southeastern geographer, 49(2) 2009: pp. 108–131

Florida Hurricanes and Damage Costs

JILL MALMSTADT

Florida State University

KELSEY SCHEITLIN

Florida State University

JAMES ELSNER

Florida State University

Florida has been visited by some of the most de-

structive and devastating hurricanes on record in

the United States causing well over $450 billion in

damage since the early 20

th

century. The value of

insured property in Florida against windstorm

damage is the highest in the nation and on the

rise. The frequency and severity of hurricanes af-

fecting Florida are examined from the best set of

available data and the damages are related to

characteristics of the storms at landfall. Results

show that normalized losses are increasing over

time consistent with small increases in hurricane

intensity and hurricane size. The best predictor

of potential losses is minimum central pressure.

Hurricane size alone or in combination with hur-

ricane intensity does not improve on the simpler

relationship. An estimate of potential losses from

hurricanes can be obtained using a formula in-

volving only a forecast of the minimum pressure

at landfall. The ability to estimate potential losses

in Florida will increase the ability to estimate

losses in other areas of the United States, and will

also allow policy makers and insurance com-

panies to provide relevant information to the con-

cerned public.

key words: Florida, hurricanes, landfall,

insurance, losses, trends, correlation

introduction

The hurricane is an awesome, yet deadly

and destructive natural phenomenon of

the Earth’s occasionally tumultuous atmo-

sphere. A hurricane is powered by the heat

and moisture of the tropical oceans rather

than thermal contrasts across latitudes as

is the case for the more common extra-

tropical cyclone. The result is a powerful

storm, causing unprecedented amounts of

deaths and economic loss. Dollar losses

from hurricanes are at the top of the list of

catastrophic events ahead of tornadoes

and terrorism. Not surprisingly, because of

its location relative to the warm waters of

the North Atlantic (including the Gulf of

Mexico and the Caribbean Sea), Florida is

more likely to get hit by a hurricane than

any other state in the union. On average at

least one hurricane strikes Florida every

two years and a strong hurricane hits Flor-

ida on average once every four years (aver-

ages come from available data during

1900–2007). Eight of the 10 most expen-

sive hurricanes ever to make landfall in

U.S. history have had at least some affect

on Florida, causing in excess of $60 billion

(constant 2005 dollars) in insured losses

Hurricanes and Damage Costs 109

(hurricanes Andrew 1992, Charley, Fran-

ces, Ivan and Jeanne in 2004, and Katrina,

Rita, and Wilma in 2005). For this reason,

as well as the devastating impact these

storms have on human lives, scientists have

been tackling the issue of hurricanes in

order to further understand their charac-

teristics and better predict their impending

impact on the coastline ahead. This paper

will focus on economic loss in the state of

Florida, as Florida represents a unique case

study for hurricane science.

Interest in economic loss from hur-

ricanes is not new, as it was discussed

throughout the 1960s (Demsetz 1962;

Sugg 1967), but interest has become ele-

vated in recent times due to the destruc-

tive Atlantic hurricane seasons of 2004

and 2005.

The most damage-causing characteris-

tics of a hurricane are the high winds,

storm surge and large waves, as they each

have potential for total destruction of prop-

erty and livelihoods (Williams and Duedall

1997). This potential for damage has re-

cently increased due, in part, to a notable

rise in global atmospheric temperatures.

The issue of climate change brings

along a challenge to hurricane research-

ers, as attempts are made to try to quan-

tify the impact of climate change on the

future of hurricanes. While many other

factors play a role in hurricane develop-

ment and intensity, the increasing sea sur-

face temperatures associated with climate

change provide an obvious increase of fuel

for these storms and a heightened cause

for alarm. Elsner et al. (2008) found an

increasing trend in the strength of the

strongest hurricanes, especially the 90

th

percentile, meaning, in short, the strong-

est storms are getting stronger. Emanuel

(2005) uses the observed increase in sea

surface temperature to explain the in-

crease in power dissipation within the av-

erage North Atlantic hurricane and found

that tropical cyclones have become more

destructive within the last 30 years. The

combination of increasing storm strength

and coastal develop ment should yield in-

creasing economic loss due to hurricanes.

Changnon (2003) believes that coastal de-

velopment is the main reason for recent

increasing economic loss, as the increase

in losses throughout the 1990s occurred

when hurricane frequencies decreased;

the data showing no shift due to global

warming. That is not to say that weather

extremes do not cause notable increases in

economic loss, as the active weather of

1991–1994 and associated hurricanes, se-

vere storms, floods, tornadoes, etc. caused

more economic loss due to weather events

than any other four-year period. Yet still,

the largest increases occurred in areas with

the greatest population growth (Chang-

non 1997).

Florida, like most of the coastal United

States, has seen a building boom, and the

increasing population and wealth is forc-

ing insurers and re-insurers to rethink

their exposures. According to the U.S.

Census Bureau, Florida has the highest

population growth among states affected

by hurricanes and is expected to gain

about 13 million residents between 2000

and 2030. The Citizens Property Insurance

Corporation in Florida (aka, Citizens), set

up by the State of Florida in 2002 to be the

property insurer of last resort, is now the

largest provider of property insurance in

the state. Florida homeowners can buy

coverage from Citizens if the rates for a

comparable policy from a private insurer

exceed by 15 percent Citizens’ rates.

According to the Insurance Informa-

110 ji l l m a lmstadt, k e l s e y sch e i t l i n, an d j a m es el s n e r

tion Institute (Hartwig 2008), the value of

insured coastal property in Florida ranks

first in the nation and, as of 2007, exceeds

$2 trillion with about 60 percent in com-

mercial exposure and the rest in residen-

tial exposure (AIR 2005). Florida home-

owner insurers’ underwriting losses in

2004 ($9.3 billion) and 2005 ($3.8 bil-

lion) resulted in a four-year cumulative

loss of $6.7 billion, even after including

the profitable years of 2006 ($3 billion)

and 2007 ($3.4 billion), when there were

no hurricanes (Hartwig 2008). Since 1992,

Florida insurers have experienced a net

loss of $6.2 billion (Hartwig 2008).

Citizens’ total exposure to loss is high

and growing, increasing from $154.6 bil-

lion in 2002 to $434.3 billion during the

first quarter of 2007 (Insurance Informa-

tion Institute 2007). The number of pol-

icies written by Citizens is also on the rise

with the total reaching 1.35 million as of

July 31, 2007. If losses by Citizens exceed

its claim-paying capacity in a single sea-

son, the state is required to impose an as-

sessment on other lines of insurance, in-

cluding policies not written by Citizens.

Loss assessments (collected from all in-

sured property owners from the entire

state), general revenue appropriations,

and the reinsurance market can be aug-

mented with the issuance of catastrophe

bonds. Catastrophe bonds help alleviate

the risk of a catastrophic event by transfer-

ring some of that risk to investors. In July

of 2007, Citizens floated a catastrophe

bond worth nearly $1 billion, and in July

of 2008, Berkshire Hathaway, Inc. agreed

to buy $4 billion in bonds if Citizens incurs

at least $25 billion in losses. The state has

estimated the probability of this level of

damage occurring annually in the state of

Florida to be about 3.1 percent per year. In

2008, in exchange for taking on this risk,

Florida will pay Berkshire Hathaway, Inc.

$224 million for a guarantee that the state

will receive up to $4 billion if the damage

threshold is reached (Kaczor 2008). Large

investors are becoming increasingly in-

terested in catastrophe bonds and other

insurance-linked securities because of their

low correlation to traditional financial

market performance providing a better di-

versification of investment portfolios.

This paper provides a climatology of

hurricanes and hurricane losses in Florida.

It is hypothesized that hurricane intensity

is a predictor of total economic loss due

to hurricane landfalls. The purpose is to

build a foundation for assessing the likeli-

hood of future hurricane losses. The strat-

egy is to graph and tabulate the historical

record of hurricane strikes and their asso-

ciated damage costs, and examine how the

statistics of occurrence, intensity, and size

are related to losses. Although others have

examined damage losses from hurricanes

(Katz 2002; Pielke et al. 2008; Jagger et

al. 2008), this work is the first to look

at the problem focusing exclusively on

Florida.

The paper begins with a brief descrip-

tion of the data sets followed by an exam-

ination of Florida’s hurricane statistics

from the period 1900–2007. Inter-annual,

seasonal, and intra-seasonal variability of

various hurricane characteristics are ex-

amined first. Then the distributions and

temporal variations of the direct damage

costs associated with Florida hurricanes

are considered. To bring together geophys-

ical and economic issues, relationships be-

tween losses and hurricane characteristics

are examined. It is found that historical

losses correlate best with minimum cen-

tral pressure alone.

