By Trevor W. Lewis and M. Ankith Reddy

NET-ZERO CLIMATE-CONTROL

POLICIES WILL FAIL THE FARM

NET-ZERO CLIMATE-CONTROL

POLICIES WILL FAIL THE FARM

By Trevor W. Lewis and M. Ankith Reddy

February 7, 2024

1

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

TABLE OF CONTENTS

Executive Summary

2

Introduction

6

Lessons from Around the World

9

Europe: High Prices for Energy, Manufacturing, and Food

Sri Lanka: Fertilizer or Famine

America’s Net-Zero Experiment: Dire Economic

Consequences

17

Impacts of Cutting U.S. Oil and Gas Supplies

Choking Off Chemicals’ Feedstock

Green New Deal Can’t Power Farms

Environmental, Social, Governance Reporting

Requirements: Making Food More Expensive

25

Quantifying Carbon Costs of Environmental, Social,

Governance: The Methodology

27

Quantifying Carbon Costs of Environmental, Social,

Governance: The Results

32

Recommendations for Avoiding the Failure of Net-

Zero Policies

39

Conclusion

43

About the Authors

44

2

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

EXECUTIVE SUMMARY

Federal policymakers are pursuing expensive climate-control and emissions

policies that have largely failed in Europe—and the American farm and household

will be required to pay for them. President Trump withdrew the United States from

the ideological Paris Climate Accords that burden U.S. industry with strident

carbon emissions reduction efforts theoretically designed to reach unreachable

emissions objectives. President Biden rejoined the accords on his first day in office,

and his administration has pursued a quixotic goal of “net-zero” carbon emissions

by regulation and legislation ever since. After recommitting the United States to

the net-zero climate-control agenda, the president and Congress revived

significant misguided features of the once-failed “Green New Deal” through the

Inflation Reduction Act. Then, the Biden administration used executive power to

restrict oil and natural gas supply, make chemical feedstocks more expensive to

buy and produce, and enlisted the Securities Exchange Commission to require new

“environmental, social, governance” or ESG reports to track carbon emissions

from farm to table. These federal initiatives and requirements will prove expensive

and economically destructive here—just as they have been in Europe.

To better appreciate the true costs that American farms and households will likely

pay for the Biden administration’s net-zero policies and objectives, The Buckeye

Institute’s Economic Research Center developed a model corn farm that must play

by the government’s new carbon emissions rules. The farm’s operational costs, as

expected, all rose significantly. Diesel fuel needed for trucks, tractors, and

combines became more expensive. As did propane needed to power grain dryers

and heat barns. And prices for the nitrogen fertilizer needed to grow crops rose,

too. The economic model then traced how those additional operating costs affected

food prices for the American consumer. Once again, prices rose to compensate

farmers for the government’s actions. The results are predictable and unsurprising,

but many U.S. policymakers seem unwilling to address or even acknowledge them.

That has to change, or the United States will face dire economic consequences

instead.

3

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

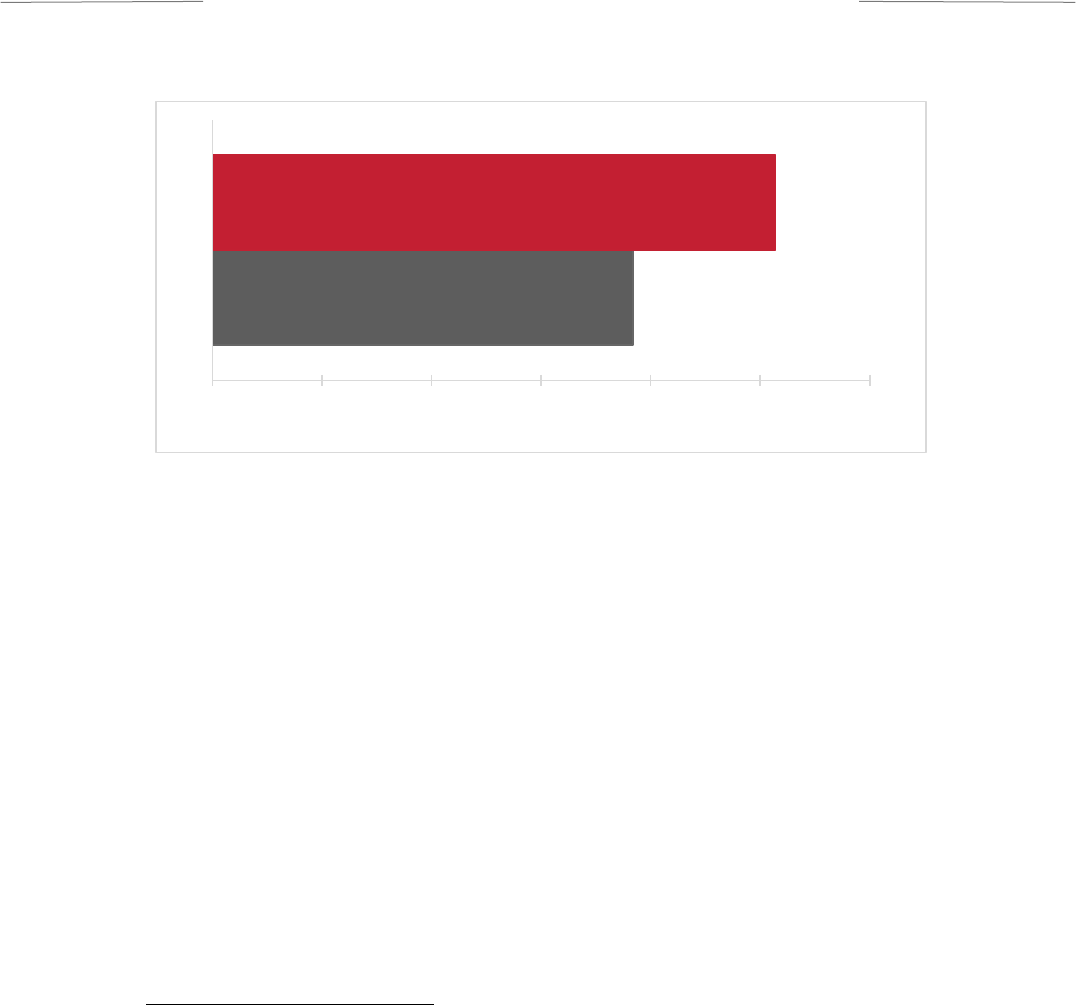

Complying with net-zero emissions policies and corporate ESG reporting

requirements will increase prices of farm inputs, the costs of which will ultimately

be passed onto consumers at grocery stores and restaurants.

1

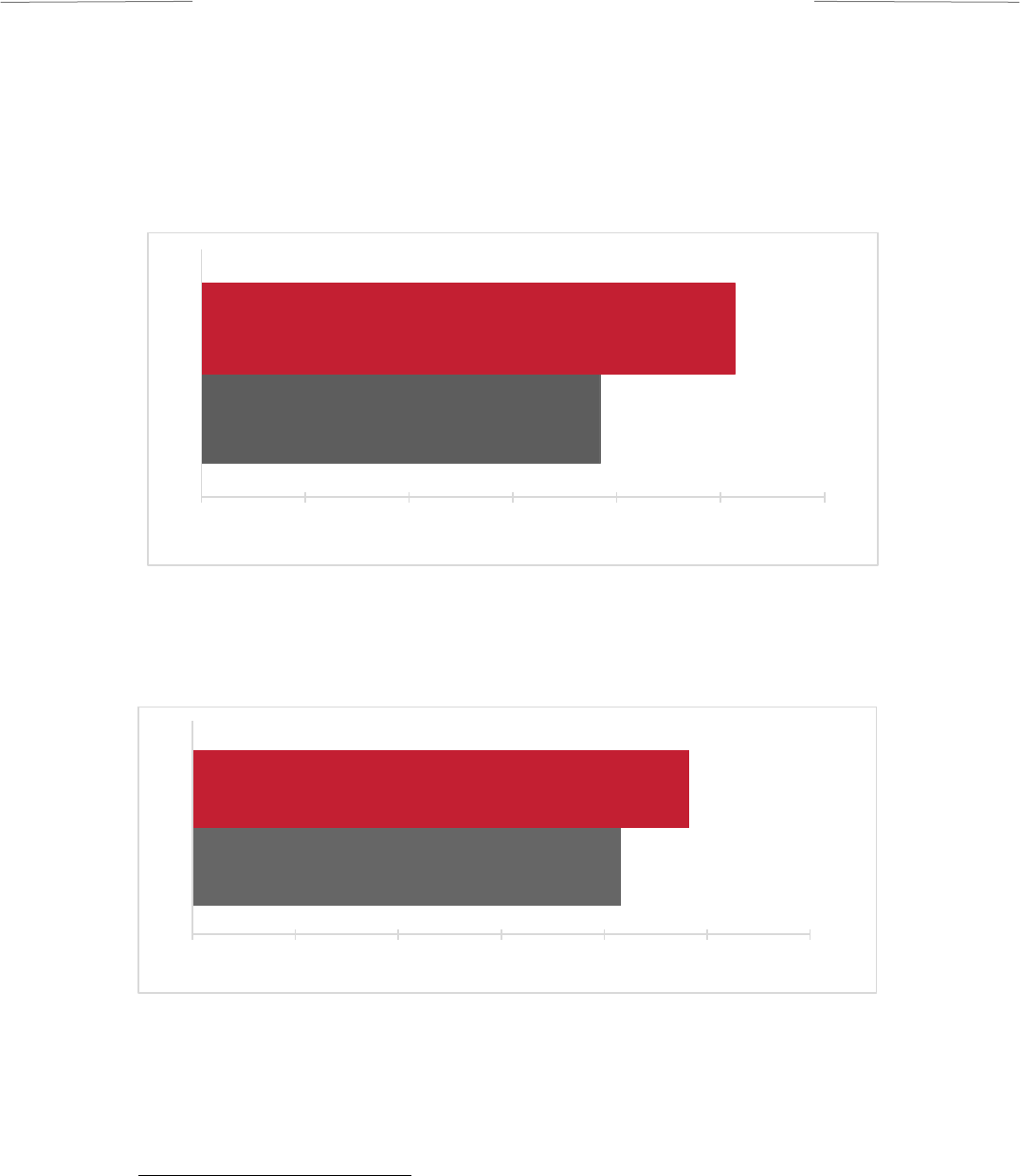

Farmers will see costs

rise by at least 34 percent.

