Introduction

The purpose of this factsheet is to prevent the loss of land owned as heirs’ property in Texas. It

examines state laws that are relevant to heirs’ property owners in Texas, and outlines steps they can

take to resolve property issues before seeing an attorney.

It also explains relevant legal issues, including:

1. how to identify the legal heirs of the original ancestor who owned the land,

2. state partition law,

3. state law that permits the sale of land due to unpaid property taxes, and

4. state law addressing adverse possession and condemnation

(these terms are dened in the glossary, below).

This resource may be useful to professionals assisting heirs’ property owners, such as lawyers,

nonprot and community development advocates, and cooperative extension agents.

For a glossary of legal terms used in this factsheet, refer to page 12.

HEIRS’

PROPERTY:

Understanding the Legal Issues in

Texas

By Francine Miller

November 2022

What is Heirs’ Property?

Heirs’ property (sometimes known as family land) is property that has been transferred to multiple

family members by inheritance, usually without a will. Typically, it is created when land is transferred

from someone who dies without a will to that person’s spouse, children, or other heirs who have a legal

right to the property. However, even if the person who died had a will, they may still create heirs’ property

if they leave land to multiple heirs without specifying which heirs get which section of the land.

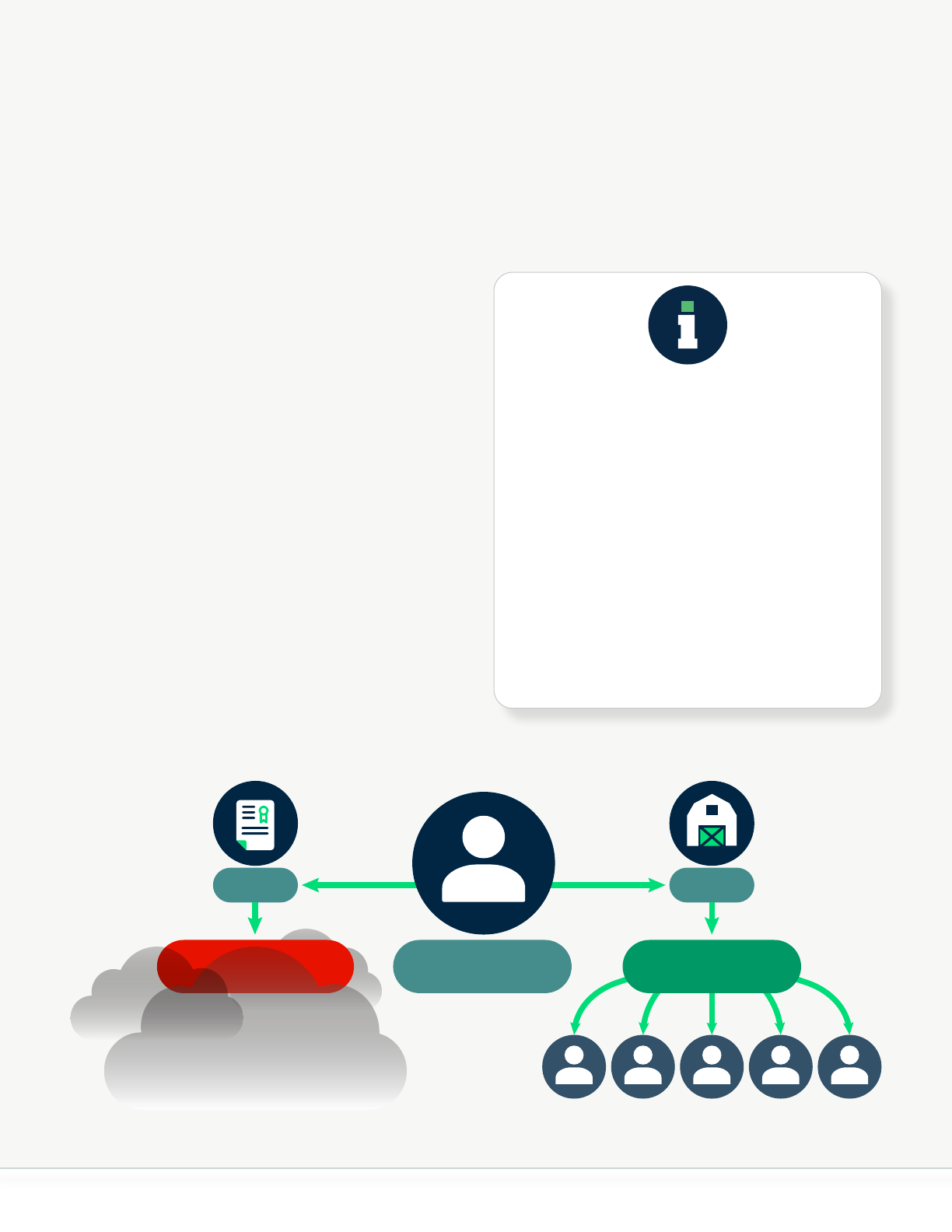

When heirs’ property is created, the heirs own all

the property together (in legal terms, they own

the property as “tenants in common”). In other

words, they each own an interest in the undivided

land rather than each heir owning an individual

lot or piece of the land. In addition, unless the

heirs go to the appropriate administrative

agency or court in their jurisdiction and have the

title or deed to the land changed to reect their

ownership, the land will remain in the name of the

person who died.