Hurricanes and Damage Costs 111

florida hurricane

and loss data

This study relies on two principal sources

of data. For hurricanes affecting Florida,

we use the list of historical hurricanes em-

ployed to evaluate a risk model developed

by the Florida Commission on Hurricane

Loss Projection Methodology (FCHLPM)

and supported by a research grant from the

Florida Office of Insurance Regulation

(FOIR). A hurricane is a tropical cyclone

with maximum sustained wind speeds of at

least 33 m/s (64 kt/74 mph). The data set

largely conforms to the U.S. National Hur-

ricane Center’s HURDAT storm archive

(Ho et al. 1987; Landsea et al. 2004), but in-

cludes storms only for the state of Florida.

This dataset is available online at http:

//www.aoml.noaa.gov/hrd/lossmodel/

AllFL.html.

The focus here is on hurricanes that di-

rectly strike Florida. A direct strike (or hit)

is one in which all or part of the hurri-

cane’s eye wall reaches the coast. For this

work, the Florida coast is defined as the

boundary of the sea with the mainland,

including all barrier islands surrounding

Florida. For the purposes of this study, hur-

ricanes that approach Florida, but where

the eye wall remains out at sea (e.g., Hur-

ricane Elena in 1985) are not considered

directly striking Florida. A direct strike in-

cludes landfalling hurricanes and those

that hit the islands making up the Florida

Keys.

A hurricane can make more than one

direct hit on the state. This occurs for in-

stance when it first strikes the peninsula

then moves out over the eastern Gulf of

Mexico before striking the panhandle re-

gion (e.g., Storm #3 in 1903). Since a hur-

ricane weakens over land, the intensity of

the hurricane at second landfall is typ-

ically less than at first landfall. That said,

most of the descriptive statistics presented

in this study are based on characteristics at

the time of first landfall, which for our pur-

poses, is defined as the first direct strike

to the mainland or a direct hit to the Flor-

ida Keys only if the hurricane makes no

other landfall in the state. If the hurri-

cane makes landfall in the state more than

once, the landfall characteristics at max-

imum intensity are used because this com-

parison is between loss data and hurricane

characteristics, and the majority of losses

come from the strike of greatest intensity.

For losses incurred by hurricanes that

directly strike Florida, normalized damage

data are taken from the work of Pielke et al.

(2008). There are two normalization pro-

cedures presented in Pielke et al. (2008),

both of which are estimates of the damage

that would have occurred if historic hur-

ricanes struck in the year 2005. One pro-

cedure allows for changes in inflation,

wealth, and population, and the other pro-

cedure allows for inflation, wealth, and an

additional factor that represents a change

in the number of housing units that exceed

population growth between the year of the

loss and 2005. The methodology produces

a longitudinally consistent estimate of eco-

nomic damage from past tropical cyclones.

Losses caused by each storm event are ag-

gregated from around the entire state and

do not necessarily cluster around the loca-

tion of landfall. However, it is well known

that the amount of damage experienced is

highly dependent upon where the storm

makes landfall in terms of buildings, in-

frastructure, population, and so forth. Al-

though this research focuses on aggre-

gated loss values, it is useful because it

provides a general understanding of the

112 ji l l m a lmstadt, k e l s e y sch e i t l i n, an d j a m es el s n e r

1900 1940 1980

0

1

2

3

4

Year

Annual Count (1900−2007)

a

024

Hurricane Events

Number of Years

0

10

20

30

40

50

60

b

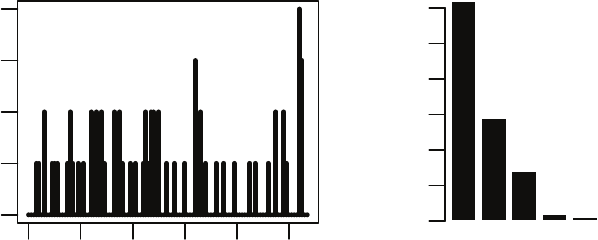

Figure 1. Florida’s annual hurricane occurrence (1900–2007). (a) Time series of annual Florida

hurricane counts. Only storms that made a direct strike on Florida with hurricane-force winds and

that have available economic loss values are included. (b) Distribution of annual Florida counts. There

are a total of 67 known Florida hurricanes in the 108-year period.

economic losses experienced throughout

Florida from 1900 to 2007.

hurricane statistics

The analysis begins with an examina-

tion of the frequency of Florida hurricanes.

Here the record starts with the 1900 sea-

son and ends after the 2007 season. Note

that these economic loss data are referred

to as losses and damage costs interchange-

ably throughout this study. A Florida hur-

ricane is a tropical cyclone that makes at

least one direct strike on the state as a hur-

ricane. A hurricane that makes more than

one landfall in the state of Florida (e.g.

Storm #3 in 1903) is considered and

counted as one, single Florida hurricane.

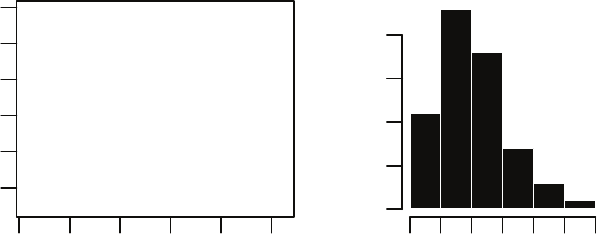

Figure 1 shows the time series and dis-

tribution of annual Florida hurricanes over

the 108-year period. There are a total of 67

Florida hurricanes. There are 62 years

without a Florida hurricane and one year

(2004) with 4 different hurricanes affect-

ing the state. There are more years without

Florida hurricanes during the second half

of the 20

th

century (Elsner et al. 2004).

Approximately 16 percent of the years

have more than one hurricane event. The

average annual number of Florida hur-

ricanes is 0.62 hur/yr with a variance of

0.72 (hur/yr)

2

. Assuming that hurricane

occurrence in Florida follows a Poisson dis-

tribution similar to the climatological rec-

ord for the rest of the United States af-

fected by hurricanes (Elsner and Jagger

2006), this translates into a 46 percent

chance that Florida will be hit by at least

one hurricane each year.

Florida’s hurricane season runs from

the beginning of June through the end of

November (even though storms occasion-

ally occur outside this season), but the

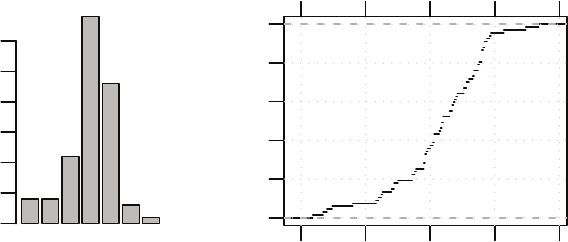

most active months are September fol-

lowed by October (Figure 2). In fact, twice

as many hurricanes have hit Florida in Oc-

tober than in August. Collectively the

months of June, July, and November ac-

Hurricanes and Damage Costs 113

Monthly Count (1900−2007)

0

5

10

15

20

25

30

J J A S O N D

a

150 200 250 300 350

0.0

0.2

0.4

0.6

0.8

1.0

Julian Day

Cumulative Distribution

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Jun. 1 Sep. 8 Dec. 17

b

Figure 2. Florida’s intra-seasonal hurricane occurrence. (a) Monthly counts and (b) cumulative

distribution function (CDF) of Florida hurricanes.

count for about 16 percent of all Florida

hurricanes while August, September, and

October account for the remaining 84 per-

cent. Yet the monthly distribution does not

tell the entire story; another way to look at

intra-seasonal activity is with the cumula-

tive distribution function (CDF). The CDF

suggests a division of the season into four

distinct periods. The periods are marked

by a nearly straight line on the CDF indi-

cating a constant probability of observing

a hurricane during the period, but the pe-

riods do not have equal lengths. The early

period runs from 1 June through 31 July.

The early mid period (with a steeper slope

on the CDF) runs from 1 August through

about 5 September. The mid-season pe-

riod, featuring the highest probability of

observing a Florida hurricane, runs from 6

September through 25 October, although

there is a slight break in activity during

late September and October (represented

by a small line just prior to Julian Day 300

in Figure 2). The late period runs from

26 October through the end of November.

The 1

st

quartile, median, and 3

rd

quar-

tile dates are 242, 260, and 284, respec-

tively. This implies that only 25 percent of

the Florida hurricane season is typically

complete by 31 August, half the season is

complete by 18 September, and 75 percent

of the season is over by 12 October. The 1

st

quartile date, 31 August, falls into the sec-

ond period (early-mid) established by the

CDF. As expected, the median date, 18

September, falls during the mid-season

period established by the CDF, which is

slightly more than a week after the median

date for all Atlantic hurricanes (Elsner and

Kara 1999). The 3

rd

quartile date, 12 Octo-

ber, also falls into this mid-season period.

