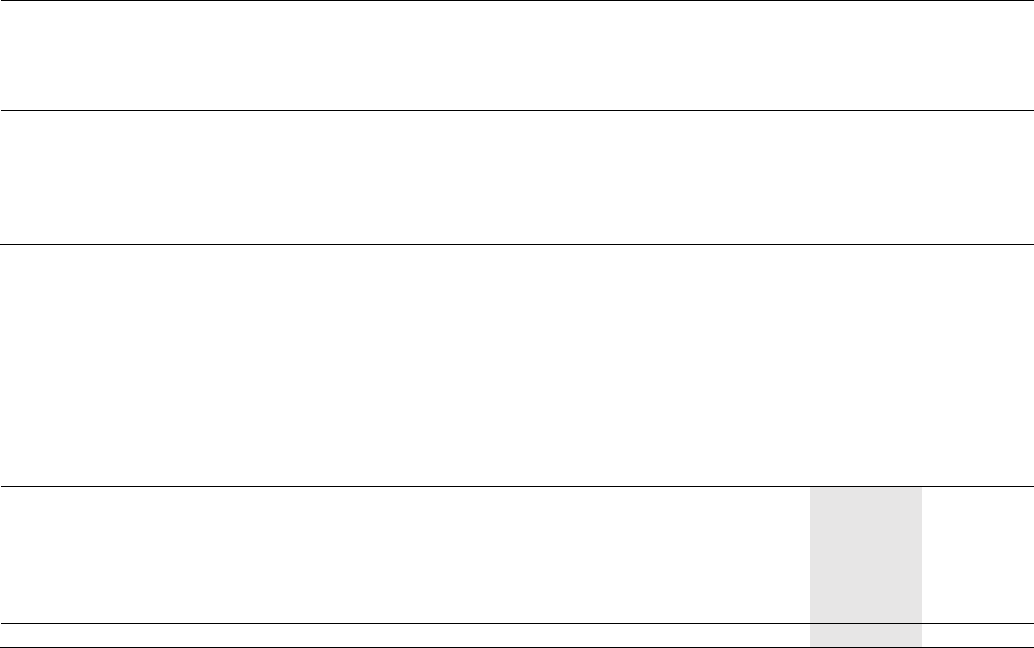

Cash flow and net debt

£m

FY-22

FY-21

Q4-22

Q4-21

Cash generated from operating activities

127.1

178.9

184.0

27.5

Cash used in investing activities (excl. interest)

(286.9)

(185.2)

(73.5)

(49.0)

Net cash interest paid

(139.0)

(116.9)

(73.7)

(62.6)

Free Cash (outflow)/inflow

(298.8)

(123.2)

36.8

(84.1)

Cash inflow/(outflow) from financing activities

(excl. interest)

456.2

51.5

(210.5)

7.5

Increase/(decrease) in net cash

157.4

(71.7)

(173.7)

(76.6)

Effect of exchange rates on cash and cash

equivalents

7.0

1.2

(14.8)

0.3

Cash balance

583.3

418.9

583.3

418.9

Net cash inflow from operating activities was £127m (2021: £179m). The year-on-year change in cash flow from

operating activities was primarily due to adverse movements in working capital. Cash flow from operating

activities in 2022 included a £15m outflow related to movements in working capital, compared with a £56m

inflow in 2021. The largest movement in 2022 was a £82m increase in trade and other payables, principally

associated with higher accruals related to future product rollout plans, which was partially offset by a £78m

increase in inventories, which was significantly impacted by supply chain and logistics disruptions, most notably

in Q2 and Q3.

Demand for Specials remained strong throughout the year, with deposit intake for Valhalla and the Aston

Martin Valkyrie Spider. However, this was offset by higher deliveries of Aston Martin Valkyrie programme

vehicles, resulting in a net £18m outflow from deposits during the year.

As expected, the Company generated a significant improvement in cash flow from operating activities in Q4,

driven by a combination of strong profitability and cash inflows from working capital. Cash inflow from

operating activities was £184m in Q4 (Q4 2021: £28m).

Capital expenditure was £287m in 2022, an increase of £102m year-on-year, with investment focused on the

future product pipeline, particularly the next generation of sports cars, as well as development of the

Company’s electrification programme.

Free cash was a net outflow of £299m, compared to a £123m outflow in 2021. This was primarily due to the

year-on-year increase in capital expenditure, as well as the changes in working capital-related cashflows

described above.