For the heirs, owning property as tenants in

common without a clear title can lead to many

challenges. Because it is difcult for heirs to prove

ownership, they may be unable to access loans

and mortgages, apply for USDA grants or loans,

and build wealth from the land by engaging in

commercial activity, such as selling timber or

other resources—all of which require proof of

ownership. It also leaves the property vulnerable

to being acquired by real estate developers and

unscrupulous actors.

Learn More Using

the Farmland Access

Legal Toolkit

For a more comprehensive overview

of heirs’ property issues, visit

farmlandaccess.org/heirs-property.

Find additional advice for heirs’

property owners, including how to

proactively avoid and address legal

challenges, at farmlandaccess.org/

suggestions-for-heirs-property-

owners.

Grandfather

Title Land

Passes

to Heirs

Remains in

Grandfather’s Name

Heirs who inherit

the property do not have

clear legal title to the land.

This is referred to as “cloudy title.”

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 2

Identifying Heirs

To resolve heirs’ property issues, an important rst

step is tracing the ownership of the land from the

original titled owner to the current owners. Many

practitioners encourage heirs’ property owners

to build a family tree identifying all the heirs,

deceased and living. Specically, heirs’ property

owners will want to collect:

1. the heirs’ birth and death dates,

2. county of death,

3. proof of whether they died with a will, and

4. any current contact information for living heirs.

The goal is to gather information about anyone

who may have at any time held any interest in the

land, so it is important to identify all the heirs, all of

whom might be entitled to an interest in the land.

When a person dies with a valid will, they die

“testate” and their will determines who inherits

their property.

1

When a person dies without a

will, they die “intestate” and state law governing

intestate succession determines who inherits that

person’s real estate and other assets.

2

Who inherits

a person’s land by intestate succession varies

depending on which family members survive the

decedent.

There are generally a number of types of living heirs

entitled to inherit from a decedent, including: the

spouse of the decedent; biological and adopted

children, and their descendants; parents of the

decedent; siblings of the decedent, and if they have

died, their descendants (the decedent’s nieces and

nephews); and grandparents and cousins.

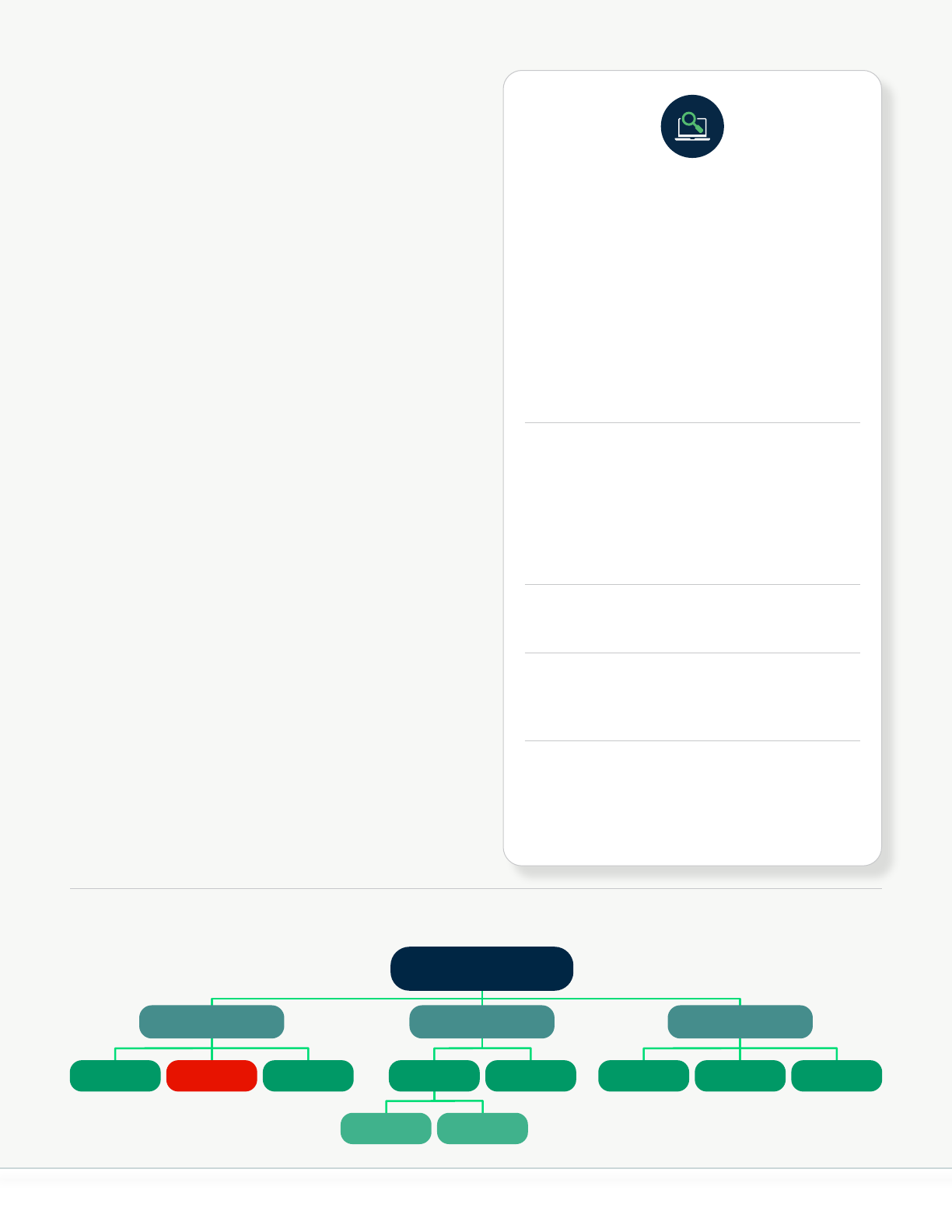

Finding the Family (Genealogy)