None of these dates fall into the late period

established by the CDF showing that, for

this sample of Florida hurricanes, the ma-

jority of the season is over by 12 October.

When comparing this seasonality of

Florida hurricanes to the remainder of the

United States coastline, Florida stands as

unique. Coasts that are affected by Atlantic

hurricanes extend from Texas to Maine,

114 jill ma l m s ta d t , kels e y s c heitli n , a nd jam e s e lsner

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 22

Annual Sequence Number of a Florida Hurricane

Frequency

0

2

4

6

8

10

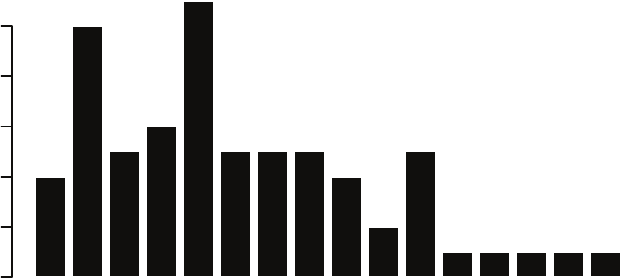

Figure 3. Florida’s occurrence of hurricanes by sequence number. The number refers

to the sequence of tropical storms and hurricanes within a season, where 1 is the

first named tropical cyclone of the season.

and have been regionalized into four areas

for comparison purposes. The first region

extends from Texas to Alabama, and the

second region consists of only Florida. The

third and fourth regions consist of the en-

tire eastern coast beginning with Georgia

and ending at Maine, and are separated at

the state of Virginia. It is found that for all

regions, the month of highest hurricane

occurrence is September. The main differ-

ence between Florida and the other re-

gions is that Florida experiences hurri-

canes during the entire span of the Atlantic

hurricane season with a median date of 18

September, while the other regions experi-

ence hurricane seasonality of a different

scale. Region 1 experiences hurricanes from

June through October with a median date

of 30 August. Region 3 is affected by storms

from July through November and has a me-

dian date of 4 September, and the northern

most region, region 4, experiences storms

during the shortest amount of time than

any other region, July through September

with a median date of 11 September. Flor-

ida, therefore, is unique in its susceptibility

to hurricanes because it experiences a

much longer season than other regions,

and it experiences more storms later in the

year than any other region as its median

landfall date is later than anywhere else.

It is interesting also to consider which

tropical storm of the season is most likely

to strike Florida. Figure 3 shows the dis-

tribution of storm numbers associated

with Florida hurricanes. Storm number re-

fers to the sequence of tropical storms and

hurricanes within a season, with the first

named tropical cyclone being storm one.

The plot shows that historically the most

likely hurricane to affect Florida is the 5

th

tropical cyclone of the season followed, in

likelihood, by the 2

nd

tropical cyclone.

Florida has seen every sequence number

through 15. The highest sequence number

(22) was Hurricane Wilma in 2005. There

were a record 27 tropical storms and hur-

ricanes during this remarkable season.

Hurricanes and Damage Costs 115

1900 1920 1940 1960 1980 2000

900

920

940

960

980

Year

Min. P (hPa)

a

Min. P (hPa)

Frequency

900 940 980

0

5

10

15

b

1900 1920 1940 1960 1980 2000

80

100

120

140

Year

Max. Speed (kt)

c

Max. Speed (kt)

Frequency

60 80 100 120 140

0

5

10

15

d

Figure 4. Florida’s hurricane intensity at time of landfall (1900–2007). (a) Time series of minimum

central pressure (hPa) and (b) distribution of minimum central pressure. (c) Time series of maximum

wind speed (kt) and (d) distribution of maximum wind speed.

The average intensity (as measured by

the minimum central pressure) of Florida

hurricanes at the time of first landfall is 966

hPa (millibars), and 90 kts as measured by

the maximum wind speed. The average in-

tensity of Florida hurricanes at second land-

fall is 981 hPa (75 kt). All five of the second

landfalls (for storms striking Florida more

than once) occurred over the northwestern

part of the state. These five events have a

mean central pressure at first landfall of 970

hPa showing that, for these five storms, the

average difference between first and sec-

ond landfall is +11 hPa. This increase in air

pressure from first to second landfall in-

dicates a decrease in intensity for these

storms. The lowest pressure of any Florida

hurricane is 892 hPa, which occurred with

the Labor Day hurricane of 1935 that de-

molished the middle Florida Keys.

Figure 4 shows the time series and his-

togram of minimum central pressures and

wind speeds at landfall. If the hurricane

made more than one landfall (or Keys

crossing), the highest intensity (lowest

pressure and highest wind speeds) is used.

There appears to be no obvious long-term

trend in these variables for this sample of

Florida hurricanes. The distributions are

skewed (negatively for pressure and posi-

tively for wind speed) as expected from a

set of data representing a threshold pro-

cess (only cyclones at hurricane intensity

are considered).

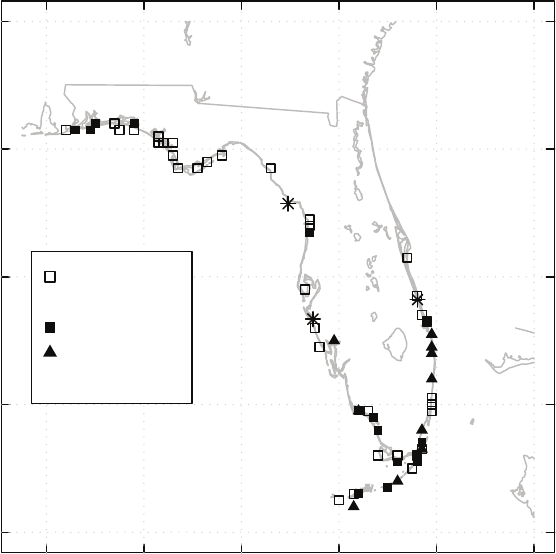

Locations of hurricane landfalls are

shown in Figure 5. The points delineate

where the eye crossed the shore (or crossed

the Keys). Symbols signify intensity as de-

termined by the maximum wind speeds

and grouped by the Saffir/Simpson cate-

116 j ill ma l m s ta d t , kels e y s c heitl i n , a nd ja m e s e lsner

−88 −86 −84 −82 −80 −78

24

26

28

30

32

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

−88 −86 −84 −82 −80 −78

24

26

28

30

32

Sarasota−−−

Cedar Key−−−

−−−Vero Beach

●

●

64−83 kt

83−96 kt

96−114 kt

114−135 kt

> 135 kt

°°N

°°W

Figure 5. Florida hurricane landfalls 1900–2007. The locations indicate the landfall (or Key crossing)

locations, including second landfalls. The symbols denote hurricane intensity as measured by the

maximum wind speed and categorized by the Saffir-Simpson hurricane damage potential scale. A

notable lack of hurricane strikes have occurred along the peninsula north of Cedar Key. All of the

strongest hurricanes (Category 4 & 5) have occurred south of a line from Sarasota to Vero Beach.

gories. Landfalls are more common over

the southern half of the peninsula includ-

ing the Keys and along the panhandle.

There is a notable lack of hurricane strikes

along the northeast coast and around the

western peninsula north of Cedar Key. All

of the strongest hurricanes (categories 4

and 5, having wind speeds of 114 kt or

greater) have occurred south of a line from

Sarasota to Vero Beach.

The size of hurricanes directly affecting

Florida varies from storm to storm. Figure

6 shows the time series and distribution of

the radius of maximum wind (RMW) at

landfall as an indication of hurricane size.

Five of the 67 Florida hurricanes do not

Hurricanes and Damage Costs 117

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●●

●

●

●

●

●

●

●

●

●

●

●●

●

●

●

●

●

●

●

● ●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

1900 1940 1980

20

40

60

80

100

120

Year

Radius of Max. Winds (km)

a

Radius of Max. Winds (km)

Frequency

0 20 60 100

0

5

10

15

20

b

Figure 6. Florida’s hurricane size at time of landfall (1900–2007). (a) Time series of radius of

maximum wind (km) and (b) distribution of the radius.

have a value for RMW. The variation in

size is quite large but there appears to be

a modest trend toward larger hurricanes.