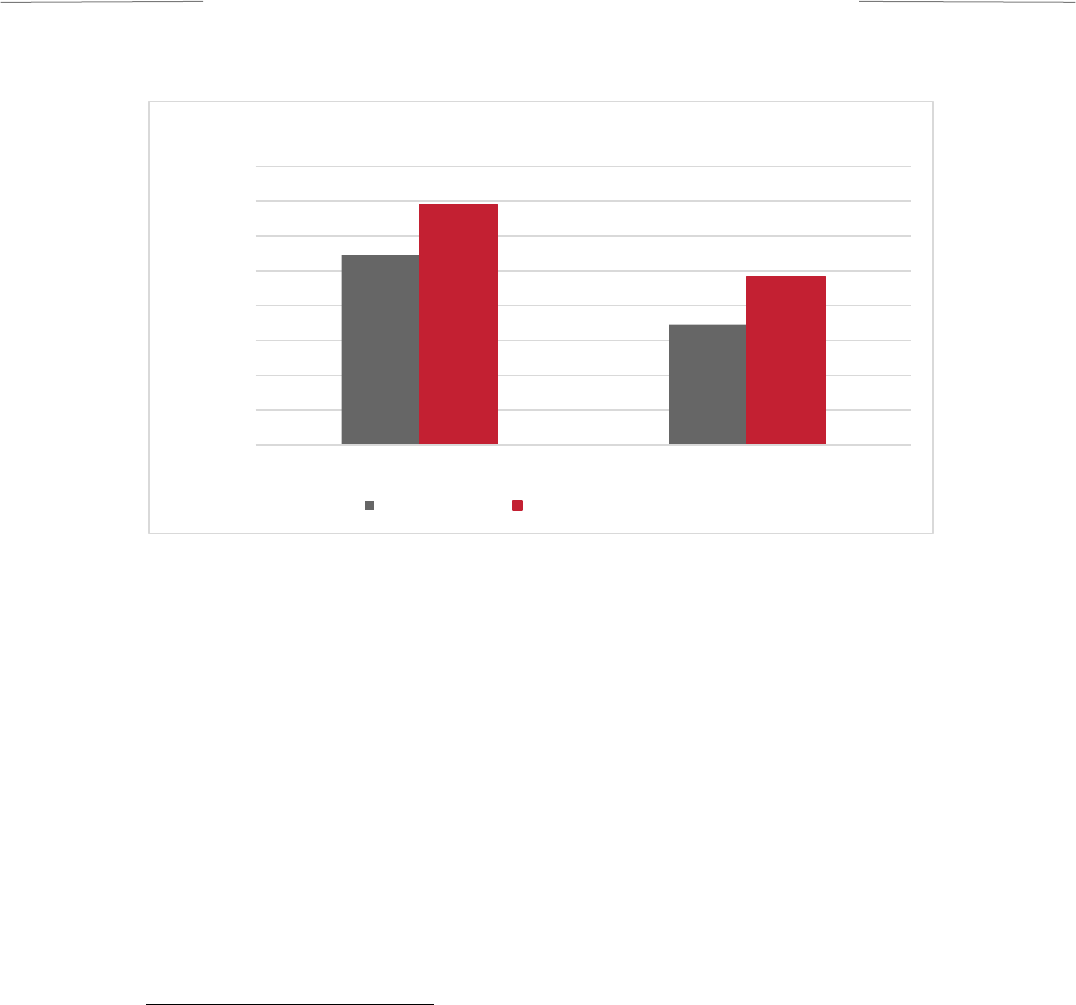

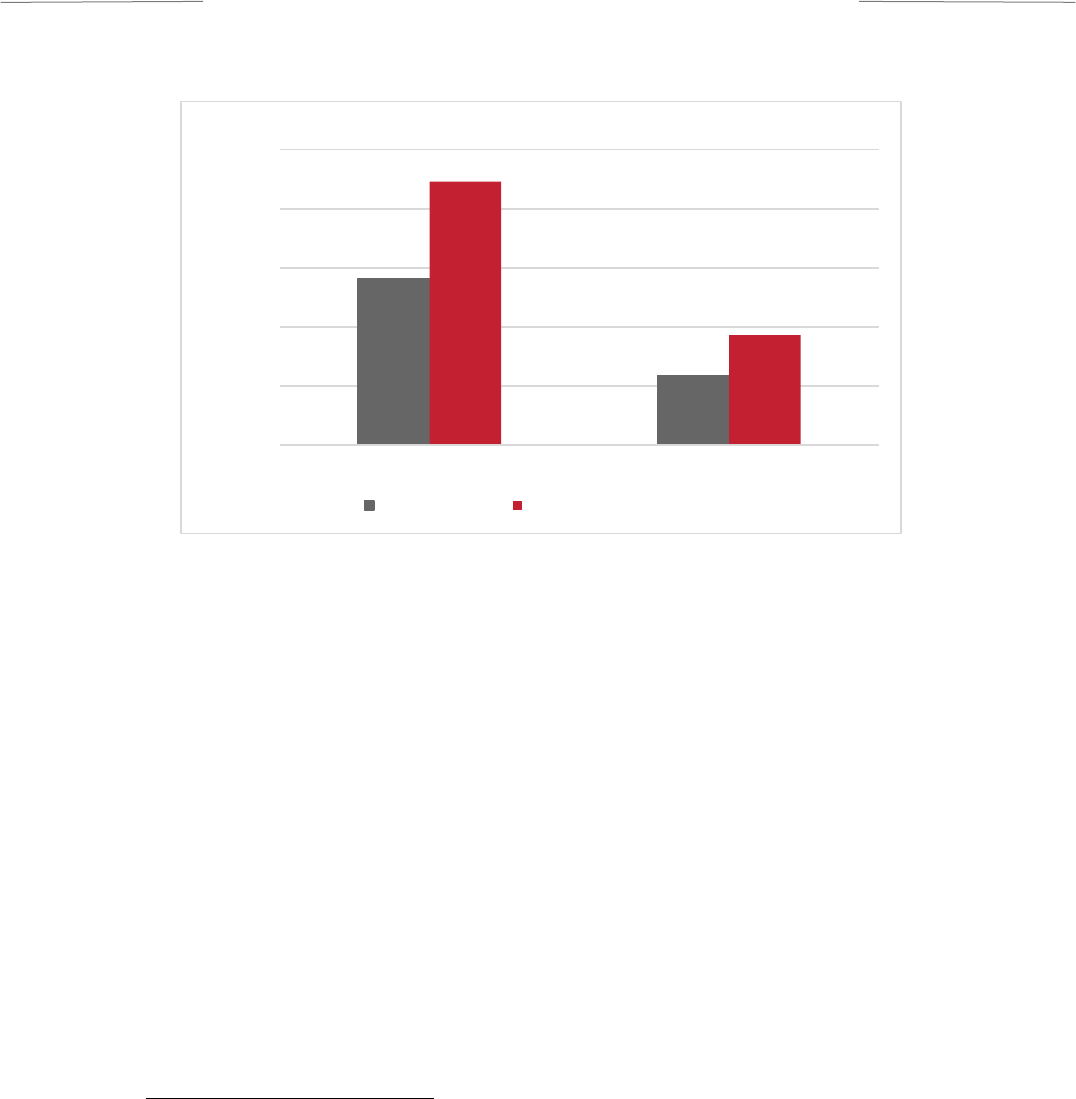

Farm Operating Expenses Under ESG

Pricing in food’s carbon emissions will increase an American family of four’s

household grocery bills $1,330 per year.

Increase in Annual Grocery Bills

1

Emily Joner and Michael A. Toman, Agricultural Greenhouse Gas Emissions 101, Resources

for the Future, September 8, 2023.

$192,000 Current Costs

$257,000, 34% Increase in Annual

Farm Operating Expenses Due to Carbon Pricing

$0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000

$8,320, Current Annual

Grocery Bills

$9,650, 15% Increase In Annual Grocery

Bills Due to Carbon Pricing

$0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000

4

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Carbon emission intensive foods like cheese and beef could increase more than 70

percent per pound.

Price Increases of U.S. Groceries

Item

Percent Increase

American Cheese

78%

Bananas

59%

Beef

70%

Bread

7%

Butter

24%

Chicken

39%

Coffee

13%

Dozen Eggs

36%

Flour

32%

Milk

9%

Oranges

3%

Pork

28%

Potatoes

22%

Rice

56%

Spaghetti

13%

Strawberries

47%

Sugar

43%

Corrective action can be taken at every level. President Biden is unlikely to

decommit the U.S. from the Paris Climate Accords he just rejoined, but the next

president can and should. Republicans in Congress can pursue meaningful

bipartisan collaboration with Democrats from energy-producing and agricultural

states to tap the brakes on runaway spending and net-zero regulations. State

legislatures can limit some of the ill effects of ESG-minded activists by ensuring

fair insurance and lending practices for businesses and farms. And U.S.

shareholders can vigilantly hold corporate leaders and boards accountable for poor

ESG-guided investment decisions and mandates that needlessly raise producer

costs and consumer prices. Without taking remedial steps to fix the problems being

perpetrated by international agreements and federal climate-control rules, the

5

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

American economy, businesses, farms, and consumers will pay the price, and that

price must be understood.

6

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

INTRODUCTION

On President Joe Biden’s first day in office, he recommitted the United States to

the Paris Climate Accords,

2

a binding international agreement that has had

devastating economic effects in Europe that will soon be replicated in America.

3

The agreement, first signed by the United States in 2016, targets “net-zero”

greenhouse gas (GHG) emissions, defined by the United Nations as “cutting

greenhouse gas emissions to zero or as close to zero as possible, with any remaining

emissions re-absorbed from the atmosphere.”

4

To achieve that target, the Biden

administration agreed to reduce America’s emissions by 50-52 percent by 2030

and to reach economy-wide net-zero GHG by 2050.

5

Achieving the

administration’s desired decarbonized economy will require aggressive climate-

emission reduction policies that drain and replace fossil fuels from every sector of

the U.S. economy. The Biden administration has already begun implementing

stringent regulatory policies designed to dramatically reduce carbon dioxide (CO

2

)

emissions from the oil, natural gas, and chemicals industries, and the

administration’s looming rule on “environmental, social, governance” (ESG)

reporting threatens to force carbon compliance onto every other emission-

intensive industry. Contrary to assurances from the U.S. Security and Exchange

Commission (SEC),

6

American agriculture, which accounts for 10 percent of

America’s total CO

2

emissions, will not be spared. Farmers and ranchers will need

to reduce their emissions by adopting “climate smart agricultural practices

(including, for example, cover crops), reforestation, rotational grazing, and

nutrient management practices.”

7

Compliance with these policies will be

monitored by ESG’s new statutory carbon emissions reporting requirements.

These policies and mandates have costs and benefits that have not been thoroughly

examined or understood and that oversight needs correcting.

Ostensibly to curb rampant inflation following the pandemic lockdowns, Congress

and the Biden administration worked together to enact the Inflation Reduction Act

2

The United States Officially Rejoins the Paris Agreement, press statement from Secretary

Antony J. Blinken, U.S. Department of State, February 19, 2021.

3

The Paris Agreement, United Nations Climate Action (Last visited November 2, 2023).

4

What is Net Zero?, United Nations Climate Action (Last visited November 2, 2023).

5

The White House, Fact Sheet: President Biden Sets 2030 Greenhouse Gas Pollution

Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S.

Leadership on Clean Energy Technologies, April 22, 2021.

6

Mark Segal, SEC Chair Says Climate Disclosure Rule Feedback Pushes Back on Scope 3

Reporting as Less Developed, Unreliable, ESG today, September 28, 2023.

7

Nationally Determined Contribution: Reducing Greenhouse Gases in the United

States: A 2030 Emissions Target, unfccc.int, April 15, 2021.

7

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

of 2022 (IRA)—deceptively named legislation that includes much of the regulatory

regime necessary for reaching the Paris Climate Accords’ net-zero emissions goals.

The IRA contains massive federal subsidies for the progressive environmental

agenda over the next 10 years,

8

effectively reviving the failed “Green New Deal”

(GND) introduced by Rep. Alexandria Ocasio-Cortez in 2019. The GND had

proposed a 10-year plan to achieve net-zero greenhouse gas emissions through

various means, including pressing farmers and ranchers to “remove pollution and

greenhouse gas emissions from the agricultural sector as much as is

technologically feasible.”

9

Following that lead, the IRA includes more than $43

billion in U.S. Department of Agriculture (USDA) subsidies to carry out a “green”

transition for America’s farms and ranches.

10

The Biden administration has also adopted the Green New Deal’s goal of “ensuring

that the Federal Government takes into account the complete environment and

social costs and impacts of emissions.”

11

To do that, the administration has leaned

on sympathetic activist investors and encouraged the SEC to pursue ESG policy-

making through new reporting requirements that will put the burden of

monitoring, reporting, and offsetting emissions on farmers and ranchers. ESG-

reporting obligations will force new emissions monitoring protocols and computer

software to track carbon emissions associated with virtually every aspect of the

farm. Farmers rely on diesel fuel to drive their equipment; propane powers their

grain dryers and heats their barns; and nitrogen fertilizer, weed killers, and bug

sprays are all synthesized from natural gas and oil byproducts, which makes

agriculture one of the most fossil-fuel-dependent industries worldwide. The new

ESG requirements will be expensive for farmers to produce and maintain—and

that cost will be realized by consumers.

Europe, fully committed to the Paris Climate Accords’ decarbonization plan,

provides a forecast of the agricultural and economic consequences likely to result

from the ESG-reporting agenda. After implementing strict ESG-reporting

mandates, European banks, for example, became reluctant to lend to farmers with

high nitrogen and methane emissions.

12

Reduced credit strained family farms.

Europe’s emissions cap-and-trade policies exacerbated the problem and helped

8

Joint Committee on Taxation, Estimated Revenue Effects of Division A, Title III of H.R.

2811, April 26, 2023.

9

U.S. House of Representatives, H. Res. 109, February 7, 2019.

10

The White House, Inflation Reduction Act Guidebook, last updated September 21, 2023.

11

U.S. House of Representatives, H. Res. 109, February 7, 2019.

12

Net-Zero Banking Alliance, United Nations Environment Programme (Last visited November

3, 2023); Vincent Gauthier, How banks can move toward net zero agriculture portfolios,

Environmental Defense Fund, February 24, 2022; Virginia Furness, UK farmers hungry for

climate finance but banks want more data, Capital Monitor, January 25, 2022.

8

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

put generational farmers out of business.

13

Those policies also raised prices of

farm-related energy and fertilizer, which, in turn, raised the price of food and

groceries.

14

Europe immolated its farming industry and made the continent’s food

supply more expensive and less secure.

Adopting similar policies in the United States will yield similar results. A policy

that encourages or requires an electric farm truck, for instance, will raise monthly

insurance premiums by 25 percent, increase maintenance costs, and decrease

productivity. And the immense weight of electric tractors causes severe damage to

soils, effectively and ironically negating the benefits of preferred sustainable

farming practices like no-till and cover crops. Relying more heavily on renewable

power sources will destabilize the power grid and raise energy prices for farm

incubation and refrigeration. ESG requirements will add the cost of carbon to every

agricultural act—fertilizer prices will rise 27 percent, grain drying costs 38

percent—and 22 percent of a U.S. farm’s expenses will be paying a de facto carbon-

reduction tax.

As in Europe, higher farming costs to comply with net-zero emissions policies will

be passed along to consumers who will pay higher prices at grocery stores and

restaurants.

15

In the wake of the Inflation Reduction Act, U.S. food prices rose 12.9

percent in 2022,

16

and American households can expect to pay an additional

$1,330 per year for carbon emissions from farms. Historic inflation rates have

plagued the U.S. economy since President Biden took office. Rejoining the Paris

Climate Accords and pursuing an activist environmental agenda that imposes

expensive regulatory requirements to meet aggressive emissions-reduction targets

have only added to the cost of living in the United States—and those costs,

especially for food, are expected to rise if the administration continues to follow

the European net-zero trend. Farmers and families will struggle to make ends

meet, and a progressive U.S. climate policy will be partly to blame. Before

continuing down this perilous path, federal regulators and lawmakers should learn

the economic lessons from the failed net-zero agricultural policy experiments in

Europe and Sri Lanka.

13

Farms and Farmland in the European Union – Statistics, Eurostat Statistics Explained,

November 2022.