Cash inflow from financing (excluding interest) of £456m (2021: £52m) included £654m of gross proceeds from

the equity capital raise, partially offset by a £187m net cash outflow related to the $200m debt tender, which

was completed in Q4.

Net cash inflow of £157m resulted in a closing cash balance of £583m as at 31 December 2022 (31 December

2021: £419m). Net debt of £766m, a £126m reduction from £892m at the end of 2021, included a £156m

negative impact of non-cash FX revaluation of US dollar-denominated debt as the pound weakened against the

US dollar during the year.

£m

31 Dec-22

31 Dec-21

Loan Notes

1

(1,104.0)

(1,074.9)

Inventory financing

(38.2)

(19.7)

Bank loans and overdrafts

(107.1)

(114.3)

Lease liabilities (IFRS 16)

(99.8)

(103.4)

Gross debt

(1,349.1)

(1,312.3)

Cash balance

583.3

418.9

Cash not available for short-term use

0.3

1.8

Net debt

(765.5)

(891.6)

1 US$ notes of £1.1bn equivalent (First Lien of £935m at 10.5% interest maturing in November 2025; Second Lien of £169m at 15.0%

split interest (8.9% cash; 6.1% PIK) with detachable warrants maturing in November 2026). These instruments carry no-call options

of two years for the Second Lien and three years for the First Lien.

APPENDICES

Dealerships

31 Dec-22

31 Dec-21

UK

21

22

Americas

44

44

EMEA ex. UK

52

53

APAC

48

49

Total

165

168

Number of countries

54

56

Alternative Performance Measure

£m

FY-22

FY-21

Loss before tax

(495.0)

(213.8)

Adjusting operating expense

23.9

2.2

Adjusting finance income

(12.5)

(34.1)

Adjusting finance expense

32.6

-

Adjusted EBT

(451.0)

(245.7)

Adjusted finance income

(3.0)

(2.3)

Adjusted finance expense

336.1

173.7

Adjusted operating loss

(117.9)

(74.3)

Reported depreciation

88.8

74.6

Reported amortisation

219.3

137.6

Adjusted EBITDA

190.2

137.9

Alternative performance measures

In the reporting of financial information, the Directors have adopted various Alternative Performance

Measures ("APMs"). APMs should be considered in addition to IFRS measurements. The Directors believe that

these APMs assist in providing useful information on the underlying performance of the Group, enhance the

comparability of information between reporting periods, and are used internally by the Directors to measure

the Group's performance.

• Adjusted operating loss is loss from operating activities before adjusting items

• Adjusted EBITDA removes depreciation, loss/(profit) on sale of fixed assets and amortisation from

adjusted operating loss

• Adjusted EBITDA margin is adjusted EBITDA (as defined above) divided by revenue

• Adjusted EBT is the loss before tax and adjusting items as shown in the Consolidated Income

Statement

• Adjusted Earnings Per Share is loss after income tax before adjusting items, divided by the weighted

average number of ordinary shares in issue during the reporting period

• Net Debt is current and non-current borrowings in addition to inventory financing arrangements,

lease liabilities recognised following the adoption of IFRS 16, less cash and cash equivalents, cash held

not available for short-term use

• Free cashflow is represented by cash (outflow)/inflow from operating activities less the cash used in

investing activities (excluding interest received) plus interest paid in the year less interest received.

Further details and definitions of adjusting items are contained in note 5 of the Financial Statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER

2022

2022

2021

Notes

Adjusted

£m

Adjusting

items*

£m

Total

£m

Adjusted

£m

Adjusting

items*

£m

Total

£m

Revenue

3

1,381.5

–

1,381.5

1,095.3

–

1,095.3

Cost of sales

(930.8)

–

(930.8)

(751.6)

–

(751.6)

Gross profit

450.7

–

450.7

343.7

–

343.7

Selling and distribution expenses

(113.0)

–

(113.0)

(84.8)

–

(84.8)

Administrative and other operating expenses

(455.6)

(23.9)

(479.5)

(333.2)

(2.2)

(335.4)

Operating loss

4

(117.9)

(23.9)

(141.8)

(74.3)

(2.2)

(76.5)

Finance income

6

3.0

12.5

15.5

2.3

34.1

36.4

Finance expense

7

(336.1)

(32.6)

(368.7)

(173.7)

–

(173.7)

Loss before tax

(451.0)

(44.0)

(495.0)

(245.7)

31.9

(213.8)

Income tax (charge)/credit

8

(32.7)