and Land Records

Resources to help identify and locate heirs

and build the family tree include genealogists

and family history sites such as ancestry.com,

myheritage.com, and familysearch.org. Family

bibles can be a good source of information

and can sometimes be used to show heirs.

Local libraries can also be a great resource for

genealogical records and research help (see

contact information below). Individuals can

also visit the following resources:

Texas State Library and Archives Commission

Lorenzo de Zavala State Archives

and Library Building

Capitol Complex, 1201 Brazos St.

Austin, TX 78701

Phone: (512) 463-5455

Email: [email protected]

Online Genealogy Search

tsl.texas.gov/arc/genrst.html

Specically for African American

Genealogical Resources

tsl.texas.gov/ref/africanamericangenealogy

For land records, individuals should visit the

local county recorder or tax assessor’s ofce to

request copies of records. There are numerous

online search engines, but note that some of

them require payment for searches.

Uncle AuntFather

Ms. Smith

(Farming Property)

Brother Sister Cousin Cousin Cousin

Cousin

(Deceased)

Cousin

ChildChild

Grandfather

(On Deed)

An example of a simple family tree for Ms. Smith

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 3

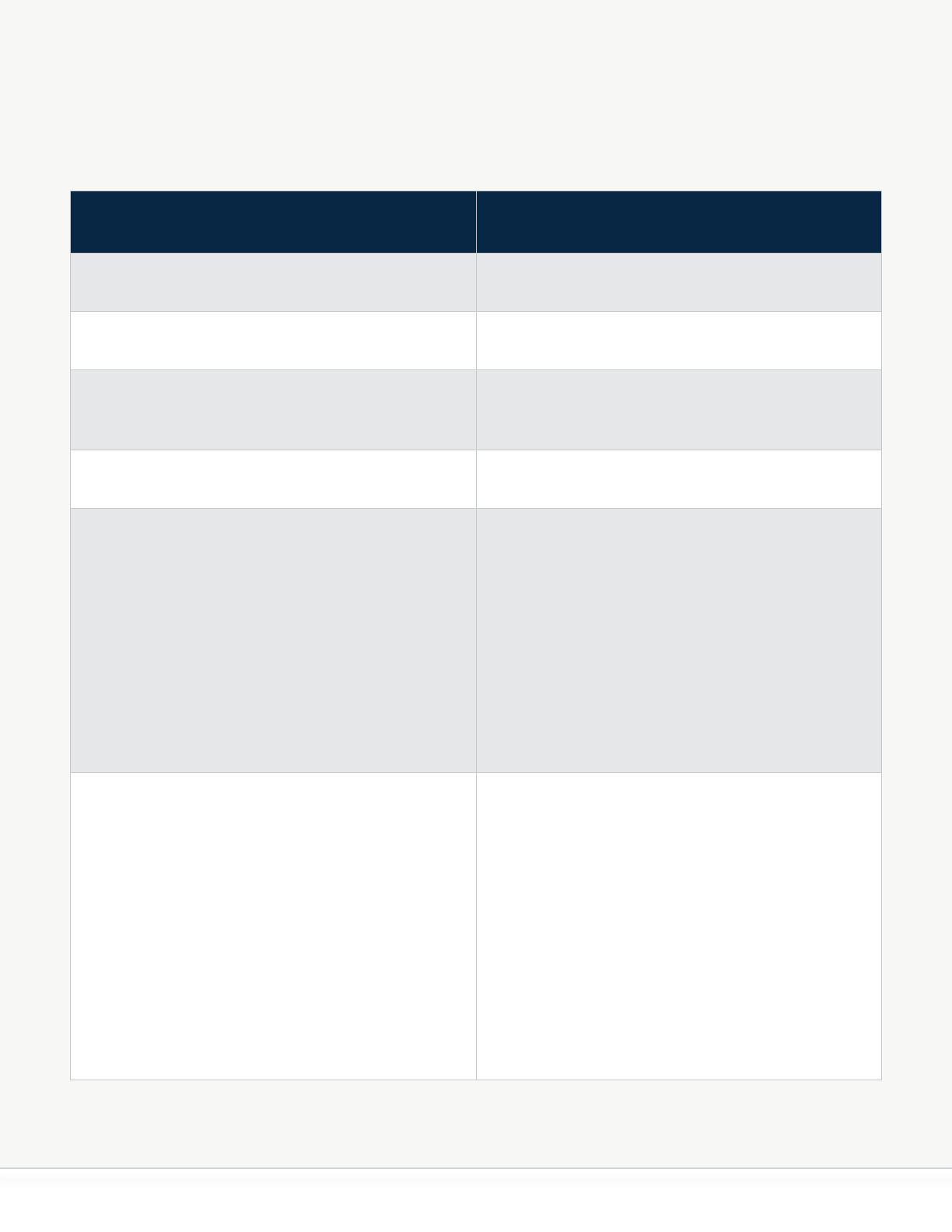

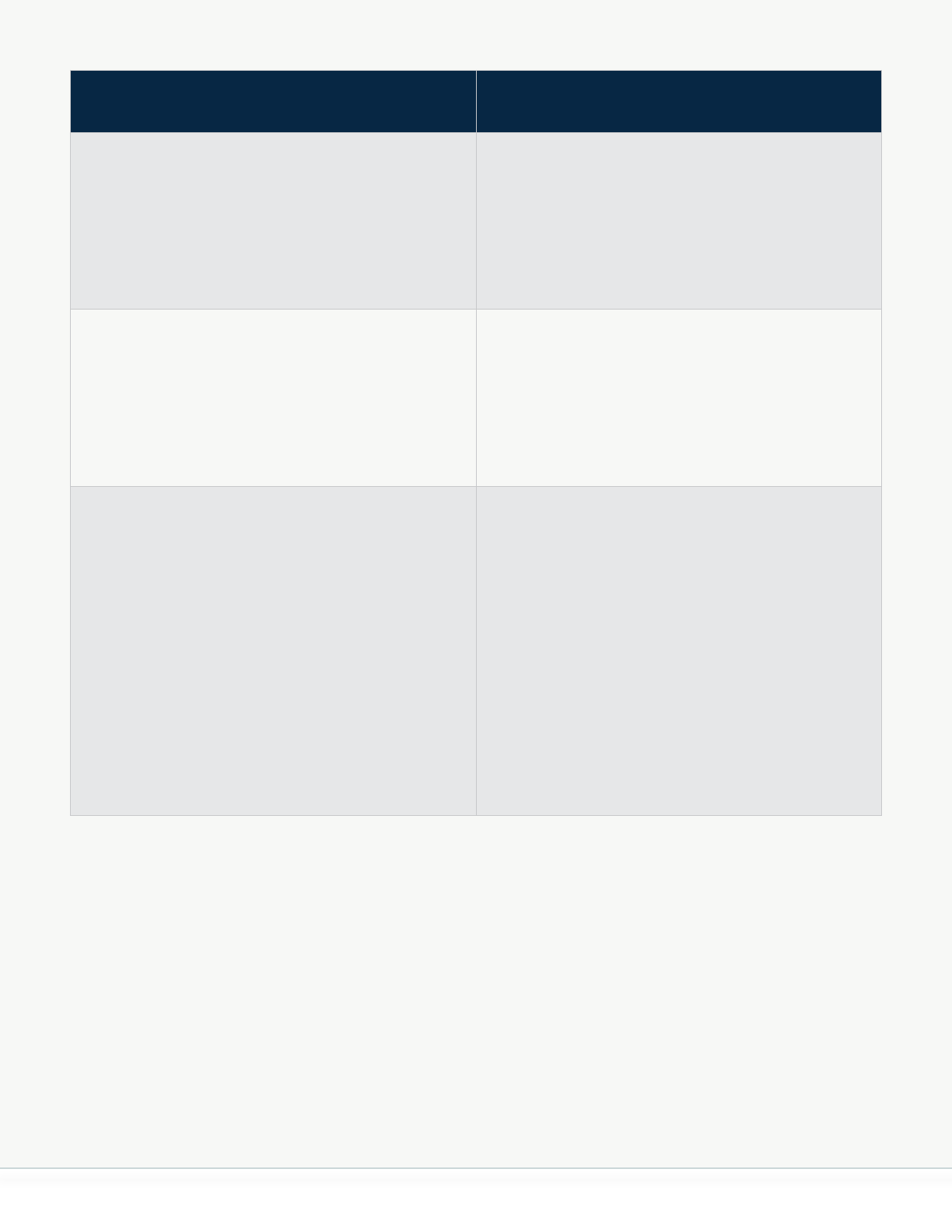

Intestate Succession in Texas

3

The following chart describes some of the many possibilities under Texas intestate succession laws. If

there are multiple generations involved, it will likely be important to work with an attorney to successfully

identify all the current owners.

If a person dies with: Here’s who inherits:

children but no spouse the children inherit everything

a spouse but no children, parents, or siblings the spouse inherits everything

parents but no children, spouse, or siblings the parents inherit everything; each receive

half the intestate property

siblings but no children, spouse, or parents the siblings inherit everything equally

a spouse and children of the spouse and the

decedent

the spouse inherits all the community

property, one-third of the decedent’s separate

personal property, and if the decedent owned

real estate as separate property, the right to

use the decedent’s real estate for life (a life

estate)

the children inherit everything else, including

two-thirds of the decedent’s separate

personal property, and the decedent’s

separate real estate after the spouse’s death

a spouse and children of the decedent who

are not children of the spouse

the spouse keeps their one-half interest in

the community property and inherits one-

third of the decedent’s separate personal

property, and if the decedent owned real

estate as separate property, the right to use

the decedent’s real estate for life (a life estate)

the children inherit everything else, including

the decedent’s one-half interest in the

community property, two-thirds of the

decedent’s separate personal property, and

the decedent’s separate real estate after the

spouse’s death

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 4

If a person dies with: Here’s who inherits:

a spouse and parents the spouse inherits all of the decedent’s

community property, all of the decedent’s

separate personal property, and half of the

decedent’s separate real estate

the parents inherit one-half of the decedent’s

separate real estate

a spouse and siblings, but no parents the spouse inherits all of the decedent’s

community property, all of the decedent’s

separate personal property, and half of the

decedent’s separate real estate

the siblings inherit half of the decedent’s

separate real estate

children born outside marriage Children of an unmarried father may receive a

share of his estate if (1) the father participated

in a marriage ceremony that later turned out

to be void, (2) he acknowledged paternity

in writing, (3) he adopted the child, (4) his

paternity was established under Texas law

during his lifetime, or (5) his child petitions

the probate court to determine paternity and

inheritance rights and paternity is established

in that process.

A woman who gives birth to a child is

presumed to be their mother, unless there is

evidence of adoption by another family.

4

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 5

Understanding Partition Law

Heirs who inherit land intestate (without a

will) own it as tenants in common.

5

Tenants in

common each own an undivided interest in the

whole parcel of land, which means that none of

the heirs can claim any specic piece of land. As

tenants in common, each heir has equal rights

to use and occupy the land.

Heirs’ property owners are especially

vulnerable to losing their land

because they are subject to partition

actions to physically divide or sell the

land.

As co-owners of the property, any of the tenants

in common can bring an action in court asking

for partition of the property.

There are two ways a court can partition or

divide the property: partition in kind or partition

by sale. If a court orders partition in kind, the

land must be physically divided equitably and

proportionate to the fractional interest and

value of each co-owner’s share. If the court

orders partition by sale, it triggers a process that

requires the property to be sold.

Historically, when a court ordered partition by

sale, the property was sold to the public. This

typically happened by a mandatory sale at

an auction. Often, property owners lost their

family legacies and generally received a small

percentage of what the land was worth—far

below the property’s fair market value.

6

This has

resulted in a tremendous amount of land loss

among African Americans in the United States.

Since 2010, there have been efforts to pass

legislation at the state level to ensure that heirs’

property owners have certain due process rights,

or fair treatment under the law in accordance

with established rules and requirements. This

includes protections to ensure that property

sold in a partition action is sold for fair market

value. That legislation, drafted by the Uniform

Law Commission, is called the Uniform Partition

of Heirs Property Act (UPHPA). It provides a more

equitable system for partition actions of heirs’

property.

The UPHPA became effective in Texas in 2017.

7

The law changes the way partition sales occur in

states that have adopted it. In Texas, the UPHPA

made three major reforms to partition law:

1. If a co-owner brings a partition action in

court, the court must provide an opportunity

for the other co-owners to buy out the co-

owner who brought the partition action.

2. If there is no buyout of co-owners’ interests

in the property, then the law provides a set

of factors for the court to consider that take

into account sentimental value and family

legacy when determining whether to order

a partition in kind and divide up rather than

sell the property.

3. If the court does not order a partition in

kind, the UPHPA requires the court to sell

the property at fair market value and

lays out a process for the property to be

fairly appraised and sold, with proceeds

distributed to all co-owners based on their

respective shares.

Court actions for partition should be avoided

if possible. If a physical partition of the land

is desired by all co-owners, they should

attempt to divide the property voluntarily by

agreement with the help of a surveyor and real

estate attorney. If an heir receives a notice of

a partition action, they should immediately

consult an attorney to protect the heirs’ rights in

the land. Historically, partition sales have been

devastating to African American landowners,

resulting in forced sales of millions of acres of

property and the loss of a tremendous amount

of land, wealth, and family legacy.

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 6

Avoiding Tax Sales

It is very important for heirs’ property owners

to make sure property taxes are paid in full

because tax sales can lead to loss of land.

Property becomes subject to a tax sale when a

landowner fails to pay annual property taxes on

time. The overdue amount generally becomes a

tax lien, which may cause the local government

authority to begin a process to sell the land.

Heirs’ property owners should not

wait to clear title to the property (see

denition in the glossary) before

paying the property taxes.

Note that in many families, one or more of

the heirs pays the total amount of the annual

property taxes due, including the portions owed

by other co-owners. Ideally, the other co-owners

reimburse the family members who cover their

share. If they do not, the co-owner who paid the

taxes can get reimbursed through voluntary

repayment, distribution of income received from

the property, or sale proceeds if the land is sold.

Importantly, payment of taxes does not increase

a co-owner’s ownership interest. Rather, it

creates a claim for reimbursement from any co-

owner who is not paying the taxes. Anyone who

pays taxes on the property should keep tax bills

and receipts so that they can request or claim

reimbursement.

How Tax Sales Work

in Texas

In Texas, property tax bills are mailed around

October 1, and become delinquent if they are

not paid by February 1 of the following year.

8

Texas law provides that the property tax due is

automatically a lien on the property until those

taxes are paid.

9

If the taxes are not paid prior

to February 1, the taxing unit can le a lawsuit

to foreclose on the lien to ensure payment of

the tax, or enforce personal liability for the tax.

10

The court can order the sale of the property if

the lawsuit is successful.

11

The sale is held in the

form of a public auction and the property is sold

to the highest bidder. If the municipality has

approval, the auction can be held online.