14

EU Agricultural Prices Continued to Rise in Q2 2022, Eurostat, September 30, 2022.

15

Emily Joner and Michael A. Toman, Agricultural Greenhouse Gas Emissions 101, Resources

for the Future, September 8, 2023.

16

Bureau of Labor Statistics, Consumer spending increased 9.0 percent in 2022, October 4,

2023.

9

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

LESSONS FROM AROUND THE WORLD

Europe: High Prices for Energy, Manufacturing, and Food

Net-zero policies require industries across economic sectors to reduce carbon

emissions. But in setting net-zero goals and standards, European policymakers

largely ignore the critical role that the so-called fossil fuels still play in modern

economies. Oil consumption and gross domestic product (GDP), for example, are

almost perfectly positively correlated.

17

The United States is the world’s largest

consumer of oil and natural gas,

18

and it has the highest GDP.

19

Likewise, China is

the world’s second-largest and third-largest single-nation consumer of oil and

natural gas, respectively,

20

and it has the world’s second-largest economy.

21

The

fossil fuel-to-GDP correlation is unsurprising inasmuch as oil and natural gas

provide the foundation for chemical and agricultural industries, both drivers of

economic growth. The European Union is both the world’s third-largest economy

22

and consumer of oil.

23

But, as if unaware of this correlation and economic reality,

European leaders have pursued unrealistic policy plans and objectives in the name

of eliminating carbon-based emissions. And since introducing various emissions

reduction strategies, like “cap-and-trade,” which try to put a price on emissions,

Europe’s economy, in general, has struggled to achieve meaningful economic

growth above zero percent

24

, and economies in some member states, like Germany,

have even begun shrinking.

25

17

William E. Rees, The Human Ecology of Overshoot: Why a Major ‘Population

Correction’ is Inevitable, World, Volume 4, p. 509 – 527.

18

Frequently Asked Questions: The Top 10 oil consumers and share of total world oil

consumption in 2021, U.S. Energy Information Administration (Last visited October 4, 2023);

GDP (current US$), World Bank national accounts data (Last visited November 3, 2023).

19

Frequently Asked Questions: The Top 10 oil consumers and share of total world oil

consumption in 2021, U.S. Energy Information Administration (Last visited October 4, 2023);

GDP (current US$), World Bank national accounts data (Last visited November 3, 2023).

20

Frequently Asked Questions: The Top 10 oil consumers and share of total world oil

consumption in 2021, U.S. Energy Information Administration (Last visited October 4, 2023);

Ziwei Zhang, Shangyou Nie, and Erica Downs, Inside China’s 2023 Natural Gas Development

Report, Center on Global Energy Policy, September 11, 2023.

21

GDP (current US$), World Bank national accounts data (Last visited November 3, 2023).

22

Pallavi Rao, These are the EU countries with the largest economies, World Economic

Forum, Feb. 1, 2023.

23

Oil Refining, European Commission (Last visited November 16, 2023).

24

Balazs Koranyi, Europe’s problems are far bigger than a shallow recession, Reuters,

November 14, 2023.

25

Economic Forecast for Germany, European Commission (Last visited November 16).

10

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Under the Paris Climate Treaty, the European Union (EU) pledged to reduce

emissions 55 percent below 1990 levels by 2030. These policies included

establishing an emissions trading scheme, carbon border adjustment mechanisms

(CBAM), closing natural gas fields, curbing nitrogen fertilizer use, and shutting

down generational farms. In 2003, the EU introduced a “cost-effective” cap-and-

trade program

26

—known as the EU Emissions Trading Scheme (EU ETS)—to

create a market for carbon emissions. Under that scheme, the EU creates and

allocates allowances or “credits” to member nations. The total number of credits

represents the maximum emissions the European economy is permitted to emit in

that year. Each year, ETS decreases the total number of emission credits available

to member nations.

27

Member countries and industries may purchase these

allowances, effectively creating a market for emissions in which buyers bid on

available credits, and prices rise as the credit supply dwindles.

28

Incremental steps

phase in the program. Phase I began in 2005, and power plants and other energy-

intensive industries were the first required to participate.

29

Phases II and III both

reduced the number of credits offered and expanded the program to cover more

industries and further cut emissions.

30

Nice in theory, the program has faced steep pragmatic hurdles. A 2019 United

Nations report, for example, predicted that nearly every participating country

would miss its pledged Paris Climate Agreement targets.

31

The EU responded and

demonstrated its commitment to the Paris Climate Agreement by substantially

cutting the number of emissions credits offered in EU ETS Phase IV. Beginning in

January 2021, Phase IV started reducing credit allowances by 2.2 percent annually.

This move shrank the credit pool too quickly, pitting emitting industries against

each other and sparking an expensive bidding war

32

between Europe’s power

plants, refineries, manufacturers, and chemical producers

33

that tripled the price

of EU ETS credits from $30 to $90 in 2021.

34

26

EU Emissions Trading System (EU ETS), European Commission (Last visited November 2,

2023); Development of EU ETS (2005 – 2020), European Commission (Last visited November

2, 2023).

27

Development of EU ETS (2005 – 2020), European Commission (Last visited November 14).

28

Ibid.

29

Ibid.

30

Ibid.

31

Juliane Berger et al., Emissions Gap Report 2019, United Nations Environment Programme,

November 2019.

32

Emissions cap and allowances, European Commission (Last visited November 2, 2023)

33

Emissions Trading Scheme – Stationary Installations, Ireland Environmental Protection

Agency (Last visited November 2, 2023); Martina Igini, EU Carbon Price Tops Symbolic

€100/Tonne For the First Time, Earth.org, February 24, 2023.

34

EU Carbon Permits, Trading Economics (Last visited November 15, 2023).

11

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

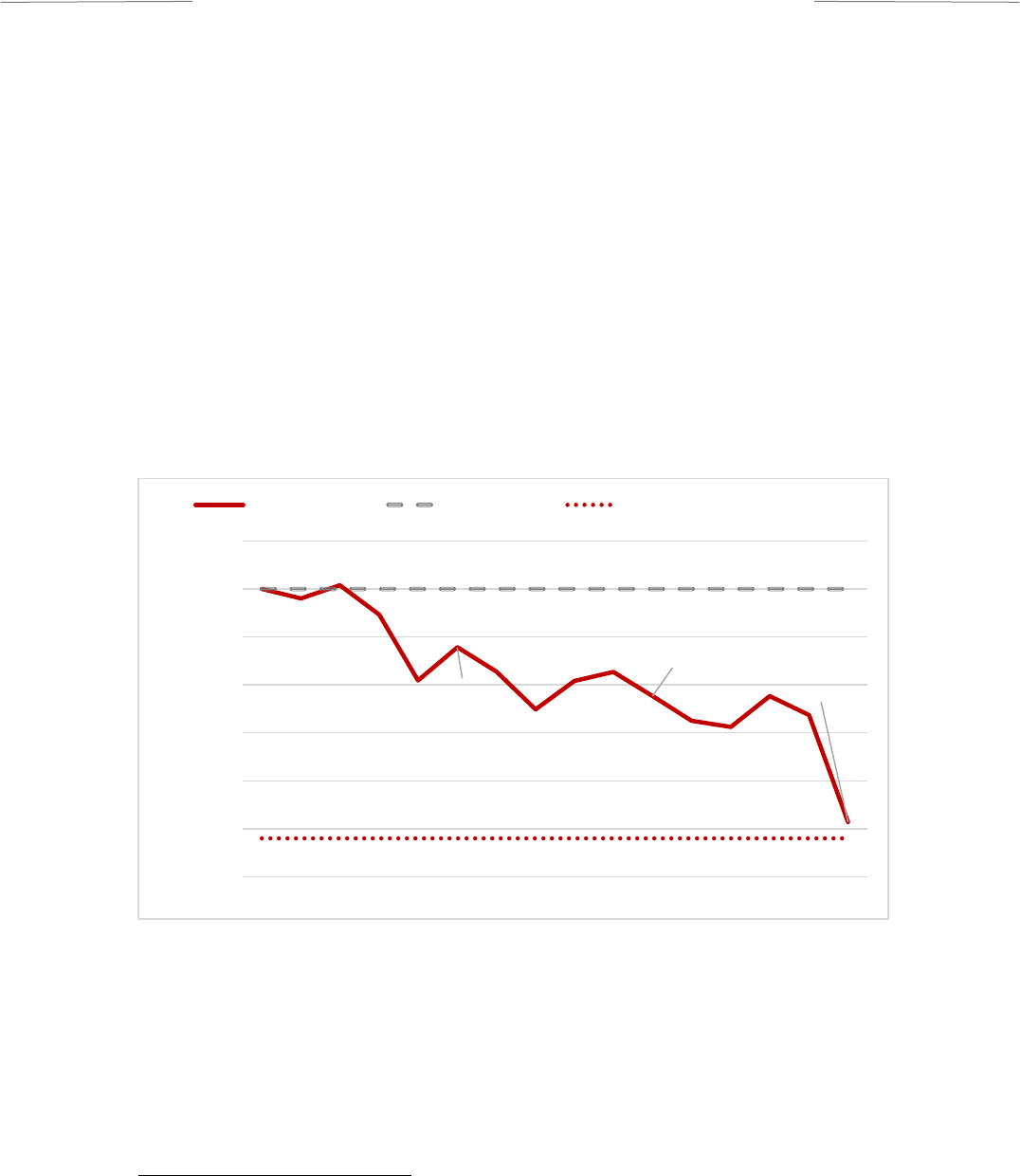

Faced with rapidly accelerating costs, Europe’s electric companies have since

shouldered some of the burden while passing their higher costs on to consumers.

Residential and industrial power prices rose 131 and 59 percent, respectively,

between January 2021 and January 2022.

35

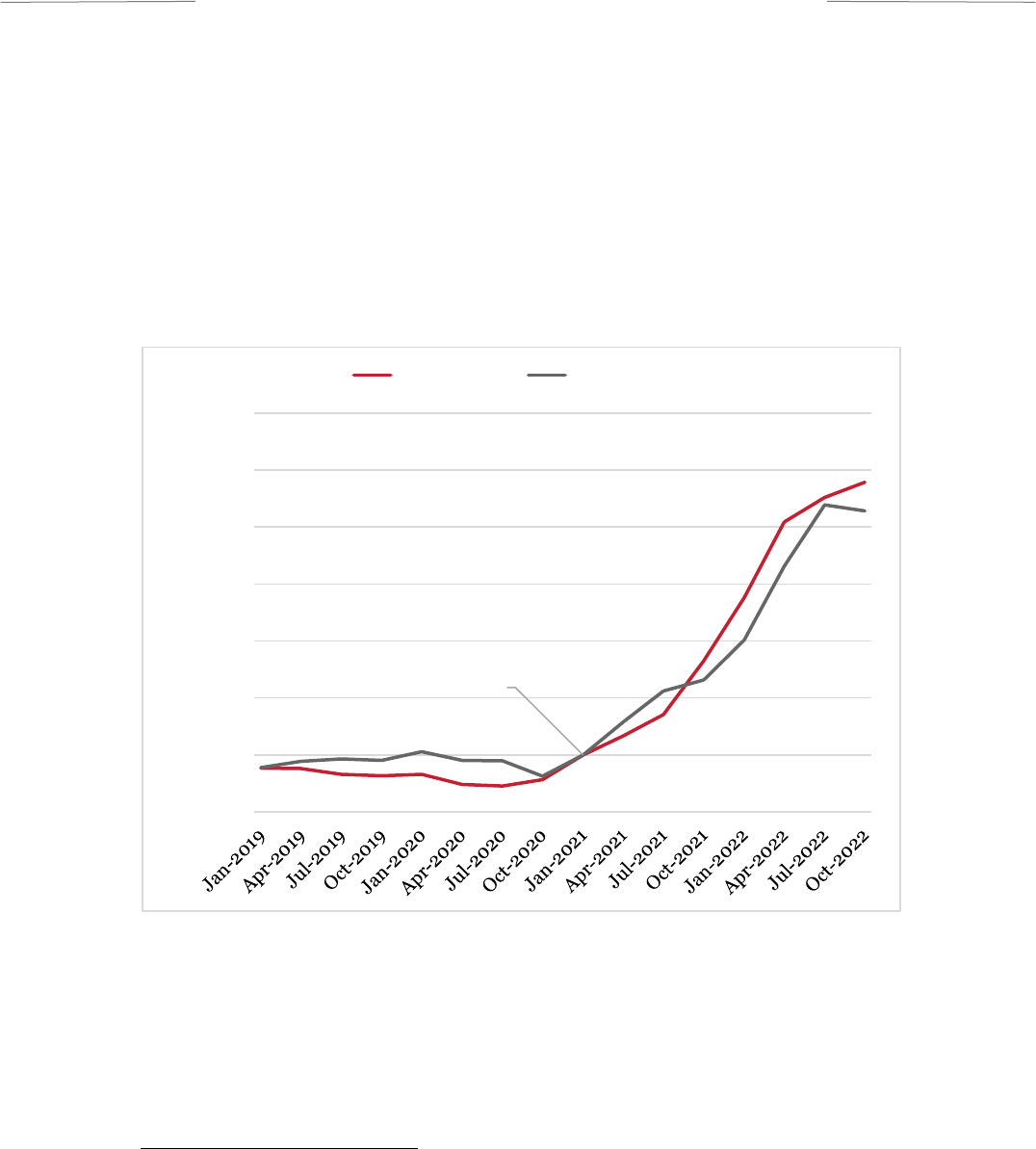

(Figure 1.) Russia’s invasion of

Ukraine in February 2022 made matters worse, spiking European power prices 92

percent between June 2021 and June 2022.