The average size is 41 km (radius) with a

variance of 434 km

2

. The distribution is

positively skewed with most hurricanes

having an RMW between 20 and 60 km,

and only a few greater than 80 km. Histor-

ically, the smallest storm was Hurricane

Charley (2004) at 8 km and the largest

was Hurricane Earl (1998) at 119 km.

damage statistics

The data on damage losses from hur-

ricanes are taken from Pielke et al. (2008).

The values represent the total estimated

economic damage amounts normalized to

2005 dollars. The values are based on total

damage estimates as opposed to insured

loss figures. Economic damage is the di-

rect loss associated with a hurricane’s im-

pact. It does not include losses due to busi-

ness interruption or other macroeconomic

effects including increases in demand for

construction materials and other house-

hold items. Total damage costs are twice

the estimated insured damage costs. De-

tails and caveats of the normalization pro-

cedure are provided in Pielke et al. (2008).

The complete set of data used in this study

is provided as an Appendix. It should be

noted that prior to 1940, 32 storms made

landfall somewhere on the United States’

coastline with no reported damages, where

only 8 such storms have occurred since

1940 (Pielke et al. 2008). Some damage

likely occurred during all early 20

th

century

storms but the lack of data probably results

in an undercount of the overall economic

loss from the storms affecting the United

States prior to 1940, and, if at least one

hurricane strikes Florida every two years,

there is an undercount of overall damage

in Florida prior to 1940 as well.

There are two sets of damage estimates

based on slightly different normalization

procedures provided in Pielke et al. (2008).

The two approaches are the methodology

used by Pielke and Landsea (1998), which

adjusts for inflation, wealth, and popula-

tion updated to 2005, and the methodol-

118 j i l l m almstadt, k e l s ey sc h e i t l in, an d j a mes el s n e r

ogy used by Collins and Lowe (2001),

which adjusts for inflation, wealth, and

housing units updated to 2005 (Pielke et

al. 2008). Pielke et al. (2008) have taken

the methodologies given by Pielke and

Landsea (1998) and Collins and Lowe

(2001) and have slightly adjusted their

methodologies to be appropriate for 2005

dollars. Here we focus on the data set from

the Collins and Lowe methodology, but

note that both data sets are quite similar. In

both cases, researchers have estimated to-

tal dollar value of damage that historic

storms would have caused had they oc-

curred in 2005—given all the growth and

development that has taken place since

these historical storms occurred. The Col-

lins and Lowe methodology produces a

temporally consistent estimate of eco-

nomic damage from past tropical cyclones

affecting the U.S. Gulf and Atlantic coasts.

Results presented in this study are not sen-

sitive to the choice of data set. The Collins

and Lowe methodology is used for this

study, as opposed to that of Pielke and

Landsea, because the housing unit variable

included in Collins and Lowe is more rele-

vant when dealing with economic loss than

population statistics. The Collins and Lowe

(2001) values, adjusted to 2005 dollars in

Pielke et al. (2008), are presented in our

Appendix under the Damage column.

Table 1 lists the top ten all-time hur-

ricane loss events in Florida since 1900.

The damage amount (loss) is in billions of

U.S. dollars. Fourteen of the 67 Florida

hurricanes do not have an estimated loss

value for unknown reasons. Topping the

list is the Great Miami Hurricane of 1926

with an estimated total damage to Florida

of $129 billion. Again, this dollar figure

represents an estimate of the total damage

if the same cyclone were to have hit in

Table 1. Top ten loss events from Florida

hurricanes (1900–2007). Damage amount is in

billions of U.S. dollars, normalized to the dollar

value of 2005. Loss values come from the

adjustments made to Collins/Lowe (2001)

presented in Pielke et al. (2008).

Rank Storm Year Region

Loss

($bn)

1 Great Miami 1926 SE 129.0

2 Andrew 1992 SE 52.3

3 Storm # 11 1944 SW 35.6

4 Lake Okeechobee 1928 SE 31.8

5 Donna 1960 SW 28.9

6 Wilma 2005 SW 20.6

7 Charlie 2004 SW 16.3

8 Ivan 2004 NW 15.5

9 Storm # 2 1949 SE 13.5

10 Storm # 4 1947 SE 11.6

2005. Hurricane Andrew, which hit south-

east Florida in 1992, comes in second with

a damage tag of $52.3 billion if it would

have hit in 2005. Note that 3 of the top ten

costliest Florida hurricanes occurred in

2004 and 2005.

The total normalized losses for the 53

Florida hurricanes (for which contempo-

rary damage estimates are available) would

be $459 billion if these storms occurred in

2005. Eighty percent of this total is from the

top 11 (21 percent) storm event losses. The

median loss amount is $2.21 billion, but the

95th percentile value is $33.3 billion. Figure

7 shows the time series and histogram of

hurricane damage losses in the state of Flor-

ida since 1900. The distribution is highly

skewed with many relatively small losses

and few very large losses. The Great Miami

Hurricane of 1926 is clearly the worst loss

event (normalized) in Florida since 1900.

There are two years with total losses of less

Hurricanes and Damage Costs 119

1900 1920 1940 1960 1980 2000

0

20

40

60

80

100

120

Year

Damage (2005 $US bn)

a

Damage (2005 $US bn)

Frequency

0 50 100 150

0

10

20

30

40

b

1900 1920 1940 1960 1980 2000

7

8

9

10

11

Year

Log Damage (2005 $US bn

)

c

Log Damage (2005 $US bn)

Frequency

6 7 8 9 10 11

0

2

4

6

8

10

12

d

Figure 7. Florida’s hurricane damage losses (1900–2007). (a) Time series and (b) distribution of

losses by event and (c) time series and (d) distribution of the logarithm (base 10) of losses. Some years

are without loss events.

than $15 million. The Insurance Service Of-

fice (ISO), a private corporation that pro-

vides information about risk assessment,

defines a catastrophe as an event that causes

more than $25 million in insured ($50 mil-

lion total) losses and causes a major disrup-

tion (Insurance Information Institute

2008). Of the Florida hurricanes that have

available economic loss values, 96 percent

of the events were above this $50 million

threshold. There are only two storms of the

53 in this sample that do not have losses

exceeding this amount, and they are Flor-

ence (1953) and Floyd (1987).

A good way to examine skewed distri-

butions is to use logarithms. Figure 7c

shows the time series and histogram after

taking the logarithm (base 10) of each an-

nual loss amount. In this figure, a value of

nine indicates a billion dollar loss, a value

of 10 indicates a $10 billion loss, and a

value of 11 indicates a $100 billion loss.

Consistent with the modest increase in size

for hurricanes affecting Florida seen in the

previous section, there appears to be a

slightly increasing trend in the upper and

lower quartile amounts of normalized

damage since 1900, although these

slightly increasing trends are not statis-

tically significant.

To estimate the annual probability of

yearly losses exceeding specified amounts

the normalized data are fit to a model. The

model consists of the generalized Pareto

distribution (GPD) to describe the behav-

ior of extreme losses and the Poisson dis-

tribution to specify the rate of loss years

above a given threshold level (Jagger and

Elsner 2006). Here the threshold value is

set at $250 million as a compromise be-

120 ji l l m a lmstadt, k e l s e y sch e i t l i n, an d j a m es el s n e r

Annual Probability

Loss Exceedance (bn)

$0.1

$1

$10

$100

0% 5% 10% 15% 20%

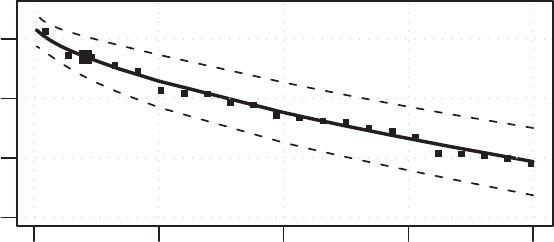

Figure 8. A model for Florida’s hurricane damage losses. The solid curve is based on using a generalized

Pareto distribution for describing the magnitude of yearly total loss amount and a Poisson distribution

for the number of years exceeding a threshold loss amount of $250K. The dashed lines are the upper

and lower 95 percent confidence limits on the loss model. The small boxes are empirical estimates of

the loss amount and the large box corresponds to a total loss of $25 bn. The empirical estimates are

based on 1-e

[-

a

*(rank-0.5)/M]

, where

a

is the number of years with losses (M) divided by the total number

of years (N), and rank is the order of losses, with a rank of 1 being the greatest loss.

tween being low enough to retain enough

years to estimate the parameters of the

GPD, but high enough so that the yearly

loss amount (exceedance) follows a GPD

(Jagger and Elsner 2006). The model spe-

cifies exceedance loss levels as a function

of annual probabilities.