Texas landowners have opportunities to

redeem, or get back, their property. First the

landowner can redeem the property up to

the time of any sale by paying the relevant

taxes, penalties, interest, and any other costs

assessed by the state. Landowners also can

redeem their property up to two years after

any sale takes place. The amount that must

be paid, including a steep redemption penalty

fee, differs depending on how the property is

used and when it is redeemed, so landowners

should consult an attorney before attempting to

redeem a property.

12

If a homeowner with heirs’ property is 65 or

older, or has a qualied disability, they can defer

their taxes until they pass away or the property

is sold. (Note that interest still accrues on the

taxes due.) They also have the right to enter into

payment plans. The homeowner must le a short

application with their local appraisal district

requesting the deferral.

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 7

Potential Tax Savings for Agricultural Land

A. Agricultural Exemptions.

Heirs’ property owners of agricultural land should also be aware of the

potential for nancial savings by receiving an agricultural exemption for

property taxes due, by having the land deemed as “designated for agricultural

use.” Land designated in this way is appraised at its agricultural value, which is

based on its use as agricultural land and its ability to generate income.

13

In Texas, the criteria for whether land can be designated as agricultural

include:

1. whether the land has been used continuously for agriculture for

three years;

2. whether the landowner is using the land for agriculture as an occupation

or as a business for prot;

3. and whether agriculture is the landowner’s primary occupation and

source of income.

14

Only individuals can qualify (not corporations or

other business entities). Savings over time can be signicant for heirs’

property owners because an appraisal based on land’s agricultural value

is usually much less than appraisals based on market value. Forestland,

cropland, and land managed for wildlife all may be eligible for this type

of special appraisal. The Texas Comptroller’s ofce provides resources

regarding these appraisals.

15

B. Homestead Exemptions.

Homestead exemptions generally reduce property taxes for the primary

residence of a homeowner. Until recently, it was difcult for heirs’ property

owners to qualify for the homestead exemption in Texas due to unclear

application requirements for people who inherited their land by intestate

succession (without a will). Texas Senate Bill 1943, adopted in 2019, reformed

the homestead exemption in Texas to make it easier for heirs’ property

owners to qualify, and it also lowered the tax bill for many homeowners that

reside on heirs’ property. The bill created clear documentation requirements

for heirs’ property owners to qualify for the homestead exemption. It also

changed the rules so that heirs’ property owners can access all the possible

reductions in their property taxes that come with a homestead exemption,

rather than the reductions being based on the percentage of their ownership

interest in the property.

16

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 8

Avoiding Adverse Possession

Heirs’ property owners must also manage and monitor their land to ensure the property is not taken

through adverse possession or eminent domain (that is, condemned by the local, state, or federal

government).

Adverse Possession

Adverse possession allows a trespasser to

become the owner of land they do not own if

they meet certain criteria and bring an action in

court asking a judge to declare them the owner.

Failure to monitor and manage heirs’ property

can invite neighbors and others to develop a

strong case for seeking ownership of land in this

way. To avoid this, “No Trespassing” signs should

be posted, and if a family member cannot check

the land periodically, a manager should be hired.

A person can gain full ownership of land they do

not own by occupying the land and meeting the

following requirements.

The possession of the land must be:

• actual and visible;

• hostile (the person must be living or working

on the land without permission);

• exclusive (the person must possess the land

for themselves);

• distinct (i.e., not jointly owned with the adverse

party);

• obvious (there’s an unmistakable claim of

exclusive ownership);

• open and notorious; and

• continuous for the statutory period (5 or 10

years, depending on the situation).

17

“Possession” means that the person has been

cultivating the land, has fenced all the land, or

has improved the land in some way such as

building structures, planting timber, or other

activities that add to its value. In Texas, the

possession must also be “peaceable,” meaning

that the original owner has not led suit during

the statutory period to recover the property.

Adverse possession under “color of title” means

the person must be relying on a recorded written

document that they believe shows they are the

actual owner of the property. In Texas, if a person

tries to claim adverse possession under color of

title, the person must prove they occupied the

land for three years.

18

Co-owners and Adverse Possession

Texas heirs’ property owners should know that

there are circumstances under which a co-

tenant heir can attempt to gain sole title to heirs’

property based on adverse possession against

another co-tenant heir. For example, a person

can claim adverse possession of land they co-

own with other heirs after living on the property

and paying taxes for at least ten years if no other

co-tenant has done anything to establish their

ownership of the property.

19

The co-tenant heir

seeking title under adverse possession must

give the other co-tenants notice, including

publishing notice in a local newspaper, and must

le afdavits in the county ofces where deed

records are kept. The co-heirs have ve years

to le an afdavit objecting to the co-tenant’s

claim of adverse possession or le a lawsuit to

recover their interests.

Condemnation

Condemnation occurs when the local, state,

or federal government forces a landowner to

sell their land to the government. State and

federal governments, local city and county

governments, and private businesses can take

private land under “eminent domain” laws if they

can show that doing so is necessary for a public

use or purpose.

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 9

Agricultural Mediation Services

Family disputes are unfortunately common with heirs’

property. There are often multiple generations of heirs

who must come to an agreement, which can be difcult.