36

Caught between poorly conceived

economic policy choices and dwindling resource supply caused by geopolitical

turmoil, European businesses, and families should not expect energy prices to fall

anytime soon. In fact, they will likely only get worse. EU ETS credit prices are

projected to reach 130 euros ($137.8) by 2030, further tightening industry and

household budgets. The “temporary” power conservation methods like cold

showers and clothesline drying that many Germans experienced in summer 2022

will probably become mainstays of an electricity-poor Europe.

37

Figure 1: EU Electricity Prices Per Kilowatt Hour (KWh)

38

35

Electricity price statistics, Eurostat (Last visited November 1, 2023); Benjamin Wehrmann,

What German households pay for electricity, Clean Energy Wire, January 16, 2023.

36

Electricity price statistics, Eurostat (Last visited November 1, 2023)

37

Philip Oltermann, German Cities Impose Cold Showers and Turn off Lights amid

Russian Gas Crisis, The Guardian, July 28, 2022.

38

Electricity price statistics, Eurostat (Last visited November 1, 2023)

€ 0.09

Jan 2021

(Beginning of ETS

Phase IV)

131%

Increase

59%

Increase

€ -

€ 0.05

€ 0.10

€ 0.15

€ 0.20

€ 0.25

€ 0.30

Euros/KWh

Residential Industrial

12

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Heavy-handed climate policies have also made European companies less

competitive internationally. Germany’s chemical fertilizer industry, for example,

has been hit especially hard by rising EU ETS credit prices and taxes that have

driven up domestic production costs to facilitate stringent emissions reduction

policies. The response by German manufacturing and chemical companies:

relocate. German firms have now invested $650 billion, moving their operations

to the United States. But Germany supplies significant chemical and manufactured

goods to Europe, which means that more of those products must now be imported.

The EU responded to German offshore fertilizer production in the United States

by levying the world’s first carbon tariff

39

in October 2023. CBAM

40

is a tax added

to imported goods to prevent companies from manufacturing goods less expensive

in countries with lower emission standards.

41

Europe’s CBAM stops European

chemical companies from shipping cheaper U.S.-produced fertilizer back to

Europe. But the tariff simply raises prices that many European households and

farmers will have to pay for foreign-made goods and fertilizers—all in the name of

paying for carbon dioxide emitted while making goods in another country.

Although European farmers are not yet required to participate in the EU ETS

Phase IV program, they have not escaped the effects of Europe’s climate-control

regime. Several EU countries and industries have forced farmers to reduce their

emissions to meet national and privately backed climate targets. European banks

have begun withholding loans and funds from farmers with high GHG emissions.

42

In 2021, the Netherlands began debating rules that would buy out certain farms in

order to meet the EU-imposed emission reduction goals. And in May 2023, the EU

approved the Netherlands’ plan to pay $1.61 billion and use eminent domain to

acquire farms and livestock to reduce emissions.

43

Then, in June 2023, the

Netherlands announced that it would shut down gas production at the Groningen

field on October 1, 2024,

44

which will make manufacturing nitrogen fertilizer and

other agro- and petrochemicals in continental Europe more expensive. Belgium

also plans to restrict nitrogen fertilizer emissions, prompting Belgian farmers to

39

Mitchell Beer, Europe Launches World’s First Carbon Border Adjustment Rule, Energy

Mix, October 9, 2023.

40

Carbon Border Adjustment Mechanism, European Commission (Last visited November 3,

2023).

41

Raymond J. Kopp, William Pizer, and Kevin Rennert, Carbon Border Adjustments: Design

Elements, Options, and Policy Decisions, Resources for the Future, October 10, 2023.

42

Dutch gov’t to buy out farmers to reduce livestock emissions, Al Jazeera English, May

20, 2023.

43

EU okays $1.61 billion for Dutch government to buy out farmers, reduce nitrogen,

Reuters, May 3, 2023.

44

Netherlands to end Groningen Gas production by Oct 1, Reuters, June 23, 2023.

13

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

block the capital streets with tractors and burning tires in protest. “No Farmers,

No Food,” read one protester’s sign.