–

(32.7)

16.2

8.3

24.5

Loss for the year

(483.7)

(44.0)

(527.7)

(229.5)

40.2

(189.3)

(Loss)/profit attributable to:

Owners of the Group

(528.6)

(191.6)

Non-controlling interests

0.9

2.3

(527.7)

(189.3)

Other comprehensive income

Items that will never be reclassified to the Income Statement

Remeasurement of Defined Benefit liability

6.8

3.8

Taxation on items that will never be reclassified to the

Income Statement

8

(1.7)

(1.0)

Effect of change in rate in taxation

8

–

6.0

Items that are or may be reclassified to the

Income Statement

Foreign currency translation differences

3.8

2.3

Fair value adjustment – cash flow hedges

(6.1)

(0.3)

Amounts reclassified to the Income Statement –

cash flow hedges

2.9

(4.3)

Taxation on items that may be reclassified to the

Income Statement

8

0.8

1.2

Other comprehensive income for the year, net of income tax

6.5

7.7

Total comprehensive loss for the year

(521.2)

(181.6)

Total comprehensive (loss)/income for the year

attributable to:

Owners of the Group

(522.1)

(183.9)

Non-controlling interests

0.9

2.3

(521.2)

(181.6)

Earnings per ordinary share

Restated**

Basic loss per share

9

(124.5p)

(58.6p)

Diluted loss per share

9

(124.5p)

(58.6p)

All operations of the Group are continuing.

* Adjusting items are defined in note 2 with further detail shown in note 5.

** Earnings per ordinary share has been adjusted to reflect the bonus element of the rights issue undertaken in September 2022. See notes 9 and 12.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Group

Share

capital

£m

Share

premium

£m

Merger

reserve

£m

Capital

redemption

reserve

£m

Capital

reserve

£m

Translation

reserve

£m

Hedge

reserves

£m

Retained

earnings

£m

Non-

controlling

interest

£m

Total

equity

£m

At 1 January 2022

11.6

1,123.4

143.9

9.3

6.6

2.7

6.7

(662.4)

18.6

660.4

Total comprehensive loss

for the year

(Loss)/profit for the year

–

–

–

–

–

–

–

(528.6)

0.9

(527.7)

Other comprehensive

income

Foreign currency translation

differences

–

–

–

–

–

3.8

–

–

–

3.8

Fair value movement – cash

flow hedges

–

–

–

–

–

–

(6.1)

–

–

(6.1)

Amounts reclassified to the

Income Statement – cash

flow hedges

–

–

–

–

–

–

2.9

–

–

2.9

Remeasurement of Defined

Benefit liability

–

–

–

–

–

–

–

6.8

–

6.8

Tax on other comprehensive

income (note 8)

–

–

–

–

–

–

0.8

(1.7)

–

(0.9)

Total other comprehensive

income/(loss)

–

–

–

–

–

3.8

(2.4)

5.1

–

6.5

Total comprehensive

income/(loss) for the year

–

–

–

–

–

3.8

(2.4)

(523.5)

0.9

(521.2)

Transactions with owners,

recorded directly in equity

Issuance of new shares

(note 11)

58.3

574.0

–

–

–

–

–

–

–

632.3

Credit for the year under

equity-settled share-based

payments

–

–

–

–

–

–

–

1.0

–

1.0

Tax on items credited

to equity

–

–

–

–

–

–

–

–

–

–

Total transactions

with owners

58.3

574.0

-

–

–

–

–

1.0

–

633.3

At 31 December 2022

69.9

1,697.4

143.9

9.3

6.6

6.5

4.3

(1,184.9)

19.5

772.5

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY CONTINUED

Group

Share

capital

£m

Share

premium

£m

Merger

reserve

£m

Capital

redemption

reserve

£m

Capital

reserve

£m

Translation

reserve

£m

Hedge

reserves

£m

Retained

earnings

£m

Non-

controlling

interest

£m

Total

equity

£m

At 1 January 2021

11.5

1,108.2

144.0

9.3

6.6

0.4

10.9

(503.1)

16.3

804.1

Total comprehensive loss

for the year

(Loss)/profit for the year

–

–

–

–

–

–

–

(191.6)

2.3

(189.3)

Other comprehensive

income

Foreign currency translation

differences

–

–

–

–

–

2.3

–

–

–

2.3

Fair value movement – cash

flow hedges

–

–

–

–

–

–

(0.3)

–

–

(0.3)