The United States Department of Agriculture’s Farm

Service Agency (FSA) runs an Agricultural Mediation

Program which can be used by heirs’ property owners

to mediate family disputes. The FSA provides funding to

relevant state agencies to support mediation between

individuals involved in many kinds of disputes related

to agricultural issues. These include USDA decisions on

loans, conservation programs, wetland determinations,

and rural water loan programs; lease issues between

landlords and tenants; family farm transition issues;

farmer-neighbor disputes; and family disputes regarding

heirs’ property.

If family members co-owning heirs’ property cannot

reach agreement, agricultural mediation services can

help. In Texas, families can reach out to:

Texas Rural Mediation Services

P.O. Box 10536

Lubbock, TX 79408

Phone: (866) 329-3522 or (806) 775-1720

Email: [email protected]

Website: lubbockcounty.gov/department/division.

php?structureid=111

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 10

Additional Resources

Organizations in Texas Supporting Heirs’ Property Owners

Prairie View A&M University, Agricultural Extension

Clarence Bunch, Ph.D, Program Leader

Phone: (936) 261-5117

Email: [email protected]

Website: pvamu.edu/cahs/cep/agriculture-and-

natural-resources/programs

Texas Coalition of Rural Landowners

PO Box 681

Prairie View, TX 77446

Phone: (832) 779-1186

Email: [email protected]

DISCLAIMER: This document provides general legal information for educational purposes only. It is not meant to

substitute, and should not be relied upon, for legal advice. Each operation and situation is unique, state laws vary,

and the information contained here is specic to the time of publication. Accordingly, for legal advice, please

consult an attorney licensed in your state.

Visit farmlandaccess.org

for more resources related

to accessing, transferring,

and conserving farmland.

For a list of national organizations helping heirs’ property owners, visit

farmlandaccess.org/heirs-property/#organizationsprovidingassistance

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 11

Glossary

The following denitions are from multiple sources and are not specic to any particular state statute.

Of course, any statutory denitions (terms dened in the laws of a particular state) would overrule these

denitions in any legal proceeding.

Ad litem attorney

An attorney appointed by a court in a

Determination of Heirship procedure

(see denition below) to represent the

interests of unknown heirs. This person

reviews the application to the court and

conducts an independent investigation

of the decedent’s family history to

make sure no heirs are left out of the

proceeding.

Adverse possession

A legal doctrine that describes when

someone occupies property for a period

of time and then claims legal rights to it.

Ancestor

A person from whom someone is

descended; a direct blood relative.

Clearing title

The legal process of proving and

obtaining a deed for the current owners

of heirs’ property.

Community Property

Property, other than separate property

(see denition below), acquired by

either spouse during marriage. All

community property is held by both

spouses equally with an undivided

interest. In Texas, there is a presumption

that property owned by either spouse

is community property unless there is

clear and convincing evidence that it is

separate property.

Condemnation/eminent domain

The right of a government or its agent

to take private property for a public

purpose, with compensation to the

property owner (such as a public utility

taking land so they can build power

lines).

Co-tenants

Those who own heirs’ property with

others. In a partition action under the

Uniform Partition of Heirs Property Act,

the co-tenants are all the co-owners of

heirs’ property, regardless of the size of

the fractional interest owned. See the

denition of tenants in common, below.

Decedent

A person who has died; decedent is also

often referred to as “the deceased.”

Deed

A legal document, usually recorded in

the ofce of a town or county that keeps

land records, often used to show the

legal owner(s) of a piece of property.

Descendant

A person related to someone who

has died, either directly (parent, child,

grandchild) or indirectly (aunts and

uncles, cousins). This includes anyone

legally adopted.

Determination of heirship

procedure

A court procedure in which the court

declares the identities of a decedent’s

heirs and the heirs’ interests in property.

Estate

The real property (land and buildings)

and personal property (clothing,

furniture, cars, and so on) of a person

who has died. In probate settings, the

“estate” includes the total assets (things

one owns) and liabilities (debts) of a

person who has died.

Heirs

People who are entitled under state

“intestate” law to inherit property from

someone who has died.

Intestate

A person dies “intestate” when they die

without a valid will.

Intestate real estate

Land and other property (such as

houses or buildings) owned by the

decedent when they died and not

addressed in a will, and which does not

pass to anyone based on language

in the deed itself (such as a joint

survivorship clause).

Intestate succession

State laws addressing who inherits

property from someone who dies

without a will (or when a will is found to

be invalid), or any property that was not

included in the decedent’s will.

Joint tenants

Two or more owners of equal shares

of property who have a right of

survivorship, meaning that if one joint

tenant dies their share goes to the other

joint tenant(s) in equal shares.

Life estate

Ownership of real property (house,

building, land) for a person’s lifetime.

Once the person dies, the property

transfers to someone else designated

by whoever granted the life estate.

Probate

The legal process of proving the validity

of a will in court, and handling the

estate of a decedent whether there is a

will or not.

Separate property

Property owned by either spouse before

marriage, and property acquired by

either spouse during marriage as a gift

or inheritance.

Tax lien

A state or local government’s right to

keep real estate for payment of some

debt or obligation.

Tax sale

A legal process used by a county

or town to take the property of a

landowner who has not paid their

property taxes in full and sell it to

recover the unpaid taxes.

Tenants in common

People who each own an individual,

undivided interest in property (also

known as “co-tenants”), but not

necessarily equal interests. See the

denition of co-tenants, above.

Testate

A person dies “testate” when they have

a valid will.