Figure 8 shows the model as a curve on

a semi-log plot; the higher the annual loss,

the lower the probability of occurrence.

The model indicates a 5 percent chance of

losses exceeding about $19.6 billion on an

annual basis and a 10 percent chance of

losses exceeding $5.8 billion. Finally, Flor-

ida can expect a storm to produce at least

$1 billion in damage once every five years

(a probability of 20 percent in any given

year). According to the model, a loss of at

least $25 billion occurs with an annual

probability of about 2.1 percent, which is a

percentage point below the state’s esti-

mate of 3.1 percent mentioned in the

Introduction. Although this difference is

not statistically significant it shows that

the state of Florida estimates their cata-

strophic losses ($25 billion +) to occur a

bit more often than this model suggests.

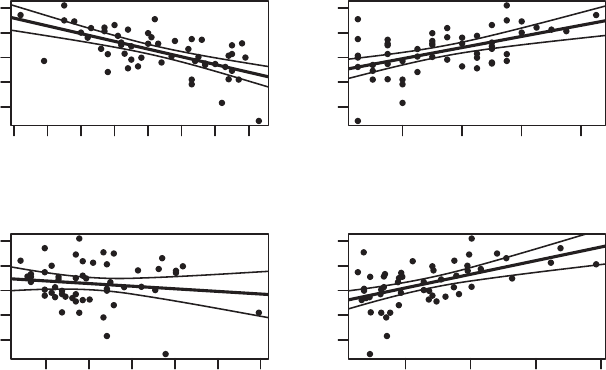

trends and associations

As seen in the previous section, there

appears to be increasing trends in the size

and intensity of Florida hurricanes and in

normalized damage costs. To examine these

observations in more detail, trends are com-

puted and examined using ordinary least

squares regression and quantile regression

(Elsner et al. 2008). Ordinary regression is a

Hurricanes and Damage Costs 121

1900 1940 1980

920

930

940

950

960

970

980

990

Year

Min. P (hPa)

a

1900 1940 1980

80

100

120

140

Year

Max. Speed (kt)

b

1900 1940 1980

20

40

60

80

100

120

Year

Radius of Max. Wind (km)

c

1900 1940 1980

7

8

9

10

11

Year

Log Damage (2005 $US bn

)

d

Figure 9. Florida’s hurricane trends (1900–2007). (a) minimum central pressure, (b) maximum wind

speed, (c) radius of maximum wind, and (d) logarithm of damage costs (losses). The thick line is the

trend in mean value. The upper, thin line is the trend in the upper quartile values for wind speed,

RMW, and damage cost and the lower quartile for central pressure. The lower, thin line is the trend in

lower quartile values for wind speed, RMW, and damage cost, and the upper quartile for central

pressure. The trend values and standard errors are given in Table 2.

model for the conditional mean, where the

mean is conditional on the value of the ex-

planatory variable. Quantile regression ex-

tends ordinary least-squares regression to

quantiles of the response variable. Quan-

tiles are points taken at regular intervals

from the cumulative distribution function of

a random variable. The quantiles mark a set

of ordered data into equal-sized data sub-

sets. Thus, quantile regression is a model for

the conditional quantiles. For trend analysis

the explanatory variable is year. Relation-

ships between hurricane characteristics and

losses are also examined.

Figure 9 shows the median and upper

and lower quartile trends in hurricane in-

tensity and size at landfall, and the corre-

sponding damage costs. Downward trends

are found in the mean and lower quartile

of minimum central pressures, and up-

ward trends are found in the mean and

upper quartile of maximum wind speeds,

both showing an increase in the strong-

est storms over time. An upward trend is

found in the upper quartile of the size of

Florida hurricanes. This indicates that on

average and for the strongest cyclones,

Florida hurricanes are getting more pow-

erful over time. Trend values along with

their associated standard errors are given

in Table 2. The relatively large standard

errors on the trends indicate the increases

in trend values shown in Table 2 are not

statistically significant against the null hy-

122 ji l l malmstadt , k e l sey sc h e i t lin, an d j ames el s n e r

Table 2. Trend statistics and standard error

(1900–2007). The lower quartile of the pressure

trend corresponds to the upper quartile of

damage cost trend.

Minimum Central Pressure (hPa/yr)

Trend S.E.

upper quartile 0.000 0.0367

mean –0.064 0.0687

lower quartile –0.083 0.0918

Maximum Wind Speed (hPa/yr)

Trend S.E.

upper quartile +0.091 0.1403

mean +0.094 0.0787

lower quartile 0.000 0.1225

Radius to Maximum Wind (km/yr)

Trend S.E.

upper quartile +0.318 0.1038

mean +0.093 0.0865

lower quartile –0.204 0.0614

Log Damage Costs (/yr)

Trend S.E.

upper quartile +0.0042 0.00398

mean +0.0018 0.00408

lower quartile +0.0056 0.00356

pothesis of no trend. However, the upward

trends in the 25

th

and 75

th

percentiles of

damage costs might be associated with the

upward trends in the power characteris-

tics of hurricanes as seen in the previous

section.

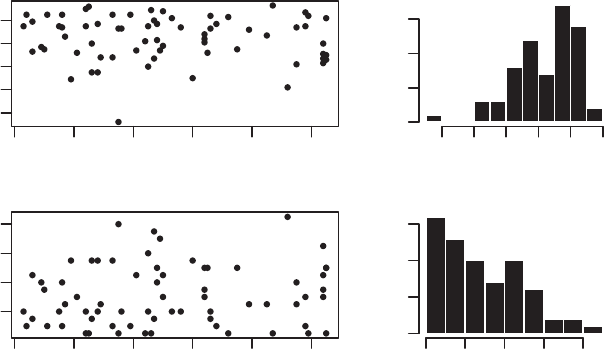

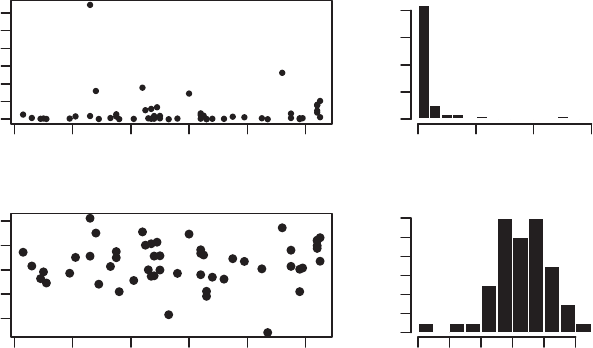

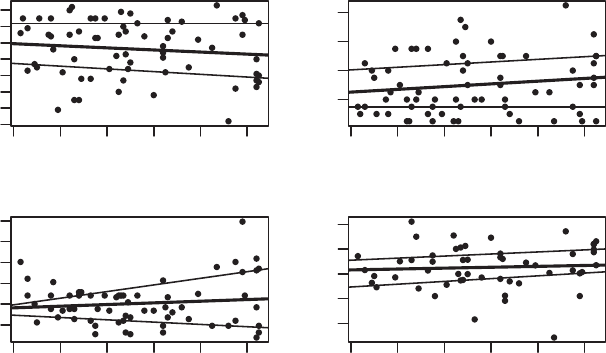

Figure 10 shows a scatter plot matrix

along with regression lines of damage costs

as a function of hurricane characteristics.

It is clear that there is a statistically signifi-

cant relationship between the intensity of

the hurricane at landfall and the amount of

damage. This strong relationship is seen

using either minimum central pressure or

maximum wind speed as the indicator of

hurricane intensity. However, the rela-

tionship between damage amount and

hurricane size is much less clear. In fact,

the weak negative relationship is counter-

intuitive as the larger hurricanes are asso-

ciated with somewhat less damage. This

somewhat puzzling observation can be ex-

plained by the fact that hurricane intensity

is inversely related to hurricane size for this

set of hurricanes. Thus the larger hur-

ricanes tend to be weaker and thus cause

less damage.