Amounts reclassified to the

Income Statement – cash

flow hedges

–

–

–

–

–

–

(4.3)

–

–

(4.3)

Remeasurement of Defined

Benefit liability

–

–

–

–

–

–

–

3.8

–

3.8

Effect of change in rate of

taxation (note 8)

–

–

–

–

–

–

(0.8)

6.8

–

6.0

Tax on other comprehensive

income (note 8)

–

–

–

–

–

–

1.2

(1.0)

–

0.2

Total other comprehensive

income/(loss)

–

–

–

–

–

2.3

(4.2)

9.6

–

7.7

Total comprehensive

income/(loss) for the year

–

–

–

–

–

2.3

(4.2)

(182.0)

2.3

(181.6)

Transactions with owners,

recorded directly in equity

Warrant options exercised

(note 11)

0.1

15.1

–

–

–

–

–

14.8

–

30.0

Credit for the year under

equity-settled share-

based payments

–

–

–

–

–

–

–

3.1

3.1

Effect of change in rate

of taxation (note 8)

–

–

–

–

–

–

–

4.7

–

4.7

Tax on items credited to

equity (note 8)

–

–

–

–

–

–

–

0.1

–

0.1

Reclassification (note 11)

–

0.1

(0.1)

–

–

–

–

–

–

–

Total transactions

with owners

0.1

15.2

(0.1)

–

–

–

–

22.7

–

37.9

At 31 December 2021

11.6

1,123.4

143.9

9.3

6.6

2.7

6.7

(662.4)

18.6

660.4

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 2022

Notes

31 December

2022

£m

31 December

2021

£m

Non-current assets

Intangible assets

1,394.6

1,384.1

Property, plant and equipment

369.9

355.5

Right-of-use lease assets

74.4

76.0

Trade and other receivables

6.3

2.1

Other financial assets

–

0.5

Deferred tax asset

8

133.7

156.4

1,978.9

1,974.6

Current assets

Inventories

286.2

196.8

Trade and other receivables

245.7

243.4

Income tax receivable

1.4

1.5

Other financial assets

8.8

7.3

Cash and cash equivalents

583.3

418.9

1,125.4

867.9

Total assets

3,104.3

2,842.5

Current liabilities

Borrowings

107.1

114.3

Trade and other payables

876.3

721.0

Income tax payable

6.3

5.5

Other financial liabilities

26.2

34.8

Lease liabilities

7.4

9.7

Provisions

18.6

19.9

1,041.9

905.2

Non-current liabilities

Borrowings

1,104.0

1,074.9

Trade and other payables

9.1

9.8

Lease liabilities

92.4

93.7

Provisions

22.5

19.0

Employee benefits

61.2

78.7

Deferred tax liabilities

8

0.7

0.8

1,289.9

1,276.9

Total liabilities

2,331.8

2,182.1

Net assets

772.5

660.4

Capital and reserves

Share capital

11

69.9

11.6

Share premium

1,697.4

1,123.4

Merger reserve

143.9

143.9

Capital redemption reserve

9.3

9.3

Capital reserve

6.6

6.6

Translation reserve

6.5

2.7

Hedge reserves

4.3

6.7

Retained earnings

(1,184.9)

(662.4)

Equity attributable to owners of the Group

753.0

641.8

Non-controlling interests

19.5

18.6

Total shareholders’ equity

772.5

660.4

The Financial Statements were approved by the Board of Directors on 28 February 2023 and were signed on its behalf by

AMEDEO FELISA DOUG LAFFERTY

CHIEF EXECUTIVE OFFICER CHIEF FINANCIAL OFFICER

COMPANY NUMBER: 11488166

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2022

Notes

2022

£m

2021

£m

Operating activities

Loss for the year

(527.7)

(189.3)

Adjustments to reconcile loss for the year to net cash inflow from operating activities

Tax charge/(credit) on operations

8

32.7

(24.5)

Net finance costs

353.2

137.3

Other non-cash movements

(2.0)

(0.1)

Depreciation and impairment of property, plant and equipment

4

77.8

65.3

Depreciation and impairment of right-of-use lease assets

4

11.0

9.3

Amortisation and impairment of intangible assets

4

219.3

137.6

Difference between pension contributions paid and amounts recognised in Income Statement

(12.1)

(11.4)

(Increase)/decrease in inventories

(78.4)

7.7

Increase in trade and other receivables

(0.1)

(75.4)

Increase in trade and other payables

81.5

52.8

(Decrease)/increase in advances and customer deposits

(17.9)