Title

Refers to ownership rights in land. As a

legal concept, title exists even without

any documents, but a deed is the most

common way to determine who has title

in land. (See denition of deed, above.)

Sometimes a will or an afdavit may be

used to document ownership rights.

Undivided interest

An interest in property that is held

in common with others in a single

property. These interests can be

unequal; that is, the value of each

interest can vary.

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 12

Acknowledgments

This resource was developed as a collaboration between Vermont Law and Graduate School’s Center

for Agriculture and Food Systems, the Federation of Southern Cooperatives, and the Policy Research

Center for Socially Disadvantaged Farmers and Ranchers at Alcorn State University, with funding from

the US Department of Agriculture’s National Agricultural Library. This project was led by Francine Miller,

Senior Staff Attorney and Adjunct Professor, Center for Agriculture and Food Systems at Vermont Law

and Graduate School. Special thanks to Heather Francis, Constantin Mathioudakis, and Suhasini Ghosh

for their extensive work researching and developing this resource as student clinicians and research

assistants as well as Legal Food Hub Fellow Andrew Marchev. We thank L.D. Thomas, Esq., for reviewing

this report.

About CAFS

The Farmland Access Legal Toolkit is a project of Vermont Law

and Graduate School’s Center for Agriculture and Food Systems

(CAFS), which uses law and policy to build a more sustainable and

just food system. With local, regional, national, and international

partners, CAFS addresses food system challenges related to food

justice, food security, farmland access, animal welfare, worker

protections, the environment, and public health, among others.

CAFS works closely with its partners to provide legal services that

respond to their needs and develops resources that empower the

communities they serve. Through CAFS’ Food and Agriculture Clinic

and Research Assistant program, students work directly on projects

alongside partners nationwide, engaging in innovative work that

spans the food system.

Please visit www.vermontlaw.edu/cafs to learn more.

farmlandaccess.org

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 13

Endnotes

1 It is important to le a deceased person’s

will along with a petition to probate the

will with the local court where the person

resided and where the property is located

as soon as possible after the person has

died. See Probate: General Information,

Tex. STaTe L. Library, https://guides.sll.texas.

gov/probate (last visited Nov. 16, 2022)

(providing a guide to probate in Texas).

2 Estate planning and will making are

critical to avoid the challenges for heirs’

property owners outlined above. For more

information on the importance of wills and

estate planning see the Farmland Access

Legal Toolkit. Heir’s Property, CnTr. agriC.

& Food SySS., https://farmlandaccess.org/

heirs-property/#challenges (last visited

Oct. 25, 2022); Wills, CnTr. agriC. & Food

SySS., https://farmlandaccess.org/wills/

(last visited Oct. 25, 2022).

3 Chart created based on one by Valerie

Keene. Valerie Keene, Intestate Succession

in Texas, NOLO, https://www.nolo.com/

legal-encyclopedia/intestate-succession-

texas.html (last visited Nov. 11.2022).

Substance of the chart from Texas Probate

Codes Annotated. Tex. Prob. Code ann. § 201

(West 2021).

4 Tex. Prob. Code ann. § 201.052 (West 2021).

5 Heirs who inherit property through a valid

will may also own the land as tenants

in common if it is left to them without

designation of the specic land each heir

receives.

6 Thomas W. Mitchell, Historic Partition

Law Reform: A Game Changer for Heirs’

Property Owners, TexaS a&M Univ. SCh. L. 74

(June 12, 2019), https://papers.ssrn.com/

sol3/papers.cfm?abstract_id=3403088.

7 Tex. ProP. Code ann. § 23A.001 (West 2021).

8 Tex. Tax Code ann. § 31.02 (West 2021).

9 Tex. Tax Code ann. § 32.01 (West 2000).

10 Tex. Tax Code ann. § 33.41 (West 2019).

11 Tex. Tax Code ann. § 33.53 (West 1999).

12 Tex. Tax Code ann. § 34.21 (West 2019).

13 Tex. Tax Code ann. § 23.41 (West 1999).

14 Tex. Tax Code ann. § 23.42 (2020).

15 See Taxes: Property Tax Assistance,

CoMPTroLLer.TexaS.hov, https://comptroller.

texas.gov/taxes/property-tax/ag-timber/

index.php (last visited Nov. 16, 2022).

16 University of Texas participated in

drafting Senate Bill 1943 and has helpful

information regarding its provisions on

its website. See Have You Inherited Your

Home?: How to Lower Your Property Taxes

by Qualifying for the Full Benets of the

Homestead Exemption in Texas, Univ. oF

Tex. aT aUSTin enTrePreneUrShiP & CMTy. dev.

CLiniC, https://law.utexas.edu/wp-content/

uploads/sites/11/2020/08/2020-12-ECDC-

heirproperty_2pg.pdf (last visited Feb. 11,

2023). For the law as codied, see Chapter

11 of the Texas Property Code. Tex. Prop.

Code Ann. § 11.01 (West 2021).

17 Tex. Civ. PraC. & reM. Code § 16.021–16.0265

(West 1985).

18 Tex. Civ. PraC. & reM. Code § 16.024

(West 1985).

19 Tex. Civ. PraC. & reM. Code § 16.0265

(West 2017).

HEIRS’ PROPERTY: Understanding the Legal Issues in Texas | 14