45

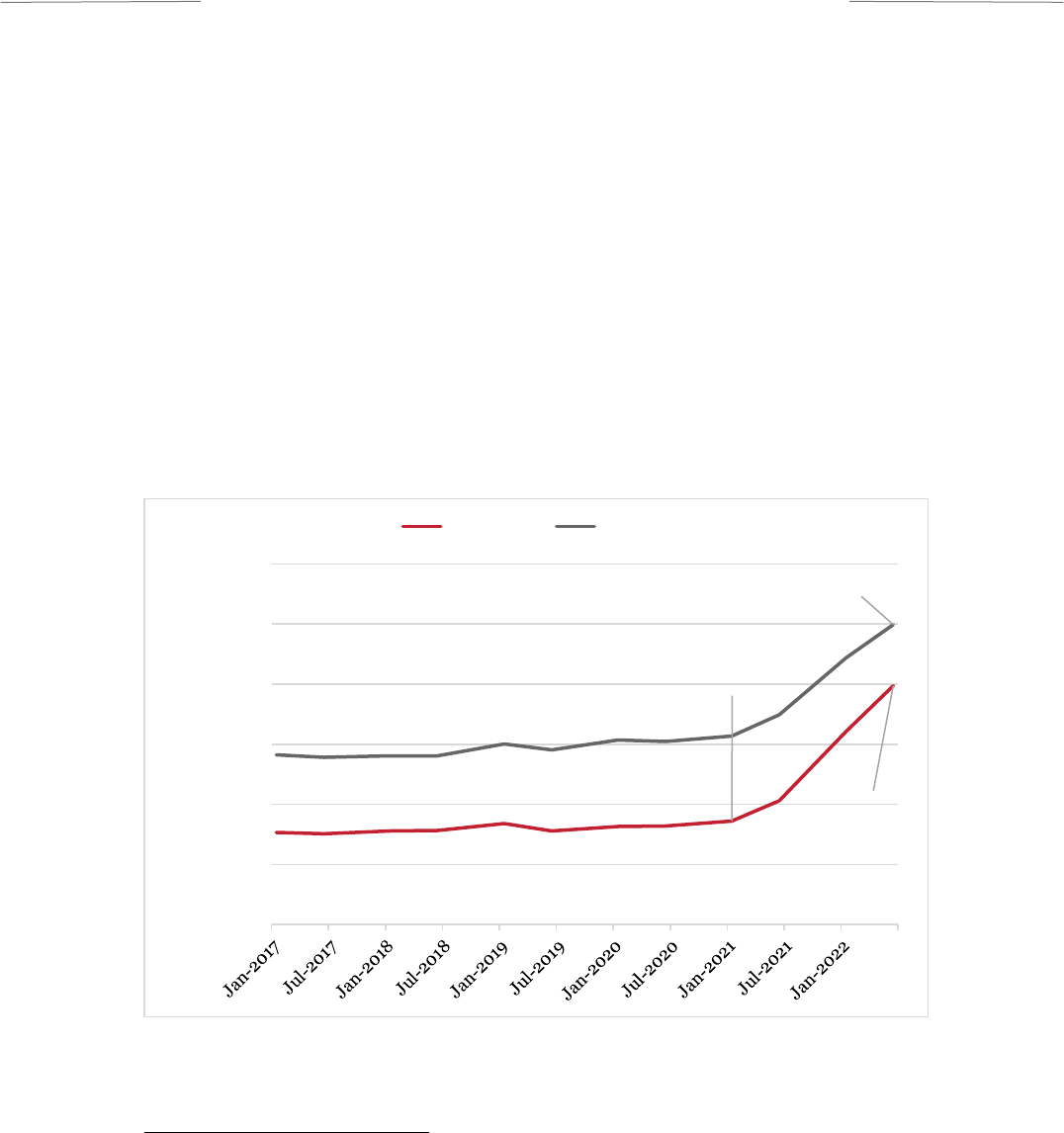

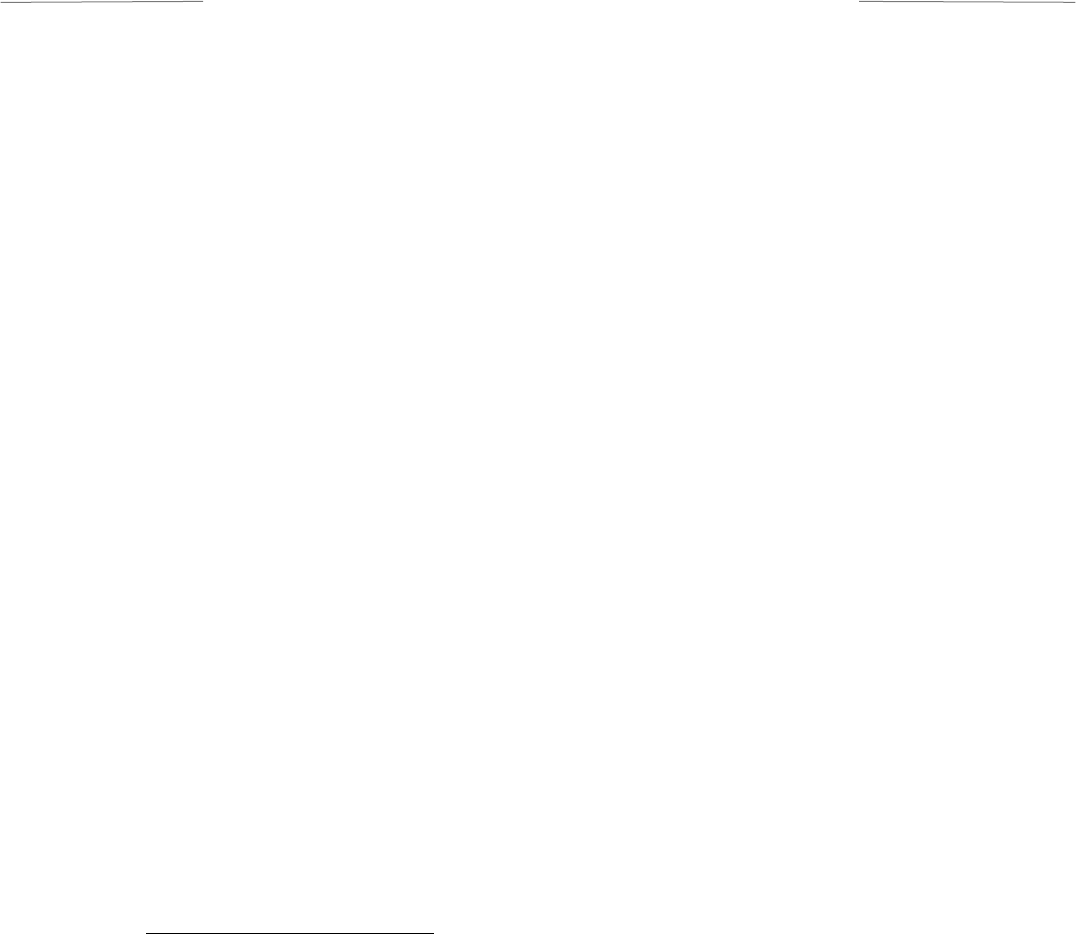

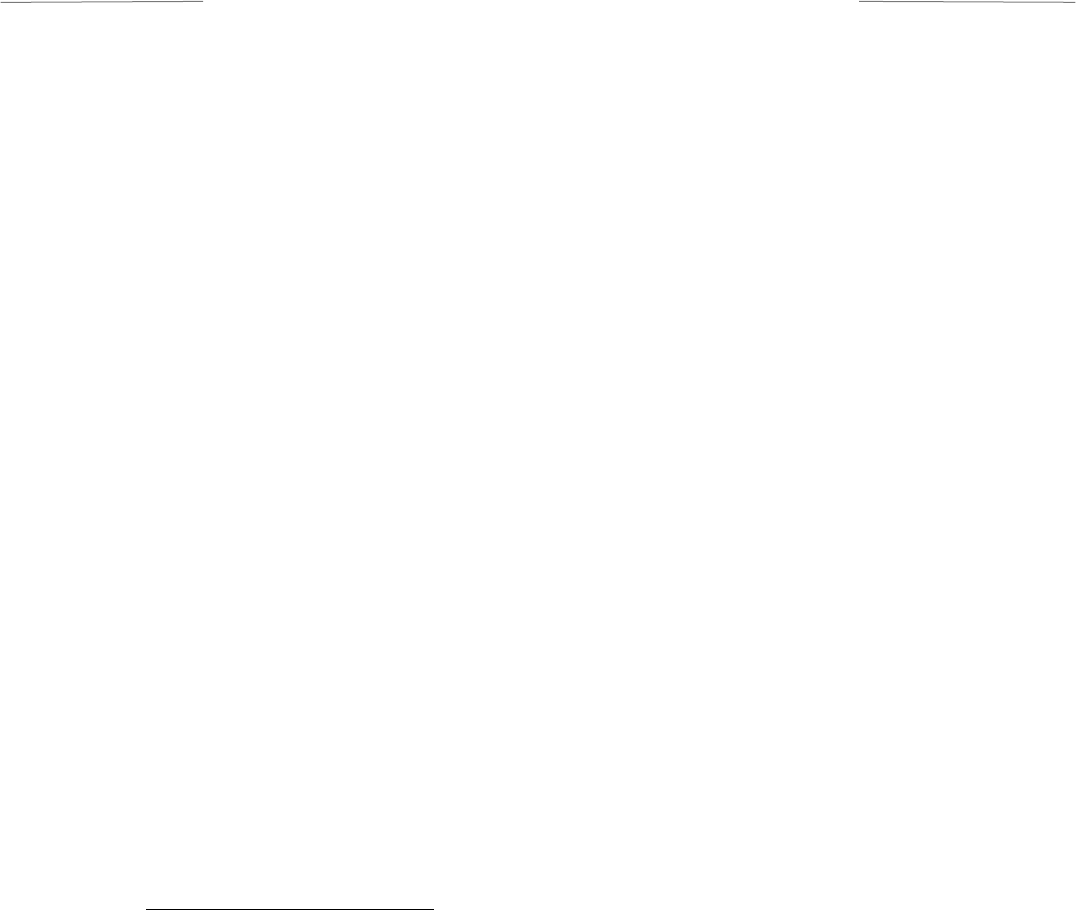

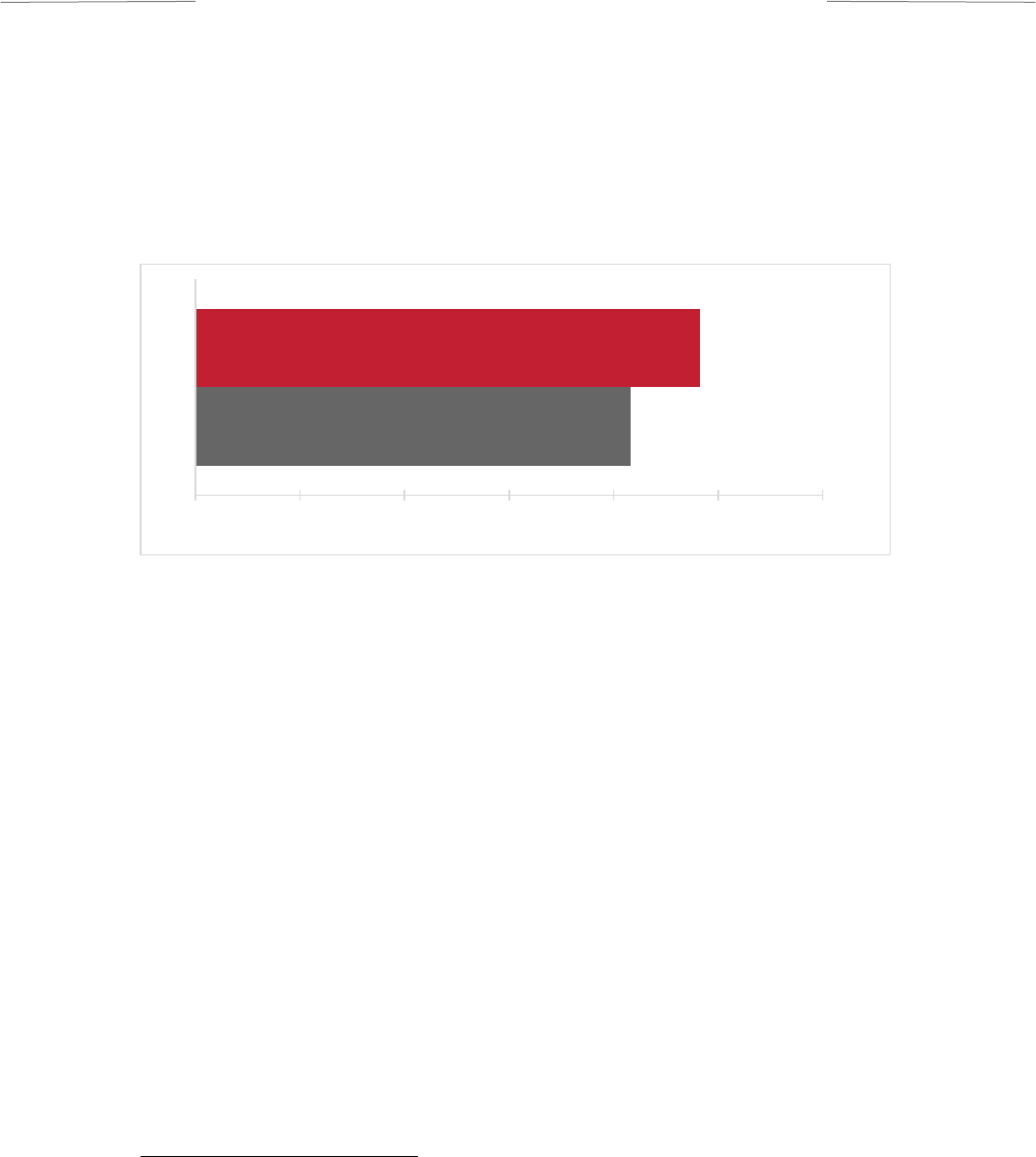

Mass livestock culls and new nitrogen fertilizer limits jeopardize Europe’s

increasingly fragile food security. Since the beginning of ETS Phase IV (January

2021-December 2022), the cost of farm fertilizers and soil improvers increased 49

percent.

46

As expected, the price of farm products like cereal grains, oils, fruits,

and eggs rose 42 percent. (Figure 2.)

47

Figure 2: European Farm Input and Output Price Indices

45

Susannah Savage, Aggro-culture: Farmers’ protest brings Brussels’ EU Quarter to a

standstill, Politico, March 3, 2023.

46

EU Agricultural Prices Continued to Rise in Q2 2022, Eurostat, September 30, 2022.

47

Ibid.

ETS Phase IV

Begins

-10%

0%

10%

20%

30%

40%

50%

60%

Percent Increase (Euros 2015)

Farm Inputs Farm Products

14

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Over the same time, average food costs increased 22 percent. (Table 1.)

48

Table 1: Food Price Indices

49

Item

January 2021

December 2022

Percent

Increase

Average Food Costs

136.7

167.2

22%

Bread/Cereals

137.3

171.7

25%

Meat

134.2

161.5

20%

Milk Cheese/Eggs

142.2

175.1

23%

Fats/Oils

124.2

208.9

68%

As Europe’s chemical companies face increasing prices for ETS credits, a state-

mandated input for production, the cost of producing fertilizers has increased

considerably. These companies have passed the carbon price of their fertilizer onto

farmers, who have, in turn, passed most of the cost onto European consumers. The

rising food prices have forced many Europeans to look abroad for more affordable

international food options. In 2022, for example, the EU needed to raise its high-

quality beef import quota with the United States,

50

and food imports increased

generally by 32 percent due in part to declining domestic corn production.

51

Ultimately, European households must pay the price for the EU’s regulatory

regime, the reduced production, the more expensive imports, the tariffs, the

shipping, and the foreclosed farms and factories. And with the international

adjusted carbon tariff taking effect, European families will have no choice but to

pay higher prices for animal proteins and dairy products. These are the results that

Europe’s net-zero central planners have wrought.

48

Agriculture and Rural Development, European Commission (Last visited November 16,

2023).

49

Ibid.

50

European Union: US Beef Imports into the EU High Quality Beef Quota Increased in

2022, U.S. Department of Agriculture, March 1, 2023.

51

Good performance of EU agri-food trade in 2022 despite challenges, European

Commission, April 13, 2023.

15

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Sri Lanka: Fertilizer or Famine

Carbon pricing

52

or emissions trading schemes

53

are commonly seen as the most

economically efficient method for reducing GHG emissions. In Europe, a large and

relatively diverse landmass and economy, they led to higher food prices. But Sri

Lanka shows what could happen when nitrogen and climate-control emission

reduction goals are enforced on a smaller, more fragile economy: famine.

In May 2021, Sri Lankan President Gotabaya Rajapaksa claimed that chemical

fertilizers posed a threat to public health and threatened the country’s long history

of “sustainable food systems.”

54

He promptly banned the use of artificial fertilizers.

That same year, President Rajapaksa relayed similarly negative feelings about

chemical fertilizers at the United Nations Climate Change Summit in Scotland and

justified his decision by citing emission reduction benefits: “Reactive nitrogen

emissions from overuse of artificial fertilizer is a major contributor to climate

change. In 2019, Sri Lanka spearheaded the Colombo Declaration on Sustainable

Nitrogen Management, which seeks to halve Nitrogen waste by 2030.”

55

Public

health concerns and emission reduction informed the Sri Lanka policy. President

Rajapaksa, for example, was historically and heavily influenced by scholar and

environmentalist activist Vandana Shiva, who cheered the decision, lauding the

plan to create a “poison free” world.

56

And less nitrogen fertilizer means less GHG

emissions, which would help Sri Lanka meet its Paris Climate pledge to reduce

emissions by 14.5 percent by 2030.