70.7

Movement in provisions

0.7

(0.2)

(Increase)/decrease in other derivative contracts

(2.3)

0.7

Other movements in deferred tax asset

(3.5)

(2.9)

Cash generated from operations

132.4

179.8

Decrease in cash held not available for short term use

1.5

8.1

Income taxes paid

8

(6.8)

(9.0)

Net cash inflow from operating activities

127.1

178.9

Cash flows from investing activities

Interest received

6

2.2

1.1

Increase in loan assets

–

(1.4)

Decrease in loan assets

–

0.9

Payments to acquire property, plant and equipment

(58.6)

(40.7)

Payments to acquire intangible assets

(228.3)

(144.0)

Net cash used in investing activities

(284.7)

(184.1)

Cash flows from financing activities

Interest paid

(141.2)

(118.0)

Proceeds from equity share issue

653.9

–

Proceeds from issue of equity warrants

–

15.3

Proceeds from financial instrument utilised as part of refinancing transactions

4.2

–

Principal element of lease payments

(10.0)

(9.9)

Repayment of existing borrowings

(172.7)

(37.3)

Premium paid upon redemption of borrowings

(14.3)

–

Proceeds from inventory repurchase arrangement

75.7

19.0

Repayment of inventory repurchase arrangement

(60.0)

(40.0)

Proceeds from new borrowings

–

108.5

Transaction fees paid on issuance of shares

(18.7)

(1.3)

Transaction fees paid on financing activities

(1.9)

(2.8)

Net cash inflow/(outflow) from financing activities

315.0

(66.5)

Net increase/(decrease) in cash and cash equivalents

157.4

(71.7)

Cash and cash equivalents at the beginning of the year

418.9

489.4

Effect of exchange rates on cash and cash equivalents

7.0

1.2

Cash and cash equivalents at the end of the year

583.3

418.9

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2022

1 BASIS OF ACCOUNTING

Aston Martin Lagonda Global Holdings plc (the “Company”) is a company incorporated in England and Wales and domiciled in the

UK. The Group Financial Statements consolidate those of the Company and its subsidiaries (together referred to as the “Group”).

The Group Financial Statements have been prepared and approved by the Directors in accordance with UK adopted international

accounting standards.

The Group Financial Statements have been prepared under the historical cost convention except where the measurement of

balances at fair value is required as explained below. The Financial Statements are prepared in millions to one decimal place, and in

sterling which is the Company’s functional currency.

The financial information set out does not constitute the Company's financial statements for the years ended 31 December 2022

or 2021 but is derived from those financial statements. Financial statements for 2021 have been delivered to the registrar of

companies, and those for 2022 will be delivered in due course. The auditors have reported on those accounts. Their reports for

both years ended 31 December 2022 and 31 December 2021 were not qualified. Their reports did not contain a statement under

Section 498(2) or (3) of the Companies Act 2006.

CLIMATE CHANGE

In preparing the Consolidated Financial Statements management has considered the impact of climate change, particularly in the

context of the disclosures included in the Strategic Report this year and the new sustainability goals including the stated net-zero

targets. Climate change is not expected to have a significant impact on the Group’s going concern assessment to June 2024 nor the

viability of the Group over the next five years following consideration of the below points.

• The Group has modelled various scenarios to take account of the risks and opportunities identified with the impact of climate change to

assess the financial impact on its business plan and viability.

• The Group has a Strategic Cooperation Agreement with Mercedes-Benz AG. The agreement provides the Company with access to a

wide range of world-class technologies for the next generation of luxury vehicles which are planned to be launched through to 2027.

• The Group is planning to leverage strategic long term partnerships with vendors to develop EV powertrain technology with significant

capital expenditure planned to support the transition to a fully electrified portfolio of Sport/GT cars and SUVs by 2030.

• The Group continues to invest in onsite renewable energy generation solutions for our facilities and the increased use of sustainable

materials within production and the required capital investment is included in our five-year forecasts to enable us to meet our target for

net-zero manufacturing facilities by 2030.

• The Group has a clear plan in place to deliver a transformed product range to meet climate change regulations impacting the automotive

sector, launching a Plug-In Hybrid Electric Vehicle (“PHEV”) by 2024 and targeting the launch of our first Battery Electric Vehicle (“BEV”) in

2025.