It has been suggested that estimations

of potential losses from hurricanes com-

bine intensity and size characteristics

(Kantha 2006). The Carvill Hurricane In-

dex (CHI), discussed in Kantha (2006),

determines a numerical measure of the

potential for damage from a particular

hurricane event. On the Chicago Mercan-

tile Exchange, the CHI is used as the basis

for trading hurricane futures and for trad-

ing options about how best to mitigate the

storms, and captures this idea using the

following equation:

CHI = (v/v

o

)

3

+ 1.5 (r/r

o

) (v/v

o

)

2

(1)

where v is the maximum wind speed (kt),

v

o

is the threshold hurricane-wind speed

(64 kt), r is the radius of threshold hurri-

cane-wind speed or greater (km), and r

o

is

the threshold radius (97 km). To obtain r,

a form of the Rankine vortex equation is

used to obtain the radial decay of the

winds from their maximum value (Hol-

land 1980). The equation is given by:

r = r

max

(v/v

o

)

1.5

(2)

The CHI is computed from the set of

Florida landfalling characteristics. As ex-

pected, the relationship between damage

Hurricanes and Damage Costs 123

920 940 960 980

7

8

9

10

11

a

Minimum Central Pressure (hPa)

Log Damage (2005 $US bn

)

80 100 120 140

7

8

9

10

11

b

Maximum Wind Speed (kt)

Log Damage (2005 $US bn

)

20 40 60 80 100 120

7

8

9

10

11

c

Radius to Maximum Winds (km)

Log Damage (2005 $US bn

)

5 10 15 20

7

8

9

10

11

d

Carvill Hurricane Index

Log Damage (2005 $US bn

)

Figure 10. Scatterplot matrix of damage costs and hurricane characteristics. Logarithm of damage cost

as a function of (a) minimum central pressure, (b) maximum wind speed, (c) radius to maximum

wind, and (d) Carvill Hurricane Index. The thick line is the trend in mean value, the thin lines are the

95 percent confidence limits on the trend.

losses and the CHI is positive and signifi-

cant. However the relationship does not

appear to be stronger than either of the

intensity estimates alone. The strong link

between hurricane intensity and damage

cost coupled with the rather weak link

with hurricane size indicates that the

Saffir-Simpson hurricane scale, which is

based solely on wind speed, is, in large

measure, an adequate measure of poten-

tial damage amount, at least in Florida.

Yet based on the somewhat better correla-

tion of losses with minimum central pres-

sure (see Table 3), we argue that central

pressure be used as a single variable for

potential loss estimation.

For instance, regressing the logarithm

(base 10) of losses onto the minimum cen

tral pressure, an equation representing a

loss index for Florida, called the Florida

hurricane loss index (FHLI), is defined by

the following equation:

FHLI = 10

40.912-0.0329pmin

(3)

where p

min

is the minimum central pres-

sure in units of hPa forecast at landfall.

Values of FHLI are damage estimates ex-

pressed in dollar amounts. For multiple

landfalls the lowest minimum pressure is

used. This model (which is not applicable

for hurricanes that hit only the Florida

Keys) explains only 40 percent of the vari-

ability in the logarithm of Florida loss

amounts but compares favorably with the

CHI, which explains less than 28 percent

of the losses. Table 4 shows resulting ex-

124 jill m a l m s ta d t, ke l s e y scheit l i n , and ja m e s elsne r

Table 3. Correlation of hurricane characteristics

at landfall with damage costs (losses) based on

53 Florida hurricanes. Correlation coefficient r

and the associated 95 percent confidence interval

on that correlation under the null hypothesis of

zero correlation.

r 95% Confidence Interval

P min –0.59 (–0.74, –0.38)

W max +0.52 (+0.29, +0.70)

RMW –0.13 (–0.39, +0.14)

CHI +0.53 (+0.30, +0.70)

pected economic loss from the FHLI based

on the pressure categorization associated

with the Saffir-Simpson Scale (Kantha

2006). The expected losses do not reflect

future changes in wealth and inflation, nor

the expected increases in coastal develop-

ment. It is important to note that these loss

index values will be highly dependent

upon where the storm makes landfall and

the amount of development and popula-

tion in the affected area.

Of course, the actual amount of dam-

age a hurricane inflicts will also depend to

some extent on its forward speed and the

rate at which the wind subsides over land.

Neither of these characteristics are consid-

ered here, but have been analyzed else-

where. Huang et al. (2001) considers eco-

nomic loss as a function of the wind decay

rate, and Watson and Johnson (2004)

look at forward speed as one of the param-

eters of their hurricane loss estimation

models. These characteristics could be in-

cluded in this model in a future study to

try and increase its ability to explain the

variability in the logarithm of Florida loss

amounts.

summary

More hurricanes strike Florida than

anywhere else in the United States. Rec-

ords of Florida hurricanes have recently

been updated and are reliable back to

1900. This study examines various statis-

tics of hurricanes affecting the state over

the period 1900–2007 and their associ-

ated damage costs.

It is shown that the annual count of

Florida hurricanes is consistent with a ran-

dom Poisson process with a mean of 0.62

hurricanes per year that translates to an

annual probability of 46 percent for at

least one hurricane. Florida differs from

other regions of the United States in terms

of hurricane seasonality because it is af-

fected by storms throughout the entire At-

lantic hurricane season, and it experiences

storms later into the year than any other

area of the United States’ coastline.

Although the variability in the amount

of damage is quite large from one hurri-

cane to the next, normalized losses are in-

creasing over time, which is consistent

with the slight increases in hurricane in-

tensity and hurricane size. The model pro-

vided shows that on an annual basis, we

can expect a 10 percent chance of losses

exceeding $5.8 billion and a 5 percent

chance of losses exceeding $19.6 billion.

In addition, each year Florida has a 20 per-

cent chance of experiencing at least $1 bil-

lion in hurricane related losses; in other

words, the State can plan on at least $1

billion in losses once every five years.

Of the hurricane landfall characteris-

tics examined here, the best predictor of

potential losses is minimum central pres-

sure. Hurricane size by itself or in com-

bination with hurricane intensity does not

Hurricanes and Damage Costs 125

Table 4. Expected loss computed using the Florida Hurricane Loss Index based on categorical pressure

values presented by Kantha (2006). Approximate exponent values are x where FLHI = 10

x

. Expected

loss is given in US dollars, normalized to 2005 dollar amounts. These approximate losses do not reflect

future changes in wealth, inflation, and property, and are highly reliant on where the storm actually

makes landfall in terms of development and population.

Category

Pmin

Values

Approximate

Exponent Values (x)

Approximate Expected Loss

(Normalized 2005 $US)

1 989–980 8.40–8.69 $250 million–$499 million

2 979–965 8.70–9.17 $500 million–$1.49 billion

3 964–945 9.18–9.90 $1.50 billion–$7.99 billion

4 944–920 9.91–10.69 $8.00 billion–$49.99 billion

5 [920 ?10.70 ?$50.00 billion

improve on the simpler relationship. An

estimate of potential losses from hur-

ricanes can be obtained by a formula in-

volving only an estimate of the minimum

pressure at landfall. Expected economic

damage costs are computed using the

FHLI and categorized to provide a scale

similar to the Saffir-Simpson for economic

loss based on minimum central pressure.

In one sense Florida has been rather

fortunate. Although the 2004 and 2005

seasons featured 7 Florida hurricanes,

there are more years during the second

half of the record without a Florida hur-

ricane. Moreover, despite some large losses

since 1950, Florida has not seen a repeat,

in terms of losses, of the Great Miami Hur-

ricane (of 1926).

Florida, along with other coastal states,

is in a race to retrofit and harden its in-

frastructure before another major storm oc-

curs. Over the past 20 years alone, Hur-

ricane Andrew (1992) almost made a direct

hit on downtown Miami, Hurricane Floyd

(1987) made a last minute turn away from

the state, and Hurricane Charley (2004)

veered east and away from the Tampa Bay

area just hours before landfall. Had any of

these storms made direct strikes on urban

areas, they could have caused losses larger

than anything Florida has experienced to

date.