57

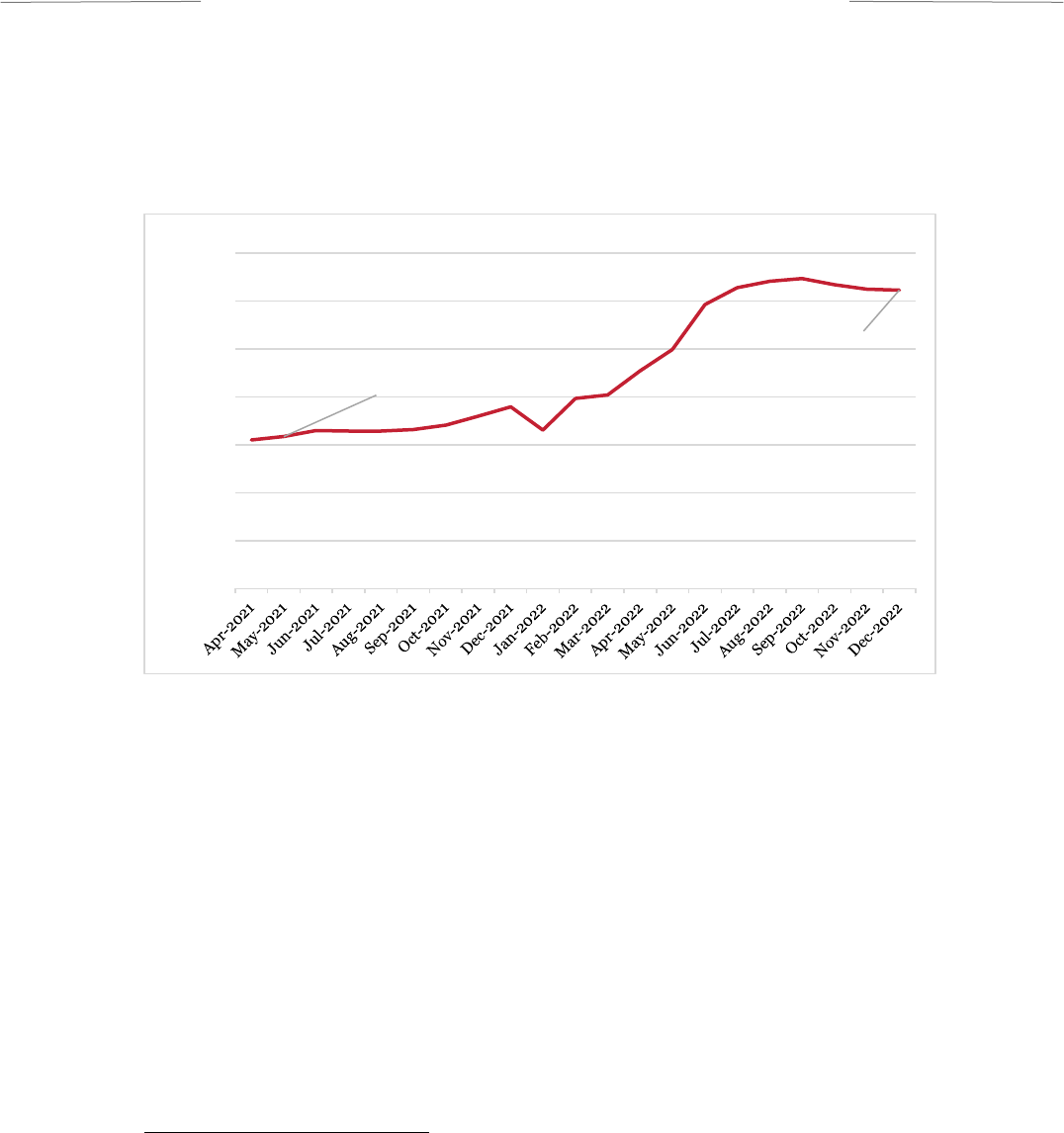

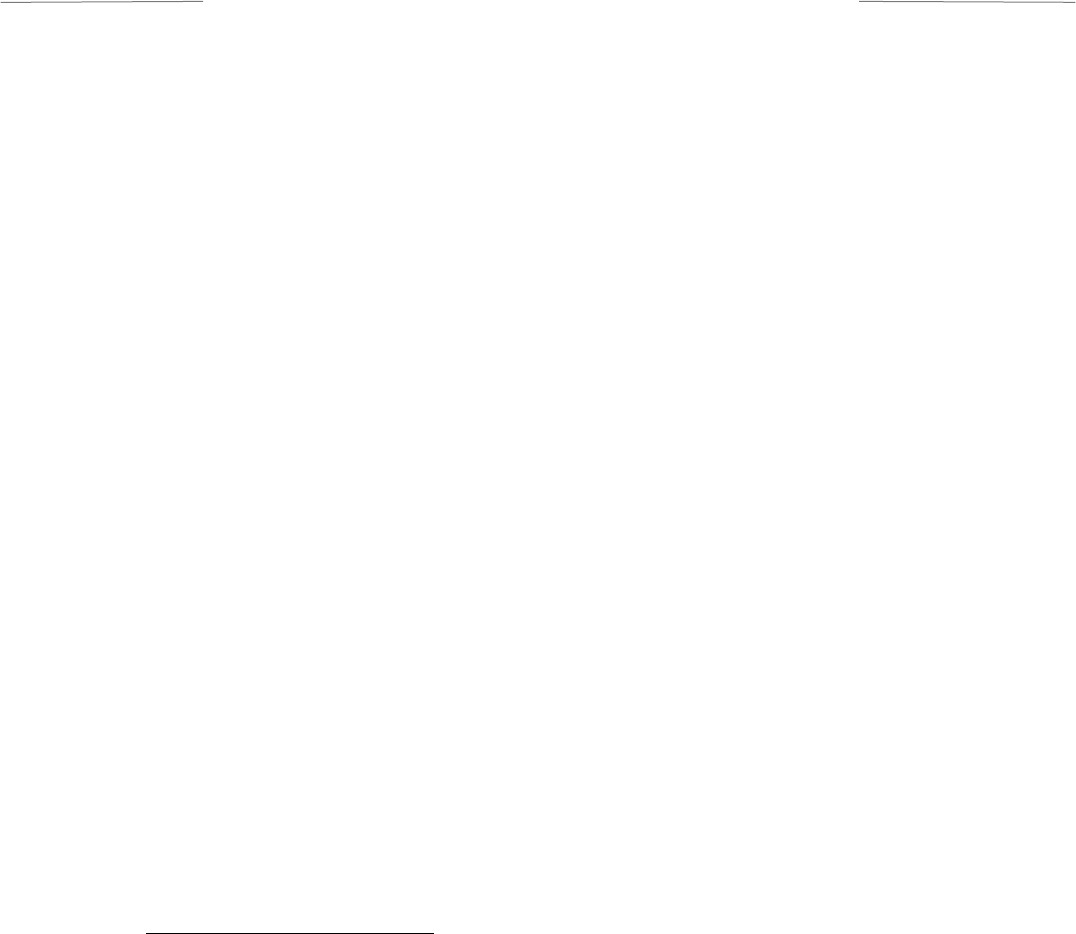

Nine months after the ban took effect, Sri Lanka fell into a climate policy-induced

famine, with yields for some crops falling as much as 30 percent.

58

Declining crop

yields contributed to food inflation, with prices ultimately rising 89 percent in

52

Effective Carbon Rates 2021, Organization of Economic Co-operation and Development, 2021;

Extended Brief on the Proposed Oil and Gas Cap, by Andrew Leach, House of Commons,

Standing Committee on Natural Resources, Parliament of Canada.

53

Emission trading systems, Organization of Economic Co-operation and Development (Last

visited November 20, 2023).

54

Kelly Torrella, Sri Lanka’s organic farming disaster, explained, Vox, July 15, 2022.

55

Speech by President Gotabaya Rajapaksa at the “World Leaders Summit of COP26”,

UN Climate Change Conference, Scotland, UK, Permanent Mission of Sri Lanka to the United

Nations, November 2, 2021; Ted Nordhaus, In Sri Lanka Organic Farming Went

Catastrophically Wrong, Foreign Policy, March 5, 2022.

56

Tunku Varadarajan, Sri Lanka’s Green New Deal Was a Human Disaster, The Wall Street

Journal, July 14, 2022.

57

Sri Lanka, Climate Promise, September 2021.

58

Chad De Guzman, The Crisis in Sri Lanka Rekindles Debate Over Organic Farming,

Time, July 13, 2022.

16

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

2022.

59

(See Figure 3.) And the rising food costs have induced famine. A quarter of

Sri Lankan adults have skipped meals so their children can eat. And half of Sri

Lankan families have had to let their children go hungry.

60

Figure 3: Sri Lanka Food Costs

61

59

Shyamika Jayasundara-Smits, Sri Lanka’s disastrous 2022 ends with a sliver of

optimism, East Asia Forum, January 13, 2023.

60

Sri Lanka: Half of Families Reducing Children’s Food Intake As The Country Slips

Further Into Hunger Crisis, Save the Children, March 2, 2023.

61

Colombo Consumers’ Price Index CCPI, Sri Lankan Government (Last visited November 2,

2023).

Nitrogen Fertilizer Ban

Promulgated

89%

Increase in

Food Prices

0

50

100

150

200

250

300

350

Sri Lankan Rupees (Real 2016)

17

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

AMERICA’S NET-ZERO EXPERIMENT:

DIRE ECONOMIC CONSEQUENCES

Sri Lanka may present an extreme example of failed sustainability and climate

policy, but Europe’s population, temperate climate, growing seasons, and diets are

similar to those in the United States and provide an ominous warning. One key

difference is Europe’s wholesale adoption of the Paris Climate Accord’s net-zero

policies.

When the United States first joined the Paris Climate Accords in September 2016,

it pledged to reduce total carbon dioxide equivalent (CO

2

e) emissions by 26-28

percent below 2005 emissions rates by 2025.

62

By 2020, the United States had

nearly achieved that initial goal, decreasing total GHG emissions by 24 percent

below 2005 levels. (See Figure 4). The Energy Information Administration

projected that even if America experienced record-setting economic growth and

reindustrialization, the U.S. would still be at or below the threshold set by the Paris

Climate Agreement.

63

Much of that successful emissions reduction was due to the

glut of natural gas caused by the domestic shale revolution’s onshore production.

That glut, which reduced the price of natural gas,

64

had two significant emissions

effects. First, it enticed U.S. utilities to use natural gas—a cleaner-burning energy

source—for electric power.

65

And second, it made natural gas a cost-competitive

chemical feedstock for fertilizers, plastics, chemicals, herbicides, and pesticides.

62

Natural Resource Defense Council, The Road From Paris: The United States Progress

Toward Its Climate Pledge, Issue Brief, November 2017.

63

Earth Institute, What is the U.S. Commitment in Paris?, Columbia Climate School, December

11, 2015; Climate Change Indicators: U.S. Greenhouse Gas Emissions, U.S. Environmental

Protection Agency (Last visited October 29, 2023); Energy-related CO

2

emissions could fall

25% to 38% below 2005 levels by 2030, U.S. Energy Information Administration (Last visited

October 29, 2023).

64

Henry Hub Natural Gas Spot Price, U.S. Energy Information Administration (Last visited

November 2, 2023). Natural gas prices had fallen from an average of $8.86 per million British

thermal units (MMBtu) in 2008 to an average of $3.04/MMBtu for the decade spanning 2011 to

2021.

65

Energy and Security: Developments in the energy field and questions of international

security, The University of Texas at Austin: Strauss Center (Last visited November 3, 2023); Daron

Acemoglu, Philippe Aghion, Lint Barrage, and David Hemous, Climate Change, Directed

Innovation, and Energy Transition: The Long-Run Consequences of the Shale Gas

Revolution, working paper, National Bureau of Economic Research, September 11, 2023.

18

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Despite having achieved its original Paris Climate Agreement goal, President Biden

recommitted the United States to the Paris Climate Accords and promised to

reduce emissions by 50-52 percent below 2005 emissions by 2030. But there is no

second shale revolution on the horizon to help fulfill this pledge. Instead, the Biden

administration has promulgated a series of subsidies, regulations, taxes, and

executive orders to restrict the supply of oil and natural gas. Reducing that supply

will raise prices for refineries, chemical plants, fertilizer manufacturers, and

ultimately, the farmers who rely on the products those industries produce. Without

a new shale revolution to help cut emissions, the regulatory apparatus will try to

meet the administration’s quixotic goals by cutting oil and natural gas supplies,

replacing fossil-fuel energy with renewable power sources, and requiring farmers

to reduce emissions on their farms. Much like they did in Europe, these net-zero

policies will have dire impacts on farmers and food prices.

Figure 4: U.S. GHG Emissions from All Sources

66

Impacts of Cutting U.S. Oil and Gas Supplies

The Biden administration’s primary tactic to achieve net-zero emissions targets

has been to reduce America’s oil and natural gas supplies through regulation,

delay, and revocation. Complying with a net-zero-inspired provision in the

Inflation Reduction Act, the Department of the Interior (DOI) began raising oil and

66

Climate Change Indicators: U.S. Greenhouse Gas Emissions, U.S. Environmental

Protection Agency (Last visited October 29, 2023).

-6%

2010

-11%

2015

-24%

2020

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

2005 2010 2015 2020

Emissions (Millions of Tonnes CO2e)

Total Emissions 2005 Baseline 2015 Paris Agreement Target

19

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

natural gas royalty rates for onshore oil and gas wells in April 2022.

67

Royalty rates

are a tax on energy producers, making it harder for drillers to profitably drill on

federal lands.

68

A proposed DOI rule released on July 25, 2023, began the process

of codifying the higher royalty rates. Then, in August 2023, the Biden

administration finalized a rule banning new offshore oil and natural gas leasing.

69

In September 2023, the Biden administration proposed yet more bans on drilling

new oil wells on highly productive shale oil lands in New Mexico,

70

an ominous

move for shale oil drillers who need constant access to new land to drill and replace

rapidly declining production from shale wells.

71

Even without domestic production restrictions, the United States does not produce

enough heavy oil to satisfy the demand for diesel fuel vital to farmers. Most of

America’s heavy oil comes from Alberta, Canada. The Keystone XL pipeline would

have expanded Alberta’s export capacity and dropped the price of heavy oil for

Houston refineries, but President Biden revoked the Keystone XL pipeline permit

by executive order on his first day in office.

72

That order made America’s diesel

supply dependent on heavy oils from Venezuela and Saudi Arabia—adding

shipping expenses, transportation risks, and geopolitical insecurity to the diesel

supply chain.

Artificially restricting access to oil and natural gas through federal climate-based

policies has economic consequences. The world has seen some of the consequences

of restricted supply already in the wake of Russia’s invasion of Ukraine in February

2022

73

and protests in Libya

74

that sent crude oil prices up to $120 per barrel

twice.

75

An International Monetary Fund (IMF) study highlighted the role of

67

Biden Increases Oil Royalty Rate and Scales Back Lease Sales on Federal Lands, The

Associated Press, April 16, 2022.

68

U.S. Bureau of Land Management, Proposed update to Fluid Mineral Lease and Leasing

Process, July 24, 2023.

69

Zack Budryk, Biden Administration Reinstates Obama-era Offshore Drilling Safety

Rules, The Hill, August 22, 2023.

70

Thomas Catenacci, Biden admin unleashes 50-year mining, oil drilling ban across

thousands of acres in New Mexico, Fox News, September 18, 2023.

71

Benjamin Storrow, Offshore oil is about to surge, Climate Wire, March 22, 2023.

72

Matthew Brown, Keystone XL pipeline nixed after Biden stands firm on permit,

Associated Press, June 9, 2021.

73

Annabelle Liang and Daniel Thomas, Ukraine war: Oil prices fall back after cap on Russian

crude kicks in, BBC, December 5, 2023.

74

Kimberly Peterson and Candace Dunn, Conflict in Libya since 2011 civil war has resulted

in inconsistent crude oil production, U.S. Energy Information Administration, August 12,

2022.

75

U.S. Crude Oil First Purchase Price, U.S. Energy Information Administration (Last visited

November 16, 2023).

20

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

surging fossil fuel prices that raised Europe’s cost of living in 2022 by 7 percent.

76

In America, decade-high oil and natural gas prices led to surging inflation, and U.S.

gas prices hit an all-time high, crossing $5.00 per gallon in June 2023.

77

A hot summer and drought in the U.S. caused wind turbines to stop turning and

hydroelectric power shortages across the country.

78

Natural gas was in high

demand, and utility companies quickly bought as much as they could to maintain

power grid stability. As a result, August 2022 saw natural gas prices crest $9.00

per thousand cubic feet, a decade high.

79

And Americans paid dearly for it.

Electricity bills rose 14.3 percent, double the inflation rate.

80

Fortunately,

American drillers were still able to provide energy companies with enough oil and

natural gas to keep businesses and households lit, but the Biden administration’s

climate initiatives have hindered, not helped, that effort.

Choking Off Chemicals’ Feedstock

Restrictions on U.S. oil and natural gas drilling, which ultimately depletes oil and

gas supplies, will have the same impact in America that Europe’s natural gas

import limits and looming closure of its largest natural gas field have had in

Europe: chemical companies will be less competitive internationally. In 2022, U.S.

chemical companies faced rising input costs brought on by rapidly rising natural

gas and energy prices.

81

Now, chemical companies face nearly $7 billion in

compliance costs from the Biden administration’s 13 proposed European-style

regulations on chemical producers.

82

American Chemical Council president Chris

Jahn emphasized in a September 2023 press conference that “the cumulative

regulatory impact we are talking about here is unprecedented in [the chemicals

industry]… there are more major reg[ulations] pending in regards to [the

76

Anil Ari et al., Surging Energy Prices in Europe in the Aftermath of the War: How to

Support the Vulnerable and Speed up the Transition away from fossil fuels, International

Monetary Fund, working paper, July 29, 2022.