Consistent with the above, management have further considered the impact of climate change on a number of key estimates

within the Financial Statements and has not found climate change to have a material impact on conclusions reached. Climate

change considerations have been factored into impairment assessments of the carrying value of non-current assets (such as

capitalised development cost intangible assets) through usage of a pre-tax discount rate which reflects the individual nature and

specific risks relating to the business and the market in which the Group operates. In addition the forecast cash flows used in both

the impairment assessments of the carrying value of non-current assets and the assessment of the recoverability of deferred tax

assets reflect the current energy cost headwinds and future costs to achieve net-zero manufacturing facilities by 2030 as well as

the forecast volumes for both existing and future car lines given current order books and our assessment of changing customer

preferences.

GOING CONCERN

The Group meets its day-to-day working capital requirements and medium term funding requirements through a mixture of

$1,143.7m of First Lien notes at 10.5% which mature in November 2025, $229.1m of Second Lien split coupon notes at 15% per

annum (8.89 % cash and 6.11% PIK) which mature in November 2026, a revolving credit facility (£90.6m) which matures August

2025, facilities to finance inventory, a bilateral RCF agreement and a wholesale vehicle financing facility. Under the RCF the Group

is required to comply with a liquidity covenant until May 2022 and a leverage covenant tested quarterly.

The Directors have developed trading and cash flow forecasts for the period from the date of approval of these Financial

Statements through 30 June 2024 (the going concern review period). These forecasts show that the Group has sufficient financial

resources to meet its obligations as they fall due and to comply with covenants for the going concern review period.

The forecasts reflect our ultra-luxury performance-oriented strategy balancing supply and demand and the actions taken to

improve cost efficiency and gross margin. The forecasts include the costs of the Group's environmental, social and governance

("ESG") commitments and make assumptions in respect of future market conditions and, in particular, wholesale volumes, average

selling price, the launch of new models, and future operating costs. The nature of the Group's business is such that there can be

variation in the timing of cash flows around the development and launch of new models. In addition, the availability of funds

provided through the vehicle wholesale finance facility changes as the availability of credit insurance and sales volumes vary, in

total and seasonally. The forecasts take into account these factors to the extent which the Directors consider them to represent

their best estimate of the future based on the information that is available to them at the time of approval of these Financial

Statements.

The Directors have considered a severe but plausible downside scenario that includes considering the impact of a 25% reduction in

DBX volumes and a 8% reduction in sports volumes from forecast levels, operating costs higher than the base plan, incremental

working capital requirements such as a reduced deposit inflows or increased deposit outflows and the impact of the strengthening

of the sterling dollar exchange rate.

The Group plans to make continued investment for growth in the period and, accordingly, funds generated through operations are

expected to be reinvested in the business mainly through new model development and other capital expenditure. To a certain

extent such expenditure is discretionary and, in the event of risks occurring which could have a particularly severe effect on the

Group, as identified in the severe but plausible downside scenario, actions such as constraining capital spending, working capital

improvements, reduction in marketing expenditure and the continuation of strict and immediate expense control would be taken

to safeguard the Group’s financial position.

In addition, we also considered the circumstances which would be needed to exhaust the Group’s liquidity over the assessment

period, a reverse stress test. This would indicate that vehicle sales would need to reduce by 35% from forecast levels without any

of the above mitigations to result in having no liquidity. The likelihood of these circumstances occurring is considered remote both

in terms of the magnitude of the reduction and that, over such a long period, management could take substantial mitigating

actions, such as reducing capital spending to preserve liquidity.

Accordingly, after considering the forecasts, appropriate sensitivities, current trading and available facilities, the Directors have a

reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future and

to comply with its financial covenants therefore the Directors continue to adopt the going concern basis in preparing the Financial

Statements.

2 ACCOUNTING POLICIES

ADJUSTING ITEMS

An adjusting item is disclosed separately in the Consolidated Statement of Comprehensive Income where the quantum, nature or

volatility of such items would otherwise distort the underlying trading performance of the Group including where they are not

expected to repeat in future periods. The tax effect is also included.

Details in respect of adjusting items recognised in the current and prior year are set out in note 5 in the Financial Statements.

3 SEGMENTAL REPORTING

Operating segments are defined as components of the Group about which separate financial information is available and is

evaluated regularly by the chief operating decision-maker in assessing performance. The Group has only one operating segment,

the automotive segment, and therefore no separate segmental report is disclosed. The automotive segment includes all activities

relating to design, development, manufacture and marketing of vehicles including consulting services; as well as the sale of parts,

servicing and automotive brand activities from which the Group derives its revenues.

Revenue