Recently, researchers have made im-

provements in understanding and predict-

ing hurricane intensity (Jones et. al 2006,

Davis et. al 2008), hurricane tracks (Bar-

ret et al. 2006), and seasonal hurricane

activity (Elsner and Jagger 2006). In com-

bination with this paper, better under-

standing of hurricane activity and result-

ing damage can better prepare coastal

communities with what to expect with

each approaching season, allowing for in-

formed decisions by their citizens, policy

makers and insurance agencies about the

future of Florida’s hurricane seasons and

the proper way to mitigate.

appendix

Year Region Seq Name Mo Da Lat Lon Wmax Pmin RMW Time SNBR Damage Code

1903 FLSE 3 Storm3 9 11 26.1 80.1 75 976 80 2300 397 5.2 billion 1

1903 FLNW 3 Storm3 9 13 30.1 85.6 80 975 NA 2100 397 NA 2

1904 FLSE 3 Storm3 10 17 25.3 80.3 70 985 NA 700 407 NA 1

1906 FLSW 2 Storm2 6 17 25.2 80.8 75 979 48 700 416 NA 1

1906 FLNW 6 Storm6 9 27 30.4 88.7 95 958 80 1200 420 NA 0

1906 FLSW 8 Storm8 10 18 25.1 80.8 105 953 64 1100 422 142 million 1

1909 FLSW 10 Storm10 10 11 24.7 81 100 957 40 1800 450 433 million 1

1910 FLSW 5 Storm5 10 18 26.5 82 95 955 23 600 456 814 million 1

1911 FLNW 2 Storm2 8 11 30.3 87.6 70 985 NA 2200 458 286 million 1

1912 FLNW 4 Storm4 9 14 30.4 88.4 65 990 48 800 466 NA 0

1915 FLNW 4 Storm4 9 4 30.1 85.4 80 975 NA 1000 480 NA 1

1916 FLNW 13 Storm13 10 18 30.3 87.4 100 974 35 1400 494 NA 1

1916 FLSW 14 Storm14 11 15 24.5 82 70 985 48 1800 495 NA 1

1917 FLNW 3 Storm3 9 29 30.4 86.7 85 966 61 300 498 NA 1

1919 FLSW 2 Storm2 9 10 24.4 81.7 115 929 27 400 505 720 million 1

1921 FLSW 6 TampaBay 10 25 28 82.8 90 952 34 1900 516 3.2 billion 1

1924 FLNW 4 Storm4 9 15 30.2 85.7 65 990 48 1500 531 NA 1

1924 FLSW 7 Storm7 10 21 25.9 81.4 80 975 35 300 534 NA 1

1925 FLSW 2 Storm2 12 1 27.2 82.5 65 992 NA 430 537 NA 1

1926 FLNE 1 Storm1 7 28 28.3 80.6 75 960 26 600 538 3.6 billion 1

1926 FLSE 6 GrtMiami 9 18 25.6 80.3 115 935 35 1200 543 129 billion 1

1928 FLSE 1 Storm1 8 8 27.4 80.3 80 977 48 600 556 NA 1

1928 FLSE 4 Lake 9 17 27.1 80.1 115 935 51 600 559 31.8 billion 1

1929 FLSE 2 Storm2 9 28 25.1 80.7 85 948 51 1800 563 256 million 1

1929 FLNW 2 Storm2 9 30 29.7 85.3 65 988 NA 1700 563 NA 2

1933 FLSE 5 Storm5 7 30 27.4 80.3 70 985 48 2000 591 NA 1

1933 FLSE 12 Storm12 9 4 26.9 80.1 115 948 24 400 598 1.4 billion 1

1935 FLSW 2 LaborDay 9 3 24.9 80.7 140 892 11 130 620 NA 3

1935 FLNW 2 LaborDay 9 4 29.7 83.4 75 985 39 1900 620 3.1 billion 1

1935 FLSE 6 Storm6 11 4 25.9 80.1 65 973 19 1500 624 5.6 billion 1

1936 FLNW 5 Storm5 7 31 30.4 86.6 80 973 35 1500 629 126 million 1

1939 FLSE 2 Storm2 8 11 27.3 80.2 70 985 48 1900 659 NA 1

1939 FLNW 2 Storm2 8 13 29.7 84.9 70 985 NA 0 659 NA 2

1941 FLSE 5 Storm5 10 6 25.4 80.3 105 954 34 1030 675 362 million 1

1941 FLNW 5 Storm5 10 7 29.8 84.7 75 981 34 900 675 NA 2

1944 FLSW 11 Storm11 10 19 26.9 82.4 65 962 47 630 707 35.6 billion 1

1945 FLNW 1 Storm1 6 24 28.9 82.6 80 975 48 1100 708 NA 1

1945 FLSE 9 Storm9 9 15 25.3 80.3 120 940 23 2200 716 10.1 billion 1

1946 FLSW 5 Storm5 10 8 27.8 82.7 65 989 48 300 723 991 million 1

1947 FLSE 4 Storm4 9 17 26.4 80.1 135 947 48 1500 728 11.6 billion 1

1947 FLSW 8 Storm8 10 12 25.2 81.2 75 980 24 200 732 540 million 1

1948 FLSW 7 Storm7 9 21 24.6 81.6 105 NA NA 1400 740 NA 3

1948 FLSW 7 Storm7 9 22 25.6 81.2 100 963 13 0 740 3.6 billion 1

1948 FLSW 8 Storm8 10 5 24.7 81 110 NA 24 2000 741 NA 3

1948 FLSE 8 Storm8 10 5 25.2 80.4 110 977 29 2200 741 565 million 1

1949 FLSE 2 Storm2 8 27 26.8 80.1 130 954 42 0 744 13.5 billion 1

1950 FLNW 5 Easy 9 5 28.7 82.6 105 958 27 1200 760 973 million 1

1950 FLSE 11 King 10 18 25.8 80.2 90 988 11 600 766 3.7 billion 1

1953 FLNW 8 Florence 9 26 30.3 86.2 80 982 48 1700 793 14.3 million 1

1956 FLNW 7 Flossy 9 24 30.3 86.5 80 974 34 2300 829 711 million 1

1960 FLSW 5 Donna 9 10 24.8 80.8 115 930 34 700 864 NA 3

appendix (continued)

Year Region Seq Name Mo Da Lat Lon Wmax Pmin RMW Time SNBR Damage Code

1960 FLSW 5 Donna 9 10 25.9 81.6 120 938 34 1600 864 28.9 billion 1

1964 FLSE 5 Cleo 8 27 26.1 80.1 90 968 13 1000 896 4.7 billion 1

1964 FLNE 6 Dora 9 10 29.9 81.3 95 961 63 500 897 6.6 billion 1

1964 FLSW 11 Isbell 10 14 25.8 81.3 110 964 19 2100 902 624 million 1

1965 FLSE 3 Betsy 9 8 25.1 80.4 110 952 37 1100 906 4.0 billion 1

1966 FLNW 1 Alma 6 9 29.9 84.4 80 973 47 2000 910 81.3 million 1

1966 FLSW 9 Inez 10 4 25 80.5 75 984 27 1800 918 131 million 1

1968 FLNW 8 Gladys 10 19 28.8 82.6 70 977 32 500 936 495 million 1

1972 FLNW 2 Agnes 6 19 29.9 85.4 65 983 37 2100 979 411 million 1

1975 FLNW 5 Eloise 9 23 30.4 86.2 110 955 26 1230 1008 2.8 billion 1

1979 FLSE 4 David 9 3 26.7 80 85 972 50 1500 1044 2.2 billion 1

1985 FLNW 5 Elena 9 2 30.4 89.1 100 959 27 1300 1100 3.8 billion 0

1985 FLNW 11 Kate 11 21 30 85.5 85 967 19 2230 1106 1.1 billion 1

1987 FLSW 7 Floyd 10 12 25.2 80.4 65 993 76 2200 1119 2.6 million 1

1992 FLSE 2 Andrew 8 24 25.5 80.3 145 922 19 905 1166 52.3 billion 1

1995 FLNW 5 Erin 8 2 27.7 80.4 75 985 56 600 1191 1.4 billion 1

1995 FLNW 5 Erin 8 3 30.3 87.1 85 974 24 1500 1191 NA 2

1995 FLNW 15 Opal 10 4 30.3 87.1 100 942 80 2200 1201 6.3 billion 1

1998 FLNW 5 Earl 9 3 30.1 85.7 70 987 119 600 1231 126 million 1

1998 FLSW 7 Georges 9 25 24.5 82.2 90 975 17 1630 1233 1.1 billion 1

1999 FLSW 9 Irene 10 15 24.6 81.7 65 987 56 1300 1249 NA 3

1999 FLSW 9 Irene 10 15 25.2 81.2 65 984 48 1900 1249 1.2 billion 1

2004 FLSW 3 Charley 8 13 27 82.1 125 947 8 2100 1313 16.3 billion 1

2004 FLSE 6 Frances 9 5 27.2 80.2 90 960 84 600 1316 9.7 billion 1

2004 FLNW 9 Ivan 9 16 30.2 87.8 95 943 37 730 1319 15.5 billion 1

2004 FLSE 10 Jeanne 9 26 27.3 80.2 105 951 72 400 1320 7.5 billion 1

2005 FLNW 4 Dennis 7 10 30.4 87 110 946 13 1930 1329 2.2 billion 1

2005 FLSE 11 Katrina 8 25 26 80.1 65 982 19 2230 1336 NA 1

2005 FLSW 22 Wilma 10 24 25.9 81.6 110 950 74 1030 1347 20.6 billion 1

Notes

1906 Storm 2 P min taken from the hurricane earlier in the day

1906 Storm 8 P min taken from the hurricane earlier in the day

1911 Storm 2 Landfall point in Alabama

1916 Storm 4 P min and wind speed from hurricane 3 hours later

1926 Storm 6 Additional losses from FLSW & AL 1.08E+10

1941 Storm 5RMW taken from 2nd landfall

1948 Storm 7 P min taken from earlier along track

1960 Storm 5 RMW taken from island pass

1985 Storm 5 Losses from AL & MS are included

2004 Storm 6 RMW taken from when it was over the Bahamas

2004 Storm 9 Landfall point in Alabama

Damage = Collins/Lowe (2001) data adjusted to 2005 dollars presented in Pielke et al. (2008) rounded to 1 significant decimal point

SNBR= Storm sequence number as catalogued in HURDAT dataset

Code=

0: Not direct landfall, hurricane force winds may have been felt somewhere in the state

1: First direct landfall, Keys hit if this is the only direct hit in the state

2: Second direct landfall

3: Keys hit if the hurricane made landfall elsewhere in the state

Units

Wind speeds (kt); Pressure (hPa); RMW (statute miles)

130 ji l l malmstadt , k e l sey sc h e i t lin, an d j ames el s n e r

acknow ledgments

Thanks go to King Burch for his contribution

of background material on Florida’s insurance.