77

U.S. All Grades All Formulation Retail Gasoline Prices, U.S. Energy Information

Administration (Last visited November 16, 2023).

78

Kirby Lawrence, Average cost of wholesale U.S. Natural Gas in 2022 highest since 2008,

U.S. Energy Information Administration, January 9, 2023; Jayme Lozano Carver, Why the Texas

grid causes the High Plains to turn off its wind turbines, Texas Tribune, August 2, 2022;

Laila Kearney, Soggy California winter set to charge up state’s hydropower sector, Reuters,

April 3, 2023.

79

Natural Gas, U.S. Energy Information Agency (Last visited November 16, 2023).

80

Stephen Singer, Electricity prices surged 14.3% in 2022, double overall inflation: US

report, Utilty Dive, January 19, 2023.

81

Natural Gas, U.S. Energy Information Agency (Last visited November 16, 2023).

82

Snapshot: Anticipated Regulation Burden/Costs Facing the Chemical Sector,

American Chemical Council, September 20, 2023

21

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

chemicals] industry than the last three administrations combined.”

83

At the top of

the regulatory list is the SEC’s proposed ESG-reporting rule, which will cost the

industry an estimated $2.4 billion.

84

Restricted oil and gas supplies raise oil and gas prices, which make it more

expensive for chemical producers to synthesize chemicals for basic products on

which U.S. households and farmers rely. Farm pesticides, herbicides, and

fertilizers synthesized from oil and natural gas will be more expensive to make, and

farmers will have little choice but to pass those higher costs on to American

consumers.

85

In late 2021, nitrogen fertilizer prices soared 235 percent

86

due to

elevated global demand, surging natural gas prices that reduced fertilizer

production,

87

and the closure of two major European fertilizer plants.

88

The USDA

estimated that the spike in fertilizer prices increased farmer’s operating costs for

growing corn and wheat by 35 and 36 percent, respectively.

89

Those higher

production costs led to the largest increase in food prices—nearly 11 percent—in

over 40 years.

90

And although inflation has since slowed, food and fertilizer prices

have not returned to pre-2021 levels.

91

Green New Deal Can’t Power the Farm

The Green New Deal’s net-zero emissions policies, revived by the Inflation

Reduction Act, encourage by regulatory rule a national shift from fossil-fuel-

powered vehicles and equipment to electric vehicles (EVs) and equipment. That

transition is problematic—especially for farmers and food prices—for several

reasons.

83

American Chemical Council, Chemistry Creates, America Competes, September 20, 2023.

84

American Chemical Council, Snapshot: Anticipated Regulation Burden/Costs Facing the

Chemical Sector, September 20, 2023.

85

Products made from oil and natural gas, U.S. Department of Energy Office of Fossil Energy

(Last visited November 16, 2023).

86

Angelica Williams and Amy Boline, Fertilizer prices spike in leading U.S. market in late

2021, just ahead of 2022 planting season, U.S. Department of Agriculture Economic Research

Service, February 9, 2022.

87

Shelby Myers, Too many to count: Factors Driving Fertilizer Prices Higher and Higher,

Farm Bureau, December 13, 2021.

88

Patrick Knight, Major Fertilizer Plant Closures in Europe Instil Price Rise and Threat

to Food Supply, Chemanalyst, September 17, 2021.

89

Impacts and Repercussions of Price Increases on the Global Fertilizer Market, U.S.

Department of Agriculture Foreign Agricultural Service, June 2022.

90

Steve Morris, Sticker Shock at the grocery store? Inflation Wasn’t the only reason food

prices increased, U.S. Government Accountability Office, April 11, 2023.

91

Consumer Price Index for All Urban Consumers: Food in U.S. City Average, FRED (Last

visited November 16, 2023).

22

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

First, EVs are significantly less reliable and more expensive to purchase, repair,

power, and maintain than combustion engine vehicles, making them impractical

and ill-suited to working farms. Farm equipment must be durable and capable of

operating in all weather conditions. Tractors and farm equipment must operate in

offroad environments and on poorly paved roads under constant risk of collisions

that can permanently damage an electric vehicle’s sensitive parts, rendering it

useless.

92

EV batteries drain faster in extreme cold and heat,

93

and EVs lose range

in the rain due to lower resistance between the car and the road and power

diversion to the windshield wipers and headlights.

94

Water damage from rain or

flooding can damage and prematurely kill an EV’s battery.

95

And although electric

cars have fewer parts, they require more maintenance and expensive repairs than

conventional gas-powered cars. Replacing an electric vehicle battery typically costs

from $5000 – $15,000,

96

and general EV repairs require more labor and cost 25

percent more than standard combustion vehicles.

97

Insurance companies have

noticed these extra costs and raised premiums by 25 percent on electric vehicles.

98

And the immense weight of the battery makes electric tractors poorly suited for

farms because it damages soil, reduces speed, and consumes more energy

equivalent than a conventionally powered tractor.

99

These heavy farm vehicles

would effectively negate the soil-health benefits accrued from no-till farming, a

government-sanctioned “green” farming practice.

These reliability and financial concerns make EVs unattractive as farm equipment

and will make running a successful farm more expensive, but Biden administration

92

What happens when your car is totaled, USAA, December 5, 2022; The real costs of

driving and insuring your electric vehicle, USAA, August 30, 2023.

93

Kyle Stock, A heat wave will cook your EV’s battery, if you let it, Los Angeles Times, July

13, 2023.

94

Mike, Becker, How does the weather affect the range of an electric car?, EVadapt, October

12, 2023.

95

Responding to Electric Vehicle Fires Caused by Salt Water Flooding, U.S. Fire

Administration, October 20, 2022.

96

The real costs of driving and insuring your electric vehicle, USAA, August 30, 2023.

97

Dave LaChance, CCC report: Repair costs, turnaround times higher for EVs, Repairer

Driven News, July 12, 2022; Lora Kolodny, Hertz pulls back on EV plans citing Tesla price

cuts, high repair costs, CNBC, October 26, 2023; Ryan Mandell, Plugged-In: EV Collision

Insights Q2 2023, Mitchell, August 10, 2023; Andrew Lambrecht, EVs are More Expensive to

Repair In Collisions, Study Finds, InsideEVs, August 28, 2023.

98

Dillon Leovic, How Much Does Electric Car Insurance Cost?, ValuePenguin, June 1, 2023;

Ryan Brady, Electric Car Insurance: What to Know Before you Buy, Nerdwallet, July 7, 2023.

99

J Sitompul, H Zhang, R Noguchi , and T Ahamed, “Optimization Study on the Design of

Utility Tractor Powered by Electric Battery” IOP Conference Series: Earth and

Environmental Science, (2019); Oscar Lagnelöv, Gunnar Larsson, Anders Larsolle, and Per-

Anders Hansson, “Impact of Lowered Vehicle Weight of Electric Autonomous Tractors in

a Systems Perspective” Smart Agricultural Technology, Volume 4, (August 2023).

23

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

rules will all but force farmers to buy or subsidize them anyway. The Department

of Transportation’s new tailpipe emissions standards on heavy-duty trucks and

passenger cars will require two-thirds of all vehicles sold in 2032 to be electric.

100

But thus far, electric truck makers have failed to profitably deliver reliable electric

trucks suitable for the farm despite significant federal subsidies. In 2023, two

electric truck manufacturers filed for bankruptcy.

101

Ford Motor Company lost

roughly $36,000 on every F-150 Lightening truck that rolled off its assembly

line.

102

To offset those losses, Ford raised its prices on standard trucks,

103

which

means that farmers and other heavy-duty truck buyers have been involuntarily

subsidizing the EV transition and paying more than necessary for their truck

preferences—hardly an endorsement of the EV option.

Second, a nationwide transition to electric energy depends entirely on

intermittent, unreliable zero-emission sources of electric power, namely wind and

solar. Wind and solar do not produce power consistently throughout the day, and

the variation in renewable power generation makes it harder for operators to

schedule power demand, which makes energy prices volatile and ultimately more

expensive.

104

In Texas and California, the first and second largest producers of

variable renewable electricity in America,

105

renewable power production during

daylight hours surges, causing power prices to plummet, but in the early evening

when power prices peak, natural gas power plants need to be brought online.

During hot August nights in Texas, power prices hit $4,000 per megawatt-hour

(MWh) in 2023,

106

which meant that farmers hatching broiler chickens at an

industrial scale paid six cents per KWh—a 666.67 percent increase in incubation

costs during the elevated price period.

107

For farmers who use electric incubators

100

Biden-Harris Administration Proposes Strongest-Ever Pollution Standards for Cars

and Trucks to Accelerate Transition to a Clean-Transportation Future, U.S.

Environmental Protection Agency Office of Air and Radiation news release, April 12, 2023.

101

Thomas Catenacci, Electric truck company touted by Trump as ‘an incredible concept’

files for bankruptcy, Fox Business, June 27, 2023; Nick Carey, Electric truck maker Volta

Trucks files for bankruptcy in Sweden, Reuters, October 17, 2023.

102

Paul Lienert and Nathan Gomes, Ford again warns on EV results, withdraws 2023

forecast, Reuters, October 27, 2023.

103

Sean Tucker, 2024 Ford F-150 Gets Across-the-board Price Increase, Kelly Blue Book,

October 6, 2023.

104

Severin Borenstein, The West Coast’s Bleak Energy Winter, Energy Institute at HAAS,

January 30, 2023.

105

1.11 Net Generation from Renewable Sources excluding hydroelectric by state July

2023, U.S. Energy Information Administration (Last visited October 4, 2023).

106

Saul Elbein, Texas electricity price surges amid record heat and demand, The Hill, June

26, 2023.

107

G.T. Tabler, I.L. Berry, and A.M. Mendenhall, “Energy Costs Associated with Commercial

Broiler Production” Avian Advice, Volume 5, Number 4 (Winter 2003) p. 1 – 4.

24

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

or refrigerators, an unstable electricity grid could mean thousands of dollars lost

on unhatched chicks or spoiled produce.

To facilitate a zero-emissions electric grid buildout would raise electricity prices

and threaten reliability.

108

Nevertheless, the federal government has offered

billions of grant dollars to build renewable energy sources across the country.

109

The USDA offered $11 Billion to rural communities to build solar arrays, wind

farms, and high-voltage transmission lines.

110

But, renewable power is only feasible

if natural gas power plants remain ready to replace gaps in generation. The only

alternative are daily blackouts.

111

Instead of securing natural gas stopgaps,

however, the Biden administration has threatened this critical component in rural

America. On June 3, 2023, President Biden signed the Fiscal Responsibility Act

(FRA),

112

which expedites the federal permitting reform for all energy

infrastructure projects, especially natural gas pipelines. But less than two months

later, the White House Council on Environmental Quality proposed new rules to

expedite renewable projects while reinstating the bureaucratic red tape on natural

gas projects that the FRA had just removed.

113

The Biden administration’s efforts to force farmers to adopt electric equipment ill-

suited to farming and to replace natural gas generators with unreliable renewable

energy sources is a recipe for unsustainable farming. Unfortunately, Washington’s

central planners seem oblivious to that stubborn fact and remain committed to

making Europe’s mistakes.

108

Institute for Energy Research, The Challenges and Costs of Net-Zero and the Future of

Energy, August 2023.

109

Federal Financial Interventions and Subsidies in Energy in Fiscal Years 2016 – 2022,

Energy Information Administration, August 1, 2023.

110

Biden-Harris Administration Makes Historical $11 Billion Investment to Advance

Clean Energy Across Rural America Through Investing in America Agenda, United States

Department of Agriculture Rural Development news release, May 16, 2023.

111

Isaac Orr, American Experiment modeling finds EPA’s Carbon Rule would cause

blackouts in MISO, cost $246 billion, American Experiment, August 9, 2023.

112

Fiscal Responsibility Act of 2023, Public Law 118-5, Congress.gov, June 3, 2023

113

Biden-Harris Administration Proposes Reforms to Modernize Environmental

Reviews, Accelerate America’s Clean Energy Future, and Strengthen Public Input,

White House press release, July 28, 2023; Patrice Douglas, Biden’s Permitting Proposal Would

Backfire, Add Red Tape for Affordable Energy Projects, RealClear Energy, September 19,

2023.

25

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

ENVIRONMENTAL, SOCIAL,

GOVERNANCE REPORTING

REQUIREMENTS: MAKING FOOD

MORE EXPENSIVE

ESG reporting requirements have become increasingly important and

burdensome. Their initial focus offered financial planners information about a

company’s emissions so that investors could assess whether the company aligned

with a fund’s sustainable investment goals. And now, as Blackrock’s CEO

emphasized in 2022, “climate risk [is] investment risk,” and “transparency around

your company’s planning for a net zero world [is] an important element of that.”

ESG requirements were originally directed at oil companies and led investors to

eschew investing in oil production, with investment in petroleum extraction sitting

at record lows.

114

But ESG attention has crept out of the fossil-fuel space and into

other industries, including agriculture. With its heavy use of artificial fertilizers

and fossil fuels, livestock methane emissions, weed and bug sprays, and genetically

modified crops, agriculture has been targeted by ESG fiduciaries. As Jeremy Coller,

a leading ESG fund manager, said, “[w]hen it comes to climate change, cows are

the new coal.”

115

ESG reporting is currently optional, but in March 2022, the SEC proposed a

mandatory ESG disclosure rule that would apply to every publicly traded

company.

116

The rule would mandate costly ESG emissions reporting for a firm’s

entire supply chain, requiring large publicly traded food processing companies,

grocery stores, and restaurant groups to track and report emissions from farm to

table. Large companies looking to reduce their overall emissions would stop

purchasing food from farmers with high emission rates, once again applying

financial costs and pressures to the American farmer. In a letter to the SEC, 118

members of Congress expressed their concern with the rule’s

117

“significant and

114

MacroVoices #385 Dr. Anas Alhajji: 2024 Energy Markets Outlook & More,

MacroVoices, July 20, 2023.

115

Jeremy Coller, When it comes to climate change, cows are the new coal, Context,

Thomson Reuters Foundation, November 8, 2022.

116

SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for

Investors, U.S. Securities and Exchange Commission press release, March 21, 2022.

117

Tyler Olson, SEC’s proposed ESG rule will leave small farms in the lurch, lawmakers

from both parties say, Fox Business, May 26, 2022.

26

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

unworkable regulatory burden” that will misplace “time and energy… into

complying with this new regulation [and] will divert American farmers away from

their primary goal of producing our food, fuel, and fiber.”

118

And those

congressional cost concerns are warranted. In 2022, ESG-related reporting

expenses reached $8.4 billion. For farmers and ranchers, hiring a single ESG

consultant can cost at least $25,000, with prices increasing with the scale of the

operation.

119

As ESG ratings reach the farm either by the SEC’s new climate disclosure rule or

regulation, there will be downstream consequences.

120

Banks with obligations to

ESG-conscious shareholders will withhold loans from farmers with poor practices,

as they do in Europe.

121

Insurance companies using climate models to write carte

blanche premiums

122

will raise rates to cope with perceived climate risks and use

ESG metrics to calculate new premiums for farmers—moves that risk putting

farmers out of business. Similarly, food processors and restaurant groups may only

deal with farmers who meet their ESG requirements or help lower their emissions

scores. In 2018, farmers were projected to pay an additional $1,200 annually in

ESG compliance, resulting in the closing of small businesses and destabilizing food

security.

123

Additionally, in 2018, nearly 70 percent of farmers were using non-

computerized tools that would need to be updated to comply with ESG

standards.

124

Under the SEC’s mandatory disclosure rule, farmers who sell their

produce to publicly traded companies will have no choice but to purchase the

monitoring software and begin quantifying their emissions. But their costs won’t

stop there.

118

Letter to Securities and Exchange Chair Gary Gensler from Members of the U.S.

House of Representative, 117

th

Congress 2

nd

Session, May 25, 2022.

119

Rick Brundrett, Serious business: How ESG mandates can hurt small SC firms, The

Nerve, May 12, 2022.

120

Shelby Myers, Overreach of SEC Proposed Climate Rule Could Hurt Agriculture,

American Farm Bureau Federation, May 6, 2022.

121

Net-Zero Banking Alliance, United Nations Environment Programme (Last visited November

3, 2023); Vincent Gauthier, How banks can move toward net zero agriculture portfolios,

Environmental Defense Fund, February 24, 2022; Virginia Furness, UK farmers hungry for

climate finance but banks want more data, Capital Monitor, January 25, 2022.

122

Ken Sweet, Homeowners face rising insurance rates as climate change makes

wildfires, storms more common, Associated Press, September 20, 2023.

123

Nina Sparling, US Farm Management Software Market to Reach $1.62bn – Report,

AgFunder Network Partners, April 4, 2018; ZeroHedge, New ESG Rules are Hurting American

Farmers, Oil Price.com, July 2, 2022.

124

ZeroHedge, New ESG Rules are Hurting American Farmers, Oil Price.com, July 2, 2022.

27

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

QUANTIFYING CARBON COSTS OF

ENVIRONMENTAL, SOCIAL,

GOVERNANCE: THE METHODOLOGY

The Economic Research Center (ERC) at The Buckeye Institute uses publicly

available emissions and consumer spending data and a basic carbon pricing

methodology to estimate the economic impact that Biden administration policies

designed to meet net-zero carbon emissions pledges under the Paris Climate

Accords will have on American farmers and households.

The ERC assumes the best-case scenario in which the net-zero target is achieved

through an efficient carbon pricing system with no deadweight loss or costs of

enforcing the policy. The ERC does not include the cost of purchasing the

emissions monitoring technology that farmers will need to purchase before they

can begin mitigating or offsetting emissions. The ERC could only find one cost

projection for emission monitoring software. Without a much larger sample size,

the ERC could not determine how much a farm will need to pay to monitor

emissions. The ERC also does not consider the bureaucratic costs associated with

preparing the emission reports for companies or any legal fees incurred.

Estimating the Cost of Environmental Social Governance

ESG-reporting requirements and other climate-related disclosure policies are still

too nascent to measure accurately. But, based on global experiences with net-zero

policies, the goals of ESG reporting, and emissions data from fossil-fuels, the ERC

can estimate the economic impact a carbon pricing system will have on farms and

consumers.

The ERC assumes that the SEC’s new ESG rule and other state regulations will

create a de facto carbon pricing system by requiring companies to monitor

emissions from their entire supply chain and produce disclosure reports. Further,

the ERC assumes that Farmers who sell their meat and produce to publicly traded

companies will need to report their emissions to publicly traded companies who

will be subjected to the rule.

Designing the Model Farm

The ERC constructs a model American corn farm to estimate the impact of ESG-

reporting requirements on farms. Corn has the most available fertilizer usage data,

it is the largest crop in the country, and most U.S. farms will plant it in rotation

28

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

with other crops during a harvest year. Corn’s high nitrogen fertilizer and grain

drying requirements make it the most energy and emissions-intensive crop to

grow.

125

The ERC’s model farm is 725 acres, the average size corn farm reported by

the United States Department of Agriculture.

126

The ERC estimates its model

farm’s operating costs and total emissions from fertilizer, diesel fuel, and propane-

powered grain drying. These three emitters are large sources of emissions more

easily tracked by ESG consultants. ESG consultants may focus on other

environmental impacts such as riparian and lacustrine fertilizer run-off, soil

health, and GMOs. These and other potential ESG concerns are not related to

carbon emissions, making them much harder to estimate mitigation costs, and are

not included in the model.

Operating Costs

The ERC’s model operating cost estimate focuses on harvesting one average crop

of corn. The ERC assumes the national average yield of 172 bushels per acre, as

reported by the University of Illinois Urbana-Champaign.

127

The ERC assumes 1.25

lbs. of nitrogen fertilizer per bushel of corn, as reported in a fertilizer management

study published by Louisiana State University in 2021,

128

for a total farm fertilizer

usage of 97.4 short tons. The ERC uses the June 2023 price of $1116 per ton for

nitrogen fertilizer, as reported in the University of Illinois Urbana-Champaign’s

FARMDOC daily,

129

for a total farm price of approximately $109,000.

The ERC’s model fuel consumption relies on field operation and maintenance and

total tillage. The ERC’s estimate for tillage farm operations derives from Iowa State

University’s Farm Energy Study: Energy Consumption for Row Crop

Production,

130

which estimates that conventional till farms consume 6 gallons of

fuel per acre for a conventional till and a no-till field. The ERC’s model farm

assumes a conventional till operation to determine overall farm costs, but the ERC

also models fuel consumption for no-till farms to assess whether no-till farms will

be economically harmed by ESG-reporting policy.

125

Mark Hanna, John E. Sawyer, and Dana Petersen, Energy consumption for row crop

production, Iowa State University, June 2012.

126

Monica Saavoss, Tom Capehart, William McBride, and Anne Effland, Trends in Production

Practices and Costs of the U.S. Corn Sector, U.S. Department of Agriculture Economic

Research Service, Economic Research Report Number 294, July 2021.

127

Gary Schnitkey, Nick Paulson, Jim Baltz, and Carl Zulauf, Corn and Soybean Yields in 2022,

Farmdoc Daily, December 13, 2022

128

Rasel Parvej et al., Corn Nitrogen Management, Louisiana State University, March 2021.

129

Gary Schnitkey, Nick Paulson, and Jim Baltz, Nitrogen Fertilizer Prices Stabilize at High

Levels in Spring 2023, University of Illinois, farmdoc Daily, June 13, 2023.

130

Energy Consumption for Row Crop Production, Farm Energy, Iowa State University, June

2012.

29

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

The ERC estimates using 4,350 gallons of total diesel fuel on the conventional farm

and 1813 gallons on the no-till farm. The ERC estimates the price of diesel fuel

using the average diesel price of $3.25 per gallon over the last decade, as reported

by the U.S. Energy Information Administration.

131

The ERC averaged fuel prices

over a decade as a check against inherent price volatility. Assuming that 10-year

average price per gallon, the diesel costs for a conventional till farm total

$14,137.50. But farm operations must be performed regardless of diesel prices, so

fuel costs may represent a greater share of farm expenses than modeled here.

The ERC model farm reduces crop moisture content by five percent with a

propane-powered grain dryer because over 80 percent of all grain dryers in

America are powered by propane.

132

The ERC uses the Propane Education and

Research Council’s publicly available tool to estimate that 12,900 gallons of

propane will be needed.

133

The ERC uses the average propane price of $2.68 per

gallon from October 2022 to March 2023 for a total cost of $34,572.

134

Farm Emissions

The ERC estimates carbon dioxide emissions on the model farm from fertilizer,

diesel, and propane. The ERC uses a report published by the Royal Society to

estimate that producing one metric ton of androgynous ammonia, the purest form

of nitrogen fertilizer, produces 1.6 metric tons (tonnes) of CO2 emissions.

135

The

ERC uses EIA’s fuel emissions estimates of 5.75 KG of CO2 per gallon of propane

and 10.19 KG of CO2 per gallon of diesel to estimate its model farm’s propane and

diesel fuel emissions.

136

Total CO2 emissions from fertilizer, propane, and diesel

fuel were 155.9, 148.4, and 44.3 tonnes, respectively.

131

U.S. No 2 Diesel Retail Prices, U.S. Energy Information Administration (Last visited

November 2, 2023).

132

Propane’s role in the ag market: An overview of key applications, LPGas, July 17, 2023.

133

Grain Dryer Propane Use Calculator, Propane Education and Research Council (Last visited

November 2, 2023).

134

Weekly U.S. Propane Residential Price, U.S. Energy Information Administration (Last

visited November 16, 2023).

135

Bill David et al., Ammonia: zero-carbon fertiliser fuel and energy store, The Royal

Society, February 2020; Abdullah Emre Yüzbaşıoğlu, Ali Hikmet Tatarhan, and Ahmet Ozan

Gezerman, “Decarbonization in ammonia production, new technological methods in

industrial scale ammonia production and critical evaluations,” Heliyon, Volume 7, Issue

10, October 25, 2021; and fertilizer emissions converted to short tons by The Economic Research

Center at The Buckeye Institute from metric to short tons;

136

Carbon Dioxide Emissions Coefficients, U.S. Energy Information Administration, October

5, 2022.

30

THE ECONOMIC RESEARCH CENTER AT THE BUCKEYE INSTITUTE

Monetizing Emissions

The ERC assumes that ESG-reporting requirements will ultimately lead to

monetized agricultural emissions. That is, a farm’s carbon emissions will receive a

tangible economic value that will then need to be offset by new agricultural

practices. The ERC assumes carbon pricing will monetize emissions using the

widely accepted social cost of carbon (SCC) metric, with a price of $185 per tonne

derived from the “Comprehensive evidence implies a higher social cost of CO2”

study published by Resources for the Future fellow, Kevin Rennert. The ERC

monetizes farm emissions by multiplying the model farm’s total emissions by the

SCC.

Carbon Pricing

The ERC assumes that carbon pricing created by ESG requirements will not be

collected like traditional carbon taxes. Instead, reporting entities likely will price

total emissions reduction using the SCC to report the total value of emissions

reduced and placing a private carbon fee on Scope 3 emitters. Farms will be

expected to pay this fee either by investing in net-zero infrastructure, adopting new

farming practices, or buying carbon emission offsets.

Impact on Consumers

The ERC uses publicly available data from government agencies, universities, and

business analytic software to estimate the costs of ESG-reporting requirements

and carbon pricing that the ERC assumes will be passed on to consumers.

The ERC uses the Consumer Expenditure Survey to find what the average

American household ($70,000 per year) spends on groceries per year: $8,320. The

ERC uses data from the University of Michigan’s Center for Sustainability (UMCS)

to estimate the total carbon emissions for an average American household per year:

48 tons.

137

UMCS reported that 10-30 percent of a household’s annual emissions

come from their groceries’ supply chain. The ERC takes the midpoint of that

estimate, 15 percent of total emissions, to find that a typical household’s emissions

from food is equivalent to 7.2 tons of CO2e.

The Bureau of Labor Statistics and the USDA track the monthly average price of

meats, produce, grains, and dairy products.

138

These goods reflect typical American

consumption habits. The ERC uses Carboncloud’s Climatehub, a Swedish carbon

emissions database that tracks CO2e emissions from food products in grocery

137

Carbon Footprint Factsheet, Center for Sustainable Systems, University of Michigan, 2021.

138

Announcement of Class and Component Prices, U.S. Department of Agriculture,

November 1, 2023; Average Retail Food and Energy Prices, U.S. City Average and West

Region, U.S. Bureau of Labor Statistics (Last visited November 2, 2023).

31