Thanks also go to Thomas Jagger for his assistance

with the loss model. All computations were com-

pleted using R Statistical Package (R Develop-

ment Core Team 2007). This work is supported by

the National Science Foundation (ATM-0738172)

and by the Florida Catastrophic Storm Risk Man-

agement Center. Finally, the lead author would

like to thank Chris Meindl for his encouragement

and editorial guidance.

refer ences

AIR Worldwide. 2005. The Coastline at Risk,

September 2005. Accessed at http://www

.air-worldwide.com/

—

public/NewsData/

000797/The

—

Coastline

—

at

—

Risk-AIR

—

Worldwide.pdf.

Barrett, B.S., L.M. Leslie, and B.H. Fiedler.

2006. An Example of the Value of Strong

Climatological Signals in Tropical Cyclone

Track Forecasting: Hurricane Ivan (2004).

Monthly Weather Review 134:1568–1577.

Changnon, S.A. 2003. Shifting economic

impacts from weather extremes in the

United States: A result of societal changes,

not global warming. Natural Hazards

29:273–290.

Changnon, S.A., D. Changnon, E.R. Fosse,

D. Hoganson, R.J. Roth, and J. Totsch. 1997.

Effects of recent extremes on the insurance

industry: Major implications for the

atmospheric sciences. Bulletin of the American

Meteorological Society 78:425–435.

Collins, D.J., and S.P. Lowe. 2001. A macro

validation dataset for U.S. hurricane models,

Casualty Actuarial Society Forum. Arlington,

VA: Casualty Actuarial Society. Accessed at

http://www.casact.org/pubs/forum/

01wforum/01wf217.pdf.

Davis, C., W. Wang, S.S. Chen, Y. Chen,

K. Corbosiero, M. DeMaria, J. Dudhia,

G. Holland, J. Klemp, J. Michalakes,

H. Reeves, R. Rotunno, C. Snyder, and

Q. Xiao. 2008. Prediction of Landfalling

Hurricanes with the Advanced Hurricane

WRF Model. Monthly Weather Review

136:1990–2005.

Demsetz, H. 1962. Economic gains from storm

warnings: Two Florida case studies,

Memorandum RM-3168-NASA. Santa

Monica, CA: The Rand Corporation. 43pp.

Elsner, J.B., and A.B. Kara. 1999. Hurricanes of

the North Atlantic: Climate and Society. New

York: Oxford University Press.

Elsner, J., J. Kossin, and T. Jagger. 2008. The

increasing intensity of the strongest tropical

cyclones. Nature 455:92–95.

Elsner, J.B., and T.H. Jagger. 2006. Prediction

models for annual U.S. hurricane counts.

Journal of Climate 19:2935–2952.

Elsner, J.B., X.F. Niu, and T.H. Jagger. 2004.

Detecting shifts in hurricane rates using a

Markov chain Monte Carlo approach.

Journal of Climate 17:2652–2666.

Emanuel, K. 2005. Increasing destructiveness

of tropical cyclones over the past 30 years.

Nature 436:686–688.

Hartwig, R.P. 2008. Florida Property Insurance

Facts. New York: Insurance Information

Institute. Accessed January 2008 at http://

www.iii.org/media/research/florida

facts08.

Ho, F.P., J.C. Su, K.L. Hanevich, R.J. Smith, and

F.P. Richards. 1987. Hurricane Climatology

for the Atlantic and Gulf coasts of the United

States, NOAA Technical Memorandum,

NWS-38. Silver Spring, MD: National

Oceanic and Atmospheric Administration,

National Weather Service. 195pp.

Holland, G.J. 1980. An analytic model of the

wind and pressure profiles in hurricanes.

Monthly Weather Review 108:1212–1218.

Huang, Z., D.V. Rosowsky, and P.R. Sparks. 2001.

Hurricane simulation techniques for the

Hurricanes and Damage Costs 131

evaluation of wind-speeds and expected

insurance losses. Journal of Wind Engineering

and Industrial Aerodynamics 89:605–617.

Insurance Information Institute. 2007. Florida

Citizens Property Insurance Corporation

(CPIC): What It Is and How It Works.

Accessed August 2007 at http://server

.iii.org/yy

—

obj

—

data/binary/777211

—

1

—

0/FLCitizensbrief2007.pdf.

Insurance Information Institute. 2008. Facts

and Statistics, Catastrophes: U.S. Accessed at

http://www.iii.org/media/facts/

statsbyissue/catastrophes/.

Jagger, T.H., and J.B. Elsner. 2006. Climatology

models for extreme hurricane winds near

the United States. Journal of Climate

19:3220–3226.

Jagger, T.H., J.B. Elsner, and M.A. Saunders.

2008. Forecasting U.S. insured hurricane

losses. In Climate Extremes and Society,

editors H.F. Diaz and R.J. Murnane, 189–

208. New York: Cambridge University Press.

Jones, T.A., D. Cecil, and M. DeMaria. 2006.

Passive-Microwave-Enhanced Statistical

Hurricane Intensity Prediction Scheme.

Weather and Forecasting 21:613–635.

Kaczor, Bill. 2008. Florida, Berkshire Hathaway

strike $224 million deal on insurance fund.

Insurance Journal: Southeast News.

Accessed July 2008 at http://www

.insurancejournal.com/news/southeast/

2008/07/31/92371.htm.

Kantha, L. 2006. Time to Replace the Saffir-

Simpson Hurricane Scale?. Eos 87 (1):3.

Katz, R.W. 2002. Stochastic modeling of

hurricane damage. Journal of Applied

Meteorology 41:754–762.

Landsea, C.W., C. Anderson, N. Charles,

G. Clark, J. Dunion, J. Fernandez-Partagas,

P. Hungerford, C. Neumann, and

M. Zimmer. 2004. The Atlantic hurricane

database re-analysis project:

Documentation for the 1851–1910

alterations and additions to the HURDAT

database. In Hurricanes and Typhoons: Past,

Present, and Future, editors. R.J. Murname

and K-B Liu, 177–221. New York: Columbia

University Press.

Pielke, R.A, Jr., and C.W. Landsea. 1998.

Normalized hurricane damages in the

United States: 1925–1995. Weather and

Forecasting 13:621–631.

Pielke, R.A, Jr., J. Gratz, C.W. Landsea,

D. Collins, M.A. Saunders, and R. Musulin.

2008. Normalized hurricane damage in the

United States: 1900–2005. Natural Hazards

Review 9:29–42.

R Development Core Team. 2007. R: A language

and environment for statistical computing.

Vienna, Austria: R Foundation for Statistical

Computing.

Sugg, A. 1967. Economic aspects of hurricanes.

Monthly Weather Review 95:143–146.

Watson, C.C. and M.E. Johnson. 2004.

Hurricane loss estimation models. Bulletin

of the American Meteorological Society

85:1713–1726.

Williams, J. and I. Duedall. 1997. Florida

Hurricanes and Tropical Storms. Gainesville,

FL: University Press of Florida.

jill malmstadt

is a Master’s student in the

Department of Geography at the Florida State

University, Tallahassee, FL 32306. Email:

jmalmstadt@fsu.edu.

kelsey scheitlin

is a Ph.D. student in the

Department of Geography at the Florida State

University. Email: kscheitlin@fsu.edu.

dr. james elsner

is a Professor in the

Department of Geography at the Florida State

University. Email: jelsner@fsu.edu. His

research interests include hurricanes, climate,

and spatial statistics.